Abstract

This study investigates the dynamic linkage among foreign direct investment, energy consumption, and environmental pollution of China spanning from 1990 to 2014. Despite the extant literature on the FDI-energy-growth-environmental pollution nexus, most of the conclusion seems inconsistent. Hence, this study utilized recent econometric techniques such as the dynamic ordinary least square (DOLS), autoregressive distributed lag (ARDL) bounds test approach, Gregory and Hansen structural cointegration, and the bootstrap Granger causality. The study also disaggregated energy consumption into various sources to identify their respective distinct impact on the environment. Our study confirmed the presence of the EKC curve for China in a quadratic equation applying the DOLS. The result of the bootstrapped Granger causality confirmed the presence of a unidirectional Granger causality running from CO2 emission to economic growth and export; non-renewable energy to economic growth, export to economic growth, and renewable energy; and urbanization to economic growth. Moreover, our study recognized the presence of a bi-directional connection between FDI and economic growth. Our study highly recommends that China modify its energy mix by incorporating more renewable energy resources such as hydro, wind, geothermal. Additionally, the regulatory bodies should strictly implement improved energy efficiency in the various sectors that complement total proper urban land usage as the urban population to total population significantly impelled an upsurge in environmental deterioration in China.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Decades of rapid economic growth and FDI inflow have significantly increased China’s energy use and environmental pollution (Wang et al. 2016). With GDP growing more than 10% on average over the last half-century, more foreign institutions have been attracted to set up industries in China, which has further boosted trade among its international partners. China is currently the world’s second-largest FDI recipient after the United States, receiving 140 billion US dollar foreign investment in 2019 (UNCTAD 2020). FDI is believed to be one of the economic activities that are assumed to be linked to China’s economic growth (Wang and Chen 2014), with a nominal GDP of $11.19 trillion in 2016 (World Bank 2016). However, this current trend has led to an expansion of energy use, mostly fossil fuel, which results in massive ecological degradation issues such as pollution (Salim et al. 2017; Sarkodie and Strezov 2019). According to Fan and Hao (2019), FDI contributes immensely to China’s energy consumption. They argue that a rise in economic growth emanating from FDI significantly accounts for increased energy and environmental pollution issues characterized in most Chinese provinces.

China is among the world’s largest energy consumers (Li et al. 2016) and carbon emitter (EPA 2018). In China’s quest to advance economically, it is asserted that energy consumption and environmental pollution will continually be on the ascendancy (Liu et al. 2013; Rauf et al. 2018). The question that lingers in mind has to do with the right measures to put in place to reduce pollution as the economy advances. Therefore, this study aims to examine the causal nexus amid FDI, energy consumption, and environmental pollution of China.

Due to the rapidly growing FDI flow in China, several researchers in recent years have studied the FDI-energy-environmental pollution link in China using different econometric approaches (Xu et al. 2016; Li et al. 2019; Zhang et al. 2019; Li and Li 2020; Li et al. 2015). Their empirical results, however, seem inconclusive. The use of varied variables, samples, low-power conventional econometric models, and recommendations that accompanied most of these studies has also sown confusion and, in some cases, deliberate ambiguous findings. Li et al. (2019) used the Markov Chain model to examine the FDI effect on China’s energy intensity convergence. This study considered FDI growth as a determinate of energy consumption, and no consideration was given to the economic impact of CO2 emission. Li et al. (2015), also observed the factors influencing CO2 emission in Tianjin, China exploring the STIRPAT technique. Although the authors considered FDI, they uniquely focused on population and affluence levels. Xu et al. (2016) used the ARDL approach to study the association amid FDI, environmental regulation, and energy use in China and evidenced that FDI stimulates energy consumption. These authors, however, aggregate energy consumption and neglected the influence of the separate individual components of energy use on the environment. Rauf et al. (2018) adopted the ARDL bounds testing technique to examine structural alteration, energy use, and CO2 emission in China. However, the researchers ignore the influence of structural reform on the variables. The deficiency of accurate study on the linkage in the environmental-economic growth nexus can be ascribed to the following: different energy consumption patterns, ordinary econometric approaches such as, and sample biases. This study pursues to contribute immensely to the extant literature by the following three key contributions.

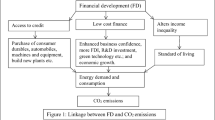

First, this study departs from the economic-environmental nexus literature on China as this study innovatively tested for a structural break on the variables to further clarify the findings from the effect of structural breaks, as shown in Fig. 1. For the benefit of remarkable social and economic development changes, structural reforms are often embarked on in countries by government and institutions. However, most of the studies on China (Li et al. 2016; Liu et al. 2018; Zhao et al. 2019; Danish and Ulucak 2020; Zhang et al. 2020) did not consider the effect of structural breaks in their examination, though there have been massive economic reforms in China. Overlooking or not including structural breaks in analyses of FDI-energy-environmental pollution nexus is possible to discard the assumption of cointegration, notwithstanding the presence of cointegration. Hence, there is a need to test for a structural break in such studies to reveal the occurrence of any shifts in the data over a given time.

Secondly, this current study estimates recent econometric models as dynamic ordinary least square (DOLS), bootstrap causality, and Gregory and Hansen structural cointegration in analyzing the nexus amid FDI, energy consumption, and environmental pollution. This study further estimated the causal direction amid FDI, energy consumption, and environmental pollution beyond the study period exploring the variance decomposition. Recently developed models are used to achieve reliable results and avoid well-known problems connected to low-power traditional econometric models such as OLS and vector autoregression. This comprehensive study will offer countries policy recommendations on how to mitigate environmental pollution whiles using China’s economic success as a role model.

Thirdly, our study impanels and utilized a group of essential variables predominant in recent literature on environment-economic causality: FDI, energy consumption, economic growth, export, urbanization, and CO2 emission. Most literature on the FDI-energy-economic growth- environment nexus mostly aggregate energy consumption and trade as the total of export and imports to the share of GDP (Kasman and Duman 2015; Wang et al. 2016; Xu et al. 2016; Osathanunkul et al. 2018; Shahbaz et al. 2019; Zhang et al. 2019) and hence ignored the real impact of the various individual separate components of energy use and international trade. Boamah et al. (2017) and Appiah et al. (2019), in their recent studies, highly recommend the usage of the individual components rather than the aggregated trade and energy consumption in the quest to expound their respective distinctive contribution to the environmental deterioration. For this purpose, we utilized the variable-export separately and disaggregated energy consumption into their various sources: renewable energy and non-renewable to identify their respective effect on the environment. This, therefore, guarantee the formulation of policies and strategies on the individual variables to ensure sustainable growth.

The rest of the study is structured as follows: “Literature review” provides the recent literature on the topic. “Data and model” offers the econometric models used. In “Empirical results and discussion,” the empirical results and findings are discussed, while “Conclusion, recommendations, and limitations” comprises the conclusion, possible policy recommendations, and limitations of the study.

Literature review

This section concisely reviewed literature that is essential to our present study.

