Abstract

This paper investigates the effects of economic uncertainty on growth performance of Pakistan through developing a small macroeconomic model. The GARCH method has been used for construction of economic uncertainty variables related to macroeconomic policies. The structural outcomes clearly indicate that economic policy uncertainty affects negatively on real and nominal sectors of Pakistan. The forecasting of model and different policy uncertainty simulation shocks also indicated that an adjustment in economic policies due to change of policy objectives create uncertain environment in country, which not only deteriorates the investment climate of country, it also affects the economic growth. Our study concludes that economic uncertainty not only reduces the current investment and economic growth, it also affects the future decision of investment and economic growth. This study suggests that sustainable and steady economic policies always reduce economic uncertainty and promote the confidence of economic agents, which help in achieving the targets of investment, trade and economic growth. Our study also maintains the predictability and reliability of government policies for the accomplishment of macroeconomic goals and economic development of country.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

According to Keynesian, the stability of economy directly associated with the external and internal balances. Over the past decades, the significant changes in economic structures and policies created uncertainty in economic environment that changes the investment climate and resources allocation, which lead to the internal and external imbalances. Furthermore, the distortion of investment plans not only affects the economic growth, it also intensely affects the well-being of economic agents.Footnote 1 The economic stability of nation always depends upon the economic growth accompanied by low inflation and high productivity that leads to real economic activity [Ocampo (2005)].

Economic uncertainty mostly exists in developing nations because of lack of information, pervasive knowledge, low productivity and low technological advancement and high dependency on the policies and plan of developed nations and international financial institutions. An economic agent always perceived that major source of economic uncertainty is the variability in government policies, which happen due to the volatility in the behavior of policy makers in response to change in economic environment and the policy objectives. In literature, the association between uncertainty-investment and uncertainty-growth is study since more than a half century. Hek (1999) revealed that volatility of the productivity reflects the level of uncertainty and higher volatility signified more uncertainty. Perhaps, this type of uncertainty is observed in Pakistan in different decades due to instability and uncertainty in economic policies. The uncertainty affects economy of Pakistan severely due to underdeveloped economic and financial structure. In past, no considerable attention given to study the effects of economic policies uncertainty on macroeconomic performance of Pakistan. This is first study, which demonstrates the effects of economic uncertainty on macroeconomic performance of Pakistan. Macroeconomic model is useful to study the effects of uncertainty on growth performance of Pakistan. Herve et al. (2010) also relied on macroeconomic models for productive means of tracking of a variety of exogenously and policy driven shock implications. Footnote 2

The Macroeconomic model has a long tradition and is widely used for policy analysis and forecasting. Many countries have developed macroeconomic models to design long-term development plans and to investigate the effects of economic policies on growth, employment, balance of payment and inflation by applying the different approaches of demand and supply side economies (Klein and Goldberger 1955; Klein et al. 1961; Duesenberry et al. 1965; Fair 1976; Rashid 1981; Pindyck and Rubinfeld 1997).

More specifically, this study investigates the effects of economic uncertainty on macroeconomic performance of Pakistan. In this respect, a small macroeconomic model is being constructed, consisting of 30 equation including 18 structural equation and 12 identities. Different Economy policy uncertainty variables related to fiscal policy, trade policy and monetary policy is used in all equations to demonstrate the effects of uncertainty.Footnote 3 After evaluating the tracking performance, the model will be used for forecasting and simulation of policy changes in response to exogenous shocks. The model presented in this paper is built on the basis of distinctive characteristics of Pakistan’s economy and the accumulated knowledge of the past models and makes an attempt to provide improved specifications and estimation (see Allen et al. 2002; Arreaza et al. 2003; Tjipe et al. 2004; Ducanes et al. 2005; Hanif et al. 2010; Baumgartner et al. 2004; Hossain and Razzaque 2003; Félix 2005; Waheed 2005; Khan and Din 2011).Footnote 4

The rest of the paper is structured as follows: Sect. 2 briefly reviews the major empirical studies on the subject of macroeconomic uncertainty. Section 3 lay out the specification and structure of the model along with the illustration of the underlying linkages and also elaborates the modeling framework. Section 4 presented the estimation results for sector-specific individual equations within sample and out of sample forecast of the model, while the simulations of the model with key findings are discussed in Sect. 5. Finally, the concluding observations and future direction of research are presented in Sect. 6.

2 Review of literature

Economic uncertainty plays a dynamic role in real economic activity and emphasizes the challenges that appear in investment-decisions and optimal resources allocations towards the economic development. In the cross country literature, Aizenman and Marion (1993a, b) investigate the relationship of uncertainty and economic growth and uncertainty and private investment for developing countries for the period of 1970–1985.Footnote 5 The authors found that macroeconomic uncertainty has negative affected on growth and private investment. Later on, the effect of uncertainty on economic growth was studied by Lensink et al. (1999) by performing Barro-type regression for the period of 1970–1995 for 138 countries. They measured uncertainty related to the fiscal policy, financial market and good prices.Footnote 6 The authors found that uncertainty has negative effects on economic growth. Serven (1998) re-examined the links between uncertainty and investment for developing nations.Footnote 7 The author constructed different alternative measures of uncertainty based on the dispersion of the innovations to five keys macroeconomic variables.Footnote 8 The authors concluded by employing the simple correlations that there is a significant negative relationship between uncertainty variables and private investment of developing nations.

Lensink (2000a) studied the effect of uncertainty on economic growth for the period of 1970–1998 for 94 countries. The author founds that countries that have developed financial sector are better able to nullify the negative effects of policy uncertainty on economic growth. Moreover, Lensink (2000b) study the effect of uncertainty on capital output ratio and economic growth for a sample of 17 developed countries for the period of 1970–1997.Footnote 9 The author concluded that low level of uncertainty has a positive effect on the per capita income and capital output ratio, and high levels of uncertainty have negative effects on per-capita economic growth.

Later on, Serven (2002) examined the relationship between real exchange rate uncertainty and private investment of developing countries. The author constructed GARCH based measures of real exchange rate uncertainty and found its negative significant effect on private investment of developing nations. Jeong (2002) developed a model, where policy uncertainty creates short-term bias in investment of an economy, which leads to a higher capital cost, and further lower the long-run investment and output. The author adjusted the model by different simulation experiments and found that policy uncertainty can create large differences in the long-run capital price, investment, and output across the countries.

Asteriou and Price (2005) investigate the relationship between uncertainty, investment and economic growth. The authors tested for the long-run coefficients with a Hausman-type test for the panel data of 59 industrialized and developing countries for the period of 1966–1992. The authors concluded that uncertainty reduces both investment and growth of industrialized and developing nations.Footnote 10

Grier and Smallwood (2007) investigate the relationship between real exchange rate uncertainty and foreign income uncertainty on exports growth of eighteen countries. The authors used monthly data for the period of 1973–2003 by employing exponential smooth transition autoregressive model (ESTAR).Footnote 11 The study concluded that real exchange rate uncertainty effects negatively on exports growth of six less-developed nations out of nine and insignificant effects on the majority of developed nations. While foreign income uncertainty has the persistent significant negative effects on exports of both developed and developing nations.

In time series studies, Kim (1993) examines different sources of monetary growth uncertainty for U.S. using monthly data for the period 1962–1989 and adopts reduced form equation for money growth to lagged inflation, lagged money, lagged interest rates and lagged fiscal measure and then empirically relates it to the economic activity. The author suggests that different sources of uncertainty have the different impact on the value of new information and economic activity and that the financial deregulations may be one of the factors that boosted the size of uncertainty.

Grier and Perry (2000) examine the relationship between uncertainty and average inflation and output growth by using bi-variate GARCH-M model for the economy of United States for the period of 1948–1996. The authors found no evidence that higher inflation uncertainty or higher output growth uncertainty raises the average inflation rate. The author are not supported the idea that riskier output growth is associated highly with an average real growth rate. For supporting the conclusion, the authors used a variety of models and different sample periods and accomplished that uncertainty of inflation significantly lowers the real output growth.

