Abstract

A considerable literature documents the deleterious economic consequences of incarceration. However, little is known about the consequences of incarceration for household assets—a distinct indicator of economic well-being that may be especially valuable to the survival of low-income families—or about the spillover economic consequences of incarceration for families. In this article, we use longitudinal data from the Fragile Families and Child Wellbeing Study to examine how incarceration is associated with asset ownership among formerly incarcerated men and their romantic partners. Results, which pay careful attention to the social forces that select individuals into incarceration, show that incarceration is negatively associated with ownership of a bank account, vehicle, and home among men and that these consequences for asset ownership extend to the romantic partners of these men. These associations are concentrated among men who previously held assets. Results also show that post-incarceration changes in romantic relationships are an important pathway by which even short-term incarceration depletes assets.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Incarceration in the United States has risen at an unprecedented rate since the mid-1970s. In 2014, more than 2.2 million individuals were incarcerated in prisons or jails, and the vast majority will eventually be released back to their families and communities (Kaeble et al. 2015). A considerable literature has documented how, upon release, formerly incarcerated men experience difficulty finding employment, earn low wages, accumulate legal debt, and have difficulty making ends meet (e.g., Apel and Sweeten 2010; Harding et al. 2014; Pager 2003; Western 2006). Given the tremendous increase in incarceration, the concentration of incarceration among already marginalized populations, and the wide-reaching consequences for individuals and families, mass incarceration may exacerbate social inequality (Wakefield and Uggen 2010). More than simply punishing offenders, incarceration appears to be a fundamental cause of durable inequality.

Sociological treatments of inequality have almost always focused on income, employment, education, and occupation. Yet scholars have argued that wealth represents the “sedimentation” of inequality (e.g., Conley 1999; Oliver and Shapiro 2006). Despite that recognition of the central importance of wealth, little research has examined this fundamental axis of stratification. Although wealth has not featured prominently in sociological accounts of inequality (Spilerman 2000), the tide is beginning to turn as scholars have established that wealth—which for most people includes the ownership of assets (e.g., homes, vehicles, bank accounts)—is a distinct and important measure of economic well-being (Keister and Moller 2000) that is not mechanically determined by earnings or employment (McKernan et al. 2012). Additionally, the common assumption that poverty is incompatible with asset building is too strong. Research has shown that those living in poverty often wish to save, try to save, and can accumulate basic assets when impediments are removed (McKernan et al. 2012; Sherraden 2009). Therefore, for low-income families most affected by incarceration, these assets may be particularly important for economic survival and may buffer households from financial shocks (McKernan et al. 2009).

In this manuscript, we use data from the Fragile Families and Child Wellbeing Study (FFCWS), a longitudinal study of mostly unmarried parents living in urban areas, to investigate the short-term relationship between incarceration and asset ownership (measured as ownership of a bank account, vehicle, and home) among men and the women who share children with them. This research builds on two recent studies that addressed the relationship between incarceration and wealth. Schneider and Turney (2015) used state-level data to show the association between incarceration rates and black-white gaps in homeownership. Our study extends this work by taking an individual- and family-level perspective, allowing us to establish a more convincing causal relationship for a broader set of important assets and to examine the mechanisms that connect incarceration and asset ownership. Maroto (2014) used data from the National Longitudinal Study of Youth 1979 (NLSY79) to examine the relationship between incarceration history and wealth (measured as both homeownership and net worth). We expand on those analyses by taking a more expansive view of assets and by focusing on men with children, which allows us to draw out the consequences of incarceration for intergenerational inequality.

In addition, in this article, we contribute in a new way to the nascent literature on the collateral consequences of incarceration for the social intimates of incarcerated and formerly incarcerated men. Geller et al. (2011) examined the association between fathers’ incarceration history and fathers’ financial contributions to households. Schwartz-Soicher et al. (2011) examined the association between fathers’ incarceration history and material support of mothers. We build on this research by documenting the association between fathers’ incarceration and mothers’ assets—an important and distinct measure of socioeconomic well-being and one that has broad implications for inequality. Our results show how incarceration perpetuates wealth inequality in potentially far-reaching ways. Just as affluent families may entrench wealth advantage with inter vivos transfers and bequests, we show the network effects of social disadvantage on wealth through the mechanism of incarceration, which affects men themselves, the mothers of their children, and, ultimately, we expect, the next generation.

In sum, we contribute to existing literature by (1) providing an estimate of the association between incarceration and the ownership of three key assets, (2) examining how recent incarceration affects both formerly incarcerated individuals and their romantic partners in a sample of parents, and (3) examining the mechanisms linking incarceration to asset ownership. Taken together, our research examines how mass incarceration—a relatively new institutional driver of stratification—affects wealth accumulation, which is a fundamental but understudied dimension of inequality (Grusky et al. 2015; Keister and Moller 2000).

Background

Asset Ownership and Well-being

Assets are a key aspect of household well-being that capture a dimension of advantage that is related to, but distinct from, other elements of socioeconomic status (SES), such as income and education (Keister and Moller 2000). Simply owning assets can have important positive consequences for child and adult well-being (Lerman and McKernan 2008; Orr 2003; Sherraden 1991). Homeownership is perhaps the clearest example of such beneficial consequences. Owning a home rather than renting has been traced to higher levels of community and political engagement, increased residential stability, and improved educational outcomes for children (see review by Kuebler 2013; but see Barker 2013). Additionally, owning a vehicle, regardless of its market value, facilitates access to work (Baum 2009). Finally, bank accounts can assist families with managing tasks that can be costly to accomplish in the absence of formal financial services. For instance, unbanked households often resort to high-cost alternative financial services providers, such as check-cashers, pawnshops, and informal lenders (Barr 2004). Simply having an account—regardless of the value of the account—can allow families to avoid the otherwise high costs of managing cash. Further, bank accounts can be a stepping stone to greater financial inclusion and wealth accumulation (Hogarth et al. 2005), and the security they provide can minimize the risk of theft or loss of savings (Washington 2006).

Furthermore, scholars have also suggested that asset ownership matters for well-being because of the important symbolic value that it conveys. For instance, homeownership is often seen as a key symbol of having “made it” to the middle class (Blank 2010). Relatedly, recent accounts of marriage among low-income individuals have suggested that the ownership of basic assets have become important social prerequisites of matrimony (Edin and Kefalas 2005; Schneider 2011). Taken together, these studies suggest that understanding the predictors of asset ownership may shed light on broader processes of social inequality.

Consequences for Asset Ownership Among Incarcerated Men

Economic Pathways

Theoretically, incarceration may lead to asset loss or make acquiring new assets difficult. Perhaps most obviously, time spent behind bars impedes men’s economic opportunities. The negative, enduring effects of incarceration for men’s economic well-being begin during incarceration. Incarcerated men have few opportunities to earn income and, when they do have employment opportunities, these pay very low wages (Zatz 2008). Expenses do not disappear upon incarceration and may stem directly from the incarceration experience. For example, during incarceration, child support orders often continue to accrue, and homeowners are usually required to make mortgage payments (Pearson 2004).

Release from prison does not resolve these economic difficulties and may amplify them. Former inmates have difficulty finding employment because employers stigmatize men with criminal records (Pager 2003). Additionally, the time spent incarcerated reduces human and social capital. Incarcerated men lose work experience, become disconnected from social ties that facilitate employment, and acquire social ties that may impede securing work, thereby making employment difficult (Apel and Sweeten 2010; Hagan 1993; Western 2006). Furthermore, formerly incarcerated men accumulate legal debt, which reduces access to housing and credit markets and can also create a disincentive for employment in the formal labor market because payments are often made through wage garnishment (Harris et al. 2010).

