Abstract

Foreign direct investment (FDI) plays a vital role in economic growth in Shanghai but also gives rise to a series of environmental pollution problems. With more voices calling for strengthening of environmental regulations, it is necessary to explore the relationship among FDI, environmental regulations, and energy consumption. We apply autoregressive distributed lag bounds testing approach and error correction-based Granger causality model to verify the connection among these economic variables for the period from 1991 to 2013. The results show that environmental regulations have a negative effect on FDI in both the long and short term. Energy consumption has a significantly positive impact on FDI in the short and long run, but is only significant in the short run. Granger causality results indicate that FDI is a Granger cause of energy consumption, which confirms the validity of the pollution haven hypothesis. Finally, we suggest that stringent environmental regulations and improvements in energy efficiency are required when absorbing FDI inflows.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Since reform and implementation of an open policy in 1978, China has attracted a large amount of foreign direct investment (FDI). According to the United Nations Conference on Trade and Development (UNCTAD 2015), foreign real direct investment reached approximately US$11.96 million in 2014 and China overtook the USA as the country attracting the most FDI. Studies have shown that a large amount of FDI flows into China because of its rich resources and less strict environmental regulation (Chen et al. 2014; Wang et al. 2016). Copeland and Taylor (1994) proposed the pollution haven hypothesis (PHH), according to which FDI promotes economic growth but also causes increases in energy consumption and carbon dioxide emissions. Furthermore, according to the industrial flight hypothesis, foreign enterprises prefer to transfer industry to minimize production costs (Asghari 2013) and the resources and environment of the host country gradually deteriorate over time. Therefore, the nexus among FDI, environmental regulations, and energy consumption is the focus of this study, with an empirical analysis of Shanghai in China during the period 1991–2013.

Because Shanghai has a prosperous market economy, trade and FDI are important in the economic development of the city. The first China (Shanghai) pilot free trade zone (FTZ) was established in 2013. The proportion of the Shanghai gross domestic product (GDP) accounted for FDI was on average 4 % points higher than the national level during the period 1991–2013. Meanwhile, the Shanghai per capita energy consumption showed an annual increase from 2.59 ton of standard coal (tsc) in 1991 to 4.85 tsc in 2013, which is two to three times higher than the national average over the study period. In 2013, energy consumption reached 113.37 million tsc, making the city the eighth-largest energy consumer in China. Thus, energy demands for economic growth in Shanghai are relatively large.

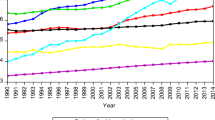

It is clear that there is a great need to impose stringent environmental regulations to reduce environmental degradation arising from energy consumption and the pollution caused by international trade and FDI. Figure 1 shows that the volume of sewage disposed by sewage disposal plants increased approximately 16-fold from 1.2 million tons in 1991 to nearly 20.32 million tons in 2013. The rate of wastewater abatement, as an indicator of environmental regulation, jumped from 6 % in 1991 to 91 % in 2013 at an average annual growth rate of 40 %. These data indicate that environmental regulations have been progressively strengthened. However, stricter environmental regulations will exert a stronger impact not only on domestic companies. How does it influence FDI in Shanghai? How does it affect energy consumption? And what is the nexus among FDI, environmental regulations, and energy consumption in Shanghai? These practical problems will be explored in this study.

2 Literature review

FDI, environmental regulations, and energy consumption, as three key economic factors, have been widely investigated; however, studies on their relationships seem to be divergent. The focus of related studies can be classified as follows: the nexus between FDI and environmental regulations; the nexus between FDI and energy consumption; and the environmental regulations and energy consumption nexus.

