Abstract

Redistribution is one of the most central functions of modern government. Against the backdrop of rising income inequality in many countries, policymakers and economists call for redistributive policies to address the rising inequality directly. Yet, there has been little systematic analysis of whether and how inequality influences redistribution and of the role of economic, political and institutional factors of redistribution. Our paper fills this important gap in the literature. To our knowledge, this is the first paper that systematically analyzes and presents evidence from a large panel of countries over 1967–2014 that high-income inequality is consistently associated with greater redistribution. Making it richer, evidence shows the role of economic factors such as trade openness, old age dependency, and financial development, and suggests that political institutions are important factors in understanding a cross-country variation in the size of redistribution. Extensive robustness checks confirm the results.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The past few decades have witnessed a significant and sustained increase in (within-country) income inequality in many advanced and emerging market economies, with a notable exception for some developing countries in Latin America and Sub-Saharan Africa that have had historically high income inequality (see IMF 2014; OECD 2015; Caminada et al. 2017).Footnote 1 By some estimates, income and wealth inequality in some countries are near their highest levels since the nineteenth century after more than 40 years of declining inequality following the Great Depression (see Alvaredo et al. 2013; Saez and Zucman 2016; Piketty et al. 2018 among others). More recently, fiscal adjustments to bring down public debt from historically high levels in many countries have exacerbated inequality further (Woo et al. 2017). To make matters worse, the global pandemic has exposed and aggravated socio-economic inequalities, both within nation and between developed and developing countries.Footnote 2 Importantly, there is growing evidence that high levels of income inequality can be detrimental to macroeconomic stability and long-term growth through various channels (e.g., Alesina and Rodrik 1994; Benabou 1996; Easterly 2007; Woo 2009, 2011; Berg et al. 2018). The rising gap between rich and poor has fueled social unrest, while driving the recent upsurge of populism in many parts of the world, including the Brexit referendum, the election of Donald Trump, and support for populist parties across Europe.Footnote 3 Against the backdrop of stagnant income growth for the majority of households in major economies amid slow recovery from the Great Recession, some policymakers and economists have called for policy interventions to address the rising inequality directly (see Stiglitz 2014; Piketty 2014; Boushey 2019).Footnote 4

Does high inequality lead to more redistribution? Why do some countries achieve more redistribution than others? What is the role of economic, political, and institutional factors in determining the extent of redistribution? Redistribution of incomes, achieved mainly through taxation and transfer payments, is one of the most central functions of the modern state. From an empirical point of view, however, the relationship between market income inequality and redistribution is not well understood. The empirical evidence in the literature is inconclusive or at best mixed, and the existing studies often suffer from shortcomings for various reasons (including data problems and estimation method issues). More importantly, little is known about how and, if any, the extent to which the economic, political, and institutional factors influence the magnitude of redistribution, although a large body of literature highlights the role of economic and political factors in determining redistribution and, more generally, welfare state. Surprisingly, there has been little (or no) systematic empirical analysis of these critical issues. This paper fills this important gap in the literature.

The main contribution of this paper is twofold. First, we provide a comprehensive empirical evaluation of the relationship between income inequality and redistribution in a large panel data from the Luxembourg Income Study (LIS) for 47 advanced, emerging market and developing economies over the period of 1967–2015, which provides unparalleled high-quality measures of inequality for both market income (i.e., income before taxes and transfers) and net income (i.e., income after taxes and transfers) that allow for direct measurement of the extent of redistribution (i.e., absolute redistribution and relative redistribution).Footnote 5 The main results are further strengthened and confirmed by using an additional panel data of (up to) 140 advanced, emerging market and developing economies over 1965–2015 from Standardized World Income Inequality Database (SWIID). Following the empirical strategy in Woo and Kumar (2015), we employ a variety of econometric techniques and carefully address several estimation issues.

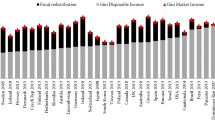

To our knowledge, this is the first paper that systematically analyzes and presents evidence that high income inequality is consistently and significantly associated with more redistribution (as measured by either absolute redistribution or relative redistribution). (See Fig. 1.) It is robust to the inclusion of a wide range of other control variables and to the estimation method. Yet, the magnitude of reduction in inequality via redistribution appears to be insufficient to offset the recent rising trend of market income inequality. According to our baseline estimates, on average, a 1 Gini point increase in market income inequality is associated with a 0.5 Gini point increase in redistribution (accordingly, net income inequality will rise by 0.5 Gini points).Footnote 6 We also investigate whether there exists a nonlinearity in the relationship between the two, for example, whether the magnitude of redistribution varies, depending on the level of market income inequality. However, we do not find clear evidence of such nonlinearity. Further, we do not find evidence that the relationship between income inequality and redistribution has weakened in recent years—for example, when we split the sample into two sub-periods, before and after 2000 and run the regressions separately, the statistical significance and size of coefficients of redistribution remain much the same between the two periods. Taken together, our results suggest that rising market income inequality has been the main driver of the upward trend in net income inequality, while redistribution has tended to compensate for about half of the increase in market income inequality.Footnote 7

Second, our study goes beyond the basic question regarding the relationship between inequality and redistribution and examines an array of economic, political, and institutional variables to derive a more robust conclusion about which ones are important in explaining a cross-country variation in the size of redistribution. To this end, we put together different strands of literature related to redistribution or fiscal policy in general, and accordingly assembled large data sets. We consider three types of structural determinants of redistribution: (i) socio-economic factors such as income per capita, old age dependency, trade openness, financial market depth, government size, and GDP growth, (ii) political institutions such as democracy versus non-democracy, presidential versus parliamentary systems, and institutionalized checks and balances, and (iii) political factors such as political orientation of the party in power and government fragmentation (e.g., divided versus unified governments).

In this regard, we obtain rich and interesting results. Income per capita, trade openness, and old age dependency turn out to be consistently and positively associated with redistribution. Rich countries tend to engage in greater extents of redistribution, which must be made affordable by high levels of national income (see Fig. 2). At the same time, it may reflect the growing demand for social functions of the state, including social security and welfare programs, as national income rises, which is known as Wagner’s law. On the other hand, population aging tends to result in more income redistribution, such as in the form of cash transfers, because the elderly rely on a public pension scheme for income support in many countries (Causa and Hermansen 2017).Footnote 8 Our results confirm that population aging as measured by old age dependency ratio is closely related to the size of redistribution. Also, the consistent positive correlation between trade openness and redistribution suggests that in more open countries, there is a greater demand for a social insurance mechanism due to exposure to foreign import competition and external shocks. Our finding is consistent with Rodrik’s (1998) seminal paper that reports a robust positive correlation between an economy’s exposure to international trade and the size of its government in a cross-country data. He argues that government spending plays a risk reducing role in the economies exposed to a significant amount of external risk (e.g., terms-of-trade risks).Footnote 9

