Abstract

We investigate the relationship between competition and privatization policies. Existing studies measure the strength of competition based on the number of firms, and show that the optimal degree of privatization is higher in more competitive markets. We introduce an interdependent payoff structure into a mixed oligopoly and revisit this problem. Here, we assume that firms consider their own and other firms’ profits. In the model, competition increases when firms are negatively affected by rivals’ profits. We find that under the assumption of quadratic production costs, which is popular in mixed oligopolies, the optimal degree of privatization is higher when there is less market competition. This finding contrasts with those of prior studies. However, this result may be reversed when we adopt alternative model formulation. Furthermore, in the constant marginal cost case, the optimal degree of privatization is always lower when there is less market competition, which is opposite to the result in the quadratic cost case. Our results suggest that the relationship between an optimal privatization policy and the strength of competition crucially depends on the market structure, including the cost conditions.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Privatization has increased worldwide since the 1980s. Nevertheless, public and semi-public (partially privatized) firms remain active, and many compete with private firms in developed, developing, and transitional economies. Recently, studies on mixed oligopolies involving private and public enterprises have become increasingly popular.Footnote 1 In the literature on mixed oligopolies, the privatization of public enterprises remains an important research topic. Furthermore, the privatization of temporarily nationalized firms during a financial crisis could become an important political and economic issue in the near future. In this study, we adopt the partial privatization model formulated by Matsumura (1998), and discuss the optimal degree of privatization in a mixed oligopoly.Footnote 2

The privatization of public firms often takes place in conjunction with competition policy reforms. As a result, the relationship between a privatization policy and market competition in a mixed oligopoly has attracted considerable attention among researchers. Existing studies on mixed oligopolies show that privatization is more likely to improve welfare when there are more private firms (De Fraja and Delbono 1989; Fjell and Pal 1996; Han and Ogawa 2008; Matsumura and Shimizu 2010; Lin and Matsumura 2012). However, since these studies assume increasing marginal costs, the cost structure in the industry would change with the number of private firms. For example, given a total output, the total production costs of the industry can be decreasing in the number of firms. There are other problems in measuring the degree of competition based on the number of firms. For example, if economies of scale play an important role,Footnote 3 an increase in the number of firms usually decreases the market share of each firm, which directly affects economic performance. Furthermore, recent studies on mixed oligopolies show that an increase in the number of private firms can increase the profit of each private firm (Matsumura and Sunada 2013; Wang and Lee 2013). This implies that other factors may be more important than the number of firms when it comes to measuring the competitiveness of mixed oligopolies.Footnote 4 Finally, in some circumstances, the number of firms should be endogenized. Many papers on mixed and private oligopolies discuss this problem.Footnote 5 In free-entry markets, the number of firms entering the market becomes smaller as the market becomes more competitive. In this context, a smaller number of firms may indicate a more competitive market. Therefore, we adopt a different approach to that usually taken in studies on mixed oligopolies, and revisit the relationship between market competition and privatization policies.

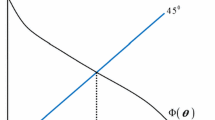

In this study, we introduce an interdependent payoff structure into a mixed oligopoly. We explain our approach, as well as the method we follow to measure the competitiveness of the market in our approach.Footnote 6 Consider a model in which firms focus on their own profits and their rivals’ profits in a symmetric n-firm private oligopoly. Here, firm i’s payoff is \(\pi _i-\alpha \left( \sum _{j \ne i} \pi _j/(n-1)\right) \), where \(\pi _i\) represents firm i’s profit and \(\sum _{j \ne i} \pi _j/(n-1)\) is the average profit of its rivals. The firms choose their outputs independently (Cournot competition). In this model, the equilibrium outcome becomes the Cournot equilibrium when \(\alpha =0\), and converges to the perfectly competitive outcome (Walrasian) when \(\alpha \) approaches 1. Thus, we can interpret \(\alpha \) as a parameter indicating the competitiveness of the market, with a larger \(\alpha \) indicating a more competitive market.Footnote 7 This interdependent payoff approach enables us to treat the degree of market competition as a continuous variable.Footnote 8

We introduce this approach into a mixed oligopoly setting and discuss the relationship between \(\alpha \) and the optimal degree of privatization. First, we assume that both public and private firms consider the average profit of other firms. In this model formulation, the greater level of concern accelerates competition, which enables us to discuss the relationship between the optimal degree of privatization and competitiveness of the market. We adopt a standard model with increasing marginal costs, as formulated by De Fraja and Delbono (1989). Here, we find that the optimal degree of privatization is decreasing in \(\alpha \). In other words, a more competitive market decreases the optimal degree of privatization. This result contrasts sharply with the findings of previous studies that a more competitive market increases the optimal degree of privatization.

