Abstract

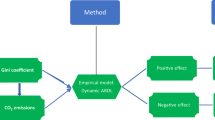

The emerging environmental concerns are entrenched in social issues, largely stem from income differences and power disparity. Income distribution and environmental disruption are increasingly pointed as obstacles in securing sustainable development goals and environmental preservation. The existing empirical studies have explored the environmental pollution impact of income inequality. However, the results are conflicting, and little attention has been paid to explore the short and long-run environmental impacts from a national viewpoint. Similarly, the role of aggregate income and financial sector for environmental quality has attracted considerable attention and many studies have provided conflicting empirical evidence. The literature generally ignores the importance of relative income in explaining environmental outcomes and also assumes symmetric association, ignoring asymmetric shocks. The present study explores the role of nonlinear associations in forming the links between income distribution and environmental quality using linear and nonlinear autoregressive distributed lag models from 1972 to 2018. The study follows the extended environmental Kuznets curve (EKC) approach. The results suggest that inequality promotes environmental pollution. Further financial development also escalates carbon emissions. The nonlinear analysis confirms the asymmetric effect of inequality on ecological footprint. The EKC, however, is not validated for Pakistan. The results suggest important policy implications.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

In recent decades, a growing consensus is emerging among environmental economists, energy experts, and social scientists that climate change has negative effects on human life. Particularly, emerging economies are facing grave environmental concerns owing to their leading role in global greenhouse gas (GHG) emissions (Yang et al. 2020; You et al. 2020). To prevent a significant ecological catastrophe, researchers and policymakers have been increasingly emphasizing the mitigation of rising GHG emissions, which are recognized to be the leading reason for global warming (Bhattacharya et al. 2017). The forest cover degradation, rising sea level, output volatility, droughts, storms, and floods across the globe are attributed to global environmental changes (Majeed and Mazhar 2019). Such outcomes jeopardize people’s lives, infrastructures, natural resources, and agricultural lands.

The literature has identified diverse drivers of environmental loss and solutions to preserve the global environment. Particularly, GHG emissions are regulated in certain boundaries in the wake of the Kyoto Protocol, signed in 1997 and executed in 2005. Similarly, the United Nations (UN) has declared “clean energy” as the 17th sustainable development goal (SDG) to manage global environmental issues. According to IPCC (2018), GHG emissions need to be curtailed by 45% by 2030 in comparison to 2010 levels, achieving net-zero status about 2050 to maintain the 1.5 °C goal.

Environmental problems are largely attributed to growth mania where growth is prioritized at the cost of environmental quality (Ozturk et al. 2021; Hundie 2021). The growth mainly relies on non-renewable energy sources which negatively influence the ecosystem services (Li et al. 2021; Ahmed et al. 2021b). In particular, the developing world aims to attain high growth rates. In this respect, many emerging economies have shown marvelous growth performance in the recent decades. Many economists, energy experts, environmental scholars, and policymakers see the continuous expansion and global impact of emerging economies as both remarkable and alarming (Majeed and Mumtaz 2017; Zhao et al. 2021). In addition to the many socioeconomic problems, such economic performance is coming at the cost of severe conservation crises. Pakistan is ranked among the top two high polluting economies and “more than 20% of deaths in Pakistan are attributable to the negative health impacts of air pollution exposure” (IQAir 2020).

Given such a scenario, the contemporary research streams need to move beyond conventional determinants of environmental pollution and need to work on some deeper environmental drivers such as the role of income imbalances to conserve the earth’s natural environment. The burgeoning research studies on the environmental Kuznets curve (EKC) have discovered several important variables other than aggregate income affecting environmental performance. The importance of income distribution, however, is generally overlooked in shaping environmental preferences. Any economic activity that boosts carbon emissions produces both winners and losers. The winners take the benefit of that activity whereas the losers are deprived of the gain and become vulnerable to that activity. The winners have the potential to lobby the government to relax the environmental laws, thereby deteriorating environmental quality (Boyce 1994). Contrary to this, if we assume that losers are the rich and they negotiate with the winners and influence the government for setting stringent environmental regulations. Hence, environmental quality depends upon both aggregate income and its distribution.

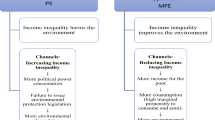

Now the question arises as to how income distribution can influence environmental quality. The literature suggests the following potential links. First, the impact of income distribution on environmental quality can be expounded using the “political economy” approach proposed by Boyce (1994). The basic idea is that the rich prefer more pollution. They have the economic capacity to gain more political rights to manipulate environmental laws. Consequently, less stringent environmental regulation is implemented to safeguard the interest of the rich.

Second, the positive impact of income distribution on environmental loss could be explained through the “consumption competition” approach which postulates that as income distribution becomes unequal, consumption of pollution-intensive goods and services tend to increase, and environmental quality is compromised (Schor 1998). One likely explanation is that income inequality can alter consumption style in favor of rich households. They consume more to maintain their lifestyles and status. Another reason is that high inequality also drives working hours. The longer working hours put pressure on energy sources and escalate pressure on the environment (Bowles and Park 2005; Knight et al. 2013; Fitzgerald et al. 2015).

Third, income inequality influences environmental quality by changing “marginal propensity to emit (MPE)”. The MPE framework relies on a different hypothesis. According to Ravallion et al. (2000) and Schmalensee et al. (1998), the MPE is influenced by income changes. When citizens with lower income have a comparatively higher MPE, then any policy to lower inequality will result in higher environmental degradation. Contrary to this negative effect, if they have a relatively lower MPE, the policy lowering income inequality might result in less emission. The poorest can have high MPE for the following reasons. First, they might employ inefficient energy sources than the richest ones that might lead to higher MPE. Second, low-carbon goods usually need modern and clean technology, which the poor may not afford.

