Abstract

This study determines the relationship between economic growth, foreign direct investment, energy intensity, and carbon dioxide emissions along the Belt and Road initiative considering their income classification. The study employs data from 1995 to 2015, the panel unit root test, Westerlund cointegration test, augmented mean group estimation, and the Dumitrescu-Hurlin Granger causality test. The empirical results indicate that (1) the data from all income group had cross-sectional association; (2) the variables are integrated of order 1 after first difference; (3) The variables under discussion were cointegrated; (4) at 1% increase in energy consumption, carbon dioxide emissions increased by 0.8606%, 0.9082%, 0.91815%, and 0.8043% in high-, upper-middle-, lower-middle-, and low-income countries, respectively; (5) a bidirectional causal relationship was found between foreign direct investment and carbon dioxide across all income groups. Energy intensity has a bidirectional association with carbon dioxide in low-, upper-middle-, and high-income countries but one-way association in lower-middle-income countries. These recent methodologies take cross-sectional dependence into account in their estimation and findings show that the causal affiliations together with long-run estimated effects amid employed variables are influenced by the different income levels of Belt and Road countries in a tender to reduce carbon dioxide emissions. The empirical results point to some important policy implications.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

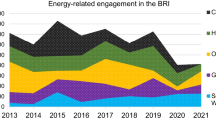

The Belt and Road initiative (BRI) is an ambitious move by China to promote economic cooperation. The “Belt” (Silk Road economic belt) links China with central Asia, South Asia, and Europe. The “Road” (new maritime Silk Road) connects China with Southeast Asian countries, gulf countries, North Africa, and Europe. As an economic cooperation, it provides interaction for organizations, enterprises, and governments along the BRI route. The interaction among these countries basically is to increase their economic growth. As stated by Mishkin (2009) in order to attain economic growth, countries must be open to the world through economic cooperation. Through economic cooperation, the host countries have several benefits not limited to wealth creation, increased in capita income, innovation products, and investments (Shahbaz et al. 2016).

In ripple effects, economic cooperation affects human lives in several ways, being it through overexploitation of natural resources, changes in consumption of energy, economic growth, foreign direct investment (FDI), jobs creation, and environmental changes (Benería et al. 2015). Among the various changes, CO2 emissions resulting from economic growth and the concomitant changes in the environmental are of much concern. In order to achieve the sustainable developmental goals, especially goal number 13, reduction of CO2 emissions which is known to be the main contributor to global warming cannot be underscored (Shahbaz et al. 2019). To this light Bulkeley and Newell (2015) stated that Climate change has become a key issue which has been debated worldwide and a global phenomenon which has become a threat to sustainable development.

The effects of economic cooperation on environmental pollution have had diverging opinions such that the endorsement of economic cooperation without paying attention to environmental pollution has been opined albeit the existence of opposing views. The principle that environmental pollutions are the trade-offs for economic benefits is arguable (Wang et al. 2016). Moreover, the economic cooperation benefits are felt only in developed economies as a result of social and political stability (Lipset 2018). Also, Ghosh (2010) stated that the effects of economic cooperation with regards to the environment pollutions are highly susceptible in developing countries owing to weak environmental standards and institutional quality.

The linkage between economic cooperation and pollution has been a subject of global discussion. Mishkin (2009) stated that economic cooperation leads to rise in gross domestic product (GDP), but some studies have hinted that the rise in GDP spikes CO2 emissions since it lowers the economic credit limits. The quest to establish the long-term link between the environment quality and GDP was set off by early works of Grossman and Krueger (1995). The existing literature widely used Kuznets Curve Environment (EKC) concept to depict the association among economic growth and carbon emissions. The inverted U-shape of EKC suggests the direct relationship between economic growth and the deterioration of the quality of environment. However, as the economic growth reaches its turning limit, the further increase in economic growth leads to environmental improvements (Charfeddine and Mrabet 2017). Recently, the EKC hypothesis has utilized in several studies (Hanif et al. 2019; Kaika and Zervas 2013; Sarkodie and Strezov 2018). Considering an increase in gross domestic product in the BRI countries from US $23.3199 trillion to US$ 25.466 trillion (constant in 2010) between 2014 and 2016 with a growth rate averaged at 1.2% (author computation), the BRI could be marked for emissions of CO2. Intriguingly, the findings by Sun et al. (2019) earlier envisaged the economic growth along the BRI upon using the PSM-DID to evaluate BRI. Therefore, this study included GDP into the discussion of carbon dioxide emissions in BRI countries.

The quality of the environment can as well be examined using foreign direct investment inflows (FDI). The relationship between FDI and environmental pollution has been controversial one. The pollution haven hypothesis has been the most famous hypothesis supporting the relationship between FDI and environmental pollution (López et al. 2018; Yang et al. 2018). The hypothesis stated that multi-state companies, mostly in developed countries, shift pollution-intensive industries to countries with lower environmental regulations to avoid costly compliance rules in their homeland. Hence, environmental pollution is heavily felt by developing countries making these developing countries a pollution haven. FDI can generate more pollution issues in the host country (Li et al. 2018; Zaidi et al. 2019). Hence, it was appropriate to include FDI in this study.

