Abstract

The effect of a broad financial index (FD), hydro-energy output, and expansion of the economy on the intensity of carbon were investigated by incorporating the effect of financial expansion through the channel of hydro-energy. The cross-sectional autoregressive distributed lag (CS-ARDL), Mean Group (MG), Augmented Mean Group (AMG), and vector error correction mechanism causality approaches were employed to study panel data for the period from 1980 to 2017 for the top four hydro-energy producing states. The outcomes revealed that FD raises the intensity of carbon in both the short and long term. In contrast, hydro-energy output (HYP) is stated to be a significant factor for attaining a low carbon intensity in the short and long term. The outcomes also indicated that the expansion of the economy augments the intensity of carbon. However, FD lowers the intensity of carbon via the channel of hydro-energy. The causality test outcomes revealed a short-run causality moving from the intensity of carbon to hydro-energy as well as a short-term causality moving from GDP to the intensity of carbon. It was also observed that there is a long-term causality running from all the variables to the intensity of carbon. Important policy implications are suggested at the end of the research.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

The growth of the global economy and international society has increased the importance of sustainable expansion. Pollution poses a significant threat to both emerging and developed states. It creates a negative effect on the productivity of labour, natural assets, and historical and cultural agglomeration. Therefore, it has both direct and indirect influences on the economy. Many international conferences, including the Stockholm Conference of 1972, the Kyoto Climate Change Conference of 1997, the Milan Climate Change Conference of 2003, and the Paris Climate Conference of 2015, have been conducted to determine the measures that should be taken to prevent pollution and implement the prevailing practices. The Kyoto Protocol of 2009 promoted the utilization of sustainable energy to decrease greenhouse gas (GHG) emissions (Assi et al. 2020).

The majority of the empirical literature has approximated financial expansion by using the private credit to GDP ratio or by equity market capitalization to GDP. However, solely depending on bank-centred or stock market data could be misleading. Even though banks are the largest financial institutions, it is crucial to consider investment banks, mutual funds, pension funds, venture capital firms, and insurance companies, and many other categories of non-bank financial intermediaries that now play substantive roles. With the Basel requirements for capital on financial institutions’ lending and with the banks’ consideration that the majority of renewable projects involve risks, banks are not willing to finance such projects. Another issue is that banks’ resources are based on deposits, which have short or medium-term maturity. However, green projects need long-term financing, which results in a mismatch of maturity for the banks. The banking sector cannot cover all the green projects’ financing, and the other financial channels should be explored to finance these types of projects. Moreover, non-bank financial institutions should be considered as a component of the financial expansion in RE projects. The financial markets grant firms and individuals a means of transforming their savings, and firms can raise funds through the issuance of bonds, stocks, and foreign exchange markets. Therefore, financial markets and institutions promote the provision of financial services. In this paper, we employed a financial expansion index that includes markets as well as banking and non-banking institutions, which measures three dimensions, namely efficiency, depth, and access. It is stated that financial expansion decreases volatility by reducing informational asymmetries; it also reduces financing conditions’ sensitivity to changes in the equity of borrowers (Bernanke et al. 1999). Financial expansion also promotes the sharing of risk and increases the ability of households and firms to absorb shocks. An opposing theory is that finance rises financial volatility and the possibility of a crisis by encouraging higher leverage and risk-taking, especially within periods in which financial systems are poorly regulated.

In addition, as a clean energy resource, hydroelectricity is sustainable and free of pollution. Hydroelectricity consists of the transformation of energy from water to electricity. Today, hydropower is the oldest technique that provides a permanent supply of sustainable energy. Hydroelectricity is considered a more reliable source of energy compared to solar energy as it offers a permanent supply of power (Solarin and Ozturk 2016). Hydroelectricity is a combination of sustainable technologies that can have a positive effect on the environment due to its impacts on the supply of water, flood control, and the provision of recreational opportunities. On the other hand, it can have a negative influence on the environment, because of the huge amounts of land and reserves used, as well as the impact on the natural flow of lakes and rivers (Frey and Linke 2002). This can result in biodiversity loss, migration of fish, and disruption of human settlements (Tahseen and Karney 2017). Also, according to the study of Gagnon and Vate (1997) who calculated the GHGs from the water-gas reservoirs interface, the assumption that hydropower is a “clean energy” can be questioned (Rudd et al. 1993). Fearnside (1999) stated that the carbon emissions of reservoirs in tropical rainforest areas were equivalent to those from power plants that used fossil fuels. The GHGs from reservoirs are generated from the organic carbon inundation from the surrounding ecological system. However, hydroelectricity is closely related to the production of sustainable energy and the management of water. This plays a significant role in global sustainable development as billions of individuals do not have a fair supply of energy and safe drinking water (Yüksel 2008). However, hydroelectricity is an efficient source of sustainable energy that provides major advantages, such as its high level of reliability, cost-effectiveness as an energy source, and low operation and maintenance costs (Lau et al. 2016).

When viewed from these perspectives, it can be observed that China is a country that has many hydropower sources, and it is ranked first in terms of proven hydropower resources. In 2018, the hydroelectricity generation of China reached 6.8 trillion kilowatt-hours, which accounted for about 25.49% of the global hydroelectricity generation. China has an installed hydropower capacity of about 350 million kilowatts, which makes its hydropower electricity production the highest in the world (Liang et al. 2020). Moreover, the water resources of China have outstanding features such as steep rivers and large drops, which are favourable for the expansion of hydroelectricity. In addition, hydroelectricity in China is the second-largest resource after coal. Therefore, the utilization of hydroelectricity can sustain coal sources, decrease greenhouse gases, and enable sustainable expansion with low carbon emissions. However, the degree of hydroelectricity expansion of China is still low in comparison to the development of hydropower in the USA, Japan, or Germany, where it is more than 67% of total electricity production. However, the production of hydroelectricity in China is just 37%.