The empirical literature produces mixed evidence. The studies explore the inequality-environment nexus for different groups of economies but do not provide a clearer relationship. The studies from a national perspective are also not conclusive and ignore asymmetric associations between inequality and the environment. Against this backdrop, the aim of the present study is to examine the asymmetric impacts of inequality on ecological quality.

Besides, the role of the financial sector in explaining environmental changes has become fundamental in environmental economics research (Ahmed et al. 2021a; Kihombo et al. 2021a; Kihombo, et al. b). In recent years, the association between financial development and environmental degradation has become critical owing to the increasing role of green financing. Green finance supports environmental conservation by supporting such projects which are carbon-neutral and environmentally friendly (Majeed and Mazhar 2019). Moreover, financial development helps to mitigate carbon pollution facilitating financial assistant for research and development ventures, supporting environmentally clean technologies, and providing monetary and technical support to firms (Yuxiang and Chen 2010).

Whereas financial development can have adverse effects on the environment owing to the fact that the financial sector facilitates production activities which, in turn, enhance carbon emission, natural source loss, and health-related problems (Zhang 2011; Tang and Tan 2014; Tsaurai 2019). Furthermore, financial support to consumers increases the demand for manufactured goods such as equipment and automobiles, thereby stimulating GHG emissions (Sadorsky 2010). Thus, financial development can disrupt the environment by enhancing economic activities and economic performance (Tamazian and Rao 2010; Yuxiang and Chen 2010; Majeed 2018; Ahmed et al. 2021a, b).

The motivation for selecting Pakistan’s economy is based on the following reasons. Pakistan is ranked among the top two high polluting economies (IQAir 2020). The environmental quality is deteriorating owing to a rapid rise in CO2 and NO nitrogen oxide emissions (Khan and Majeed 2019). Thermal sources comprise more than 60% of electricity production, thereby polluting environmental quality by escalating emissions. The share of Pakistan in global GHG emissions is 0.8%; however, it disproportionately confronts major effects of global warming and climate change. “An estimated annual cost of environmental problems in Pakistan amounts to 6% of its GDP” (Majeed et al. 2020).”

Now, the State Bank of Pakistan (SBP) has commenced managing environmental pressure by supporting clean finance projects. The SBP and International Finance Corporation (IFC) signed an agreement to promote green finance (Mumtaz and Smith 2019). JS Bank of Pakistan endorsed Green Climate Fund. These initiatives inspire us to analyze the relationship financial sector with environmental quality in the case of Pakistan.

The present paper extends empirical literature by exploring the effect of income inequality on the ecological footprint for Pakistan covering the time span from 1972 to 2018. This research also explores hidden asymmetric associations between income inequality and environmental pollution by exploiting the non-linear autoregressive distributive lags (NARDL) approach. To the authors’ best information, this research is the first of its kind that explores asymmetric impacts of income distribution on the ecological quality of Pakistan. Prior studies have mainly analyzed the symmetric effect of inequality on CO2 emissions ignoring the role of hidden relationships between inequality and ecological quality. This research considers ecological footprint as a better measure of environmental quality because it covers diverse dimensions of the environment including carob emissions. Analyzing ecological footprint as an environmental indicator will offer an analysis of environmental quality from a wider perspective, rather than merely relying on carbon pollution as in many prior empirical studies.

The results of the present study will help researchers, development economists, ecologists, commercial banks, central banks, and global organizations. The study will endeavor policy recommendations for safeguarding environmental degradation and managing redistribution issues. The outcomes of the present research are supportive for Pakistan and for other developing economies with similar profiles which are prioritizing social and financial reforms to safeguard the environment.

The remaining study is divided into the following sections: A brief “review of the related literature” is provided in the next section. Section 3 explains the data and model. The empirical outcomes and their interpretation are provided in Section 4. Section 5 puts forward the concluding discussion and policy implication.

Literature review

Following the pioneering study of Boyce (1994), many studies have been devoted to exploring the association of income distribution with environmental degradation. The scholars have made excellent contributions towards this end. However, the outcomes of these studies are not yet decisive on this topic. In view of this, some theorists claim that inequality is good to preserve the environmental quality while on the contrary, many studies disregard this claim.

Torras and Boyce (1998) agree that citizen’s demand for clean environmental matter for policy formation as suggested by the EKC; however, they disagree that alone income is sufficient to explain the falling part of the EKC. In addition, they claim that a high equitable income distribution leads to improved environmental preservation employing the data of 58 economies from 1977 to 1991. That is, they confirm Boyce’s claim that inequality escalates environmental pollution.

Magnani (2000) rebuttals the claim of a “development path” that mechanically associates per person income growth with lower environmental degradation when fiscal policy choices are associated with heterogeneous individuals. He suggests that the degree of environmental preservation relies on two effects, “an absolute income effect and a relative-income effect”. On the one hand per person, income growth may enhance the ability to pay for environmental amenities (“the absolute income effect”). On the other hand, unequal income distribution may significantly lower citizens’ willingness to pay for environmental preservation (“the relative income effect”) by switching the median voter’s inclinations away from consumption of the public good “environmental amenities”. Magnani (2000) also found the positive influence of unequal income on environmental loss for “organization for economic co-operation and development (OECD)” economies over the period 1980–1991. Further, he argues that these findings cannot be generalized for a developing economy.

Eriksson and Persson (2003) argued that the relationship of income inequality with environmental pollution is contingent on the level of democracy. In a strong democracy, less income inequality generates less pollution while the opposite outcome turns out in a weak democracy. Employing the “autoregressive distributed lag (ARDL)” method, Baek and Gweisah (2013) showed the emissions boosting effects of a high level of income inequality in the short- and long-term from1967 to 2008. Contrary to this, Heerink et al. (2001) argue that income redistribution has an adverse impact on environmental quality.

