Abstract

This paper examines the relationship between marital sorting and income inequality in Switzerland using individual tax data. We find that assortative mating intensifies at the tails of the income distribution. High and low earners specifically tend to marry alike. This pattern is exacerbating household income inequality—the Gini coefficient increases by more than 10% and the top 1% share by around 5% compared to random matching. By comparison, we show that the redistributive impact of marital sorting offsets the effect induced by taxation for most of the top income quintile. However, tax dominates the opposing mating redistribution from the top 5% income share.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

’Opposites attract’ is a famous saying that does not apply to spouses’ financial resources. The proportion of couples sharing similar incomes and educational backgrounds has increased over the past few decades (e.g., Schwartz & Mare, 2005). Regardless of the causes for this secular trend studied by different academic disciplines, mating behavior has significant economic consequences. Studies show that the increase in homogamy exacerbates income inequality (e.g., Eika et al., 2019). Income would be more evenly spread if couples were less keen to marry similar sorts. At the same time, tax systems play a crucial role in income redistribution and aim at reducing inequality. Hence, opposing distributional effects coincide. Therefore, the question arises: Does the marital impact on inequality offset the redistributive effect of taxes?

Our paper addresses this question by studying the distributional consequences of marital sorting in Switzerland using a comprehensive dataset that combines individual tax information with survey data. This dataset allows us to provide evidence on the effect of assortative mating at the tails of the income distribution. This paves the way for more sophisticated distributive analysis. In particular, we consider after-tax income what allows us to compare the marital impact on inequality to the redistributive effects of taxes.

Previous literature has examined marital sorting concerning household income. The available evidence for the United States and European countries points to a sizable correlation of up to 0.5 (e.g., Schwartz, 2010). However, evidence on inequality effects is relatively sparse. According to US studies, the contribution of assortative mating to inequality is around 5 % (Eika et al., 2019)Footnote 1. A recent study for France even finds a mating-induced increase in the Gini coefficient of up to 20% (Frémeaux & Lefranc, 2020).

The existing literature suffers from empirical limitations. First, they mostly measure the extent of marital sorting within married couples. However, individual earnings are affected by marriage (e.g., Chiappori et al., 2009; Chiappori, 2020; Chiappori et al., 2022). Our paper addresses this issue by focusing on couples one year before their wedding when they are still taxed as singles. Second, previous studies relied on survey data, which usually limit the analysis to considering medium effects, without accurately assessing the effects across the income distribution (Atkinson et al., 2011). In contrast, our data’s coverage and detailed nature allow us to identify tax data of all spouses in the respective jurisdictions and time period. Third, prior analyses have focused on labor earnings, leaving aside other sources of income (Frémeaux & Lefranc, 2020). We base our analysis on total income, including capital income.

However, our main contribution does not lie in the more precise measurement of assortative mating and the resulting distributional effects. Rather, this forms the basis for being the first study to juxtapose this effect with the opposing tax redistribution effect. We conduct our analysis in Switzerland as a case study to introduce this novel conceptual approach, comparing the mating effect with the tax redistributive effect. It would be advantageous for this comparison to be extended to other countries in future projects.

Our paper offers two sets of results. First, we show that assortative mating in Switzerland occurs throughout the income distribution. Most importantly, we provide evidence that marital sorting is particularly pronounced at the distribution tails. For instance, a woman in the top income quintile is twice as likely to marry a man from the same quintile as expected under random mating. In addition, we find an increase in assortative mating as the level of income rises. For example, the probability of marriages among spouses from the top income percentile is almost 15 times higher than under random mating. The measured marital sorting has significant effects on economic inequality. Assortative mating increases the income Gini coefficient by 10.7%. Additionally, we measure a mating-induced increase in the top 1% income share of 5%. In other words, the share in total income of top earners increases by 5% due to marital decisions.

Second, we determine the adverse tax redistribution effect for the respective income groups. By comparing those two effects in the top quintile, we find that the mating effect offsets the tax redistribution effect up to the top 5% income share. After that, the mating effect is dominated by the tax effect. Our findings are robust to employing different income measures and accounting for sensitivities concerning age, children, and nationality.

The remainder of the paper is structured as follows: Section 2 presents the dataset at hand. Section 3 contains the main results on the extent of assortative mating. In Section 4, we show the mating-induced inequality effect. Furthermore, we compare it to the inequality-reducing effect of income taxation. Moreover, we perform several specification checks to examine the sensitivity of our results. Finally, we conclude in Section 5.

2 Data

We analyze comprehensive administrative data of permanent residents in Switzerland between 2011–2015.Footnote 2 The dataset combines harmonized cantonal tax data with several administrative registers such as the Population and Households Statistics, the structural survey, or the Old-age and survivor’s insurance (OASI) / Disability insurance (DI) pension register. The respective data is linked at the individual level via anonymized personal identification numbers. The extensive tax data in the dataset is available for 7 out of 26 cantons, namely Aargau, Basel-Landschaft, Basel-City, Bern, Lucerne, St. Gallen, and Valais.Footnote 3 The structural survey data included in the dataset contains information on the highest completed education and its sample is representative for overall Switzerland. It enables the comparison of income-based sorting, measured through tax data, to marital sorting concerning educational status. In Appendix A, we describe the details of the overall dataset and the main components we used for our analysis (tax data and structural survey data). For our comparison between mating-induced inequality effect and tax-induced inequality reducing effect in Section 2.2, we need to know the respective tax burden of every individual. Indeed, our dataset provides us with this information. However, this includes the taxation of both capital and labor income alongside wealth in Switzerland, resulting in an aggregated tax burden at the state level. Our data consolidates all levels of state taxation (municipal, cantonal, and federal taxes) without being able to differentiate between specific income and wealth tax burdens. However, this lack of distinction does not impede our comparative analysis, as our focus remains on assessing whether the mating effect can counterbalance tax redistribution effects. However, the largest portion of these taxes is comprised of income tax. For an individual reaching the top 10% income and wealth thresholds for the overall population (CHF 124,000 for income and CHF 540,600 for wealth), the share of wealth taxes in total taxes amounts to 6.78% (or 7.42% in our seven cantons). Thus, it becomes evident that the burden of wealth tax is merely a fraction when compared with the burden of income tax.Footnote 4