Onatski and Williams (2002) study the monetary policy under model uncertainty through developing different methods to investigate the sources of uncertainty in one coherent structure. The author proposed error modeling and membership identification approach to model uncertainty. The authors concluded that different terms of uncertainty may have significantly different effects on the monetary policy of small model of US economy. The authors found that pure-model uncertainty is the most harmful source uncertainty for policy makers. The real-time data uncertainty and pure shock uncertainty is the second and third harmful sources of uncertainty.Footnote 12

Grier et al. (2004) investigates the economic growth uncertainty and inflation uncertainty effects on average growth and inflation of US economy for post war data. The outcomes of the study found that there is negative association between average output growth and growth uncertainty. The rise in growth uncertainty significantly decreases the output growth. While the inflation uncertainty showed negative effect on output growth and average inflation of US economy.

Ruiz (2005) re-examined the effects of inflation and exchange rate uncertainty on real economic activity of Colombia. The author use a GARCH model for the extraction of the conditional variances of the model’s forecast errors for inflation and exchange rate uncertainty.Footnote 13 The outcome suggest that higher levels of inflation Granger cause more uncertainty for the Colombian economy and inflation uncertainty only put negatively effects on an output of economy.

Fountas and Karanasos (2006) examined the relationship between economic growth and real uncertainty for the G3 countries (Germany, Japan, and USA) by using a long series of an annual data that covered almost one and half century and employed GARCH-ML model.Footnote 14 The authors’ found that output growth uncertainty is a positive determinant of economic growth in the case of Japan and Germany. Fountas et al. (2006) investigates the links between macroeconomic (nominal and real) uncertainty and macroeconomic performance for the G7 countries. The authors measured the nominal uncertainty by the average inflation rate and real uncertainty by the average rate of economic growth and employing the GARCH methodology. The authors concluded that inflation is a negative determinant of real growth rate. This supported the vision that inflation doesn’t have real effects and demonstrated the objectives of low inflation for monetary policy-making.

Stockhammer and Grafl (2008) used a Post Keynesian perspective to analyze the effect of financial uncertainty on investment expenditures. The authors used the data of five countries such as; USA, UK, Netherland, France and Germany and develop model of all countries according to the openness of countries and structure of financial system. The authors found that a rising of volatility of variables value is a sufficient condition for an increase in uncertainty of variables, but not a necessary condition for an increase in uncertainty. Moreover, the outcomes of model concluded that financial uncertainty has significant negative impact on investment of USA and Netherlands. Overall, the results of effects of financial uncertainty are statistically and economically significant with market-based financial systems.

In case of Pakistan, Ahmad and Qayyum (2007, 2008, 2009a, b) studied the effects of macroeconomic uncertainty in determining sectoral private fixed investment of Pakistan for the period of 1972–2005. The authors found that macroeconomic instability and uncertainty effects the private fixed investment of agriculture, industry and service sector negatively.

All the above study concluded that uncertainty affect negatively economic growth and investment of nations.

3 The Model Specification

In Pakistan, there are a few attempts to construct macroeconomic models such as Naqvi et al. (1983, 1986), Chisti et al. (1992), Pasha et al. (1995) etc.Footnote 15 Later on; Waheed (2005) constructed a financial macroeconomic model for Pakistan and designed a comprehensive debt reduction strategy based on the simulation of the model. Hanif et al. (2010) constructs a small macroeconomic model to estimate the effects of monetary policy on Pakistan’s economy.Footnote 16 Khan and Din (2011) also develop a dynamic macroeconometric model to examine the behavior of major macroeconomic variables.Footnote 17 None of these models demonstrates the effects of economic uncertainty on macroeconomic performance of Pakistan.

Our model is a small macroeconomic model, which presented all features of demand side and supply side of economy and is divided into six key blocks; such as production, consumption, investment, government, trade and monetary block. Pakistan is developing nation faced supply constraint problem and dynamics of all production sectors are different. In order to gain insight into the supply constraint and different dynamics of production sector, our model specifies the sectoral production function. For capturing the demand side features, this model also specifies the sectoral investment function among the other function of aggregate demand.

The structural specification of the macroeconomic model is considered below and equations are given in Appendix I.

-

a)

Production block

The production block basically represents the structure of the economy, which is disaggregated into three sub-sectors, such as agriculture, industrial and service sectors (see Eqs. 1–3 in Table 1). The entire sectors play a significant role in an economy of Pakistan and mainly depend upon the labor force availability and capital. Moreover, in order to capture the effects of other exogenous factors such as availability of water and infrastructure for the production of agricultureFootnote 18 and the availability of imported raw materials and intermediate goods, agricultural output and infrastructure for industrial sectors and real aggregate demand for service sector is also used in structural equation.Footnote 19 Additionally, the policy uncertainty variables are incorporated to demonstrate the effects of economic uncertainty. It is expected that all the key factors affect positively on production, whereas the uncertainty variables effects negatively on sectoral production.

-

b)

Consumption block

Consumption is the main components of aggregate demand and mostly represents the largest part of aggregate demand, which can be divided into private and government consumption expenditure. The Government Consumption is considered in the government block, and private consumption is only considered in this block, which is specified as a function of current disposable income.Footnote 20Additionally, The uncertainty variables related to the fiscal policy and remittances is included to expose the effect of uncertainty (see Eq. 4). It is expected that personal disposable income effect positively and uncertainty effect negatively the private consumption.

-

c)

Investment block

Investment is another major element that has been divided into private and public investment. Public investment is a policy variable; it mostly concentrates on the provision of infrastructure and exerts an important influence on private investment.Footnote 21 Private investments play a crucial role in promoting sustainable economic development through economic growth channel.Footnote 22 In this block, separate equations estimated for private investment in agriculture, industrial and service sector, which depends upon the interest rate, sectoral income and government development expenditures (Eq. 5–7). It is expected that sectoral income and development expenditure affect positively, whereas interest rate affect negatively on private investment.Footnote 23 In addition to the above determinants, the uncertainty related to monetary policy, fiscal policy, and development expenditure is incorporated in order to foresee the effects of uncertainty.

-

d)

Government block

This block is divided into government revenues and expenditures. The revenue mainly originated from tax and non tax sources. Tax revenue includes the direct and indirect taxes and may be influenced by size of economy (Proxied by nominal GDP), average tax rate and inflation.Footnote 24 In addition to these, the import is also taken into indirect tax function and non tax revenue is likely to be influenced by nationwide economic activities.Footnote 25 Furthermore, uncertainty related to fiscal policy, monetary policy and imports are considered for the effects of uncertainty (Eq. 8–10).Government expenditures include the government consumption expenditure and government development expenditures. Government development expenditure is assumed to be exogenously determined and the government consumption expenditure depends upon the development expenditures, inflation and government tax revenue (Khan and Din 2011).Footnote 26 The uncertainty variables related to fiscal policy, and monetary policy is incorporated in the model (Eq. 11).

In this block, the government budget is in deficit when government expenditures are greater than the government revenue. If the government expenditures are equal to the government revenue, then the budget is balanced.

-

e)

Trade block

The trade block consists of five equations; three equations determine the volume of exports and two volumes of imports (Eq. 12–16). Exports are specified for primary, manufactured and semi manufactures commodities as the exports supply function and imports are specified for capital and consumer goods as import demand function. Pakistan is a price taker in world market, so that the export and import prices are given by the world market prices. Therefore, it is assumed that the main constraint of Pakistan’s exports emerges from the supply side; and is determined by the unit value of exports to domestic prices,Footnote 27 exchange rate, cost of production, and capacity utilization.Footnote 28 The uncertainty regarding the domestic price level and exchange rate used to demonstrate the effects of economic uncertainty.

The imports are determined by imports price relative to domestic price, exchange rate and national output. Moreover, the credit to private sector is included in imports of capital goods.Footnote 29 Furthermore, uncertainty related to exchange rate, fiscal policy, and private sector credit is considered in the model. In this block trade deficit occurs when exports are lower than imports.

-

f)

Monetary block

The monetary system of Pakistan consists of central bank and commercial banks, and commercial banks interact with the public and create money held by the public. The total money supply is specified as a function of the government budget deficit financed by domestic borrowing, total foreign reserve and total credit to private sector. Footnote 30 In addition to above determinants, the uncertainty regarding the government borrowing and private sector credit is used to measure the effects of uncertainty (Eq. 17).

In Pakistan, interest rate is regulated by the central bank. The equilibrating mechanism in the money market does not work through the demand and supply of money determining the rate of interest. The change in a money supply also affects the aggregate price level. Therefore, instead of specifying money demand function, a price-level equation is specified, which is derived from the money demand function, and is determined by money supply, interest rate, price of foreign goods and national income (Eq. 18). Uncertainty regarding the monetary policy and foreign prices is used in this model to see the effects of economic uncertainty on domestic price level. In this block, the expected sign of uncertainty variables is positive.

