Abstract

Objectives

This study extends our knowledge on the negative effects of incarceration to the accumulation of wealth by examining whether, how, and how much incarceration affects home ownership and net worth. It also investigates how these outcomes vary with the time since a person was incarcerated and the number of incarceration periods, along with addressing potential mechanisms behind this relationship.

Methods

I apply hybrid mixed effects models that disaggregate within- and between person variation to investigate incarceration’s relationship with home ownership and net worth, using National Longitudinal Study of Youth data from 1985 to 2008. I also incorporate a set of mediation models in order to test for indirect effects of incarceration on wealth through earnings, health, and family formation.

Results

My results show that incarceration limits wealth accumulation. Compared to never-incarcerated persons, ex-offenders are less likely to own their homes by an average of 5 percentage points, and their probability of home ownership decreases by an additional 28 percentage points after incarceration. Ex-offenders’ net worth also decreases by an average of $42,000 in the years after incarceration.

Conclusions

When combined with previous research on incarceration, my findings show that incarceration acts as an absorbing status, potentially leading to the accumulation of disadvantage. Although incarceration’s negative effects on wealth accumulation were partially mediated by its relationship with earnings and family formation, incarceration directly affected home ownership and net worth. In most cases, former inmates began with flatter wealth trajectories and experienced additional losses after incarceration.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Criminologists and sociologists have highlighted the role of incarceration in reproducing inequality in employment, education, voting, and health (Wakefield and Uggen 2010). As a stigmatized legal status, incarceration hinders an offender’s re-integration into society and often becomes a primary status for the evaluation of that person. In addition, state and federal laws limit access to voting rights, employment, and social services for previously incarcerated persons (Manza and Uggen 2006; Samuels and Mukamel 2004). Due to the incarceration of numerous young, minority, and low-income men in the United States, the lingering negative effects of incarceration disproportionately harm members of these groups (Western 2006). As a result, incarceration often exacerbates broader societal inequalities through its negative social status.

The status of an “ex-offender” or “former prisoner” results not only from individual involvement in criminal activity, but also from the criminal justice system’s varying enforcement efforts and responses to charges, which often depend on the crime, its location, and the characteristics of the defendant and the victim (Pettit and Western 2004; Wacquant 2001; Western 2006). Once the status of ex-offender is achieved, however, this status, often referred to as a criminal credential, can lead to long lasting negative consequences for former offenders (Pager 2003, 2007; Wakefield and Uggen 2010). With such negative effects, a previous incarceration can become an overarching absorbing status and the basis for the accumulation of disadvantage over time.

In view of the growing body of research on the contribution of incarceration to inequality, this paper examines whether, how, and how much incarceration affects two indicators of wealth: home ownership and net worth. The persistent negative effects of incarceration in multiple spheres likely spread to areas of wealth accumulation. This can then influence personal wellbeing because wealth confers a variety of advantages, including better neighborhoods, social and cultural capital, and political sway (Bricker et al. 2012; Bucks 2012; Keister 2000a; Keister and Moller 2000). Even a modest amount of wealth can create a safety net for households in times of financial distress (Spilerman 2000).

The many advantages of wealth, along with its unequal distribution in the United States, make it a key site for inequality where wealth disparities remain across many groups today (Bricker et al. 2012; Bucks 2012; Keister 2000a). With their limited access to employment, former prisoners may also face similar barriers to wealth accumulation. Even though it is likely that former prisoners will hold little wealth due to their multiple disadvantaged statuses, we have no research that demonstrates the presence of a relationship between incarceration and wealth accumulation. I seek to remedy this omission by analyzing the association between incarceration and the outcomes of home ownership and net worth using data from the National Longitudinal Study of Youth 1979 cohort.

I begin this paper by drawing on theories of ascription, stigma, and cumulative advantage/disadvantage as well as Pager’s (2003, 2007) concept of the criminal credential in order to introduce incarceration as an absorbing status. I continue by discussing the negative effects of incarceration and my reasons for expecting a link between incarceration and wealth. After describing my measures and methods, which include hybrid mixed effects models, I present findings showing that incarceration is associated with a reduced probability of home ownership and lower net worth. Because I investigate change over time and the potential mechanisms that contribute to incarceration’s relationship with wealth accumulation, a feat that few incarceration studies have accomplished, these findings also demonstrate how the negative effects of incarceration extend into this new area through multiple pathways.

The Status of Incarceration and its Negative Effects

Wakefield and Uggen (2010, 388) described current and former prisoners as a “Weberian status group sharing similar life chances determined by a common and consequential mark of [dis]honor.” This mark of dishonor potentially lasts indefinitely and can outweigh other statuses that a person may prefer to identify with. Incarceration, therefore, acts as a stigmatized status that is formalized through a criminal record or “credential” (Pager 2007). As a result, incarceration can become part of a process of ascription, where roles are assigned and resources are allocated based upon categorical group membership (Kemper 1974; Mayhew 1968).

Incarceration as a Criminal Credential

In defining characteristics as reference points for ascription, researchers often refer to the difference between distributing resources based on personal attributes acquired at birth versus individual performance that can change over time. In reality, this ascription-achievement dichotomy is not always so straightforward where multiple characteristics have been conceptualized as both achieved and ascribed (Cadge and Davidman 2006; Jacobsen and Kendrick 1973; Lorber 1994). The status of an “ex-convict,” “ex-felon,” or “formerly incarcerated person” falls somewhere in between this dichotomy of status acquisition categories, which is encompassed by Pager’s (2007) concept of a criminal credential that limits access to opportunity.

According to Pager (2007), credentials represent formalized status distinctions that can be used to define legal rights or barriers, which legitimizes their use for the distribution of resources. Like a college degree, a criminal credential certifies an individual’s position in society, but unlike a degree, this “earned” credential comes with legal restrictions and a stigma that brands ex-offenders as untrustworthy (Pager 2007; Pettit and Lyons 2007). A criminal credential is achieved once a person is incarcerated for his or her criminal behavior and then released. However, after a person acquires this status, it becomes a lasting marker and a normatively acceptable basis for unequal treatment in a society that purports to treat people as equals. A previous incarceration then becomes a status that works ascriptively by determining the distribution of resources.

Incarceration as a Stigmatized Status

Of course, incarceration is more than an achieved status; it is a stigmatized status. As a stigma, or according to Goffman (1963, 3) “an attribute that is deeply discrediting,” incarceration acts differently than a credential. The term “credential” generally implies the receipt of a positive status, one that a person would choose to share with others. As undesirable characteristics, stigmas are not markers that people choose; stigmas are imposed upon people, usually on people with less power. Stigmas can play a critical role within the process of stratification, particularly when they are used to justify the differential treatment of groups (Link and Phelan 2001).

Like ascription, stigma encompasses a power component. As Link and Phelan (2001, 377) noted: “stigma exists when elements of labeling, stereotyping, separation, status loss, and discrimination occur together in a power situation that allows them.” Current and former prisoners typically come from groups who already lack power, which facilitates passing along this mark of dishonor. Members of less powerful groups are at higher risk of incarceration than others with far reaching effects, which is reflected by the composition of the prison population in the United States (Western 2002, 2006). Prisoners in the United States tend to come from the most disadvantaged groups—groups whose members lack social, economic, and political power (Wakefield and Uggen 2010; Western 2006). They are young, from low-income families, and average less schooling than a high school degree. The prison population also disproportionately comprises racial and ethnic minorities.Footnote 1 It is likely then that the continuing negative effects of incarceration will compound these race and class inequalities, exacerbating the disadvantage of former prisoners.

