Abstract

A natural disaster like an earthquake has the capability of damaging critical infrastructure systems, and valuable assets, limiting products or services movements, and in extreme conditions may cause injuries and even mortalities. The unavailability of a workforce as a response to an earthquake can directly affect the regional sector's productivity, as most business operations are labor dependent. In addition, the inherent interdependency of regional economic sectors can further delay the recovery process, This paper presents the dynamic inoperability input–output (DIIM) model and sector resilience to formulate a recovery analysis model by incorporating both the deterministic and stochastic modeling for workforce-interdependent sectors in the aftermath of an earthquake. The developed model is capable of evaluating the social and economic losses caused by workforce disruption. Moreover, a risk-based framework developed for the guidance of policymakers is to manage and control the adverse effects of the earthquake on the disrupted region. This paper identifies and prioritizes critical industry sectors based on two metrics i.e., inoperability and economic loss. Inoperability levels describe the percentage variation between the maximum production of the sector to the reduced production level, while economic loss is the quantified monetary value associated with the reduced level of sector output. The main contribution of this work focuses on the modeling of uncertainty caused by new disruption to the interconnected sectors within a recovery horizon of the initial outbreak of the disaster using a dynamic model for the disrupted region. This model is developed and applied to the regional sectors of Pakistan for an earthquake disaster but can be generalized to other regions and other disaster scenarios as well. Finally, the purpose of presenting different earthquake intensity scenarios is to validate the effective use of risk and uncertainty analysis in modeling the inoperability and economic loss behaviors because of time-varying perturbations and their related ripple effects on interdependent economic sectors.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction and background

The Asian Disaster Reduction Center (2003) defined disasters as serious events that disrupt society's functioning and have catastrophic effects, including significant losses in terms of human life, property, infrastructure, and environment, etc. In some cases, disasters even threaten government stability, go beyond its ability in the affected area (society), and limit that region to adapt using only its resources. According to (Shaluf 2007) disasters can be classified into three types (natural disaster, man-made, and hybrid disaster).

An earthquake is a type of natural disastrous event that takes place below the earth’s surface. It is the sudden release of energy from the earth's crust initiated by the movement along fault planes or by volcanic activity, which generates extremely destructive seismic waves on the surface (Becek 2014). Tectonic, volcanic, collapse, and explosion earthquakes are the four different types of earthquakes. According to (Ainuddin and Routray 2012) based on their intensities and magnitude, earthquakes are further divided into categories that vary from minor to significant. An earthquake will negatively affect the region’s socioeconomic environment. For example, high-magnitude earthquakes can have severe effects on communications, health, and transportation, which may further restrict post-emergency response. When an earthquake strikes near a populated area, it leaves the disrupted region unable to react regularly and causes substantial damage, disturbance, and possibly losses over thousands of square kilometers. Economically, it results in billions of dollars in property damages, multiple losses of human, infrastructure, and financial capital, and a decrease in some business activities such as revenue generation, investment, production, and employment in the affected regions (Benson and Clay 1998). Since the interconnectedness amongst the production sectors in a regional economy expanded the influences, which will delay the recovery process. As a result, the disruption will have a negative impact on industry output and partially halt economic activity for days or even months. Hence, the availability of a workforce is crucial to the interconnected production sectors; their absence in the aftermath of an earthquake in the disrupted region is a significant problem. It is necessary to develop a model to link the uncertainties of workforce availability level to earthquake intensity. A case in point, natural disasters mainly includes floods and earthquake that hit the Pakistan region several times, the regions that are prone to these two main natural disasters are shown in Figs. 1 and 2 respectively. Other disasters may include heatwaves floods, landslides, tsunamis, etc. which are not very common in the stated region.

Flood-affected areas of Pakistan (Ul Hasan and Zaidi 2012)

Earthquake risk map of Pakistan (Khan et al. 2019)

In the year 2005, Pakistan faced a great earthquake that causes massive destruction and losses in the country’s history (Khalid and Ali 2019), killing 6700 people with a total income loss of about $576 million followed by recovery and reconstruction costs of a further $5.2 billion. In 2010 floods affect the entire country disturbing almost 78 districts follow by 2011 severe flooding that affects 9.6 million people and caused considerable destruction across the country (Khalid and Ali 2019). To minimize the disruption of such natural disasters Pakistan government in the year 2010 established an organization named the National Disaster Management Authority (NDMA) to improve disaster response and develop safety procedures to relieve the overall effects for identifying and increasing the use of disaster risk funding.

2 Research goals

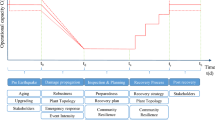

The current research aims to examine the uncertainties associated with the ripple effects of an earthquake’s impacts on interconnected workforce industry sectors. A high-magnitude earthquake has serious aftereffects, such as injuries, fatalities, and disruptions to the transportation system, which further delay the recovery process by restricting the movement of services and goods like post-emergency response and health communications and possibly causing significant damage to critical infrastructure. This reduces the workforce's availability to industry sectors. In addition, it has several other adverse effects, such as ground failure, vibration damage, and in the worst scenarios, tsunamis, which seriously damage roads, bridges, flyovers, highways, and railways. The output of interconnected economic sectors decreases because of this decreased workforce level. While tracing the various levels of inoperability values over the course of the recovery horizon, the economic resilience of an industry sector is considered, i.e., (The sector’s internal resistance or capacity to engross the disaster's impact and recover to their initial degree of functionality). Thus, the inoperability trend is decreasing over time due to the economic resilience of sectors. However, certain events, such as earthquake aftershocks, could change the downward pattern in inoperability levels. For instance, more people are likely to be injured or limited to their houses during aftershocks, which will degrade the level of inoperability of the interconnected economic sectors. Figure 3 depicts the scope of research in the context of the overall problem.

The goal of the present research is to determine.

-

Based on the currently available information, develop workforce perturbation models for their absenteeism because of an earthquake scenario.

-

To improve the resolution of earthquake impacts, local (disrupted region) analysis must incorporate into the extended DIIM model.

-

To develop a system that supports decisions in identifying and prioritizing industries that are vulnerable to inoperability and economic loss.

-

To use the judgment support system to carry out various earthquake-intensity situations to assess and classify their severity.

-

To create a standard model that will improve the idea of a statistical dependence-based model of workforce uncertainty levels.

-

To perform sensitivity analysis for various degrees of economic losses and an inoperability matrix for various earthquake scenarios.

3 Methodology

This study focuses on extending the Leontief economic (I–O) model to predict and quantify the effects of workforce disruption caused by a natural disaster like an earthquake. The section begins with a discussion of input–output models, then moves on to a discussion of the fundamental Leontief input–output (I–O), and finally, its extensions, including the IIM and DIIM models respectively, which serve as a foundation of this study’s methodology.

3.1 Input–output model

Considering the significance of economic losses incurred by disasters in the interconnected sectors, it is necessary to concentrate attention on the studies related to risk analysis. The Leontief (I–O), model and its disaster-specific extensions like the IIM are used extensively in interdependency analysis. To evaluate and manage the economic effects of disasters, the model is updated and improved. (Olsen et al. 1997) suggests an I–O-based model for reporting risk analysis concerns regarding flood protection that are linked to the outcomes of such disasters. With grouping, the Leontief inter-industry model, (Hsu and Chou 2000) suggests a model for analyzing \({CO}_{2}\) reduction strategies in Taiwan. (Cho et al. 2001) employs a similar methodology to report the overall effects of high-magnitude earthquakes in urban areas to both industrial and nonindustrial sectors. Similarly, (Haimes and Jiang 2001) suggest an addition to the Leontief (I–O) model, to reveal the effects of disaster for illustrating the interdependencies and impact on key sectors. The same methodology is used by (Alcántara and Padilla 2003) to identify sectors based on energy usage from sector-specific flexibility in final energy demand. (Lenzen et al. 2004) suggest the model by introducing a multi-regional analysis for \({CO}_{2}\) multipliers and trade balances accountable for emitting greenhouse gas by-products. (Okuyama and Chang 2004) discusses the same model for calculating the total economic losses brought on by natural disasters. (Rose and Liao 2005) carries out a case study for economic losses based on Computable General Equilibrium (CGE) methods for the disruption of water delivery in the wake of an earthquake. The approach taken by (Rose 2004) is an addition to the I–O model, not its replacement. (Velázquez 2006) outlines a combined strategy using the extended Leontief (I–O) model and the energy model put forth by (Proops 1984) for sectorial water usage and implements the findings to the Andalusia region in Spain, which was classified as having a water shortage. The generalized hypothetical extraction method, which allows examining what would happen if a specific interdependent industry becomes inoperable, and a mixed endogenous/exogenous input–output model, which offers a distinct assessment of the retrieval process, (Dietzenbacher and Miller 2015) proposed as alternative methods for disaster impact analysis. (Ali et al. 2015) employs a similar strategy, concentrating on the interactions between industries, and presents a setup that aids in identifying the industrial sectors that contribute to total output. Additionally, a comparison achieved applied successfully to actual statistics for the Italian economy from the year 1995 to 2011. Similarly, by incorporating all the segments of the money flow to or from the vulnerable to disruption sectors into the overall disaster impact on the economy. (El Meligi et al. 2019) introduce the Inoperability Extended Multi-sectoral model to improve the existing approach, which was deployed to examine disruptive events and provide guidance for policymakers.