Next, we discuss a different formulation. Private firms consider the profits of private rivals, but the public firm does not do so. In this model formulation, the higher degree of concern again accelerates competition, which enables us to discuss the relationship between the optimal degree of privatization and the competitiveness of the market. In this case, the result is ambiguous, with the optimal degree of privatization being either increasing or decreasing in \(\alpha \).

Finally, we adopt another standard model, a constant marginal cost model. Here, we find that the optimal degree of privatization is increasing in \(\alpha \). Our results suggest that the relationship between an optimal privatization policy and the competitiveness of the market crucially depends on the market structure, including the cost conditions. Furthermore, we find that the two standard models in this field (i.e., the increasing and constant marginal cost models) yield contrasting implications.

When marginal costs are increasing, a high value of \(\alpha \) implies that private firms have a high marginal cost, because each private firm produces a greater output. Thus, the social benefit of stimulating private production by privatization is small. This is why the optimal degree of privatization can be decreasing in \(\alpha \). However, in the model of constant marginal costs, this effect disappears. In other words, in the constant marginal cost model, an increase in \(\alpha \) does not decrease the difference in marginal costs between public and private firms, as it does in the case of increasing marginal costs. Thus, in the constant marginal cost model, the government has a significant incentive to stimulate private firms’ production by privatization, even when \(\alpha \) is large. This finding contrasts with that of the increasing marginal cost model.

We discuss the rationale for employing interdependent objective functions in a general context. First, managerial performance is often evaluated based on the relative and the absolute performance of managers.Footnote 9 Overperforming managers often obtain good positions in management job markets. This provides the rationale for considering a strictly positive \(\alpha \) in our model. Second, many laboratory (experimental) works have noted the importance of relative performance that is related to strictly positive \(\alpha \).Footnote 10 Third, as Armstrong and Huck (2010) convincingly discuss, focusing on relative profit is closely related to imitative behavior among competing firms.Footnote 11 Fourth, if private stockholders use \(\alpha \) strategically, they adopt a positive \(\alpha \).Footnote 12 We believe that, even in mixed oligopolies, it is reasonable to consider that private firms are not always profit-maximizers. Furthermore, we believe that an interdependent payoff approach is useful in the context of mixed oligopolies.

2 The model

Firms produce perfectly substitutable commodities, for which the market demand function is given by \(p=1-Q\) (i.e., price is a function of quantity). Firm i’s cost function is given by \(c_i(q_i)=(c/2) (q_i)^2\), where \(q_i\) is the output quantity of firm \(i \ (i=0,1,\ldots ,n)\) and c is a positive constant.Footnote 13 Firm 0 is a semi-public (partially privatized) firm, and competes with n private firms in the domestic product market.

Let \(\pi _k\) \((k=0,1,\ldots ,n)\) be firm k’s profit. Let

be firm i’s relative profit. Firm i’s \((i=1,2,\ldots ,n)\) payoff is given by \(V_i\), and firm 0’s payoff is given by \(U_0=\theta V_0 +(1-\theta )W\), where W is the total social surplus (i.e., consumer surplus + the profits of firms). Here, \(\theta \in [0,1]\) represents the degree of privatization.Footnote 14 We assume that \(\alpha \in [0, 1]\). We can show that, given \(\theta \) and n, the resulting equilibrium price is decreasing in \(\alpha \), and that it converges to the Walrasian equilibrium when \(\alpha \) approaches 1 (see Proposition 1 in the next section). Thus, we can use \(\alpha \) as a measure of the competitiveness of the market in our mixed oligopoly model, as well as in the standard private oligopoly model mentioned in the introduction.

In the first stage, the government sells the shares of firm 0 to the private sector and chooses \(\theta \). In the second stage, after observing \(\theta \), each firm i chooses \(q_i \ (i=0,1, \ldots , n)\) independently (Cournot competition). Let \(\sum _{i=0}^{n}q_i\) be Q. Then, the profit of firm i is given by \(\pi _i = p(Q)q_i -c_i(q_i) = (1- Q)q_i - cq_i^2/2\), and the total social surplus W is given by \(Q^2/2+\sum _{i=0}^n \pi _i\).

3 Equilibrium analysis and results

We adopt subgame perfection as the equilibrium concept, and solve the game by backward induction. First, we investigate the second-stage competition. Let \(Q_{-i}:= \sum _{j \ne i}q_j\) be the total output of firms other than firm i. The first-order conditions for firm 0 and firms \(i \ (i=1,2,\ldots ,n)\) are

Let superscript S denote the second-stage equilibrium. Solving the above equations yields

where

The following proposition describes the relationship between the equilibrium outputs of public and private firms.