Absorbing Statuses and the Accumulation of Disadvantage

In order to better describe the status of former prisoners, I borrow the term “absorbing state” from the literature on social mobility, which uses Markov chain models to represent the relationship between social structure and social mobility (Henry et al. 1971; Matras 1967; McGinnis 1968). In these models, the axiom of cumulative inertia predicts that the probability of remaining in a state will increase with the time spent in that state, to the point that some states become finite absorbing states (Henry et al. 1971; McGinnis 1968).Footnote 2 When applied to certain characteristics, this perspective highlights how even achieved statuses can become lasting markers that act as if they were ascribed. The negative effects of incarceration show that it can become an absorbing status that is used ascriptively across multiple spheres of life, leading to a process of accumulating disadvantage.

According to cumulative advantage/disadvantage theory, achieved and ascribed statuses can have persisting effects in returns to resources, leading to diverging outcomes in which some people continually build their resources relative to others. This theory originated with Merton’s (1968, 1988) work on recognition in the scientific community. Since then researchers have applied aspects of cumulative advantage theory to various arenas, including crime and delinquency (DiPrete and Eirich 2006; Sampson and Laub 1997). I use the term accumulating disadvantage broadly to explain the persisting effects of a previous incarceration on a person’s credit market outcomes, similar to Lyons and Pettit’s (2011) use of compounded disadvantage. The negative status of “ex-convict” reflects incarceration’s lingering effects that compound any prior disadvantaged status.

Incarceration’s Far Reaching Effects

The many negative effects of incarceration support a process of cumulative disadvantage that continues after prisoners, who already come from disadvantaged groups, are released. Labor market barriers disadvantage ex-convicts and often lead to segmented labor market access for those with a previous incarceration on their record (Piore 1970; Western and Beckett 1999). Research on labor market outcomes using longitudinal data and administrative records has consistently shown lower employment rates and earnings for previously incarcerated persons, particularly black men (Apel and Sweeten 2010; Freeman 1992, 1996; Kling 2006; Lott 1990; Nagin and Waldfogel 1998; Waldfogel 1994; Western 2002; Western and Beckett 1999; Western and Pettit 2000). Even though wage trajectories begin to recover over time, many years after they are released, previously incarcerated persons earn less and spend more time without employment than persons who have never been to prison (Pettit and Lyons 2007; Western 2002; Western and Beckett 1999). Moreover, the effects of incarceration on labor market outcomes are much greater than the penalties for more limited interactions with the criminal justice system, such as arrests and convictions (Western et al. 2001).

In addition to affecting employability and earnings, incarceration reduces men’s likelihood of marriage and places those who do marry at a higher risk of divorce while they are incarcerated, but not always after incarceration (Apel et al. 2010; Lopoo and Western 2005; Wildeman and Muller 2012). Although they often depend on a family’s situation prior to a paternal incarceration, the consequences of incarceration extend to other family members as well; they often lead to psychological issues for children, in addition to family poverty (Turney and Wildeman 2013; Wildeman 2009, 2010). Inmates have also been shown to experience illness, depression, stress, and other psychological problems at disproportionately higher rates than the larger population (Massoglia 2008a, b). These effects continue and can even worsen long after incarceration (Schnittker and John 2007; Schnittker et al. 2011). Despite a pressing need for social services and aid, former prisoners in many states find that their criminal credential restricts their ability to obtain state support (Samuels and Mukamel 2004). In view of these negative effects and added restrictions, it seems likely that incarceration could further disadvantage former prisoners in their ability to accumulate wealth.

Incarceration and Wealth

I investigate a potential consequence of incarceration that has not been studied: whether incarceration limits wealth accumulation. With its basis in various types of property ownership, wealth shapes people’s economic and personal wellbeing, creates more stability than income, and provides benefits that extend to many areas (Keister 2000a; Spilerman 2000). For example, home ownership can provide access to better neighborhoods and school systems, assets can increase social networks, and the ownership of various goods heightens social status (Keister 2000a; Spilerman 2000).

Due to these advantages, I focus on wealth accumulation and examine the effects of a previous incarceration on home ownership and net worth. Specifically, my research addresses the following questions: How does incarceration affect the accumulation of wealth for formerly incarcerated individuals? Does the time since a person was incarcerated influence these outcomes, as a process of accumulating disadvantage implies? Do these outcomes vary by the length of an incarceration or the number of incarceration periods? Finally, what are the potential mechanisms behind this relationship? This mark has been shown to shape labor market outcomes, and I expect that a previous incarceration will present a negative association with a person’s probability of home ownership and accumulation of net worth through multiple related pathways.

Disadvantage for previously incarcerated persons operates through numerous mechanisms. These include selection barriers, such as ex-offenders’ limited education, skills, and work experience; ex-offenders’ physical, mental, drug, and motivational problems; discrimination by employers and other gatekeepers; and the stigmatization of formerly incarcerated persons (Holzer et al. 2003; Pager 2007; Western et al. 2001). Although secondary data analyses seldom address which of these mechanisms furthers disadvantage, audit studies emphasize the barriers generated through employer discrimination that ex-offenders face in the labor market. Audit studies of employers in Milwaukee and New York showed that employers were one-half to one-third less likely to consider an ex-offender for an open position than an equally qualified person without a criminal credential, controlling for race (Pager 2003, 2007; Pager et al. 2009).

The individual and structural factors that limit the employability of previously incarcerated persons could also affect their ability to accumulate wealth, particularly if, like employers, lenders interpret a previous incarceration as a signal of untrustworthiness or instability (Holzer 1996; Holzer et al. 2003; Pager and Quillian 2005). In this case, a previous incarceration would limit access to lending, a general requirement for wealth building, but incarceration affects wealth in other ways as well. Recent research on legal financial obligations (LFOs) demonstrates how the criminal justice system imposes added debt burdens on offenders through the use of heavy pre- and post-conviction fines and fees that ex-offenders often cannot afford to pay (Harris et al. 2010, 2011). Furthermore, incarceration limits an individual’s ability to make payments, which could lead to debt delinquency, negative reports from collection agencies, and limitations on future lending. Thus, I expect that the stigmatized status of incarceration will directly limit wealth accumulation for previously incarcerated persons. I also expect that these effects will worsen over time and with additional periods of incarceration, as former prisoners fall farther behind. With these expectations, I expand on Harris et al. (2010) research to demonstrate the broader implications of incarceration for wealth accumulation beyond fees imposed by the legal system.

Because it acts as an absorbing status that affects multiple areas of life, incarceration should also limit wealth accumulation through multiple pathways or mechanisms. Several of these mechanisms operate with respect to a person’s absence from the labor market. For instance, increased earnings are positively associated with home ownership and wealth accumulation (Keister and Moller 2000). The lost work experience that incarceration imposes and its consequences for earnings later on can also impede a person’s ability to accumulate assets and develop a credit history. Because family formation often leads to wealth accumulation and home ownership (Bricker et al. 2012), incarceration should affect wealth through its relationship with marriage. Finally, the added problems created by the health limitations of formerly incarcerated persons should also affect wealth accumulation. Overall, I expect that ex-offenders’ stigmatization, lost earnings, limited marriage prospects, and added health limitations will all lead to post-incarceration wealth reductions.

Data

I use the 1979 cohort of the National Longitudinal Study of Youth (NLSY79) to estimate the effects of incarceration on credit market outcomes.Footnote 3 The NLSY79 cohort is a stratified multistage sample of 12,686 men and women who were between 14 and 22 years old when first surveyed in 1979.Footnote 4 Respondents were interviewed annually until 1994, after which they were interviewed every 2 years. The survey is ongoing with debt and asset data most recently collected in 2008.

