Abstract

Based on the panel data of 46 countries in “Belt and Road” (B&R) from 2004 to 2016, this paper studies the impact of innovation investment and institutional quality on green total factor productivity (GTFP). Firstly, the ICRG database, World Bank WDI database, Traditional Foundation database, and Wind database are matched to obtain the balanced panel data of 46 countries along the B&R from 2004 to 2016. Secondly, the Malmquist-Luenberger index, which can be included in the unexpected output, is used to calculate the GTFP of countries along B&R. Thirdly, the evaluation system of national institutional quality of B&R is constructed from three dimensions (political institutional quality, economic institutional quality, and legal institutional quality), and the overall system quality of different countries is measured by entropy method. Finally, an empirical study is made on the relationship among innovation investment, institutional quality, and green total factor productivity. The results show that innovation investment has significantly promoted the GTFP of the B&R countries. It is worth noting that there is a non-linear relationship between innovation investment and GTFP in the B&R countries. With the improvement of overall system quality, political system quality, economic system quality, and legal system quality, the promotion effect of innovation investment on GTFP is further enhanced. In addition, the heterogeneity regression results show that the impact of innovation investment on GTFP is significantly heterogeneous in different regions of the B&R countries. Specifically, innovation investment has the greatest impact on GTFP in South Asia, followed by East Asia and Pacific, Europe and Central Asia, Middle East, and North Africa.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

With the increasingly negative impact of environmental degradation on human life, achieving green development has become the consensus of the international community (Yan et al., 2021; Khan et al., 2021; Irfan et al., 2021a,b; Wu et al., 2020a,b). According to the “Environmental Performance Index Report 2016” released by Yale University, the green development status of “the belt and road initiative” countries is not optimistic. Although the average economic growth rate of countries along the route is higher than that of the same period in the world, its carbon dioxide emission intensity is more than twice that of other countries, and its total emissions account for about half of the global emissions, with an average annual emission growth rate of 1.08 percentage points higher than that of the same period in the world. Therefore, how to achieve the synergy between economic and social development, ecological environmental protection, and build a green “the belt and road initiative” has become the key to the economic development and transformation of “the belt and road initiative” countries (Razzaq et al., 2021; Liu and Xin 2019; Xie and Zhang 2021; Ozcan and Ozturk 2019). “Total factor productivity,” as a tool to analyze the sources of economic growth, is the core indicator to measure economic development, and the difference in its growth is the fundamental reason for the economic differences among countries. Traditional total factor productivity analysis distorts the evaluation of social welfare changes and economic performance, and economic growth is unsustainable. Therefore, resources and environmental factors are introduced into the total factor productivity measurement system (Färe et al., 2007; Lin and Chen 2018; Işık et al. 2021a,b). Green total factor productivity takes energy, capital, and labor into the production function, environmental pollution as an unexpected “bad” output, and adopts the directional distance function proposed by Yang et al. (2021) so that economic units can minimize the “bad” output and maximize the economic output (Iqbal et al., 2021a,b; Tanveer et al., 2021; Hao et al., 2021b). On this basis, some scholars regard carbon emissions as a “bad” output and build green total factor productivity, which can effectively analyze the development of a low-carbon economy (Mani et al., 2021; Razzaq et al., 2020; Xia and Xu 2020).

The transformation of economic development mode must be driven by technological progress and innovation. Building “the Belt and Road initiative” into an innovative road is the key to realizing its green development (Wu et al., 2020a). Although, scholars have mentioned innovation as the core power of the green development of "the belt and road initiative"; however, as the motive force of innovation, it is unclear whether there is any difference between innovation investment and green total factor productivity in the belt and road initiative (Ahmad and Zhao 2018; Qin and Ozturk 2021; Azam et al. 2019). In view of the unbalanced development of politics, economy, and law in "the belt and road initiative" countries, the system quality is quite different (Ahmad et al., 2021a,b,c,d,e). In fact, the system is a very broad concept, covering law, property rights, government efficiency, executive power, and other aspects. Suppose a set of systems is established in the production activities of enterprises, which can not only effectively motivate people to engage in productive activities but also ensure that all parties involved can realize their rights and obligations fairly. In that case, it will not only promote the innovation ability but also promote the growth of the economic performance of enterprises (Irfan and Ahmad 2021). Scholars regard institutional quality as an important source of comparative advantage of a country or region (Irfan et al., 2019a; Levchenko 2007; Nunn 2007; Jabeen et al. 2019; Azam et al., 2021). Among them, Levchenko (2007) takes the data of 389 industries in 177 countries as research samples and builds a new theoretical model based on the Ricardian model and H–O model. The research results show that institutional quality can be the source of a country’s comparative advantage and this comparative advantage helps to overcome the problem of institutional dependence. Nunn (2007) conducted an empirical study with data from 223 industries in 146 countries. The results showed that institutional quality (contract enforcement) is an important source of comparative advantage and the impact of this advantage on international trade is greater than the sum of capital and labor. Ahmed et al. (2021a) found that specialized division of labor and trade are not the result of technological differences and endowments, but the difference of institutional quality and emerging markets often uses institutional advantages to make up for their disadvantages in international competition. Therefore, it is of great significance to study how innovation investment affects green total factor productivity under different institutional qualities. The contribution of this paper is threefold: First, it studies how innovation investment affects the green total factor productivity of the belt and road initiative countries. Secondly, the green total factor productivity of 46 countries in the belt and road initiative is calculated. Thirdly, this paper examines how innovation investment affects green total factor productivity under different institutional qualities.

The remaining sections of this paper are arranged as follows: The second section is literature review; the third section is methods and data. The fourth section is the results and discussion. The fifth section is the conclusion.

Literature review

There is little literature about innovation investment, institutional quality, and green total factor productivity. This paper will summarize and comment on previous studies from the perspectives of innovation and green total factor productivity, institutional quality, and total factor productivity.

