Abstract

This study investigates the asymmetric effects of economic growth, energy use, and financial development, on carbon dioxide emissions in Saudi Arabia, from 1971 to 2014, using the nonlinear autoregressive distributed lag (NARDL) model. Prior to the application of the model, the integration proprieties of the variables were examined employing the recently RALS-LM (Residual Augmented Least squares—Lagrange Multiplier) unit root test, with two endogenous structural breaks. The main finding is that there exists an asymmetric cointegration relationship among the variables. In the long-run, both positive and negative shocks in economic growth rise emissions, but the effect of positive shocks is larger. In addition, both positive shocks in energy consumption and negative shocks in financial development surge CO2 emissions. In the short-run, the increasing economic growth is being made at the expense of the polluted environment. In contrast, any decrease in the economic growth would contribute to the improvement of environmental quality. Furthermore, positive shocks on energy consumption surges CO2 emissions and positive shocks in financial development reduces emissions. The asymmetric causality test of Hatemi-J (2012) suggests that economic growth (positive shocks) causes carbon dioxide emissions. At the same time, CO2 emissions (positive shocks) cause energy consumption. However, no significant causal relationship is found between financial development and CO2 emissions. In light of these findings, some policy implications are recommended.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

The earth’s climate is changing more rapidly than ever experienced in the recorded human history, mainly due to the fast release of carbon dioxide (CO2) from the burning of fossil fuels. Determined by higher energy demand, energy-related CO2 emissions attained a new record in 2018 and rose by 1.7% to 33.1 billion tons from the previous year, the highest level of growth since 2013, according to a recent report released by the International Energy AgencyFootnote 1 (IEA). In the same report, the IEA warned that the level of carbon dioxide (CO2) in the atmosphere is becoming alarming and therefore “urgent action” is needed in order to mitigate environmental degradation and climate change.

Within this context, countries worldwide should take this issue more seriously, by implementing effective strategies to reduce environmental degradation and the use of resources, ultimately contributing to the well-being of societies (Cioca et al. 2015).

Saudi Arabia is one of the countries seriously concerned with environmental degradation and climate change. There are at least three important reasons behind this. First, Saudi Arabia is relying heavily on hydrocarbon resources, which are widely regarded as the main source of CO2 emissions. Particularly, the oil sector represents the backbone of Saudi’s economy as the country is the world’s largest crude oil exporter and it holds about 16% of the world’s proven oil reserves EIA (2017). Furthermore, the sector rolls roughly 29.6% of its gross domestic product (GDP) and about 78.7% of export revenues, in 2018, according to a recent reportFootnote 2 published by the Saudi Arabian Monetary Authority (SAMA). Owing to the sharp economic expansion in recent decades, the domestic energy demand and CO2 emissions have increased rapidly (Krane 2019). In particular, the country is now ranked as the sixth largest consumer of oil behind the five largest economies in the world (USA, China, India, Japan, and Russia). This huge consumption led Saudi Arabia to become one of the main contributors to carbon emissions and global climate change (Alshehry and Belloumi 2017 and Krane 2019). In addition to the environmental concerns, the continued growth in domestic energy consumption may threaten its future export revenues (Lahn and Stevens 2011).

Second, with an increasing concentration of CO2 emissions, the country seems to be more susceptible to the adverse effects of climate change (Bekhet et al. 2017). It, in particular, and also in conjunction with other factors like its semiarid to arid climate (Abdullah and Al-Mazroui 1998), characterized by harsh summer weather, tends to make the country further prone to the effects of climate change especially risks of rising temperatures (Raggad 2018a). According to Pal and Eltahir (2016), the Arab Gulf region and parts of southwest Asia could be uninhabitable before the end of the century as temperatures are expected to rise to unlivable levels. Consequently, and in order to adapt to climate change, the domestic energy demand is also expected to increase more rapidly—in part due to higher temperatures. The situation, consequently, raises levels of CO2 emissions.

Third, the Saudi financial sector has expanded markedly in the last decades, mainly in the banking, stock market, and insurance domains (Alghfais 2016). With this expanding, owing to its oil revenues, the country stands out as one of the most financially developed countries among petroleum exporters (Knoop 2013). According to Bekhet et al. (2017) “greater oil production facilitates greater finance in two ways.” On the one hand, oil-exporting countries, unlike other countries, will usually require more financial transactions, linked to international trade and investments in the petroleum sector. On the other hand, oil industry represents the engine of economic growth, and a major source of wealth, resulting in considerable amounts of business and financial activities (Bekhet et al. 2017). Therefore, for countries like Saudi Arabia, it might make sense to investigate how financial development impacts its CO2 emissions.

Motivated by these considerations, in this paper, we seek to investigate and deepen our understanding of the effect of financial development, in conjunction with economic growth and energy consumption, on the quality of the environment in Saudi Arabia.

Since the pioneering work of Grossman and Krueger (1991), who introduced the EKC hypothesis stipulating the existence of an inverted-U-shaped pattern between economic growth and environmental quality, there has been an abundant literature analyzing the relationship between CO2 emissions and economic growth. However, overall, no consensus was reached regarding the validity of the EKC hypothesis. Furthermore, its econometric applications have been criticized due to the specification problems, other major econometric weaknesses are heteroskedasticity, omitted variables bias, and critical issues relating to cointegration analysis (Stern 2004).

To prevent omitted variable bias, other factors such as energy consumption, foreign trade, trade openness, urbanization, foreign direct investment, and financial development are also considered by literature for their influence on environmental degradation. While the implications of economic growth and energy consumption on environmental quality have been the subject of the bulk of research, the impact of financial development, as a potential driver of CO2 emissions, has received comparatively less attention until it has been introduced recently.

In particular, the financial sector is an integral part of an economic system and it is perhaps a major catalyst to sustainable economic growth and development. Several attempts have been made to discover the effect of financial development on carbon emissions. However, no conclusive results have been reached. Some researchers, such as (e.g., Zhang 2011; Abbasi and Riaz 2016; Shahbaz et al. 2016, and Danish et al. 2017), found that financial development can be beneficial for the environment. Others (e.g., Sadorsky 2010; Omri et al. 2015; Abbasi and Riaz 2016), however, argued that financial development may contribute to environmental deterioration.

Our investigation aims to further explore the asymmetric effects of economic growth, energy use, and financial development on carbon dioxide emissions in Saudi Arabia from 1971 to 2014.

To our knowledge, despite the various publications on the nexus between economic growth, energy consumption, and financial development, the existing literature focusing directly on an oil-based economy, like Saudi Arabia is very limited. Among the few papers, Xu et al. (2018) assessed the impact of financial development on environmental quality in Saudi Arabia, using the ARDL and vector error correction methods (VECM) and Mahmood et al. (2018) used the NARDL model to test the effect of financial market development (FDM), measured by domestic credit to the private sector by banks (percentage of GDP), on CO2 emissions in Saudi Arabia.

This research contributes to the related literature in four aspects. First, it performs the new Residual Augmented Least Squares-Lagrange Multiplier (RALS-LM) unit root tests, with two endogenous structural breaks to examine the integration proprieties of the considered variables. Second, the NARDL model of Shin et al. (2014) is applied to address the potential asymmetric cointegration between the variables. Third, the asymmetric causality test of Hatemi-J (2012) is used to investigate the causal relationship among the variables. Fourth, it introduces, in the model, the domestic credit to the private sectorFootnote 3 (as a share of GDP) as a measure for financial development, which is different from the one used in Mahmood et al. (2018). We argue that this variable is more representative (include the whole financial system) of the financial sector in Saudi Arabia.

The rest of this paper is structured as follows. “Review of the related literature” refers to the literature review. The econometric methodology is discussed in “Econometric methodology.” Data and model are presented in “Data and model.” “Empirical results and discussion” presents the empirical results and discussion. Concluding remarks and policy implications are provided in “Conclusions and policy implications.”

Review of the related literature

Numerous studies have been conducted in global, national, regional, or even provincial levels in order to explore the main drivers of CO2 emissions. In what follows, we present three main components of literature that are closely related to our work. For a comprehensive survey of the literature, readers may refer to recent papers such as Al-Mulali et al. (2016), Waheed et al. (2019), and Mardani et al. (2019).

The first component of studies concerns the relationship between economic growth and CO2 emissions. The theoretical framework of this relationship resides in the so-called environmental Kuznets curve (EKC) model. Originally suggested by the seminal work of Grossman and Krueger (1991), the EKC states that there exists an inverted U-shaped pattern between economic growth and environmental standard. This relationship points out that environmental degradation will surge with economic development up to a certain extent, on which further development will result in less environmental degradation.

