Abstract

The effects of competition regulations on innovation are, in theory, ambiguous. Using a panel of twenty-five OECD countries over 1995–2015, we estimated how domestic and foreign competition affects innovation. Reducing regulation intensifies domestic and foreign competition, increasing R&D expenditure and patenting. Accounting for interaction between these two sources of product market competition, we find that domestic regulation directly led to growing R&D expenditure and patent production, whereas competition from foreign regulation influences innovation toward its effect on domestic competition.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The relationship between innovation and productivity growth in the endogenous growth literature and among policy makers is at the heart of the debates (e.g., Grossman and Helpman 1991, Romer 1990, and Aghion and Howitt 1992).Footnote 1 This broad consensus on the contribution of innovation contrasts with the mixed evidence of the effects of competition on innovation. This paper empirically considers the effectiveness of competition on innovation, differentiating between domestic and foreign competition. We look at how various kinds of competition impact directly innovation intensity, which is relevant for prioritizing reforms (Tables 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11).

How competition impacts innovation is of long-standing theoretical interest. In theory, the impact of competition-enhancing product market regulation on innovation is based on competing theories advanced by Schumpeter (1934) and Arrow (1962).Footnote 2 Schumpeter (1934) suggested that rising market competition discourages innovation (i.e., "Schumpeterian effect") by lowering expected Research and Development (R&D) investment payoffs (e.g., Dasgupta and Stiglitz 1980, Dixit and Stiglitz 1977, and Romer 1990). By contrast, Arrow (1962) argued that competition improves the incentive to innovate through an escape effect, hence raising innovation rents (e.g., Gilbert and Newbery 1982 and Reinganum 1983). Endogenous growth theory has introduced a model in which the Schumpeterian and escape effects interact with innovation intensity via an inverted U-shape (Aghion and Howitt 1998). Thus, depending on the market structure (i.e., the technological gap between firms) and the initial level of competition, competition-enhancing policies may have opposing impacts on innovation intensity at the country level.

In this paper, we evaluate the effects of domestic and foreign product market competition regulation on R&D intensity and patenting, as well as how they directly or indirectly promote innovation, using data from 25 OECD countries from 1995 to 2015.Footnote 3 We used aggregate as well as sub-indicators on factors reflecting rules and bureaucratic procedures that impede entrance and trade barriers that diminish competition to quantify domestic and international product market regulation.

Our findings imply that reducing regulation while enhancing domestic product market competitiveness is related to higher R&D intensity and patenting. Furthermore, raising the level of foreign competition increases the number of patents while having ambiguous impacts on the intensity of R&D in our baseline specification. Using the sub-indicators of domestic and foreign competition, the effects can be partially explained by market competition policies that reduce barriers to new entrants and administrative costs, whereas non-tariff barriers, rather than tariffs, had the effects according to our innovation measures. Finally, the effect of domestic and foreign competition can be nonlinear and depends on country’s characteristics like the level of development or exposure to trade. We explore these interactions and find evidence of nonlinearities. The effects of domestic regulation are more favorable for R&D expenditures in countries in which the level of development and trade openness are stronger. In contrast, deregulation fostering foreign competition harms patenting intensity, which is strongest for more developed countries and where the level of trade exposure is higher.

The main challenge to our identification strategy is the possible reverse causality between innovation and competition reforms as well as the existence of omitted variables. We address these issues in several ways. First, to address endogeneity issues we use aggregate measures of competition regulation in European and non-European countries as an instrument for regulation in a particular country. Our conclusions are robust to the instrumental variable (IV) specification with larger point estimates than Ordinary Least Squares (OLS) estimates. Second, the estimates are stable to the inclusion of lagged competition regulation indicators that reduce potential reserve causality between competition and innovation intensity. Finally, our results are robust to alternative specifications, controlling for confounding factors such as import intensities and foreign R&D and measuring product market regulation through OECD’s indicators. Domestic and foreign competition might have a different magnitude in enhancing innovation. Related literature does not compare the effect of the source of competition reforms. In addition to challenging the ambiguous empirical findings on the relationship between innovation and regulation, this paper goes even further in empirical identification. Instead of findings based only on regression identification and reduced-form,Footnote 4 we use causal structure methodology that allows discovering endogenously causal relations and ordering determinants of innovation. Differentiating between domestic and foreign competition regulations (i.e., the extent to which regulation directly promotes innovation) may reconcile contradictory findings and the significance of underlying processes. We investigate causal relationships to determine whether sources of competition rules are direct drivers of innovation intensity. We rely on a Directed Acyclic Graph (DAG) technique based on a search algorithm (Pearl 1995). According to the DAG, the sole direct driver of innovation intensity is domestic regulation that improves product market competitiveness, whereas international regulation has an indirect influence on R&D intensity and patenting at the country level. Furthermore, the magnitude of the causal effect of product market regulation is quite close to the point estimate obtained by IV specification. These findings point out mechanisms in the innovation–competition relationship, which have important policy implications.

The remainder of the paper is organized as follows. Section 2 presents the related literature and states empirical hypotheses. Section 3 presents the main variables, data sample and discusses our identification strategy. Section 4 discusses our results and robustness tests. Section 5 concludes and discusses the policy implications of our results.

2 Related Literature and Hypotheses

2.1 Domestic Competition and Regulation

Regulation of competition in the product market is to encourage the entry of new firms or to protect existing monopoly positions. Efficient regulation on the product market (PMR hereafter) can encourage firms to invest in technological innovation, R&D activities at each step of the innovation process (Bourlès et al. 2013; Ciriaci et al. 2016). Lowering excessive PMR barriers may enhance competition dynamics among rivals by increasing firm entrance rates and stimulating the production of new knowledge (Andrews and Criscuolo 2013). Finally, less severe regulation can promote the dynamism and turnover of firms, as well as the emergence of efficient firms.

The empirical literature on a sufficient degree of competition on the PMR appears to be rather voluminous. This body of literature tends to support the idea that less burdensome regulation may improve competitive pressure. Two important contributions derived from Blind (2012) and Westmore (2013) have provided evidence on the impact of legal regulation of competition based on cross-country panels. On the one hand, Westmore (2013) adopts the PMR indicator to evaluate the effect of anti-competitive regulation on R&D expenditures and patenting intensity. According to Westmore (2013), there is a large and negative association between pro-competition reforms in product market regulation and a rise in innovation. Furthermore, he finds that lowering excessive PMR promotes information spillovers on local patenting, implying that pro-competitive changes may encourage firms to amass a stock of knowledge from foreign countries. Blind (2012) does not support the positive argument that pro-competition reforms drive innovation. In contrast, the author finds, in accordance with Schumpeter’s reasoning, that long-term pressure reduction is a favorable influencing factor for innovation.