Energy intensity (EI) has been identified as another determinant of environmental quality. Energy intensity is the amount of energy required to produce a unit of an output (Greening et al. 2000). Since energy is equivalent to the value of converting energy into economic development, it functions as an indicator of energy usage and is debated as a necessary condition for economic cooperation (Overland 2016). Several studies have described a long-term link among EI and environmental pollution (Ben Jebli and Hadhri 2018; Solarin and Al-Mulali 2018). Therefore, this study included EI into the discussion of carbon dioxide emission in “One Belt And One Road” countries.

The relationship between CO2 emissions, GDP, EI, and FDI has been investigated for both developing countries (Liu and Hao 2018; Salahuddin et al. 2018; Saud et al. 2019b) as well as developed countries (Cai et al. 2018; Sarkodie and Strezov 2019) for which the long-term cointegration between those variables was established. It is worth noting that the validity of the EKC was established for some studies (Abdouli et al. 2018; Phuong 2018). The summary of literature in relation to this study is presented in Table 1.

Although the relationship between CO2 emissions, GDP, EI, and FDI has been well studied and reported in literature, the various income classification among the countries under studied remains vague. In response to this deficiency, we propose the significance of analyzing the different income samples from different countries. It is noteworthy that BRI can be a platform for countries to make greater contributions to achieving CO2 emission reduction targets (Liu and Hao 2018). By exploring links between these variables, researchers may be able to help determine whether FDI or EI is the main driver of increased CO2 emissions in various income groups. If FDI or EI helps mitigate emissions in income groups, then pursuing more FDI and the usage of EI will have beneficial effects on mitigating CO2 emissions. On the other hand, if FDI or EI increases CO2 emissions in income groups, then policies in reduction CO2 emission should be considered.

Therefore, the present study seeks to establish the dynamic link between CO2 emission and GDP, EI, and FDI of countries on the “One Belt And One Road” taking into consideration the income classifications. Also, the newly developed panel data augmented mean group (AMG) estimator employed in the study. More obviously, the advantage of the AMG is it robustness when dealing with cross-sectional dependency and the parameter of universal dynamic effect.

The remainder of this paper is organized as follows: section “Methodology” presents the methodology followed by empirical analysis; section “Long-run estimation and coefficient analysis” presents long run estimation and coefficient analysis, lastly with conclusion and policy recommendation.

Methodology

Theoretical model specification

Examining the causal relationship among GDP, EI, FDI, and CO2 emissions, this study adopts Balsalobre-Lorente et al. (2018) and others’ model; hence, we write our carbon emission estimate function as:

Where CO2 is carbon emission, GDP represents gross domestic product, GDP2 represents gdp squared, to measure EKC, EI stands for energy intensity, and foreign direct investment is represented by FDI. To address the problem of heteroskedasticity, the variables converted into natural log. Therefore, our multivariate carbon emission function for our natural log model is given by

where β0 represents the slope coefficient, i denotes the countries selected in this study (1, 2… N), t indicates the time frame for the analysis, and εit designates the error term. β1, β2, β3, and β4 are the coefficients of GDP, GDP2, EI, and FDI. The association between economic growth and CO2 emissions is known as the environmental Kuznets curve hypothesis (EKC). According to the EKC hypothesis, economic growth is initially accompanied by high carbon dioxide emissions and then declines as the economy reaches a mature level and reaches the threshold of real income per capita (Stern 2004). We therefore expect β1 > 0, β2 < 0 if linkage between economic growth and CO2 emissions is inverted U-shaped, i.e., EKC hypothesis otherwise β1 < 0, β2 > 0 if the relationship is U-shaped between economic growth and CO2 emissions.

Econometric approach

This study employs newly developed panel data analysis to obtain the empirical results. Panel data analysis is generally superior to pure cross section analysis. The advantage of panel data is its ability to provide least collinearity between larger data sets, greater variability among variables, which is not a criterion in cross-sectional data analysis. Therefore, a more reliable estimate can be obtained in the empirical analysis. In addition, the advantage of using panel data is the power to check individual heterogeneity between groups. The framework of the methods is as follows:

Cross-sectional dependence

Cross-sectional dependence is usually found in panel data, since countries are related at regional, income, and global level. CSD in different groups may occur due to mutual shock, spillovers, or common factors that cannot be observed. If studies ignore the existence of CSD, then the efficiency of the estimated results is arguable (Urbain and Westerlund 2006). Hence, before the empirical analysis, the Pesaran (2004) CD test was used to access the cross-sectional dependency. The panel data model can be described as

where i = 1, 2, ……N, t = 1, 2……T, βit is the K × 1 parameter vector to be estimated, xit is the K × 1 explanatory variable, αi is the individual redundant parameter, and μit is the time invariant assuming independent and identical distributions. The Pesaran (2004) statistic test is given by

where N is the sample size, T represents the period, and ρij is the product correlation errors of country i and j.

