Abstract

In the production and inventory management of perishables, environmental considerations are gaining prominence. By reducing carbon emissions from various supply chain processes, such as production, transportation, warehousing, and waste disposal of perishable items, the present study aims to minimize the overall cost to the manufacturer through an optimized investment in green technology. Additionally, cycle time and preservation technology investment are optimized to decrease deterioration and revenue loss in order to minimize cost. The originality of the present research lies in the following considerations. Due to an increase in fuel price, the transportation cost of every subsequent order will also increase, thus resulting in an increase of average delivery cost in a production cycle. We investigate the impact of changes in fuel prices on transportation costs and production inventory model policies due to the volatile nature of fuel prices. The function of transportation cost can be used to calculate transport costs in the future. The deterioration rate is a random variable with a double triangular distribution. Precisely, the demand for any product depends on the product’s price; therefore, linear price-dependent demand is considered. Per unit production cost is a function of direct material cost, tooling cost, and manpower cost. Taking into account all the aforementioned parameters, this paper simultaneously optimizes green technology investment, preservation investment, and cycle time. To achieve the solution of the proposed sustainable production system, an optimization technique for the nonlinear function is employed. Finally, numerical experiments are conducted to validate the model. A special case of a numerical example demonstrates that the expected value of the total average cost is reduced by 10.723% when investments are made in both green and preservation technology, whereas investments in green technology alone result in a cost reduction of only 2.15%. Then, managerial implications and a discussion of findings are proposed after a sensitivity analysis that examines the model’s response to key parameter variation. The study concludes with a discussion of the limitations of current work and possible future scopes.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Global warming is caused primarily by carbon emissions. Researchers and world leaders are pursuing control measures to reduce emissions amid alarming global climate change. Due to government rules and regulations and growing environmental consciousness of consumers, most businesses are eager to go green. The emission of carbon from various sources, such as industries, transportation, and warehousing, among others, is one of the major determinants of the environmental problems facing the world today, according to research (Jaber et al. 2013; Tang et al. 2018; Rout et al. 2020; Sepehri et al. 2021). Recently, Kharaji Manouchehrabadi and Yaghoubi (2022) described the use of fossil fuels as damaging to the environment. They also emphasized using solar energy instead of fossil fuel in the supply chain. In the same year, Manteghi et al. (2022) identified the food supply chain as a major source of greenhouse gas (CHG) emissions and urged all the stakeholders to implement measures to reduce CHG emissions. As per the literature, the first inventory model based on emission was given by Hua et al. (2011), who proposed a carbon cap and tax policy and considered ordering and warehousing operations as a source of emission. After 1 year, Bouchery et al. (2012) revealed only a handful of quantitative inventory model is available that consider sustainability, so they modified the classical inventory model taking environmental concern into account. Later, Taleizadeh et al. (2018) highlighted the drawbacks of basic EOQ and EPQ models because these models ignore many actual issues and insisted on giving equal importance to both economic and environmental concerns. Following this, Mishra et al. (2020a, b) identified supply chain activities as an important source of emission and emphasized the development of an emission-reducing inventory model. An attempt to rectify the drawback of fundamental EOQ and EPQ models has been made by Sahoo et al. (2022). They included carbon emission in the EOQ model because carbon emission is the primary cause of global warming and climate change. Recently, Mashud et al. (2022a, b) mentioned various activities of supply chain and logistics like production, storage, transportation, and waste disposal are also responsible for carbon emissions. After that, Zhang and Qin (2022), for a three-echelon supply chain consisting of the manufacturer, transporter, and retailer, described the manufacturer’s production process and transportation process as emission sources.

Researchers have discussed methods for reducing carbon emissions, such as Pan et al. (2020) mentioned carbon emitted from business activities can be reduced by investing in green technologies. They also cited carbon cap and trade and carbon offset as crucial policies for lowering emissions. Afterward, Yadav and Khanna (2021) developed sustainable inventory models for perishable items having expiration dates and mentioned deterioration, warehousing, and transhipment as a source of carbon emissions as well as carbon tax policy as an effective tool to diminish emissions. As we invest in green technology to reduce emissions, cost increases. Moving one step further, Soleimani et al. (2021) claimed that a comprehensive model is required to deal with competing objectives like simultaneous reduction of cost and carbon emission because as we invest in green technology to reduce emissions, the cost rises. Consequently, the present study develops an inventory model that simultaneously reduces deterioration-related waste, carbon emissions from various stages of the supply chain, and the total cost of the inventory system.

When perishables are stored for a longer duration, losses due to deterioration aggravate. Any product can maintain freshness and usefulness for a limited period (Soni and Suthar 2019). The profit of any firm can be increased by slowing down the pace of deterioration by optimizing cycle time. By optimizing cycle time, Sarkar et al. (2018) attempted to enhance the performance of inventory management. The deterioration phenomenon is observed in real life on inventory items such as fruits, vegetables, pharmaceuticals, volatile liquids, and others (Dye 2013). Optimizing cycle time alone is insufficient to maintain the freshness of perishables; a suitable environment is also required. Utilizing efficient preservation technology (processes and equipment) to create a suitable environment, such as refrigeration, prevents microbial spoilage and chemical deterioration. Proper packaging, along with preservation, is highly effective in slowing down the deterioration of packed food Fang et al. (2017). The spoilage rate of deteriorating items can be controlled through investment in preservation technologies (Yang et al. 2015). From the aforementioned works of literature, deterioration issues are a major concern, but they can be controlled by investing in preservation technologies. According to Mashud et al. (2021), the simultaneous use of green investment to reduce emissions and preservation investment to reduce waste is extremely rare in the literature. As the deterioration of products results in revenue loss and its disposal harms the environment, businesses are utilizing preservation technologies to extend product life and reduce deterioration-related waste. Therefore, all these issues have been simultaneously addressed in the present study. A carbon tax policy is implemented and investments are made in green technologies in order to control emissions. To prevent deterioration-related waste, investments are made in preservation technologies, and the cycle time for replenishment is optimized. By simultaneously optimizing green technology investment, preservation technology investment, and replenishment cycle time, the overall cost to the manufacturer is minimized.

Figure 1 is a visual representation of how various stages of the supply chain, such as production, storage, and transportation, contribute to carbon emissions and the associated costs at various stages. At the manufacturing unit, the manufacturer incurs costs for setup, production, and emissions due to the manufacturing process. Due to warehouse operations, the manufacturer incurs deterioration costs, holding costs, screening costs, waste disposal costs, and emission costs. Another significant expense incurred by the manufacturer is the cost of transporting the product to the distributor. Green technology is invested in reducing emissions, and preservation technology is invested in minimizing waste.

The aim of this paper is three-fold: the first one is to develop a mathematical model for a sustainable inventory problem involving perishable products when items cannot be reworked. Generally, the deterioration rate is not constant; it varies between a maximum under the worst condition and a minimum under the most favorable condition; hence in this paper, it is assumed that the deterioration rate follows double triangular probability distribution. Unit production cost is variable, and it is a function of production rate, cost of raw materials, tooling cost, and manpower cost. The demand rate is price dependent as the demand for perishables is greatly dependent on price. Transportation cost is a function of distance travelled by the vehicle, load carried by the vehicle, and fuel price variation with time, so the transportation cost function used in this study can also calculate future transportation cost if fuel price varies. The second is to optimize the decision variables investment in green technology, investment in preservation technology, and replenishment cycle time to minimize the total cost. The third is to identify the key parameters by performing sensitivity analysis and suggest some insights for the industry. The proposed sustainable inventory model considers all these issues to answer the following research questions.

-

What are the implications of investment in green technologies and preservation technologies on total average cost and inventory decisions?

-

What is the optimum replenishment cycle time to restart the production process so that the total average cost can be minimized?

-

What is the influence of key parameters on total average cost and inventory decisions?

The rest of the paper is organized as follows. In the “Literature review” section, literature review is mentioned. The “Assumption and notations” section consists of assumptions and notations used in the paper. Furthermore, the “Problem description” section deals with problem description and derivations. The “Numerical experiments” section covers numerical examples and algorithms to solve the problem. Furthermore, the “Sensitivity analysis, theoretical implications, and discussion of findings” section presents sensitivity analysis, theoretical implications, and a discussion of findings. The “Insights for industry” section proposes insights into the industry. Finally, in the “Conclusion, limitation, and future scope” section, conclusions, limitations, and future scopes are mentioned.

Literature review

In this section, previous studies and fundamental theories supporting this model have been written. Inventory models related to deteriorating items and preservation technology investment and carbon emission are mentioned.

