Abstract

We consider a mixed oligopoly, taking into account partial privatization. While early literature finds that competition intensification brings the optimal degree of privatization (ODP) close to perfect privatization, a recent study, using a payoff interdependence approach, shows that competition intensification brings ODP close to perfect nationalization. This study uses a linear supply function approach, another method of evaluating competition intensification, to examine the robustness of the results from the payoff interdependence approach. As a result, we also show that fierce competition brings ODP close to perfect nationalization. This has practical implications and serves as a warning with respect to privatization.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Does a privatization policy improve social welfare? This is a fundamental question when considering privatization programs, and it is a controversial subject among policymakers and watchers.Footnote 1

In the field of economics, theorists have often discussed this problem using mixed oligopoly market models in which public firms maximize the social welfare, whereas private firms maximize their enterprise profits. De Fraja and Delbono (1989), who conduct one of the main studies to consider the problem, show that an increase in the number of private firms, representing intensification of competition, causes the optimal degree of privatization (ODP) to shift to perfect privatization.Footnote 2 The authors justify privatizing public firms. Vickers and Yarrow (1988, p.52)Footnote 3 consider which objective the managers of a public firm faced by a number of profit-maximizing competitors should be tasked with. The authors find that if the number of firms is large enough, it may be better for the public firm to have profit maximization, rather than welfare maximization, as its objective.

However, some cases show that privatization programs have not been successful.Footnote 4 Gradually, theorists have become skeptical about the incumbent result. Matsumura and Okamura (2015; hereafter, MO) object to utilizing the classical method to confirm whether privatization improves social welfare. The authors claim that the traditional definition of intensification of competition is “increasing the number of firms,” which is misleading. To be accurate, MO note that, when the number of firms (n) expands, the industry supply curve shifts out if each marginal cost is increasing, and hence the industry structure changes so that the “n-increasing approach” cannot evaluate the intensification of competition correctly. MO claim that n should be fixed within the analysis. MO alternatively adopt the payoff interdependence approach, which redefines intensifying competition as the transition from the quantity competition to price competition between firms. We sum their work within a duopoly as follows: MO assume that both a public firm and a private firm compete à la De Fraja and Delbono (1989), but their profit functions are described as mi = πi − απj, i,j = 0,1. Here, parameter α ∈ [0,1] implies the intensification of competition, and MO investigate how ODP is affected by α. Interestingly, the authors show that, contrary to the result from traditional analyses, ODP shifts to perfect nationalization. Thus, MO show that privatization can be detrimental to social welfare.

This study adopts the linear supply function (LSF) approach, which is another method to evaluate the intensification of competition in an output market.Footnote 5 LSF competition is described as follows: Each firm has a supply function qi = si + tp; namely, production is described as a linear function of price. Each firm determines the intercept si. The standard Cournot model describes the case of t = 0, and this is proved in Menezes and Quiggin (2012). This applies to the case of increasing marginal costs. In sum, the critical difference between the Cournot and the LSF model appears in the interval of \(t\in (0,\infty )\). Delbono and Lambertini (2016) investigate the relationships among the Cournot, Bertrand, and LSF equilibria in a private oligopoly. In addition, Yamane (2018) studies linear supply function competition in a mixed duopoly to investigate product differentiation but posits the degree of privatization given.

This study reproduces the above-mentioned analyses following MO to confirm the robustness of their main results. Additionally, this study reexamines the traditional “n-increasing approach,” although we recognize the validity of MO’s discussion. Our main results are as follows. First, if we fix n following MO, we find that fierce competition brings ODP close to perfect nationalization. Next, if we adopt the traditional approach, we find that fierce competition brings ODP close to perfect privatization; thus, we reach the same results as MO. Although privatization of public firms has been promoted globally, our study and other recent studies imply the need for sober and deliberate policymaking.

The rest of the paper is organized as follows. Section 2 presents the model. Sections 3 and 4 analyze each stage of the game. Section 5 concludes the study. In the Appendix, the case of the different slope of linear supply functions is demonstrated.

2 The Model

We consider a homogenous goods market in which one public firm and n private firms compete. The inverse demand is given by \(p=1-{\sum }_{i}q_{i}\) (qi indicates firm i’s output). Each firm’s cost function is assumed to be symmetric and is given by \(C(q_{i})=(c/2){q_{i}^{2}}\), where c > 1.Footnote 6 Thus, the profit function of each firm (including a public firm) is denoted as follows:

Additionally, social welfare is defined as the sum of consumer surplus and firms’ profits:

where firm 0 is a public firm, and private firms are denoted as 1,...,n. The objective function of each private firm is its enterprise profit πi, whereas that of a public firm is assumed to be the weighted sum of social welfare and its profit v0 = λW + (1 − λ)π0, where λ ∈ [0,1].

