Abstract

The existing literature on the determinants of income redistribution has identified a ‘paradox’. Namely, that countries with a high degree of market income inequality redistribute little, which is in disagreement with the median voter theorem. In a first step, this paper outlines several mechanisms that explain why government corruption might be partially responsible for this ‘paradox’. In a second step, different corruption perception indices and an instrumental variable approach are used to provide empirical evidence that indicates a significant negative impact of corruption on redistribution levels for a sample of 148 developing and developed countries. This finding suggests that, next to political and need factors, government corruption explains to some extent the ‘paradox of redistribution’. This is especially true for many developing countries, given that they typically have relatively high degrees of corruption and low levels of redistribution.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Income inequality can be measured either in market terms (based on labor and capital income) or in net terms (based on market income adjusted by tax payments on income and wealth, social contributions, and transfer receipts). According to the median voter theorem, countries with high market income inequality are expected to have progressive tax and transfer systems, because for the majority of voters the potential gains from redistribution are huge (Black 1958; Roberts 1977; Römer and Rosenthal 1979; Meltzer and Richard 1981). However, the reality is rather different in the sense that many countries with relatively high levels of market income inequality have relatively low levels of redistribution. Breyer and Ursprung (1998) call this phenomenon the ‘paradox of redistribution’.

Previous studies argue that fairness considerations (Alesina and Angeletos 2005), mobility expectations (Piketty 1995; Bénabou and Ok 2001; Smyth et al. 2010) or political institutions and the electoral and political system (Bradley et al. 2003; Iversen and Soskice 2006; Mahler and Jesuit 2006) explain this ‘paradox’ to some extent. The aim of this paper is to assess government corruption (i.e. the use of official power for illegitimate private enrichment) as an additional explanation for the ‘paradox’.

Our hypothesis is that countries with higher levels of government corruption tend to redistribute less income. Between 2003 and 2015 countries that where above Transparency International’s average corruption score (4.05) had a relative redistribution level of 28%, whereas the relative redistribution level for countries below the mean was 13%.Footnote 1 That is to say, on average, countries with low levels of corruption redistributed more than twice as much income as countries with high corruption levels.

Synthetizing existing literature, it is argued that various mechanisms can explain why corruption has a negative effect on redistribution. On the one hand, voters in corrupt countries might demand less redistribution because they have low trust in the institutions (Rothstein and Uslaner 2005; Yamamura 2014) or because the rich elite is buying their votes to prevent higher taxes and redistribution (Breyer and Ursprung 1998; Docquier and Tarbalouti 2001). On the other hand, corruption might limit the government’s response to the redistribution demands of the median voter. LobbyingFootnote 2 and bribery might prevent the implementation of high tax rates and redistributive policies (Hasen 2012; Crotty 2013; Gilens and Page 2014), or corruption might lead to an inefficient tax collection system and leaves fewer resources available for social welfare programs (Sanyal et al. 2000; Rothstein and Uslaner 2005).

The unique contribution of this paper is that it empirically examines the overall impact of government corruption on income redistribution for up to 148 developing and developed countries. An important limitation of the existing empirical literature that aims to explain the ‘paradox of redistribution’ is that it concentrates on developed countries (e.g. Milanovic 2000; Crepaz 2002; Iversen and Soskice 2006; Huber and Stephens 2014). Moreover, the few existing papers that study the impact of corruption on redistribution do not measure the actual degree of redistribution but instead use redistribution proxies such as the tax rate and government revenue (e.g. Balafoutas 2011; Pani 2011). In contrast, the redistribution measure in this paper is the difference between market and net income inequality Gini coefficients (normalized by market inequality Gini coefficients) that are reported in the relatively new but widely used Standardized World Income Inequality Database (SWIID).

The obtained results suggest that corruption certainly has a negative impact on income redistribution; a decrease of one standard deviation in corruption (measured by Transparency International’s Corruption Perception Index (CPI)) implies an increase in redistribution of approximately 3.8 percentage points. The results are robust after controlling for potential endogeneity caused by reverse causality—applying an Instrument Variable (IV) and Two-Stage Least Square (2SLS) methodology—and also in specifications that consider alternative corruption proxies.

The paper is organized as follows: Sect. 2 discusses the ‘paradox of redistribution’ and its standard explanations. Section 3 synthesizes the possible effects of corruption on redistribution demand and supply. Section 4 gives an overview of the model specification and the data used. Section 5 presents and discusses the empirical results. Section 6 offers conclusions.