The kind of low-wage and irregular employment most available to formerly incarcerated men may then reduce incentives for them to have formal bank accounts. Although bank accounts can be more affordable than alternative financial services, such mainstream products also carry costs in the form of minimum balance requirements and overdraft fees (Campbell et al. 2012). Volatility in household income may end up making formal accounts quite costly, and informal services are designed with such volatility in mind. Indeed, in surveys of the unbanked, the cost of maintaining an account is often given as an important reason for avoiding formal transaction accounts (i.e., Caskey 2005).

Although incarceration is generally not a legal disqualification for having a bank account, taking a vehicle loan, or holding a mortgage, the incapacitation associated with incarceration may directly lead to the loss of such assets. Nonpayment of loans may result in foreclosure and repossession, and the failure to meet minimum bank account balance requirements or inadvertent overdrafts may lead to fees and involuntary bank account closure (Campbell et al. 2012). These processes may also inhibit future asset reacquisition if they lead to negative credit reports and to flags in the ChexSystems database that banks use to vet potential account holders (Barr and Blank 2009). Although prior incarceration could make it difficult to amass the funds necessary to purchase a vehicle, these credit-related processes might further impede purchase by reducing the ability of men to secure auto loans. Beyond the purchase of a vehicle, prior incarceration might also limit men’s capacities to plan for and afford the regular costs of auto insurance, registration, and maintenance.

Non-economic Pathways

Incarceration may also have deleterious consequences for asset ownership for reasons not narrowly economic. For one, the association between incarceration and asset ownership may work through family characteristics, such as relationship dissolution. The familial consequences of incarceration are well documented (e.g., Turney and Wildeman 2013). For example, incarceration increases the likelihood of relationship dissolution and, among couples that remain together, decreases relationship quality (e.g., Turney 2015a, b). In turn, relationship dissolution and instability decreases economic well-being (Smock et al. 1999).

Additionally, formerly incarcerated men may end up residing in disadvantaged neighborhoods following prison release (Massoglia et al. 2013). These neighborhoods are distinguished by high levels of poverty and segregation and a paucity of institutional supports for asset building, such as banks and credit unions (Graves 2003). The lack of such institutions in disadvantaged neighborhoods may create a barrier to account opening, saving, and obtaining a mortgage (Ergungor 2010). Further, the overrepresentation of alternative financial service providers in disadvantaged neighborhoods—including check-cashers, payday lenders, and pawnshops—may deplete wealth (Graves 2003). Of course, the availability of such alternative financial services providers may also offer a viable alternative to the use of formal banking institutions.

Relatedly, qualitative research has shown that the increase in surveillance and policing in poor neighborhoods, which has risen in tandem with incarceration rates, encourages men to go “on the run” and withdraw from social institutions. In one ethnographic account of a heavily surveilled neighborhood, none of the men in the sample established bank accounts (Goffman 2009:353; also see Brayne 2014). Formerly incarcerated men may have warrants for their arrest, especially if they are not fulfilling child support obligations or making payments to reduce their legal debt (Harris et al. 2010), or may simply avoid banks and other institutions for fear of being imprisoned again.

Consequences for Asset Ownership Among Women Connected to Incarcerated Men

The consequences of incarceration for asset ownership likely do not end with incarcerated men because these marginalized men are connected to families as romantic partners and fathers (Mumola 2000). Although their romantic partners may shed the stigma of incarceration by distancing themselves from the incarcerated person or moving on to a new romantic partner, they may be unable to discard the economic consequences of their partners’ incarceration. The incarceration of a romantic partner may lead to asset loss and difficulty acquiring assets.

To begin with, incarcerated men, although a disadvantaged group, often contribute economically to family life prior to their confinement (Travis et al. 2005), and the removal of men from households via incarceration can be associated with a large and immediate decrease in household income. Further, women who share children with incarcerated men may be left with parenting or household responsibilities that force them to leave the paid labor market and, consequentially, impede their ability to maintain the family’s economic standard of living (Comfort 2008). In addition to the reduction in household income that accompanies incarceration, romantic partners of the incarcerated may have additional expenses from the incarceration. For one, maintaining relationships with incarcerated men is costly. Prisons are often located far from former residences of the incarcerated, and getting to these prisons is time-consuming and expensive (Grinstead et al. 2001). Women may also spend money on care packages and collect calls. One study found that poor women spent more than one-quarter of their income maintaining contact with an incarcerated partner (Grinstead et al. 2001). The economic consequences of incarceration for these women likely persist after the release of their romantic partner. When men return to households after incarceration, as many do (Harding et al. 2013), their difficulty securing employment may strain household finances or destabilize romantic relationships (Western 2006), both of which can have serious economic consequences for women (Avellar and Smock 2005).

However, these spillover effects may not be inevitable. In particular, there is good reason to suspect that the consequences for asset ownership are especially consequential for women living with men immediately prior to their incarceration. The economic shocks, decreases in household income, and relationship difficulties may be acutely experienced by these women. Women married to these men are likely especially disadvantaged given that they are often responsible for legal fees and fines. Beckett et al. (2008), for example, described how legal debt can influence family life above and beyond its influence on the offender. They reported that in Washington state, county clerks can seize up to 25 % of the earnings of former inmates’ spouses and are also allowed to seize jointly held bank assets, home equity, and tax refunds (Beckett et al. 2008). Although assets such as cars and homes that are likely to be jointly held are vulnerable, individually held bank accounts by spouses may be less susceptible than these other assets and than accounts held by former inmates themselves. Further, prior research has suggested that the consequences of incarceration for material hardship (Schwartz-Soicher et al. 2011) and other aspects of family life (Turney and Wildeman 2013) are concentrated among households in which men are living prior to incarceration.

Threats to Causal Inference

Despite existing evidence suggesting that incarceration may have deleterious consequences for asset ownership, there are steep threats to causal inference. It is possible that the observed individual-level relationship between incarceration and asset ownership reflects formidable selection forces. Incarceration, as discussed earlier, is most common among the socioeconomically disadvantaged—and as such, these individuals are likely to experience challenges to asset ownership even absent incarceration.

Our analytic strategy carefully considers these substantial threats to causal inference (described in more detail in the Analytic Strategy section below). First, we adjust for an array of individual-level characteristics associated with incarceration and asset ownership. Second, we adjust for a lagged measure of asset ownership to consider the relationship between incarceration and asset ownership net of prior asset ownership. Third, we employ propensity score matching models to match those who are and are not incarcerated. Furthermore, we conduct a series of supplemental analyses that provide additional tests of our main findings—for instance, limiting unobserved heterogeneity by restricting the sample to men (and women connected to men) who have been previously incarcerated.

Data and Methods

Data Source

We examine the relationship between incarceration and asset ownership with data from the Fragile Families and Child Wellbeing Study (FFCWS), which is a population-based longitudinal study of nearly 5,000 mostly unmarried parents in 20 large U.S. cities. When weighted or regression-adjusted, the data are representative of births in the survey period in large U.S. cities. Parents completed a survey almost immediately after the focal child was born (between February 1998 and September 2000) and were then interviewed by telephone approximately one, three, five, and nine years later. Approximately 86 % of mothers and 78 % of fathers in the sampling frame completed the baseline interview. Of these, approximately 89 %, 86 %, 85 %, and 76 % of mothers and 69 %, 67 %, 64 %, and 59 % of fathers completed the one-, three-, five-, and nine-year surveys, respectively.Footnote 1 Given that the key explanatory variable—paternal incarceration—is most precisely measured between the three- and five-year surveys, the analyses primarily use data from the first four waves of data collection.

The FFCWS data are ideal for considering the relationship between incarceration and asset ownership. First, because the data include an oversample of unmarried parents (a disproportionately economically disadvantaged group), they include a relatively large number of incarcerated men. The demographic characteristics of these men are comparable to men with young children in local jails, state prisons, and federal prisons (Turney and Wildeman 2013). The data are also advantageous because they include longitudinal measures of asset ownership reported by both partners and an array of covariates. Although the data are non-experimental and are therefore limited in their ability to provide causal estimates, their longitudinal nature allows for strategies to reduce unobserved heterogeneity. Finally, examining asset ownership among parents, specifically, may be especially important because these households are of considerable policy interest, as they include vulnerable children for whom assets may be especially consequential.

