Abstract

The regulatory environment in a country is an important factor that affects firm performance. This study investigates the impact of a particular regulation—license requirements for certain firm activities—on the innovation performance of Indian firms in the 1990s. Using a unique firm-level panel data set, it shows that the removal of license requirements led to an eight percentage points higher innovation rate within two years following the reform. We measure innovation as the introduction of new product varieties that had not been produced by the firm before. It takes a longer time for firms to innovate in industries in which they were not producing before. The findings of this study are also robust to the inclusion of controls for other policy reforms that occurred during the period of licensing reform. They also persist in tests with different subgroups of firms and with the use of alternative estimation methods.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The regulatory environment in a country plays an important role in the success of technology adoption strategies and innovative efforts. This paper studies the effects of India’s delicensing reform in the 1980s and 1990s on firms’ innovation performances.Footnote 1 Before the reform, firms were required to obtain a license to establish a new factory, significantly expand capacity, start a new product line, or change location. Delicensing reform led to freedom from constraints on the choice of output, use of inputs and technology, and facilitated location choice. The reform allowed firms to take advantage of economies of scale, allocate inputs more efficiently, and use newer technologies.

This study shows that the delicensing reform in India increased the product innovation rate by eight percentage points within the first two years following the reform. In our analysis, we use a novel firm-level panel dataset that allows us to observe product-level information for each firm. We measure innovation through the introduction of new product varieties. We also use real sales as an alternative proxy for firms’ innovative output. Our empirical analysis yields a strong, positive impact of delicensing reform on innovation and sales growth.

In the empirical framework, we compare the product growth of firms that were in recently delicensed industries with those firms that were delicensed earlier. Using the panel nature of our data, we introduce firm-level fixed effects and compare the innovation performance of the two groups using the difference-in-difference methodology. We also introduce several industry-level control variables such as input tariffs, output tariffs, and foreign direct investment exposure to control for other potential factors that could affect the innovation performance of firms. These additional variables also help control for other policy reforms that took place during the time of our analysis.

We further investigate whether any particular subgroup of firms in the dataset such as export-oriented firms could drive the results. Our estimation results are also robust to using alternative specifications and different estimation methods. The product growth rates of firms in recently delicensed industries reach growth rates that are observed in the control group in about two years after reform.

Although the theoretical and empirical literature on innovation is rich, it is a demanding task to measure innovation empirically. Most of the existing studies on innovation proxy it with patenting activity, the number of patent citations received, labor productivity, total factor productivity (TFP), or data from innovation surveys.Footnote 2 The innovation measure that we use is the introduction of a new product variety by a firm. The use of such a direct measure of innovation differentiates this study from most of the existing work in this field with firm-level datasets.

Although patent data could provide a good measure of innovation as compared to innovation survey data or TFP estimates, patent data are usually available for a small set of firms. Moreover, in developing countries, the patent recording mechanism might not work efficiently. Thus, such data allows a limited analysis of innovation performance. An alternative proxy for the innovative outcome—TFP—measures firm performance as a residual of production function estimations. Although TFP or labor productivity are commonly used measures of firm performance, they can reflect innovation output only indirectly. Moreover, the assumptions as to the shape of the production function, the prices of outputs, and the use of inputs make it difficult to estimate TFP.

The remainder of this paper is organized in the following sections: In Sect. 2 we provide a brief review of the literature. Section 3 outlines the relevant reforms in India that affect the results of this study. Section 4 describes our estimation methodology. Section 5 discusses the data, while Sect. 6 presents the main results. In Sect. 7, we provide a set of robustness tests. In Sect. 8, we provide concluding remarks.

2 Literature Review

Many studies analyze how changes in market dynamics and regulatory environment affect innovation performance. New competition that arises from a reform may cause a reallocation of production factors across firms. More competition by new entrants and peers may push firms to increase their efficiency by: curtailing costs (Helpman and Krugman 1985); concentrating on products of firms’ comparative advantage (Bernard et al. 2011); or increasing incentives to innovate to respond to the threat of new firm entries (Aghion et al. 2005). Aghion et al. (2005) use a sequence of competition policy reforms to investigate how product market competition level affects innovation performance. Goldberg et al. (2010a) show that the liberalization of tariff rates increases the rate at which firms introduce new products to the market.

This study shows—with empirical evidence from India—how changes in the regulatory environment affect innovation performance. Several studies have analyzed the impact of regulatory reforms in India: in particular, the delicensing reform. However, most of these studies use repeated cross-sectional data which allows driving inferences at the industry level. Aghion et al. (2008), for example, focus on registered manufacturing output and the interaction between the delicensing reform and other labor market regulations. Meanwhile, Chari (2011) examines the effects of the delicensing reform on total factor productivity. Chamarbagwala and Sharma (2011) analyze the effect of delicensing reform on skill upgrading. None of these studies can analyze growth at the firm level as the data they use is formed by a repeated cross-section of firms. Our use of firm-level panel data gives us the advantage of controlling for firm-specific idiosyncratic factors.

Several models show how reforms affect firm performance. Restuccia and Rogerson (2008) analyze the effects of policy distortions on firm performance where they model these distortions as output tax. They find that distortions in the profits of a firm can lead to sizable losses in productivity.Footnote 3 A similar interpretation is also used in Hsieh and Klenow (2009). They introduce a tax on output of firms. Being required to provide a license to increase capacity or start a new product line, firms have to deal with government officials which is likely to take time and is costly. This distortion can be considered as a tax on a firm’s profit or revenue. License requirements prevent firms from responding quickly to the changes in market conditions and lead to loss of competitiveness. We base our empirical analysis on a model introduced by Klette and Kortum (2004) which was then extended by Şeker (2012b).

3 Economic Reforms in India

Starting from the 1980s, India liberalized its economy by dismantling government controls over industries and trade. One of these reforms was on product market regulations. Until 1985, the Industries Act of 1951 brought all key industries in the registered manufacturing sector under central government control through industrial licensing. Under this act, firms had to get a license to undertake many economic activities. Yet, granting licenses were subject to heavy bureaucracy. These barriers discouraged investment projects because each project would require many licenses. In 1985, after Rajiv Gandhi’s rose to power, a group of industries were delicensed.