2 The ‘Paradox of Redistribution’ and Its Standard Explanations

The most widely discussed theory about why some governments redistribute more than others is the median voter theorem. This theorem argues that: (i) in unequal countries the representative citizen will demand redistribution because her income is below the mean, and (ii) the higher the level of market income inequality, the higher the gains of redistribution for the median voter, and thus the higher her demand for redistributive policies. Considering that politicians are self-interested and want to reach and stay in power, countries with high levels of market income are expected have high levels of redistribution (Meltzer and Richard 1981; Milanovic 2000; Luebker 2014).

However, the empirical evidence for this theorem is rather shaky. In studies that consider market and net income, some find that higher market inequality leads to higher levels of redistribution (Milanovic 2000; Kenworthy and Pontusson 2005), but others do not find a significant relationship between these two variables (Iversen and Soskice 2006; Luebker 2014). Considering that especially highly unequal developing countries have low levels of redistribution (Corbacho et al. 2013), a common shortcoming of these studies is that they concentrate on developed countries.Footnote 3 Hence, some studies use redistribution proxies (like tax rates, the GDP share of government spending or public social spending) in order to include more developing countries in the analysis. However, the results of these studies also do not provide strong support for the median voter theorem (see e.g. Perotti 1996; de Mello and Tiongson 2006).

There are various explanations for this ‘paradox of redistribution’. One strand of literature hypothesizes that people consider other aspects besides their income or present position in the distribution when demanding redistributive policies. For example, Alesina and Angeletos (2005) propose that fairness judgments about the source of inequality and mobility expectations might be one reason why some countries with high market inequality have low levels of redistribution. According to this view, people demand low redistribution levels even when inequality is high when they think it is an outcome of effort and hard work. Piketty (1995), Bénabou and Ok (2001) and Smyth et al. (2010) show that, additionally, redistribution demand depends on people’s considerations regarding upward mobility prospects, i.e. people that at present have an income below the mean do not demand redistributive policies when they expect to move up the income ladder in the future.

A second strand of literature relates redistributional differences to power structures and political institutions. Instead of concentrating on the formation of public redistribution preferences, this literature examines how certain political institutions may create distortions between the actual demand for and the supply of redistribution policies (i.e. the non-implementation of the demand for redistribution). Large parts of this literature provide empirical evidence that indicates that countries have higher levels of redistribution when they have a coordinated working-class (i.e. countries with high union density or a high degree of wage coordination) and/or left-wing parties in power (e.g. Crepaz 2002; Bradley et al. 2003; Mahler and Jesuit 2006; Huber and Stephens 2014). In the same vein, proportional electoral systems are associated with more redistribution (Iversen and Soskice 2006, 2009), whereas countries with presidential governments have been found to redistribute less (Becher 2012; Corbacho et al. 2013).

Finally, so called need factors might explain why some countries redistribute more than others. These need factors are related to social security payments that typically target specific population groups, which means that an increase in their relative population size automatically leads to an increase in transfers. Examples of such population groups are the unemployed (Iversen and Soskice 2006; Huber and Stephens 2014; Luebker 2014) and those claiming state pensions (Mahler and Jesuit 2006; de Mello and Tiongson 2006; Luebker 2014).

3 Corruption and the Demand and Supply for Redistributive Policies

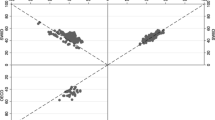

Some studies also discuss the effect of government corruption on redistribution patterns. This literature can be separated in two groups: one group that studies the potential negative effect of corruption on the public demand for redistribution and a second group that analyzes how far corruption might influence the supply of funds available for redistribution. To be more precise, the ‘demand-side’ literature argues that corruption might discourage voters to demand redistributive policies, whereas the ‘supply-side’ literature asserts that corruption can affect negatively the implementation of redistributive policies (see Fig. 1 for an overview).

Of the ‘demand-side’ literature, one set of studies argues that high income earners have the financial ability to buy a sufficiently large fraction of votes to ensure that the majority of voters votes against confiscatory taxation (Breyer and Ursprung 1998; Docquier and Tarbalouti 2001; Acemoglu et al. 2011). This bribery of the median voter can take various forms like cash payments, payments in kind (like food), job offerings, or the promise that after the election some sorts of public goods will be provided to them by the elected government. A necessary condition for the presence of vote-buying is that its cost is smaller than the expected gains for the economic elite, which implies that the incentive to bribe voters is especially large in developing countries where many voters are relatively poor. Moreover, it has been argued that vote-buying becomes cheaper over time, given that it decreases the expectations of the poor regarding future government policies (Balafoutas 2011).