-

g)

Linkages of the model

The model captures different linkages as they exist in the economy.

-

Production affects consumption, exports, imports, government revenue and expenditure. Finally, it affects the price level.

-

Real Interest rate affects the private investment; it’s consecutively affects the real output; further affect the government revenue and government expenditure and hence budget deficit.

-

Public investment also influences private investment, which affects the economy through various channels.

-

The exchange rate determines the exports and imports and further affects the private investment.

-

Foreign price level also affects the general price level through import prices of goods.

-

Money supply is affected by government borrowing for budget deficit financing, which consecutively influences the general price.

-

Price level is affected by real sector and monetary sector variables, influences an exporter’s incentives to export and importer’s decision to import.

-

The disequilibrium between aggregate demand and aggregate supply also affects domestic price level.

-

h)

Methodological framework

The literature distinguishes several methods to measure the uncertainty variable; i.e. the standard deviation of forecasting equation or standard deviation of the variable that are under consideration, conditional variances estimated from GARCH, the residuals of forecasting equations estimated through autoregressive (AR) process or the standard deviation from Geometric Brownian process see Lensink et al. 1999.Footnote 31 The modern and most appropriate method of constructing uncertainty is generalized autoregressive conditional heteroscadasticity (GARCH) method, which is used in this study (Lensink 2000b; Byrne and Davis 2002; Andreou et al. 2008; Mehrara and Mojab 2010; Fatima and Waheed 2011; Waheed and Fatima 2012). The mean of the variable of interest (uncertainty variable) is specified by using the following equation:

The conditional variance \((\delta _t^2 )\) of the uncertainty variable is estimated by the following equation:

In the above equations, Yt is the uncertainty variable, \(\delta ^{2}\) is the conditional variance of the variable and \(\varepsilon _t \) is the error term.

4 Model estimation

The simple OLS method is used to estimate the structural equations and estimated results are presented in Table 1. The estimated outcomes of sectoral production function are presented in Eq. 1–3. Eq. 1 indicated that labour force, infrastructure, capital stock and availability of water affect positively on output of agriculture sector as per theoretical expectations, whereas the uncertainty related to availability of water and monetary policy (URT) demonstrates significantly negative impact on output of agriculture sector. Footnote 32The estimated results of Eq. 2 show that capital stock, imports of raw material, agriculture output, infrastructure and labour force influence positively on industrial income, whereas the uncertainty regarding trade policy (UER), fiscal policy (UTAX) and monetary policy effects negatively on output of industrial sector. Uncertainty regarding the trade policy indicates that fluctuation and variability in exchange rate will create uncertainty among importers about the cost of imports, which ultimately affect the imports of raw materials and further impact negatively on industrial output. Moreover, uncertain fiscal and monetary policy always negatively affects on industrial output through investment channel. When investors doesn’t distinguish clear signal from government and central bank regarding taxes and interest rate, then they postpone the decision of investment. The empirical results of Eq. 3 signified that capital, labour force and real GDP encouraged the income of service sector, whereas the uncertainty related to interest rate and fiscal policy effects significantly negative on output of service sector.

The Eq. 4 indicates the effects of personal disposable income, uncertainty related to fiscal policy (taxes) and foreign policy (remittance) on private consumption expenditure. The results showed that personal disposable income effects positively on private consumption;Footnote 33 whereas uncertainty related to fiscal policy and foreign policy discourage the private consumption expenditures. These policies affects the private consumption through effects the disposable income channel.

The Eqs. 5–7 shows the estimated coefficients of the private investment function for agriculture, industrial and service sector. The variables sectoral output and government development expenditures show a positive effect on private investment, which indicate that development expenditure for given incentives and provision of infrastructure always encourage the investors to do investment. The positive sign of sectoral national incomes supports the idea of accelerator principle in the determination of private investment.Footnote 34 The interest rate illustrates significantly negative effect on private investment, which shows that highest user cost of capital always decline the private investment in country. Moreover, uncertainty affects negatively on private investment as per theory because in the time of uncertainty of government policies, the investors mostly postpone the decision of investment.

The Eqs. 8–10 show the outcomes of fiscal block of model. The results indicates that size of economy and average direct tax rate affect positively on direct tax revenue collection as per theoretical expectations, whereas the negative coefficient of inflation indicated that inflation always hurt the collection of taxes due to narrow tax based. Moreover, the results shows that uncertainty related to fiscal policy (taxes) and monetary policy affect negatively on collection of direct tax revenue.Footnote 35 The empirical outcomes of the indirect tax collection equation show that there is a positive relationship between size of economy and average indirect tax rate with indirect tax rate. As the size of economy expanded, it will increase the indirect tax revenue due to large amount of collection of taxes from sales tax. A rise in average indirect tax rate also increases the indirect tax collection and inflation hurt the indirect tax collection as explained earlier. The other variable imports reflect positive effects on indirect tax revenue, while the imports uncertainty indicates that uncertainty create hurdle in collection of indirect tax revenue. The nominal GDP also effects positively on non tax revenue in case of Pakistan as per theoretical indication, whereas the policy uncertainty regarding the monetary and fiscal policy indicated an insignificant effects on non tax revenue except inflation uncertainty.

The Eq. 11 signified the effects of uncertainty on government consumption expenditure. The determinants such as government development expenditures and total revenue positively affect the government consumption, but the inflation has insignificant effects on government consumption expenditures. The uncertainty variables showed negatively affects the government consumption expenditures. The Eqs 12–14 implies the empirical outcomes of export supply function of primary, manufactured and semi manufactured commodities. The results clearly indicated that exports prices relative to domestic price and exchange rate significantly positively affect the export supply of all commodities. As in international markets the exports prices increases, Pakistan can definitely take the benefits by raising the exports supply. The other determinant cost of production effects negatively on the exports supply of all commodities.Footnote 36 The national income also affect positively the exports supply. The uncertainty regarding exchange rate and inflation (competitiveness) effects negatively on exports supply.

The empirical outcomes of imports demand regarding capital and consumers goods are shown in Eqs. 15 and 16. The results clearly signify that the imports price of capital good relative to domestic price negatively affects the imports demand of goods. Footnote 37 The other variable exchange rate also showed positive effects due to competitiveness. The variable private sector credit indicated positive effects due to the increase demand of capital goods, as the domestic credit for industrial investment increases. The national income also showed positive effects on imports demands of capital and consumer goods, because of favorable environment and stable economic policies of countries. The variable regarding policy uncertainty related to private sector credit and exchange rate effects negative on imports demand of capital goods. The variable uncertainty related to policy such as taxes (fiscal policy) and exchange rate weakened the imports demands of consumer goods.

The results of money supply equation are exposed in Eq. 17, which clearly supports that government borrowing for budget deficit financing, foreign reserve and credit to private sector effects positively on money supply increases. The uncertainty regarding these determinants will affect positively but insignificantly on the money supply in case of Pakistan.Footnote 38 The Eq. 18; GDP deflator is significantly determined by nominal money balances, output growth, exchange rate, interest rate and international price rate. The results suggested that money supply, international prices and interest rate are the main factors accelerating inflationary pressure in Pakistan. On the other hand, the coefficient of real output indicated that higher output significantly depressed the domestic price level in Pakistan. This might suggest that in the context of Pakistan the demand-pull has dominated the movement in the price level and an increase in output supply has a very big influence on the changes in the price level. Uncertainty in monetary policy and foreign prices affects inflation positively on domestic prices through reduction in investment and economic growth. The lower investment and economic growth increases inflation in Pakistan.

Moreover, to evaluate the appropriateness of the estimated results, diagnostic tests such as; Jarque–Bera (JB), Lagrange Multiplier (F-LM), autoregressive conditional heteroscadasticity (F-ARCH) is employed. The results are shown in Table 1, which indicated that there is no serial correlation and heteroscadasticity problem and residuals of all behavioral equations indicated the normality of the model.

4.1 Results of ex-ante simulations

After obtaining the satisfactory performance of each equation (at baseline), the model is solved for the period 1978–2008 to assess in-sample performance of the model and to evaluate the forecasting ability before the policy simulations. Table 2 explained the tracking performance of the model based on the correlation, mean absolute percent error (MAPE), and the Theil’s U inequality coefficient (U). The coefficient of U is less than unity and closest to Zero for all variables, which renders the model well for future policy simulations.Footnote 39 This can also be seen from the correlation coefficients, which showed high correlation between the actual and estimated series.

