Abstract

This study involves an optimum balance between ordering cost reduction and product deterioration in controllable carbon emissions for a sustainable green warehouse. The sensitivity analysis is to simulate the impact of those attributes. Industries are foraging to find a proper balance between the use of fossil fuels and reducing carbon emissions, as burning fossil fuels is also indispensable for industrialization. Carbon can emit through inevitable logistic activities in the chains (e.g., lighting, heating, air-conditioning, product deterioration). An industry always attempts to curb those emissions through energy-efficient green technology. The green warehouse is a popular store system in present supply chains to limit the carbons. Product deterioration, particularly for perishable items, is also important for a practitioner to decide how to preserve a perishable product for maximum shelf-life. There is a common tendency among industries to increase order frequencies and volumes in search of a better preservation strategy, increasing the ordering cost and the probability of carbon emissions due to increased transportation. A realistic mathematical model is proposed based on those decision parameters by a sensitivity analysis to demonstrate the impacts. The results showed an increase of 46.30% profit is achieved when all three proposed reduction attributes, but shortages are considered. This improvement is significant without shortage, whereas the increased profit is 94.75%.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

The challenge is to ensure optimal balance between the natural environment and production capacity by efficiently utilizing renewable resources and respecting local communities. Prior studies showed one major interpretation of sustainable developments (SD) studies is the lack of clarity regarding its definition and applicability in the last decade (Shamsuddoha, 2015; Pohlmann et al., 2020). Increasing concern about climate change and natural resource depletion has instigated the SD concern. Essentially, natural environments and social equity are increasingly becoming the two foremost pillars for industry; while the onus is on the firms to safeguard natural environments, social equity is also being asked in their everyday chores (Tavassoli & Saen, 2022; Vachon and Mao, 2008). SD realms span from public policies and international trade to economic growth and are linked to the supply chain, i.e., natural environments and social impacts are analyzed in isolation (Centobelli et al., 2020; He et al., 2020; Nahr et al., 2020).

Inarguably, linking supply chain strength considering social, economic, and environmental dimensions is a daunting task and challenging for practitioners. The growing consideration paid to sustainable manufacturing has been directed to improve logistic models by minimizing internal and external costs of logistics. Prior studies focus on reducing the carbon footprint on logistics accomplishments when external expenses are rarely considered and involve carbon emissions for perishable products in inventory management (Venkat, 2007; Hua et al., 2016; Poursoltan et al., 2021). A proper balance among social, economic, and environmental dimensions remains a dilemma. For instance, a warehouse needs to increase the number of deliveries for their raw materials and finished goods, which incurs higher transportation costs to increase production capacity and manufacturing quantity. (Andiappan et al., 2021; Ansari et al., 2020), As a result, the transportation increases result in more greenhouse gas (GHG) emissions to hamper environments.

Industries take to green the whole supply chain system, spanning from raw material delivery to finished goods transportation toward environmental sustainability (Battini et al., 2014). It needs to find ways to reduce carbon emissions from production-based problems to ensure environmental sustainability (Tseng et al., 2020). In addition to CO2 emissions from transportation, excessive burning of fossil fuels and deforestation are generated by urbanization to ensure climate change and global warming (Cholette and Venkat, 2009; Mtalaa et al., 2009). A proper strategy to reduce the rate of emissions is pivotal for an SD (Ansari et al., 2020; Jaiswal et al., 2019). Recently, due to technological advancement and globalization, many strategies have been taken to ensure carbon emission reduction. Many industries have used carbon capture, cap-and-trade, carbon offset, and cap and tax in recent days to curb emissions. However, some industries are not encouraged to modify their ways.

One of the most serious flaws in the cap-and-trade system is to encourage companies that are most reliant on fossil fuels to continue harming the environment. There is no incentive to switch to renewables or become more inventive due to the needed price has no influence. As a result of the maximum caps, the government collects more money, but no serious effort is made to reduce carbon dioxide or other glasshouse emissions. Some corporations may be enticed to cheat by cap-and-trade schemes. This arrangement can help corporations comply, but it also encourages them to game the system. Agencies can continue to pollute, as usual, diverting attention away from the larger goal of saving the world for future generations. In a cap-and-trade system, it is not uncommon for agencies to request extensions or greater room under the cap in order to maintain their commercial prospects. Continual updates to the program that allows more pollution would depreciate the value of the trade mechanism, putting this alternative on the verge of failure. The implementation costs would be extremely high. Cap-and-trade systems can only work globally if every country participates in programs that operate within the same framework and context. When one country allows higher levels of pollution than another, the number of glasshouse gas emissions that are released into the atmosphere each year may be insignificant. Despite these disadvantages of the mentioned strategies, green technology can only work efficiently with a minimum drawback in modern days green supply chain to limit the emissions (Mashud et al., 2021; Mishra et al., 2020a; Mishra et al., 2021; Datta, 2017).

GHG emission happens due to the disposal of deteriorated products and many other reasons, while deterioration is common for perishable items. Product deterioration has significant social and environmental impacts along with its outstanding economic aspects. (Jouzdani and Govindan, 2020). Fundamentally, if the quality of the product deteriorates, its functionality diminishes, or values decrease over time, that product is contextualized as a perishable product (Amorim et al., 2013). The preservation of perishable items has a significant connection with GHG emissions. It is a natural behavior that applies vastly to agronomic products, food items, capricious liquids, perfumes, pharmaceutical products, radioactive substances, electronic components, gasoline, and photographic films (Jouzdani and Govindan, 2020). Manufacturers should develop suitable preservation technology to control GHG emissions (Mishra et al., 2019). For example, the deterioration rate of ice cream condensed by keeping the item in a deep fridge or by using ice. Incorporating a cool supply-chain policy can diminish the deterioration rate of certain fruits items. The cost of preservation technology is expensive; however, it attempts to reduce the total preservation costs while ensuring the expected profit margin. Studies showed effective ways of preserving products to lengthen their lifetime. Integrating the concept of product deterioration factor into the green policy is ignored.

The usual practice is increasing the order quantity and frequency to minimize product shortages or unavailability of raw material. However, each order brings transportation costs, managerial costs, and others. In addition to those costs, increased order frequency and quantity also result in increased transportation numbers and subsequently escalating GHG emissions. Unsatisfied customers in the dynamic demand pattern and unforeseen buying behaviors due to product shortages may leave the brand or switch to other products to escalate further firms’ losses (Finco et al., 2022; Mashud et al., 2020). Firms take proactive measures to stop that shortage from happening. After transportation the products, the retailer needs a considerable amount of ordering cost to finish the purchase appropriately and reduces GHG emissions by using green technology. The parameters involved in this study are product deterioration and ordering costs in controllable CO2 emissions. From a sustainable perspective, designing a supply chain strategy by an isolated consideration of green policy or even green policy and preservation technology may not include all factors associated with environmental impacts (Mishra et al., 2020a).

Reducing carbon emission and deriving for economic order quantity (EOQ) model or a sustainable inventory model has been involved in a recent and challenging research domain (Mishra et al., 2020a; Poursoltan et al., 2021). This study tried to bridge this gap and is motivated by the necessity of consolidating SD concerns with the EOQ model and derives an EOQ model with the concentration on reducing ordering cost, impacts of green policy and deterioration of products. Carbon emission and green policy are considered and along with a consideration of green technology investment. This study deliberates that the customer’s impatience factor depends on the waiting time to minimize the impact of shortages due to reducing ordering costs. The total demand during the stock-out period is either lost or backlogged, and this is allowed deficits with partial back ordering as an important assumption. The objective is to derive a sustainable inventory model considering product shortage and preservation technology of perishable items for a controllable CO2 emission green warehouse industry. The contributions of this study are mainly in four folds:

-

This study shows how optimal replenishment time may vary during the business and how it impacts the other model attributes.