Importantly, there is some evidence that democracies tend to engage in greater redistribution from the rich to the poor than non-democracies. This is consistent with the popular belief that democratic regimes will choose policies that are more favorable to the poor than non-democratic regimes, to the extent that public decisions are made (directly or indirectly) by voting (e.g., see Meltzer and Richard 1981; Mulligan et al. 2004). However, the evidence is not robust. The statistical significance of the democracy indicator is sensitive to whether it is a continuous measure of democracy or a dichotomous measure (i.e., a dummy variable for democracy), or whether its interaction term with market income inequality is included along with the democracy indicator. It is also sensitive to the inclusion of other political variables. This makes it difficult to draw a strong conclusion about the relationship between democracy and redistribution. With this caveat, for example, when a dummy variable for democracyFootnote 10 is entered in the baseline panel regression, it is statistically significant at the conventional levels for most estimation methods. According to the (significant) coefficients, the size of redistribution differential between the democracies and non-democracies is around 3.23 Gini points, which is not trivial (it amounts to 7% of the average level of market income inequality in our sample). Strictly speaking, this indicates that greater redistribution is achieved in democratic countries for the same levels of market income inequality—that is, a constant gap in the extent of redistribution between democracies and non-democracies. It does not imply that democracies react to higher inequality with more redistribution. When we allow for a difference in slopes by including the democracy dummy variable and its interaction term with market income inequality in the baseline specification, the coefficients of the interaction term are statistically insignificant and even of a wrong sign (–). That said, it is equally important to note that even in non-democracies, market income inequality is significantly and positively associated with redistribution. Even after controlling for the democracy indicator (with or without the interaction term) and other variables, the coefficients of market income inequality remain highly significant, and their size is quantitatively similar to that in the baseline regression.Footnote 11 Therefore, the evidence seems to suggest that a country with higher inequality of market income tends to engage in more redistribution, irrespective of whether the country is democratic or not, and yet, the extent of redistribution in a democratic country tends to be greater, as compared to a non-democratic one.

Given that the evidence on the relationship between democracy and redistribution is not robust and that market income inequality is consistently and positively associated with redistribution, irrespective of democracy or non-democracy, a more granular approach focusing on other specific political and institutional factors could be fruitful. With this respect, it is noteworthy that parliamentary systems (as opposed to presidential systems), left-wing governments (as opposed to right-wing), and checks and balances in political decision making (as measured by the number of institutional veto players) are positively associated with redistribution, while unified governments (i.e., the party of the executive branch controls both houses of the legislative branch) as opposed to divided governments are negatively associated with redistribution. Although there are no directly comparable studies that are concerned with redistribution per se, our findings are consistent with the broad implications for redistribution (e.g., such as welfare state) from the political economy literature (more on this later).Footnote 12

Our paper is related to a few empirical studies on inequality and redistribution (see Perotti 1996; Milanovic 2000; Kenworthy and Pontusson 2005; de Mello and Tiongson 2006; Scervini 2012; Luebker 2014 among others). The evidence from these papers is inconclusive or at best mixed. The existing studies mostly focus on testing Meltzer and Richard’s (1981) theoretical prediction that in an economy where the size of income redistributed is determined by majority rule an increase in income inequality leads to greater redistribution.Footnote 13 More precisely, two variants of the Meltzer-Richard hypothesis often are examined—the redistribution hypothesis (greater inequality leads to more redistribution) and the median voter hypothesis (the middle class plays a special role in the policy making). Partly for the lack of quality data on direct measures of redistribution (and inequality), earlier studies examine the relationship between inequality and tax rates or share of government transfer spending in GDP. For example, Perotti (1996) does not find higher tax rates in countries with more unequal income distribution, and de Mello and Tiongson (2006) find that more unequal societies spend less on redistribution. Based on the direct measure of redistribution (either absolute or relative redistribution), Kenworthy and Pontusson (2005) and Scervini (2012) find evidence of the positive association between market income inequality and absolute redistribution, while Luebker (2014) finds the evidence on relationship between market income inequality and relative redistribution to be weak.Footnote 14 On the other hand, Mulligan et al. (2004) call into the question the validity of the median voter theorem which is the key mechanism in Meltzer-Richard model. Also, Milanovic (2000) and Scervini (2012) find that the evidence of the median voter hypothesis is weak.

Compounding matters further, for most existing studies, the empirical analysis is done with very parsimonious regression specifications (for example, inclusion of only income level and inequality as explanatory variables of redistribution), not to mention that various econometric issues are not carefully addressed. Thus, other economic, political and institutional factors of redistribution are not properly considered. At minimum, this can cause an omitted-variable bias in the estimate, and in a bigger picture, richer and more interesting aspects of redistribution are not explored. Furthermore, they often suffer from a small sample size due to the unavailability of large quality data sets on inequality indicators for market income and net income until very recently. Earlier studies have used Deininger and Squire (1996) database or its successor, the World Income Inequality Database (WIID) of the United Nations University. For the purposes of studying inequality and redistribution, these data sets share a serious problem: no consistent distinction is made between market income and net income from which the magnitude of redistribution can be measured, let alone differences in reference units and coverage. In our paper, we overcome this data problem by using high-quality direct measures of redistribution (both absolute redistribution and relative redistribution) and inequality measures for both market income and net income from the LIS and confirm our main results by using the SWIID data alternatively.

That said, there are difficult econometric issues including endogeneity. Perhaps the more important issue would be the extent of total bias on the estimated coefficients, given several sources of bias that can cause inconsistent estimates of the coefficients in the panel regressions (for example, omitted-variables bias, measurement errors, endogeneity, and dynamic panel bias). Yet, each estimation technique involves some trade-off: an estimator that may seem attractive to address a specific econometric problem can lead to a different type of bias. With this in mind, we employ five different estimation techniques, such as pooled OLS, robust regression (RR), between estimator (BE), fixed-effects (FE) panel estimator, and system GMM (SGMM) panel estimator, to draw a robust conclusion. In this regard, Hauk and Wacziarg (2009) provide an important Monte Carlo study (albeit in growth regression) in which they show that the BE performs the best among the four estimators (pooled OLS, BE, FE, and difference GMM) in terms of the extent of total bias on each of the estimated coefficients in the presence of omitted-variables bias and a variety of measurement errors. Thus, the BE and (on a theoretical merit) SGMM estimators can be considered as the preferred estimation techniques in our paper, although we utilize and report the other techniques as well.

The rest of the paper is organized as follows: Sect. 2 describes data; Sect. 3 discusses a number of methodological issues and estimation strategy, and then presents the main panel regression results on the relationship between inequality, redistribution, and other economic and political variables. Section 4 concludes. Appendixes 1–5 provide details on country sample, data sources, summary statistics, and additional regression results.

2 Data

In studying the relationship among inequality, redistribution, and other economic and political variables, a critical issue is the availability and quality of data for both income distribution before and after taxes and transfers, from which a meaningful measures of size of redistribution can be derived. There have been substantial efforts to compile cross-country datasets on income inequality over the last decades. Two datasets have been particularly influential—the Luxembourg Income Study (LIS) and the dataset assembled by Deininger and Squire (1996) and its successor, the World Income Inequality Database (WIID) of the United Nations University. However, the Deininger and Squire data and the WIID have limitations for international comparison purposes. They are often not comparable across countries or even over time within a single country because they are based on different definitions of income (e.g., market income, disposable income, or consumption expenditure) and different reference units (e.g., households, household adult equivalents, or persons). (See Atkinson and Brandolini 2001; Babones and Alvarez-Rivadulla 2007 among others.) With no consistent distinction made between market income and net income, it is practically impossible to derive a consistent measure of the size of redistribution for a sufficiently large number of countries and years. Given our purpose of studying the relationship between inequality and redistribution, therefore, this deficiency renders the data sets unappealing.