My data take the form of an unbalanced panel sample in which the number of time periods may differ across individuals. I restrict my sample to 1985 through 2008 and I exclude data from 1991, 2002, and 2006 because the NLSY did not consistently collect data on assets and debt over time. After removing years when wealth questions were not asked, individuals from the military oversample, observations with missing data, and extreme outliers on net worth, a sample of 10,274 individuals (or cases) and 96,180 observations (or person-years) remained. My sample therefore covers over 90 percent of respondents from the original 11,406 individuals who were not a part of the military subsample.

Methods

For my analyses, I use hybrid mixed effects regression models that include fixed effects for time-varying covariates and random effects for time-invariant covariates, which allow me to disaggregate within- and between-person variation in the same models (Allison 2009). These models take the form of random effects models—also known as multilevel varying-intercept, mixed, and hierarchical models— that account for correlated disturbance terms for the same person over time by assigning each person a separate intercept (Allison 2009; Gelman and Hill 2007). I incorporate fixed effects for time-varying covariates within each model by expressing these variables as deviations from their person-specific means, which represent the within-person variation across time periods (Allison 2009). I also include the person-specific means in order to provide estimates based on the average between-person variation.

By incorporating the deviations from person-specific means for time-varying covariates along with the person-specific means into each model, I am able to discuss the variation of a particular score for an individual in the sample (or the average of the average change in a score for an individual over time) as well as the variation in the average score across individuals. This allows me to control for unobserved, stable, time-invariant, individual-level characteristics while assessing the effects of time-varying and time-invariant factors (Allison 2009). Hybrid mixed effects models, therefore, help to overcome the limitations of separate fixed and random effects models, yet they provide estimates consistent with both procedures.Footnote 5

Equation 1 represents the general random effects model for continuous data, which I use to estimate an individual’s net worth at time, t,Footnote 6

where i indexes the individual respondent and t indexes yearly observations per individual. In this equation, \(\mu_{t}\) represents the time-varying intercept, \(\gamma Z_{i}\) represents vectors of the time-invariant coefficients and predictor variables, \(\beta X_{it}\) represents vectors of the time-varying coefficients and predictor variables, and \(\varepsilon_{it}\) is the error term that represents random variation at each point in time. These models assume that \(\alpha_{i}\), which is treated as a set of random variables with a specified probability distribution, is independent of all other variables in the model.

I then partition the within- and between-person variation through person-specific mean-centering of the time-varying predictors in Eq. 1 (Allison 2009; Curran and Bauer 2011). The process of person-specific mean-centering controls for unobserved heterogeneity in time-varying covariates by decomposing these variables into their within- and between-person variation. Equation 2 illustrates this process,

where \(x_{it}^{*}\) represents the person-mean centered time-varying covariate, \(x_{it}\) is the original score for individual i at time t, and \(\overline{x}_{i}\) represents the person-specific mean for individual i. I include both components in the models, and report the coefficients for within-person and between-person variation separately. I also report random effects coefficients for time-invariant covariates in the model. Although I report coefficients for both levels, I primarily discuss the within-person effects in my results. Equation 3 summarizes this full model, which now includes coefficients and vectors for \(X_{it}^{*}\) and \(\overline{X}_{i}\).

I also incorporate an autoregressive disturbance term to account for the correlation of error terms within persons over time. The error term is described by Eq. 4:

where \(\left| \rho \right| < 1\) and \(\eta_{it}\) is independent and identically distributed with mean 0 and variance \(\theta_{\eta }^{2}\).

I include a set of mediation models in order to also test for indirect relationships between incarceration and wealth at both the within- and between-person levels. The most common method for calculating indirect effects involves estimating two equations for the outcome variable, one that includes the mediator and one that does not, and then finding the difference in coefficients for the initial variable across the two equations (Krull and MacKinnon 2001).Footnote 7 However, this method often produces biased estimates for non-linear models, including logit models with binary outcomes, because the coefficients and error variance are not separately identified (MacKinnon and Dwyer 1993). In order to estimate indirect effects and overcome these biases, I apply Karlson et al. (2011) KHB-method that accounts for model rescaling (Breen et al. 2013; Karlson and Holm 2011). This allows me to then discuss both the direct and indirect effects of incarceration on wealth accumulation.

Measures

Outcome Variables

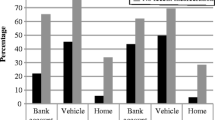

My first outcome variable is home ownership, that is, whether the respondent owns or makes payments on his or her dwelling. Most families’ major sources of wealth are their homes, and home ownership provides benefits that include residential stability, tax breaks, and access to schooling (Keister 2000a; Shapiro 2004; Spilerman 2000). Moreover, home ownership entails access to mortgage lending, which generally requires both an income and a strong credit history. As illustrated by Table 1, the gap in home ownership rates by incarceration status is obvious; 24 percent of ever-incarcerated respondents owned their homes in 2008 compared to 67 percent of never-incarcerated respondents.

I use a measure of net worth in 2010 dollars as my second outcome variable. The survey calculates net worth by subtracting the respondent’s total debts from the total value of all assets.Footnote 8 Using wealth data as my outcome variable creates certain limitations. As Spilerman (2000) noted, wealth figures in representative surveys can be inconsistent due to the complexity of wealth, a lack of standardization across surveys, and the difficulty many respondents have in estimating their wealth. In order to address these limitations, I exclude extreme outliers on these variables and remove cases with missing data.Footnote 9 I also limit my analysis to variables consistently collected in the survey. Similar to home ownership, Table 1 shows a gap of approximately $173,000 in net worth by incarceration status. The disparity is smaller in terms of median net worth; the median net worth of ever-incarcerated respondents in 2008 was $507 compared to $92,000 for never-incarcerated respondents.

Predictor Variables

My primary predictor variable measures the respondent’s incarceration status as whether the respondent was previously incarcerated prior to the current time period. The NLSY provides information on incarceration through two measures. The 1980 survey, which included an extensive set of questions related to illegal activity, asked respondents if and when they were incarcerated. The NLSY also records a respondent’s residence each year, including whether the person resided in a jail or prison at the time of the interview.Footnote 10 I use these two measures to create a variable that indicates whether the respondent was ever incarcerated as an adult over 18 years of age at each time point. To ensure that my estimates of the effects of incarceration apply only to people who were previously incarcerated, I control for whether the respondent was incarcerated at the current survey wave. As Table 1 shows, approximately six percent of NLSY respondents had been incarcerated by 2008.

I also test two categorical variables that encompass different aspects of incarceration because the effects of incarceration on wealth accumulation can vary based upon the timing of incarceration, as well as the length and number of incarceration spells. Therefore, in order to estimate the accumulating effects of incarceration over time, I created a categorical variable that measures a respondent’s time since incarceration. This variable has six categories: never incarcerated, currently incarcerated, incarcerated in the past year, incarcerated one to 5 years ago, incarcerated 6–10 years ago, and incarcerated more than 10 years ago. In addition, I created a categorical variable to measure the effects of multiple incarcerations and the length of an incarceration. This variable has five categories: never incarcerated, currently incarcerated, previously incarcerated for one survey-year, incarcerated for 2–4 survey-years, or incarcerated for five or more survey-years.Footnote 11

Time-Varying Covariates

I include time-varying covariates for demographic, employment, health, family, and regional variables commonly used in studies that predict wealth and earnings (Keister and Moller 2000; Kenworthy 2007). I control for an individual’s labor market situation by including the respondent’s employment status, cumulative job gaps, and earnings. I categorize employment status as employed full-time (35 or more hours per week), employed part-time (less than 35 h per week), unemployed, and out of the labor force, with individuals employed full-time as the referent category. I measure a respondent’s cumulative number of job gaps lasting 8 weeks or more using a categorical variable with the following categories: no job gaps, a single job gap, and multiple job gaps. I use the respondent’s earnings in thousands of 2010 dollars, unless noted otherwise. I also include measures that indicate whether the respondent was employed in a government job or was self-employed.