-

It shows how green investment reduces carbon emissions to the environment produced due to logistics activities.

-

The proposed model provides insights into how the deterioration of products impacts the total profit and how one can control the deterioration by implementing preservation technology.

-

This study proposes a model for a sustainable inventory system for the industry by simultaneously integrating product deteriorations, ordering cost reductions, green policy, and shortages into an inventory model and shows how they contribute to the proposed model with fluctuations of each parameter individually or combined.

This study’s remaining section is prepared as follows: The “Literature review” section delivers a literature review about inventory models and green policy integration with the inventory models. The problem background, notations, and assumptions are described in the “Problem definition” section, while the “Mathematical formulations” section discusses the mathematical formulation of the model, and its associated theoretical derivations have been discussed in the “Theoretical derivation” section. The “Case study and numerical illustrations” Section provides computational experiments with a case study for model validation, the “Results analysis” section represents discussions of results, the “Sensitivity analysis” section highlights the sensitivity analysis of the model, and the “Managerial Insights” section leads a few managerial insights. Finally, the “Conclusions” section presents the concluding remarks with a narration of possible future studies.

Literature review

The literature review section reviews four main streams of sustainable greenhouse firms. The streams are the SD concept in sustainable inventory management, the concept of product deterioration reduction (preservation technology), the ordering cost reduction, and finally, the impacts of inventory system shortages. These four main pillars of the literature represent our model. At the end of the literature review, some striking sentences are provided to reflect the validation of the proposed model with the combination of these emerging issues. A summary of existing literature is provided in Table 1 to show the difference between the proposed and existing models.

Sustainable inventory management

Bonney and Jaber (2011) included SD on the EOQ model and asserted the importance to the economic and environmental point of view but lags in social aspects. Soleymanfar et al. (2015) deliberated a model for the sustainable lot-sizing problem under partial backorder shortages and presented a lot-sizing problem that later transferred all the emissions in a tangible matrix to show the model’s superiority. Xu et al. (2016) incorporated the cap-and-trade policy in the lot-sizing model to curb emissions. Hariga et al. (2017) derived an integrated model with economic and environmental policy for the temperature-controlled supply chain model but ignored the social issues. Taleizadeh et al. (2018) developed an economic production quantity model with SD and shortages with obsolescence in production and proposed four different models concerning SD and shortages. Tayyab et al. (2019) developed a sustainable model for a multi-item, multistage textile production system. They claimed a 3.29% reduction in total cost by investing 86% for defective items and 14% for setup cost reduction. Mishra et al. (2020) evolved a closed-loop supply chain model with cap-and-trade policy and waste management and tried to make the system more profitable, while Ghosh et al. (2017) anticipated carbon cap policy in a lot-sizing problem. Prior studies claimed both SD and inventory issues and highlighted the potential impacts of not implementing SD in inventory management. The possible way is to desegregate SD philosophy into proper inventory management. Mishra et al. (2019) added an attribute called environmental emission. Yet, this study illustrates a specific source of environmental emissions to improve the prior study, such as transportation, lighting, heating, air-conditioning, and product deterioration. In addition, Mishra et al. (2019) involved a non-linear holding cost. On the contrary, this study considers a linear holding cost, which is more realistic than non-linear because the price of the products varies according to the holding cost of the products.

Carbon emission lessening has become a global contest for industries worldwide (Ansari et al., 2020; Finco et al., 2022; Jaiswal et al., 2019). Food wastage is also a big contributor to GHG emissions in the global economy. According to an FAO assessment in 2011, the total amount of carbon emissions to the environment is approximately 3.6 Gt CO2 (See Fig. 1) without counting deforestation. This amount is further raised to 0.8 Gt and equivalent to 4.4 Gt CO2 per year. If food wastage were a country, it would become the third-highest carbon-emitting country in the world, according to Fig. 1.

Considering the production system, Hammami et al. (2015) vested in a multi-echelon production-inventory model for carbon emissions with a cap-and-trade policy and lead time constraints; as a result, carbon emissions from transportation have applied the cap policy first then the trade.

Hou et al. (2016) developed an integrated inventory model with imperfect quality and environmental impact and claimed that the model is useful particularly for inventory systems where the vendor and the buyer form a strategic alliance for profit sharing. Zhang (2019) derived a model and determined which policy is more effective for carbon reduction in all industries. Many studies on carbon cap policy are related to external carbon emission control systems rather than coagulating within the inventory management strategies to minimize carbon emitted products (Ansari et al., 2020; Hammami et al., 2015). This study argues that the carbon emissions control policies for the business profitability and a better carbon-free environment.

Preservation technology

In addition to this green policy and carbon emission reduction measures, deteriorating inventories is another primary concern among practitioners and researchers, mostly due to a few items’ perishable nature. For instance, due to the high uncertainty in demand, the retailer cannot guarantee that deteriorating items are sold before it deteriorates entirely. Thus, preservation technology is often beneficial for the retailer to prevent product deterioration and, consequently, the retailer’s profit. Dye (2013) and Mashud et al. (2019) concentrated on different deterioration types, including variable and constant, whereas both presented their model focusing on non-instantaneous deteriorating items while Teng et al. (2016) and Taleizadeh (2014) presented their model for deteriorating items with an advance payment system. These studies showed that every product has a fresh lifetime; maybe the time is short; in that period, the products have no degradation in quality or quantity. Earlier Goyal and Giri (2001) presented a brief survey on deteriorating items over a decade in inventory management. Both have tried to control the deteriorating items by implementing preservation technology. To lessen the deterioration rate for food and medicine items, Pervin et al. (2020) derived a deteriorating model with preservation technology with stock and price-sensitive demand. The model would maximize the profit, and the amount for preservation technology is minimum concerning optimal cycle length. Combining preservation and carbon emission reduction, Sepehri and Gholamian (2021) presented a lot-sizing model. They argued that cap-and-trade policy effectively curbs emissions and discovers pricing strategies in that model. However, some countries worldwide still suffer from implementing cap-and-trade policy strategies due to the weak regulatory administration. But some industries want to follow some regulations to reduce carbons. Hopefully, these attempts fill gaps with the proper use of green technology, which does not need to be controlled by any authority but by the owner.

Ordering cost reduction

In a classical inventory model, setup or ordering cost is assumed to be a fixed, constant, and uncontrollable variable. However, in practice, the ordering cost is controlled. It is essential for sustainable inventory management because due to the businessman’s volatile nature in the retailing business, it is a prerequisite to reserve some money as an ordering cost that ensures completing the order and helps the supplier to run the business smoothly. Sometimes in an integrated inventory model, the retailer is willing to provide ordering costs to a supplier collaboratively to reduce the turnover of the supply chain (Glock, 2012; Nahr et al., 2020; Poursoltan et al., 2021; Tavassoli & Saen, 2022). Tahami et al. (2016) proposed an integrated inventory model with ordering cost reduction and controllable lead time by applying a just-in-time policy. Kim and Sarkar (2017) formulated an inventory model with multistage quality improvement, which led to time-dependent ordering costs. But it lags to design for multistage supply chains with environmental issues. Dey et al. (2019a) utilized the concept of discrete investment to reduce setup costs and improve the quality of products and the contemplation of environmental impacts in an integrated inventory model. Later, Dey et al. (2019b) proposed a continuous investment in reducing the whole production systems setup cost and a discrete investment for ordering cost reduction. Tiwari et al. (2020) recently provided an integrated inventory model with setup cost reduction. The study showed that a setup cost reduction could significantly intensify the profit by balancing the relations to other chain attributes.

In most cases, ordering cost reduction was addressed through some capital investment, but the important thing that was missing was environmental issues. It is commonly observed that for a bigger lot, huge amounts of carbon are emitted daily in retailing business through transportation or holding of products, which is not highlighted in previous studies. Moreover, managing a more substantial amount of inventory is closely related to the lot size, which is closely associated with products’ transportation.