Nowadays, research in this area is extensive but their findings remain controversial. Some researchers concluded to the existence of a linear link between CO2 emissions and economic growth (i.e., Azomahou et al. 2006). The U-shaped link between economic growth and environmental degradation was also reported by several researchers including Grossman and Krueger (1994), Perman and Stern (2003), Galeotti et al. (2006), Apergis and Payne (2009), Lean and Smyth (2010), Shahbaz et al. (2013b), Apergis and Ozturk (2015), and Al-Mulali et al. (2015). However, other researchers concluded to the existence of an N-shaped mode of EKC such as Moomaw and Unruh (1997), Martínez-Zarzoso and Bengochea-Morancho (2004), Ajmi et al. (2013), Friedl and Getzner (2003), and Sterpu et al. (2018). On the contrary, no relationship is reported by Richmond and Kaufmann (2006)).

Concerning the analysis of causal relationships between CO2 emissions and economic growth, various studies have been done. For example, Jalil and Mahmud (2009), Saboori et al. (2012), Farhani and Rejeb (2012), and Chandran and Tang (2013). Ahmad et al. (2017) reported a unidirectional causality between economic growth and CO2 emissions, running from economic growth to CO2 emissions. However, other articles stated unidirectional causality between economic growth and CO2 emissions, running from CO2 emissions to economic growth (i.e., Bekun et al. 2019). Further, some researchers found a bidirectional relationship (i.e., Han et al. 2018) or no causal link between the two variables (i.e., Saidi and Ben Mbarek 2016).

Regarding the veracity of the EKC hypothesis, the various studies conducted over various countries or country groups, with increasingly strong econometric approaches, have reported mixed results. For instance, the EKC hypothesis has been empirically accepted by several studies such as Farhani and Shahbaz (2014), Al-Mulali et al. (2016), Danish et al. (2017), Pata (2018), and de Souza et al. (2018). However, studies by Al-Mulali et al. (2015), Dogan and Turkekul (2016), Raggad (2018b), and Karasoy (2019) reject it.

The EKC concept has widely familiarized and evolved substantially since its introduction. However, the concept has received a number of criticisms. One of the main reproaches of the EKC models is related to the econometric problems, such as heteroscedasticity, simultaneity, omitted variables bias, and cointegration (Stern 2004). Accordingly, various studies have introduced extra variables like energy consumption in explaining environmental degradation. In particular, energy consumption plays a key role in economic and demographic developments. However, it is considered as a major cause of CO2 emissions.

The second component of studies primarily focuses on the linkage between energy consumption and CO2 emissions. Broadly speaking, the main objective of this stream of literature is the analysis of the causality link between energy consumption and CO2 emissions and/or the investigation of the relationship between the considered variables. Examples include Ang (2007), Soytas et al. (2007), Zhang and Cheng (2009), Soytas and Sari (2009), Zhang and Cheng (2009), Shahbaz et al. (2013b), Begum et al. (2015), Alkhathlan and Javid (2015), Saidi and Ben Mbarek (2016), Dogan and Aslan (2017), Bekhet et al. (2017), Shabestari (2018), Cai et al. (2018), and Sarwar et al. (2019).

For instance, the study of Soytas et al. (2007) suggests that energy use Granger cause carbon emissions in the USA in the long run, nonetheless income does not. They concluded that income growth by itself may not ameliorate environmental quality.

Similarly, Ang (2007), using French data during 1960–2000, that there exists a causal impact from economic growth to both energy use and environmental degradation in the long run.

In the case of China, Zhang and Cheng (2009) highlighted the existence of a one-way causality relationship from GDP (energy consumption) to energy consumption (carbon emissions) in long run. In addition, Soytas and Sari (2009) have addressed the issue of causality for the case of Turkey, over the period of 1960–2000. The main finding is that there exists a one-way causality relationship running from CO2 emissions to energy consumption. Focusing on the case of Malaysia, over the period 1970–1980, Begum et al. (2015) concluded that both energy consumption and GDP has a long-term positive effects with CO2 emissions. In a paper appeared in 2016, Javid and Sharif (2016) demonstrated a long-run causal relationship from energy consumption to CO2 emissions in the case of Pakistan. Further, their main results reported a short run bidirectional relationship between energy consumption and carbon emissions.

Similarly, the study of Dogan and Aslan (2017), conducted on a sample of 25 European Union and candidate countries during the period 1995–2011, revealed the existence of a unidirectional causality relationship from tourism to carbon emissions, and bidirectional causality between CO2 emissions and energy consumption, and between real income and CO2 emissions.

More recently, Shabestari (2018) argued the existence of a bidirectional causality relationship between energy consumption and carbon emissions, in the long-run, in Sweden, over the period 1970–2016. Additionally, the study of Sarwar et al. (2019) concluded to the existence of positive impacts of coal consumption, oil consumption, and industrialization on CO2 emission in China.

In relation to the second strand of literature, we can also see some papers (i.e., Apergis et al. (2010), Waheed et al. (2018), (Pata 2018), Anwar et al. (2019), Al-Mulali et al. (2016), de Souza et al. (2018), Cai et al. (2018), Anwar et al. (2019)) that introduced the energy consumption variable in its disaggregated forms (non-renewable, renewable), when they applied the environmental degradation models.

For instance, Apergis et al. (2010) discovered that nuclear energy consumption decreases environmental deterioration, whereas renewable energy rises it. Similarly, Menyah and Wolde-Rufael (2010) established that nuclear energy decreases environmental degradation whereas renewable energy consumption has no significant consequence on environmental standard. Nevertheless, in the case of Pakistan, Waheed et al. (2018) studied the effect of renewable energy consumption on CO2 emissions and established that the emissions can be mitigated by increasing the share of renewable energy usage. Likewise, Pata (2018) concluded that renewable energy consumption was not at a required level to ameliorate CO2 emissions in Turkey. Quite recently, Anwar et al. (2019) investigated the relationship between carbon emissions and nuclear energy consumption dividing the countries into four income groups: low, low-middle, middle, and high. Their results concluded to the existence of a two-way causality between the two variables.

In view of the previous discussion, we note that the general agreement in the literature of most empirical studies is that renewable energy lessens CO2 emissions and non-renewable energy increases environmental degradation. However, some researchers proved that both forms of energy consumption contribute to environmental degradation (i.e., Farhani and Shahbaz 2014; Solarin et al. 2017).

The third component tends to focus principally on the effects of financial development on environmental degradation. Numerous studies debated on the subject. However, their findings support both sides of the coin. On the one hand, several studies including Kumbaroǧlu et al. (2008), Tamazian et al. (2009), Tamazian and Bhaskara Rao (2010), Shahbaz et al. (2013a), and Abbasi and Riaz (2016) have manifested the benefits generated by financial development for the environment.

For instance, Kumbaroǧlu et al. (2008) asserted that, in a country with a well-developed financial system, active technological innovation typically produces a significant decrease in environmental degradation. Similarly, Tamazian et al. (2009) investigated the relationship between financial development, economic growth, and environmental standards in Brazil, Russia, India, and China (BRIC countries). According to them, financial development lead to a reduction in environmental degradation. Further, Tamazian and Bhaskara Rao (2010) established that both institutional quality and financial development play an important role in the environmental performance in transition economies. In the case of Indonesia, Shahbaz et al. (2013a) analyze the linkages among economic growth, energy consumption, financial development, trade openness, and CO2 emissions over the period of 1975–2011. The empirical findings indicate that economic growth and energy consumption increase CO2 emissions, while financial development and trade openness decrease energy pollutants. In addition, Abbasi and Riaz (2016) found that financial development contributes significantly in alleviating CO2 emissions in small, emerging economies. Furthermore, Khan et al. (2018) examined the effects of financial development, income inequality, energy usage, and per capita GDP on carbon dioxide (CO2) emissions for Bangladesh, India, and Pakistan, over the period 1980–2014. The findings concluded that financial development decreases CO2 emissions in Bangladesh and Pakistan, however, not in India.

On the other hand, many researchers (i.e., Sadorsky 2010; Zhang 2011; Boutabba 2014; Farhani and Ozturk 2015; Shahbaz et al. 2016;, Al-Mulali et al. 2016; Abbasi and Riaz 2016; Abbasi and Riaz 2016; Zakaria and Bibi 2019; Ali et al. 2019) reported the negative consequences of financial development for the environment. For instance, the empirical work of Sadorsky (2010) highlighted that the development of financial market is responsible for increasing of energy demand and can consequently lead to a deterioration of the environmental quality. Besides, Zhang (2011) showed that financial development has a positive effect on carbon emissions for China. In the case of Tunisia, Farhani and Ozturk (2015) concluded that financial development engenders environmental pollution.

Later, the study of Shahbaz et al. (2016) in Pakistan during the period of 1985Q1 to 2014Q4 revealed that financial development was responsible for increasing CO2 emissions through positive shocks. Further, their research supported the existence of a one-way causal relationship from positive shocks in bank-based financial development toward CO2 emissions. Likewise, in a study relative to a sample of European countries, Al-Mulali et al. (2016) reported that financial development deteriorates environmental standards. In the case of Pakistan, Abbasi and Riaz (2016) contended that financial development has a detrimental effect on environmental standards. Particularly, it accelerates the economic growth by enchanting the FDI and facilitates the granting of credit that can be used to buy high energy-consuming products such cars, refrigerators, and air conditioners that add to CO2 emissions.