I control for the respondent’s age, education, marital status, presence of children, and health limitations. Because the age of this sample is truncated at 51 years, I expect a positive effect of age on wealth, but I also include a quadratic age-squared term in order to account for any non-linear relationships (Dynan and Kohn 2007; Modigliani 1986).Footnote 12 I measure education as the number of completed years of schooling because that is how the NLSY collected education information. Marital status indicates whether the respondent was married, formerly married (separated, divorced, or widowed), or never married. I treat any children and health limitations as binary variables. Marriage, the presence of children, and added education should increase wealth, but marriage dissolution and health limitations should have the opposite effect (Bricker et al. 2012; Dynan and Kohn 2007; Smith 1999).

Time-Invariant Covariates

I include time-invariant covariates for the respondent’s sex, race, AFQT score, and teenage drug use, covariates that do not change over time and that could affect a respondent’s likelihood of incarceration and his or her ability to accumulate wealth. Incarceration rates differ greatly by a person’s race and sex (BJS, 2010; Carson and Sabol 2012; Western 2006), as does wealth accumulation (Keister 2000b; Krivo and Kaufman 2004). I therefore measure sex as a dichotomous variable of male or female and race as two dichotomous variables, black and Hispanic origin.

AFQT score refers to the respondent’s Armed Forces Qualification Test percentile score, which the survey collected for each respondent in 1980. Although AFQT score has been a controversial measure of intelligence, it offers a standardized measure of cognitive aptitude and school-based knowledge (Farkas 2003; Maume et al. 1996; U.S. Department of Defense 1982). I also include three binary variables that indicate whether the respondent reportedly used marijuana, cocaine, or other drugs as a teenager, which can relate to a person’s level of self control that influences employment and potentially wealth accumulation (Gottfredson and Hirschi 1990). The category of other drugs includes heroin, psychedelics, inhalants, and any other drugs.

In addition to these time-invariant covariates, I also include indicator variables to designate the cross-sectional sample and survey wave year. The cross-sectional sample variable indicates whether the respondent was a member of the original cross-sectional sample, where the referent category refers to members of this sample. The survey-year variable is an indicator variable with 14 categories where the referent is the most recent wave (2008). I include this variable to account for any unobserved period effects.

Findings

Incarceration was negatively associated with both measures of wealth accumulation across analyses. Formerly incarcerated individuals generally had lower average wealth, as measured in terms of home ownership and net worth, than individuals who had never been to prison. Moreover, formerly incarcerated persons averaged less wealth in the years after incarceration compared to the years before. In most cases, former inmates began with flatter wealth trajectories, partly due to their already disadvantaged statuses, lower levels of education, and limited earnings, and they experienced additional losses after incarceration. My findings therefore emphasize how prior disadvantages are then compounded by incarceration.

Home Ownership

Net of time-invariant individual characteristics accounted for by within-person fixed effects coefficients, formerly incarcerated persons were less likely to be homeowners in the years after incarceration compared to the years before. As illustrated by the between-person random effects coefficients that controlled for earnings, employment, family, and education, ever-incarcerated persons were also less likely than similar never-incarcerated persons to own a home at any point between 1985 and 2008. These results appear in Table 2, which uses whether the respondent was previously incarcerated to predict home ownership.

All models in Table 2 include time-invariant covariates, but in Models 1–3, I sequentially added certain time-varying covariates in order to observe changes in the effects of a previous incarceration on home ownership. Model 1 controls for only age and its quadratic term, Model 2 includes family and health covariates, and Model 3 (the full model) includes controls for employment and earnings. Adding controls decreased the magnitude of the coefficients for incarceration, but across all models a previous incarceration showed a significant negative association with home ownership, as evidenced by the coefficients representing within- and between-person variation. This means that, on average, the probability of home ownership was lower for people who experienced incarceration, and, among those who were incarcerated at one point, the average probability of home ownership decreased in the years after being incarcerated.

Net of control variables, the average probability of home ownership was only about 5 percentage points lower for respondents with a previous incarceration when compared to similar never-incarcerated individuals. Moreover, for those who were incarcerated, the average probability of home ownership decreased by approximately 28 percentage points in the years after incarceration, an estimate that corresponds to the within-person coefficient for incarceration in Model 3.Footnote 13 It is also important to note that these estimates do not include currently incarcerated individuals, who experienced even larger declines in the probability of home ownership.

As seen in Model 3, most time-varying and time-invariant control variables were statistically significant and associated with home ownership in the expected direction. Marriage, the presence of children, employment, and earnings were all positively associated with home ownership. Age showed a curvilinear relationship with home ownership, in which its effects decreased over time. As expected from the literature on race and wealth, blacks and Hispanics had a lower average probability of home ownership than other racial groups. Additionally, most teenage drug use variables were not significantly associated with later home ownership, except for cocaine use, which showed a negative association. Finally, AFQT scores had a positive association, albeit a small one.

To better understand the effects of incarceration on home ownership, Table 3 displays the results from models that considered the time since a person was incarcerated and the length of incarceration. The timing and length of incarceration showed a stronger and more consistent association with home ownership when comparing individuals before and after incarceration, as opposed to comparing average outcomes for previously and never-incarcerated persons. In addition, the negative effects of incarceration on home ownership seem to increase over time, as a theory of accumulating disadvantage would predict.

As shown in Table 3 Model 1, the effects of incarceration on home ownership increased over time, but not by much. Most of the between-person coefficients were not significantly different from zero. In terms of the within-person coefficients, the gap in the predicted probability of home ownership was greatest for currently incarcerated individuals and persons incarcerated over ten years ago, at 21 and 25 percentage points. This indicates that the negative effects of incarceration continue well after a person is released. Model 2, which partitions incarceration based on the number of survey-years for which the respondent had been incarcerated, shows fairly consistent disparities in home ownership, except for respondents who were incarcerated for more than 4 survey-years. However, the currently incarcerated population likely influences this outcome because over half of all currently incarcerated observations at time t were incarcerated for more than four survey-years.

Net Worth

Table 4, which presents the results from hybrid mixed effects regression models predicting total net worth, shows that the effects of incarceration on wealth accumulation extend beyond home ownership. Although the interpretation varied when comparing between- and within-person coefficients, net of stable unobserved individual characteristics and of observed control variables that change over time, incarceration was also associated with a decrease in net worth.

As seen in Model 1, when controlling for only age and time-invariant covariates, previously incarcerated individuals had an average net worth that was $28,000 less than that of never-incarcerated individuals, and, for those with an incarceration, their net worth was about $67,000 less in the years after incarceration compared to the years before. This disparity declined, but still remained statistically significant, after controlling for family and health aspects in Model 2. When I incorporated additional controls in Model 3, the between-person coefficient was no longer associated with net worth, indicating that differential rates of employment, earnings, and home ownership explain much of the average disparity in net worth across never- and formerly-incarcerated individuals. However, the within-person coefficient for incarceration showed that, even after controlling for labor market aspects and home ownership—by far the largest contributor to wealth—net worth decreased by approximately $42,000 in the years after incarceration.

Most time-varying and time-invariant covariates were significantly related to the outcome variable in the expected direction. For example, marriage, earnings, education, and home ownership were positively associated with between- and within-respondent net worth disparities over time. In terms of time-invariant covariates, blacks and Hispanics held lower net worth than non-blacks and non-Hispanics, which demonstrates the continuing gaps in racial wealth. However, there were several variables that did not affect net worth in the expected direction. In this model, use of cocaine as a teenager was positively associated with net worth, although this variable was negatively related to home ownership in Table 2. Unemployment also showed a positive relationship with net worth, but this association was positive only in models that controlled for income and education, as Model 3 does.