Here, we slot the linear supply function (LSF). Following the early work of LSF, each firm is supposed to have a linear supply function qi = si + tip.Footnote 7 With this function, each firm is supposed to decide the intercept si and/or slope ti. However, Delbono and Lambertini (2015) show that deciding both is mathematically equivalent in the sense that the first-order conditions are not linearly independent so that either of them should be assumed given. Pioneering work of LSF, Menezes and Quiggin (2012), posit that the slope is given (ti = t, ∀i) and show the following result.

Remark 1

Under the linear supply function competition in private oligopoly, the equilibrium values correspond with the Cournot one when t = 0 and correspond with perfect competition one when \(t\rightarrow \infty \).

This proposition implies that the parameter t can be utilized as an indicator of competition type, which holds Cournot and Bertrand competition as special cases.Footnote 8 Using this parameter, it is possible to analyze an infinitesimal variation when the competition mode moves from quantity competition to price competition. Although the above-mentioned work analyzes private oligopoly (composed of only private firms), the results also hold in mixed oligopoly settings, as shown in this paper. Following Menezes and Quiggin (2012), we adopt the linear supply function:

where \(t\in [0,\infty )\) is given and si > 0. Firm i chooses its output qi in accordance with qi = si + tp and it is common knowledge to all the firms.

The game runs as follows. In the first stage, the regulator (government) determines λ by selling the stock shares of a public firm. In the second stage, after observing λ, all firms simultaneously carry out the supply function competition. We solve the game by backward induction.

3 Second Stage

3.1 Equilibrium

Substituting Eq. 3 into the inverse demand, \(p=1-q_{0}-q_{i}-{\sum }_{j\neq 0,i}q_{j}\), we obtain \(p=1-(s_{0}+tp)-(s_{j}+tp)-\left [{\sum }_{j\neq 0,i}s_{j}+(n-1)tp\right ]\), or \(p=\left (1-s_{0}-s_{i}-{\sum }_{j\neq 0,i}s_{j}\right )/(nt+t+1)\). Substituting this again into Eq. 3, the quantities are characterized as a function of \(S=(s_{0},s_{i},{\sum }_{j\neq 0,i}s_{j})\), such as q0 = f0(S) and qi = fi(S). Using these, we can describe the payoff functions as πi(S) and v0(S).

Note that, using \(\bar {Q}(S)=\left [s_{0}+{\sum }_{j\neq 0}s_{j}+(n+1)t\right ]/[1+(n+1)t]\) and \(P\left (\bar {Q}(S)\right )=\left (1-s_{0}-{\sum }_{j\neq 0}s_{j}\right )/[1+(n+1)t]\), each firm’s payoff function is described as follows:

The first-order conditions of ∂πi(S)/∂si = 0 and ∂v0(S)/∂s0 = 0 with symmetry S− 0,i = (n − 1)si yield the following reaction functions:

The stability conditions are assumed to be satisfied for simplicity. Using these, we obtain the equilibrium intercepts of \(s_{0}^{*}\) and \(s_{i}^{*}\).

Thus, the main equilibrium obtained is as follows:

where

Now, we must confirm whether Remark 1 also holds here with mixed oligopoly, since Menezes and Quiggin (2012) and Delbono and Lambertini (2015) only analyze private oligopoly. Here, we briefly explain MO’s model. In their main analysis, assuming each firm’s payoff function as \(m_{i}=\pi _{i}-\alpha {\sum }_{j\neq i}\pi _{j}/(n-1),\ i=0,1,...,n\) and the objective function of private and public firms as πi = mi, i = 1,...,n, π0 = λW + (1 − λ)m0, respectively, they examine the comparative statics in equilibrium.

Because MO’s results when α = 0 and α = 1, respectively, correspond to the Cournot and Bertrand equilibria, it is sensible to compare the results we obtain here with those of MO. That is, it must be shown that our model’s result when \(t=0\ (t\rightarrow \infty )\) corresponds with the result in MO when α = 0 (α = 1). We believe that we must only check the quantities. Denoting MO’s result as superscript MO, we obtain the following:

Thus, we confirm that Remark 1 also holds in our mixed oligopoly model.Footnote 9 Naturally, if λ = 0, the above equations correspond, since this implies a symmetric private oligopoly.

Remark 2

Under the linear supply function competition in a mixed oligopoly, the equilibrium values correspond with the Cournot one when t = 0 and with perfect competition one when \(t\rightarrow \infty \).

