Abstract

This paper is focused on a triopoly closed-loop supply chain (CLSC) game model, including triopoly oligopolies applying for circular economy development. In the CLSC model, manufacturers sell new products and re-collect waste products for maximizing their profits. This paper analyzes the game processing, the Nash equilibrium solutions, and the stability of the game model. Moreover, the influences of parameters on the system’s stability have been investigated, using the maximal Lyapunov exponent, bifurcation graph, and the stable domain. The results show that the system will be unstable when the adjustment speed of the manufacture is too high; unreasonable price strategies could easily cause system bifurcation; the critical point of system bifurcation is closely related to the collecting price.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

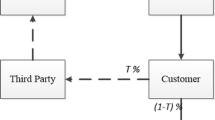

With rapid economic development, the quality of life has been greatly improved. In order to pursue higher living quality, the demand for new products is growing and old products have been discarded easily. The premature discard of products is undoubtedly a waste of resources and often pollutes the environment. Therefore, the recycling of waste materials must be paid great attention from various industries and effective recycling plan must be put forward in order to achieve sustainable development. In recent years, the state vigorously advocates the recycling of resources to implement the strategy of green development. The total amount of recycling of regenerated resources is gradually rising every year. By the end of 2016, the total amount of recycling regenerated resources of ten categories including waste steel, waste nonferrous metals, waste plastics, waste tires, waste paper, abandoned electrical and electronic products, scrap automobile, waste textiles, waste glass and waste battery was about 256 million tons growing 3.7 percent year-on-year (Ministry of Commerce 2017). Correspondingly, the reverse supply chain including the recycling and remanufacturing process of waste goods has gradually formed. It’s combined with the traditional positive supply chain forming CLSC in the market. The closed-loop supply chain improves the utilization of resources and promotes the economic and social effectiveness. With the development of science and economy, the main body of waste collecting has been gradually extended to manufacturer, retailer, the third party and central authority.

In practical, the direct collecting by manufacturers is very common in business, and will become the main recycling mode. In the past 10 years, the developed countries mainly carried out the extended producer’s responsibility in electrical and electronic recycling. Japanese law (Wang 2015) clearly stipulates the standard line for the recycling of electrical and electronic manufacturing enterprises. 23 states of the United States have also promulgated relevant laws and regulations to carry out the extended producer responsibility system. Besides, more than 20 countries and regions have established extended producer responsibility system for recycling management. In December 2016, the office of the State Council (General Office of the State Council (2016) issued a notice on the implementation of extended producer responsibility system pointing out that we should carry out the overall layout of the “five in one” and the coordinated promotion of the “four comprehensive” strategic layout in accordance with the decision of the Party Central Committee and the State Council. We should firmly establish the development beliefs of innovation, coordination, green and open to speed up the establishment of the institutional framework for extending producer’s responsibilities. We should promote the production enterprises to effectively implement the responsibility for the resources and environment and improve the level of ecological civilization construction by developing product ecological design, using recycled raw materials, guaranteeing the standardized recycling and safe disposal of the waste products, strengthening information disclosure. The relevant electrical and electronic enterprises should consider how to recycle the waste products to meet the requirements of the regulations. For example, Changhong and TCL (China Household Electrical Appliances Research Institute 2016), two TV giants in China, have established their own recycling channels and their annual standard dismantling is located at the top of the industry.

Our work is corresponding to two streams of literature: literature of CLSC and literature of complex system theory.

Browse the literature regarding of CLSC first. Since Guide et al. (2003) put forward the concept of CLSC, many researchers have researched this hotspot issues, and many of them focused on three problems: (1) how the subsidy impacts on the CLSC; (2) the coordination for a CLSC; (3) the competition in CLSC. Wang et al. (2011) established a CLSC consisting of a manufacturer and a retailer and studied its pricing and coordination with centralized and decentralized decision under three channel power structures, and they found that a two-part tariff pricing mechanism could coordinate a CLSC. Different from Wang’s research, Yi and Yuan (2012) studied the problem of decision-making in the CLSC under the premise of the conflicts between the sale channel and the recycling channel. Li and Yibiao (2015) also researched the decision problem in the CLSC composed of a manufacturer and a retailer considering the government replacement-subsidy. They found that by setting reasonable subsidy, the government can effectively improve the economic benefits of the closed-loop supply chain system and its participating members, as well as the benefits of consumers and environmental protection. Qiang et al. (2013) built the CLSC network including raw material suppliers, retailers and manufacturers who are responsible for recycling. Akinning to the study of Wang et al. (2011), by considering the demand’s uncertainty, they derived the optimal solution of the decision-makers and analyzed the influence of competition, distribution channel investment yield, conversion rate on the equilibrium transaction quantity and price. Also focusing on the subsidy policy, Ma et al. (2013) investigated the impact of consumption-subsidy on dual-channel closed-loop supply chain and analyzed the impact of government funding on participants’ decisions in 2013. Their results showed that consumption-subsidy was beneficial to consumers, manufacturers and retailers. Georgiadis and Athanasiou (2013) discussed the capacity planning strategy in the reverse channel of CLSC. They used different planning strategies to carry out a huge number of numerical analyses, and found that the flexible policy can improve the adaptability of the supply chain and avoid overcapacity. Gan et al. (2016) established a multi-channel CLSC model for short life-cycle products and analyzed the pricing strategy of new products and remanufactured products. The results showed that implementing a separate channel could improve the profitability of supply chain.