Inventory models for deteriorating items

For the past many years, various studies have incorporated the influence of deterioration rate on inventory decisions. A significant amount of study was carried out by many researchers (He et al. 2010; Lee and Dye 2012; Bhunia et al. 2018; Tiwari et al. 2018a, b; Khakzad and Gholamian 2020). Another paper investigated the inventory model for deteriorating items presented by Rana et al. (2021a). They examined the impact of demand disruption on deteriorating items in a two-warehouse system with time-dependent demand and a two-parameter Weibull distribution deterioration rate with an objective to minimize the cost of the retailer in the event of sudden demand disruption. Afterward, Rout et al. (2021) proposed a production inventory model for deteriorating items with constant demand and deterioration rate with piecewise constant demand during stock-out condition with a goal to minimize the cost of the manufacturer. Later, Dai and Wang (2022) proposed an inventory model for deteriorating items considering stochastic demand; by optimizing order quantity and the number of shipments, they maximized the profit of the retailer. In the same year, Anil Kumar and Paikray (2022) proposed an inventory model for deteriorating items considering trapezoidal demand, completely backlogged shortage, and constant deterioration to minimize the cost of the retailer. Murmu et al. (2022b) proposed a production inventory model for perishable items during pandemics. Although significant studies have been done in the case of deteriorating inventory, none of the above has considered double triangular probability distributed deterioration with price-dependent demand and variable production cost, which depends on raw material cost, production rate, tooling cost, and manpower cost, variable fuel price, and optimization of preservation technology investment.

Inventory models with preservation technology investment

Wastage of perishable items is a serious issue that needs to be addressed. Based on producer prices, the direct economic cost of food wastage of agricultural products (excluding fish and seafood) is roughly USD 750 billion, equivalent to Switzerland’s GDP (FAO, 2013). Researchers have paid considerable attention to the reduction of food waste throughout the supply chain’s various stages. Such as Hsu et al. (2010), in their inventory model, first used preservation technology investment to reduce deterioration. Then, Tsao (2016) designed a supply chain network under preservation effort and trade credit and mentioned that perishable goods such as medicine, vegetables, and volatile items quantity decrease due to deterioration. Yang et al. (2019) introduced the concept of cross perishability, in which the storage of different items together shortens the shelf life of other products, necessitating the need for continuous screening to remove the deteriorated product. Later, Yang et al. (2020), in their research work, mentioned that the deterioration rate is the main characteristic of perishable inventory and it is unavoidable; however, there are ways to reduce it. Furthermore, Saha et al. (2021) optimized preservation technology investment for seasonable or fashionable products. But in the above-mentioned literature, preservation technology investment has not been optimized with green technology investment and cycle time in a production inventory model.

Inventory model with carbon emission

A sustainable supply chain has received significant attention from academicians and companies such as Seuring and Müller (2008), Jaber et al. (2013), Jauhari et al. (2022), and Tang et al. 2018. According to Yadav et al. (2021), carbon emission is responsible for environmental degradation, and at the same time, wastage due to deterioration affects the ecosystem significantly. In the same line, Sarkar et al. (2021) insisted on sustainable energy generation due to the rising demand for energy and greenhouse gas emissions. Later, Thomas and Mishra (2022) also emphasized emission reduction and waste minimization in the plastic forming industry in their inventory model and urged to invest in green technology to minimize emissions. Later, Rana et al. (2022) considered emissions from various supply chain activities and used carbon cap and carbon tax policy to curb carbon emissions. After going through the available literature and observing the facts highlighted by the researchers, like environmental degradation due to carbon emission and ill effects of the deteriorated product on our ecosystem motivated to develop an inventory model that can simultaneously control these issues.

Research gaps and contribution of the study

These research gaps have been identified after a comprehensive literature review of numerous inventory models (Table 1). It has been found that various supply chain activities, from production to consumption, emit carbon. However, the majority of research work ignores the consideration of investment in green technology and carbon tax policy to reduce carbon emissions. On the contrary, a significant investment in green technologies significantly raises the cost of the manufacturer; as a result, optimization of investment in green technologies is crucial to reduce emissions as well as the overall cost of the manufacturer. Therefore, the current research work optimizes green technology investment and considers carbon tax policy to reduce emissions. Moreover, a large number of studies has considered the deterioration rate as constant, but in reality, it is not so, and in the case of perishable inventory, we cannot let it deteriorate at a normal rate because the deterioration rate is very high, so it is vital to slow down the deterioration rate; despite its importance, very few have investigated the influence of investment in preservation technology. Again, a large investment in preservation technologies increases the cost of the manufacturer; therefore, a manufacturer must optimize their investment in preservation technologies to reduce both cost and emissions due to the disposal of deteriorated products. So, the current work is focused on optimizing investment in preservation technologies. Despite adopting preservation facilities, perishable inventory remains fresh for a limited time; therefore, it is crucial to sell perishable products within a specific time frame, and another more significant challenge is to determine when to restart the production process. Optimizing cycle time simultaneously addresses these two concerns. Consequently, the present study simultaneously optimizes three crucial parameters: green technology investment, preservation technology investment, and cycle time. Most literature has assumed that the unit production cost is constant, but it is actually a complex function of direct material cost, tooling cost, and labor cost. Very few pieces of literature have considered the transportation cost of the manufacturer in delivering goods to the retailers, and those who have taken transportation cost into account viewed fuel price as constant, but it is varying if we observe data of the fuel price from a base year till now. Due to an increase in fuel price, the transportation cost of every subsequent order will also rise, thus resulting in a surge of average delivery cost in a production cycle. We investigate the impact of changes in fuel prices on transportation costs and production inventory model policies due to the volatile nature of fuel prices, and this variation in fuel price is only observed by Gurtu et al. (2015) in the basic EOQ model. The transportation costs function is able to evaluate transportation cost in future if fuel price changes. In general, the rate of deterioration of perishables is not constant; it varies depending on the ambiance; therefore, in the current study, the rate of deterioration is treated as a double triangular random variable. Cross perishability can increase the rate of deterioration, so continuous screening of perishables is necessary to prevent further deterioration of fresh items from ethylene emitted by a deteriorated product; thus, screening is included in the present study. In this study, the demand rate is considered to be a function of the selling price because the demand for perishables is highly price-sensitive.

To the author’s knowledge, no research study to date has taken into account all these plausible phenomena in an inventory model for the manufacturer. Consequently, in the current research, an effort has been made to create an integrated production inventory model that is sustainable and minimizes the manufacturer’s overall cost by simultaneously optimizing cycle time, green technology investment, and preservation technology investment.

Assumption and notations

Notations

A list of notations used to formulate this model is given below with proper units.

Decision variables |

G: investment in green technology to reduce carbon emission ($) ξ: investment in preservation technology to reduce deterioration of product ($) T: cycle time (unit of time) |

Parameters |

P: production rate (units/time) \({{\varvec{T}}}_{{\varvec{m}}}\): production time at which available inventory becomes maximum (unit of time) υ: indicates the efficiency of green technology implemented λ: indicates efficiency of preservation techniques used to reduce deterioration E(θ): expected value of deterioration rate of on-hand inventory (units) \({{\varvec{c}}}_{{\varvec{h}}}\): it is holding cost per unit product per cycle ($) X: being the time in years between first order since 1990 (unit of time) d: distance travelled by the vehicle to deliver product (km) l: fuel consumed by the vehicle (liter) α: fuel price ($) \({{\varvec{f}}}_{{\varvec{c}}{\varvec{a}}}\): additional fuel consumption by the vehicle (per kg of payload/km) x: vehicle emission standard (kg CO2/liter fuel) w: weight of a single product in (kg) β: annual increment in fuel price ($) γ: conversion factor for oil from liters to per barrel US \({{\varvec{f}}}_{{\varvec{t}}{\varvec{c}}}\): fixed transportation cost ($) σ: screening time (min/unit) ψ: a positive constant n: trip or shipment number being sent by the manufacturer Q: lot size (units) \({{\varvec{\beta}}}_{{\varvec{o}}}\): a positive constant \({{\varvec{W}}}_{{\varvec{d}}}\): weight of waste produced from one unit (kg/unit) \({{\varvec{E}}}_{{\varvec{q}}}\): carbon emitted due to inventory carried out by the vehicle (kg/unit) \({{\varvec{E}}}_{{\varvec{p}}}\): carbon emitted from the production process (kg/unit) \({{\varvec{E}}}_{{\varvec{w}}{\varvec{d}}}\): carbon emitted from waste disposal process (kg/unit) \({{\varvec{E}}}_{{\varvec{h}}}\): carbon emitted from warehousing operations (kg/unit) \({\varvec{\delta}}\): carbon tax per cycle ($/kg) |

Function and expression |

TC: total average cost ($) D (s): selling price dependent demand rate (units/ time) f(G): carbon emission reduction function ω(ξ): deterioration reduction function \({{\varvec{A}}}_{0}\): transportation cost at the start of an order point ($) \({{\varvec{A}}}_{1}\): annual incremental increase in transportation cost ($) \({{\varvec{Q}}}_{1}({\varvec{t}})\): inventory level at any time t during the time interval 0 ≤ t ≤ \({{\varvec{T}}}_{{\varvec{m}}}\) (units) \({{\varvec{Q}}}_{2}({\varvec{t}})\): inventory level at any time t during the time interval \({{\varvec{T}}}_{{\varvec{m}}}\)≤ t ≤ T (units) |

Assumptions

Following assumptions are made while developing this model.