Panel unit root test

Pesaran (2007) CD cross-sectionally dependent augmented dickey fuller (CADF) test was adopted since it considers CSD. The regression for this test is given as

where \( {\overline{y}}_{\mathrm{t}}=\frac{1}{N}{\sum}_{i=1}^N{y}_{\mathrm{it}} \) and its inclusion in the equation can be used to replace the effect of the unseen common factor. αi is the time invariant individual intercept parameters, βi, θi, γij and δij represent individual specific effect, individual specific linear trend, and common time effect, respectively. εit is the error term. According to Pesaran (2007), stationarity test can be performed on the t-value of βi, either seperately or jointly. Since the test is like to the IPS statistic of Im et al. (2003), it is given as;

where ti(N, T) is the measure of βi in the equation above.

Panel cointegration

In observing the long run association amidst the variables in the model, the Westerlund-Edgerton bootstrap panel cointegration was adopted. They proposed four panel cointegration tests for the null hypothesis of no cointegration, taking into account structural dynamics. This test does not enforce any common constraints. This test not only provides good results, but also applies to all situations where CSD exists or does not exist. Westerlund and Edgerton (2007) suggested four residual test methods to evaluate the null hypothesis of no cointegration. Two of the tests are panel statistics (Gt and Ga), and the other two are group statistics (Pt and Pa), which are normally distributed. In effect, this test measures the existence of cointegration by judging whether there is an error correction in a single panel group and the whole panel. The model was built on

where i = 1……N, t = 1……T, xit = xi, t − 1 + vit is the k-dimensional vector being I(1). Dit represents the break dummy variables. Dit = 1 if \( t>{T}_{\mathrm{i}}^{\mathrm{b}} \) and zero otherwise.\( {T}_{\mathrm{i}}^{\mathrm{b}} \) represents the break for individual i.

Long run parameter estimation

AMG estimator formulated by Bond and Eberhardt (2013) was used in estimating the variables in this study. Ma (2015) stated that AMG method is robust in handling cross-sectional dependence. In addition, the AMG algorithm is not restricted by non-stationarities of variables during estimation (Balcilar et al. 2019). The main panel model Eq. (2) can be calculated as follows:

Equation 8 represents a standard ordinary least square (OLS) regression in the first difference (FD-OLS) with T-1 period dummies in the first difference(∆Dt), where qt is the parameter of the periodic dummy. Equation 9 contains ωt in the model. The inclusion of ωt is to compensate any excluded idiosyncratic process which evolve over time. ωt is subtracted from the dependent variable (equation 10), which means a common procedure is imposed on each set of unit coefficient. The AMG estimates are then derived as averages of the individual country estimates. The regression model for the group specific was first adjusted with βt; then, the average group-specific parameters were computed.

Causality estimation method

AMG algorithm estimation only gives the long-run estimation for the variables and cannot give the direction of causality unlike pooled mean group (PMG). Hence, the panel causality test proposed by Dumitrescu and Hurlin (2012) was employed. The D-H causality test adapts heterogeneousness and cross-sectional dependence in panel data, which cannot in the case vector error correction model (VECM) granger causality. The data model can be specified as

where n refers to lag length, x and y are the basic variables for n cross section in t perios.\( {\gamma}_{\mathrm{i}}^{\left(\uprho \right)} \) and \( {\beta}_{\mathrm{i}}^{\left(\uprho \right)} \) are the autoregressive parameters and regression coefficient for each panel or country, respectively.

Empirical results

Data source and description

About 70 countries make up the BRI; however, due to the availability of data and since this study used balanced data sets, only 44 countries were selected for this study with respect to the variables involved, with period 1995–2015. According to the 2014 world bank atlas method of gross national income per capita (GNI), the 44 countries were divided into four categories: high income (more than $12,736), upper-middle income ($4126–$12,736), lower-middle income ($1046–$4125), and low income (less than $1045). The HIC in this study consists of data from 15 countries, UMIC, LMIC, and LIC consist of data from 13, 10, 6 countries, respectively (Table 10). The data is converted into natural logarithms for the coefficient estimates to be explained as the elasticity of the dependent variable (carbon emissions). The countries involved were selected from the belt and road initiative book published in May 2016. Variables selected as a result of data are exemplified in Table 2 with their definition, symbol, and unit of measurement.

Descriptive statistics for the selected variables with respect to the sampled countries and the various income groups are presented in Table 3. It reveals that for the selected sampled countries, GDP is on average of 8.491 with a standard deviation of 0.918 compared to CO2 (M = 10.727, SD = 1.765). EI and FDI have M = 8.056 , SD = 1.411 and M = 15.662, SD = 1.701 , respectively. Comparing the descriptive for the various income groups, Table 3 again depicts that for GDP, HIC have M = 8.703 , SD = 0.720, UMIC have M = 8.881, SD = 0.304, LMIC have M = 8.407 , SD = 0.505, and LIC have M = 7.256, SD = 1.519, indicating that GDP is relatively high in UMIC followed by HIC then with LMIC and LIC having the lowest GDP among the income classification. In regard to CO2 emissions, HIC (M = 10.851, SD = 1.429), UMIC (M = 11.118, SD = 1.811), LMIC (M = 10.911, SD = 1.998), and LIC (M = 9.261, SD = 1.208), depicting CO2 emissions is averagely higher in UMIC and low in LIC among the groups. Considering energy intensity among the groups, HIC (M = 9.350 , SD = 0.767), UMIC (M = 7.990, SD = 0.914), LMIC (M = 7.026, SD = 0.746), and LIC (M = 6.680, SD = 1.598), indicating that energy consumption is averagely high in HIC and low in LIC among the classification. In regards to FDI, HIC (M = 14.756, SD = 1.304), UMIC (M = 15.761, SD = 1.731), LMIC (M = 16.615, SD = 1.841), and LIC (M = 16.122, SD = 1.037), revealing that FDI inflows is relatively high in LMIC while HIC has the lowest inflows among the income classification.