3.2 The Leontief I–O model for economy

The (I–O) model is the main focus of this study. The basic purpose of the Leontief I–O Model is to investigate how regional businesses are interconnected (Miller and Blair 2009). These (I–O) tables are excellent for analyzing how each economic sector is performing within a region.

Wassily Leontief won the Alfred Nobel Memorial Prize for developing an economic model in 1973. The developed model offers insightful information about how industries interact within a given economic region. (Miller et al. 1989; Lahr and Stevens 2002) contends that this model is widely used because it is a decision-making tool for many different economic applications.

It is a linear equation system that describes the shared output of each sector in an economic system (Miller and Blair 2009), and it is only able to comprehend the interdependent behavior of sectors when we add this intermediate consumption to the ultimate demand for an economic region (Leontief 1936). The primary premise of this model is that final and intermediate demands are added together to form the overall output of any industry. Equation (1) illustrates the model's relationship, which is as follows:

In the relationship shown in Eq. (1), x represents the overall production output, \(A\) is the technical coefficient matrix of \({a}_{ij}\) that shows the output from sector \(i\) that fulfills the input requirement of sector \(j\), \(Ax\) represents intermediate consumption of output within the sectors, and c represents the final customer demand.

3.3 Inoperability input–output (IIM) model

The Inoperability input–output Model (IIM), an extension of Leontief’s I–O model, is capable of measuring the inoperability of interdependent economic sectors as their total production output declines as a response to either direct or indirect effects of the disaster (Orsi and Santos 2009). In response to a catastrophe like terrorism, (Santos and Haimes 2004) introduced a novel method for the IIM analysis that was centered on demand reduction. This study focuses on analyzing the effects of the September 11th, 2001, terrorist attacks on the aviation industry and how demand was affected, which influenced other related industries. (Haimes et al. 2005) discusses the theory and techniques that underpin the development of the IIM based on Leontief's model. It illustrates the interdependence of economic sectors and analyzes those sectors for initial disruption and their cascading effects upon other sectors. This analysis was applied to terrorist activity to quantify and highlight the critical sectors and those whose operability is crucial during the recovery process, (Santos 2006) uses the IIM to assess the impact of disasters on interconnected economic sectors, rather than assessing impacts in terms of financial aspects. (Lian and Haimes 2006) also suggests the IIM model using inoperability analyses to model how interdependent sectors will recover after a disruptive event, like terrorism or any natural catastrophe, by taking into account the resilience coefficient and expected recovery time to gauge the effectiveness of the sector. (Santos et al. 2007) put forth a framework for performing static and dynamic analysis to show how combined demand and supply impacts interact. Their study's main objective was to model cybersecurity for the defense of the oil and gas industry from any natural and or man-made disaster. (Anderson et al. 2007) proposed a risk management framework to identify the vulnerabilities related to and their effects on the operability of other interconnected critical infrastructure by presenting the IIM model for demonstrating the economic and inoperability effects of the power sector in the 2003 Northeast America Blackout. (Crowther et al. 2007) proposed an analysis technique that emerges from the IIM structure to analyze the effects of disruptive events like Hurricanes Katrina and Rita on different regional sectors and to demonstrate hypothetical, reduced impacts as a result of different strategic awareness decisions for policymakers. Uses the same model to assess the effects of disruption brought on by natural disasters like floods on the transportation sector and their effects on the economy in terms of unpredictability and uncertainty related to the crucially interconnected sectors on the Philippine island. According to (Oosterhaven 2017) the key limitation of the IIM model is that it frequently overestimates the financial costs associated with real applications. This study's primary goal was to use the IIM to investigate and rank indirect economic impacts and proposed two distinct approaches to obtain the impact of major natural and man-made disasters. Equation (2) illustrates the basic relation of this model.

where q represents normalized financial losses and indicates a sector's level of operational inoperability, (operational inoperability is the proportional decrease in output level). \({{{A}}}^{*}\) represents the degree of coupling between industry sectors by the inoperability interdependency matrix, and \({{{c}}}^{*}\) represents the normalized drop in the final request.

3.4 The DIIM model

The DIIM model, presented by (Lian and Haimes 2006) as an extension of the IIM formulation, allows for taking into account the resilience of each sector in a region, which, according to (Santos and Haimes 2004; Santos 2006), resolves some limitations of the IIM model. For example, in the IIM model, inoperability levels were measured without taking into account time-varying parameters (Santos et al. 2009). The fundamental function of DIIM development is to establish the idea of economic resilience through the dynamic inoperability of sectors for a predetermined recovery horizon.

As a result, (Santos et al. 2009) present an analysis of a pandemic recovery using the DIIM. This analysis highlights the significance of workforce availability as a pandemic response and the necessity of taking into consideration the workforce distribution across the region. (Barker and Santos 2010) propose a methodology for classifying sectoral interdependencies based on inventory and the DIIM to give policy-makers clear evidence about the sectors that offer and/or receive significant impact from the inventory-caused interruptions in inoperability as a result of a catastrophe. (Akhtar and Santos 2013) added a workforce recovery model to the DIIM for identifying key industrial sectors. A decision support tool combines extended DIIM model and survey data to simulate different hurricane intensities for the identification of critical sectors, making it easier for policymakers and advancing post-disaster recovery. By considering a variety of risk scenarios and their likelihood to occur within the GPN, (Niknejad and Petrovic 2016) provides a novel methodology of fuzzy DIIM, a risk evaluation method in a global production network (GPN), to measure interconnectedness among nodes in a GPN using expert knowledge for strategic decision-making. Three distinct phases were suggested by (Ramirez et al. 2016) as a way to represent the uncertainty in flood peak discharges and their duration as a response to climatic changes in a hydrodynamics model with reduced complexity for flood simulation. (Khalid and Ali 2019) constructed an (I–O) table for the Pakistan economic system and implement the DIIM through resilience and recovery time to case studies involving flooding. Their work's primary goal was to provide a rough estimate of the impact and its effects on the sectors' inoperability that persists for days after disruptive events like a flood so that policymakers and related departments could respond appropriately. As a response to the catastrophe for an interdependent sector exposed to that disaster, a dynamic recovery modeling introduced a resilience matrix (K). It may be defined as the ability of an industry to protect against and absorb losses and productivity reductions (Holling 1973; Perrings 2001; Santos 2012). While the level of economic resilience influences how quickly each interconnected industry recovers from a disruptive event (Anderson et al. 2007). Equation (3) illustrates the basic formulation of the DIIM model.