3.2 Comparison to Matsumura and Okamura (2015)

We compare the result in this stage with MO. First, for the quantities, the following relation holds:

This corresponds with MO; the equation holds when λ = 1 or \(t\rightarrow \infty \). As the authors note, this stems from the fact that the public firm is so interested in improving the consumer surplus that it produces more than private firms.

Next, we confirm how the equilibrium changes as market competition intensifies. This can be confirmed through the variation of t because of Remark 2. For the quantities and prices, we obtain

These are natural results because when the market competition intensifies in the sense that it is close to price competition, private firms increase production and prices decrease, and the difference between public and private firms shrinks.

Here, we confirm the equilibrium profits of private firms although this is not conducted in MO. Differentiating \(\pi _{i}^{*}\) with respect to t, we obtain

where

U determines the sign of Eq. 7. If λ = 0, U is positive so that Eq. 7 is negative, which is quite natural. However, this does not always hold. For example, the set of λ = 1, n = 2, and t = 0 result in U = − 3c < 0, which causes Eq. 7 to be positive.

Property 1

In a mixed oligopoly under the linear supply function competition, the intensification of competition, in the sense that competition mode turns from quantity competition to price competition, can boost private firms’ profits.

Next, comparing the public firm’s profits with the private firms’ profits, we obtain the following:

Property 2

If λ≠ 0, then \(\pi _{0}^{*}>\pi _{i}^{*}\) holds. Otherwise, \(\pi _{0}^{*}=\pi _{i}^{*}\) holds.

As can be seen in Eq. 5, the public firm has strong incentives to increase production, as it is interested in improving consumer surplus. This implies that the enterprise profits of the public firm can exceed those of the private firm. It is important to note that Fershtman and Judd (1987) and Sklivas (1987) show that in an oligopoly market, firms deviating from profit maximization could boost profits.

4 First Stage

First, in this stage, we observe the following:

Lemma 1

Definingλ∗asthe welfare-maximizing degree of privatization,

where

Proof

Substituting Eq. 4 into Eq. 2, we obtain W(t) ≡ W∗. The condition in which this is a concave function of λ is V ≡ ∂2W∗/∂λ2 < 0, ∀λ ∈ [0,1]. Here, the crucial term that determines the sign of V is a linear function of λ, and its coefficient is

Defining \(\hat {\lambda }\) as the value that satisfies V = 0,

Therefore, this is a quadratic function of t, since n ≥ 1 and c > 1. A discriminant is obtained as

so that \(\hat {\lambda }<0\) holds. Hence, V < 0 ∀λ ∈ [0,1] is proved. Further, since

holds, W∗ is maximized when \(\lambda =\bar {\lambda }\).

Next, since \(\bar {\lambda }\geq 0\) is obvious, λ∗ = 1 if \(\bar {\lambda }\geq 1\).Footnote 10□

Hereafter, we proceed with the analysis assuming \(\lambda ^{*}=\bar {\lambda }\) to compare it with the result in MO. Here, we assume t < 1/(c + 1), which is a sufficient condition for the following proposition. The claim that corresponds to Proposition 5 in MO is as follows:

Proposition 1

The following hold:

-

(i)

\(\frac {\partial \lambda ^{*}}{\partial n}<0\quad \forall t<\min \left \{t_{x},\frac {1}{c+1}\right \}\),

-

(ii)

\(\frac {\partial \lambda ^{*}}{\partial t}>0\quad \forall t<t_{x}\).

Proof of (i).

First, the sign of ∂λ∗/∂n is as follows:

Since this is a linear function on n, statement (i) holds if both of the following are satisfied:

-

(a)

(c2 + c)t − c − 2 < 0, and

-

(b)

the value of n satisfying sign (∂λ∗/∂n) = 0 is negative.

Second, solving (c2 + c)t − c − 2 = 0 with respect to t, we obtain

Defining A ≡ n(c + 3) + (c + 1)2 > 0 and B ≡ n2 + 2(c − 1)n + (c + 1)2 > 0, the sign of ty − tx is determined by \(A-(c+1)\sqrt {B}\), and the sign of this term is equivalent to the sign of A2 − (c + 1)2B. Expanding this, we obtain

Hence, (a) is proved.

Next, putting the term that determines the sign of ∂λ∗/∂n equal to 0 and solving it with respect to n, we obtain

Since the numerator is negative because of (a), and 1 − t − ct > 0 because of the assumption of t < 1/(c + 1), \(\bar {n}<0\) holds. Therefore, (b) is proved. □

Proof of (ii).

