Abstract

The primary purpose of this paper is to analyze the connectedness between edible oils and oilseeds from various international commodity markets and the U.S. Economic Policy Uncertainty Index (EPU). The TVP-VAR method has been adopted in this paper to analyze the inter-commodity connectedness and spillover relationships among them. We also study how the effect on the price of one edible oil or oilseed affects other edible oils in the international markets. For this purpose, daily closing prices of near-month contracts of 6 edible oil commodities and the Economic Policy Uncertainty (EPU) index have been considered for a period that starts from January 2013 to April 2023. Results show a moderate level of connectedness among the edible oil and oilseed commodities; however, connectedness increases during times of economic or geopolitical crisis. Results also show that soybean is the most dominant commodity in the edible oil and oilseed commodity nexus, and rapeseed meal is the commodity with the lowest transmission power.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The global economy is inherently interconnected, and its various facets are subject to a complex web of influences. Agricultural commodities, especially, have seen unparalleled interconnectedness in this recent financialization period. Simultaneously, it has created an increased interest in learning more about how those commodities interact. Among these commodities, edible oils are essential for global food security and economic stability. Understanding the dynamics of volatilities of edible oils is paramount in today's interconnected world. Volatility in agricultural commodities impacts not only the farm revenue but also the consumers' disposable income. Price volatility increases uncertainty in agricultural markets, leading to food emergencies, political conflicts, and higher levels of poverty (Umar et al., 2021; Wright, 2011). Similarly, Roache (2010) found price volatility in agricultural commodities to have an adverse effect on the balance of payments, imports and exports, government budget and inflation.

On the other hand, Economic Policy Uncertainty (EPU) has garnered significant scholarly interest in the field of economics, notably in the aftermath of the financial crisis in 2008. EPU is a multifaceted construct that captures the uncertainty surrounding government policies and their potential impact on the broader economy. Researchers have extensively studied its ramifications, as it is believed to significantly influence various economic indicators, including investment, employment, and consumption (Baker et al., 2016). It is generally noted that changes in economic policy, whether at the domestic or international level, may significantly impact commodities markets. Empirical evidence suggests that shifts in government policies can lead to price fluctuations, disruptions in supply chains, and increased market volatility (Hung, 2021; Su et al., 2023). In an era characterized by globalization, policies enacted in one country can have far-reaching consequences for markets and consumers worldwide. Understanding these dynamics is crucial for market participants, policymakers, and researchers. Second, we seek to equip ourselves with enhanced tools to measure the volatilities introduced by new economic policy approaches and discern their impacts on the edible oils market. Edible oils are fundamental components of diets worldwide. They are utilized for cooking and producing various food products, making their prices and availability vital for global food security. Moreover, with the development of the biofuel and biodiesel industry, the price of edible oil has become more susceptible to the volatility of the overall economy. Also the volatility in the price of commodities can have a substantial impact on the emergence of greener energy in a country (Kaur et al., 2023a, 2023b). Hence, understanding these linkages is pivotal for policymakers, traders, and consumers to anticipate and manage market fluctuations effectively. Nevertheless, the commodity sector of the edible oil market has been lacking in comprehensive industrial and academic research. The volatility in the price of edible oil and oilseeds has the capacity to make the stakeholders of the agricultural and food product market more susceptible, leading to significant strain. Therefore, it is crucial for farmers and policymakers to improve their understanding of the interconnectedness between edible oils and oilseeds in order to successfully implement various policy initiatives aimed at maintaining stable prices and ensuring food security.

This research paper delves into the intricate relationship between the edible oils from diverse international commodity markets and the U.S. Economic Policy Uncertainty Index (USEPU). Subsequently, this study investigates the role of each commodity as a transmitter or receiver of volatility in the overall market, as well as their impact on the volatility of other commodities. The goal is to analyze the connectedness and spillover relationships among these commodities and analyze the effects on hedging and risk management. This paper aims to answer the following research questions. Firstly, how do changes in the price of one type of edible oil or oilseed affect other edible oils in international commodity markets? Secondly, how do economic policy changes introduced in multiple countries, with the United States as a prominent example, impact the prices and volatilities of edible oils?