Quite recently, Zakaria and Bibi (2019) reported that financial development has contributed to the environmental deterioration in South Asia region, which point out that such region has used financial development for capitalization (i.e., encouragement of development of small industries that have minor impact on pollution reduction) and not to ameliorate technology (i.e., funding environment- friendly projects). In the same vein, Ali et al. (2019) disclosed that the economic growth, the financial sector, and the energy consumption have a positive and significant effect on environmental deterioration in Nigeria.

Studies related to Saudi Arabia

With regard to Saudi Arabia, the literature reveals the existence of various studies that explored the relationships between economic growth, energy consumption, and environmental standards. However, very few papers deal with the effect of financial development on environment. The existing literature may be divided in two groups. The first one, treats Saudi Arabia as a member of a regional or intergovernmental organizations (i.e., Gulf Cooperation Council (GCC), Organization of the Petroleum Exporting Countries (OPEC), or Middle East and North Africa countries (MENA)), includes among others: Al-Iriani 2006; Mehrara 2007; Arouri et al. 2012; Al-Mulali et al. 2015; Bekhet et al. 2017; and Mahmood et al. 2018). The second centers straightforwardly in Saudi Arabia (i.e., Alkhathlan and Javid 2013; Banafea 2014; Taher and Hajjar 2014; Alshehry and Belloumi 2015; Mezghani and Ben Haddad 2017; Samargandi 2017; Mahmood and Alkhateeb 2017; and Raggad 2018b).

In the first group, for instance, a one-way causality link was found to run from economic growth to energy consumption (Mehrara 2007). Additionally, energy consumption, in conjunction with other variables such as urbanization, trade openness, industrial output, and political stability variables were found responsible for the increase of environmental degradation in the long run (Al-Mulali et al. 2015). Similarly, Bekhet et al. (2017) established that financial development leads to an increase of CO2 emissions in all GCC countries, excluding the United Arab Emirates. Likewise, Mahmood et al. (2018) reported the absence of a causal link between economic growth and carbon emission in the MENA region. Further, they found that energy consumption causes economic growth in the long run and Granger causes CO2 emissions in the short run. Furthermore, their findings conclude to the existence of a two-way causality link between energy use and CO2 except in the short run.

In the second group of studies, we can cite, for instance, Alkhathlan and Javid (2013) who demonstrated a positive long-run association between electricity consumption and CO2 emissions and no causality between per electricity consumption and GDP. Further, the research carried out by Banafea (2014) disclosed that there exists a causal link between GDP and oil consumption in the short run as well as in the long run. In particular, He reported a one-way causal relationship from real GDP toward oil consumption in short run. However, he confirmed the reverse causality in long run. In the same vein, Alshehry and Belloumi (2015) discovered a two-way causality between CO2 emissions and energy consumption in both the short and long run. They also reported a one-way causality running from economic growth to CO2 emissions and energy consumption in the long run in Saudi Arabia.

In a related line of research, some papers focused on the veracity of the EKC hypothesis, among others, we can cite Taher and Hajjar (2014), Samargandi (2017), and Raggad 2018b) who concluded to validate the EKC hypothesis. However, others, like Mahmood and Alkhateeb (2017) proved its validity for Saudi Arabia.

Very recently, there exist some papers that introduced the financial development as a driver of environmental degradation in Saudi Arabia. Of the few studies, Xu et al. (2018) who studies the impact of financial development of environmental degradation in Saudi Arabia during the period 1971–2016, using ARDL model and vector error correction methods (VECM). The outcomes reported that financial development affects CO2 emissions and deteriorates environmental quality. Furthermore, bidirectional causality exists between financial development and CO2 emissions. Distinctly, Mahmood et al. (2018) used the NARDL model to examine the long- and short-run relationships in the hypothesized model, and validated EKC hypothesis. Further, they reported that the decreasing Financial Market Development (FMD) engenders environmental deterioration and decreasing energy consumption contributes in reducing CO2 emissions.

As we can see from the above review, very little research has been done, especially in the investigation of the potential asymmetric link between economic development, energy consumption, financial development, and carbon dioxide emissions in Saudi Arabia. This study aims to in-depth our understanding of the above relationship by using recent econometric tools.

Econometric methodology

The econometric methodology can be divided into three main phases. First, we need to inspect the integration properties of the considered variables. This step will be accomplished through the use of the recently LM and RALS-LM unit root tests. Second, the NARDL model of Shin et al. (2014) is employed to investigate the potential asymmetric cointegration between the variables. Lastly, the asymmetric causality test of Hatemi-J (2012) is conducted.

LM and RALS-LM unit root tests

With reference to the existing literature, various tests can be applied to inspect the integration properties of a time series data. In a first class, we find the conventionalFootnote 4 unit root tests such as augmented Dickey-Fuller (ADF) (Dicky and Fuller 1981) and Phillips and Perron (1988) (PP), DF-GLS (Elliott et al. 1996) and N-P (Ng and Perron 2001) tests. However, among the major issues of these tests is that they failed to accommodate structural breaks or heteroscedastic error term and suffer from power problems. To overcome these limitations, a second class of tests that allow for structural break(s) has been proposed including, LM test, Narayan and Popp (2013), and RALS-LM.

The new RALS-LM test exhibits several merits over other alternative unit root tests. According to Meng et al. (2017), the test is more robust than the standard LM test which does not address the issue of non-normality distributed errors. In this sense, it permits to handle data with non-normality to improve the power of the tests without supposing a specific non-linear function (Meng et al. 2014; Payne et al. 2015). Additionally, it allows for possible presence of structural break(s) under both the null and the alternative hypotheses. Furthermore, even if the errors are normally distributed, the power of the test is not significantly impacted (Payne et al. 2014).

Below is an outline of the LM and RALS-LM unit root tests. For a complete description of the test, we refer to the initial paper of Meng et al. (2014).

To start, we assume the following data generation process (DGP):

where, zt includes exogenous variables. Under the null hypothesis H0: β=1, yt is non-stationary.

For instance, if there is a shift in both level and trend and 푅 structural breaks, zt will be defined as [1, t, D1, t, …, DR, t, DT1, t, …, DTR, t ]′ where Dj, t = 1 for any t≥ TBj +1, j = 1,…,R and zero otherwise. Dj, t = 1 for any t≥ TBj +1, j = 1,…,R and zero otherwise, and DTj, t = t − TBj for any t≥ TBj +1, j = 1,2,…,R and zero otherwise.

Following the LM (score) procedure, the following regression model in differences can be obtained, in the first stage, after imposing the null restriction H0: β=1:

Where \( \delta ={\left[{\delta}_1^{\prime },{\delta}_2^{\prime },{\delta}_{3j}^{\prime },{\delta}_{4j}^{\prime }\ \right]}^{\prime }, for\ i=1,\dots, R. \) Consequently, the statistics of the unit root test can be derived from the following regression:

where \( {\overset{\sim }{S}}_{t-1} \)denotes the detrended series:

where \( \overset{\sim }{\updelta} \) denotes the vector of regression coefficients related to Eq. (3), and \( \overset{\sim }{\varphi } \) is the restricted maximum likelihood estimate of φ specified by \( {y}_1-{z}_1\overset{\sim }{\updelta} \); y1 and z1 denote the first observations of yt and zt.

Alternatively, one can include the terms (Lee et al. 2012), in Eq. (3) to correct for serial correlation in:

By applying the following transformation, given in Eq. (6), we can remove the reliance of the test statistic on the nuisance parameter (Lee et al. 2012):

Then \( {\overset{\sim }{S}}_t \) in Eq. (5) is replaced with \( {\overset{\sim }{S}}_{t-1}^{\ast } \) such that:

such that \( \tilde{y}_{t}={y}_t-\overset{\sim }{\omega }-{z}_t\overset{\sim }{\delta } \), t=2,…,T.

Under the unit root null hypothesis ∅ = 0 in Eq. (7), the t statistic is defined as \( {\overset{\sim }{\tau}}_{LM} \). Subsequently, the modified test statistic\( {\overset{\sim }{\tau}}_{LM} \) will not vary according to the nuisance parameter in the trend-shift model. Rather, \( {\overset{\sim }{\tau}}_{LM} \)relies exclusively on the number of trend breaks.

To ameliorate the power of the LM test, Im et al. (2014) extended the initial formulation in order to take account of on non-normal errors.