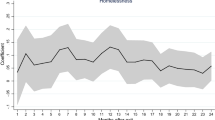

Replicating the analysis for home ownership, Table 5 presents models that consider the time since a person was incarcerated (Model 1) and the length of incarceration (Model 2). Interestingly, the between-person coefficients in this table indicate that the timing and length of incarceration were not associated with average net worth between ever- and never-incarcerated persons, but the within-person coefficients show that, net of stable unobserved individual-level characteristics, the negative effects of incarceration grew over time and with the length of incarceration. For instance, formerly incarcerated persons had a net worth of approximately $105,000 less, on average, in the years where they were incarcerated 11 or more years ago, when compared to the years prior to their incarceration. However, the gap for those incarcerated 1–5 years ago was about $45,000. In terms of the length of incarceration, having spent 5 or more survey-years in prison was associated with a $71,000 decrease in net worth, compared to the years prior to incarceration, a value more than double that of those who were incarcerated for only one survey-year. These results therefore partially support my expectation that incarceration’s negative effects on net worth would increase over time and with the length of incarceration.

Potential Mechanisms

Isolating the effects of any single variable is a complex process, particularly in the case of incarceration because it affects so many aspects of a person’s life. It decreases education and employment opportunities, impedes family formation, and leads to physical and psychological health limitations (Wakefield and Uggen 2010). Incarceration is also implicated in the broader U.S. race discrimination system (Reskin 2012). Incarceration, therefore, acts a cause and consequence of multiple aspects within my models, which complicates my ability to extract specific mechanisms, but it also supports incarceration’s role as an absorbing stigmatized status.

In the case of wealth accumulation, other areas, such as the family or labor market, can act as mechanisms that influence home ownership and net worth for former prisoners. Tables 2 and 4 show that multiple covariates influence the relationship between incarceration and wealth accumulation, as the coefficients for incarceration decreased with the addition of controls across Models 1–3. Due to its absorbing status, it is likely that incarceration affects other family, employment, and health variables, which in turn influence net worth and home ownership. Therefore, in order to parse out some of these potential pathways, I also tested for mediating effects with marital status, earnings, health, and home ownership for a previous incarceration.Footnote 14

The model results that appear in Tables 6 and 7 show that the total effect of incarceration on wealth outcomes is much greater than just its direct effect, once indirect effects are also considered. These tables present coefficients for a previous incarceration’s total and direct effects on home ownership (Table 6) and net worth (Table 7), as well as the indirect effects of a previous incarceration on the outcome variables through the listed mediating variables. In addition to coefficients, I also include estimates of the relative percentage of the total effect explained by the decomposed relationships.

Except for the between-person effects for net worth, the direct effects of incarceration accounted for the majority of its effects on wealth, but they played a larger role in explaining home ownership than net worth. The indirect effects through marriage, earnings, and health limitations explained 14 percent of the within-person effects and 23 percent of the between-person effects for home ownership. These variables, along with home ownership, accounted for 35 percent of the within-person effects and 99 percent of the between-person effects for net worth.

Marriage was a strong and consistent predictor of home ownership and net worth in all models (Tables 2, 4). Marriage also mediated the relationship between incarceration and home ownership (Table 6), but not between incarceration and net worth (Table 7). Incarceration presented additional indirect effects on home ownership and net worth via earnings, which was positively associated with home ownership and net worth in all cases (Tables 2, 4). However, earnings was a much stronger mediating variable for the relationship between incarceration and net worth, than for home ownership, accounting for 17–40 percent of the total effects in terms of net worth. Finally, although health limitations generally showed a negative association with wealth outcomes, the indirect effects related to a previous incarceration were negligible. Overall, though, health limitations may not be the best measure of health status because they often refer to certain disabilities, not specific illnesses or diseases.

Home ownership, as one of the major sources of wealth for most people, was by far the strongest mediator between incarceration and net worth (Table 7). This relationship likely explains many of the non-significant effects of incarceration on net worth in Model 3 in Table 4, which controls for home ownership. In addition, the indirect effects of incarceration on net worth through home ownership were very large, in terms of both within- and between-person variation.

In summary, the mechanisms behind these incarceration effects resemble those implied by labor market research, which include ex-offenders’ limited education, skills, and work experience and their physical, mental, drug, and motivational problems (Holzer 1996; Holzer et al. 2003; Pager 2007). I control for many of these mechanisms by including certain covariates in my models and by focusing on within-person variation over time. I also test for indirect relationships between marriage, earnings, health limitations, and wealth outcomes. I find that, by reducing ex-offenders’ labor market experience and earnings, as well as their marriage prospects, incarceration limits their opportunities to accumulate wealth. Incarceration’s effects on wealth are also related, where home ownership mediates its relationship with net worth.

Beyond these mechanisms and mediating relationships, current and previous incarcerations were directly associated with wealth outcomes. This occurs in part because time in prison reduces a person’s opportunity to accumulate wealth and debt by removing him or her from society. In this situation, growing legal debt, hiatuses, and periods without spending money, concomitants of incarceration, can negatively affect future wealth accumulation. In addition, the fact that conviction and incarceration leave a “record” means that the absorbing status of incarceration confers a stigma that restricts a person’s ability to re-enter society and start over. In view of evidence that discrimination and the general stigmatization of formerly incarcerated persons limit their labor market outcomes (Pager 2003, 2007), it follows that incarceration could directly diminish wealth accumulation through similar pathways.

Discussion

My findings further confirm incarceration’s continuing negative effects on people’s post-incarceration lives. In addition to employment disadvantages, previously incarcerated persons also face disadvantages in accumulating wealth, an area of growing interest for researchers (Turney and Schneider 2014). My findings show that, in most models, people who had spent some time in prison were less likely to own their homes and often accumulated less wealth than similar individuals who had never been incarcerated, net of unobserved individual aspects and other time-varying and time-invariant indicators. More importantly, formerly incarcerated persons were less likely to be homeowners and held less wealth on average in the years after incarceration than in the years prior to their incarceration.

Beyond illustrating this basic relationship, my findings highlight many of the nuances in incarceration’s association with wealth accumulation. This relationship was largely mediated by the effects of incarceration on marriage, and earnings, as well as by home ownership in the case of net worth. Across models, I also allowed the effects of incarceration on home ownership and net worth to vary based on the person’s time since incarceration and length of incarceration. These findings showed that the effects of the timing and length of incarceration did not differ between never- and ever-incarcerated persons, net of control variables. In terms of within-person variation, persons incarcerated longer ago and for more survey-years had lower rates of home ownership and levels of net worth, which is consistent with the accumulation of disadvantage.

Through the use of hybrid mixed effects models, this paper also offers a methodological contribution to research on the consequences of incarceration. Hybrid mixed effects modeling helps to isolate the effects of incarceration because it generates estimates that control for all unobserved time-invariant individual-level characteristics, as well as estimates that can be used to compare average differences across similar individuals and deal with issues of selection into incarceration. These models therefore address the common concerns about identifying the effects of incarceration when it is often correlated with other disadvantaged statuses. With these methods, I was also able to estimate coefficients for time-invariant covariates that include measures for sex, race, and, at least crudely, for past drug use and cognitive ability. Thus, incarceration was related to a person’s wealth net of his or her earnings, age, education, race, or sex, key variables that also affect a person’s probability of incarceration.