The inoperability vector at the time (t + 1) is illustrated in Eq. (3). While \({c}^{*}\left(t\right)\) is the initial perturbation vector identical to that used in the IIM, \(q\left(t\right)\) represents the inoperability vector at the specified time. \({A}^{*}\), representing the interdependency matrix demonstrating the sector's interdependencies. The resilience coefficient matrix, or \(K\), measures how quickly an industry can resume production at its pre-event level in a given region (Lian and Haimes 2006). The mathematical relation of \(K\) is given as in Eq. (4) .

where \({K}_{i}\) is the resilience vector of the sector.\({T}_{i}\) Shows the length of time acquired by the sector to recover to its original production level after disruption with the original inoperability level of \({q}_{i}\left({t}_{i}\right)\) from an initial level of \({q}_{i}\left(0\right)\). In short, a higher value of \({K}_{i}\) indicates that a sector will recover more quickly from a catastrophe and suffer relatively fewer economic losses, which indicates that the sector is more disaster-resistant (Lian and Haimes 2006). The DIIM model calculates a disaster's impacts on inoperability and monetary losses. To address the effects of workforce interruptions due to earthquakes and their subsequent effects on interdependent regional economic sectors, this research centers on the use of an extended form of the DIIM model.

Nevertheless, there is a lot of pertinent literature on modeling, evaluating, and dealing with the negative effects of disasters on human infrastructure. However, there has not been much substantial work done in stochastic modeling. It is important to classify the most serious disruptions in the sector and rank them based on financial loss and inoperability metrics using an extended form of the (I–O) model. To evaluate the effects based on reduced workforce availability in the aftermath of an earthquake scenario; this study is an attempt to advance the concept of human infrastructure by modeling the relationship between workforce recovery across the interdependent sector and disaster time scale.

To determine the inoperability of an industry sector as a response to a reduced level of workforce in the aftermath of an earthquake. A proper methodology is required that can link the level of the reduced workforce to that of an inoperability of workforce-dependent sectors. Hence, a new approach adopted in this study is to predict the workforce involvement factor for every industry sector by assessing the workforce perturbation elements for determining inoperability across all the industry sectors. (Arnold et al. 2006) determine the inoperability by evaluating workforce productivity. However, the data utilized in the study applies to a relatively small set of sectors. This study, however, according to (El Haimar and Santos 2015) modeled the inoperability level of economic sectors by combining the effects of the new perturbation (i.e., stochastic pattern) and the inoperability level brought on.

by the DIIM model pattern. Equation (5) illustrates the assigned weighted average relationship.

For the DIIM pattern level of inoperability in Eq. (5), recall Eq. (3) given below.

where; \(q\left(t\right)\) in Eq. (3) represents the inoperability vector level at time t. \(K\) shows the resilience matrix, and \({c}^{*}\left(t\right)\) is the vector of initial sectors demand perturbation at time t. \({A}^{*}q\left(t\right)\) is inoperability caused by other interconnected sectors.

The inoperability trajectory over the recovery period modeled using a combination of both the DIIM pattern and new perturbation (i.e., stochastic pattern). Equation (6) depicts the relation to measuring the inoperability level for the new perturbation (i.e., stochastic pattern) during the recovery horizon.

where \(\lambda \left(t\right)\) represents a scaling factor, the value of this factor ranges from 0 to 1. Where 0 corresponds to deterministic modeling when the probability of a new perturbation during the recovery horizon is 0, while a value of 1 corresponds to the maximum probability of a new perturbation during the recovery horizon.

As stated in Eq. (5) this study combines both the modeling techniques (i.e., DIIM and stochastic pattern) to compute the overall inoperability trajectory over the recovery horizon. The DIIM pattern models the declining trend of inoperability over time due to the sector’s internal resilience effect against that disruptive event, while the stochastic pattern of inoperability models either the increasing or decreasing trend of inoperability caused by the new perturbation during the recovery horizon.

4 Results and discussion

4.1 Data collection

To determine the level of inoperability and economic losses for the regional industry sectors across Pakistan, it is necessary to collect all the relevant data of all sectors and manage them in the (I–O) table form to facilitate post-disaster aid and policymakers to help in decision-making, hence promoting faster recovery. These data sets normally include industrial demand and supply etc. (Khalid and Ali 2019) successfully develop (I–O) data tables in 2016, including data for 24 most workforce-dependent distinct sectors, including both the industrial and non-industrial sectors. The inclusion of non-industrial sectors in this study is to evaluate and provide a better understanding of the inoperability matrix, as the majority of these non-industrial sectors are workforce dependent and have a higher workforce as compared to the industrial sectors in Pakistan. Table 1 depicts the 24 different sectors.

4.2 Pakistan earthquake case study

To support the implementation of the workforce recovery modeling in the extended DIIM, this section considers the use of earthquake recovery data along with local economic information gathered from the Bureau of Economic Analysis (BEA) illustrated in Appendix 1 and Pakistan Standard Industrial Classification ((PSIC) Revision 4 2022). The information in Appendix 1 shows how various industries contributed to the total output of a network of interrelated industries in a given economic region. In other words, it illustrates the output multiplier for each unit change in demand for each industry, In input–output modeling, the stated data represents the matrix \({\left[I-A\right]}^{\_1}\). Where A is the square matrix of the technical coefficients \({a}_{ij}\). Moreover, the use of extended DIIM is to determine how different earthquake scenarios affect workforce recovery in the regional industry sectors across Pakistan.

Significant literature is available about earthquake intensities and consequences. (Ainuddin and Routray 2012) provided comprehensive detail that reveals earthquakes with magnitudes, their effects based on economic losses and human fatalities, and estimated annual occurrence. This paper focuses on two earthquake scenarios (i.e., low-magnitude and high-magnitude) in the regional workforce-dependent sectors of Pakistan, by utilizing workforce survey data from (Khalid and Ali 2019). For briefness, only the detailed results are presented in this section. Data comparisons based on the overall level of inoperability and economic losses to inquire about impacts of different earthquake magnitudes in the stated region are incorporated from available regional economic and workforce data provided by ((PSIC) Revision 4 2022).

4.2.1 Scenario 1: low probability and low magnitude earthquake

The earthquakes are categorized into various categories ranging from minor to great, depending on their intensities, effects, and frequency per year (Hossain 2002). While considering scenario 1, a low probability and low magnitude earthquake must exhibit the following main features.

-

Include categories from minor to light (i.e., Magnitude ranges from 3.0 to 4.9 on the Richter scale).

-

Higher estimated numbers per year (i.e., frequency), but comparatively lower consequences.

-

Lower Inoperability levels, Cumulative Economic losses, and faster recovery.

-

The impact of the stochastic pattern is assumed to be equal to 1% of that of the initial disaster for all low probability and low magnitude cases discussed below (i.e., when \(\lambda \ne 0)\).

-

Considering the case where up to 25% workforce fails to report their work in the aftermath of an earthquake.

-

In addition, for a better understanding of the stochastic pattern, three aftershocks are also assumed during the recovery horizon on the 5th, 10th, and 15thday of the initial disaster with a magnitude of 99%, 50%, and 1% to that of the initial disaster, respectively for all cases where (when \(\lambda \ne 0\)).

As stated in Eq. (5) earlier, the overall inoperability is the sum of both the \({q}_{DIIM}(t)\) and \({q}_{stochastic}\left(t\right)\), therefore, the low probability and low magnitude earthquake scenario is further divided into four different cases depending upon the values of \(\lambda \), that ranges from \(\lambda =0, 0.25, 0.50, {\rm and}\, 0.75\), respectively.

Case 01: when \(\lambda (t)=0\) (100% deterministic modeling case)

The first step corresponds to the case when the probability of a new perturbation is equal to zero i.e., \(\uplambda (\mathrm{t})\)= 0. By putting the value in Eq. (5) we have.

Equation (7) is the true case of DIIM modeling for the level of inoperability measures. Since the sectors, expected to have their resilience and they tend to regain their original initial operability with time, shown in Fig. 4.

Figure 4 shows the level of inoperability of those sectors that are relatively more workforce dependent and are most vulnerable to an earthquake disaster. The highest inoperability levels for the mentioned top ten sectors range (1.6–19.3%) from minimum to maximum, but drop to (0.3–4.7%) within 5 days and almost vanishes to 0% after 20 days for all listed industry sectors shown in Fig. 4. This ranking of inoperability recognizes all critical sectors based on the normalized loss of each sector as a part of its overall production output rather than based on overall economic losses.