The restraining effect of environmental regulation stringency on FDI inflows is always an entry point for research on the relationship between FDI and environmental regulations. Developing counties may drift into a polluted paradise if FDI growth increases without consideration of environmental costs and benefits. For example, Dean et al. (2009) and Chung (2014) report that intensely polluting enterprises have transferred from developed countries to China and South Korea, respectively, because of their weak environmental regulations. Some researchers claim that strict environment regulation is effective in restricting FDI inflows associated with environmental pollution. He (2006) finds that increasing stringent environmental regulation acts as a modest deterrent to FDI inflows. Similarly, Naughton (2014) concludes that environmental regulation stringency inhibits the pollution haven effect by decreasing FDI inflows. Rezza (2013) proves that environmental stringency has a negative effect on FDI in both host and home countries. Bialek and Weichenrieder (2015) suggest that stricter environmental regulation will have a deterrent impact on Greenfield pollution, while higher environmental stringency seems to attract clean mergers and acquisitions.

In contrast to the pollution haven effect, FDI spillovers of the latest pollution abatement technologies and innovations have narrowed the gap between developing and developed countries, which is called the pollution halo hypothesis (Zarsky 1999; Asghari 2013). For instance, Doytch and Narayan (2016) provide evidence of a halo effect of FDI in the service sector because of technological spillovers. Following this point of view, some studies suggest that environmental regulation stringency may not induce a decline in FDI inflow, mainly because multinational companies (MNCs) have already reached the environmental requirements and standards imposed by host countries (Eskeland and Harrison 2003). Moreover, products exported from host countries must meet the high environmental standards in home countries (Rezza 2013). In an analysis of panel data for 30 provinces in China, Zeng (2010) finds that the PHH is weak, as the sign for the influence of environmental regulations on regional FDI inflows is negative and there is no Granger causality between FDI and environmental regulations. Saikawa and Urpelainen (2014) conclude that stricter environmental standards can increase technology diffusion via automobile FDI. Noailly and Ryfisch (2015) find that 17 % of green patents held by MNCs involve research and development (R&D) investment in developing countries such as China or other host Organization for Economic Co-operation and Development (OECD) countries, probably because stringent environmental regulation plays a critical role in attracting green foreign R&D investment.

Research on the relationship between FDI and energy consumption mainly addresses the issue of energy saving. Supporters of the PHH have shown that FDI inflows increase energy usage due to transfer of energy-consuming and resource-intensive industries. For example, Azam et al. (2015) prove that FDI plays an important role in increasing energy consumption for a macro data set for Thailand, Malaysia, and Indonesia. Seker et al. (2015) and Baek (2016) reach the same conclusion for Turkey and ASEAN, respectively. According to research by Hakimi and Hamdi (2016), FDI inflows to Morocco and Tunisia do not involve clean industries. For a sample of 65 countries, Omri and Kahouli (2014) find that FDI Granger-causes energy consumption in middle- and low-income countries, and there is two-way causality between energy consumption and FDI in high-income countries. Nevertheless, some studies provide evidence of an energy-saving effect. For instance, Bento (2011) concludes that FDI has a modest negative effect on energy consumption in Portugal. Furthermore, Elliott et al. (2013) observe that FDI contributes to decreases in energy intensity, especially in Western and Central China. Doytch and Narayan (2016) provide strong evidence that FDI plays a critical role in increasing the consumption of renewable energy while having a negative impact on fossil energy. Sbia et al. (2014) find that FDI has a negative impact on energy consumption in the United Arab Emirates. Zhang and Zhou (2016) present evidence of a halo effect of FDI on carbon emissions in China. In terms of causality, Hassaballa (2014) confirms that a bidirectional Granger causality relationship exists between FDI and energy-related emissions in both the short and long run, which is known as the feedback hypothesis, whereby both variables have a mutual influence and reciprocal causation.