Recently, Wu and Xie (2020) analyzed the relationship of income distribution with carbon emissions for 78 OECD and non-OECD economies from 1990 to 2017. They employed ARDL, fully modified ordinary least squares (FMOLS), and dynamic ordinary least squares (DOLS) estimation approaches. The empirical findings reveal that an increase in income inequality encourages per person CO2 emission in OECD economies, while does not exert any significant influence in lower-income non-OECD economies. Kazemzadeh et al. (2021) investigated the effects of economic complexity and income inequality on the ecological footprint for 25 economies covering the period 1970–2016 and employing the panel quantile regression method. The findings show a positive influence of unequal income distribution on the ecological footprint in the 10th, 25th, and 50th quantiles.

One main issue with the above-discussed studies is that they either use cross-sectional data or panel data for a group of economies and generalized their findings for an individual country. Notwithstanding heterogeneous conditions of different countries, these studies assume that an individual country will mirror the pattern of a group of economies irrespective of the development stage and country-specific characteristics. No prior study has estimated the EKC with inequality and financial development using linear and nonlinear ARDL approaches for Pakistan. This study attempts to contribute to the extant literature by exploring the growth-inequality-environment nexus for Pakistan. This study focuses on the short-and-long-run impacts of aggregate income and income distribution on ecological footprint (EFP) over the period 1970–2018.

Now, it is widely argued that income is not the alone indicator to elucidate environmental quality, prior studies may suffer the omitted variable bias problem (Baek and Gweisah (2013). Consequently, it has become a common practice to model environmental indicators like energy usage, foreign investment, and financial growth in the EKC framework (Majeed et al. 2020). Although a plethora of variables have been included in the EKC framework to explain environmental outcomes, less focus is given to income distribution. In earlier studies, Boyce (1994) emphasized that income inequality influences the demand for the natural environment and thus induces policy response. Accordingly, he emphasized that income distribution needs to be modeled while estimating the EKC to explain environmental outcomes. This is referred to as a “political economy” argument. The literature also suggests that income disparities can help to preserve the environment. Ravallion et al. (2000) suggest that “trade-offs exist between climate control (on the one hand) and both social equity and economic growth (on the other)”. They conclude that higher-income imbalances are food for environmental quality. Using the data over 1985–2012 for 149 countries, Hübler (2017) concluded higher-income imbalances improve environmental quality in pooled regression model while the opposite results are shown with fixed-effects estimation.

Using the data over 1960–1990 for 88 countries, Coondoo and Dinda (2008) also confirmed the positive connection between unequal income distribution and environmental performance. For Europe and America, they found that an equalizing redistribution of income will escalate carbon emissions; however, this effect is not validated for much poor country-group of Asia and Africa. Employing Swedish household data from the “Swedish Family Expenditure Survey (FES)” of 1984, 1988, and 1996, Brännlund and Ghalwash (2008) also confirmed a positive association between unequal income distribution and environmental quality (air pollution). Grunewald et al. (2017) showed that inequality-environmental nexus depends upon the income level of countries. Using panel data from over 1980 to 2008, covering 158 countries they demonstrated that higher unequal income distribution enhances per person emission in high middle-income and high-income countries while decreases per person emission in low middle-income and low-income economies.

Despite growing consensus on the harmful effects of inequality on the environment a parallel research body also disregards this positive association. For example, Scruggs (1998) argues that the validity of Boyce’s (1994) argument depends on strong assumptions. He critically evaluates the “equality hypothesis” using theoretical and empirical perspectives. The equality hypothesis has two problematic assumptions. The assumption is that “marginal demand for environmental degradation (MDED)” goes up as an individual’s relative income or power goes up. Though, socio-economic and political sciences do not validate this assumption that rich people desire more environmental quality than that of their counterparts. Second, the “equality hypothesis” postulates that democratic social preferences generate the most appropriate solutions to public issues. In reality, however, similar forms of democratic collective choice institutions deliver varied results, whereas non-democratic institutions can deliver environmentally friendly outcomes. Employing air and water pollution data for 29 counties over the period 1979–1990, he demonstrates the favorable impact of unequal income distribution on environmental sustainability.

Some latest studies also suggest mixed evidence on inequality-emissions nexus. For example, Yang et al. (2020) explored the effects of income distribution and financial instability on carbon emissions for 47 developing economies from 1980 to 2019 using the “stochastic impacts by regression on population, affluence, and technology (STIRPAT)” model. Their results confirm that income inequality decreases environmental degradation while financial instability does not exert any independent impact on pollution. You et al. (2020) look into the interactive effect of income distribution and democracy on carbon emission for 41 “Belt and Road Initiative (BRI)” economies covering the time span from 1997 to 2012 employing the extended EKC framework. The results exhibit that more inequality in combination with a weak democracy produces higher CO2 emissions.

Uddin et al. (2020) claim that the relationship of income distribution with emission varies over time. Using the panel data for G-7 economies covering the time span from 1870 to 2014 and employing a nonparametric econometrics approach, they found significant positive and negative effects of income distribution on CO2 emissions over the period 1870–1880, 1950 to 2000, respectively, while insignificant impact during 1881–1949 and 2000–2014.

Guo et al. (2020) explored the effects of income distribution and country risk on carbon emission for 73 countries with heterogenous income levels over the period 1995–2014 and employing a panel quantile regression approach. The study exhibits diverse relationships between inequality and emissions depending upon the income level of countries, the degree of risk, and the existing level of emissions. From a global perspective, the authors confirm that coefficients associated with income inequality drop consistently along with declining country risk at 10th to 50th quantiles, while at the remaining quantiles, the emission effects of inequality consistently remain negative. Chen et al. (2020) explored the inequality-emissions nexus for G20 economies covering the time span from 1988 to 2015 employing an extended EKC framework. The results for the developing economies suggest that a lower income inequality mitigates CO2 emissions while in the case of most developed economies no significant relationship is identified.