Figure 5 shows the cumulative economic losses recovery trends of top ten the industry sectors. The behavior of the recovery plots shown in Fig. 5 for all industry sectors’ economic loss flattens after almost 15 days for a low-magnitude earthquake scenario. The total expected monetary loss for this scenario estimates at up to $1651 million (Approx. 0.47% of GDP).

These figures i.e., Figs. 4 and 5 are obtained after entering all the necessary data regarding the workforce perturbation and published data from BEA of Pakistan and Pakistan Standard Industrial Classification Revision (PSIC) for a low-magnitude earthquake in the extended DIIM model. Table 2 illustrates the top ten industry sectors with the highest degree of inoperability ranging from (1) Recycling(S-12) to (10) Wholesales(S-16) with codes (Alphanumeric) assigned against each sector:

Similarly, Table 3 illustrates the top ten industry sectors based on the highest overall cumulative economic losses ranging from; (1) Financial Intermediation and Business Activities(S-20) with a total loss of worth $522.66 million to (10) Construction(S-14) with a total loss of worth $57.03 million. The main reason for using two tables for each case is to discuss both the matrix i.e. inoperability and economic loss independently, as the results mentioned in Tables 2 and 3 revealed that for the top ten inoperable and economic loss sectors, the most inoperable sectors did not appear in the economic loss sectors list, which further shows that both the matrices are independent of each other even for the same earthquake scenario.

The ten highest inoperable sectors listed in Table 2 contribute 23% of total loss while the ten highest economic loss sectors listed in Table 3 contribute 91.7% of the total loss worth of the region.

-

(ii)

Case 02: when \({\varvec{\lambda}}\left({\varvec{t}}\right)=0.25\) (Combined case 25% stochastic & 75% deterministic modeling)

The second step corresponds to the case when the probability of a new disruption has some value like \(\lambda \)(t) = 0.25 other than \(\lambda \) (t) = 0, which means we are interested in putting some impact or influence of inoperability caused by new perturbation to allow us to perform the sensitivity analysis with varying corresponding weights given to each level of inoperability. By putting the value in Eq. (5) we have.

The Eq. (8) is the linear summation of both the stochastic inoperability \({q}_{stochastic}\left(t\right)\) and DIIM inoperability \({q}_{DIIM}\left(t\right)\) multiplied with their probabilities of 25% and 75%, respectively.

Figure 6 shows the level of inoperability, as the overall inoperability is the summation of both the \({ q}_{stochastic}(t)\) and \({q}_{DIIM}\)(t) ranges (1.1–15.0%) from minimum to maximum that drops to (0.4–5.0%) within 4 days. However, as per assumption, three aftershocks strike on the 5th, 10th, and 15th day having magnitudes of 99%, 50%, and 1%, respectively to the initials disruption. The declining trend of inoperability increases from (0.4 to 5.0%) on the 4th day of disaster to (1.7 to 23.0%) on the 5th day, (0.8 to 11.0%) on the 10th day, and (0.2 to 2.6%) on the 15th day, respectively. Because of the stochastic pattern, there is uncertainty and the overall inoperability is never set to zero again. The overall effects of aftershocks are also sensed in Fig. 7, which represents the cumulative economic loss.

Figure 7 shows the cumulative economic losses recovery trends of the top ten industry sectors. However, the highest sector economic loss in this case as compared to the 1st case discussed earlier is 14% less because of that stochastic element and uncertainty in the overall inoperability the plot never flattens and for this reason, the expected monetary loss estimates up to $1822 million (Approx. 0.52% of GDP).

Table 4 depicts the top ten industry sectors with the highest degree of inoperability ranging from (1) Recycling(S-12) to (10) Wholesales(S-16). Similarly, Table 5 illustrates the top ten industry sectors based on the highest overall cumulative economic losses ranging from (1) Financial Intermediation and Business Activities(S-20) with a total loss of worth $449.92 million to (10) Hotels and restaurants(S-17) with a total loss of worth $65.05 million.

The ten highest inoperable sectors listed in Table 4 contribute 27% of total loss while the ten highest economic loss sectors listed in Table 5 contribute 90.6% of the total loss worth of the region.

-

(iii)

Case 03: When \(\uplambda (\mathrm{t})\)= 0.50: (Combined case 50% stochastic & 50% deterministic modeling)

The third step corresponds to the case when the probability of a new perturbation is equal \(\uplambda (\mathrm{t})\)= 0.50. By putting the value in Eq. (5), we have.

Figure 8 illustrates the overall inoperability is the average summation of both the \({q}_{stochastic}(t)\) and \({q}_{DIIM}\)(t) ranges (0.5–10.6%) form minimum to the maximum that drops to (0.4–4.1%) within 4 days. However, as per assumption, three aftershocks strike on the 5th, 10th, and 15th day having magnitudes of 99%, 50%, and 1%, respectively to the initials disruption. The declining trend of inoperability increases from (0.4 to 4.1%) on the 4th day of disaster to (1.3 to 22.5%) on the 5th day, (0.7 to 11.4%) on the 10th day, and (0.2 to 3.07%) on the 15th day, respectively. Because of the stochastic pattern, there is uncertainty and the overall inoperability is never set to zero again.

Figure 9 shows the overall cumulative economic losses. However, the highest sector economic loss in this case as compared to the 1st and 2nd cases discussed earlier is 32% and 22% less, respectively. The main reason is the high impact of stochastic elements and uncertainty in the overall inoperability, the plot never flattens as in case 2, and for this reason, the expected monetary loss estimates up to $1649 million (Approx. 0.47% of GDP).

Table 6 illustrates the top ten industry sectors with the highest degree of inoperability ranging from (1) Recycling(S-12) to (10) Metal products(S-8) for this case. Similarly, Table 7 illustrates the top ten industry sectors based on the highest overall cumulative economic losses ranging from (1) Petroleum, Chemical, and Non-Metallic Mineral Products(S-7) with a total loss of worth $350.22 million to (10) Electricity, Gas, and Water (S-13) with a total loss of worth $60.84 million.

The ten highest inoperable sectors listed in Table 6 contribute 28.3% of total loss while the ten highest economic loss sectors listed in Table 7 contribute 89.2% of the total loss worth of the region.

-

(iv)

(iv) Case 04 When \({\varvec{\uplambda}}(\mathbf{t})\)= 0.75: (Combined case 75% stochastic & 25% deterministic modeling)

The next step is when there is a case of \(\uplambda (\mathrm{t})\) = 0.75, setting the stochastic probability of a new perturbation i.e., \(\uplambda (\mathrm{t})\) = 0.75. Shown in Eq. (10) i.e., setting \(\uplambda (\mathrm{t})\) = 0.75 for stochastic inoperability of a new perturbation means giving more significance to the inoperability of a new perturbation \({q}_{stochastic}\left(t\right)\) in comparison to the inoperability results from the DIIM modeling \({q}_{DIIM}\left(t\right).\) Putting the value in Eq. (5) we have.

Figure 10 depicts the overall inoperability ranges (0.3–6.2%) from minimum to maximum which drops to (0.2–3.0%) within 4 days. However, as per assumption, three aftershocks strike on the 5th, 10th, and 15th day having magnitudes of 99%, 50%, and 1%, respectively to the initials disruption. The declining trend of inoperability increases from (0.2 to 3.0%) on the 4th day of disaster to (1.3 to 21.8%) on the 5th day, (0.7 to 11.6%) on the 10th day, and (0.2 to 3.4%) on the 15th day, respectively. Because of the high impact of stochastic pattern, there is uncertainty and the overall inoperability is never set to zero again.

Figure 11 shows the overall cumulative economic losses. However, the highest sector economic loss in this case, as compared to the first case is 37% low but because of the high impact of stochastic elements and uncertainty, increased weightage in the overall inoperability. The plot never flattens as in cases 2 and 3 for the reason the expected monetary loss estimates at up to $1477 million (Approx. 0.42% of GDP). Note that the expected monetary loss in cases 2, 3, and 4 is less as compared to the first case as the analysis performed is only for 45 days, and as the plot never flatten in cases 2,3, and 4 while in 1st cases the plot flatten after 20 days. These losses from cases 2 to 4 increase if the duration of analysis is further increased.

