Abstract

Singapore has been ranked in the most dynamic financial market and the highest ecological deficit country, indicating that the trade-off hypothesis may exist. The main goal of the present study is to probe the impact of financial development, economic growth, and human capital on ecological footprint in Singapore from 1980 to 2016. The outcomes obtained from the Autoregressive Distributed Lag (ARDL) method have failed to provide a clear impact of financial sector development on ecological footprint. However, the Bayesian analysis reveals that both financial development and economic growth have a harmful influence on EF, while the impact of human capital is beneficial. A theoretical conclusion derived is that monetary expansion policies should be associated with improving human capital to achieve the United Nations SDGs in the context of Singapore. The findings of the study are of particular interest to policymakers for developing sound policy decisions for sustainable economic progress which is not at the cost of environment.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Climatic change is one of the biggest issues of the twenty-first century and a topic of overwhelming interest among the research community, policymakers, and professionals to achieve Sustainable Development Goals (Bayar and Maxim 2020; Murshed et al. 2021b). Therefore, environmental protection is the top priority of countries, particularly signatories of the Paris Agreement (Saud et al. 2020; Sohail et al. 2021; Usman et al. 2020a). The biggest threat to the environment is the emission of Green House Gases (GHG) which causes an increase in the temperature of the earth and consequently disturbing ecological balance (Ahmed et al. 2019; Baloch et al. 2019). Although CO2 emission is the major contributor of GHG and cause of climate change (Bilgili et al. 2021), anthropogenic actions particularly, fossil fuel-based energy consumption, water waste management, and production of fertilizers are causing damage to the ecosystem too. Earlier literature used the ecological footprints as a proxy of pressure on nature by human activities (Al-Mulali and Ozturk 2015). The ecological footprint is a comprehensive measure of pressure on the ecosystem due to various human activities (Ahmed et al. 2019; Sharif et al. 2020).

While on the other side, keeping an equilibrium between economic growth and environmental damage is a key issue that policymakers are facing. Therefore, it is emphasized to keep the environmental consequences of growth policies (Adedoyin et al. 2021; Destek et al. 2018; Ozturk et al. 2016). In addition, factors that are essential for economic activities may or may not damage the ecosystem. While human capital is regarded as an environment-friendly determinant of economic growth (Ahmed and Le 2021; Danish et al. 2019), financial sector development may (Saud et al. 2020) or may not (Shahbaz et al. 2013; Uddin et al. 2017) be harmful; there is a negative relationship between financial sector development and pollution (Hashmi and Alam 2019; Meirun et al. 2021).

An efficient financial system contributes to economic growth, and it enables people to buy houses, home appliances, and automobiles; however, all this puts pressure on nature by increasing energy demand (Baloch et al. 2019). Furthermore, a financial development boosts investment in new plants and factories and consequently causes more water waste and pollution (Danish et al. 2018). However, financial development is also credited to reducing pollution by boosting investment in the research and development of green technologies and energy-efficient machines (Shahbaz et al. 2016). Financial development serves as a strong policy tool for the government to control pressure on the environment. Government can use their influence on financial institutions on their credit provision to less pollute production activities. The financial sector can contribute to environmental protection by discouraging loans to those investment initiatives that produce massive pollution. In addition, investment in a green environmental project, loans to socially responsible firms, and credit to eco-friendly projects curb environmental degradation (Saud et al. 2020).

Indisputably, financial sector development — the crucial factor for economic development — is associated with ecological quality through technique, scale, and composition effects (Saud et al. 2020). However, findings of previous literature about the influence of financial sector development on the natural environment are mixed. On the one hand, literature reported the negative effect of financial development on EF; for instance, in a panel of 27 countries (Uddin et al. 2017), for China (Destek and Sarkodie 2019), for Malaysia (Furuoka 2015), and for Nigeria (Omoke et al. 2020). On the other hand, other studies reported a positive influence of financial development on EF, for instance (Usman et al. 2020a) for a panel of 20 highest economies, (Mrabet and Alsamara 2017) for Qatar, and (Godil et al. 2020) for Turkey.

Interestingly, Singapore is a country with rapid economic growth, industrialization, and structural change experience (Katircioğlu 2014; Tan et al. 2014). Though the country is small in size 721 km2, it faces serious challenges of environmental pollution due to its dense population (Han 2017). While the country has achieved enormous economic growth targets, the government of Singapore is much concerned about negative externalities such as risk to the environment (Ridzuan et al. 2017). Though the literature has been indicating the factors that put pressure on the environment in Singapore, and the government has been introducing regulations, the voices are raised to curb environmental pollution in a way that does not compromise on the economic growth of Singapore (Meirun et al. 2021).

The main contribution of the present study is that earlier literature on Singapore examining the influence of financial sector development on EF has mixed findings. Some studies have found that financial development has increased EF (Destek and Sarkodie 2019), while the others show an opposite result (Naqvi et al. 2020; Saud et al. 2020). These contradictable findings have made a big question about the impact of financial development on EF in Singapore. Therefore, the purpose of this study is to further investigate the impact of financial development, economic growth, and human capital on EF in Singapore. However, our research differs from some previous studies in many ways. Firstly, previous studies have attempted to reveal the relationship between financial development and EF (Destek and Sarkodie 2019; Naqvi et al. 2020; Saud et al. 2020), but no studies included economic growth and human capital as control variables. Secondly, the impact of financial development on EF in Singapore has seemingly been ambiguous or even contradictable (Destek and Sarkodie 2019) found positive and (Khan et al. 2019b) insignificant and (Naqvi et al. 2020; Saud et al. 2020) negative. This ambiguity might be the result of the adoption of a frequentist inference, where parameters are unknown but fixed. Therefore, the present study applied two statistical inference types: frequentist inference and Bayesian inference, to provide probability interpretations of uncertainty and various effects of financial development, economic growth, and human capital on EF.

The remainder of the study is presented as follows. The next section shows discussions related to relevant literature about the nexus between economic growth, financial development, pollution, and human capital. This section is followed by the “Data and methodology” section; after which, the results and findings are discussed in the “Empirical results and discussion” section. Lastly, the conclusion and policy recommendations based on empirical findings are presented in the “Conclusion and recommendations” section of the present study.

Literature review

The extant literature on the environment merely used the novel ecological footprint proxy for environmental degradation (Ahmad et al. 2021; Murshed et al. 2021b; Tillaguango et al. 2021; Xue et al. 2021; Zeraibi et al. 2021). Most of the studies on environmental degradation use carbon emission as a measure of environmental decay (Bandyopadhyay and Rej 2021; Rej and Nag 2021). In this section, an overview of studies related to the empirical model is presented.