Hundie (2021) explores the inequality-emission nexus for Ethiopia covering the time span from 1979 to 2014 and using the ARDL and the DOLS approaches to cointegration. The results demonstrate a positive relationship between inequality and emission; however, the findings are sensitive to the use of econometric approaches. Cheng et al. (2021) investigate inequality-emissions nexus for 30 provinces in China covering the time span 2000–2015 and employing the STIRPAT framework and quantile regression approach. Their outcomes show that higher inequality significantly promotes direct CO2 emissions across all quantiles; however, no significant impact is found on indirect carbon emissions. Langnel et al. (2021) explore inequality-emission nexus for 11 Economic Community of West African States (ECOWAS) over the period 1984-2016. The empirical outcomes posit a mixed picture for inequality-emission nexus. The results based on Augmented mean group estimator suggest that income inequality improves environmental quality in Burkina Faso, Nigeria, and Senegal; however, it degrades environmental quality in Benin.

Aforementioned discussion suggests that the overall impact of income inequality on environmental quality is not yet conclusive. The existing studies mainly focus on absolute income ignoring relative income. Furthermore, the prior studies assume a linear association between income inequality and environmental quality ignoring nonlinear hidden dynamic effects. Besides, existing research mainly focuses on CO2 emissions to measure environmental quality which, however, just represents one dimension of environmental quality. The present work contributes to the extant literature by exploring the short and long-run associations between income inequality and ecological footprint for Pakistan over the period 1972–2018. Moreover, this study employs a nonlinear ARDL approach to explore the dynamic associations between selected variables.

Data and methodology

Data

This research analyzes the asymmetric effects of income inequality on environmental degradation including the role of growth, energy usage, and financial development for Pakistan from 1972 to 2018. The outcome variable is EFP while GDP per capita, energy usage, and financial development are control variables. The outcome variable EFP is measured in global hectares. Economic performance is measured with GDP per capita in constant 2010 local currency, energy use is measured in kg of oil equivalent, financial development is measured domestic credit to private sector % of GDP, and income inequality is measured with Gini coefficient. Table 1 presents the description and sources of the selected variables for empirical analysis.

Figure 1 shows the EFP trend over the study period. The EFP has considerably increased over the study period suggesting that the ecological burden is increasing in Pakistan. Figure 2 displays the EFP components trend over the study period. Comparatively, carbon and cropland footprints are contributing more to overall EFP while footprints related to the fishing ground, forest products, and grazing land are putting the lowest pressure on overall EFP. Since 2001, carbon footprint is outpacing cropland footprint.

Empirical model

For the empirical model, we follow the theoretical model proposed by Torras and Boyce (1998) and Heerink et al. (2001) to reflect the long-term association between ecological footprint and its main factors. Following the theoretical literature, a simple regression modeling in a linear logarithmic form can be specified as follows:

Where, EFP is ecological footprint, Ineq is inequality, FD represents financial development, GDP per capita indicates the growth of the economy and EU is the energy consumption.

Model specification: ARDL

To investigate the effect of inequality on ecological footprint, initially, the standard framework of the ARDL is used. For this purpose, the specification is provided in Eq. (2).

Equation (2) shows short-term dynamics by parameters associated with difference operators (α1, α2, α3, α4, α5, α6), while long-term effects are shown using coefficients attached with the first lags of the variables. In the following stage, the error correction mechanism (ECM) for short-run dynamics is specified as follows:

The term ECTt-1 reflects the error correction mechanism and η shows the speed of adjustment. The expected association between the ECM and ecological footprint is negative.

Model specification: NARDL

The long-run relationship between variables can be estimated through ARDL, ECM, and Granger causality, but these linear models do not consider the nonlinear nature of the variables. To consider the nonlinear behavior of variables, Shin et al. (2014) developed the method of NARDL by extending the Pesaran et al. (2001) bound test approach.

The long-term relationships among selected variables can be determined using the ARDL, ECM, and Granger causality. However, these models only detect linear association among selected variables ignoring the non-linear associations. To frame the nonlinear associations among variables, Shin et al. (2014) constructed nonlinear ARDL on the basis of the bound test method given by Pesaran et al. (2001).

Equation (4) represents an extension of Equation 1 as it decomposes inequality into two separate positive and negative components. The parameters are \(\varnothing =\left({\varnothing}_o,{\varnothing}_1,{\varnothing}_2,{\varnothing}_3^{+},{\varnothing}_4^{-}{,\varnothing}_5,{\varnothing}_6\right)\) and\({Ineq}_t={Ineq}_O+{Ineq}_t^{+}+{Ineq}_t^{-}\) represents the vector of unknown long-run parameters. The terms \({Ineq}_t^{+}\ and\ {Ineq}_t^{-}\) show the partial sum of positive and negative alteration in Ineqt:

Equation (5) reflects the positive and negative partial sum decomposition of inequality to estimate the asymmetric impacts on inequality on ecological footprint. Equation (5) is developed on the basis of methodology provided by Shin et al. (2014):

The notations (p, a, h and n) represent the lag orders. Equation (4) posits certain issues such as it does not reflect hidden cointegration and, therefore, it is not able to provide a valid interpretation of calculated asymmetric parameters. To address this issue, certain parameter restrictions are imposed in Eq. (4) that is \({\varnothing}_3^{+}={~}^{-{\vartheta}_2^{+}}\!\left/ \!\!{~}_{{\delta}_1}\right.\) & \({\varnothing}_4^{-}={~}^{-{\partial}_3^{-}}\!\left/ \!\!{~}_{{\delta}_1}\right.\). The short-term impact of a positive change in income inequality on ecological footprint is calculated with \({\sum}_{i=0}^n{\varnothing}_i^{+}\) while the short-term influence of a negative change in income inequality on ecological quality is calculated with \({\sum}_{i=0}^n{\varnothing}_i^{-}\). Thus, Eq. (6) provides the outcomes for asymmetric influences of income inequality on the ecological footprint in both the short and long run.