Studies on the relationship between environmental regulations and energy consumption, and energy-related carbon emissions are relatively limited. In a case study for Chongqing city, Zhou et al. (2016) find that effective environmental regulations actually curb energy consumption and air emissions. Zhou et al. (2015) observe an inverted U-shaped relationship between environmental regulation and per capita fossil energy consumption, so energy consumption increases up to a certain environmental regulation threshold, after which an energy-conserving effect emerges. This result corroborates findings by Zhang and Wei (2014), who observed that the direct impact of environmental regulations on carbon emissions follows an inverted U-shaped curve. Results from these two studies provide evidence of the green paradox (Sinn 2008), whereby policies aimed at improving climate change accelerate fossil energy production because of expectations regarding stricter climate policies in the future. Zhao et al. (2015) categorize environmental regulation into three types: command and control regulation (CCR), market-based regulation (MBR), and government subsidy (GS). Although MBR and GS are better than CCR in improving efficiency and reducing CO2 emissions, CCR has dominated Chinese environmental regulations. Zhu et al. (2014) suggest that because of the increasing stringency of environmental regulation, the smaller a pollution-intensive firm is, the more likely it is to relocate to a region with weak environmental regulation.

To sum up the above research, because FDI, environmental regulation, and energy consumption are interconnected, there should be broader consideration of the nexus among these three key economic factors. From this perspective, our study fills a gap in research, particularly for Shanghai. Both FDI and energy consumption in Shanghai have exceeded national average levels, in contrast to other provinces. The impact of environmental regulation on these two variables should be identified. In addition, because Shanghai FTZ is the first pilot FTZ in China, its unique characteristics make Shanghai an interesting case to explore. To this end, we use the ARDL bounds testing approach to better understand the links among FDI, environmental regulations, and energy consumption, and the Granger causality test via vector error correction model (VECM) to examine the direction of the causality within the Shanghai system during the period 1991–2013. Based on the empirical analysis, policy implications and accurate measurements will be presented for Shanghai and generalized to the rest of China.

The remainder of the paper is organized as follows. Section 3 describes the data and methodology. Section 4 presents our empirical findings. Section 5 contains a discussion, and Sect. 6 concludes and presents policy implications.

3 Data and methodology

3.1 Data

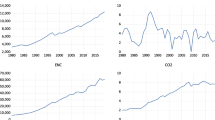

We use annual time-series data covering the period from 1991 to 2013. The FDI variable is the ratio of real foreign direct investment to GDP. E is a proxy for energy consumption and corresponds to the standard quantity for final energy consumed, expressed as 104 tsc equivalents. FDI and GDP data are from the Shanghai Statistical Yearbook. Energy consumption data are from the China Energy Statistical Yearbook. Exchange rates are from statistical data published by the People’s Bank of China.

ER represents environmental regulation stringency. However, it is difficult to directly obtain environmental regulation data (Wang et al. 2016). Considering data quality and availability, we use the wastewater abatement rate to indicate the stringency of environmental regulation, similar to the approach of Liu and Chen (2008). Effectively, ER is the ratio of the volume of sewage disposed by sewage disposal plants to total wastewater discharged. We selected this variable because the ratio removes the effect of production on pollution emissions. Since water is widely used, ER reflects the cost of corporate governance pollution from a broader perspective to better indicate the level of environmental regulation. Because there is no standard for measuring waste gas and solid waste, these are not taken into consideration here. Data for the volume of sewage disposed by sewage disposal plants and total wastewater discharged are from the Shanghai Statistical Yearbook, which only covers the period after 1990, so our study period is 1991–2013.

3.2 ARDL bounds testing approach to cointegration

The ARDL bounds testing approach improved by Pesaran and Pesaran (1997) is applied to test long-run equilibrium relationships among economic variables. The ARDL bounds testing approach offers many advantages over traditional cointegration test methods such as Engle–Granger cointegration and Johansen cointegration. First, it can be used irrespective of purely order zero or one or fractional integration. Second, it is suitable for small samples and the empirical results are robust. Third, the results are unbiased and efficient even if there are endogenous explanatory variables in the model. Finally, both short- and long-term coefficients can be estimated at the same time. Because of these merits, we chose the ARDL bounds testing approach in this study. To explore long-term relationships among FDI, environmental regulations, and energy consumption in Shanghai, the ARDL model can be expressed as follows:

where ∆ is the first difference operator; ε is a white noise error term; m is the maximum lag length; b 11, b 12, b 13, b 21, b 22, b 23, b 31, b 32, and b 33 are short-term factors; and b 14, b 15, b 16, b 24, b 25, b 26, b 34, b 35, and b 36 are long-term factors. All the variables are in natural logarithmic form. The null hypothesis of no cointegration among the variables in Eq. (1) is H0: b 14 = b 15 = b 16, and the long-run equilibrium relationship can be confirmed when the null hypothesis is rejected. The alternative hypothesis is H1: b 14 ≠ 0 or b 15 ≠ 0 or b 16 ≠ 0, and there is no long-run relationship among the variables when the alternative hypothesis is rejected. In the ARDL model, we apply the bounds test to estimate the existence of a cointegration relationship among the variables. The bounds test is based on the F-statistic computed in Eqs. (1)–(3). Owing to the small sample range, we compare the F-statistic with the critical bound values given by Narayan (2005). According to Narayan, the null hypothesis of no cointegration is rejected when the F-statistic exceeds the upper critical bound, while the result is not rejected when the F-statistic is below the lower bound, otherwise the result is inconclusive.

If a cointegration relationship among the variables is confirmed, we directly estimate the short-term coefficients using an error correction mechanism (ECM) expressed as follows:

where ecm t−i is the error correction term and λ is its coefficient, which shows restoration of balance within the economic system under a shock. p1, p2, and p3 denote the optimal lag order of LnFDI, LnER, and LnE, respectively, in the model. They can be defined using the Akaike information criterion (AIC) and the Schwarz Bayesian criterion (SBC).

3.3 Vector error correction model for Granger causality

After confirming the cointegration relationship, we apply the VECM Granger causality approach to investigate the causality relationships among the three economic variables as follows:

where (1−L) indicates the difference operator and μ are error terms. ECM t−1 is the lagged error correction term, which is generated from the long-run equilibrium relationship. \(\beta\) is the speed of adjustment. Both long-run and short-run Granger causality can be given within the VECM framework. The significance of the ECM t−1 coefficient according to the t-statistic represents the long-run causal relationship. We test the short-run causality using the significance of the F-statistic for lagged variables via the Wald test. For example, d 13,i ≠ 0∀ i implies that energy consumption Granger-causes FDI. Conversely, d 31,i ≠ 0∀ i suggests that FDI leads to energy consumption.

4 Empirical findings

4.1 Unit root test

It is necessary to develop a unit root test for time series whose power is robust to the initial observation before using the ADRL bounds testing approach (Jiang et al. 2012). There are many unit root tests, such as the augmented Dickey–Fuller (Dickey and Fuller 1981), Phillips–Perron (Phillips and Perron 1988), and Dickey–Fuller generalized least square (Elliot et al. 1996) tests. However, their results are distorted for finite samples (Guan et al. 2015). Hence, we use the Ng–Perron test (Ng and Perron 2001) as the sample size is only 23.

The stationarity test results are given in Table 1. The null hypothesis of the presence of a unit root is not rejected for the level series but is rejected for the first difference. Therefore, as all the variables are integrated of order one, i.e., I (1), the ARDL bounds testing approach can be applied.

4.2 Bounds test

We use the ARDL bounds testing approach to estimate Eqs. (1)–(3) for the existence of cointegration among FDI, environmental regulation, and energy consumption when each variable is considered as a dependent variable. Considering that the data span is short, the maximum lag length is defined as two.

Table 2 presents the bounds test results. When FDI is the dependent variable, the F-statistic of 7.218 is higher the upper bound at the 5 % significance level. However, when ER or E is the dependent variable, the F-statistic is 2.750 or 0.475, respectively. These values are smaller than the lower bound at the 5 % significance level. Therefore, there is only cointegration among FDI, environmental regulation, and energy consumption when FDI is the dependent variable.

4.3 Coefficient estimation

We estimate the long- and short-run dynamic parameters using the ARDL bounds testing approach. Applying the AIC and SBC, the optimal lengths are p1 = 1, p2 = 2, and p3 = 0. The same ARDL (1, 2, 0) specification is confirmed.