From the existing literatures, the key points of the researches are recycling logistics, recycling channel, recycling inventory management and recycling related policies. What should be noticed is that most scholars’ researches on CLSC are limited to single phase static decision-making instead of a dynamic game. However, dynamic competition between manufacturers could not be ignored: like the case of HP, ASUS, and Apple, three giants in the computer world. They are not the giants “being at a loose end” after the calculations of a Nash equilibrium solution. By contrary, their recycling strategy is commonly seen when a new type of product is on sale. We noticed that there are some academics who have done long-term and dynamic researches on CLSC. For example, Xie and Ma (2016) studied the stability of the recycling market of China’s waste household appliances and controlled chaos in the market. Genc and De Giovanni (2018) investigated a CLSC based on different consumer return behaviors. They found the manufacturer likes the low variable rebates while the retailer prefers large variable rebates in a CLSC modelling. To give an investigation for CLSC, Fang et al. (2016) established an integer linear programming model, and an optimal production planning is well provided. Gutgutia and Jha (2018) developed a modelling of inventory in a single-vendor single-buyer supply chain under an unknown demand distribution at the buyer. In order to optimize the order quantity, they derived closed-form functions for the model. By the comparison of traditional supply chain and reverse supply chain, Zheng et al. (2016) studied the competition and product returns of the supply chain. They find that centralization is the optimal strategy for one supply chain. In additional, with the combination of dynamic game and competition, many scholars have studied the stability of a supply chain (Ma et al. 2018; Ma and Wang 2014; Dai et al. 2017).

Additionally, competition in a market is very common in business. Many academics have studied the oligopoly game in the market competition. Zhang et al. used the Cournot model to study the competition strategy selection of duopoly manufacturers with bounded rationality and service difference. They carried out the complexity analysis by system dynamics and numerical simulation. The results showed that the service level and profit were not absolutely positively correlated when the competition entered a chaotic state. The duopoly manufacturers need to strictly control the speed of production adjustment and avoid over competition (Zhang et al. 2013). In 2012, Jin et al. studied the best marketing strategy of the retailers in a green supply chain and analyzed the retailer’s marketing strategy game relationship using game theory and Hotelling model. The research showed that a certain amount of subsidies could exert the regulatory role of the government and the government should vigorously propagandize green awareness to promote the development of green supply chain (Jin et al. 2012).

When comes to the supply chain system’s stability, many academics have studied the application of complex system theory in supply chain. Guo et al. built a model composed of two manufacturers responsible for direct recovery and analyzed the dynamic properties of the system in detail (Guo et al. 2011). Ding et al. studied the stability of the duopoly advertising game model and used adaptive method to control the model (Ding et al. 2012). Guo and Ma (2013) set up a closed-loop supply chain model in which retailers are responsible for sales and recycling. They studied the complex characteristic of the system.

In general, to the author’s knowledge, few of the previous works study the dynamic CLSC game among manufacturers being collectors based on the above background. Besides, few researches have discussed about the competition for a CLSC from a dynamic modelling view. This paper studies the triopoly competition game in which three manufacturers establish their own direct collecting channels and analyzes the dynamics of the game by stability analysis. Since the firms will not make decisions only one time, they will adjust their decision variables gradually to achieve the equilibrium. Hence, it is necessary to find the stability regions of parameters, so that we can get the insight that which speed of adjustment would be feasible.