Proposition 1

\(q_0^S \ge q_i^S\) \((i=1,2,\ldots ,n)\), and the equality holds if and only if \(\theta =1\) or \(\alpha =1.\)

Proof

\(q_0^S-q_i^S= (1-\alpha )(1-\theta )/H.\) Since \(H>0\), we obtain Proposition 1. \(\square \)

Suppose that \(\alpha <1\). Proposition 1 is a common result in the literature. The public firm is more aggressive than are private firms, unless it is fully privatized, because it is concerned with social welfare, which includes consumer surplus. Thus, it produces aggressively to increase consumer surplus.

We now consider the Walrasian outcome. Suppose that all firms are private and are price takers. Let \(q^W\) be the output of each firm at the Walrasian equilibrium. Each firm i chooses \(p=cq_i\) (i.e., the price is equal to its marginal cost). Substituting \(Q=(n+1)q^W\) and \(p=cq^W\) into the demand function \(p=1-Q\) yields \(q^W= 1/(c+n+1)\). Then, \(q_0=q_1=,\ldots ,q_n=q^W\) yields the first-best outcome.

We can show that \(\alpha =1\) yields the Walrasian equilibrium. In other words, if \(\alpha =1\), the equilibrium outcome is the competitive equilibrium that yields the first-best outcome. As explained in the introduction, in a private oligopoly, \(\alpha =1\) yields the Walrasian equilibrium. Suppose that one firm is nationalized and, thus, its objective changes from profit to welfare. Given the other firms’ behaviors, this nationalized firm has no incentive to change its output since the outcome is the first best. This is why both \(\theta =0\) and \(\theta =1\) yield the first-best outcome when \(\alpha =1\). Since welfare-maximizing and profit-maximizing behaviors yield the first-best outcome, any combinations of \(\theta \) and \(\alpha \) do so as well.

The next proposition describes the relationship between \(\alpha \) and the second-stage equilibrium outcome when \(\alpha <1\).

Proposition 2

For any \(\theta \in [0,1]\) and \(\alpha \in [0.1)\), (i) \(q_i^S\) \((i=1,2,\ldots ,n)\) is increasing in \(\alpha \), and (ii) \(q_0^S-q_i^S\) is decreasing in \(\alpha \).

Proof

-

(i)

\(\partial q_i^S/\partial \alpha = (nH)^{-2}(\theta \alpha ^2+2\theta n(c+\theta )\alpha +(c+\theta )(1+c)n^2 +((1+c) -(c+\theta )\theta ) n\). Here, \(n \ge 1,\) \(H>0\), and \(\theta \alpha ^2+2\theta n(c+\theta )\alpha +n(c+\theta )((1+c)n-\theta )+(1+c)n >0\), for \(\theta \in [0,1]\). Therefore, we have Proposition 2(i).

-

(ii)

\(q_0^S-q_i^S=n(1-\alpha )/(nH)\).

$$\begin{aligned} \frac{\partial (q_0^S-q_i^S)}{\partial \alpha }= - H^{-2}\left( H + (1-\alpha ) \frac{\partial H}{\partial \alpha }\right) . \end{aligned}$$Thus, sign\((\partial (q_0^S-q_i^S)/\partial \alpha = - \)sign\((H+(1-\alpha )(\partial H/\partial \alpha )).\) Since \(H+(1-\alpha )(\partial H/\partial \alpha ) = (c+\theta )n+((1+c)(1+c+\theta )-c) +(1+c)n^{-1} +\theta (1-\alpha )^2 n^{-1} >0\), we obtain Proposition 2(ii). \(\square \)

Propositions 2(i) and (ii) indicate that an increase in \(\alpha \) stimulates production by private firms and decreases the difference between the outputs of the public firm and each private firm. Since \(q_i <q_0\) for \(\alpha <1\) and \(i \ne 0\), the marginal cost is smaller in each private firm than in the public firm. Therefore, this production reallocation improves production efficiency.

Next, we consider the first-stage choice. The government chooses \(\theta \) to maximize W. Let \(\theta ^{*}\) be the optimal \(\theta .\) As already stated, if \(\alpha =1\), the first-best outcome is obtained regardless of \(\theta \). Thus, any \(\theta \in [0,1]\) is optimal.Footnote 15

Suppose that \(\alpha <1.\) The first-order condition is

where \(J:= (c+1+\alpha /n)^2 + c(n-\alpha )>0\). These lead to the following proposition.