Later in 1991, as a part of the structural reforms pursuing the balance of payments crisis, licenses were removed for another group of industries. Aghion et al. (2008) provide a discussion on how the delicensing reform was mostly unanticipated. A number of industries were retained from the reform due to security and strategic concerns, social reasons, hazardous nature, and high-end consumption of the products in the industry.Footnote 4

In Table 1, we present the percentage of firms that belong to 4-digit NIC industries that have been delicensed.Footnote 5 In 1989, around 43% of the firms belonged to industries that were delicensed on or before 1988. In 1992, the share of delicensed firms more than doubled. Lastly, in 1993 a very few industries were further delicensed.

India had several other major market reforms during the same period. One of these reforms involved international trade. Average tariff rates and non-tariff barriers were quite restrictive in Asia towards the end of the 1980s. There have been radical changes in economic policies during the 1990s. Topalova and Khandelwal (2011) show that average tariff rates declined from 97% in 1989 to 46% in 1995. They also show that there were significant decreases in the share of products that are subject to quotas which went down from 87% in 1987 to 45% in 1994.Footnote 6

The Indian government also reduced the barriers to foreign direct investment in a group of industries after the balance of payments crisis in 1991. The reform allowed majority ownership rights to foreign firms. Foreign-owned companies are usually better at technology adoption. They are more innovative than domestic firms. They can get easier access to technology, capital resources, and R&D facilities of their parent companies which support innovation and growth.Footnote 7

Trade liberalization and FDI reforms can affect innovation performances of firms. In the empirical analysis, we test whether delicensing reform increased the innovation performances of firms controlling for all these policy changes as well as firm-specific factors.

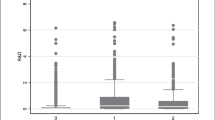

We provide a detailed discussion of how we define a product in Sect. 5. Figure 1 depicts the evolution of the average number of products for the firms that were in delicensed industries during the sample period (treatment group) and the average number of products for firms that were in delicensed industries before the sample period started (control gro1up). As presented in Table 1, the majority of delicensing took place towards the end of 1991 in our sample.

After 1991, the average number of products of firms increase significantly in delicensed industries, whereas during the same period no major trend is observed in the number of products in the control group. Moreover, the graph shows a strong convergence in the number of products between the treatment and control groups. In about two years after the main reform period, firms in the treatment group catch up with firms in the control group in the number of products.

In the empirical analysis, we use the difference-in-differences method. Hence, it is important to see whether there are any trends in product evolution between the treatment and control groups in the pre-reform period. The data shows that half of the firms were delicensed before 1989, the first year of our sample. As can be seen in Fig. 1, there is no particular trend before the reform. While the average number of products varies around 3.7 for the control group throughout the sample period, there is a positive trend for the treatment group after the reform.

4 Hypotheses

In the empirical model, we examine the impact of delicensing reform on the number of products of individual firms. We test whether firms that are delicensed later catch up with those firms that are delicensed earlier in their innovation efforts.

We define Delicen1 as an indicator variable that takes value 1 for the first year after the reform and 0 otherwise. Delicen2 is defined in the same way as an indicator variable that takes value 1 for the second year after the reform and 0 otherwise. These two variables are the main variables of interest.Footnote 8 Using an indicator measure that spans the entire life of a firm after reform rather than only first and only second years could be a more appropriate measure. However, firm innovation performance long after the reform could capture macroeconomic factors and other firm-time-specific shocks in addition to the impact of reform. Moreover, as we will show in the following analysis, the duration of the catching-up of the firms that are delicensed relatively later with the ones that are delicensed relatively earlier lasts around two years. We showed this finding already in Fig. 1. Another factor for choosing only two years after the reform is the data attrition.

We use the number of products that a firm produces in a year, \(n_{it}\) as the dependent variable for a firm i at year t. However, we use log(n) instead of n in the estimation to restrain the impact of the skewness of product distribution. Using log(n) also allows us to interpret the estimated coefficients as semi-elasticities.Footnote 9 The baseline specification is presented in Eq. (1).

We test the following hypothesis

The dummy variables measure whether the number of new products introduced by firms increases significantly compared to the control group within the first (Delicen1) and the second (Delicen2) years after the reform. They measure the impact of the reform on firms’ innovation performances.

At any given time, pre/post variable is one for a firm if it is operating in a deregulated industry and zero otherwise. It controls group-specific common trends after the reform. \(Industry4_{t-1}\) represents control variables which are the lagged values of the three policy reform measures at the NIC4 industry level: output tariff OTariff, input tariff ITariff, and industry level foreign direct investment amount FDI.Footnote 10 Unless stated otherwise, we control for NIC4-level fundamentals with \(Industry4_{t-1}\) and pre/post at every specification. \(\gamma _{i}\) is the firm fixed effect that controls all time-invariant firm characteristics. \(\mu _{NIC2,t}\) is the NIC2-year fixed effect and accounts for all annual macro and industry-specific shocks including NIC2 level demand or supply volatilities over the years.

To allow for correlation of error terms, we report robust standard errors that are heteroskedasticity-consistent and clustered at the industry (NIC2) level. In all specifications, we use lagged tariff and FDI variables because changes in all these variables are unlikely to have an instantaneous impact on the firm’s product scope.

Our identification strategy depends on intertemporal and across-industry variation in delicensing reform. In the estimation, we exploit the specific timing as well as the differential degree of deregulation across industries to identify the impact of the delicensing reform on firm’s innovation behavior. We study the impact of this reform not only on firm’s product scope but also on sales. Sales can indirectly reflect the improvements in the firm’s innovative performance which the number of products may not fully capture.