For normality test, skewness and kurtosis were to specify the normality assumption. For normal distribution, skewness and kurtosis must be 0, and 3 respectively. The results considering the sampled BRI countries, Table 3 reveals skewness for GDP and the squared of GDP are to the left which means that these variables are more to the left than normal distribution. CO2 emissions, FDI, and EI are skewed right, that is flattering to the right. This indicates that three out of five of the observations are heavily right tailed. With the peakness (kurtosis) of the distribution, CO2 emissions and FDI were approximately 3, indicating a mesokurtic distribution. For the value of GDP, squared of GDP and EI were above 3 which also symbolizes that their distribution is leptokurtic. Therefore, kurtosis and skewness conditions for normality were not satisfied by any variables; hence, we affirm that none of the variables were normally distrusted. Table 3 again reveals the violation of the normality assumption among the income groups for all the variables. In HIC and UMIC, GDP, GDP2, and EI are flattering to the left while CO2 and FDI are skewed to the right. In LMIC, GDP, GDP2, and CO2 are skewed to the left while EI and FDI are flattering to the right. This results from the three groups that indicate that three of variables are heavily left tailed. However, in LIC, CO2, EI, and FDI are skewed to the right while GDP and GDP2 are skewed to the left indicating more variables tailed to the right. The rejection of the normality assumption was strongly supported by the Jarque-Bera test for normality with the null hypothesis that all the variables follow a normal distribution at a rejection of a probability less than 0.05.

Multicollinearity among the independent variables (GDP, the square of GDP, EI, and FDI) was done using correlation and variance inflating factor. Table 4 gives the results of the interconnection test. The VIF value must not be greater than 5 and the tolerance value should be greater than 0.2 (Craney and Surles 2002). Hence, it can be concluded that each independent variable is uniquely impacting the dependent variable. The results from the correlation test support that there is no strong correlation among the independent variable (threshold 0.7). Hence, each variable is independent of the other and a unique and significant impact on CO2 emission.

Cross-sectional dependence test

Cross-sectional dependency (CSD) has been the key focus in current energy-economic literature (Dogan and Inglesi-Lotz 2017; Ozcan and Ari 2017). Table 5 gives the value of the CSD test and their corresponding probability values. CSD test values of each series in each panel (sampled BRI, HIC, UMIC, LMIC, and LIC) are significant at 1% level. Hence, the countries involved are connected in some way. Having confirmed CSD among groups of countries, the study relies on the second-generation panel unit root test to check stationarities of the variables. Therefore, CIPS and CADF were used in this study.

Panel unit root test

Table 6 indicates that variables in this study have unit roots at the level; however, in their first difference, they have no unit roots. Convinced that all variables are non-stationary at I(0), but become stationary at I(1), it is appropriate to study the existence of long-term association among variables.

Panel cointegration test

Westerlund-Edgerton bootstrap panel cointegration test was utilized to analyze whether there was a long-run association among variables. Techniques such as Kao and Johansen’s panel cointegration ignore CSD when testing for the long-term association. Findings from the Westerlund-Edgerton bootstrap panel cointegration are displayed in Table 7. Using CO2 as the dependent variable revealed that all the variables have long-term association in the various panels. Hence, the null hypothesis of no long-term association is declined at various significant level with respect to the statistics Gτ, Gα, Pτ, and Pα. Our argument was based on the robust p values which gives a robust evidence of long-term association within the series.

Long-run estimation and coefficient analysis

Long-run analysis (AMG estimation)

In the estimation analysis of our parameters, the paper employed AMG estimator to check the effects of GDP, GDP2, EI, and FDI on CO2 emissions. The results obtained are displayed in Table 8. The relationship between coefficients of GDP2 and CO2 emissions reflects the concept of EKC. When GDP increases by 1%, CO2 discharge also goes up by 0.0189%, while 1% rise in GDP2, shorten the quality of the environment by 0.2055% which is statistically significant for all countries in BRI. Likewise for HIC when GDP accelerates by 1%, the quality of the environment is shortened by 0.0208% while a percentage mount in GDP2 diminishes CO2 discharge by 0.3243% significantly. Also, for UMIC 1% increases in GDP vitiate the quality of environment by 0.01660% which is statistically significant, while 1% rise in GDP2 quashes the quality of the environment by 0.1909% significantly. Similarly in LMIC countries, a 1%, rise in GDP also corrupts the environment by 0.0095%, while a 1% boost in GDP2 increases CO2 emissions by 0.3094% but not significant.

Likewise for LIC when GDP increases by 1%, it weakens the environment quality by 0.0572%, and while 1% rise in GDP2 diminishes the quality of the environment by 0.9552% but not statistically significant. Considering the insignificant GDP2 in LMIC and LIC suggests that EKC does not exist in this income group. This may be due to the same concept as other developing economies, LMIC and LIC have not yet achieved a full-standard industrial economy. The inverted U-shaped in HIC suggests increased economic growth in HIC at early stage also stimulated carbon dioxide emissions to a certain level in the early stages, but after reaching this limit, carbon dioxide emissions began to decline as economic growth increased further.

