Abstract

In this paper, we develop an output diffusion model in which a monopoly firm faces a cost of adjusting output over time and across geographic regions. First, we investigate a dynamic monopoly model and a simple spatial model with only regional adjustment costs. Then, we explore how the firm maximizes profits over time and space, a calculus of variation problem. The Euler equation yields a partial differential equation which forms our output diffusion model. It extends the traditional inter-temporal output path into output diffusion over time and space. As long as regional adjustment costs exist, steady-state output in the diffusion model is less than the static monopoly output level. This model suggests that a policy designed to lower regional adjustment costs can increase supply in all geographic regions.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

When demand or cost conditions are interconnected over time, a firm will take a dynamic approach to identify its optimal level of production. Dynamic models with these characteristics are well known and are reviewed in Tirole [1] and Tremblay and Tremblay [2].

A dynamic environment can result from inertia, which arises when a firm is unable to instantaneously adjust output to a change in market conditions. Inertia can occur for technological reasons. For example, an increase in production may require additional capacity that takes time to put into place. Several papers have addressed dynamic settings that are caused by inertia. Examples include those by Fisher [3], Driskill and McCafferty [4], and Dockner [5], who consider deterministic versions of output determination over time. Youn and Tremblay [6] extend these models to consider a dynamic model with a stochastic component that is described by Brownian motion.

In this paper, we propose that if a firm supplies output to different locations of the country, then there can be geographic inertia as well as inertia over time. Geographic inertia can arise because of logistical problems that make it costly to adjust output across locations. We develop a dynamic monopoly model where the firm faces a cost of adjusting output spatially as well as inter-temporally. In this setting, the firm’s goal is to choose the optimal level of output over time for each geographic region.

In Sect. 2, we review the dynamic monopoly model. This model is well known in the literature and is used as a building block for our ultimate model, but ignores geography. Then, we develop a static spatial model. To our knowledge, this is the first monopoly model with this type of spatial component. In Sect. 3, we reach our ultimate goal of synthesizing the two previous models into one that has both time and spatial dimensions. We call this a diffusion model. In Sect. 4, we provide a brief conclusion and discussion of policy implications.

2 Dynamic and Spatial Models

First, we consider a dynamic monopoly model that derives from Driskill and McCafferty [4] and Dockner [5]. The firm’s inverse demand is \(p\left( t \right) =\frac{1}{4}-q\left( t \right) \), where \(p\left( t \right) \) is price and \(q\left( t \right) \) is output in period t. Production costs are normalized to zero for convenience.

There is an adjustment cost of changing output over time. This cost increases quadratically with the change in output and is defined as \(A\left( t \right) =k\left( {q_t } \right) ^{2}\), where \(q_t =\frac{\hbox {d}q\left( t \right) }{\hbox {d}t}\) and k is the time adjustment cost parameter, \(0<k<\infty \).

At \(t=0\), the firm starts with \(q\left( 0 \right) =0\). The firms’ goal is to choose a production plan that maximizes the economic value of the firm, the present value of its stream of profits:

where \(r(>0)\) is the interest rate.

This is a calculus of variation problem in \(q\left( t \right) \). According to Kaimen and Schwartz [7], the solution must satisfy Euler’s equation:

where \(F\left( {t,q\left( t \right) ,q_t } \right) =\hbox {e}^{-rt}\left\{ {\left[ {\frac{1}{4}-q\left( t \right) } \right] q\left( t \right) -kq_t ^{2}} \right\} \), or

The equation has the solution of \(q^{*}\left( {t,k} \right) =\frac{1}{8}(1-\hbox {e}^{\alpha t})\) where \({\upalpha }=\frac{1}{2}\left( {r-\sqrt{r^{2}+\frac{4}{k}}} \right) <0\).

The dynamic output path increases gradually over time from 0 to the steady-state value \(\frac{1}{8}\), the static monopoly output level. It is the adjustment cost that prevents the firm from reaching the static monopoly output in finite time.