2.1 Identification

We measure the extent of assortative mating for couples one year before marriage. In contrast to studies related to educational mating (e.g., Eika et al., 2019), the measurement of income assortative mating among married couples is subject to an endogeneity problem. Observed economic outcomes, such as income, are based on joint household decisions after marriage. By analyzing couples one year before marriage, we address this potential measurement error.Footnote 5 For the same reason, we also omit remarriages, i.e., marriages in which one spouse is divorced or widowed at the time of marriage because they might have made joint decisions with their previous spouses, which influenced their current social status. As a result, we consider all couples of which both spouses married for the first time between 2012 and 2015.

It is noteworthy that we cannot capture spouses who did not live in the respective tax jurisdictions before their union formation. We have detailed information about all spouses in the year of their wedding. Nonetheless, they might have been taxed in another canton not included in our dataset or another country the year before. Consequently, we were not able to obtain information about those people. This concerns roughly 20% of future spouses.Footnote 6 Therefore, it is worthwhile to additionally measure the extent of assortative mating based on educational data stemming from a survey that is representative for overall Switzerland. In terms of the number of observations, our original dataset contained 8.97 million observations. By narrowing down to first marriages for the years 2011 to 2015, our sample size was reduced to 261,248 observations. Ultimately, we ended up with 64,224 observations because we required income data from only 7 cantons one year before marriage.

2.2 Descriptive statistics

Table 1 provides core information on the main variables. The tax dataset covers 32,112 couples. The average age of future spouses is 32 for men and 29 for women. The mean annual income is substantially lower for women (CHF 55,000) than for men (CHF 74,000). The annual income consists of the sum of all financial inputs of an individual, including capital income (Wanner, 2019). The share of negative or null annual income values amounts to 1.7% for women and 1.6% for men. In our analysis, we incorporate zero incomes while excluding the negligible portion of negative incomes, as the reasons behind negative income might also stem, in part, from erroneous recording. In general, while gender differences in income levels might have important reasons and implications, those differences are not part of our research question.Footnote 7 Furthermore, Table 1 shows that labor income - that, opposed to the main variable of annual income - does not include capital incomes is substantially less skewed. The skewness remains in net income (as capital incomes are included), but the average is substantially lower. In Swiss tax statistics, net income encompasses taxable income along with deductions such as the child deduction, second earner deduction, married person’s deduction, and insurance deduction.Footnote 8 For the last two sensitivity checks in Section 4.5, we focus on childless couples and Swiss families. Swiss families refer to couples where both partners and their parents are Swiss. This also explains the relatively low value of only 55%. Conversely, Table 1 clearly shows that most couples do not have children yet one year prior to marriage (87%).

While our analysis’ primary focus is on the tax data, we also look at the mating preferences concerning education in order to relate to prior studies (e.g., Eika et al., 2019). The respective survey dataset entails 3,883 couples. Again, the age difference between men and women is, on average, three years. As depicted in Table 1, we distinguish five educational levels according to the groups of the International Standard Classification of Education (ISCED). Within the tertiary education sector, we distinguish between "non-university tertiary" and "university". The former includes qualifications, such as a degree of a technical or vocational school or a higher vocational training with a professional certificate or federal diploma. In contrast, the category "University" includes Bachelor’s and Master’s degree as well as doctorates and habilitations for universities, universities of applied sciences or equivalent. The proportion with a university degree is 32% for men and 31% for women.Footnote 9 In general, educational levels do not differ considerably between genders. The share of people with vocational training exceeds the share of university-trained people. It amounts to 36% for both men and women.Footnote 10

3 Assortative mating

3.1 Measuring marital sorting

Marital sorting is the subject of a growing literature in economics, but there is no standard measure empirically describing mating behavior. While the empirical approach depends on the variable under investigation, rank measures are increasingly popular in social mobility research (Chetty et al., 2014). However, income measures in survey data are typically imprecise at the distribution’s tails, leading to different estimates when using rank-based measures than those obtained in administrative datasets such as the one used here. Therefore, previous studies on the effect of marital income sorting often waived rank measures. We use two different rank-related sets of statistics.

3.1.1 Contingency tables

Assortative mating can be quantified by the contingency table for the wife’s and husband’s (relative) status levels to a contingency table generated by random matching for husbands and wives (Eika et al., 2019). Based on these contingency tables, it is possible to measure marital sorting as the likelihood of a particular match compared to the probability under random matching:

where \(Y_f\) (\(Y_m\)) denotes the relative position in a chosen status distribution (e.g., the respective individual income quintile) of the woman (man) and \(e(y_f, y_m)\) the assortative mating parameter. An assortative mating parameter above (below) one means that the respective match is more (less) likely to occur than under random matching (i.e., expresses the degree of excess probability). The joint distribution of the spouses is fully described by this parameter and the marginal distributions of wives and husbands. To derive the similarity under random mating, we simulate this random mating by bootstrapping with a sample of 1,000. Furthermore, it is noteworthy, that this random matching procedure is conducted without conditioning on e.g., age, children, etc. Therefore, it is worthwhile investigating specific subsamples in the sensitivity checks in Section 4.5.

3.1.2 Rank-rank slope (RRS)

As alternative measures, we complement those rank-based contingency tables by rank-rank linear regressions. Let \(M_i\) denote men’s and \(F_i\) women’s percentile rank, respectively, whereby ranks are computed separately for both genders. The regression of women’s rank \(F_i\) on men’s rank \(M_i\) yields the rank-rank-slope (RRS):

The regression coefficient \(\rho _{mf}\) complements the probability findings in the diagonal of the contingency tables. The diagonal of a contingency table shows the probability that the man and the woman are in the same income quintile compared to the probability under random mating. If assortative mating parameters are above one on the diagonal status distribution, \(\rho _{mf}\) is assumed to be significantly above zero.