With the coverage and comparability in mind, for the main analysis, we utilize the LIS data on income inequality and redistribution indicators for 47 countries over the period of 1967–2014 from Caminada et al. (2017). The LIS data provide data series, including market income inequality, net income inequality, and measure of redistribution, which are generated from the LIS micro-data. The quality and comparability of the LIS data are unparalleled, and the data cover relatively large number of countries and years for cross-country study. Nonetheless, to ensure the consistency of our main conclusions based on the LIS data, we also estimate the relationship between inequality, redistribution, and other variables by using the Standardized World Income Inequality Database (SWIID) from Solt (2018). It is reassuring to find similar results. The SWIID has advantages in terms of better coverage and comparability for relatively long time periods and does provide indicators of market income inequality and net income inequality on the household adult equivalent basis. It maximizes the comparability of income inequality data while preserving the broadest possible coverage across countries and over time by standardizing the WIID database. It provides comparable Gini coefficients for both market and net income for up to 153 countries for as many years as possible from 1960 to 2015 (see Solt 2016 for details, and Jenkins 2014 for a criticism of the SWIID).Footnote 15

Macroeconomic data such as real GDP, real GDP per capita, trade openness, government size, old age population dependency ratio, and measures of financial market depth are obtained from the Penn World Table 9.0, the IMF’s World Economic Outlook, World Bank’s World Development Indicators and Finance Structure Database. Political and institutional variables including indicator of democracy, political system, political orientation of the party in power, party structure, electoral rules, and checks and balance are from the Polity IV (2018) and the Database of Political Institutions (2017). The availability of data on inequality and other variables included in the regression dictates the sample size: the main analysis is based on a panel of 47 advanced, emerging markets and developing economies for the period of 1967–2014, while we also present the panel regression results using the SWIID data for a sample of 59 OECD and emerging market economies over 1965–2015. We also check on the robustness of results in terms of sample, including restriction to a sample of 21 advanced industrial countries.

3 Econometric analysis

3.1 Model specification

The analysis focuses on the medium/longer-run relationship between market income inequality and redistribution, while exploiting both cross-sectional and time-series dimensions of the data. While controlling for other explanatory variables, we estimate the relationship between market income inequality and redistribution.Footnote 16

Our baseline panel data spans 48 years from 1967 to 2014, and comprises 11 non-overlapping periods that match up the 11 LIS Waves (1967–1973, 1974–1978, …, 2009–2011, 2012–2014).Footnote 17 The baseline panel regression specification is as follows:

where t denotes time period; i denotes country; Redisti,t denotes the size of redistribution for country i and the period t; νi denote the country-specific fixed effects (to control for country-specific factors including the time-invariant component of the institutional environment); ηt are the time-fixed effect (to control for global factors); εit is an error term; Xit is a vector of economic and political control variables; and Zit denotes the measure of market income inequality. The income inequality is measured by Gini coefficients which are between 0 (complete equality) and 100 (complete inequality). Following Caminada et al. (2012) and Kakwani (1986), we measure the size of redistribution (via taxes and social transfers) by the difference between market income inequality and net income inequality (i.e., absolute amount of the reduction in market income inequality due to taxes and transfers). We also consider a relative measure of redistribution (i.e., reduction in inequality as percent of market income inequality).Footnote 18 Further, we try an alternative regression specification which uses the first-differenced terms of redistribution and inequality, instead of their levels.Footnote 19 The results turn out to be strong and strengthen our main findings (see Appendix Table 4).

Explanatory variables of redistribution include: (i) market income inequality (as measured by Gini coefficient); (ii) real GDP per capita (in log) to consider Wagner’s lawFootnote 20 as well as the Kuznets curveFootnote 21; (iii) government size (as measured by government consumption share of GDP). Theories of government size often emphasize the government’s function as a redistributor of income and wealth (Meltzer and Richard 1981); (iv) old age dependency ratio to capture redistributive spending pressure from an aging society. Population aging tends to result in more income redistribution, because the elderly rely on a public pension scheme for income support in many countries (Causa and Hermansen 2017); (v) trade openness (sum of export and import as a percent of GDP). In a more open economy exposed to external shocks, voters may demand a more extensive social insurance system (Rodrik 1998 and Epifani and Gancia 2009); (vi) real GDP growth (averaged over the previous period). To the extent that growth raises income prospects for the poorer, growth may relieve political pressure for redistribution. On the contrary, however, it is equally possible that a growing economy may mean expanding resources (i.e., government revenue) available for further redistribution. In this case, growth may be associated with more redistribution, making the coefficient sign of output growth somewhat ambiguousFootnote 22; (vii) financial market depth as measured by either liquid liabilities or private credit extended by banks and other financial institutions (as a percent of GDP); (viii) indicator of democracy: Democracy score from Polity IV which ranges from 0 to 10 (full democracy) or a dummy variable which takes a value of 1 if Democracy score is greater than 8, and 0 otherwise; (ix) political system, which takes a value of 1 for presidential, 2 for assembly-elected presidential, and 3 for parliamentary system; (x) policy orientation of the ruling party, which takes a value of 1 for right-wing, 2 for center, and 3 for left-wing; (xi) indicator of unified/divided government, which takes a value of 1 if the party of the executive branch controls both houses of the legislative branch, and 0 otherwise; (xii) indicator of checks and balances in political decision making as measured by the number of veto players or constraints on executive decision making as a proxy of institutionalized constraints (Hallerberg and von Hagen 1999; Woo 2003; König et al. 2011).Footnote 23 (We have more to say about political and institutional variables in Sects. 3.5 and 3.6).

To ensure the robustness of results, our analysis begins with a parsimonious specification that includes income per capita, market income inequality, and country-specific and time fixed-effects, and subsequently, additional explanatory variables are included in the regressions.

3.2 Sources of bias and estimation strategies

There are multiple sources of bias that can cause inconsistent estimates of the coefficients in the panel regression. Each of the estimators involves some trade-off: an estimator that may seem attractive to address a specific econometric problem can lead to a different type of bias. With this in mind, we employ a variety of techniques, such as pooled OLS, between estimator (BE), fixed-effects (FE) panel estimator, and system GMM (SGMM) panel estimator (Blundell and Bond 1998). Speaking of the important sources of bias, the first is the omitted-variables bias (so-called heterogeneity bias) resulting from possible correlation between country-specific fixed effects (νi) and the regressors, affecting the consistency of pooled OLS and BE estimates. The second is the endogeneity problem due to correlation between the regressors and the error term, which would affect the consistency of pooled OLS, BE and FE. (Specific to dynamic panels, there is a dynamic panel bias which will make the FE estimate inconsistent.) The third is classical measurement errors (errors in variables) in the independent variables, which affects the consistency of pooled OLS, BE, and FE estimates, although the bias tends to be exacerbated under FE and moderated under BE.

Specifically, the BE estimator (which applies the OLS to a single cross-section of variables averaged across time periods) tends to reduce the extent of measurement errors via time averaging of the regressors, but does not deal with the omitted-variables bias; pooled OLS and BE suffer from both heterogeneity bias and measurement errors but will still reduce the heterogeneity bias because other things equal, measurement errors tend to reduce the correlation between the regressors and the country fixed effects; FE addresses the problem of the omitted-variables bias via controlling for fixed effects, but tends to exacerbate the measurement error problem, relative to BE and OLS. This measurement error bias under FE tends to worsen when the explanatory variables are more time-persistent than the errors in measurement (Hauk and Wacziarg 2009).Footnote 24 Theoretically, the GMM estimator addresses a variety of biases such as the omitted-variables bias, endogeneity, and measurement errors (as long as instruments are uncorrelated with the errors in measurement, for example, if they are white noise as is in the classical case), but it may be subject to a weak instruments problem (Roodman 2009; Bazzi and Clemens 2013; Kraay 2015). While the SGMM that is used in this paper is generally more robust to weak instruments than the difference GMM, it can still suffer from weak instrument biases. In sum, it is difficult to see which estimator yields the smaller total bias in the presence of various sources of bias a priori.