A second, growing body of literature argues that an increase in corruption leads to a decrease in the social trust in institutions and, as a consequence, to a decrease in the demand for redistribution (Rothstein and Uslaner 2005; Uslaner 2008; Yamamura 2014). Levels of trust in a government depend on how well its leaders behave and manage society, and a high degree of corruption reduces confidence that a government uses tax revenues in a socially beneficial way. A decrease in social trust thus diminishes public demand for taxes and redistributive policies. Marr and Ming (2014), Algan et al. (2016) and Pellegata and Memoli (2016) provide empirical evidence for this view that the efficiency of institutions (parliament, politicians and the legal system) is a significant determinant of support for redistribution and that corruption can erode confidence in political institutions. Furthermore, their research suggests that corruption is positively correlated with the people’s perception regarding the quality of services provided by the welfare state.

Regarding the ‘supply-side’ mechanisms, two channels can again be distinguished. The first is related to lobbying, group pressure and bribery payments to politicians. These can result in the shaping of laws and programs in favor of particular interest groups that are not in accordance with the demands of the median voter. Here it is helpful to make the distinction between de jure and de facto political power (Acemoglu and Robinson’s 2008). De jure political power is determined by the country’s political institutions, whereas de facto political power depends on the organization of and money spent by different groups within society. The economic elite tends to use its money to influence political decisions with the aim of achieving de facto outcomes in accordance with its interests, in spite of being the minority.

This paper refers specifically to circumstances in which the elite obtains de facto political power trough bribes and lobbying practices that negatively influence taxation or the implementation of redistribution policies. That is to say, that the economic elite might successfully prevent the implementation of high tax rates on high incomes (Hasen 2012; Crotty 2013) or that they accept these taxes but influence policies in a way that the transfer of the tax revenue is not redistributive. In line with this argument, Gilens and Page (2014) provide empirical evidence that shows that economic elites have a substantial impact on US government policy, while average citizens and mass-based interest groups have very little influence.

The second channel relates to the direct costs of government corruption. On the one hand, corruption might bring about a loss of tax revenue when it impedes an efficient tax collection system, e.g. when it fosters tax evasion or the improper use of discretionary tax exemptions (Mauro 1997; Gupta et al. 1998; Sanyal et al. 2000). On the other hand, corrupt governments leave fewer resources available to be spent on social welfare programs (Tanzi 1998; Mauro 2004; Rothstein and Uslaner 2005). To quote Robinson (2010: 47), “politicians may deviate from promises because…they want to steal for themselves money that they promised to spend on providing public goods for citizens”.

Quantifying the direct costs of corruption on public funds is difficult, given the secretive nature of corruption. Nevertheless, Pani (2011: 164) provides some empirical evidence suggesting that “corruption appears to have a significant negative impact on tax revenue in democratic countries”, and Olken (2006) shows that corruption can lower the gains of in-kind transfers in developing countries; studying the effect of corruption on subsidized rice distribution to poor households in Indonesia, he finds that corruption lowers the welfare gains of the program by about 20%.

The following hypothesis is derived based on this literature:

-

Government corruption diminishes the redistribution of income.

Existing cross-country studies that provide empirical evidence for this hypothesis have the limitation that they use government revenue or income tax rates as proxies to calculate the degree of redistribution (Balafoutas 2011; Pani 2011). These indirect redistribution measures have the shortcoming that “a society with high taxes and transfers may have contributors and beneficiaries who are the same people” (Milanovic 2000: 370). To address this limitation, we use the difference between market and net income inequality (normalized by market inequality) as a redistribution measure. This redistribution measure does not permit a distinction between the above discussed mechanisms, but it has the advantage that it allows a direct evaluation of the total effect of government corruption on the overall progressivity of the tax and transfer system.

4 Research Design

4.1 Model Specification

To test our hypothesis that redistribution is negatively correlated with the level of corruption, we set out a panel data model with the following specification:

where Redistr it is the level of redistribution of the i-th country in year t, defined as (Gini market − Gini net )/Gini market ), Corrup it is the level of corruption of the i-th country in year t; X′ is a set of covariates, and µ it is an error term.

We estimate the model using the between effects estimator, which averages out the time components in each country (i.e. the model exploits only the cross-sectional variation of the data). We use this approach for three reasons: First, it is well established that our variables of interest, corruption and redistribution, are very persistent through time.Footnote 4 This means that the usage of a fixed effects model would be problematic, given that slowly changing variables can result in inefficient and biased estimates because the fixed effects and the explanatory variable are highly correlated (see Beck and Katz 2001; Plümper and Troeger 2007, 2011).