3.2 Income sorting

3.2.1 Conditional probabilities

Figure 1 shows income quintiles and education groups of men on the x-axis and those of their female partners on the y-axis. If people married independently of their economic situation, one would expect marrying to be relatively homogeneously distributed across quintiles. Men and women in each quintile should form couples with approximately 20% of each quintile of the opposite sex. This would manifest itself in a value of 1 in Fig. 1. Correspondingly, a value of 2 indicates a relative frequency that is twice as big as expected. A value of 0.5 corresponds to a relative frequency that is half of what one would expect with random partnering.

The respective numbers on the diagonals in both graphs of Fig. 1 are all above one. This pattern implies that spouses in the same income group are more likely to match than under random matching. Consistently, a marriage between people in more distant groups is relatively unlikely. Assortative mating seems to be particularly pronounced at the distributions’ tails. One statistic of particular interest in this matrix is the conditional probability of marrying from the bottom quintile into the top quintile. For example, a match between a man of the highest and a woman of the lowest income quintile is only half as likely as expected under random matching. Another interesting measure is the conditional probability of marrying from within the top quintile, which allows a perception of status preservation through marriage. For instance, we find that a couple’s match with both spouses in the top quintile of the income distribution is twice as likely as expected under random matching.

In addition to marital sorting, the figure provides evidence for income hypergamy. Hypergamy describes a woman’s marriage with a man of higher social status. We find a consistent excess probability of marriages between men from a certain quintile and women from the one just below, while we do not observe this pattern the other way around. We do not further analyze the reasons nor the impact of income hypergamy. However, hypergamy is an important subject of current research (e.g., Almås et al., 2020).

To investigate the tails of the distributions, we also calculate 1%-, 5%- and 10%-shares (see Figures O1 to O3). Analogously, we find an increase in assortative mating as the level of income increases above the 90\(^{th}\) and decreases below the 10\(^{th}\) percentile, respectively. For example, the excess mating probability for marriages within the top income percentile is 14.5. For marriages within the bottom income percentile, it amounts to 33.5, meaning that the occurrence of a marriage within the bottom 1% is 33.5 times more likely than under random matching.

Thanks to the availability of wealth data in Switzerland (OECD, 2018), it is possible to compare those findings to the similarities in wealth status. Marriages within the top 20% occur not only with regard to income but also in terms of wealth at a rate twice as high as if couples were to marry randomly (Häner et al., 2022). However, the overrepresentation in the bottom 20 percent in terms of wealth is higher than in income (excess probability of 2.5 vs. 1.7). On the contrary, however, the overrepresentation in income is substantially greater at the tails than in wealth (Häner et al., 2022). For instance, marriage between partners in the top 1% of the income distribution is 7.9 times more likely (compared to 14.5 times for income), and marriage in the bottom 1% of the income distribution is 19.4 times more likely (compared to 33.5 times for income) than under random mating (Häner et al., 2022).

The existing literature is often based on educational data (e.g., Eika et al., 2019). Therefore, it is worthwhile to replicate our analysis for education. Furthermore, it serves as an external validity test to see whether the marital sorting is observable with regard to other status indicators besides income. As the right part of Fig. 1 shows, the pattern is very similar for education: A clear marital sorting which is particularly pronounced within the top and the bottom educational groups.Footnote 11

Income and educational marital sorting. The figure shows the assortative mating parameters with regard to income and education. The assortative mating parameter expresses for each income quintile or educational group combination how frequent a marriage is, compared to its frequency under random mating

3.2.2 Rank–rank estimates

Next we present estimates of the rank-rank slope, our second measure of assortative mating. We measure the percentile rank of men based on their positions in the distribution of men’s incomes in the core sample. Similarly, we define women’s percentile ranks based on their positions in the distribution of women’s incomesFootnote 12.

Figure 2 presents a scatter plot of the mean percentile rank of wives against their husbands’ percentile rank. The conditional expectation of a wife’s rank given her husband’s rank is quite linear. Applying an OLS regression, we show that a 1 percentage point increase in the husbands rank is associated with a 0.337 percentage point increase in the wife’s mean rank, with a statistical significance at the 1% significance level (see Table 4 in the Appendix).

Previous studies measure the extent of assortative mating mainly by linear log-log regressions. The existing estimates with regard to income are in general lower, but with an extensive range from 0.12 to 0.49 (Ciscato & Weber, 2019; Holmlund, 2020; Frémeaux & Lefranc, 2020).

4 Inequality effects of marital decisions

4.1 Assessing the impact on the income distribution

To examine the impact of assortative mating on economic inequality on the household level, we assess the difference between the measured and theoretical income distribution under random matching. To derive the theoretical distribution under random matching, we replicate the same analyses for the random couples, i.e., we randomly match all couples in our sample. In other words, we additionally calculate the Gini coefficient and the top sharesFootnote 13 for randomly composed households.Footnote 14 To derive the mating-induced inequality effect, we follow equation 3:

whereas \(I_{p}\) is the actual distributional measure p and \(I_{p,r}\) describes the respective measure under random mating.

We focus on couples before their marriage and thus apply the addition approach to the couples covered in our core sample. Randomly matching individuals that are one year prior to marriage – and thus not over all individuals in the society – is further deemed sufficient as we do not intend to explain overall inequality developments causally.

4.2 Results

4.2.1 Gini coefficient

We find a relative distributional change of 10.7% in the Gini index of income (see Table 2). By comparison, a 10% increase in the Gini coefficient corresponds to introducing an equal-sized lump sum tax of 10% of the mean income and redistributing the collected tax as proportional transfers in which each household receives 10% of its income (Aaberge, 1997). Compared to the wealth inequality effects, the income inequality effects are substantial. Assortative matching contributes to a 5% increase in the Gini coefficient, from 0.85 to 0.89 (Häner et al., 2022). However, it’s crucial to consider that wealth inequality is significantly higher than income inequality. The standardized effects are roughly similar for both income and wealth (Häner et al., 2022).