Financial development and EF

The previous studies showed that there were two effects (technological effect and structural effect) of financial development on the environment, which means financial development may be beneficial or harmful to EF (Du et al. 2012; Saud et al. 2020). On the positive side, financial development boosts a country’s financial structure, brings about financial channels, and attracts FDI, which in turn brings green-environment technology and fosters R&D activities. As a result, global commercials, renewable energy, and technology advancements take place (Ahmed and Le 2021; Hsueh et al. 2013). Thus, financial development can improve environmental quality and decrease EF. On the other side, financial development can cause some scale effects on the economic growth process. This point of view suggests that financial development could increase pollution which is caused by a high level of production of the economic-liberalization and higher energy consumption (Pazienza 2015; Saud et al. 2020). According to Ha et al. (2020), it is impossible to do economic and household activities without having a harmful influence on the natural ecosystem or environment.

Surprisingly, some empirical evidence supports both of these views based on the various development policies in each country and region. For instance, Uddin et al. (2017) has applied the FMOLS and DOLS methods on the panel data of 27 leading world EF contributors from 1991 to 2012 and found that financial development has improved environmental quality by decreasing EF. Similarly, Ahmed et al. (2019) has researched the connection between financial development and EF in Malaysia from 1971 to 2014. By adopting the Bayer-Hanck cointegration test and ARDL method, the outcomes have verified that financial development mitigates EF. Omoke et al. (2020) has discovered the negative relationship between financial development and EF in Nigeria from 1971 to 2014. However, some studies have revealed a contrary result regarding the relationship between financial development and EF. Khan et al. (2019a) used five Belt and Road initiative (BRI) regions as a research context for the association between financial development and EF. They used the augmented mean group (AMG) and the common correlated effect mean group (CCEMG) approaches, and then they found that EF has been fostered by financial development.

In the same line, Usman et al. (2020a, 2020b) examined the 20 highest economies from 1995 to 2017. The results showed that financial development deteriorates environmental quality by increasing EF. Godil et al. (2020) has also revealed a similar finding while testing the financial development — EF nexus in Turkey between 1986 and 2018. A comprehensive literature review is presented in Table 1.

Economic growth, human capital, and EF

Literature on the EKC hypothesis mainly discusses the relationship between environment and economic growth (Bilgili et al. 2021; Kocoglu et al. 2021). Moreover, there is evidence that financial development has a mutual relationship with economic growth and human capital (Hsueh et al. 2013). Economic growth (Ahmed et al. 2020a; Al-Mulali and Ozturk 2015; Alola et al. 2019; Murshed et al. 2021c; Usman et al. 2020b) and human capital (Ahmed et al. 2020a; Ahmed et al. 2020b; Pata and Caglar 2021)) also have influences on EF. Accordingly, the investigation of the interaction between financial development and EF cannot provide a clear understanding without integrating human capital and economic growth.

Regarding the influence of economic growth on EF, most previous studies have demonstrated a trade-off between economic growth and EF since the rapid economic development has generated an unprecedented rise in energy demand, especially non-renewable energy (S. Nathaniel and Khan 2020; Udemba 2020; Zafar et al. 2019). Furthermore, economic growth could facilitate urban migration and urbanization (Ahmad et al. 2019; Nathaniel et al. 2020; Ozturk et al. 2016; Wu et al. 2019), which means that it could certainly bring more pressures to urban infrastructure and ecological assets (Wu et al. 2019). However, there are also some studies suggesting that economic growth would improve EF in Africa and Europe (Usman et al. 2020b) or Pakistan (Hassan et al. 2019).

Earlier literature also verifies that human capital mitigates environmental degradation, including EF (Nathaniel et al. 2020; Nathaniel and Khan 2020; Pata and Caglar 2021). Some scholars argue that human capital plays a significant role in fostering the adaption of technology change, so it could probably make sustainable growth (Ackah and Kizys 2015; Consoli et al. 2016). Moreover, human capital generates concerns about environmental problems (Adil 2018; Asongu 2018; Reynolds et al. 2010; Ulucak and Li 2020). Nevertheless, some studies, such as Croes et al. (2021) and Ahmed et al. (2021), postulated that the beneficial outcomes of economic growth are insufficiently invested in human capital. As the result, human capital is not giving a significant effect on sustainable development (Dietz et al. 2007). In a recent study, Kassouri and Altıntaş (2020) indicated that human capital increases EF in MENA countries.

Besides, the impact of financial development on EF in Singapore is likely ambiguous or even contradictable (positive; Destek and Sarkodie (2019); insignificant; Khan et al. (2019a, 2019b); negative; Naqvi et al. (2020); Saud et al. (2020). In addition, Singapore has been ranked in the most dynamic financial markets in the world, but Singapore has also been listed in the highest ecological deficit countries. It implies that the trade-off hypothesis between financial development and ecological assets may be valid. Therefore, further investigation is necessary to provide probabilistic interpretations of model uncertainty and various influences of financial development, economic growth, and human capital on EF in Singapore.

Data and methodology

Research model and data sources

The role of financial development in economic growth is enormous, but it is undeniable to say that it could be harmful to natural ecosystems. Mutually, a rise in financial development brings about an increase in economic growth, which is directly proportional to EF. Besides, the study incorporated the human capital per person index (labeled, HC) as the control variable. According to Neumayer (2012), it is recognized that the concern on environmental quality in a high human capital country is better than in a low human capital country. Therefore, to assess the impact of financial development, economic growth, and human capital on EF in the case of Singapore, the study has followed the previous works of Baloch et al. (2019); Godil et al. (2020); Pata and Yilanci (2020); Saud et al. (2020); Chen et al. (2019); Usman et al. (2020a, b); and Zhao et al. (2019) to propose an initial model, detailed as:

where β1, β2, and β3 are the long-run coefficients, while t is the time (from 1980 to 2016) and u is the error term. The EF variable is the ecological footprint index (units: gha per capita) collected from the Global Footprint Network. The FD variable is the financial development index (units: point) obtained from the International Monetary Fund (IMF).

In the study, we have used the financial development index as a proxy of financial development because it is a financial inclusion index, which is calculated based on the depth, access, and efficiency of financial institutions and financial markets of a country. The GDP variable is the income per capita (at a fixed price of 2010, units: US dollar) abstracted by the World Bank, while the HC variable is the human capital per person index (units: point), quoted by the Federal Reserve Bank of St. Louis. A scale of zero to ten is applied for the human capital per person index, where zero is the lowest educated economy and 10 is the highest educated economy. In this work, two variables (FD and GDP) are used by following the logarithm to clarify smooth data, while the EF and HC variables have original data in use. The descriptive statistics of all variables are demonstrated in Table 2.