5 Data

Firm-level data used in the analysis is obtained from the Prowess Database which is constructed by the Center for Monitoring Indian Economy (CMIE) in India. This dataset has advantages over the Annual Survey of Industries (ASI) which is India’s manufacturing census. ASI is constructed from a repeated cross-section of firms whereas the Prowess database includes a panel of firms. The panel feature allows us to track firms over time.Footnote 11 It is also a rare database that records annual information on firms’ product mix. Hence product creation and destruction can be observed at the firm level. This unique feature of the data allows us to test the relationship between how firms adjust their product lines and policy changes.

In the literature, there are several ways that firms can introduce innovation. They can introduce process innovation by improving their production processes or gaining efficiency or they can introduce product innovation by introducing a new product variety that they did not produce before. Studies like (Bertschek 1995; Parisi et al. 2006; Fritsch and Meschede 2001) explain various properties of these two innovation types and analyze their drivers. The data from the Prowess database is appropriate for analyzing product innovation.

The data contains information from income statements and balance sheets of publicly listed (relatively large-sized) Indian firms from 1989 to 1995. This dataset is well suited for the particular purpose of this study as large firms contribute more to aggregate product creation compared to small firms. Goldberg et al. (2010a) use data from 1989 to 2003 and illustrate that the Prowess database accounts for 60 to 70 percent of the economic activity in the organized industrial sector. It also accounts for 75% of corporate tax payments. The panel used is unbalanced and the number of firms included in the data increases from 762 in 1989 to 2334 in 1995. We include only manufacturing firms in the analysis.

In the dataset, product-level information is available for around 85% of firms in the manufacturing sector.Footnote 12 Products are defined according to CMIE’s internal product classification. Goldberg et al. (2010b) present a detailed description of the data, product classification, and product mix change. They identify 1886 products linked to the 108 four-digit 1998 version of NIC industries in the manufacturing sector. They find that products that can be mapped to four or five-digit NIC codes account for 99% of total output. They also show that the number of products classified in India is quite comparable to the number found in Bernard et al. (2010) for the US manufacturing sector.

Descriptive statistics for the variables are presented in Table 2. An average firm in the sample has 1.95 products and a sales amount of 176.4 million 1993/1994 Indian Rupees. We use the data on delicensing reform compiled by Aghion et al. (2008). They use various issues of the Handbook of Industrial Policy and Statistics, press notes, and notifications issued by the federal government to code when different industries were exempted from industrial licensing. Delicen1, Delicen2 are indicator variables that take value 1 for a firm only for the first and second years after the industry that the firm operates in, is deregulated. They take value zero, otherwise.

We obtain data on tariff rates at four-digit industry level from Topalova and Khandelwal (2011). They construct a database of annual tariff rates at the 6-digit level according to the Indian Trade Classification Harmonized System Code based on various publications of the Ministry of Finance. Then they match the products at 6-digit with 4-digit NIC codes using the concordance introduced by Debroy and Santhanam (1993) to calculate average industry level tariffs. These industry-level output tariffs are combined with the input-output transaction table from 1993-1994 to calculate input tariffs. Output and input tariffs for a firm in a NIC4 industry are represented as OTariff and ITariff. The mean values of these variables are 0.75 and 0.27 respectively.

We also use the data compiled by Topalova and Khandelwal (2011) which is a 4-digit industry level, time-varying measure of openness to foreign direct investment represented by FDI. They obtain the data from the publications of the Handbook of Industrial Statistics. The FDI variable takes the value of zero before 1991 in all industries when FDI was strictly controlled. After that year it shows the percentage of the industry that is opened to FDI. The average level of FDI openness in the sample is 30%.

The average product growth rate is 6%. Add variable is a dummy variable that takes value one if a firm adds at least one product and zero otherwise. Similarly, Drop is a dummy variable that takes value one if a firm drops at least one product and zero otherwise. The data shows that average product addition is more frequent than product dropping. While, on average, 9% of firms add at least one product, only 3% of them drop at least one product.Footnote 13

Multi-product firms make around 45% of the firm population in the data. An average multi-product firm produces around 3 products and these firms make around 80% of total sales. A descriptive analysis of the evolution of multi-product and single product firms is presented in Table 3. The table shows the percentage of firms that showed various product evolution patterns annually, over three and five-year periods for the 1989-1995 period. The values presented in Table 3 are quite similar to those presented in Goldberg et al. (2010b) who construct the same table for the 1989-2003 period. The percentage of firms that change their product mix increases over longer periods. Over five years, around 40% of firms add or drop a product.

6 Main Results

Table 4 presents the baseline results for firm product scope in four columns. In column (1), we find that in the first year after the delicensing reform, the average number of products of a firm in a delicensed industry grows 3.2% faster. As one year may not be long enough to observe the full effect of delicensing, in column (2) we add Delicen2 to capture the impact in the second year after delicensing. We find that the total impact over two years is about 8 percent. Adding Delicen2 leads to an increase in the estimated impact of Delicen1. Since the impact of delicensing is spread over multiple years, this is an expected outcome. If we do not include Delicen2, observations with a higher number of products (n) due to the reform are treated in the control group observations, and hence they bias the estimated coefficient downwards.

Delicen dummies reflect how firms in later-delicensed industries catch up with firms in earlier-delicensed industries in innovation performance which we proxy by the growth rate of the number of products. These regression results support the descriptive graph presented in Fig. 1. A large group of industries was delicensed towards the end of 1991. Starting in 1992, we see more product growth in firms that belong to these later-delicensed industries. But, after the second year following reform, the difference in the average number of products of firms in later and earlier delicensed industries decreases and eventually vanishes by the third year after the reform.

The specifications in columns (1)–(2) control for firm and industry (NIC2)-year fixed effects. As briefly discussed in Sect. 3, other factors such as the concurrent trade liberalization reforms can also affect firms’ innovation performances. In columns (3)–(4) we introduce three more control variables to account for the impact of these reforms. We control for input tariff by Itariff, output tariff by Otariff, and foreign direct investment level by FDI.