Analytic Sample

The analyses use two analytic samples—one to estimate fathers’ assets (N = 2,703), and a second to estimate mothers’ assets (N = 3,831). To construct the first analytic sample, we first deleted the 2,173 observations in which the father did not participate in either the three- or the five-year survey. We then deleted an additional 22 observations missing data on any of the three dependent variables. The second analytic sample excludes the 1,051 observations in which the mother did not participate in the three- or five-year survey and the additional 16 observations missing data on any of the three dependent variables.

With respect to mothers, there are few statistically significant differences between the analytic and full samples. However, there are several statistically significant differences between the analytic sample of fathers and the full FFCWS sample of fathers. Fathers in the analytic sample, compared with fathers in the full sample, are more likely to be non-Hispanic white (22.0 % vs. 18.4 %) and less likely to be Hispanic (25.4 % vs. 27.8 %), less likely to be foreign-born (15.9 % vs. 18.3 %), more likely to be married (30.8 % vs. 24.2 %) or cohabiting (39.1 % vs. 36.4 %) with the mother at baseline, and have higher educational attainment at baseline (36.1 % vs. 31.5 % had post-secondary education). In short, men lost to attrition are of modestly lower SES than those not lost to attrition. At the one-year survey (when comparable measures of asset ownership were first asked), fathers in the analytic sample are somewhat more likely to report bank account ownership (56.9 % vs. 53.9 %) and homeownership (24.3 % vs. 21.7 %), but there are no statistically significant differences in vehicle ownership.

This differential attrition could lead us to either under- or overestimate the relationship between recent paternal incarceration and asset ownership. We risk underestimating the relationship if men most vulnerable to any negative consequences of incarceration for asset ownership are also most likely to attrite from the survey. To the extent that this unobserved vulnerability to incarceration is correlated with SES, differences in education, marital status, nativity, and race/ethnicity between men who attrite and those who do not at baseline are suggestive of underestimation. Conversely, we risk overestimating the association between incarceration and asset ownership if men whose asset ownership is unlikely to be affected by incarceration are more likely to attrite. Such weak associations between incarceration and asset ownership could be brought about if men who attrite have substantial enough social or economic advantages that they are inured from the consequences of incarceration, which seems unlikely and does not align with the actual SES bias in attrition that we observe. Such weak associations could also be brought about if men who attrite are so unlikely to have assets that they simply have no assets to lose by being incarcerated. Although men who attrite are somewhat less likely to own homes and bank accounts than men who do not attrite, the percentages make clear that these differences are very modest and that substantial shares of the men who go on to attrite do hold these assets before incarceration.

The vast majority of observations have complete data across both analytic samples. In the mother’s analytic sample, nearly all covariates are missing fewer than 1 % of observations, with exceptions including parents’ educational attainment (11 % missing), neighborhood characteristics (5 %), father’s impulsivity (35 %), and father’s cognitive ability (18 %). There are more missing data in the father’s analytic sample, but only two variables—parents’ educational attainment (17 %) and father’s impulsivity (22 %)—are missing for more than 10 % of observations. In both analytic samples, missing covariates values are preserved by producing 20 multiply imputed data sets and averaging results across data sets.

Measures

Asset Ownership

The dependent variables include ownership of a bank account, vehicle, and home, all measured at the five-year survey. First, bank account ownership is measured affirmatively if fathers and mothers report they have a bank account in their name (and/or a joint account in their name and their partners’ name). Parents reporting that the account is only in their partners’ name are considered not to have a bank account. Second, vehicle ownership is measured affirmatively if fathers and mothers report they or their romantic partner (if they have a partner) report owning a car, truck, or van.Footnote 2 Third, fathers and mothers were asked about their current housing situation and are considered homeowners if they report owning their own home. Parents who did not move between the three- and five-year surveys were not asked this question at the five-year survey; and for these parents, homeownership is measured by information provided at the three-year survey. In some analyses, we examine change in asset ownership by adjusting for asset ownership at the three-year survey.

Recent Paternal Incarceration

The key explanatory variable is recent paternal incarceration, which indicates that the father spent time in prison or jail between the three- and five-year surveys. Importantly, we do not select this measure as our key explanatory variable because of theoretical reasons to expect that recent incarceration is especially associated with asset ownership; in fact, other work has suggested the consequences of incarceration may accumulate over time (Maroto 2014). Rather, we focus on recent incarceration—that is, incarceration between the three- and five-year surveys—because we want to ensure appropriate time-ordering among outcome, explanatory, and control variables and because incarceration is measured most precisely between the three- and five-year surveys.

Both parents were asked about fathers’ recent paternal incarceration. Consistent with prior research suggesting that individuals underreport incarceration (Geller et al. 2012; Groves 2004), fathers are considered recently incarcerated if either the mother or the father reports that the father was incarcerated (or if the father was interviewed in prison or jail). Because incarceration may be associated with an automatic loss of assets for currently incarcerated men, we adjust for current incarceration (prison or jail at the five-year survey) in our estimates of fathers’ assets. Estimates of mothers’ assets do not adjust for current incarceration because we do not expect an automatic loss for them, but supplemental analyses show that results remain robust to this additional adjustment.

Although our measures of current and recent incarceration are quite precise, certain characteristics of the incarceration experience remain unmeasured. For example, we cannot distinguish between jail and prison spells (given that this information is available only for the currently incarcerated). However, other research has found that incarcerated men in these data are in both jail and prison (Wildeman et al. 2016). Cycling through jail is a common experience (e.g., Minton 2012), which means that our results are applicable to a much larger population than if we were solely considering prison incarceration. We are able to consider variation by incarceration duration and incarceration offense type in supplemental analyses described later.Footnote 3

Control Variables

The multivariate analyses adjust for characteristics associated with both incarceration and asset ownership. Control variables include the following demographic characteristics: race/ethnicity, foreign-born, age, lived with both parents at age 15, relationship status with other parent, relationship quality with other parent (ranging from 1 = poor to 5 = excellent), in a relationship with a new partner, number of children in the household, multipartnered fertility, parenting stress (average of parents’ responses to four questions (e.g., “Being a parent is harder than I thought it would be”) that ranges from 1 = strongly disagree to 4 = strongly agree), and parent’s mother living in household. Analyses also adjust for economic characteristics, including employment in the past week, education, education of the parent’s parent, income-to-poverty ratio (a measure that includes reported legal and illegal earnings), and material hardship; neighborhood characteristics, including neighborhood disadvantage (sum of the following four standardized census tract characteristics: percentage unemployed in the civilian labor force, percentage living below the poverty line, percentage receiving public assistance, and percentage older than 25 years without a college degree) and percentage of housing in the neighborhood that is renter-occupied; and health characteristics, including depression, fair/poor health, and substance abuse. Finally, analyses adjust for fathers’ and mothers’ cognitive ability (measured by the Wechsler Adult Intelligence Scale (WAIS)), fathers’ domestic violence (mothers’ reports that the father hit, kicked, or slapped her), fathers’ and mothers’ impulsivity (Dickman 1990), and fathers’ and mothers’ prior incarceration.

For the most part, estimates of fathers’ asset ownership adjust for fathers’ characteristics and estimates of mothers’ asset ownership adjust for mothers’ characteristics. However, controls especially associated with selection into incarceration—substance abuse, domestic violence, cognitive ability, impulsivity, and prior incarceration—are included in analyses estimating both fathers’ and mothers’ outcomes. All control variables—except for mothers’ impulsivity, which is considered a stable characteristic and measured at the five-year survey—are measured at or before the three-year survey and thus prior to the key independent variable, recent paternal incarceration.