4.2.2 Top income shares

Thanks to the full coverage of our administrative data, we are able to shed light on the distributional effect at the top of the income distribution. The top 1% income share is 0.3 percentage points higher due to assortative mating at the couple’s level than expected under random matching. This difference corresponds to a relative change of 5.2%. We find similar effects on the top 5% and top 10% income shares. Table 2 summarizes the distributional impact of marital sorting.

4.3 International comparison

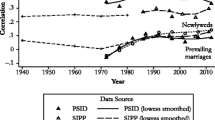

While evidence on top incomes is sparse, effects on the Gini coefficient are comparable internationally. Whereas most previous studies analyzed labor income based on survey data, we find a similar impact analyzing annual income including capital income. Figure 3 puts the inequality estimates of Switzerland in context to other countries.

In an international comparison, Norway exhibits the lowest marital sorting (Eika et al., 2019). According to Greenwood et al. (2014a), the Gini coefficient is only 2.33 percent higher compared to random matching.Footnote 15 In a more recent study, Eika et al. (2019) find a slightly higher Gini increase of 5 percent for the US. Also comparing to the random matching situation, Fiorio and Verzillo (2018) measure a 6.6 percent Gini increase for Italy. The effects measured for Germany vary between 3.1 percent increase (for Western Germany) and 9.4 percent (for Eastern Germany) (Pestel, 2017). For Switzerland, Kuhn and Ravazzini (2017) find a similar inequality increase for hourly wages and a lower increase in realised earnings. As they consider couples after their marriage, they cannot disentangle the pure mating effect from the incentive effects of being taxed jointly after marriage. This might be one explanation for the fact that they do not find statistically significant effects.Footnote 16 For France, studies find significantly higher values. However, the effect size also depends on the respective income concept. Whereas for annual earnings, the effect amounts to an increase of about 4%, the effect on household potential earnings is up to 20% (Frémeaux & Lefranc, 2020).

Our estimates for Switzerland are substantial compared to most other Western countries. It is important to note that the results depend strongly on the time of observation (i.e., before or after marriage), on the type of income, and other variables. From an empirical perspective, our effect is best comparable to the one obtained by Frémeaux and Lefranc (2020) for France, where they account for full-time equivalents.

International comparison of the effect of marital sorting on the income distribution. The figure compares results of recent studies regarding the effect of assortative mating on income inequality that use high-quality data and are thus likely to provide reliable results. It displays the range of mating-induced effects on the Gini coefficient measured for the indicated countries. It is important to note that our paper uses administrative tax data and focuses on couples one year before their wedding. Existing papers measure the extent of marital sorting within married couples. However, individual earnings are affected by marriage (e.g., Chiappori et al., 2009; Chiappori, 2020). Our effect is best comparable to the one obtained by Frémeaux and Lefranc (2020), where they account for full-time equivalents. They measure a mating-induced increase in the Gini coefficient of up to 20% when focusing on couples’ potential earnings

4.4 Comparison with tax redistribution

To interpret the magnitude of the inequality implications, we suggest a comparison with the tax redistribution effects.

4.4.1 Measuring the redistributive impact of taxation

Various studies evaluate the effect of tax policy on pre-tax top income shares (e.g., Piketty et al., 2014). To assess the full redistributive impact of tax policy, it is necessary to assess inequality in post-tax income. Thereby, the difference in inequality between pre- and post-tax incomes can be attributed to the redistributive effect of income taxes (Musgrave & Thin, 1948).Footnote 17

We apply this concept to income concentration and measure redistribution based on the difference between the pre-tax income share \(I_{p,pre}\) of the top income group p and their respective post-tax income share \(I_{p,post}\) in our sample:Footnote 18

The main advantage of this measure is that it includes information about both the share of income and the tax burden of top earners, relative to the general population. It is important to note that spouses are taxed individually at the time of observation.Footnote 19

4.4.2 Estimates of redistribution

Table 3 presents the redistribution effect of income taxes for our sample of couples. The first column expresses the resulting redistributive effect as relative change. The second column presents the mating-induced inequality effect for comparison. We find a relative redistribution effect on top 1% income shares of 9%. Due to the the progressivity of the tax schedule the redistributive effect is smaller for the top 5% and top 10% income shares.Footnote 20 These results are in line with other analyses on the effect of taxation on income shares for Switzerland (e.g., Frey & Schaltegger, 2016).

When we contrast tax redistribution with our mating-induced effects working in the opposite direction, we find that current marriage behavior offsets the tax redistribution effect in the top quintile up to the top 5% income shares. For the top 1%, on the other hand, the tax redistribution effect clearly exceeds the mating effect. Marital sorting increases the top 1% income share by 5.20%, while the tax effects reduces the respective share by 8.96%.

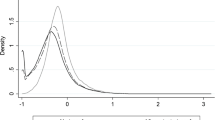

Given the progressive design of the Swiss income tax system, it is worthwhile to take a closer look at the relationship between the two counteracting effects. Figure 4 compares the mating-induced effect to the tax-induced effect for each percentile within the top 20%.Footnote 21 The graph shows that at the top of the distribution, the mating-induced effect offsets the tax effect up to the 95\(^{th}\) percentile. Thereafter, the mating effect is significantly smaller than the progressive tax effect. This is consistent with our results in Table 3.