Involving shortages

The shortage is a natural phenomenon and happens in real life for a certain situation, and it has a significant value for the inventory model. Shortage always negatively impacts the customer, and they usually leave the system, except for some fashionable items. In contrast, some customers may like to wait for the next slot. But the willingness diminishes with increasing the waiting time. Hence, a detailed analysis of this system has been developed by (Papachristos and Skouri, 2000; Yang, 2005; Teng et al., 2007). Taleizadeh et al. (2018) anticipated a sustainable economic production quantity model with stock-out situations. It illustrates four cases based on real-life problems and shows the difference between shortages. Recently, Khan et al. (2020) presented that the perishable product is under partial shortages and considers two models based on shortages; one is partially backlogged, and another is without shortages. Optimum management among deterioration and reduced carbon emissions has been correlated in a sustainable supply chain model and argues that a proper green technology can significantly reduce carbon emissions for both with and without shortage cases. Mashud et al. (2020) formulated a sustainable two-warehouse problem with an advance payment scheme and a partially backlogged shortage. It provides a portion of demand that is partially backlogged when stock-out situations happen. While most of the existing works had considered customer’s impatience factor depends linearly on the waiting time due to shortages; however, in practice, this impatience factor depends exponentially on the waiting time, which needs further attention for advanced research.

In summary, while most of those existing works have attempted to reduce emissions by applying different green policies (cap-and-trade, carbon offset etc.), however, very few of them have considered the deterioration of the product. However, despite the necessity of considering green policies, product deterioration, preservation technology, product shortages, and ordering cost reductions significantly impact the recent sustainable supply chain. In contrast, surprisingly, there has been no work on such a combination yet, which instigates this research work and is claimed as a major contribution stemming from this study.

Problem definition

A retailer-customer relationship is presented through the projected model, where the retailer’s primary purpose is to serve the customers better and increase the profit. The retailer makes orders to purchase the desired products from the manufacturer and sells them to customers at retail prices. So, replenishment is considered instantaneous. But the delivery system is continuous, and no gaps are created due to the strong interrelation between the supplier and the retailer. In this case, the lead time is ignorable. Here, the ordering cost is controlled by the manufacturer on investing capital. Upon receivable of the manufacturer’s purchased products, the retailer has to store them in the warehouse until they are sold. Since the customers’ demand depends on many factors, the retailer used a deterioration-protected technology to protect from erosion during this time. Using preservation technology, the rate of deterioration is reduced by using the function, x(λ) = e−bλ, which satisfies \(\frac{\partial x\left(\lambda \right)}{\partial \lambda }<0,\frac{\partial^2x\left(\lambda \right)}{\partial {\lambda}^2}\) Here, λ denotes the investment and b the sensitive parameter of investment (He and Huang, 2013; Mishra et al., 2018).

Moreover, sometimes the sale of products may go faster than the retailer thoughts, a shortage often occurs, and the retailer needs to backlog some items from the next lot to fulfil the customers’ demand. So, in the proposed model, this realistic assumption is also considered. If w > 0 be the backlogging parameter, then the rate of partial backlogging is determined as e−w(L − t) and (L − t)denotes the waiting time for the latter replenishment (Tiwari et al., 2018).

As evident, carbon emissions are prone to occur during the holding and transportation from suppliers to retailers and retailers to end customers. So, it has adverse impacts on the environment. Considering these emerging issues, it is obvious to obey the government rule, e.g., cap-and-trade policy, emission trading, Carbon Offset policy, etc. However, some countries, e.g., Bangladesh, are still suffering from creating such type of rule and its implementation. Thus, in these countries, reducing carbon emissions by using green technology is a popular tool for a cleaner supply chain. To reduce carbon emissions, green technology is considered to reduce carbon emissions (motivated by Lou et al., 2015; Datta, 2017). This green technology needs capital investment to improve its efficiency of technology and diminish emissions. This model’s main target is to show how a retailer can generate maximum profit by investing less in ordering costs, preservation costs, and the costs associated with implementing green technology. Some notations are used to accomplish the whole model in a harmonic way (placed in Appendix C).

Mathematical formulations

Three significant elements are taken into concern for the proposed model: preservation technology, investment in the reduction of ordering cost, and green technology. As shortage plays a significant role in the daily supply chain system from retailing perspective, considering the importance, the model’s profit for each situation is discussed below.

Case I (inventory system considering shortage)

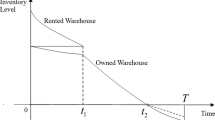

Figure 2 delineates the nature of the inventory system during the cycle [0, L] In the initial phase; the retailer has Samount of product in stock. As observed in Fig. 2, the inventory level decreases with time due to product decay and customer demands. At the time t = L1,the stock goes blank, and a shortage arises during the interval [L1, L]. To compensate for this shortage, the retailer makes a new order to re-stock the product of Y quantity.

with I1(L1) = 0 = I2(L1), I1(0) = S, I2(L) = − Y

By solving Eqs. (1) and (2) with boundary conditions, we get

At t=0, I1(0) = S the initial inventory for the chain is

At t=L, I2(L) = − Y, the maximum shortage is

Now total order quantity per cycle

The earnings that a seller earns from the selling of his products during certain period is called sales revenue. The total sales revenue is written as

Ordering cost represents the cost associated with making and processing an order for a certain amount of product to the supplier. Ordering cost per cycle is,

In order to purchase a product, the retailer has to spend the money decided by the supplier based on the quality or level or price of the product. If cpr indicates the purchase cost per unit and Q the order quantity, then the purchasing cost per cycle is written as

Holding cost is the expense of storing and managing products securely in a certain location, such as a warehouse, until the stock becomes zero. If chl indicates the holding cost per unit, then the holding cost per cycle is written as

When product supply is low and fails to meet customer demand from the stock within a specified lead time, a shortage of the product occurs. If csr indicates the shortage cost per unit, then the shortage cost per cycle is written as

Transportation cost involves the associated expenses of delivering ready products to the customer. If g is the fixed part of the transportation cost (e.g., expenses related to roads (toll, tax fees), loading and unloading fees) per trip, h the variable part of transportation cost per trip, m denotes the per unit weight of the transported item, and d is the per distance travelled, the total number of trips is n1, then the transportation cost per cycle is as follows.

During the time of holding products in the warehouse, some of them begin to degrade over time and are no longer suitable for sale. To prevent deterioration, preservation technology is projected, which makes an investment. Preservation cost per cycle is addressed as follows.

Carbon emits due to lightning, heating, air-conditioning, and product deterioration while holding the product in the warehouse. During transportation, burning fossil fuel from trucks also generates carbon emissions. If ef and ev denote respectively the fixed and variable carbon emission factor per inventory, m is the weight of product, ε the excess progressive tariff per unit carbon emission, d the distance, n2 the number of gallons, et the amount of GHG emissions from one gallon of diesel truck fuel, and Tx be the carbon emission tax, then the carbon emission cost per cycle is written as,

From Eqs. (8) to (15), the total profit per cycle is derived as,

Considering the investment in ordering cost reduction

Ordering costs are to reduce by investment and play an important role in increasing the profit of the retailer. To reduce ordering cost, an expression v(F) = e−δFis used, which satisfies \(\frac{\partial v(F)}{\partial F}<0,\frac{\partial^2v(F)}{{\partial F}^2}>0\)where δ(>0)is a constant parameter and Fdenotes the investment (motivated by Sarkar et al., 2016). Investment in ordering cost reduction per cycle is shown in Eq. (17).