Analytic Strategy

Our analytic strategy proceeds in three stages. In the first stage, we use logistic regression and propensity score matching models to estimate fathers’ and mothers’ asset ownership as a function of recent paternal incarceration. In Model 1, we adjust for a host of covariates that may render the relationship between incarceration and asset ownership spurious. Model 2 adjusts for a lagged dependent variable. Finally, Model 3 presents results from propensity score matching, which allows us to match recently incarcerated fathers and not recently incarcerated fathers on the distribution of their covariates. Within each imputed data set, we generate a propensity score for each individual and ensure the treatment and control groups have a similar distribution of covariates. We then use kernel matching (Epanechnikov kernel with a bandwidth of .06) to estimate asset ownership.Footnote 4 Because differences may remain between groups, we further adjust for all covariates when matching. We test for differences in the relationship between recent incarceration and asset ownership by asset type and note the robustness of our results to a correction for multiple comparisons.

These models are designed to rule out many sources of confounding in the relationship between incarceration and asset ownership. We provide additional evidence to strengthen causal inference. First, in Model 1, to further diminish unobserved heterogeneity, we restrict the sample to fathers (and mothers who share children with fathers) most at risk of incarceration (LaLonde 1986) by limiting the analyses to men who have been incarcerated at some point. We compare recently incarcerated fathers (those incarcerated between the three- and five-year surveys) with those not recently incarcerated but incarcerated prior to the three-year survey. Second, in Models 2A and 2B, we estimate fathers’ and mothers’ asset ownership separately by parents’ residential status at the three-year survey (prior to the measure of recent incarceration). Here, we reason that we should not expect a differential association between recent incarceration and fathers’ asset ownership by parents’ residential status, but that we should expect the association between recent incarceration and that mothers’ asset ownership will be stronger among mothers living with fathers prior to incarceration.

In the second analytic stage, we examine differences in the association between incarceration and asset ownership by prior asset ownership. These analyses allow us to better understand whether incarceration results in fathers and their romantic partners losing assets, experiencing impediments to asset acquisition, or some combination of the two. We estimate subgroup analyses for individuals who did and for those who did not report ownership of a bank account, vehicle, and home at the three-year survey, adjusting for all control variables in the equivalent of Model 1 of Table 2, and test for differences across the two groups (Paternoster et al. 1998).Footnote 5

In the third analytic stage, we assess some mechanisms by which incarceration might affect asset ownership. We consider how economic characteristics, relationship characteristics, and neighborhood characteristics—all measured at the five-year survey (and, thus, after the measure of incarceration and concurrently with asset ownership)—explain the association between incarceration and asset ownership. Economic characteristics are measured by employment and earnings, relationship characteristics are measured by union dissolution, and neighborhood characteristics are measured by the four standardized census tract characteristics described earlier.

Urban cities vary in their availability of public transportation and rental properties, costs of maintaining assets (especially vehicles, given that registration fees and insurance costs vary across locales), and incarceration rates, all of which may confound the association between incarceration and asset ownership. Therefore, all analyses include city fixed effects for city at baseline (not necessarily their city of residence when the outcome variables are measured) to account for the fact that respondents are drawn from 20 cities in the United States.

Sample Description

Descriptive statistics for all variables are presented in Table 1, comparing recently incarcerated fathers (and mothers connected to recently incarcerated fathers) with those who have not been recently incarcerated. This table shows that recently incarcerated fathers (and mothers connected to these fathers) experience more demographic, socioeconomic, and behavioral disadvantages than their counterparts. For example, recently incarcerated fathers are less likely to be married to the focal child’s mother (11.6 % vs. 44.5 %), have lower income-to-poverty ratios (2.06 vs. 2.98), and are more likely to report depression (22.8 % vs. 12.7 %).

Results

Differences in Fathers’ and Mothers’ Asset Ownership, by Recent Paternal Incarceration

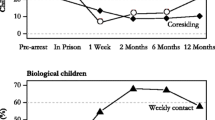

Figure 1 shows striking differences in fathers’ and mothers’ asset ownership by recent incarceration. We turn first to fathers’ assets. Only one-fifth (22.0 %) of recently incarcerated fathers report bank account ownership, compared with 65.2 % of not recently incarcerated fathers. Recently incarcerated fathers are less likely to report vehicle ownership (45.3 % vs. 79.5 % of not recently incarcerated fathers) and homeownership (5.6 % vs. 33.8 % of not recently incarcerated fathers). The differences in mothers’ assets, by fathers’ incarceration, are equally striking. Mothers who share children with recently incarcerated fathers, compared with their counterparts, are less likely to report bank account ownership (43.5 % vs. 62.2 %), vehicle ownership (49.6 % vs. 69.5 %), and homeownership (4.6 % vs. 28.6 %). All group differences are statistically significant (p < .001).

Fathers’ and mothers’ assets, by recent paternal incarceration. Data are from the Fragile Families and Child Wellbeing Study. Among fathers, 395 were recently incarcerated, and 2,308 were not recently incarcerated. Among mothers, 676 share children with a recently incarcerated father, and 3,155 share children with a not recently incarcerated father. All differences between recent incarceration and no recent incarceration are statistically significant (p < .001)

Estimating Fathers’ and Mothers’ Asset Ownership

Beginning with Table 2, we present a series of logistic regression and propensity score matching models designed to consider how much of these descriptive differences in asset ownership by recent paternal incarceration are attributable to incarceration rather than other characteristics. We turn first to the estimates of fathers’ asset ownership in panel A. In Model 1, which adjusts for an array of covariates, recent incarceration is associated with a lower likelihood of ownership of a bank account (b = −0.66, p < .01), vehicle (b = −0.58, p < .001), and home (b = −0.68, p < .05). In Model 2, which includes a lagged dependent variable, the relationship between incarceration and homeownership falls from statistical significance, but a negative and statistically significant relationship remains between incarceration and bank account ownership (b = −0.69, p < .01; predicted probabilities are 0.52 and 0.68 for recently and not recently incarcerated fathers, respectively) and vehicle ownership (b = −0.84, p < .001; predicted probabilities are 0.76 and 0.85 for recently and not recently incarcerated fathers, respectively). Model 3 presents the propensity score matching estimates, which are consistent with the patterns from the logistic regression models. Therefore, these findings suggest that recent paternal incarceration is associated with a lower likelihood of bank account and vehicle ownership.

Panel B estimates the association between recent paternal incarceration and mothers’ asset ownership. Model 1 shows that mothers who share children with recently incarcerated men, compared with their counterparts, have a lower likelihood of vehicle ownership (b = −0.31, p < .01) and homeownership (b = −0.85, p < .001). There is no statistically significant association between recent paternal incarceration and mothers’ bank account ownership. Model 2, which adjusts for a lagged dependent variable, shows that recent paternal incarceration continues to be associated with a lower likelihood of vehicle ownership (b = −0.33, p < .01; predicted probabilities are .69 for mothers connected to recently incarcerated fathers and .76 for mothers connected to not recently incarcerated fathers) and homeownership (b = −0.83, p < .001; predicted probabilities are .07 for mothers connected to recently incarcerated fathers and .14 for mothers connected to not recently incarcerated fathers) among mothers who share children with these men. Finally, the propensity score matching estimates presented in Model 3 are of a similar magnitude and statistical significance.Footnote 6 , Footnote 7 Therefore, these findings suggest that recent paternal incarceration is associated with a lower likelihood of vehicle and bank account ownership among mothers.