At the initial stages of economic growth, these countries focused mainly on economic expansion, ignoring the environment and aiming at boosting trade and infrastructure with other countries through cooperation and financial development. Economic growth has increased personal income, thus increasing energy demand and worsening environmental conditions. Finally, rising income levels bring social and environmental awareness, which helps abridge environmental pollution (Zaidi et al. 2018). The evolution of EKC effect is due to the improvement of mass production technology and citizens’ demands on environmental quality. These results are consistent to those of Rafindadi and Ozturk, 2017for African economies, Haseeb et al. (2018) for BRICS countries, Bekhet and Othman, 2017 on Malaysia, and Sinha and Shahbaz (2018) for India. The U-shape in BRI panel and UMIC is an indication of no strong evidence for the existence of EKC for CO2 emissions. Therefore, these results are consistent with Liu and Hao, 2018 research in investigating EKC hypothesis in the BRI, Balaguer and Cantavella (2016) for Spain, Pata (2018) for Turkey.

The results also display that EI has a significant positive relation with CO2 emissions, as a 1% rise in EI corresponds to a 0.9441% rise in CO2 emissions in BRI panel. In their income group levels, 1% increase in EI increases 0.8606%, 0.9082%, 0.91815%, 0.8043% rise in CO2 emissions in HIC, UMIC, LMIC, and LIC, respectively, which are statistically significant. This result depicts that the establishment of more local and foreign companies in these countries enable local residents have more jobs and energy needs rises. The increment of firms enhances energy usage which then increases CO2 emissions. However, at later stages, when the local and foreign firms have matured, they invest in energy-efficient infrastructure to lessen CO2 emissions. Our results show that energy use is the main cause of carbon dioxide emissions. Therefore, BRI construction must shift energy consumption to renewable energy and achieve zero-emission growth. In addition as stated by Qasemi-Kordkheili and Nabavi-Pelesaraei (2014), energy efficiency demands innovative models to estimate the optimization of energy need and the potential decrease of greenhouse gases. We support their view that traditional energy can promote economic growth, but it is very harmful to the environment since it increases carbon dioxide emissions.

For the link between FDI with CO2 emissions, a percentage increment in FDI pollutes the environmental quality by 0.6945% for all countries involved in the whole panel. For high-income countries, a 1% increase in FDI mitigates the quality of environment by 0.0581%. In low-income countries, a rise of 1% in FDI also corrupts the environment by 1.8287%. It can be concluded that FDI stimulates carbon emission in the long term in this panel group.

The RMSE value is a good measure of how accurately the model predict the response variable. Small value of RMSE indicates a better model fit; hence, it can be deduced that the values of RMSE for BRI countries, HIC, UMIC, LMIC, and LIC are 0.0553, 0.0353, 0.0383, 0.02558, and 0.0432, respectively. Therefore, each panel model is fit in predicting the CO2 emissions.

Panel causality test

Dumitrescu and Hurlin (2012) causality test (D-H) was used due to the occurrence of CSD among the variables since AMG estimate does not propose a causal path. In the D-H test, the significance of causal relationship is tested by two kinds of statistics: w-bar statistics (average statistics are used for the test) and z-bar information (standard normal distribution is used for the test). The results of D-H causality test are reproduced in Table 9 for all countries in the Belt and Road initiative.

For all county panel, the results proposed a bidirectional causality amidst CO2 emissions and all the independent variables (GDP, EI, and FDI). A bidirectional causal effect was found between GDP and EI, GDP and FDI, and EI and FDI. This outcome implies that EI in countries on the BRI and their economic growth is correlated, such that increase in EI will spark economic growth of these countries. This outcome is in consonant with the study done (Li et al. 2015; Saud et al. 2019c). For HIC, there was an evidence of a unidirectional causality between GDP and CO2 emissions. Notwithstanding, a bidirectional causality between CO2 and EI, CO2 and FDI, and EI and FDI was depicted. Last but not the least, there is a one-way causal effect from EI to GDP. In the case of LIC, there is a unidirectional causality from CO2 emissions to GDP. Likewise, a bidirectional causal effect between CO2 and FDI, EI and GDP, and EI and FDI was revealed. Finally, there is a one-way causal relationship from FDI and GDP.

For LMIC, there is a two-way causal relationship that was depicted between CO2 and GDP, CO2 and FDI, and GDP and EI. The results also suggest a unidirectional causality from EI to CO2 emission, likewise from FDI to EI. Lastly for the UMIC, a bidirectional causal effect amidst CO2 emissions and the each of the other variables (GDP, EI, and FDI), likewise a bidirectional association between GDP and EI and a unidirectional causality from EI to FDI was depicted. Interestingly, the relationship between EI and CO2 emissions in all panel groups is in consonant with the findings of Liu and Hao (2018) in their study on BRI countries, Asafu-Adjaye et al. (2016) for of 53 countries globally. Not forgetting the causal relationship amid CO2 emissions and GDP, the findings are consistent with that of Shahbaz et al. (2015) in studying some African countries, and Ali and Malik (2018) for the study on Pakistan. The results from the D-H granger causality links are summarized in Fig. 1.

