Abstract

This study is focused on analyzing the linkage between carbon dioxide (CO2) emissions, renewable energy consumption (RE), foreign direct investment (FDI), national patents (NP), exports (X), imports (M), and gross domestic product (GDP) in Tunisia by using the time series data from 1980 to 2017. A unit root test and an autoregressive distributed lag (ARDL) model were applied to avoid bias caused by data mismatch and autocorrelation of time series data. Elasticity long-run test shows that renewable energy consumption, exports, and gross domestic product have a positive impact on CO2 emissions, while foreign direct investment acts negatively on CO2 emissions. Depending on the error correction term test, there is a long-run causality: from CO2 emissions, renewable energy, foreign direct investment, exports, and gross domestic product to home patent. Findings of the short-run causality show that there is a unidirectional causality running from exports to CO2 emissions and from exports to gross domestic product. Our results also show that Tunisia should encourage foreign direct investment because it seems to be an important factor in the mitigation of CO2 emissions.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

According to the World Data Atlas (2020), Tunisia’s CO2 emissions are rising at a 4.31% yearly rate, and it climbed from 4.2 to 32.1 million tonnes from 1970 to 2019. It also represents the largest contributor to the total GHG emissions in Tunisia, accounting for nearly 98.3% (Cherni and Essaber-Jouini 2017). Tunisia is one of the Mediterranean regions most vulnerable to climate change (World Energy Council 2019), as its energy system is highly dependent on natural gas and oil imports (Schmidt et al. 2017; Banacloche et al. 2020).

In 2015, the United Nations General Assembly established the sustainable development goals (SDGs), with the aim of achieving them by 2030. Featuring 17 objectives and 169 targets, the SDGs offer new opportunities for member countries to address global development challenges (Rusydiana et al. 2021). Energy presents the seventh goal, and it ultimately seeks to ensure that each country will be able to expand international cooperation to improve access to clean energy research and technologies (Kumar and Jan 2014). Also, it enhances investment in clean energy infrastructure and technology development to provide developing countries with advanced and sustainable energy utilities (Gamoori et al. 2017; Saudi et al. 2019).

Therefore, it is necessary for Tunisia to move from an economy based on fossil fuels to an economy based on clean energies. As a result, the country has opted to push forward with the energy transition, focusing on two key elements: energy efficiency and renewable energy (Ministry of Environment and Sustainable Development 2015; Banacloche et al. 2020).

Tunisia covers about 97% of its electrical requirements from gas and oil. The government spent over 150 billion euro on energy subsidies in 2015. At the same time, there is now an ecological and economical alternative for producing electricity, given the constantly falling costs of photovoltaic (PV) systems. Although the geographical conditions are extremely favorable, the PV capacity installed at present is only 35 MW. A higher level of PV systems requires higher private and public investment. This will necessitate a more beneficial legal and administrative environment, client-oriented services offered by the private sector, and policies to ensure market growth in deprived areas (Beerfeltz 2013).

The Government of Tunisia lately initiated the Tunisian Renewable Program (TRP), which aims to raise the proportion of renewables in the country’s energy package to 30% by 2030. It is a transformative and unparalleled phenomenon. The TRP must be reached in three stages: 1.28 GW of wind and solar capacity should be put into service by 2020, an extra 1.25 GW between 2021 and 2025, and an additional 1.25 GW between 2026 and 2030. This large size of renewable energy (RE) will make a decisive contribution to counter the regression of the country’s energy self-sufficiency and to minimize the carbon imprint of electricity production (World Bank 2019).

During the previous 3 years, Tunisia has developed its inputs and outputs of innovation. It succeeded to improve its score in terms of innovation inputs, by winning 5 ranks compared to 2016 and reaching 77th place in 2018. Innovation outputs place 63rd this year, with an increase of 8 places from 2017 and 21 places from 2016. Tunisia ranks 55th in the efficiency ratio of innovation, increasing from 65th in 2017 and 86th in 2016. Compared to its global GII place (66th), Tunisia ranks strongly in this ratio, due to a greater position in terms of innovation outputs (63rd) in comparison to inputs (77th) (WIPO 2018).

The International Property Rights Index (IPRI) score of Tunisia raised from 0.045 to 5.142, ranking it 11th in the Middle East and North Africa (MENA) region and 77th in the world. The degree of the intellectual property rights sub-index in Tunisia jumped from 0.018 to 4.659; this leads to impact the achievement of intellectual property protection level with 4.777, the patent registration level with 6.50 for, and finally the copyright safeguard level with 2.70 (IPRI 2019).

Tunisia’s foreign direct investment (FDI) flows decreased by 9.6% to reach 2,479 MDT in 2019: 17.7% of all external medium and long-term financing and 2.2% of gross domestic product (GDP) (compared to 23.4% and 2.6%, respectively, in 2018). Therefore, it is important to note that the recovery of foreign direct investment flows to their past rates depends on the implementation of several reforms aimed at enhancing the business environment to restore confidence among international investors and support the attractiveness of Tunisia’s location. Besides, foreign direct investment flows, except for the energy sector, involved 603 investment transactions, contributing to the creation of 14,353 new jobs in 2019. This includes 126 new projects and 477 extension ones for values of 209 MDT and 1361 MDT respectively. Exports of goods and services fell sharply in current terms (10.4% compared to 20.5% in the preceding year) and declined marginally in constant terms (0.9% compared to 4.1%). Especially, exports of goods, which grew by 7% in terms of current values and declined by 5% in constant prices, were severely impacted by low foreign demand, mostly from the euro area, which had a negative impact on manufacturing sectors. Exports were likewise affected by the impact of the sharp decline in olive oil production, combined with problems in the fuel and phosphate segments. Nonetheless, this tendency was partially mitigated by increased revenues from services, especially tourism, which grew by 35.9% in current terms and by 27.6% without the exchange rate adjustment (Central Bank of Tunisia 2020).

In recent decades, developed countries have become overwhelmingly dependent on imports from developing ones, raising concerns about trade’s environmental implications. Higher demand for imports in wealthy economies definitely boosts exports from developing nations; however, emissions do not have to scale in lockstep with exports if national sales or emissions levels change endogenously with external demand (Barrows and Ollivier 2021).