At the industry-level, more evidence has also been provided. Nicoletti and Scarpetta (2003), among others, analyze the influence of competition through policy regulations that directly affect market competitiveness in 18 OECD countries and 23 two-digit manufacturing and services sectors from 1984 to 1998. They find a positive impact of fewer entry barriers and reduced levels of state control on productivity growth and advancement of the technology frontier, particularly in lagging countries. Their findings show that product market changes that increase competition boost the adoption of new technologies and innovation. Using OECD-derived regulatory data and a difference-in-differences (DID) specification, Bourlès et al. (2013) show that upstream regulation (e.g., non-manufacturing industries) negatively influences productivity growth as assessed by multifactor productivity, indicating an increase in interconnections between the services and manufacturing sectors.

In line with these findings, several studies show that competitive markets have a positive impact on innovation intensity at the firm level (e.g., Blundell et al. 1993; Nickell 1996). Recent empirical findings support the notion that lowering legislative and administrative barriers (e.g., processes for starting a firm, cost of closure) improves firm dynamics and favorably affects productivity (Andrews and Cingano 2014). However, Aghion et al. (2005) empirically demonstrated the existence of an inverted U-shaped relation between competition and the number of US patents granted. This result implies that at low levels of competition, an "escape competition" effect dominates, while the "Schumpeterian" effect is dominant when the initial levels are already high. Extensive subsequent findings supported the inverted U-shaped relationship (Negassi et al. 2019; Tingvall and Poldahl 2006), even though other evidence has been more unclear (Buccirossi et al. 2013; Hashmi 2013). But these findings rely on competition measures, differences among countries and industries, as well as the estimated time period. Consistent with the discussion above, we expect a positive impact of competition-increasing product market regulation on R&D and patenting intensities at the country level.

Consistent with the discussion above, we expect a positive impact of competition-increasing product market regulation on R&D and patenting intensities at the country level.

-

Hypothesis 1: Lessen domestic market regulation promotes competitive pressure and increase innovation intensity at the country level.

2.2 Foreign Competition and Regulation

Trade liberalization has a broad range of effects on innovation, including increasing a firm’s exposure to the foreign stock of knowledge, promoting the dissemination of ideas, technological transfers, and quality enhancement (Bloom et al. 2016; Coe and Helpman 1995). Furthermore, trade liberalization induces higher foreign competition pressure Melitz (2003). However, the emerging empirical research does not appear to reach a consensus on the impact of import competition (Akcigit et al. 2018; Autor et al. 2016; Bloom et al. 2016).

A first strand of the literature proposed a theoretical framework of monopolistic competition with heterogeneous firm characteristics (Melitz and Ottaviano 2008) that investigates the effect of trade liberalization and the demand side effect (i.e., market size). Melitz and Ottaviano (2008) suggest a short-term negative impact on mark-ups, but a positive impact on aggregate productivity. In the same line, several recent papers confirm the potential benefit to trade liberalization, enhancing incentive firms to innovate in long term (Impullitti and Licandro 2018; Perla et al. 2021). The second strand of the literature combines theoretical foundations of heterogeneous firms and monopolistic competition with step-by-step innovation (Aghion and Howitt 1998). Looking into the effect of import competition, these papers provide evidence of positive and negative impacts according to the distance from the technological frontier. On the one hand, a negative effect of competition on firms behind the technology frontier while, on the other hand, the most productive firms tend to respond positively to an import shock (Aghion et al. 2017; Akcigit et al. 2018).

Finally, recent contributions examine the effect of import competition resulting from China’s shock on US and European firms. These two works reach opposing findings. On the one hand, Bloom et al. (2016) show that lower import tariff rates in low technology countries such as China increase strategic investments in R&D by lowering the opportunity cost. On the other hand, Autor et al. (2020) found at the firm level, several negative impacts. First, following an increase in imports of products from China, they report a negative impact on innovation input and output, but also on firms’ dynamics with a decrease in employment and sales. However, these findings rely on the theoretical framework or are limited by the unilateral trade liberalization shock (Coelli et al. 2022). Griffith et al. (2010) investigated the impact of entry into the Single Market Program in Europe, suggesting that the adoption of this single program increases competition between countries and increases innovation and productivity. Similarly, Coelli et al. (2022) found that multilateral changes in trade policy are associated with an increase in firm patenting.

Based on the discussion above, we state the following hypothesis:

-

Hypothesis 2: Lessen foreign market regulation promotes competitive pressure and increase innovation intensity at the country level.

3 Data and Identification Strategy

3.1 Measuring Innovation

For our main sample, we combine data from several sources into a balanced panel dataset, which covers 25 OECD countries for the period 1995–2015.Footnote 5

To measure innovation intensity, we collect country-year observations from the latest version (i.e., edition 2017) of the OECD Science and Technology Indicators Database (MSTI) and the OECD Triadic Patent Families Database. These two databases provide detailed information on R&D expenditures for the manufacturing sector and the number of patents registered with the three major patent offices: EPO, JPO, and USPTO. In line with the empirical literature, our primary measure of innovation is R&D intensity in the manufacturing sector, defined as the ratio of industry Business Expenditure in Research and Development (BERD) over nominal GDP. The second measure is the count of granted triadic patent per capita, transformed in logarithm where Patent denotes the count of patents owned by the resident of each country measuring in millions of inhabitants.Footnote 6 Using triadic patents has the advantage that it is not be biased according to regional legislation and that if a firm has protected its invention in the three main offices, it is possible to assume that the invention is of major importance (Aghion et al. 2017). However, measuring innovation raises some issues, in particular at the country level. Several issues are regularly discussed in the literature but have long been used as an indicator for innovative activities (Griliches 1990; Hall et al. 2010). R&D expenditures are an input in the innovation process, according to the OECD’s Frascati Manual (2015) and the Oslo Manual (2005), and the number of patents is a proxy for intermediate innovation output (Mairesse and Mohnen 2010). As a result, these indicators are an imprecise measure of innovation and useless outside the manufacturing sector. Not all firms invest in basic and applied R&D activities or filed a patent for their inventions. On the one hand, firms can conduct other activities, such as getting intangible assets. On the other hand, patents measure successful inventions, but they can be protected by informal means, such as secrecy or lead-time over competitors.Footnote 7 However, R&D expenditures and the count of patents have been regularly collected in a large sample of countries, usually on an annual basis, and they are readily available. Furthermore, to our knowledge, it is the only international data source which provides comparable estimates of business R&D expenditures and technological progress.

3.2 Measuring Market Regulation

We focus on legal rules that capture market regulations, following Griffith and Harrison (2004) and Aghion et al. (2009). As a result, we focus on framework conditions that reflect both internal and international competitiveness. The Fraser Institute’s Economic Freedom of the World Database provides these metrics. On a scale of 0 to 10, there are measures of economic freedom in Business rules and Trade Barriers. In terms of economic interpretation, a low number (i.e., near 0) denotes strict regulation, whereas a higher number (i.e., near 10) implies less regulation.