Next, we develop a spatial monopoly model that ignores time. Each consumer’s geographic location is identified by \(x\in \left[ {0,1} \right] \). The density of consumers at location x is described by \(g\left( x \right) \). Consumers have unit demands, so that the demand at location x is identified by the number of consumers at that location. The demand is assumed to be greatest at the center and diminish in more outlying areas. The inverse demand function is \(p\left( x \right) =g\left( x \right) -q\left( x \right) \), where \(p\left( x \right) \) is price and \(q\left( x \right) \) is output at location x. It implies that the firm may charge a different price in each location due to differences in demand. We assume that consumers cannot relocate despite differences in prices across regions. Migration frictions or strong location preferences prevent consumers from moving from one location to another.

The firm faces a logistical cost of adjusting output from one neighboring location to another. This spatial adjustment cost is assumed to grow with the size of the change in output. This adjustment cost is \(A\left( x \right) =\nu \left( {q_x } \right) ^{2},\) where \(q_x =\frac{\hbox {d}q\left( t \right) }{\hbox {dx}}\) and \(\nu \) is the spatial adjustment cost parameter, \(0<\nu <\infty \).

The firm’s problem is to maximize its profits with respect to the output it sells in each location:

subject to the assumption that \(q\left( 0 \right) =q\left( 1 \right) =0\). As before, according to Kaimen and Schwartz [7], the solution must satisfy Euler’s equation:

where \(F\left( {q\left( x \right) ,q_x } \right) =\left[ {g\left( x \right) -q\left( x \right) } \right] q\left( x \right) -\nu (q_x )^{2}\), or

Equation (4) describes a boundary value problem with a forcing term, \(g\left( x \right) \) which is the geographic demand function. For simplicity, we take \(g\left( x \right) =x-x^{2}\), a concave function in \(\left[ {0,1} \right] \) that reaches a maximum at \(x=\frac{1}{2}\). This specification is in accordance with our earlier assumptions about demand and satisfies the boundary value constraint with \(g\left( 0 \right) =g\left( 1 \right) =0\).

Theorem 2.1

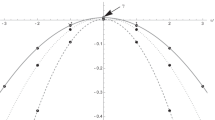

Let \(g\left( x \right) =x-x^{2}\) and \(m=\frac{1}{\sqrt{\nu }}\). The optimal output \(q^{*}\left( {x,m} \right) \) by region is the solution of Eq. (4) which is given by:

Proof

The solution equation of (4) can be expressed as \(q^{*}\left( {x,m} \right) =a_1 \cosh \left( {mx} \right) +a_2 \sinh \left( {mx}\right) -\frac{1}{2}x^{2}+\frac{1}{2}x-\frac{1}{m^{2}},\) and the boundary condition of \(q\left( 0 \right) =q\left( 1 \right) =0\) shows that \(a_1 =\frac{1}{m^{2}}\) and \(a_2 =\frac{1}{m^{2}}\frac{\left( {1-\cosh \left( m \right) } \right) }{\sinh \left( m \right) }\). Using hyperbolic trigonometric identities (Table 6.12 on p. 522 in Finny et al. [8]), \(q^{*}\left( {x,m} \right) \) can be simplified further, yielding \(q^{*}\left( {x,m} \right) =\frac{1}{m^{2}}\left\{ {\frac{\cosh \left( {\frac{m\left( {1-2x} \right) }{2}} \right) }{\cosh \left( {\frac{m}{2}} \right) }-1} \right\} +\frac{1}{2}g\left( x \right) \). \(\square \)

Note that as long as m is finite (or equivalently \(\nu >0)\), \(q^{*}\left( {x,m} \right) \) is less than the simple static monopoly level of output, \(\frac{1}{2}g\left( x \right) \), which follows from the fact that \(\cosh \left( {\frac{m\left( {1-2x} \right) }{2}} \right) <\cosh \left( {\frac{m}{2}} \right) \) when \(0<x<1\). The properties of the spatial equilibrium output \(q^{*}\left( {x,m} \right) \) are listed next.