Because I do not have counterfactual cases (i.e., outcomes for identical persons who had never been incarcerated) with whom I can compare wealth outcomes, I cannot truly infer causality in my findings. Issues of dynamic selection may affect these results where the time-varying factors that influence an individual’s likelihood of incarceration can also shape his or her ability to accumulate wealth (Bjerk 2009). In order to address this issue, I conducted a series of sensitivity analyses using data from the NLSY 1997 cohort to look at how arrests, convictions, and incarceration periods connect to wealth outcomes (see the Supplemental Appendix for analyses). I could not employ as rigorous models with these data due to the age of the cohort, whose members were born between 1980 and 1984, and the collection of wealth information, which occurs at five-year intervals. However, I was able to compare wealth outcomes for respondents at age 25 based upon multiple types of interactions with the criminal justice system, including arrests, convictions, and incarceration periods. Across models with a variety of controls, arrests and convictions were often negatively associated with asset and debt outcomes, but previous incarcerations generally presented much larger negative associations in these data. Thus, when combined with these sensitivity analyses, my results strongly suggest that incarceration directly and indirectly limits wealth accumulation more so than other sanctions.

My findings are robust and stable across various NLSY79 samples as well. In addition to my analyses of the full NLSY79 sample, I estimated the same models using the cross-sectional sample with and without sampling weights and using full samples where I employed multiple imputation procedures to account for missing data (see the Supplemental Appendix for analyses). The general rates of home ownership, levels of net worth, and rates of incarceration varied across these samples, but the results for these models were analogous to those from the full complete-case sample. Incarceration presented a consistent negative association with wealth outcomes that varied by the timing and length of incarceration.

Despite my use of multiple models and data samples, the structure of the data and the measurement of incarceration still impose limitations on my results. The structure of the NLSY, which is a cohort sample of persons who aged together over time and experienced similar macroeconomic trends, limits the generalizability of my findings. While I expect previously incarcerated persons of any cohort to accumulate limited wealth, the disparities will vary based upon the broader economic and political situation. In particular, my analysis ends before the recent recession that likely exacerbated group disparities in wealth.

Due to the available measures of incarceration, these findings provide limited, and likely conservative, estimates of the effects of incarceration on home ownership and wealth accumulation. My measure underestimates the rate of incarceration for this sample because it captures only whether the respondent was incarcerated at the time of the survey interview. Many respondents may have also “aged-out” of the key at-risk population for offending prior to the years of increasing mass incarceration in the United States. Additionally, the data do not include the reason for incarceration, which may affect incarceration’s relationship with home ownership and net worth. Thus, my results might not generalize across all types of criminal activity.

Conclusion

My results show that incarceration directly and indirectly disadvantages previously incarcerated persons in terms of wealth accumulation. Compared to never-incarcerated persons, ex-offenders are less likely to own their homes by an average of 5 percentage points, and specifically after incarceration, when compared to their average probability of home ownership prior to incarceration, the probability decreases by 28 percentage points. Former prisoners have a lower net worth, which also decreases by an average of $42,000 in the years after incarceration. Thus, my research shows that, in terms of home ownership and net worth, previously incarcerated persons begin on worse trajectories and experience added negative effects on these outcomes after being incarcerated.

Outside of these substantive contributions, this paper offers a theoretical contribution by bringing together ascription, stigma, and cumulative advantage in order to show how incarceration acts as an overarching absorbing status. I use the term “absorbing status” to indicate first, how an achieved status, such as incarceration, can act as if it were ascribed, and second, how ascription is linked with the accumulation of disadvantage. Once achieved, a previous incarceration becomes a stigmatized mark of dishonor that brands a person as untrustworthy. When stigmatized and credentialized, incarceration status can have far-reaching, cumulative effects. The extension of its negative effects to multiple areas, in which it may not be a useful predictor of performance or trustworthiness, indicates that once achieved, this status in many ways acts as if it were ascribed. Through this process incarceration can feed into a system that continually disadvantages members of certain groups.

My findings are consistent with a model of accumulating disadvantage, where certain statuses lead to the accumulation of disparities. In particular, the differences in net worth depend on the previously incarcerated person’s time and length of incarceration. As shown by models that included these measures, the effects of incarceration on net worth were more pronounced later on and with longer periods of incarceration. The effects of incarceration on wealth accumulation were incredibly long lasting. Due to the nature of the NLSY data, respondents who were incarcerated longer ago were also incarcerated at a younger age. Thus, there has been more time for the status of incarceration to affect multiple areas of their lives.

My research shows that disadvantage can also be compounded when the negative effects of different statuses build upon each other. Enduring wealth barriers already impede the social and economic mobility of individuals from disadvantaged race and class groups. Income and education are associated with wealth (Dynan and Kohn 2007; Keister 2000a). Black/white racial wealth disparities that exceed income disparities continue today as white families pass on more wealth to their offspring than black families (Conley 1999; Oliver and Shapiro 1997; Shapiro 2004). Significant disparities in wealth accumulation, home ownership rates, and home equity also exist between white and Hispanic households (Flippin 2001; Krivo and Kaufman 2004; Campbell and Kaufman 2006). Having been incarcerated adds to these inequalities.

In my models, earnings and race were consistently associated with home ownership and net worth; when combined with incarceration status, low-earnings and racial minority status added to this disadvantage. My mediation models also demonstrated how incarceration indirectly affected wealth accumulation through its negative effects on other areas, including the labor market. The additive negative consequences of disadvantaged statuses on wealth outcomes are obvious in this paper. Disadvantage then not only accumulates over time for previously incarcerated people, but incarceration also adds to the obstacles already in place for some of the least advantaged people.

With the multiple mechanisms behind my findings, this research provides further evidence that incarceration is an absorbing status by demonstrating the continuing disadvantage that ex-convicts face after they complete their prison sentences. Incarceration is associated with diminished education and employment opportunities, stagnant earnings, health problems, and family breakup for many former offenders (Wakefield and Uggen 2010). I add home ownership and net worth to this growing list. My findings, when taken in conjunction with those focused on the effects of incarceration on labor market, health, family, and political situations, portray a criminal justice system that places additional burdens on some of the more disadvantaged and less powerful members of society in conjunction with incarceration’s absorbing status.

Notes

In 2011 the incarceration rate for black non-Hispanic males ranged between 5 and 9 times that of white non-Hispanic males, depending on the age group, and the rate for Hispanic males was two to three times that of white non-Hispanic males (Carson and Sabol 2012). The largest disparities occurred for younger age groups.

In the vacancy chain literature, a vacancy is created when a new resource unit enters a population and an individual leaves his or her unit behind to take that new position (Chase 1991; White 1970). This move initiates a sequence of moves as other individuals in the chain transfer into the vacant units. Within a vacancy chain an absorbing state acts as the end state or the termination of a chain.

In using this longitudinal survey I expand upon the research of Freeman (1992), Western and Beckett (1999), Western (2002), and the more recent work of Massoglia et al. (2013). These studies applied fixed effects models to NLSY data to investigate the effects of incarceration on labor market outcomes.

The original sample comprised a cross-sectional sample of 6,111 respondents, a supplemental sample of 5,295 respondents that oversampled civilian Hispanic, black, and economically disadvantaged non-black/non-Hispanic youth, and a military sample of 1,280 respondents (NLSY79 User’s Guide). I use the full dataset except for the military sample in my analyses to observe as many incarcerations as possible. I also include a variable in all models to indicate whether the respondent was a member of the cross-sectional sample.

Although the coefficient estimates are consistent with both procedures, they are not identical. In particular, the fixed effects coefficients vary from the within-person coefficients because my data are unbalanced. Random effects coefficients differ from the between-person coefficients because random effects models do not purely rely on between-person variation. They also consider some within-person variation.

I use a logit form of this equation to estimate an individual’s probability of home ownership at time, t.

The basic “product-of-coefficient” method is another popular way to estimate indirect effects (Bauer et al. 2006; Krull and MacKinnon 2001; Zhang et al. 2009). Estimates obtained using the additive and the product-of-coefficient methods are usually equivalent for linear outcomes in single-level models, but they often diverge in multilevel and nonlinear models (Krull and MacKinnon 2001; MacKinnon and Dwyer 1993).