Comparison between mating effects on income inequality and tax redistribution. The figure compares the smoothed mating-induced and tax-induced effects on income shares per percentile. The mating effect represents the relative increase in the respective income share due to marital sorting compared to a random scenario. The tax effect shows the relative decrease of the respective income share due to taxation. If both effects amount to the same value, we consider this is an offsetting situation

4.5 Sensitivity analysis

We perform several specification checks to examine the sensitivity of our results. For each sensitivity analysis, we measure the extent of assortative mating and the distributional consequences.Footnote 22

4.5.1 Alternative income measures

First, we base our analysis on labour income instead of annual income. Compared to the more broadly defined annual income, this measure is limited to the professional income of the couple. If the similarity among partners, particularly at the upper end of the income distribution, were primarily driven by capital income, the extent of marital sorting in labor income would be expected to be lower than in annual income. However, we find a similar mating pattern as in the baseline model (see Figure O4 in the Online Appendix OB). This confirms the findings by Gallusser and Krapf (2022) of a clear correlation between labor and capital income. A similar relationship can be inferred from the results of Häner et al. (2022), as they demonstrate a strong correlation between an individual’s income and personal wealth for both men and women in Switzerland. However, differences in the extent of marital sorting emerge when examining the extreme ends of the income distribution – the top 1% and bottom 1%. The excess probability for assortative mating in the top 1% is notably lower for labor income at 11.9, compared to the corresponding figure for annual income, which is 14.5. Additionally, significant differences are observed at the lower end, with an excess probability of 25.9 for labor income as opposed to 33.5 for annual income. Overall, the patterns are very similar, with the distinction that annual income, which additionally considers capital income, further reinforces sorting at the extreme ends.

Second, we run a sensitivity analysis based on net income. As this net income – in contrast to gross annual income – already takes deductions into account, we would expect a slight increase in the similarity, as the deductions might lead to a decrease in the within-household inequality even among still non-married couples. The results show that the income-based assortative mating is indeed more prominent than in the baseline model (see Figure O4 in the Online Appendix OB).

Thus, the kind of income influences the size of the assortative mating parameter and ultimately the size of the inequality effect (see Table O1 in the Online Appendix OB). E.g., if we wouldn’t focus on a broad measure including not only labor income but also capital income, we would underestimate the actual extent of assortative mating.

4.5.2 Age

Second, we consider specific subgroups in our sample. For instance, we limit the age of the couples to 25 to 44 years to see whether the distributional effect differs between younger and older spouses. We remain with 50,482 observations. We anticipate that strong marital sorting among older (high-earning) individuals has a significantly more pronounced effect on total income inequality in society compared to when we exclude older people (people over 44 years of age prior to their first marriage). We find that the assortative mating patterns with respect to income and education remain similar to the baseline model (see Figure O6 in the Online Appendix OB). The effect on inequality also remains stable (see Table O1 in the Online Appendix OB). However, as expected, the impact on inequality is slightly smaller than in the baseline model without age limitations.

4.5.3 Children

Another interesting distinction to make is between couples having children and childless couples. For example, couples with children are already more likely to make joint economic decisions which are expected to reduce the measured assortative mating. E.g., we would expect one of the partners to renounce a certain work participation rate to look after the children. Consequently, we expect the mating-induced inequality effect to be smaller than for couples without children. That’s why we focus on the childless couples in another sensitivity analysis.

Overall, the findings are similar to the baseline model. The extent of assortative mating among childless couples is comparable to the one of overall couples included in the baseline analysis (see Figure O7 in the Online Appendix B). Again, the mating-induced inequality effect offsets more than half of the distributional effect of taxes in the respective sub-sample (see Table O1 in the Online Appendix B). The main reason is likely that we have only 8,156 observations with children, while the remaining couples do not have children yet one year prior to their marriage. Thus, when we exclusively examine the childless couples, they are automatically very similar to the overall sample.

4.5.4 Nationality

Furthermore, it is worthwhile to analyze whether the couple’s nationality affects the inequality consequences. Therefore, we consider only Swiss families in this last sensitivity check. We define these families very restrictively, requiring both partners and their parents to be of Swiss nationality for a couple to be coded as "Swiss". This explains the substantial drop in the sample size to 35,400 observations. Possible differences could have various reasons, which also complicates the formulation of an appropriate hypothesis. As long as preferences for marital sorting across nationalities are similar and income distributions between Swiss and non-Swiss individuals are relatively analogous, we would not expect significant differences. As the results show, the extent of marital sorting for the subsample of couples with Swiss nationality is indeed similar to the one in our baseline model (see Figure O8 in the Online Appendix B). The distributional effects also remain similar when we restrict the sample to couples with Swiss nationality (see Table O1 in the Online Appendix B). Again, the mating-induced inequality effect is substantial compared to the redistributive effect of taxes.

5 Conclusion

This paper examines the relationship between marital sorting and income inequality in Switzerland. Our analysis shows that assortative mating occurs throughout the income distribution. Sorting intensifies as the level of income rises and is more pronounced at the distribution tails. In other words, high and low earners specifically tend to marry alike. Moreover, we provide evidence that this pattern is exacerbating household income inequality. By comparison, the redistributive effect of marital sorting at the top of the distribution offsets the tax redistribution effect up to the top 5 percentile. After that, the tax effect dominates.

In light of ongoing public debates on rising inequality and the redistribution of income, our results further stress the economic significance of assortative mating. Our paper is first to provide transparency about the relationship between the two counteracting effects. While the tax system aims at reducing, assortative mating exacerbates income inequality. As such, our analysis sheds light on the interaction between collective and individual behavior. The concentration of household income, amongst others, follows from individual mating preference. At the same time, the collectively determined tax system aims at redistributing this income. Progressively designed tax systems redistribute most where marital sorting is most pronounced: at the tails of the income distribution. Thus, we observe a tipping point where the tax effect exceeds the mating effect.

Future empirical research should focus on the dynamic interplay between martial sorting and redistributive policies. On the one hand, it would be particularly interesting to compare countries with regard to these two opposite distributional effects. On the other hand, the design of couples’ income taxation matters, e.g., for partners’ labor supply decisions (Bredemeier & Juessen, 2013). Therefore, future studies should also analyze the impact of tax system design on inequality driven by assortative mating.

Notes

i.e. leads to an increase in inequality of 5%.