2 Model background, assumptions and notation

2.1 Model background

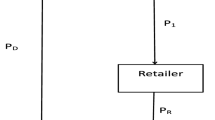

This paper mainly considers the situation in which three manufacturers collect similar waste products from consumers, remanufactures, and finally sell them to consumers so as to make profits. The oligopolistic competition is formed among the three manufacturers all making decisions with bounded rationality, as shown in Fig. 1.

2.2 Assumptions

The following assumptions are made:

-

1.

This paper only considers the market of remanufactured products, that is, new products and remanufactured products do not form a competitive market. This is in line with the actual situation in China.

-

2.

The closed-loop supply chain is formed by three equivalent manufacturers who collect the same kind of waste products directly from the consumers, remanufacture them and then sell the remanufactured products directly to the consumers. The manufacturers are independent decision-makers. Their strategic space is to choose the optimal collecting price. They make decision in the discrete time period as t = 0, 1, 2, …. Their goal is to maximize their own profits.

-

3.

The amount of collecting is increasing function of the collecting price. The manufacturers’ collecting ability and remanufacturing ability are unlimited. In order to simplify the problem and highlight the influence of the main parameters on the system, the manufacturers are set up to process all the recycled products to form remanufactured products, which means there is no waste.

-

4.

The three manufacturers sell similar products and collect similar waste products, so the competition among them is Bertrand competition.

2.3 Notations

- P 0 :

-

Unit retail price of the remanufactured product defined as a constant;

- c i :

-

Unit remanufacturing cost of manufacture i defined as a constant, i = 1, 2, 3;

- Pi (t):

-

Unit collecting price of manufacturer i in period t. It’s the manufacturer’s decision variable, i = 1, 2, 3;

- Q i :

-

Collecting amount of manufacturer i, i = 1, 2, 3;

- b i :

-

Sensitivity coefficient of consumers to the directly collecting price Pi of manufacturer i, i = 1, 2, 3;

- \(\alpha_{\text{i}} ,i = 1,2,3\) :

-

The price adjustment speed the three manufacturers respectively;

- e 12 :

-

Competitive influence coefficient of the collecting price of manufacturer 2 to the collecting amount of manufacturer 1;

- e 21 :

-

Competitive influence coefficient of the collecting price of manufacturer 1 to the collecting amount of manufacturer 2;

- e 31 :

-

Competitive influence coefficient of the collecting price of manufacturer 1 to the collecting amount of manufacturer 3;

- e 13 :

-

Competitive influence coefficient of the collecting price of manufacturer 3 to the collecting amount of manufacturer 1;

- e 23 :

-

Competitive influence coefficient of the collecting price of manufacturer 3 to the collecting amount of manufacturer 2;

- e 32 :

-

Competitive influence coefficient of the collecting price of manufacturer 2 to the collecting amount of manufacturer 3;

- a :

-

Number of waste products which are returned by consumers voluntarily. It’s not affected by other market factors;

- πi:

-

Profit of manufacturer i, i = 1, 2, 3.

3 Model building and analysis

3.1 Model building

According to the above model assumption and notation, the competition between the manufacturers is in accordance with Bertrand price game model. The collecting function of the three manufacturers is in the form of:

In order to analyze the impact of the main parameters on the closed-loop supply chain system and simplify calculation, it is assumed that the sensitivity coefficient of consumers to the collecting price of the three manufacturers is the same, that is, b1 = b2 = b3 = b, since the three manufacturers are equivalent competitors on the same position in the industry. Besides, it is assumed that the competition coefficient between manufacturers is the same, for example, the competition coefficient of the collecting price of manufacturer 2 to the collecting amount of manufacturer 1 is the same as that of collecting price of manufacturer 1 to the collecting amount of manufacturer 2, that is, e12 = e21 := e1, e23 = e32 := e2 and e23 = e32 := e3 (where {:=} means replace the left parameters with the new parameter in the right). So Eq. (1) can be simplified as:

The profits of the three manufacturers are:

3.2 Model analysis

By calculating \(\tfrac{{\partial \pi_{i} (p_{1} ,p_{2} ,p_{3} )}}{{\partial p_{i} }}(i = 1,2,3)\), the marginal profits of the three manufacturers can be calculated as:

According to the marginal profit of Eq. (4), the optimal strategy of three manufacturers can be obtained as follows:

Because of the incomplete symmetry of information, the three manufacturers don’t fully know the market demand and the recovery of the competitors in most cases. They adjust their own recovery according to their marginal profit. When the marginal profit is positive (negative), it means that the increase of the price can increase (reduce) profit and the manufacturer will increase (reduce) collecting price in the next period. When the marginal profit is 0, the collecting price remains unchanged in the next period. This decision method is called bounded rational decision. Manufacturers 1, 2, and 3 make decisions based on bounded rationality. The expression of the dynamic system is:

We call the above Eq. (6) the system (6). In the system (6), \(\alpha_{\text{i}} ,i = 1,2,3\) (\(\alpha_{\text{i}} > 0\)) represent the price adjustment parameters of the three manufacturers respectively. It represents the adjustment speed of manufacturer’s collecting price. In order to maximize profits, manufacturers usually speed up the price adjustment.