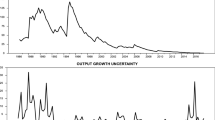

The coefficient of MAPE is reasonable and lies within the range of 2.10–12.90 %.Footnote 40 Overall, forecasting ability of the model is satisfactory, as indicated by correlation, MAPE and U statistics. Moreover, for graphical evaluation, the actual values of all estimated equation also compare with the in-sample estimated baseline values (see Fig. 1). Footnote 41

4.2 Out-of-sample forecast

The objective of the modeling exercise is to examine the effects of uncertainty on macroeconomic performance due to change in economic policy. To attain this objective, we have estimated the future path of values of endogenous variables on the basis of full sample growth assumption.

Table 3 reports the future projected values of endogenous variables. Out of the sample, it is projected that output growth rate would be nearest to 4 % during 2009–2014; with an average agriculture growth 3.3 %, industrial growth 4.79 % and service sector 4.69 %. The projection of private investment also suggests a positive mixed growth in Pakistan; on average, the private investment in an agriculture sector could be 7.71 %; in industrial sector, it could be 10.16 % and in-service sector it will 11.37 %. The reason behind the low growth and investment of agriculture is the unavailability of water and low capital formation.Footnote 42 Moreover, the external and internal shocks such as rising of oil prices, depreciation of currency, global financial crisis, energy shortage, security issues, infrastructure, and law and order condition are the key factors behind the low growth of output and investment. However, the sign of recovery is expected only; when the government is succeed in resolving the above issues. Footnote 43 Moreover, the model predicted that growth of private consumption expenditure will remain an average 10.78 % and government consumption is 8 %.Footnote 44

The projected value of direct, indirect and non tax revenue also reveals a mixed trend due to low economic activity and narrow tax base in Pakistan.Footnote 45 In trade block, the exports of primary, semi-manufactured and manufactured commodities projected averagely at 8.60, 5.00 and 3.49 %. The reason behind the low growth rate is high cost of doing business, lack of product and market diversification, market access and global financial crisis, which makes our product uncompetitive in international markets. The projection of imports demands of capital and consumer goods also showing a decreasing trend averagely to 13.40 and 16.75 % due to declining of private-sector investment and low economic activity in Pakistan. The projection of an inflation rate revealed that average inflation will remain in double digit, and tight monetary policy that exists since 2008 might be not success in lowering the inflation because of supply constraint. The projections of a money supply also showed a mixed trend, and averagely grow at 11.24 %.Footnote 46 Moreover, the double-digit interest rate is projected by IMF Standby Arrangement Programme (SBA) for lowering the government borrowing and increasing the revenue; that could not help in reducing inflation in Pakistan.

Thus, overall projections of macroeconomic variables are showing positive outlook of Pakistan. However, all forecasts have been dependent on the exogenous assumptions that are made for future outlook of the development of Pakistan’s economy.

5 Simulations in the model

Following the estimation and validation of the stability of the model, the next step is to do some simulation experiments.Footnote 47 With the policy simulation, we can measure the time paths of counterfactual effects of uncertainty due to change in policy variables on macroeconomic indicators. In this model, we consider seven shocks comprising both fiscal, trade and monetary policy. Simulation effects are computed using the deviations of major economic variables from the baseline during 2009–2014 and are shown in Table 4.

5.1 Scenario 1: effects of uncertainty due to 10 % increase in government borrowing for budget deficit financing (GBNB)

-

In this scenario, no change observed on production and private consumption expenditure.

-

In investment block, private investment averagely declined by 0.001 %, whereas in fiscal block, on average direct tax declined by 0.002 %, and indirect taxes declined by 0.07 % from baseline, the further budget deficit increased by 0.034 %.

-

In government block, the government consumption expenditures also declined by 0.34 %.

-

In trade block, the exports declined by 0.004 % and imports increased by 0.003 %, which deviate from the trade deficit to 0.051 % from baseline.

-

In monetary block, the money supply is also showing the positive deviation by averagely 0.268 % and inflation by 0.045 %.

Therefore, this scenario clearly indicates that the uncertainty raises the money supply in economy, further lead to upward stress on interest rate and inflation. The high interest rate deteriorates the private investment and further lowers the economic activity and worsens the trade balance of economy. Furthermore, this also reduces the tax collection and increases the government consumption expenditure, which further deteriorates the budget deficit.

5.2 Scenario 2: effects of uncertainty due to 10 percent decline in private sector credit (PSC)

-

In this scenario, no change observed in production block and on private consumption expenditures.

-

In investment block, private investment declined by 0.003 %, while in fiscal block, direct tax declined by 0.03 % averagely and indirect taxes declined by 0.03 %. Overall, tax revenue declined by 0.06 % and government consumption expenditure also illustrate the declining trend to averagely 0.07 %, which further worsen the budget deficit to 0.06 %.

-

In trade block, the exports also showed a decreasing trend by 0.01 %, and imports declined by 3.26 %. Overall, averagely the trade deficit declined by 0.06 % from baseline.

-

In monetary block, the money supply is also showing the negative trend by 0.15 %, and inflation increased averagely by 0.11 %.

Therefore, the uncertainty due to declining of private sector credit reduces the private investment, further affects the fiscal and trade balances of nations by decreasing the tax revenue and exports and creates the inflationary pressure in an economy.

5.3 Scenario 3: effects of uncertainty due to 10 % depreciation of nominal exchange rate (ER)

-

In this simulation, on average, in production block the average output declined by 2.55 % due to the declining of industrial sector output as compare to baseline results.Footnote 48

-

In investment block, the private investment in the industrial sector is declined by 0.13 % averagely, and overall private investment showed declining of 0.56 %.

-

In fiscal block, the direct and indirect tax revenue also demonstrates a declining trend. Averagely the direct tax rate declined by 0.19 % from 2009 to 2014 and indirect tax declined by 2.66 %.

-

In government block, government consumption expenditure also reveals an increasing trend. Averagely government consumption expenditures increased by 2.31 %, which further deteriorate the budget deficit by 2.22 %.

-

In trade block, on average the exports and imports both reveal declining trend; the exports of primary, semi manufactured and manufactured commodities declined by 2.45, 6.0 and 2.89 %, whereas the imports of capital goods declined by 5.50 % and consumer goods declined by 5.23 %. This declining trend also deteriorates the net exports to the 12.90 % averagely.

-

In monetary block, the average prices deviate by \(-1.0\) %, and no change observed on money supply.

Therefore, the increase in uncertainty due to the depreciation of nominal exchange rate reduces the output growth through trade channel and further affects the private investment. Furthermore, reduces the tax collection and increases the government consumption expenditures, and increases the budget deficit of the country and decline the domestic price level.

5.4 Scenario 4: effects of uncertainty due to 10 % increase in interest rate (RT)

-

In this scenario, the uncertainty declining the output growth of economy averagely by 2.15 % with the decline of agriculture, industry and service sector output by 1.32, 4.30 and 1.81 %.

-

In investment block, the private investment deviate by \(-6.75\) %, including agriculture sector, industrial and service sector by \(-2.25\), \(-14.0\) and \(-3.38\) % from the baseline averagely.

-

In fiscal block, the direct and indirect taxes deviated by \(-0.04\) and \(-2.01\) %, whereas non tax revenue showed an increasing trend average to 1.30 % from base line. Overall, the revenue declined by 0.32 % and the government consumption expenditures also declined by 0.94 %; which deteriorate the budget deficit by \(-1.80\) % averagely from baseline.

-

In trade block, exports of primary, semi manufactured and manufactured commodities deviate by \(-3.09\), \(-10.03\) and \(-3.17\) % from baseline. The imports of capital and consumer goods also revealed a declining trend by 5.09 and 7.17 %. Overall, the exports declined by 4.86 %, and imports 1.69 %, which deviate the net exports by \(-4.30\) % averagely.

-

In monetary block, the inflation increases from baseline by 2.31 % and no change observed on money supply.Footnote 49

Therefore, the uncertainty due to rise in an interest rate directly affect the private-sector investment by raising the cost of capital; and further affect the output of an economy, which subsequently declines the trade and further revenue collection and creates inflation in economy.