Interestingly, an important conclusion from the Monte Carlo study of growth regressions by Hauk and Wacziarg (2009) is that the BE performs the best among the four estimators (pooled OLS, BE, FE, and difference GMM) in terms of the extent of total bias on each of the estimated coefficients in the presence of both potential heterogeneity bias and a variety of measurement errors. In light of this, the BE and (on a theoretical merit) SGMM estimators would be preferred estimation techniques in this paper, while we utilize the other techniques as well.

As additional robustness checks, we run regressions by using five-year panel data. This helps address the issue that the time interval in each period associated with LIS Wave is entirely not uniform. The results based on five-year panel data, however, turn out to be similar to the main ones (including the order of magnitude of the coefficients). We check the robustness of results in terms of sample, including restriction to a sample of 21 industrialized countries. On the other hand, the least squares estimates tend to be sensitive to outliers, either observations with unusually large errors or influential observations with unusual values of explanatory variables.Footnote 25 To ensure that our results are not unduly driven by outliers, a robust regression (RR) is implemented.Footnote 26 Therefore, we report the econometric results based on five estimators (BE, pooled OLS, RR, FE, and SGMM).

3.3 Baseline results

The basic results based on a parsimonious specification are presented in Table 1. Columns 1–5 show that the coefficients of market income inequality are of positive sign and statistically significant at the 1–5% levels, with their values ranging from 0.376 to 0.678 across the various estimation techniques. Thus, a reduction in inequality via redistribution does not seem to be sufficient to offset the recent rising trend of market income inequality. The estimates suggest that, on average, a 1 Gini point increase in market income inequality is associated with a 0.57 Gini point increase in redistribution. Hence, net income inequality will rise by 0.43 Gini points. That said, it is interesting to note that the coefficients of market income inequality under the OLS, RR, FE and SGMM estimations are comparable in size, while the BE estimate turns out to be relatively smaller. On the other hand, the coefficients of income per capita are of positive sign and significant at 1–5%, which reflects the fact that rich countries tend to have well-developed social welfare states that function as a redistribution mechanism.

Consistency of the SGMM estimator depends on the validity of the instruments. We consider two specification tests, suggested by Arellano and Bover (1995) and Blundell and Bond (1998). The first is a Hansen J-test of over-identifying restrictions, which tests the overall validity of the instruments by analyzing the sample analog of the moment conditions used in the estimation process. It indicates that we cannot reject the null hypothesis that the full set of orthogonality conditions are valid (p value = 0.302).Footnote 27 The second test examines the hypothesis that the error term εi,t is not serially correlated. We use an Arellano-Bond test for autocorrelation and find that we cannot reject the null hypothesis of no second-order serial correlation in the first-differenced error terms (p value = 0.428).Footnote 28

Columns 6–10 show the results when the sample is restricted to 21 OECD economies that are often classified as industrialized and mature democratic countries. The coefficients of income per capita are now insignificant and even change their signs, except for the SGMM estimate in Column 10 which are of positive sign and significant at 10%. This is likely due to a smaller cross-country variation in income level among the relatively rich economies. By contrast, the coefficients of market income inequality remain of positive sign and significant at 1–5%, with their values ranging from 0.561 to 0.664. The BE regression in Column 6 suggests that a 1 Gini point increase in market inequality is associated with a 0.561 Gini point increase in redistribution. The size of the coefficients of market income inequality is comparable to that from the results based on the entire sample of 47 countries across the five different estimation methods, with the average value being around 0.59 (versus the average value of 0.57 in Columns 1–5).

Table 2 presents the baseline results. Besides the income per capita and market income inequality, we control for trade openness, old age dependency, government size, and financial market depth in Columns 1–5 and include two additional variables, economic growth and political system, in Columns 6–10. First, it is remarkable that the coefficients of market income inequality are all significant at 1% and of positive sign, with their values ranging from 0.315 to 0.665. Second, the coefficients of other explanatory variables (trade openness, old age dependency, government size, financial market depth, and political system) are largely of the expected sign and often significant at the conventional levels across various estimation methods. Notably, the results confirm that population aging tends to result in more income redistribution. The coefficients of old age dependency as a proxy for population aging are of positive sign and significant at 1–10% (except for the FE estimates). Also, trade openness turns out to be positively and significantly associated with redistribution (except for the FE estimates in Columns 4 and 9 and SGMM in Column 5), which seems to reflect a greater demand in more open countries for a social insurance mechanism due to exposure to foreign import competition and external shocks. According to the statistically significant coefficient estimates, a 10 percentage point of GDP increase in trade is associated with a 0.3–0.5 Gini point increase in redistribution, while a 1 percentage point increase in old age dependency (as a percent of working-age population) is associated with a 0.4–0.5 Gini point increase in redistribution. Government size also matters. It is positively and significantly associated with redistribution, supporting the conventional wisdom that large governments tend to redistribute more (government programs such as income transfers can be viewed as mechanisms for redistribution). Interestingly, financial market depth is negatively (and often significantly) associated with redistribution. Statistically significant coefficients suggest that a 10 percentage point of GDP increase in liquid liability is associated with a 0.3–0.4 Gini point decrease in redistribution.Footnote 29 One potential explanation is that a well-developed financial system may reduce social demand for redistribution by allowing the lower-income group to borrow and sustain their living standards to some extent.Footnote 30

However, the coefficients of real GDP growth are completely insignificant and even change sign. As noted earlier, the sign of the coefficient of economic growth is ambiguous a priori. It is because to the extent that growth raises income prospects for the poorer, growth may relieve political pressure for redistribution, but it is also equally possible that a growing economy may mean expanding resources available for further redistribution, causing growth to be associated with more redistribution, not less. On the other hand, the coefficients of political system (i.e., parliamentary versus presidential) suggest that the parliamentary system tends to engage in more redistribution than the presidential system. They are positive and significant under the BE, OLS, and RR methods, while they are no longer significant under the FE and SGMM. According to the statistically significant estimates, choosing between parliamentary and presidential regimes can result in a non-negligible difference in the size of redistribution, which is around 3.96 Gini points (we will have more discussion of political and institutional factors shortly).

In Table 3, we repeat the same regression exercises as in Table 2 by using an alternative measure of the magnitude of redistribution: a relative measure of redistribution.Footnote 31 The results are remarkably similar to those shown in Table 2. In Columns 1–5, the coefficients of market income inequality are all significant and of positive sign, except for the BE in Column 1. Also, income per capita, trade openness, old age dependency, government size are positively and mostly significantly associated with redistribution. The indicator of financial market depth enters the regression with negative-signed coefficients (and significant under OLS and RR). In Columns 6–10, two additional explanatory variables, economic growth and political system, are included. As in Table 2, the coefficients of real GDP growth are insignificant, while the coefficients of political system are all significant at 1–5% (except for the FE) and of positive sign. Again, they indicate that a parliamentary system tends to engage in more redistribution, compared to a presidential system. Also, the coefficients of market income inequality are of positive sign and significant at 1% (except for the BE in Column 6). On average, the results from the OLS, RR, FE and SGMM regressions suggest that a 1 Gini point increase in market income inequality is associated with an increase in redistribution by around 0.45–47 percentage points of the market income inequality.Footnote 32

We check whether the relationship between (market income) inequality and redistribution has weakened in recent years. To this end, we split the sample into two sub-periods, before and after 2000 and run the regressions separately. Table 4 shows the results. It is striking that the statistical significance and size of coefficients of inequality are much the same between the two periods. Also, the results for other variables are similar, although their statistical significance tends to be stronger in the period after 2000. Thus, we do not find evidence in support of the view that redistribution has de facto declined in recent decades.