Next, we study the system equilibrium points. Make \(p_{i} (t + 1) = p_{i} (t),\;i = 1,2,3, \ldots ,8\) equilibrium points \(E_{j} ,j = 1,2,3, \ldots ,8\) of system (6) can be obtained. Among them, \(E_{1} = (0,0,0)\), \(E_{2} = \left( {\frac{{b(p_{0} - c_{1} ) - a}}{2b},0,0} \right)\), \(E_{3} = \left( {0,\frac{{b(p_{0} - c_{2} ) - a}}{2b},0} \right)\), \(E_{4} = \left( {0,0,\frac{{b(p_{0} - c_{3} ) - a}}{2b}} \right)\), \(E_{5} \left( {\frac{{2b\left( {a + b\left( {c_{1} - p_{0} } \right)} \right) + e_{1} \left( {a + b\left( {c_{2} - p_{0} } \right)} \right)}}{{d_{1}^{2} - 4b^{2} }},\frac{{2b\left( {a + b\left( {c_{2} - p_{0} } \right)} \right) + e_{1} \left( {a + b\left( {c_{1} - p_{0} } \right)} \right)}}{{d_{1}^{2} - 4b^{2} }},0} \right)\), \(E_{6} \left( {\frac{{2b\left( {a + b\left( {c_{1} - p_{0} } \right)} \right) + e_{3} \left( {a + b\left( {c_{3} - p_{0} } \right)} \right)}}{{e_{1}^{2} - 4b^{2} }},0,\frac{{2b\left( {a + b\left( {c_{3} - p_{0} } \right)} \right) + e_{3} \left( {a + b\left( {c_{1} - p_{0} } \right)} \right)}}{{e_{1}^{2} - 4b^{2} }}} \right)\), \(E_{7} \left( {0,\frac{{2b\left( {a + b\left( {c_{2} - p_{0} } \right)} \right) + e_{2} \left( {a + b\left( {c_{3} - p_{0} } \right)} \right)}}{{e_{2}^{2} - 4b^{2} }},\frac{{2b\left( {a + b\left( {c_{3} - p_{0} } \right)} \right) + e_{3} \left( {a + b\left( {c_{2} - p_{0} } \right)} \right)}}{{e_{2}^{2} - 4b^{2} }}} \right)\), \(E_{8} (p_{1}^{*} ,p_{2}^{*} ,p_{3}^{*} ){ \cdot }E_{8} (p_{1}^{*} ,p_{2}^{*} ,p_{3}^{*} )\).

By observing the 8 equilibrium points of the system (6), it can be seen that \(E_{1}\) is the source of the system and \(E_{2}\)–\(E_{7}\) are all boundary equilibrium points of the system. However the collecting price decided by the decision-maker is impossible to be zero in economics, so they are not practical and the 7 points are unstable. \(E_{8}\) is the only Nash equilibrium point of the system (6). The collecting price of this point is of practical significance.

4 Analysis of system stability

4.1 Lyapunov exponent

The Lyapunov exponent represents the numerical characteristics of the average exponential divergence rate of the adjacent trajectories in phase space, also called the Lyapunov characteristic exponent. It’s used to identify the chaotic motion. The sign and size of the Lyapunov exponent along a certain direction indicates the average diverge or converge speed of the adjacent trajectories of the long time system along this direction in the attractor.

Only from the mathematical point of view, the Lyapunov exponent has no dimension. The one-dimensional system has only one exponent and the two-dimensional system has two exponents to characterize it. The n-dimensional system has n Lyapunov exponents forming an exponential spectrum. The largest value is called the maximal Lyapunov exponent. The maximal Lyapunov exponent is not only an important index to distinguish chaotic attractors, but also a quantitative description of initial value sensitivity of chaotic system. In actual computation, it is difficult to calculate all Lyapunov exponents, especially when the system is multidimensional.