An examination of the energy structure of Brazil reveals that it has unique combination of hydroelectricity and biofuels. Hydroelectricity and ethanol production significantly increased from 1970, and environmental benefits developed into the essential ones from the 1990s (Vieira and Dalgaard 2013). However, the volume of energy-related emissions rose from 9 to 22% between 1990 and 2014 (SEEG 2019). The reason for this was the increase in the utilization of oil and natural gas. This trend has led to questions about Brazil’s ability to comply with the global temperature targets stipulated in the Paris Agreement of 2015. Also, although hydroelectricity was the primary source of electricity production from 1970, the amount of local production capacity decreased as a result of social and environmental effects. This became an obstacle to the construction of a large dam in 1990. Cardoso’s market-based model was under pressure because it could not make sufficient investments in production capacity, and the drought that occurred in 2001–2002 also exposed the vulnerabilities of the hydropower–based electricity system. Brazil’s complicated regime for environmental licensing also affected the expansion of hydroelectricity. Project developers were required to obtain several licenses under different administrative rules. Licensing itself suffered from insufficiency of planning, and low environmental influence estimations, and inadequate regulatory authorities’ review (World Bank 2008). Therefore, since hydroelectricity developers were not able to obtain licenses, hydroelectricity projects were excluded from the auction system and were substituted with diesel and natural gas resources. Also, subsidies for fossil fuels made about 70-85% in electricity production and increased between 2007 and 2011.

Over the decades, hydro-energy has been a major electricity source in Canada. A large proportion of the electricity of Canada is generated from water due to a variety of factors including the large abundance of water, the availability of efficient technologies, the long service life of stations, its cost-effectiveness, and because the electricity produced is clean and sustainable. Canada has many rivers in different states, and all regions of Canada have hydropower. Hydropower in Canada accounts for about 62% of its total electricity production. The Canadian association of national hydroelectricity power stated that the best way of meeting the rising demand for energy and controlling emissions is to develop hydropower energy. In terms of US energy sources, hydro-energy is the oldest energy source, and as of 2019, it was the largest sustainable energy production source in the country. The use of hydro-energy as an industrial source of electricity dates back to 1880.

Based on the aforementioned information, it is therefore crucial to investigate the association between hydro-energy output, financial advancement, expansion of the economy, and carbon intensity for the top four hydroelectricity producing states. This paper contributes to the current literature in several ways. Many research papers have investigated the association between renewable energy utilization and the quality of the environment. They have stated that the influence of total sustainable energy utilization on the environment is positive. However, the number of papers that have researched the influence of HYP on the quality of the environment is limited, and the outcomes are mixed. Also, recent studies have investigated the association between financial advancement and quality of the environment by employing one or two bank-based or stock market indicators. However, the number of papers that have utilized financial indexes comprising banking and non-banking institutions as well as markets, which have measured three dimensions such as efficiency, depth, and access, are limited, and their outcomes are also mixed. Therefore, this paper analyses the influence of HYP and financial advancement index on the quality of the environment as well as the influence of financial expansion via the hydro-energy channel for the top four hydropower-producing states. Also, this research employs recently developed and second-generation techniques including CS-ARDL(Chudik et al. 2016), which deals with cross-dependency(CSD) and unit root bias, and static approaches like Mean Group (MG)(Pesaran and Smith 1995) and AMG (Eberhardt and Teal 2010, 2011), which take into account cross-sectional dependency and heterogeneity, because the data employed suffer from heterogeneity and CSD.

The rest of the research has the following structure: a review of the existing literature concentrating on hydro-energy output, financial advancement, and emissions is given in the second section. The third section focuses on empirical approaches, while the fourth section provides the estimated outcomes. The fifth section finalizes the outcomes of the study and provides direction for future studies.

Empirical literature

The association among the utilization of renewable energy and emissions has attracted the interest of a large number of researchers around the world. Thus, many studies have tested the association between sustainable energy utilization and emissions from carbon by employing time series, panel, and cross-country investigations. The outcomes of those studies have supported the positive influence of renewable energy and its effect on decreasing emissions. However, although many studies have concentrated on the association between renewable energy utilization and emissions, there is scarce research that has concentrated on the influence of hydroelectricity output on emissions in developed and developing states. One such study was conducted by Bildirici (2014), who tested the connection between hydroelectricity utilization, pollution of the environment, and expansion of the economy in fifteen states. The author stated that there was no causation between hydro-energy utilization and emissions in the UK, Iceland, and Belgium, but there was a one-way causality from emissions to hydro-energy utilization for the other states. Also, Lau et al. (2016) investigated hydro-energy utilization, the advancement of the economy, and emissions in Malaysia during the period from 1965 to 2010. It was revealed that there was a short-run one-way causation from hydro-energy to emissions, and in the long term, a one-way causality spanned from hydro-energy and expansion of the economy to emissions. Furthermore, Bildirici and Gökmenoğlu (2017) studied the hydro-energy utilization, expansion of the economy, and emissions association in G7 states for the period from 1961 to 2013. The authors’ outcomes indicated that there was one-way causation from emissions to hydro-energy in the first three regimes, while a unidirectional causality spanned from hydro-energy to emissions in several G7 states. Also, the authors found a one-way causality moving from emissions to the advancement of the economy in all regimes. Recently, Pao and Chen (2019) studied a sample of the Group of 20 (G20) countries for 1991–2016 period and confirmed the hydro-led growth hypothesis for these states. The authors suggested that hydro-energy generation is not influenced by any other variables, and limited use of hydro-power would decrease the expansion of the economy. Another study by Destek and Aslan (2020) tested disaggregated sustainable energy utilization, the advancement of the economy, and pollution of the environment for the period from 1991 to 2014 period for the G7 states by using the A.M.G technique. Their findings stated that hydro-power was the most effective sustainable energy resource with respect to increasing the quality of the environment. Also, Solarin et al. (2017) tested the effect of hydro-energy utilization on emissions, and he found that it lowers emissions in India and China; the outcomes revealed a two-way causality among the variables. Bello et al. (2018) analysed the causality among the expansion of the economy, pollution of the environment, and hydro-energy utilization for the period 1971–2016. The authors found a one-way causation moving from hydro-energy utilization to all pollution indicators and expansion of the economy. The article stated that hydro-energy utilization causes pollution of the environment to decline in Malaysia. Also, Ummalla and Samal (2018) stated that the utilization of hydro-power increases the expansion of the economy and lowers emissions. Their outcomes revealed a two-way causality between hydro-powerutilization and emissions.