FDI and growth-CO2 emission

FDI is believed to be an economic activity that is assumed to be linked to economic growth and climate variability. This premise within the environmental economies has been challenged by recent empirical studies revealing varied and ambiguous results ranging from the argument that FDI and economic growth exacerbates CO2 emission (Li et al. 2019; Shahbaz et al. 2019) to the absence of any link amid the variables (Bakhsh et al. 2017; Liu et al. 2018; Fan and Hao 2019). The disparities in the results mainly arise from the approach of the analysis adopted, variables utilized, and the country. For instance, using a panel of 285 Chinese cities, Liu et al. (2018) scrutinized the impact of FDI on environmental pollution. The spatial autocorrelation results showed an insignificant effect of FDI on environmental pollution. This implies that FDI inflow does not scale-up pollution in the cities, supporting the assumption of pollution haven and the pollution halo. Also, Salim et al. (2017) argued that a rise in economic growth emanating from FDI significantly accounts for the rise in CO2 emission issues characterized in China. Shahbaz et al. (2019), however, considered the nexus among FDI and carbon dioxide in the Middle East and North African economies. The authors evidenced that FDI scale-up CO2 emission growth in the economies. The study further revealed a bi-directional link from biomass energy consumption to CO2 emission. Similarly, Ssali et al. (2019) examined the linkage between environmental pollution, GDP growth, energy use, and FDI in six African countries. Estimating ARDL and PMG technique, the empirical result revealed a bi-directional link between energy use and CO2 emission in both the short and long term.

Additionally, the authors discovered a positive and unidirectional link from CO2 emission to FDI in the long run. Whereas, Opoku and Boachie (2019) analyzed the environmental effect of industrialization and FDI for 36 Africa economies spanning 1980–2014. The finding from the GMM approach revealed a nonsignificant of industrialization but a significant effect of FDI on environmental pollution. Moreover, Sung et al. (2018) confirmed that FDI growth alleviates CO2 emission in 28 Chinese manufacturing sectors spanning 2002–2015. They further exposed that industrial GDP and cleaner production contribute positively to environmental quality, whereas domestic capital stock adversely affects the environment. Recent research by Fan and Hao (2019) securitized the connection amid renewable energy consumption, GDP growth, and FDI for 31 Chinese regions spanning 2000–2015. The empirical results exposed that FDI has an insignificant influence on renewable energy use in the short-run but a significant effect in the long run. The study also recorded a significant effect of GDP on renewable energy in the long run. Our study, therefore, proposes the following hypotheses:

-

Hypothesis 1a:

FDI significantly influences carbon dioxide emissions in China.

-

Hypothesis 1a:

FDI is positively connected with the energy consumption of China.

Environmental pollution-economic growth

Environmental pollution-economic growth relationship is one of the most studied areas of pollution-growth literature. Several studies (Charfeddine and Ben Khediri 2016; Zhu et al. 2016; Gorus and Aslan 2019) have revealed that economic growth contributes to CO2 emissions, particularly at the early phase of growth. This is commonly referred to as the Environmental Kuznets curve (EKC) initially developed by Grossman and Krueger (1991). The underlying implication is that economic growth will ultimately unfasten the adverse environmental impact experienced in the early phases of economic development. Thus, pressure on the environment scale-up faster than income in the initial phases of economic growth and reduces relative to economic growth at higher income levels. It can be inferred that the EKC theory is permeated with the economic growth theory. Extensive studies have, therefore, been conducted in both quadric and cubic forms of economic growth to validate the presence of EKC using different approaches, empirical procedures, country, time, and variables (Al-mulali et al. 2015; Ahmad et al. 2016; Esmaeilpour Moghadam and Dehbashi 2018; Sarkodie and Strezov 2019). The use of different variables and methods have, however, led to conflicting and controversial results about the EKC hypothesis validity. Li et al. (2016) tested the EKC, considering economic growth, energy use, trade, and urbanization for 28 Chinese regions spanning from 1996 to 2012. The GMM estimates with the ARDL technique support the EKC hypothesis. Ulucak and Bilgili (2018), similarly affirmed the existence of the EKC proposition for high, middle, & low-income economies. Shahbaz et al. (2017) examined the EKC hypothesis for China spanning from 1970 to 2012. The results evidenced the existence of EKC in China; that is, the authors found a positive effect of GDP on CO2 emission. Zhao et al. (2019) analysis on the effect of growth, energy, and financial growth on ecological pollution for 30 regions in China also supported the EKC theory, which confirms the findings of other studies. Pata (2018) research established a short- and long-run nexus among renewable energy consumption, urbanization, financial development, income, and CO2 emission. The authors revealed an inverted U-shaped link among the utilized variables that affirm the EKC proposition presence in Turkey using the ARDL approach and Gregory-Hansen and Hatemi-J structural cointegration model. An empirical study by Boamah et al. (2017) on CO2 emission and economic growth of China found N-shape nexus among the variables. However, a recent study by Cetin (2018) rejected the EKC proposition in emerging and advanced economies. Katircioğlu and Katircioğlu (2018) in Turkey and Zhu et al. (2016) in ASEAN could not acknowledge the EKC theory in their respective studies. Based on the EKC theory, our study formulated the following hypothesis:

-

Hypothesis 2: GDP has an inverted U-shaped connection with the carbon dioxide emission of China.

Energy-growth-CO2 emission

The nexus between energy use, economic growth, and CO2 emission has been a topic of study for the past decades (Ahmad et al. 2016; Pata 2018; Zhang et al. 2019; Chen et al. 2020). Humans’ and industries’ energy use activities in both developed and developing countries lead to precarious environmental challenges. According to Zi et al. (2016), energy consumption directly influences economic growth and accounts for the rise in CO2 emission in most countries. This has elicited researchers’ attention to examine the risk connected with and struggled to recognize environmental pollution indicators. However, there remains ambiguity about this topic with varied results. For example, Zhang et al. (2019) realized the causality connection between CO2 emissions, energy use, and economic growth in China’s agricultural sector spanning 1996–2015. Applying the ARDL, VECM model, impulse response, and variance decomposition approach, their analysis acknowledged an adverse effect of energy use on agricultural CO2 emission. The study also found a bi-directional link between agricultural CO2 emission and GDP growth and a unidirectional connection from energy use to CO2 emission. Sugiawan and Managi (2019) also chimed in by examining energy-growth linkage for 104 countries data spanning 1993–2014. Their empirical results found a negative effect of energy use on inclusive wealth. The authors further recommended the usage of renewable energy to promote economic growth.

On the other hand, Danish and Wang (2019) exhibited a favorable effect of energy use on CO2 emission for BRICS economies spanning 1992–2013. The authors’ results propose the use of biomass energy to reduce pollution. Recently, Zhang et al. (2020) analyzed CO2 emission and economic growth in China and the ASEAN from 1990 to 2014 using VECM, impulse response function, and Granger causality. Their empirical results outlined that per capita GDP is the main factor of CO2 emission growth, whereas energy intensity decreases CO2 emissions in most countries. The authors’ works also propose the use of renewable energy in the economies. Moreover, Li and Li (2020), in recent research on energy investment, economic growth, and CO2 emission for 30 Chinese provinces using the spatial Durbin approach, concluded that energy investment and GDP growth scale up CO2 emission in the regions. In this regard, our study proposes the following hypotheses:

-

Hypothesis 3a:

Energy consumption causes a rise in the economic growth of China.

-

Hypothesis 3b:

Energy consumption positively stimulates China’s CO2 emissions.

