Abstract

In recent years, researchers have increasingly studied the association between the stock market and economic policy uncertainty (EPU). To have more profound knowledge, this paper investigates the evolution of the mean spillover effects between EPU and BRICS stock markets by employing both the multivariate DECO-GARCH model proposed by Engle and Kelly (J Bus Econ Stat 30(2):212–228, 2012) and the spillover index of Diebold and Yilmaz (Int J Forecast 26(1):57–66, 2012). The results uncover that the average return equicorrelation between the BRICS stock indices and EPU is positive. In addition, there is a bidirectional return spillover between EPU and BRICS stock returns in the aftermath of the recent European debt crises and the global financial crisis. Overall, our results reveal the existence of the short term, the pass-through impact of EPU via stock price fluctuation in BRICS countries. These findings might provide significant implications for portfolio managers, investors, and government agencies.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Fluctuations in asset prices represent a significant challenge for policymakers because the co-movements in the financial markets can not only have important implications for production costs, corporate benefits, and employment growth rate but also result in deviations from macroeconomic policies to enhance the development and social welfare (Liu and Zhang 2015; Yin et al. 2017). In addition, to avoid and forecast the future economic downturn, governments all over the world have dramatically risen their level of intervention (Chen et al. 2019). According to Li et al. (2016), government policymakers play a part in massive economic uncertainty as they are unable to agree or change economic policies frequently. The resulting policy-related economic uncertainty would elicit the stock markets slumping (Jin et al. 2019). To evaluate policy uncertainty, Baker et al. (2016) build economic policy uncertainty (EPU), which has been widely used in theoretical and empirical studies (Luo and Zhang 2020). In the existing literature, a growing number of papers has investigated the role of EPU on financial markets such as Bitcoin (Wang et al. 2019; Demir et al. 2018; Fang et al. 2019; Paule-Vianez et al. 2020), crude oil prices (Antonakakis et al. 2014; Chen et al. 2019,2020a, b; Mei et al. 2019), foreign exchange markets (Al-Yahyaee et al. 2020; Chen et al. 2019; Bartsch 2019). Specifically, the interdependence between EPU and stock markets has been studied using different methodologies by Arouri et al. (2016), Kang and Ratti (2013), Lam and Zhang (2014), Tsung-Pao et al. (2016), Liu and Zhang (2015), Asgharian et al. (2016), Christou et al. (2017), Ko and Lee (2015), Das and Kumar (2018), Tiwari et al. (2019), Yin et al. (2017), Luo and Zhang (2020). We continue this research by scrutinizing the dynamic connectedness between the BRICS stock markets and EPU using both the multivariate DECO-GARCH model of Engle and Kelly (2012) and the spillover index of Diebold and Yilmaz (2012).

Theoretical and empirical evidence provide evidence that EPU considerably impacts stock returns and their volatility and correlation since EPU can serve as a crucial driver of real economic activity (Zhang et al. 2019). Nevertheless, a critical nexus that arises here is if EPU has dramatic influences on these economic factors, then it might also be expected to have real effects on stock market performance. As per Li et al. (2016), the stock price fluctuations would be negatively impacted by EPU, while EPU might have a positive impact on stock prices.

The motivation to examine the effect of EPU on BRICS equity markets is because EPU was a vector of financial contagion within the US, raising the question that it might have played a similar role in transmitting the crisis to BRICS stock markets (Liang et al. 2020). Also, although a few studies have examined the nexus between the stock markets and EPU, the findings have been inconsistent (Tiwari et al. 2019). To our knowledge, we are the first to investigate the dynamic linkages between BRICS equity markets and EPU. Our results would provide a point of departure for future research on large economy macroeconomic variations and their spillover effects in the BRICS countries and other regions.