The RALS method adds the following term \( {\hat{w}}_t \) to the testing equation (7).

where \( {\hat{e}}_t \)is the OLS residual from regression (8), \( \hat{k}=\frac{1}{T}\sum \limits_{t=1}^Th\left({\hat{e}}_t\right) \) and \( {\hat{D}}_2=\frac{1}{T}\sum \limits_{t=1}^T{h}^{\prime}\left({\hat{e}}_t\right). \) To take account of non-normal errors, we admit \( h\left({\hat{e}}_t\right)={\left[{\hat{e}}_t^2,{\hat{e}}_t^3\ \right]}^{\prime } \), which includes the second and third moments of \( {\hat{e}}_t. \) Thence, admitting \( {\hat{m}}_t=\frac{1}{T}\sum \limits_{t=1}^T{\hat{e}}_t^j \), the added term can be specified as

where \( {\hat{e}}_t \)is the residual from the testing regression in Eq. (7). The terms in \( {\hat{w}}_t \) are related to the moment condition of \( {\hat{e}}_t \), mj + 1 = jσ2mj + 1, where the sample moment is given as \( {\hat{m}}_j=\frac{1}{T}\sum \limits_{t=1}^T{\hat{e}}_t^j \). Thus, the modified RALS–LM test statistic is achieved from the equation regression

The modified RALS–LM test statistic, denoted as \( {\overset{\sim }{\tau}}_{RALS- LM} \), is the corresponding t-statistic for ∅=0. The asymptotic distribution of \( {\overset{\sim }{\tau}}_{RALS- LM} \) is as follows:

where ρ is the quotient of the variances of two error terms.

The NARDL bounds testing approach for cointegration

The non-linear ARDL approach introduced by Shin, Yu, and Greenwood-Nimmo in 2014 is an asymmetrically extended form of the linear autoregressive distributed lags (ARDL) model to cointegration developed by Pesaran et al. (2001). The choice of non-linear ARDL model is driven by various motivations. First, the model utilizes negative and positive partial sum decompositions of the considered independent variables, which permit detecting the non-linear and asymmetric cointegration between variables. Second, it can be performed even if the considered regressors have a mixed order of integration (I(0) and I(1)). Third, the NARDL is able to capture hidden cointegration.Footnote 5 Finally, it discriminates between the short- and long-term impacts of the explanatory variables on the dependent variable in a non-linear co-integration framework.

Along the lines of Shin et al. (2014) and Karasoy (2019), we restrict the presentation of the NARDL model to the bivariate framework. The following NARDL approach, can be easily extended to multivariate cases.

Let zt and yt be two time series and consider the following non-linear asymmetric long-run equilibrium relationship:

where α+ and α− are the long-run parameters to be estimated.\( {y}_t^{+} \)and \( {y}_t^{-} \) are the partial sum of positive and negative changes in yt:

By confronting Eq. (12) to the linear ARDL(p, q) model, the subsequent asymmetric error correction model (AECM) can be expressed as:

for j = 1,…,q − 1. From Eq. (15), long-run effects of positive and negative chocks in yt on zt are given as α+ = − (γ+/δ) and α− = − (γ−/δ), respectively.

Along with the existing literature, two alternative tests can be applied (Shin et al. 2014) to assess the asymmetric cointegration between the variables. The first is the t-BDM statistic, developed by Banerjee et al. (1998), that consists on testing the null hypothesis H0: δ = 0 against the alternative H1: δ < 0. The second suggested by Pesaran et al. (2001), denoted by F-test (FPSS), is used to assess for the null hypothesis of no cointegration (H0: δ = γ+ = γ− = 0).

Additionally, both long- and short-run symmetries can be examined by performing the standard Wald test. For the long-run case, the null hypothesis of long-run symmetry (γ+ = γ−) is tested. However, for the short-run case, the test can be conducted under the null hypothesis H0 to be either \( {\pi}_j^{+}={\pi}_j^{-} \) for all j = 0,…, q – 1 or \( \sum \limits_{j=0}^{q-1}{\pi}_j^{+}=\sum \limits_{j=0}^{q-1}{\pi}_j^{-} \).

Furthermore, the statistical significance of both positive and negative long-run coefficients is perused by considering the following null hypotheses of α+ = − (γ+/δ) = 0 and α− = − (γ−/δ) = 0, respectively.

Note that the NARDL approach concisely described above for the case of two variables, can similarly be extended to the case of model involving several variables.

Asymmetric causality test of Hatemi-J (2012)

To capture the potential existence of the nonlinear causality relationship between the variables under consideration, we employed the asymmetric causality test suggested by Hatemi-J (2012).

This new test is an asymmetrically extended version of Toda and Yamamoto (1995) technique for testing of granger causality that takes account of non-linear effects and differentiates between negative and positive shocks.

Suppose that we are concerned with examining the asymmetric causality link between two integrated variables, z1t and z2t.

The first step is to express the two variables as random-walk processes:

where t = 1, 2,…,T. The constants z10 and z20 are the initial values and e1, t and e2, t are supposed to be the noise error terms. Positive and negative shocks are denoted by \( {e}_{1,t}^{+}=\mathit{\max}\left({e}_{1,i},0\right) \) and \( {e}_{2,t}^{+}=\mathit{\max}\left({e}_{2,i},0\right) \), \( {e}_{1,t}^{-}=\mathit{\min}\left({e}_{1,i},0\right) \) and \( {e}_{2,t}^{-}=\mathit{\min}\left({e}_{2,i},0\right) \) respectively.

So that Eqs. (16) and (17) can be reformulated as follows:

For instance, if we are concerned with testing the causality between positive components, the vector to consider is \( {z}_t^{+}=\left({z}_1^{+},{z}_2^{+}\right). \)

The test of causality can be performed through building a p-lag vector autoregressive model, VAR (p):

where \( {z}_t^{+} \) is the (2 × 1) vector of time series variables, ϑ is the (2 × 1) vector of intercepts, and \( {u}_t^{+} \) is a 2 × 1 vector of residuals terms and Ak is a (2 × 2) coefficients matrix for lag order k (k = 1,…, p).

The lag length that minimizes the following information criterion, HJC, is the optimal lag order.

here \( \left|{\hat{A}}_j\right| \) is the determinant of the estimated variance–covariance matrix of the error terms of the VAR model built on lag-length q. The denotation n represents the number of equations in the model and T is the size sample.

Once the model is estimated, the Wald test can be performed by imposing restriction on the autoregressive parameters, in order to investigate the asymmetric causality among variables. The statistic of the test is distributed an asymmetric chi-squared with degrees of freedom equal to the number of restrictions.

Formally, the null hypothesis, H0, of no causality among variables can be formulated as follows: H0: the row ω; column k element in \( {\hat{A}}_j \) equals zero for j = 1,…,p.

Using bootstrap method, Hatemi-J (2012) showed that the asymmetric causality test furnishes a “valid inference” even if the underlying variables are not normally distributed with possible ARCH effects. For more details, we refer to the paper of Hatemi-J (2012). The implementation of the test was performed using GAUSS code9Footnote 6 provided by Hatemi-J (2012).

In our empirical analyses, we are going to use the asymmetric causality test propounded by Hatemi-J (2012) to test for the asymmetric causality between the variables. To this end, the positive and negative shocks of each variable can be expressed in a cumulative form as:\( CO{2}_t^{+}=\sum \limits_{i=1}^t{e}_{1,i}^{+} \),\( CO{2}_t^{-}=\sum \limits_{i=1}^t{e}_{1,i}^{-} \), \( {GDP}_t^{+}=\sum \limits_{i=1}^t{e}_{2,i}^{+} \),\( {GDP}_t^{-}=\sum \limits_{i=1}^t{e}_{2,i}^{-} \),\( {EU}_t^{+}=\sum \limits_{i=1}^t{e}_{3,i}^{+} \),\( {EU}_t^{-}=\sum \limits_{i=1}^t{e}_{3,i}^{-} \), \( {FD}_t^{+}=\sum \limits_{i=1}^t{e}_{4,i}^{+} \), \( {FD}_t^{-}=\sum \limits_{i=1}^t{e}_{4,i}^{-}. \)

Data and model

Data overview

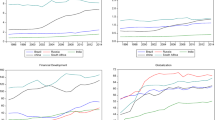

The study covers the period of 1971–2014 and annual data on Saudi Arabia were used. The data consist of CO2, EU, GDP, and FD, respectively, indicate carbon dioxide emissions (metric tons per capita), energy consumption (kg of oil equivalent per capita), per capita real GDP (constant 2010 US$), and financial development proxied by domestic credit to private sector as share of GDP. The data have been sourced from the World Development Indicators (WDI) online databaseFootnote 7 and are expressed in logs. The time span for the study was constrained by the availability of full series for all the considered variables. Figure 1 displays the time series plot of the data during the period 1971–2014.

Summary statistics as well as contemporaneous correlation matrix are reported in Table 1. As shown in this table, financial development (GDP) displays the highest (least) variability, measured by the coefficient of variations, during the analyzed period. The Jarque-Bera test displays that all the variables deviate from the normal distribution, at 10% significance level, except CO2. Further, all the series are negatively skewed, except GDP.

In the same table, we display the correlation coefficient matrix and its significance level, respectively. We can see that CO2 emissions are positively and significantly associated to both energy use and financial development, suggesting that both variables might be convenient in clarifying CO2 dynamics. Positive and significant correlation is also established between energy use and financial development. However, negative and significant correlations are found between GDP and energy use and between GDP and financial development. Further, GDP is inversely but insignificantly correlated with CO2 emissions.

Model

After analyzing the integration properties of the series by the unit root tests, we perform the NARDL model of Shin et al. (2014) to examine the potential asymmetric cointegration between economic growth, energy consumption, financial development, and carbon emissions for Saudi Arabia.