5.5 Scenario 5: effects of uncertainty due to 10 % increase in inflation (GDPDEF)

-

In this scenario, on average the output growth of economy deviate by 1.63 % from baseline, whereas in investment block, the private investment showed an increasing trend to 0.02 % averagely from 2009 to 2014 as compare to baseline outcomes.

-

In fiscal block, the direct and indirect tax revenue increased by 0.19 and 0.52 % from baseline. The non tax revenue showed a declining trend to 4.52 % averagely. Overall, the government revenue deviate by \(-3.57\) % from baseline.

-

In government block, the government consumption expenditures also showed an increasing trend to 2.37 %, which further worsen the budget deficit to 7.52 %.

-

In trade block, the exports of primary commodities, manufactured and semi manufactured commodities declined by 2.54, 5.77 and 2.51 % and imports of capital and consumer goods declined by 0.61 and 5.13 %. Overall, the exports declined by 3.31 %, and imports deviate to \(-2.60\) %, which declined the trade deficit by \(1.39\) % from baseline.

-

In monetary block, the money supply and inflation deviate to \(-0.07\) and \(-0.32\) % averagely.

Thus, the uncertainty due to increase in inflation reduces the economic activity and deteriorate the fiscal and trade balance of an economy by declining the revenue and exports due to rising cost of production. The declining of exports increases the domestic supply of commodities, which further decline the domestic price level.

5.6 Scenario 6: effects of uncertainty due to 10 % decline in government development expenditure (GDE)

-

In this scenario, No Change observed in production block, monetary block, trade block and private consumption block.

-

The private investment showed a deviation of \(- 17.03\) % in comparison to base line estimates averagely due to deviation of the private investment in agriculture, industrial and service sector \(-12.22\), \(-25.08\) and \(-1.25\) % as compare to baseline.

-

In fiscal block, no change observed in direct tax revenue and indirect revenue, whereas non tax revenue deviate by \(-1.325\) % from base line and overall revenue collection deviate by \(-0.682\) %.

-

In government block, the government consumption expenditures increased by 0.535 % and budget deficit also showed an increasing trend to 3.598 % average from baseline.

Therefore, economic uncertainty due to declining of government development expenditures directly affects the private-sector investment of a country, which further decline the collection of tax revenue and increases the government consumption expenditure; which further deteriorate the budget deficit of the country.

5.7 Scenario 7: effects of uncertainty due to 10 % decline in tax revenue collection (TXR)

-

In this scenario, the output growth deviated by \(-2.83\) % averagely and also declines the private-sector investment to \(-4.88\) % from baseline.

-

The private consumption expenditure also showed a negative deviate averagely to 0.01 % from baseline.

-

In fiscal block, the direct tax and indirect signified a negative deviation by 0.46 and 0.66 % in compare to baseline. Overall, the government revenue shows a deviation of 0.17 %.

-

In government block, the government consumption also deviates to 2.21 % averagely, which further worsen the budget deficit to 2.22 %.

-

In trade block, on average exports of primary commodities, manufactured and semi manufactured commodities declined by 2.41, 5.77 and 2.50 % and imports of capital and consumer goods declined by 0.61 and 5.14 %. Overall, the exports declined by 3.29 %, and imports deviate to \(-2.49\) %, which further declined the trade deficit to 1.66 % from baseline.

-

In monetary block, the average inflation showed deviation of \(-3.32\) % from baseline.

Thus, economic uncertainty due to declining of tax revenue collection directly affects the budget deficit and further deteriorating the trade of economy through declining the private-sector investment and creates deflation in economy and reduces the economic growth.

Overall, the basic conclusion that emerges from simulations of the model indicated that rise in policy uncertainty worsening the twin deficit and affects the investment climate of country and output of economy. The low and minimum uncertainty always stimulates the private-sector investment and further enhances economic growth by lowering inflation.

6 Conclusion and policy implication

This study is an addition in a macroeconomic modeling framework of Pakistan, through incorporation of economic policy uncertainty. Economic uncertainty mostly exists in developing nations, because of high variability and volatility in economic policies and dependence on the developed countries to attain the status of development. The objective of this study is to demonstrate the effect of economic uncertainty on growth performance of Pakistan. In this respect, a small macroeconomic model is constructed, which captures all the important dynamics of the demand and supply side of economy.

This study estimates the uncertainty variables through GARCH estimation and the conditional variances of policy variables is utilized as an indicator of uncertainty related to fiscal policy, trade and monetary policy uncertainty. The model estimated the structural equations for the period of 1975–2008 and forecasted to 2009–2014. The structural baseline outcomes clearly show the negative effects on all economic indicators except monetary block indicator. The results shows that uncertain policy always deteriorates the economic growth through trade and investment channel and further worsens the revenue collection and create inflationary pressure in economy. Economic uncertainty not only affects current decisions of economic agents; it also affects the future decisions of policy makers and creates the hurdles in the economic development and put country into crisis. The tracking performance of model is evaluated with correlation, MAPE and Theil’s U test and forecasted for the period of 2009–2014.

For investigating the future effects of economic uncertainty, different policy uncertainty shocks is performed, which showed that an adjustment in economic policies due to change of policy objectives create uncertainty in Pakistan, which deteriorates investment and economic growth and ultimately affects the economic development of nation. The economy can function efficiently only in that condition, when economic agents receive clear signal from market regarding decision-making of an investment and consumption because many decisions are mostly depends upon the formation of expectations. We conclude that sound and steady government policies always reduce uncertainty and volatility of economic policies; resultantly, the targets of massive investment and sustainable economic growth would be achieved, which help in achieving the status of developed nation. Our study also maintains the predictability and reliability of government policies for the accomplishment of macroeconomic goals and economic development of Pakistan

At this stage, there is a dire need to recommend the future studies in order to highlights the appropriateness of the sustainable economic policies for developing nations. The current study can be extended to regional countries; to demonstrate the effects of volatility of one country on the economic performance of another country. Moreover, uncertainty related to socio political; global policies, financial and politics are needed to be study for in-depth analysis. Moreover, the study at sectoral level uncertainty is needed to conduct by constructing a micro level sectoral model in Pakistan to further demonstrate the effects of policy uncertainty on macroeconomic goals.

Notes

See Varvarigos (2004).

The authors constructed a macroeconomic model for OECD countries.

For the monetary policy, we used real interest rate uncertainty, private sector credit and inflation uncertainty in the equation, for the trade policy, uncertainty directly linked to imports and exchange rate is used, whereas for the fiscal policy uncertainty related to government budget borrowing, tax rate and government development expenditures is used.

The present macroeconomic model is a small, compact and highly aggregate macro model.

Their uncertainty—investment analysis depends upon the assumption that investment is characterized by irreversibility and fluctuates between the low and high tax regimes’ policies of government.

Data of 138 countries was collected from Barro Lee data set. (1994) available at NBER website.

The sample size of the study is 94 countries for the period 1970–1995.

Three related to the macroeconomic environment and aggregate profitability of capital-growth, inflation and the relative price of investment goods and another two more closely related to the relative profitability of different economic sectors the terms of trade and the real exchange rate.

The author divided overall data set into five sub periods. Each period contain five years data except last sub period. Last sub period includes 7 years data. The aim behind division of this data set is to use the GARCH method to measurement of uncertainty variables.

The authors estimated reduced form equation to explore the possible effects of uncertainty on investment and economic growth and assumed that all countries acquired a common production structure. In a cross country studies they used output variable as estimate of uncertainty variable and check whether the uncertainty of output effect the investment decision of countries.

Their sample includes nine developed and nine developing countries.

The authors found that the uncertainty at highest frequency is largest.

The author used monthly data of Colombian economy for the period 1980–2003.

The sample period started 1850 for Germany, 1860 for the US, and 1874 for Japan to 1999.

Pasha et al. (1995) model is an integrated social policy macroeconomic model (ISPM), which evidently shows the relationship between macroeconomic performance and social sector development.

Their model comprising of 17 equations, out of which 11 are behavioral equations while the rest are either identities or definitional equations.

This model comprises of 21 equations, out of which 13 are behavioral and the rest are identities.

Agriculture has strong linkage with rest of the economy by providing raw material to downstream industry and contributing substantially to national exports. In Pakistan, there is no agriculture tax, thats why uncertainty regarding fiscal policy variable is not used in agriculture equation.