Interesting findings were presented by Ummalla et al. (2019) who studied the association among hydroelectricity and emissions for the BRICS nations during 1990–2016 by using the panel quantile regression approach. It was found by the authors that hydro-energy has a negative and positive influence on emissions in the lower and higher quantiles. They stated that the utilization of hydro-power raises emissions in the nations that have a high amount of emissions, suggesting that that these states are heavy consumers of conventional energy. Thus, the utilization of hydropower does not decrease emissions in states with high levels of emissions. Additionally, Pata and Aydin (2020) investigated the association among hydro-power utilization, ecological footprint, and expansion of the economy for the six states with the highest hydro-power utilization. They employed data from the period from 1965 to 2016 and the Fourier bootstrap ARDL technique. It was found that these series were not cointegrated. The results of the causality test indicated there was no causal association between hydropower and ecological footprint. Therefore, it was suggested that alternative energy types should be taken into consideration by states to solve their environmental issues.

The other strand of the literature discusses the association between financial expansion and the deterioration of the environment. Tahir et al. (2021) analysed the effect of financial expansion and energy utilization on the quality of the environment for South Asian states during 1990–2014 by employing the second generation tests. The financial index included “domestic credit provided by the financial sector (% of GDP), domestic credit to the private sector (% of GDP), and domestic credit to the private sector by banks (% of GDP).” The outcomes suggested that financial expansion contributes to emissions, and the causality moves from financial expansion to environmental quality. It was suggested by the authors that the distribution of loans for green financing and research and development should be supervised. Another study by Wang et al. (2020) analysed the influence of financial advancement and sustainable energy consumption on emissions for the N-11 states for the period from 1990 to 2017 by applying the MG and AMG approaches. A positive association between financial expansion and emissions was found. Also, Nasir et al. (2020) determined that financial advancement influences emissions via different dimensions such as “financial efficiency, access and depth in financial markets and institutions” with other financial advancement proxies during 1980–2014. The authors found that financial advancement positively affects emissions. Also, Ali et al. (2021) tested the linkage among conventional energy utilization, financial advancement, and emissions from 1970 to 2019 in Vietnam by employing the ARDL approach. The outcomes of the study revealed a positive but insignificant impact of financial expansion on emissions for Vietnam. The study by Amin et al. (2020) tested the association between financialisation and emissions from carbon by employing nine proxies for financial expansion during the 1984–2014 period. The quantile regression outcomes showed the mixed influence of financial expansion on emissions over quantiles; this effect was different for every quantile and for different proxies of financial expansion for the ten states with the highest emissions.

In contrast, Shahbaz et al. (2018) tested the influence of financial advancement and innovations in energy in France by employing the ARDL technique for the period between 1955 and 2016. It was found that financial advancement enhances the quality of the environment based on innovations in energy and financial stability. The empirical outcomes for Indonesia showed that financial advancement reduces the emissions from carbon (Shahbaz et al. 2013). Another study by Pata and Yilanci (2020) tested the association between financial advancement, globalization, energy utilization, and ecological footprint in the G7 countries during 1980–2015. The outcomes of the long-term estimates demonstrated that financial expansion decreases pollution in Japan. The causality test outcomes indicated that financial advancement affects ecological footprint.

Based on the aforementioned empirical literature, it can be stated that the majority of the studies have concentrated on the association between sustainable energy utilization and emissions, and they found that in general, renewable energy positively affects the quality of the environment. Based on the studies conducted on hydro-energy utilization, financial advancement, and emissions, some research outcomes support a positive or neutral influence, while others support the negative influence of hydro-energy and financial improvement on emissions. This study contributes to the existing research by concentrating on the four highest hydro-energy utilizing states to test the influence of hydro-energy and financial improvement on the quality of the environment by employing the financial expansion index introduced by the International Monetary Fund (IMF). It also utilizes the newly introduced techniques such as CS-ARDL that deal with heterogeneity and cross-sectional dependence to determine whether the effects of hydroelectricity output and improvement in the financial sector are beneficial for the quality of the environment or deteriorate it in these states.

Data and methodology

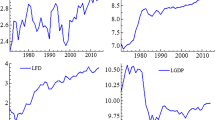

In this paper, we investigated the effect of financial expansion index, expansion of the economy, hydro-energy production, and the interaction variable of hydro-energy output and financial advancement on carbon intensity during the period from 1980 to 2017 for the four states with the highest hydro-power output, namely Brazil, Canada, China, and the USA (Statista 2019). However, hydro-power is dependent on long-term financial commitments. For this reason, we used new proxies for financial advancement gathered from the financial expansion database of the IMF that include banking and non-banking institutions, markets, and measure three dimensions, namely efficiency, depth, and access. The data were retrieved from the World Bank Development Indicators, 2019 (WDI, 2019) (Table 1).