Proposition 3

(i) If \(\alpha =1\), any \(\theta \) is optimal. (ii) If \(\alpha <1\), the optimal degree of privatization \(\theta ^*\) is given by

We now present our main result.

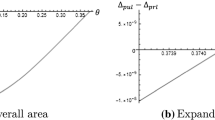

Proposition 4

(i) \(\theta ^*\) is decreasing in \(\alpha \). (ii) \(\theta ^*\) is increasing in n.

Proof

From (5), we have

\(\square \)

Propositions 4(i) and (ii) present a sharp contrast. Proposition 4(ii) is similar to the findings of existing studies (i.e., an increase in the number of private firms is more likely to improve welfare).Footnote 16 Suppose that \(\theta =0.\) The marginal cost of the public firm is equal to the equilibrium price, while that of a private firm is strictly lower than the equilibrium price. Thus, in equilibrium, the public firm’s marginal cost is higher than that of the private firm. An increase in \(\theta \) decreases the public firm’s output and increases the other firms’ outputs. In other words, privatization induces production substitution from the public firm to the private firms. Since the marginal cost of the private firm is lower than that of the public firm, this production substitution economizes the total production costs, thereby improving welfare (production–substitution effect). At the same time, privatization decreases total output and, hence, the consumer surplus (total output effect). This tradeoff determines the optimal degree of privatization \(\theta ^{*}.\)

An increase in the number of private firms decreases the output of each private firm (and, hence, the firms’ marginal costs). Thus, an increase in the number of private firms strengthens the welfare-improving production–substitution effect. In addition, an increase in the number of private firms increases the total output of private firms and the consumer surplus, given the output of the public firm. Hence, this decreases the price–cost margin in each private firm, as well as the marginal gain from the increase in total output and consumer surplus. Thus, an increase in the number of private firms weakens the marginal loss caused by an increase in \(\theta \). These two effects (i.e., the production–substitution effect and the total output effect) yield Proposition 4(ii).

In contrast, given the number of private firms, an increase in \(\alpha \) accelerates competition and increases the output of each private firm (thereby increasing the private firms’ marginal costs). Thus, the welfare gain of production substitution from the public firm to the private firms is smaller when \(\alpha \) is larger. In other words, if the market is more competitive, the welfare gain from the production–substitution effect induced by privatization is smaller. On the other hand, an increase in \(\alpha \) increases the total output of private firms and the consumer surplus, given the output of the public firm. Thus, an increase in \(\alpha \) weakens the marginal loss caused by an increase in \(\theta \). In this setting, the production–substitution effect dominates the total production effect, and Proposition 4(i) holds.

In Proposition 4(ii), the production–substitution effect and the total production effect move in the same direction. However, in Proposition 4(i), these two effects move in opposite directions. There is a possibility that Proposition 4(i) is specific to our model formulation and, thus, is not robust. In the next section, we discuss this problem by using an alternative model formulation.

4 Alternative payoff

In the introduction, we noted that private firms are often concerned with their relative profit. However, there is no convincing evidence that public firms share the same concern. Thus, the formulation \(V_0=\pi _0-n^{-1} \sum _{i=1}^{n}\pi _i\) might be unreasonable. In addition, because of the heterogeneity between public and private firms, it may be reasonable to assume that private firms only consider the relative profits of other private firms. In our model, firm 0 and firms \(1,\ldots ,n\) have different cost and payoff functions. Thus, if a private firm outperforms firm 0, it is doubtful that a manager of this private firm will be evaluated as successful. In contrast, if a private firm outperforms other private firms, this must be the result of the manager’s behavior, and not the initial conditions. Therefore, it may be natural to assume that each private firm is only concerned about the performance of other private firms. For the same reason, even if firm 0 is outperformed by a private rival, the manager of firm 0 can excuse this as being the result of the initial cost condition or the difference in the payoff function (firm 0 is concerned with welfare). Thus, it may also be natural to assume that firm 0 is not concerned with relative profits.

Henceforth, we consider an alternative formulation of payoffs. We assume that \(V_0=\pi _0\) and \(V_i= \pi _i - \alpha \left( \sum _{ j \ne i, j=1}^{n}\pi _j\right) /(n-1)\). In other words, the public firm focuses on social welfare and its own profit, and each private firm focuses on its own profit and its private rivals’ profits.Footnote 17

Apart from the payoff functions, the model is the same as that used in the previous sections. Henceforth, we refer to this model as “Model 2,” and the original model as “Model 1.” Furthermore, we assume that \(n \ge 2\).