Innovation and green total factor productivity

Scholars have made a series of studies on how innovation affects total factor productivity, including the following viewpoints: One viewpoint is that innovation environment can affect innovation ability and then total factor productivity (Furman et al., 2002; Gans and Hayes 2006). Another point of view is that innovation mode is the main factor affecting total factor productivity (Geroski 1989; Hall et al., 2009; Crespi and Zuniga 2012; Aghion et al., 2009; Chudnovsky et al., 2006). Although scholars have achieved fruitful results on the impact of innovation on total factor productivity, previous studies have not included factors such as energy consumption and environmental pollution into the measurement framework of total factor productivity (Elavarasan et al., 2021a,b; Wu et al., 2021b; Griffith et al., 2006; Irfan et al., 2021d). Therefore, it is a progress to evaluate the green development of the economy to bring environmental and resource factors into the measurement framework of total factor productivity (Wu et al., 2020a,b, 2021a; Koondhar et al. 2021). In the measurement of green total factor productivity, beginners substitute energy consumption and pollution emissions into the extended C-D production function for calculation (Wu et al., 2021a; Liu et al., 2020). The academic circles have improved the calculation method of green total factor productivity. Green technological progress was a key driver of optimal land use in China (Gao et al., 2021; Chandio et al., 2021). Anser et al. (2021b) disclosed that renewable energy technology was added to the green growth in the South Asian context. Also, Ahmad et al. (2021a) argued that energy-industry investment in emerging technology played a critical role in the economic progress of China. Irfan et al. (2019b) argued that solar energy technology development was a necessary pillar of the economic development of Pakistan. Fatima et al. (2021) employed a structural equation modeling approach to find the drivers and barriers to renewable technology development and revealed that environmental innovation factors determined technology development. Färe et al. (2007) regards environmental pollution as an undesired output and constructs a directional distance function. However, this method is based on the calculation model that one input or output is unchanged, thus changing the other to calculate the input–output efficiency, so there are defects in angle and radial direction. Moreover, Ahmad et al. (2020b) revealed that energy investment abated environmental pollution and promoted economic activity across Chinese provinces. Additionally, Li et al. (2021a) found that renewable energy technology innovation promoted environmental sustainability in China. Contrastingly, Ahmad and Jabeen (2020) found that investment in innovation in construction activities brought about electricity consumption reduction in the Chinese provinces. Given the defect of measuring green total factor productivity by a directional distance function, Fukuyama and Weber (2009) developed a more general non-angular and non-radial SBM directional distance function and proposed to calculate green total factor productivity by Luenberger productivity index. Anser et al. (2021a) used panel quantile regression to find the negative impact of information and communication technologies on carbon emissions. Likewise, Rehman et al. (2021) examined and found that information technologies reduced carbon emissions in Pakistan. Jabeen et al. (2020) opted for the diffusion of innovation framework and found that biogas technology development could play its role in promoting environmental and green economic development. Finally, scholars studied and found that renewable energy technologies played an essential part in enhancing green growth (Akram et al., 2021; Irfan et al., 2021c,e; Irfan et al., 2020a,b; Yan et al., 2019).

Institutional quality and total factor productivity

Since institutional quality usually involves political, economic, and legal aspects, related studies mostly study the relationship between institutional quality and total factor productivity of a country or region from these three angles (Wu et al., 2020a, b). The authors conducted research on political system quality and total factor productivity of a country or region. Scully (1988) used the data of 118 countries to study and found that in countries with high political system quality, their productivity growth rate is also relatively fast. Golec and Vernon (2010) believe that the high degree of government regulation will hinder the enthusiasm of R&D investment and innovation structure of pharmaceutical enterprises and then inhibit the improvement of productivity of the pharmaceutical industry. Shan et al. (2021) investigated and found that institutional quality was a significant role player in improving the environment and economic situation. Similarly, Iqbal et al. (2021a,b) revealed that institutional quality negatively contributed to environmental sustainability in the OECD nations. The research of Bardey et al. (2010) shows that government regulation will lead to low innovation levels of enterprises and reduce regional total factor productivity. Ran et al. (2019) took regional corruption as the proxy variable of the political system. The research results show that the improvement of regional corruption reduces the quality of the political system and then inhibits the improvement of regional innovation ability. As for the quality of the economic system, previous studies mostly used the degree of marketization as the proxy variable of economic system quality for the empirical test. The research of Dai and Liu (2013) shows that the improvement of marketization has significantly promoted the total factor productivity of high-tech industries. Shi and Wang (2016) empirically tested the impact of marketization on economic growth with the Bayesian model and found that China’s marketization reform effectively promoted economic development and productivity. The same idea was investigated and supported by Li et al. (2019). Ren et al. (2021) studied China’s energy consumption pattern through the development of Internet. The authors found that internet development affects the energy consumption pattern through R&D investment, human capital, economic growth, industrial structure, and financial development. According to Cao et al. (2014), the improvement of economic system quality, such as intermediary market organization and factor market development degree, has significantly promoted the improvement of total factor productivity of enterprises. On the relationship between the quality of the legal system and total factor productivity, Helpman (1993) showed that the improvement of intellectual property protection reduces the monopoly power of owners and inhibits the increase of R&D investment and the progress of total factor productivity. Shahzad et al. (2021) opined that the enhancement of intellectual property protection hinders international technology transfer and reduces the innovation efficiency of enterprises. However, under the condition of international technology transfer license, the enhancement of intellectual property protection will promote productivity (Yang and Maskus 2001).

Methods and data

Econometric model

The following measurement model is constructed to test the impact of innovation investment on green total factor productivity (Wu et al., 2020a, b):

In which \({gml}_{it}\) represents green total factor productivity, \({ii}_{it}\) is innovation investment, \({\alpha }_{i}\) and \({v}_{t}\) respectively indicate time and regional fixed effect, and \({e}_{it}\) represents random error term.

According to previous studies, green total factor productivity is also affected by other factors. Therefore, we add internet development, labor, energy consumption, urbanization, and industrial structure to the model. Therefore, model (1) is extended to the following equation:

where \({x}_{n}\) represents a series of control variables, including internet development (internet), labor (labor), energy consumption (energy), urbanization (urban), and industrial structure (str).

In addition, from the previous literature, it can be known that the green total factor productivity is also affected by the early stage (Wu et al., 2020b), so we add the lag period of the explained variable to the model and get the benchmark regression model of this paper:

Benchmark regression analysis only verifies the direct effect of innovation investment on green total factor productivity. However, will this effect always exist in “the Belt and Road initiative” countries as time goes by and space changes horizontally? Due to the unbalanced development of politics, economy, and law in the belt and road initiative countries, the system quality of different countries is quite different. Therefore, in order to study how innovation investment affects green total factor productivity under different institutional qualities, this paper will introduce a threshold regression model. At the same time, to avoid potential endogenous problems, this paper draws lessons from the research of Wu et al. (2019), introduces the dynamic threshold panel model, takes the urbanization level as the threshold variable, and further transforms Eq. (3) into the following dynamic threshold panel model:

where \({q}_{it}\) represents the threshold variable and, for simplicity, it is assumed that the threshold variable does not change with time and is exogenous; I () represents the index function; and c is the specific threshold value.

Variables

Green total factor productivity

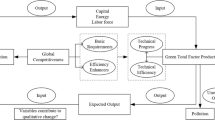

Following the previous research, the Malmquist-Luenberger (ML) index is used to calculate the GTFP. The MAXdea 7.0 Ultra software is used for the specific measurement process. From the DEA’s ML index, this paper calculates the GTFP. The specific results are shown in Tables 1 and Fig. 1. In the specific calculation process, capital, labor, and energy are selected as input factors; the expected output is GDP; and the non-expected output is based on the carbon emissions of each country (kg carbon emissions/USD GDP, also known as carbon emission intensity). Among them, the total labor force of each country is taken as the proxy variable of labor input; the estimation of capital stock is based on the perpetual inventory method, referring to the research of Hall and Jones (1999); the depreciation rate is set at 6%. Energy input takes per capita standard kilogram of oil as a proxy variable. Considering the availability of data and the serious lack of data in some countries, the research object is the panel data of 46 countries along the “the Belt and Road initiative” from 2003 to 2016.