Data and model

Data

This study investigates the link between FDI, energy consumption, and environmental pollution of China spanning from 1990 to 2014. The data for this study is derived from the World Bank Indicators. The dependent variable is the environmental pollution computed by the amount of carbon dioxide emitted (measured as metric tons per capita). The explanatory variables include GDP (measured as real GDP per capita); non-renewable energy (non-renewable energy consumption, i.e., coal and natural gas); renewable energy (renewable energy consumption, i.e., geothermal, wind, solar, and biomass); total export (measured as merchandise export per capita); urbanization (urban population to total population); and FDI (net flows of foreign direct investment). The study variables are converted into a natural logarithm to reduce the issue of heteroscedasticity. Figure 1 shows the trend of the study variables. As shown in Fig. 1, the economic growth of China has been on a significant increase and stable since 1996. This indicates that the economy of China has hugely improved in the past three decades. Comparatively, both renewable energy and urbanization of the country have been stable since 2004. Non-renewable energy, as shown in Fig. 1, has also been on a significant increase since 1990. This could result from the upsurge in demand for energy by the vast industries to meet production and consumption needs. Export seemingly matched its non-renewable energy from 2010 to 2014. However, beyond 2002, China witnessed an increase in CO2 emission. The definitions for the utilized variables are shown in Table 1.

Conceptual framework of the study

This present study initially constructed a framework to help us know the right time series models to estimate. The following significant factors were used in our study: renewable, non-renewable, export, FDI, and urbanization, GDP, and CO2 emission in examining how they affect the environment. Our study asserts that a continuous increase in export in China accounts for the surge in demand for energy, such as coal, to meet production. These directly increase the GDP and emissions level and adversely affect the environment (Boamah et al. 2017; Shahbaz et al. 2013). In the same vein, an increase in FDI inflow as a result of the upwards rise in industrialization, population growth, and infrastructure; consequently, translating into more usage of energy, mostly fossil fuel leading to an increase in GDP and CO2 emissions of China (Aust et al. 2020).

Moreover, the increasing urban populations in China impose a burden on the resources to meet consumption and manufacturing needs as the country advances. Thus, the large-scale urbanization in China has led to substantial urban growth and economic growth, and the subsequent CO2 emissions from the industries that generally resort to cheap fossil energy. (Zi et al. 2016; Phimister and Pilossof 2017). Our study, therefore, conceptualized that renewable, non-renewable, export, FDI, and urbanization of China cause economic development and CO2 emissions. The study further proposes that structural transformation influence the macroeconomic indicators of China. Our conceptual model is exhibited in Fig. 2.

Model specification

EKC curve estimation

This study theoretically tested for the presence of the Environmental Kuznets Curve in a modified quadratic equation, as shown in Eq. 1 below:

where GDP denotes the economic growth, GDP2 is the quadratic form of GDP, NRE symbolizes non-renewable energy, RE signifies renewable energy, EX is the export, URB urbanization, FDI represents foreign direct investment, and Vt is the error term, whereas α0 is the constant term, and α1, …, α7 measures the elasticities of GDP with respect to GDP2, NRE, RE, EX, URB, and FDI.

In examining the long-term connection between GDP, non-renewable energy, renewable energy, export, urbanization, FDI, and CO2 emission of China, the study used a recently developed model-DOL. The DOLS long run is used as it includes cointegrating regression with lags, and the error term is orthogonal. The DOLS is expressed in Eq. (2) as:

where \( {\mathrm{X}}_{\mathrm{t}}^{\ast }=\hat{\Big[{\mathrm{X}}_{\mathrm{t}}},\Delta {\mathrm{X}}_{\mathrm{t}-\mathrm{k}}+\dots, \Delta {\mathrm{X}}_{\mathrm{t}+\mathrm{k}}\Big] \) signifies the regressors and \( {\mathrm{CO}}_{2\mathrm{t}}^{\ast }={\mathrm{CO}}_{2\mathrm{t}}-\overline{{\mathrm{CO}}_{2.}} \)

Stationarity test

The study performed a prerequisite unit root test to know the right econometric approaches to obtain robust results. The study computed Dickey and Fuller (1981), Phillips and Perron (1988), and the recent covariate Augmented Dicker Fuller Test (CADF) unit root to confirm stationarity among the variables. Additionally, the study confirmed the structural breaks in the variables using Zivot and Andrews (1992) unit root.

ARDL model

The study computed the Pesaran et al. (2001) ARDL bounds testing technique to affirm the long-run integration amid FDI, energy consumption, and environmental pollution. The ARDL model is used for the following reasons: it can be used for small data, and this model can estimate both the short- and long-term nexus. Also, it does not consider the variables being I (0) or I (1). Our study estimated ARDL, as shown in Eqs. 3–9.

where ∆ symbolizes the first difference, β0 denotes the drift component, In is the logarithm, δi denotes the long-run nexus, and μt signifies the white noise error term. The study utilized the critical values and F-statistics for cointegration, as conducted by Narayan (2005). In the case where F-statistics is more than the upper critical, the null hypothesis of no link will be discarded regardless of the series being order zero or one. Likewise, we accept the null hypothesis when the F-statistics value is less than the upper critical

Structural cointegration test

The ARDL bounds test is ineffective in confirming a structural breakpoint in the variables; hence, this study additionally performed the Gregory and Hansen (1996) structural cointegration test that allows essential breaks. Gregory and Hansen (1996) test propose three models that consider the structural change at the level shift, level shift with slope, and the regime shift. Moreover, to capture these shifts in the variable, we specified Eqs. (10–12) as:

Intercept shift

Trend (Slope) shift

Regime shift

where Dt(τ) =1 if t > 𝜏 and 0 or else. DDt(τ) = t − 𝜏 if t > 𝜏 and 0 or else. The unidentified parameter 𝜏 signifies the period of the breakpoint. Dt(τ) symbolizes the dummy that signifies a change that occurred in intercept, whereas DDt(τ) is the shift in the trend. The ωO and ω1 denote the intercept coefficients while m0 and m1 signify slope coefficients vectors before the break and at the period of the break accordingly. The μt is the error term.

Estimation of causality

The study estimated the causality direction amid the variables exploring the Granger (1969) causality analysis from the VECM. We used a VECM model instead of the VAR model as the long-run causality has been confirmed amid the variables. The Granger shows the existence of causality and direction amid the study variables. We formulated the Granger causality test in the extended form with the VECM model as in Eq. 13.

The (1 − L) lag operator enumerates lags selected in the model; and the ECMt − 1denotes the error correction term.

The bootstrap causality model

Additionally, our study estimated and modified the bootstrap model to confirm causality among the variables as proposed by (Hacker and Hatemi-J 2006). We used bootstrap Causality to re-assess the conventional causality analysis for the following reasons: First, the bootstrap approach generates robust and accurate estimates as it performs simulations several times. Secondly, the bootstrapped approach offer improved critical values that are less biased for statistical references. Thirdly, the bootstrapped approach reveals a consistent and accurate causal linkage among the variables over a given period.