The ECM for Eq. (6) can be displayed as follows:

The terms Πi, Ρi and Ηi represent short-run parameters to be estimated and \({\Psi}_i^{+},{\Psi}_i^{-}\) reflect the short-run symmetry adjustment. Furthermore, Ωi denotes to the parameter of ECM.

The framework of NARDL is based on the following stages: First, the implementation of NARDL requires the testing of unit-roots. The objective of confirming the presence of unit roots is to assure whether all series are stationary at level or first difference or have mixed orders of integration. It is also important to make sure that no series is stationary at the second difference. To check for the integration order. the conventional “Augmented Dickey-Fuller” and “Phillips Perron” tests of unit roots are employed.

Second, for empirical analysis using the conventional approach of ordinary least squares, Eq. (6) is constructed. That is, we calculate the positive and the negative variables of income inequality to discover their asymmetric impacts on ecological quality. Having specified Eq. (6), the NARDL framework is improved using a general to specific approach by reducing insignificant lags. Third, the procedure of bounds testing is adopted to confirm the long-run relationships and to estimate the long-run parameter estimates. The test comprises Wald F-test. The null hypothesis is, Ho: \({\partial}_1={\gamma}_1={\pi}_2={\varphi}_3^{+}={\sigma}_4^{-}={\tau}_5={\rho}_6\) whereas the alternative is H1: \({\partial}_1\ne {\gamma}_1\ne {\pi}_2\ne {\varphi}_3^{+}\ne {\sigma}_4^{-}\ne {\tau}_5\ne {\rho}_6\). Fourth, confirming the existence of cointegration, the short and long-run asymmetric impacts of income inequality on ecological footprint are estimated. Moreover, “asymmetric cumulative multiplier effect” of one % change in \({Ineq}_{t-i}^{+}\kern0.5em\)and \({Ineq}_{t-i}^{-}\) is formulated as:

It should be noted that as b →∞,\({K}_b^{+}\)→\({\varnothing}_3^{+},\) & \({K}_b^{-}\)→\({\varnothing}_4^{-}\).

Results and discussion

For empirical analysis, initially, we check the stationarity of all selected variables. The stationarity of a series is important to rule out the chances of spurious regression analysis. Furthermore, it is important for reliable and unbiased parameter estimates and serves as a prerequisite for the use of ARDL and NARDL approaches. These approaches require that time series should be either integrated at level or first difference, but no variable should be integrated at the second difference. We apply ADF and PP tests with constant and trend elements of the variables. Table 2 presents the outcomes of these tests suggesting that all indicators are integrated at first difference. That is, all series do not exhibit stationary at level but turn out to be stationary at the first difference, thus obeying the condition that no variable is stationary at the second difference.

The results of the ADF test may become misleading when structural breaks persist in the series (Perron 1989). To confirm it, we proceed further with Zivot and Andrews (2002) unit root test which includes structural breaks in the data. The findings reported in Table 3 confirm that the selected variables have integration of order one and no variable is integrated of order two. Hence, we can proceed to the next step.

After confirming the stationarity of the selected series, optimal lag length and cointegration among the series are confirmed. Table 4 shows optimal lag selection criteria. We have used the “Akaike Information Criterion (AIC)” criterion to specify the optimal lags of the series.

We have used the “Autoregressive distributed lag (ARDL)” method to cointegration provided by Pesaran et al. (2001). One main advantage of this approach is that it does not limit cointegration. Table 5 presents the outcomes based on the ARDL bound test approach. Since the “null hypothesis of no co-integration” is rejected, we infer long-term association among the selected series.

After confirming cointegration, we estimate the long-and-short-term estimates. Table 6 provides the results for long-term estimates. The coefficient on inequality shows a positive and significant influence on EFP. In particular, a 1% rise in inequality leads to a 0.1% rise in EFP. This incline in EFP demonstrates that inequality in Pakistan is exerting high pressure on environmental quality. This result is in line with the prior studies (Boyce 1994; Torras and Boyce 1998; Kazemzadeh et al. 2021). Furthermore, Hundie (2021) and Cheng et al. (2021) find a similar result for Ethiopia and China, respectively. This finding differs from the outcome of Scruggs (1998) who demonstrated the favorable effect of inequality on environmental sustainability using air and water pollution data for 29 counties from 1979 to 1990.

The findings for GDP per person and GDP per person square reflect the negative and positive effects, respectively. That is, the association between economic growth and EFP exhibits a U-shaped relationship implying that economic growth escalates the pressure on earth at a higher level of economic development. This finding contradicts the existing studies favoring the EKC validity (Majeed 2018; Ahmed et al. 2021b). The likely reason of this inconsistency could be that earlier studies confirm the EKC in a cross-country analysis or different country-specific studies. However, this finding is consistent with Majeed et al. (2021b) who found the U-shaped relationship between economic growth and EFP for Pakistan. The coefficient on energy consumption has a positive and significant impact on EFP showing that a 1% increase in energy consumption EFP increases by 0.1%. An incline in energy consumption puts pressure on carbon footprint, thereby enhancing the pressure on overall EFP. This finding is in line with the findings of Majeed et al. (2021a).