Second, the available corruption and redistribution data make a fixed effects model impractical. The values of the most widely used corruption proxy, Transparency International’s CPI, are not directly comparable over time on the grounds that the score of a country is defined by its relative rank in various categories. To be more precise, a country can have a higher (lower) CPI score in the year t + 1 than in the year t when its corruption levels improve (worsen) compared to other countries while at the same time its actual degree of corruption increases (decreases). Moreover, the methodology of the index changed in 2012 (see Transparency International 2012), so that time series comparisons should only be made after that date. Similarly, the redistribution data from SWIID is not appropriate for annual panels given that these data represent 5-year moving averages (Acemoglu et al. 2015).

Third, empirical models that try to measure the impact of corruption on redistribution are likely to suffer from an endogeneity bias caused by reverse causality. Redistribution is highly correlated with government spending and size, which have been found to influence government corruption (Goel and Nelson 1998; Kotera et al. 2012). To overcome this potential bias, we use an instrumental variable approach. However, the corruption independent variables (IVs) that are typically employed in the literature are only available at one point in time.

For the IV estimations, a Two-Stage Least Squares (2SLS) regression analysis is used that considers information about the complexity of the judicial system and state antiquity. The antiquity of the state is a standard IV for the quality of institutions and is also likely to influence existing levels of government corruption (Balafoutas 2011). Moreover, we consider the complexity of the judicial system on the grounds that governmental corruption and judicial corruption are highly correlated and that research shows that the more complex a judicial system, the more corrupt it is (Rodriguez and Ehrichs 2007). Our measure of the complexity of the judicial system is a procedural formalism index of solving a legal dispute over a check collection (developed by Djankov et al. (2003)). All these variables are not directly related to income redistribution and are therefore valid IVs.

4.2 Data

As stated above, the dependent variable is a relative redistribution measure, which is in line with most existing studies (Iversen and Soskice 2006; Huber and Stephens2014; Luebker 2014).Footnote 5 The data source for market and net income inequality is the SWIID (Solt 2016a, b). The SWIID combines and adjusts Gini coefficients from different sources such as the Luxembourg Income Study (LIS) and the World Income Inequality Database (WIID). SWIID data have been widely used in previous cross-country studies concerned with income inequalityFootnote 6 and enable us to evaluate the effect of corruption on redistribution with a sample that comprises both developed and developing countries.

The proxy for government corruption is Transparency Internationals’ CPI. The CPI is a composite index that measures the perception of corruption in the public sector from 1995 onwards, drawing on data from several institutions (the World Bank, the European Intelligence Unit, The World Economic Forum, etc.). It ranges from 0 to 10, with 0 indicating the most corruption. The CPI is the most commonly used corruption indicator in the literature that studies the determinants and consequences of corruption (see e.g. Rothstein and Uslaner 2005; Egger and Winner 2006; Méndez and Sepúlveda 2006; Balafoutas 2011; Pani 2011). Given that the CPI covers a wide range of surveys with different types of respondent, it avoids a possible perception bias, which can arise when only the perception of selected groups, such as expatriates or country experts are considered (Egger and Winner 2006).

Such a perception bias might arise in two alternative corruption indicators that are used for a robustness check of the results that are obtained when the CPI is the dependent variable, i.e. the Control of Corruption Indicator (CCI) from World Bank’s Worldwide Governance Indicators, and the index of the Diversion of Public Funds (DIV) from the World Economic Forums’ Global Competitiveness Report. The CCI is based on several underlying data sources that report the perceptions of governance of a large number of survey respondents and expert assessments worldwide. The index ranges from − 2.5 to 2.5, where greater a number means better control of corruption. The DIV is based on expatriates’ perceptions about the commonness of the diversion of public funds to companies, individuals or groups. The index ranges from 1 to 7, where 1 means large diversions of public funds. In all three cases we expect a positive sign of our variable of interest (i.e. more redistribution in less corrupt countries). We rescale both the CC and DIV to a scale of 0−10 to make the regression results better comparable with those obtained with the CPI as dependent variable.

The choice of the control variables was guided by the existing literature. To account for the pre-redistribution level of income inequality, market Gini coefficients from SWIID are used. As discussed above, the degree of initial inequality is expected to influence the voting behavior of the median voter. It can also be expected that in more democratic countries the will of the median voter is more decisive. Hence, a democracy index is included that is retrieved from the Quality of Government dataset from the Quality of Government Institute. It combines information of the Freedom House indices of political rights and civil liberties and the democratic index of the Polity IV project. This index ranges from 0 to 10, where greater values indicate more democratic countries.

Given that it has been found that countries tend to redistribute more when they have left-wing parties in power (Crepaz 2002; Huber and Stephens 2014), proportional electoral systems (Iversen and Soskice 2006, 2009), and non-presidential governments (Becher 2012; Corbacho et al. 2013), the following three dummy variables are considered: (i) a dummy that equals one if at least in 1 year a left-wing party was the largest party in the parliament; (ii) a dummy that equals one if the electoral system is proportional (instead of majoritarian); (iii) a dummy that equals one if the political system is presidential. All of these data are retrieved from the Database of Political Institutions (DPI).