By using Eq. (17) in Eq. (16), one can write the total profit per cycle as,

Considering the investment in carbon emission reduction

Carbon emission occurs during the holding and transportation of products. This emission can be reduced by using green technology, where a certain amount of investment is made, as earlier used by Lou et al. 2015 and Datta 2017. The fraction of reduction of average emission is defined as Z, which isZ = ζ(1 − e−rK). When K = 0, Z becomes zero, which means there is no investment. WhenK ⟶ ∞, Z tends to ζ, where ζrepresents the efficiency of greener technology in reducing emission. Then the green investment cost per cycle is,

Adding the GIC per cycle to Eq. (18), the total profit per cycle becomes,

Case II (inventory system without shortage)

In this case, the inventory starts with the total Q = S units of ordered products. Over time, as product sales increase according to customer demand and at the same time, the deterioration of goods also increases, so during the cycle[0, L], the inventories begin to decline and run out att = L. Figure 3 illustrates the nature of the inventory system over the length of the entire cycle.

The differential equation that represents the state of the inventory system during the interval [0, L] is as follows:

\(\mathrm{With}\;I_3(0)=S,I_3(L)=0\)

Solving Eq. (21) with boundary conditions, we get

At t=0, I3(0) = S the initial inventory for the chain is

The sales revenue for this inventory is

The purchasing cost per cycle is

The holding cost per cycle is

Taking the other costs as like as case I, excluding the shortage cost, the total profit per cycle becomes

Theoretical derivation

In this section, a theoretical derivation for the proposed two cases is presented one by one. First, in the “For case I (considering shortage)” section, the theoretical derivation for case I (with Shortage) is given, and the “For case II (without considering shortage)” section presents the theoretical derivation for the without shortage case (case II).

For case I (considering shortage)

The theoretical derivations set out in this section prove the profit function’s concavity. The critical points for which the profit function behaves concave should be figured out. We use the necessary concavity condition by differentiating the profit function represented by Eq. (20) concerning the decision variables (F, K, L) and then setting those derivatives to zero to obtain the required critical points.

where

Now solving Eqs. (21), (22), and (23), we get

Where

Since the profit function is highly non-linear, it is difficult to prove the concavity regarding all decision variables, as usual. Therefore, in this section, it is proved by imposing some conditions.

Proposition 1. For any fixed Kand L, ϕ(F, K, L)is a pseudo-concave function of ordering cost reduction investment F, if δ > 0 and hence there exists a unique optimal investment F which characterized as

Proof: Let us take the first and second-order partial derivatives of the profit function in Eq. (20) with respect to F; one gets

To get the optimum solution, expand the result of Eq. (34) in Taylor’s series (taking the first two terms), then set this to zero, and after some manipulation, one gets

\(F\cong \frac{1}{\delta}\left(1-\frac{L}{\delta {O}_{rd}}\right)={F}^{\ast }\), which is the optimal point where one can get the optimum value of the retailer’s profit function. If the value of δ < 0, then the value of F becomes negative, which is not acceptable as F is considered an investment in reducing ordering costs. Thus, when it happens, F is considered zero. This proves the first part (a) of the proposition. To check the concavity at F = F∗let us substitute the value of F in Eq. (35), and performing some calculations one can write,

\({\left[\frac{\partial^2}{{\partial F}^2}\right]}_{F={F}^{\ast }}=-\delta <0\ \mathrm{when}\ \delta <0\). As the second-order derivative satisfies at F = F∗, so the optimal maximum profit attains in this point, which satisfies the second part (b) of the proposition. This completes the proof.

Some other necessary properties which help to obtain the maximum profit for the retailer are:

Proposition 2. For any fixed Fand L, ϕ(F, K, L)is a pseudo-concave function of green investment K and hence there exists a unique investment K∗.

Proof: To avoid redundancy, the proof is omitted as it is akin to that of Proposition 1.

Proposition 3. For any fixed Fand K, ϕ(F, K, L)is a pseudo-concave function of the replenishment time L and hence there exists a unique period L∗.

Proof: To avoid redundancy, the proof is omitted as it is akin to that of Proposition 1.

To prove the retailer’s profit function jointly concave or, in other words, provides maximum profit with regard to decision variables, one can easily accomplish Eq. (20) by exploiting Eqs. (31), (32), and (33).

Lemma 1. When the value ofM > 0, then the retailer’s profit function ϕ(F, K, L)attains maximum values.

Proof: Placed in Appendix A.

Now, using Lemma 1, one can easily prove the following proposition.

Proposition 4. For any fixedF, ϕ(F, K, L)is a pseudo-concave function of green technology investment K and replenishment time L,hence, there exists a unique solution at (K∗, L∗) and which are characterized as:

Proof: Please see Appendix B

Proposition 5. For any fixed K, ϕ(F, K, L) is a pseudo-concave function of ordering cost reduction investment F and replenishment time Lthus, there exists a unique solution at (F∗, L∗)

Proof: To avoid redundancy, the proof is omitted as it is akin to that of Proposition 4.

Proposition 6. For any fixed L, ϕ(F, K, L)is a pseudo-concave function of ordering cost reduction investment F and green technology investment K, hence there exists a unique optimal investment at (F∗, K∗)

Proof: To avoid redundancy, the proof is omitted as it is akin to that of Proposition 4.

For case II (without considering shortage)

To derive the concavity of Eq. (27), it is required to obtain the critical points by aggregating the first-order derivative with reliant to decision variables to zero. However, the critical points are revealed through some relations, which are:

The critical points are:

Where

\(\theta_4=\;D\gamma x(hmdn_1+\;e_vm\varepsilon\),\({\theta}_6={O}_{rd}{e}^{-\delta F}+{gn}_1+{Dc}_{pr}+\frac{D}{\gamma x}{e}_v m\varepsilon\),

\({\theta}_8=\frac{{\theta_5}^2}{9{\theta}_4}\), \({\theta}_{10}=\frac{\theta_6}{3{\theta}_4}\) .

Now, need to put these critical points obtained from Eqs. (39), (40), and (41) in second-order derivative regard to respective decision variables to verify the sufficient conditions and the derivation system is the same as case I. So, similar way as shown in case I, it is possible to derive the concavity of the profit function (27) with the help of some propositions and a lemma’s. As the nature of the profit function of case II is almost the same as the profit function for case I, so the need for the same solution approach has been avoided here to circumvent redundancy.

Case study and numerical illustrations

To validate the proposed theoretical model, we have considered a practical case study of a green warehouse in India (motivated by the works of Taleizadeh et al., 2018 and Mishra et al., 2020), where the main item is vegetables. Here, the assumption is that the garden manager stores some vegetables that are highly prone to deteriorate over time (Fig. 4). To reduce the deterioration of items, the manager used air-conditioning system. To secure a long lifetime of the items, the garden manager uses limited lighting and heating systems whenever needed. All these systems (air-conditioning, heating, lightning) produce carbons for the environment. The manager always tries to curb the emissions by introducing energy-efficient green technology, which helps the warehouse to become greener and cleaner than traditional ones. We have accumulated some relevant data from the garden with a face-to-face discussion with the garden manager to illustrate the model and then tried to fit it into the presented model. All those primary data are employed and exemplified with three sample cases (i.e., examples 1, 2, and 3).

A proper experimental setup and result analysis have demonstrated that using green technology investment to control the carbon emission and implementation of advanced preservation technology can give better benefits to monitoring the environment and sustainable developments with healthy profit margins. To solve these examples, we have considered the key steps as outlined in Algorithm 1. More importantly, all the numerical examples are based on the original model. At the same time, Taylor expansion is used only to show the theoretical derivations as the profit function is highly non-linear.

Example 1. Let us assume that the following parameters are collected from the green warehouse industry of India.