Using micro-level data from developing countries, (Almeida and Fernandes 2008; Şeker 2012a) provide evidence on importing and exporting firms being more innovative. Criscuolo et al. (2010) reach a similar conclusion on the contribution of exporting on innovation for British firms. Goldberg et al. (2010b) find a significant increase in product growth rate caused by the reduction in input tariffs. The FDI reform is another factor that can affect the innovation performances of firms. It can reduce the cost of innovation by increasing R&D capacity or lowering capital and transaction costs. Using the Prowess database, (Vishwasrao and Bosshardt 2001) find that foreign ownership is among the factors that impact a firm’s probability of adopting new technology.

If delicensing reform across industries and over time is correlated with the process of tariff reduction and openness to FDI, then the empirical strategy could erroneously attribute the impact of these other reforms to delicensing reform. With the addition of these control variables (represented as \(Industry4_{t-1}\)), which are at NIC4 level industries, in column (3) to (4) of Table 4 we continue to find similar impacts for the Delicen dummies. In column (4), the impact is 5.0% (exp(0.049)-1) in the first year following the reform and 3.3% in the second year. We use the specification in column (4) as our baseline specification in the remaining sections. Results in Table 4 show that the catch-up effect seems to last about two years. Also, data attrition is not very severe in this specification which allows us to run further robustness tests with sub-samples.

Coefficients of tariff rates are not significant in these estimations. Our inclusion of industry (NIC2)-year and firm fixed effects seems to capture a significant variation across industries. This might contribute to the insignificant estimates for the tariff rates.Footnote 14 On the other hand, the results in column (4) confirm the significant contribution of the FDI reform. Foreign ownership increases the innovation rate by about 5%. Results in this table show that accounting for two major policy reforms, delicensing reform significantly increases product creation rates.

Industries evolve through product creation and destruction of incumbent firms and entry and exit margin. Although entering and exiting firms could contribute to the reallocation of resources and aggregate innovation in an economy, the Prowess database does not allow us to observe entry/exit dynamics. Firms can exit and re-enter the database. Since it is not possible to identify new entrants and actual exiting firms, the empirical analysis does not discuss the contribution of entrants and exiting firms to aggregate innovation. Goldberg et al. (2010a) use the Prowess database and provide a similar discussion regarding the possible contribution of entering and exiting firms.

Information on change in the number of products produced by a firm is rarely available and yet it is a concrete measure of innovative output. However, it is not straightforward to define a product in empirical literature using micro-level datasets. Furthermore, although our focus is to explain the impact of delicensing reform on product innovation, there are other means of innovation as discussed earlier in the data section. For these reasons as an alternative to number of products (\(n_{t}\)), we use real sales (\(log(sales_{t}\))) and real sales per product (\(log(sales_{t}/n_{t})\)) as dependent variables. Firms that introduce new products are likely to increase their sales as a result. Hence, \(n_{t}\) and \(sales_{t}\) should be correlated. Previous studies such as (Bernard et al. 2011; Goldberg et al. 2010b) show a positive correlation between firm product scope, sales and productivity. Besides, changes in sales and sales per product may also capture process innovation. This type of innovation, as discussed in Bernard et al. (2011), occurs through significantly improving the quality of an existing product.

In the first column of Table 5, we examine the impact of the reform on sales. In the first year after the reform, real firm sales grew by 19.3% (exp(0.177)-1) on average, and in the second year after the reform real sales grew by 9.2% (exp(0.088)-1). These findings are in line with the findings of Topalova and Khandelwal (2011), Aghion et al. (2005, 2008, 2009), Chamarbagwala and Sharma (2011), and Chari (2011). In column (2) we use sales per product as dependent variable. We again get significant coefficient estimates for the impact of the reform. However, only the first coefficient is significant.

Using sales, sales per product, and the number of products as dependent variables simultaneously allow us to decompose the impact of the reform on product and process innovation if we interpret product innovation as the change in the number of products and process innovation as the change in sales per product. We find the impact on sales as 19.3% for the first year after reform. This is roughly the sum of the impact on sales per product, 13.7% (exp(0.128)-1) and the impact on product scope, 5% (exp(0.049)-1). The increase in process innovation is more than twice the increase in product innovation in the first year after the reform. This could be interpreted as it requires much more effort to introduce a new product to the firm than to improve the quality or the efficiency in producing its existing products.

7 Robustness Tests and Extensions

In this section, we provide several tests to support the main estimation findings. First, we test the main hypotheses with several sub-samples to see whether there are any particular groups of firms in the data that could derive the results. Second, we modify the definition of innovation. Introduction of a new product within the same NIC4 industry would require less innovative effort than the introduction of a new product in a different NIC4 or NIC2 industry. We analyze whether the process of catching-up is sensitive to this modified definition of innovation. Lastly, we introduce alternative estimation methods to test the sensitivity of the results to the methodology implemented.

7.1 Tests with Sub-samples

As discussed earlier, our dataset is not suitable for analyzing firm entry and exit. However, there still is some firm turnover in the data. Using an unbalanced panel could bias results, and yet the direction of the bias is not clear. After the reform, if inefficient firms from delicensed industries exit from the sample, average innovation in these industries would increase more and this would lead to higher average innovation performance. On the other hand, an inefficient firm in the control group exiting after the reform could lead to lower innovation performance of catching-up industries. We restrict the dataset to a balanced sample of firms that are present in the dataset throughout the 1991-95 period and test the potential impact of such bias.

The result of this specification is presented in column (1) of Table 6. When we compare the result in column (1) of this table with column (4) of Table 4, we see that the number of observations drops from 6144 to 4517 and the number of firms drops from 1722 to 874. However, the coefficients of \( Delicen1 \& 2\) do not lose significance and their magnitudes are almost the same in both tables. This result shows that the entry and exit of firms from the sample do not distort the findings of our analyses.