For the general discrete high dimensional nonlinear system:

In Eq. (7), \({\text{x}}_{k} = (x_{1}^{(k)} ,x_{2}^{(k)} , \ldots ,x_{n}^{(k)} )^{n} \in {\text{R}}^{n}\), \(f_{k}\) is continuously differentiable within the scope of the study. Let the Jacobian matrix at the point z of the system (7) be \({\text{J}}_{k} (z)\), then there is:

Note \({\text{T}}_{j} \left( {x_{0} } \right) = {\text{J}}_{j} (x_{j} ){\text{J}}_{j - 1} (x_{j - 1} ) \cdots {\text{J}}_{1} (x_{1} ){\text{J}}_{0} (x_{0} ) = \prod\nolimits_{i = 0}^{j} {{\text{J}}_{i} (x_{i} )}\). If the eigenvalue of the n-order matrix \({\text{T}}_{j} \left( {x_{0} } \right){\text{T}}_{j}^{ *} \left( {x_{0} } \right)\) is \(\beta_{i}\), then \(\mu_{\text{i}} \left[ {{\text{T}}_{j} \left( {x_{0} } \right)} \right]{ = }\sqrt {\sigma_{i} }\) is the ith singular value of the matrix \({\text{T}}_{j} \left( {x_{0} } \right)\) where i = 1, 2, 3,…, n, j = 0, 1,… The ith Lyapunov exponent corresponding to trajectory \(\left\{ {x_{0} } \right\}_{{{\text{k}} = 0}}^{\infty }\) starting from the point \(x_{0}\) is

From the n Lyapunov exponents, the maximal Lyapunov exponent of high-dimensional discrete nonlinear system (7) can be obtained. Generally speaking, the Lyapunov exponent derived from this has nothing to do with the starting point.

For system (6) we can have:

where

where

where

Using the above matrixes, we can get the n Lyapunov exponents of system (6)

4.2 Stability analysis

Next, Jacobian matrix is used to judge the stability of system (6). The form of the Jacobian matrix is as follows:

where \(A_{\text{i}} = p_{0} - 4p_{i} - c_{i} ,\;i = 1,2,3\).

We use Jury criterion to determine the necessary and sufficient condition for local stability of equilibrium point \(E_{8}\). The characteristic polynomial of the Jacobian matrix corresponding to \(E_{8}\) is \(F(\lambda ) = \delta_{3} \lambda^{3} + \delta_{2} \lambda^{2} + \delta_{1} \lambda + \delta_{0}\). The necessary and sufficient condition for local stability of equilibrium point \(E_{8}\) is:

where \(\gamma_{0} = \left| {\begin{array}{*{20}c} {\delta_{0} } & {\delta_{3} } \\ {\delta_{3} } & {\delta_{0} } \\ \end{array} } \right|\), \(\gamma_{1} = \left| {\begin{array}{*{20}c} {\delta_{0} } & {\delta_{2} } \\ {\delta_{3} } & {\delta_{1} } \\ \end{array} } \right|\), \(\gamma_{2} = \left| {\begin{array}{*{20}c} {\delta_{0} } & {\delta_{1} } \\ {\delta_{3} } & {\delta_{2} } \\ \end{array} } \right|\).

The equilibrium point \(E_{8}\) is locally asymptotically stable in the region composed of inequalities (11). In this paper, the stability domain of the system is given in the numerical simulation part.

5 Numerical simulation and result analysis

According to the above analysis, the adjustment of direct collecting price of the three manufacturers effects the stability of the system. When the collecting price is adjusted by small amplitude, the system can be ensured to be stable. However with the increase of the proportion of adjustment, the system will bifurcate and gradually enter into the chaotic state. If any one or two of the three manufacturers make a big adjustment to the direct collecting price, it will not cause the system into chaos. The chaos is caused by the adjustment of these three manufacturers at the same time. In order to study how the adjustment will affect the stability of the system, the main research method is to analyze the three-dimensional stable domain. Besides, we can also use three-dimensional or two-dimensional bifurcation diagram to study how the adjustment of the direct collecting price by other manufacturers affect the stability of the system and how the manufacturer’s profit changes when one or two manufacturers keep the price constant.

In order to further understand the specific dynamic evolution process of the system, this section uses numerical simulation and two-dimensional bifurcation diagram to analyze the stability domain, the period doubling region and the chaotic region of the system. We use the maximal lyapunov exponent to verify the bifurcation characteristics of the system. Then we elaborate the influence of each variable parameter on the system dynamics and stability domain in detail. The relevant conclusions are drawn to guide the price game of enterprises.