The models can be expressed in the form of panel data as follows:

Empirical tests

In the panel data approaches, it is crucial to test the CSD; otherwise, it might lead to “over-rejection of the null hypothesis of the unit root” (O’Connell 1998). Also, if it is not taken into account, the outcomes might be misleading. The initial test for the states studied in this research is the CSD test.

The model introduced by Breusch and Pagan (1980) is as follows:

The LM statistic introduced by Pesaran (2004) to deal with CSD:

The “null hypothesis is rejected when the p-value is lower than the significance value. Otherwise, we fail to reject the null hypothesis.”

Further, the data were checked if the cross-sectional units are heterogeneous, which can be tested by the slope homogeneity technique derived by Pesaran and Yamagata (2008). These tests are as follows:

The variance and mean bias-adjusted version of \( \hat{\Delta } \) and \( \overset{\sim }{\Delta } \) are shown below:

where \( \hat{\beta_i\ } \) is the estimation of the ordinary least squares(OLS) equation without common factor (ft) in the deviations from a mean form of each cross section; \( \hat{\beta_{WFE}\ } \) are estimators of weighted fixed effects (\( \hat{\upsilon_i^2} \) is used to construct weights). \( \overline{X} \) is used as a matrix that contains an explanatory series in deviation from the mean.

The null hypothesis is that the slopes are homogeneous, which is checked against the heterogeneous slopes hypothesis.

As the next step after approving the CSD, the relevant unit root technique is the cross-sectional augmented Dickey-Fuller(CADF) unit root test (Pesaran 2007), and it gives the robust outcomes considering the effects of cross sections.

The Westerlund Error Correction Model (Westerlund 2007) panel cointegration techniques test whether co-integration exists including individual states and all the panel of states.

The Westerlund (2007) technique is shown as follows:

α in the above equation presents the parameter of error correction, and dt = (1, t) includes the “deterministic components.”

Westerlund introduced four techniques, where two of them test the group means statistics and are represented as follows:

\( CSE\left({\hat{\alpha}}_i\right) \) denotes the regular standard error for \( {\hat{\alpha}}_i \), and \( \left({\hat{\alpha}}_i\right) \) represents the estimator of the semiparametric kernel of \( {\hat{\alpha}}_i(1) \). The other two techniques are presented in the following equations:

The alternative assumption of these tests is that there is a co-integration for at least one single unit.

As a further analysis, we should consider the possibility of CSD among the four states with the highest hydro-energy output, which might be because of the interconnection in the form of financial assimilation, technology, and globalization. Since there is CSD and the variables are non-stationary, this research utilizes the CS-ARDL technique that was developed by Chudik et al. (2016). This technique employs the lagged dependent series. Also, it approves “a weak exogenous regressor under the error correction framework.” Additionally, it takes into account the specifications of ARDL which are unit-specific, to obtain the influence of the unobserved common factors, and it is employed to test the long-run effect. The CS-ARDL is effective at handling CSD in both the long and short terms. This article employs all three types of CS-ARDL to deal with the issues of CS in the short and long terms. This technique is presented in Eq. 14:

where ΔLCI refers to the dependent series, Xit includes all independent variables;\( {\overline{\ LCI}}_{t-1} \) stands for the long-run mean of the dependent series; ΔLCIit − j represents the short-term dependent series; ΔXit − j refers to the short-run independent series;\( \varDelta {\overline{LCI}}_t \) is the mean of the short-run dependent series; \( \varDelta {\overline{X}}_t \)is the mean of the short-term independent variables; εitis the error term; and t refers to time and t=1…..T.

As a robustness check, this study used the MG and Augmented Mean Group (AMG) techniques. The MG approach was introduced by Pesaran and Smith (1995). This approach evaluates heterogeneity coefficients for each cross section and gathers the unweighted means. The drawback of the MG technique is that it considers heterogeneity but does not take into account the CSD. Thus, the AMG approach was used to evaluate the cross-sectional dependency. The AMG technique combines the “common dynamic effect” (ƒt), and it is a two-step technique employed to receive the undetected common dynamic impact. Initially, it considers regression with augmented dummies; thus, the time dummies are gathered. Then, the coefficients of the time dummies are replaced with the “unobserved common effect,” and individual regressions are estimated with OLS estimates. The OLS estimated equation (ƒt) is replaced by the \( {\hat{\ominus}}_t \) gathered for each period, and AMG estimates are gathered by OLS for each cross section.

Therefore, the measured MG is then compiled.

\( \overset{\sim }{B_i} \)is a measure of OLS of the coefficients that are state-specific in Eq. (16).

Once cointegration is found between the variables, this indicates that at least one causality association exists. To find short-term and long-term causalities, the Engle-Granger test (Engle and Granger 1987) of co-integration under the “vector error correction mechanism” (VECM) is employed. In this technique, the error correction term (ECT) is added to the VAR system as a supplementary variable. The ECT coefficient indicates that a long-run association exists between the variables. The short-run causality is established by the Wald test’s F statistics to determine the significance of the related coefficient. The long-run causality is determined via the significance of the lagged ECT which is based on a t test (Ecevit 2015).

Empirical outcomes

Table 2 shows the outcomes of the CD test, and unit root tests. Based on these results, it can be concluded that the null hypothesis of cross-sectional independence is rejected for all the series. The outcomes are significant at 0.01% level. The alternative hypothesis is supported by the outcomes of the tests; thus, the first-generation unit root tests will not be used because of their inability to overcome the aforementioned issues. The panel unit root test outcomes are presented in Table 2. The CADF unit root test of Pesaran (2007) was applied since it considers CSD. The outcomes of the tests show that the variables are stationary at first difference; thus, the order of integration of the variables is I(1).