The influence of financial development on EFP turns out to be positive and significant revealing that financial development is enhancing pressure on EFP. The possible reason could be the low priority of the financial sector for environmental amenities. In Pakistan, funding is given to those projects which prioritize growth over the environment. Financial development pollutes the environment influences the environment by supporting production processes that require the intensive use of energy. Since the major share of energy comes from fossil fuels which pollute the environment by releasing harmful gases, further, natural resources are overexploited, and ecosystem services are disrupted causing health issues. Likewise, financial facilities for equipment purchase and vehicles usage also increase the CO2 emissions in the atmosphere. This outcome is in line with the past studies (Sadorsky 2010; Tamazian and Rao 2010; Yuxiang and Chen 2010; Zhang 2011; Tang and Tan 2014; Majeed 2018; Gul et al. 2018; Tsaurai 2019; Ahmad et al. 2020; Ahmed et al. 2021a; Ahmad et al. 2021; Kihombo et al. 2021a; Kihombo et al. b). Ahmad et al. 2020 show pollution-enhancing effects of financial development for 40 Asian economies for 1990–2018.

The findings for short-run analysis are reported in Table 7. The error correction mechanism reflects a negative and significant effect on EFP at a 1% level of significance. This finding confers that disequilibrium in the model converges to equilibrium. The speed of convergence is quite high as 0.85% of the error is resolved each year. The effect of inequality on EFP is positive and significant.

Nonlinearity BDS test

To check nonlinearity, we used the nonlinear BDS test provided by Broock et al. (1996). Table 8 provides the estimations based on the BDS test. The results suggest that nonlinearity exists because the null hypothesis of linearity is not accepted for all indicators.

Estimates of Nonlinear Auto-Regressive Distributed Lag (NARDL) model

The NARDL methodology is used to analyze the asymmetric association between inequality and EFP. Table 8 provides the results estimated using the NARDL. The calculated F-value (5.5) is greater than that of the value of the upper bound at a 1% level of significance confirming that linear cointegration does not persist. Table 9 presents long-term estimates found using the NARDL. The findings confirm the asymmetric effects of inequality on EFP in the long run. A positive shock in inequality demonstrates a positive and significant effect on inequality. However, a negative shock in inequality exerts less influence on EFP. The effects of other variables are similar to the findings obtained using ARDL. The effects of energy consumption on EFP are positive and significant suggesting that overall energy sources used in Pakistan are escalating environmental degradation by enhancing EFP. The consumption of fossil fuels is the main energy source in Pakistan (Ahmad and Majeed 2021; Ullah et al. 2021a; Ullah et al. b). This finding is consistent with Li et al. (2021) who showed positive influence of fossil fuel energy consumption on environmental pollution for one belt and road initiative (OBRI) countries over the period 2007–2019.

Table 10 reports the shot-run estimates obtained using NARDL. The short-run effects also confirm asymmetric associations between inequality and EFP. The ECM term shows a negative and significant impact on EFP suggesting that any short-run disequilibrium adjusts at a faster pace. The tests are also performed to check the quality of the results. The adjusted R-squared shows that the overall model demonstrates a good fit, the Lagrange multiplier test for autocorrelation suggests that the results are free from the autocorrelation problem, and the Jarque-Bera test shows that the distribution of residuals is normal. The Wald test also rejects the null hypothesis of long-run symmetry, therefore reconfirming the long-run asymmetries between inequality and EFP.

We also isolate the negative and positive components of inequality using the NARDL method. Figure 3 shows the disintegrated negative element whereas Fig. 4 displays the positive constituent of inequality.

Finally, the stability of the model is also tested. Figure 5 shows that that the coefficients and variance are stable following the cumulative sum (CUSUM) and CUSUM of the squares at the 5% level of significance.

To plot nonlinearity, the dynamic multiplier figure is illustrated. The figure reflects the adjustments of asymmetries in the long run in response to the negative and positive shocks in inequality. The asymmetry adjustment is apparent from the positive and negative changes at a certain time. The graph for the dynamic multiplier in Fig. 6 indicates that the negative shocks of income inequality have a weaker influence on ecological footprint than that of the positive shocks.

Conclusion

This research explores the associations among inequality, economic growth, financial development, energy consumption, and ecological footprint for Pakistan covering the period from 1972 to 2018. The results are estimated using both ARDL and NARDL approaches. The NARDL analysis suggests the asymmetric relationship between income inequality and ecological footprint as the positive and negative shocks in inequality exert different influences on ecological footprint. The ARDL results exhibit that inequality significantly increases EFP in the longer term in Pakistan. Besides, the dynamic multiplier analysis suggests that the positive shock in inequality has a greater influence on EFP than that of the negative shocks. In addition, the EKC is not validated, and energy use and financial development significantly have a positive effect on EFP.

Following the empirical outcome, this research offers the following policies. First, as it is clear from the results that inequality is a key factor influencing ecological footprint in Pakistan therefore, redistribution policy choices need to be considered taking into account ecological concerns. In this regard, welfare programs can be strengthened by sparing more budget for social activities. The effect of negative shocks in inequality is worth incorporating while developing social sector policies. Second, as an increase in financial development positively affects ecological footprint, the policymakers may consider the financial reforms while devising environmental conserving policies. The financial sector can be regulated to support green finance for clean and carbon-free projects. Third, as the findings exhibit that energy use increases ecological footprint, the government may strive to substitute nonrenewable energy sources with renewable energy sources. The use of coal and fossil fuels in the production process can be curtailed.

The analysis of this study can be replicated for other developing countries with similar profiles. Besides, other significant determinants of EFP such as foreign trade, poverty, employment, and global value chain can be explored. Future research can also explore the distribution profile of EFP while analyzing its determinants. Moreover, this research considers overall EFP, and future research can explore different components of EFP in a comparative setting to explain EFP and inequality nexus.

Data availability

Data sources are clearly mentioned. Interested person can access the data.