We fixed the values of each parameters: \(a = 0.9,\,b = 1.1,\,c_{1} = 0.17,\,c_{2} = 0.15,\,c_{2} = 0.13,\,e_{1} = 0.4,\,\,e_{2} = 0.6,e_{3} = 0.5,p_{0} = 1.5\). First, the three-dimensional trend graph of the system stability domain changing with the price adjustment parameters \(\alpha_{\text{i}} (i = 1,2,3)\) of various enterprises can be simulated by the inequalities (11).

From Fig. 2, it can be seen that the system stability domain is concentrated in a range of \(\alpha_{\text{i}} < 2,(i = 1,2,3)\). In other words, when \(\alpha_{\text{i}} (i = 1,2,3)\) are small to a certain degree, the system (6) will be stable. When any enterprise’s price adjustment parameter is too large, the system will be out of stable and become chaotic.

Three-dimensional stability domain of system (6)

In system (6), the decision-making rules of the three oligopolies are all bounded rationality and the demand function and cost function of the three enterprises are in the same form. Therefore, their price adjustment parameters have similar effects on the system in essence. So this section only discusses the effect of one manufacturer’s price adjustment parameter on the system complexity. The influences of the other two enterprises’ price adjustment parameters are not repeated here. First, the stable domain of the system changing with \(\alpha_{1} ,\alpha_{2}\) is obtained when \(\alpha_{3} = 1\). The corresponding regions are {1.838, 0.1587} and {0.3114, 1.686}.

From Fig. 3, it can be seen that when manufacturer 3 keeps the direct collecting price, the adjustment coefficient of manufacturer 1 changes on the interval (0.1587,1.838) and the adjustment coefficient of manufacturer 2 changes on the interval (0.3114, 1.686), the system will still be in the stable state. Once the adjustment coefficient of manufacturer 1 or 2 is out of the corresponding interval, the system will enter into chaos. In other words, if the price adjustment of one manufacturer is too large, the whole recycling market will enter into chaos.

Two-dimensional stability domain of system (6) when \(\alpha_{3} = 1\)

Besides, it can also be obtained from Fig. 3 that when \(\alpha_{3} = 1\) the stability domain of the system is \(0 < \alpha_{1} < 1.838\) and \(0 < \alpha_{2} < 1.686\). All price adjustment parameters of enterprises taking any combination of values within this range will make the system reach the Nash equilibrium. Meanwhile, in order to analyze the influence of price adjustment parameter on system complexity, it can be seen from Fig. 3 that when \(\alpha_{2} = 1\), the range of \(\alpha_{1}\) making system stable is \(0 < \alpha_{1} < 1.829\).

When the adjustment parameters take the value of 1.829, 1.001, 1 respectively, other parameters keep the above values and the optimal price of manufacturer 3 is \(p_{3}^{*} { = }0.51\), the profits of the three manufacturers changing with the collecting prices of manufacturer 1 and 2 are shown in Figs. 4, 5 and 6.

From Figs. 7, 8 and 9, it can be seen that when the collecting price of the third enterprise changes, the flip bifurcation appears. Bifurcation means the decision variable amount being two and even more. Too many decision would confuse the players in this system, because they would not know how to make the decisions, and which is the best decision. The different collecting prices of the three enterprises lead to the different bifurcation point of the system. The comparison among Figs. 7, 8 and 9 shows that when \(p_{3}\) takes the optimal value of 0.51, the first bifurcation point of the system is the maximum. In other words, the stability region of the system is largest when \(p_{3}\) takes the optimal value of 0.51.

The color corresponding to the period doubling of Figs. 7, 8 and 9 is shown as Table 1.

Figures 10, 11 and 12 describe the two-dimensional bifurcation of the system which show that the system is first in a stable state when the price of manufacturer 3 is fixed and the price adjustment speeds of the other two manufacturers increase from 0. When the price adjustment speed increases to a certain value, the system the first bifurcation appears. As the price adjustment speed continues to increase, the system enters the second bifurcation. The number of bifurcations increases gradually until the system enters chaos. The blue line represents the first enterprise’s collecting price and the green line represents the second enterprise’s collecting price. We can see that the collecting price of the second enterprise is always larger than that of the first enterprise no matter how the value of \(p_{3}\) changes. This is corresponding to Figs. 4, 5 and 6 in which when \(p_{3}\) takes the optimal value, the profit of the second enterprise is larger than the first one.