The industrial sector includes the production of manufacturing, mining and quarrying, construction, electricity and gas distribution. The service sector is composed of tertiary activities includes transport, communication, storage, whole sale, retail trade, finance, insurance, dwelling ownership, public admin, defense and social and community service.

According to the Keynesian absolute-income hypothesis, the disposable income is assumed to have a positive influence on private consumption. Later theories, such as the life-cycle or the permanent-income hypothesis introduced other explanatory factors like the real interest rate or the inflation rate, whose impact is not clear a priori.

The government development expenditures provides basic infrastructure to the private sector.

The policy makers frequently advocated that public investment harmonized the private investment instead of crowding out of private sector in developing countries like Pakistan.

With higher-income levels, investors would tend to shift more of their wealth to finance investment and high interest rate increases the cost of capital and reduces profitability of private sector.

The formula of average direct tax rate and indirect tax rate is used as suggested by Tjipe et al. (2004).

Nominal GDP used as proxy of economic activities. The non tax revenue includes the profits of post offices/Pakistan Telecommunication Authority, interest, dividend, transfer of State Bank of Pakistan, defense, development surcharge on gas, discount retained on crude oil, royalties on gas and others etc.

This also discussed in investment block as public investment.

Real GDP is used as the proxy of capacity utilization and wage rate as a proxy of cost of production in all equation. (For more detail, see Atique and Ahmad 2003).

As the private sector credit increases, the investment of private sector raises, which further increases the import demand of capital goods.

Government budget deficit provides an important mechanism for providing monetary base in Pakistan.

Others measures are the 5 years moving average or 5 years moving standard deviation etc were also used to proxy uncertainty (Goel and Ram 2001).

Water is key input for agriculture sector. Any natural calamity regarding water which increases or decreases the water supply compare to requirement may reduces the agriculture output. Moreover, the uncertainty regarding monetary policy affects the availability of agriculture credit.

It may reflect the situation that as income increases; private investment in these sectors also increases but the structural transformation of economy from agriculture to strong industrial base or service sector requires technological innovation and product diversification.

Inflation hurt the poor more as compare to rich due to narrow tax base. According to some experts, inflation is cruelest for poor.

High cost of production increases always deteriorates the international competitiveness of Pakistan.

As imports prices increases relative to domestic prices, the import demand clearly decline.

This indicated that as uncertainty increases the money supply also increases.

Theil’s inequality coefficient compares the forecast with the random walk and always lies between zero (i.e. zero indicate perfect fit) and one (i.e. forecast is not better than that of the random walk).

The graphs clearly indicated that the responses of each endogenous variable are in line with the expected signs and also tracking the policy shock in equal magnitude.

The reason of low availability is lack of storage facility in Pakistan. The reason of private sector low formation is lack of infrastructure particularly in rural areas and lack of government support to agriculture sector in Pakistan.

Currently the capital formation in industrial sector and service sector is at its lower level due to political instability and bad law and order condition.

The reason behind the increase in government consumption may be increase in government borrowing from banks to finance the budget.

The high level of inflation and lowering of average tax to GDP ratio in Pakistan also significantly contributed towards the declining of revenue.

This reason of this growth may be the highest government borrowing for financing the budget deficit due to lowering of revenue collection.

All simulations are carried out without any policy rules. With the policy simulation, we can measure the time paths of counterfactual effects of uncertainty due to change in policy variables on macroeconomic indicators.

The output of industrial sectors effects due to imports of capital goods and raw material.

This indicated negative effects on economic activity.

References

Ahmad, I., Qayyum, A.: Do Public Expenditure and Macroeconomic Uncertainty Matter to Private Investment? Evidence from Pakistan. Pak. Dev. Rev. 46(2), 145–161 (2007)

Ahmad, I., Qayyum, A.: Effect of government spending and macroeconomic uncertainty on private investment in service sector: evidence from Pakistan. Eur. J. Econ. Finance Adm. Sci. 11, 84–96 (2008)

Ahmad, I., Qayyum, A.: Role of public expenditures and macroeconomic uncertainty in determining private investment in large scale manufacturing sector of Pakistan. Int. Res. J. Finance Econ. 26, 34–40 (2009a)

Ahmad, I., Qayyum, A.: Dynamic modeling of private investment in agricultural sector of Pakistan. 24th Annual General Meeting/Conference PSDE, Pakistan Institute of Development Economics, Islamabad, 31 Mar–02 April 2009

Aizenman, J., Marion, N.P.: Policy uncertainty, persistence and growth. Rev. Int. Econ. 1(2), 145–163 (1993a)

Aizenman, J., Marion, N.P.: Macroeconomic uncertainty and private investment. Econ. Lett. 41, 207–210 (1993b)

Allen, C., Hall, H., Robinson, W.: Estimating a small scale macroeconomic model of the Jamaican economy: some preliminary result. Paper presented at the XXXIV Annual monetary studies conference, Georgetown, 12–16 Nov 2002

Andreou, E., Pelloni, A., Sensier, M.: Is volatility good for growth? Evidence from the G7. Economics Discussion Paper Series EDP-0804 (2008)

Asteriou, D., Price, S.: Uncertainty, investment and economic growth: evidence from a dynamic panel. Rev. Dev. Econ. 9(2), 277–288 (2005)

Arreaza, A., Blanco, E., Dorta, M.: A small scale macroeconomic model for Venezuela. Serie Documentos de Trabajo Oficina de Investigaciones Económicas No 43, Banco Central De Venezuela (2003)

Atique, Z., Ahmad, M. H.: The supply and demand for exports of Pakistan: the polynomial distributed lag model (PDL) approach. Pak. Dev. Rev. 42(4) Part II (winter), 961–972 (2003)

Barro, R. J., Lee, J. W.: Data set for a panel of 138 countries. NBER internet site (1994)

Baumgartner, J., Kaniovski, S., Thomas, Url.:Macroeconomic Models and Forecasts for Austria. Oesterreichische National bank WORKSHOPS NO. 5/2005. (2004)

Bhattarai, K.R.: Keynesian models for analysis of macroeconomic policy. http://www.hull.ac.uk/php/ecskrb/Macromodel_ISLM.pdf (2005)

Brown, T.M.: Habit persistence and lags in consumer behavior. Econometrica 20, 355–371 (1952)

Byrne, J. B., Davis, E. P.: Investment and uncertainty in the G7. National Institute of Economic and Social Research NIESR Discussion Papers number 198. (2002)

Chaudhary, M.A., Shabbir, G.: Macroeconomic impacts of budget deficit on Pakistan’s foreign sector. Pak. Econ. Soc. Rev. XLIII(2) (winter), 185–198 (2005)

Chisti, S., Hasan, M., Aynul, Mahmud Syed, F.: Macroeconometric modeling and Pakistan’s economy: a vector autoregression approach. J. Dev. Econ. 38, 353–370 (1992)

Ducanes, G., Cagas, M.A., Qin, D., Quising, P., Ramos, N.M.: A small macroeconometric model of the Philippine economy. Asian Development Bank, ERD Working Paper No (2005). 62

Duesenberry, J., Fromm, G., Klein, L.R., Kuh, E., Chicago, : The Brookings Quarterly Econometric Model of the United States. Rand McNally, Chicago (1965)

Fair, R.C.: A Model of Macroeconomic Activity. The Empirical Model, vol. II. Ballinger, Pensacola (1976)

Fatima, A., Waheed, A.: Effects of macroeconomic uncertainty on investment and economic growth: evidence from Pakistan. Transition Stud. Rev. 18(1), 112–123 (2011)

Fountas, S., Karanasos, M.: The relationship between economic growth and real uncertainty in the G3. Econ. Model. 23(4), 638–647 (2006)

Fountas, S., Karanasos, M., Kim, J.: Inflation uncertainty output growth uncertainty and macroeconomic performance. Oxf. Bull. Econ. Stat. 68(3), 319–343 (2006)

Ferderer, J.P.: The impact of uncertainty on aggregate investment spending: an empirical analysis. J. Money Credit Bank. 25, 30–48 (1993)

Félix, R. M.: A Macroeconomic Structural Model for the Portuguese Economy. BANCO DE PORTUGAL, Economic Research Department WP 13–05 (2005)

Goel, R.K., Ram, R.: Irreversibility of R &D investment and the adverse effect of uncertainty: evidence from the OECD countries. Econ. Lett. 71, 287–291 (2001)

Green, W.: Econometric Analysis, 5th edn. Prince Hall, New Jersay (2003)