-

a.

Demand rate is deterministic and linear decreasing function of price \(D\left(s\right)={D}_{o}-bs\), where \({D}_{o}\) and b are constant greater than zero and s is the selling price per unit of product.

-

b.

Per unit production cost is given by \({C}_{p}=c+\frac{J}{P}+kP\), where c is the unit cost of raw material, P is the production rate and assumed constant, J represents per unit cost components that reduce as the production rate increases (manpower cost), and k represents the unit cost component that increases with production rate (tooling cost).

-

c.

Fuel price is changing with time.

-

d.

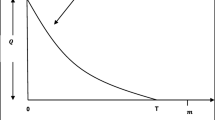

Manufacturer invests in green technology to make the production system more sustainable. The fraction of carbon reduction after making the green investment is given by the continuously differentiable function f(G) = ϕ (1- \({e}^{-\mathrm{\upsilon G}}\)), where υ is the efficiency of green technology. f(G) tends to zero when G = 0, and when G → ∞, f(G) tends to ϕ (Sepehri et al. (2021)). Figure 2 shows as the investment in green technology increases, the fraction of carbon reduction rises, but after a certain limit curve becomes almost asymptotic.

-

e.

Manufacturer invests in preservation technology to minimize waste. Fraction of deterioration reduction after making preservation technology investment is given by continuously differentiable function ω(ξ) = (1- \({e}^{-\mathrm{\lambda \xi }}\)), where λ is the efficiency of preservation technology. ω(ξ) tends to zero when ξ = 0, and when ξ → ∞, ω(ξ) tends to 1, (Mashud et al. (2022)). From Fig. 3, we can observe as the investment in green technology increases, the fraction of carbon reduction rises, but after a certain limit, curve becomes almost asymptotic.

-

f.

The deterioration rate is uncertain, follows the double triangular probability distribution where θ ∈ [a, c] and a < b < c, and the expected value is given by E(θ) = \(\frac{a+4b+c}{6},\) where a is the deterioration rate under the most optimistic condition, c is the deterioration rate under the most pessimistic condition, and b is the most likely value of the deterioration rate (Sarkar et al. (2020)).

-

g.

The shortage is not allowed.

-

h.

The production rate is known and greater than price dependent demand rate.

Problem description

In this section, a sustainable economic production quantity model for deteriorating items is developed where the deterioration rate is uncertain and follows the double triangular distribution. Various sources of carbon emission at different stages of the supply chain are outlined, and relevant costs are calculated.

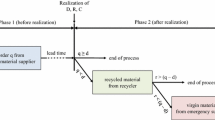

Mathematical model

The inventory level is zero at time t = 0. When the buyer places an order, production process starts from t = 0, and simultaneous production and demand fulfillment takes place; it is assumed that the production rate is greater than demand, so a gradual build-up of inventory takes place. At t = \({T}_{m}\) inventory level reaches a maximum value, and the production process stops. After time t = \({T}_{m}\), inventory depletes due to the combined effect of demand and deterioration (Fig. 4).

For the time period 0 < t < \({T}_{m}\), inventory is being produced with a production rate P and depleting due to the combined effect of demand and deterioration, the governing differential equation is given by,

The deterioration rate is uncertain and follows double triangular distribution, and it is being controlled by investing in preservation technology let ω (\(\xi\)).

Solving the above differential equation and using the boundary conditions at t = 0, \({Q}_{1}\left(t\right)\) = 0,

For the interval \({T}_{m}\)≤ t ≤ T, governing differential equation is given by

Applying boundary conditions at t = T, \({Q}_{2}\left(t\right)\) = 0

Cost estimation

Various costs associated with the vendor are discussed as follows:

Setup cost (SC) is the cost required to prepare equipment for making products of different batches. This includes the downtime losses and consumables etc.

Production cost is the cost required to manufacture a product. It depends on the quantity to be produced. It includes a material cost (raw material), labor cost, and tool die cost. If \({C}_{p}\) is the cost required to produce a single product and is given by \({C}_{p}=\mathrm{ C}+\frac{J}{P}+KP\), where C = unit cost of raw material, \(\frac{J}{P}\) is the cost component that decreases with the production rate (labor cost), and \(\mathrm{KP}\) is the unit cost component that increases with the production rate (tooling cost).

Holding cost (HC) is the cost incurred of storing and maintaining the unsold, finished, and semifinished product in the warehouse. It depends on the holding time and quantity of products in the warehouse. It includes rent and insurance of the warehouse, wages for the labor, etc. If \({C}_{h}\) = is the holding cost per unit, then the holding cost per cycle is given by HC.

Waste disposal cost (WC) is the cost related to disposing of the waste produced during the production process, and it is a fixed cost.

There is a deterioration of products at different stages like production and storage in the warehouse. So, a certain amount of money is invested by the vendor to reduce the deterioration rate called preservation technology investment cost (PIC) or waste minimization technique cost; preservation technology investment cost per cycle is given by

Vendors have to hold the product in their warehouse after production. To get rid of ripening hormones and fungus in the warehouse, the deteriorated product needs to be screened out. When the vendors do not have enough budget, the temporary staff inspects products from time to time manually.

In transportation cost, vendors deliver the product to their distributor as an order placed by them, so a certain cost is incurred in delivering the product to distributors. Variation of transportation cost with time is calculated as mentioned by Gurtu et al. (2015).

From Fig. 5, we can observe world oil demand has been increasing every year since 2016 except in 2020, when demand decreased but again increased in 2021. An increase in demand for oil is one of the main reasons for the increment in price with time.

The world oil demand in 1000 barrels/day (2022 OPEC Annual Statistical Bulletin 57th Edition, 2022)

Another reason for the fuel price hike is taxation, as a huge tax is imposed on crude oil by the governments, as shown in Fig. 6. Thus, the cost of transportation increases with time due to the surge in fuel prices. So, the cost of transportation for a particular cycle varies dynamically. Therefore, it is important to consider the variation in transportation costs with time.

where α is the fuel price, the oil price has been steadily increasing over the years. The form α = 2.8917 X + 11.802 is the best curve for the price of oil per barrel in US dollars, where X is the number of years counting from 1990.\(\alpha =\frac{ 2.8917 X + 11.802 }{\gamma }\), where γ is equal to 159 L per barrel US.

The distribution of crude price, industry margin, and tax on the price of crude oil (2022 OPEC Annual Statistical Bulletin 57th Edition, 2022)

\({B}_{1}=2dl\beta\), where \(\beta =\frac{2.8917}{\gamma }\)

In Green technology investment, carbon emission costs, various supply chains activities like production, storage, transportation, wastage, and consumption emit a large amount of CO2. Emissions due to the production process depend on production time, whereas emission due to transportation depends on distance travelled and fuel consumption. Carbon emission due to waste disposal depends on the amount of solid waste produced. Emissions from warehousing operations depend on the quantity stored in the warehouse as well as holding time in the warehouse; various sources of carbon emission during warehousing operation are energy consumption for lightening, some items require hot ambiance, whereas some require cold ambiance, so heating or cooling is also a source of carbon emissions.

Emissions due to transportation \({{E}_{T} = 2 n d l V}_{e}\). It is emission due to distance covered by the vehicle, two is used for round trip

Additional carbon emission during transportation due to the load carried by the vehicle

So total carbon emission during transportation is \({{E}_{T }+ {E}_{Q} = 2 n d l {V}_{e}+\mathrm{ w Q d }{f}_{ca}V}_{e}\)

Emissions due to the production process \({{e}_{p} = {E}_{p}\mathrm{ P}T}_{m}\)

Emissions due to waste disposal \({{e}_{wd} = {W}_{d}\mathrm{ Q }E}_{wd}\)

Emission from warehousing operation \({e}_{h}{=E}_{h}\left\{{\int }_{0}^{{T}_{m}}{\mathrm{Q}}_{1}\left(\mathrm{t}\right)dt+{\int }_{{T}_{m}}^{T}{\mathrm{Q}}_{2}\left(\mathrm{t}\right)dt\right\}\)

Total carbon emission \(\mathrm{TCE }= 1-\upphi (1- {e}^{-\mathrm{\upsilon G}}) ({E}_{T }+{E}_{Q}+{e}_{p}+{e}_{wd}+{e}_{h}\)).