We examined the test statistics \( \hat{\boldsymbol{\chi}} \) from the VECM model as presented in Eq. (14):

where \( {\boldsymbol{P}}_{u_o} \) and \( {\boldsymbol{P}}_{v_1} \) signifies the residual covariance matrices

Further, the study calculated for the pseudo-data using the same data as shown in Eq. (15):

This study specified \( \left[\begin{array}{c}\boldsymbol{In}{\boldsymbol{CO}}_{\mathbf{2}\boldsymbol{t}-\boldsymbol{i}}\ast \\ {}{\boldsymbol{InGDP}}_{\boldsymbol{t}-\boldsymbol{i}}\ast \\ {}\boldsymbol{In}{\boldsymbol{NRE}}_{\boldsymbol{t}-\boldsymbol{i}}\ast \\ {}\boldsymbol{In}\boldsymbol{R}{\boldsymbol{E}}_{\boldsymbol{t}-\boldsymbol{i}}\ast \\ {}{\boldsymbol{InEX}}_{\boldsymbol{t}-\boldsymbol{i}}\ast \\ {}\boldsymbol{In}{\boldsymbol{URB}}_{\boldsymbol{t}-\boldsymbol{i}}\ast \\ {}\boldsymbol{In}{\boldsymbol{FDI}}_{\boldsymbol{t}-\boldsymbol{i}}\ast \end{array}\right] \) = \( \left[\begin{array}{c}\mathbf{0}\\ {}\mathbf{0}\\ {}\mathbf{0}\\ {}\mathbf{0}\\ {}\mathbf{0}\\ {}\mathbf{0}\\ {}\mathbf{0}\end{array}\right] \) for the pth lag order.

This denotes \( \left[\begin{array}{c}{\boldsymbol{\mu}}_{\mathbf{1}\boldsymbol{t}}\ast \\ {}{\boldsymbol{\mu}}_{\mathbf{2}\boldsymbol{t}}\ast \\ {}{\boldsymbol{\mu}}_{\mathbf{3}\boldsymbol{t}}\ast \\ {}{\boldsymbol{\mu}}_{\mathbf{4}\boldsymbol{t}}\ast \\ {}{\boldsymbol{\mu}}_{\mathbf{5}\boldsymbol{t}}\ast \\ {}{\boldsymbol{\mu}}_{\mathbf{6}\boldsymbol{t}}\ast \\ {}{\boldsymbol{\mu}}_{\mathbf{7}\boldsymbol{t}}\ast \end{array}\right] \) the pseudo innovation term. To get 10,000 bootstrapped models, we repeat this step 10,000 times. Next, the coefficients in the VECM model (15) were re-tested for each of the bootstrapped models. Also, we examined the test statistics χ∗ as in the previous step as presented in Eq. (16):

Finally, the study estimated a new bootstrapped p value and distribution using the 10,000 test statistics \( \hat{\boldsymbol{\chi}}\ast \) results in the third estimation.

Impulse response function

The bootstrap causality model and VECM granger causality failed to show the reaction of CO2 emission when any standard deviation shot is imputed in the predictors. Several studies have highlighted the importance of the causality direction in the future for proactive policy formulation and implementation (Alola et al. 2019; Fan and Hao 2019; Zhang et al. 2019). Hence, our study revealed the direction of the causality among CO2 emission, GDP, non-renewable energy, renewable energy, export, urbanization, and FDI for the next decade; thus, from the year 2015 to 2024 using the impulse response function (IRF). The IRF shows the evaluation of the variable of interest along a specified time horizon after a shock. Hence, it exhibits how environmental pollution responds to each of the series when one positive structural shot (innovation) is attributed to each of the error terms in a given moment.

Empirical results and discussion

This section of the study presents the results and deliberates the findings in light of recent literature.

Descriptive statistics

The descriptive statistics quantitatively concise the features of the utilized data in this study. The results of the descriptive statistics regarding the study period are shown in Table 2. The results outlined that economic growth (GDP) had the greatest mean (7.29), showing as a vital variable for China. The results also back the assumption that economic growth (GDP) influences CO2 emission in the country. Export on other hand, had the highest standard deviation (1.15) as compared to economic growth (1.00); non-renewable energy (0.44); CO2 emission (0.43); urbanization (0.22); renewable energy (0.15); and FDI (0.15).

Correlation results

The results of the correlation are exhibited in Table 3. As presumed, CO2 emission has a positive and significant connection with all the utilized variables. Therefore, the results seem to support erstwhile studies that economic growth, non-renewable energy, renewable energy, export, urbanization, and FDI stimulate environmental pollution. Strangely, the population correlates positively and strongly with non-renewable energy, renewable energy, export, urbanization, and FDI, which implies that economic growth contributes to energy consumption, urban growth, foreign investment, and trade in China.

Estimation of EKC curve in quadratic equation

Our study investigated the presence of the EKC curve hypothesis for China’s case in a quadratic equation using a recent econometric approach-the DOLS. The results from the EKC curve estimation exploring DOLS, as presented in Table 4, depicts a U-shaped EKC curve as the variable GDP is significantly positive while the squared GDP is significantly negative. Meaning, income levels in China trigger CO2 emissions to increase at the early phases of economic growth but drops after reaching a specific turning point. In line with the study of Zhu et al. (2016), together with Wang et al. (2017), the resulting drop in environmental emissions can be ascribed to structural changes and industrialization in China. Specifically, the surge in income levels increases environmental awareness, which drives China’s inhabitants to demand a clean environment. This implies that more strict environmental measures in China would help to validate the Kuznets curve. Our study results are in line with hypothesis 2 and further supports the recent study of Zhao et al. (2019), and Li et al. (2016) in China but in contrast with the results of Cetin (2018), Katircioğlu and Katircioğlu (2018) and Zhu et al. (2016) who evidenced that the EKC theory is not valid.

Unit root test

The study undertook an initial unit root test to confirm the properties of the variables using a conventional approach-ADF & PP test and recent covariate Augmented Dicker Fuller Test (CADF). As reported in Table 5, all these tests evidence that all the utilized variables as non-stationary in their levels but become stationary after the first differencing. At levels, the p values of all the variables were greater than 0.05%. However, after the 1st differences, all the p values unit root tests were less than 0.05 (p < 0.05) in the variables. Thus, all the utilized variables are assimilated into the first order: I (1).

The augmented Dickey-Fuller and Philips-Perron unit root test offer partial results about the integration order when data shows a structural break. Additionally, the study utilized the Andrews-Zivot unit root test to confirm structural shifts or breaks in the variables spanning 1990–2014. The study additionally estimated three models: break-in intercept, trend, and the intercept and trend. The Andrews-Zivot unit root test results exhibited in Table 6 exposed the existence of structural breaks for all the utilized variables. However, the periods of the break of the utilized variables vary for the study at the intercept, trend, and intercept & trend. CO2 emission breaks at 1997, 2002, 2003; GDP at 2007, 2003, 2001; non-renewable energy at 1996, 2000, 2003; renewable at 2009, 2006, 2009; export at 2003, 1998, 2003; urbanization at 2011, 2010, 2009 and FDI at 2005, 2000, 2005 at intercept, trend, and at both intercept & trend shifts accordingly. The ZA statistics (Table 6) showed that all the variables at the years above of the breaks are significant at the intercept except urbanization. At the trend, CO2 emission, GDP, non-renewable energy, renewable energy, export, urbanization, and FDI are also significant at 5%, and 10% expect export.