The results for long- and short-run coefficients are reported in Table 3. The estimated coefficients are significant for environmental regulations but nonsignificant for energy consumption in the long run. Environmental regulations have a significant negative impact on FDI at the 5 % level. The results indicate that stricter environmental regulation restricts FDI inflow: a 1 % increase in environmental regulation stringency will lead to 0.281 % decrease in FDI. This result is in agreement with findings reported by Naughton (2014), Rezza (2013), and Bialek and Weichenrieder (2015). It also indicates that the PHH holds for FDI in Shanghai, consistent with findings reported by Dean et al. (2009) for China and by Chung (2014) for South Korea, among others. The energy consumption coefficient is positive but nonsignificant at the 5 % level, which argues against the energy-saving hypothesis. This means that energy consumption stimulates FDI inflows, although other factors play an important role in FDI in Shanghai.

In the short run, the coefficient for environmental regulation is significantly negative at the 10 % level. A 1 % increase in environmental regulation stringency leads to a 0.195 % decrease in FDI. The absolute value is smaller for the short-run coefficient than for the long-run coefficient. This indicates that environmental regulations have a stronger influence on FDI inflows in the long run. The coefficients for both energy consumption and its first-lagged term are significantly positive at the 5 % level. A 1 % increase in energy consumption and its first-lagged counterpart lead to increases in FDI of 2.056 and 1.800 %, respectively. This indicates that energy usage promotes FDI inflow in the short run. In addition, the coefficient is greater for current energy consumption than for its first-lagged counterpart, which implies that FDI inflow in Shanghai currently has an increasing dependence on energy. However, the long-run coefficient for energy consumption is nonsignificant and smaller than the short-run coefficient, possibly because of increasingly stringent environmental regulation and the gradual rise in high-quality FDI inflows.

The ecm coefficient is significantly negative at the 1 % level and indicates that short-term fluctuation in FDI will return to equilibrium in the long run when the annual rate of adjustment is approximately 69.5 %.

The R 2 value is 0.5912, which means the explanatory variables can explain the 59.12 % of the total information, so the explanatory power is good. The F-statistic for testing the joint significance of explanatory variables is positively significant at the 10 % level. The Durbin-Watson statistic is nearly two, which implies that the probability of linear autocorrelation is low.

4.4 Parameter stability

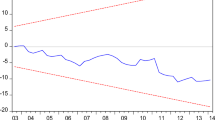

To test the stability of the estimated parameters, we plotted the cumulative sum of recursive residuals (CUSUM) and the cumulative sum of squares of recursive residuals (CUSUMSQ) (Pesaran and Pesaran 1997).

Figures 2 and 3 show that plots for the CUSUM and CUSUMSQ tests are within the critical bounds at the 5 % significance level, confirming the stability of the coefficients.

4.5 Granger causality

Based on the previous cointegration, the VECM Granger causality approach is applied to explore the causal relationship between FDI, environmental regulation, and energy consumption in Shanghai.

Table 4 lists the Granger causality results. In the long run, energy consumption has a unidirectional causality relationship with FDI and environmental regulation, which implies that the causality runs interactively through the error correction term from both FDI and environmental regulation. Constraints on FDI and implementation of more stringent environmental regulation may contribute to decreases in energy consumption. The existence of unidirectional Granger causality running from FDI to energy consumption indicates that there is pollution transference during FDI inflows in Shanghai. This means that an increase in FDI inflows will increase the amount of energy consumed in the long run, which supports the validity of PHH. We also find environmental regulation Granger-causes energy consumption in the long run. The relationship may exist mainly because of the higher energy consumption and lower energy efficiency in Shanghai. Increasing stronger environmental regulation may inhibit the high consumption of energy. In the short run, there is no significant Granger causality among the variables, but FDI Granger-causes energy consumption with a significantly positive sign at the 1 % level. The results indicate that restrictions on FDI inflow may dampen energy consumption. Our results corroborate the findings reported by Omri and Kahouli (2014) in the case of Australia.