To answer the above research questions, a Time-Varying parameters Vector Autoregression (TVP-VAR) model (Antonakakis et al., 2020) and the connectedness approach developed by Diebold and Yilmaz (2012), Diebold and Yılmaz (2014) have been employed. The use of the TVP-VAR approach effectively addresses the limitations of conventional VAR models that rely on variance decomposition to measure connectedness (Antonakakis et al., 2020).

This study sets itself apart from existing literature in two distinct manners. Previous studies have mostly concentrated on examining the interconnectedness between food grains and crude oil in order to get insights into the inter-sectoral connection. This work makes a valuable contribution to the existing body of knowledge by examining the interrelationship between edible oil, oilseeds and Economic Policy Uncertainty. Additionally, this study considers the edible oil and oilseed commodity contracts based on trading volume in exchanges across the globe rather than just focusing on the Chicago Mercantile Exchange (CME) of the United States.

The analysis finds that a moderate degree of connectedness exists between the variables; however, it exhibits an upward trend during periods of economic or geopolitical turmoil. The findings also indicate that soybean holds the highest level of dominance within the edible oil and oilseed commodity network, whereas rapeseed meal exhibits the lowest transmission power among the commodities.

The remaining part of the paper is organized as follows: Sect. 2 reviews the existing literature on connectedness among different asset classes. Section 3 provides the details of the dataset and methodology used for the analysis. Section 4 explains the empirical analysis and results, Sect. 5 presents the practical implications, and finally, Sect. 6 concludes the paper.

2 Literature Review

The literature review in this paper is divided into three sub-sections. The first sub-Sect. 2.1, explains the literature related to agricultural commodity markets, sub-Sect. 2.2 presents previous studies on economic policy uncertainty, and sub-Sect. 2.3 explains a few fundamental studies on connectedness and spillover in financial markets. All three sub-sections are presented one after another as follows:

2.1 Connectedness and Spillover Among Agricultural Commodities

Numerous scholarly works have elucidated the volatility spillovers among agricultural commodities and have addressed whether commodities constitute a unified asset class or are distinct. One of the first studies in agricultural economics, conducted by Anderson (1985), found that seasonality predicts a consistent pattern of price variation in nine American grain and edible oil and livestock futures markets that include wheat, soybean, soybean oil, corn, cattle and cocoa. Pindyck and Rotemberg (1990) were two of the pioneers who argued in favour of the co-movement of prices of unrelated commodities. In recent times, research on co-movement, connectedness and commodity spillover has increased multiple times. Steen and Gjolberg (2013) referred to financialization and proved that following 2004, there was an increase in the interdependence of commodity markets with the stock market, and after 2008, the interrelationship between commodities became even higher. On the other hand, Musunuru (2014) shows that Wheat and corn prices fluctuate in tandem and show notable resilience to shocks. Similarly (Grieb, 2015) discovered recently that information about price innovations for one commodity is transmitted to other commodities. By employing the GARCH-M model, the authors show that corn was the most dominant commodity, transmitting and receiving the highest price and volatility spillovers. Similarly, Mensi et al. (2014) investigated the dynamic spillovers between energy and cereal commodity prices, providing insights into the interdependencies within the commodity markets.

However, a small number of studies provided contradictory results. Chevallier and Ielpo (2013) found that compared to other asset classes, commodities have weaker volatility spillovers. In specific, the lowest spillovers are seen in agricultural commodities among the overall commodity markets. Similarly, Vivian and Wohar (2012) used the GARCH(1,1) model to prove that commodities are disintegrated and their prices do not move together. Moreover, Gardebroek et al. (2016) looked at the cross-market dependency of corn, wheat, and soybeans and found that agricultural markets are not interdependent.