Initial expense for placing order product demand \(D=\frac{1000\mathrm{unit}}{year},\) cost on product purchases \({c}_{pr}=\frac{\$160}{\mathrm{unit}},\) cost of holding the purchased items \({c}_{hl}=\frac{\$2}{\mathrm{unit}},\) cost for a backlogging item due to shortage \({c}_{sr}=\frac{\$3}{\mathrm{unit}},\) deterioration rate γ = 0.55, investment cost to preserve items from decay λ = $10, the sensitive parameter of investment in preservation technology b = 0.6, sale price ps = $250, the backlogging parameter w = 0.2, the constant parameter of order cost reduction investment δ = 0.95, fixed part of transportation cost of transporting items g = $0.03/trip, variable part of transportation cost per trip h = 0.02, the distance to travel d = 100km, weight to carry during transportation m = 2kg/unit, number of travel times n1 = 5, fixed carbon emissions while holding inventory ef = 0.9 variable carbon emission factor per holding cost ev = 0.7, additional progressive tariffs per unit of carbon emissions ε = 5, number of gallons per truck n2 = 30, the amount of GHG emitted from one gallon of diesel truck fuel et = 0.4, tax imposed on carbon emissions Tx = $3/ton CO2, the part of carbon emissions when investing in green technology ζ = 0.2, green technology efficiency in reducing emissions r = 0.6.

Now, by dint of Algorithm 1 and exploiting sufficient conditions presented in Eq. (35), one gets

\({\left[\frac{\partial^2\phi }{\partial {F}^2}\right]}_{F={F}^{\ast }}=-0.95<0\) By using Proposition 1.

And from Equation (42), the value of M = 17778.23, which is positive and so large value.

So, by using Lemma 1, from Eq. (50), one has

\({\left[\frac{\partial^2\phi }{\partial {L}^2}\right]}_{L={L}^{\ast }}=-762.7210<0\) And it satisfies the condition stated in Proposition 4.

Now, with the help of Lingo 17 software with the aid of an exact optimization approach, we have obtained the following optimal solutions:

time from which shortage starts

The graphical view of the profit margin under various investments and timeframes is displayed through the following 3D graphs. Figure 5 delineates the concavity of the profit function subject to F and L. In contrast, Fig. 6 delineates the profit function subject to K andLAfter these, a complete procedure of the total solution system is depicted in Fig. 7 through a flowchart. It provides a clear idea about calculating the proposed model numerically by imposing preservation technology, order cost reduction, and green technology investment.

Example 2. If we contemplate such a situation when carbon emissions do not occur, then taking the same parameter values mentioned in Example 1 and neglecting the carbon-related parameters, we obtain the following optimal solutions:

As per the result, the capital investment on ordering costs and the system’s profit has increased. It is rational since there is no carbon emission during the chain’s transportation; the retailer does not need to invest in a green policy and can order a bigger lot with the money he is supposed to use to control carbon emissions. Some further investment in ordering cost is required to maintain a bigger lot. Therefore, to control the intensification of ordering costs, the retailer raised the capital investment in it.

Example 3. When there is no shortage, then taking the same parametric values mentioned in Example 1 and the backlogging parameter w = 9999999999 (here, we have taken backlogging parameter as large as possible because in the proposed model, when the backlogging parameter tends to infinity, the solver generates a case without shortages). By applying this concept, we obtain the following optimal solutions,

λ = 18.87, F = $5.459, K = $7.930, L = 2.657, and ϕ = $57789.01. which shows the result is less profitable than the case with shortages. When there is no shortage, it means that all the stocks need to be held by the retailer for a certain period together with their deterioration. Thus, to maintain these consequences, it needs some expenses. Consequently, the case without shortages provides less profit than the case of shortages in the supply chain.

Results analysis

A recent and challenging study domain has been involved in reducing carbon emissions and developing an economic order quantity (EOQ) model or a sustainable inventory model (Mishra et al., 2020a; Poursoltan et al., 2021). This study attempted to close the gap by combining SD issues with the EOQ model and developing an EOQ model that focuses on lowering ordering costs, green policy implications, and product deterioration. Carbon emissions and green policies are taken into account, as well as a green technology investment. The customer’s impatience factor is based on the waiting time to minimize the impact of shortages due to lower ordering costs, according to this study. During the stock out phase, the complete demand is either lost or backlogged, and thus allows for deficits with partial back ordering as a key assumption. The goal is to create a sustainable inventory model that takes into account product shortages and perishable item preservation technology for a low-CO2 green warehouse sector. To form Fig. 8, Lingo 15 software and Algorithm 1 (for case I) with the flowchart depicted in Fig. 6 are combinedly used and alternatively plugged-in different parameters for both the cases in a Core 2 duo PC of speed 3 GHz. Figure 7 provides information about the earned profits of two cases through bar diagrams and compares them in 8 different situations. Overall, in all circumstances, it is promptly evident that case I (with shortage) acquired maximum profits than case II (without shortage).

It is noted that when investments in preservation, order cost reduction, and green technology are present together, the profit obtained is 58107.45 for case I and 57789.01 for case II, which are the highest among all the other combinations or sub-cases. The profit for case II is 0.55%, lower than case I. In the absence of all these three investments, the margin of the profit declines massively, and the value is 48994.86 for case I, 15.68% lower than case I (with shortage), and reduced profit is 21416.18 for case II, which is 62.94% lower than case I (without shortage).

However, when only green technology is absent, the profit for case I is 57926.91. At the same time, 57604.65 for case II, which is slightly lower (0.31%, with shortage and 0.32%, without shortages), than the profits of the situation in the presence of all three investments. However, the second smallest profit arises in the case (both with and without shortages) when preservation and ordering cost reduction are absent. Moreover, it is in a better position compared to the lack of only preservation technology. On the other hand, we can see that the profit rate decreases dramatically when a single investment in order cost reduction is absent. Generally speaking, a significant fall in profit was noticed in some situations where order cost reduction is absent.

Interestingly, only order cost reduction is present when preservation and green technology are absent. The profit rates are in a much inferior position. The value is 49434.15 for case I with 22823.08 for case II, which are 14.93% and 60.51% lower than case I (with shortage) and case II (without shortage), respectively, when all three investments are imposed.

Sensitivity analysis

Based on the above examples and on the collected data from the greenhouse vegetable garden, a sensitivity analysis has been executed to further evaluate the relative impact of different parameters on the profit margin, which helps the retailer to make informed strategical decisions. This sensitivity analysis is conducted through some bar diagrams (Figs. 9, 10, 11, 12, 13, 14, 15, 16, 17, 18) by varying a specific parameter from −20% to +20%, while other parameters are considered fixed at that time.

Based on the results obtained from the sensitivity analysis, as outlined in Figs (9–18), the following observations can be enumerated:

-

Increasing the values of (cpr), (chl), and (csr) minimizes the total profit significantly (Figs 9, 10, 11), which is analogous to Mishra et al. (2020a), while the vice versa is noticed in (δ). An important observation has been noticed that without preservation technology, the profit bar is significantly smaller than other bars in Figs 10, 11, and 12 while the vice versa is noticed in Figs 9, 13, 14, and 15. Moreover, with the increase in demand, the value of profit without preservation slowly increases (Fig. 18).

-

With the increase in deterioration rate (γ), total profit decreases (Fig. 12). Because when the rate of deterioration increases, the inventory starts to decline, and so the retailer has to make an investment to prevent this deterioration. The same observation was noticed in Mishra et al. (2019). As the deterioration goes high, the profit bar follows a downward direction for the case without preservation technology.

-

As the distance(d)increases, the total profit decreases (Fig. 13). This is because to cover this increasing distance, transportation cost increases.

-

Total profit declines with the increase in product weight (m) (Fig. 15). Because the truck cannot carry overload when the weight is increased. Therefore, to carry all the products, a new trip n1has to be added, which raises transportation and carbon emission costs. Overall, the profit decreases (Fig. 14).

-

From Fig. 16, one can easily notice that an increase in the amount of GHG emissions (et) enhances the carbon emission cost. To control these emissions, the retailer must increase the investment in green technology. This causes a decrease in profit for all the cases. The special effect has been noticed without preservation investment.