The Business Regulations indicator measures the extent to which market regulation restricted domestic competition. It is based on a subset of indicators: the ease of starting a business and the cost associated with time spent on bureaucracy procedures. The rationale for using these indicators is that more stringent market regulation might be associated with a lower innovation intensity. The starting a business indicator measures the extent to which firm entry is restricted through the perception of decision-makers, which we use to access the effects of new entrants’ competition on innovation intensity. Bureaucracy costs represent the time spent with administrative procedures that might lengthen the process of starting a business or slow down the growth of incumbent firms. Finally, we include an index of Trade Regulations composed of a subset of indicators: average import tariff and non-tariff trade barriers that can hinder the exchange of goods, technology transfers, and competition from foreign competitors.

Several measures have been used to estimate the effects of competition on innovation and productivity outcomes, including mark-ups (Griffith and Harrison 2004) and market concentration, as measured by the Herfindahl or Lerner index (Aghion et al. 2017). However, they may be concerned about endogeneity issues. For example, increased competitive pressure on the domestic market has most likely resulted in a decrease in market concentration. Furthermore, because of a reallocation effect from less efficient to the most efficient firms, profits and mark-ups are impacted differently depending on the firm’s structure. The rationale for considering these economic regulations as exogenous is not straightforward (Cette et al. 2017).

To overcome this challenge and better capture underlying policies that affect competition, several contributions have used product market policy indicators, such as the OECD’s International Product Market Regulation Indicators. However, the measures drawn from the Fraser Institute have the advantage of being available at an annual frequency and five-year intervals before 2000,Footnote 8 in contrast to the OECD economy-wide PMR indicator, which has been available at five-year intervals since 1998 and will end in 2013 (Égert 2016). To avoid the time-invariant nature of the PMR indicator, it would be possible to use the ETCR indicator that measures the regulation in non-manufacturing sectors that include network services such as energy, transport, and communications. This indicator is available annually for the 1975–2018 period and coded on a scale of 0 to 6 reflecting the restrictiveness. The main advantage of non-manufacturing regulation is can be reasonably considered exogenous (Bourlès et al. 2013), but with indirectly competitive pressure on manufacturing sectors through intermediate inputs.Footnote 9 However, the influence of competition in upstream sectors for innovation improvements in downstream sectors is outside the scope of this study. It should be noted that subjective metrics have the disadvantage of relying on subjective assessments that might be affected by factors unrelated to underlying policy, such as economic conditions or personal beliefs (Nicoletti and Pryor 2006). Reassuringly, the Business Regulation indicator is negatively correlated with OECD indicators, as shown in Figure 5 and Table 9. In any case, we assess the robustness of our main results using both OECD measures and IV, which produce qualitatively identical results, which mitigates this issue.

Several control variables are included in our main specification to adjust for factors impacting competitive pressure and time-varying drivers of innovation (Teece 1996). First, if both innovation and competition are related to the economic cycle, the link between them may be overestimated, resulting in a pro-cyclical connection. To address this problem, we use GDP Growth, which is the yearly percentage growth rate of a country’s GDP measured in constant-price US dollars PPP (2010) (Westmore 2013).Footnote 10 Second, innovation might be driven by the country’s comparative advantage in an industrial sector, confounding our main estimates. Following Acharya et al. (2013), we control for comparative advantages using the ratio of value-added (VA) in the manufacturing sector relative to the total country’s VA. These control variables are from the World Bank WDI database. Finally, another concern is that market regulation in a given country may be correlated with additional regulations (Acharya et al. 2013; Buccirossi et al. 2013). As a result, we control for the legal system’s quality, which includes data on the rule of law, intellectual property protection, and the legal system’s efficiency. This variable is based on the Fraser Institute Database and is scaled from 0 to 10, with higher values signifying stronger institutional quality.

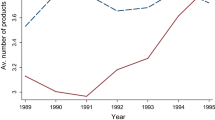

3.3 Cross-country Characteristics

Table 1 reports descriptions, data sources, and summary statistics of the main variables used in this analysis. First, during our sample period, there was significant variation in innovation measures across OECD countries, with R&D intensities ranging from 0.6 percent of GDP (Mexico) to 3.35 percent (Japan) and the number of granted triadic patents per capita ranging from 0.031 (Turkey) to 4.993 (Japan). Second, we highlight preliminary relationships between market competition regulation and innovation intensity. In Figure 2, we show the scatter plot of all country-year data points of the R&D intensity and the count of patent per capita distribution. The left-hand sub-figures refer to business regulations as a measure of domestic competition, where the vertical axes refer to innovation measures and the horizontal axes to the business regulations. The right-hand sub-figures refer to trade regulations as a measure of foreign competition, where the vertical axes refer to innovation measures and the horizontal axes to the trade regulations. Overall, the linear prediction from the regression of innovation intensity on the market regulation indicators is consistent with the positive relationship between innovation intensity and competition-enhancing regulations. Furthermore, these patterns are consistent with the correlation coefficients report in Table 2.

3.4 Identification Strategy

In this paper, we examine the effects of market regulation on the intensity of innovation. First, we estimate panel fixed-effects specifications using innovation measures as dependent variables and our variables of interest as domestic and foreign market rules. To avoid overburdening the econometric estimation, market regulation variables are included progressively. The specification is then supplemented with each sub-indicator to capture the channels via which innovation activity is influenced. The baseline specification is as follows:

where yct denotes our main dependent variables that measure innovation intensity from country c in year t, including R&D intensity, and Patent. Regct is the market regulation indicators for country c, measuring the stringency of domestic and foreign competition regulation. The main coefficient of interest is β1 that denotes the effect of market regulation on the dependent variable of interest. Xct is a set of control variables, uc and ut are country and time fixed effects. Different OECD countries have experienced different level of innovation intensity over the years that are not directly correlated with market regulations and competition, but might be correlated with institutional environment (Aghion et al. 2005). Adding country and time fixed effects allows us to control for time-invariant unobserved factors at the country level. Robust (Huber-White) standard errors are used.

Using fixed-effects transformation has the advantage of providing unbiased estimates if omitted variables are correlated with explanatory variables. However, the fixed-effects transformation is less efficient for the estimation of rarely changing variables, resulting in biased point estimates (Hsiao 2003; Wooldridge 2010). This is particularly relevant to the variables that describe the political and legal environment. Thus, an identification strategy using fixed-effects transformation could lead to a biased or underestimated coefficient of interest. Following Plümper and Troeger (2007), we implemented a three-stage estimator with vector decomposition in the third stage. This estimator provides an efficient estimate of time-varying variables in addition to an unbiased estimate of rarely changing variables through pooled least squares.Footnote 11 The rarely changing variables are Business Regulation and Trade Regulation as well as sub-indicators, which exhibit a larger "between" than "within" variance, justifying the Fixed Effects Vector Decomposition (FEVD) estimator. Nonetheless, the FEVD estimator is controversial due to the inferences made from the estimated coefficients. Therefore, we use FEVD estimator for comparison to OLS.Footnote 12