2.2 U.S. Economic Policy Uncertainty (US EPU) Index

The U.S. Economic Policy Uncertainty (US EPU) index is a widely recognized economic indicator that measures the level of uncertainty regarding economic policy in the United States. It quantifies the uncertainty associated with fiscal, monetary, and trade policies and has been the subject of extensive research in economics and finance. This seminal paper by Baker et al. (2016) introduces the US EPU index and provides a detailed methodology for its construction. It discusses the importance of measuring economic policy uncertainty and its impact on various economic variables, including investment, employment, and GDP growth. Bloomberg's research explores the consequences of economic policy uncertainty, focusing on the adverse effects of uncertainty shocks on investment and economic activity. It emphasizes the relevance of the US EPU index in understanding these dynamics (Bloom, 2009). This study by Jurado et al. (2015) examines different measures of economic uncertainty, including the US EPU index, and provides insights into their construction and interpretation. It highlights the role of uncertainty in driving economic outcomes. Similarly, the study undertaken by Kaur et al., (2023a, 2023b) involved a comprehensive literature research aimed at synthesizing existing research on the relationship between macroeconomic variables and economic growth in the BRIC nations. Hassan et al. (2019) utilize the US EPU index as a critical component in analyzing firm-level political risk. They show how economic policy uncertainty can impact firms' investment decisions and operational strategies. Leduc and Liu (2016) explore the link between economic policy uncertainty and aggregate demand shocks, providing insights into how changes in policy uncertainty can affect macroeconomic outcomes. Ludvigson et al. (2021) investigated whether economic policy uncertainty acts as an exogenous impulse or an endogenous response to business cycle fluctuations, contributing to the debate on causality. Similarly, this paper by Bachmann et al. (2013) investigates the relationship between economic uncertainty, as captured by the US EPU index and other measures, and economic activity using business survey data.

2.3 Connectedness in Financial Markets

Dynamic connectedness refers to the time-varying interdependencies and spillover effects between different financial markets, assets, or economic variables. Understanding dynamic connectedness is crucial for risk management, portfolio diversification, and assessing the stability of financial systems. Diebold et al. (2009) introduced a framework for measuring and visualizing spillover effects in financial markets using a VAR-BEKK model. They apply this methodology to study global equity markets' interconnectedness. This paper by Diebold and Yilmaz (2012) proposes a new metric for directional connectedness, allowing researchers to assess whether markets are net transmitters or receivers of volatility spillovers. Bartram and Bodnar (2009) studied the global financial crisis of 2008/2009 and examined the interconnectedness and contagion effects across international equity markets, highlighting the importance of dynamic connectedness during crises. In a similar direction, the cointegration of stock market across the BRICS nations was examined by Aggarwal and Raja (2019) who identified a long-term cointegration among the four markets. Billio et al. (2012) developed econometric connectedness and systemic risk measures, focusing on the finance and insurance sectors. They provide valuable tools for assessing interconnectedness in these industries. Bubák et al. (2011) investigate volatility transmission in emerging European foreign exchange markets, shedding light on the dynamics of spillover effects among currencies. Moreover, Dimitriou and Kenourgios (2013) explored the dynamic linkages among international currencies during financial crises, revealing how these linkages evolve. In summary, dynamic connectedness in financial markets has become a crucial area of research for understanding how shocks and events propagate across asset classes, regions, and time periods. Researchers have developed and applied various methodologies to financial assets, providing valuable insights into the evolving nature of financial market interdependencies.

3 Data and Methodology

This section is divided into two sub-sections. Section 3.1 explains the data used in this paper, presents the descriptive statistics, and shows the time-series plots of all seven variables. Section 3.2 explains the methodology and economic models used in the paper in detail.

3.1 Data

Daily last trading prices of near-month contracts of 6 edible oil commodities have been considered for this study along with the Economic Policy Uncertainty (EPU) index. The study period starts from 04 January 2013 to 04 April 2023. Edible oil and oilseeds futures trading at the Chicago Board of Trade (CBOT), Intercontinental Exchange (ICE), Zhengzhou Commodity Exchange (ZCE) and Bursa Malaysia Berhad (BMD) have been selected for the analysis. The seven variables included in the paper are soy oil, crude palm oil (CPO), canola, soybean, soymeal, rapeseed meal and US-EPU index. All the datasets used in this paper have been collected from Bloomberg Terminal. Dates with data points for all seven variables have been considered for the study, and there is a total of 2247 observations for each variable. To mitigate the limitations of non-stationarity in the dataset, the entire dataset has been transformed into the first natural log difference, which can be interpreted as a daily return series. The daily time-series plots of the variables are shown in Fig. 1. Moreover, Table 1 shows the descriptive statistics of the variables. The optimal lag length of 1 is given by AIC, BIC and HQIC (Appendix 1).