3.4 Levels of inequality and size of redistribution

So far, we have presented evidence that high inequality is consistently and significantly associated with greater redistribution for various estimation techniques. Moreover, the magnitude of impact on redistribution of inequality is consistently around 0.5. We further examine whether there is a nonlinearity in the relationship between the two, for example, whether the magnitude of redistribution varies, depending on the level of market income inequality.

First, we investigate whether only high levels of inequality matter for redistribution. We test this idea by including interaction terms between market income inequality and dummy variables for two ranges of market income inequality: d_high_ineq (above 75 percentile) and d_low_ineq (below 75 percentile). (Note that the 75 percentile cutoff level of market income Gini coefficients is 49.64).Footnote 33 Surprisingly, the size of redistribution is not significantly greater when the level of market income inequality is high. Columns 1–5 of Table 5 shows that the coefficients of both interaction terms, market income inequality × d_high_ineq and market income inequality × (1 − d_high_ineq), are all significant at 1–5% and of the positive sign. Further, we cannot reject the null hypothesis that the coefficients of these two interaction terms are equal (except for the BE in Column 1). Also, it is noteworthy that the results for other economic variables such as income per capita, trade openness, old age dependency, government size, and financial market depth are qualitatively and quantitatively similar to the baseline results in Table 2.

Second, we consider a quadratic form of nonlinearity by including market income inequality squared in the baseline regression. Evidence on this type of nonlinearity is mixed. The results are shown in Columns 6–10 of Table 5. The coefficients of either market income inequality or its squared term lose statistical significance in the pooled OLS, FE, and SGMM regressions. Further, the signs of these two variables are reversed in the FE regression. The FE result suggests a U-shaped relationship between inequality and redistribution, whereas the rest indicate an inverted U-shaped relationship. Interestingly, the maximum point of redistribution is reached when the market income Gini index is around 57 (under BE), 87 (under OLS), 71 (under RR), and 71 (under SGMM) respectively, whereas the minimum point is attained when the Gini index is around 29 under FE. The value of market income Gini index in our data ranges from 27.2 to 66.5. Thus, the relationship between the two variables is effectively on the increasing interval of the quadratic curve, with the rate of increase in redistribution (i.e., the second derivative) declining in the case of the BE, OLS, RR, and SGMM and increasing in the case of the FE. That is, the evidence does not suggest a meaningful quadratic form of nonlinearity. Instead, the results of Table 5 suggest an approximately linear positive relationship between inequality and redistribution, which is consistent with the baseline regression (which assumes a linear relationship).

3.5 Democracy and redistribution

It is widely held that democratic regimes will choose policies that are more favorable to the poor than non-democratic regimes, to the extent that public decisions are made (directly or indirectly) by voting (e.g., Mulligan et al. 2004). It is because the distribution of political power is more equal than the distribution of income or wealth. This is an important reason why Meltzer and Richard’s (1981) model (which is based on the median voter hypothesis) confirms de Tocqueville’s (1835) fear that democracies would excessively redistribute from rich to poor. In countries with more unequal income distribution, the median voter’s income is lower than the average income and the income gap between the median and the mean is greater. Thus, in democracies, the median voter (the decisive voter for majority rule) has a greater tendency to vote for higher redistributive fiscal spending that is accompanied by higher taxes because the benefit to the median voter from redistributive transfers outweighs the burden of taxation (i.e., the tax burden disproportionately falls on higher income voters). More generally, the skewness of the distribution of taxable income can be an important determinant of income redistribution in democracies, because it measures the amount that the middle class can gain by forming a voting coalition with the poor (see Alesina and Rodrik 1994; Persson and Tabellini 1994). We confront this idea with data by including an indicator of democracy in the baseline specification (with or without an interaction term with market income inequality).

Table 6 shows the results. In Columns 1–5, we add to the baseline specification an indicator of democracy from Polity IV which ranges from 0 (no democracy) to 10 (full democracy). The coefficients of the democracy indicator are of positive sign as expected, but their statistical significance is not robust. They are statistically significant only under OLS and RR (Columns 2 and 3). By contrast, all the coefficients of inequality remain significant at 1–5% and of positive sign, ranging from 0.27 to 0.685, which are comparable to those in the baseline regressions. In Columns 6–10, we use a dichotomous indicator of democracy, that is, a dummy variable for democracy which takes a value of 1 if the democracy indicator’s score is greater than 8, and 0 otherwise.Footnote 34 The results turn out to be stronger. The coefficients of the democracy dummy are significant at 1–10%, except for the FE. According to the four significant coefficients, the size of redistribution differential between the democracies and non-democracies is around 3.23 Gini points, which amounts to 7% of the average of market income Gini coefficients in our sample. It is not trivial. This result indicates that greater redistribution is attained in democratic countries for the same levels of market income inequality, that is, there is a (constant) gap in the extent of redistribution between democracies and non-democracies.

However, this does not imply that democracies react to higher inequality with greater redistribution. When we allow for a difference in slopes by including an interaction term between the democracy dummy variable and market income inequality, the coefficients of the interaction term are insignificant and of the wrong sign (−), except for the FE estimate which is significant at 5% and of the expected sign (+) and for the SGMM estimate which is of positive sign but insignificant. See Columns 11–15. The coefficients of the democracy dummy are of the expected sign (+), except for the FE, but they are significant only under the BE and RR regressions. In stark contrast, the coefficients of market income inequality remain highly significant, and their size is quantitatively similar to that in the baseline regression. Finally, it is equally important to note that even in non-democracies, market income inequality is consistently and positively associated with redistribution, which is evident from the statistically significant coefficients of inequality in Columns 1–15. To see this more directly, we split the sample between democracies and non-democracies and run the regressions separately. A similar conclusion is reached.Footnote 35 See Appendix Table 5. Therefore, it seems reasonable to conclude that a country with higher inequality of market income tends to engage in more redistribution, irrespective of whether the country is democratic or not, and yet, the extent of redistribution in a democratic country tends to be greater.

3.6 Political institutions and redistribution

We turn to political and institutional variables. In particular, we pay close attention to whether certain aspects of political institutions (such as policy-orientation of the party in power, unified versus divided government, institutionalized veto players) matter for redistribution.

Before proceeding to the regression results, we highlight a few points from related literatures that are relevant for our analysis. There is a large political economy literature on the origins, character, effects, and prospects of welfare states in advanced industrial democracies. The constitutions of modern democracies can be classified in terms of presidential versus parliamentary systems. In parliamentary systems where the executive branch derives its democratic legitimacy from its ability to command the confidence of the legislative branch, typically a parliament, and is held accountable to that parliament. Thus, to maintain their office, the executive branch may be more sensitive to demands of the parliament which represents the interests of their constituents. By contrast, the executive in presidential systems is often given more flexibility and discretion when making decisions, without fear of losing office at least in the short term.Footnote 36 Persson and Tabellini (2003) find parliamentary systems to have larger governments, as compared to presidential systems.Footnote 37 Also, Woo (2003) finds evidence that parliamentary regimes tend to run larger deficits than presidential regimes. Consistent with these earlier findings, we already saw from the baseline results that the parliamentary systems are significantly associated with greater redistribution than presidential systems for various estimation methods (with a couple of exceptions). See Tables 2 and 3. In addition, whether the government is unified or divided can make a difference in terms of policy outcomes. Theoretically, a divided government can be a source of policy delays, but also of policy moderation due to the needed political compromise (Alt and Lowry 1994; Alesina and Rosenthal 2000). If this is the case, the divided government may be more prone to fiscal largesse.