5 Discussion

Our empirical results show that environmental regulation has a significant negative impact on FDI in both the long and short term. The findings indicate that environmental regulation in Shanghai will decrease FDI inflows because of the possibility of the pollution haven effect of FDI. In this situation, stringent environmental regulation will act as a constraint to reduce the pollution haven effect and will promote the introduction of FDI with advanced environmentally friendly technologies in Shanghai. Therefore, Policies to attract FDI should take environmental consequences into account. The Shanghai government should gradually improve environmental standards and strictly enforce entry standards. On the one hand, the aim should be to increase production costs for highly polluting industries. High barriers to entry in high-carbon sectors should reduce the inflow of FDI involving high energy consumption. On the other hand, because environmental costs can be reduced via green technology innovations, it is beneficial to attract foreign environmentally friendly enterprises.

Second, we find that energy consumption has a significant positive influence on FDI in the short run, but a nonsignificant positive effect in the long run. Notably, in the short term, energy consumption caused a one- to twofold increase in FDI. The results indicate that higher energy consumption contributes to more FDI inflows, and environmental pollution increases as a result. However, we find that the long-run coefficient for the effect of energy consumption on FDI is small and nonsignificant. This is probably because increasingly stringent environmental regulations adopted in Shanghai have exerted an energy-saving effect. In recent years, the GDP growth rate has been decreasing annually, and in 2013 it was only 7.7 %, the lowest rate in the country, indicating that policy for Shanghai has emphasized ecological well-being and sustainable growth instead of pursuing absolute economic growth.

Third, the Granger causality results reveal a strong significant causal relationship from FDI to energy consumption in the short run, and both FDI and environmental regulations Granger-cause energy consumption in the long run. This indicates that FDI impediments may reduce energy use in Shanghai. As the biggest economic, finance, and trade center in China, Shanghai seems to introduce FDI inflows involving low energy consumption and high efficiency according to theoretical analysis. However, the Granger causality results confirm that the PHH holds in Shanghai. This case is an important reminder for the Shanghai government that energy consumption must be considered when absorbing FDI inflows. The reason for the high energy consumption may be low energy efficiency. More attention should be paid to FDI technology spillovers when promoting FDI inflow. The promotion of energy-saving technological innovations and migration of resource-intensive FDI enterprises will help not only in maintaining sustainable growth but also in improving living standards in Shanghai.

6 Conclusions and policy implications

Although a host of high-quality research on the PHH has been conducted, increasing stringent environmental regulation should be taken into consideration. Our main contribution is investigation of relationships among FDI, the environment, and energy systems, particularly for Shanghai. We explored the nexus among FDI, environmental regulations, and energy consumption in Shanghai during 1991–2013. Variables were integrated at I (1) with a unit root test. We applied ARDL bounds testing approach to confirm the existence of a long-run relationship within the system and obtain long- and short-term elasticity coefficients with FDI as the dependent variable. In both the long and short run, environmental regulations had a significant negative impact on FDI. Energy consumption had a positive influence on FDI, but this was nonsignificant in the long run. According to cointegration among the variables, we explored the causal relationship by using the VECM Granger causality approach. We found that both FDI and environmental regulations Granger-cause energy consumption in the long run. There is strong evidence of short-term unidirectional causality from FDI to energy consumption. The Granger causality results confirm the PHH for Shanghai.