3.2 Methodology

The TVP-VAR method given by Antonakakis et al. (2020) has been adopted in this paper to measure return connectedness among the variables. This method is an improved version of connectedness measures proposed by Diebold and Yilmaz (2012), Diebold and Yılmaz (2014) in two ways: the DY method is not deemed perfect as the result of this operation is sensitive to the setting of an arbitrary rolling window and can lose valuable observations in the process. However, the TVP-VAR methodology avoids the problem of arbitrary rolling windows and loss of observations by adjusting to the events immediately. This methodology allows the variance–covariance matrix to vary via a Kalman filter estimation with forgetting factors, which helps in capturing the possible variability of the underlying dataset.

Given that our datasets encompass varied economic situations over several time periods, it is expected that the mean and variance of each time series will vary over time. Therefore, we believe that employing the TVP-VAR methodology with a variance–covariance structure would be a suitable approach.

We are estimating a TVP-VAR (1) as suggested by AIC, HQIC and SBIC (appendix 1) which can be outlined as follows:

In this context, we have vectors \({y}_{t}\) and \({r}_{t-1}\), which are sized m × 1 and mq × 1, respectively. The parameter \({\rho }_{t-1}\) encompasses all available information up to time t—1. Both \({V}_{t}\) and \({V}_{it}\) are matrices, with dimensions m × mq and m × m, respectively. Additionally, the error term \({\omega }_{t}\) is an m × 1 vector, and \({\tau }_{t}\) is a vector with dimensions mq × 1. The variance–covariance matrices \({\sigma }_{t}\) and \({\varepsilon }_{t}\) vary with time and have dimensions m × m and \({m}^{2}q\) × \({m}^{2}q\), respectively. It is worth noting that \(vec\left({V}_{t}\right)\) represents the vectorization of \({V}_{t}\) and has dimensions \({m}^{2}q\) × 1.

To calculate the generalized impulse response functions (GIRF) and generalized forecast error variance decompositions (GFEVD) developed by Koop et al. (1996) and Pesaran and Shin (1998), TVP-VAR is transformed to its vector moving average (VMA) representation based on the Wold theorem.

where \({A}_{jt}\) is an m × m matrix.

We derive the GFEVD (\({\rho }_{ij,t}(H)\)) representing the pairwise directional connectedness from j to i, illustrating the influence that variable j exerts on variable i in terms of its contribution to forecast variance. To ensure comparability, these variance shares are then standardized by summing them across all rows, effectively demonstrating that all variables collectively account for 100 percent of variable i's forecast error variance. The GFEVD is computed as follows:

The numerator is the cumulative effect of a shock in variable i, whereas the denominator is the cumulative effect of all the shocks.

The next stage involves the computation of the total connectedness index. This equation elucidates the manner in which a disturbance in one variable spills over to other variables. By employing GFEVD, the total connectedness index is determined as follows:

The above equation is extended to study directional connectedness; we will divide it into three components: total directional connectedness to others, total directional connectedness from others, and net total directional connectedness.

Total directional connectedness TO others calculates the shock variable i transmits to all other variables j, and it is defined as:

Secondly, we calculate directional connectedness FROM others that calculates the shocks variable i receives from other variables j.

Finally, net total directional connectedness is obtained by subtracting the “total directional connectedness FROM others” Eq. (8) from “total directional connectedness TO others” Eq. (7)

Equation 9 unveils the extent to which variable i exerts influence on the analyzed network. Consequently, when \({C}_{i,t}\) is positive, it indicates that variable i holds greater influence over the network compared to how much it is influenced by others. Conversely, when \({C}_{i,t}\) is negative, it suggests that variable i is primarily influenced by the network rather than being a significant influencer itself.

To delve deeper into the bidirectional relationships within the network, we break down the net total directional connectedness by calculating the net pairwise directional connectedness, as illustrated in the following equation.

If \({\mathrm{NPDC }}_{ij}(H)\) is negative, this infers that i is dominated by j, whereas if \({\mathrm{NPDC }}_{ij}(H)\) is positive, it describes that i dominates j.