As noted earlier, the relationship between recent incarceration and men’s homeownership and the relationship between recent incarceration and women’s bank account ownership is not significantly different from 0. However, because the difference between a statistically significant coefficient and a statistically nonsignificant coefficient is not necessarily significant, we tested whether the association between recent incarceration and asset ownership differed by asset type (Paternoster et al. 1998). We focus our discussion here on the most conservative model, Model 2. For fathers, we find that the recent incarceration coefficient is not statistically different between bank account ownership and vehicle ownership (z = −0.50), between vehicle ownership and homeownership (z = −0.81), and between bank account ownership and homeownership (z = −0.51). For mothers, we find marginally significant differences between bank account and vehicle ownership (z = 1.64) and significant differences between vehicle ownership and homeownership (z = 2.31) and between bank account ownership and homeownership (z = 3.56). Therefore, although recent incarceration is similarly deleterious for fathers’ assets, there is a significantly stronger association between recent incarceration and mothers’ ownership of homes compared with bank accounts or vehicles and between mother’s ownership of vehicles and bank accounts. These tests affirm the importance of considering bank account ownership, vehicle ownership, and homeownership as separate outcomes.

Strengthening Causal Inference

In Table 3, we present the results of three additional models that further isolate the causal relationship between recent paternal incarceration and asset ownership. Here, we remain focused on the association between recent paternal incarceration and asset ownership, but we subject that relationship to additional scrutiny. First, in Model 1, we include all covariates from Model 2 of Table 2 but limit the analytic sample to previously incarcerated fathers (and women who share children with previously incarcerated fathers). This approach provides a more conservative test of the relationship because all men in the model presumably share the omitted unobservable characteristics that might select men into incarceration and not holding assets. In panel A, Model 1 shows that recently incarcerated fathers have a lower likelihood of bank account ownership (b = −0.57, p < .05) and vehicle ownership (b = −0.56, p < .01) as those without recent incarceration. In panel B, Model 1 shows that mothers attached to recently incarcerated fathers have a lower likelihood of vehicle ownership (b = −0.38, p < .01) and homeownership (b = −0.67, p < .05) as those attached to not recently incarcerated men. This conservative test then further buttresses the evidence that recent incarceration is negatively associated with asset ownership.

Next, in Models 2A and 2B, we estimate fathers’ and mothers’ asset ownership separately by parents’ residential status at the three-year survey (prior to the measure of recent incarceration). As a reminder, we do not expect a differential association between incarceration and fathers’ asset ownership by parents’ residential status, but we do expect that the association between incarceration and mothers’ asset ownership will be stronger among mothers living with fathers prior to incarceration. In panel A, for men’s asset ownership, we find that incarceration is similarly associated with asset ownership for fathers coresiding and those not coresiding with mothers at the three-year survey. These similar associations between incarceration and fathers’ assets, regardless of coresidence, are further supported by z scores that test for statistically significant differences between the two coefficients. Panel B shows striking differences for mothers’ asset ownership by coresidential status, with associations between recent paternal incarceration and asset ownership concentrated among mothers living with fathers at the three-year survey. Among mothers living with fathers at the three-year survey, incarceration is associated with a lower likelihood of ownership of a bank account (b = −0.27, p < .10), vehicle (b = −0.85, p < .001), and home (b = −1.35, p < .001). There are no statistically significant associations between incarceration and asset ownership among mothers not living with fathers prior to incarceration. As confirmed by z scores, the subgroup differences for vehicle ownership and homeownership are statistically different.

In Appendix 1, we conduct two sets of supplemental analyses that consider the robustness of these findings. We reason that if unobserved confounders drive the relationship between incarceration and asset ownership, then we might expect that these characteristics would also be associated with length of incarceration and offense type. Tables 6 and 7 in Appendix 1 investigate whether the relationship between incarceration and asset ownership varies depending on these parameters. We find little evidence of such variation, strengthening our confidence that the consequences of incarceration for asset ownership are not spurious.

In sum, we subject the association between recent incarceration and asset ownership to extensive tests designed to rule out confounding from omitted variables. Models controlling for and/or matching on a rich set of observables, including a lagged dependent variable, as well as models conditioning on prior incarceration and on coresidential status, all show that recent paternal incarceration is negatively related to father’s bank account and vehicle ownership and to mother’s vehicle ownership and homeownership. These results are quite consistent across models and are robust to the sensitivity analyses in Appendix 1.

Additional Features of the Relationship Between Incarceration and Asset Ownership

Asset Loss or Impediments to Gain?

In Table 4, we examine how the association between incarceration and asset ownership varies by prior asset ownership to consider whether the relationship between incarceration and asset ownership operates through processes of asset loss, through impediments to accumulation, or both. Estimates of fathers’ outcomes, presented in panel A, show that the size of the incarceration coefficient is larger for fathers who reported ownership of a bank account (b = −1.12, p < .001), vehicle (b = −1.25, p < .001), and home (b = −1.32, p < .10) at the three-year survey. As indicated by z scores, with respect to vehicle ownership, incarceration is more strongly associated with asset loss than an inability to acquire new assets among fathers (z = −4.27).

Panel B, which presents estimates of mothers’ outcomes, also shows that the magnitudes of the incarceration coefficients are larger for mothers with prior ownership of a bank account (b = −0.10, n.s.), vehicle (b = −0.36, p < .05), and home (b = −1.16, p < .05); but z scores show that these coefficients are not statistically different from one another, suggesting that mothers experience both asset loss and challenges to acquiring new assets. However, notably, these processes of asset loss are most apparent for homes and vehicles, and we find no significant associations with bank account ownership for mothers. In contrast, fathers experience significant bank account loss. This difference could be traceable to patterns of asset sharing with women more likely to hold separate, nonjointly held bank accounts than vehicles and homes.

Finally, in Appendix 2, we examine asset ownership at the nine-year survey for those who owned assets previously and find that the deleterious effects of incarceration continue to play out over the ensuing years. Taken together, these results suggest that the negative relationship between recent paternal incarceration and father’s asset ownership is driven primarily by asset loss rather than by decelerations in acquisition, while mother’s reduced asset ownership is a product of both loss and reduced gain.

Mechanisms Linking Incarceration to Asset Ownership

In Table 5, we consider three sets of mechanisms—economic, relationship, and neighborhood characteristics—that may link incarceration to asset ownership. In panel A, we consider the association between incarceration and fathers’ assets, focusing on ownership of a bank account, vehicle, and home. Model 1 presents the baseline relationship (the equivalent of Model 2 of Table 2). Model 2, which includes measures of fathers’ employment and earnings at the five-year survey, shows that relative to the estimates in Model 1, these economic characteristics explain 19 %, 12 %, and 19 % of the association between incarceration and ownership of a bank account, vehicle, and home, respectively. Supplemental analyses (not presented) show that earnings alone, compared with employment alone, explain more of the association for ownership of a bank account, vehicle, and home (17 %, 10 %, and 19 %, respectively, compared with 4 %, 5 %, and 2 %). Relationship characteristics, measured as union dissolution at the five-year survey, reduce the incarceration coefficient by 12 % for bank account ownership, 10 % for vehicle ownership, and 35 % for homeownership (Model 3 relative to Model 1). Finally, neighborhood characteristics reduce the incarceration coefficient by 6 %, 0 %, and 0 %, respectively (Model 4 relative to Model 1).

In panel B, we consider the association between incarceration and mothers’ assets, focusing on vehicle ownership and homeownership. Model 1 presents the baseline relationship (the equivalent of Model 2 of Table 2). These results show that economic characteristics, included in Model 2, explain none of the association between incarceration and vehicle ownership and homeownership. In Model 3, relationship characteristics reduce the incarceration coefficient by 40 % for vehicle ownership and by 20 % for homeownership. In Model 4, neighborhood characteristics explain none of the relationship.

In sum, for men, the most important pathways by which recent incarceration affects asset ownership are economic and relational (the latter of which perhaps operates through family economic consequences) rather than locational. For women, the primary mechanism is relational. In both cases, much of the incarceration coefficient remains unexplained.