Similarly, at both the intercept and trend, all the variables (except GDP and urbanization) are significant at 1% and 5% significance level. The confirmed breaks accord with economic and political shocks. These breaks depict the changes and structural breaks that happened in China.

Results of the ARDL model

The optimal lag for the ARDL was selected following the optimal lag selection procedure (Fig. 3). The ARDL model presented in Table 7 established a significant long-run interrelationship among the variables as the obtained F- statistics is more than the critical value at a 1% critical level. The long-term estimates (Table 8) of the ARDL model revealed a significant link between non-renewable energy and CO2 emission. A 1% rise in non-renewable energy contributes to about a 1.83% increase in CO2 emission in the long-term. The findings support the view that non-renewable energy contributes as much as one-third of CO2 emission, mostly through fossil fuel use in developing countries of which China is inclusive. Thus, in recent years, China is staking its ascent on enormous infrastructure and manufacturing ventures, as well as developing an economic engine that is now highly dependent on fossil fuels, which in turn increases CO2 emission. Also, the overdependence on fossil fuels will further aggravate the environmental issues of China in the future. This finding confirms Hypothesis 2b and support studies of Dogan and Seker (2016) and Anwar et al. (2020), who found that non-renewable energy boosts CO2 emissions. For an economically sustainable environment, Sugiawan and Managi (2019), Zhang et al. (2020), and Chen et al. (2020) advocate for more renewable sources to be incorporated into the energy mix of a country in the quest to alleviate environmental pollution in most economies, a detriment to the lives of living species. Though a rise in income, export, and FDI of China mitigates the CO2 emission in the long-term (Table 8), they are statistically insignificant. Liu et al. (2018) Sung et al. (2018) also confirmed that FDI reduces CO2 emission but insignificant in Chinese manufacturing sectors.

In the short run, the ARDL (Table 8) revealed the following variables: the preceding GDP, the preceding renewable energy, the preceding FDI, and non-renewable energy significantly affect China’s CO2 emissions. Thus, the noticeable impact from non-renewable energy to the emanation of CO2 in the short-run further implies that China, which is classified to be among the top emitters of CO2-emissions in the world, is highly reliant on energy use; specifically, a fossil fuel which is used in large quantities to achieve industrial needs and economic progression. In support of the assertion made by Shahbaz et al. (2017), an increase in non-renewable energy causes economic growth that later leads to high rates of carbon emissions. In line with the study of Ren et al. (2014), the positive significant coefficient of FDI on CO2 emission suggests that when more foreign investors come with maximal environmental damage products and setup pollutant industries, the CO2 emissions further is boosted. Comparatively, Song et al. (2018) found that FDI contributes to the disastrous levels of CO2 emissions in China. Salim et al. (2017) argued that a rise in economic growth emanating from FDI significantly accounts for the increase in CO2 emission issues characterized in China. Also, the substantial affiliation between GDP and CO2-emissions validates the income-led CO2 assumption. This finding tandem with the recent work of Li and Li (2020) and Zhang et al. (2020), who evidenced that economic growth contributes to CO2 emission in China but in contrary to the findings of Zhu et al. (2016), who instead witnessed economic growth to reduce environmental pollution.

Renewable energy, however, negatively influences CO2 emission. The implication is that renewable energy substantially mitigates the emission of CO2, thus enhancing environmental quality in China. This result supports the respective studies of Pata (2018) for Turkey, Dong et al. (2018) and Chen et al. (2019) in the case of China. Contrarily, our study findings contrast.

Gregory and Hansen cointegration results

As the ARDL bounds test is ineffective to confirm a structural breakpoint in the variables, the Gregory and Hansen Cointegration test was suggested. The Gregory and Hansen test is estimated as it suggests models that take into cognizance the structural change. Thus, level shift, level shift with slope, and at the regime shift. The Gregory and Hansen cointegration results shown in Table 9 established cointegration amid the time series in the existence of structural breaks. The three tests: ADF, ZA, and ZT statistics, appeared to be more than the critical values at significant levels of 5%. Both the level shift and level shift with the trend confirmed a break in the cointegration relationship and a regime shift. These results intensely support the study of Charfeddine and Ben Khediri (2016), who assumes that structural alterations significantly influence macroeconomic indicators.

Bootstrap Granger causality test results

For better and more accurate statistical results regarding the link and direction of the causality amid the variables, the study utilized the recent bootstrap Granger causality test. The bootstrapped technique is used as it more robust and provides precise critical values (Ko and Ogaki 2015; Boamah et al. 2017).

The results of the bootstrapped Granger causality shown in Table 10 exposed the presence of a unidirectional Granger causality from CO2 emission to GDP and export; non-renewable energy to GDP; export to GDP, and renewable energy; and urbanization to GDP, and export. The result supports the recent study of Amri (2017), who found that non-renewable energy contributes to economic growth in Algeria. The results also support recent research (Shahbaz et al. 2013), who evidenced that energy positively affects China’s GDP growth. These imply that the rise in CO2 emission, plausibly due to the vast industrialization characterized in China in recent times, causes an increase in its economic growth and export. The rapid industrialization accounts for the increase in energy consumption to meet the industry’s production needs further, leading to a boost of the economy, which is in line with Hypothesis 3a.

The bootstrapped granger causality findings also revealed that as export rises, it causes growth in GDP and renewable energy. Our study additionally revealed that an upsurge in the urban population to total pollution causes export to rise. Our study collaborates with recent studies of (Zi et al. 2016; Wang et al. 2016; Pata 2018), who assert that a rise in urbanization contributes to the environmental deterioration in respective studies. Moreover, we recognized the presence of bi-directional causality amid FDI and GDP (Y) in the short run. Similarly, Amri (2016) established bi-directional causality amid FDI and economic growth in the developed and emerging economies while examining the relationship amid energy use, FDI, and output of seventy-five nations for the period 1990–2010.

The study also recognized a two-(2) long-run causal relationship (shown in column 8 of Table 10). First, there is a long-run causal link from CO2 emission, non-renewable energy, renewable energy, export, urbanization, and FDI to GDP. Second, from CO2 emission, GDP, non-renewable energy, renewable energy, export, and FDI to urbanization. Figure 4 depicts the short-run and long-run bootstrap Granger causality between the study variables.

Diagnostics tests

The study performed residual diagnostics tests to check the adequacy and stability of the model using Heteroskedasticity, Breusch-Godfrey serial correlation, and normality test. The diagnostic test results in Table 11 proved the models in our study overcome serial correlation and arch effects problem with a p value of 0.20 and 0.74 and respectively. The result of the Jarque-Bera test also reveals that the utilized variables are routinely distributed (p value 0.86). The model used in this study is appropriate for econometric analyses, policy recommendations, and formulation as the stability of CUSUM and CUSUM square tests (Fig. 5) also falls within the critical bounds at a 95% confidence level.