Table 8 illustrates the top ten industry sectors with the highest degree of inoperability ranging from (1) Recycling(S-12) to (10) Fishing(S-2) for this case. Similarly, Table 9 illustrates the top ten industry sectors based on the highest overall cumulative economic losses ranging from (1) Petroleum, Chemical, and Non-Metallic Mineral Products(S-7) with a total loss of worth $325.72 million to (10) Construction(S-14) with a total loss of worth $59.12 million.

The ten highest inoperable sectors listed in Table 8 contribute 27.6% of total loss while the ten highest economic loss sectors listed in Table 9 contribute 88.4% of the total loss worth of the region.

4.2.2 Scenario 2: high probability and high magnitude earthquake

While considering scenario 2 of a high-probability and high-magnitude earthquake it must exhibit the following main features.

-

Include categories from major to great (i.e., Magnitude ranges from 7.0 or above on the Richter scale).

-

Lower estimated numbers per year i.e., frequency, but comparatively higher consequences.

-

Higher Inoperability levels, Cumulative Economic losses, and relatively slower recovery.

-

The impact of the stochastic pattern is assumed to be equal to 99% of that of the initial disaster for all high probability and high magnitude cases discussed below (i.e., when \(\lambda \ne 0)\).

-

Considering the case where up to 75% workforce fails to report their work in the aftermath of an earthquake.

-

In addition, to better understand the stochastic pattern three aftershocks are also assumed during the recovery horizon on the 5th, 10th, and 15th day of the initial disaster with a magnitude of 99%, 50%, and 1% to that of the initial disaster, respectively for all cases where (when \(\lambda \ne 0\)).

As stated in Eq. (5), the overall inoperability is the linear summation of both the \({q}_{DIIM}(t)\) and \({q}_{stochastic}\left(t\right)\), therefore, the high probability and magnitude earthquake scenario is also further divided into four different cases depending upon the values of \(\lambda \), discussed earlier the same case for a low-magnitude earthquake for extended DIIM model.

-

(i)

Case 01: when \({\varvec{\lambda}}({\varvec{t}})=0\) (100% deterministic modeling case)

The first step corresponds to the case when the probability of a new perturbation is equal to zero i.e., \(\uplambda (\mathrm{t})\)= 0. Recall Eq. (7) discussed in scenario 1.

Figure 12 shows the level of inoperability. The highest inoperability levels for the mentioned top ten sectors range (from 4.9 to 58%) from minimum to maximum, but drop to (1.05 to 18.8%) within 4 days and almost vanishes to 0% after 20 days for all listed industry sectors.

Figure 13 shows the cumulative economic loss recovery trends of the top ten industry sectors. The behavior of the recovery plots shown for all industry sectors, the economic losses flatten after 25–30 days for a high-magnitude earthquake scenario. The total expected monetary loss for this scenario estimates at $4955 million (Approx. 1.42% of GDP). Whereas Table 10 depicts the top ten industry sectors with the highest degree of inoperability ranging from (1) Recycling(S-12) to (10) Wholesales(S-16) for this stated case.

Similarly, Table 11 illustrates the top ten industry sectors based on the highest overall cumulative economic losses ranging from; (1) Financial Intermediation and Business Activities(S-20) with a total loss of worth $1567.98 million to (10) Construction(S-14) with a total loss of worth $171.09 million.

The ten highest inoperable sectors listed in Table 10 contribute 20.9% of total loss, while the ten highest economic loss sectors listed in Table 11 contribute 91.9% of the total loss worth of the region.

(ii) Case 02: when \({\varvec{\lambda}}\left({\varvec{t}}\right)=0.25\) (Combined case, 25% stochastic & 75% deterministic modeling)

The second step corresponds to the case when the probability of a new disruption has some value like \(\lambda \)(t) = 0.25 other than \(\lambda \left(t\right)=0\), as already discussed the same case for low probability and low-magnitude earthquake case, referring to the Eq. (8).

Figure 14 shows the level of inoperability, as the overall inoperability is the summation of both the \({q}_{stochastic}(t)\) and \({q}_{DIIM}\)(t) which ranges (3.2–57.9%) from minimum to maximum that drops to (2.4–28.5%) within 4 days. However, as per assumption, three aftershocks strike on 5th, 10th, and 15th day the declining trend of inoperability increases from (2.4 to 28.5%) on the 4th day of disaster to (5.4 to 82.6%) on the 5th day, (3.16 to 46.6%) on the 10th day, and (1.4 to 20.9%) on the 15th day, respectively. Because of the stochastic pattern, there is uncertainty and the overall inoperability never set to zero again.

Figure 15 shows the cumulative economic losses recovery trends of the top ten industry sectors, because of that stochastic element and uncertainty in the overall inoperability the plot never flattens, and for this reason, the expected monetary loss estimates up to $11,917.5 million which is almost 58.4% more than a case where \(\lambda =0\) (Approx. 3.42% of GDP).

Table 12 depicts the top ten industry sectors with the highest degree of inoperability ranging from (1) Recycling(S-12) to (10) Fishing(S-2) for a high-magnitude earthquake. Similarly, Table 13 illustrates the top ten industry sectors based on the highest overall cumulative economic losses ranging from; (1) Petroleum, Chemical, and Non-Metallic Mineral Products(S-7) with a total loss of worth $2607.72 million to (10) Construction(S-14) with a total loss of worth $472.98 million.

The ten highest inoperable sectors listed in Table 12 contribute 27.15% of total loss while the ten highest economic loss sectors listed in Table 13 contribute 88.35% of the total loss worth of the region.

-

(iii)

Case 03: When \({\varvec{\uplambda}}(\mathbf{t})=\,0.50\) :(Combined case 50% stochastic & 50% deterministic modeling)

The third step corresponds to the case when the probability of a new perturbation is equal \(\uplambda (\mathrm{t})\) = 0.50. Earlier discussed for low-magnitude earthquake cases so by putting the value in Eq. (5) we have.

Figure 16 illustrates the overall inoperability which is the average summation of both the \({q}_{stochastic}(t)\) and \({q}_{DIIM}\)(t) and ranges (3.6–57.8%) form minimum to maximum that drops to (2.31–38.18%) within 4 days. But as per assumption, three aftershocks strike on the 5th, 10th, and 15th day of disruption that increases the declining trend of inoperability from (2.31–38.18%) on the 4th day of disaster to (5.8–93.4%) on the 5th day, (3.7–60.1%) on the 10th day, and (1.8–35.06%) on the 15th day, respectively. Because of the stochastic pattern, there is some uncertainty and the overall inoperability never set to zero again.

Figure 17 shows the overall cumulative economic losses. Because of that stochastic element and uncertainty in the overall inoperability, the plot never flattens like in case 2 and for this reason, the expected monetary loss estimates up to $17,850.3 million, which is 72% more than case 1 and 33% more than case 2 discussed for high probability and high magnitude earthquake cases (Approx. 5.12% of GDP).

Table 14 depicts the top ten industry sectors with the highest degree of inoperability ranging from (1) Recycling(S-12) to (10) Agriculture (S-1) for a high-magnitude earthquake case 3. Similarly, Table 15 illustrates the top ten industry sectors based on the highest overall cumulative economic losses ranging from; (1) Petroleum, Chemical, and Non,-Metallic Mineral Products(S-7) with a total loss of worth $4017.73 million to (10) Construction(S-14) with a total loss of worth $731.60 million.

The ten highest inoperable sectors listed in Table 14 contribute 29.8% of total loss while the ten highest economic loss sectors listed in Table 15 contribute 87.6% of the total loss worth of the region.

Case 04 When \({\varvec{\uplambda}}(\mathbf{t})\)= 0.75: (Combined case 75% stochastic & 25% deterministic modeling)

The last step is when there is a case of \(\uplambda (\mathrm{t})\)= 0.75, setting the stochastic probability of a new perturbation i.e., \(\uplambda \left(\mathrm{t}\right)\) = 0.75, as already discussed for the low magnitude earthquake scenario shown in Eq. (10).