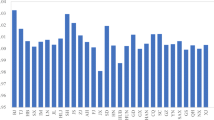

In Table 1, the annual growth rate of the GTFP of B&R countries from 2003 to 2016 is 0.015. The average growth rates of technical efficiency and technological progress are − 0.023 and 0.044, respectively. The growth of GTFP of countries along the route is mainly driven by technological progress. Regarding the change in technical efficiency, the average annual growth rate of pure technical efficiency and scale efficiency are both negative. From the perspective of time trends, the average annual growth rate of GTFP of the countries along the route shows a wave-like rise during the inspection period. The GTFP indices for the 2003–2007 and 2009–2016 periods are positive, showing an overall improvement in GTFP for countries along the route. However, the GTFP was negative in 2007–2009, indicating a decline in countries along the B&R between 2007 and 2009. The reason could be the decline in technical efficiency and fall in technical level due to the relatively low investment in technology management and green production in the B&R countries around the 2008 world economic crisis. In general, technological progress showed a relatively steady increase but dropped by 0.022, 0.007, and 0.039 in 2004–2005, 2007–2008, and 2008–2009, respectively. However, technological progress continued to rise during 2009–2016, suggesting a steady increase in the B&R countries’ investment in technology. As regards pure technical efficiency, except for 2006–2007, 2012–2013, and 2014–2016, the B&R countries showed a decline, with the output capacity of most countries declining during this period from too extensive production methods. Regarding scale efficiency, the economies of scale continued to rise along the line during 2004–2007 and 2014–2016, with a decline in 2007–2014, and the overall level showing a downward trend, indicating an inefficient state on the overall scale. To more intuitively reflect the changes of GTFP in the B&R countries, a line chart of the annual growth rate of GTFP in the B&R countries for the period of 2003–2016 is drawn based on Fig. 2.

Innovation investment

In the long run, the investment of innovation funds and human capital will play a significant role in promoting the development of the regional economy. Knowledge and technology play a decisive role in high-quality economic development, and the most common evaluation indicators are R&D investment and human capital. Following the previous research (Bobillo et al., 2006; Cumming et al., 2016), the evaluation index of innovation investment is established by using the sum of R&D investment of each country and education investment of each region. The specific calculation equation is as follows:

where \({ii}_{it}\) is the innovation investment.

Institutional quality

According to previous research, the political risk index and economic risk index in the International Country Risk Guide (ICRG) database and the intellectual property protection level index in the database of the Heritage Foundation are adopted (Roelfsema and Zhang 2012; Jude and Levieuge 2015; Irfan et al. 2020c). They are the proxy variables of politics (pi), economy (ei), and legal system quality (li), and a comprehensive evaluation system is established by entropy method to measure the overall system quality (inst) of “the Belt and Road initiative.” The higher the index value of the four indicators, the higher the system quality will be.

Control variables

With reference to previous studies (Hao et al., 2020), R&D investment intensity (rd), education investment (edu), urbanization level (urban), and industrial structure (str) are selected as control variables. Among them, R&D investment intensity is measured by the ratio of R&D expenditure to GDP, education investment is expressed by the ratio of education expenditure to GDP, the urban population is taken as the proxy variable of urbanization level, and industrial structure is measured by the ratio of tertiary industry.

Data

Innovation investment (ii), R&D investment intensity (rd), education investment (edu), energy consumption, labor, urbanization level (urban), and industrial structure (str) come from the WDI database of World Bank, while politics (pi), economy (ei), and legal system quality (li) come from ICRG database and traditional foundation database In order to eliminate the price fluctuation, this paper takes 2010 as the constant price for GDP-related data. Considering the availability of data and the serious lack of data in some countries, the research object is the panel data of 46 countries along the “the Belt and Road initiative” from 2004 to 2016. Since green total factor productivity is a growth rate, we use 2004 as the initial year of the sample in our empirical analysis. See the following table for the relevant statistical information of each variable (Table 2).

Results and discussion

Related test

Multicollinearity test

Generally speaking, before conducting empirical research, relevant variables need to be tested. We first test the variables for multicollinearity. Multicollinearity refers to the fact that the explanatory variables in the linear regression model are distorted or difficult to estimate accurately due to the existence of precise correlation or high correlation. Generally speaking, due to the improper design of the model due to the limitation of economic data, there is a general correlation between the explanatory variables in the design matrix. The situation of complete collinearity is rare. Generally, there is a certain degree of collinearity, that is, approximate collinearity. Following previous research, we use the method of variance expansion factor to test for multicollinearity. It can be seen from Table 3 that the variance expansion factor of the model is less than 4, so there is no serious multicollinearity in the model.

Before starting the empirical analysis, considering that the original data may have a time trend and cross-sectional correlation, the unit root test is first performed on the variables to test their stationarity. As shown in Table 4, both the ADF-Fisher test and LLC test show that the two variable series are stationary and can be used for further empirical analysis.

Regression results and discussion

Benchmark regression analysis

Since the baseline linear regression model contains a one-period lag of the explained variable, the results obtained using ordinary panel regression will be biased and inconsistent. This article uses the systematic GMM method to estimate Eq. (3). At the same time, to ensure the robustness of the regression results, we use the method of adding control variables one by one for stepwise regression analysis. Table 5 reports the parameter estimation results of the system GMM panel model. The following conclusions can be drawn.

First, in the dynamic panel model, the coefficients of the gml lagging one-period term are all significantly positive at the 1% level, indicating that the green total factor productivity of the Belt and Road countries will be affected by the previous period and there are dynamic and continuous changes. From the results of the residual series correlation test, it can be seen that the P value of the AR (2) test is greater than the significance level of 10%, so there is no autocorrelation in the random error term and differential GMM can be used. It can be seen from the Hansen test results that all test results show that the selection of model instrumental variables is effective. Wald statistics also show that the overall model is highly significant. Therefore, the results of dynamic panel regression are credible.

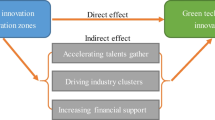

Second, in the process of gradually adding control variables, the estimated coefficient of innovation investment has always been significantly positive. The results show that innovative investment has promoted the green total factor productivity of the “Belt and Road” countries. The possible reason is that, from the perspective of technological progress, the economic development methods of some countries along the “Belt and Road” have resulted in relatively high demand and consumption of resources. In contrast, high-quality economic development methods mainly rely on technological innovation. Through technological innovation, the utilization rate of production factors and labor productivity can be improved, thereby promoting the improvement of green total factor productivity (Hao et al., 2020; Su et al., 2021; Shah et al. 2020). In this regard, Irfan et al. (2020d) viewed that renewable energy technology triggered green economic progress in Pakistan. This notion was also supported by Fatima et al. (2019) and Jabeen et al. (2021b) in Pakistani perspective and Wang et al. (2021) in the Chinese perspective. Likewise, Mukeshimana et al. (2020) also supported this idea in Rwanda. Secondly, innovation investment provides funds for technological innovation. Technological innovation as a factor can change the function of other factors. As a regenerative factor, technological innovation can continuously update itself while also recombining other factors, thereby improving the role of other factors (Griffith et al., 2006; Mehmood, 2021; Irfan et al. 2019c; Ullah et al. 2020). From the perspective of human capital, human capital investment is conducive to the improvement of labor productivity. The more human capital invested in a region, the higher the quality, the more innovative talents will be, and the investment of these innovative talents in the field of energy conservation and emission reduction can also increase the green total factor productivity (Bloom and Van Reenen, 2011; Riti et al., 2021; Irfan et al. 2019d). Along these lines, Li et al. (2021b) also revealed that an innovative energy structure was responsible for emissions reduction in China. Likewise, Ahmad et al. (2021c) uncovered that innovation-based energy utilization in China was a significant driver of economic performance. Hussain et al. (2021) supported the idea that an innovative financial system promoted economic progress in Pakistan’s developing economy. In this respect, Durrani et al. (2021) studied and found that primary energy investment was a significant promoter of economic progress in the Pakistani economy. This finding is also consistent with Sarkodie and Ozturk (2020). Jabeen et al. (2021a) supported the idea that renewable energy technology was responsible for sustainable development.