Impulse response function results

The impulse response function (IRF) revealed the reaction of CO2 emission when a standard deviation shot is attributed in the predictors. The results of the IRF is shown in Fig. 6. China’s CO2 emission in the 10 years, as indicated by the impulse response function (Fig. 6), discovered that CO2 emission would decline as China’s economy grows in the following periods. Thus, CO2 emission responds to the growth of the economy by reducing. Therefore, China must engage in more economic activities to increase growth and reduce its environmental influences. In the short run, the impulse function result encapsulates a positive effect of most of the independent variables on CO2 emission at different stages. For example, when the non-renewable energy is escalating, the CO2 emission effect is that CO2 emission increases and then becomes negative, as shown in Fig. 6. Export, on the other hand, exhibits a similar impact on CO2 emission as on-renewable energy. Urbanization seems to have the most significant influence on CO2 emission in the long run. The IRF exhibited that from the 5th period onwards, urbanization leads to a far increasing rate of CO2 emission in China. This result is in line with the study of Li et al. (2015) and Wang et al. (2013), who found that urbanization contributes massively to CO2 emission in China. Therefore, the impulse response function confirmed that among the independent variables in clarifying growth in China’s pollution are urbanization and export. This is a significant concern for China.

Conclusion, recommendations, and limitations

Economic activities are speedily increasing greenhouse gas emissions worldwide, most notably in developing economies, impelling a rise in CO2 emissions. For years, studies have been conducted in response to ecological quality challenges, though most of the finding seems contradictory and inconclusive. To resolve the conflicting and inconclusive results of the erstwhile studies, we examine the link between FDI, energy consumption, and environmental pollution in China spanning from 1990 to 2014 using the latest econometric models: CADF, Zivot and Andrews unit root test, DOLS, bootstrap causality, Gregory and Hansen structural break cointegration, and the IRF. To overcome omitted variables bias, we included additional explanatory variables.

The study affirmed the EKC hypothesis for China under the quadratic framework using the recent econometric approach-DOLS. The unit root tests with CADF, ADF, and PP revealed all the variables as non-stationary at levels but became stationary after first differencing. Thus, all the variables are being integrated into the first order: I (1). The Zivot and Andrews structural breaks unit root test also exhibits that the variables are integrated.

A structural cointegration among the study variables was found. The results intensely supported the assumption that structural change has a significant influence on economic indicators. After cointegration was confirmed amid the variables using the ARDL, this study also scrutinized the causal direction using the bootstrap causality. We estimate the bootstrap model 10,000 times. The results of bootstrapped Granger causality evidenced the presence of a unidirectional Granger causality from CO2 emission to GDP and export, non-renewable energy to GDP, export to GDP, and renewable energy; and urbanization to GDP, and export in the short run.

This implies a rise in carbon emission, plausibly due to the vast industrialization characterized in China in recent times has increased its economic growth and export. Again, the rapid industrialization accounts for the increase in demand for energy to meet the industries’ production, consequently leading to a boost in the economy. The bootstrapped granger causality findings evidenced that as export rises, it causes growth in its economy and the demand for renewable energy. Our study also revealed that a surge in the urban population to total pollution causes China’s export to rise. Additionally, our study established a bi-directional causality between FDI and GDP.

Furthermore, a two-(2) long-run causal link was evidenced from CO2 emission, non-renewable energy, renewable energy, export, urbanization, and FDI to GDP, and from CO2 emission, GDP, non-renewable energy, renewable energy, export, and FDI to urbanization. The IRF results also show that China’s urbanization will contribute more to environmental pollution in the future. Our study, therefore, suggests the following three recommendations.

First, China should modify its energy mix by incorporating more renewable energy resources such as hydro, wind, and geothermal and implement comprehensive regulatory policies that enforce renewable energy usage by the industries. Again, as renewable energy has become crucial in mitigating pollution, it is critical to include environmental mitigation regulations in the economy’s national schedule and plans. This could be met by increasing funds for research and technology and mechanisms that encourage the use of sustainable fuels to promote environmental sustainability in China. Secondly, as revealed from the study findings, urbanization will significantly contribute to the rise in China’s environmental deterioration in the future; therefore, regulatory bodies should strictly implement improved energy efficiency in the urban areas that are in line with recent urban population growth in China. Third, although FDI is beneficial to China’s economy, evidence from this current study shows that in the short-run foreign direct investment has an adverse effect on the environment. Relying on the study outcome, we recommend policymakers to address pollution embodied in FDI through policies and engage in low-emission foreign industries. Also, policymakers in China must make drastic, far-reaching, and unparalleled reforms in all facets of society and adjust FDI structures to avert the catastrophic levels of CO2 emissions.

The study limitation is that the research used specific variables for estimating the nexus between FDI, energy consumption, and environmental pollution. Given this, further, researchers should use different exogenous variables such as regulations, import, bioeconomy, and biomass energy to clarify and excavate the key factors that impact the environment. Also, the study exposed that export has a significant effect on CO2 emissions. This can be reaffirmed using import. Further research should examine the impact of the variables on all emerging and developing nations’ environmental pollution. Export and import cause environmental pollution, but most of the studies aggregate trade. Future research work should disaggregate trade into export and import and look at the effect of each on environmental pollution.

Data availability

Data on study variables can be extracted from https://databank.worldbank.org/source/world-development-indicators

References

Ahmad A, Zhao Y, Shahbaz M, Bano S, Zhang Z, Wang S, Liu Y (2016) Carbon emissions, energy consumption and economic growth: an aggregate and disaggregate analysis of the Indian economy. Energy Policy 96:131–143. https://doi.org/10.1016/j.enpol.2016.05.032

Al-mulali U, Weng-Wai C, Sheau-Ting L, Mohammed AH (2015) Investigating the environmental Kuznets curve (EKC) hypothesis by utilizing the ecological footprint as an indicator of environmental degradation. Ecol Indic 48:315–323. https://doi.org/10.1016/j.ecolind.2014.08.029

Alola AA, Yalçiner K, Alola UV, Akadiri SS (2019) The role of renewable energy, immigration and real income in environmental sustainability target. Evidence from Europe largest states. Sci Total Environ 674:307–315. https://doi.org/10.1016/j.scitotenv.2019.04.163

Amri F (2016) The relationship amongst energy consumption, foreign direct investment and output in developed and developing countries. Renew Sust Energ Rev 64:694–702. https://doi.org/10.1016/j.rser.2016.06.065

Amri F (2017) The relationship amongst energy consumption (renewable and non-renewable), and GDP in Algeria. Renew Sust Energ Rev 76:62–71. https://doi.org/10.1016/j.rser.2017.03.029

Anwar A, Siddique M, Dogan E, Sharif A (2021) The moderating role of renewable and non-renewable energy in environment-income nexus for ASEAN countries: Evidence from method of moments quantile regression. Renew Energ 164:956–967

Appiah K, Jianguo D, Yeboah M, Appiah R (2019) Causal correlation between energy use and carbon emissions in selected emerging economies—panel model approach. Environ Sci Pollut Res 26(8):7896–7912. https://doi.org/10.1007/s11356-019-04140-2

Aust V, Morais AI, Pinto I (2020) How does foreign direct investment contribute to sustainable development goals? Evidence from African countries. J Clean Prod 245:118823. https://doi.org/10.1016/j.jclepro.2019.118823

Bakhsh K, Rose S, Ali MF, Ahmad N, Shahbaz M (2017) Economic growth, CO2 emissions, renewable waste and FDI relation in Pakistan: new evidences from 3SLS. J Environ Manag 196:627–632. https://doi.org/10.1016/j.jenvman.2017.03.029