For the last few decades, politicians, economists, and the public have been worried about globalization’s environmental implications. The main concern is that free trade will promote a transfer of production to developing economies, which have lax environmental rules and inefficient production (Antweiler et al. 2001; Copeland and Taylor 2004; Frankel and Rose 2005; Levinson 2009). The increase in exports by developing states over the past few years reinforces this concern, particularly in the context of stalled global climate change negotiations and the delay by governments in regulating greenhouse gas (GHG) emissions (Barrows and Ollivier 2021). In addition, exports are employed to highlight the importance of global trade in a national economy; it affects a national’s carbon emissions (Piaggio et al. 2017; Hu et al. 2018; Cheng et al. 2019).

To the extent of our knowledge, there is no work that investigates this link between CO2 emissions, renewable energy, foreign direct investment, national patents, and gross domestic product in Tunisia. To fill this gap, this paper studies this link with introducing exports and imports during the period 1980–2017. The contribution of this paper compared to the previous literature is that CO2 emissions is a function of national patents, exports, renewable energy, gross domestic product, and foreign direct investment. The topic is very interesting, and it is related with the current environmental studies issues.

This article is organized as follows. “Literature review” section investigates the literature review. “Data and descriptive statistics” section is concerned with the data and descriptive statistics. Methodology and results are presented in “Methodology and results” section. Finally, conclusion and recommendations are mentioned in “Conclusion and recommendations” section.

Literature review

The context of CO 2 emissions

First, there is important to mention that Tunisia approved the protocol of Kyoto in 2003, to decrease GHG emissions (Farhani et al. 2014). According to Cherni and Essaber-Jouini (2017), energy consumption is the principal reason for environmental pollution in Tunisia, because about 97% of consumptions of primary energy belong to gas and oil that generate CO2 emissions in the environment. Since 2001, Tunisia moved to the status of net energy importer because the national energy production is in stagnancy while the energy consumption is increasing. The energy processing industry, transports, tertiary, manufacturing industry, and agriculture are the principal sources of GHG emissions. In Tunisia, CO2 emissions represent 98.3% of the total emissions; CH4 emissions account for 1.1% and 0.6% for N2O. Recently, Tunisia attempts to solve problems of energy and the environment and to use renewable energy that can decrease CO2 emissions and promote sustainable development. Farooq et al. (2019) studied the relationship between greenhouse gas emission and health issues. Results of the quantile regression show the positive link between these two variables. Ghazouani et al. (2020) studied the impact of carbon tax reforms on CO2 emissions in European countries. They found that carbon tax improve the environmental quality by mitigating CO2 emissions. Examining 30 Chinese provinces during the period 2004–2015, Sarwar et al. (2019) find that industrialization, oil use, and coal use increase CO2 emissions. In his study, Shahzad (2020) found that the energy consumption for economic activities increase the CO2 emissions.

The context of research and development

The research and development (R&D) is one of the main characteristics of the evolution and development of countries. Leahy and Neary (2007) investigated the theoretical implication of poof suggesting that R&D that directly contributes to profitability raises the absorptive capacity of a firm. Their results showed that expensive absorption may increase the effectiveness of own R&D but it decreases the effective spillover coefficient, which enfeebles the encouragement of research joint venture. Moreover, this result involves an additional strategic pay-off to policies that increase the level of extra-industry knowledge. Hammerschmidt (2009) studied the hypothesis of absorptive capacity in a model by endogenizing the spillovers. His results showed that when the spillovers parameter is superior, firms will invest more to promote absorptive capacity. Fershtman and Markovich (2010) examined the effect of licensing arrangements, patents, and imitation on the rapidity of firm value, consumers’ surplus, and innovation by using a race model of two firms that have asymmetric ability R&D multistage. Their results showed that when the patent protection regime is fragile, free imitation of any intermediate technology will be easy to do, which can produce a higher consumer surplus than a regime that confers a patent for final innovation. Amir et al. (2008) investigated the economic forms of R&D cost functions when the inventive output is imperfectly appropriate. The main basis is that investment in R&D ought to generate more reduction in costs when it is specified to one lab rather than two independent labs functioned under natural spillovers. When there are input spillovers, this postulate is widely persuaded. Nevertheless, if there are output spillovers, it is not the status for R&D technologies that have declining returns to scale. Wiethaus (2005) studied the endogenous determination of R&D appropriability via the R&D approaches adopted by the firm. Approaches of identical broad R&D tried to maximize absorptive capacity and to bind companies with their environmental R&D. But that is not the case when idiosyncratic R&D approaches is adopted; this because that competing firm favors identical R&D approaches to attend goals mentioned above.

El Elj (2012) examined the impact of external and internal elements of companies on the innovation in Tunisia, which can change by the modification of characteristics of the firms, like the opening of capital to external firms. In this study, he used a sample of 543 industrial companies. His findings showed that the major factors of innovation performance of Tunisian companies are the technological skills of companies, resulting from internal R&D and innovation efforts and cooperation. His results also indicated that companies with raised exportation and important external capital participation innovate less than companies with partially exportation and small external capital share. Therefore, governors should make a new strategy of foreign direct investment regarding their technological content and their effect on the internal R&D training system and innovation. Kriaa and Karray (2010) used a sample of 320 Tunisian companies between 2002 and 2005, to study factors of R&D investment in these firms, by analyzing the correlation between firms’ innovation effort and R&D expenditures. Their findings exhibited that there is a positive effect of R&D activities experience in innovation and public subsidies and human capital quality on innovation probability of companies, but the structure of ownership acts negatively. Whereas, results show that there are spillover effects only for innovating companies and which has absorptive capacity. Besides, they found that R&D expenditures can be well explained by acquisition channels for external technologies. The ownership system acts significantly on R&D investment, particularly for foreign-controlled companies. There is a positive impact on innovating companies and negative impacts on non-innovating ones. In the same line, using a survey for years 2002, 2003, and 2004, Koouba et al. (2010) clarified the cause that some companies decide to innovate; however, some others do not. Results of the exploratory tentative logistic regression showed that the relationship between the innovation-decision with the market structure and the companies’ size, which are traditional elements of innovation, is inverted. Also, they found that public incentives and skills of workers did not have any impact on the innovation-decision in Tunisian companies. Zouari and Zouari-Hadiji (2015) used a sample of 95 Tunisian companies in 2006 and 2007 to study the correlation link between company performance and the structure of the ownership. Their findings exhibited that the level of innovation of companies had a significant impact on the correlation between the concentration of ownership with managerial ownership and with the performance of the firm.