Robustness test

This article adopts the method of replacing the explained variables and adding control variables one by one to further ensure the robustness of the regression results. Specifically, we use the SBM-DDF method to recalculate the green total factor productivity of the Belt and Road countries and then bring it back into the equation as the explained variable. The regression results are displayed. Investment in innovation still significantly promotes green total factor productivity in the Belt and Road countries. At the same time, other control variables did not change significantly. Therefore, the regression results of this paper are robust (Table 6).

Non-linear relationship test

In the above benchmark regression model, we found that innovation investment has significantly promoted the green total factor productivity of the Belt and Road countries. However, is the impact of innovation investment on green total factor productivity non-linear? Will it show non-linearity due to the differences in the quality of systems in different countries? Therefore, in this section, we will use the dynamic threshold regression model to study the impact of innovation investment on the green total factor productivity of the Belt and Road countries. Before the threshold return, it is necessary to determine whether there is a threshold effect. In this paper, under the assumption of no threshold effect, institutional quality, political institutional quality, economic institutional quality, and legal institutional quality are used as the significance test of the threshold variables. Wald statistics and its P value show that the dynamic threshold model test with innovation investment as the core explanatory variable found that the null hypothesis of no threshold effect was rejected at a significance level of 1% (see Table 7), that is, due to the Belt and Road countries’ system quality is heterogeneous, and the impact of innovation investment on green total factor productivity presents a non-linear threshold characteristic.

Table 8 reports the regression results of the dynamic threshold model. Among them, models (1)–(4) respectively represent models constructed with the threshold of overall institutional quality, political institutional quality, economic institutional quality, and legal institutional quality. It is worth noting that the main variables in the model have passed tests such as serial correlation and instrumental variable validity, indicating that the dynamic threshold regression results are credible.

The regression results of model (1) show that the impact of innovation investment on the green total factor productivity of the “Belt and Road” countries presents a non-linear relationship. Specifically, with the improvement of institutional quality, the impact of innovation investment on green total factor productivity has gradually increased. At the same time, the regression results of models (2)–(4) all show that with the improvement of the quality of political, economic, and legal systems, the role of innovation investment in promoting green total factor productivity is further enhanced. The reason may be that countries with higher institutional quality usually have good government governance capabilities and administrative management mechanisms, which can regulate government and market behaviors, which is conducive to reducing the rent-seeking costs of enterprises and making more resources turn to technology-seeking activities. This weakens the negative rent-seeking effect (Kaasa, 2016; Lasagni et al., 2015). Because the government has an important voice in the allocation of resources and through the formulation of relevant policies to influence business activities, therefore, once there are implicit rules, such as ties, rebates, and entertainment, due to project application approval, it will increase the non-productive capital investment of the company, thereby creating a crowding-out effect on innovation activities such as corporate technology research and development (Sobel et al., 2008). In addition, corruption will prompt companies to take rent-seeking behavior, and the additional benefits generated by rent-seeking behavior will induce more corporate capital to shift from the production field to non-productive rent-seeking activities. This will further deepen the degree of misallocation of corporate funds, thereby weakening the positive effect of innovation marginal efficiency, thereby reducing green total factor productivity (Song et al., 2018).

In addition, regions with higher economic system quality have high efficiency and high-quality financial services. This can not only provide a good external financing environment for enterprises’ innovative investment and financing activities, but also help them integrate into the global value chain, participate in international market competition, and provide convenience for enterprises to absorb advanced foreign technology. In an open market environment, economic activities are less controlled by the government, which can stimulate market entities to transfer more corporate capital to the research and development of new products that can meet market needs, thereby alleviating the distortion of government administrative intervention in the allocation of corporate resources (Doyle and Martinez-Zarzoso, 2011; Weimin et al., 2021). In addition, the increasingly fierce market competition and environmental regulations will further “force” enterprises to increase innovation and investment, large technology introduction, or R&D investment while maintaining competitive market advantages; it can also promote green total factor productivity (Ahmad et al. 2020a, 2021b; Wu et al. 2021a, b; Nasreen and Ozturk 2017).

The quality of the legal system also plays an important role, especially the degree of intellectual property protection. Specifically, the monopoly profit generated by the protection of intellectual property rights is a key factor in motivating enterprises to engage in technology research and development and technology introduction. This can effectively avoid the risk of technological innovation achievements being imitated and plagiarized by competitors and protect enterprises’ exclusive rights and interests in technological achievements within a certain period of time (Sun et al., 2019; Ahmed et al., 2021b). While mobilizing the enthusiasm of enterprises for the reverse transfer of various explicit or tacit knowledge, it also stimulates the research and development of local new technologies and new processes to a certain extent, thereby promoting the improvement of green total factor productivity (Reichman et al., 2014; Abdel-Latif, 2015; Raiser et al., 2017; Hao et al., 2021a). On the contrary, the loss of exclusive intellectual property protection will likely increase the risk of imitators’ patent infringement. Innovative companies will lose the motivation and willingness to develop or introduce technology because they cannot guarantee the recovery of innovation investment, which will inhibit green total factor productivity.

Analysis of regional heterogeneity

In the analysis of regional heterogeneity, according to the World Bank grouping, we divide the 46 countries of the “Belt and Road” into 4 groups, including East Asia and Pacific, South Asia, Europe and Central Asia, and Middle East and North Africa. It is evident from Table 9 that the impact of innovation investment on green total factor productivity shows significant heterogeneity in different regions of the Belt and Road countries. Specifically, in South Asia, innovation investment greatly impacts green total factor productivity, followed by East Asia and Pacific, Europe and Central Asia, and the Middle East and North Africa. The possible reason is that countries in the South Asia region have relatively high overall economic development competition, and they pay more attention to technological innovation and energy conservation, and emission reduction in the development process. In the Middle East and North Africa countries, the degree of economic development is generally low, and the development model is still relatively extensive.