Boamah KB, Jianguo D, Bediako IA, Boamah AJ, Abdul-Rasheed AA, Owusu SM (2017) Carbon dioxide emission and economic growth of China—the role of international trade. Environ Sci Pollut Res 24(14):13049–13067. https://doi.org/10.1007/s11356-017-8955-z

Cetin MA (2018) Investigating the environmental Kuznets curve and the role of green energy: emerging and developed markets. Int J Green Energy 15(1):37–44. https://doi.org/10.1080/15435075.2017.1413375

Charfeddine L, Ben Khediri K (2016) Financial development and environmental quality in UAE: COINTEGRATION with structural breaks. Renew Sust Energ Rev 55:1322–1335. https://doi.org/10.1016/j.rser.2015.07.059

Chen Y, Wang Z, Zhong Z (2019) CO2 emissions, economic growth, renewable and non-renewable energy production and foreign trade in China. Renew Energy 131:208–216. https://doi.org/10.1016/j.renene.2018.07.047

Chen C, Pinar M, Stengos T (2020) Renewable energy consumption and economic growth nexus: evidence from a threshold model. Energy Policy 139:111295. https://doi.org/10.1016/j.enpol.2020.111295

Danish, Ulucak R (2020) Linking biomass energy and CO2 emissions in China using dynamic autoregressive-distributed lag simulations. J Clean Prod 250:119533. https://doi.org/10.1016/j.jclepro.2019.119533

Danish, Wang Z (2019) Does biomass energy consumption help to control environmental pollution? Evidence from BRICS countries. Sci Total Environ 670:1075–1083. https://doi.org/10.1016/j.scitotenv.2019.03.268

Dickey DA, Fuller WA (1981) Likelihood ratio statistics for autoregressive time series with a unit root. Econometrica 49(4):1057–1072. https://doi.org/10.2307/1912517

Dogan E, Seker F (2016) The influence of real output, renewable and non-renewable energy, trade and financial development on carbon emissions in the top renewable energy countries. Renew Sust Energ Rev 60:1074–1085. https://doi.org/10.1016/j.rser.2016.02.006

Dong K, Sun R, Dong X (2018) CO2 emissions, natural gas and renewables, economic growth: assessing the evidence from China. Sci Total Environ 640-641:293–302. https://doi.org/10.1016/j.scitotenv.2018.05.322

EPA (2018) U.S Environmental Protection Agency. https://www3.epa.gov/climatechange/reducingemissions.html Last Accessed on 22.01.2020. 2018

Esmaeilpour Moghadam H, Dehbashi V (2018) The impact of financial development and trade on environmental quality in Iran. Empir Econ 54(4):1777–1799. https://doi.org/10.1007/s00181-017-1266-x

Fan W, Hao Y (2019) An empirical research on the relationship amongst renewable energy consumption, economic growth and foreign direct investment in China. Renew Energy 146:598–609. https://doi.org/10.1016/j.renene.2019.06.170

Gorus MS, Aslan M (2019) Impacts of economic indicators on environmental degradation: evidence from MENA countries. Renew Sust Energ Rev 103:259–268. https://doi.org/10.1016/j.rser.2018.12.042

Granger CWJ (1969) Investigating causal relations by econometric models and cross-spectral methods. Econometrica 37(3):424–438. https://doi.org/10.2307/1912791

Gregory AW, Hansen BE (1996) Residual-based tests for cointegration in models with regime shifts. J Econ 70(1):99–126. https://doi.org/10.1016/0304-4076(69)41685-7

Grossman, Krueger (1991) Environmental impacts of a North America Free Trade Agreement." NBER Working Paper NO. 3914

Hacker RS, Hatemi-J A (2006) Tests for causality between integrated variables using asymptotic and bootstrap distributions: theory and application. Appl Econ 38(13):1489–1500. https://doi.org/10.1080/00036840500405763

Kasman A, Duman YS (2015) CO2 emissions, economic growth, energy consumption, trade and urbanization in new EU member and candidate countries: a panel data analysis. Econ Model 44:97–103. https://doi.org/10.1016/j.econmod.2014.10.022

Katircioğlu S, Katircioğlu S (2018) Testing the role of urban development in the conventional environmental Kuznets curve: evidence from Turkey. Appl Econ Lett 25(11):741–746. https://doi.org/10.1080/13504851.2017.1361004

Ko H-H, Ogaki M (2015) Granger causality from exchange rates to fundamentals: what does the bootstrap test show us? Int Rev Econ Financ 38:198–206. https://doi.org/10.1016/j.iref.2015.02.016

Li J, Li S (2020) Energy investment, economic growth and carbon emissions in China—empirical analysis based on spatial Durbin model. Energy Policy 140:111425. https://doi.org/10.1016/j.enpol.2020.111425

Li B, Liu X, Li Z (2015) Using the STIRPAT model to explore the factors driving regional CO2 emissions: a case of Tianjin, China. Nat Hazards 76(3):1667–1685. https://doi.org/10.1007/s11069-014-1574-9

Li T, Wang Y, Zhao D (2016) Environmental Kuznets curve in China: new evidence from dynamic panel analysis. Energy Policy 91:138–147. https://doi.org/10.1016/j.enpol.2016.01.002

Li W, Zhao T, Wang Y, Zheng X, Yang J (2019) How does foreign direct investment influence energy intensity convergence in China? Evidence from prefecture-level data. J Clean Prod 219:57–65. https://doi.org/10.1016/j.jclepro.2019.02.025

Liu J, Niu D, Song X (2013) The energy supply and demand pattern of China: a review of evolution and sustainable development. Renew Sust Energ Rev 25:220–228. https://doi.org/10.1016/j.rser.2013.01.061

Liu Q, Wang S, Zhang W, Zhan D, Li J (2018) Does foreign direct investment affect environmental pollution in China's cities? A spatial econometric perspective. Sci Total Environ 613-614:521–529. https://doi.org/10.1016/j.scitotenv.2017.09.110

Narayan PK (2005) The saving and investment nexus for China: evidence from cointegration tests. Appl Econ 37(17):1979–1990. https://doi.org/10.1080/00036840500278103

Opoku EEO, Boachie MK (2019) The environmental impact of industrialization and foreign direct investment. Energy Policy 137:111178. https://doi.org/10.1016/j.enpol.2019.111178

Osathanunkul R, Kingnetr N, Sriboonchitta S (2018) Emissions, trade openness, urbanisation, and income in Thailand: an empirical analysis. In: International Conference of the Thailand Econometrics Society. Springer, Cham, pp 517–535

Pata UK (2018) Renewable energy consumption, urbanization, financial development, income and CO2 emissions in Turkey: testing EKC hypothesis with structural breaks. J Clean Prod 187:770–779. https://doi.org/10.1016/j.jclepro.2018.03.236

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econ 16(3):289–326. https://doi.org/10.1002/jae.616

Phillips PCB, Perron P (1988) Testing for a unit root in time series regression. Biometrika 75(2):335–346. https://doi.org/10.1093/biomet/75.2.335

Phimister I, Pilossof R (2017) Wage labor in historical perspective: a study of the de-proletarianization of the African working class in Zimbabwe, 1960–2010. Labour Hist 58(2):215–227. https://doi.org/10.1080/0023656X.2017.1306166