Moreover, the policy orientation of the party in power may matter for redistribution. The role of the political left as the main driving force of social welfare expansion is well-documented in the literature (e.g., Esping-Andersen 1991; Huber and Stephens 2001). Huber and Stephens (2001) find in industrial democracies that a prolonged government by different parties (loosely speaking, left versus right) results in markedly different welfare states, with strong differences in levels of poverty and inequality. However, Jensen (2014) challenges the common wisdom that right-wing parties have a single goal of cutting public social spending in order to reduce tax burden of their constituents (presumably, disproportionately high-income groups), arguing the right-wing parties’ impact on types of welfare is more nuanced (e.g., unemployment benefits versus health care). On the other hand, institutional checks and balances (as measured by the number of veto players) or constraints on the executive decision makings (as a proxy of institutionalized constraints) can influence the outcome of political decision process. Regarding the impact of institutionalized veto players on fiscal policies, see Hallerberg and von Hagen (1999), Woo (2003, 2009), Crepaz and Moser (2004), and König et al. (2011) among others. In general, countries with many veto players (e.g., coalition governments, bicameral political systems, and president with a veto power) are expected to have difficulty altering the budget structure or social welfare programs, while avoiding large fiscal policy volatilities.

In Columns 1–5 of Table 7, we add to the baseline specification: (i) an indicator of policy orientation of the executive’s party which takes a value of 1 for right-wing, 2 for center, and 3 for left-wing; (ii) an indicator of a unified government, all house, which takes a value of 1 if the party of the executive branch controls both houses of the legislative branch, and 0 otherwise; and (iii) an indicator of institutionalized checks and balances as measured by the number of institutional veto players. First, the coefficients of the variable all house turn out to be of negative sign and statistically significant at 1–10% (except for the BE). According to the significant coefficients, the magnitude of redistribution associated with a unified government as opposed to a divided government is non-negligible. The size of redistribution is about 1.7 Gini points smaller under the unified government than the divided government, other things being equal (i.e., it is equivalent to 3.7% of the average level of market income inequality in our sample). Second, the coefficients of policy orientation turn out to be positive as expected, indicating that a left-wing government tends to engage in more redistribution. But the statistical significance is not robust—they are statistically significant only under the BE, OLS and RR. According to the significant coefficients, the size of redistribution is about 0.6 Gini points greater under the left-wing government than the right-wing government, with other variables controlled for. Third, the coefficients of checks and balances are of positive sign and significant at 1–10% only under the BE and OLS methods. They even change their sign under FE and SGMM. Finally, we note that the coefficients of political system remain of positive sign, but they are now statistically significant only under RR and SGMM. That said, it is remarkable that the coefficients of market income inequality remain positive and all significant at 1%, with their values ranging from 0.329 to 0.723. Moreover, the coefficients of other variables such as income per capita, trade openness, old age dependency, government size, and financial market depth retain the same signs as in the baseline regressions and are mostly significant at the conventional levels.

In Columns 6–10 of Table 7, we include the dummy variable of democracy in addition to the above political variables. The coefficients of the democracy dummy variable retain the positive sign but loses statistical significance, except for the RR regression, when compared to Columns 6–10 in Table 6. Similarly, the statistical significance of other political variables (all house, political orientation, checks and balances, and political systems) weakens, while most of them retain the same signs as shown in Columns 1–5. Again, all the coefficients of market income inequality remain significant at 1% and of positive sign, ranging from 0.305 to 0.728. Likewise, the results for other variables such as income per capita, trade openness, old age dependency, government size, and financial market depth do not change appreciably.

3.7 Alternative data on inequality and redistribution

As additional robustness check, we use the alternative data on inequality and redistribution from the SWIID for the period of 1965–2015 whose main advantage is a large sample size. Table 8 shows the regression results for OECD and emerging market economies (to account for the possibility that the relationship between inequality and redistribution can be different, depending on the stages of economic development, we restrict the sample to 59 OECD and emerging market economies as with the case of the LIS data). Columns 1–5 present the results for the baseline specification, Columns 6–10 adds political variables to the baseline regression, and Columns 11–15 adds political variables and democracy indicator. The results turn out to be qualitatively similar to the main results based on the LIS data, but the overall statistical significance of other explanatory variables is somewhat weaker. Importantly, the coefficients of market income inequality are of positive sign and all significant at 1–5%, while the size of the coefficients tend to be smaller, ranging from 0.256 to 0.37. Also, the results for other socio-economic variables such as income per capita, trade openness, old age dependency, and government size are broadly similar to the baseline regression results, although their statistical significance is weaker. With regard to political and institutional variables, parliamentary systems and left-wing governments are associated with more redistribution, while unified governments tend to engage in less redistribution, which is consistent with our previous findings. However, their statistical significance turns out to be weaker and some of them even changes their signs depending on estimation methods. The coefficients of the democracy dummy variable are all insignificant.Footnote 38

4 Concluding remarks

Income inequality has significantly increased in many advanced and emerging market economies over the past few decades. In some countries, income and wealth inequality have reached their highest levels in recent history, which raises concern for adverse socio-economic consequences. In this context, some economists and policymakers advocate redistributive policies to tackle this problem. Although redistribution of income is one of the most central functions of the modern sate, there are many questions in the literature, including why some countries achieve more redistribution than others; whether high-income inequality leads to more redistribution; and to what extent the economic, political, and institutional factors influence the magnitude of redistribution. To address these questions, we have put together different strands of literature related to redistribution and examined the relationship among redistribution, income inequality, and economic, political, and institutional factors in a panel of 47 countries over the period of 1967–2014.

To our knowledge, this is the first paper that presents robust evidence that high income inequality is consistently and significantly associated with more redistribution. According to the baseline results, on average, about half of the increase in market income inequality is offset through redistribution in our sample. Interestingly, we do not find evidence of nonlinearity between the two, nor do we find that redistribution has weakened in more recent years. On the flipside, this means that many countries have not pushed (or could not) for greater redistribution beyond what they have already been doing for years. Thus, our results suggest that rising market income inequality is the main driver of the rising trend in net income inequality, with redistribution moderately alleviating market income inequality.

Furthermore, we obtain many interesting novel results from studying a wide array of economic, political, and institutional factors of redistribution. First, we find that income per capita, trade openness, and old age dependency are consistently positively associated with redistribution, while financial market depth is negatively associated with redistribution. In a sense, some of these results may not be surprising. For example, given the well-known observation that share of the public sector in the economy increases as national income rises (i.e., Wagner’s law), one might expect that the extent of fiscal redistribution also increases as the income per capita rises. From an empirical standpoint, however, it is a new finding that the income per capita is consistently and positively associated with the size of redistribution as measured by the amount of reduction in market income inequality via taxes and transfers. So are the results for old age dependency, trade openness, and financial market depth.

Second, the evidence suggests that a country with higher market income inequality tends to engage in more redistribution, irrespective of whether the country is democratic or not, and yet, the extent of redistribution in a democratic country tends to be greater. As noted previously, earlier studies focusing on government spending and tax policies as a proxy of redistribution often failed to find significant evidence in support of Meltzer and Richard’s (1981) prediction. In contrast, by utilizing a single direct measure of the extent of fiscal redistribution we can clearly see from the data that democracies tend to redistribute more than non-democracies. At the same time, the finding that a country (democratic or not) with higher inequality tends to redistribute more may have to do with the existing studies’ failure to discern a definite difference in government spending or tax policy under democracy. It is because such a spending or tax measure only gives a partial view of the redistribution at work. Nonetheless, we still need to be cautious in drawing firm conclusions. Statistical significance of the evidence turns out to be sensitive to types of the democracy indicator, the inclusion of its interaction term with inequality, and to the inclusion of other political variables.