4 The Effect of Market Regulation on Innovation

4.1 Baseline Estimates

Table 3 shows the average effect of competition-enhancing product market regulation on R&D (Panel A) and patent intensity (Panel B). We report point estimates using OLS and FEVD for a balanced sample of 525 country-year observations in 25 OECD countries for the period 1995–2015. Our main finding is that the point estimate for the business regulation indicator is positive and statistically significant at conventional levels. The point estimate in column (1) of Panel A suggests that increasing product market competition by one standard deviation (0.997) increases R&D intensity by 0.062 (0.062×0.997). In the sample estimation, the average R&D intensity is 0.986. As a result, the intensity of R&D increased by 6.3 percent. Our main finding remains if we estimate the effect of the competition-increasing product market regulation through FEVD estimator (columns 4 and 6), which produces an efficient estimate of rarely changing variables. Note that the point estimate increased in magnitude relative to OLS estimation. In Panel B of Table 3, we will look at the link between business regulation and patenting activities. We find a positive and substantial influence of market rivalry on the number of patents granted in both the OLS and FEVD specifications. Our results support Hypothesis 1. These findings are consistent with an escape-competition effect, and when competition-enhancing product market restrictions are increased, innovation levels rise (Aghion et al. 2005; Griffith et al. 2010).Footnote 13 Our second result is that trade regulations have a mixed influence on innovation intensity. In columns 2 and 4 of Panel A, estimated coefficients are positive and statistically significant but turn out to be no different from zero (column 3) or negatively correlated (column 6) with R&D intensity in specifications that include both business and trade regulation indicators. In contrast, we find a positive effect of trade competition on patenting intensity in Panel B of Table 3. This is consistent with previous empirical evidence, in particular, for European countries exposed to import competition from China (Bloom et al. 2016). Our results partially confirm Hypothesis 2. Point estimates for control variables have the expected sign and conform to previous evidence. We find that GDP growth is negatively associated with investment intensity, albeit insignificantly, whereas manufacturing value-added is positively and significantly associated with R&D intensity. The positive correlation between innovation intensity and manufacturing value-added reflects variation in the propensity to innovate and technological opportunities that differ across industries. Finally, the quality of institutions measured through legal system indicators to account for the effectiveness of competition regulation has opposite sign according to our measure of innovation intensity. We show the point estimate on the legal system is positively associated with an increase in patenting intensity, while it is not statistically different from zero for R&D intensity.

We then examine the effect of the sub-indicators of domestic and foreign competition. We use the ease of starting business and bureaucracy cost as our main measures of domestic market regulations. Furthermore, we examined economic and non-tariff barriers to competition from foreign competitors. We estimate specification (1) and report the results in Table 4. In column (1) of Panel A, the point estimate suggests that lessening barriers to new entrants by one standard deviation is associated with a 0.054 increase in R&D intensity. The point estimate on bureaucracy cost is positively related to R&D intensity in column (2), implying that lowering administrative burden by one standard deviation enhances R&D intensity by 0.025. In column (3), the coefficient on the tariff barriers is negative and significant but the coefficient on the non-tariff trade barriers is not statistically different from zero (column 4). A possible explanation for this negative effect of reducing tariff barriers is the direct positive effect on imported products, increasing knowledge spillovers, thereby reducing incentives to innovate. In summary, the results in Panel A of Table 4 confirm our baseline results and show that enhancing the reforms to promote market competition leads to an increase in R&D intensity while lowering tariff barriers deters domestic R&D intensity.

In Panel B, the dependent variable is replaced with the natural logarithm of patents corrected for country size. Our findings assist in identifying if product market sub-indicators influence innovation output. Except for the sub-indicators of trade regulation, our findings are identical to those obtained when R&D intensity was used as a dependent variable. The point estimate in column (3) of Panel B is insignificant, indicating no effect of tariff barriers on patenting activities. In contrast, the estimated coefficient in column (4) is positive and statistically significant, suggesting that reducing non-tariff trade barriers by one standard deviation is associated with a 0.109 increase in patenting. This represents 3.9 percent at the mean value of patents.

Overall, enhancing regulation that increases domestic competition is associated with an increase in innovation intensity at the country level. In contrast, our results imply a negative association between foreign competition and R&D intensity, but reforms that reduce non-tariff barriers on patenting and confirm our baseline results in Panel B of Table 3.

4.2 Nonlinear Effects

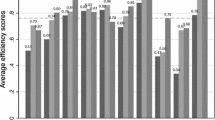

So far, we have assumed that the response to domestic and foreign competition is the same across countries. For example, several studies provide evidence that anti-competitive market regulation can have differential aggregate effects on innovation and productivity in different countries or industries according to the distance to the technological frontier or institutional environment (Bourlès et al. 2013; Buccirossi et al. 2013; Égert 2016). Therefore, we now investigate the heterogeneous effect of competition-enhancing product market regulation. The effect of one policy could interact with other factors. For example, the scatter plot of country-year data points reported in Figure 1 suggests that both business and trade regulation have differential effects on innovation intensity according to a group of countries. More specifically, the effect of regulation may be exacerbated in countries with stronger levels of development or trade openness (Égert 2016).

To explore the heterogeneity effects of regulation, we extend the specifications in Table 3 by including interaction terms between the measures of domestic or foreign regulations and the level of development as well as exposure to trade. First, the level of development at the country level is measured as the logarithm of GDP per capita (Qian 2007). Second, trade openness is measured as the ratio of exports plus imports to GDP, after correcting for country size (Jaumotte and Pain 2005). The results of the heterogeneity effects are reported in Table 5.Footnote 14 The coefficient estimates on the interaction of domestic and foreign regulation with the log of GDP per capita PPP are significantly positive. These results suggest that R&D intensity responds more strongly to competition in countries with high levels of development. In contrast, the interaction term between domestic regulation and the log of GDP per capita is significantly negative for innovation output (column 5). While the effect of foreign regulation is insignificant in column 6, it suggests that patenting intensity can decrease in countries with high levels of domestic competition and development, which is consistent with Schumpeterian effects. Finally, the interaction term between domestic regulation and trade openness is positive and significant at conventional levels (column 3). Again, the response of R&D intensity to domestic competition-enhancing regulation is stronger for countries that are more open to trade. But, for patenting intensity, we observe a decreasing effect of competition-enhancing domestic regulation, so the country is more open to trade. Concerning competition-enhancing foreign regulation, the interaction terms are small (0.024 and -0.003) and statistically insignificant, suggesting no effect for countries with high levels of trade openness on both R&D and patenting intensity.

Thus, our results suggest that the effects of domestic regulation are nonlinear and are more favorable for R&D expenditures in countries in which the level of development and trade openness are more important. In other words, the "escape competition" effect dominates in more developed countries and at a higher level of trade exposure. However, a contrasting picture emerges for patenting intensity, suggesting that an increase in foreign competition through the trade channel may reduce overall patenting activity if the level of domestic competition is high.