The Lyapunov exponent of \(\alpha_{1}\) is shown in Fig. 13 when the third enterprise selects the optimal collecting price. Lyapunov exponent represents the degree of separation of two close initial values running forward according to a certain mode from the same time. The maximal Lyapunov exponent can be used to determine whether the system enters chaos. When the system is in a stable state, the maximal Lyapunov exponent of the system is negative. When the system gradually enters into chaotic state, the maximal Lyapunov exponent of the system becomes positive.

The Lyapunov exponent of \(\alpha_{1}\) corresponds to a period bifurcation point in Fig. 10 respectively when it returns to the 0 axis. As shown in Fig. 13, when the Lyapunov exponent of \(\alpha_{1}\) first returns to the 0 axis, the system reaches the two times period bifurcation point. When it returns and passes through the 0 axis for the third time, the system begins to reach the four times period bifurcation point. When it returns and passes through the 0 axis for the fourth time, the system falls into the chaotic state. Similarly, when the Lyapunov exponent of \(\alpha_{2}\) moves and shuttles around the 0 axis, the system will also gradually enters into chaotic state, not repeated here.

Comparing Fig. 13 with Fig. 10, we can find that the stability domain, bifurcation area and chaotic region of the system correspond to each other.

In addition, we are curious about the results for the triopoly circumstance with the change of parameters. Hence, we investigate this game modelling by sensitivity analysis in this section which is widely used in corelative researches. Based on the benchmark, each price coefficient factor will be switched to − 50%, − 25%, + 25% and + 50%, to find some valuable results. We collect all the results into Table 2 as follows. From the observation of Table 2, we can find that all the three prices will increase with the rise of price coefficient factor in the range excepting f12. Besides, the prices are extremely depended on the price coefficient factor.

6 Extension

In this section, we consider a more competitive market, with \(n \in N^{ + }\) players. They collect waste products for remanufacturing them to meet the demand. Denote a new parameter \(f_{\text{ij}}\) to replace the price efficiency, which represent the efficiency between player i and player j (\(i \ne j\;{\text{and}}\; i,j \in n\)). Thus, based on the above model, we can obtain the collecting amount of manufacturer i:

Since we get the collecting amount, the profit equation could be easily derived:

Also, calculate the first-order condition on the profit function for player I, getting:

For simplification, let \(\phi_{i}\) replace the constant part:

Hence, we can get the following functions due to the Nash equilibrium:

Due to the complexity of Eq. 16, the solution could not be shown directly. However, we can know \(p_{i}^{*} = f\left( {\phi_{i} ,b,f_{\text{ij}} } \right),\;i \ne j\;{\text{and}}\;i,j \in n\).

7 Conclusion

This paper constructs a triopoly closed-loop supply chain game model consisting of three manufacturers in the background of circular economy. In this model, the three manufacturers are all independent decision-makers. Based on bounded rationality decision, this paper establishes dynamic model of the system and analyze the dynamic evolution process of the system. With the aid of three-dimensional graph, parameter field graphs and bifurcation graphs, the complexity of the system has been investigated, including bifurcation and chaos. We reach the following conclusions:

-

1.

The stability region of the system is probably concentrated in a certain range. A too large price adjustment parameter of any enterprise will make the system out of stable and fall into chaos. Hence, this paper will insight the decision makers so that they can avoid to adjust irrationally.

-

2.

When the price of an enterprise is fixed to the optimal price, the profit of this enterprise has a linear correlation with the price of the other two enterprises, while the relationship between the profit of the other two enterprises and their own price is quadratic.

-

3.

When the enterprise’s collecting price changes, the system’s period doubling bifurcation appears flip bifurcation. The different collecting prices lead to the different bifurcation points of the system.

For further research, we provide some possible research directions:

-

1.

In this paper, we assume all the manufactures have the complete information. However, complete information will not always appear in practice. Hence, this model could be extended into an information asymmetry circumstance.

-

2.

In this paper, we assume all the waste products are collected by manufactures directly. However, some retailers are also responsible for collecting waste products from the consumers, and then sell back to the manufactures in real world. Thus, the model could also be extended including retailer behaviors in a close-loop supply chain.