The NLSY calculates net worth with the following equation: NET WORTH = HOME VALUE − MORTGAGE − PROPERTY DEBT + CASH SAVING + STOCKS/BONDS + TRUSTS + BUSINESS ASSETS − BUSINESS DEBT + CAR VALUE − CAR DEBT + POSSESSIONS − OTHER DEBT + IRAs + 401Ks + CDs. Net worth also includes the respondent’s spouse’s assets and debt. In order to account for this, I include marital status as a control variable in all full models. I also estimated additional models for a subset of respondents who were never married, and I tested for interactions between incarceration and marital status. In these models, the effects of incarceration remained statistically significant and negative.

I removed cases with a total net worth greater than $2 million or less than −$2 million 2010 USD. This removed 313 cases.

Because interviews record whether the respondent was incarcerated only at the time of the interview, my measure of incarceration misses persons who were not imprisoned at the time of the interview, but spent some time in prison during that year.

Because the survey reports whether the respondent was incarcerated only at the time of each interview, I am not able to determine whether being incarcerated for multiple survey-years refers to a single multi-year incarceration spell or multiple separate incarceration spells. For example, a respondent who was incarcerated for two survey-years could have been incarcerated two separate times for a few months that coincided with when the interview occurred, or the respondent could have been incarcerated for two full years. Either situation would place this respondent in the category of incarcerated for two to four survey-years.

Age also acts as a proxy for time or year because the NLSY is a longitudinal cohort sample.

These estimates represent the effects of covariates at the mean of the data as determined by the intercept, which gives the predicted probability of home ownership when all variables are held at their means for continuous variables and referent categories for categorical variables. This estimate specifically applies to the 2008 survey wave because that is the referent category for the survey wave year variable. To obtain the upper bound of the predictive difference we can also divide the coefficient by four to approximate the difference at which the slope of the logistic curve is maximized (Gelman and Hill, 2007). Doing so provides the values of −0.14 and −0.34 for the between- and within-person coefficients for previous incarceration.

To simplify this set of analyses, I coded marital status as currently married or not currently married for the mediation models.

References

Allison PD (2009) Fixed effects regression models. Sage Publications, California

Apel R, Sweeten G (2010) The impact of incarceration on employment during the transition to adulthood. Soc Probl 57(3):448–479

Apel R, Blokland AAJ, Niewbeerta P, van Schellen M (2010) The impact of imprisonment on marriage and divorce: a risk set matching approach. J Quant Criminol 26:269–300

Bauer DJ, Preacher KJ, Gil KM (2006) Conceptualizing and testing random indirect effects and moderated mediation in multilevel models: new procedures and recommendations. Psychol Methods 11(2):142–163

Bjerk D (2009) How much can we trust causal interpretations of fixed-effects estimators in the context of criminality? J Quant Criminol 25(4):391–417

Breen R, Karlson KB, Holm A (2013) Total, direct, and indirect effects in logit models. Sociol Methods Res 42(2):164–191

Bricker J, Kennickell A, Moore K, Sabelhaus J (2012) Changes in U.S. family finances from 2007 to 2010: evidence from the survey of consumer finances. Fed Reserve Bull 98:1–80

Bucks BK (2012) Out of balance? Financial distress in U.S. households. In Porter K (Ed.) Broke: how debt bankrupts the middle class. Stanford University Press, Stanford

Bureau of Justice Statistics (BJS). (2010) Prison inmates at midyear 2009-statistical tables, NCJ 230113. Washington, DC: U.S. GPO, U.S. Department of Justice. Retrieved on August 5, 2011. (http://www.bjs.ojp.usdoj.gov/index.cfm?ty=pbdetail&iid=2200)

Cadge W, Davidman L (2006) Ascription, choose, and the construction of religious identities in the contemporary United States. J Sci Study Relig 45(1):23–38

Campbell LA, Kaufman RL (2006) Racial differences in household wealth: beyond black and white. Res Soc Stratif Mobil 24:131–152

Carson EA, Sabol WJ (2012) Prisoners in 2011. U.S. Department of Justice, Office of Justice Programs, Bureau of Justice Statistics. NCJ 2399808

Chase ID (1991) Vacancy chains. Ann Rev Sociol 17:133–154

Conley D (1999) Being black, living in the red: race, wealth, and social policy in America. University of California Press, California

Curran PJ, Bauer DJ (2011) The disaggregation of within-person and between-person effects in longitudinal models of change. Annu Rev Psychol 62:583–619

DiPrete TA, Eirich GM (2006) Cumulative advantage as a mechanism for inequality: a review of theoretical developments. Annu Rev Sociol 32:271–297

Dynan KE, Kohn DL (2007) The rise in U.S. household indebtedness: Causes and consequences. Finance and Economics Discussion Series Working Paper No. 2007-37

Farkas G (2003) Cognitive skills and noncognitive traits and behaviors in stratification processes. Annu Rev Sociol 29:541–562

Flippin CA (2001) Racial and ethnic inequality in home ownership and housing equity. Sociol Q 42(2):121–149

Freeman RB (1992) Crime and the employment of disadvantaged youth. In: Peterson G, Vroman W (eds) Urban labor markets and job opportunity. Urban Institute, Washington, DC, pp 201–237

Freeman RB (1996) Why do so many young American men commit crimes and what might we do about it? J Econ Perspect 10(1):25–42

Gelman A, Hill J (2007) Data analysis using regression and multilevel/hierarchical models. Cambridge University Press, New York

Goffman E (1963) Stigma: notes on the management of spoiled identity. Simon & Schuster, New York

Gottfredson MR, Hirschi T (1990) A general theory of crime. California University Press, California

Harris A, Evans H, Beckett K (2010) Drawing blood from stones: legal debt and social inequality in the contemporary United States. Am J Sociol 115(6):1753–1799

Harris A, Evans H, Beckett K (2011) Courtesy stigma and monetary sanctions: toward a socio-cultural theory of punishment. Am Sociol Rev 76(2):234–264

Henry NW, McGinnis R, Tegtmeyer HW (1971) A finite model of mobility. J Math Sociol 1:107–118

Holzer HJ (1996) What do employers want? Job prospects for less-educated workers. Russell Sage, New York

Holzer HJ, Raphael S, Stoll MA (2003) Employment barriers facing ex-offenders. Paper presented at Urban Institute Reentry Roundtable, employment dimensions of reentry: understanding the nexus between prisoner reentry and work, May 19–20, 2003, New York University Law School

Jacobsen B, Kendrick JM (1973) Education and mobility: from achievement to ascription. Am Sociol Rev 38:439–460

Karlson KB, Holm A (2011) Decomposing primary and secondary effects: a new decomposition method. Res Stratif Soc Mobil 29:221–237

Karlson KB, Holm A, Breen R (2011) Comparing regression coefficients between same-sample nested models using logit and probit: a new method. Sociol Methodol 42:286–313

Keister LA (2000a) Wealth in America: trends in wealth inequality. Cambridge University Press, New York

Keister LA (2000b) Race and wealth inequality: the impact of racial differences in asset ownership on the distribution of household wealth. Soc Sci Res 29:477–502

Keister LA, Moller S (2000) Wealth inequality in the United States. Annu Rev Sociol 26:63–81

Kemper TD (1974) On the nature and purpose of ascription. Am Sociol Rev 39(6):844–853

Kenworthy L (2007) Inequality and sociology. Am Behav Sci 50:584–602

Kling JR (2006) Incarceration length, employment, and earnings. Am Econ Rev 96(3):863–876

Krivo LJ, Kaufman RL (2004) Housing and wealth inequality: racial–ethnic differences in home equity in the United States. Demography 41(3):585–605