Theorem 2.2

Assume that the conditions of Theorem 2.1 hold. Then,

-

(a)

\(0<q^{*}\left( {x,m} \right) <\frac{1}{2}g\left( x \right) \) for all \(0<x<1\) and \(q^{*}\left( {x,m} \right) \) is symmetric with respect to \(x=\frac{1}{2}\),

-

(b)

\(q^{*}\left( {x,m} \right) \rightarrow \frac{1}{2}g\left( x \right) \) when \(m\rightarrow \infty \) (or equivalently \(\nu \rightarrow 0)\),

-

(c)

\(q^{*}\left( {x,m} \right) \rightarrow 0\) when \(m\rightarrow 0\) (or equivalently \(\nu \rightarrow \infty ),\)

-

(d)

\(\frac{\partial }{\partial x}q^{*}\left( {\frac{1}{2},m} \right) =0\) and \(\frac{\partial ^{2}}{\partial x^{2}}q^{*}\left( {x,m} \right) <0\) for all \(m>0\) and \(0<x<1\),

-

(e)

\(\frac{\partial }{\partial m}q^{*}\left( {x,m} \right) >0\) for all \(0<x<1\) and for all \(m>0\).

Proof

The upper bound and symmetry of \(q^{*}\left( {x,m} \right) \) in (a) are obvious. To prove positivity of (a), we replace \(q^{*}\left( {x,m} \right) \) by \(q^{*}\left( x \right) \) and argue by contradiction. If there is some interior point where \(q^{*}\left( x \right) \) is negative or zero, then there is also an interior point \(\bar{x} \) at which \(q^{*}\) achieves its nonpositive minimum:

\(q^{*}\left( {\bar{x} } \right) =\mathop {\min }\nolimits _{x\in \left( {0,1} \right) } q^{*}\left( x \right) \) for some \(0<\bar{x} <1\). By the Strong Maximum Principle (Theorem 4 on p. 333 in Evans [9]), \(q^{*}\) must be constant in (0, 1). If \(q^{*}\left( {\bar{x} } \right) <0\), this contradicts that \(q^{*}\left( 0 \right) =q^{*}\left( 1 \right) =0\). If \(q^{*}\left( {\bar{x} } \right) =0\), then \(q^{*}\left( x \right) =0\) for all x, but this leads to a contradiction as well.

The proof of (b) and (d) is obvious, and (c) follows from a repeated application of l’Hospital’s rule in (5). Again we use the Strong Maximum Principle to prove (e). Recall that \(m=\frac{1}{\sqrt{\nu }}\), and therefore, \(Q^{*}\left( {x,\nu } \right) =q^{*}\left( {x,\frac{1}{\sqrt{\nu }}} \right) \) solves (4). Consequently, the partial derivative \(Q_\nu ^*\) solves the following boundary value problem:

We claim that \(Q_\nu ^*\left( x \right) <0\) for all \(0<x<1\). First, \(Q_{xx}^*=q_{xx}^*<0\) if \(0<x<1\) by (d), making the right-hand side of (6) negative in \(\left( {0,1} \right) \). If the claim were false, then there would be some interior point where \(Q_\nu ^*\) is positive or zero. But then there is also an interior point \(\bar{x} \) at which \(Q_\nu ^*\) achieves its nonnegative maximum: \(Q_\nu ^*\left( {\bar{x} } \right) =\mathop {\hbox {max}}\nolimits _{x\in \left( {0,1} \right) } Q_\nu ^*\left( x \right) \) for \(0<x<1\). By the Strong Maximum Principle, \(Q_\nu ^*\) must be constant in \(\left( {0,1} \right) \). If \(Q_\nu ^*\left( {\bar{x} } \right) >0\), this contradicts \(Q_\nu ^*\left( 0 \right) =Q_\nu ^*\left( 1 \right) =0\). If \(Q_\nu ^*\left( {\bar{x} } \right) =0\), then \(Q_\nu ^*\left( x \right) =0\) for all x, but this leads to a contradiction. The claim finally implies \(\frac{\partial }{\partial m}\hbox {}q^{*}\left( {x,m} \right) >0\) because m is related inversely with \(\nu \). \(\square \)

The spatial equilibrium \(q^{*}\left( {x,m} \right) \) is symmetric, positive, concave in x for any \(m>0\) and achieves a unique maximum at \(x=\frac{1}{2}\). In this case, at each location \(q^{*}\left( {x,m} \right) \) is proportional to the competitive or efficient level of output, \(g\left( x \right) =x-x^{2}\).