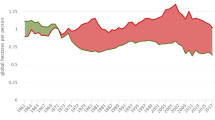

According to Table 2, the mean of Singapore’s ecological footprint was 5.843 gha per capita, which is more than 2.8 gha per capita, the global average. Singapore has been listed in a group of countries where the ecological deficit is severe. Recently, Singapore has implemented many positive steps to reduce the ecological deficit situation and has made significant advancements in renewable energy technology. However, based on the International Energy Agency (IEA, 2018) data, Singapore has been ranked as 27th out of 142 countries in terms of emissions per capita. Likewise, the mean of the lnGDP variable was 10.287, while the maximum value of the HC variable was 3.809. These data showed that Singapore had been a developed education system and high-income country.

Methodology

The estimated coefficients of Eq. (1) have only provided the long-run effects of financial development, economic growth, and human capital on ecological footprint. To analyze the short-run impacts, the study has applied the autoregressive distributed lag (ARDL) model, introduced by. The ARDL model has some advantages, such as firstly, the estimated coefficients are unbiased and reliable in the case of small sample size; secondly, it could be applied in all three cases whether the variables are stationary at I(0), I(1), or a mixture of both; thirdly, it provides both the short and long-run estimated coefficients; and fourthly, it could be used in two cases, where the cointegration among all variables exists or not (Nkoro and Uko 2016).

Therefore, (Eq.1) is written by the ARDL(p,q) model, as follows:

where:

Δ is the first difference.

β 1, β2, β3, and β4 are coefficients of the long-run impacts.

α 1, α2, α3, and α4 are coefficients of the short-run impacts.

ε t is the error.

To achieve the research objectives, our approach is summarized in a four-step process. First, the ordinary least square (OLS) method is applied to Eq.(2) to estimate the long-run coefficients. Second, the cointegration test is used to verify the integration among variables, in which the null hypothesis is stated: (H0 : β1 = β2 = β3 = β4 = 0), while the alternative hypothesis is written (H1 : β1 ≠ β2 ≠ β3 ≠ β4 ≠ 0). If the F-statistic value lies below the F-critical values, the null hypothesis 4\ is accepted accordingly. That means there is no cointegration among variables in the long run. On the other hand, if the F-statistic value exceeds the F-critical value (the upper Bound value, I(1)), the null hypothesis is denied, and Eq. (2) would be re-parameterized as an error correction model (ECM) as:

where p and q are the lag order of each variable collected from the stationary test result. In Eq. (3), if the estimated coefficient of λ is negative, and belongs [0;1] and significant, it means that the EF variable can itself re-adjust to long-run equilibrium point after short-run shocks caused by financial development, economic growth, or human capital.

Third, the major problem with the frequentist inference (e.g., ARDL model) is that estimated coefficients are unknown but fixed. More importantly, it is impossible to assess the link between two variables if the estimated coefficient is insignificant. To solve this case, the Bayesian inference approach through the integrated Markov chain Monte Carlo sample is applied to provide probabilistic interpretations of model uncertainty and to differ effects of financial development, economic growth, and human capital on EF. And in the last process, the modified Wald test introduced by Toda and Yamamoto (1995) is used to reveal the causal relationship between a pair of variables in our proposed model. The Toda and Yamamoto procedure is based on the vector autoregressive model (VAR). The causal relationship between the EF variable and lnFD variable is illustrated as follows:

where h is the optimal lag order of the VAR model, and p = (h + dmax), with dmax is the maximum lag order. According to Toda and Yamamoto (1995), the maximum of dmax is 2, because if dmax > 2, the tests based on F-statistic are not reliable (Davoud et al. 2013; Nkoro and Uko 2016)

In Eq. (4), if an estimated coefficient of δ1 is significant, there will be a uni-directional causality running from financial development to ecological footprint. The advantage of the Toda and Yamamoto (1995) procedure is beneficial in minimizing the risk of wrong determination of each variable’s lag order and being able to be applied to the variable that is stationary at I(0) or I(1), or a combination of both cointegration and no-cointegration (Sankaran et al. 2019; Toda and Yamamoto 1995), or either of them.

Empirical result and discussion

Empirical results

Unit-root test

Nelson and Plosser (1982) suggested that it is necessary to check the stationary of the time-series variable because most of the economic variable is non-stationary. Therefore, to avoid the empirical results being spurious, the three tests are employed, including the ADF test (Dickey and Fuller 1981), the PP test (Phillips and Perron 1988), and the GLS-ADF test proposed by Elliott et al. (1992) to confirm the stationary of each variable. Compared to the ADF test, the PP test is advantageous in accounting for the potential serial correlation and heteroskedasticity in the residuals. Similarly, the GLS-ADF test has an advantage in allowing the series to be stationary around a linear time trend; or it is to allow the series to be stationary around a possible nonzero mean with no time trend. Results of the stationary tests are presented in Table 3.

The stationary test presented in Table 3 provides evidence to reject the null hypothesis of a random walk with drift. More particularly, the lnFD variable remains stationary at I(0), while three variables (EF, lnGDP, and HC) remain unchanging at I(1) obtained from three tests. No variable is stationary at I(2). In a brief conclusion, the condition in applying the ARDL model is satisfied accordingly (Nkoro and Uko 2016; Pesaran et al. 2001). Hence, the cointegration test could proceed for further analysis.

Cointegration test

The stationary test provided an inconsistent result of lag order between variables (mixture of I(0) and I(1)). In the next step, it is necessary to check the long-run association of all variables. Hence, a new cointegration test, Bound-testing, has been employed to verify the cointegration in financial development, economic growth, human capital, and ecological footprint in the case of Singapore. The Bound-testing technique was proposed by Pesaran et al. (2001) with the null hypothesis quoted that H0: No cointegration, against the alternative hypothesis H1: there is cointegration between examined variables. The result of the Bound-testing is given in Table 4. Accordingly, the F-statistic value (= 4.602) exceeds the F-critical value (= 4.35) at a significant level of 5%. Likewise, the t-critical value (= −3.46) is higher than the t-statistic value (= −3.671) at a significant level of 10%. These results give evidence to reject the null hypothesis, which means that a long-run association between variables in our proposed model exists. Thus, Eq. (2) must be estimated by using the ECM model.

The short and long-run impacts by the error correction model

Another advantage of the ARDL model is that it could auto-select the optimal lag of each variable. Based on the Akaike information criterion (AIC), Schwarz Bayesian information criterion (SBIC), and Hannan-Quinn information criterion (HQIC), the empirical result in Table 5 showed that the optimal lag of EF and lnGDP variable is one and lnFD variable is zero. Simultaneously, the obtained result also indicates that the volatility of current-period human capital is associated with two-period previous human capital.