-

Investment in green technology (K∗) increases, and total profit decreases with the increase of carbon emission tax (Tx) (Fig. 17) which is a similar observation as (Datta 2017; Mishra et al. 2020a). This means that the retailer raises his investment (K∗) in reducing carbon emissions in order to pay less tax (Tx)

-

When the demand (D) for the products increases, cycle time (L∗) decreases, which means that the time of holding inventory decreases, and this minimizes the holding cost of the retailer. So, the total profit increases similar to Mishra et al. [29] (Fig. 18).

-

For all parameters, the retailer faces the maximum profit when he invests money in reducing order cost, deterioration of products, and carbon emission.

Managerial insights

Some valuable managerial insights can make from the study, which the practitioners and decision-makers can easily follow to secure a better, sustainably developed industry with a healthy profit margin. Some of them are:

-

The intensification of GHG emissions causes some additional carbon emission costs. So, to manage these emissions, the firm’s manager should invest in carbon reduction technology. Moreover, the manager should remember that he needs to invest up to a certain level; otherwise, he may face some losses in his business.

-

Product deterioration is also an essential issue in inventory management. So, reducing the deterioration of the products simultaneously with carbon emission is a very arduous task for an industry manager. This study provides some critical suggestions for the industry managers to follow to ensure a better profit margin. However, they need to be mindful of the appropriate investment in preservation technology. Figure 7 supports the contribution in controlling the deterioration of the products where the investment brings more profit for the retailer than without investment.

-

Ordering cost is vital for the retailer. Retailers want to make the best use of their capital. The retailers order something from the supplier to complete the order. The total cost needs to be paid as an ordering cost on maintaining that order component (i.e., the labor cost of receiving the product, the labor cost of making the voucher). This model gives insight (see Fig. 7 to visualize the fact) to the industry managers. They can quickly reduce the ordering cost by investing capital in it and knowing the investment range to bring profits.

-

This study also explores how inventory shortages can play a part in the economic benefits of a retailer.

-

Green transportation is suggested to avoid the emission to the environment. This study has highlighted the impact of the number of trips on the greenness of a supply chain and its subsequent impact on profit. How a practitioner can easily optimize the travel distance by compared with other costs is also explained in this study.

-

Inarguably, an increase in the amount of GHG emissions increases the carbon emission cost. To control these emissions, the retailer must increase the investment in green technology. This causes a decrease in profit for all the cases. This study has highlighted the ‘green investment’ impact on profit by comparing this with the resulting profit without preservation investment. This can lead to a good managerial insight for practitioners.

-

Customers nowadays are excessively concerned about product quality. As a result, industry executives must pay close attention to product quality in order to obtain the best possible quality at the lowest possible cost. For example, the quality could be the highest, but the price could be too costly compared to current real-world markets, preventing those high-quality products from being sold. As a result, industry executives must choose between optimum quality and total cost. The proposed study advises managers on the best product quality values to retain the worldwide optimum solution while keeping the overall cost low (this has been observed based on the study executed to observe the impact of cots spent for controlling product deteriorations, e.g., Fig. 7).

-

This model demonstrates that by introducing environmentally responsible production, the industry can play a significant role in reducing global warming. When the number of trips increases, environmental pollution is promptly increased. However, that increment is mediated by implementing an emission reduction strategy, ensuring that sustainability is maintained. However, it has been discovered that, in order to maintain completed products, an industry can determine how much time should be spent preparing ready-to-sell finished products based on the rate of degradation. Finally, by including a quality control approach, the entire supply chain cost is discovered to be minimized, allowing the market status to be maintained.

Conclusions

This study provides a sustainable green warehouse inventory system, including suitable investments to reduce order cost, product degradation, and CO2 emissions. The model showed the appropriate use of green technology to reduce GHG from the environment to the holding and transportation of products. After shipment of the products, the retailer may need a considerable amount of ordering costs to finish the purchase appropriately and reduce carbon emissions by using green technology. To minimize such expenses, the retailer may order more products with the same amount, which leads to more carbon emissions.

A proper balance ensures maximum supply chain profit and sustainable development. This study gives insights into reducing the ordering cost by investing some capital in the original ordering cost and showing its validity range by which one can invest safely. This study also integrated that product deterioration factor into the green policy, ensuring product deterioration and ordering cost reduction. However, the effective way of preserving products is to lengthen their lifetime. In the absence of these three investments, the proposed models showed a decrease in profit, and the value is 15.68% lower than when all the investments were active for case I (with shortage). Likewise, for the second case (without shortage), a similar observation is true, i.e., the profit (obtained without considering the three investments) was reduced by 62.94% when all the three investments are considered. Meanwhile, this study has also proved that there might be an economic benefit for case I (with shortage) against case II (without shortage), should that be at a marginal level. The theoretical derivations have been given to justify the model for the practitioners to support the numerical results.

This model lags in noticing some crucial issues responsible for producing carbon in the environment, e.g., carbon emissions from production processes and waste disposal. This study has some limitations regarding the model’s choice and the features included in the model. One can quickly investigate a situation where more carbon emitted means (e.g., oil and gas industries) can consider. In contrast, this study only examines product retention and transportation as a means of carbon emissions. This study is to introduce some payment systems, such as trade-credit policy and advance payment scheme. Incorporating variable customers’ demands can be another exciting extension of this proposed study.

Data availability

No authorized.

References

Amorim P, Meyr H, Almeder C, Almada-Lobo B (2013) Managing perishability in production-distribution planning: a discussion and review. Flex. Serv. Manuf. J. 25:389–413. https://doi.org/10.1007/s10696-011-9122-3

Andiappan V, Foo DCY, Tan RR (2021) Automated targeting for green supply chain planning considering inventory storage losses, production and set-up time. J. of Ind. & Prod. Eng. https://doi.org/10.1080/21681015.2021.1991015

Ansari MA, Haider S, Khan NA (2020) Does trade openness affects global carbon dioxide emissions: evidence from the top CO2 emitters. Manag. Environ. Qual. 31:32–53. https://doi.org/10.1108/MEQ-12-2018-0205

Battini D, Persona A, Sgarbossa F (2014) A sustainable EOQ model: theoretical formulation and applications. Int. J. Prod. Econ. 149:145–153. https://doi.org/10.1016/j.ijpe.2013.06.026

Bonney M, Jaber MY (2011) Environmentally responsible inventory models: non-classical models for a non-classical era. Int. J. Prod. Econ. 133:43–53. https://doi.org/10.1016/j.ijpe.2009.10.033

Centobelli P, Cerchione R, Esposito E (2020) Pursuing supply chain sustainable development goals through the adoption of green practices and enabling technologies: a cross-country analysis of LSPs. Technol. Forecast. Soc. Change. 153:119920. https://doi.org/10.1016/j.techfore.2020.119920

Cholette S, Venkat K (2009) The energy and carbon intensity of wine distribution: a study of logistical options for delivering wine to consumers. J. Clean. Prod. 17:1401–1413. https://doi.org/10.1016/j.jclepro.2009.05.011

Datta TK (2017) Effect of green technology investment on a production-inventory system with carbon tax. Adv. Oper. Res. Article ID 4834839:1–12. https://doi.org/10.1155/2017/4834839

Dey BK, Sarkar B, Pareek S (2019b) A two-echelon supply chain management with setup time and cost reduction, quality improvement and variable production rate. Mathematics 7:328. https://doi.org/10.3390/math7040328

Dey BK, Sarkar B, Sarkar M, Pareek S (2019a) An integrated inventory model involving discrete setup cost reduction, variable safety factor, selling-price dependent demand, and investment. RAIRO-Oper. Res. 53:39–57. https://doi.org/10.1051/ro/2018009