CO2 emissions and R&D

Concerning the relation between R&D and pollution, Grover (2017) studies the causes of the decrease of industrial R&D spending to abating pollution in the USA over 1973–1998. Results of the industry-level panel data showed that the decrease was engendered a little part by policy design changes and spillovers from other industry pollution abatement R&D substituting for R&D spending in the focal sector. Lee et al. (2015) studied the environmental R&D and its link with climate change and international environmental agreement. To this aim, they used a sample of 362 companies from 2003 to 2010 using a fixed effect model for estimation. Their results showed that the firm value declines constantly by carbon emissions. Besides, they showed that the market taxes firms when they have negative environmental performance more than having a positive one. They also note that efforts made by firms to conform to international environment agreements will not hamper their performance. Ouchida and Goto (2016) study the environmental R&D formation by a new method. Also, they investigate four types of environmental R&D in a Cournot duopoly where the regulator did not impose from before an emission tax. The four environmental R&D are environmental research joint venture (ERJV), environmental R&D competition, environmental R&D, and ERJV competition. They found that, in the case of a weak environmental damage or the case of a serious environmental damage, environmental costs are very inefficient, and then the ERJV frame is socially higher than the other three cases. While, when there is serious environmental damage and R&D costs adopted by the firm are limited, so social welfare is upper than the three others.

CO2 emissions and innovation

Fernández Fernández et al. (2018) examine the impact of innovation on CO2 emission. Sample used is the USA, EU (15), and China from 1990 to 2013. They found that, in developed countries, R&D expenditures decrease CO2 emissions. Also, there is a relationship between CO2 emissions and energy consumption, so when a growth in energy consumption will rise CO2 emissions. Therefore, this work wants to realize a separation between these two variables. So, R&D expenditures can be considered as the key of sustainable development and not only of the economic growth. Apergis et al. (2013) investigate the relationship between CO2 emissions and R&D expenditures in companies of 3 European countries (the UK, France, and Germany) over the period 1998–2011 before and after the compulsory adoption of International Financial Reporting Standards (IFRS). Results of the threshold autoregressive model showed that after the compulsory adopting of IFRS, R&D expenditures decrease CO2 emissions in companies. This is probably by dint of the application of incentives of new regime.

CO2 emissions and renewable energy

Nowadays, renewable energy became a primordial subject. Többen (2017) showed that electricity generation from renewable sources had low positive effects on industries, but a large drain on domestic revenue and declining distributional consequences. Nevertheless, spending on new capacity can eventually turn these negative effects into a positive path for the majority of households. Talbi et al. (2020) examined the impact of gross domestic product, electricity price, and urbanization on the residential electricity in Tunisia from 1980 to 2018 using ARDL approach. Their results of the long-run elasticity showed that urbanization and electricity price act positively on the residential electricity. However, the gross domestic product presented an insignificant and negative impact on the residential electricity. Dogan and Seker (2016) examined the impact of real income, renewable and non-renewable energies, and trade openness on CO2 emissions in the European Union between 1980 and 2012. Findings of the dynamic ordinary least squares proved that non-renewables lead to higher CO2 emissions whereas renewables and trade reduce carbon emissions. According to the Dumitrescu-Hurlin non-causality approach, there is unidirectional causality from trade openness to CO2 emissions, from real income to carbon emissions and from CO2 emissions to non-renewables, and a bi-directional causality between carbon emissions and renewables. Doğan et al. (2021) examined the impact of renewable energy, population growth, economic progress, and economic complexity on carbon emissions in 28 OECD economies from 1990 to 2014. Their results of alternative panel data techniques showed that renewable energy and economic complexity have negative impacts on CO2 emissions. Fatima et al. (2021) use the GMM, random effects, fixed effects, regression models, and panel causality techniques to study the impact of renewable energy and increased income on CO2 emissions. They found that an income rise may moderate the relationship between renewable energy and CO2 emissions. In addition, their results showed that increased income may cause environmental pollution. In their study and applying GMM, FGLS, FMOLS, and DOLS approaches, Shahzad et al. (2020) found that in the newly industrialized countries from 1971 to 2014, export diversification, extensive and intensive margin decrease the energy use. In addition, they found that urbanization, economic growth, and natural resources act positively on energy consumption.

Studying the case of Tunisia and using ARDL approach and Granger causality test, Ghorbal et al. (2021) found that trade and foreign direct investment have a negative impact on renewable energy while home patents have a positive impact on it.

The context of patents

The patent is the most vigorous intellectual property rights. Prud’homme (2017) examined how the strategic sequencing of patent regimes for utility models over time is intended to support technological development via fixed effects regressions. His findings indicated that laggards in East Asia set up less rigorous utility model patent systems less suited to the early economic catch-up stages, presumably to assist technological learning. Thereafter, the stringency of the regimes improved as knowledge build-up and, to some degree, technological abilities rose and, in the case of mainland China in particular, as issues of patent quality was encountered. There is also evidence that in the short term, more rigorous utility model patent regimes can decrease the number of patents, but not in the long term. In the same context, Choung et al. (2014) examined the varied pathways of innovation activity and highlight key features in the transition period of emerging countries. For this reason, they identified three types of innovation activities: the strengthening of the process, architectural, and radical innovations. They noted that each path of innovation activity in the transition period of the developing countries needs appropriate institutional structures, a different capacity base, and different interactions between innovation participants to ease the passage from imitator to innovator. Also, Cai et al. (2020) investigated the huge rise in foreign patent requests in China. They assessed the assumptions of market coverage and the threat to competition based on industry data from 19 regions and countries from 1985 to 2009. They found that the demand for foreign patents in China relies on the patent decision of competing countries, the market decision, and the patent system reformation in China.