Let Δ be the term that determines the sign of ∂λ∗/∂t. Then, we obtain

□

Proposition (i) corresponds with De Fraja and Delbono (1989) and MO. That is, an increase in the number of private firms can support perfect privatization. On the contrary, Proposition (ii) claims that perfect nationalization is justified if intensification of competition is defined to be the transition from quantity to price competition where n is given. This is consistent with MO, and Proposition (ii) can be explained in the same way as MO. From Eq. 6, fierce competition increases private firms’ production and shrinks the production difference between firm 0 and firm i. These properties (particularly the latter property) imply that privatization of the public firm does not contribute to an improvement in social welfare so that the intensification of competition leads ODP to perfect nationalization.

MO claims that intensification of competition, an increase in α with a given n, brings ODP close to 1. This claim also holds in our model. Moreover, our model shows that intensification of competition, in the sense that n increases, can bring ODP close to 0. Hence, our analysis with a linear supply function equilibrium model lends robustness to MO’s analysis with a payoff interdependence model.

5 Conclusion

We conclude our study by comparing our study with Matsumura and Okamura (2015). First, MO reveal that (i) a state of partial privatization, rather than perfect privatization, maximizes social welfare; (ii) intensification of competition, in the sense that the number of private firms increases, creates the optimal degree of privatization (ODP) close to perfect privatization; and (iii) intensification of competition, in the sense that the competition mode changes from quantity to price competition, brings ODP close to perfect nationalization. MO’s contribution to the literature is (iii) and reveals another aspect of privatization.

On the other hand, this paper, using a linear supply function approach, reveals that (i) a state of partial privatization, rather than perfect privatization or nationalization, maximizes social welfare (the same as MO), (ii) intensification of competition, in the sense that the number of private firms increases, brings ODP close to perfect privatization (the same as literature), and (iii) intensification of competition, in the sense that the competition mode changes from quantity to price competition, brings ODP close to perfect nationalization (the same as MO).

MO’s study successfully induces researchers and policymakers to take a hard look at privatization policy, and our study lends robustness to their study. Of course, more detailed analysis will be required in the future. We finish this study by suggesting three directions for further study. First, we must consider the market in which multiple public firms exist. Second, it might be interesting to examine whether the two models, namely, the interdependence payoff model and linear supply function model are completely equivalent in the sense that there is a one-to-one mapping which allows us to interchange one model to the other model. Third, realistically, firms determine their own margin, for example, through the full-cost principle, so that competition attitude may be determined by firms. Thus, we need to endogenize t.

Notes

For the effects of increasing the number of public firms, see Matsumura and Shimizu (2010).

Their comments are from De Fraja and Delbono’s working paper, 1986 version.

For the UK’s privatization, see, for instance, Liberati (2005) and the literature cited.

The supply function competition model is often used to investigate the electricity spot market (see, for instance, Green and Newbery (1992)).

The constraint on c stems from the sufficient condition in which the social welfare W is a concave function of λ. Additionally, replacing the parameter c with ci (c0 ≥ cj,∀j≠ 0) does not change the main results, as MC(q0) = cq0 is not equivalent to MC(qj) = cqj. This is because the different objective functions yield different production between the two types of firms.

For the early work on the supply function equilibrium model in private oligopoly, see Klemperer and Meyer (1989).

Note that this model assumes exogenous competition in which firms are not able to decide the competition attitude (e.g., through determining their margins) since, for instance, it is regulated by the government. For competition whereby each firm selects strategic variables as a quantity contract or a price contract (endogenous competition), see Singh and Vives (1984).

Since the weight attached to W is 1 − 𝜃 in MO, note that λ corresponds to 1 − 𝜃 in MO’s model.

Although it is counterintuitive that the ODP can be lower than one, MO explain this as follows. On the one hand, as the marginal cost function is increasing, the public firm, which seeks first-best pricing, faces higher marginal costs than private firms do. Thus, this firm, called firm 0, is productivity inefficient compared with private firms. On the other hand, when privatization is instituted, consumer surplus worsens (∂p∗/∂λ < 0), but production efficiency improves since firm 0 faces lower marginal costs than before. Thus, when the production efficiency is largely improved (\(\lambda \in [\bar {\lambda },1]\) in our model), privatization improves welfare. Note that λ∗ is always one if the marginal cost function is constant, because, in such a situation, privatization makes production efficiency steady and consumer surplus worse.