The database was maintained by the Swiss Federal Social Insurance Office and is called the database on the economic well-being of the working- and retirement-age population (WiSiER). Unfortunately, we had to delete the dataset due to a limited contract between the cantons and the federal offices. An analogous dataset is in construction, but cannot be accessed before the end of 2026 according to the Federal Statistical Office.

These seven cantons represent 40 percent of Switzerland’s total population. On average, 40,000 people get married in Switzerland annually. In these specific cantons, this would equate to 16,000 individuals, calculated as 0.4 multiplied by 40,000. Therefore, over the period from 2011 to 2014, a total of 64,000 individuals would be expected to marry in these cantons. This aligns closely with our recorded observations of 64,224 (cf. Descriptive Statistics in Table 1, see also Häner et al. (2022). Additionally, these cantons serve as suitable units of analysis regarding income inequality. The seven cantons are approximately situated in the middle concerning the top 10% income share (see e.g., Swiss Inequality Database, www.sid.swiss). Neither outliers towards the top (e.g., Zug) nor towards the bottom (e.g., Uri) are included in the sample. While complete coverage would be preferable, we are confident that we are not examining a biased sample, and thus, our findings can be interpreted as representative for the Swiss average.

For more details, refer to the tax calculator of the Federal Tax Administration, available at https://swisstaxcalculator.estv.admin.ch/#/calculator/income-wealth-tax.

Unfortunately, we had to delete the data as of December 31, 2023, and it is expected to be made available again for research projects only by the end of 2026. Therefore, we were unable to ascertain the changes several years after marriage. Additionally, the time frame of our dataset would have been limited anyway. However, it would be interesting for future studies to investigate the effect of this distortion.

To examine the variability in marriage behavior concerning nationality, please refer to the Sensitivity Analysis in Section 4.5.

Unfortunately, we cannot adjust for hours worked due to the unavailability of data. However, a higher share of part-time employment among women could account for some of the differences. The Gender Overall Earnings Gap (GOEG) for the 25-34 age group in Switzerland stood at 29.3 percent in 2014. A comparable calculation within our dataset yields a similar figure (34.5 percent). Notably, the GOEG for individuals aged 35 to 44 in the same year was substantially higher at 52.3 percent, primarily driven by varying employment rates between these age groups. In Switzerland, the leading factor contributing to the gender pay gap is the difference in monthly working hours. It accounts for half of the GOEG (Bundesrat, 2022). Concurrently, it is evident that mothers are predominantly engaged in part-time employment. In 2014, approximately 61.2 percent of women aged 25 to 54 years worked part-time. This percentage significantly differs within the same age group: only 32.8 percent of childless women living alone and 41.4 percent of childless women cohabiting with a partner engaged in part-time work. In essence, the likelihood of part-time employment increases with age, particularly in the context of motherhood. Therefore, we execute a sensitivity restricting our sample to childless couples only. As Section 4.5 shows, there is no substantial difference compared to the full sample, as most couples included in the sample are not parents yet. Moreover, it is important to note that our chosen methodological approach offers the advantage of maintaining the integrity of the analysis when ranking the incomes of women and men separately. That is, their actual level of income is not important, only their income rank compared to other women.

As this variable expresses the highest level of education completed, "University" also comprises people who first completed vocational training and then went on to study at university.

While the share of university degrees is comparably low in Switzerland, the vocational education and training (VET) system is rather popular. As a result, for example, intergenerational income mobility is much higher than university education mobility because high wages can be earned even without university education (Chuard & Grassi, 2020).

It is evident that the excess probability in the lowest education group is extremely high at 4.4. Indeed, individuals in this educational category exhibit specific characteristics. Data on "Educational Attainment of the Resident Population by Labor Market Status, Gender, Nationality, Age Groups, and Family Type" for the year 2015, provided by the Federal Statistical Office (see FSO (2023), https://www.bfs.admin.ch/bfs/en/home/statistics/work-income/employment-working-hours/labour-force-characteristics/educational-level.assetdetail.28245056.html, for reference to the dataset), reveal that, on average, approximately 19.8% of the permanent population completed compulsory schooling as their highest level of education. This figure is 16.3% for Swiss nationals and almost twice as high for foreign nationals at 31%. Regardless of nationality, within the 25-39 age cohort, only 9.8% have completed compulsory education as their highest qualification, a share that is significantly lower than across all age groups (19.8%). Concerning family type, the proportion of individuals with a compulsory school degree as their highest level of education is higher among those without children under the age of 15 (20.16%) compared to those with children under the age of 15 (13.5%).

It is noteworthy that the rank-based measure allows us to include zeros. Moreover, as Fig. 2 shows, the rank-based relationship is linear. Therefore, rank-based analyses are often preferred over log-log regressions in the literature on intergenerational social mobility (e.g., Chetty et al. (2014). However, as Table 4 in the Appendix shows, the two approaches yield similar results in our analysis.

As an addition, exploring the distributional effects at the bottom of the distribution would have been intriguing. However, to accurately assess inequality effects for lower incomes, it would be necessary to account for all transfer incomes as well. Unfortunately, our dataset lacks comprehensive information on transfers. Notably, systematic records of health premium reductions are unavailable. Therefore, we focused on inequality effects for higher incomes. Furthermore, in a progressive tax system, the redistribution burden is highest for the top incomes, which makes a comparison of the two opposing effects (tax effect vs. mating-induced effect) on inequality even more interesting.

The measurement of the effect of assortative mating on income inequality has been the subject of debate. There are two different approaches to randomizing couples: either individual incomes are kept constant (addition approach) or household incomes are kept constant (imputation approach) – the latter aims at addressing the endogeneity of labor supply decisions (for an overview, see Frémeaux & Lefranc (2020).

Note that this is the value from the corrigendum. In the original study, the authors found a significantly larger inequality increase of 20.9 percent (Greenwood et al., 2014).