According to the study of Wang et al. (2012), home patents of carbon-free energy technologies have a significant impact on the reduction of CO2 emissions in eastern China. For them, home patents (or national patents) have been used as a proxy of innovation. More precisely and during the period 1980–2014, they found for ten nations that renewable energy, gross domestic product, non-renewable energy production, urbanization, and export quality increase CO2 emissions, while renewable energy supply reduces it. And, for the main complex economies, the quality of exports and renewable energy mitigate CO2 emissions, whereas, urbanization and non-renewable energy increase it. In another work, Cheng et al. (2019) use the panel OLS and panel quantile regression approaches. They found that renewable energy supply and foreign direct investment affect negatively the CO2 emissions; while, economic growth, domestic credit to private sectors, development of environmental patents, and exports have a positive impact on it in BRICS over the period 2000–2013. At the same line, Wang et al. (2020) study the case of 30 provinces in mainland China from 1997 to 2008 employing dynamic panel data method. They find that Chinese advanced and new technology manufacturing decreases incorporated CO2 emissions in the industrialized world but raises those in the developing ones.

CO 2 emissions and exports

In another context, low economic advantage exports lead to reduce CO2 emissions, while high economic advantage exports lead to high carbon emissions. The technological improvement in the sector of optical and electrical devices may efficiently enhance the pollution abatement. For this reason, Shahzad et al. (2020) examined the mixed effects of the diversified export products, the intensive margin, and the extensive margin on carbon emissions in of 63 developed and developing nations, during the period 1971–2014. And they found that the three indicators of export diversification decrease CO2 emissions. Employing sequential estimation, panel quantile regressions, system, and difference GMM, Bashir et al. (2020) investigated the impact of export product diversification, extensive and intensive margin on carbon, and energy intensity in 29 OECD nations from 1990 to 2015. Their results showed that these three indicators of export diversification have a negative effect on carbon and energy intensity.

Data and descriptive statistics

This study uses the time series data of Tunisia from 1980 to 2017. The data sources are the World Bank (2020), U.S. Energy Information Administration (EIA 2020), and World Data Atlas (2020). The variables employed are carbon dioxide (CO2) emissions measured in kilotons, renewable energy consumption (RE) measured in Btu, foreign direct investment net inflows (FDI) measured in percentage of GDP, national patents (NP) measured in the number of patents, exports of goods and services (X) and imports of goods and services (M) measured in percentage of GDP, and gross domestic product (GDP) measured in constant 2010 USD. Time series are limited to the year 2017 because of the data availability. Eviews 12.0 is used as basic software for all estimates.

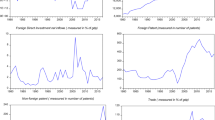

The empirical analysis begins with the study of some descriptive statistics and graphs’ representations before the transformation of the variables to the logarithmic form. Descriptive statistics and graphs’ representations for the selected time series are respectively reported in Table 1 and Fig. 1.

Some descriptive statistics (as mean, maximum, and minimum) are made to assess the trend of the selected time series (CO2 emissions, renewable energy consumption, FDI, national patents, exports, imports, and gross domestic product) from1980 to 2017. Based on these statistics and graphs, the trend in CO2 emissions is steadily rising over time, with a maximum number of 31,840.00 in 2017 and a minimum number of 9345.906 in 1980. The consumption of renewable energy was relatively constant, with almost identical values from 1980 to 2004. However, from 2014 to 2017, its evolution increased continually. The trend in the rate of foreign direct investment over time is growing favorably but with some sharp fluctuations. The highest peak was reached in 2006 with a share of 9.42%. The number of national patents has gradually risen over time with only small variations. The highest number of patents was 235 in 2016, while the lowest number was 12 in 1984. The tendency of exports and imports has also some sharp fluctuations. The evolution of gross domestic product was steady in this period. Imports were unsteady over the considered period. It reached its minimum share of 35.81% in 1987, and its maximum share of 58.69% in 2008.

All variables are converted to natural logarithms before proceeding with the empirical investigation.

Methodology and results

The empirical work consists to use the ARDL bounds test to cointegration. This approach is practically applied the bounds suggested by Pesaran et al. (2001). This test employs the combined significance of Fisher’s statistical test (Wald test) to test the long-term relationship between the time series data. This estimation technique has several advantages over other methods. First, the time series can be either zero-order (I(0)), one order (I(1)), or both. Second, the coefficients estimated in the short and long term can be included in the same model. Third, results are more efficient with small sample size.

Unit root and correlation tests

In our model, the number of observations equals 38, indicating that our sample is small. Before investigating cointegration, the order of integration must be studied for each data in the time series. To do this, two-unit root tests are used namely ADF of Dickey and Fuller (1979) and PP of Phillips and Perron (1988). All these tests are estimated for three cases which are (i) intercept and trend; (ii) intercept; and (iii) no intercept and no trend.

According to the 2 tests mentioned in Table 2, all variables are integrated of order one, i.e., I(1), except GDP for the ADF test, while with the PP test, all variables are I(1).Therefore, we can use the ARDL cointegration method.

Before applying our model, we propose to identify both exports and imports in order to take into account of the international exchange. More precisely, we will use these two variables, but separately for two raisons. First, Liddle (2018) and Mahmood et al. (2020) proposed to assess the impacts of exports and imports separately on carbon emissions. As exports can lead to higher emissions in manufacturing processes while imports may raise emissions from consumption processes. Second, because in developing countries the trade balance is not well balanced (Farhani et al. 2014).

Considering these arguments, we will use exports and imports variables instead of the trade variable in the following way:

Since exports and imports are strongly correlated (Table 3), so we will use 2 models to choose which one is the most suitable.

The following model will be developed as follows:

To explore the long-run relationships between the variables, the log-linear equations between variables can be expressed as follows:

where t and \({\alpha }_{0}\), designate the time and the constant, respectively; ɛ and ξ indicate the white noise term of two equations 4–5; and \({\alpha }_{i}, i=1,\dots ,5\) designate the long-term elasticity of CO2 emissions variable with respect to each corresponding explanatory variable.

Diagnostic tests and cointegration

Diagnostic tests are then estimated to check for autocorrelation of residues (Breusch-Godfrey LM test), residual heteroscedasticity (Breush-Pagan-Godfrey test), and normality distribution tests (Jarque-Bera statistic).

Table 4 shows that in the model F1 (where CO2 emissions is the dependent variable), there is cointegration between variables. The diagnostic tests approve that there is, no heteroscedasticity, no residues autocorrelation, and residues are well normally distributed.

Related to Table 5, there is none of these models which obeys all the conditions (cointegration, no heteroscedasticity, no autocorrelation, and normally distribution). So we cannot choose any of the previous models. For this reason, we will keep to work on Eq. 2.