Third, it is noteworthy that parliamentary systems (as opposed to presidential system), left-wing governments (as opposed to right-wing), and checks and balances in political decision making (as measured by the number of institutional veto players) are positively associated with redistribution, while unified governments (as opposed to divided governments) are negatively associated with redistribution. These new findings contribute to better understanding of the economic outcomes of political and institutional setups.

Still many questions remain unanswered. For example, redistributive policy tools are not equal, and their macroeconomic effects, including the impact on economic growth, are not well understood. Intuitively, some of them such as (targeted) income transfers and progressive tax may have a more immediate impact on inequality, while mitigating social polarization owing to high inequality. Others such as expanding the economic opportunities for the poor may not reduce inequality immediately but can promote inclusive growth and reduce the gap between rich and poor over the long run. The redistributive tools would involve some trade-offs in terms of timing of their impact on income distribution and efficiency costs to the society.

Notes

Rising inequality has been attributed to a range of factors, including the globalization and liberalization of factor and product markets, skill-biased technological change, automation, weakening of labor bargaining power, superstar professionals and superstar firms, and declining top marginal income tax rates.

According to Jenkins et al. (2012), in the first two years following the Great Recession there was not much immediate change in disposable income distribution in many advanced economies because of government support via tax and benefits, with real income levels declining throughout the income distribution and large wealth losses for those at the top of the distribution. However, since then, widening inequality seems to have resumed in the recovery, as asset prices have risen, while wage growth has been stagnant (see Yellen 2014 and therein references). Some argue that post-crisis unconventional monetary policy has contributed to worsening inequality by inflating asset bubbles that tend to mostly benefit the wealthiest. See Bunn et al. (2018) on the recent UK experience.

Absolute redistribution (via taxes and social transfers) is measured by the difference between market income inequality and net income inequality, that is, absolute amount of the reduction in market income inequality due to taxes and transfers. Relative redistribution refers to the reduction in market income inequality as percent of initial market income inequality.

To put the order of magnitude in perspective, the median value of net income inequality (as measured by Gini coefficient on a 0–100 scale) is 29.15 and median size of redistribution (as measured by difference between market income inequality and net income inequality) is 15.77 in our LIS data for 47 countries in 1967–2014. On the other hand, the median value of 10-year change in the size of redistribution is 1.41.

Interestingly, Caminada et al. (2017) reach the similar conclusion by using a very different method (i.e., decomposition of the Gini coefficient of market income into net income Gini coefficient and contributions from 9 different benefits and income taxes and social contributions).

Related, Razin et al. (2004) develop a majority-voting model that predicts that tax rates on capital income could rise as the population ages, and find supporting evidence from a panel data for ten European Union countries in 1970–1996.

In a broad context, there have been debates on whether globalization would lead to a retrenchment of the welfare state by eroding the government’s capability to redistribute income and wealth, even when it makes the redistribution more desirable in more open economies, as multilateral trade liberalization and technological progress make borders less of a barrier to economic activity (e.g., relocation of firms to low-tax and low-cost countries). See Rodrik (1997), Garrett and Mitchell (2001) and Crepaz and Moser (2004) among others. More recently, globalization seems to have played an important role in driving up support for populist movements. See Rodrik (2021).

It takes a value of 1 if Democracy score from Polity IV is greater than 8 and 0 otherwise. Democracy score ranges between 0 (no democracy) and 10 (full democracy). Further details are provided in the text later.

Also, if we split the sample between democracies and non-democracies and run regression separately, we reach a similar conclusion.

For example, see Persson and Tabellini (2003) and Woo (2003) for empirical studies on fiscal policy outcomes of political systems; see Esping-Andersen (1991), Huber and Stephens (2001), and Jensen (2014) about the role of left-wing political parties as a driving force of social welfare expansion in advanced industrial democracies; see Hallerberg and von Hagen (1999), Woo (2003, 2009), Crepaz and Moser (2004), and König et al. (2011) about the role of institutionalized checks and balances in political decision makings; and see Alt and Lowry (1994) and Alesina and Rosenthal (2000) about policy outcomes of united versus divided governments.

It is because the distribution of political power is more equal than the distribution of income or wealth. To the extent that public decisions are made by majority rule, the decisive voter (i.e., median voter) will vote for higher redistributive spending which is accompanied with higher taxes because the benefit to the median voter from redistributive transfers outweighs the burden of taxation (i.e., the tax burden disproportionately falls on higher income voters).

Somewhat related to this, Acemoglu et al. (2015) finds that democracy is associated with an increase in tax revenue as a percent of GDP, but not significantly associated with lower income inequality. Their focus is on the direct effects of democratization per se on inequality and other variables such as tax revenue and secondary school enrollment.

The SWIID employs a missing-data algorithm that uses information from proximate years within the same countries, while taking the LIS as a benchmark. However, the increased coverage and comparability does not come without cost—for example, when the information from proximate years within the same countries is unavailable, the quality of imputation itself and how to account for multiply-imputed observations are the issues. This leads some (e.g., Jenkins 2014) to prefer to use the WIID with a dummy variable approach (that is, dummy variables indicating whether the data point is net income inequality or market income inequality, or it is per household or household adult equivalent, etc.) rather than the SWIID. However, for our purpose, this approach would not work.

For lack of the standard empirical model of redistribution, we consider a large empirical literature on the determinants of income inequality, which includes national income per capita, education, trade openness, and old age dependency as explanatory variables of cross-country variations in inequality (e.g., de Gregorio and Lee 2002; Barro 2008; Woo et al. 2017).

The time interval for each LIS Wave is not uniform. Historical Wave I (1967–1973) has a 7-year interval, and from Historical Wave II (1974–1978) through Wave V (1998–2002), each has a 5-year interval. Beginning with Wave VI (2003–2006), it is a 3-year interval.

The absolute measure of redistribution makes it easier to interpret the coefficients. On the other hand, the relative measures of redistribution tracked over time can be viewed as the “percentage change in percentage change” (Caminda et al. 2012).

This was performed given that redistribution and inequality are likely persistent over time. Note that the panel data has N = 47 (countries) and T = 11 (periods) where the periods are several years apart (3 or 5 or 7 years). The number of available data points on redistribution and inequality from the LIS tends to be fewer than 11 for most countries. For example, only Germany and the UK have 11 observations available; Australia (8 observations), Austria (6); Belgium (4); Brazil (4); China (1); Denmark (8); Egypt (1); France (7); Japan (1); Korea (4); South Africa (3); Spain (9); Switzerland (7); and the US (10). For practical purposes, this raises doubt about the power of augmented Dickey-Fuller test for a stationarity of redistribution and inequality. Nonetheless, for example, if we perform an augmented Dickey-Fuller test for Germany and the US, we can still reject the null hypothesis of a random walk (with drift) for redistribution at the conventional levels.

It refers to the tendency that as nations industrialize, the share of the public sector in the economy grows because of political pressure for social activities of the state, administrative and protective actions, and welfare functions. For example, Bojanic (2013) and Afonso and Alves (2017) provide evidence based on disaggregated expenditure data for Bolivia and 14 European countries, respectively.