4 Empirical Analysis and Results

We begin our analysis by accounting for the directional spillover between the volatility series of the variables considered in Table 2. Column-wise, each of the values except the diagonal elements represents the individual spillover from one variable to another variable. Thus, the sum of these depicts the contribution to others. At the same time, the values row-wise define the contribution received by a variable by others individually. This also sums up the contributions of others. Definitively, “contributions to others” account for the total contribution of shocks of an asset to other assets, while the reverse is the case for “contributions from others”. Specifically, the spillover table is like the input–output as it unravels how shocks are transmitted and absorbed within the system. The values diagonally are noted as their shocks to and from assets. The net spillovers reveal the market that is receiving (or giving) more shocks than it gives (receives) from other assets. Intuitively, this is calculated by subtracting “contributions from others” from “contributions to others”. A positive value depicts that the assets in question spill shocks to other assets than they receive, while the reverse indicates that the assets in question are more vulnerable to shocks from the other markets.

4.1 Dynamic Total Connectedness

Total Connectedness Index (TCI) reveals the total spillovers transmitted among the considered assets. It is calculated by expressing the sum of contributions from others (or the sum of contributions to others) as a percentage of the sum of contributions, including own. The time-varying total connectedness index is illustrated in Fig. 2. The figure shows that the total connectedness index fluctuates between 20 to 60%, and a few clear spikes are visible in Fig. 2, portraying different crisis and uncertainty periods such as the Syrian civil war, shell oil shocks, Covid-19 pandemic, Russia-Ukraine war etc. Connectedness level reached the highest during the covid-19 pandemic, depicted by a sharp spike. The findings align with prior research conducted by Belcaid et al. (2023), So et al. (2021), which demonstrated the fast and dynamic transmission of financial contagion during the COVID-19 epidemic and the Russia-Ukraine conflict. Next, we turn our attention to Table 2, which represents the full sample return connectedness of log-returns of the six commodities and Economic policy uncertainty.

The last value of the last row and last column represents the total connectedness index (TCI) value, which is 45.62%, meaning that nearly 45.62 per cent of the total variance of forecast errors for seven variables in the system is explained by spillover shocks across the network, and the rest 54.38% of the total variance is explicated by the idiosyncratic industry or commodity-category specific shocks. In general, this observation suggests a moderate level of interconnectedness between the returns of edible oil and oilseeds. Upon examination of the individual commodities, it becomes evident that soybean, soyoil, and canola emerge as significant transmitters of disturbance that impact the returns of other commodities within the network. These commodities exhibit transmission rates of 77.09%, 52.56%, and 49.98%, respectively. The aspect of net directional connectedness and net pairwise directional connectedness, which represents those variables that are net transmitters and net receivers of shocks throughout the network, are explained in sub-ìs. 4.2 and 4.3, respectively.

4.2 Net Directional Connectedness

This sub-section explains the time-varying net directional connectedness of each variable to show the net contribution of each variable to the system. A positive net directional connectedness in the connectedness table, also depicted by a shaded area on the upper side of the graph, indicates that the variable transmits more shocks to the system than it receives from the system. Hence, the variable is called a net transmitter. On the other hand, negative directional connectedness indicates a variable as a net receiver of shocks.

From Fig. 3, it is pretty evident that soybean and soybean oil are positive most of the time and CPO and rapeseed meal are negative most of the time. A net connectedness value of 20.07 also proves the same that soybean is a very strong net transmitter of shocks to other variables in the system. The reverse is true for CPO and rapeseed meal; it remained mostly in the negative zone throughout the period except for very few short positive spikes, thus represented by -11.64 and -14.09 net directional connectedness values. Canola, Soyoil, and Soymeal are also net transmitters of shocks, but as compared to soybeans, these three are much lower in magnitude. EPU, which is a news-based uncertainty index, also turns out to be a net receiver of shocks.

4.3 Net-Pairwise Directional Connectedness

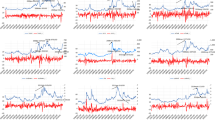

In this sub-section, net pairwise directional connectedness between the seven variables is explored. Net pairwise directional connectedness plots are drawn in Fig. 4, and further, the network plot in Fig. 5 explains the relationship between each pair of variables.