Conclusion and policy recommendation

This empirical study seeks to establish the dynamic nexus among CO2 emissions, GDP, EI, and FDI along the BRI countries using data from 1995 to 2015. The main panel was divided into sub-panel group using the four income classification: HIC, UMIC, LMIC, and LIC. Analysis was done on the sampled panel and the sub-panels. In summary, Pesaran CD’s test was done to determine CSD among the variables. In addition, the CADF and CIPS panel stationarity tests were performed due to the presence of CSD. From the result, we infer that the variables are unstable at their level, but stable at their first difference. Westerlund-Edgerton panel bootstrap cointegration test was used to determine if the variables are cointegrated. From the results, the variables were cointegrated and we deduced that there is a structural long-run relationship. Hence, we employed AMG estimator which is more robust to CSD in estimation of the variables. Since AMG cannot indicate the direction of the long-run relationship, Dumitrescu and Hurlin (2012) panel causality test employed. The result from the causality test indicated that the results depicted that LIC, UMIC, and HIC followed the feedback hypothesis, which is indicated by a bidirectional causal effect between CO2 and energy consumption. That income groups (HIC, UMIC, and LIC) exhibited a bidirectional association among EI and CO2 emissions with exception of LMIC which has a one-way causal effect from CO2 to EI. However, the main sampled BRI countries, a bidirectional causal effect amidst CO2 and EI. In addition, all panel exhibits a bidirectional causal effect between CO2 and FDI, indicating that environmental pollution is enhanced by FDI inflows. Again, UMIC and LMIC displayed a bidirectional causal relationship among GDP and CO2 emissions. While a unidirectional causal effect was depicted from GDP to CO2 emissions in HIC and LIC, EKC was found in HIC (inverted U-shape) while in UMIC, LMIC, and LIC, no presence of EKC (U-shape).

Policy implications in regards to this study will be as follows; first, the results indicate that for most countries, CO2 emissions are energy-driven; the long-term two-way granger causality affirms this conclusion. This result shows that countries along the BRI must strive to establish effective energy policies to reduce CO2 emissions in order to achieve the sustainable development goal (13). Hence, reducing the use of fossil fuels which is the main cause of CO2 is a shared responsibility. Secondly in regards to FDI-CO2 emission relationship, countries along the BRI need to develop policies that encourage public-private partnerships in producing safe energy from different sources. Thirdly from these findings is the role that a country’s income level plays, the most common factor in increasing CO2 emissions among all income groups (HIC, UMIC, LMIC, and LIC) is FDI. However, EI also plays an important role in increasing CO2 emissions in LIC, UMIC, and HIC while GDP increases CO2 emissions in UMIC and LMIC. Given these differences, decision makers need to take into account the effects of various variables in their decision-making process and consider them in different ways depending on the income level of a given country. Lastly, for all income groups, GDP tends to mean increase in energy consumption and increased CO2 emissions; therefore, promoting the transition to a renewable or nuclear energy usage is best way to reduce environmental pollution associated with economic cooperation.

The limitation of this study is that some BRI countries were excluded from the panel set due to missing data. Although this study conducted a preliminary quantitative study on CO2 emission, GDP, FDI, and EI of countries along the BRI, still has some limitations, which may become the direction of future research. Future research may include all countries using unbalanced data when investigating the income groups in BRI countries. Again, since the relationships discussed in this paper may be quadratic, some appropriate methods, such as panel smooth transition regression models, can be used to establish relationships when the time frame is much longer. Due to non-linear reasons, the longer the sample time and the longer the period, the clearer the result.

References

Abdouli M, Kamoun O, Hamdi B (2018) The impact of economic growth, population density, and FDI inflows on $$\text {CO} _ {2} $$ emissions in BRICTS countries: does the Kuznets curve exist? Empir Econ 54:1717–1742

Ali M, Malik IR (2017) Impact of foreign direct investment on economic growth of Pakistan. Foundation University Journal B E, 3(2):189–224

Asafu-Adjaye J, Byrne D, Alvarez M (2016) Economic growth, fossil fuel and non-fossil consumption: a pooled mean group analysis using proxies for capital. Energy Econ 60:345–356

Balaguer J, Cantavella M (2016) Estimating the environmental Kuznets curve for Spain by considering fuel oil prices (1874–2011). Ecol Indic 60:853–859

Balcilar M, Gungor H, Olasehinde-Williams G (2019) On the impact of globalization on financial development: a multi-country panel study. Eur J Sustain Dev 8(1):350–364

Balsalobre-Lorente D, Shahbaz M, Roubaud D, Farhani S (2018) How economic growth, renewable electricity and natural resources contribute to CO2 emissions? Energy Policy 113:356–367

Bekhet HA, Othman NS (2017) Impact of urbanization growth on Malaysia CO2 emissions: evidence from the dynamic relationship. J Clean Prod 154:374–388

Ben Jebli M, Hadhri W (2018) The dynamic causal links between CO2 emissions from transport, real GDP, energy use and international tourism. Int J Sust Dev World 25:568–577