Also, in Table 3, the null hypothesis of the homogenous slope coefficients of the Pesaran and Yamagata (2008) test is rejected, and it is valid at 1%. All statistics of these tests, apart from “delta hat adjusted,” reject the null hypothesis of slope homogeneity.

Therefore, after conducting the unit root test, we should test for the presence of cointegration among the series. Westerlund’s (2007) Error Correction Model (ECM) panel cointegration test tests for the absence of cointegration for the panel as a whole as well as the individual cross sections. In Table 4, the initial rows (Gt, Ga) of the group statistics, with a negative value of Gt , reject the null hypothesis; thus, it can be stated as there is a cointegration association for at least one of the groups. In the panel statistic, the null hypothesis is rejected with negative values suggesting that a cointegrating association exists for the panel. The results of the Westerlund (2007) panel cointegration test show that the null hypothesis of no cointegration among hydro-energy output, financial advancement, economic expansion, and intensity of carbon emission is rejected. These outcomes’ significance demonstrates that there is a long-run interaction among the aforementioned series.

The test regression is fitted with a constant. AIC is used to determine optimal lag and lead lengths for each series with 3 at most and with the Bartlett kernel window width set according to 4(T/100)2/9 ≈ 3. The p-values are based on 400 bootstrap replications

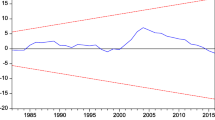

As we found a long-term interaction among the variables, we continue with the estimation of the long-term coefficients with CS-ARDL, the outcomes of which are presented in Table 5. This study used the CS-ARDL, given the presence of non-stationary variables, heterogeneity, and cross-sectional dependence. The second, third, and fourth columns in Table 5 present the outcomes considering CD in the short term, long term, and both short term and long term. However, we refer to the 4th column outcomes as economic spillover happens in both the short term and long term between these four states with the highest hydro-power output. The outcomes show that the ECM coefficient is significant and negative, and it adjusts to the long-term equilibrium by adjusting 40% per year after any shocks. This shows that the coefficients from the CS-PMG long-term estimates are statistically significant.

According to the outcomes in Table 5, it can be stated that a 1% increase raises the intensity of carbon by 0.001% with a significance of 99%. These findings infer that the “scale effect” is positive regarding the intensity of carbon in the long term. The positive association among GDP and LCI is in agreement with other researchers such as Omri (2013), Alkhathlan and Javid (2013), Lotfalipour et al. (2010), Pao and Tsai (2011), and Ang (2008). These findings imply that an increased amount of economic expansion raises the energy utilization and emissions from carbon rise accordingly. These findings are similar to the findings of Al-Mulali et al. (2015), who stated that the increased economic deals that comprise utilization, investment, and purchases by the government also increase the need for energy, thus increasing energy utilization.

The outcomes further show that hydro-energy output has a significant negative influence on the intensity of carbon as a 1% increase in hydro-energy leads to decrease of 0.13% in carbon in the long run. This implies that it leads to lower carbon emissions. Our outcomes agree with those of other empirical researches that found an opposite association among hydro-power and emission, such as the findings of Pao and Chen (2019). They found a negative influence of hydro-energy on emissions, and similar to the outcomes of Destek and Aslan (2020), who found that hydro-energy is the most effective way of decreasing emissions in the Group of Seven (G7). Furthermore, they stated that a “conservative policy” to decrease hydro-power utilization will have a harmful effect on the economic expansion of the USA and Germany. These findings are also supported by the those of Solarin et al. (2017), who found the opposite influence of hydro-power on emissions in India and China, and Bello et al. (2018) who presented a negative influence of hydro-energy on pollution in Malaysia. Additionally, hydro-power is a sophisticated technology that has a cost advantage and has a minimum environmental effect. It is also the most convenient solution for the usage of sustainable energy in the electrification of rural areas and productive usage (UNIDO 2016). However, states with mature hydro-power systems should consider rebuilding the environment that has been harmed by extant hydro-power deals, and emerging hydro-power states should promote regulations and laws to allow their hydro-power industries to flourish (Rudberg et al. 2015).

The coefficient of the financial expansion index is positive and significant in both the short and long terms. These outcomes are similar to those of Al-Mulali et al. (2015), Tahir et al. (2021), Wang et al. (2020), Cetin et al. (2018), and Nasir et al. (2020). The obtained outcomes indicate that banking and non-banking resources were invested in projects that harm the environment, and this suggests that financial expansion boosts high carbon emissions in the long and short periods. This outcome is in line with the statement that financial advancement raises emissions by increasing the utilization of conventional energy. Thus, Sadorsky (2010) emphasized that financial advancement enables customers to obtain funds to buy cars and household devices; therefore, the higher energy utilization leads to higher carbon emissions. This finding is also in line with other studies, such as Javid and Sharif (2016) and Zhang (2011) who argued that financial advancement enhances foreign investment to expand the growth of the economy; thus, financial advancement leads to emissions via higher energy utilization. Precisely, financial advancement enhances the utilization of consumer loans that are used to buy high energy-consuming machines and appliances; thus, financial advancement raises emissions as a result of the increased energy utilization by households.

The interaction variable of financial expansion index and hydro-power production is negative and statistically significant concerning the intensity of carbon in the long term, which implies that financial advancement leads to lower emissions via the channel of hydro-energy. Our research agrees with the findings of Al Mamun et al. (2018), who revealed the positive effect of financial advancement on sustainable energy, and it is also in line with the outcomes of Zeqiraj et al. (2020). This shows that the direct effect of financial expansion on the intensity of carbon is limited; the financial expansion index as an interaction variable is favourable to boost hydro-energy output to decrease the emissions in the top four hydro-energy utilizing states.