Dye CY (2013) The effect of preservation technology investment on a non-instantaneous deteriorating inventory model. Omega 41:872–880. https://doi.org/10.1016/j.omega.2012.11.002

Finco S, Battini D, Converso G, Murino T (2022) Applying the zero-inflated Poisson regression in the inventory management of irregular demand items. J. of Ind. and Prod. Eng. https://doi.org/10.1080/21681015.2022.2041741

Ghosh A, Jha JK, Sarmah SP (2017) Optimal lot-sizing under strict carbon cap policy considering stochastic demand. Appl. Math. Modell. 44:688–704

Glock CH (2012) The joint economic lot size problem: a review. Int. J. Prod. Econ. 135:671–686. https://doi.org/10.1016/j.ijpe.2011.10.026

Goyal SK, Giri BC (2001) Recent trend in modeling of deteriorating inventory. Eur. J. Oper. Res. 134:1–16. https://doi.org/10.1016/S0377-2217(00)00248-4

Hammami R, Nouira I, Frein Y (2015) Carbon emissions in a multi-echelon production-inventory model with lead time constraints. Int. J. Prod. Econ. 164:292–307. https://doi.org/10.1016/j.ijpe.2014.12.017

Hariga M, As’ad R, Shamayleh A (2017) Integrated economic and environmental models for a multi stage cold supply chain under carbon tax regulation. J. Clean. Prod. 166:1357–1371. https://doi.org/10.1016/j.jclepro.2017.08.105

He B, Li F, Cao X, Li T (2020) Product sustainable design: a review from the environmental, economic, and social aspects. J. Comput. Inf. Sci. Eng. 20:1–75

He Y, Huang H (2013) Optimizing inventory and pricing policy for seasonal deteriorating products with preservation technology investment. J. Ind. Eng. Article ID 793568:1–7. https://doi.org/10.1155/2013/793568

Hou KL, Lin LC, Huang YF (2016) Integrated inventory models with process quality improvement under imperfect quality and carbon emissions. 2016 IEEE International Conference on Mobile Services (MS), San Francisco, CA, 166-169. https://doi.org/10.1109/MobServ.2016.33

Hua GW, Cheng TCE, Zhang Y, Zhang JL, Wang SY (2016) Carbon-constrained perishable inventory management with freshness-dependent demand. Int. J. Simul. Model. 15:542–552. https://doi.org/10.2507/IJSIMM15(3)CO12

Jaiswal A, Samuel C, Mishra CC (2019) Minimum carbon dioxide emission based selection of traffic route with un-signalized junctions in tandem network. Manag. Environ. Qual. 30:657–675. https://doi.org/10.1108/MEQ-08-2018-0147

Jouzdani J, Govindan K (2020) On the sustainable perishable food supply chain network design: a dairy products case to achieve sustainable development goals. J. Clean. Prod. 123060. https://doi.org/10.1016/j.jclepro.2020.123060

Khan MAA, Shaikh AA, Konstantaras I, Bhunia AK, Cárdenas-Barrón LE (2020) Inventory models for perishable items with advanced payment, linearly time-dependent holding cost and demand dependent on advertisement and selling price. Int. J. Prod. Econ. 230. https://doi.org/10.1016/j.ijpe.2020.107804

Kim MS, Sarkar B (2017) Multistage cleaner production process with quality improvement and lead time dependent ordering cost. J. Clean. Prod. 144:572–590. https://doi.org/10.1016/j.jclepro.2016.11.052

Lou GX, Xia HY, Zhang JQ, Fan TJ (2015) Investment strategy of emission-reduction technology in a supply chain. Sustainability 7:10684–10708. https://doi.org/10.3390/su70810684

Mashud AHM, Roy, Daryanto DY, Kumar RK, Tseng ML (2021) A sustainable inventory model with controllable carbon emissions, deterioration and advance payments. J. Clean. Prod., 296 (12), Article 126608, https://doi.org/10.1016/j.jclepro.2021.126608

Mashud AHM, Hasan MR, Wee HM, Daryanto Y (2019) Non-instantaneous deteriorating inventory model under the joined effect of trade-credit, preservation technology and advertisement policy. Kybernetes 49:1645–1674. https://doi.org/10.1108/K-05-2019-0357

Mashud AHM, Wee HM, Sarkar B, Chiang Li YH (2020) A sustainable inventory system with the advanced payment policy and trade-credit strategy for a two- warehouse inventory system. Kybernetes, Vol. ahead-of-print No. ahead-of-print. https://doi.org/10.1108/K-01-2020-0052

Mishra M, Hota SK, Ghosh SK, Sarkar B (2020) controlling waste and carbon emission for a sustainable closed-loop supply chain management under a cap-and-trade strategy. Mathematics 8:466. https://doi.org/10.3390/math8040466

Mishra U, Mashud AHM, Tseng ML, Wu JZ (2021) Optimizing a sustainable supply chain inventory model for controllable deterioration and emission rates in a greenhouse farm. Mathematics 9:495. https://doi.org/10.3390/math9050495

Mishra U, Tijerina-Aguilera J, Tiwari S, Cárdenas-Barrón LE (2018) Retailer’s joint ordering, pricing, and preservation technology investment policies for a deteriorating item under permissible delay in payments. Math. Probl. Eng., Volume 2018, Article ID 6962417, 1-14. https://doi.org/10.1155/2018/6962417

Mishra U, Wu JZ, Sarkar B (2020a) A sustainable production-inventory model for a controllable carbon emissions rate under shortages. J. Clean. Prod. 256:120268. https://doi.org/10.1016/j.jclepro.2020.120268

Mishra U, Wu JZ, Tsao YC, Tseng ML (2019) Sustainable inventory system with controllable non-instantaneous deterioration and environmental emission rates. J. Clean. Prod. 244:118807. https://doi.org/10.1016/j.jclepro.2019.118807

Mtalaa W, Aggoune R, Schaefers J (2009) CO2 emission calculation models for green supply chain management. http://coba.georgiasouthern.edu/hanna/FullPapers/Fullpaper. htmS, accessedon05/04/2010

Nahr JG, Pasandideh SHR, Niaki STA (2020) A robust optimization approach for multi-objective, multi-product, multi-period, closed-loop green supply chain network designs under uncertainty and discount. J. Ind. Prod. Eng. 37(1):1–22. https://doi.org/10.1080/21681015.2017.1421591

Papachristos S, Skouri K (2000) An optimal replenishment policy for deteriorating items with time-varying demand and partial-exponential type-backlogging. Oper. Res. Lett. 27:175–184. https://doi.org/10.1016/S0167-6377(00)00044-4

Pervin M, Roy SK, Weber GW (2020) Deteriorating inventory with preservation technology under price- and stock-sensitive demand. J. Ind. Manag. Optim. 16:1585–1612. https://doi.org/10.3934/jimo.2019019

Pohlmann CR, Scavarda AJ, Alves MB, Korzenowski AL (2020) The role of the focal company insustainable development goals: a Brazilian food poultry supply chain case study. J. Clean. Prod. 245:118798. https://doi.org/10.1016/j.jclepro.2019.118798

Poursoltan L, Seyedhosseini SM, Jabbarzadeh A (2021) A two-level closed-loop supply chain under the constract of vendor managed inventory with learning: a novel hybrid algorithm. J. Ind. Prod. Eng. 38(4):254–270. https://doi.org/10.1080/21681015.2021.1878301

Sarkar B, Saren S, Sarkar M, Seo YW (2016) A Stackelberg game approach in an integrated inventory model with carbon-emission and setup cost reduction. Sustainability 8:1244. https://doi.org/10.3390/su8121244

Sepehri A, Gholamian MR (2021) Joint pricing and lot-sizing for a production model under controllable deterioration and carbon emissions. Int. J. Syst. Sci. Oper. Logist. https://doi.org/10.1080/23302674.2021.1896049