Benería L, Berik G, Floro M (2015) Gender, development and globalization: economics as if all people mattered. Routledge. New York

Bond S, Eberhardt M (2013) Accounting for unobserved heterogeneity in panel time series models. Nuffield College, University of Oxford, mimeo, Discussion paper series 2010 (No. 515)

Bulkeley H, Newell P (2015) Governing climate change. Routledge, London

Cai Y, Sam CY, Chang T (2018) Nexus between clean energy consumption, economic growth and CO2 emissions. J Clean Prod 182:1001–1011

Cetin M, Ecevit E, Yucel AG (2018) The impact of economic growth, energy consumption, trade openness, and financial development on carbon emissions: empirical evidence from Turkey. Environ Sci Pollut Res 25:36589–36603

Charfeddine L, Mrabet Z (2017) The impact of economic development and social-political factors on ecological footprint: a panel data analysis for 15 MENA countries. Renew Sust Energ Rev 76:138–154

Craney TA, Surles JG (2002) Model-dependent variance inflation factor cutoff values. Qual Eng 14:391–403

Destek MA, Sarkodie SA (2019) Investigation of environmental Kuznets curve for ecological footprint: the role of energy and financial development. Sci Total Environ 650:2483–2489

Dogan E, Inglesi-Lotz R (2017) Analyzing the effects of real income and biomass energy consumption on carbon dioxide (CO2) emissions: empirical evidence from the panel of biomass-consuming countries. Energy 138:721–727

Dong F, Wang Y, Su B, Hua Y, Zhang Y (2019) The process of peak CO2 emissions in developed economies: a perspective of industrialization and urbanization. Resour Conserv Recycl 141:61–75

Dumitrescu E-I, Hurlin C (2012) Testing for granger non-causality in heterogeneous panels. Econ Model 29:1450–1460

Ghosh S (2010) Examining carbon emissions economic growth nexus for India: a multivariate cointegration approach. Energy Policy 38:3008–3014

Greening LA, Greene DL, Difiglio C (2000) Energy efficiency and consumption—the rebound effect—a survey. Energy Policy 28:389–401

Grossman GM, Krueger AB (1995) Economic growth and the environment. Q J Econ 110:353–377

Hafeez M, Chunhui Y, Strohmaier D, Ahmed M, Jie L (2018) Does finance affect environmental degradation: evidence from one belt and one road initiative region? Environ Sci Pollut Res 25:9579–9592

Hanif I, Raza SMF, Gago-de-Santos P, Abbas Q (2019) Fossil fuels, foreign direct investment, and economic growth have triggered CO2 emissions in emerging Asian economies: some empirical evidence. Energy 171:493–501

Haseeb A, Xia E, Baloch MA, Abbas K (2018) Financial development, globalization, and CO 2 emission in the presence of EKC: evidence from BRICS countries. Environ Sci Pollut Res 25:31283–31296

Im KS, Pesaran MH, Shin Y (2003) Testing for unit roots in heterogeneous panels. J Econ 115:53–74

Jugurnath B, Emrith A (2018) Impact of foreign direct investment on environment degradation: evidence from SIDS countries. J Dev Areas 52:13–26

Kaika D, Zervas E (2013) The environmental Kuznets curve (EKC) theory—part a: concept, causes and the CO2 emissions case. Energy Policy 62:1392–1402

Li P, Qian H, Howard KW, Wu J (2015) Building a new and sustainable “silk road economic belt”. Environ Earth Sci 74:7267–7270

Li MH, Cui L, Lu J (2018): Varieties in state capitalism: outward FDI strategies of central and local state-owned enterprises from emerging economy countries, state-owned multinationals. Springer, pp. 175-210

Lipset S (2018) Social mobility in industrial society. Routledge, London and New York

Liu Y, Hao Y (2018) The dynamic links between CO2 emissions, energy consumption and economic development in the countries along “the belt and road”. Sci Total Environ 645:674–683

Liu H, Kim H (2018) Ecological footprint, foreign direct investment, and gross domestic production: evidence of Belt & Road Initiative countries. Sustainability 10:3527

López LA, Arce G, Kronenberg T, Rodrigues JF (2018) Trade from resource-rich countries avoids the existence of a global pollution haven hypothesis. J Clean Prod 175:599–611

Ma B (2015) Does urbanization affect energy intensities across provinces in China? Long-run elasticities estimation using dynamic panels with heterogeneous slopes. Energy Econ 49:390–401

Magazzino C (2016) The relationship between real GDP, CO2 emissions, and energy use in the GCC countries: a time series approach. Cogent Economics & Finance 4:1152729

Mishkin FS (2009) Globalization and financial development. J Dev Econ 89:164–169

Nasir MA, Huynh TLD, Tram HTX (2019) Role of financial development, economic growth & foreign direct investment in driving climate change: a case of emerging ASEAN. J Environ Manag 242:131–141

Overland I (2016) Energy: the missing link in globalization. Energy Res Soc Sci 14:122–130

Ozcan B, Ari A (2017) Nuclear energy-economic growth nexus in OECD countries: a panel data analysis. JEP 11:138–154