Long-run elasticity results

Based on the similar empirical researches considered by Ghorbal et al. (2021) and Ben Jebli and Ben Youssef (2015) for the Tunisian context, the use of ARDL model in this study may show econometric advantages over other approaches to co-integration. These advantages were previously supported by Pesaran and Pesaran (1997), Pesaran and Smith (1998), Pesaran and Shin (1999), and lastly developed by Pesaran et al. (2001). The ARDL equation is presented as follows:

where Δ, ε, and q are the first difference operator, the error term, and the number of lags, respectively.

The results of the long-run elasticity test reported in Table 6 show that the coefficients of renewable energy consumption, exports, and gross domestic product are positive and statistically significant at the 1% level; whereas, the coefficient of foreign direct investment is negative and statistically significant at the 5% level.

In another sense, the positive impact of renewable energy consumption on CO2 emissions can be explained by the fact that some renewable energy can contain a small part of polluting energy (Ben Jebli and Ben Youssef 2015). Renewable energies did not lead to mitigation in emissions because some countries have possibly not attained the level where renewables begin to reduce CO2 emissions (Chiu and Chang 2009). This is in line with the results of Apergis et al. (2010) and Menyah and Wolde-Rufael (2010) for the US case. Tunisia should develop clean and renewable energy until it can succeed to reduce CO2 emissions, and therefore achieves the seventh objective of the sustainable development goals.

The negative impact of foreign direct investment on CO2 emissions means that although foreign projects are polluting and damaging to the environment, their negative effect is surely less than that of domestic projects. Therefore, the foreign direct investment will lead to a decrease in CO2 emissions. This is similar to the findings of Cheng et al. (2019), and Sarkodie and Strezov (2019) for the case of developing countries, and Atici (2012) and Zhu et al. (2016) for the Association of Southeast Asian Countries. Also, this negative effect of foreign direct investment on carbon emissions may be justified by the hypothesis of the halo effect. As the Tunisian government gives more importance to environmental issues, it promotes foreign investors to spread their specific skills and technologies. In addition, transnational companies also aim to share their technology and management competencies with companies in host nations and to support them in minimizing the harmful effects of carbon emissions (Cheng et al. 2019). In addition, Tunisian policymakers should encourage environment friendly foreign investments by reducing their taxes, and they should also stimulate the ability for new knowledge to be absorbed, resulting in the growth of green products and businesses.

Concerning the positive impact of exports on CO2 emissions, it is important to mention that Tunisia, as a developing country, is firstly interested in improving and accelerating its production to export the maximum of its products and earn more money without paying attention to the environment. Also, this positive effect can be interpreted as the fact that developing countries are still at the bottom of the world manufacturing chain because of the scarcity of advanced technology and design. Therefore, they simply fabricate or reassemble goods designed by foreign countries or export natural resources. During the production process of the manufactured goods and the natural resource exploration process, CO2 is emitted in Tunisia, while the produced goods or natural resources are consumed by the importers. This problem is known in the work of Chen and Chen (2011) and Meng et al. (2018) as embedded carbon dioxide emission. Also, Cheng et al. (2019) showed that such exports could seriously threaten the environment of developing countries and BRICS countries. These results are also in line with Wang et al. (2021) who found a positive impact of exports on CO2 emissions in the top ten renewable energy countries. Per contra, our results are contrary with authors that found a negative impact of exports on CO2 emissions, such as, Hu et al. (2018) who worked on the case of 25 developing countries, Barrows and Ollivier (2021) for India, Mahmood et al. (2020) for the case of North Africa, and Wang et al. (2021) for the case of leading complex economies.

For the positive impact of gross domestic product on CO2 emissions, we can remark that this result is consistent with the outcomes of Dong et al. (2017), Hu et al. (2018), Cheng et al. (2019), and Sarkodie and Strezov (2019), but is inconsistent with the findings of Liu et al. (2017). The explanations of these findings can be provided by the EKC. The EKC hypothesizes that as economic growth increases, carbon emissions increase throughout an economy’s process of industrialization. In particular, industrialization requires huge natural resources, notably energy. Overuse of natural resources may lead to environmental deficiency and severe ecological issues (Sarkodie and Strezov 2019). As the economy keeps expanding, the country will undergo a phase of post-industrialization. The consciousness of the environment, laws and regulations, and the economic structural shift to the tertiary sector in the post-industrial phase may lead to carbon emission abatement. As a developing country, Tunisia is in the phase of industrialization; the secondary sector is one of the engines of economic progress in this country. Tunisia is challenged to expand its gross domestic product without damaging the environment. In order to limit CO2 emissions, it is necessary for policymakers to balance both economic growth and economic sophistication.

Particularly, the national patents are insignificant in the long run; this is because that Tunisia is a developing country; so, it does not have a big capacity of innovation that may impact the carbon emissions whether positively or negatively. The Tunisian government should devote an important amount of its budget to green and clean technology research and development.

CUSUM and CUSUM of squares

The long-term stability of the parameters was tested through the application of certain powerful and effective techniques like the statistical tests of the cumulative sum (CUSUM) and cumulative sum of squares (CUSUM of squares) established by Brown et al. (1975), and then by Pesaran and Pesaran (1997). Figure 2 shows the statistical test results, which demonstrate the stability of the long-term estimated coefficients since the graphs are within the critical bounds at the 5% significance level.

Granger causality results

After establishing the link between variables in the long run by the ARDL approach, we should study the significance of error correction term. Engle and Granger (1987) techniques are involved to investigate the short- and long-term combination betwixt CO2 emissions, renewable energy consumption, foreign direct investment, national patents, exports, and gross domestic product in two phases.

The short-term effect of the variables was validated employing the Granger pairwise causality test, which evaluates causality between variables in pairs to see whether if (i) the causality is unidirectional; or (ii) the causality is bidirectional; or (iii) there is no Granger causality. Long-term causality is assessed by the error-correction term’s (ECT) significance for each cointegration equation. If the error correction term is statistically significant, then there is a long-term causality of all explanatory variables to the explained variable. The first phase is to assess long-term coefficients and retrieve the residuals, while the second phase is to assess the terms of the short-run adjustment. The short-term link between the variables is studied by the Granger causality, and their significance is assessed using Fisher statistics. The significance across variables for the long-term correlation is adjusted by setting Student’s t test statistics.