4.3 Robustness Tests

To test the sensitivity of the baseline results, we conduct several robustness tests. First, an important issue with our main specification is the potential endogeneity problem of market regulation due to reverse causality bias as well as omitted variables (Aghion et al. 2005). For example, R&D expenditures and successful innovations might increase economic rents and market concentration, reducing competition among firms. As incumbents and successful innovations grow, OLS estimates are more likely to be downward biased. Furthermore, variations in trade regulation may reflect governments’ perceptions of domestic rivalry and the technological frontier to support international competition, thus biasing OLS estimates. To address the endogeneity issues, we propose an alternative identification strategy using an instrumental variable (IV) approach. Specifically, we use a 2SLS strategy. Following Buccirossi et al. (2013), and Ayyagari et al. (2008), we instrumented competition-increasing product market regulation with the average value of these regulations in other countries.Footnote 15 We use the average value based on country-group (i.e., European and non-European). The exclusion restriction is that competition regulation in a country is more likely to be correlated with trends in competition regulations in the same geographical or jurisdictional region but are uncorrelated with innovation intensity in the country.Footnote 16

The results of these IV estimations are reported in Panel A of Table 6. The estimated coefficients on the IV are positive and statistically significant at the 1 percent level with larger point estimates than OLS in Table 3. This OLS bias is consistent with the idea that positive product market regulation in the same geographical or jurisdiction region increases the probability of increasing competition for a given country. Thus, OLS underestimates the innovation intensity response to competition-increasing product market regulation. Furthermore, instruments are highly significant with an F-statistic that exceeds the rule of thumb value of 10 (Stock and Yogo 2002). In Panel B, we add the lagged value of regulation indicators to control for reverse causality between competition policy and innovation intensity. This approach relies on the assumption that the lagged indicators are unrelated to the error terms in specification (1) (Griffith and Harrison 2004). The estimated coefficients are quite comparable to OLS estimations in terms of magnitude. Competition-increasing product market regulation might be driven by omitted variables that are correlated to other competition-enhancing policies that could affect innovation intensity. Control variables that may be related to market regulation are included in Panel C: import penetration ratio and foreign stock of R&D.Footnote 17 Our results remain robust across all specifications. Note that import penetration is positively associated with R&D intensity, but insignificant in the specification of the patent intensity. For example, one standard deviation in import penetration increases R&D intensity by 0.184 (2.144x0.086). In contrast, the estimated coefficient on foreign R&D stock is always negatively associated with R&D intensity, whereas a rising foreign stock of R&D is associated with an increase in patenting. A one standard deviation increases in the foreign stock of R&D increases patenting by 0.149. This tends to support our baseline results and our confidence in the mitigation of endogeneity issues. Finally, the business regulation indicator from the Fraser Institute is used in the baseline specification. The choice has been made because the indicator provides more variation than the OECD’s International Product Market Regulation Indicators. The estimated coefficients are comparable if the Economic-Wide PMR is used or if the lagged value is used (see Table 10).Footnote 18 Using the ETCR indicator that measures regulation in non-manufacturing sectors, we observe some effect. Concerning R&D intensity, the point estimates for the ETCR (lagged or not) are small and statistically insignificant are conventional levels, suggesting no effect of market regulation in upstream sectors on the incentive to innovate in downstream sectors. In contrast, the results are robust for patenting intensity (see Table 11).Footnote 19

4.4 Direct and Indirect Effect of Competition

The main focus of this paper is to identify the causal determinants of innovation intensity and compare the results from previous estimates. The relationship between competition and innovation has grown in importance in the endogenous growth literature, but also for policymakers. However, this issue has led to contrasting theoretical arguments and empirical evidence. Following Ayyagari et al. (2013) and Ayyagari et al. (2008), we use a Directed Acyclic Graph (DAG) that allows us to explore the potential direct mechanism between competition-increasing product market regulation and innovation as well as causal relations among market regulation measures.Footnote 20 Unlike studies that investigate the impact of competition on innovation, using DAG methodology has several advantages over classical econometric specifications. DAG can endogenously and non-parametrically specify the causal ordering of the entire set of variables by producing a graph of robust causal relations (Ayyagari et al. 2013; Spirtes et al. 2000). DAG allows us to investigate innovation determinants that have (i) direct impacts, variables that have (ii) indirect impacts on another variable, and those that do not have (iii) causal impacts. In addition to regression estimations, the use of DAG enables the validation of empirical findings.

The causal model corresponds to a set of random observed and unobserved variables X={X1 ; · · · ; Xn}

associated with independent error terms ε={ε1 ; · · · ; εn}. The causal relationships between the variables X are represented by a graph G in which nodes are connected by directed edges E according to the joint probability function P as follows:

Nodes in the set of variables X are linked from PaG to X, where PaG represents the set of ancestors of Xi in the structural causal model G.Footnote 21 That illustrates the causal links among the variables in the set X. Furthermore, if the joint distribution function P is empty, no variable in set X causes the variable Xi. To summarize, the DAG approach has two objectives. The first function generates a collection of probability distributions, and the second function reflects a causal structure across many variables. In other words, this method generates dense networks of joint probability distributions between random variables, which are represented by nodes and a set of edges connecting each pair of nodes. The DAG methodology implements an objective procedure under two assumptions underpinning the probability connections among each node to causal inference (i) Causal Markov Condition, (ii) Faithfulness to obtain graphs and causal inference (Ayyagari et al. 2013; Pearl 2009). First, the Causal Markov Conditions state that if a variable X1 and another variable X2 have no direct influence on X1, then X1 is probabilistically independent of X2 conditional on X1.Footnote 22 Finally, the faithfulness assumption states that independence relations are discovered using the Causal Markov Condition rather than through chance. As a result, if there are independence relations in the observational data that are not from the Causal Markov Condition, the causal model is unfaithful.

We used the PC algorithm developed by Spirtes et al. (2000) to examine the causal relationships between domestic and foreign market regulation and innovation intensity. The method uses the correlation matrix shown in Table 2. The PC algorithm generates an undirected graph in the first phase, displaying connections between all variables without imposing conditional independence relations. In the second phase, the algorithm generates an endogenous causal ordering of variables, evaluating all conditional independence connections between variables. Finally, each edge without zero-order conditional independence connections is eliminated until the right causal structure is found.Footnote 23 To compare our findings to our main results, we state the prior knowledge of variables order that consists market regulations are defined as our independent variables of state innovation measures as outcomes. Concerning specifications (2) and (3), competition-increasing product market regulations are defined as our independent variables.Footnote 24 Figure 2 reports conditional independence relations from the PC algorithm using the correlation matrix of our balanced sample of 525 country-year observations. Figure 2 shows that conditional independence relations at the 5 percent level of significance are similar whether we use R&D, or patent intensity as outcomes, suggesting the same set of direct and indirect effects according to the innovation input and output. Furthermore, this figure shows that the business regulation indicator has a direct effect on R&D intensity and the number of patents granted. The bidirectional arrow between business and trade regulation indicators suggests that domestic and foreign competition regulations are causing each other. Finally, conditional independence relationships demonstrate that the relationships between market rules and control variables are multiples. However, our primary goal is to uncover the direct causal drivers of internal and international competitiveness. The DAG causal relations are compatible with requirements (1) and (2), but the DAG analysis allows us to discriminate between the direct and indirect impacts of increased competition in the product market. The difference between regression specifications and DAG analysis is that domestic product market competition is the only statistically significant direct source of innovation intensity, whereas foreign product market rivalry has an indirect influence on innovation.