Although FDI inflows are seen as an important component in the economic growth of Shanghai, our empirical results reveal that FDI is also associated with increasing environmental pollution and energy consumption. Therefore, it is crucial to coordinate FDI, environmental regulations, and energy consumption for economic development in Shanghai. First, polices aimed at reducing environmental pollution and regulating the FDI–environment relationship should be adopted. Stringent environmental regulations including an energy conservation policy should be used as a tool to test the environmental health of FDI investment. Second, FDI spillover effects should be emphasized to drive the adoption of advanced energy-saving and low-carbon technologies from foreign companies. Local enterprises need to eliminate outdated technology via upgrading and utilizing technology spillovers from foreign investment. Moreover, the capacity to adopt technology should be enhanced to accelerate technological innovation and increase technology diffusion. Third, the Shanghai government should continue to promote sustainable development and focus on wise use of energy, especially increased use of clean energy, renewable energy, and other low-carbon or carbon-free energy, such as hydro, wind, solar, and ocean energy. It is the inevitable choice for low-carbon economy to optimize energy structure. Fourth, to improve energy efficiency, domestic enterprises should be encouraged to strengthen cooperation with foreign-owned enterprises in the fields of new and renewable energy, device development, green building, and low-carbon transportation. It is essential to strengthen international cooperation and communication and to jointly research and develop new technology and products to narrow the technological gap. By optimizing FDI quality and improving energy efficiency, sustainable growth can be achieved in Shanghai via increasing FDI.

References

Asghari M (2013) Does FDI promote MENA region’s environment quality? Pollution halo or pollution haven hypothesis. Int J Sci Res Environ Sci 1(6):92–100

Azam M, Khan QA, Zaman K, Ahmad M (2015) Factors determining energy consumption: evidence from Indonesia, Malaysia and Thailand. Renew Sustain Energy Rev 42:1123–1131

Baek J (2016) A new look at the FDI-income-energy-environment nexus: dynamic panel data analysis of ASEAN. Energy Policy 91:22–27

Bento JP (2011) Energy savings via foreign direct investment? Empirical evidence from Portugal. Maastricht School of Management Working Paper No. 2011/24

Bialek S, Weichenrieder AJ (2015) Do stringent environmental policies deter FDI? M&A versus Greenfield. Cestifo Working Paper No.5262

Chen Q, Min M, Shi YL, Wilson C (2014) Foreign direct investment concessions and environmental levies in China. Int Rev Financ Anal 36:241–250

Chung S (2014) Environmental regulation and foreign direct investment: evidence from South Korea. J Dev Econ 108:222–236

Copeland B, Taylor MS (1994) North-South trade and the environment. Q J Econ 109:755–787

Dean JM, Lovely ME, Wang H (2009) Are foreign investors attracted to weak environmental regulation? Evaluating the evidence from China. J Dev Econ 90:1–13

Dickey DA, Fuller WA (1981) Likelihood ratio statistics for autoregressive time series with unit root. Econometrica 49:1057–1072

Doytch N, Narayan S (2016) Does FDI influence renewable energy consumption? An analysis of sectoral FDI impact on renewable and non-renewable industrial energy consumption. Energy Econ 54:291–301

Elliot G, Rothenberg TJ, Stock JH (1996) Efficient tests for an autoregressive unit root. Econometrica 64:813–836

Elliott RJR, Sun PY, Chen SY (2013) Energy intensity and foreign direct investment: a Chinese city-level study. Energy Econ 40:484–494

Eskeland GS, Harrison AE (2003) Moving to greener pastures? Multinationals and the pollution haven hypothesis. J Dev Econ 70:1–23

Guan XL, Zhou M, Zhang M (2015) Using the ARDL-ECM approach to explore the nexus among urbanization, energy consumption, and economic growth in Jiangsu Province, China. Emerg Mark Finance Trade 51:391–399

Hakimi A, Hamdi H (2016) Trade liberalization, FDI inflows, environmental quality and economic growth: a comparative analysis between Tunisia and Morocco. Renew Sustain Energy Rev 58:1445–1456

Hassaballa H (2014) Testing for Granger causality between energy use and foreign direct investment inflows in developing countries. Renew Sustain Energy Rev 31:417–426

He J (2006) Pollution haven hypothesis and environmental impacts of foreign direct investment: the case of industrial emission of sulphur dioxide (SO2) in Chinese provinces. Ecol Econ 60:228–245

Jiang SJ, Chang MC, Chiang IC (2012) Price discovery in shock index: an ARDL-ECM approach in Taiwan case. Qual Quant 46:1227–1238

Liu JM, Chen G (2008) An empirical analysis on impact of environmental regulations upon distribution of FDI. China Soft Sci 1:102–108