Grier, K.B., Henry, O.T., Olekalns, N., Shields, K.: The asymmetric effects of uncertainty on inflation and output growth. J. Appl. Econ. 19(5), 551–565 (2004)

Grier, K.B., Smallwood, A.D.: Uncertainty and export performance: evidence from 18 countries. J. Money Credit Bank. 39(4), 965–979 (2007)

Grier, K.B., Perry, M.J.: The effects of real and nominal uncertainty on inflation and output growth: some garch-M evidence. J. Appl. Econ. 15(1), 45–58 (2000)

Hanif, M.N., Hyder, Z., Lodhi, M.A.K., Khan M. H., Batool, I.: Small-size macroeconometric model for Pakistan economy. SBP Working Paper Series No. 34 May. (2010)

Hasan, R., Shahzad, M.M.: A macroeconometric framework for monetary policy evaluation: a case study of Pakistan. Econ. Model. 28, 118–137 (2011)

Hek, P.A.D.: On endogenous growth under uncertainty. Int. Econ. Rev. 40(3), 727–744 (1999)

Hek, P. A. D.: Endogenous technological change under uncertainty. Tinbergen Institute Discussion Paper No. 2002–047/2. (2002)

Herve, K., Pain, N., Richardson, P., Sedillot, F., Beffy, P.O.: The OECD’s new global model. Econ. Model. 28, 589–601 (2010)

Hossain, M. I., Razzaque, A.: A Macroeconometric Model of Bangladesh: Specification and Estimation. MIMAP-Bangladesh Technical Paper No. 6. (2003)

Jeong, B.: Policy uncertainty and long-run investment and output across countries. Int. Econ. Rev. 43(2), 363–392 (2002)

Kim, C.J.: Sources of monetary growth uncertainty and economic activity: the time varying - parameter model with heteroskedastic disturbances. Rev. Econ. Stat. 75(3), 483–492 (1993)

Klein, L.R., Goldberger, A.S.: An Econometric Model of the United States, 1929–1952. North-Holland, Amsterdam (1955)

Klein, L., Ball, R.J., Hazelwood, A., Vandome, P.: An Econometric Model of the United Kingdom. Blackwell, Oxford (1961)

Khan, M.A., Din, M.U.: A dynamic macroeconometric model of Pakistan’s economy. PIDE Working Papers 2011, 69 (2011)

Lensink, R.: Does financial development mitigate negative effects of policy uncertainty on economic growth?. Centre for Research in Economic Development and International Trade University of Nottingham Credit, Research Paper No.00/1. (2000)

Lensink, R.: Is there uncertainty laffer curve?. University of Groningen, Research Institute SOM (Systems, Organizations and Management) Research, Report No. 00E12. (2000)

Lensink, R., Bo, H., Sterken L.: Does uncertainty affect economic growth? an empirical analysis. Weltwirtschaftliches Archiv 135, 379–396 (1999)

Mallick, S.K.: Modelling Macroeconomic Adjustment with Growth in Developing Economies: The Case of India. Ashgate, Farnham (1999)

Mehrara, M., Mojab, R.: Real and nominal uncertainty in Iran (1960–2006). International Research Journal of Finance and, Economics Issue (2010). 48

Naqvi, S.N., Haider, Khan A.H., Khilji, N.M., Ahmad, A.M.: The PIDE Macroeconometric Model of Pakistan’s Economy. Pakistan Institute of Development Economics, Pakistan (1983)

Haider Naqvi, S.N., Ahmad, A.M.: Preliminary Revised P.I.D.E. Macro-econometric Model of Pakistan’s Economy. Pakistan Institute of Development Economics, Karachi (1986)

Ocampo, J. A.: A broad view of macroeconomic stability. DESA Working Paper No. 1. ST/ESA/2005/DWP/1. (2005)

Onatski, A., Williams, A.N.: Modeling model uncertainty. European Central Bank working Paper Series No 169. August (2002)

Pasha, H.A., Hasan, M.A., Pasha, A.G., Ismail, Z.H., Rasheed, A., Iqbal, M.A., Ghaus, R., Khan, A.R., Ahmed, N., Bano, N., Hanif, N.: ntegrated Social Policy and Macro-Economic Planning Model for Pakistan. Social Policy and Development Centre, Karachi (1995)

Pindyck, S.R., Rubinfeld, L.D.: Econometric Models and Economic Forecasts, 4th edn. McGraw-Hill, New York (1997)

Rashid, M.A.: A Macro Econometric Model of Bangladesh. Bangladesh Dev. Stud. IX(3), 22–44 (1981)

Ra, S., Rhee,C. Y.: Nepal Macroeconometric Model. Asian Development Bank Working Paper Series No. 1. (2005)

Ramey, G., Ramey, A.V.: Cross-country evidence on the link between volatility and growth. Am. Econ. Rev. 85(5), 1138–1151 (1995)

Ruiz, I.C.: Empirical analysis on the real effects of inflation and exchange rate uncertainty: The case of Colombia Ecos de Economía No. 20 Medellín, April PP 7–28. (2005)

Serven, L.: Macro economic uncertainty and private investment in developing countries: an empirical investigation. The World Bank Development Research Group Macroeconomics and Growth, Policy Research Working Paper No. 2035. (1998)

Serven, L.: Real exchange rate uncertainty and private investment in developing countries. The World Bank Development Research Group Macroeconomics and Growth, Policy Research Working Paper No. 2823. (2002)

Stockhammer, E., Grafl, L.: Financial uncertainty and business investment. Vienna University of Economic Working Paper Series No.123. (2008)

Tjipe, T., Nielsen, H., Uanguta, E.: Namibia Macroeconometric Model (NAMEX). Research Department, Macroeconomic Modelling and Forecasting Division, Bank of Namibia (2004)

Varvarigos, D.: Non-neutrality and uncertainty in a model of growth. University of Manchester working paper No, Centre for Growth and Business Cycle Research School of Economic Studies (2004). 041

Waheed, A.: The behavior of public external debt in Pakistan: a financial macroeconomic analysis. Forum Int. Dev. Stud. 28, 201–228 (2005)

Waheed, A., Fatima, A.: Economic Uncertainty, Investment and Growth: Cross Country Empirical Analysis for Fifty Developing Countries. Asian Economic Review, Volume 54, No. 1 April. (2012)

Author information

Authors and Affiliations

Corresponding author

Appendix I

Appendix I

Equations of the Model

Behavioral equations | |

|---|---|

Production block: | |

1 | \(\text{ Y }_{AGR} =\beta _0 +\beta _1 CAP_{AGR} +\beta _2 AW+\beta _3 INF+\beta _4 LAB_{AGR} +\beta _5 UAW+\beta _6 URT+\varepsilon \) |

2 | \(\text{ Y }_{IND} =\beta _7 +\beta _8 CAP_{IND} +\beta _9 Y_{AGR} +\beta _{10} IRM+\beta _{11} INF+\beta _{12} LAB_{IND} +\beta _{13} URT+\beta _{14} UER+\beta _{15} UTAX+\varepsilon _2 \) |

3 | \(\text{ Y }_{SER} =\beta _{16} +\beta _{17} LAB_{SER} +\beta _{18} CAP_{SER} +\beta _{19} YA+\beta _{20} URT+\beta _{21} UTAX+\varepsilon _3 \) |

Consumption block | |

4 | \(PCE=\beta _{22} +\beta _{23} YD+\beta _{24} UWR+\beta _{25} UTAX+\varepsilon _4 \) |

Investment block | |

5 | \(PI_{AGR} =\beta _{26} +\beta _{27} RT+\beta _{28} Y_{AGR} +\beta _{29} GDE+\beta _{30} URT+\beta _{31} UGDE+\varepsilon _5 \) |

6 | \(PI_{IND} =\beta _{32} +\beta _{33} RT+\beta _{34} Y_{IND} +\beta _{35} GDE+\beta _{36} UTAX+\beta _{37} URT+\beta _{38} UGDE+\varepsilon _6 \) |

7 | \(PI_{SER} =\beta _{39} +\beta _{40} RT+\beta _{41} Y_{SER} +\beta _{42} GDE+\beta _{43} UGDE+\beta _{44} UTAX+\beta _{45} URT+\varepsilon _7 \) |

Government block | |

8 | \(DTR=\beta _{46} +\beta _{47} NGDP+\beta _{48} ADTR+\beta _{49} GDPDEF+\beta _{50} UTAX+\beta _{51} UGDPDEF+\varepsilon _8 \) |