Conclusion and policy recommendations

This paper uses panel data from 46 countries along the “Belt and Road” from 2003 to 2016 to study the impact of innovation investment and institutional quality on green total factor productivity. The research results show that innovation investment has significantly promoted the green total factor productivity of the “Belt and Road” countries. It is worth noting that there is a non-linear relationship between the impact of innovation investment on the green total factor productivity of the Belt and Road countries. With the improvement of overall system quality, political system quality, economic system quality, and legal system quality, the role of innovative investment in promoting green total factor productivity has been further strengthened. In addition, the heterogeneity regression results show that the impact of innovation and innovation investment on green total factor productivity shows significant heterogeneity in different regions of the Belt and Road countries. Specifically, in South Asia, innovation investment greatly impacts green total factor productivity, followed by East Asia and Pacific, Europe and Central Asia, and the Middle East and North Africa. According to the above research conclusions, the following policy recommendations are put forward.

According to the research, innovation investment is an important factor to promote green total factor productivity in the belt and road initiative countries. Therefore, every country should pay attention to the investment in research and development and education. Especially for small and medium-sized private enterprises, they should pay attention to the efficiency of innovation research and development and the quality of research and development results while investing in innovation. Only by improving the output level of innovation investment can enterprises achieve good circular development, continuously expand market influence, and achieve green development. The government should support and help enterprises’ innovative investment so that enterprises can achieve high-quality development and then help the high-quality development of domestic economy. In addition, the impact of innovation investment on the green total factor productivity of the belt and road initiative countries is also affected by the institutional quality of each country. Therefore, countries should constantly strengthen the protection of intellectual property rights. The government should pay enough attention to and protect intellectual property rights, improve the enthusiasm and initiative of enterprises’ innovative investment, eliminate counterfeit goods according to law, strengthen the protection of market environment, and create a good market business environment. Because the achievements of innovation investment can be easily used by peers, innovation investment has become an investment with high cost and low profit. Enterprises are more willing to imitate other people’s innovative achievements, and their enthusiasm for innovative research and development is not high, which aggravates the problem of bad competition in the market. The government should strengthen the publicity of the importance of intellectual property rights and, at the same time, strengthen policy guidance and control, establish perfect laws and regulations on intellectual property rights, provide more detailed guidance for enterprises to invest in innovation, and regulate the use of intellectual property rights by enterprises. In addition, countries should further establish the supervision mechanism of government power, standardize government behavior, and overcome subjectivity and randomness in government decision-making, so as to curb the distortion of resource allocation caused by administrative monopoly, strengthen anti-corruption legislation, reduce the possibility of enterprises obtaining monopoly privileges through rent-seeking behavior, and create a good institutional environment for innovative investment.

Although this paper studies the impact of innovation investment and institutional quality on green total factor productivity in the belt and road initiative countries, there are still some limitations. Due to the availability of data, we only used data from 46 countries, and the sample size may be a little small. Future research can use data from more countries as research samples. In addition, the micro-level mechanism analysis may require further research in the future.

Data availability

Not applicable.

References

Abdel-Latif A (2015) Intellectual property rights and the transfer of climate change technologies: issues, challenges, and way forward. Climate Policy 15(1):103–126

Aghion P, Blundell R, Griffith R, Howitt P, Prantl S (2009) The effects of entry on incumbent innovation and productivity. Rev Econ Stat 91(1):20–32

Ahmad B, Da L, Asif MH, Irfan M, Ali S, Akbar MIUD (2021a) Understanding the antecedents and consequences of service-sales ambidexterity: a motivation-opportunity-ability (MOA) framework. Sustainability 13(17):9675

Ahmad F, Draz MU, Chandio AA, Su L, Ahmad M, Irfan M (2021) Investigating the myth of smokeless industry: environmental sustainability in the ASEAN countries and the role of service sector and renewable energy. Environ Sci Pollut Res Int 16(1):18

Ahmad M, Jabeen G (2020) Dynamic causality among urban agglomeration, electricity consumption, construction industry, and economic performance: generalized method of moments approach. Environ Sci Pollut Res 27:2374–2385. https://doi.org/10.1007/s11356-019-06905-1

Ahmad M, Jan I, Jabeen G, Alvarado R (2021c) Does energy-industry investment drive economic performance in regional China: implications for sustainable development. Sustain Prod Consum 27:176–192. https://doi.org/10.1016/j.spc.2020.10.033

Ahmad M, Khan Z, Rahman ZU et al (2021d) Can innovation shocks determine CO2 emissions (CO2e) in the OECD economies? A new perspective. Econ Innov New Technol 30:89–109. https://doi.org/10.1080/10438599.2019.1684643

Ahmad M, Khattak SI, Khan A, Rahman ZU (2020a) Innovation, foreign direct investment (FDI), and the energy–pollution–growth nexus in OECD region: a simultaneous equation modeling approach. Environ Ecol Stat 27:203–232. https://doi.org/10.1007/s10651-020-00442-8

Ahmad M, Zhao Z-Y, Mukeshimana MC, Irfan M (2021c) Dynamic causal linkages among urbanization, energy consumption, pollutant emissions and economic growth in China. In: CRIOCM 2018: Proceedings of the 23rd International Symposium on Advancement of Construction Management and Real Estate. pp 90–105

Ahmad M, Zhao Z (2018) Causal linkages between energy investment and economic growth: a panel data modelling analysis of China growth. Energy Sources, Part B Econ Planning, Policy 13:363–374. https://doi.org/10.1080/15567249.2018.1495278

Ahmad M, Zhao ZY, Irfan M et al (2020b) Modeling heterogeneous dynamic interactions among energy investment, SO2 emissions and economic performance in regional China. Environ Sci Pollut Res 27:2730–2744. https://doi.org/10.1007/s11356-019-07044-3

Ahmed N, Ahmad M, Ahmed M (2021a) Combined role of industrialization and urbanization in determining carbon neutrality: empirical story of Pakistan. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-021-16868-x

Ahmed F, Kousar S, Pervaiz A, Shabbir A (2021b) Do institutional quality and financial development affect sustainable economic growth? Evidence from South Asian countries. Borsa Istanbul Review

Akram R, Chen F, Khalid F, Huang G, Irfan M (2021) Heterogeneous effects of energy efficiency and renewable energy on economic growth of BRICS countries: a fixed effect panel quantile regression analysis. Energy 215:119019

Anser MK, Ahmad M, Khan MA et al (2021a) The role of information and communication technologies in mitigating carbon emissions: evidence from panel quantile regression. Environ Sci Pollut Res 28:21065–21084. https://doi.org/10.1007/s11356-020-12114-y

Anser MK, Shabbir MS, Tabash MI et al (2021b) Do renewable energy sources improve clean environmental-economic growth? Empirical investigation from South Asian economies. Energy Explor Exploit 107:2411-2502 2. https://doi.org/10.1177/01445987211002278

Azam M, Khan AQ, Ozturk I (2019) The effects of energy on investment, human health, environment and economic growth: empirical evidence from China. Environ Sci Pollut Res 26:10816–10825. https://doi.org/10.1007/s11356-019-04497-4

Azam M, Liu L, Ahmad N (2021) Impact of institutional quality on environment and energy consumption: evidence from developing world. Environ Dev Sustain 23(2):1646–1667

Bardey D, Bommier A, Jullien B (2010) Retail price regulation and innovation: reference pricing in the pharmaceutical industry. J Health Econ 29(2):303–316

Bloom, N., & Van Reenen, J. (2011). Human resource management and productivity. In Handbook of labor economics (Vol. 4, pp. 1697-1767). Elsevier

Bobillo AM, Sanz JR, Gaite FT (2006) Innovation investment, competitiveness, and performance in industrial firms. Thunderbird International Business Review 48(6):867–890

Cao Q., Ren G., Luo Y. (2014). The impact of regional institutional environment on enterprise technological innovation. Finance and Economics, 2014(1).