Following Karasoy (2019), the general non-linear form of the model can be expressed as:

where CO2, EU, GDP and FD, respectively, indicate carbon dioxide emissions, energy consumption, per capita real GDP, and financial development. The superscripts + and – denote the partial sums of positive and negative chocks in the examined series.

Analogous to the AECM model displayed in Eq. (14), Eq. (22) can be formulated in its NARDL form:

Empirical results and discussion

Integration analysis

Both the standard (Augmented Dickey-Fuller 1981 and Phillips–Peron 1988) and the structural break unit root (LM and RALS-LM) tests were employed in the analysis of the integration properties of the variables. The results of integration analysis of the variables under consideration are reported in Tables 2 and 3.

According to results depicted in Table 2, the ADF and the PP tests fail to reject the null hypothesis of non-stationarity for all variable series in their levels. However, they become stationary after being differenced one time (I(1)). However, as we noted above, these tests may lose power when some facts (i.e., Structural breaks, heteroscedastic error term, or non-normality) are not taken into consideration. This issue is solved by applying the relatively new RALS-LMFootnote 8 unit root tests with two endogenously determined structural breaks. Table 3 displays the results from performing the LM and the RALS-LM tests with two structural breaks. As shown in Table 3, the result of these tests are overall in line with the findings reported by the standard unit root tests.

Our findings underscore that the considered variables are non-stationary at level but become stationary at first difference. Consequently, the NARDL framework is a suitable tool for the analysis of the asymmetric cointegration between the variables under consideration. Furthermore, the presence of structural breaks in the analyzed series confirms the asymmetric behavior of the series, and henceforth underscores the potential asymmetric short- and long-run relationships between the variables (Mensi et al. 2018). These facts motivate and further justify the use of the NARDL model.

NARDL approach results

After performing integration analyses, we proceed to the asymmetric cointegration analysis based on the NARDL of Eq. (23). Following Shahbaz et al. (2017), we opt for the general-to-specific modeling strategy, in defining the adequate NARDL specification, starting from a maximum length of p = q = 3. Table 4 reports the estimates of the model selected, along with co-integration, diagnostic, and the p values of the long- and short-run asymmetry tests.

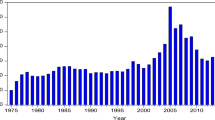

From the empirical results in Table 4, we come to the conclusion that the model is well satisfactory as approximately 90% (R2=0.90) of CO2 emission dynamics is elucidated by economic growth, energy consumption, and financial development. Furthermore, in order to approve the adequacy of the retained model, standard diagnostic tests were operated (see Table 4, Panel E). According to the reported findings, our model appears to be suitable as it passes various standard diagnostic tests such as serial correlation, normality, functional form, and heteroscedasticity. In addition, the graph plots (Figs. 2 and 3) of the cumulative sum (CUSUM) and cumulative sum of squares (CUSUMSQ) tests conclude to the stability of the estimated NARDL model. Finally, the estimated coefficient of lnCO2t − 1 is negative and significant, which also confirms the stability of the model (Shahbaz et al. 2017).

In order to peruse the potential asymmetric co-integration long-run relationship between the variables, we have applied two testing procedures: the (tBDM) of Banerjee et al. (1998) and the F-test (FPSS) of Pesaran et al. (2001), suggested by Shin et al. (2014). The results of both test, presented in Panel B of Table 2, are statistically significant and therefore we conclude to the existence of an asymmetric cointegration between the considered variables at 1% significance level. Moreover, the long-run positive and negative coefficients can be defined as \( {\theta}_{GDP}^{+}=-\frac{\rho_{GDP}^{+}}{\rho_{CO2}} \) and \( {\theta}_{GDP}^{-}=-\frac{\rho_{GDP}^{-}}{\rho_{CO2}} \) respectively for GDP, \( {\theta}_{EU}^{+}=-\frac{\rho_{EU}^{+}}{\rho_{CO2}} \) and \( {\theta}_{GDP}^{-}=-\frac{\rho_{EU}^{-}}{\rho_{CO2}} \) respectively for EU, \( {\theta}_{FE}^{+}=-\frac{\rho_{FD}^{+}}{\rho_{CO2}} \) and \( {\theta}_{FE}^{-}=-\frac{\rho_{FD}^{-}}{\rho_{CO2}} \), respectively, for FD and their significance are tested by referring to the null hypotheses of\( {\theta}_{GDP}^{-}=0,\kern0.5em \)\( {\theta}_{GDP}^{-}=0, \)\( {\theta}_{EU}^{+}=0 \), \( {\theta}_{EU}^{-}=0 \), \( {\theta}_{FD}^{+}=0 \) and \( {\theta}_{FD}^{-} \)=0. The findings show all the long-run positive and negative coefficients, except\( {L}_{FD}^{+} \) and \( {L}_{EU}^{-} \), are significantly different from zero at 5% significance level.

The potential existence of an asymmetric effect in both long (WLR) and short run (WSR) and short run are investigated by the Wald test. Wald test results, reported in panel D of Table 3, show that the null hypothesis of long run symmetries between the positive and negative components of each one of the considered variables long run symmetry is rejected at 5% significance level in all cases. This finding also confirms the pertinence of the asymmetric model. Further, the short-run results reveal the rejection of the null hypothesis of a weak form summative symmetric adjustment (WSR) for all involved variables.

Then, we move to the analysis of the estimated long- and short-run coefficients of the asymmetric ARDL model.

-

In the long run, the economic growth significance is proven for both positive (\( {L}_{GdP}^{+}\Big) \) and negative (\( {L}_{GdP}^{-}\Big) \) estimated coefficients, with the signs being positive. This result means that both increases and decreases of GDP rise CO2 emissions, with increases having the larger effect. Further, it confirms that economic growth has a highly significant asymmetric effect on CO2 in the long-run. For instance, the estimated long-run coefficients on \( {L}_{GdP}^{+} \) (\( {L}_{GdP}^{-} \)) is 2.689 (1.126) indicating that a 1% increases (decreases) in economic growth results in a 2.689% (1.126%) increases in CO2 emissions. Overall, this finding implies that an increase in economic growth tends to increase the environment degradation in the long run. This outcome is confirmed with the earlier findings such as, Halicioglu (2009) for Turkey; Saboori et al. (2012) for Malaysia Shahbaz et al. (2016) for Pakistan, and Zhang and Da (2015) for China. Accordingly, implementation of any strategy that focuses on economic growth should take account of environmental rules and regulations in order to avoid the environmental deterioration (Shahbaz et al. 2013a).

-

Concerning energy consumption, a statistically significant long-run effect is found only from the positive chocks (\( {L}_{EU}^{+} \)) at 5% significance level. The estimated long-run coefficients on \( {L}_{EU}^{+} \) is 0.164 signifying that a positive change in energy consumption of 1% engender a rise of 0.164% in CO2 emissions. In contrast, the estimated long-run coefficients on (\( {L}_{EU}^{-} \)) is negative and not significant (significant) at 5% (10%) significance level. In other words, positive shocks in energy consumption increase CO2 emissions, while negative shocks do the opposite.Footnote 9 This result advocates that rises in energy consumption engender more environmental deterioration. This empirical finding is in line with several studies such as: Shahbaz et al. (2013a) in Indonesia, Boutabba (2014) India, Saboori et al. 2012, 2016) for Malaysia, Al-Mulali et al. (2015) for Vietnam, Javid and Sharif (2016) in Pakistan, and Zakaria and Bibi (2019) who showed that energy consumption is a major source of environmental deterioration in South Asia. The result seems very reasonable as Saudi Arabia has experienced a rapid growing energy demand that is heavily reliant on fossil fuel and consequently any increase in energy consumption will lead to more CO2 emissions. In particular, economic growth needs high levels of energy consumption, mostly fulfilled by fossil fuels which were accompanied by carbon emissions, subsequent in environmental deterioration, and an augmented global warming (Alkhathlan and Javid 2015). Consequently, policymakers should implement measures to improve energy efficiency, reform energy subsidies, and particularly upsurge the share of renewable energies such as solar, wind) in the total energy mix. With these actions, the country can preserve hydrocarbon resources, conserve its world leadership in the oil market, and reduce its carbon emissions (Raggad 2018b), while maintaining economic growth. Further, it may reduce the effect of climate changes.