We also control for the proportion of population over 65 years and the unemployment rate on the grounds that previous studies find that the needs of these population groups are important to explain redistribution patterns (Luebker 2014). Moreover, trade openness is taken into account to capture the potential effect of decreasing bargaining power of workers and a ‘race to the bottom’ in social welfare expenditure due to increasing competition between countries (see Genschel 2002; Davies and Vadlamannati 2013). All three variables are taken from the World Development Indicators (WDI) database.

Finally, we control for the gross national income (GNI) per capita, on the ground that it is likely that the level of development influences the amount of redistribution. On the one hand, rich countries have more resources to respond to redistribution needs. On the other hand, their citizens tend to have a higher degree of upward mobility so that their redistribution demands might be lower than in poor countries. Moreover, rich countries tend to have better corruption indicators. Hence, it might be that the level of redistribution rather depends on the level of development than on the degree of corruption as such.

The existing data allows for the consideration of up to 148 developed and developing countries over the period 2003–2015 (see Table 5 in the “Appendix” for an overview). Table 1 shows that the sample is relatively heterogeneous. For example, the market Gini coefficient ranges from 31.1% (Belarus) to 72.5% (Namibia), and the degree of relative redistribution lies between 0.7% (China) and 50% (Sweden). The latter demonstrates that some of the sample countries have relatively high redistribution levels, whereas others have regressive tax and transfer policies. The same is true for corruption. According to the three corruption measures, some countries are highly corrupt, whereas in others corruption does not seem to be a major issue.

5 The Impact of Corruption on Redistribution

Table 2 shows the result of four different specifications. Regression (i) is the most basic between effects estimator model that controls for the median-voter hypothesis by considering the market Gini coefficient and the democracy index. Regression (ii) controls also for income per capita. Regression (iii) adds further control variables to account for differences in the political institutions. Regression (iv) accounts additionally for potential need and globalization issues. Regression (v) presents the results when Regression (iv) is estimated as a Two-Stage Least Squares regression with corruption IVs.

The hypothesis that a lower level of corruption (i.e. higher values of the CPI) leads to a higher degree of redistribution is confirmed by all four between effects estimator models at the 5% significance level. Moreover, the CPI coefficients are reasonable. According to Model (iv), a one-unit increase in the CPI score of a country leads to a 1.8 percentage point increase in its relative redistribution level (ceteris paribus). This means that if Italy, for example, would improve its CPI score to the same level of France, redistribution in Italy would increase by around 4.2 percentage points. This value represents approximately a 13.5% increase in Italy’s redistribution level. In more general terms, a decrease in one standard deviation in corruption (computed as an increase in one standard deviation of the CPI score) implies an average redistribution increase of around 3.8 percentage points.

The IV Regression (v) of Table 2 confirms the main finding that lower corruption fosters redistribution.Footnote 7 This implies that the OLS results are not biased by reverse causality. Table 3 shows the significance of the IVs of the first-stage. The complexity of the judicial system has the expected sign and is significant at the 1% level, whereas state antiquity is not significant. In other words, the complexity of the judicial system seems to be a better IV than state antiquity when accounting for the corruption level of a country. The higher the complexity of the judicial system, the higher the government corruption level of the country (i.e. the lower the CPI).

With regard to the control variables, Table 2 shows that the effect of corruption on redistribution stays robust when one controls for the level of development (i.e. GNI per capita). Having said this, the effect of the corruption on redistribution diminishes when this variable is introduced. Furthermore, the results suggest that the needs of pensioners are a highly significant predictor of redistribution levels. Moreover, in line with previous research, (iii) and (v) associate a proportional government with higher levels of redistribution, and (iii) suggests that presidential governments might have a negative influence on redistribution. The other control variables, on the contrary, are not significant.

To check if these results are influenced by the choice of the corruption variable, the two parsimonious models (iv) and (v) (Table 2) were tested with two different corruption proxies: the CCI from the World Bank and the DIV from the World Economic Forum. Table 4 shows that all four regressions confirm the finding that lower levels of corruption lead to more income redistribution. This means that the main finding is robust independent of the specification and corruption proxies used. Moreover, the signs of the control variables, and in most cases also their significance, remain unchanged compared to the regressions of Table 2.