Delicen variables vary across 430 distinct NIC4-year pairs. So far, we controlled for NIC2-year fixed effects to account for idiosyncratic shocks that affect industries and firms over time other than delicensing reform. We can increase the level of control to NIC3-year fixed effects to have more refined control on industry-level variation (the industry-year pairs increase from 129 to 268 in this specification). Yet, this refinement comes at the expense of absorbing a great fraction of variation which is expected to identify the reform dummies (Delicen variables). Column (2) of Table 6 displays results with NIC3-year fixed effects. We still get a positive and significant impact of delicensing on the innovative performance of firms for Delicen2 while the coefficient of Delicen1 loses significance.

Delicen dummies take value one if the main industry in which the firm performs undergoes delicensing reform. However, we observe that in the data 61 firms whose main industries are licensed, introduce 63 products from delicensed industries to their product scope after the reform. In the main estimation exercise, according to our definition, these firms are treated in the control group (respective Delicen dummies are set to zero). In the sample, we have 1693 product additions and these cross-industry additions make up a small fraction (3.8% ) of all product additions in the sample. However, these observations could still bias the estimation results. We present the specification where we exclude all such observations in column (3) of Table 6. We observe that coefficients of Delicen dummies continue to be significant and similar to those obtained in column (4) of Table 4.

The introduction of a new product by a firm might not be a true innovation, but rather a consequence of two firms merging or one firm acquiring another one. Thus, potential merger and acquisition (M&A) activities could bias our estimates. In the Prowess data, we do not have any information on the M&A activities of firms. There is a module in the Prowess database that has M&A transactions, however, that information starts in 2000.

The data on M&A that goes to the earliest date is some aggregate data from The Institute for Mergers, Acquisitions, and Alliances (IMAA).Footnote 15 However, that data also goes back to as far as 1996. Data from the IMAA website shows that both the number and value of M&A activity in India were at very low levels even immediately after the period of our analysis. The numbers of M&A transactions in India between 1996 and 1998 are 115, 127, and 157. Their total values are 1.6, 1.59, and 1.49 billion USD, respectively. This evidence provides some comfort for the relatively low scale of M&A activity during the period of our analysis and M&A activities should not lead to a substantial bias to our results.

Although we do not directly observe M&A activities, we perform a test with our data that can provide indirect evidence on M&A activity not being a concern that could obscure our results. If a firm goes through a merger or an acquisition activity, we would expect a sudden and significant increase in its number of products or sales levels or both. We can follow the firms’ product and sales growth and exclude them from the sample if their annual growth rates are significantly high.

We perform two regressions in columns (4) and (5) using the same baseline estimation method. In column (4) we drop firms that add more than one product (i.e. net addition of at least two products) annually and in column (5) we exclude firms whose sales grow by more than 50% annually. Estimation results show that in both specifications we get significant coefficients for both Delicen variables. This finding shows that even if we exclude potential firms that might have gone through M&A activities, delicensing reform still increases the innovation performance of firms.

7.2 Controlling for Policy Reforms and Industry Characteristics

As discussed in Sect. 3, there were several other reforms introduced around the time of delicensing reform in India. We tried to control their impacts in the regressions by including Itariff, Otariff, and FDI variables along with NIC2-year fixed effects. These economic reforms did not affect all industries in the same magnitude. Share of products that were opened to FDI and tariff rate reductions were not homogeneous across industries. Among firms that had tariff reductions or FDI liberalization, the ones with the highest reduction would be more likely to increase their innovation rates. This relationship could bias our estimation results. We estimate the same specifications by excluding firms that were likely to benefit most from these concurrent reforms.

The results are presented in Table 7. In the first column, we exclude 4-digit industries that had more than half of the industry liberalized in FDI by 1995. As we saw in column (4) of Table 4, FDI had a positive and significant impact on innovation. When we exclude industries with the highest exposure to FDI, we still get significant coefficients for \( Delicen1 \& 2\). This finding shows that the impact of delicensing reform on innovation is not driven by firms in industries that are heavily exposed to FDI. The main estimation result presented in column (4) of Table 4 is robust to this sub-sample.

As discussed earlier, (Goldberg et al. 2010b) showed that tariffs had a significant negative impact on innovation. When we included output and input tariffs in our baseline specification, related coefficients had negative but insignificant coefficients. We ascribed this result to firm fixed effects since they absorb a significant part of the variation in the data. Here, we test whether the exclusion of industries with the highest drop in tariffs affects the main findings. In column (2), we exclude the top quartile of NIC4 industries that had the highest drops in output tariff rates between 1989 and 1995. In column (3), we exclude the top quartile of the NIC4 industries that had the highest drops in input tariffs for the same period. In both columns (2) and (3), delicensing reform significantly increases the innovation performance of firms and the relationship between delicensing reforms and innovation is not affected by these other reforms.

We also want to make sure that the results are not driven by any group of industries with certain characteristics such as export orientation, import-competition level, or employee skill level. In his survey on technology diffusion, (Keller 2004) summarizes theoretical and empirical literature on how imports provide knowledge and technology transfer. As discussed earlier, there is a well-established body of literature that relates to innovation with imports and exports.

We follow (Topalova and Khandelwal 2011) in defining export orientation and import competition level of industries. They use the classification of industries in India proposed by Nouroz (2001). The export orientation level is determined by calculating the industry level export to sales ratio. To capture the effect of import competition, tariff rates and non-tariff barriers are used. Using this data, we calculate the proportion of imports covered by quantitative restrictions (import-protection) for each industry. In the fourth and fifth columns of Table 7 we exclude firms that are in the top 25% of most export-oriented and import-competing industries, respectively. The coefficients of the delicensing reform variables continue to be significant in these specifications.

Lastly, we look at average wage earnings in industries in column (6). Industries with high wage payments are likely to employ more skilled workers and produce more knowledge embodied products, thus firms in these industries could be more innovative. We exclude the top quartile of industries with the highest wage payments.Footnote 16 Regression result indicates that firms that are likely to employ less-skilled workers experience more increase in their product scope after the reform. The coefficient values of Delicen1 and Delicen2 more than double from 0.049 to 0.106 and from 0.033 to 0.083 respectively when industries with relatively high wage earnings are excluded. Previous studies have shown that firm/product turnover is lower in markets with higher entry costs (e.g., Asplund and Nocke 2006). It is also possible that firms that are likely to employ more skilled workers are those that produce products with higher entry costs. Such a mechanism could explain the larger impact of reform on the product scope of firms with relatively lower-skilled workers.