Figure 18 depicts the overall inoperability which ranges (from 3.6 to 57.6%) from minimum to maximum which drops to (2.9 to 47.8%) within 4 days. However, as per assumption, three aftershocks strike on the 5th, 10th, and 15th day of the initial disaster that increases the declining trend of inoperability from (2.9 to 47.8%) on the 4th day of the disaster to (6.5 to 104%) on the 5th day, (4.6 to 73.6%) on the 10th day, and (2.7 to 49.91%) on the 15th day, respectively. Because of the high impact of stochastic pattern, there is uncertainty and the overall inoperability never set to zero again.

Figure 19 shows the overall cumulative economic losses. Because of the stochastic element and uncertainty, increased weightage in the overall inoperability the plot never flattens likewise in cases 2 and 3. Hence, the expected monetary loss estimates up to $23,783.2 million which is 81%, 50%, and 24.9% greater than Cases 1, 2, and 3, respectively i.e., (Approx. 6.1% of GDP) and this cost further increases if the analysis duration is increased from 45 days.

Table 16 depicts the top ten industry sectors. The level of inoperability ranges from (1) Recycling(S-12) to (10) Agriculture(S-1) for this case. Similarly, Table 17 illustrates the top ten industry sectors based on the highest overall cumulative economic losses ranging from; (1) Petroleum, Chemical, and Non-Metallic Mineral Products(S-7) with a total loss of worth $5427.74 million to (10) Construction (S-14) with a total loss of worth $990.23 million.

The ten highest inoperable sectors listed in Table 16 contribute 31.02% of total loss while the ten highest economic loss sectors listed in Table 17 contribute 87.3% of the total loss worth of the region.

5 Conclusions

This study extends the DIIM workforce recovery model, which is capable of estimating the impacts of an earthquake on the industry/non-industry sector within an economic region. The study focuses on two risk metrics (i.e., economic loss and inoperability) for analyzing and evaluating the effects of workforce absenteeism in the aftermath of different earthquake scenarios. The main reason for using two tables for each case in this study is to discuss both these matrices independently, as results revealed that for the top ten inoperable and economic loss sectors, the most inoperable sectors did not appear in the economic loss sectors list, which reveals that both the matrices are independent of each other even for the same scenario. Also, it was noted that in case of low probability and low-magnitude, inserting and increasing the impact of stochastic pattern in the overall inoperability and economic loss cuts down the monetary loss worth for a particular period say 45 days (in this study). It will increases if we increase the period as already mentioned that after inserting the uncertainty of the stochastic pattern the inoperability and economic loss curve never flattens to a zero or horizontal line. In contrast, inserting and increasing the impact of stochastic pattern in high probability and magnitude cases further increases the inoperability and cumulative economic loss as compared to the true DIIM case for the particular period (say 45 days in this case) and will keep on increasing as the curves never set to zero or remain parallel to the horizontal lines.

The results obtained in this study will assist in post-disaster policy-making, specifically in systems-based resource allocation areas. As these results reveal critical industry sectors for various earthquake scenarios for the stated region, focusing on such sectors will boost the post-disaster recovery process, and keeping in view the level of interdependencies across these critical sectors for allocation of optimal resources will enhance the recovery pace. Furthermore, the higher labor-dependent sectors i.e., Recycling(S-12), Maintenance & Repair(S-15), and other manufacturing(S-11) remain the most inoperable while (petroleum, chemical, and non-metallic mineral product(S-7), Financial Intermediation and Business Activities(S-20) and Wholesale Trade(S-16) are amongst the most economic loss sectors in all scenarios. In addition, some industry sectors like Wood and paper(S-6), metal products(S-8), Electricity, Gas and water(S-13), etc. in some scenarios appeared in both the Tables i.e., the top ten inoperable sectors and top ten economic loss sectors as well. The methodology discussed in this paper is specifically designed for the regional economic sectors of Pakistan; however, it may work for other regions and for some other natural disasters as well.

References

Ainuddin S, Routray JK (2012) Institutional framework, key stakeholders and community preparedness for earthquake-induced disaster management in Balochistan. Disaster Prev Manag Int J

Akhtar R, Santos JR (2013) Risk-based input–output analysis of hurricane impacts on interdependent regional workforce systems. Nat Hazards 65:391–405

Alcántara V, Padilla E (2003) “Key” sectors in final energy consumption: an input–output application to the Spanish case. Energy Policy 31(15):1673–1678

Ali Y, Ciaschini M, Pretaroli R, Socci C (2015) Measuring the economic landscape of Italy: target efficiency and control effectiveness. Econ e Pol Ind 42:297–321

Anderson CW, Santos JR, Haimes YY (2007) A risk-based input–output methodology for measuring the effects of the August 2003 northeast blackout. Econ Syst Res 19(2):183–204

Arnold R, De Sa J, Gronniger T, Percy A, Somers J (2006) A potential influenza pandemic: possible macroeconomic effects and policy issues. The congress of the United States, congressional budget Office.

Barker K, Santos JR (2010) A risk-based approach for identifying key economic and infrastructure systems. Risk Anal Int J 30(6):962–974

Becek K (2014) The Internet of Things

Benson C, Clay EJ (1998) The impact of drought on sub-Saharan African economies: a preliminary examination. World Bank Publications, Washington, D.C.

Cho S, Gordon P, Moore JE II, Richardson HW, Shinozuka M, Chang S (2001) Integrating transportation network and regional economic models to estimate the costs of a large urban earthquake. J Reg Sci 41(1):39–65

Crowther KG, Haimes YY, Taub G (2007) Systemic valuation of strategic preparedness through application of the inoperability input–output model with lessons learned from Hurricane Katrina. Risk Anal Int J 27(5):1345–1364

Dietzenbacher E, Miller RE (2015) Reflections on the inoperability input–output model. Econ Syst Res 27(4):478–486

El Haimar A, Santos JR (2015) A stochastic recovery model of influenza pandemic effects on interdependent workforce systems. Nat Hazards 77:987–1011

El Meligi AK, Ciaschini M, Ali Khan Y, Pretaroli R, Severini F, Socci C (2019) The inoperability extended multisectoral model and the role of income distribution: a UK case study. Rev Income Wealth 65(3):617–631

Haimes YY, Jiang P (2001) Leontief-based model of risk in complex interconnected infrastructures. J Infrastruct Syst 7(1):1–12

Haimes YY, Horowitz BM, Lambert JH, Santos JR, Lian C, Crowther KG (2005) Inoperability input-output model for interdependent infrastructure sectors. I: theory and methodology. J Infrastruct Syst 11(2):67–79

Holling CS (1973) Resilience and stability of ecological systems. Annu Rev Ecol Syst 4(1):1–23

Hossain M (2002) Vulnerability due to natural hazards in South Asia: a GIS aided characterization of arsenic contamination in Bangladesh. Master thesis, Agricultural University, Norway

Hsu GJ, Chou F-Y (2000) Integrated planning for mitigating CO2 emissions in Taiwan: a multI–Objective programming approach. Energy Policy 28(8):519–523

Khalid MA, Ali Y (2019) Analysing economic impact on interdependent infrastructure after flood: Pakistan a case in point. Environ Hazards 18(2):111–126

Khan SU, Qureshi MI, Rana IA, Maqsoom AJSAS (2019) Seismic vulnerability assessment of building stock of Malakand (Pakistan) using FEMA P-154 method 1(12):1625

Lahr ML, Stevens BH (2002) A study of the role of regionalization in the generation of aggregation error in regional input–output models. J Reg Sci 42(3):477–507

Lenzen M, Pade L-L, Munksgaard J (2004) CO2 multipliers in multi-region input–output models. Econ Syst Res 16(4):391–412

Leontief WW (1936) Quantitative input and output relations in the economic systems of the United States. Rev Econ Stat, pp 105–125

Lian C, Haimes YY (2006) Managing the risk of terrorism to interdependent infrastructure systems through the dynamic inoperability input–output model. Syst Eng 9(3):241–258

Miller RE, Blair PD (2009) Input-output analysis: foundations and extensions. Cambridge University Press, Cambridge

Miller RE, Polenske KR, Rose A (1989) Frontiers of input-output analysis. Oxford University Press, Oxford