Total cost due to carbon emission \(TCEC=\delta \left\{ 1-\upphi (1- {e}^{-\mathrm{\upsilon G}}) ({E}_{T }+ {E}_{Q}+{e}_{p}+{e}_{wd}+{e}_{h})\right\}\)

The green technology investment cost is the cost incurred to reduce the carbon emission from various stages of the supply chain.

Green technology investment cost \(\mathrm{GIC }= \frac{GT}{T}\)

Therefore, the expected value of the total average cost of the inventory system for a cycle time T can be written as follows:

It is very difficult to show the convexity of E [TC (T, G, ξ)] due to highly complicated equations, but it can be shown for a fixed value of ξ.

Lemma 1

E [TC (T, G, ξ)] provides a minimum value in green investment G when investment in preservation technology ξ and cycle time T is fixed.

Proof: Appendix 1

Corollary 1

For a fixed value of ξ and T if the term \(-1+e^{-e^{-\lambda\xi}m\theta}>\;0\;\&\;m-T+\frac{e^{\lambda\xi}\left(-1+e^{e^{-\lambda\xi}\left(-m+T\right)\theta}\right)}\theta>\;0\), then minimum exists at E [TC (T, G, ξ)].

Proof: Appendix 2

Figure 7 shows that as the green investment increases, the total cost reduces and becomes minimum at \({G=G}^{*}\) and further increment in green investment causes an increase in total cost. To plot Fig. 7, values are considered from the data mentioned in the numerical experiment.

Lemma 2

E [TC (T, G, ξ)] provides a minimum value in cycle time T when investment in preservation technology ξ and green investment G is fixed.

Proof: Appendix 3

Figure 8 shows that as the cycle time rises, the total cost diminishes and becomes minimum at \({T=T}^{*}\) and further increment in cycle time causes an increase in total cost. To plot Fig. 8, values are considered from the data mentioned in the numerical experiment.

Lemma 3

The principal minors of E [TC (T, G, ξ)] are positive definite at the optimal values (\({T}^{*},{ G}^{*},{\xi }^{*}\)) for a given value of ξ.

Proof: Appendix 4

Numerical experiments

In this section, numerical examples are solved with the proposed algorithm to validate the model, and the convexity of the total average cost function has been proved.

An illustrative case study

Values for the validation of the model are adopted from Mashud et al. (2022) and modified according to our elaboration, which is a case study Taiwanese greenhouse flower production company. Values pertaining to fuel prices are obtained from (OPEC Annual Statistical Bulletin 57th Edition 2022) and Gurtu et al. (2015). However, the unavailability of real-time data for all the parameters which is mentioned in the conclusion is one of the limitations.

\({D}_{o}\) = 10,000 unit/year, b = 1, s = 60 $, P = 12,000 unit/year, k = 0.0009, J = 100, c = 30$, a = 0.02, b = 0.04, c = 0.06, \({T}_{m}\) = 2.5 unit time, \({c}_{st}\) = 100 $ per setup, \({c}_{wd}\) = 60 $, Q = 100 units, \({\beta }_{o}\) = 0.3, σ = 0.2 min/unit, ψ = 1, n = 3, υ = 0.9, ϕ = 0.4, λ = 0.9, \({c}_{h}\) = 2 $/unit time, X = 32 years, d = 10 km, l = 1 L, \(\delta\) = 5 $/kg, \({E}_{w}\) = 1.2 kg CO2/unit, \({E}_{p}\) = 1.2 kg CO2/unit, \({f}_{\mathrm{ca}}\) = 1 L/unit km, \({E}_{wd}\) = 0.24 kg CO2/kg waste, \({V}_{e}\) = 3 kg CO2/L fuel, F = 100$, \({W}_{d}\) = 0.2 kg/unit, w = 3 kg/unit. For the given condition, the objective is to find the optimum expected total average cost per cycle \({TC}^{*}\), optimum investment in waste minimization \({\xi }^{*}\), optimum investment in green technology \({G}^{*}\), and optimum cycle time \({T}^{*}\).

Algorithm

The objective of this algorithm is to get the optimum value of total average cost \(E [TC (T, G, \xi )]\) and the corresponding optimal value of preservation technology investment (ξ), green technology investment (G), and cycle time (T). The given production inventory model is solved with the help of Mathematica software and the steps are mentioned below.

-

Step 1: assign the values to the parameters

-

Step 2: set the value of ξ = n where n = 0, 1, 2, 3…….

-

Step 3: for n = 0, find the optimal value of (\({G}^{*},{ T}^{*}\)) by equating the first derivative of the total average cost function with respect to G and T equal to 0

-

Step 4: compute the total average cost with the help of \({G}^{*}\mathrm{and} {T}^{*}\) and the value of the parameter set in step 1

-

Step 5: set the value of n = 1, repeat steps 3 and 4

-

Step 6: continue the steps 3 and step 4 until the total cost starts to increase, reach a negative value for any variable or a non-real value

-

Step 7: the values of ξ, G, and T corresponding to the lowest value of the total cost function is the optimal value of preservation technology investment \({\xi ,}^{*}\) green technology investment \({G}^{*}\) and cycle time \({T}^{*}\)

-

Step 8: end

As per the result obtained in Table 2, considering no investment in waste minimization technique, the total average cost obtained E[TC] = 355,308.8875, cycle time T = 7.272, and investment in green technology G = 1.111. From the above-mentioned algorithm, as the ξ increases and converges to optimal cycle time \({T}^{*}\) = 7.6454, optimal investment in green technology \({G}^{*}\) = 1.111, and optimal investment in waste minimization technique \({\xi }^{*}\) = 10, with the total average cost \({E[TC}^{*}]\) = 347,799.9214. The 3D plot of the total average cost with respect to cycle time (T) and investment in green technology (G) is given in Fig. 9 below.

Convexity conditions (Fig. 10) are held by

If the leading minors of H are

\({\mathrm{H}}_{1}=\frac{{\partial }^{2}E [TC (T, G, \xi )] }{{\partial \mathrm{G}}^{2}}> 0\), \(\&\;{\mathrm H}_2=\begin{bmatrix}\frac{\partial^2E\lbrack TC(T,G,\xi)\rbrack}{{\partial\mathrm G}^2}&\frac{\partial^2E\lbrack TC(T,G,\xi)\rbrack}{\partial\mathrm T\partial\mathrm G}\\\frac{\partial^2E\lbrack TC(T,G,\xi)\rbrack}{\partial\mathrm G\partial\mathrm T}&\frac{\partial^2E\lbrack TC(T,G,\xi)\rbrack}{{\partial\mathrm T}^2}\end{bmatrix}>0,\) then minimum exists for the function \(E [TC (T, G, \xi )]\) at \({T}^{*}\) & \({G}^{*}\)

Therefore, the determinant of the above matrix \(\left|{\mathrm{H}}_{2}\right|\) = 394958812.7 > 0.

A contour plot is also presented to show the convergence of the total average cost function TC w.r.t T and G.

Special case study of the numerical example

In this section, we study some special cases (Fig. 11) that arise and reveal some very useful facts:

-

Case 1: for a given value of cycle time T = 7.6454, and other parameters remain constant as mentioned in the above numerical example, but investment in green technology G = 0, and investment in preservation technology ξ = 0, total average cost E[TC] = 385,095.005.

-

Case 2: ξ = 0, T = \({T}^{*}\) = 7.6454, G = \({G}^{*}=1.111\), total expected average cost \(E[{TC}^{*}]\) =355,308.8875.

-

Case 3: when ξ = \({\xi }^{*}=10\), total expected average cost E[TC] = 347,799.9214. So, we can see total average cost is minimum when we are investing in both green and waste minimization techniques and maximum when investment in green and waste minimization techniques is zero. So, it is beneficial to invest in green and waste minimization techniques.

Sensitivity analysis, theoretical implications, and discussion of findings

Sensitivity analysis is conducted to study the influence of different parameters on total average cost function (TC) and decision variables (G, T, ξ). The sensitivity analysis is conducted by changing one variable from − 20 to + 20% while keeping other parameters constant.