After confirmation of cointegration, the error correction model is applied to study the impact of financial development, economic growth, and human capital on EF both in the short and long run. The optimal lag of each variable is set to select the final ARDL specification. Applying to the data of Singapore, the best ARDL model is the ARDL (1,1,0,0). The coefficients of the short and long-run impacts are shown in Table 6.

The empirical result showed in Table 6 indicates that the coefficient of CoinEq(−1) is negative and significant level at 1% (λ = −0.5647, p value = 0.001). This finding supports that ecological footprint can re-adjust itself to the long-run equilibrium point after the short-run is suddenly affected by financial development, or economic growth, or human capital. Two years is the time needed for an adjustment (=1/|λ|). Table 6 also indicates that economic growth has a positive and significant impact on EF in the short and long run. More specifically, a 1% rise in economic growth leads to a 4.39 gha per capita increase in the short-run ecological footprint and a 7.78 gha per capita increase in the long-run ecological footprint. Hence, our analysis reveals that the long-run impact of economic growth on EF is greater than the short-run impact. Similarly, the estimated coefficient of the HC variable is −2.10 in the short run and is −3.72 in the long run, respectively. These results imply that EF is affected by human capital in the case of Singapore. However, contrary to the influence of economic growth, an increase in the human capital per person induces a fall in ecological footprint. We believe that these fascinating findings could provide Singapore policymakers with more insights into sustainable development strategies. More details about these findings will be discussed in the next section.

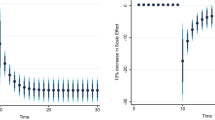

Nevertheless, the main aim of our research is to study the influence of financial development on EF in Singapore, which means that whether there is a trade-off between economic growth and environmental destruction. Interestingly, the empirical outcome reveals that financial development has a positive impact on EF, but not yet significant. In the view of frequentist inference, the obtained outcome from the ECM approach has failed to demonstrate the influence of financial development on EF in the case of Singapore. Besides, the major diagnostic tests were used to confirm the above conclusions, including the heteroskedasticity test, the autocorrelation test, the distribution of residuals, and the functional form test. The results of diagnostic tests are given at the bottom of Table 6. Accordingly, the four tests have a p value that is higher than 0.05, and it is evident to reject the null hypothesis. Besides, the work has conducted the cumulative sum of recursive residuals (CUSUM) and the cumulative sum of squares of recursive residuals (CUSUMSQ) test to check the stability of the long-run coefficients and the short-run dynamics. Both CUSUM and CUSUMSQ lie within the Bound-critical value at the level of 5% significance (see Fig. 1a, b). When all diagnostic tests are satisfied, it is possible to conclude that our proposed model is stable and the obtained coefficients by the ECM approach are reliable.

As the result, the failure in defining the effect of financial development on EF leads to difficulty makes some difficulties in suggesting efficient environmental protection policies. Therefore, the Bayesian analysis for the generalized linear model (GLM) was employed to re-examine the influence of financial development on EF in the context of Singapore.

The empirical results by Bayesian inference

Contrary to frequentist inference (i.e., where observed are assumed to be random and estimation parameters are unknown but have fixed quantities), the Bayesian inference assumes that the observed data is fixed, and estimation parameters are random (Bernardo and Smith 1994). The Bayesian analysis is based on the Bayes’s rule and the posterior distribution results from using the prior information about model parameters with evidence from the observed data. An advantage of Bayesian analysis is that the Bayesian paradigm allows us to prove some probability statements, as a variable is likely or unlikely to impact on another, or the true value of a parameter falls into a certain interval with a pre-specified probability (Bernardo and Smith 1994; Thompson 2012).

The specification of the Bayesian GLM regression is expressed as

where yt is the ecological footprint drawn from normal Gaussian distribution and Xt is the matrix of the independent variables. βT denotes the transposed weight matrix, while δ2 is the variance and I is the identity matrix, to give the model a multi-dimensional formulation. Generally, the prior distribution is defined as pre-existing information about model parameters and is often derived from theoretical or expert knowledge. Fortunately, Lemoine (2019) suggested that the estimated coefficients obtained from the OLS approach could be used in the case of weakly informative priors in Bayesian analysis. By this brilliant suggestion, the study adopts the estimated coefficient of variables from the OLS estimator to set the initial information of the Bayesian GLM model with assuming a normal distribution.

In the Bayesian GLM model, the posterior distribution of the estimated model parameters is generated from a probability distribution based on the prior information, observed data, and outputs. The posterior distribution can be calculated as the following equation:

where P(yt|β, Xt)is the likelihood of the data and P(β|Xt)denotes the prior probability information of the model parameters, while P(yt|Xt)represents the normalization constant. In this work, the adaptive random-walk Metropolis-Hastings algorithm was used to avoid the spurious convergence and provide probabilistic interpretations of model uncertainty and varying effects of financial development, economic growth, and human capital on EF. The result of Bayesian analysis is presented in Table 7.

The empirical outcome given in Table 7 reveals a positive effect of financial development and economic growth on EF, while the impact of human capital is negative. These results are in line with the coefficients obtained by the ECM model. More importantly, the linkage between financial development and ecological footprint has been established. Additionally, the acceptance rate of 0.37 is larger than the optimal acceptance rate of 0.234 (Gelman et al. 1997), whereas standard deviation values of the parameters are small, and the Monte Carlo chain standard errors (MCSE) are close to one decimal. Besides, the CUSUM plots of the parameters are jagged, not smooth, and cross the X-axis (see Fig. 2). These obtained outcomes provide evidence to accept the Metropolis-Hastings algorithm and confirm the high accuracy of the parameter estimates (Cowles and Carlin 1996). Thus, Bayesian inference is valid.

Contrary to frequentist inference, in Bayesian inference, 95% credible intervals indicate which range the true value of a certain parameter belongs to. For example, the mean value of the financial development variable (lnFD) lies in an interval between −0.1329 and 0.3213 with a 95% probability. As expected, given probability, we may state that financial development has a strongly positive effect on ecological footprint with a 79% probability (Block et al. 2011). Our robustness analysis using FMOLS, DOLS, and CCR method shown in Table 8, also supported positive effect of financial development on EF. The outcome is justified by the historical trend in money supply strategies and the serious ecological deficit situation in Singapore.

The Granger causality test

The ECM or GLM approach does not guide us about the causal relationship among the variables. In the final step, the Toda and Yamamoto (1995) procedure is applied to check the Granger causality between numbers of pairs of variables. The equation is used to test has been shown in the “Data and methodology” section, and the empirical result is given in Table 9 and Fig. 3. According to Table 9, there is bi-directional causality between either economic growth (lnGDP) or human capital (HC) and ecological footprint (EF). At the same time, Fig. 3 also indicated that (there if) uni-directional causality running lnGDP or EF or HC to financial development (lnFD), and running from HC to lnGDP.