We first consider the second-stage competition. The first-order conditions for firm 0 and firms \(i \ (i=1,2,\ldots ,n)\) are as follows:

The second-order conditions are satisfied. Solving these equations yields

where

Next, we consider the first-stage choice. The government chooses \(\theta \) to maximize W. Let \(\theta ^{*}\) be the optimal \(\theta .\) The first-order condition is

where \(L:= nc+(1+c-\alpha )^2\). Solving this equation yields

This yields the following proposition.

Proposition 5

(i) \(\theta ^* \) is increasing in n. (ii) \(\theta ^* \) is decreasing in \(\alpha \) if and only if \(c^2+nc> (1-\alpha )^2\).

Proof

-

(i)

$$\begin{aligned} \frac{\partial \theta ^*}{\partial n}= \frac{c(1-\alpha )(1+c-\alpha )^2}{L^2} > 0 \quad \text{ for } \quad \alpha <1. \end{aligned}$$

This leads to Proposition 5(i).

-

(ii)

$$\begin{aligned} \frac{\partial \theta ^*}{\partial \alpha } = -\frac{nc(c^2+nc-(1-\alpha )^2)}{L^2}. \end{aligned}$$

This leads Proposition 5(ii).

\(\square \)

As discussed in the previous section, the result that the optimal degree of privatization is increasing in n is robust, while the result that the optimal degree of privatization is decreasing in \(\alpha \) may be less robust. Proposition 5(ii) states that the optimal degree of privatization is increasing in \(\alpha \) if n is small and c is low.

Then, given the number of private firms, an increase in \(\alpha \) accelerates competition and increases the output of each private firm (thereby increasing the private firms’ marginal costs). Thus, the welfare gain of production substitution from the public firm to the private firms is smaller when \(\alpha \) is larger. Owing to this effect, the optimal degree of privatization can be decreasing in \(\alpha \). In Model 1, when \(\alpha \) is larger, firm 0 has an incentive to choose a larger output in order to reduce the private firms’ profits. Thus, the government must choose a larger \(\theta \) in order to reduce firm 0’s output and to induce production substitution from firm 0 to the private firms. In Model 2, firm 0 is not negatively affected by the private firms’ profits. Therefore, the government can more effectively reduce firm 0’s output and induce production substitution from firm 0 to the private firms by controlling \(\theta \). This weakens the production-substitution effect. Therefore, in Model 2, the total production effect can dominate the production–substitution effect, in contrast to the situation in Model 1.

However, because \(n \ge 2\), the optimal degree of privatization is decreasing in \(\alpha \) if \(c \ge \sqrt{2}-1\), and the threshold is lower when n is larger. Thus, we think that the optimal degree of privatization is decreasing in \(\alpha \) for a reasonable range of c and n.

5 Constant marginal costs

Until now, we have adopted a model with quadratic production costs, which is quite a popular approach in the literature on mixed oligopolies. Another popular approach is to use asymmetric constant marginal costs in the model.Footnote 18 Therefore, we examine this approach here.

In this section, the model is the same as that in the previous section, but with different cost functions. We refer to this model as “Model 3.” We assume that marginal costs are constant. Without loss of generality, we assume that the marginal cost of each private firm is zero. Furthermore, we assume that the marginal cost of firm 0 is \(c_0>0\). In other words, we assume that the public firm is less efficient than are the private firms.Footnote 19

First, we consider the second-stage competition. The first-order conditions for firm 0 and firms \(i \ (i=1,2,\ldots ,n)\) are

The second-order conditions are satisfied. Solving the above equations yields

where \(N:=(1+\theta )(n+1 - \alpha ) -n >0.\)

When \(c_0 \ge (1-\alpha )(n+1-\alpha )^{-1}\), firm 0 does not produce in equilibrium and, thus, \(\theta \) does not affect the equilibrium outcomes. Thus, we restrict our attention to the case where \(c_0 < (1-\alpha )(n+1-\alpha )^{-1}\).

Next, we consider the first-stage choice. The government chooses \(\theta \) to maximize W. As long as the solution is interior, the first-order condition is

The second-order condition is satisfied. Solving this yields

We observe that \(\theta ^* < 1\) if and only if

Note that \(\bar{c_0} < (1-\alpha )(n+1-\alpha )^{-1}.\)

This yields the following proposition.

Proposition 6

(i) \(\theta ^*\) is non-decreasing in n and is strictly increasing in n if \(\theta ^*<1\). (ii) \(\theta ^*\) is non-decreasing in \(\alpha \) and is strictly increasing in \(\alpha \) if \(\theta ^*<1\).