Chandio AA, Jiang Y, Akram W, Adeel S, Irfan M, Jan I et al (2021) Addressing the effect of climate change in the framework of financial and technological development on cereal production in Pakistan. J Clean. Prod 288:125637

Chudnovsky D, López A, Pupato G et al (2006) Innovation and productivity in developing countries: a study of Argentine manufacturing firms’ behavior (1992–2001). Res Policy 35(2):266–288

Crespi G, Zuniga P (2012) Innovation and productivity: evidence from six Latin American countries. World Dev 40(2):273–290

Cumming D, Rui O, Wu Y (2016) Political instability, access to private debt, and innovation investment in China. Emerg Mark Rev 29:68–81

Doyle E, Martinez-Zarzoso I (2011) Productivity, trade, and institutional quality: a panel analysis. South Econ J 77(3):726–752

Durrani SF, Jan I, Ahmad M (2021) Do primary energy consumption and economic growth drive each other in Pakistan? Implications for Energy Policy. Biophys Econ Sustain 6:1–10. https://doi.org/10.1007/s41247-021-00090-x

Elavarasan RM, Leoponraj S, Dheeraj A, Irfan M, Sundar GG, Mahesh GK (2021) PV-Diesel-Hydrogen fuel cell based grid connected configurations for an institutional building using BWM framework and cost optimization algorithm. Sustainable Energy Technologies and Assessments 43:100934

Elavarasan RM, Pugazhendhi R, Shafiullah GM, Irfan M, Anvari-Moghaddam A (2021) A hover view over effectual approaches on pandemic management for sustainable cities–the endowment of prospective technologies with revitalization strategies. Sustainable Cities and Society 68:102789

Färe R, Grosskopf S, Pasurka CA Jr (2007) Environmental production functions and environmental directional distance functions. Energy 32(7):1055–1066

Fatima N, Li Y, Ahmad M et al (2021) Factors influencing renewable energy generation development : a way to environmental sustainability. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-021-14256-z

Fatima N, Li Y, Ahmad M et al (2019) Analyzing long-term empirical interactions between renewable energy generation, energy use, human capital, and economic performance in Pakistan. Enegy, Sustain Soc 9:42. https://doi.org/10.1186/s13705-019-0228-x

Fukuyama H, Weber WL (2009) A directional slacks-based measure of technical inefficiency. Socioecon Plann Sci 43(4):274–287

Furman JL, Porter ME, Stern S (2002) The determinants of national innovative capacity. Res Policy 31(6):899–933

Gans J, Hayes R (2006) Measuring innovative performance-Essential for effective innovation policy and economic growth. Melbourne Review: A Journal of Business and Public Policy, the 2(1):70–77

Gao X, Wang S, Ahmad F et al (2021) The nexus between misallocation of land resources and green technological innovation: a novel investigation of Chinese cities. Clean Technol Environ Policy. https://doi.org/10.1007/s10098-021-02107-x

Geroski PA (1989) Entry, innovation and productivity growth. The Review of Economics and Statistics 71(4):572–578

Golec J, Vernon JA (2010) Financial effects of pharmaceutical price regulation on R&D spending by EU versus US firms. Pharmacoeconomics 28(8):615–628

Griffith R, Huergo E, Mairesse J, Peters B (2006) Innovation and productivity across four European countries. Oxf Rev Econ Policy 22(4):483–498

Hall BH, Lotti F, Mairesse J (2009) Innovation and productivity in SMEs: empirical evidence for Italy. Small Bus Econ 33(1):13–33

Hall RE, Jones CI (1999) Why do some countries produce so much more output per worker than others? Q J Econ 114(1):83–116

Hao Y, Ba N, Ren S, Wu H (2021a) How does international technology spillover affect China’s carbon emissions? A new perspective through intellectual property protection. Sustainable Production and Consumption 25:577–590

Hao Y, Gai Z, Wu H (2020) How do resource misallocation and government corruption affect green total factor energy efficiency? Evidence from China. Energy Policy 143:111562

Hao Y, Gai Z, Yan G, Wu H, Irfan M (2021) The spatial spillover effect and nonlinear relationship analysis between environmental decentralization, government corruption and air pollution: Evidence from China. Sci Total Environ 763:144183

Helpman E (1993) Innovation, imitation, and intellectual property rights. Econometrica 61(6):1247–1280

Hussain A, Oad A, Ahmad M, Irfan M (2021) Do Financial development and economic openness matter for economic progress in an emerging country ? Seeking a Sustainable Development Path. J Risk Financ Manag 14(6):237. https://doi.org/10.3390/jrfm14060237

Iqbal N, Abbasi KR, Shinwari R et al (2021a) Does exports diversification and environmental innovation achieve carbon neutrality target of OECD economies? J Environ Manage 291:112648. https://doi.org/10.1016/j.jenvman.2021.112648

Iqbal W, Tang YM, Chau KY, Irfan M, Mohsin M (2021b) Nexus between air pollution and NCOV-2019 in China: application of negative binomial regression analysis. Process Saf Environ Prot 150:557–565

Irfan M, Ahmad M (2021) Relating consumers’ information and willingness to buy electric vehicles: Does personality matter? Trans Res D Trans Environ 100:103049. https://doi.org/10.1016/j.trd.2021.103049

Irfan M, Elavarasan RM, Hao Y, Feng M, Sailan D (2021c) An assessment of consumers’ willingness to utilize solar energy in China: End-users’ perspective. J Clean Prod 292:126008

Irfan M, Hao Y, Ikram M, Wu H, Akram R, Rauf A (2021b) Assessment of the public acceptance and utilization of renewable energy in Pakistan. Sustainable Production and Consumption 27:312–324

Irfan M, Hao Y, Panjwani MK, Khan D, Chandio AA, Li H (2020a) Competitive assessment of South Asia’s wind power industry: SWOT analysis and value chain combined model. Energy Strategy Rev 32:100540

Irfan M, Razzaq A, Suksatan W, Sharif A, Elavarasan RM, Yang C, Hao Y, Rauf A (2021a) Asymmetric impact of temperature on COVID-19 spread in India: evidence from quantile-on-quantile regression approach. J Therm Biol

Irfan M, Zhao ZY, Ahmad M, Batool K, Jan A, Mukeshimana MC (2019a) Competitive assessment of Indian wind power industry: a five forces model. Journal of Renewable and Sustainable Energy 11(6):063301. https://doi.org/10.1063/1.5116237