Robustness check

The CS-ARDL technique is criticized for the long-term homogeneity restriction on the long-term parameters if the panel of the states is diversified in terms of the capacity and complexity of the economies. The top four states with the highest hydro-power output have some heterogeneities regarding the size of their economies, financial advancement, and energy structure. Therefore, we used MG developed by Pesaran (2006) as well as AMG, which allow the parameters to be heterogeneous and have CSD in the long term. Table 6 presents the outcomes for the MG and AMG tests. The coefficient of GDP is positive in both tests and significant in AMG. The coefficient of HYP is negative in both models, and it is statistically significant in MG. The outcomes of Table 6 validate the outcomes from Table 5 as the interaction of LFD and LHYP is significant and negative in both models.

Once the long-term association was found between carbon intensity, financial expansion, economic expansion, hydro-energy output, and the interaction variable, at least a one-way causality should be identified between the variables. This research employs the Granger causality test based on VECM to define the direction of the causality in both the short and long run. Table 7, which is based on the causality outcomes and the conservation hypothesis, shows that the short-term causality moves from GDP to the intensity of carbon. This outcome follows Lau et al. (2016). Thus, the policies to improve energy efficiency and the management of demand for energy to reduce pollution and waste might not have the opposite effect on the expansion of the economy. There is also short-run causality moving from the intensity of carbon to hydro-energy output. These outcomes concur with Bildirici (2014), who found a one-way causality moving from carbon emissions to hydro-energy utilization for some of the states. Therefore, to deal with the negative impacts that can arise from the pollution of the environment, the states should reduce the dependence of their economies on energy from fossil fuels that degrades the environment and support the production of hydro-energy, which is the most sustainable source of energy for the productive utilization and electrification of rural areas (UNIDO 2016). In the long term, it is also observed that the ECT coefficient is statistically significant at a significance of 95% when the LCI is the dependent variable. This infers that the intensity of carbon leads to a long-term equilibrium and there is a long-term causality running from the LY, LFD, LHYP, and LHYDLFD variables to the intensity of carbon. The empirical outcomes show that the other long-term causalities are neutral where LY, LFD, LHYP, and LHYDLFD are the dependent variables since the ECT coefficients are statistically insignificant for the ∆LY, ∆LFD, ∆LHYP, and ∆LHYDLFD equations.

Conclusion

An extensive number of studies have concentrated on the influence of financial expansion on emissions from carbon. However, few studies have studied the effect of financial expansion by not only including financial institutions but also financial markets. There is also extensive literature on the influence of renewable energy on emissions; however, the number of studies that have investigated the effect of hydro-energy on emissions is still limited, and the outcomes are inconclusive. Therefore, to the best of our knowledge, no previous study has concentrated on the effect of broad financial expansion index, hydro-energy, and their interaction variable on the intensity of carbon. The methodology employed involved the use of the CS-ARDL technique, as well as robustness techniques such as MG and AMG analysis. These are important outliers that can provide reliable outcomes. Thus, this study investigated the association among a broad index of financial advancement, hydro-energy, and intensity of carbon for the top four hydro-energy producing states, namely Brazil, Canada, China, and the USA, for the period from 1980 to 2017.

The test outcomes indicated the presence of cross-sectional dependency and heterogeneity. Evidence of these facts allowed us to employ the CS-ARDL, MG, and AMG techniques for the nexus between the intensity of carbon, financial advancement, hydro-energy, and GDP. The VECM causality technique was applied to test the short and long-term causalities.

This study has several important outcomes. Economic expansion raises the intensity of carbon in both the short and long term. The financial expansion index has different impacts on the intensity of carbon. FD significantly raises the intensity of carbon in the short and long term when hydro-energy is produced. However, FD decreases the intensity of carbon via the channel of hydro-energy (in both the short and long term). Hydro-energy output has a negative association with the intensity of carbon in the short and long term. Therefore, hydro-energy is still a sophisticated technology that is cost-effective and has minimal effect on the environment. It is one of the most sustainable energy sources for the productive utilization and electrification of rural areas (UNIDO 2016). Based on the causality techniques, it was found that there is also short-run causality moving from intensity of carbon to hydro-energy output and a short-term causality moving from GDP to the intensity of carbon. It was also observed that there is a long-term causality running from all the variables to the intensity of carbon.

Based on the outcomes, it can be stated that hydro-energy output increases environmental quality while financial expansion can improve the quality of the environment through the channel of hydro-energy. As Rajan and Zingales (2003) stated, an upgraded financial system grants convenience to investors and can transfer funds to the productive parts of the economy.

To achieve a low carbon intensity and sustainable expansion, the following policies are recommended:

-

It is crucial that financial expansion is developed and that it is accompanied by environmental protection policies. It is also important to obtain capital with a lower cost for the hydro-energy projects since their initial costs are high.

-

It is crucial to raise projects and financing that further boost the role of hydro-power energy and further develop research in hydro-energy energy technologies. This increased role of hydro-power can further reduce the cost of this type of energy.

-

It is also suggested that mature hydro-energy companies should make efforts to restore the environment that has been damaged by hydro-energy projects.

-

These states should have financial institutions that concentrate on green expansion strategies which promote the process of cleaner output.

-

Since the outcomes indicated that the financial expansion index by itself raises the intensity of carbon, but it lowers it through the channel of hydro-energy output, it is suggested that these states should improve the services and products provided by the financial system by concentrating on the hydro-energy field to achieve a lower intensity of carbon.