Proof

Suppose that \(c_0 <\bar{c_0}\). Then,

which implies the latter part of Proposition 6(i). Then,

which implies the latter part of Proposition 6(ii).

Because \(\bar{c_0}\) is decreasing in n and \(\alpha \), we obtain the former parts of Propositions 6(i) and (ii). \(\square \)

The result in the constant marginal cost model (Model 3) contrasts sharply with that in the quadratic cost models (Models 1 and 2).

In all three models, an increase in \(\theta \) reduces the total output. Because the total output level is less than the perfectly competitive equilibrium level (the first-best level), a decrease in the total output level increases the dead-weight loss of welfare. This is the cost of privatization. However, this cost is smaller when n is larger or when \(\alpha \) is larger because the output level is closer to the perfectly competitive equilibrium level.

In all three models, an increase in \(\theta \) also increases each private firm’s output level, but reduces the output level of the public firm. This improves the production efficiency because the public firm’s marginal cost is higher than those of the private firms. This is the gain of privatization.

Under the assumption of increasing marginal costs (in Models 1 and 2), the difference of marginal costs between public and private firms is smaller when \(\alpha \) is larger because the private firms produce more aggressively. Thus, the welfare gain from an increase in \(\theta \) is smaller when \(\alpha \) is larger. Therefore, the optimal degree of privatization can be decreasing in \(\alpha \).

However, this effect disappears if the marginal cost is constant (in Model 3). In other words, the welfare gain of an increase in \(\theta \) remains unchanged as \(\alpha \) increases and, therefore, only the welfare cost effect changes. Thus, the optimal degree of privatization is always increasing in \(\alpha \).

Our results have another important implication in mixed oligopolies. As mentioned earlier, both the constant marginal cost model and the quadratic cost model are popular in the literature on mixed oligopolies, and these two models often yield similar welfare implications (Matsumura 1998; Pal 1998; Tomaru and Kiyono 2010; Lin and Matsumura 2012; Haraguchi and Matsumura 2014). However, our results suggest that these two models can yield contrasting results. The constant marginal cost model suggests that the degree of the privatization should be higher when the competition is tougher, while the increasing marginal cost model suggests the opposite result. Thus, it is necessary to check carefully whether the results depend on the cost assumptions when discussing the implications of a privatization policy in a mixed oligopoly.

6 Concluding remarks

In this study, we investigate the relationship between competition and privatization policies. We find that an increase in the number of private firms increases the optimal degree of privatization. This result has already been established in the literature on mixed oligopolies. We also show that this result is quite robust among different settings. However, more intense competition may decrease the number of firms. Thus, it might not be appropriate to use the number of firms as a measure of the level of competition in a market.

We introduce an interdependent payoff approach and revisit this problem. We find that, for a given number of firms, an increase in competition can decrease the optimal degree of privatization. In the linear demand and symmetric quadratic cost model, which is popular in the literature on mixed oligopolies, greater competition decreases the optimal degree of privatization. However, we find the opposite result if we use the linear demand and asymmetric constant marginal cost model, which is another popular model in mixed oligopolies. In this case, greater competition increases the optimal degree of privatization.

These two popular models often yield similar welfare implications in the literature on mixed oligopolies. However, our results indicate that this similarity does not always hold. Thus, it is necessary that we choose a model carefully, and check its robustness, when discussing the implications of a privatization policy in a mixed oligopoly.

Notes

This interest in mixed oligopolies is the result of their importance to European, Canadian, and Japanese economies. Although they are less significant, there are some examples of mixed oligopolies in the United States, such as the packaging and overnight-delivery industries. Analyses of mixed oligopolies date back to at least (Merrill and Schneider 1966), although it is only more recently that the literature in this field has become richer and more diverse. See Gil-Moltó et al. (2011) and Bose and Gupta (2013), and the works referenced therein, for recent developments in this field.

Partial ownership in privatized firms has become increasingly popular worldwide and, as a result, partial privatization has been discussed intensively in the literature. For a general discussion, see Matsumura (1998). In addition, see Ishibashi and Kaneko (2008) for quality-improving investments, Kato (2006, 2013) for environmental problems, Matsumura and Kanda (2005), Fujiwara (2007), Wang and Chen (2010) and Cato and Matsumura (2012) for free-entry markets, Bárcena-Ruiz and Garzón (2003) for merger problems, and Matsumura and Ogawa (2010), Bárcena-Ruiz and Garzón (2010), and Naya (2015), who examine the endogenous timing game.

For a general discussion of this approach, see Matsumura et al. (2013).