The Kuznets curve implies that inequality exhibits an inverted U-curve as the economy develops: economic development (including shifts from agriculture to industry and services and adoption of new technologies) initially benefits a small segment of the population, causing inequality to rise. Subsequently, inequality declines as the majority of people find employment in the high-income sector. However, the existing evidence for the Kuznets curve is mixed (see Barro 2008 and references therein).

A similar argument can apply to terms-of-trade growth, including the ‘voracity effect’ in Tornell and Lane (1999) in which a windfall gain (e.g., oil boom) may perversely generate a more than proportionate increase in fiscal redistribution, when a country lacks legal, political, and institutional constraints on the government spending policy.

For economic variables such as income per capita, government size, old age dependency ratio, trade openness, and financial market depth, their initial values (i.e., measured at the beginning year of each period) are used in the regression. For political variables, their average values over the previous period are used to capture the slower yet long-lasting effects on redistribution of political institutions.

Intuitively, the within-transformation (i.e., demeaning) under FE may exacerbate the measurement error bias by decreasing the signal-to-noise ratio (Grilliches and Hausman 1987).

In an extensive evaluation of growth regressions in relation to macroeconomic policy variables, for example, Easterly (2005) argues that some of the large effects on growth of a policy variable in the earlier empirical studies are often caused by outliers that represent “extremely bad” policies.

It is essentially an iterated re-weighted least squares regression in which the outliers are dropped (if Cook’s distance is greater than 1) and the observations with large absolute residuals are down-weighted.

Importantly, the difference-in-Hansen tests of exogeneity of instrument subsets do not reject the null hypothesis that the instrument subsets for the level equations are orthogonal to the error (p value = 0.13), that is, the assumption that lagged differences of endogenous explanatory variables that are being used as instruments in levels is uncorrelated with the errors. This is the additional restriction that needs to be satisfied for the SGMM estimator.

The dynamic panel GMM can generate too many instruments, which may overfit endogenous variables and run a risk of a weak-instruments bias. However, a standard test of weak instruments in panel GMM regressions does not currently exist (Bazzi and Clemens 2013). See Stock et al. (2002) on why the weak instrument diagnostics for linear IV regression do not carry over to the more general setting of GMM. Given that, one recommendation when faced with a weak-instrument problem is to be parsimonious in the choice of instruments. Roodman (2009) and Kraay (2015) suggest restricting the number of lagged levels used in the instrument matrix or collapsing the instrument matrix or combining the two. We followed this recommendation and obtained the SGMM results for our paper by combining the “collapsed” instrument matrix with lag limits.

As an alternative variable of financial depth, we tried private credit extended by banks and other financial institutions (as a percent of GDP) and obtained similar results (not reported to save space).

A plausible idea is as follows. In a seminal paper, Galor and Zeira (1993) show that in the presence of credit markets’ imperfections and indivisibilities in investment in human capital, the initial distribution of wealth can perpetuate the initial inequality of wealth. It is because agents whose initial endowment is below a certain minimum needed to pay for education cannot accumulate human capital unless they have access to credit. Thus, to the extent that well-developed financial markets alleviate the budget constraint and provide the poor to access to credit, the poor can also accumulate human capital and earn higher income, thereby reducing their demand for income redistribution. However, access to credit may still remain unequitable despite the financial market development, which can then aggravate inequality and lead to a greater demand for redistribution, not less. Thus, it is fundamentally an empirical question.

In their original model of Meltzer and Richard (1981), the relative measure of redistribution can be viewed as a proxy for the linear income tax rate which they predict will rise as a result of greater market income inequality (as measured by the gap between average income and median voter’s income). The model assumes that taxes are levied on all private sector income using a linear tax rate and that all the proceeds from taxation are redistributed in an equal lump sum among the economic agents.

Put this in perspective, the mean value of market income inequality in the LIS data is 46.2; mean absolute redistribution is 14.4; and mean relative redistribution is 31. Thus, 0.45–0.47 percentage points of the average market income inequality are about 0.2 Gini points.

We also tried the 50th percentile as the threshold. The results do not change any appreciably.

The cutoff value of 8 for the dummy variable corresponds to the 39th percentile of available observations.

A caveat is that in the sample of non-democratic countries, the size and statistical significance of the coefficients of market income inequality tends to lessen.

They also find that in parliamentary regimes, spending (and particularly welfare spending) displays a more pronounced response than in presidential regimes to the common global events that led to the expansion of government spending from the 1960s to the mid-1980s.

In the previous version, we presented the baseline regression results for the entire sample of 140 countries. They are qualitatively similar to the baseline results based on the LIS, especially with the coefficients of market income inequality being positive and all significant at 1–5% (the coefficients range from 0.210 to 0.245). The overall goodness of fit and statistical significance of other variables further weaken. Not surprisingly, this may reflect the fact that low-income developing countries engage in much less fiscal redistribution because of their limited government budgets and effectiveness (recall Fig. 2).

References

Acemoglu D, Naidu S, Restrepo P, Robinson JA (2015) Democracy, redistribution, and inequality. In: Atkinson AB, Bourguignon F (eds) Handbook of income distribution, vol 2. North-Holland, Amsterdam, pp 1885–1966

Afonso A, Alves J (2017) Reconsidering Wagner’s law: evidence from the functions of the government. Appl Econ Lett 24(5):346–350

Alesina A, Rodrik D (1994) Distributive politics and economic growth. Q J Econ 109(2):465–490

Alesina A, Rosenthal H (2000) Polarized platforms and moderate policies with checks and balances. J Public Econ 75:1–20

Alt JE, Lowry RC (1994) Divided government, fiscal institutions, and budget deficits: evidence from the states. Am Polit Sci Rev 88(4):811–828

Alvaredo F, Atkinson AB, Piketty T, Saez E (2013) The top 1 percent in international and historical perspective. J Econ Perspect 27(3):3–20

Arellano M, Bover O (1995) Another look at the instrumental variables estimation of error-components models. J Econom 68:29–51

Atkinson AB, Brandolini A (2001) Promise and pitfalls in the use of secondary data-sets: income inequality in OECD countries as a case study. J Econ Lit 39(3):771–799

Babones SJ, Alvarez-Rivadulla MJ (2007) Standardized income inequality data for use in cross-national research. Sociol Inq 77(1):3–22

Barro R (2008) Inequality and growth revisited. Asian Development Bank Working Paper Series on Regional Economic Integration, No. 11, January

Bazzi S, Clemens M (2013) Blunt instruments: avoiding common pitfalls in identifying the causes of economic growth. Am Econ J Macroecon 5(2):152–186

Benabou R (1996) Inequality and growth. In Bernanke BS, Rotemberg JJ (eds) NBER macroeconomics annual 1996, vol 11, pp11–92

Berg A, Ostry JD, Tsangarides CG, Yakhshilikov Y (2018) Redistribution, inequality, and growth: new evidence. J Econ Growth 23(3):259–305

Blundell R, Bond S (1998) Initial conditions and moment restrictions in dynamic panel data models. J Econom 87(1):115–143

Bojanic AN (2013) Testing the validity of Wagner’s law in Bolivia: a cointegration and causality analysis with disaggregated data. Revista De Analisis Economico Econ Anal Rev 28(1):25–45

Boushey H (2019) Unbound: how inequality constricts our economy and what we can do about it. Harvard University Press, Cambridge

Bunn P, Pugh A, Yeates C (2018) The distributional impact of monetary policy easing in the UK between 2008 and 2014. Bank of England, Staff Working Paper No. 720

Caminada K, Goudswaard K, Wang C (2012) Disentangling income inequality and the redistributive effect of taxes and transfers in 20 LIS countries over time. LIS Working Paper No. 581