-

It is also suggested that financial policies that are beneficial for the hydro-energy sector are boosted for companies that comply with the environmental policies.

Availability of data and materials

The data that support the findings of this study is available on request.

References

Al Mamun A, Mohamad MR, Yaacob MRB, Mohiuddin M (2018) Intention and behavior towards green consumption among low-income households. J Environ Manag 227:73–86

Ali K, Bakhsh S, Ullah S. et al. (2021) Industrial growth and CO2 emissions in Vietnam: the key role of financial development and fossil fuel consumption. Environ Sci Pollut Res 28, 7515–7527. https://doi.org/10.1007/s11356-020-10996-6

Alkhathlan K, Javid M (2013) Energy consumption, carbon emissions and economic growth in Saudi Arabia: an aggregate and disaggregate analysis. Energy Policy 62:1525–1532

Al-mulali U, Weng-Wai C, Sheau-Ting L, Mohammed AH (2015) Investigating the environmental Kuznets curve (EKC) hypothesis by utilizing the ecological footprint as an indicator of environmental degradation. Ecol Indic 48:315–323

Amin A, Dogan E, Khan Z (2020) The impacts of different proxies for financialization on carbon emissions in top-ten emitter countries. Sci Total Environ 740:140127. https://doi.org/10.1016/j.scitotenv.2020.140127

Ang JB (2008) A survey of recent developments ın the lıterature of fınance and growth. J Econ Surv 28(3):536–576

Assi AF, Isiksal AZ, Tursoy T (2020) Highlighting the connection between financial development and consumption of energy in countries with the highest economic freedom. Energy Policy 147:111897

Bello MO, Solarin SA, Yen YY (2018) The impact of electricity consumption on CO2 emission, carbon footprint, water footprint and ecological footprint: the role of hydropower in an emerging economy. J Environ Manag 219:218–230

Bernanke BS, Gertler M, Gilchrist S (1999) The financial accelerator in a quantitative business cycle framework. Handbook of macroeconomics. 1:1341-1393.

Bildirici ME (2014) Hydropower energy consumption, environmental pollution, and economic growth. J Energy Dev 40(1/2):189–208

Bildirici ME, Gökmenoğlu SM (2017) Environmental pollution, hydropower energy consumption and economic growth: evidence from G7 countries. Renew Sust Energ Rev 75:68–85

Breusch TS, Pagan AR (1980) The Lagrange multiplier test and its applications to model specification in econometrics. Rev Econ Stud 47:239–253

Cetin M, Ecevit E, Yucel AG (2018) The impact of economic growth, energy consumption, trade openness, and financial development on carbon emissions: empirical evidence from Turkey. Environ Sci Pollut Res 25:36589–36603

Chudik A, Mohaddes K, Pesaran MH, Raissi M (2016)Long-run effects in large heterogeneous panel data models with cross-sectionally correlated errors. Emerald Group Publishing Limited

Destek MA, Aslan A (2020) Disaggregated renewable energy consumption and environmental pollution nexus in G-7 countries. Renew Energy 151:1298–1306

Eberhardt M, Teal F (2010) Productivity analysis in global manufacturing production. Discussion Paper 515 Department of Economics, University of Oxford. Retrieved from: http://www.economics.ox.ac.uk/research/WP/pdf/paper515.pdfAccessed 01 Aug 2020

Eberhardt M, Teal F (2011) Econometrics for grumblers: a new look at the literature on cross-country growth empirics. J Econ Surv 2:109–155

Ecevit E (2015) Urbanization, energy consumption and CO2 emissions in sub-Saharan countries: a panel cointegration and causality. J Econ Dev Stud 3(2):66–76

Engle RF, Granger CWJ (1987)Co-integration and error correction: representation, estimation, and testing. Econometrica 55:251–276

Fearnside PM (1999) Social ımpacts of Brazil’s Tucuruí Dam. Environ Manag 24(4):485–495

Frey GW, Linke DM (2002) Hydropower as a renewable and sustainable energy resource meeting global energy challenges in a reasonable way. Energy Policy 30(14):1261–1265

Gagnon L, Vate JF (1997) Greenhouse gas emissions from hydropower: the state of research in 1996. Energy Policy 25(1):7–13

IMF (2019) Available at: https://www.imf.org/en/Data. Accessed on 1st of August 2020

Javid M, Sharif F (2016) Environmental Kuznets curve and financial development in Pakistan. Renew Sust Energ Rev 54:406–414

Lau E, Tan CC, Tang CF (2016) Dynamic linkages among hydroelectricity consumption, economic growth, and carbon dioxide emission in Malaysia, Energy Sources, Part B: Economics, Planning, and Policy, 11(11):1042-1049. DOI: 10.1080/15567249.2014.922135

Liang D, Tian Z, Ren F, Pan J (2020) Installed hydropower capacity and carbon emission reduction efficiency based on the EBM method in China. Front Energy Res 8:82

Lotfalipour MR, Falahi MA, Ashena M (2010) Economic growth, CO2 emissions, and fossil fuels consumption in Iran. Energy 35:5115–5120

Nasir MA, Canh NP, Le TNL (2020) Environmental degradation & role of financialisation, economic development, industrialisation and trade liberalisation. J Environ Manag 277:111471

O’Connell P (1998) The overvaluation of purchasing power parity. J Int Econ 44:1–19

Omri (2013) CO2 emissions, energy consumption and economic growth nexus in MENA countries: evidence from simultaneous equations models. Energy Econ 40(C):657–664

Pao HT, Chen CC (2019) Decoupling strategies: CO2 emissions, energy resources, and economic growth in the Group of Twenty. J Clean Prod 206:907–919