References

Ahmad, M, Ahmed, Z, Yang, X, Hussain, N, & Sinha, A (2021) Financial development and environmental degradation: do human capital and institutional quality make a difference?. Gondwana Research

Ahmad, W, & Majeed, MT (2021) Does renewable energy promote economic growth? Fresh evidence from South Asian economies. Journal of Public Affairs, e2690

Ahmad, W, Ullah, S, Ozturk, I, & Majeed, MT (2020) Does inflation instability affect environmental pollution? Fresh evidence from Asian economies. Energy & Environment, 0958305X20971804

Ahmed, Z, Cary, M, Shahbaz, M, & Vo, XV (2021b) Asymmetric nexus between economic policy uncertainty, renewable energy technology budgets, and environmental sustainability: Evidence from the United States. Journal of Cleaner Production, 127723

Ahmed Z, Zhang B, Cary M (2021a) Linking economic globalization, economic growth, financial development, and ecological footprint: evidence from symmetric and asymmetric ARDL. Ecological Indicators 121:107060

Baek J, Gweisah G (2013) Does income inequality harm the environment? Empirical evidence from the United States. Energy Policy 62:1434–1437

Bhattacharya M, Churchill SA, Paramati SR (2017) The dynamic impact of renewable energy and institutions on economic output and CO2 emissions across regions. Renewable Energy 111:157–167

Bowles S, Park Y (2005) Emulation, inequality, and work hours: was Thorsten Veblen right? The Economic Journal 115(507):F397–F412

Boyce JK (1994) Inequality as a cause of environmental degradation. Ecological Economics 11(3):169–178

Brännlund R, Ghalwash T (2008) The income–pollution relationship and the role of income distribution: an analysis of Swedish household data. Resource and Energy Economics 30(3):369–387

Chen J, Xian Q, Zhou J, Li D (2020) Impact of income inequality on CO2 emissions in G20 countries. Journal of Environmental Management 271:110987

Cheng Y, Wang Y, Chen W, Wang Q, Zhao G (2021) Does income inequality affect direct and indirect household CO 2 emissions? A quantile regression approach. Clean Technologies and Environmental Policy 23(4):1199–1213

Coondoo D, Dinda S (2008) Carbon dioxide emission and income: a temporal analysis of cross-country distributional patterns. Ecological Economics 65(2):375–385

Eriksson C, Persson J (2003) Economic growth, inequality, democratization, and the environment. Environmental and Resource Economics 25(1):1–16

Fitzgerald JB, Jorgenson AK, Clark B (2015) Energy consumption and working hours: a longitudinal study of developed and developing nations, 1990–2008. Environmental Sociology 1(3):213–223

Global Footprint Network (2020) Living planet report. Species and spaces, people and places. Available at http://data.footprintnetwork.org/#/analyzeTrends?type=EFCtot&cn=5001

Government of Pakistan (2020) Economic survey. Economic Advisor’s Wing, Ministry of Finance, Islamabad

Grunewald N, Klasen S, Martínez-Zarzoso I, Muris C (2017) The trade-off between income inequality and carbon dioxide emissions. Ecological Economics 142:249–256

Gul F, Usman M, Majeed MT (2018) Financial inclusion and economic growth: a global perspective. J Bus Econ 10(2):133–152

Guo, Y, You, W, & Lee, CC (2020) CO 2 emissions, income inequality, and country risk: some international evidence. Environmental Science and Pollution Research, 1-21

Heerink N, Mulatu A, Bulte E (2001) Income inequality and the environment: aggregation bias in environmental Kuznets curves. Ecological Economics 38(3):359–367

Hübler M (2017) The inequality-emissions nexus in the context of trade and development: a quantile regression approach. Ecological Economics 134:174–185

Hundie, SK (2021) Income inequality, economic growth and carbon dioxide emissions nexus: empirical evidence from Ethiopia. Environmental Science and Pollution Research, 1-20

IPCC (2018) Special report on global warming of 1.5 _C. Incheon, Republic of Korea: Intergovernmental Panel on Climate Change. Available at: https://www.ipcc.ch/site/assets/uploads/2018/11/pr_181008_P48_spm_en.pdf. Accessed 30 June 2021

IQAir (2020) World air quality report region & city PM2. 5 ranking. IQAir AirVisual, Goldach, Switzerland

Kazemzadeh, E, Fuinhas, JA, & Koengkan, M (2021) The impact of income inequality and economic complexity on ecological footprint: an analysis covering a long-time span. Journal of Environmental Economics and Policy, 1-21

Khan S, Majeed MT (2019) Decomposition and decoupling analysis of carbon emissions from economic growth: a case study of Pakistan. Pakistan Journal of Commerce and Social Sciences 13(4):868–891

Kihombo, S, Ahmed, Z, Chen, S, Adebayo, TS, & Kirikkaleli, D (2021a) Linking financial development, economic growth, and ecological footprint: what is the role of technological innovation?. Environmental Science and Pollution Research, 1-11

Kihombo, S, Saud, S, Ahmed, Z, & Chen, S (2021b) The effects of research and development and financial development on CO 2 emissions: evidence from selected WAME economies. Environmental Science and Pollution Research, 1-11

Knight KW, Rosa EA, Schor JB (2013) Could working less reduce pressures on the environment? A cross-national panel analysis of OECD countries, 1970–2007. Global Environmental Change 23(4):691–700

Langnel Z, Amegavi GB, Donkor P, Mensah JK (2021) Income inequality, human capital, natural resource abundance, and ecological footprint in ECOWAS member countries. Resources Policy 74:102255

Li, X, Sohail, S, Majeed, MT, & Ahmad, W (2021) Green logistics, economic growth, and environmental quality: evidence from one belt and road initiative economies. Environmental Science and Pollution Research, 1-11

Magnani E (2000) The environmental Kuznets curve, environmental protection policy and income distribution. Ecol Econ 32(3):431–443

Majeed MT (2018) Information and Communication Technology (ICT) and environmental sustainability in developed and developing countries. Pakistan Journal of Commerce and Social Sciences 12(3):758–783

Majeed MT, Mazhar M (2019) Environmental degradation and output volatility: a global perspective. Pakistan Journal of Commerce and Social Sciences 13(1):180–208