When \(m\rightarrow \infty \) (or equivalently \({\nu }\rightarrow 0)\), the optimal output approaches the simple static monopoly output level, \(\frac{1}{2}g\left( x \right) \). Without regional adjustment costs, the simple static monopoly level of output is profit maximizing. On the other hand, when \(m\rightarrow 0\) (or equivalently \({\nu }\rightarrow \infty )\), the optimal output collapses to 0 everywhere. It is found that \(\frac{\partial }{\partial \nu }q^{*}\left( {x,\frac{1}{\sqrt{\nu }}} \right) <0\) when \(0<x<1\), which implies that optimal output decreases monotonically everywhere from \(\frac{1}{2}g\left( x \right) \) to zero when regional adjustment costs increase from zero to infinity.

3 The Output Diffusion Model Over Time and Space

We synthesize the previous models to create a monopoly model with both time and spatial components. We call this a diffusion model. In this case, price, output, and inverse demand depend upon both time and geographic location: \(p\left( {t,x} \right) =g\left( x \right) -q\left( {t,x} \right) \). As before, output is always 0 at the extreme values of x, \(q\left( {t,0} \right) =q\left( {t,1} \right) =0\). In addition, output is zero initially, \(q\left( {0,x} \right) =0\) for all x. The total adjustment cost is the sum of the time and spatial adjustment cost components, \(A\left( {t,x} \right) =k\left( {q_t } \right) ^{2}+\nu \left( {q_x } \right) ^{2},\) where k and \(\nu \) are positive and represent the respective adjustment cost parameters over time and location.

At \(t=0\), the monopolist’s goal is to choose an output plan for each period and geographic location that maximizes total discounted profits:

given that \(0<r,k<\infty \) and \(0<\nu <\infty \), and \(q\left( {0,x} \right) =q\left( {t,0} \right) =q\left( {t,1} \right) =0\).

According to Kaimen and Schwartz [7], the solution must satisfy Euler’s equation:

where \(F\left( {t,q\left( {t,x} \right) ,q_t ,q_x } \right) =\hbox {e}^{-rt}\left[ {\left\{ {g\left( x \right) -q\left( {t,x} \right) } \right\} q\left( {t,x} \right) -k\left( {q_t } \right) ^{2}-\nu (q_x )^{2}} \right] \), or

This partial differential equation identifies how output evolves over time and across regions when there are inter-temporal and spatial adjustment costs.

Theorem 3.1

Again, let \(g\left( x \right) =x-x^{2}\) and \(m=\frac{1}{\sqrt{\nu }}\). The solution of Eq. (8) identifies optimal output over time for each location:

where the steady-state level of output is \(q^{*}\left( {x,m} \right) \) from Theorem 2.1, \(c_n =0\) when n is even, and \(c_n =-4\left[ {\frac{1}{\left( {n\pi } \right) ^{3}}-\frac{1}{m^{2}n\pi +\left( {n\pi } \right) ^{3}}} \right] <0\) when n is odd, and \(\alpha _n =\frac{1}{2}\left( {r-\sqrt{r^{2}+4\frac{1+n^{2}\pi ^{2}m^{2}}{k}}} \right) <0,n=1,2,3,\ldots \).