Establishing the optimal number of lags is a major stage in explaining the validity of a cointegrating connection among the variables. This stage involves the estimation of the appropriate number of lags to run the VAR model. Setting the optimal lags is done according to different selection criteria, mainly the Akaike information criteria (AIC) and the Schwarz information criteria (SIC).

Table 7 shows that all criteria selected a maximum number of lags equal to 1; therefore, a VAR (1) model is considered and the Granger causality approach discussion can be addressed. The causality study among the variables in the analysis can be studied through Engle and Granger’s (1987) study. This technique can be carried out in two steps. The first involves estimating the long-term equation (Eq. (2)) to recover the residuals. The second step consists of estimating the short-term equilibrium. The Granger causality tests are applied to verify the short-term causality between the variables and based on the Fisher statistic. The long-term relationship among the time series can be checked through the use of the significance of the lagged error correction term (ECTt-1).

More precisely, this paper investigates the causal linkages using a VECM model based on Toda and Yamamoto (1995) approach. This model is given as below:

where Δ indicates the first difference operator; q represents the VAR lag length; ECTt−1 indicates the lagged ECT corresponding to each equation; \(\beta\) is the speed of adjustment from the short- to the long-run equilibrium, and ζt indicates the residual term.

The lagged ECT of national patents is negative and statistically significant even at the level of 1% that denotes that there is a long-run causality running from CO2 emissions, renewable energy consumption, foreign direct investment, exports, and gross domestic product to national patents. Results of the short-run causality show that there is a unidirectional causality running from exports to CO2 emissions and from exports to gross domestic product. This result is similar to Wang et al. (2021) for the case of leading renewable energy economies (Table 8).

Conclusion and recommendations

Climate change presents now an important challenge facing many countries, including Tunisia. This leads us to look for different factors that lead to the mitigation of CO2 emissions in this country. This paper studies the channel linking CO2 emissions, renewable energy consumption, foreign direct investment, Tunisian patents, exports, and gross domestic product in Tunisia by using the time series data over the period 1980–2017. ARDL approach is employed, and then cointegration and Granger causality tests are demonstrated.

The finding results show that the error correction term of national patents is negative and statistically significant even at the level of 1%; this means that there is a long-run causality running from CO2 emissions, renewable energy consumption, foreign direct investment, exports, and gross domestic product to national patents. Also, the results of the short-run causality show that there is a unidirectional causality running from exports to CO2 emissions and exports to gross domestic product.

The findings of the long-run elasticity test show that renewable energy consumption has a positive impact on CO2 emissions; this means that renewable energy consumption increases CO2 emissions, and this can be explained by the fact that some renewable energy can contain a small part of polluting energy. In addition, renewable energies did not lead to mitigation in emissions because some countries have possibly not attained the level where renewables begin to reduce CO2 emissions. Although foreign projects are polluting and damaging to the environment, their negative effect is surely less than that of domestic projects. Therefore, foreign direct investment will lead to a decrease in CO2 emissions. Concerning exports, this factor has a positive impact on CO2 emissions. As a developing country, Tunisia is interested in improving and accelerating its production to export the maximum of its products and earn more money without paying attention to the environment. For the gross domestic product, there is a positive impact on CO2 emissions. The explanations of this finding can be provided by the EKC, where the EKC hypothesis suggests that as economic growth increases, carbon emissions increase throughout an economy’s process of industrialization. In particular, industrialization requires huge natural resources, notably energy. Without forgetting the case of Tunisia as a developing country, this country is in the phase of industrialization, so the secondary sector is one of the engines of economic progress. Therefore, Tunisia can benefit from different initiatives, like tax deductions or exonerations for non-polluted foreign direct investment, to motivate foreign investors to turn to ecologically friendly industries. Also, foreign direct investment in polluting products should be limited or eliminated in these areas. In future research, we can work on a panel of countries (such as MENA countries), and we can also add new variables like energy efficiency and fossil fuels.

Data availability and materials

Not applicable

References

Amir R, Jin JY, Troege M (2008) On additive spillovers and returns to scale in R&D. Int J Ind Organ 26(3):695–703

Antweiler W, Copeland BR, Taylor MS (2001) Is free trade good for the environment? Am Econ Rev 91(4):877–908

Apergis N, Eleftheriou S, Payne JE (2013) The relationship between international financial reporting standards, carbon emissions, and R&D expenditures: evidence from European manufacturing firms. Ecol Econ 88:57–66

Apergis N, Payne JE, Menyah K, Wolde-Rufael Y (2010) On the causal dynamics between emissions, nuclear energy, renewable energy, and economic growth. Ecol Econ 69(11):2255–2260

Atici C (2012) Carbon emissions, trade liberalization, and the Japan–ASEAN interaction: a group-wise examination. J Japan Int Econ 26(1):167–178

Banacloche S, Herrera I, Lechón Y (2020) Towards energy transition in Tunisia: sustainability assessment of a hybrid concentrated solar power and biomass plant. Sci Total Environ 744:140729

Barrows G, Ollivier H (2021) Foreign demand, developing country exports, and CO2 emissions: firm-level evidence from India. J Dev Econ 149:102587

Bashir MA, Sheng B, Doğan B, Sarwar S, Shahzad U (2020) Export product diversification and energy efficiency : empirical evidence from OECD countries. Struct Change Econ Dyn 55:232–243

Beerfeltz H-J (2013) Bundesministerium für wirtschaftliche Zusammenarbeit und Entwicklung (BMZ). Voluntaris 1(1):18–20

Ben Jebli M, Ben Youssef S (2015) The environmental Kuznets curve, economic growth, renewable and non-renewable energy, and trade in Tunisia. Renew Sustain Energy Rev 47:173–185

Brown RL, Durbin J, Evans JM (1975) Techniques for testing the constancy of regression relationships over time. J R Stat Soc Ser B Methodol 37(2):149–192

Cai HH, Sarpong D, Tang X, Zhao G (2020) Foreign patents surge and technology spillovers in China (1985–2009): evidence from the patent and trade markets. Technol Forecast Soc Change 151:119784

Central Bank of Tunisia (2020). Annual Report 2019. Available online: https://www.bct.gov.tn/bct/siteprod/documents/RA_2019_en.pdf