Niknejad A, Petrovic D (2016) A fuzzy dynamic inoperability input–output model for strategic risk management in global production networks. Int J Prod Econ 179:44–58

Okuyama Y, Chang SE (2004) Modeling spatial and economic impacts of disasters. Springer Science & Business Media, Berlin

Olsen J, Beling P, Lambert J, Haimes Y (1997) Leontief input-output model applied to optimal deployment of flood protection. J Water Resour Plan Manage 124(5):237–245

Oosterhaven J (2017) On the limited usability of the inoperability IO model. Econ Syst Res 29(3):452–461

Orsi MJ, Santos JR (2009) Incorporating time-varying perturbations into the dynamic inoperability input–output model. IEEE Trans Syst Man Cybern Part A Syst Humans 40(1):100–106

Perrings C (2001) 13. Resilience and sustainability. Front Environ Econ 319:342

Proops JL (1984) Modelling the energy-output ratio. Energy Econ 6(1):47–51

((PSIC) Revision 4 2022.). (PSIC) Revision 4 https://www.pbs.gov.pk/sites/default/files/other/documents/PSIC_2010.pdf,

Ramirez JA, Rajasekar U, Patel DP, Coulthard TJ, Keiler M (2016) Flood modeling can make a difference: disaster risk-reduction and resilience-building in urban areas. Hydrol Earth Syst Sci Discuss, pp 1–21

Rose A, Liao SY (2005) Modeling regional economic resilience to disasters: a computable general equilibrium analysis of water service disruptions. J Reg Sci 45(1):75–112

Rose A (2004) Economic principles, issues, and research priorities in hazard loss estimation. In: Modeling spatial and economic impacts of disasters. Springer, pp 13–36

Santos JR (2006) Inoperability input-output modeling of disruptions to interdependent economic systems. Syst Eng 9(1):20–34

Santos JR, Haimes YY (2004) Modeling the demand reduction input–output (I–O) inoperability due to terrorism of interconnected infrastructures. Risk Anal Int J 24(6):1437–1451

Santos JR, Haimes YY, Lian C (2007) A framework for linking cybersecurity metrics to the modeling of macroeconomic interdependencies. Risk Anal Int J 27(5):1283–1297

Santos JR, Orsi MJ, Bond EJ (2009) Pandemic recovery analysis using the dynamic inoperability input–output model. Risk Anal Int J 29(12):1743–1758

Santos JR (2012) An input-output framework for assessing disaster impacts on Nashville metropolitan region. In: The 20th International input–output conference and the 2nd edition of international school of input–output analysis. Bratislava, Slovakia

Shaluf IM (2007) Disaster types. Disaster Prev Manag Int J

Ul Hasan SS, Zaidi SSZ (2012) Flooded economy of Pakistan. J Dev Agric Econ 4(13):331–338

Velázquez E (2006) An input–output model of water consumption: analysing intersectoral water relationships in Andalusia. Ecol Econ 56(2):226–240

Yu KDS, Tan RR, Santos JR (2013) Impact estimation of flooding in Manila: an inoperability input-output approach. In: 2013 IEEE Systems and information engineering design symposium, IEEE

Acknowledgements

Pakistan Standard Industrial Classification (PSIC) supports this work up to a certain extent. The Bureau of Economic Analysis (BEA) of Pakistan and the Federal Bureau of Statistics (FBS) of Pakistan also provided some of the primary sources for information and practical data extraction used in the present research project. Department of Mechanical Engineering at the CECOS University of IT & Emerging Sciences provides additional financial support leading to the completion of this paper. A viewpoint expressed in this manuscript belongs to the authors and does not represent the official positions of PSIC, BEA, and FBS.

Funding

No funding was provided for completion of this study.

Author information

Authors and Affiliations

Contributions

Conceptualization: RA and MIH; Methodology: MIH and RA; Investigation and writing original draft: MIH; Review and supervision: RA.

Corresponding author

Ethics declarations

Competing interests

The article declares no competing interests.

Ethical approval

The article follows the guidelines of the Committee on Publication Ethics (COPE) and involves no studies on human and animal subjects.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix 1: Industry-by-industry total requirements table

Appendix 1: Industry-by-industry total requirements table

Source: Bureau of Economic Analysis of Pakistan—2016

Code | Industry description | Agriculture | Fishing | Mining and quarrying | Food & beverages | Textiles and wearing apparel | Wood and paper | Petroleum, chemical, and non-metallic mineral products | Metal products | Electrical and machinery | Transport equipment | Other manufacturing | Recycling |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

S1 | S2 | S3 | S4 | S5 | S6 | S7 | S8 | S9 | S10 | S11 | S12 | ||

S1 | Agriculture | 1.2043 | 0.0060 | 0.0023 | 0.0697 | 0.0141 | 0.0178 | 0.0067 | 0.0004 | 0.0002 | 0.0001 | 0.0096 | 0.0031 |

S2 | Fishing | 0.0007 | 1.1422 | 0.0000 | 0.0917 | 0.0001 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0174 | 0.0000 |

S3 | Mining and quarrying | 0.0274 | 0.0200 | 1.0120 | 0.0103 | 0.0078 | 0.0133 | 0.2704 | 0.0689 | 0.0018 | 0.0065 | 0.0094 | 0.0792 |

S4 | Food & beverages | 0.0302 | 0.1021 | 0.0011 | 1.0083 | 0.0407 | 0.0063 | 0.0091 | 0.0000 | 0.0001 | 0.0001 | 0.0163 | 0.0215 |

S5 | Textiles and wearing apparel | 0.0094 | 0.0482 | 0.0020 | 0.0054 | 1.1161 | 0.0184 | 0.0071 | 0.0033 | 0.0093 | 0.0152 | 0.1007 | 0.0010 |

S6 | Wood and paper | 0.0587 | 0.0172 | 0.0086 | 0.0208 | 0.0159 | 1.2561 | 0.0713 | 0.0254 | 0.0305 | 0.0180 | 0.2107 | 0.0547 |

S7 | Petroleum, chemical, and non-metallic mineral products | 0.0792 | 0.0536 | 0.0172 | 0.0226 | 0.0752 | 0.0230 | 1.1424 | 0.0101 | 0.0163 | 0.0170 | 0.0707 | 0.0966 |

S8 | Metal products | 0.0215 | 0.0122 | 0.0417 | 0.0152 | 0.0571 | 0.0338 | 0.0647 | 1.1994 | 0.2952 | 0.2250 | 0.0732 | 0.3718 |

S9 | Electrical and machinery | 0.0411 | 0.0600 | 0.0110 | 0.0404 | 0.0481 | 0.0678 | 0.0752 | 0.0126 | 1.2368 | 0.9519 | 0.0735 | 0.0063 |

S10 | Transport equipment | 0.0087 | 0.0522 | 0.0196 | 0.0090 | 0.0036 | 0.0022 | 0.0138 | 0.0063 | 0.0498 | 1.0539 | 0.0212 | 0.0049 |

S11 | Other manufacturing | 0.0055 | 0.0325 | 0.0048 | 0.0162 | 0.0107 | 0.0177 | 0.0068 | 0.0064 | 0.0100 | 0.0437 | 1.0815 | 0.0073 |

S12 | Recycling | 0.0002 | 0.0000 | 0.0007 | 0.0011 | 0.0047 | 0.0160 | 0.0044 | 0.0487 | 0.0008 | 0.0001 | 0.0150 | 1.2293 |

S13 | Electricity, gas, and water | 0.0872 | 0.0056 | 0.0834 | 0.0884 | 0.0169 | 0.0995 | 0.0123 | 0.0879 | 0.0279 | 0.0162 | 0.0702 | 0.0394 |

S14 | Construction | 0.0446 | 0.0094 | 0.0174 | 0.0300 | 0.0312 | 0.0459 | 0.0471 | 0.0391 | 0.0182 | 0.0090 | 0.0617 | 0.0010 |

S15 | Maintenance and repair | 0.0069 | 0.0027 | 0.0015 | 0.0083 | 0.0215 | 0.0063 | 0.0049 | 0.0038 | 0.0044 | 0.0045 | 0.0179 | 0.0011 |