Discussion

In frequentist inference, the obtained results demonstrate that the impact of financial development exerts an ambiguous effect in both the short run and long run, which is similar to the finding of Khan et al. (2019b). However, using the Bayesian inference, the obtained outcomes have found a positive strongly influence of financial development on EF. With a 79% probability, the study may conclude that an expansion financial development policy may be harmful to environmental quality in the context of Singapore. The finding is inconsistent with Saud et al. (2020) and Naqvi et al. (2020), who validate the negative impact of financial development on EF, while it is in line with Destek and Sarkodie (2019), who find that financial development increases EF in Singapore. More importantly, by applying Bayesian analysis, this work overcame the ambiguity found in a previous study (Khan et al. 2019b). Thus, the study confirmed that financial development plays a positive role in the ecological footprint in Singapore. More broadly, the finding is consistent with many studies in various contexts, such as the research of Khan et al. (2019a) in the context of five Belt and Road initiative (BRI) regions or Godil et al. (2020) in Turkey. Nevertheless, it should be noted that some studies show contradicted results, such as Uddin et al. (2017) on 27 leading world EF contributors, Ahmed et al. (2019) in Malaysia, or Omoke et al. (2020) in Nigeria (see also Table 1). In the context of Singapore, the study believes that financial development causes the scale effect by fostering economic liberalization and attracting foreign direct investment (Pazienza 2015; Saud et al. 2020). It means that an increase in financial development in Singapore leads to a rise in economic growth, high manufacturing and energy consumption, especially non-renewable energy consumption due to economic liberalization (Destek and Sarkodie 2019). This argument is consistent with some recent studies that ASEAN countries, including Singapore where non-renewable energy has been largely used in many industries (Kongbuamai et al. 2020; Nathaniel and Khan 2020). Consequently, the financial development is both side-effects on the increase of CO2 emissions, air and soil pollution, and on ultimate raise level of EF (Pazienza 2015; Saud et al. 2020). As a result, the Singapore Government should considerably improve current policies regarding to financial development.

Both the ARDL and Bayesian analyses confirm that economic growth has a positive impact on EF (probability of 100%). The finding is consistent with the trade-off theory and the empirical evidence between economic growth and EF since economic growth has increased energy (Nathaniel and Khan 2020; Ozcan et al. 2018; Udemba 2020; Zafar et al. 2019), facilitation of urbanization (Ahmed et al. 2019; Nathaniel et al. 2020; Wu et al. 2019), and pressure on infrastructure and ecological assets (Sharma et al. 2020). Consequently, economic growth may break the balance in the biodiversity and increase EF, supported by the hypothesis of scale effect. As mentioned above, the increase in economic growth has generated a high level of non-renewable energy consumption in ASEAN countries, including Singapore (Kongbuamai et al. 2020; Nathaniel and Khan 2020). To maintain environmental quality, therefore, more effective economic growth strategies should be implemented.

Finally, human capital mitigates EF in both the short and long run. The results are firmly validated by both the ARDL and Bayesian analyses with the probability of 100%. The finding is justifiable since some scholars (for instance, Nathaniel 2020; Nathaniel et al. 2021; Pata and Caglar 2021), who have discussed and empirically confirmed that human capital decreases EF. The results show that an increase in human capital leads to a corresponding rise in technological change adoption (Ackah and Kizys 2015; Consoli et al. 2016) as well as the awareness towards environmental quality problems (Adil 2018; Asongu 2018; Reynolds et al. 2010; Ulucak and Li 2020); and thus, activities of environmental destruction should be reduced and sustainable development could be more promoted in Singapore. The findings also demonstrate the consistency with other contexts that emphasize the importance of human capital and have appropriate policies to foster human capital, such as the USA (Zafar et al. 2019)¸ G7 countries (Ahmed et al. 2020a; S. P. Nathaniel 2020), and Central and Eastern European Countries (Chen et al. 2019), among the others. The results likely prove how human capital is important and beneficial in the context of Singapore.

Conclusion and policy implications

Conclusions

We aim to uncover the association between financial development and EF by incorporating economic growth and human capital as control variables. To achieve this purpose, the study used the ARDL approach to provide preliminary results, and then a Bayesian analysis was employed to provide more insightful outcomes. As expected, the Bayesian analysis enables us to firmly conclude that both financial development and economic growth have a positive impact on EF, while human capital decreases EF. These findings indicated that the trade-off hypothesis between financial development and ecological assets is valid. Hence, monetary expansion policies should be associated with improving human capital to achieve sustainable development goals in the context of Singapore.

The findings confirm that the current financial development policies of Singapore may threaten environmental quality. They should be better assimilated and used more effectively in policy instruments regarding financial development. As noted by the previous studies, financial development may improve environmental quality by boosting research and development and technological advancement (Ahmed et al. 2019). Thus, the Singapore Government should emphasize the vital role of the financial sector in providing funds for an adaption to use eco-friendly technologies in new ventures and also to in the existing businesses as a replacement of outdated technologies (Ahmed et al. 2019; Usman et al. 2020a). Furthermore, the study also recommends that Singapore Government should facilitate the optimal utilization of energy by boosting financial support for eco-friendly projects at a minimum interest rate (Usman et al. 2020a). Finally, additional funds should be allocated to support environmental policies as well as to raise the environmental awareness of residents (Pata and Yilanci 2020).

Based on the positive impact of economic growth on EF in Singapore, the study suggests that the economic development policies should be focused to achieve less dependence on non-renewable energy (Nathaniel and Khan 2020; Udemba 2020; Ulucak and Apergis 2018; Zafar et al. 2019). Furthermore, the policies of financial development and economic growth in the context of Singapore should be integrated seamlessly to effectively foster environmental quality. More specifically, financial development should allocate more resources to developing and applying cleaner and more eco-friendly technologies. Novel technology is likely to remove dirty and obsolete technologies while fostering advanced and smart technologies in the manufacturing and residential sectors.

Furthermore, policies to improve environmental problems awareness are also significant in improving environmental quality (Adil 2018; Asongu 2018; Reynolds et al. 2010; Ulucak and Li 2020). Similarly, the study emphasizes an integrated approach to formulate policies about financial development, economic growth and human capital (Ahmed et al. 2021; Croes et al. 2021). Therefore, the work suggests that the Singapore Government should have a comprehensive vision about why financial development, economic growth, and human capital influence ecological footprint and provide an integrated yet effective way to improve environmental quality.