In addition to the causal relations identified in Figure 2 we can infer the conditional distribution of a direct cause. For that purpose, we use the do-operator developed by Pearl (1995). The do-operator consists of intervention in the structural causal model obtained from our observational data represented in Figure 2.

A value x is fixed for X conditional on X=x’.

For each realization of x of X, the causal direct effect P(y|do(X=x)) assigns the probability y that is the postintervention of distribution of outcome variable y. Specifically, the do-operator change the causal relations, removing each arrow going into X and substituting by a specific value X=x in remaining equation (Imbens 2020; Pearl 2009). Thus, we estimate the conditional distribution of business regulation on R&D intensity and the number of patents granted per capita as follows P(R&D intensity|do(Business Reg.=x)) and P(Patent|do(Business Reg.=x)). Using the do-operator suggests that the causal effect of product market regulation on R&D intensity is 0.440 and 0.360 for the number of patents granted per capita, and significant at the 5 percent level. The estimated causal effect of business regulation on innovation intensity appears similar to the coefficient for the FEVD and IV specifications (columns 4-6) of Table 3 and Panel A of Table 6. For example, the estimated causal effect of business regulation on R&D intensity through do-operator has a coefficient of 0.440 compared to 0.348 in the FEVD specification and 0.408 in the IV specification. Similarly, the causal effect of business regulation on the number of patents granted per capita has a coefficient of 0.360 compared to 0.782 in the FEVD specification and 0.304 in the IV specification. Consequently, lessen product market regulation increases the R&D intensity as well as the number of patents granted per capita at the country level.

5 Conclusion

In this paper, we have examined the impact of competition-increasing product market regulation, summarized in domestic and foreign competition on innovation intensity in twenty-five OECD countries between 1995 and 2015. Our motivation stems from the broad consensus on the importance of innovation for productivity growth contrasts with the long-lasting policy debate on the competition-enhancing product market interventions. We use a novel identification strategy and country-year level data on innovation input (R&D expenditures) and output (patenting) to understand the direct and indirect effects of competition on innovation.

Our findings show that enhancing domestic and international competition through product market regulation has a considerable influence on both innovation input and output. Moreover, we showed that the estimated effect on innovation input is larger in more developed countries and where exposure to trade is important. By contrast, in countries where the level of development and trade openness are high, the effect of domestic competition reduces innovation output. According to the DAG model, the positive innovation response to product market competition is directly produced by domestic competition-enhancing legislation, but foreign competition is related to innovation intensity via its influence on domestic competition-enhancing regulation. Overall, our data show that boosting domestic product market competition is an efficient way for OECD countries to see large increases in innovation. Finally, our results are robust to sensitivity analysis, addressing potential endogeneity issues through instrumental variable strategy, including lagged competition-enhancing regulation indicators, confounding factors, and alternative measures of market regulations.

Our findings corroborate Arrow’s (1962) theoretical argument that product market rivalry stimulates innovation through an escape effect. In terms of policy consequences, OECD countries may lead technological progress through innovation by eliminating restrictions that stifle competitiveness in the domestic market. There are several directions this paper can be extended. First, it would be valuable to examine the firms’ response to competition regulation, using novel firm-level data on innovation activities and market competition. This would allow us to deeply explore the underlying mechanism that depends on the technological frontier and reallocation process. Second, extended our analysis on OECD countries to other countries would be precious.

Notes

For example, Corrado et al. (2012) estimate that knowledge capital investments contribute to 0.5 percentage points of GDP growth in European countries and 0.9 percentage points in the United States.

Our identification strategy assumes that the relationship between innovation intensity and competition is linear at the country level and we do not examine the inverted-U shape. A large literature provides evidence of nonlinearity, see for example Aghion et al. (2005), Negassi et al. (2019), and Tingvall and Poldahl (2006). In the appendix, we provide empirical evidence for focusing on the linearity of regulation on innovation (see Figs. 4-5 and Tables 7-8).

The sample includes: Austria, Belgium, Canada, Denmark, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Japan, Korea, Mexico, Netherlands, Norway, Poland, Portugal, Slovak Republic, Spain, Sweden, Switzerland, Turkey, United Kingdom, and the United States.

To address this concern, we implement a linear interpolation for each indicator between 1996 and 1999. On our estimation period, few changes appear over time describing characteristics variables with low within variance.

Non-manufacturing sector regulation can reduce competitive pressure on manufacturing sectors by raising the cost of services used. As a result, this rise leads to an increase in goods produced, which leads to an increase in intermediate inputs.

Instead of GDP Growth, it is also possible to control short-term cyclical fluctuations using the output gap. The output gap is defined as the difference between actual and potential GDP as a percent of potential GDP, obtained using the HP filter. The results, available upon request, are robust controlling for the output gap.

Plümper and Troeger (2007) provide two conditions for efficient point estimates with precisely estimated standard errors. First, the FE and FEVD estimators are preferable to the random effects estimator (GLS) for which individual effects are assumed to be uncorrelated with the independent variables. Second, FEVD becomes more efficient when the within variance is close to zero, and the ratio of the between-to-within variance exceeds 2.8 for at least one of our independent variables.

As mentioned in the introduction, our paper assumes and estimates a linear relationship between innovation intensity and competition regulation, although we do not examine an inverted-U relationship. As supported by Aghion and Howitt (1998) and Aghion et al. (2005), both escape-competition and Schumpeterian effects might co-exist. However, consistent with previous findings, the escape-competition effect dominates in the linear relationship (Aghion et al. 2005; Griffith et al. 2010).

We do not report the coefficient estimates for control variables due to space limits because they are comparable to those reported in our baseline regressions.

For example, in 1992, the European Union implemented a large-scale internal reform: the Single Market Program (SMP). The SMP aimed at reducing internal barriers within the EU with the objective of increasing the movement of products and production factors, fostering competition, innovation, and productivity growth.

In these specifications, we control for the domestic demand of goods and services and R&D is satisfied by foreign producers. The import penetration ratios are defined as the ratio between the value of imports as a percentage of total domestic demand and are drawn from the OECD Trade Indicators Database. The R&D foreign stock measure is based on trade-weighted data from all other partners’ countries, with weights derived from the IMF Trade Statistics database (Westmore2013).

As mentioned in Sect. 3.2, the OECD’s PMR indicator is available at five-year intervals between 1998 and 2013. Following the literature, we fill the gap by linear interpolation (Westmore2013). However, for this indicator, no information is available for Turkey, resulting in a balanced sample of 379 observations.

Note in that case, we lose the U.S., since there is no information on the last version of the ETCR indicators for this country. However, very similar results are obtained in our baseline specification by dropping this country.