Rauf A, Zhang J, Li J, Amin W (2018) Structural changes, energy consumption and carbon emissions in China: empirical evidence from ARDL bound testing model. Struct Chang Econ Dyn 47:194–206. https://doi.org/10.1016/j.strueco.2018.08.010

Ren S, Yuan B, Xie M, Chen X (2014) International trade, FDI (foreign direct investment) and embodied CO2 emissions: a case study of Chinas industrial sectors. China Econ Rev 28:123–134. https://doi.org/10.1016/j.chieco.2014.01.003

Salim R, Yao Y, Chen G, Lin Z (2017) Can foreign direct investment harness energy consumption in China? A time series investigation. Energy Econ 66:43–53. https://doi.org/10.1016/j.eneco.2017.05.026

Sarkodie SA, Strezov V (2019) Effect of foreign direct investments, economic development and energy consumption on greenhouse gas emissions in developing countries. Sci Total Environ 646:862–871. https://doi.org/10.1016/j.scitotenv.2018.07.365

Shahbaz M, Khan S, Tahir MI (2013) The dynamic links between energy consumption, economic growth, financial development and trade in China: fresh evidence from multivariate framework analysis. Energy Econ 40:8–21. https://doi.org/10.1016/j.eneco.2013.06.006

Shahbaz M, Khan S, Ali A, Bhattacharya M (2017) The impact of globalization on CO2 emissions in China. Singap Econ Rev 62(04):929–957. https://doi.org/10.1142/s0217590817400331

Shahbaz M, Balsalobre-Lorente D, Sinha A (2019) Foreign direct investment–CO2 emissions nexus in Middle East and North African countries: importance of biomass energy consumption. J Clean Prod 217:603–614. https://doi.org/10.1016/j.jclepro.2019.01.282

Ssali MW, Jianguo D, Mensah IA, Hongo DO (2019) Investigating the nexus among environmental pollution, economic growth, energy use, and foreign direct investment in 6 selected sub-Saharan African countries. Environ Sci Pollut Res 26(11):11245–11260. https://doi.org/10.1007/s11356-019-04455-0

Sugiawan Y, Managi S (2019) New evidence of energy-growth nexus from inclusive wealth. Renew Sust Energ Rev 103:40–48. https://doi.org/10.1016/j.rser.2018.12.044

Sung B, Song W-Y, Park S-D (2018) How foreign direct investment affects CO2 emission levels in the Chinese manufacturing industry: evidence from panel data. Econ Syst 42(2):320–331. https://doi.org/10.1016/j.ecosys.2017.06.002

Ulucak R, Bilgili F (2018) A reinvestigation of EKC model by ecological footprint measurement for high, middle and low income countries. J Clean Prod 188:144–157. https://doi.org/10.1016/j.jclepro.2018.03.191

UNCTAD (2020) Investment trends monitor. https://unctad.org/en/Pages/publications.aspx (last accessed on 20.01.2020)

Wang DT, Chen WY (2014) Foreign direct investment, institutional development, and environmental externalities: evidence from China. J Environ Manag 135:81–90. https://doi.org/10.1016/j.jenvman.2014.01.013

Wang P, Wu W, Zhu B, Wei Y (2013) Examining the impact factors of energy-related CO2 emissions using the STIRPAT model in Guangdong Province, China. Appl Energy 106:65–71. https://doi.org/10.1016/j.apenergy.2013.01.036

Wang Q, Wu S-d, Zeng Y-e, Bo-wei W (2016) Exploring the relationship between urbanization, energy consumption, and CO2 emissions in different provinces of China. Renew Sust Energ Rev 54:1563–1579. https://doi.org/10.1016/j.rser.2015.10.090

Wang Y, Zhang C, Lu A, Li L, He Y, ToJo J, Zhu X (2017) A disaggregated analysis of the environmental Kuznets curve for industrial CO2 emissions in China. Appl Energy 190:172–180. https://doi.org/10.1016/j.apenergy.2016.12.109

World Bank (2016) World Bank indicators. http://data.worldbank.org/indicator. Last accessed on 20.01.2020

Xu J, Zhou M, Li H (2016) ARDL-based research on the nexus among FDI, environmental regulation, and energy consumption in Shanghai (China). Nat Hazards 84(1):551–564. https://doi.org/10.1007/s11069-016-2441-7

Zhang L, Pang J, Chen X, Zhongmingnan L (2019) Carbon emissions, energy consumption and economic growth: evidence from the agricultural sector of China's main grain-producing areas. Sci Total Environ 665:1017–1025. https://doi.org/10.1016/j.scitotenv.2019.02.162

Zhang J, Fan Z, Chen Y, Gao J, Liu W (2020) Decomposition and decoupling analysis of carbon dioxide emissions from economic growth in the context of China and the ASEAN countries. Sci Total Environ 714:136649. https://doi.org/10.1016/j.scitotenv.2020.136649

Zhao J, Zhao Z, Zhang H (2019) The impact of growth, energy and financial development on environmental pollution in China: New evidence from a spatial econometric analysis. Energy Econ:104506. https://doi.org/10.1016/j.eneco.2019.104506

Zhu H, Duan L, Guo Y, Keming Y (2016) The effects of FDI, economic growth and energy consumption on carbon emissions in ASEAN-5: evidence from panel quantile regression. Econ Model 58:237–248. https://doi.org/10.1016/j.econmod.2016.05.003

Zi C, Jie W, Hong-Bo C (2016) CO2 emissions and urbanization correlation in China based on threshold analysis. Ecol Indic 61:193–201. https://doi.org/10.1016/j.ecolind.2015.09.013

Zivot E, Andrews DWK (1992) Further evidence on the great crash, the oil-Price shock, and the unit-root hypothesis. J Bus Econ Stat 10(3):251–270. https://doi.org/10.1080/07350015.1992.10509904

Funding

This study was financially supported by the National statistical science research project (No. 2014566), the Qing Lan Project of Jiangsu Province, and the Key Members of Outstanding Young Teacher Training Project of Jiangsu University.

Author information

Authors and Affiliations

Contributions

Conceptualization: Emma Serwaa Obobisa and Haibo Chen. Data curation and formal analysis: Emma Serwaa Obobisa, Haibo Chen and Kofi Baah Boamah; Funding acquisition: Haibo Chen. Investigation and methodology: Emma Serwaa Obobisa, Haibo Chen and Kofi Baah Boamah. Software: Emma Serwaa Obobisa, Kofi Baah Boamah, and Claudia Nyarko Mensah. Supervision: Haibo Chen. Roles/writing—original draft: Emma Serwaa Obobisa and Haibo Chen. Writing—review and editing: Emma Serwaa Obobisa, Haibo Chen, Emmanuel Caesar Ayamba, and Nelson Amowine.

Corresponding author

Ethics declarations

Consent to participate

Not applicable

Consent to publish

The authors of this manuscript grant the publisher of this manuscript the sole exclusive license of the full copyright, which the publisher hereby accepts.

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

Responsible Editor: Nicholas Apergis

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Obobisa, E.S., Chen, H., Boamah, K.B. et al. Environmental pollution of China to foreign investors: detrimental or beneficial?. Environ Sci Pollut Res 28, 13133–13150 (2021). https://doi.org/10.1007/s11356-020-11549-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-020-11549-7