References

Ackah I, Kizys R (2015) Green growth in oil producing African countries: a panel data analysis of renewable energy demand. Renew Sust Energ Rev 50:1157–1166

Adedoyin FF, Nathaniel S, Adeleye N (2021) An investigation into the anthropogenic nexus among consumption of energy, tourism, and economic growth: do economic policy uncertainties matter? Environ Sci Pollut Res 28(3):2835–2847

Adil AA (2018) Could Human Development Be the Key to Environmental Sustainability? Leonardo 51(2):197–198

Ahmad M, Zhao Z-Y, Li H (2019) Revealing stylized empirical interactions among construction sector, urbanization, energy consumption, economic growth and CO2 emissions in China. Sci Total Environ 657:1085–1098

Ahmad M, Jiang P, Murshed M, Shehzad K, Akram R, Cui L, Khan Z (2021) Modelling the dynamic linkages between eco-innovation, urbanization, economic growth and ecological footprints for G7 countries: does financial globalization matter? Sustain Cities Soc 70:102881

Ahmed Z, Le HP (2021) Linking information communication technology, trade globalization index, and CO 2 emissions: evidence from advanced panel techniques. Environ Sci Pollut Res 28(7):8770–8781

Ahmed Z, Wang Z, Mahmood F, Hafeez M, Ali N (2019) Does globalization increase the ecological footprint? Empirical evidence from Malaysia. Environ Sci Pollut Res 26(18):18565–18582

Ahmed Z, Asghar MM, Malik MN, Nawaz K (2020a) Moving towards a sustainable environment: the dynamic linkage between natural resources, human capital, urbanization, economic growth, and ecological footprint in China. Res Policy 67:101677

Ahmed Z, Zafar MW, Ali S (2020b) Linking urbanization, human capital, and the ecological footprint in G7 countries: an empirical analysis. Sustain Cities Soc 55:102064

Ahmed Z, Zhang B, Cary M (2021) Linking economic globalization, economic growth, financial development, and ecological footprint: Evidence from symmetric and asymmetric ARDL. Ecol Indic 121:107060

Al-Mulali U, Ozturk I (2015) The effect of energy consumption, urbanization, trade openness, industrial output, and the political stability on the environmental degradation in the MENA (Middle East and North African) region. Energy 84:382–389

Alola AA, Bekun FV, Sarkodie SA (2019) Dynamic impact of trade policy, economic growth, fertility rate, renewable and non-renewable energy consumption on ecological footprint in Europe. Sci Total Environ 685:702–709

Asongu SA (2018) CO 2 emission thresholds for inclusive human development in sub-Saharan Africa. Environ Sci Pollut Res 25(26):26005–26019

Baloch MA, Zhang J, Iqbal K, Iqbal Z (2019) The effect of financial development on ecological footprint in BRI countries: evidence from panel data estimation. Environ Sci Pollut Res 26(6):6199–6208

Bandyopadhyay A, Rej S (2021) Can nuclear energy fuel an environmentally sustainable economic growth? Revisiting the EKC hypothesis for India. Environ Sci Pollut Res. 10.1007/s11356-021-15220-7

Bayar Y, Maxim A (2020) Financial development and CO2 emissions in post-transition European Union countries. Sustainability 12(7):2640

Baz K, Xu D, Ali H, Ali I, Khan I, Khan MM, Cheng J (2020) Asymmetric impact of energy consumption and economic growth on ecological footprint: Using asymmetric and nonlinear approach. Sci Total Environ 718:137364. https://doi.org/10.1016/j.scitotenv.2020.137364

Bernardo JM, Smith AF (1994) Bayesian theory: John Wily and Sons. New York

Bilgili F, Kuşkaya S, Khan M, Awan A, Türker O (2021) The roles of economic growth and health expenditure on CO 2 emissions in selected Asian countries: a quantile regression model approach. Environ Sci Pollut Res:1–24

Block JH, Jaskiewicz P, Miller D (2011) Ownership versus management effects on performance in family and founder companies: a Bayesian reconciliation. Journal of Family Business Strategy 2(4):232–245

Charfeddine L (2017) The impact of energy consumption and economic development on ecological footprint and CO2 emissions: evidence from a markov switching equilibrium correction model. Energy Econ 65:355-374. https://doi.org/10.1016/j.eneco.2017.05.009

Chen S, Saud S, Saleem N, Bari MW (2019) Nexus between financial development, energy consumption, income level, and ecological footprint in CEE countries: do human capital and biocapacity matter? Environ Sci Pollut Res 26(31):31856–31872

Consoli D, Marin G, Marzucchi A, Vona F (2016) Do green jobs differ from non-green jobs in terms of skills and human capital? Res Policy 45(5):1046–1060

Cowles MK, Carlin BP (1996) Markov chain Monte Carlo convergence diagnostics: a comparative review. J Am Stat Assoc 91(434):883–904

Croes R, Ridderstaat J, Bąk M, Zientara P (2021) Tourism specialization, economic growth, human development and transition economies: The case of Poland. Tour Manag 82:104181

Danish, Wang B, Wang Z (2018) Imported technology and CO2 emission in China: collecting evidence through bound testing and VECM approach. Renew Sust Energ Rev 82:4204–4214. https://doi.org/10.1016/j.rser.2017.11.002

Danish, Hassan ST, Baloch MA, Mahmood N, Zhang J (2019) Linking economic growth and ecological footprint through human capital and biocapacity. Sustain Cities Soc 47:101516. https://doi.org/10.1016/j.scs.2019.101516

Davoud M, Behrouz SA, Farshid P, Somayeh J (2013) Oil products consumption, electricity consumption-economic growth nexus in the economy of Iran: a bounds test co-integration approach. International Journal of Academic Research in Business and Social Sciences 3(1):353–367

Destek MA, Ulucak R, Dogan E (2018) Analyzing the environmental Kuznets curve for the EU countries: the role of ecological footprint. Environ Sci Pollut Res 25(29):29387–29396

Destek MA, Sarkodie SA (2019) Investigation of environmental Kuznets curve for ecological footprint: the role of energy and financial development. Sci Total Environ 650:2483–2489

Destek MA, Sinha A (2020) Renewable, non-renewable energy consumption, economic growth, trade openness and ecological footprint: Evidence from organisation for economic Co-operation and development countries. J Clean Prod 242:118537. https://doi.org/10.1016/j.jclepro.2019.118537

Dickey DA, Fuller WA (1981) Likelihood ratio statistics for autoregressive time series with a unit root. Econometrica: Journal of the Econometric Society, 1057–1072.

Dietz T, Rosa EA, York R (2007) Driving the human ecological footprint. Front Ecol Environ 5(1):13–18

Du L, Wei C, Cai S (2012) Economic development and carbon dioxide emissions in China: provincial panel data analysis. China Econ Rev 23(2):371–384

Elliott G, Rothenberg TJ, Stock JH (1992) Efficient tests for an autoregressive unit root. National Bureau of Economic Research Cambridge, Mass., USA.