Proof

A particular solution of (8) which depends only on space but not time satisfies the following equation:

The solution of Eq. (10) is \(q^{*}\left( {x,m} \right) \); see (5) in Theorem 2.1. Now, we look for the solution of the homogeneous equation associated with (8):

This problem can be solved using the method of separation of variables, yielding:

where

Putting together the particular solution and the homogeneous solution, we obtain the solution of (8):

To find the \(c_n \), we invoke the initial condition in (8):

Using Fourier series, we obtain:

We substitute (5) in (15) and compute \(c_n \) by integration by parts to see:

This concludes the proof. \(\square \)

From (9), we note that \(q^{*}\left( {t,x,k,m} \right) \) contains an inter-temporal term, \(\mathop \sum \nolimits _{n=1}^\infty c_n \hbox {e}^{\alpha _n t}\hbox {sin}n\pi x\) and a spatial term, \(q^{*}\left( {x,m} \right) \). Also, \(q^{*}\left( {t,x,k,m} \right) \) in (9) is symmetric at \(x=\frac{1}{2}\) since both of the following are symmetric at \(x=\frac{1}{2}\): \(q^{*}\left( {x,m} \right) \) and \(\hbox {sin}n\pi x\) when n is an odd number. We can now prove that \(q^{*}\left( {t,k,x,m} \right) \) converges to \(q^{*}\left( {x,m} \right) \) in the spatial model as time goes to infinity and is nonnegative for all periods in the interval [0, 1].

Theorem 3.2

Assume that the conditions of Theorem 3.1 hold. Then, \(q^{*}\left( {t,x,k,m} \right) \) converges to \(q^{*}\left( {x,m} \right) \) as \(t\rightarrow \infty \) for all \(0\le x\le 1\), and all \(k,m>0\).

Proof

For convergence, it is sufficient to show that the time component of \(\mathop \sum \nolimits _{n=1}^\infty c_n \hbox {e}^{\alpha _n t}\hbox {sin}n\pi x\) converges to 0. We derive the following inequalities using the properties of the sequences, \(\left\{ {a_n } \right\} \) in (12) and \(\left\{ {c_n } \right\} \) in (16):

Hence, \(\mathop \sum \nolimits _{n=1}^\infty c_n \hbox {e}^{\alpha _n t}\hbox {sin}n\pi x\rightarrow 0\) as \(t\rightarrow \infty \) since \(\hbox {e}^{\alpha _1 t}\rightarrow 0\) given the negativity of \(\alpha _1 \). \(\square \)

Theorem 3.3

Assume that the conditions of Theorem 3.1 hold. Then, \(q^{*}\left( {t,x,k,m} \right) \ge 0\) for all \(t\ge 0\), all \(0\le x\le 1\), and all \(k,m>0\).

To prove this nonnegativity, we need the following Lemma.

Lemma 3.1

There exists \(T>0\) such that \(q^{*}\left( {t,k,x,m} \right) \ge 0\) for all \(t\ge T\) and for all \(0\le x\le 1\).

Proof

To simplify notation, we replace \(q^{*}\left( {t,x,k,m} \right) \) by \(q^{*}\left( {t,x} \right) \). Suppose that there is no such T. Then, there is a sequence \(\left( {t_n ,x_n } \right) \) with \(0\le x_n \le 1\) for all n, and \(t_n \rightarrow \infty \) and \(n\rightarrow \infty \) such that \(q^{*}\left( {t_n ,x_n } \right) <0\) for all n. By passing to a subsequence, we may assume that \(x_n \rightarrow \bar{x} \) as \(n\rightarrow \infty \). If \(0<\bar{x} <1\), then by taking limits, we get that \(\mathop {\lim }\nolimits _{n\rightarrow \infty \hbox {}} q^{*}\left( {t_n ,x_n } \right) =q^{*}\left( {\bar{x} } \right) \le 0\), which contradicts (a) of Theorem 2.2. Therefore, \(\bar{x} =0\) or 1. We treat the case of \(\bar{x} =0\) first. Then, we have:

because \(q^{*}\left( {t_n ,x_n } \right) <0\) and \(q^{*}\left( {t_n ,0} \right) =0\) for all n. However, we find \(\frac{\hbox {d}q^{*}}{\hbox {d}x}\left( 0 \right) >0\) by taking the derivative of (5) with respect to x, which leads to a contradiction. A similar argument holds in case of \(\bar{x} =1\). We have proven the nonnegativity for all \(t\ge T\). \(\square \)