6 Conclusions

Cross-country research on the redistribution of income has identified a ‘paradox’; in many countries redistribution is relatively modest although the degree of market inequality is relatively high. This paper hypothesizes that the level of corruption can partially explain this ‘paradox’. Corruption can distort the demand for and supply of redistributive policies through various mechanisms. On the one hand, vote-buying practices and low trust in a government can reduce the demand for redistribution. On the other hand, bribery and lobbyism from the economic elite can influence the implementation of redistributive policies, and corruption might lead to a decrease of resources available for redistribution.

To the best of our knowledge, this is the first empirical study that provides evidence of a negative relationship between the level of government corruption and the level of redistribution across countries. The results suggest that, according to the preferred corruption measure from Transparency International, a decrease in one standard deviation in corruption implies an increase in relative redistribution of approximately 3.8 percentage points. The main finding that corruption diminishes income redistribution is robust when one controls for the income level, and uses alternative corruption measures and an instrumental variable approach. This suggests that citizens desiring higher levels of redistribution should consider demanding more effective anti-corruption policies and laws (especially in developing countries, given that they typically have relatively high degrees of corruption and low levels of redistribution).

Finally, it is important to note that the used cross-country setting does not allow to distinguish between the different mechanisms that might be at play in preventing higher income redistribution levels (for instance, whether vote-buying practices are more important than lobbying practices to explain the obtained result). Hence, future research should be undertaken to analyze in detail the main mechanisms that explain the negative effect of corruption on redistribution.

Notes

Transparency International’s Corruption Perceptions Index ranges from 0 to 10, with 10 indicating no corruption. Relative redistribution is the percentage reduction in the market income Gini coefficient when taxes and transfers are considered, i.e. (Gini market − Gini net )/Gini market ) * 100.

The reason why these studies concentrate on developed countries is that they rely on the Luxembourg Income Study (LIS) dataset that comprises mainly OECD countries.

Damania et al. (2003) and Mauro (2004) recognize that one reason why corruption is highly persistent may be that when corruption is widespread, it does not make any sense for individuals to attempt to fight it; once corruption is entrenched, it is difficult to eliminate. With respect to redistribution, Iversen and Soskice (2009) show that the patterns of redistribution across countries can be traced back to the nineteenth century. With our data, we found, for example, that the correlation between the redistribution in 1995 and 2012 is 93%.

Some studies argue that the absolute amount of redistribution is a more suitable measure than relative redistribution (Kenworthy and Pontusson 2005; Mahler and Jesuit 2006). To ensure that these results are not influenced by employing a relative measure, regressions with an absolute measure (Gmarket − Gnet) instead of the relative one were run. The main results stay robust when this absolute redistribution measure is used.

Please note that the main results of Regression (i)–(iii) also stay robust when the IVs are used for these specifications.

References

Acemoglu, D., Naidu, S., Restrepo, P., & Robinson, J. (2015). Democracy, redistribution and inequality. In A. B. Atkinson & F. Bourguignon (Eds.), Handbook of income distribution (pp. 1885–1966). Amsterdam: North-Holland.

Acemoglu, D., & Robinson, J. (2008). Persistence of power, elites and institutions. American Economic Review, 98(1), 267–291.

Acemoglu, D., Tichhi, D., & Vindigni, A. (2011). Emergence and persistence of inefficient states. Journal of the European Economic Association, 9(2), 177–208.

Agnello, L., & Sousa, R. M. (2014). How does fiscal consolidation impact on income inequality? Review of Income and Wealth, 60(4), 702–726.

Alesina, A., & Angeletos, G. M. (2005). Fairness and redistribution. American Economic Review, 95(4), 960–980.

Algan, Y., Cahuc, P., & Sangnier, M. (2016). Trust and the welfare state: The twin peaks curve. The Economic Journal, 126(593), 861–883.

Balafoutas, L. (2011). How much income redistribution? An explanation based on vote-buying and corruption. Public Choice, 146(1/2), 185–203.

Becher, M. (2012). Presidentialism, parliamentarism, and redistribution. Paper presented at the General Conference of the European Political Science, Berlin.

Beck, N., & Katz, J. (2001). Throwing out the Baby with the Bath water: A comment on Green, Kim and Yoon. International Organization, 55(2), 487–495.

Bénabou, R., & Ok, E. A. (2001). Social mobility and the demand for redistribution: The POUM hypothesis. The Quarterly Journal of Economics, 116(2), 447–487.

Black, D. (1958). The theory of committees and elections. Cambridge: Cambridge University Press.

Bradley, D., Huber, E., Moller, S., Nielsen, F., & Stephens, J. (2003). Distribution and redistribution in postindustrial democracies. World Politics, 55(2), 193–228.