The blue colour nodes represent a net transmitter of shocks, and the yellow colour nodes represent a net receiver of shocks. Moreover, the degree of transmission of shocks is represented by the thickness of the edges. Soybean is a net transmitter to every other variable in the system, however the relationship with EPU is very insignificant. The most it transmits its shock to soymeal and rapeseed meal followed by soyoil, canola and CPO. Rapeseed meal is the net receiver of shocks from soybean, soymeal, soy oil and canola, making rapeseed the highest receiver of shocks. Similarly, CPO receives shocks from canola, soybean and soy oil, which makes it the second-largest net receiver of shocks. These relationships complement the results shown by the net total connectedness in Sect. 4.2.

5 Practical Implications

Understanding the dynamic connectedness between edible oils and oilseeds markets has potential policy implications. Policymakers can benefit from insights into how their connectedness and spillover in the futures market affect food prices and access to essential commodities. These results are expected to enable more informed policymaking in international trade and food security. We ascribe the bidirectional spillover of returns between EPU and edible oil commodities, which offers a pragmatic method for policymakers to oversee and control agricultural prices. Closing the research gap by analyzing the relationship between edible oils markets and EPU can provide a more comprehensive understanding of how economic policy uncertainty affects global food commodity prices, contributing to better risk management, policy formulation and food security strategies.

6 Conclusion

This paper explores the dynamics of connectedness and spillover network among six edible oil commodities and the Economic Policy Uncertainty (EPU) index. The selected edible oil and oilseed commodities are soybean, soy meal, soy oil, canola, CPO, and rapeseed meal. The whole sample period is from January 2013 to April 2023. The period of increased demand for commodities and the subsequent significant decline in prices due to the COVID-19 pandemic, again a dramatic increase during the Russia-Ukraine War, were followed by an unprecedented surge in foreign investor involvement in the commodity markets.

The empirical findings of our study may be succinctly described as follows: First, we calculate the Total Connectedness Index (TCI) by employing Time-Varying Vector Autoregression (TVP-VAR) methods. The total connectedness index shows a moderate level of connectedness with a TCI value of 45.62%. Besides, the results show that the total connectedness increases during crisis periods such as the COVID-19 pandemic and geopolitical crises like the Russia-Ukraine war. Empirical evidence also shows soybean is the most dominant commodity in the oil and oilseed market, with a massive net spillover value of 20.07, followed by soy oil. Rapeseed meal is the largest receiver of shocks with a value of negative 14.9, followed by CPO with a negative 11.64 and EPU with 4.38.

In summary, it can be inferred that there are notable dependent patterns regarding the transmission of information across the edible oil and oilseed commodity markets. These findings have substantial implications for portfolio managers, investors, and government agencies. In light of these findings, it is imperative to implement policies that effectively address the issue of food inflation and its impact on farmers' income.

7 Appendix

7.1 Lag-order selection criteria

Sample:04 jan 2013 to 04 April 2023 Number of obs. 2,243 | |||||||

|---|---|---|---|---|---|---|---|

Lag | LL | LR | df | p FPE | AIC | HQIC | SBIC |

0 | 37,925.2 | 8.4e–23 | −33.805 | −33.794 | −33.775 | ||

1 | 38,074 | 297.62 | 36 | 0.000 7.6e–23* | −33.906* | −33.861* | −33.784* |

2 | 38,098 | 47.963 | 36 | 0.088 7.7e–23 | −33.895 | −33.817 | −33.681 |

3 | 38,123.1 | 50.152 | 36 | 0.059 7.7e–23 | −33.885 | −33.774 | −33.580 |

4 | 38,152.9 | 59.631* | 36 | 0.008 7.8e–23 | −33.880 | −33.735 | −33.482 |

7.2 Connectedness To Others

7.3 Connectedness From Others

References

Aggarwal, S., & Raja, A. (2019). Stock market interlinkages among the BRIC economies. International Journal of Ethics and Systems, 35(1), 59–74. https://doi.org/10.1108/IJOES-04-2018-0064

Anderson, R. W. (1985). Some determinants of the volatility of futures prices. The Journal of Futures Markets, 5(3), 331.