Under the standard conditions in a Cournot oligopoly, the ratio between profit margin (price less marginal cost) and the price, known as Lerner index, is decreasing in \(\alpha \). This index is popular in the empirical literature as a measure of the intensity of market competition in product markets. Furthermore, Matsumura and Matsushima (2012) show that collusion is less stable when \(\alpha \) is larger under moderate conditions. In this sense, a larger \(\alpha \) again indicates a more competitive market.

The conjectural variation approach is another possibility, and contains three models as special cases. However, the conjectural variation model assumes that firm 1’s output affects that of firm 2, and vice versa. Needless to say, this assumption is inconsistent in any static model. One advantage of the interdependent payoff approach is that it does not suffer from this problem.

See Gibbons and Murphy (1990) for empirical evidence. The payoff function based on relative wages or relative wealth status has also been intensively discussed in the macroeconomics context.

See Armstrong and Huck (2010), and the works referenced therein.

See Vega-Redondo (1997) for an evolutionary game model in this regard. He considers a quantity-setting model in a homogeneous product market, and shows that if firms myopically imitate the most profitable firm’s strategy, the industry converges to a highly competitive outcome.

See Fumas (1992) and Kockesen et al. (2000). Although we do not endogenize this parameter, we presume that the owners of private firms set \(\alpha \) as positive if they are able to do so. However, the owner of a public firm may have little incentive to choose a positive \(\alpha \). From this viewpoint, the alternative model formulation of payoffs discussed in Sect. 4 is important.

If we replace \(V_i\) with \(\pi _i\), this becomes the standard formulation of the payoff for a semi-public firm (Matsumura 1998). See also Fujiwara (2007) for recent works adopting this approach. We assume that W represents the sum of the consumer surplus and the profits of firms, rather than the sum of the consumer surplus and the payoff of all firms, \(V_0+V_1+\cdots +V_n\). CEOs of firms might be concerned with the relative performance of their firms because good relative performance will increase their current and future incomes. However, we regard this simply as an income transfer.

For example, De Fraja and Delbono (1989) discuss the case of \(\alpha =0\), and show that there exists m such that a private oligopoly (\(\theta =1\)) yields greater welfare than a mixed oligopoly (\(\theta =0\)) if and only if \(n>m\).

In this setting, the payoff of each private firm is non-negative in the symmetric equilibrium, whereas it could have been negative in the original setting. This might be another advantage of this alternative formulation over the original formulation. However, in the alternative formulation, \(\theta =1\) does not imply a symmetric private oligopoly. In contrast, in the original formulation, we can treat a symmetric private oligopoly as a special case. This is an advantage of the original formulation discussed in Sect. 3.

If \(c_0 = 0\), the first-best outcome is achieved and the optimal degree of privatization is zero. See Bárcena-Ruiz (2012).

References

Armstrong M, Huck S (2010) Behavioral economics as applied to firms: a primer. CESIFO working paper 2937

Bárcena-Ruiz JC (2012) Privatization when the public firm is as efficient as private firms. Econ Model 29(4):1019–1023

Bárcena-Ruiz JC, Garzón MB (2003) Mixed duopoly, merger and multiproduct firms. J Econ 80(1):27–42

Bárcena-Ruiz JC, Garzón MB (2010) Endogenous timing in a mixed oligopoly with semipublic firms. Portuguese Econ J 9(2):97–113

Bose A, Gupta B (2013) Mixed markets in bilateral monopoly. J Econ 110(2):141–164

Cato S, Matsumura T (2012) Long-run effects of foreign penetration on privatization policies. J Inst Theor Econ 168(3):444–454

Cato S, Matsumura T (2013) Long-run effects of tax policies in a mixed market. Finanz Archiv 69(2):215–240

Cato S, Matsumura T (2015) Optimal privatization and trade policies with endogenous market structure. Econ Rec. doi:10.1111/1475-4932.12189

De Fraja G, Delbono F (1989) Alternative strategies of a public enterprise in oligopoly. Oxford Econ Pap 41(2):302–311

Fjell K, Pal D (1996) A mixed oligopoly in the presence of foreign private firms. Can J Econ 29(3):737–743

Fujiwara K (2007) Partial privatization in a differentiated mixed oligopoly. J Econ 92(1):51–65

Fumas VS (1992) Relative performance evaluation of management : the effects on industrial competition and risk sharing. Int J Ind Organ 10(3):473–489

Gibbons R, Murphy KJ (1990) Relative performance evaluation for chief executive officers. Ind Labor Relat Rev 43(3):30–51

Gil-Moltó MJ, Poyago-Theotoky J, Zikos V (2011) R&D subsidies, spillovers and privatization in mixed markets. South Econ J 78(1):233–255