References

Armstrong M, Cowan S, Vickers J (1995) Regulatory reform: economic analysis and British experience. The MIT Press, Cambridge

De Fraja G, Delbono F (1989) Alternative strategies of a public enterprise in oligopoly. Oxf Econ Paper 41(2):302–311

Delbono F, Lambertini L (2015) On the properties of linear supply functions in oligopoly. Econ Lett 136:22–24

Delbono F, Lambertini L (2016) Ranking Bertrand, Cournot and supply function equilibria in oligopoly. Energ Econ 60:73–78

Evans AW (2013) The economics of railway safety. Res Transport Econ 43:137–147

Fershtman C, Judd KL (1987) Equilibrium incentives in oligopoly. Am Econ Rev 77(5):927–940

Green RJ, Newbery DM (1992) Competition in the British electricity spot market. J Polit Econ 100:929–953

Klemperer PD, Meyer MA (1989) Supply function equilibria in oligopoly under uncertainty. Econometrica 57(6):1243–1277

Liberati P (2005) UK Privatization and household welfare. FinanzArchiv 61 (2):220–255

Matsumura T, Okamura M (2015) Competition and privatization policies revisited: the payoff interdependence approach. J Econ 116:137–150

Matsumura T, Shimizu D (2010) Privatization waves. Manchester Sch 78 (6):609–625

Menezes FM, Quiggin J (2012) More competitors or more competition? Market concentration and the intensity of competition. Econ Lett 117:712–714

Nepal R, Foster J (2015) Electricity networks privatization in Australia: an overview of the debate. Econ Anal Pol 48:12–24

Singh N, Vives X (1984) Price and quantity competition in a differentiated duopoly. RAND J Econ 15(4):546–554

Sklivas SD (1987) The strategic choice of managerial incentives. RAND J Econ 18(3):452–458

Vickers J, Yarrow G (1988) Privatization: an economic analysis. The MIT Press, Cambridge

Vickers J, Yarrow G (1991) Economic perspectives on privatization. J Econ Perspect 5(2):111–132

Winston C, Yan J (2011) Can privatization of U.S. highways improve motorists’ welfare? J Publ Econ 95:993–1005

Yamane K (2018) Mixed duopoly and the indirect effect in linear supply function competition. Econ Polit Indust 45(4):519–532

Acknowledgements

The author is grateful to Tomomichi Mizuno (Kobe University), Takashi Yanagawa (Kobe University), and the anonymous referees for their helpful comments and suggestions.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of Interests

The author declares that he has no conflict of interest.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

We examine the case of the different slope of linear supply functions in a mixed duopoly, namely, the competition between firm 0 (the public firm) and firm 1 (the private firm). Let us assume the inverse demand function as p = 1 − q0 − q1; cost function of each firm as \(c{q_{0}^{2}}\) and \(c{q_{1}^{2}}\); and the linear supply functions as given by q0 = s0 + t0p and q1 = s1 + t1p, respectively. The objective functions, as well as other conditions of the parameter and variables, are the same as in the main manuscript. Using a similar procedure, we derive the unique λ∗ as follows:

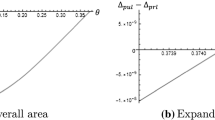

Using this, we confirm how λ∗ is affected by t0 or t1. The numerical examples are as follows:

w = (c,t0,t1) | λ∗(w) | ∂λ∗(w)/∂t0 | ∂λ∗(w)/∂t1 |

|---|---|---|---|

(5, 1, 0) | 0.929 | – | – |

(5, 0.5, 0) | 0.910 | positive | positive |

(5, 0, 0) | 0.878 | positive | positive |

(5, 0, 0.1) | 0.946 | positive | positive |

(5, 0, 0.15) | 0.986 | – | – |

In all the rows, the second-order conditions are satisfied. The base line is the third row, w = (5, 0, 0), which corresponds to the case of n = 1, c = 5, t = 0 in the paper. The discrete change of λ∗ by the change in the public firm’s competition intensity can be checked through comparison with the first and second rows. In the table, the value increases as t0 increases. Conversely, the change in λ∗ by the change in the private firm’s competition intensity can be checked through comparison with the fourth and fifth rows. In both cases, the table shows that the optimal degree of privatization approaches perfect nationalization (\(0.878\rightarrow 0.910\rightarrow 0.929\) and \(0.878\rightarrow 0.946\rightarrow 0.986\)). Further, the infinitesimal effect is checked by the third and fourth columns. The table shows that continuous changes by t0 and t1 are the same as the discrete changes.

Rights and permissions

About this article

Cite this article

Yamane, K. Market Structure, Competition, and Optimal Privatization: a Linear Supply Function Approach. J Ind Compet Trade 20, 605–615 (2020). https://doi.org/10.1007/s10842-019-00315-2

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10842-019-00315-2