Results mentioned in Table 3 and Fig. 12 reveal the effect of production rate, appraised by changing production rate on both sides while other parameter remains unchanged. The data obtained show that the production rate (P) is highly sensitive to the total average cost (TC), as well as cycle time (T), and has a positive impact on total average cost (TC). The linear relationship between the production rate and the total average cost is shown in Eq. 9 of total average cost TC (T, G, ξ), which is also confirmed by Fig. 12; if the production rate increases uniformly, total average cost rises linearly. The first reason behind the nonlinear increment in total average cost is the high tooling cost because the wear rate intensifies as the production rate rises, and the second reason is high stock available because for a given demand rate, an increase in production rate results in large available inventory, which in turn causes high holding cost. The reason for the large cycle time is more time required to dispatch large accumulated inventory, but the production rate does not influence green technology investment.

The influence of production time can be realized from the data revealed in Table 4 and Fig. 13, and it has been observed that the production time has a positive impact on total average cost (TC) and increases cycle time (T). The reason behind the increment in cost is the high manufacturing cost and also significant manufacturing time results in a large inventory stock which requires more time to deplete, causes rise in holding and deterioration cost. The total average cost varies nonlinearly with production time; demonstrated in Eq. 9 of total average cost and Fig. 13, we observe that total average cost flattens at low production time and becomes rather steep as the production time rises which may be due to the accumulation of large inventory stock. The influence on green technology investment (G) is significantly less, but it rises with production time.

From Table 5 and Fig. 14, a surge in total average cost (TC) and replenishment cycle time can be perceived with the rise in direct material cost. The relationship between total average cost and direct material cost is linear shown in Eq. 9 of total average cost and Fig. 14. In real conditions, more direct material is required as production volume increases, and the requirement of the material rises linearly with production volume as each product requires an equal amount of material, resulting in a linear increase of total average cost.

Results of Table 6 and Fig. 15 show the same impact of manpower cost on total average cost (TC) and cycle (T) as the direct material cost, and the reason behind the surge in total average cost (TC) and cycle (T) is also the same. The relationship between total average cost and manpower cost is linear as demonstrated in Eq. 9 of total average cost and Fig. 15. Manpower cost increases linearly with workforce number, therefore increasing manufacturing cost in the same manner and so does the total average cost.

Data mentioned in Table 7 and Fig. 16 shows the same impact of tooling cost (k) on total average cost (TC) and cycle (T) as direct material (c) and manpower costs (J). Since large tooling cost means a high production rate which results in large inventory and it will increase the other associated cost. The relationship between total average cost and tooling cost is linear as shown in Eq. 9 of total average cost and Fig. 16. As the tooling cost increases, manufacturing cost rises linearly so does the total average cost.

From Table 8 and Fig. 17, varying holding cost per unit on both sides while keeping other parameters constant, as the holding cost rises, total average cost upsurges whereas cycle time (T) reduces because longer cycle time will cause more holding cost, so warehouse should be evacuated on optimum cycle time. In contrast, it does not influence green investment (G). Total average cost varies linearly with holding cost per unit, as holding cost of each unit is the same, so rise in holding cost per unit will cause linear increase in total average cost, and it can be confirmed from Eq. 9 and Fig. 17.

From the results mentioned in Table 9 and Fig. 18, we can see for a given investment in preservation technology, the rise in preservation technology efficiency has a diminishing effect on total average cost (TC) and an increment in cycle time (T) has been noticed. This happens because the rise in preservation technology efficiency results in the reduction of deterioration rate so the vendor can sell the product for a longer period of time. However, it does not influence green technology investment. Preservation technology efficiency has a nonlinear relationship with total cost as shown in Eq. 9 of total average cost and in real condition, also cost will not decrease uniformly with the rise in efficiency of preservation system.

From the results of Table 10 and Fig. 19, it can be perceived changing the deterioration rate on both sides and keeping other parameters constant, the deterioration rate has a positive influence on total average cost (TC) because with a surge in deterioration rate, wastage as well as emission cost due to deterioration upsurges. Total cost varies linearly as well as nonlinearly with deterioration rate and it can be seen from Eq. 9. The influence of linear term for the chosen value may be more dominating, so the total average cost seems to vary linearly with the deterioration rate.

We can see from the data in Table 11 and Fig. 20 that as the distributor orders a larger quantity in a lot, the total cost incurred to the vendor rises. At the same time, it does not influence green investment (G) but increases cycle duration (T). Total cost varies linearly with lot size and it can be seen from Eq. 9 as well as Fig. 20. As the lot size increases, the transportation and other associated cost rises linearly and so does the total cost.

Results mentioned in Table 12 and Fig. 21 demonstrate that screening time positively impacts the total average cost (TC) because the manufacturer needs an extra person to employ for the screening purpose. Total cost varies nonlinearly with screening time and it can be seen from Eq. 9 as well as Fig. 21. As the screening time increases, the screening cost rises nonlinearly and so does the total cost.

Data mentioned in Table 13 and Fig. 22 shows as the fuel price is growing every year, it positively impacts the transportation cost incurred in delivering the product by the vendor, resulting in increased total average cost (TC). Cycle time (T) also rises, but green investment (G) remains unaffected. Total cost varies linearly with time and it can be seen from Eq. 9 as well as Fig. 22. As the time increases, the transportation cost varies linearly and so does the total cost.

From Table 14 and Fig. 23, the distance travelled by the vehicle has a rising influence on total average cost (TC) and cycle time (T). There are two reasons for the increment in total average cost. First, as the distance travelled by the vehicle increases, the vehicle consumes more fuel, resulting in high transportation costs, and at the same time, vehicle emits more carbon if it travels more distance, so carbon emission cost also surges, which leads to a negative influence on total average cost. Cycle time also increases because if the vehicle takes more time to deliver the product, cycle time is likely to be longer. Total average cost varies linearly with distance travelled by the vehicle and it can be seen from Eq. 9 as well as Fig. 23. As the distance travelled by the vehicle increases, the transportation cost varies linearly and so does the total cost.

Results of Table 15 and Fig. 24 show as the vehicle consumes more fuel, transportation cost increases, and vehicles emit more carbon when travelling large distances, so carbon emission cost also rises; as a result, the total cost per cycle increases. Total average cost varies linearly with fuel consumption and it can be seen from Eq. 9 as well as Fig. 24. As the fuel consumption increases, the transportation cost varies linearly and so does the total average cost.

Results of Table 16 and Fig. 25 show the positive influence of additional fuel consumption (\({f}_{\mathrm{ca}}\)) on total average cost (TC). Total cost varies linearly with additional fuel consumption and it can be seen from Eq. 9 as well as Fig. 25. As the additional fuel consumption increases, the transportation cost varies linearly and so does the total average cost.

From Table 17 and Fig. 26, as the vendor sends shipments to the distributor, it becomes costlier because of the rising trends in fuel price, so transportation costs increase. Total average cost varies linearly with the shipment number and it can be seen from Eq. 9 as well as Fig. 26. As the shipment number increases, the transportation cost varies linearly and so does the total cost.

The results of Table 18 and Fig. 27 show a rise in total average cost (TC) with the carbon tax imposed to curb emissions and reduce cycle time because if the cycle time is longer, the vendor must pay more tax. Total average cost varies linearly with carbon tax per cycle and it can be seen from Eq. 9 as well as Fig. 27.

Data mentioned in Table 19 and Fig. 28 demonstrates a rise in total cost per cycle with emission from warehousing operations because the tax paid by the vendor will be more, so it is suggested to keep cycle duration smaller so that total carbon emitted in a production cycle can be minimized. Vendors should judiciously invest in green technology like solar technology to reduce emissions. Total average cost varies linearly with carbon emission due to the warehousing operations and it can be seen from Eq. 9 as well as Fig. 28 because as the emission from warehousing operations rises, emission cost increases linearly and hence the total cost.

Results of Table 20 and Fig. 29 show that total average cost (TC) upsurges with emissions from the production process because vendors have to pay more tax, and investment in green technology also increases to curb emissions. Total average cost varies linearly with carbon emission due to the production process and it can be seen from Eq. 9 as well as Fig. 29 because as the emission from the production process rises, emission cost rises linearly and hence in the same way the total cost increases.

From the above data mentioned in Table 21 and Fig. 30, as the carbon emission from waste disposal rises, the total average cost (TC) surges, but its influence is less as compared to other kinds of emissions. Total average cost varies linearly with carbon emission from waste disposal and it can be seen from Eq. 9 as well as Fig. 30. Because if carbon emission will increase linearly and hence the emission cost due to waste disposal and total cost will also rise in the same manner.

From the data mentioned in Table 22 and Fig. 31, a positive impact of vehicle standard emission (x) on total average cost (TC) can be perceived. If the vehicle carrying inventories emits more carbon vendor has to pay more tax, so they should use a vehicle having less carbon emission potential to deliver the goods, or the vendor should shift to the electric vehicle. Total average cost varies linearly with vehicle standard emission and it can be seen from Eq. 9 as well as Fig. 31.