Discussion

The rising incarceration rate in the United States, as well as its unequal distribution across the population, may widen inequalities among individuals and families (Pettit and Western 2004; Wakefield and Uggen 2010). Indeed, scholars have become increasingly attuned to how prison and jail experiences disadvantage confined men and their family members. Research has documented negative effects of incarceration on measures of economic well-being, including employment (Pager 2003), wages (Lyons and Pettit 2011), and legal debt (Harris et al. 2010). Despite attention given to incarceration’s economic consequences, as well as increasing sociological attention to inequality in household assets, prior research has mostly neglected how incarceration affects household assets (although, see Maroto 2014; Schneider and Turney 2015) and the economic well-being of families (although, see Geller et al. 2011; Schwartz-Soicher et al. 2011).

In this article, using longitudinal data from the FFCWS, we show that incarceration is significantly and detrimentally associated with asset ownership among men and the women who share children with them. We find that recently incarcerated men, compared with their counterparts, are less likely to hold bank accounts, own vehicles, or own homes. These associations persist after we adjust for a wide array of covariates and for a lagged dependent variable, and in a sample restricted to men at risk of incarceration.

Additionally, we find that disadvantages in asset ownership spill over to the women connected to incarcerated men. These women are less likely than their counterparts to own vehicles and homes, and these disadvantages are most pronounced for women living with these men just prior to their incarceration. The concentration of these spillover consequences lends strength to our findings because we expect women residing with men prior to incarceration to experience the most deleterious consequences. Furthermore, the findings suggest that at least with respect to asset accumulation, women who share children with currently and formerly incarcerated men can shed the economic consequences of incarceration in ways that the incarcerated cannot. Similar to our findings regarding men’s asset ownership, we also find some evidence that the consequences of paternal incarceration for women are strongest among those who held such assets prior to incarceration. This finding provides further evidence of the barriers created by incarceration and our supplemental analyses of assets at the nine-year survey, which show that processes of asset loss play out over a longer period, suggesting that our results are likely a conservative estimate of the barriers faced. Notably, women experience loss of homes and vehicles but not bank accounts. Prior research using FFCWS data found that approximately one-third of women in romantic partnerships hold separate accounts and that the likelihood of holding a separate account (compared with only joint accounts) is graded by SES (Addo and Sassler 2010). Our result suggests that sole-ownership structures may serve to protect the assets of women connected to former inmates.

The literature suggests a number of mechanisms through which incarceration might reduce asset ownership, including reductions in employment and income (Western 2006), accrual of legal debt (Harris et al. 2010), involuntary loss of assets (Campbell et al. 2012), relationship dissolution (Western 2006), residence in financially underserved communities (Massoglia et al. 2013), and avoidance of mainstream financial institutions (Goffman 2009). Our analyses consider some of these pathways. The results show that economic characteristics explain some of the association between incarceration and asset ownership among men. Neighborhood characteristics explain virtually none of the association. It is possible that there is measurement error in these variables and/or that they do not capture the full economic or neighborhood portrait of these families. For instance, we consider employment and earnings as potential mechanisms but ideally would have data on cumulative earnings between waves; we also consider a standard index of neighborhood disadvantage but ideally would have data on local access to banks or alternative financial services providers. Additionally, we cannot observe other dynamics, such as legal debt or avoidance of mainstream institutions. Future research should continue to interrogate these mechanisms and the additional mechanisms that we cannot test here.

Although economic and neighborhood characteristics explain a relatively small portion of the association between incarceration and asset ownership, the results show that relationship characteristics are a more powerful mechanism. Union dissolution explains between 12 % and 35 % of the association between incarceration and men’s asset ownership and between 20 % and 40 % of the association between incarceration and women’s asset ownership. The finding that the destabilization of romantic relationships resulting from incarceration reduces asset ownership is in line with a growing literature on the collateral consequences of incarceration for family life (e.g., Turney and Wildeman 2013) and provides evidence that the familial consequences of incarceration may have spillover implications for economic stratification.

Importantly, any research on the consequences of incarceration must consider the possibility that the selectivity of individuals into prison or jail leads to spurious associations between incarceration and outcomes. We take measures to guard against this possibility in our analysis. We first leverage the rich individual characteristics included in the FFCWS data to control for attributes that might both increase incarceration and reduce asset ownership. We also include a lagged indicator of asset ownership and use propensity score models that assure close comparisons between incarcerated men and their matched counterparts. Additional analyses provide some assurance that our results are not driven by selection. For example, we find similar results when we limit our analyses to examine only previously incarcerated men. We find that the negative relationship between incarceration and asset ownership among men does not vary by their pre-incarceration coresidence with the focal child’s mother, as we would expect, but rather that the relationship between incarceration and asset ownership among women is specific to those living with romantic partners prior to incarceration. Also, the associations do not vary based on offense severity, which we expect is correlated with unobserved characteristics, further strengthening causal inference. In sum, the results are robust to an array of modeling strategies.

Limitations

Several important limitations exist, in addition to the aforementioned possibility of measurement error. The FFCWS is a sample of parents in urban areas. The focus on parents is both a virtue and a limitation of these data. Parents, especially the unmarried parents included in the data, are a population of key policy interest given that any effects of incarceration on parents may have spillover effects on their children. Indeed, research on the collateral consequences of incarceration for children has speculated that economic insecurity following incarceration may be one mechanism through which paternal incarceration exerts deleterious effects on children (Geller et al. 2012), and separate research has suggested that household assets are a strong predictor of children’s outcomes (Orr 2003). However, these data do not allow us to consider whether the consequences of incarceration on household assets extend to nonparents. We also must contend with significant attrition of fathers from the sample. Although men who attrited are different in some respects from those who did not, these differences do not tell a clear story that would let us predict the direction of any attrition bias.

Few nationally representative longitudinal surveys contain reliable and complete data on incarceration. The FFCWS is one data source that includes detailed information on incarceration. However, the measures of incarceration are limited. For one, distinguishing between recent jail and prison incarceration is impossible. Prison stays, which are usually lengthier and located farther from prisoner’s families than jail stays, may be more detrimental to household wealth. However, we expect that jail time is also quite disruptive of asset holding and acquisition, and our comparison of shorter and longer confinements indirectly supports the proposition that jail (as proxied by short stays) is harmful.

Finally, although our dependent variables—ownership of a bank account, vehicle, and home—capture assets that may be important to low-income families, the measures are imprecise and do not capture the full scope and value of all assets and debts. That said, methodological work on the measurement of household assets also suggests that assets may be an effective proxy for more detailed accounts of household wealth (Cubbin et al. 2011). Surveys such as the Survey of Consumer Finances and the Health and Retirement Study contain far more detailed data on personal wealth that allows for the calculation of total net worth, liquid financial savings, and ownership of a large set of assets and debts. However, these surveys contain no data on incarceration.

Conclusion

By considering the relationship between incarceration and household asset ownership, our analysis adds to two growing and distinct literatures: one on the collateral consequences of incarceration, and another on the social processes associated with asset ownership. The contributions are threefold. First, we estimate the association between incarceration and asset ownership among formerly incarcerated men and the women who share children with them, finding that incarceration reduces assets among both men and women. The robustness of this association across an array of analytic strategies, attention to social selection processes, and the apparent individual-level associations regardless of offense type and for relatively short incarcerations bring the substantial costs of mass incarceration into sharp focus. Second, we distinguish between asset loss and difficulty acquiring new assets, and document that for both formerly incarcerated men and the women connected to them, incarceration is especially consequential for the loss of existing bank accounts, vehicles, and homes. Third, we examine the mechanisms linking incarceration to asset ownership, and we find that changes in relationships resulting from paternal incarceration are an important mechanism through which incarceration is related to asset ownership, which extends a broader literature on the consequences of incarceration for family life (e.g., Turney and Wildeman 2013). Broadly, our findings provide evidence for cycles of cumulative disadvantage: incarceration reduces assets among already disadvantaged young men and their families, and this asset poverty, in turn, further disadvantages the children of formerly incarcerated men.