Besides the time point of observations, there are further differences between their study design and ours. First, they analyze the income distribution based on Gini coefficients, while we additionally use top shares. Second, their analysis is based on survey data from the Swiss Household Panel, while we use comprehensive administrative data combined with harmonized cantonal tax data. Third, Kuhn and Ravazzini (2017) focus not only on realized earnings but also on hourly wages, distinguishing between the effect of homogamy from the effects of labor supply adjustments. We focus on annual income and extend our analysis by comparing the measured effects to the redistributive impact of taxation.

Morger and Schaltegger (2018) apply this method to assess the redistributive effect of personal income taxes in Switzerland.

Both the pre- and post-tax income shares are based on taxable income. However, taxable income does not correspond to annual income; rather, it is derived after accounting for expenses, general deductions, and social deductions. Taxable income alone serves as the basis for tax calculation (Wanner, 2019; Steuerverwaltung, 2023).

For a theoretical discussion on the interplay between taxation of couples and assortative mating see, e.g., Frankel (2014).

The tax redistribution effect on the Gini coefficient is 2.81%. It is important to note that we limit our analysis to the opposite tax redistribution effect and do not adjust for transfers. Therefore, the redistribution effect on the Gini coefficient is comparably low and not suitable for a cross-country comparison.

Note that the figure depicts smoothed effects.

Details are presented in the Online Appendix.

References

Aaberge, R. (1997). Interpretation of changes in rank-dependent measures of inequality. Economics Letters, 55,. https://doi.org/10.1016/S0165-1765(97)00075-X

Almås, I., Kotsadam, A., Moen, E. R., & Røed, K. (2020). The Economics of Hypergamy. Journal of Human Resources. https://doi.org/10.3368/jhr.58.3.1219-10604r1

Atkinson, A. B., Piketty, T., & Saez, E. (2011). Top incomes in the long run of history. Journal of Economic Literature, 49, 3–71. https://doi.org/10.1257/jel.49.1.3

Bredemeier, C., & Juessen, F. (2013). Assortative Mating and Female Labor Supply. Journal of Labor Economics, 31, 603–631. https://doi.org/10.1086/669820

Bundesrat, (2022). Erfassung des Gender Overall Earnings Gap und anderer Indikatoren zu geschlechterspe zifischen Einkommensunterschieden. Bericht des Bundesrates in Erfüllung des Postulates 19.4132 Marti Samira vom 25. September 2019. https://www.newsd.admin.ch/newsd/message/attachments/73041.pdf

Chetty, R., Hendren, N., Kline, P., & Saez, E. (2014). Where is the land of opportunity? The geography of intergenerational mobility in the United States. Quarterly Journal of Economics, 129, 1553–1623. https://doi.org/10.1093/qje/qju022

Chiappori, P. A. (2020). The Theory and Empirics of the Marriage Market. Annual Review of Economics, 12, 547–578. https://doi.org/10.1146/annurev-economics-012320-121610

Chiappori, P.A., Fiorio, C., Galichon, A., Verzillo, S., (2022). Assortative Matching on Income. HCEO Working Paper Series 006, 1–48.

Chiappori, P. A., Iyigun, M., & Weiss, Y. (2009). Investment in schooling and the marriage market. American Economic Review, 99, 1689–1713. https://doi.org/10.1257/aer.99.5.1689

Chuard, P., & Grassi, V. (2020). Switzer-Land of Opportunity: Intergenerational Income Mobility in the Land of Vocational Education. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.3662560

Ciscato, E., & Weber, S. (2019). The role of evolving marital preferences in growing income inequality. Journal of Population Economics, 33, 307–347. https://doi.org/10.1007/s00148-019-00739-4

Steuerverwaltung, Eidgenössische. (2023). Kurzer Überblick über die Einkommenssteuern natürlicher Personen. Bern: Technical Report. Steuerdokumentation ESTV.

Eika, L., Mogstad, M., & Zafar, B. (2019). Educational assortative mating and household income inequality. Journal of Political Economy, 127, 2795–2835. https://doi.org/10.1086/702018

Fiorio, C.V., Verzillo, S., (2018). Looking in your partner’s pocket before saying “yes”! Income Assortative Mating and Inequality. http://wp.demm.unimi.it/files/wp/2018/DEMM-2018_02wp.pdf.

Frankel, A. (2014). Taxation of couples under assortative mating. American Economic Journal: Economic Policy, 6, 155–177. https://doi.org/10.1257/pol.6.3.155

Frémeaux, N., & Lefranc, A. (2020). Assortative Mating and Earnings Inequality in France. Review of Income and Wealth, 66, 757–783. https://doi.org/10.1111/roiw.12450

Frey, C., & Schaltegger, C. A. (2016). Progressive taxes and top income shares: A historical perspective on pre- and post-tax income concentration in Switzerland. Economics Letters, 148, 5–9. https://doi.org/10.1016/j.econlet.2016.08.041

Gallusser, D., & Krapf, M. (2022). Joint Income-Wealth Inequality: Evidence from Lucerne Tax Data. Social Indicators Research, 163, 251–295. https://doi.org/10.1007/s11205-022-02887-9

Greenwood, J., Guner, N., Kocharkov, G., Santos, C., (2014a). Corrigendum to Marry Your Like: Assortative Mating and Income Inequality. https://www.jeremygreenwood.net/papers/ggksPandPcorrigendum.pdf.

Greenwood, J., Guner, N., Kocharkov, G., & Santos, C. (2014). Marry your like: Assortative mating and income inequality. American Economic Review, 104, 348–353. https://doi.org/10.1257/aer.104.5.348

Häner, M., Salvi, M., Schaltegger, C.A., (2022). Marry into new or old money? The distributional impact of marital decisions from an intergenerational perspective. IFF-HSG Working Papers 11.

Holmlund, H. (2020). How much does marital sorting contribute to intergenerational socioeconomic persistence? Journal of Human Resources. https://doi.org/10.3368/jhr.57.2.0519-10227r1

Kuhn, U., Ravazzini, L., (2017). The impact of assortative mating on income inequality in Switzerland. FORS Working Papers 1. www.forscenter.ch.