Krull JL, MacKinnon DP (2001) Multilevel modeling of individual and group level mediated effects. Multivar Behav Res 36(2):249–277

Link BG, Phelan JC (2001) Conceptualizing stigma. Annu Rev Sociol 27:363–385

Lopoo LM, Western B (2005) Incarceration and the formation and stability of marital unions. J Marriage Family 67(3):721–734

Lorber J (1994) The paradoxes of gender. Yale University Press, Connecticut

Lott JR Jr (1990) The effect of conviction on the legitimate income of criminals. Econ Lett 34:381–385

Lyons CJ, Pettit B (2011) Compounded disadvantage: race, incarceration, and wage growth. Soc Probl 58(2):257–280

MacKinnon DP, Dwyer JH (1993) Estimating effects in prevention studies. Eval Rev 17(2):144–158

Manza J, Uggen C (2006) Locked out: felon disenfranchisement and American democracy. Oxford University Press, New York

Massoglia M (2008a) Incarceration, health, and racial disparities in health. Law Soc Rev 42(2):275–306

Massoglia M (2008b) Incarceration as exposure: the prison, infectious disease, and other stress-related illnesses. J Health Soc Behav 49(1):56–71

Massoglia M, Firebaugh G, Warner C (2013) Racial variation in the effect of incarceration on neighborhood attainment. Am Sociol Rev 78(1):142–165

Matras J (1967) Social mobility and social structure: some insights from the linear model. Am Sociol Rev 32(4):608–614

Maume DJ Jr, Cancio AS, Evans TD (1996) Cognitive skills and racial wage inequality: reply to Farkas and Vicknair. Am Sociol Rev 61(4):561–564

Mayhew L (1968) Ascription in modern societies. Sociol Inq 38(2):105–120

McGinnis R (1968) A stochastic model of social mobility. Am Sociol Rev 33:712–722

Merton RK (1968) The Matthew effect in science. Science 159(3810):56–63

Merton RK (1988) The Matthew effect in science, II: cumulative advantage and the symbolism of intellectual property. ISIS 79:606–623

Modigliani F (1986) Life cycle, individual thrift, and the wealth of nations. Am Econ Rev 76:297–313

Nagin D, Waldfogel J (1998) The effect of conviction on income through the life cycle. Int Rev Law Econ 18:25–40

NLSY79 user’s guide: a guide to the 1979–2006 National Survey of Youth Data. Prepared for the U.S. Department of Labor by Center for Human Resource Research. Ohio State University, Center for Human Resource Research, Columbus, Ohio

Oliver M, Shapiro T (1997) Black wealth/white wealth: a new perspective of racial inequality. Routledge, New York

Pager D (2003) The mark of a criminal record. Am J Sociol 108:937–975

Pager D (2007) Marked: race, crime, and finding work in an era of mass incarceration. University of Chicago Press, Illinois

Pager D, Quillian L (2005) Walking the talk: what employers say versus what they do. Am Sociol Rev 70:355–380

Pager D, Bonikowski B, Western B (2009) Discrimination in a low-wage labor market: a field experiment. Am Sociol Rev 79:777–799

Pettit B, Lyons C (2007) Status and the stigma of incarceration: the labor market effects of incarceration by race, class, and criminal involvement. In Bushway S, Stoll MA, Weiman DF (eds.) Barriers to reentry? The labor market for released prisoners in post-industrial America. Russell Sage Foundation, New York, pp. 203–226

Pettit B, Western B (2004) Mass imprisonment and the life course: race and class inequality in U.S. incarceration. Am Sociol Rev 69(2):151–169

Piore MJ (1970) The dual labor market: theory and implications. In Beer SH, Barringer RE (eds) The state and the poor, Winthrop, pp. 55–59

Reskin BF (2012) The race discrimination system. Annu Rev Sociol 38:17–35

Sampson RJ, Laub JH (1997) A life-course theory of cumulative disadvantage and the stability of delinquency. In: Thornberry TP (ed) Developmental theories of crime and delinquency: advances in criminological theory. Transaction Publishers, New Jersey

Samuels P, Mukamel D (2004) After prison—roadblocks to reentry: a report on state legal barriers facing people with criminal records. Legal Action Center, New York

Schnittker J, John A (2007) Enduring stigma: the long-term effects of incarceration on health. J Health Soc Behav 48(2):115–130

Schnittker J, Massoglia M, Uggen C (2011) Incarceration and the health of the African American community. Du Bois Review 8(1):133–141

Shapiro TM (2004) The hidden cost of being African American: how wealth perpetuates inequality. Oxford University Press, New York

Smith JP (1999) Healthy bodies and thick wallets: the dual relation between health and economic status. J Econ Perspect 13(2):145–166

Sobel ME (1982) Asymptotic confidence intervals for indirect effects in structural models. Sociol Methodol 13:290–312

Spilerman S (2000) Wealth and stratification processes. Annu Rev Sociol 26:497–524

Turney K, Schneider D (2014) Incarceration and household wealth. Paper presented at the 2014 PAA Conference, Boston, MA

Turney K, Wildeman C (2013) Redefining relationships: explaining the countervailing consequences of paternal incarceration for parenting. Am Sociol Rev 78:949–979

U.S. Department of Defense (1982) Profile of American Youth: 1980 nationwide administration of the armed services vocational aptitude battery. Office of the Assistant Secretary of Defense, Washington, DC

Wacquant L (2001) Deadly symbiosis: when ghetto and prison meet the mesh. Punishm Soc 3(1):95–134

Wakefield S, Uggen C (2010) Incarceration and stratification. Annu Rev Sociol 36:387–406

Waldfogel J (1994) The effect of a criminal conviction on income and the trust ‘reposed in the workmen’. J Human Resour 29(1):62–81

Western B (2002) The impact of incarceration on wage mobility and inequality. Am Sociol Rev 67(4):526–546

Western B (2006) Punishment and inequality in America. Russell Sage, New York

Western B, Beckett K (1999) How unregulated is the U.S. labor market? The penal system as a labor market institution. Am J Sociol 104:1030–1060

Western B, Pettit B (2000) Incarceration and racial inequality in men’s employment. Ind Labor Relat Rev 54(1):3–16

Western B, Kling JR, Weiman DF (2001) The labor market consequences of incarceration. Crime Delinq 47:410–427

White H (1970) Chains of opportunity. Harvard Press, Massachusetts

Wildeman C (2009) Parental imprisonment, the prison boom, and the concentration of childhood disadvantage. Demography 46(2):265–280

Wildeman C (2010) Paternal incarceration and children’s physically aggressive behaviors: evidence from the fragile families and child wellbeing study. Soc Forces 89(1):285–310

Wildeman C, Muller C (2012) Mass imprisonment and inequality in health and family life. Annu Rev Law Soc Sci 8:11–30

Zhang Z, Zyphur MJ, Preacher KJ (2009) Testing multilevel mediation using hierarchical linear models problems and solutions. Organ Res Methods 12(4):695–719

Acknowledgments

I gratefully acknowledge Barbara Reskin for her insightful comments on drafts of this paper. I would also like to thank Becky Pettit and the participants of the University of Washington Sociology Deviance Seminar for their feedback. Partial support for this research came from a Eunice Kennedy Shriver National Institute of Child Health and Human Development research infrastructure Grant, R24 HD042828, to the Center for Studies in Demography & Ecology at the University of Washington.

Author information

Authors and Affiliations

Corresponding author

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Maroto, M.L. The Absorbing Status of Incarceration and its Relationship with Wealth Accumulation. J Quant Criminol 31, 207–236 (2015). https://doi.org/10.1007/s10940-014-9231-8

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10940-014-9231-8