-

Finally, for financial development, both positive and negative shocks in financial development rise CO2 emissions. However, only the influence of a negative shock is significant. For instance, a 1% decline in financial development leads to a 1.209% increase in CO2 emissions. Overall, financial development adds to environmental deterioration in Saudi Arabia in the long run. This result is in conformity with the findings of Omri et al. (2015), Shahbaz et al. (2016), Pata (2018), Zakaria and Bibi (2019), and Ali et al. (2019) and opposes the findings of Shahbaz et al. (2013a), Abbasi and Riaz (2016), Al-Mulali et al. (2016), Khan et al. (2018), Xu et al. (2018), and de Souza et al. 2018). Furthermore, Dogan and Turkekul (2016) revealed that financial development has no effect on environmental degradation. A possible justification of the results is that financial system is not sufficiently mature to allocate resources to eco-friendly activities and do not boost the transition to more fuel-efficient industries or uses. To evade the detrimental impact of financial development on environment, policymakers can adopt measures to counterbalance the propensity of credit markets to funding heavily carbon-intensive activities. For instance, financial sector may promote the green credit policy to alleviate the environmental impact. For this purpose, banks may offer funding offers only for purchases or investments that approved an environmental assessment or were clearly planned to reduce pollution (Wang et al. 2019). With these measures, banks may encourage individuals, families, and companies to use environmentally friendly products or technologies and foster a sustainable socio-economic growth of the country.

-

In the short run, the lagged terms of CO2 emissions (at lags 1, 2, and 3) add to environmental deterioration in the future. In addition, we note that a positive shock in economic growth (lagged 0, 3) increases CO2 emissions, nonetheless a negative shock in economic growth (lagged 1, 2, and 3) reduces to CO2 emissions. This result proposes that the increasing in economic growth in Saudi Arabia is being made at the expense of polluted environment in the short run. In contrast, any decreasing in economic growth will contribute to the improvement of environmental quality. Further, a positive shock in energy consumption (at lags 0 and 2) increases CO2 emissions, but a negative shock in energy consumption has insignificant effect on CO2 emissions. This result suggests that any increase of energy use in production activities, will be escorted by an increase of CO2 emissions in the short term in Saudi Arabia. Moreover, positive shocks in financial development (at lags 0, 1, and 2) decreases CO2 emissions, but a negative shock increases CO2 emissions in the very short term, at lag 0 (negative shock also increases CO2 emissions at lag 3, but it is insignificant).

Asymmetric Granger causality test of Hatemi-J (2012)

The resultsFootnote 10 of the symmetric and asymmetric tests of the Hatemi-J (2012) are presented in Table 5. A significance level of 10% is also used for causality tests. From the symmetric causality results, there is strong evidence of a unidirectional causality running from economic growth to CO2 emissions. With regard to the asymmetric causality results, reported in the same table, we also note the existence of an obvious asymmetric causal link from positive shocks in economic growth to CO2 emissions, at 5% level of significance. These findings show that economic growth (positive shocks in economic growth) cause CO2 emissions. Consequently, Saudi Arabia should realize a sustained growth that requires decoupling economic growth from its environmental impacts. In other words, economic growth and environmental performance in the country must go hand in hand. Creating a reliable environmental policy set-up is crucial in order to maintain an environment that supports welfare and allows long-term economic growth. The finding is in line with Jalil and Mahmud (2009), Saboori et al. (2012), Farhani and Rejeb (2012), Chandran and Tang (2013), and Ahmad et al. (2017). However, it opposes other articles that reported unidirectional causality between economic growth and CO2 emissions, running from CO2 emissions to economic growth (Bekun et al. 2019), bidirectional relationship (Han et al. 2018), or no causal relationship between the two variables (Saidi and Ben Mbarek 2016).

From the same table, the empirical evidence showed that there exists a unidirectional causality running from CO2 emissions to energy consumption at 10% significance level but the reverse was not true. Similarly, the same relation is found between positive chocks in CO2 emissions to energy consumption. This finding is consistent with Bekhet et al. (2017), who explored the causal relationship between CO2 emissions, energy consumption, economic growth, and financial development in GCC countries and found unidirectional causality running from CO2 to energy consumption in Saudi Arabia, UAE, and Qatar.

Finally, no significant symmetric (asymmetric) causality has been established between financial development and CO2 emissions, this means that variations in financial development would not necessarily affect CO2 emissions in Saudi Arabia, and vice versa. One likely explanation of this fact is that the financial system is not sufficiently mature to play its role in allocating resources toward sustainable or eco-friendly activities (business). This result confirms that of Dogan and Turkekul (2016), who reported the absence of causality link between the two variables. However, it does not support the findings of some papers such as Shahbaz et al. (2016) and Mahmood et al. (2018).

Conclusions and policy implications

This study explores the relationships between CO2 emissions, economic growth, energy consumption, and financial development in Saudi Arabia during the period 1971 to 2014. Prior to the application of the nonlinear autoregressive distributed lag (NARDL) model to capture the potential asymmetric impact of the considered variables on dioxide carbon emissions, the recently residual augmented least squares–Lagrange multiplier unit root test (RALS-LM) was performed in order to examine the stationarity of variables. Further, the asymmetric causality link between the variables was examined via the Hatemi-J (2012) test. The main findings indicate:

-

The existence of a cointegration relationship among the considered variables. Further, the asymmetric causality results show that only positive shocks to economic growth have impact on carbon dioxide emissions at the 5% level of significance. Similarly, economic growth causes carbon dioxide emissions. Likewise, a unidirectional causality running from CO2 emissions to energy consumption at 10% significance level but no significant causality has been established between financial development and CO2 emissions.

-

In the long run, both positive and negative shocks in economic growth surge CO2 emissions, but the influence of positive shocks is larger. In addition, positive shocks in energy consumption rise emissions. For financial development, both positive and negative shocks in financial development rise CO2 emissions. However, only the impact of negative shocks is significant.

-

In the short run, the increasing economic growth is being at the expense of polluted environment. In contrast, any decreasing economic growth would contribute to the improvement of environmental quality. Further, only positive shocks on energy consumption have a significant impact and increases CO2 emissions. Moreover, positive shocks in financial development decrease CO2 emissions, but a negative shock increases CO2 emissions in the very short term.

As part of Vision 2030 launched in April 2016, Saudi Arabia intends to reduce its dependency on oil, diversify its economic, and increase its competitiveness. Achieving these targets inevitably requires further economic and financial growth, which may increase environmental degradation and pollution. Under these circumstances, the country needs to achieve sustainable development—economic, social, and environmental, on which the welfare of current and future generations relies (Raggad 2018b). Accordingly, and in light of these findings, some policy implications can be suggested.

-

First, policymakers may realize Saudi’s economic growth while, controlling its CO2 emissions through the raising of the conservation and the efficiency in energy consumption in the threeFootnote 11 main energy-intensive sectors; buildings, transportation, and industry that represent more than 90% of the energy consumption in the Kingdom. Such a program can be implemented, for instance, through the support of more energy-efficient alternatives and the use of new energy efficient technologies in the three sectors mentioned, i.e., in buildings, highly efficient building or “green” building, shading, refrigeration, and thermic isolation insulation. In transportation, support the use of rail, fuel-efficient cars, and hybrid vehicles. In industry, use of friendly environmental industrial technologies). These measures, accompanied by the respect of environmental rules and regulations, may not only ameliorate environmental standards in Saudi Arabia but also significantly safeguard its resources for future generations.

-

Second, the positive relationship between energy use and CO2 emissions proposes that Saudi Arabia should emphasize on investing in renewable and clean energy resources to reduce its dependence on fossil fuel consumption and subsequently ameliorate the environmental quality. With this policy, the country can safeguard non-renewable energy sources, maintain its world leadership in the oil market, and therefore reduce its carbon emissions and help combat climate change.

-

The third implication is founded on the positive linkage between financial development and CO2 emissions. Policymakers should take into consideration financial development though devising policies for reducing CO2 emissions. For instance, they can adopt measures to counterbalance the propensity of credit markets to funding heavily carbon-intensive activities. In particular, the financial sector may promote the green credit policy and stimulate more low-carbon finance to alleviate the environmental impact. For this purpose, banks may prioritize and promote (i.e., interest discounts) financing purchases or investments that approved an environmental assessment or were clearly planned to reduce pollution (Wang et al. 2019). With these measures, banks may encourage individuals, families, and companies to use environmentally friendly products or technologies and therefore foster sustainable economic growth of the country. In addition to this, policymakers can also use various fiscal tools in the form of taxes, subsidies, and incentives, to stimulate the gradual transition into a green economy. These fiscal instruments can do both provide disincentives for unsustainable practices (e.g., linked to fossil fuels) and foster the incentives for investment in renewable energy.

For further research, it is would be interesting to use the recently Quantile Autoregressive Distributed Lag QARDL) model, suggested by Cho et al. (2015), to explore the quantile behavior of the relationship between economic development, energy consumption, financial development and carbon dioxide emissions in Saudi Arabia. In particular, the QARDL model is an appropriate alternative that capture precisely both the nonlinear and asymmetric dynamics between the variables (Shahbaz et al. 2018). In addition, one could extend our framework by including, in our NARDL model, variables in their disaggregated (sectoral) forms (i.e., oil, gas, and electricity consumption, non-oil GDP, oil-GDP, Liquid liabilities, stock market capitalization), which allow capturing their specific effects on CO2 emissions.

Notes

Global Energy & CO2 Status Report 2018. The latest trends in energy and emissions in 2018.