From Table 23 and Fig. 32, it can be noted that a rise in green technology efficiency has a diminishing impact on total average cost (TC) because it reduces carbon emissions as well as investment in green technology. However, it has very less influence on cycle time. Green technology efficiency has a nonlinear relationship with total average cost as shown in Eq. 9 of total average cost and in real condition, also cost will not decrease uniformly with the rise in green technology efficiency.

Discussion of findings

In this section, the present study is compared with the existing literature. However, it is not possible to compare with the existing literature as all the parameters are not the same. Some of the most important insights gained from data analysis are highlighted below.

-

Simultaneous optimization of cycle time, green technology investment, and preservation technology investment is helpful in reducing the cost incurred by the manufacturer. Similar observations have been shown by Mashud et al. (2022) in their inventory model for the manufacturer. They maximized the profit of the manufacturer; however, they considered constant demand, production rate, deterioration rate, and fuel price.

-

The results of the special case of the numerical example make it abundantly clear that investments in both waste minimization and green technology would produce superior results compared to the situation in which neither preservation technology nor green technology is invested in. This observation aligns with Mashud et al. (2022).

-

A high production rate increases the manufacturer’s overall costs, and this observation is consistent with Sepehri et al. (2021). This might be brought on by an increase in tooling costs, significant wear and tear, and high holding costs brought on by a massive build-up of inventory. Therefore, a manufacturer should select their production rate carefully. However, Sepehri et al. (2021) considered constant demand, production rate, and deterioration rate, whereas no discussion of transportation cost and fuel price. They also optimized different parameters in their profit maximization problem.

-

Emissions from various sources and significant carbon tax increase the cost of the manufacturer. This observation is consistent with Ruidas et al. (2021), so a manufacturer should invest in green technologies to reduce the cost of emissions from various activities. But large investment in green technologies again leads to a rise in cost, so an optimum investment is recommended.

-

As the efficiency of green technology increases, green technology investment reduces, which results in the reduction of the overall cost of the manufacturer, this result is inline with Mishra et al. (2020a).

-

As the preservation technology efficiency rises total cost reduces, this result is consistent with Hsu et al. (2010).

-

As the holding cost per unit cost increases, total cost of the manufacturer surges Hsu et al. (2010).

Insights for industry

The industrial benefits of this paper are discussed in this section as follows. This paper may assist the managers in taking operational and tactical level decisions, including cycle time, green technology investment, and preservation technology investment, as described below.

-

a.

This study considers dynamic fuel pricing while taking decisions. As the fuel prices are increasing aggressively, so transportation cost is rising every year, and manufacturers must incur more cost in delivering the product to the customer. Whereas fuel consumption is affected by the distance travelled by the vehicle as well as the load carried by the vehicle which in turn affects the cost and adds more carbon to the environment. So, from a manufacturer, a paradigm shift from conventional vehicles to modern electric vehicles is required to deliver the product to the distributor to reduce dependency on fuel. Moreover, this novel step taken by the manufacturer will help to diminish the huge carbon emission to the environment and conserve fuel.

-

b.

Optimal cycle time, investment in green technology and investment in waste minimization techniques help the industry to make their decision on how much to invest in these technologies, what would be the cost incurred, what should be the cycle time to restart the production process, and if cycle time is longer, it can increase various costs whereas if it is too small, it can lead to selling loss. Through this study, the industry can minimize its cost.

-

c.

Through sensitivity analysis, many significant parameters like production rate and fuel consumption have been identified; even a small change in these parameters affects the cost of the manufacturer significantly. As we have seen from the data mentioned in Table 6, a very high production rate does not necessarily reduce cost; instead, it surges tooling cost, deterioration cost, and holding cost, so the manufacturer should judiciously control the production rate likewise other parameters are also consequential and needs special attention.

-

d.

From the special case discussed in the numerical example, it has been observed that when a manufacturer simultaneously invests in green and waste minimization techniques, total average cost is minimum. So, the industry will be surely benefited by making optimal investments in green technology like solar energy in place of non-renewable fuel sources, and its benefit is two-fold. First, it reduces cost as it is cheap and readily available and also helps in conserving conventional fuels. Some perishable products require refrigerated space, whereas others require warm conditions to stay fresh, so a manufacturer should make arrangements accordingly.

Conclusion, limitation, and future scope

There are two bigger challenges before any sustainable perishable product supply chain deterioration or wastage and emission from various stages. The deterioration of inventory poses a huge cost to any company dealing with deteriorating items. Moreover, emissions from various sources at different stages are a matter of concern and need to be minimized. The main aim of this study is to simultaneously solve these issues. To solve the first problem of wastage, investment is made in preservation technology, but too much investment can lead to higher cost, so keeping this issue in view, investments in preservation technology has been optimized. Carbon emission can take place due to production, transportation, warehousing, and waste disposal, so with a target of achieving zero emissions and making the supply chain more sustainable, investment in green technology is made. With the goal to minimize the total cost, the cycle time to restart the manufacturing process has been optimized, as too longer cycle time can lead to more deterioration cost, holding cost, carbon emission cost due to warehousing operations and shortage, and too short a cycle time can lead to revenue e loss. An algorithm is proposed to obtain the optimum solution. A numerical experiment is done to validate the model, and the convexity of the total cost function has been proved. The purpose of sensitivity analysis is to identify significant parameters that have a huge impact on the cost of the manufacturer; some of the most important insights gained from data analysis are highlighted below. Simultaneous optimization of cycle time, green technology investment, and preservation technology investment is helpful in reducing the cost incurred by the manufacturer. Similar observations have been shown by Mashud et al. (2022). A high production rate increases the manufacturer’s overall costs, and this observation is consistent with Sepehri et al. (2021). This might be brought on by an increase in tooling costs, significant wear and tear, and high holding costs brought on by a massive build-up of inventory. Therefore, a manufacturer should select their production rate carefully.

Though an extensive study has been done yet, it has certain limitations and ample scope for future extension of the model. As the reworking process has not been considered in this model, so it is applicable for those items which cannot be reworked; this is the main limitation of this model, but the same model with little modification can be used for the items that can be reworked. This paper did not consider backlogging, which is a natural extension of the present model. The present study can be further extended by considering the time-dependent deterioration rate, which is more realistic. As the preservation technology is being used, it will surely affect the freshness of the product, so the freshness-dependent demand is a very relevant extension of the present study. Deterministic price-dependent demand can be replaced with stochastic demand, or other deterministic demand like stock-dependent demand, price, and stock-dependent demand are other possible extensions of the present study. Demand fluctuation due to supply chain disruptions can also be considered. However, the unavailability of real-time data for all the parameters is one of the limitations.

Data availability

Not applicable

References

Anil Kumar B, Paikray SK (2022) Cost optimization inventory model for deteriorating items with trapezoidal demand rate under completely backlogged shortages in crisp and fuzzy environment. RAIRO-Oper Res 56(3):1969–1994. https://doi.org/10.1051/ro/2022068

Bhunia AK, Jaggi CK, Sharma A, Sharma R (2018) A two-warehouse inventory model for deteriorating items under permissible delay in payment with partial backlogging. Appl Math Comput 200:1125–1137. https://doi.org/10.1016/j.amc.2014.01.115

Bouchery Y, Ghaffari A, Jemai Z, Dallery Y (2012) Including sustainability criteria into inventory models. Eur J Oper Res 222(2):229–240. https://doi.org/10.1016/j.ejor.2012.05.004

Cárdenas-Barrón LE, Sarkar B, Treviño-Garza G (2013) An improved solution to the replenishment policy for the EMQ model with rework and multiple shipments. Appl Math Model 37(7):5549–5554. https://doi.org/10.1016/j.apm.2012.10.017

Dai Z, Wang Y (2022) A production and inventory model for deteriorating items with two-level partial trade credit and stochastic demand in a supply chain. Kybernetes, ahead-of-p(ahead-of-print). https://doi.org/10.1108/K-02-2022-0188

Das SC, Manna AK, Rahman MS, Shaikh AA, Bhunia AK (2021) An inventory model for non-instantaneous deteriorating items with preservation technology and multiple credit periods-based trade credit financing via particle swarm optimization. Soft Comput 25(7):5365–5384. https://doi.org/10.1007/s00500-020-05535-x

Dye CY (2013) The effect of preservation technology investment on a non-instantaneous deteriorating inventory model. Omega (United Kingdom) 41(5):872–880. https://doi.org/10.1016/j.omega.2012.11.002

Fang Z, Zhao Y, Warner RD, Johnson SK (2017) Active and intelligent packaging in meat industry. Trends Food Sci Technol 61:60–71. https://doi.org/10.1016/j.tifs.2017.01.002