Majeed MT, Mumtaz S (2017) Happiness and environmental degradation: a global analysis. Pakistan Journal of Commerce and Social Sciences (PJCSS) 11(3):753–772

Majeed MT, Samreen I, Tauqir A, Mazhar M (2020) The asymmetric relationship between financial development and CO 2 emissions: the case of Pakistan. SN Applied Sciences 2(5):1–11

Majeed, MT, Ozturk, I, Samreen, I, Luni, T (2021b) Evaluating the asymmetric effects of nuclear energy on carbon emissions in Pakistan, Nuclear Engineering and Technology, early online, 1-26

Majeed MT, Tauqir A, Mazhar M, Samreen I (2021a) Asymmetric effects of energy consumption and economic growth on ecological footprint: new evidence from Pakistan. Environmental Science and Pollution Research:1–17

Mumtaz MZ, Smith ZA (2019) Green finance for sustainable development in Pakistan. Islamabad Policy Research Institute Journal 19(2):1–34

Ozturk I, Majeed MT, Khan S (2021) Decoupling and decomposition analysis of environmental impact from economic growth: a comparative analysis of Pakistan, India, and China. Environmental and Ecological Statistics:1–28

Perron P (1989) Testing for a unit root in a time series with a changing mean. Journal of Business & Economic Statistics 8(2):153–162

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. Journal of Applied Econometrics 16(3):289–326

Ravallion M, Heil M, Jalan J (2000) Carbon emissions and income inequality. Oxford Economic Papers 52(4):651–669

Sadorsky P (2010) The impact of financial development on energy consumption in emerging economies. Energy Policy 38(5):2528–2535

Schmalensee R, Stoker TM, Judson RA (1998) World carbon dioxide emissions: 1950–2050. Review of Economics and Statistics 80(1):15–27

Schor JB (1998) The overspent American. Basic Books, New York

Scruggs LA (1998) Political and economic inequality and the environment. Ecological Economics 26(3):259–275

Shin Y, Yu B, Greenwood-Nimmo M (2014) Modelling asymmetric cointegration and dynamic multipliers in a nonlinear ARDL framework. In: Festschrift in honor of Peter Schmidt (pp. 281–314). Springer, New York, NY

Tamazian A, Rao BB (2010) Do economic, financial and institutional developments matter for environmental degradation? Evidence from transitional economies. Energy Economics 32(1):137–145

Tang CF, Tan BW (2014) The linkages among energy consumption, economic growth, relative price, foreign direct investment, and financial development in Malaysia. Quality & Quantity 48(2):781–797

Torras M, Boyce JK (1998) Income, inequality, and pollution: a reassessment of the environmental Kuznets curve. Ecological Economics 25(2):147–160

Tsaurai K (2019) The impact of financial development on carbon emissions in Africa. International Journal of Energy Economics and Policy 9(3):144–153

Uddin MM, Mishra V, Smyth R (2020) Income inequality and CO2 emissions in the G7, 1870–2014: evidence from non-parametric modelling. Energy Economics 88:104780

Ullah, S, Ahmad, W, Majeed, MT, & Sohail, S (2021b) Asymmetric effects of premature deagriculturalization on economic growth and CO2 emissions: fresh evidence from Pakistan. Environmental Science and Pollution Research, 1-15

Ullah S, Ozturk I, Majeed MT, Ahmad W (2021a) Do technological innovations have symmetric or asymmetric effects on environmental quality? Evidence from Pakistan. Journal of Cleaner Production 316:128239

World Bank (2020) World development indicators. World Bank, Washington, DC. Available at http://data.worldbank.org/products/wdi

Wu R, Xie Z (2020) Identifying the impacts of income inequality on CO2 emissions: empirical evidences from OECD countries and non-OECD countries. Journal of Cleaner Production 277:123858

Yang B, Ali M, Hashmi SH, Shabir M (2020) Income inequality and CO2 emissions in developing countries: the moderating role of financial instability. Sustainability 12(17):6810

You W, Li Y, Guo P, Guo Y (2020) Income inequality and CO 2 emissions in belt and road initiative countries: the role of democracy. Environmental Science and Pollution Research 27(6):6278–6299

Yuxiang K, Chen Z (2010) Financial development and environmental performance: evidence from China. Environment and Development Economics 16(1):1–19

Zhang YJ (2011) The impact of financial development on carbon emissions: an empirical analysis in China. Energy Policy 39(4):2197–2203

Zhao, W, Zhong, R, Sohail, S, Majeed, MT, & Ullah, S (2021) Geopolitical risks, energy consumption, and CO 2 emissions in BRICS: an asymmetric analysis. Environmental Science and Pollution Research, 1-12

Zivot E, Andrews DWK (2002) Further evidence on the great crash, the oil-price shock, and the unit-root hypothesis. J Bus Econ Stat 20(1):25–44

Code availability

Computational codes are available on demand.

Author information

Authors and Affiliations

Contributions

This idea was collectively developed by Muhammad Idrees and Muhammad Tariq Majeed. Muhammad Idrees supported in all sections of this work and completed the final write up of the paper. Muhammad Tariq Majeed analyzed the data and discussed the results and drafted initial versions of the other sections. All authors have read and approved the manuscript.

Corresponding author

Ethics declarations

Ethics approval

This article does not contain any studies with human participants or animals performed by any of the authors.

Consent to participate

The author is free to contact any of the people involved in the research to seek further clarification and information.

Consent for publication

Not applicable.

Conflict of interest

The authors declare no competing interests.

Additional information

Responsible Editor: Ilhan Ozturk

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Idrees, M., Majeed, M.T. Income inequality, financial development, and ecological footprint: fresh evidence from an asymmetric analysis. Environ Sci Pollut Res 29, 27924–27938 (2022). https://doi.org/10.1007/s11356-021-18288-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-021-18288-3