Breyer, F., & Ursprung, H. W. (1998). Are the rich too rich to be expropriated?. Economic power and the feasibility of constitutional limits to redistribution. Public Choice, 94(1/2), 135–156.

Chon, D. (2016). Religiosity and regional variation of lethal violence. Homicide Studies, 20(2), 129–149.

Coate, S., & Morris, S. (1999). Policy persistence. American Economic Review, 89(5), 1327–1336.

Corbacho, A., Fretes Cibils, V., & Lora, E. (2013). Recaudar no basta. Los impuestos como instrumento de desarrollo. New York: Banco Interamericano de Desarrollo.

Crepaz, M. (2002). Global, constitutional, and partisan determinants of redistribution in fifteen OECD countries. Comparative Politics, 34(2), 169–188.

Crotty, J. (2013). The great austerity war: What caused the US deficit crisis and who should pay to fix it? Cambridge Journal of Economics, 36(1), 79–104.

Damania, R., Fredriksson, P. & Mani, M. (2003). The presistence of corruption and regulatory compliance failures: Theory and evidence. IMF Working Paper, No. 03/172.

Davies, R. B., & Vadlamannati, K. C. (2013). A race to the bottom in labor standards? An empirical investigation. Journal of Development Economics, 103, 1–14.

de Mello, L., & Tiongson, E. (2006). Income inequality and redistributive government spending. Public Finance Review, 34(3), 282–305.

Djankov, S., La Porta, R., Lopez-de-Silanes, F., & Shleifer, A. (2003). Courts. Quarterly Journal of Economics, 118(2), 453–517.

Docquier, F., & Tarbalouti, E. (2001). Bribing votes: A new explanation to the “inequality-redistribution” puzzle in LDC’s. Public Choice, 108(3/4), 259–272.

Egger, P., & Winner, H. (2006). How corruption influences foreign direct investment: A panel data study. Economic Development and Cultural Change, 54(2), 459–486.

Fox, S., & Hoelscher, K. (2012). Political order, development and social violence. Journal of Peace Research, 49(3), 431–444.

Genschel, P. (2002). Globalization, tax competition, and the welfare state. Politics and Society, 30(2), 245–275.

Gilens, M., & Page, B. I. (2014). Testing theories of american politics: Elites, interest groups, and average citizens. Perspectives on Politics, 12(3), 564–581.

Goda, T., & Torres García, A. (2017). The rising tide of absolute global income inequality during 1850–2010: Is it driven by inequality within or between countries? Social Indicators Research, 130(3), 1051–1072.

Goel, R., & Nelson, M. (1998). Corruption and government size: A disaggregated analysis. Public Choice, 97(1/2), 107–120.

Grossman, G., & Helpman, E. (2001). Special interest politics. Cambridge: MIT Press.

Gupta, S., Davoodi, H. & Alonso-Terme, R. (1998). Does corruption affect income inequality and poverty?. IMF Worlking Paper, No. 98/76.

Hasen, R. L. (2012). Lobbying, rent-seeking, and the constitution. Stanford Law Review, 64(1), 191–253.

Herzer, D., Huhne, P., & Nunnenkamp, P. (2014). FDI and income inequality—Evidence latin american economies. Review of Development Economics, 18(4), 778–793.

Huber, E., & Stephens, J. (2014). Income inequality and redistribution in postindustrial democracies: Demographic, economic and political determinants. Socio-Economic Review, 12(2), 245–267.

Iversen, T., & Soskice, D. (2006). Electoral institutions and the politics of coalitions: Why some democracies redistribute more than others. The American Political Science Review, 100(2), 165–181.

Iversen, T., & Soskice, D. (2009). Distribution and redistribution: The shadow of the nineteenth century. World Politics, 61(3), 438–486.

Kenworthy, L., & Pontusson, J. (2005). Rising inequality and the politics of redistribution in affluent countries. Perspectives on Politics, 3(3), 449–471.

Kotera, G., Okada, K., & Samreth, S. (2012). Government size, democracy, and corruption: An empirical Investigation. Economic Modelling, 29(6), 2340–2348.

Luebker, M. (2014). Income inequality redistribution and poverty. Contrasting rational choice and behavioral perspectives. Review of Income and Wealth, 60(1), 133–153.

Mahler, V., & Jesuit, D. (2006). Fiscal redistribution in the developed countries: New insights from the Luxembourg Income Study. Socio-Economic Review, 4(3), 483–511.

Marr, C. & Ming, C. (2014). Understanding Changes in attitudes towards redistribution and government after the great recession. SSRN Working Paper. doi:10.2139/ssrn.2184298.