55th Annual Report of SAMA, available at “http://www.sama.gov.sa/sites/”

From the World bank catalog, “Domestic credit to private sector refers to financial resources provided to the private sector by financial corporations, such as through loans, purchases of non-equity securities, and trade credits and other accounts receivable, that establish a claim for repayment”, accessible through https://datacatalog.worldbank.org/domestic-credit-private-sector-gdp-3.

These tests are well familiar in the literature; they are not presented in this study.

This case is confronted when time series sound to be not cointegrated although their components are cointegrated.

Abdulnasser Hatemi-J, 2011. “ACTEST: GAUSS module to Apply Asymmetric Causality Tests,” Statistical Software Components G00014, Boston College Department of Economics

The LM and RALS-LM tests were performed using the RATS code available on the Home Page of Junsoo Lee: “https://sites.google.com/site/junsoolee/codes.”

This analysis is true if we consider the 10% significance level. At 5% significance level, negative shocks have no significant effect on CO2 emissions.

The results regarding the causality test of Hatemi-J (2012) between the explanatory variables are not reported in this section, but they are available upon request.

The Saudi Energy Efficiency Program. COP 24, December 2018.

References

Abbasi F, Riaz K (2016) CO2 emissions and financial development in an emerging economy: an augmented VAR approach. Energy Policy 90:102–114. https://doi.org/10.1016/j.enpol.2015.12.017

Abdullah MA, Al-Mazroui MA (1998) Climatological study of the southwestern region of Saudi Arabia. I. Rainfall analysis. Clim Res 9:213–223

Ahmad N, Du L, Lu J et al (2017) Modelling the CO2 emissions and economic growth in Croatia: Is there any environmental Kuznets curve? Energy 123:164–172. https://doi.org/10.1016/j.energy.2016.12.106

Ajmi AN, Hammoudeh S, Nguyen DK, Sato JR (2013) On the relationships between CO2 emissions, energy consumption and income: the importance of time variation. Energy Econ 49:629–638. https://doi.org/10.1016/j.eneco.2015.02.007

Alghfais M (2016) SAMA Working paper: Comparative analysis: The impact of financial sector development on economic growth in the non-oil sector in Saudi Arabia

Ali HS, Law SH, Lin WL, Yusop Z, Chin L, Bare UAA (2019) Financial development and carbon dioxide emissions in Nigeria: evidence from the ARDL bounds approach. GeoJournal 84:641–655. https://doi.org/10.1007/s10708-018-9880-5

Al-Iriani MA (2006) Energy-GDP relationship revisited: An example from GCC countries using panel causality. Energy Policy 34:3342–3350. https://doi.org/10.1016/j.enpol.2005.07.005

Alkhathlan K, Javid M (2013) Energy consumption carbon emissions and economic growth in Saudi Arabia: an aggregate and disaggregate analysis. Energy Policy 62:1525–1532. https://doi.org/10.1016/j.enpol.2013.07.068

Alkhathlan K, Javid M (2015) Carbon emissions and oil consumption in Saudi Arabia. Renew Sust Energ Rev 48:105–111. https://doi.org/10.1016/j.rser.2015.03.072

Al-Mulali U, Tang CF, Ozturk I (2015) Estimating the environment Kuznets curve hypothesis: evidence from Latin America and the Caribbean countries. Renew Sust Energ Rev 50:918–924. https://doi.org/10.1016/j.rser.2015.05.017

Al-Mulali U, Solarin SA, Ozturk I (2016) Investigating the presence of the environmental Kuznets curve (EKC) hypothesis in Kenya: an autoregressive distributed lag (ARDL) approach. Nat Hazards 80:1729–1747. https://doi.org/10.1007/s11069-015-2050-x

Alshehry AS, Belloumi M (2015) Energy consumption carbon dioxide emissions and economic growth: the case of Saudi Arabia. Renew Sust Energ Rev 41:237–247. https://doi.org/10.1016/j.rser.2014.08.004

Alshehry AS, Belloumi M (2017) Study of the environmental Kuznets curve for transport carbon dioxide emissions in Saudi Arabia. Renew Sustain Energy Rev 75:1339–1347. https://doi.org/10.1016/j.rser.2016.11.122

Ang JB (2007) CO2 emissions, energy consumption, and output in France. Energy Policy 35:4772–4778. https://doi.org/10.1016/j.enpol.2007.03.032

Anwar A, Sarwar S, Amin W, Arshed N (2019) Agricultural practices and quality of environment: evidence for global perspective. Environ Sci Pollut Res 26:15617–15630. https://doi.org/10.1007/s11356-019-04957-x

Apergis N, Ozturk I (2015) Testing environmental Kuznets curve hypothesis in Asian countries. Ecol Indic 52:16–22. https://doi.org/10.1016/j.ecolind.2014.11.026

Apergis N, Payne JE (2009) Energy consumption and economic growth in Central America: evidence from a panel cointegration and error correction model. Energy Econ 31:211–216. https://doi.org/10.1016/j.eneco.2008.09.002

Apergis N, Payne JE, Menyah K, Wolde-Rufael Y (2010) On the causal dynamics between emissions, nuclear energy, renewable energy, and economic growth. Ecol Econ 69:2255–2260. https://doi.org/10.1016/j.ecolecon.2010.06.014

Arouri MEH, Ben Youssef A, M’henni H, Rault C (2012) Energy consumption, economic growth and CO 2 emissions in Middle East and North African countries. Energy Policy 45:342–349. https://doi.org/10.1016/j.enpol.2012.02.042

Azomahou T, Laisney F, Nguyen Van P (2006) Economic development and CO2 emissions: A nonparametric panel approach. J Public Econ 90:1347–1363. https://doi.org/10.1016/j.jpubeco.2005.09.005

Banafea WA (2014) Structural breaks and causality relationship between economic growth and energy consumption in Saudi Arabia. Int J Energy Econ Policy 4:726–734

Banerjee A, Dolado JJ, Mestre R (1998) Error-correction mechanism tests for cointegration in a single-equation framework. J Time Ser Anal 19:267–283. https://doi.org/10.1111/1467-9892.00091

Begum RA, Sohag K, Abdullah SMS, Jaafar M (2015) CO2 emissions, energy consumption, economic and population growth in Malaysia. Renew Sust Energ Rev 41:594–601. https://doi.org/10.1016/j.rser.2014.07.205

Bekhet HA, Matar A, Yasmin T (2017) CO2 emissions, energy consumption, economic growth, and financial development in GCC countries: dynamic simultaneous equation models. Renew Sust Energ Rev 70:117–132. https://doi.org/10.1016/j.rser.2016.11.089

Bekun FV, Emir F, Sarkodie SA (2019) Another look at the relationship between energy consumption, carbon dioxide emissions, and economic growth in South Africa. Sci Total Environ 655:759–765. https://doi.org/10.1016/j.scitotenv.2018.11.271

Boutabba MA (2014) The impact of financial development, income, energy and trade on carbon emissions: evidence from the Indian economy. Econ Model 40:33–41. https://doi.org/10.1016/j.econmod.2014.03.005

Cai Y, Sam CY, Chang T (2018) Nexus between clean energy consumption, economic growth and CO2 emissions. J Clean Prod 182:1001–1011. https://doi.org/10.1016/j.jclepro.2018.02.035

Chandran VGR, Tang CF (2013) The impacts of transport energy consumption, foreign direct investment and income on CO2 emissions in ASEAN-5 economies. Renew Sustain Energy Rev 24:445–453. https://doi.org/10.1016/j.rser.2013.03.054

Cho JS, Kim TH, Shin Y (2015) Quantile cointegration in the autoregressive distributed-lag modeling framework. J Econ 188:281–300. https://doi.org/10.1016/j.jeconom.2015.05.003

Cioca LI, Ivascu L, Rada EC et al (2015) Sustainable development and technological impact on CO2 reducing conditions in Romania. Sustain 7:1637–1650. https://doi.org/10.3390/su7021637

Danish ZB, Wang B, Wang Z (2017) Role of renewable energy and non-renewable energy consumption on EKC: evidence from Pakistan. J Clean Prod 156:855–864. https://doi.org/10.1016/j.jclepro.2017.03.203

de Souza ES, de Souza Freire F, Pires J (2018) Determinants of CO2 emissions in the MERCOSUR: the role of economic growth, and renewable and non-renewable energy. Environ Sci Pollut Res 25:20769–20781. https://doi.org/10.1007/s11356-018-2231-8

Dickey D, Fuller W (1981) Likelihood ratio statistics for autoregressive time series with a unit root. Econometrica 49:1057–1072

Dogan E, Aslan A (2017) Exploring the relationship among CO2 emissions, real GDP, energy consumption and tourism in the EU and candidate countries: evidence from panel models robust to heterogeneity and cross-sectional dependence. Renew Sust Energ Rev 77:239–245. https://doi.org/10.1016/j.rser.2017.03.111

Dogan E, Turkekul B (2016) CO2 emissions, real output, energy consumption, trade, urbanization and financial development: testing the EKC hypothesis for the USA. Environ Sci Pollut Res 23:1203–1213. https://doi.org/10.1007/s11356-015-5323-8