Some industries went through multiple reforms and sub-groups used in each column of Table 7 could include overlapping industries that could affect the results. Although there are industries that have been included in multiple sub-groups, their numbers are small with a possible exception of industries with the highest input and output tariff drops.Footnote 17 The overlap of industries in other sub-groups is much lower. Thus, the likelihood of certain industry-specific factors driving estimation results is rather small.

7.3 Significance of Innovation

In this section, we analyze the relationship between the significance of an innovation introduced and the duration of the catch-up process. In our analysis above, we showed that the differential impact of the reform diminishes within two years after reform. However, this result could be affected by the amount of novelty involved in the product. The introduction of a product variety within the same NIC4 industry level that the firm is already producing is likely to require less investment and effort than introducing a new product at a much different NIC4 industry. Thus, the impact of the reform on the speed of catching-up could vary due to the significance of the innovation introduced. Delicensing reform could be affecting the innovation performance of firms only if newly introduced products are in different NIC4 or NIC2 levels. The catching-up could be spontaneous if the innovation is within the same NIC4 industry. To capture how crucial the innovation is to the firm and how this affects the duration of catching-up, we introduce magnitude categories based on the changes in the NIC industry codes of the newly introduced products.

If a firm introduces a new product in the same NIC4 industry it already produces, we label this innovation as step. If the new product is in a different NIC4 industry but the same NIC2 industry, we define it as jump. If it is an innovation in another NIC2 industry, then we define it as a leap.Footnote 18 We introduce these three magnitude categories as dummy variables in the regressions which are set equal to one if the newly introduced product is in the respective category and zero otherwise.

We present the results of this exercise in Table 8. In column (1), we add the step, jump, and leap dummy variables as controls. We see that the main coefficients of interest do not lose any significance. The coefficient for each magnitude category is also significant at 1%. Although this would be expected based on our main hypothesis, we also observe an increasing innovation rate for firms with higher magnitudes of innovation steps. Firms that can introduce the most diverse and different products than their existing products happen to be more innovative than those firms that only introduce products within the same NIC4 industries.

A firm that is adding a new product in the same NIC4 (step) industry experiences, on average, a 30.1% (exp(.263)-1) faster growth in its product scope. While a firm, innovating a product in another NIC4 (jump) or NIC2 (leap) industries, grow on average 38.7% (exp(32.7)-1) and 41.2% (exp(34.5)-1) faster, respectively. As the magnitude of the innovation step increases, the innovation rate increases.

In columns (2) and (3), we consecutively exclude firms that have innovations in the jump or leap categories. We compare these results with our baseline specification (Table 4 column (4)). In column (2), we see that when we exclude only the leap category, the coefficients decrease for both Delicen1 and Delicen2. In column (3), when we exclude both leap and jump categories, the coefficient of Delicen2 becomes insignificant. This analysis reveals some interesting results. First, even when we narrow the sample to those firms that only innovate within the same NIC4 industry, firms in delicensed industries still innovate faster, yet catching up takes only one year. Second, as the magnitude of the innovation category increases, the time to catch up by delicensed firms increases. Catching up of the recently delicensed firms with the earlier delicensed ones is expected to last longer for those firms that innovate at higher magnitudes.

7.4 Alternative Specifications

In this section, we introduce two alternative estimation methods in addition to the fixed-effect regression model to test our hypothesis.

The dependent variable we use in the regressions is the number of products introduced by a firm, which is a count variable. Thus, instead of standard regressions, we can use count data models such as a Poisson regression to test our hypothesis. In the first exercise, we estimate the original model presented in Eq. (1) using Poisson regression. Column (1) of Table 9 presents the result. When we compare the result in the first column of Table 9 with the fourth column of Table 4, we get very similar results. In both regressions, coefficients of Delicen1 and Delicen2 are significant with similar magnitudes.

Secondly, we introduce a dynamic estimation model to capture the dynamic nature of firm innovation. In the structural model of firm innovation presented in Lentz and Mortensen (2008), the number of products created in this period affects the total number of products in future periods. The empirical model we introduced above includes time-invariant firm-level fixed effects to capture all firm-specific factors that could affect its capacity to introduce new products. However, that specification omits a possibly dynamic nature of the innovation process implied by the model introduced by Lentz and Mortensen (2008).

Using Delicen1 and Delicen2 variables, we apply a variation of Arellano and Bond (1991) generalized method of moments (GMM) for dynamic panels. These estimators are based on differencing regressions to control for unobserved effects such as firm efficiency and use appropriate lags of explanatory variables and dependent variables as instruments.

To reduce possible biases and imprecision, we follow the method developed by Arellano and Bover (1995) and Arellano and Bond (1998). They use the system GMM (GMM-SYS) estimator which combines the regression equation in differences and the regression equation in levels into one system. In this method, twice lagged values of output as well as the difference of other inputs are used as instruments in a differenced equation and lagged first differences of these variables are used as instruments in the level equation. In this way, we can control for the persistent part of the unobserved firm efficiency without throwing away the information contained in the levels. The standard errors presented are robust to general heteroskedasticity.

The regression equation used in this specification follows closely the equation presented in Eq. (1) where the dependent variable is the log of the number of products, n. Since the Arellano-Bouver/Blundell-Bond estimator uses first differences, firm fixed effects are omitted. When we add NIC2 or NIC2-year fixed effects, the variance-covariance matrix of the two-step estimator is not full rank. Hence, we introduce only year fixed effects into the estimation. Column (2) of Table 9 presents the estimation results. The results show that a significant impact of the reform on firm innovation continues to exist in the first year using this alternative specification method. However, it is not possible to fully compare the coefficients obtained in Tables 4 and 9 as the underlying models differ significantly.