Furuoka F (2015) Financial development and energy consumption: evidence from a heterogeneous panel of Asian countries. Renew Sust Energ Rev 52:430–444

Gelman A, Gilks WR, Roberts GO (1997) Weak convergence and optimal scaling of random walk Metropolis algorithms. Ann Appl Probab 7(1):110–120

Godil DI, Sharif A, Rafique S, Jermsittiparsert K (2020) The asymmetric effect of tourism, financial development, and globalization on ecological footprint in Turkey. Environ Sci Pollut Res 27(32):40109–40120

Ha NM, Ngoc BH, McAleer M (2020) Financial integration, energy consumption and economic growth in Vietnam. Annals of Financial Economics 15(03):2050010

Han H (2017) Singapore, a garden city: authoritarian environmentalism in a developmental state. J Environ Dev 26(1):3–24

Hashmi R, Alam K (2019) Dynamic relationship among environmental regulation, innovation, CO2 emissions, population, and economic growth in OECD countries: A panel investigation. J Clean Prod 231:1100–1109

Hassan ST, Xia E, Khan NH, Shah SMA (2019) Economic growth, natural resources, and ecological footprints: evidence from Pakistan. Environ Sci Pollut Res 26(3):2929–2938

Hsueh S-J, Hu Y-H, Tu C-H (2013) Economic growth and financial development in Asian countries: a bootstrap panel Granger causality analysis. Econ Model 32:294–301

Kassouri Y, Altıntaş H (2020) Human well-being versus ecological footprint in MENA countries: a trade-off? J Environ Manag 263:110405

Katircioğlu ST (2014) Testing the tourism-induced EKC hypothesis: the case of Singapore. Econ Model 41:383–391. https://doi.org/10.1016/j.econmod.2014.05.028

Khan A, Chenggang Y, Hussain J, Bano S (2019a) Does energy consumption, financial development, and investment contribute to ecological footprints in BRI regions? Environ Sci Pollut Res 26(36):36952–36966

Khan MTI, Yaseen MR, Ali Q (2019b) Nexus between financial development, tourism, renewable energy, and greenhouse gas emission in high-income countries: a continent-wise analysis. Energy Econ 83:293–310

Kocoglu M, Awan A, Tunc A, Aslan A (2021) The nonlinear links between urbanization and CO2 in 15 emerging countries: evidence from unconditional quantile and threshold regression. Environmental Science and Pollution Research. 10.21203/rs.3.rs-676290/v1

Kongbuamai N, Bui Q, Yousaf HMAU, Liu Y (2020) The impact of tourism and natural resources on the ecological footprint: a case study of ASEAN countries. Environ Sci Pollut Res 27(16):19251–19264

Lemoine NP (2019) Moving beyond noninformative priors: why and how to choose weakly informative priors in Bayesian analyses. Oikos 128(7):912–928

Meirun T, Mihardjo LWW, Haseeb M, Khan SAR, Jermsittiparsert K (2021) The dynamics effect of green technology innovation on economic growth and CO 2 emission in Singapore: new evidence from bootstrap ARDL approach. Environ Sci Pollut Res 28(4):4184–4194

Mrabet Z, Alsamara M (2017) Testing the Kuznets curve hypothesis for Qatar: a comparison between carbon dioxide and ecological footprint. Renew Sust Energ Rev 70:1366–1375

Murshed M, Elheddad M, Ahmed R, Bassim M, Than ET (2021a) Foreign direct investments, renewable electricity output, and ecological footprints: do financial globalization facilitate renewable energy transition and environmental welfare in Bangladesh? Asia-Pacific Financial Markets. 10.1007/s10690-021-09335-7

Murshed M, Haseeb M, Alam MS (2021b). The environmental Kuznets curve hypothesis for carbon and ecological footprints in South Asia: the role of renewable energy. GeoJournal. https://doi.org/10.1007/s10708-020-10370-6

Murshed M, Rahman MA, Alam MS, Ahmad P, Dagar V (2021c) The nexus between environmental regulations, economic growth, and environmental sustainability: linking environmental patents to ecological footprint reduction in South Asia. Environ Sci Pollut Res 28(36):49967–49988. https://doi.org/10.1007/s11356-021-13381-z

Naqvi SAA, Shah SAR, Mehdi MA (2020) Revealing empirical association among ecological footprints, renewable energy consumption, real income, and financial development: a global perspective. Environ Sci Pollut Res 27(34):42830–42849

Nathaniel SP (2020) Biocapacity, human capital, and ecological footprint in G7 countries: the moderating role of urbanization and necessary lessons for emerging economies. Energy, Ecology and Environment, 1–16.

Nathaniel S, Khan SAR (2020) The nexus between urbanization, renewable energy, trade, and ecological footprint in ASEAN countries. J Clean Prod 272:122709

Nathaniel S, Anyanwu O, Shah M (2020) Renewable energy, urbanization, and ecological footprint in the Middle East and North Africa region. Environ Sci Pollut Res:1–13

Nathaniel SP, Nwulu N, Bekun F (2021) Natural resource, globalization, urbanization, human capital, and environmental degradation in Latin American and Caribbean countries. Environ Sci Pollut Res 28(5):6207–6221

Nelson CR, Plosser CR (1982) Trends and random walks in macro-economic time series. Journal of Monetary Economics. September, 10(2), 139–162.

Neumayer E (2012) Human development and sustainability. Journal of Human Development and Capabilities 13(4):561–579

Nkoro E, Uko AK (2016) Autoregressive Distributed Lag (ARDL) cointegration technique: application and interpretation. J Stat Econ Methods 5(4):63–91

Omoke PC, Nwani C, Effiong EL, Evbuomwan OO, Emenekwe CC (2020) The impact of financial development on carbon, non-carbon, and total ecological footprint in Nigeria: new evidence from asymmetric dynamic analysis. Environ Sci Pollut Res 27(17):21628–21646

Ozcan B, Apergis N, Shahbaz M (2018) A revisit of the environmental Kuznets curve hypothesis for Turkey: new evidence from bootstrap rolling window causality. Environ Sci Pollut Res 25(32):32381–32394. https://doi.org/10.1007/s11356-018-3165-x

Ozturk I, Al-Mulali U, Saboori B (2016) Investigating the environmental Kuznets curve hypothesis: the role of tourism and ecological footprint. Environ Sci Pollut Res 23(2):1916–1928

Pata UK, Caglar AE (2021) Investigating the EKC hypothesis with renewable energy consumption, human capital, globalization and trade openness for China: evidence from augmented ARDL approach with a structural break. Energy 216:119220. https://doi.org/10.1016/j.energy.2020.119220

Pata UK, Yilanci V (2020) Financial development, globalization and ecological footprint in G7: further evidence from threshold cointegration and fractional frequency causality tests. Environ Ecol Stat 27(4):803–825