S16 | Wholesale trade | 0.1665 | 0.0061 | 0.0309 | 0.0217 | 0.3715 | 0.0140 | 0.0127 | 0.0724 | 0.0438 | 0.0614 | 0.0330 | 0.0117 |

S17 | Hotels and restaurants | 0.0034 | 0.0000 | 0.0000 | 0.0204 | 0.0314 | 0.0265 | 0.0160 | 0.0133 | 0.0080 | 0.0026 | 0.0482 | 0.0003 |

S18 | Transport | 0.0141 | 0.0325 | 0.0549 | 0.0000 | 0.0192 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0853 |

S19 | Post and telecommunications | 0.0148 | 0.0163 | 0.0128 | 0.0231 | 0.0526 | 0.0500 | 0.0289 | 0.0247 | 0.0540 | 0.0123 | 0.0923 | 0.0037 |

S20 | Financial intermediation and business activities | 0.0916 | 0.0185 | 0.0754 | 0.0521 | 0.0372 | 0.0417 | 0.5328 | 00324 | 0.0493 | 0.0309 | 0.8586 | 0.0196 |

S21 | Public administration | 0.0086 | 0.0018 | 0.0038 | 0.0050 | 0.0021 | 0.0045 | 0.0036 | 0.0020 | 0.0008 | 0.0010 | 0.0178 | 0.0000 |

S22 | Education, health, and other services | 0.0420 | 0.0611 | 0.0083 | 0.0317 | 0.0164 | 0.0226 | 0.0178 | 0.0110 | 0.0094 | 0.0076 | 0.0358 | 0.0031 |

S23 | Private households | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

S24 | Others | 0.0150 | 0.0129 | 0.0474 | 0.0177 | 0.0261 | 0.0145 | 0.0102 | 0.0178 | 0.0884 | 0.0177 | 0.0246 | 0.0792 |

Electricity, gas, and water | Construction | Maintenance and repair | Wholesale trade | Hotels and Restaurants | Transport | Post and Telecommunications | Financial Intermediation and Business activities | Public administration | Education, health, and other services | Private households | Others | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Code | Industry description | S13 | S14 | S15 | S16 | S17 | S18 | S19 | S20 | S21 | S22 | S23 | S24 |

S1 | Agriculture | 0.0004 | 0.0210 | 0.0044 | 0.0045 | 0.0120 | 0.0006 | 0.0001 | 0.0055 | 0.0037 | 0.0071 | 0.0005 | 0.0003 |

S2 | Fishing | 0.0000 | 0.0000 | 0.0014 | 0.0012 | 0.0317 | 0.0000 | 0.0000 | 0.0002 | 0.0001 | 0.0006 | 0.0001 | 0.0000 |

S3 | Mining and quarrying | 0.1462 | 0.0109 | 0.0023 | 0.0026 | 0.0076 | 0.0432 | 0.0023 | 0.0024 | 0.0208 | 0.0035 | 0.0005 | 0.0056 |

S4 | Food & beverages | 0.0006 | 0.0001 | 0.0361 | 0.0341 | 1.0821 | 0.0197 | 0.0007 | 0.0080 | 0.0352 | 0.0559 | 0.0413 | 0.0013 |

S5 | Textiles and wearing apparel | 0.0028 | 0.0229 | 0.0108 | 0.0142 | 0.0104 | 0.0050 | 0.0036 | 0.0024 | 0.0171 | 0.0163 | 0.0046 | 0.0109 |

S6 | Wood and paper | 0.0161 | 0.2867 | 0.0650 | 0.0721 | 0.0100 | 0.0619 | 0.0100 | 0.0513 | 0.0920 | 0.0711 | 0.0608 | 0.0564 |

S7 | Petroleum, chemical, and non-metallic mineral products | 0.0194 | 0.8171 | 0.0112 | 0.0117 | 0.0164 | 1.0879 | 0.0111 | 0.0554 | 0.0220 | 0.0292 | 0.0907 | 0.0190 |

S8 | Metal products | 0.0136 | 0.0550 | 0.0197 | 0.0223 | 0.0520 | 0.0809 | 0.0164 | 0.0181 | 0.0225 | 0.0120 | 0.0174 | 0.0288 |

S9 | Electrical and machinery | 0.0718 | 0.0467 | 0.0100 | 0.0862 | 0.0541 | 0.0247 | 0.0113 | 0.0540 | 0.0183 | 0.0105 | 0.00677 | 0.0422 |

S10 | Transport equipment | 0.0026 | 0.0848 | 0.0635 | 0.0468 | 0.0058 | 0.0198 | 0.0108 | 0.0162 | 0.0106 | 0.0040 | 0.0320 | 0.0068 |

S11 | Other manufacturing | 0.0080 | 0.0112 | 0.0163 | 0.0196 | 0.0335 | 0.0108 | 0.0132 | 0.0146 | 0.0138 | 0.0263 | 0.0142 | 0.0105 |

S12 | Recycling | 0.0149 | 0.0006 | 0.0011 | 0.0012 | 0.0012 | 0.0022 | 0.0018 | 0.0017 | 0.0000 | 0.0042 | 0.0001 | 0.0001 |

S13 | Electricity, gas, and water | 1.2597 | 0.0311 | 0.0538 | 0.0570 | 0.0194 | 0.0466 | 0.0311 | 0.0271 | 0.0561 | 0.0875 | 0.0182 | 0.0265 |

S14 | Construction | 0.0311 | 1.1961 | 0.0539 | 0.0471 | 0.0861 | 0.0369 | 0.0829 | 0.0944 | 0.0194 | 0.0832 | 0.0595 | 0.0361 |

S15 | Maintenance and repair | 0.0013 | 0.0166 | 1.0657 | 0.0025 | 0.0093 | 0.0032 | 0.0013 | 0.0011 | 0.0031 | 0.0025 | 0.0018 | 0.0013 |

S16 | Wholesale trade | 0.0210 | 0.0189 | 0.0864 | 1.0287 | 0.0167 | 0.0354 | 0.0329 | 0.0233 | 0.0468 | 0.0542 | 0.0474 | 0.0147 |

S17 | Hotels and restaurants | 0.0698 | 0.0196 | 0.0243 | 0.0265 | 1.4190 | 0.0445 | 0.0588 | 0.0590 | 0.0626 | 0.0677 | 0.0390 | 0.0177 |

S18 | Transport | 0.0103 | 0.0000 | 0.0138 | 0.0151 | 0.0000 | 1.0431 | 0.0421 | 0.0131 | 0.0000 | 0.0038 | 0.0000 | 0.0714 |

S19 | Post and telecommunications | 0.0596 | 0.0991 | 0.0201 | 0.0210 | 0.0178 | 0.0217 | 1.0027 | 0.0823 | 0.0166 | 0.0129 | 0.0178 | 0.2137 |

S20 | Financial intermediation and business activities | 0.0575 | 0.0315 | 0.0024 | 0.0965 | 0.0939 | 0.0360 | 0.6581 | 1.0544 | 0.0290 | 0.3032 | 0.0000 | 0.0001 |

S21 | Public administration | 0.0005 | 0.0017 | 0.0040 | 0.0030 | 0.0114 | 0.0919 | 0.0083 | 0.0052 | 1.0027 | 0.0086 | 0.0102 | 0.0722 |

S22 | Education, health, and other services | 0.0405 | 0.0393 | 0.0508 | 0.0466 | 0.0155 | 0.0415 | 0.0133 | 0.0647 | 0.0146 | 1.0047 | 0.0136 | 0.0124 |

S23 | Private households | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0014 | 0.0000 | 0.0000 | 0.0019 | 0.0000 | 1.0433 | 0.0003 |

S24 | Others | 0.0200 | 0.0126 | 0.0166 | 0.0199 | 0.0190 | 0.0110 | 0.0109 | 0.0793 | 0.0377 | 0.0777 | 0.0140 | 1.1570 |

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Hanif, M.I., Akhtar, R. Effects of seismic risk analysis on regional sectors using both the deterministic and stochastic modeling. Nat Hazards 120, 639–675 (2024). https://doi.org/10.1007/s11069-023-06202-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11069-023-06202-8