EIA (2017) Country Analysis Brief : Saudi Arabia. https://www.eia.gov/international/analysis/country/SAU

Elliott G, Rothenberg TJ, Stock JH (1996) Efficient Tests for an Autoregressive Unit Root. Econometrica 64:813–836

Farhani S, Rejeb J Ben (2012) Energy consumption, economic growth and CO2 emissions: Evidence from panel data for MENA region. Int J Energy Econ Policy 2:71–81

Farhani S, Ozturk I (2015) Causal relationship between CO2 emissions, real GDP, energy consumption, financial development, trade openness, and urbanization in Tunisia. 15663–15676. doi: https://doi.org/10.1007/s11356-015-4767-1

Farhani S, Shahbaz M (2014) What role of renewable and non-renewable electricity consumption and output is needed to initially mitigate CO2 emissions in MENA region? Renew Sust Energ Rev 40:80–90. https://doi.org/10.1016/j.rser.2014.07.170

Friedl B, Getzner M (2003) Determinants of CO 2 emissions in a small open economy. Ecol Econ 45:133–148. https://doi.org/10.1016/S0921-8009(03)00008-9

Galeotti M, Lanza A, Pauli F (2006) Reassessing the environmental Kuznets curve for CO 2 emissions: a robustness exercise. Ecol Econ 57:152–163. https://doi.org/10.1016/j.ecolecon.2005.03.031

Grossman GM, Krueger AB (1991) Environmental impacts of a North American free trade agreement

Grossman GM, Krueger AB (1994) Economic gowth and the enviornment. Natl Bur Econ Res

Halicioglu F (2009) An econometric study of CO2 emissions, energy consumption, income and foreign trade in Turkey. Energy Policy 37:1156–1164. https://doi.org/10.1016/j.enpol.2008.11.012

Han J, Du T, Zhang C, Qian X (2018) Correlation analysis of CO2 emissions, material stocks and economic growth nexus: evidence from Chinese provinces. J Clean Prod 180:395–406. https://doi.org/10.1016/j.jclepro.2018.01.168

Hatemi-J A (2011) ACTEST: GAUSS Module to Apply Asymmetric Causality Tests. Statistical Software Components No. G00014, Boston College Department of Economics

Hatemi-J A (2012) Asymmetric causality tests with an application. Empir Econ 43:447–456. https://doi.org/10.1007/s00181-011-0484-x

Im KS, Lee J, Tieslau MA (2014) More powerful unit root tests with non-normal errors. In Festschrift in Honor of Peter Schmidt (pp. 315–342). Springer, New York

Jalil A, Mahmud SF (2009) Environment Kuznets curve for CO2 emissions: a cointegration analysis for China. Energy Policy 37:5167–5172. https://doi.org/10.1016/j.enpol.2009.07.044

Javid M, Sharif F (2016) Environmental Kuznets curve and financial development in Pakistan. Renew Sust Energ Rev 54:406–414. https://doi.org/10.1016/j.rser.2015.10.019

Karasoy A (2019) Drivers of carbon emissions in Turkey: considering asymmetric impacts. Environ Sci Pollut Res 26:9219–9231. https://doi.org/10.1007/s11356-019-04354-4

Khan AQ, Saleem N, Fatima ST (2018) Financial development, income inequality, and CO2 emissions in Asian countries using STIRPAT model. Environ Sci Pollut Res 25:6308–6319. https://doi.org/10.1007/s11356-017-0719-2

Knoop T (2013) Global Finance in Emerging Market Economies. Routledge, London. https://doi.org/10.4324/9780203068229

Krane J (2019) Energy governance in Saudi Arabia: an assessment of the kingdom’s resources, policies, and climate approach

Kumbaroǧlu G, Karali N, Arikan Y (2008) CO2, GDP and RET: an aggregate economic equilibrium analysis for Turkey. Energy Policy 36:2694–2708. https://doi.org/10.1016/j.enpol.2008.03.026

Lahn G, Stevens P (2011) Burning Oil to Keep Cool: the Hidden Energy Crisis in Saudi Arabia. R Inst Int Aff:1–49

Lean HH, Smyth R (2010) CO2 emissions, electricity consumption and output in ASEAN. Appl Energy 87:1858–1864. https://doi.org/10.1016/j.apenergy.2010.02.003

Lee J, Strazicich MC, Meng M (2012) Two-Step LM Unit Root Tests with Trend-Breaks. J Statiscal Econom Methods 1:81–107

Mahmood H, Alkhateeb TTY (2017) Trade and environment Nexus in Saudi Arabia: an environmental Kuznets curve hypothesis. Int J Energy Econ Policy 7(5):291–295

Mahmood H, Alrasheed AS, Furqan M (2018) Financial market development and pollution nexus in Saudi Arabia: asymmetrical analysis. Energies 11:1–15. https://doi.org/10.3390/en11123462

Mardani A, Streimikiene D, Cavallaro F, Loganathan N, Khoshnoudi M (2019) Carbon dioxide (CO 2 ) emissions and economic growth: a systematic review of two decades of research from 1995 to 2017. Sci Total Environ 649:31–49. https://doi.org/10.1016/j.scitotenv.2018.08.229

Martínez-Zarzoso I, Bengochea-Morancho A (2004) Pooled mean group estimation of an environmental Kuznets curve for CO2. Econ Lett 82:121–126. https://doi.org/10.1016/j.econlet.2003.07.008

Mehrara M (2007) Energy consumption and economic growth: The case of oil exporting countries. Energy Policy 35:2939–2945. https://doi.org/10.1016/j.enpol.2006.10.018

Meng M, Lee J, Payne JE (2017) RALS-LM unit root test with trend breaks and non-normal errors: Application to the Prebisch-Singer hypothesis. Stud Nonlinear Dyn Econom 21:31–45. https://doi.org/10.1515/snde-2016-0050

Meng M, Im KS, Lee J, Tieslau MA (2014) More powerful LM unit root tests with non-normal errors. In: Festschrift in Honor of Peter Schmidt. Springer New York, New York, pp 343–357

Mensi W, Hussain Shahzad SJ, Hammoudeh S, Al-Yahyaee KH (2018) Asymmetric impacts of public and private investments on the non-oil GDP of Saudi Arabia. Int Econ 156:15–30. https://doi.org/10.1016/j.inteco.2017.10.003

Menyah K, Wolde-Rufael Y (2010) CO2 emissions, nuclear energy, renewable energy and economic growth in the US. Energy Policy 38:2911–2915. https://doi.org/10.1016/j.enpol.2010.01.024

Mezghani I, Ben Haddad H (2017) Energy consumption and economic growth: an empirical study of the electricity consumption in Saudi Arabia. Renew Sust Energ Rev 75:145–156. https://doi.org/10.1016/j.rser.2016.10.058

Moomaw WR, Unruh GC (1997) Are environmental Kuznets curves misleading us? The case of CO2 emissions. Environ Dev Econ 2:451–463. https://doi.org/10.1017/S1355770X97000247

Narayan PK, Popp S (2013) Size and power properties ofstructural break unit root tests. Appl Econ 45(6):721–728. https://doi.org/10.1080/00036846.2011.610752

Ng S, Perron P (2001) LAG length selection and the construction of unit root tests with good size and power. Econometrica 69:1519–1554. https://doi.org/10.1111/1468-0262.00256

Omri A, Daly S, Rault C, Chaibi A (2015) Financial development, environmental quality, trade and economic growth: what causes what in MENA countries. Energy Econ 48:242–252. https://doi.org/10.1016/j.eneco.2015.01.008

Pal JS, Eltahir EAB (2016) Future temperature in Southwest Asia projected to exceed a threshold for human adaptability. Nat Clim Chang 6:197–200. https://doi.org/10.1038/nclimate2833

Pata UK (2018) Renewable energy consumption, urbanization, financial development, income and CO2 emissions in Turkey: testing EKC hypothesis with structural breaks. J Clean Prod 187:770–779. https://doi.org/10.1016/j.jclepro.2018.03.236

Payne JE, Miller S, Lee J, Cho MH (2014) Convergence of per capita sulphur dioxide emissions across US states. Appl Econ 46:1202–1211. https://doi.org/10.1080/00036846.2013.868588

Payne JE, Anderson S, Lee J, Cho MH (2015) Do per capita health care expenditures converge among OECD countries? Evidence from unit root tests with level and trend-shifts. Appl Econ 47:5600–5613. https://doi.org/10.1080/00036846.2015.1054070

Perman R, Stern DI (2003) 1467-8489.00216.Pdf. Aust J Agric Resour Econ 325–347

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econ 16:289–326. https://doi.org/10.1002/jae.616

Phillips PCB, Perron P (1988) Testing for a unit root in time series re- gression. Biometrika 75(2):335–346

Raggad B (2018a) Stationary and non-stationary extreme value approaches for modelling extreme temperature: the case of Riyadh City, Saudi Arabia. Environ Model Assess 23:99–116. https://doi.org/10.1007/s10666-017-9588-9