Antonakakis, N., Chatziantoniou, I., & Gabauer, D. (2020). Refined measures of dynamic connectedness based on time-varying parameter vector autoregressions. Journal of Risk and Financial Management, 13(4), 84. https://doi.org/10.3390/jrfm13040084

Bachmann, R., Elstner, S., & Sims, E. R. (2013). Uncertainty and economic activity: Evidence from business survey data. American Economic Journal: Macroeconomics, 5(2), 217–249. https://doi.org/10.1257/mac.5.2.217

Baker, S. R., Bloom, N., & Davis, S. J. (2016). Measuring economic policy uncertainty. Quarterly Journal of Economics, 131(4), 1593–1636. https://doi.org/10.1093/qje/qjw024

Bartram, S. M., & Bodnar, G. M. (2009). No place to hide: The global crisis in equity markets in 2008/2009. Journal of International Money and Finance, 28(8), 1246–1292. https://doi.org/10.1016/J.JIMONFIN.2009.08.005

Belcaid, K., El Aoufi, S., & Al-Faryan, M. A. S. (2023). Dynamics of contagion risk among world markets in times of crises: A financial network perspective. Asia-Pacific Financial Markets. https://doi.org/10.1007/s10690-023-09439-2

Billio, M., Getmansky, M., Lo, A. W., & Pelizzon, L. (2012). Econometric measures of connectedness and systemic risk in the finance and insurance sectors. Journal of Financial Economics, 104(3), 535–559. https://doi.org/10.1016/J.JFINECO.2011.12.010

Bloom, N. (2009). The impact of uncertainty shocks. Econometrica, 77(3), 623–685. https://doi.org/10.3982/ECTA6248

Bubák, V., Kočenda, E., & Žikeš, F. (2011). Volatility transmission in emerging European foreign exchange markets. Journal of Banking & Finance, 35(11), 2829–2841. https://doi.org/10.1016/J.JBANKFIN.2011.03.012

Chevallier, J., & Ielpo, F. (2013). Cross-market linkages between commodities, stocks and bonds. Applied Economics Letters, 20(10), 1008–1018. https://doi.org/10.1080/13504851.2013.772286

Diebold, F. X., & Yilmaz, K. (2009). Measuring financial asset return and volatility spillovers, with application to global equity markets. The Economic Journal, 119(534), 158–171. https://doi.org/10.1111/j.1468-0297.2008.02208.x

Diebold, F. X., & Yilmaz, K. (2012). Better to give than to receive: Predictive directional measurement of volatility spillovers. International Journal of Forecasting, 28(1), 57–66. https://doi.org/10.1016/J.IJFORECAST.2011.02.006

Diebold, F. X., & Yılmaz, K. (2014). Financial and macroeconomic connectedness: A network approach to measurement and monitoring. USA: Oxford University Press.

Dimitriou, D., & Kenourgios, D. (2013). Financial crises and dynamic linkages among international currencies. Journal of International Financial Markets, Institutions and Money, 26(1), 319–332. https://doi.org/10.1016/J.INTFIN.2013.07.008

Gardebroek, C., Hernandez, M. A., & Robles, M. (2016). Market interdependence and volatility transmission among major crops. Agricultural Economics, 47(2), 141–155. https://doi.org/10.1111/agec.12184

Grieb, T. (2015). Mean and volatility transmission for commodity futures. Journal of Economics and Finance, 39(1), 100–118. https://doi.org/10.1007/s12197-012-9245-8

Hassan, T. A., Hollander, S., Van Lent, L., & Tahoun, A. (2019). Firm-level political risk: Measurement and effects. The Quarterly Journal of Economics, 134(4), 2135–2202. https://doi.org/10.1093/qje/qjz021

Hung, N. T. (2021). Directional spillover effects between BRICS stock markets and economic policy uncertainty. Asia-Pacific Financial Markets, 28(3), 429–448. https://doi.org/10.1007/s10690-020-09328-y

Jurado, K., Ludvigson, S. C., & Ng, S. (2015). Measuring uncertainty. American Economic Review, 105(3), 1177–1216. https://doi.org/10.1257/aer.20131193