Chen ZM, Chen GQ (2011) Embodied carbon dioxide emission at supra-national scale: a coalition analysis for G7, BRIC, and the rest of the world. Energy Policy 39(5):2899–2909

Cheng C, Ren X, Wang Z, Yan C (2019) Heterogeneous impacts of renewable energy and environmental patents on CO2 emission—evidence from the BRIICS. Sci Total Environ 668:1328–1338

Cherni A, Essaber-Jouini S (2017) An ARDL approach to the CO2 emissions, renewable energy, and economic growth nexus: Tunisian evidence. Int J Hydrogen Energy 42(48):29056–29066

Chiu C-L, Chang T-H (2009) What proportion of renewable energy supplies is needed to initially mitigate CO2 emissions in OECD member countries? Renew Sustain Energy Rev 13(6–7):1669–1674

Choung J-Y, Hwang H-R, Song W (2014) Transitions of innovation activities in latecomer countries: an exploratory case study of South Korea. World Dev 54:156–167

Copeland BR, Taylor MS (2004) Trade, growth, and the environment. J Econ Lit 42(1):7–71

Dickey DA, Fuller WA (1979) Distribution of the estimators for autoregressive time series with a unit root. J Am Stat Assoc 74(366):427–431

Doğan B, Driha OM, Lorente DB, Shahzad U (2021) The mitigating effects of economic complexity and renewable energy on carbon emissions in developed countries. Sustain Dev 29(1):1–12

Dogan E, Seker F (2016) Determinants of CO2 emissions in the European Union: the role of renewable and non-renewable energy. Renew Energy 94:429–439

Dong K, Sun R, Hochman G (2017) Do natural gas and renewable energy consumption lead to less CO2 emission? Empirical evidence from a panel of BRICS countries. Energy 141:1466–1478

El Elj M (2012) Innovation in Tunisia: empirical analysis for industrial sector. J Innov Econ Manag 9(1):183–197

Energy Information Administration. (2020). International Energy Outlook. Accessed at: www.eia.gov/forecasts/aeo

Engle RF, Granger CWJ (1987) Co-integration and error correction: representation, estimation, and testing. Econometrica 55(2):251–276

Farhani S, Chaibi A, Rault C (2014) CO2 emissions, output, energy consumption, and trade in Tunisia. Econ Model 38:426–434

Farooq MU, Shahzad U, Sarwar S, Zaijun L (2019) The impact of carbon emission and forest activities on health outcomes : empirical evidence from China. Environ Sci Pollut Res 26:12894–12906

Fatima T, Shahzad U, Cui L (2020) Renewable and nonrenewable energy consumption, trade and CO2 emissions in high emitter countries : does the income level matter? J Environ Plann Manag 64(7):1227–1251

FernándezFernández Y, López Fernández, Olmedillas Blanco B (2018) Innovation for sustainability: the impact of R&D spending on CO2 emissions. J Clean Prod 172:3459–3467

Fershtman C, Markovich S (2010) Patents, imitation, and licensing in an asymmetric dynamic R&D race. Int J Ind Organ 28(2):113–126

Frankel JA, Rose AK (2005) Is trade good or bad for the environment? Sorting out the causality. Rev Econ Stat 87(1):85–91

Gamoori A, Jorjorzadeh A, Mehrabani F (2017) Investigation the links between foreign investment, economic growth, and energy usage: organization of the Islamic conference countries. Int J Energy Econ Policy 7(2):304–309

Ghazouani A, Xia W, Ben Jebli M, Shahzad U (2020) Exploring the role of carbon taxation policies on CO2 emissions : contextual evidence from tax implementation and non-implementation European countries. Sustainability 12(20):8680

Ghorbal S, Ben Jebli M, Ben Youssef S (2021) Exploring the role of renewable energy and foreign and non-foreign patents on mitigating emissions: evidence for Tunisian economy. Environ Sci Pollut Res https://doi.org/10.1007/s11356-021-13108-0

Grover D (2017) Declining pollution abatement R&D in the United States: theory and evidence. Ind Corp Change 26(5):845–863

Hammerschmidt A (2009) No pain, no gain: an R&D model with endogenous absorptive capacity. J Inst Theor Econ 165(3):418–437

Hu H, Xie N, Fang D, Zhang X (2018) The role of renewable energy consumption and commercial services trade in carbon dioxide reduction: evidence from 25 developing countries. Appl Energy 211:1229–1244

IPRI (2019) International Property Rights Index, Tunisia. Accessed at: https://internationalpropertyrightsindex.org/country/tunisia

Koouba K, M’henni H, Gabsi F (2010) Innovation determinants in emerging economies: an empirical study based on an innovation survey data in Tunisia. Int J Technol Learn Innov Dev 3(3):205–225

Kriaa M, Karray Z (2010) Innovation and R&D investment of Tunisian firms: a two-regime model with selectivity correction. J Bus Inquiry 9(1):1–21

Kumar S, Jan JM (2014) Research collaboration networks of two OIC nations: comparative study between Turkey and Malaysia in the field of “energy fuels”, 2009–2011. Scientometrics 98(1):387–414

Leahy D, Neary JP (2007) Absorptive capacity, R&D spillovers, and public policy. Int J Ind Organ 25(5):1089–1108

Lee K-H, Min B, Yook K-H (2015) The impacts of carbon (CO2) emissions and environmental research and development (R&D) investment on firm performance. Int J Prod Econ 167:1–11

Levinson A (2009) Technology, international trade, and pollution from US manufacturing. Am Econ Rev 99(5):2177–2192

Liddle B (2018) Consumption-based accounting and the trade-carbon emissions nexus. Energy Econ 69:71–78

Liu X, Zhang S, Bae J (2017) The nexus of renewable energy-agriculture-environment in BRICS. Appl Energy 204:489–496

Mahmood H, Alkhateeb TTY, Furqan M (2020) Exports, imports, foreign direct investment and CO2 emissions in North Africa: spatial analysis. Energy Rep 6:2403–2409

Meng J, Mi Z, Guan D, Li J, Tao S, Li Y, Feng K, Liu J, Liu Z, Wang X, Zhang Q, Davis SJ (2018) The rise of South-South trade and its effect on global CO2 emissions. Nat Commun 9:1871

Menyah K, Wolde-Rufael Y (2010) CO2 emissions, nuclear energy, renewable energy, and economic growth in the US. Energy Policy 38(6):2911–2915

Ministry of Environment and Sustainable Development (2015). Intended nationally determined contribution: Tunisia.