Irfan M, Zhao Z-Y, Ahmad M, Mukeshimana M (2019b) Solar energy development in Pakistan: barriers and policy recommendations. Sustainability 11:1206. https://doi.org/10.3390/su11041206

Irfan M, Zhao Z-Y, Ahmad M, Mukeshimana MC (2019c) Critical factors influencing wind power industry: a diamond model based study of India. Energy Rep 5:1222–1235. https://doi.org/10.1016/j.egyr.2019.08.068

Irfan M, Zhao Z-Y, Ahmad M, Rehman A (2019d) A techno-economic analysis of off-grid solar PV system: a case study for Punjab province in Pakistan. Processes 708:1–14. https://doi.org/10.3390/pr7100708

Irfan M, Zhao ZY, Ikram M, Gilal NG, Li H, Rehman A (2020b) Assessment of India’s energy dynamics: prospects of solar energy. J Renew Sustain Energy 12(5):053701

Irfan M, Zhao Z, Kumar M et al (2020c) Assessing the energy dynamics of Pakistan: prospects of biomass energy. Energy Rep 6:80–93. https://doi.org/10.1016/j.egyr.2019.11.161

Irfan M, Zhao ZY, Li H, Rehman A (2020d) The influence of consumers’ intention factors on willingness to pay for renewable energy: a structural equation modeling approach. Environ Sci Pollut Res 27(17):21747–21761

Irfan M, Zhao ZY, Rehman A, Ozturk I, Li H (2021d) Consumers’ intention-based influence factors of renewable energy adoption in Pakistan: a structural equation modeling approach. Environ Sci Pollut Res 28(1):432–445

Işık C, Ongan S, Bulut U, Karakaya S, Irfan M, Alvarado R, Ahmad M, Rehman A (2021a) Reinvestigating the environmental Kuznets curve (EKC) hypothesis by a composite model constructed on the Armey curve hypothesis with government spending for the US States. Environmental Science and Pollution Research

Işık C, Ongan S, Ozdemir D et al (2021b) The increases and decreases of the environment Kuznets curve (EKC) for 8 OECD countries. Environ Sci Pollut Res 28:28535–28543

Jabeen G, Ahmad M, Zhang Q (2021a) Perceived critical factors affecting consumers ’ intention to purchase renewable generation technologies : rural-urban heterogeneity. Energy 218:119494. https://doi.org/10.1016/j.energy.2020.119494

Jabeen G, Ahmad M, Zhang Q (2021b) Factors influencing consumers’ willingness to buy green energy technologies in a green perceived value framework. Energy Sources, Part B Econ Planning, Policy 16:669–685. https://doi.org/10.1080/15567249.2021.1952494

Jabeen G, Yan Q, Ahmad M et al (2019) Consumers’ intention-based influence factors of renewable power generation technology utilization: a structural equation modeling approach. J Clean Prod 237:117737. https://doi.org/10.1016/j.jclepro.2019.117737

Jabeen G, Yan Q, Ahmad M et al (2020) Household-based critical in fluence factors of biogas generation technology utilization : a case of Punjab province of Pakistan. Renew Energy 154:650–660. https://doi.org/10.1016/j.renene.2020.03.049

Kaasa A (2016) Social capital, institutional quality and productivity: evidence from European regions. Economics & Sociology 9(4):11

Khan I, Hou F, Irfan M, Zakari A, Le HP (2021) Does energy trilemma a driver of economic growth? The roles of energy use, population growth, and financial development. Renew. Sustain. Energy Rev 146:111157

Koondhar MA, Shahbaz M, Ozturk I et al (2021) Revisiting the relationship between carbon emission, renewable energy consumption, forestry, and agricultural financial development for China. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-021-13606-1

Lasagni A, Nifo A, Vecchione G (2015) Firm productivity and institutional quality: evidence from Italian industry. J Reg Sci 55(5):774–800

Levchenko AA (2007) Institutional quality and international trade. Rev Econ Stud 74(3):791–819

Li M, Ahmad M, Fareed Z et al (2021a) Role of trade openness, export diversification, and renewable electricity output in realizing carbon neutrality dream of China. J Environ Manage 297:113419. https://doi.org/10.1016/j.jenvman.2021.113419

Li Y, Fatima N, Ahmad M et al (2019) Dynamic long-run connections among renewable energy generation, energy consumption, human capital and economic performance in Pakistan. 2019 4th Int Conf Power Renew Energy. ICPRE 2019:152–156. https://doi.org/10.1109/ICPRE48497.2019.9034800

Li Y, Yang X, Ran Q et al (2021b) Energy structure, digital economy, and carbon emissions: evidence from China. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-021-15304-4

Lin B, Chen Z (2018) Does factor market distortion inhibit the green total factor productivity in China? J Clean Prod 197:25–33

Liu S, Hou P, Gao Y, Tan Y (2020) Innovation and green total factor productivity in China: a linear and non-linear investigation. Environ. Sci. Pollut. Res 14(1):22

Liu Z, Xin L (2019) Has China’s belt and road initiative promoted its green total factor productivity?——Evidence from primary provinces along the route. Energy Policy 129:360–369

Mani, P. K., Mandal, A., Mandal, D., Irfan, M., Hazra, G. C., & Saha, S. (2021). Assessment of non-carcinogenic and carcinogenic risks due to ingestion of vegetables grown under sewage water irrigated soils near a 33 years old landfill site in Kolkata, India. Exposure and Health, 1–22.

Mehmood U (2021) Renewable-nonrenewable energy: institutional quality and environment nexus in South Asian countries. Environ Sci Pollut Res 28(21):26529–26536

Mukeshimana MC, Zhao ZY, Ahmad M, Irfan M (2020) Analysis on barriers to biogas dissemination in Rwanda: AHP approach. Renew Energy 163:1127–1137

Nasreen S, Ozturk I (2017) Financial stability, energy consumption and environmental quality: evidence from South Asian economies. Renew Sustain Energy Rev 67:1105–1122

Nunn N (2007) Relationship-specificity, incomplete contracts, and the pattern of trade. Q J Econ 122(2):569–600

Ozcan B, Ozturk I (2019) Renewable energy consumption-economic growth nexus in emerging countries: a bootstrap panel causality test. Renew Sustain Energy Rev 104:30–37. https://doi.org/10.1016/j.rser.2019.01.020

Qin Z, Ozturk I (2021) Renewable and non-renewable energy consumption in brics: assessing the dynamic linkage between foreign capital inflows and energy consumption. Energies 14(10):2974. https://doi.org/10.3390/en14102974

Raiser K, Naims H, Bruhn T (2017) Corporatization of the climate? Innovation, intellectual property rights, and patents for climate change mitigation. Energy Res Soc Sci 27:1–8

Ran Q, Ren S, Wu H (2019) OFDI reverse technology spillover, institutional quality and regional innovation capability: an empirical analysis based on the two-step differential GMM threshold panel model. Sci. Technol. Prog 36(07):40–47

Razzaq A, Ajaz T, Li JC, Irfan M, Suksatan W (2021) Investigating the asymmetric linkages between infrastructure development, green innovation, and consumption-based material footprint: Novel empirical estimations from highly resource-consuming economies. Resources Policy 74:102302

Razzaq A, Sharif A, Aziz N, Irfan M, Jermsittiparsert K (2020) Asymmetric link between environmental pollution and COVID-19 in the top ten affected states of US: a novel estimations from quantile-on-quantile approach. Environmental research 191:110189

Rehman A, Ma H, Ahmad M et al (2021) Estimating the connection of information technology, foreign direct investment, trade, renewable energy and economic progress in Pakistan: evidence from ARDL approach and cointegrating regression analysis. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-021-14303-9

Reichman, J. H., Rai, A. K., Newell, R. G., & Wiener, J. B. (2014). Intellectual property and alternatives: Strategies for green innovation. Intellectual property rights: Legal and economic challenges for development, 356–391.