Mauro, P. (1997). The effects of corruption on growth, investment and government expenditure: A cross-country analysis. In K. A. Elliot (Ed.), Corruption and the global economy (pp. 83–107). Washington: Peterson Institute for International Economics.

Mauro, P. (2004). The persistence of corruption and slow economic growth. IMF Staff Papers, 51(1), 1–18.

Meltzer, A., & Richard, S. (1981). A rational theory of the size of government. Journal of Political Economy, 89(5), 914–927.

Méndez, F., & Sepúlveda, F. (2006). Corruption, growth and political regimes: Cross country evidence. European Journal of Political Economy, 22(1), 82–98.

Milanovic, B. (2000). The median-voter hypothesis, income inequality, and income redistribution: An empirical test with the required data. European Journal of Political Economy, 16(3), 367–410.

Olken, B. A. (2006). Corruption and the costs of redistribution: Micro evidence from Indonesia. Journal of Public Economics, 90(4–5), 853–870.

Pani, M. (2011). Hold your nose and vote: Corruption and public decisions in a representative democracy. Public Choice, 148(1/2), 163–196.

Pellegata, A., & Memoli, V. (2016). Can corruption erode confidence in political institutions among european countries? Comparing the effects of different measures of perceived corruption. Social Indicators Research, 128(1), 391–412.

Perotti, R. (1996). Growth, income distribution and democracy: What the data say. Journal of Economic Growth, 1(2), 149–187.

Piketty, T. (1995). Social mobility and redistributive politics. The Quarterly Journal of Economics, 110(3), 551–584.

Plümper, T., & Troeger, V. E. (2007). Efficient estimation of time-invariant and rarely changing variables in finite sample panel analysis with unit fixed effects. Political Analysis, 15(2), 124–139.

Plümper, T., & Troeger, V. E. (2011). Fixed-effects vector decomposition: Properties, reliability, and instruments. Political Analysis, 19(2), 147–164.

Roberts, K. W. S. (1977). Voting over income tax schedules. Journal of Public Economics, 8(3), 329–340.

Robinson, J. (2010). The political economy of redistributive policies. In L. F. Lopez-Calva & N. Lustig (Eds.), Declining inequality in Latin America: A decade of progress? (pp. 39–71). Washington: Brookings Institution & UNDP.

Rodriguez, D., & Ehrichs, L. (2007). Global corruption report, 2007. Corruption in judicial systems. Cambridge: Cambridge University Press.

Römer, T., & Rosenthal, H. (1979). The elusive median voter. Journal of Public Economics, 12(2), 143–170.

Rothstein, B., & Uslaner, E. (2005). All for all: Equality, corruption, and social trust. World Politics, 58(1), 41–72.

Sanyal, A., Gang, I., & Goswami, O. (2000). Corruption, tax evasion and the laffer curve. Public Choice, 105(1/2), 61–78.

Smyth, R., Mishra, V., & Qian, X. (2010). Knowing one’s lot in life versus climbing the social ladder: The formation of redistributive preferences in urban China. Social Indicators Research, 96(2), 275–293.

Solt, F. (2016a). The standardized world income inequality database. Social Science Quarterly, 97(5), 1267–1281.

Solt, F. (2016). The standardized world income inequality database, version 5.1. Retrieved from https://dataverse.harvard.edu/file.xhtml;jsessionid=b6709a85a78aa0502d6227f612af?fileId=2853131&version=RELEASED&version=.0.

Tanzi, V. (1998). Corruption around the world: Causes, consequences, scope and cures. IMF Staff Paper, No. 45.

Transparency International. (2012). Corruption Perception Index 2012: An updated methodology. Retrieved from http://www.transparency.org/cpi2012/in_detail#myAnchor7.

Uslaner, E. M. (2008). Corruption inequality and the rule of law. New York: Cambridge University Press.

Yamamura, E. (2014). Trust in government and its effect on preferences for income redistribution and perceived tax burden. Economics of Governance, 15(1), 71–100.

Author information

Authors and Affiliations

Corresponding author

Additional information

We would like to thank Germán Tabares for research assistance, and two anonymous referees for the useful comments that enabled us to improve the first version of this paper. We gratefully acknowledge funding from Colombia’s Administrative Department of Science, Technology and Innovation’s (Colciencias) Jóvenes Investigadores e Innovadores Programme (convocatoria 645), and Angélica Sánchez would like to thank Universidad EAFIT for providing her with a scholarship enabling the resesarch for this article.

Appendix

Rights and permissions

About this article

Cite this article

Sánchez, A., Goda, T. Corruption and the ‘Paradox of Redistribution’. Soc Indic Res 140, 675–693 (2018). https://doi.org/10.1007/s11205-017-1781-3

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11205-017-1781-3