9 | \(IDTR=\beta _{52} +\beta _{53} NGDP+\beta _{54} AIDTR+\beta _{55} GDPDEF+\beta _{56} IMPORT+\beta _{57} UIMP+\beta _{58} UGDPDEF+\varepsilon _9 \) |

10 | \(NTXR=\beta _{59} +\beta _{60} NGDP+\beta _{61} URT+\beta _{62} UGDPDEF+\beta _{63} UGDE+\varepsilon _{10} \) |

11 | \(GCE=\beta _{64} +\beta _{65} GDE+\beta _{66} TXR+\beta _{67} GDPDEF+\beta _{68} UTAX+\beta _{69} UGDE+\varepsilon _{11} \) |

Trade block | |

12 | \(EXP_P =\beta _{70} +\beta _{71} (UNIPRI/GDPDEF)+\beta _{72} ER+\beta _{73} WAGE+\beta _{74} YA+\beta _{75} UER+\beta _{76} UGDPDEF+\varepsilon _{12} \) |

13 | \(EXP_{MAN} =\beta _{73} +\beta _{77} (UNIMAN/GDPDEF)+\beta _{78} WAGE+\beta _{79} YA+\beta _{80} ER+\beta _{80} UER+\beta _{81} UGDPDEF+\varepsilon _{13} \) |

14 | \(EXP_{SM} =\beta _{82} +\beta _{83} (UNISM/GDPDEF)+\beta _{84} ER+\beta _{85} WAGE+\beta _{86} YA+\beta _{87} UGDPDEF+\beta _{88} UER+\varepsilon _{14} \) |

15 | \(IMP_{CON} =\beta _{89} +\beta _{90} (UNICON/GDPDEF)+\beta _{91} ER+\beta _{92} YA+\beta _{93} UER+\beta _{94} UTAX+\varepsilon _{15} \) |

16 | \(IMP_{CAP} =\beta _{95} +\beta _{96} (UNICAP/GDPDEF)+\beta _{97} ER+\beta _{98} YA++\beta _{99} PSC+\beta _{100} UPSC+\beta _{101} UER+\varepsilon _{16} \) |

Monetary block | |

17 | \(MS=\beta _{102} +\beta _{103} GBNB+\beta _{104} TFR+\beta _{105} PSC+\beta _{106} UGBNB+\beta _{107} UPSC+\varepsilon _{17} \) |

18 | \(GDPDEF=\beta _{108} +\beta _{109} MS+\beta _{110} RT+\beta _{111} PF+\beta _{112} YA+\beta _{113} UPF+\beta _{114} URT+\varepsilon _{18} \) |

Identities | |

19 | \(\text{ Y } A=Y_{AGR} +Y_{IND} +Y_{SER} \) |

20 | \(Consumption=GCE+PCE\) |

21 | \(YD=YA-TXR+WR\) |

22 | \(PI=PI_{AGR} +PI_{IND} +PI_{SER} \) |

23 | \(TR=TXR+NTXR\) |

24 | \(TXR=DTR+IDTR\) |

25 | \(GXE=GCE+GDE\) |

26 | \(BD=GXE-TR\) |

27 | \(EXPORT=EXP_P +EXP_{SM} +EXP_{MAN} \) |

28 | \(IMPORT=IMP_{CON} +IMP_{CAP} \) |

29 | \(NX=IMPORT-EXPORT\) |

30 | \(NGDP=YA^*GDPDEF\) |

Description of endogenous variable

Variables | Description | Unit |

|---|---|---|

YA | Gross domestic product on 2000–2001 Prices | Rs. Million |

\(\text{ Y }_\mathrm{AGR}\) | Production of agriculture on 2000–2001 Prices | “ |

\(\text{ Y }_\mathrm{IND}\) | Production of industries on 2000–2001 Prices | “ |

\(\text{ Y }_\mathrm{SER}\) | Production of services sector on 2000–2001 Prices | “ |

\(\text{ PI }_\mathrm{AGR}\) | Private investment to agriculture sector on 2000–2001 Prices | “ |

\(\text{ PI }_\mathrm{IND}\) | Private investment to industrial sector on 2000–2001 Prices | “ |

\(\text{ PI }_\mathrm{SER}\) | Private investment to service sector on 2000–2001 Prices | “ |

NGDP | Nominal GDP | “ |

EXPORT | Total Exports on 2000–2001 prices | “ |

\(\text{ EXP }_\mathrm{P}\) | Exports of primary commodity on 2000–2001 Prices | “ |

\(\text{ EXP }_\mathrm{SM}\) | Exports of semi manufactured goods on 2000–2001 Prices | “ |

\(\text{ EXP }_\mathrm{MAN}\) | Exports of manufactured goods on 2000–2001 Prices | “ |

IMPORT | Total Imports on 2000-2001 Prices | “ |

\(\text{ IMP }_\mathrm{CAP}\) | Imports of capital goods on 2000–2001 Prices | “ |

\(\text{ IMP }_\mathrm{CON}\) | Imports of consumer goods on 2000–2001 Prices | “ |

TR | Total revenue collection | “ |

TXR | Tax revenue | “ |

NTXR | Non tax revenue | “ |

DTR | Direct tax revenue | “ |

IDTR | Indirect tax revenue | “ |

GXE | Gross government expenditures | “ |

GCE | Government consumption expenditure | “ |

YD | Personal disposable income on 2000–2001 prices | “ |

BD | Budget deficit | “ |

MS | Money supply | “ |

PCE | Private consumption expenditure on 2000–2001 prices | “ |

NX | Net exports | “ |

GDPDEF | GDF deflator | Index |

Description of exogenous variable

Variables | Description | Unit |

|---|---|---|

\(\text{ CAP }_\mathrm{AGR}\) | Investment in agriculture sector on 2000-2001 Price | Rs. Million |

\(\text{ CAP }_\mathrm{IND}\) | Investment in industrial sector on 2000-2001 Prices | “ |

\(\text{ CAP }_\mathrm{SER}\) | Investment in service sector on 2000-2001 Prices | “ |

AW | Availability of Water | MAF |

INF | Infrastructure (Roads length use as proxy of infrastructure) | Kilometers |

RT | Interest rate (weighted average rate of return on advances) | % |

ER | Exchange rate | Rs. Per US$ |

WR | Workers’ remittances | Rs. Million |

WAGE | Average daily wage of skilled labor in Karachi | Pakistani Rs. |

(proxy for cost of production) | ||

PF | Price of foreign goods (2005 base year) | % |

TFR | Total foreign reserves | US$ billion |

UNIPRI | Unit value index of Exports primary commodities | index |

UNIMAN | Unit value index of Exports of manufactured goods | “ |

UNISM | Unit value index of Exports of semi manufactured goods | “ |

UNICAP | Unit value index of Imports of capital goods | “ |

UNICON | Unit value index of Imports of consumer goods | “ |

GBNB | Government budget deficit financing borrowing | Rs. Million |

IRM | Import of raw material on 2000-2001 Prices | “ |

GDE | Government development expenditure | “ |

\(\text{ LAB }_\mathrm{AGR}\) | Labor force in agriculture sector | # |

\(\text{ LAB }_\mathrm{IND}\) | Labor force in industrial sector | # |

\(\text{ LAB }_\mathrm{SER}\) | Labor force in service sector | # |

NGDP | Nominal GDP | Rs. Million |

PSC | Banks credit to private sector | “ |

UAW | Uncertainty related to availability of water | - |

UGDPDEF | Uncertainty related to GDP deflator | - |

UER | Uncertainty related to exchange rate | - |

UPSC | Uncertainty related to private sector credit | - |

UWR | Uncertainty related to workers’ remittances | - |

UTAX | Uncertainty related to tax revenue | - |

UGBNB | Uncertainty related to government borrowing for budgetary support | - |

UGDE | Uncertainty related to government development expenditures | - |

UIMP | Uncertainty related to imports | - |

UPF | Uncertainty related to foreign inflation | - |

URT | Uncertainty related to interest rate | - |

Rights and permissions

About this article

Cite this article

Fatima, A., Waheed, A. Economic uncertainty and growth performance: a macroeconomic modeling analysis for Pakistan. Qual Quant 48, 1361–1387 (2014). https://doi.org/10.1007/s11135-013-9841-5

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11135-013-9841-5