The past decade has seen increased efforts at designing and implementing social programs to assist men returning from prison. Initiatives such as the Center for Employment Opportunities have attempted to connect ex-prisoners with work in the formal sector as well as with housing, education, and treatment services (Wildeman and Western 2010). Although such interventions may ultimately help to facilitate asset ownership by increasing the economic security of these men, our work also suggests that such interventions might also consider facilitating access to low-cost mainstream banking products and affordable vehicle ownership. Another, potentially complementary approach would be to provide additional prerelease programs that focus on how to find and open an affordable account, reestablish credit, and navigate common administrative pitfalls in the financial system. Finally, ensuring that ex-prisoners have identification documents at the time of release could also facilitate access to a bank account and vehicle ownership. Our results also suggest that relationship dissolution is an important pathway by which incarceration affects asset ownership. The provision of counseling and education services both during incarceration and soon after release could help to preserve marginal relationships and potentially also mitigate asset loss. Perhaps most clearly, however, our work suggests that reducing the broad reach of mass incarceration may help to strengthen the economic position of families, thus reducing the loss of key assets, such as bank accounts, vehicles, and homes.

Notes

Although not all mothers and fathers participate in all survey waves, the attrition levels of these data are lower than the attrition levels among cohabiting women and their partners in other representative samples (e.g., Sassler and McNally 2003).

For respondents with romantic partners, it is impossible to distinguish whether they, their partner, or both individuals own the car, truck, or van.

A relatively large number of observations are missing data on duration (18 % in the fathers’ analytic sample) and offense type (35 %). Fathers convicted for both nonviolent and violent offenses are considered violent offenders.

We use probit regression models, and all covariates from Model 2, to generate a propensity score for each observation.

It is inadvisable to compare across logistic regression models (Mood 2010). Therefore, in supplemental analyses, we used linear probability models to estimate the analyses presented in Tables 2, 3, 4, and 5 as well as Tables 6 and 7 in Appendix 1. These analyses produced coefficients that were comparable with the average marginal effects from the logistic regression models.

Interactions between incarceration and race/ethnicity show relatively little variation in the association between incarceration and asset ownership, but some evidence suggests that the relationship between paternal incarceration and bank account ownership is stronger among white fathers than among black fathers (p = .049).

Each modeling approach is applied to both men and women and to each of the three assets that we observe, potentially increasing the chance of type I error. With one exception (the association between recent paternal incarceration and fathers’ homeownership), our results hold up to both Bonferroni and Sidak corrections for multiple comparisons.

References

Addo, F., & Sassler, S. (2010). Financial arrangements and relationship quality in low-income couples. Family Relations, 59, 408–423.

Apel, R., & Sweeten, G. (2010). The impact of incarceration on employment during the transition to adulthood. Social Problems, 57, 448–479.

Avellar, S., & Smock, P. J. (2005). The economic consequences of the dissolution of cohabiting unions. Journal of Marriage and Family, 67, 315–327.

Barker, D. (2013). The evidence does not show that homeownership benefits children. Cityscape, 15, 231–234.

Barr, M. (2004). Banking the poor. Yale Journal on Regulation, 21, 121–237.

Barr, M., & Blank, R. (2009). Savings, assets, credit, and banking among low-income households: Introduction and overview. In M. Barr & R. Blank (Eds.), Insufficient funds: Savings, assets, credit, and banking among low-income households (pp. 1–22). New York, NY: Russell Sage.

Baum, C. (2009). The effects of vehicle ownership on employment. Journal of Urban Economics, 66, 151–163.

Beckett, K., Harris, A., & Evans, H. (2008). The assessment and consequences of legal financial obligations in Washington state. Olympia: The Washington State Minority and Justice Commission.

Blank, R. (2010). Middle class in America. Washington, DC: U.S. Department of Commerce, Economics and Statistics Administration.

Brayne, S. (2014). Surveillance and system avoidance: Criminal justice contact and institutional attachment. American Sociological Review, 79, 367–391.

Campbell, D., Martinez-Jerez, A., & Tufano, P. (2012). Bouncing out of the banking system: An empirical analysis of involuntary bank account closures. Journal of Banking & Finance, 36, 1224–1235.

Caskey, J. (2005). Reaching out to the unbanked. In M. Sherraden (Ed.), Inclusion in the American dream: Assets, poverty, and public policy (pp. 149–166). New York, NY: Oxford University Press.

Comfort, M. (2008). Doing time together: Love and family in the shadow of the prison. Chicago, IL: University of Chicago Press.

Conley, D. (1999). Being black, living in the red. Berkeley: University of California Press.

Cubbin, C., Pollack, C., Flaherty, B., Hayward, M., Sania, A., Vallone, D., & Braveman, P. (2011). Assessing alternative measures of wealth in health research. American Journal of Public Health, 101, 939–947.

Dickman, S. J. (1990). Functional and dysfunctional impulsivity: Personality and cognitive correlates. Journal of Personality and Social Psychology, 58, 95–102.

Edin, K., & Kefalas, M. (2005). Promises I can keep: Why poor women put motherhood before marriage. Berkeley: University of California Press.

Ergungor, O. E. (2010). Bank branch presence and access to credit in low- to moderate-income neighborhoods. Journal of Money, Credit and Banking, 42, 1321–1349.

Geller, A., Cooper, C. E., Garfinkel, I., Schwartz-Soicher, O., & Mincy, R. B. (2012). Beyond absenteeism: Father incarceration and its effects on children’s development. Demography, 49, 49–76.

Geller, A., Garfinkel, I., & Western, B. (2011). Paternal incarceration and support for children in fragile families. Demography, 48, 25–47.

Goffman, A. (2009). On the run: Wanted men in a Philadelphia ghetto. American Sociological Review, 74, 339–357.

Graves, S. M. (2003). Landscapes of predation, landscapes of neglect: A location analysis of payday lenders and banks. Professional Geographer, 55, 303–317.

Grinstead, O., Faigeles, B., Bancroft, C., & Zack, B. (2001). The financial cost of maintaining relationships with incarcerated African American men: A survey of women prison visitors. Journal of African American Studies, 6(1), 59–69.

Groves, R. M. (2004). Survey errors and survey costs. New York, NY: Wiley.

Grusky, D. B., Smeeding, T. M., & Snipp, C. M. (2015). A new infrastructure for monitoring social mobility in the United States. Annals of the American Academy of Political and Social Science, 657, 63–82.

Hagan, J. (1993). The social embeddedness of crime and unemployment. Criminology, 31, 465–491.

Harding, D. J., Morenoff, J., & Herbert, C. (2013). Home is hard to find: Neighborhoods, institutions, and the residential trajectories of returning prisoners. Annals of the American Academy of Political and Social Science, 647, 214–236.

Harding, D. J., Wyse, J. J. B., Dobson, C., & Morenoff, J. D. (2014). Making ends meet after prison. Journal of Policy Analysis and Management, 33, 440–470.

Harris, A., Evans, H., & Beckett, K. (2010). Drawing blood from stones: Legal debt and social inequality in the contemporary United States. American Journal of Sociology, 115, 1753–1799.

Hogarth, J., Angeulov, C., & Lee, J. (2005). Who has a bank account? Exploring change over time, 1989–2011. Journal of Family and Economic Issues, 26, 7–30.

Kaeble, D., Glaze, L., Tsoutis, A., & Minton, T. (2015). Correctional populations in the United States, 2014. Washington, DC: U.S. Department of Justice.

Keister, L. A., & Moller, S. (2000). Wealth inequality in the United States. Annual Review of Sociology, 26, 63–81.

Kuebler, M. (2013). Closing the wealth gap: A review of racial and ethnic inequalities in homeownership. Sociology Compass, 7, 670–685.

LaLonde, R. J. (1986). Evaluating the econometric evaluations of training programs with experimental data. American Economic Review, 76, 604–620.