7.5 Export Orientation and Innovation Performance

Various factors can affect firms’ innovation performances. The likelihood of a firm being exporter is one such factor that can have an impact on innovation. Export-oriented growth policies have been advocated in many countries as a means to attain sustainable growth. In this section, we provide a policy analysis to show how much this particular industry characteristic influenced firms’ responses to the delicensing reform.

The analysis provided in this section differs from the robustness tests with various sub-samples discussed in Sect. 7.2. There, the motivation was to show whether the results obtained in the baseline specification were affected by any particular industry characteristic. We controlled this effect by excluding the top quartile of export-oriented industries. We showed that even when we exclude this group of firms, the results continue to hold. In this section, we introduce a new dummy variable (Export orientation) set equal to 1 if the industry is in the top quartile of all industries in the ratio of average export revenues to total sales. Then, we interact this dummy variable with the reform dummies. The interaction term allows us to show how significantly the contribution of delicensing reform differs in exporting industries from other industries.

Table 10 presents the results. The coefficients on the interaction of both Delicen variables and the export orientation variable are positive and significant. The coefficient estimates of 0.090 and 0.088 for Delicen variables show that the average number of products of a firm in an export-oriented and delicensed industry is expected to grow by 9.4% (exp(0.09)-1) and 9.2% (exp(0.088)-1) faster than a firm that is not in an export-oriented industry.Footnote 19 This effect is more than twice the amount of the impact on baseline specification (column (4) of Table 4).Footnote 20 These results show that firms in export-oriented industries reacted more to the reform than firms in other industries. Therefore, complementing export-oriented growth policies with a more investment-friendly economic environment may fortify their effectiveness.

8 Conclusion

This study investigates the impact of the regulatory environment on the success of firms’ innovative efforts. Using data from the Indian manufacturing sector, it focuses on a particular reform on the license requirements of firms. This reform allowed firms to introduce new products, increase capacities, and establish new plants. The analysis relies on a difference-in-differences estimation methodology including firm and industry-year fixed effects. The analysis shows that delicensing reform increased firms’ product scope by eight percent. Firms in a delicensed industry catch up with those firms in the early-delicensed industries within two years after the reform. The reform also has a similar positive impact on firm sales.

The findings stand out against a variety of robustness exercises. In addition to delicensing reform, India had several other major economic reforms like liberalizing trade and allowing foreign ownership. We introduced additional controls to the estimation to control the possible impacts of these reforms on firm innovation. We also performed some tests excluding certain groups of firms who are likely to have the most benefit from the reforms, to see whether the results were driven by these particular firm groups. Lastly, we introduced two alternative estimation methods to measure the impact of the reform on innovation. The relationship between delicensing reform and innovation persisted in all of these robustness tests.

To provide some input for policy, we analyzed the nature of the catch-up process. We find that as the diversity between newly introduced and existing products increases, the duration of catching-up goes up. This finding also confirmed that having innovations with a larger significance or diversity requires more time. Another policy inference was on higher gains obtained by exporting firms from the reform. We showed that firms in export-oriented industries become relatively more innovative after the reform than the rest of the firms.

Innovation has been accepted as the engine of long-run growth. This study shows the importance of the regulatory environment to prosper in innovation activities. The regulatory environment is a key element of a supportive investment climate for growth. To fully benefit from investments in human capital and physical capital to achieve sustainable growth and increased welfare, a favorable investment climate is necessary. The inefficiencies in the investment climate will leave efforts to improve the economy and increase innovation incomplete.

Notes

In the paper, the reform on removal of license requirements for certain firm activities is defined as the delicensing reform.

Some examples of these surveys are Community Innovation Surveys (CIS) that the European Commission developed for member countries of the European Union.

The four-digit National Industrial Classification (NIC) of India is a statistical standard for developing and maintaining a comparable database for economic activities.

Goldberg et al. (2010b) explain that tariff liberalization until 1997 was unanticipated and not targeted toward specific industries. They were free of political-economic pressures.

We also tried indicator variables for the third and longer periods after the reform but they did not reveal any significant result.

Running the same specifications with n, we still get comparable coefficients with similar levels of significance.

Goldberg et al. (2010b) find that the reduction of input tariff rates significantly increased innovation performances of firms. Hence, the relationship between delicensing reform and innovation can be biased if the effect of tariff reform is not controlled.

The missing product information is not associated with any specific year, industry, or firm size. Hence, there does not seem to be a selection bias stemming from missing product information.

A discussion of high product creation in the data is presented in Goldberg et al. (2010b).

Only 12 out of 129 NIC2-year fixed effects are statistically insignificant within conventional significance levels. 9 out of 12 these insignificant coefficients are from the manufacture of food products and beverages (NIC2=15), manufacture of wearing apparel (NIC2=18), and tanning and dressing of leather (NIC2=19).

Further information can be retrieved from The Institute for Mergers, Acquisitions, and Alliances website, www.imaa-institute.org.

The wage data is from the 1987 Annual Survey of Industries database.

Fifty percent of firms that belong to industries in the top quartile of input tariff drop also exist in industries that are in the top quartile of output tariff drop. This is expected as input tariffs are constructed using output tariffs and the input-output table of production.

We base the definition of these magnitude categories step, jump, and leap following Whitney (2014).

Firm fixed effects absorb all firm-specific variation. Hence we cannot identify any coefficient for the export orientation dummy.

Şeker (2012a) also tests the relationship between firms’ export-orientation and product innovation. He finds a positive and significant relationship between the two using data from the manufacturing sectors of 43 developing countries. Almeida and Fernandes (2008) also show that exporting firms are more innovative than non-trading firms.

References

Aghion, P., Bloom, N., Blundell, R., Griffith, R., & Howitt, P. (2005). Competition and innovation: an inverted-u relationship. The Quarterly Journal of Economics, 120, 701–728.

Aghion, P., Blundell, R., Griffith, R., Howitt, P., & Prantl, S. (2009). The effects of entry on incumbent innovation and productivity. The Review of Economics and Statistics, 91, 20–32.