Proof of Theorem 3.3

Suppose that there exists \(\left( {{\bar{t}} , {\bar{x}}} \right) \) with \(q^{*}\left( {{\bar{t}} ,{\bar{x}}} \right) <0\). By Lemma 3.1, it must hold that \({\bar{t}} <T\). Define the open rectangle \(U=\left( {0,1} \right) \times \left( {0,T} \right) \). Note that on the boundary of this rectangle, i.e., on \(\partial U\), \(q^{*}\left( {t,x} \right) \) only takes nonnegative values because of Lemma 3.1. Thus, \(q^{*}\left( {t.x} \right) \) achieves a negative minimum over \({\bar{U}}\) for some interior point, say \(\left( {\hat{t} ,{\hat{x}} } \right) \). But then the Strong Maximum Principle implies that \(q^{*}\) is equal to a negative constant in U and in \({\bar{U}}\) as well by continuity of \(q^{*}\left( {t,x} \right) \). But this contradicts that \(q^{*}\left( {t,x} \right) \) is nonnegative on \(\partial U\). \(\square \)

We note that \(q^{*}\left( {t,x,k,m} \right) \) of the diffusion model converges to the steady-state output \(q^{*}\left( {x,m} \right) \), which is the optimal solution of the purely spatial equilibrium in Theorem 2.1 and has all the properties listed in Theorem 2.2.

4 Conclusions

In this paper, we develop an output diffusion model where a monopoly firm faces both inter-temporal and spatial inertia. The diffusion model has two important results. First, optimal output evolves from zero to its steady state, and during the transition inter-temporal adjustment costs keep supply from instantaneously reaching its steady-state level. Second, as long as there are regional adjustment costs, steady-state output is lower than the simple static monopoly output that neglects these costs. Furthermore, as regional adjustment costs get larger, steady-state output shrinks at all locations. This model suggests a public policy aimed at lowering regional adjustment costs in order to increase supply in all geographic regions. To achieve this goal, one approach would be to invest in infrastructure to lower transportation costs.

References

Tirole, J.: The Theory of Industrial Organization. MIT Press, Cambridge (1988)

Tremblay, V.J., Tremblay, C.H.: New Perspectives on Industrial Organization: With Contributions from Behavioral Economics and Game Theory. Springer, New York (2012)

Fisher, F.F.: The stability of Cournot oligopoly solutions: the effects of speeds of adjustment and increasing marginal costs. Rev. Econ. Stud. 28, 125–135 (1961)

Driskill, R.A., McCafferty, S.: Dynamic duopoly with adjustment costs: a differential game approach. J. Econ. Theory 49, 324–338 (1989)

Dockner, E.: A dynamic theory of conjectural variations. J. Ind. Econ. 11, 377–394 (1992)

Youn, H., Tremblay, V.J.: A dynamic Cournot model with Brownian motion. Theor. Econ. Lett. 5, 56–65 (2015)

Kaimen, M.I., Schwartz, N.L.: Calculus of Variations and Optimal Control in Economics and Management, 2nd edn. Dover, New York (2012)

Finny, R.L., Weir, M.D., Giordano, F.R.: Thomas’ Calculus, 10th edn. Addison Wesley, Boston (2003)

Evans, L.C.: Partial Differential Equations, 2nd edn. American Mathematical Society, Providence (2010)

Acknowledgments

We would like to thank Carol Tremblay for providing helpful comments on an earlier version of the paper.

Author information

Authors and Affiliations

Corresponding author

Additional information

Communicated by David G. Luenberger.

P. De Leenheer: supported in part by NSF-DMS-1411853.

Rights and permissions

About this article

Cite this article

Youn, H., De Leenheer, P. & Tremblay, V. Output Diffusion of the Monopolist Over Time and Space. J Optim Theory Appl 169, 290–298 (2016). https://doi.org/10.1007/s10957-015-0837-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10957-015-0837-2