Pazienza P (2015) The relationship between CO2 and foreign direct investment in the agriculture and fishing sector of OECD countries: evidence and policy considerations. Intelektinė Ekonomika 9(1):55–66

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econ 16(3):289–326

Phillips PCB, Perron P (1988) Testing for a unit root in time series regression. Biometrika 75(2):335–346

Rej S, Nag B (2021) Energy crossroads and prioritization of energy choices: the case of India. OPEC Energy Review 45(1):135–158. https://doi.org/10.1111/opec.12201

Reynolds TW, Farley J, Huber C (2010) Investing in human and natural capital: an alternative paradigm for sustainable development in Awassa, Ethiopia. Ecol Econ 69(11):2140–2150

Ridzuan AR, Ismail NA, Che Hamat AF (2017) Does foreign direct investment successfully lead to sustainable development in Singapore? Economies 5(3):29

Sankaran A, Kumar S, Arjun K, Das M (2019) Estimating the causal relationship between electricity consumption and industrial output: ARDL bounds and Toda-Yamamoto approaches for ten late industrialized countries. Heliyon 5(6):e01904

Saud S, Chen S, Haseeb A (2020) The role of financial development and globalization in the environment: accounting ecological footprint indicators for selected one-belt-one-road initiative countries. J Clean Prod 250:119518

Shahbaz M, Solarin SA, Mahmood H, Arouri M (2013) Does financial development reduce CO2 emissions in Malaysian economy? A time series analysis. Econ Model 35:145–152

Shahbaz M, Jam FA, Bibi S, Loganathan N (2016) Multivariate Granger causality between CO2 emissions, energy intensity and economic growth in Portugal: evidence from cointegration and causality analysis. Technol Econ Dev Econ 22(1):47–74

Sharif A, Baris-Tuzemen O, Uzuner G, Ozturk I, Sinha A (2020) Revisiting the role of renewable and non-renewable energy consumption on Turkey’s ecological footprint: evidence from Quantile ARDL approach. Sustain Cities Soc 57:102138. https://doi.org/10.1016/j.scs.2020.102138

Sharma R, Sinha A, Kautish P (2020) Examining the impacts of economic and demographic aspects on the ecological footprint in South and Southeast Asian countries. Environ Sci Pollut Res 27(29):36970–36982

Shujah Ur R, Chen S, Saud S, Saleem N, Bari MW (2019) Nexus between financial development, energy consumption, income level, and ecological footprint in CEE countries: do human capital and biocapacity matter? Environ Sci Pollut Res 26(31):31856–31872

Sohail HM, Li Z, Murshed M, Alvarado R, Mahmood H (2021) An analysis of the asymmetric effects of natural gas consumption on economic growth in Pakistan: a non-linear autoregressive distributed lag approach. Environmental Science and Pollution Research, 1–16.

Tan F, Lean HH, Khan H (2014) Growth and environmental quality in Singapore: is there any trade-off? Ecol Indic 47:149–155. https://doi.org/10.1016/j.ecolind.2014.04.035

Thompson SK (2012) Sampling (3rd ed.). Hoboken, N.J. : John Wiley & Sons. Inc.

Tillaguango B, Alvarado R, Dagar V, Murshed M, Pinzón Y, Méndez P (2021) Convergence of the ecological footprint in Latin America: the role of the productive structure. Environ Sci Pollut Res 28(42):59771–59783. https://doi.org/10.1007/s11356-021-14745-1

Toda HY, Yamamoto T (1995) Statistical inference in vector autoregressions with possibly integrated processes. J Econ 66(1–2):225–250

Uddin GA, Salahuddin M, Alam K, Gow J (2017) Ecological footprint and real income: panel data evidence from the 27 highest emitting countries. Ecol Indic 77:166–175

Udemba EN (2020) A sustainable study of economic growth and development amidst ecological footprint: new insight from Nigerian Perspective. Sci Total Environ 732:139270

Ulucak R, Apergis N (2018) Does convergence really matter for the environment? An application based on club convergence and on the ecological footprint concept for the EU countries. Environ Sci Pol 80:21–27. https://doi.org/10.1016/j.envsci.2017.11.002

Ulucak R, Li N (2020) The nexus between economic globalization and human development in Asian countries: an empirical investigation. Environ Sci Pollut Res 27(3):2622–2629

Usman M, Kousar R, Makhdum MSA (2020a) The role of financial development, tourism, and energy utilization in environmental deficit: evidence from 20 highest emitting economies. Environ Sci Pollut Res 27(34):42980–42995

Usman M, Kousar R, Yaseen MR, Makhdum MSA (2020b) An empirical nexus between economic growth, energy utilization, trade policy, and ecological footprint: a continent-wise comparison in upper-middle-income countries. Environ Sci Pollut Res 27(31):38995–39018

Wu Y, Shen L, Zhang Y, Shuai C, Yan H, Lou Y, Ye G (2019) A new panel for analyzing the impact factors on carbon emission: a regional perspective in China. Ecol Indic 97:260–268

Xue L, Haseeb M, Mahmood H, Alkhateeb TT, Murshed M (2021) Renewable energy use and ecological footprints mitigation: evidence from selected South Asian economies. In Sustainability (Vol. 13, Issue 4). https://doi.org/10.3390/su13041613

Zafar MW, Zaidi SAH, Khan NR, Mirza FM, Hou F, Kirmani SAA (2019) The impact of natural resources, human capital, and foreign direct investment on the ecological footprint: the case of the United States. Res Policy 63:101428

Zeraibi A, Balsalobre-Lorente D, Murshed M (2021) The influences of renewable electricity generation, technological innovation, financial development, and economic growth on ecological footprints in ASEAN-5 countries. Environ Sci Pollut Res 28(37):51003–51021. https://doi.org/10.1007/s11356-021-14301-x

Zhao J, Zhao Z, Zhang H (2019) The impact of growth, energy and financial development on environmental pollution in China: new evidence from a spatial econometric analysis. Energy Economics, 104506

Availability of data and materials

The datasets used and/or analyzed during the current study are available from the corresponding author on reasonable request.

Author information

Authors and Affiliations

Contributions

BHN conducted conceptualization, data curation, formal analysis, and writing — original draft. AA conducted the writing — review and editing — supervision, and project administration.

Corresponding author

Ethics declarations

Ethics approval

Not applicable

Consent to participate

Not applicable

Consent for publication

Not applicable

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Nicholas Apergis

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Ngoc, B.H., Awan, A. Does financial development reinforce ecological footprint in Singapore? Evidence from ARDL and Bayesian analysis. Environ Sci Pollut Res 29, 24219–24233 (2022). https://doi.org/10.1007/s11356-021-17565-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-021-17565-5