Narayan PK (2005) The saving and investment nexus for China: evidence from cointegration tests. Appl Econ 37:1970–1990

Naughton HT (2014) To shut down or to shift: multinationals and environmental regulation. Ecol Econ 102:113–117

Ng S, Perron P (2001) Lag length selection and the construction of unit root tests with good size and power. Econometrica 69:1519–1554

Noailly J, Ryfisch D (2015) Multinational firms and the internationalization of green R&D: a review of the evidence and policy implications. Energy Policy 83:218–228

Omri A, Kahouli B (2014) Causal relationships between energy consumption, foreign direct investment and economic growth: fresh evidence from dynamic simultaneous-equations models. Energy Policy 67:913–922

Pesaran HM, Pesaran B (1997) Working with Microfit 4.0: interactive econometric analysis. Oxford University Press, Oxford

Phillips PBC, Perron P (1988) Testing for a unit root in time series regression. Biometrika 97:335–346

Rezza AA (2013) FDI and pollution havens: evidence from the Norwegian manufacturing sector. Ecol Econ 90:140–149

Saikawa E, Urpelainen J (2014) Environmental standards as a strategy of international technology transfer. Environ Sci Policy 38:192–206

Sbia R, Shahbaz M, Hamdi H (2014) A contribution of foreign direct investment, clean energy, trade openness, carbon emissions and economic growth to energy demand in UAE. Econ Model 36:191–197

Seker F, Ertugrul HM, Cetin M (2015) The impact of foreign direct investment on environmental quality: a bounds testing and causality analysis for Turkey. Renew Sustain Energy Rev 52:347–356

Sinn HW (2008) Public policies against global warming: a supply side approach. Int Tax Public Finance 15:360–394

UNCTAD (2015) United Nations Conference on Trade and Development database. http://unctadstat.unctad.org/wds/TableViewer/tableView.aspx?ReportId=96740

Wang ZH, Zhang B, Zeng HL (2016) The effect of environmental regulation on external trade: empirical evidences from Chinese economy. J Clean Prod 114:55–61

Zarsky L (1999) Havens, halos and spaghetti: untangling the evidence about foreign direct investment and the environment. In: OECD conference on foreign direct investment and the environment, Paris

Zeng XG (2010) Environmental regulation, foreign direct investment “pollution haven” hypothesis. Econ Theory Bus Manag 11:65–71

Zhang H, Wei XP (2014) Green paradox or forced emission-reduction: dual effect of environmental regulation on carbon emissions. China Popul Resour Environ 24(9):21–29

Zhang CG, Zhou XX (2016) Does foreign direct investment lead to lower CO2 emissions? Evidence from a regional analysis in China. Renew Sustain Energy Rev 58:943–951

Zhao XL, Yin HT, Zhao Y (2015) Impact of environmental regulations on the efficiency and CO2 emissions of power plants in China. Appl Energy 149:238–247

Zhou XX, Feng C, Hu Y, Wei XP (2015) Environmental regulation and fossil energy consumption: based on the perspective of technological progress and economic structure transformation. China Popul Resour Environ 25(12):35–44

Zhou Q, Yabar H, Mizunoya T, Higano Y (2016) Exploring the potential of introducing technology innovation and regulations in the energy sector in China: a regional dynamic evaluation model. J Clean Prod 112:1537–1548

Zhu SJ, He CF, Liu Y (2014) Going green or going away: environmental regulation, economic geography and firms’ strategies in China’s pollution-intensive industries. Geoforum 55:53–65

Acknowledgments

We gratefully acknowledge financial support from the Jiangsu Provincial Graduate Innovation Project (KYZZ15_0371) and the Humanities and Social Science Fund of the Ministry of Education (15YJA630106).

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Xu, J., Zhou, M. & Li, H. ARDL-based research on the nexus among FDI, environmental regulation, and energy consumption in Shanghai (China). Nat Hazards 84, 551–564 (2016). https://doi.org/10.1007/s11069-016-2441-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11069-016-2441-7