Ouchida Y, Goto D (2016) Environmental research joint ventures and time-consistent emission tax: endogenous choice of R&D formation. Econ Model 55:179–188

Pesaran MH, Pesaran B (1997) Working with Microfit 4.0: interactive econometric analysis. Oxford University Press, Oxford

Pesaran, M.H., Shin, Y. (1999). An autoregressive distributed-lag modelling approach to cointegration analysis. In: Strøm, S. (Ed.), Econometrics and economic theory in the 20th century: the Ragnar Frisch centennial symposium (Econometric Society Monographs, Chapter 11, pp. 371-413). Cambridge: Cambridge University Press https://doi.org/10.1017/CCOL521633230.011

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econ 16(3):289–326

Pesaran MH, Smith RP (1998) Structural analysis of cointegrating VARs. J Econ Surv 12(5):471–505

Phillips PCB, Perron P (1988) Testing for a unit root in time series regression. Biometrika 75(2):335–346

Piaggio M, Padilla E, Román C (2017) The long-term relationship between CO2 emissions and economic activity in a small open economy: Uruguay 1882–2010. Energy Econ 65:271–282

Prudhomme D (2017) Utility model patent regime “strength” and technological development: experiences of China and other East Asian latecomers. China Econ Rev 42:50–73

Rusydiana AS, Laila N, Tubastuvi N, Ibrahim MA, Marlina L (2021) Energy efficiency in OIC countries : SDG 7 Output. Int J Energy Econ Policy 11(1):74–81

Sarkodie SA, Strezov V (2019) Effect of foreign direct investments, economic development and energy consumption on greenhouse gas emissions in developing countries. Sci Total Environ 646:862–871

Sarwar S, Shahzad U, Chang D, Tang B (2019) Economic and non-economic sector reforms in carbon mitigation : empirical evidence from Chinese provinces. Struct Change Econ Dyn 49:146–154

Saudi MHM, Sinaga O, Jabarullah NH (2019) The role of renewable, non-renewable energy consumption and technology innovation in testing environmental Kuznets curve in Malaysia. Int J Energy Econ Policy 9(1):299–307

Schmidt TS, Matsuo T, Michaelowa A (2017) Renewable energy policy as an enabler of fossil fuel subsidy reform? Applying a socio-technical perspective to the cases of South Africa and Tunisia. Glob Environ Chang 45:99–110

Shahzad U (2020) Environmental taxes, energy consumption, and environmental quality : theoretical survey with policy implications. Environ Sci Pollut Res Int 27(20):24848–24862

Shahzad U, Doğan B, Sinha A, Fareed Z (2021) Does export product diversification help to reduce energy demand: exploring the contextual evidences from the newly industrialized countries. Energy 214:118881

Shahzad U, Ferraz D, Doğan B, Rebelatto D (2020) Export product diversification and CO2 emissions: contextual evidences from developing and developed economies. J Clean Prod 276:124146

Ben Jebli M, Bashir MF, Shahzad U (2020) Does economic progress and electricity price induce electricity demand: a new appraisal in context of Tunisia. J Public Aff https://doi.org/10.1002/pa.2379

Többen J (2017) Regional net impacts and social distribution effects of promoting renewable energies in Germany. Ecol Econ 135:195–208

Toda HY, Yamamoto T (1995) Statistical inference in vector autoregressions with possibly integrated processes. J Econ 66(1–2):225–250

Wang S, Tang Y, Du Z, Song M (2020) Export trade, embodied carbon emissions, and environmental pollution: an empirical analysis of China’s high- and new-technology industries. J Environ Manag 276:111371

Wang Z, Ben Jebli M, Madaleno M, Doğan B, Shahzad U (2021) Does export product quality and renewable energy induce carbon dioxide emissions: evidence from leading complex and renewable energy economies. Renew Energy 171:360–370

Wang Z, Yang Z, Zhang Y, Yin J (2012) Energy technology patents–CO2 emissions nexus: an empirical analysis from China. Energy Policy 42:248–260

Wiethaus L (2005) Absorptive capacity and connectedness: why competing firms also adopt identical R&D approaches. Int J Ind Organ 23(5–6):467–481

WIPO (2018) The Global Innovation Index 2016, Tunisia. Accessed at: https://www.wipo.int/edocs/pubdocs/en/wipo_pub_gii_2018-profile50.pdf

World Bank (2019) The World Bank annual report 2019: ending poverty, investing in opportunity. Accessed at: https://openknowledge.worldbank.org/handle/10986/32333

World Bank (2021) World development indicators. Accessed at: http://datatopics.worldbank.org/world-development-indicators/

World Data Atlas (2020) Data and statistics - knoema.com. Accessed at: https://knoema.fr/atlas/Tunisie

World Energy Council, 2019. World energy scenarios 2019. Exploring innovation pathways to 2040. https://www.worldenergy.org/publications/entry/world-energy-scenarios-2019-exploring-innovation-pathways-to-2040

Zhu H, Duan L, Guo Y, Yu K (2016) The effects of FDI, economic growth and energy consumption on carbon emissions in ASEAN-5: evidence from panel quantile regression. Econ Model 58:237–248

Zouari G, Zouari-Hadiji R (2015) Ownership structure, innovation and firm performance: evidence from Tunisia. J Glob Acad Inst Bus Econ 1(1):132–154.

Author information

Authors and Affiliations

Contributions

Sana Ghorbal: Introduction and literature review

Sahbi Farhani: Data, descriptive statistics, methodology, and results

Slim BenYoussef: Editing, discussion, conclusion, and recommendations

Corresponding author

Ethics declarations

Ethics approval and consent to participate

Not applicable

Consent for publication

Not applicable

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Roula Inglesi-Lotz

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Ghorbal, S., Farhani, S. & Youssef, S.B. Do renewable energy and national patents impact the environmental sustainability of Tunisia?. Environ Sci Pollut Res 29, 25248–25262 (2022). https://doi.org/10.1007/s11356-021-17628-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-021-17628-7