Gautam P, Maheshwari S, Jaggi CK (2022) Sustainable production inventory model with greening degree and dual determinants of defective items. J Clean Prod 367;132879. https://doi.org/10.1016/j.jclepro.2022.132879

Gurtu A, Jaber MY, Searcy C (2015) Impact of fuel price and emissions on inventory policies. Appl Math Model 39(3):1202–1216. https://doi.org/10.1016/j.apm.2014.08.001

He Y, Wang S-Y, Lai KK (2010) An optimal production-inventory model for deteriorating items with multiple-market demand. Eur J Oper Res 203(3):593–600. https://doi.org/10.1016/j.ejor.2009.09.003

Hsu PH, Wee HM, Teng HM (2010) Preservation technology investment for deteriorating inventory. Int J Prod Econ 124(2):388–394. https://doi.org/10.1016/j.ijpe.2009.11.034

Hua G, Cheng TCE, Wang S (2011) Managing carbon footprints in inventory management. Int J Prod Econ 132(2):178–185. https://doi.org/10.1016/j.ijpe.2011.03.024

Jaber MY, Glock CH, El Saadany AMA (2013) Supply chain coordination with emissions reduction incentives. Int J Prod Res 51(1):69–82. https://doi.org/10.1080/00207543.2011.651656

Jauhari WA, Pujawan IN, Suef M (2022) Sustainable inventory management with hybrid production system and investment to reduce defects. Ann Oper Res. https://doi.org/10.1007/s10479-022-04666-8

Khakzad A, Gholamian MR (2020) The effect of inspection on deterioration rate: an inventory model for deteriorating items with advanced payment. J Clean Prod 254:120117. https://doi.org/10.1016/j.jclepro.2020.120117

KharajiManouchehrabadi M, Yaghoubi S (2022) Comparing supply-side and demand-side policies in the solar cell supply chain under competitive circumstances: a case study. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-022-21946-9

Lee C-C, Hussain J (2022) Optimal behavior of environmental regulations to reduce carbon emissions: a simulation-based dual green gaming model. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-022-19710-0

Lee Y-P, Dye C-Y (2012) An inventory model for deteriorating items under stock-dependent demand and controllable deterioration rate. Comput Ind Eng 63(2):474–482. https://doi.org/10.1016/j.cie.2012.04.006

Lin H-J (2021) An economic production quantity model with backlogging and imperfect rework process for uncertain demand. Int J Prod Res 59(2):467–482. https://doi.org/10.1080/00207543.2019.1696491

Mahapatra AS, Mahapatra MS, Sarkar B, Majumder SK (2022) Benefit of preservation technology with promotion and time-dependent deterioration under fuzzy learning. Expert Syst Appl 201:117169. https://doi.org/10.1016/j.eswa.2022.117169

Mashud AHM, Hasan MR, Wee HM, Daryanto Y (2020) Non-instantaneous deteriorating inventory model under the joined effect of trade-credit, preservation technology and advertisement policy. Kybernetes 49(6):1645–1674. https://doi.org/10.1108/K-05-2019-0357

Mashud AHM, Roy D, Daryanto Y, Chakrabortty RK, Tseng M-L (2021) A sustainable inventory model with controllable carbon emissions, deterioration and advance payments. J Clean Prod 296:126608. https://doi.org/10.1016/j.jclepro.2021.126608

Mashud AHM, Roy D, Daryanto Y, Mishra U, Tseng ML (2022a) Sustainable production lot sizing problem: a sensitivity analysis on controlling carbon emissions through green investment. Comput Indus Eng 169:108143. https://doi.org/10.1016/j.cie.2022.108143

Mashud AHM, Roy D, Chakrabortty RK, Tseng M-L, Pervin M (2022b) An optimum balance among the reduction in ordering cost, product deterioration and carbon emissions: a sustainable green warehouse. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-022-21008-0

Mishra U, Wu J-Z, Sarkar B (2020a) A sustainable production-inventory model for a controllable carbon emissions rate under shortages. J Clean Prod 256:120268. https://doi.org/10.1016/j.jclepro.2020.120268

Mishra U, Wu J-Z, Tsao Y-C, Tseng M-L (2020b) Sustainable inventory system with controllable non-instantaneous deterioration and environmental emission rates. J Clean Prod 244:118807. https://doi.org/10.1016/j.jclepro.2019.118807

Murmu V, Kumar D, Jha AK (2022a) Quality and selling price dependent sustainable perishable inventory policy: lessons from Covid-19 pandemic. Oper Manag Res. https://doi.org/10.1007/s12063-022-00266-8

Murmu V, Kumar D, Sarkar B (2022b) Production-inventory model for perishable items under COVID-19 pandemic disruptions. In Making complex decisions toward revamping supply chains amid COVID-19 outbreak (pp. 19–41). CRC Press

OPEC annual statistical bulletin 57th edition (2022) https://asb.opec.org/ Accessed 25 July 2022

Pan J, Chi C-Y, Wu K-S, Yen H-F, Wang Y-W (2020) Sustainable production–inventory model in technical cooperation on investment to reduce carbon emissions. In Processes (Vol. 8, Issue 11). https://doi.org/10.3390/pr8111438

Rana RS, Kumar D, Mor RS, Prasad K (2021a) Modelling the impact of demand disruptions on two warehouse perishable inventory policy amid COVID-19 lockdown. International Journal of Logistics Research and Applications. 1–24. https://doi.org/10.1080/13675567.2021.1892043

Rana RS, Kumar D, Prasad K (2021b) Two warehouse dispatching policies for perishable items with freshness efforts, inflationary conditions and partial backlogging. Oper Manag Res. https://doi.org/10.1007/s12063-020-00168-7

Rana RS, Cárdenas-Barrón LE, Katurka H, Kumar D (2022) Deteriorating inventory policy in a two-warehouse system under demand disruption: achieving sustainability under COVID-19 pandemic. In: Making complex decisions toward revamping supply chains amid COVID-19 outbreak (1st edn). Imprint CRC Press, p 25

Rout C, Chakraborty D, Goswami A (2021) A production inventory model for deteriorating items with backlog-dependent demand. RAIRO-Oper Res 55:S549–S570. https://doi.org/10.1051/ro/2019076

Rout C, Paul A, Kumar RS, Chakraborty D, Goswami A (2020) Cooperative sustainable supply chain for deteriorating item and imperfect production under different carbon emission regulations. J Clean Prod 272:122170. https://doi.org/10.1016/j.jclepro.2020.122170

Ruidas S, Seikh MR, Nayak PK (2021) A production inventory model with interval-valued carbon emission parameters under price-sensitive demand. Comput Indus Eng, 154. https://doi.org/10.1016/j.cie.2021.107154

Saha S, Chatterjee D, Sarkar B (2021) The ramification of dynamic investment on the promotion and preservation technology for inventory management through a modified flower pollination algorithm. J Retail Consum Serv 58:102326. https://doi.org/10.1016/j.jretconser.2020.102326

Sahoo S, Acharya M, Patnaik S (2022) Sustainable intuitionistic fuzzy inventory models with preservation technology investment and shortages. Int J Reasoning-Based Intelligent Syst 14(1):8–18. https://doi.org/10.1504/IJRIS.2022.123390

Sarkar B, Ahmed W, Choi S-B, Tayyab M (2018) Sustainable inventory management for environmental impact through partial backordering and multi-trade-credit-period. In Sustainability 10(12):4761 . https://doi.org/10.3390/su10124761

Sarkar B, Cárdenas-Barrón LE, Sarkar M, Singgih ML (2014) An economic production quantity model with random defective rate, rework process and backorders for a single stage production system. J Manuf Syst 33(3):423–435. https://doi.org/10.1016/j.jmsy.2014.02.001

Sarkar B, Dey BK, Pareek S, Sarkar M (2020) A single-stage cleaner production system with random defective rate and remanufacturing. Comput Indus Eng 150:106861. https://doi.org/10.1016/j.cie.2020.106861

Sarkar B, Mridha B, Pareek S, Sarkar M, Thangavelu L (2021) A flexible biofuel and bioenergy production system with transportation disruption under a sustainable supply chain network. J Clean Prod 317:128079. https://doi.org/10.1016/j.jclepro.2021.128079

Sebatjane M (2022) The impact of preservation technology investments on lot-sizing and shipment strategies in a three-echelon food supply chain involving growing and deteriorating items. Oper Res Perspect 9:100241. https://doi.org/10.1016/j.orp.2022.100241

Sepehri A, Mishra U, Sarkar B (2021) A sustainable production-inventory model with imperfect quality under preservation technology and quality improvement investment. J Clean Prod 310:127332. https://doi.org/10.1016/j.jclepro.2021.127332