Several studies use Extreme Bound Analysis (EBA) to test the main determinants of theoretical frameworks as well as the robustness of econometric specifications. For example, Barro (1991), Levine and Renelt (1992), Xavier et al. (1997) use EBA to test the main determinants of economic growth, and Ayyagari et al. (2013) to compare DAG’s results from the EBA methodology.

Ancestors of a variable Xi consist to all variables that are connected to Xi by an edge whose purpose is the variable Xi.

Conditional independence test is equivalent to the null hypothesis that exists no partial correlation between random variable X and Y.

conditional on a subset of variable Z.

Note that we do not impose prior knowledge among our independent variables, thus a causal structure can arise among this set of independent variables.

References

Acharya VV, Baghai RP, Subramanian KV (2013) Labor laws and innovation. J Law Econ 56(4):997–1037

Aghion P, Howitt P (1992) A model of growth through creative destruction. Econometrica 60(2):323–351

Aghion P, Harris C, Howitt P, Vickers J (2001) Competition, imitation and growth with step-by-step innovation. Rev Econ Stud 68(3):467–492

Aghion P, Bloom N, Blundell R, Griffith R, Howitt P (2005) Competition and innovation: an inverted- U relationship. Q J Econ 120(2):701–728

Aghion P, Askenazy P, Bourlès R, Cette G, Dromel N (2009) Education, market rigidities and growth. Econ Lett 102(1):62–65

Aghion P, Howitt P (1998) A schumpeterian perspective on growth and Competition. In: Coricelli F, Matteo Md, Hahn F (eds) New Theories in Growth and Development. Palgrave Macmillan, London. https://doi.org/10.1007/978-1-349-26270-0_2

Aghion P, Bergeaud A, Lequien M, Melitz MJ (2017) The impact of exports on innovation: theory and evidence. NBER Working Paper, pp 1–33

Akcigit U, Ates ST,Impullitti G (2018) Innovation and trade policy in a globalized world (No. w24543). National Bureau of Economic Research

Andrews D, Criscuolo C (2013) Knowledge-based capital, innovation and resource allocation: a going for growth report. Technical report, n° 1046, OECD Publishing

Andrews D, Cingano F (2014) Public policy and resource allocation: evidence from firms in Oecd countries. Econ Pol 29(78):253–296

Angrist JD, Krueger AB (2001) Instrumental variables and the search for identification: from supply and demand to natural experiments. J Econ Perspect 15(4):69–85

Arrow KJ (1962) The economic implications of learning by doing. Rev Econ Stud 29(3):155–173

Autor DH, Dorn D, Hanson GH (2016) The China shock: learning from labor-market adjustment to large changes in trade. Annu Rev Econ 8:205–240

Autor D, Dorn D, Hanson GH, Pisano G, Shu P (2020) Foreign competition and domestic innovation: evidence from US patents. Am Econ Rev: Insights 2(3):357–74

Ayyagari M, Demirgüç-Kunt A, Maksimovic V (2008) How important are financing constraints? the role of finance in the business environment. World Bank Econ Rev 22(3):483–516

Ayyagari M, Demirguc-Kunt A, Maksimovic V (2013) What determines protection of property rights? an analysis of direct and indirect effects. J Fin Econ 11(4):610–649

Hall B, osenberg N (2010) Handbook of the economics of innovation (vol 1). Elsevier

Barro RJ (1991) Economic growth in a cross section of countries. Q J Econ 106(2):407–443

Blind K (2012) The influence of regulations on innovation: A quantitative assessment for oecd countries. Res Pol 41(2):391–400

Bloom N, Draca M, Van Reenen J (2016) Trade Induced technical change? the impact of chinese imports on innovation, IT and productivity. Rev Econ Stud 83(1):87–117

Blundell R, Griffith R, Van Reenen J (1999) Market Share, market value and innovation in a panel of british manufacturing firms. Rev Econ Stud 66(3):529–554

Blundell R, Griffith R, Van Reenen J (1993) Knowledge stocks, persistent innovation and market dominance: Evidence from a panel of British manufacturing firms (No. W93/19). Institute for Fiscal Studies

Bourlès R, Cette G, Lopez J, Mairesse J, Nicoletti G (2013) Do product market regulations on Up- stream sectors curb productivity growth? Panel Data Evidence For OECD Countries. Rev Econ Stat 95(5):1750–1768

Breusch T, Ward MB, Nguyen HTM, Kompas T (2011) FEVD: Just IV or just mistaken? Polit Anal 19(2):165–169

Buccirossi P, Ciari L, Duso T, Spagnolo G, Vitale C (2013) Competition policy and productivity growth: an empirical assessment. Rev Econ Stat 95(4):1324–1336

Cette G, Lopez J, Mairesse J (2017) Upstream product market regulations, ICT, R&D and productivity. Rev Income Wealth 63:S68–S89

Ciriaci D, Grassano N, Vezzani A (2016) Regulation, red tape and location choices of top R&D investors (No. 01/2016). IPTS Working Papers on Corporate R&D and Innovation

Coe DT, Helpman E (1995) International R&D spillovers. Eur Econ Rev 39(5):859–887

Coelli F, Moxnes A, Ulltveit-Moe KH (2022) Better, faster, stronger: global innovation and trade liberalization. Rev Econ Stat 104(2):205–216

Cohen WM (2010) Fifty years of empirical studies of innovative activity and performance. Handbook of the Economics of Innovation 1:129–213

Corrado C, Haskel J, Jona-Lasinio C, Iommi M (2012) Intangible capital and growth in advanced economies: Measurement methods and comparative results (No. 6733). IZA Discussion Papers

Dasgupta P, Stiglitz J (1980) Industrial structure and the nature of innovative activity. Econ J 90(358):266–293

Dixit AK, Stiglitz JE (1977) Monopolistic competition and optimum product diversity. Am Econ Rev 67(3):297–308

Égert B (2016) Regulation, institutions, and productivity: new macroeconomic evidence from OECD countries. Am Econ Rev 106(5):109–113

Gilbert R (2006) Looking for Mr. Schumpeter: Where are we in the competition–innovation debate? Innov Policy Econ 6:159–215

Gilbert RJ, Newbery DM (1982) Preemptive patenting and the persistence of monopoly. Am Econ Rev 514–526

Greene W (2011) Fixed effects vector decomposition: a magical solution to the problem of time-invariant variables in fixed effects models? Polit Anal 19(2):135–146

Griffith R, Harrison R, Simpson H (2010) Product market reform and innovation in the EU. Scand J Econ 112(2):389–415

Griffith, R, Harisson R (2004) The link between product market reform and macro-economic performance. In: European Economy - Economic Papers 2008-2015 209, Directorate General Economic and Financial Affairs (DG ECFIN), European Commission

Griliches Z (1990) Patent statistics as economic indicators: a survey. J Econ Lit 28(4):1661–1707

Grossman GM, Helpman E (1991) Quality ladders in the theory of growth. Rev Econ Stud 58(1):43–61

Hall BH, Harhoff D (2012) Recent Research on the economics of patents. Annu Rev Econ 4(1):541–565