Lerman, R., & McKernan, S.-M. (2008). Benefits and consequences of holding assets. In S.-M. McKernan & M. Sherraden (Eds.), Asset building and low-income families (pp. 175–206). Washington, DC: Urban Institute Press.

Lyons, C. J., & Pettit, B. (2011). Compounded disadvantage: Race, incarceration, and wage growth. Social Problems, 58, 257–280.

Maroto, M. L. (2014). The absorbing status of incarceration and its relationship with wealth accumulation. Journal of Quantitative Criminology, 31, 207–236.

Massoglia, M., Firebaugh, G., & Warner, C. (2013). Racial variation in the effect of incarceration on neighborhood attainment. American Sociological Review, 78, 142–165.

McKernan, M.-S., Ratcliffe, C., & Vinopal, K. (2009). Do assets help families cope with adverse events? (Perspectives on Low-Income Working Families, Brief No. 10). Washington, DC: Urban Institute.

McKernan, M.-S., Ratcliffe, C., & Williams Shanks, T. (2012). Is poverty incompatible with asset accumulation? In P. N. Jefferson (Ed.), The Oxford handbook of the economics of poverty (pp. 463–493). New York, NY: Oxford University Press.

Minton, T. D. (2012). Jail inmates at midyear 2011—Statistical tables. Washington, DC: U.S. Department of Justice.

Mood, C. (2010). Logistic regression: Why we cannot do what we think we can do, and what we can do about it. European Sociological Review, 26, 67–82.

Mumola, C. J. (2000). Incarcerated parents and their children (Bureau of Justice Statistics special report). Washington, DC: U.S. Department of Justice.

Oliver, M. L., & Shapiro, T. M. (2006). Black wealth, white wealth: A new perspective on racial inequality. New York, NY: Routledge.

Orr, A. J. (2003). Black-white differences in achievement: The importance of wealth. Sociology of Education, 76, 281–304.

Pager, D. (2003). The mark of a criminal record. American Journal of Sociology, 108, 937–975.

Paternoster, R., Brame, R., Mazerolle, P., & Piquero, A. (1998). Using the correct statistical test for the equality of regression coefficients. Criminology, 36, 859–866.

Pearson, J. (2004). Building debt while doing time: Child support and incarceration. Judges’ Journal, 43(1), 5–12.

Pettit, B., & Western, B. (2004). Mass imprisonment and the life course: Race and class inequality in U.S. incarceration. American Sociological Review, 69, 151–169.

Sassler, S., & McNally, J. (2003). Cohabiting couples’ economic circumstances and union transitions: A re-examination using multiple imputation techniques. Social Science Research, 32, 553–578.

Schneider, D. (2011). Wealth and the marital divide. American Journal of Sociology, 117, 627–667.

Schneider, D., & Turney, K. (2015). Incarceration and black-white inequality in homeownership: A state-level analysis. Social Science Research, 53, 403–414.

Schwartz-Soicher, O., Geller, A., & Garfinkel, I. (2011). The effect of paternal incarceration on material hardship. Social Service Review, 85, 447–473.

Sherraden, M. (1991). Assets and the poor: A new American welfare policy. New York, NY: ME Sharpe Publishers Inc.

Sherraden, M. (2009). Individual development accounts and asset-building policy: Lessons and directions. In R. M. Blank & M. S. Barr (Eds.), Insufficient funds: Savings, assets, credit, and banking among low-income households (pp. 191–217). New York, NY: Russell Sage Foundation.

Smock, P., Manning, W., & Gupta, S. (1999). The effect of marriage and divorce on women’s economic well-being. American Sociological Review, 64, 794–812.

Spilerman, S. (2000). Wealth and stratification processes. Annual Review of Sociology, 26, 497–524.

Travis, J., Cincotta McBride, E., & Solomon, A. L. (2005). Families left behind: The hidden costs of incarceration and reentry. Washington, DC: Justice Policy Center.

Turney, K. (2015a). Hopelessly devoted? Relationship quality during and after incarceration. Journal of Marriage and Family, 77, 480–495.

Turney, K. (2015b). Liminal men: Incarceration and relationship dissolution. Social Problems, 62, 499–528.

Turney, K., & Wildeman, C. (2013). Redefining relationships: Explaining the countervailing consequences of paternal incarceration for parenting. American Sociological Review, 78, 949–979.

Wakefield, S., & Uggen, C. (2010). Incarceration and stratification. Annual Review of Sociology, 36, 387–406.

Washington, E. (2006). The impact of banking and fringe banking regulation on the number of unbanked Americans. Journal of Human Resources, 41, 106–137.

Western, B. (2006). Punishment and inequality in America. New York, NY: Russell Sage Foundation.

Wildeman, C., Turney, K., & Yi, Y. (2016). Paternal incarceration and family functioning: Variation across federal, state, and local facilities. Annals of the American Academy of Political and Social Science, 665, 80–97.

Wildeman, C., & Western, B. (2010). Incarceration in fragile families. Future of Children, 20(2), 157–177.

Zatz, N. (2008). Working at the boundaries of markets: Prison labor and the economic dimension of employment relations. Vanderbilt Law Review, 61, 857–958.

Acknowledgments

Funding for the Fragile Families and Child Wellbeing Study was provided by the NICHD through Grants R01HD36916, R01HD39135, and R01HD40421, as well as a consortium of private foundations (see http://www.fragilefamilies.princeton.edu/funders.asp for the complete list). Schneider acknowledges support from the Robert Wood Johnson Foundation Scholars in Health Policy Research Program. We are grateful to Amanda Geller, Jessica Hardie, Loic Wacquant, Anita Zuberi, and participants at the Bay Area Colloquium in Population (BACPOP) for helpful feedback.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1

Our main findings show that incarceration is robustly associated with asset ownership among both recently incarcerated men and the women with whom they share children.

First, in Table 6, we consider the potentially differential consequences of incarceration duration for fathers’ and mothers’ assets, with duration measured as a series of mutually exclusive dummy variables: less than three months (5 % in the fathers’ analytic sample), three months or longer (7 %), duration missing (3 %), and not recently incarcerated (85 %). Here, if both shorter and longer incarceration spells are similarly associated with asset ownership, these findings would provide some evidence against threats to causal inference because we expect unmeasured characteristics to be correlated with incarceration duration. We find that incarceration lasting less than three months, compared with incarceration lasting three months or longer, is similarly consequential for fathers’ vehicle ownership and homeownership: the coefficients are not statistically different from each other (in the equivalent of Model 2 of Table 2, p = .507 for vehicle ownership and p = .369 for homeownership). Some evidence suggests that incarceration lasting three months or longer is more negatively associated with fathers’ bank account ownership than incarceration lasting less than three months (p = .001). With respect to mothers’ assets, we find no statistically significant differences between fathers’ shorter and longer incarcerations (p = .712 for bank account ownership, p = .965 for vehicle ownership, and p = .948 for homeownership). Furthermore, if we instead use thresholds of six months or one year, we find no statistically significant differences by incarceration duration. Taken together, these findings provide further evidence against threats to causal inference.

Second, in Table 7, we consider the potentially differential consequences of offense type, also measured as a series of mutually exclusive dummy variables: violent offense (3 % in the fathers’ analytic sample), nonviolent offense (6 %), offense type missing (5 %), and no recent paternal incarceration (85 %). These findings would provide some evidence against threats to causal inference if both types of offenses are similarly associated with asset ownership because we expect unmeasured characteristics to be correlated with offense type. Across all models and outcomes, we find no evidence that incarceration for violent and nonviolent offenses are differentially associated with fathers’ assets (p = .692, .235, and .375 for bank account, vehicle, and homeownership, respectively, in the equivalent of Model 2 of Table 2) or mothers’ assets (p = .201, .634, and .921, respectively). Again, these lacking differential associations provide some evidence against threats to causal inference.