Seuring S, Müller M (2008) From a literature review to a conceptual framework for sustainable supply chain management. J Clean Prod 16(15):1699–1710. https://doi.org/10.1016/j.jclepro.2008.04.020

Soleimani H, Mohammadi M, Fadaki M, Mirzapour Al-e-hashem SMJ (2021) Carbon-efficient closed-loop supply chain network: an integrated modeling approach under uncertainty. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-021-15100-0

Soni HN, Suthar DN (2019) Pricing and inventory decisions for non-instantaneous deteriorating items with price and promotional effort stochastic demand. J Control Decis 6(3):191–215. https://doi.org/10.1080/23307706.2018.1478327

Taleizadeh AA, Soleymanfar VR, Govindan K (2018) Sustainable economic production quantity models for inventory systems with shortage. J Clean Prod 174:1011–1020. https://doi.org/10.1016/j.jclepro.2017.10.222

Tang S, Wang W, Cho S, Yan H (2018) Reducing emissions in transportation and inventory management: (R, Q) Policy with considerations of carbon reduction. Eur J Oper Res 269(1):327–340. https://doi.org/10.1016/j.ejor.2017.10.010

Tayyab M, Sarkar B (2016) Optimal batch quantity in a cleaner multi-stage lean production system with random defective rate. J Clean Prod 139:922–934. https://doi.org/10.1016/j.jclepro.2016.08.062

Thomas A, Mishra U (2022) A sustainable circular economic supply chain system with waste minimization using 3D printing and emissions reduction in plastic reforming industry. J Clean Prod 345:131128. https://doi.org/10.1016/j.jclepro.2022.131128

Tiwari S, Cárdenas-Barrón LE, Goh M, Shaikh AA (2018a) Joint pricing and inventory model for deteriorating items with expiration dates and partial backlogging under two-level partial trade credits in supply chain. Int J Prod Econ 200:16–36. https://doi.org/10.1016/j.ijpe.2018.03.006

Tiwari S, Daryanto Y, Wee HM (2018b) Sustainable inventory management with deteriorating and imperfect quality items considering carbon emission. J Clean Prod 192:281–292. https://doi.org/10.1016/j.jclepro.2018.04.261

Tsao YC (2016) Designing a supply chain network for deteriorating inventory under preservation effort and trade credits. Int J Prod Res 54(13):3837–3851. https://doi.org/10.1080/00207543.2016.1157272

Yadav D, Kumari R, Kumar N, Sarkar B (2021) Reduction of waste and carbon emission through the selection of items with cross-price elasticity of demand to form a sustainable supply chain with preservation technology. J Clean Prod 297:126298. https://doi.org/10.1016/j.jclepro.2021.126298

Yadav S, Khanna A (2021) Sustainable inventory model for perishable products with expiration date and price reliant demand under carbon tax policy. Process Integr Optim Sustain 5(3):475–486. https://doi.org/10.1007/s41660-021-00157-8

Yang CT, Dye CY, Ding JF (2015) Optimal dynamic trade credit and preservation technology allocation for a deteriorating inventory model. Comput Ind Eng 87:356–369. https://doi.org/10.1016/j.cie.2015.05.027

Yang Y, Chi H, Tang O, Zhou W, Fan T (2019) Cross perishable effect on optimal inventory preservation control. Eur J Oper Res 276(3):998–1012. https://doi.org/10.1016/j.ejor.2019.01.069

Yang Y, Chi H, Zhou W, Fan T, Piramuthu S (2020) Deterioration control decision support for perishable inventory management. Decis Support Syst 134:113308. https://doi.org/10.1016/j.dss.2020.113308

Zhang Y, Qin Y (2022) Carbon emission reduction cooperation of three-echelon supply chain under consumer environmental awareness and cap-and-trade regulation. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-022-20190-5

Manteghi Y, Arkat J, & Mahmoodi A (2022) Cooperation mechanisms for a competitive, sustainable food supply chain to reduce greenhouse gas emissions. Environ Sci Pollut Res 29:32142–32160 . https://doi.org/10.1007/s11356-021-17363-z

FAO (2013) Food Wastage Footprint: Impacts on Natural Resources. Summary Report pp 8–61

Author information

Authors and Affiliations

Contributions

All authors contributed to the study conception and design. Material preparation, data collection, and analysis were performed by Ranveer Singh Rana. The first draft of the manuscript was written by Dinesh Kumar and Kanika Prasad commented on previous versions of the manuscript. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Ethical approval

Not applicable

Consent to participate

Not applicable

Consent for publication

Approved the version to be published

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Philippe Garrigues

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1

Proof of Lemma 1

To determine the optimal values of G, calculate the first and second-order derivatives of E [TC (T, G, ξ)] with respect to G. First-order derivatives are given below.

To determine the minimum cost of the production inventory system, the above-mentioned partial differentiation should satisfy the necessary condition, i.e., \(\frac{\partial E [TC (T, G, \xi )] }{\partial G}=0\); from this condition, we can find the optimum value of the decision variable G.

Moreover, to satisfy optimality, i.e., convexity conditions, the sufficient condition must be satisfied, i.e., the corresponding principal minor should be positive definite.

If the leading minors of H are \({H}_{1}=\frac{{\partial }^{2}E [TC (T, G, \xi )] }{{\partial G}^{2}}> 0\)

Appendix 2

Proof of corollary 1

For a given value of ξ and P > a- bs, and a- bs = D, from the above expression we can observe possible negative terms are \({e}^{-{e}^{-\lambda \xi }{T}_{m}E(\theta )}-1\) and \(\frac{{e}^{\lambda \xi }\left({e}^{{e}^{-\lambda \xi }\left(T-{T}_{m}\right)E(\theta )}-1\right)}{E(\theta )}\)

Definitely \({e}^{{e}^{-\lambda \xi }\left(T-{T}_{m}\right)E(\theta )}\)> 1 and also \(\frac{{e}^{\lambda \xi }\left({e}^{{e}^{-\lambda \xi }\left(T-{T}_{m}\right)E(\theta )}-1\right)}{E(\theta )}>({T}_{m}-T)\) so \({e}^{\lambda \xi }\left(a-bs\right)\left({T}_{m}-T+\frac{{e}^{\lambda \xi }\left({e}^{{e}^{-\lambda \xi }\left(T-{T}_{m}\right)E(\theta )}-1\right)}{E(\theta )}\right)\) is a very large positive value. \({e}^{-{e}^{-\lambda \xi }{T}_{m}E(\theta )}< -1\), but \({e}^{\lambda \xi }\left(a-bs\right)\left({T}_{m}-T+\frac{{e}^{\lambda \xi }\left({e}^{{e}^{-\lambda \xi }\left(T-{T}_{m}\right)E(\theta )}-1\right)}{E(\theta )}\right)\) is very large as compared to \({e}^{\lambda \xi }\left(P+bs-a\right)\left({T}_{m}+\frac{{e}^{\lambda \xi }\left({e}^{-{e}^{-\lambda \xi }{T}_{m}E(\theta )}-1\right)}{E(\theta )}\right)\) so since \({H }_{1}\)> 0, corollary 1 is satisfied one can conclude \(\frac{{\partial }^{2}E [TC (T, G, \xi )] }{{\partial G}^{2}}\) > 0, therefore, E [TC (T, G, ξ)] is convex in G and a unique minimum solution exists at \({G}^{*}\) hence corollary 1 is proved.

Appendix 3

Proof of Lemma 2

To determine the optimal values of T, calculate the first and second-order derivatives of E [TC (T, G, ξ)] with respect to T. First-order derivatives are given below.

To determine the minimum cost of the production inventory system, the above-mentioned partial differentiation should satisfy the necessary condition, i.e., \(\frac{\partial E [TC (T, G, \xi )] }{\partial T}=0\); from this condition, we can find the optimum value of the decision variable T.

Moreover, to satisfy optimality, i.e., convexity conditions, the sufficient condition must be satisfied, i.e., the corresponding principal minor should be positive definite.

If the leading minors of H are \({H}_{1}=\frac{{\partial }^{2}E [TC (T, G, \xi )] }{{\partial T}^{2}}> 0\)

Appendix 4

Proof of Lemma 3

To determine the optimal values of T and G, calculate the first- and second-order derivative of E [TC (T, G, ξ)] with respect to T and G. First-order derivatives are given below.

To determine the minimum cost of the production inventory system, the above-mentioned partial differentiation should satisfy the necessary condition, i.e., \(\frac{\partial E [TC (T, G, \xi )] }{\partial G}=0\), \(\frac{\partial E [TC (T, G, \xi )] }{\partial T}=0\), from this condition, we can find the optimum value of decision variables.