References

China Household Electrical Appliances Research Institute (2016) White paper on recycling and comprehensive utilization of waste electrical and electronic products in China. www.weee-epr.org. Accessed 24 May 2017

Dai D, Si F, Wang J (2017) Stability and complexity analysis of a dual-channel closed-loop supply chain with delayed decision under government intervention. Entropy 19(11):577

Ding J, Mei Q, Yao H (2012) Dynamics and adaptive control of a duopoly advertising model based on heterogeneous expectations. Nonlinear Dyn 67(1):129–138

Fang C, Liu X, Pei J et al (2016) Optimal production planning in a hybrid manufacturing and recovering system based on the internet of things with closed loop supply chains. Oper Res Int J 16(3):543–577

Gan SS, Pujawan IN, Suparno, Widodo B (2016) Pricing decision for new and remanufactured product in a closed-loop supply chain with separate sales-channel. Int J Prod Econ 190:120–132

Genc TS, De Giovanni P (2018) Optimal return and rebate mechanism in a closed-loop supply Chain game. Eur J Oper Res 269:661–681

General Office of the State Council (2016) Circular of the General Office of the State Council on the implementation of the extended producer responsibility system. http://www.gov.cn/zhengce/content/2017-01/03/content_5156043.htm. Accessed 2016

Georgiadis P, Athanasiou E (2013) Flexible long-term capacity planning in closed-loop supply chains with remanufacturing. Eur J Oper Res 225(1):44–58

Guide VDR Jr, Jayarman V, Linton JD (2003) Building contingence planning for closed-loop supply chains with product recovery. J Oper Manag 21(3):259–279

Guo YH, Ma JH (2013) Research on game model and complexity of retailer collecting and selling in closed-loop supply chain. Appl Math Model 37(7):5047–5058

Guo YH, Ma JH, Wang GH (2011) Modeling and analysis of recycling and remanufacturing systems by using repeated game model. Ind Eng J 14(5):66–70

Gutgutia A, Jha JK (2018) A closed-form solution for the distribution free continuous review integrated inventory model. Oper Res Int J 18(1):159–186

Jin CF, Cao EB, Lai MY (2012) Analysis on green marketing strategy of duopoly retailing market based on the evolutionary game theory. J Syst Eng 27(3):383–389

Li X, Yibiao W (2015) Differential price closed-loop supply chain under the government replacement-subsidy. Syst Eng Theory Pract 35(8):1983–1995

Ma J, Wang H (2014) Complexity analysis of dynamic noncooperative game models for closed-loop supply chain with product recovery. Appl Math Model 38(23):5562–5572

Ma WM, Zhao Z, Ke H (2013) Dual-channel closed-loop supply chain with government consumption-subsidy. Eur J Oper Res 226(2):221–227

Ma J et al (2018) Research on the complexity and chaos control about a closed-loop supply chain with dual-channel recycling and uncertain consumer perception. Complexity 9:1–13

Ministry of Commerce (2017) China regenerated resource recycling industry development report 2017. Resour Regener 2017(5):16–25

Qiang Q, Ke K, Anderson T et al (2013) The closed-loop supply chain network with competition, distribution channel investment, and uncertainties. Omega 41(2):186–194

Wang Q (2015) A Sino-American comparative research on extended producer responsibility of e-waste management. Central South University of Forestry and Technology

Wang W, Da QL, Nie R (2011) The study on pricing and coordination of closed-loop supply Chain considering channel power structure. Chin J Manag Sci 19(5):29–36

Xie L, Ma JH (2016) Study the complexity and control of the recycling-supply chain of China’s color TVs market based on the government subsidy. Commun Nonlinear Sci Numer Simul 38:102–116

Yi Y, Yuan J (2012) Pricing coordination of closed-loop supply chain in channel conflicts environment. J Manag Sci China 15(1):54–65

Zhang XM, Zhao M, Dan B (2013) Dynamic competition strategy of duopoly manufacturers with bounded rationality and service differentiation. Ind Eng J 16(4):28–32

Zheng Y, Shu T, Wang S et al (2016) Analysis of product return rate and price competition in two supply chains. Oper Res. https://doi.org/10.1007/s12351-016-0273-6

Acknowledgements

The authors would like to thank the reviewers for their careful reading and some pertinent suggestions.

Funding

Funding was provided by National Natural Science Foundation of China (Grant No. 71571131).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no conflict of interest regarding the publication of this paper.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Ma, J., Zhu, L. & Guo, Y. Strategies and stability study for a triopoly game considering product recovery based on closed-loop supply chain. Oper Res Int J 21, 2261–2282 (2021). https://doi.org/10.1007/s12351-019-00509-w

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12351-019-00509-w