Aghion, P., Burgess, R., Redding, S. J., & Zilibotti, F. (2008). The unequal effects of liberalization: evidence from dismantling the License Raj in India. The American Economic Review, 98, 1397–1412.

Almeida, R., & Fernandes, A. M. (2008). Openness and technological innovations in developing countries: evidence from firm-level surveys. The Journal of Development Studies, 44, 701–727.

Arellano, M., & Bond, S. (1991). Some tests of specification for panel data: monte carlo evidence and an application to employment equations. Review of Economic Studies, 58(2), 277–297.

Arellano, M., & Bond S. (1998). Dynamic panel data estimation using DPD98 for gauss: a guide for users. Mimeo CEMFI. https://www.cemfi.es/~arellano/dpd98.pdf.

Arellano, M., & Bover, O. (1995). Another look at the instrumental-variable estimation of error-components models. Journal of Econometrics, 68(1), 29–52.

Asplund, M., & Nocke, V. (2006). Firm turnover in imperfectly competitive markets. The Review of Economic Studies, 73, 295–327.

Bernard, A. B., Redding, S. J., & Schott, P. K. (2010). Multiple-product firms and product switching. The American Economic Review, 100, 70–97.

Bernard, A. B., Redding, S. J., & Schott, P. K. (2011). Multiproduct firms and trade liberalization. The Quarterly Journal of Economics, 126, 1271–1318.

Bertschek, I. (1995). Product and process innovation as a response to increasing imports and foreign direct investment. The Journal of Industrial Economics pp. 341–357.

Chamarbagwala, R., & Sharma, G. (2011). Industrial de-licensing, trade liberalization, and skill upgrading in India. Journal of Development Economics, 96, 314–336.

Chari, A. (2009). Industrial Licensing. New Delhi, India: Oxford University Press.

Chari, A. V. (2011). Identifying the aggregate productivity effects of entry and size restrictions: an empirical analysis of license reform in India. American Economic Journal: Economic Policy, 3, 66–96.

Chari, A., & Gupta, N. (2008). Incumbents and protectionism: the political economy of foreign entry liberalization. Journal of Financial Economics, 88, 633–656.

Criscuolo, C., Haskel, J. E., & Slaughter, M. J. (2010). Global engagement and the innovation activities of firms. International Journal of Industrial Organization, 28, 191–202.

Debroy, B., & Santhanam, A. (1993). Matching trade codes with industrial codes. Foreign Trade Bulletin, 24, 5–27.

Fritsch, M., & Meschede, M. (2001). Product innovation, process innovation, and size. Review of Industrial Organization, 19, 335–350.

Goldberg, P. K., Khandelwal, A. K., Pavcnik, N., & Topalova, P. (2010). Imported intermediate inputs and domestic product growth: evidence from India. The Quarterly Journal of Economics, 125, 1727–1767.

Goldberg, P. K., Khandelwal, A. K., Pavcnik, N., & Topalova, P. (2010). Multiproduct firms and product turnover in the developing world: evidence from India. The Review of Economics and Statistics, 92, 1042–1049.

Haddad, M., & Harrison, A. (1993). Are there positive spillovers from direct foreign investment? Journal of Development Economics, 42, 51–74.

Helpman, E., & Krugman, P. R. (1985). Market structure and foreign trade: increasing returns, imperfect competition, and the international economy. Amstredam: MIT Press.

Hsieh, C.-T., & Klenow, P. J. (2009). Misallocation and manufacturing TFP in China and India. The Quarterly Journal of Economics, 124, 1403–1448.

Keller, W. (2004). International technology diffusion. Journal of Economic Literature, 42, 752–782.

Klette, T. J., & Kortum, S. (2004). Innovating firms and aggregate innovation. Journal of Political Economy, 112, 986–1018.

Krishna, P., & Mitra, D. (1998). Trade liberalization, market discipline and productivity growth: new evidence from India. Journal of Development Economics, 56, 447–462.

Lentz, R., & Mortensen, D. T. (2008). An empirical model of growth through product innovation. Econometrica, 76, 1317–1373.

Nouroz, H. (2001). Protection in Indian manufacturing: an empirical study. Basingstoke: Macmillan.

Parisi, M. L., Schiantarelli, F., & Sembenelli, A. (2006). Productivity, innovation and R&D: micro evidence for Italy. European Economic Review, 50, 2037–2061.

Restuccia, D., & Rogerson, R. (2008). Policy distortions and aggregate productivity with heterogeneous establishments. Review of Economic Dynamics, 11, 707–720.

Şeker, M. (2012a). Importing, exporting, and innovation in developing countries. Review of International Economics pp. 299 – 314.

Şeker, M., Rodriguez-Delgado, D., & Ulu, M. F. (2022). Imported intermediate goods and product innovation: evidence from India. mimeo pp. 1 – 42.

Şeker, M. (2012). A structural model of firm and industry evolution: evidence from Chile. Journal of Economic Dynamics and Control, 36, 891–913.

Sinha, R. (1993). Foreign participation and technical efficiency in Indian industry. Applied Economics, 25, 583–588.

Topalova, P., & Khandelwal, A. (2011). Trade liberalization and firm productivity: the case of India. The Review of Economics and Statistics, 93, 995–1009.

Vishwasrao, S., & Bosshardt, W. (2001). Foreign ownership and technology adoption: evidence from Indian firms. Journal of Development Economics, 65, 367–387.

Whitney, P., 2014. Levels of innovation. Retrieved Sep 30, 2018, from https://www.id.iit.edu/artifacts/levels-of-innovation/.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

We would like to thank to Mark Dutz at World Bank, participants of Finance and Private Sector Development Academy Talks in the World Bank, participants of the International Industrial Organization Conference, and members of the Research Department at the U.S. Bureau of the Census.

Rights and permissions

About this article

Cite this article

Şeker, M., Ulu, M.F. Effects of Policy Reforms on Firm Innovation. Rev Ind Organ 61, 95–121 (2022). https://doi.org/10.1007/s11151-022-09861-2

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11151-022-09861-2