Pata UK (2018) Renewable energy consumption, urbanization, financial development, income and CO2 emissions in Turkey: testing EKC hypothesis with structural breaks. J Clean Prod 187:770–779

Pesaran MH (2004): General diagnostic tests for cross section dependence in panels

Pesaran MH (2007) A simple panel unit root test in the presence of cross-section dependence. J Appl Econ 22:265–312

Phuong ND (2018) The relationship between foreign direct investment, economic growth and environmental pollution in Vietnam: an autoregressive distributed lags approach. Int J Energy Econ Policy 8:138–145

Qasemi-Kordkheili P, Nabavi-Pelesaraei A (2014) Optimization of energy required and potential of greenhouse gas emissions reductions for nectarine production using data envelopment analysis approach. IJEE 5:207–218

Rafindadi AA, Ozturk I (2017) Dynamic effects of financial development, trade openness and economic growth on energy consumption: evidence from South Africa. Int J Energy Econ Policy 7:74–85

Salahuddin M, Alam K, Ozturk I, Sohag K (2018) The effects of electricity consumption, economic growth, financial development and foreign direct investment on CO2 emissions in Kuwait. Renew Sust Energ Rev 81:2002–2010

Sarkodie SA, Strezov V (2018) Empirical study of the environmental Kuznets curve and environmental sustainability curve hypothesis for Australia, China, Ghana and USA. J Clean Prod 201:98–110

Sarkodie SA, Strezov V (2019) Effect of foreign direct investments, economic development and energy consumption on greenhouse gas emissions in developing countries. Sci Total Environ 646:862–871

Saud S, Chen S, Haseeb A (2019a) The role of financial development and globalization in the environment: Accounting ecological footprint indicators for selected one-belt-one-road initiative countries. Journal of Cleaner Production, 26(3): 2253–2269

Saud S, Chen S, Haseeb A (2019b) Impact of financial development and economic growth on environmental quality: an empirical analysis from belt and road initiative (BRI) countries. Environ Sci Pollut Res 26:2253–2269

Saud S, Chen S, Haseeb A, Khan K, Imran M (2019c) The nexus between financial development, income level, and environment in central and eastern European countries: a perspective on belt and road initiative. Environ Sci Pollut Res 26:16053–16075

Shahbaz M, Solarin SA, Sbia R, Bibi S (2015) Does energy intensity contribute to CO2 emissions? A trivariate analysis in selected African countries. Ecol Indic 50:215–224

Shahbaz M, Mallick H, Mahalik MK, Sadorsky P (2016) The role of globalization on the recent evolution of energy demand in India: implications for sustainable development. Energy Econ 55:52–68

Shahbaz M, Balsalobre-Lorente D, Sinha A (2019) Foreign direct investment–CO2 emissions nexus in Middle East and north African countries: importance of biomass energy consumption. J Clean Prod 217:603–614

Sinha A, Shahbaz M (2018) Estimation of environmental Kuznets curve for CO2 emission: role of renewable energy generation in India. Renew Energy 119:703–711

Solarin SA, Al-Mulali U (2018) Influence of foreign direct investment on indicators of environmental degradation. Environ Sci Pollut Res 25:24845–24859

Stern DI (2004) The rise and fall of the environmental Kuznets curve. World Dev 32:1419–1439

Sun Q, Zhang X, Xu X, Yang Q, Wang S (2019) Does the “belt and road initiative” promote the economic growth of participating countries? Sustainability 11:5240

Urbain J, Westerlund J (2006) Spurious regression in nonstationary panels with cross-unit cointegration. Journal of Economic Literature, C13-C33, 1–7

Wang S, Li Q, Fang C, Zhou C (2016) The relationship between economic growth, energy consumption, and CO2 emissions: empirical evidence from China. Sci Total Environ 542:360–371

Wang S, Li G, Fang C (2018) Urbanization, economic growth, energy consumption, and CO2 emissions: empirical evidence from countries with different income levels. Renew Sust Energ Rev 81:2144–2159

Westerlund J, Edgerton DL (2007) A panel bootstrap cointegration test. Econ Lett 97:185–190

Yang J, Guo H, Liu B, Shi R, Zhang B, Ye W (2018) Environmental regulation and the pollution haven hypothesis: do environmental regulation measures matter? J Clean Prod 202:993–1000

Zaidi SAH, Hou F, Mirza FM (2018) The role of renewable and non-renewable energy consumption in CO 2 emissions: a disaggregate analysis of Pakistan. Environ Sci Pollut Res 25:31616–31629

Zaidi SAH, Zafar MW, Shahbaz M, Hou F (2019) Dynamic linkages between globalization, financial development and carbon emissions: evidence from Asia Pacific economic cooperation countries. J Clean Prod 228:533–543

Funding

This study is sponsored by Prof. Wu Jiying who has received a research grant from Humanities and Social Science Research Youth Fund Project of Ministry of Education of China (17YJC910008).

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible editor: Muhammad Shahbaz

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Abban, O.J., Wu, J. & Mensah, I.A. Analysis on the nexus amid CO2 emissions, energy intensity, economic growth, and foreign direct investment in Belt and Road economies: does the level of income matter?. Environ Sci Pollut Res 27, 11387–11402 (2020). https://doi.org/10.1007/s11356-020-07685-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-020-07685-9