Han L, Ogawa H (2008) Economic integration and strategic privatization in an international mixed oligopoly. Finanz Archiv 64(3):352–363

Haraguchi J, Matsumura T (2014) Price versus quantity in a mixed duopoly with foreign penetration. Res Econ 68(4):338–353

Ishibashi I, Matsumura T (2006) R&D competition between public and private sectors. Eur Econ Rev 50(6):1347–1366

Ishibashi K, Kaneko T (2008) Partial privatization in mixed duopoly with price and quality competition. J Econ 95(3):213–232

Ishida J, Matsumura T, Matsushima N (2011) Market competition, R&D and firm profits in asymmetric oligopoly. J Ind Econ 59(3):484–505

Kato K (2006) Can allowing to trade permits enhance welfare in mixed oligopoly? J Econ 88(3):263–283

Kato K (2013) Optimal degree of privatization and the environmental problem. J Econ 110(2):165–180

Kockesen L, Ok EA, Sethi R (2000) The strategic advantage of negatively interdependent preferences. J Econ Theory 92(2):274–299

Lin MH, Matsumura T (2012) Presence of foreign investors in privatized firms and privatization policy. J Econ 107(1):71–80

Matsumura T (1998) Partial privatization in mixed duopoly. J Publ Econ 70(3):473–483

Matsumura T (2003) Endogenous role in mixed markets: a two-production period model. South Econ J 70(2):403–413

Matsumura T, Kanda O (2005) Mixed oligopoly at free entry markets. J Econ 84(1):27–48

Matsumura T, Matsushima N (2004) Endogenous cost differentials between public and private enterprises: a mixed duopoly approach. Economica 71:671–88

Matsumura T, Matsushima N (2012) Competitiveness and stability of collusive behavior. Bull Econ Res 64(s1):s22–s31

Matsumura T, Matsushima N, Cato S (2013) Competitiveness and R&D competition revisited. Econ Model 31(1):541–547

Matsumura T, Ogawa A (2010) On the robustness of private leadership in mixed duopoly. Aust Econ Pap 49(2):149–160

Matsumura T, Shimizu D (2010) Privatization waves. Manchester School 78(6):609–625

Matsumura T, Sunada T (2013) Advertising competition in a mixed oligopoly. Econ Lett 119(2):183–185

Matsumura T, Tomaru Y (2012) Market structure and privatization policy under international competition. Jap Econ Rev 63(2):244–258

Matsumura T, Tomaru Y (2013) Mixed duopoly, privatization, and subsidization with excess burden of taxation. Can J Econ 46(2):526–554

Mujumdar S, Pal D (1998) Effects of indirect taxation in a mixed oligopoly. Econ Lett 58(2):199–204

Mukherjee A, Zhao L (2009) Profit raising entry. J Ind Econ 57(4):870

Merrill W, Schneider N (1966) Government firms in oligopoly industries: a short-run analysis. Q J Econ 80(3):400–412

Naya JM (2015) Endogenous timing in a mixed duopoly model. J Econ. doi:10.1007/s00712-014-0416-2

Nishimori A, Ogawa H (2002) Public monopoly, mixed oligopoly and productive efficiency. Aust Econ Pap 41(2):185–190

Pal D (1998) Endogenous timing in a mixed oligopoly. Econ Lett 61(2):181–185

Tomaru Y, Kiyono K (2010) Endogenous timing in mixed duopoly with increasing marginal costs. J Inst Theor Econ 166(4):591–613

Vega-Redondo F (1997) The evolution of Walrasian behavior. Econometrica 65(2):375–384

Wang LFS, Chen TL (2010) Do cost efficiency gap and foreign competitors matter concerning optimal privatization policy at the free entry market? J Econ 100(1):33–49

Wang LFS, Lee JY (2013) Foreign penetration and undesirable competition. Econ Model 30(1):729–732

Author information

Authors and Affiliations

Corresponding author

Additional information

We are indebted to two anonymous referees and the editor for their valuable and constructive suggestions. We also thank seminar participants at annual meeting of Japanese Economic Association, National Dong Hwa University, Osaka University, and The University of Tokyo for their helpful comments. Needless to say, we are responsible for any remaining errors. This work was supported by Murata Science Foundation and JSPS KAKENHI Grant Numbers 15k03347.

Rights and permissions

About this article

Cite this article

Matsumura, T., Okamura, M. Competition and privatization policies revisited: the payoff interdependence approach. J Econ 116, 137–150 (2015). https://doi.org/10.1007/s00712-015-0445-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00712-015-0445-5