Morger, M., & Schaltegger, C. A. (2018). Income tax schedule and redistribution in direct democracies - the Swiss case. Journal of Economic Inequality, 16, 413–438. https://doi.org/10.1007/s10888-018-9376-z

Musgrave, R. A., & Thin, T. (1948). Income Tax Progression, 1929–48. Journal of Political Economy, 56. https://doi.org/10.1086/256742

OECD, (2018). The Role and Design of Net Wealth Taxes in the OECD. OECD Tax Policy Studies No. 26.

Pestel, N. (2017). Marital sorting, inequality and the role of female labour supply: Evidence from East and West Germany. Economica, 84, 104–127. https://doi.org/10.1111/ecca.12189

Piketty, T., Saez, E., & Stantcheva, S. (2014). Optimal taxation of top labor incomes: A tale of three elasticities. American Economic Journal: Economic Policy, 6, 230–271. https://doi.org/10.1257/pol.6.1.230

Schwartz, C. (2010). Earnings inequality and the changing association between spouses’ earnings. American Journal of Sociology, 115, 1524–1557. https://doi.org/10.1086/651373

Schwartz, C. R., & Mare, R. D. (2005). Trends in educational assortative marriage from 1940 to 2003. Demography, 42, 621–646. https://doi.org/10.1353/dem.2005.0036

Wanner, P., (2019). Préparation d’une base de données sur la situation économique des personnes en âge d’activité et à l’âge de la retraite (WiSiER). Rapport de recherche 4.

Acknowledgements

We thank participants of the Silvaplana Workshop on Political Economy 2021, the Workshop of the Swiss Network on Public Economics 2021, and the research seminar at University of Lucerne, for their valuable comments on earlier versions of this paper. We also thank Nadja Koch for her esteemed research assistance. This research did not receive any specific grant from funding agencies in the public, commercial, or not-for-profit sectors.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Appendix

Appendix

1.1 Data Appendix

Our analysis relies on an expansive Swiss database that integrates harmonized cantonal tax information with datasets sourced from the Federal Statistical Office, the Central Compensation Office, and the State Secretariat for Economic Affairs. These diverse data reservoirs are interconnected using anonymized old age insurance identifiers, facilitating the linkage of couples and family members across different generations. Known as the database on the economic well-being of the working and retirement-age population (WiSiER), it is overseen by the Swiss Federal Social Insurance Office. This comprehensive dataset encompasses 8.9 million observations across 1,089 variables, spanning the years 2011 to 2015. Further details on the dataset components crucial to our analysis, namely tax data and structural survey data, are provided below.

Tax data

We utilize tax data sourced from 7 out of the 26 Swiss cantons. Although the dataset could potentially include tax data from 11 cantons, consent for data usage in our analysis was granted solely by 7 of these cantons. As a result, our dataset comprises tax records from Aargau, Bern, Basel-Landschaft, Basel-City, Lucerne, St. Gallen, and Valais. These tax records offer a comprehensive census at the cantonal level, covering all permanent residents aged 18 and above. Notably, through the integration of various datasets, we include individuals employed by international organizations in Switzerland, who are exempt from income tax. Additionally, we have access to income data for individuals residing in Switzerland without a C residence permit, who are subject to the tax at source system. This system entails employers withholding a portion of the salary, potentially followed by a subsequent tax return verified by tax authorities. Furthermore, our dataset encompasses nonresident foreigners subject to lump-sum taxation, who are not actively employed and taxed based on their estimated expenses. Their tax assessments are determined by administrative lower limits (currently at CHF 400,000) (Wanner, 2019).

Individual taxation on income and assets relies on the submission of a tax declaration by the taxpayer for the relevant fiscal year, which is subsequently authenticated by tax authorities. In rare cases where a taxpayer fails to submit a tax return, tax authorities calculate taxes based on available information, ensuring their incorporation into the dataset. Additionally, individuals with no taxable income in a given year are required to file a tax return, thus ensuring their inclusion in the dataset (Wanner, 2019). The tax data are sourced from cantonal tax records, which may exhibit variability across cantons, but have been standardized and subjected to cleansing for the WiSiER dataset (Wanner, 2019). In contrast to survey data, tax data offer the significant advantage of encompassing the entire income distribution, from the highest to the lowest incomes. Given the pivotal role of extreme distributional outcomes in studies pertaining to inequality effects, the utilization of income information from tax data appears to be advantageous.

In our dataset, only the tax circumstances of deceased individuals or those who relocated abroad or to a non-covered canton during the year are excluded from the analysis for that particular year. An essential requirement for inclusion is the residency of the individual within the territory of one of the seven cantons at the end of the corresponding year.

Structural survey data

The structural survey, an integral component of the Population Census, supplements register-derived information with additional demographic statistics. Within this survey, a segment of the population completes a written questionnaire.

Annually, a minimum of 200,000 individuals participate in the survey. Respondents’ samples are randomly selected based on the Federal Statistical Office’s random sample register, which is constructed using data from the official population registers maintained by municipalities, cantons, and the federal government. Participation in the survey is compulsory for the selected individuals, ensuring the sample’s representativeness at the national level in Switzerland. Cantons and cities have the discretion to voluntarily expand their sample sizes. The survey encompasses individuals aged 15 years and above who are permanent residents. Both online and paper-based questionnaires are employed in data collection. Among the primary variables are household types, family compositions, languages spoken, religion, and education, with the latter being particularly pertinent to our analysis. Respondents indicate their highest level of completed education.

1.2 Appendix B

See Table 4

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Häner-Müller, M., Salvi, M. & Schaltegger, C.A. Tax redistribution offset? Effect of marital choices on income inequality. Int Tax Public Finance (2024). https://doi.org/10.1007/s10797-024-09847-8

Accepted:

Published:

DOI: https://doi.org/10.1007/s10797-024-09847-8