Ren S, Hao Y, Xu L, Wu H, Ba N (2021) Digitalization and energy: how does internet development affect China’s energy consumption? Energy Econo 98:105220

Riti JS, Shu Y, Kamah M (2021) Institutional quality and environmental sustainability: the role of freedom of press in most freedom of press countries. Environ. Impact 91:106656

Roelfsema H, Zhang Y (2012) The causal effect of institutional quality on outsourcing. J Int Trade Econ Dev 21(6):895–920

Sarkodie SA, Ozturk I (2020) Investigating the Environmental Kuznets Curve hypothesis in Kenya: a multivariate analysis. Renew Sustain Energy Rev 117:109481. https://doi.org/10.1016/j.rser.2019.109481

Scully GW (1988) The institutional framework and economic development. J Polit Econ 96(3):652–662

Shah SAA, Longsheng C, Solangi YA et al (2020) Energy trilemma based prioritization of waste-to-energy technologies: implications for post-COVID-19 green economic recovery in Pakistan. J Clean Prod 284:124729. https://doi.org/10.1016/j.jclepro.2020.124729

Shahzad U, Fareed Z, Shahzad F, Shahzad K (2021) Investigating the nexus between economic complexity, energy consumption and ecological footprint for the United States: New insights from quantile methods. J Clean Prod 279:123806. https://doi.org/10.1016/j.jclepro.2020.123806

Shan S, Ahmad M, Tan Z et al (2021) The role of energy prices and non-linear fiscal decentralization in limiting carbon emissions: tracking environmental sustainability. Energy 234:121243

Shi Z, Wang M (2016) China’s marketization process and economic growth: an empirical analysis based on the Bayesian model average method. Econ Rev 1:26–38

Sobel RS (2008) Testing Baumol: institutional quality and the productivity of entrepreneurship. J Bus Ventur 23(6):641–655

Song M, Du J, Tan KH (2018) Impact of fiscal decentralization on green total factor productivity. Int J Prod Econ 205:359–367

Su CW, Sun T, Ahmad S, Mirza N (2021) Does institutional quality and remittances inflow crowd-in private investment to avoid Dutch Disease? A case for emerging seven (E7) economies. Resources Policy 72:102111

Sun H, Edziah BK, Sun C, Kporsu AK (2019) Institutional quality, green innovation and energy efficiency. Energy policy 135:111002

Tanveer A, Zeng S, Irfan M, Peng R (2021) Do perceived risk, perception of self-efficacy, and openness to technology matter for solar PV adoption? An Application of the Extended Theory of Planned Behavior. Energies 14(16):5008

Ullah S, Ozturk I, Sohail S (2020) The asymmetric effects of fiscal and monetary policy instruments on Pakistan’s environmental pollution. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-020-11093-4

Wang J, Wang W, Ran Q, Irfan M, Ren S, Yang X, Wu Haitao, Ahmad M (2021) Analysis of the mechanism of the impact of internet development on green economic growth: evidence from 269 prefecture cities in China. Environ. Sci. Pollut. Res 12(1):15

Weimin, Z., Chishti, M. Z., Rehman, A., & Ahmad, M. (2021). A pathway toward future sustainability: assessing the influence of innovation shocks on CO2 emissions in developing economies. Environment, Development and Sustainability, 1–24.

Wu H, Hao Y, Ren S (2020) How do environmental regulation and environmental decentralization affect green total factor energy efficiency: evidence from China. Energy Econo 91:104880

Wu H, Hao Y, Weng JH (2019) How does energy consumption affect China’s urbanization? New evidence from dynamic threshold panel models. Energy Policy 127:24–38

Wu H, Hao Y, Ren S, Yang X, Xie G et al (2021) Does internet development improve green total factor energy efficiency? Evidence from China. Energy Policy 153:112247

Wu H, Ren S, Yan G, Hao Y (2020) Does China’s outward direct investment improve green total factor productivity in the “Belt and Road” countries? Evidence from dynamic threshold panel model analysis. J Environ. Manage 275:111295

Wu H, Xia Y, Yang X, Hao Y, Ren S (2021b) Does environmental pollution promote China’s crime rate? A new perspective through government official corruption. Struct Chang Econ Dyn 57:292–307

Xia F, Xu J (2020) Green total factor productivity: a re-examination of quality of growth for provinces in China. China Economic Review 62:101454

Xie F, Zhang B (2021) Impact of China’s outward foreign direct investment on green total factor productivity in “Belt and Road” participating countries: a perspective of institutional distance. Environ Sci Pollut Res 28(4):4704–4715

Yan Q, Jabeen G, Ahmad M, et al (2019) Structural equation modeling-based consumer’ s intention to utilize renewable energy technologies: a case of Pakistan. 2019 4th Int Conf Power Renew Energy 132–136

Yan G, Peng Y, Hao Y, Irfan M, Wu H (2021) Household head’s educational level and household education expenditure in China: the mediating effect of social class identification. Int. J. Educ. Dev 83:102400

Yang G, Maskus KE (2001) Intellectual property rights, licensing, and innovation in an endogenous product-cycle model. J Int Econ 53(1):169–187

Yang X, Jia Z, Yang Z (2021) How does technological progress impact transportation green total factor productivity: a spatial econometric perspective. Energy Rep 7:3935–3950

Funding

This study was supported by the Xinjiang Natural Science Foundation (Grant No. 2021D01B28) and the Scientific Research Fund of Xinjiang University of Finance and Economics (Grant No. 2020XYB003).

Author information

Authors and Affiliations

Contributions

Wei Qiu: Conceptualization, Project administration, Formal analysis, Data curation, Writing—original draft. Haitao Wu: Writing, review and editing; Validation. Jinwei Zhang: Conceptualization, Methodology, Funding acquisition, Supervision. Muhammad Irfan: Conceptualization, Methodology, Software, Validation, Supervision, Writing—review and editing. Munir Ahmad: Conceptualization, Methodology, Writing—review and editing.

Corresponding authors

Ethics declarations

Ethics approval and consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor:Ilhan Ozturk

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Qiu, W., Zhang, J., Wu, H. et al. The role of innovation investment and institutional quality on green total factor productivity: evidence from 46 countries along the “Belt and Road”. Environ Sci Pollut Res 29, 16597–16611 (2022). https://doi.org/10.1007/s11356-021-16891-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-021-16891-y