Kaur, S., Aggarwal, S., & Garg, V. (2023a). A study of macroeconomic effects on the growth of BRICS: A systematic review. International Journal of Economic Policy in Emerging Economies, 18(1), 57–81. https://doi.org/10.1504/IJEPEE.2023.134805

Kaur, S., Aggarwal, S., & Sarwar, S. (2023b). Trade balance, monetary supply, commodity prices, and greener energy growth: Contextual evidence from BRICS economies in the lens of sustainability. Environmental Science and Pollution Research, 30(29), 73928–73940. https://doi.org/10.1007/s11356-023-27475-3

Koop, G., Pesaran, M. H., & Potter, S. M. (1996). Impulse response analysis in nonlinear multivariate models. Journal of Econometrics, 74(1), 119–147. https://doi.org/10.1016/0304-4076(95)01753-4

Leduc, S., & Liu, Z. (2016). Uncertainty shocks are aggregate demand shocks. Journal of Monetary Economics, 82, 20–35. https://doi.org/10.1016/j.jmoneco.2016.07.002

Ludvigson, S. C., Ma, S., & Ng, S. (2021). Uncertainty and business cycles: Exogenous impulse or endogenous response? American Economic Journal: Macroeconomics, 13(4), 369–410.

Mensi, W., Hammoudeh, S., Nguyen, D. K., & Yoon, S. M. (2014). Dynamic spillovers among major energy and cereal commodity prices. Energy Economics, 43, 225–243. https://doi.org/10.1016/J.ENECO.2014.03.004

Musunuru, N. (2014). Modeling price volatility linkages between corn and wheat: A multivariate GARCH estimation. International Advances in Economic Research, 20(3), 269–280. https://doi.org/10.1007/s11294-014-9477-9

Pesaran, H. H., & Shin, Y. (1998). Generalized impulse response analysis in linear multivariate models. Economics Letters, 58(1), 17–29. https://doi.org/10.1016/S0165-1765(97)00214-0

Pindyck, R. S., & Rotemberg, J. J. (1990). The excess co-movement of commodity prices. The Economic Journal, 100(403), 1173–1189.

Roache, S. K. (2010). What explains the rise in food price volatility? In: IMF Working Papers Volume 2010 Issue 129 (2010). https://www.elibrary.imf.org/view/journals/001/2010/129/article-A001-en.xml

So, M. K. P., Chan, L. S. H., & Chu, A. M. Y. (2021). Financial network connectedness and systemic risk during the COVID-19 pandemic. Asia-Pacific Financial Markets, 28(4), 649–665. https://doi.org/10.1007/s10690-021-09340-w

Steen, M., & Gjolberg, O. (2013). Are commodity markets characterized by herd behaviour? Applied Financial Economics, 23(1), 79–90. https://doi.org/10.1080/09603107.2012.707770

Su, Y., Li, J., Yang, B., & An, Y. (2023). The impacts of policy uncertainty on asset prices: Evidence from China’s market. Asia-Pacific Financial Markets. https://doi.org/10.1007/s10690-023-09442-7

Umar, Z., Gubareva, M., & Teplova, T. (2021). The impact of Covid-19 on commodity markets volatility: Analyzing time-frequency relations between commodity prices and coronavirus panic levels. Resources Policy, 73, 102164. https://doi.org/10.1016/j.resourpol.2021.102164

Vivian, A., & Wohar, M. E. (2012). Commodity volatility breaks. Journal of International Financial Markets, Institutions and Money, 22(2), 395–422. https://doi.org/10.1016/j.intfin.2011.12.003

Wright, B. D. (2011). The Economics of grain price volatility. Applied Economic Perspectives and Policy, 33(1), 32–58. https://doi.org/10.1093/aepp/ppq033

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Sarma, N., Tiwari, P. & Rajib, P. From Fields to Futures: Connectedness Among Edible Oil and Oilseeds- Where Soybean Leads, Others Follow. Asia-Pac Financ Markets (2024). https://doi.org/10.1007/s10690-024-09458-7

Accepted:

Published:

DOI: https://doi.org/10.1007/s10690-024-09458-7