Shamsuddoha M (2015) Integrated supply chain model for sustainable manufacturing: a system dynamics approach. Adv. Bus. Mark. Purch. 22:155–399. https://doi.org/10.1108/s1069-09642015000022b003

Soleymanfar VR, Taleizadeh AA, Zia NP (2015) A sustainable lot-sizing model with partial backordering. Int. J. Adv. Oper. Manag. 7:157–172. https://doi.org/10.1504/IJAOM.2015.071479

Tahami H, Mirzazadeh A, Arshadi-Khamseh A, Gholami-Qadikolaei A (2016) A periodic review integrated inventory model for buyer’s unidentified protection interval demand distribution. Cogent Eng. 3. https://doi.org/10.1080/23311916.2016.1206689

Taleizadeh AA (2014) An economic order quantity model for deteriorating item in a purchasing system with multiple prepayments. Appl. Math. Modell. 38:5357–5366

Taleizadeh AA, Soleymanfar VR, Govindan K (2018) Sustainable economic production quantity models for inventory systems with shortage. J. Clean. Prod. 174:1011–1020. https://doi.org/10.1016/j.jclepro.2017.10.222

Tavassoli M, Saen RF (2022) A stochastic data envelopment analysis approach for multi-criteria ABC inventory classification. J. of Ind. & Prod. Eng. https://doi.org/10.1080/21681015.2022.2037761

Tayyab M, Jemai J, Lim H, Sarkar B (2019) A sustainable development framework for a cleaner multi-item multistage textile production system with a process improvement initiative. J. Clean. Prod. 246:119055. https://doi.org/10.1016/j.jclepro.2019.119055

Teng JT, Cárdenas-Barrón LE, Chang HJ, Wu J, Hu Y (2016) Inventory lot-size policies for deteriorating items with expiration dates and advance payments. Appl. Math. Modell. 40:8605–8616

Teng JT, Ouyang LY, Chen LH (2007) A comparison between two pricing and lot-sizing models with partial backlogging and deteriorated items. Int. J. Prod. Econ. 105:190–203. https://doi.org/10.1016/j.ijpe.2006.03.003

Tiwari S, Cárdenas-Barrón LE, Goh M, Shaikh AA (2018) Joint pricing and inventory model for deteriorating items with expiration dates and partial backlogging under two-level partial trade credits in supply chain. Int. J. Prod. Econ. 200:16–36. https://doi.org/10.1016/j.ijpe.2018.03.006

Tiwari S, Kazemi N, Modak NM, Cárdenas-Barron LE, Sarkar S (2020) The effect of human errors on an integrated stochastic supply chain model with setup cost reduction and backorder price discount. Int. J. Prod. Econ. 226:107643. https://doi.org/10.1016/j.ijpe.2020.107643

Tseng ML, Chang CH, Lin CWR, Nguyen TTH, Lim MK (2020) Environmental responsibility drives board structure and financial performance: a cause and effect model with qualitative information. J. Clean. Prod. 258:120668. https://doi.org/10.1016/j.jclepro.2020.120668

Vachon S, Mao Z (2008) Linking supply chain strength to sustainable development: a country- level analysis. J. Clean. Prod. 16:1552–1560. https://doi.org/10.1016/j.jclepro.2008.04.012

Venkat K (2007) Analyzing and optimizing the environmental performance of supply chains. Proceedings of the ACCEE Summer Study on Energy Efficiency in Industry (White Plains, New York, USA)

Xu J, Chen Y, Bai Q (2016) A two-echelon sustainable supply chain coordination under cap-and-trade regulation. J. Clean. Prod. 135:134–145. https://doi.org/10.1016/j.jclepro.2016.06.047

Yang HL (2005) A comparison among various partial backlogging inventory lot-size models for deteriorating items on the basis of maximum profit. Int. J. Prod. Econ. 96:119–128. https://doi.org/10.1016/j.ijpe.2004.03.007

Zhang T (2019) Which policy is more effective, carbon reduction in all industries or in high energy-consuming Industries? From dual perspectives of welfare effects and economic effects. J. Clean. Prod. 216. https://doi.org/10.1016/j.jclepro.2019.01.183

Author information

Authors and Affiliations

Contributions

Abu Hashan Md Mashud and Dipa Roy: conceptualization, investigation, methodology, resources, visualization, software, writing - original draft, writing - review & editing. Dipa Roy: conceptualization, investigation, methodology, software, writing - original draft. Ripon K. Chakrabortty: conceptualization, methodology, visualization, supervision, writing - original draft, writing - review & editing. Ming-Lang Tseng: conceptualization, methodology, visualization, supervision, writing - original draft, writing - review & editing. Magfura Pervin: conceptualization, methodology, visualization, supervision, writing - original draft, writing - review & editing.

Corresponding author

Ethics declarations

Ethics approval

Not applicable

Consent to participate

Not applicable.

Consent to publish

Not applicable.

Competing interests

Not applicable.

Additional information

Responsible Editor: Arshian Sharif

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1

The expression for M is,

From the above term, it has been noticed that M contains ϖ2, ϖ3, and ϖ4 and the individual values are:

Appendix 2

Let us take the first-order partial derivative of the retailer’s profit function in Eq. (20) with respect to green investment K,one has

and

To obtain the optimal investment K∗ by expanding the above result (B1) in Taylor’s series (taking the first two terms), then setting this to zero and rearranging the terms, one gets

Where

ϖ 1 = rζ[(ef + evmQ)ε + 2dn2etTx]. So, this K∗ is the optimal green investment to reduce the significant amount of carbon. It is held for only when the values ofr > 0 and ϖ1 > 0. If it is violets, the optimal green investment K∗ will provide a negative value, which is absurd regarding this proposed model, and hence it concludes optimal point zero. Which proves the first part (a) of the proposition.

Now placing the value of K∗ in profit function, one gets

Taking the first and second-order partial derivatives of (B4) with respect to L, we get

Where

To get the optimum solution, expanding (B5) in Taylor’s series (taking the first two terms), then setting this to zero and solving this, we get

\({A}_3={\varpi}_5\left({L}_1+\frac{1}{w}\right)-\frac{\varpi_4}{\varpi_1}-{w}^2{\varpi}_3{L}_1,{A}_4={\varpi}_2-\left(1+w{L}_1\right){\varpi}_3,{\eta}_1=\frac{-{A}_2}{3{A}_1},{\eta}_2={\eta_1}^3+\frac{A_2{A}_3-3{A}_1{A}_4}{6{A_1}^2}\kern0.24em \;\mathrm{and}\kern0.24em \;{\eta}_3=\frac{A_3}{3{A}_1}\) So, from Eq. (4949), it is observed that the optimal replenishment time for the retailer is L∗ and proves the second part (b) of the proposition.

Now to prove the concavity, let us substitute the value of L in (B6); we get

Since it consists of all negative terms, so if we can prove M positive by using Lemma 1,

Where \(M\;=\;\left[2\varpi_3e^{-w(L^\ast-L_1)}-2\varpi_2+\varpi_4e^{-\left(1\frac{L^\ast}{\varpi_1}\right)}e^{-w(L^\ast-L_1)}\left\{\left(\frac1{\varpi_1}-w\right)^2L^{\ast2}-2\right\}\right]\)

then we can easily say that \({\left[\frac{\partial^2\phi }{\partial {L}^2}\right]}_{L={L}^{\ast }}<0\) which completes the proof.

Appendix 3

Rights and permissions

About this article

Cite this article

Mashud, A.H.M., Roy, D., Chakrabortty, R.K. et al. An optimum balance among the reduction in ordering cost, product deterioration and carbon emissions: a sustainable green warehouse. Environ Sci Pollut Res 29, 78029–78051 (2022). https://doi.org/10.1007/s11356-022-21008-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-022-21008-0