Hall BH, Mairesse J, Mohnen P (2010) Measuring the returns to R&D. In Handbook of the Economics of Innovation, vol 2. North-Holland, pp 1033–1082

Hashmi AR (2013) Competition and innovation: the inverted-U relationship revisited. Rev Econ Stat 95(5):1653–1668

Hausman JA (1997) Valuation of new goods under perfect and imperfect competition. In: The economics of new goods. University of Chicago Press, pp 207–248

Hsiao C (2003) Analysis of panel data, 2nd edn, Econometric Society Monographs. Cambridge University Press, Cambridge. https://doi.org/10.1017/CBO9780511754203

Imbens GW (2020) Potential outcome and directed acyclic graph approaches to causality: relevance for empirical practice in economics. J Econ Lit 58(4):1129–1179

Impullitti G, Licandro O (2018) Trade, firm selection and innovation: the competition channel. Econ J 128(608):189–229

Jaumotte F, Pain N (2005) From Ideas to development: the determinants of R&D and patenting. OECD Economics Department Working Papers, n° 457, OECD Publishing

Levine R, Renelt D (1992) A sensitivity analysis of cross-country growth regressions. Am Econ Rev 82(4):942–963

Mairesse J and Mohnen P (2010) Using innovations surveys for econometric analysis. NBER Working Papers 15857, National Bureau of Economic Research, Inc

Mansfield E (1986) Patents and innovation: an empirical study. Manage Sci 32(2):173–181

Melitz MJ (2003) The iImpact of trade on intra-industry reallocations and aggregate industry productivity. Econometrica 71(6):1695–1725

Melitz MJ, Ottaviano GI (2008) Market size, trade, and productivity. Rev Econ Stud 75(1):295–316

Moser P (2005) How Do patent laws influence innovation? evidence from nineteenth-century world’s fairs. Am Econ Rev 95(4):1214–1236

Negassi S, Lhuillery S, Sattin J-F, Hung T-Y, Pratlong F (2019) Does the relationship between innova- tion and competition vary across industries? comparison of public and private research enterprises. Econ Innov New Technol 28(5):465–482

Nickell SJ (1996) Competition and Corporate Performance. J Polit Econ 104(4):724–746

Nicoletti G, Pryor FL (2006) Subjective and objective measures of governmental regulations in OECD nations. J Econ Behav Organ 59(3):433–449

Nicoletti G, Scarpetta S (2003) Regulation, productivity and growth: Oecd evidence. Economic Policy 18(36):9–72

Pearl J (1995) Causal diagrams for empirical research. Biometrika 82(4):669–688

Pearl J (2009) Causality, 2nd edn. Cambridge University Press, Cambridge

Perla J, Tonetti C, Waugh ME (2021) Equilibrium technology diffusion, trade, and growth. Am Econ Rev 111(1):73–128

Plümper T, Troeger VE (2007) Efficient Estimation of Time-Invariant and Rarely Changing Variables in Finite Sample Panel Analyses with Unit Fixed Effects. Polit Anal 15(02):124–139

Qian Y (2007) Do National Patent Laws Stimulate Domestic Innovation in a Global Patenting Environment? A Cross-Country Analysis of Pharmaceutical Patent Protection, 1978–2002. Rev Econ Stat 89(3):436–453

Reinganum JF (1983) Uncertain Innovation and the Persistence of Monopoly. Am Econ Rev 73(4):741–748

Romer PM (1990) Endogenous technological change. J Political Econ 98(5, Part 2):S71–S102

Schumpeter JA (1934) The theory of economic development (translation of second german edition by redvers opie). MA, Harvard University, Cambridge

Spirtes P, Glymour CN, Scheines R (2000) Causation, Prediction, and Search. Mit Press: Cambridge

Stock JH, Yogo M (2002) Testing for weak instruments in linear IV regression. NBER Technical Working Papers 0284, National Bureau of Economic Research, Inc

Teece DJ (1996) Firm organization, industrial structure, and technological innovation. J Econ Behav Organ 31(2):193–224

Tingvall PG, Poldahl A (2006) Is there really an inverted u-shaped relation between competition and r&d? Econ Innov New Technol 15(2):101–118

Westmore B (2013) R&D, patenting and growth: the role of public policy. OECD Economics Department Working Papers, n° 1047, OECD Publishing

Wooldridge JM (2010) Econometric analysis of cross section and panel data. The MIT Press

Xavier SIM et al (1997) I just ran two million regressions. Am Econ Rev 87(2):178–83

Acknowledgements

We are grateful to the Editor and an anonymous referee for very valuable and constructive suggestions. The author would like to thank Michele Cincera, Jackie Krafft, Nadine Levratto, Maryann Feldman, Jacques Mairesse, Thierry Philipponnat and conference participants at the KID 2018 Thematic School CNRS for helpful comments.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

1.1 Nonlinearity of Domestic Regulation on the Product Market

As discussed in Section 2.1, competition might have an inverted U-shape relationship with innovation. The endogenous growth theory has introduced a model where innovation occurs step-by-step, reconciling the escape competition and the Schumpeterian effects (Aghion et al. 2001). In neck-and-neck sectors, increasing the intensity of competition spurs the incentive to innovate, resulting in a positive escape competition effect. In contrast, laggards’ firms have little incentive to innovate to reach the leaders when the intensity of competition is already high. As a result, if the level of competition is already strong, an increase in competition should result in a slower average pace of innovation. Aghion et al. (2005) find supportive evidence of an inverted U-shaped relationship between the degree of competition and innovation using firm-level data in the UK, confirming these theoretical predictions.

The paper assumes a linear relationship at the country level. However, we estimate a nonlinear relationship between business regulation and innovation. Table 7 shows the point estimates for the squared term of business regulation using OLS and Poisson estimators. Using OLS, the estimated coefficients in column (1) are negative for the linear term, while the squared term is positive and only statistically significant at the 10 percent level. However, the sum of the two coefficients is jointly non-significant. Column (2) reports the identical specification for patent intensity. In contrast to R&D, the linear term is positive but statistically significant only at the 10 percent level, whereas the squared term is negative and non-statistically significant. The linear and squared terms are jointly significant at the 10 percent level. Figure 3 shows the fitted quadratic curved and fails to show an inverted U-shape.

In addition, we replicate specifications in Aghion et al. (2005) using the Poisson estimator. The point estimates for the exponential quadratic specification are reported in columns (3) and (4). Except for patent intensity, for which we find a small nonlinear relationship (Figure 3, right-down panel), the results are consistent with the absence of a significant inverted U-shape effect of business regulation on innovation.

Table 8 and Figure 4 show the point estimates and the fitted quadratics curves for the trade regulation indicator and again failed to find an inverted U-shape.

Rights and permissions

Springer Nature or its licensor holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Quignon, A. Market Regulation and Innovation: Direct and Indirect Effects. J Ind Compet Trade 22, 429–456 (2022). https://doi.org/10.1007/s10842-022-00390-y

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10842-022-00390-y