Pao HT, Tsai CM (2011) Modeling and forecasting the CO2 emissions, energy consumption, and economic growth in Brazil. Energy. 36:2450–2458 https://doi.org/10.1016/j.energy.2011.01.032

Pata K, Aydin M (2020) Testing the EKC hypothesis for the top six hydropower energy-consuming countries: evidence from Fourier Bootstrap ARDL procedure. J Clean Prod 264:121699

Pata UK, Yilanci V (2020) Financial development, globalization and ecological footprint in G7: further evidence from threshold cointegration and fractional frequency causality tests. Environ Ecol Stat 27(4):803–825

Pesaran MH (2004) General diagnostic tests for cross section dependence in panels. University of Cambridge, Cambridge Working Papers in Economics No. 0435

Pesaran MH (2006) Estimation and inference in large heterogenous panels with multifactor error structure. Econometrica 74:967–1012

Pesaran MH (2007) A simple panel unit root test in the presence of cross-section dependence. J Appl Econ 22:265–312

Pesaran MH, Smith R (1995) Estimating long-run relationships from dynamic heterogeneous panels. J Econ 68(1):79–113

Pesaran MH, Yamagata T (2008) Testing slope homogeneity in large panels. J Econ 142(1):50–93

Rajan RG, Zingales L (2003) The great reversals: the politics of financial development in the 20th century. J Financ Econ 69(1):5–50

Rudberg PM, Escobar M, Gantenbein J, Niiro N (2015) Mitigating the adverse effects of hydropower projects: a comparative review of river restoration and hydropower regulation in Sweden and the United States. Geo Environ Law Rev 27:251–274

Rudd MD, Dahm PF, Rajab MH (1993) Diagnostic comorbidity in persons with suicidal ideation and behavior. Am J Psychiatry 150:928–934

Sadorsky P (2010) The impact of financial development on energy consumption in emerging economies. Energy Policy 38(5):2528–2535

SEEG (2019) Available at: http://seeg.eco.br/en. Accessed on 15th of August 2020

Shahbaz M, Hye QMA, Tiwari AK, Leitao NC (2013) Economic growth, energy consumption, financial development, international trade and CO2 emissions in Indonesia. Renew Sust Energ Rev 25:109–121

Shahbaz M, Omay T, Roubaud D (2018) Sharp and smooth breaks IN unit root testing OF renewable energy consumption. J Energy Dev 44:5–40

Solarin SA, Ozturk I (2016) The relationship between natural gas consumption and economic growth in OPEC members. Renew Sust Energ Rev 58(C):1348–1356

Solarin SA, Al-Mulali U, Ozturk I (2017) Validating the environmental Kuznets curve hypothesis in India and China: the role of hydroelectricity consumption. Renew Sust Energ Rev 80:1578–1587

Statista (2019) Available at: https://www.statista.com/. Accessed on 1st of August 2020

Tahir T, Luni T, Majeed MT (2021) The impact of financial development and globalization on environmental quality: evidence from South Asian economies. Environ Sci Pollut Res 28:8088–8101. https://doi.org/10.1007/s11356-020-11198-w

Tahseen S, Karney B (2017) Opportunities for increased hydropower diversion at Niagara: an SWOT analysis. Renew Energy 101:757–770

Ummalla M, Samal A (2018) The impact of hydropower energy consumption on economic growth and CO2 emissions in China. Environ Sci Pollut Res 25(35):35725–35737

Ummalla M, Samal A, Goyari P (2019) Nexus among the hydropower energy consumption, economic growth, and CO2 emissions: evidence from BRICS countries. Environ Sci Pollut Res 26(34):35010–35022

UNIDO (2016) Industrial Development Report 2016. The role of technology and innovation in inclusive and sustainable industrial development

Vieira MA, Dalgaard KG (2013) The energy-security–climate-change nexus in Brazil. Environmental Politics 22(4):610–626

Wang R, Mirza N, Vasbieva DG, Abbas Q, Xiong D (2020) The nexus of carbon emissions, financial development, renewable energy consumption, and technological innovation: What should be the priorities in light of COP 21 Agreements? J Environ Manag 271(6–10):111027

Westerlund J (2007) Testing for error correction in panel data. Oxf Bull Econ Stat 69:709–748

World Bank (2008) Available at: https://documents.worldbank.org/en/publication/documents-reports/documentdetail/452391468323718231/the-world-bank-annual-report-2008-year-in-review. Accessed on 15th of October 2020

World Bank (2019) Available at: https://data.worldbank.org/. Accessed on 1st of August 2020

Yüksel I (2008) Hydropower in Turkey for a clean and sustainable energy future. Renew Sust Energ Rev 12(6):1622–1640

Zeqiraj V, Sohag K, Soytas U (2020) Stock market development and low-carbon economy: the role of innovation and renewable energy. Energy Econ 91:104908

Zhang (2011) The impact of financial development on carbon emissions: an empirical analysis in China. Energy Policy 39(4):2197–2203

Acknowledgements

I would like to thank the editor and anonymous reviewers for the insightful comments that helped to improve the paper.

Author information

Authors and Affiliations

Contributions

The author conducted conceptualization, data collection, methodology, and writing of the article.

Corresponding author

Ethics declarations

Ethics approval

Not applicable.

Consent for publication

Not applicable.

Consent to participate

Not applicable.

Consent for publication

Not applicable.

Conflict of interest

The author declares no competing interests.

Additional information

Responsible Editor: Nicholas Apergis

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Isiksal, A.Z. The decline in carbon intensity: the role of financial expansion and hydro-energy. Environ Sci Pollut Res 29, 16460–16471 (2022). https://doi.org/10.1007/s11356-021-16117-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-021-16117-1