The motivation for the specification of the empirical model unfolds as follows. First, this study is the increase in widespread economic activities among countries in our data sample. It is clear for our results that there exists a potential connectedness between BRICS equity markets and EPU. Second, the increased importance of emerging markets in general and BRICS countries, in particular, should be taken into account. The two strong points of the emerging markets are their high returns and potential diversification benefits for global investors (Vo and Ellis 2018). Specifically, the empirical approaches adopted in the present paper are the multivariate DECO-GARCH model alongside with spillover index. Based on the combination of two techniques, Kang et al. (2019) successfully captured the directional spillover effects between ASEAN and world stock, and the dynamic spillovers among Chinese stock and future commodity markets had been implemented by Kang and Yoon (2019).

The current study adds in the existing literature by examining the dynamic spillovers between EPU and BRICS stock markets. We analyze the time-varying correlations between BRICS stock indices and EPU by employing a multivariate GARCH model with the DECO specification. Unlike the conventional multivariate GARCH models, the DECO model allows the estimation of a dynamic correlation function with the assumption that the correlation is equal across assets at any given time. It can tackle a large set of indicators without encountering estimation issues rising from numerical problems, declining the estimation noise of the correlation (Bouri et al. 2020). In particular, our sample is marked with the global financial and European debt crises, and we are able to analyze whether the cross-market integration of BRICS markets to EPU increases after a crisis or not. Further, we apply the spillover index to shed light on the direction of spillovers among various variables. The main advantage of this technique is that the spillover index estimates the dynamic magnitude of return spillovers over time and explores the direction of spillovers (Kang et al. 2019; Kang and Yoon 2019). Besides, we analyze the net spillovers of each series and between each pair of indices to identify which indicators are net recipients and transmitters of spillovers over the period shown, which is helpful for investors and policymakers. Our findings suggest that managing policy risk exposures in an economy can provide partial hedging benefits towards risk exposures in connection with both EPU and stock price volatility.

The remainder of this paper is organized as follows. Section 2 provides a brief of existing literature on this topic. Section 3 depicts the comprehensive description of the methodology and data. Section 4 discusses the empirical results. Section 5 presents some concluding remarks.

2 Literature Review

A growing number of papers have explored the critical role of EPU on financial markets. Uncertainty in connection with economic policies can have multi-faceted impacts on investors, corporations, and consumers since increased policy uncertainty can discourage corporations from taking on new investment ventures and force consumers to be more conservative in their spending habits (Liang et al. 2020; Arouri et al. 2016). It is valid for lenders because increased uncertainty with regard to governmental economic policies can result in them to adopt a more conservative approach in their lending practices. Therefore, policy uncertainty would have direct economy-wide effects, which gradually sweep into financial markets. Our research makes an excellent supplement to the literature regarding the dynamic connectedness between the stock markets and EPU.

EPU plays a prominent role in identifying stock prices or returns, and with understanding the connectedness between EPU and stock markets, more and more researchers have studied the association between stock prices and EPU with different methods. Arouri et al. (2016) make an outstanding contribution to the literature on the impacts of EPU on economic variables of the cases of two major emerging markets (China and India) and the US. The authors show that an increase in EPU in the US and India reduces dramatically stock returns and augments market volatility. In addition, the influence of EPU on stock market return and volatility seems to be solidly persistent in the US and India, which implies that EPU could help improve the prediction of returns and volatility for these two countries. Another impressive result, Kang and Ratti (2013) confirm that EPU is interrelated and impact stock market returns in Europe and in energy-exporting Canada. Lam and Zhang (2014) carry out the test on whether EPU influences global equity returns, and find the significance and distinct characterization of EPU in the worldwide equity markets. By contrast, Mensi et al. (2014) suggest insignificant dependence across various quantiles for each of the BRICS stock markets with the exception of the case of India in which the influence of EPU is negative and significant for lower quantiles. Tsung-Pao et al. (2016) examine a causal interaction between EPU and stock markets in nine countries. The empirical findings show that all examined countries are different and that the theoretical forecast that stock returns fall at the announcement of a policy change is not always supported. Liu and Zhang (2015) examines the predictability of economic policy uncertainty to stock market volatility and provide evidence that higher EPU results in significant rises in market volatility. Asgharian et al. (2016) investigate the nexus between EPU and the US and UK stock markets. The results show that the long-run US–UK stock market relationship relies positively on US economic policy uncertainty shocks. Besides, the volatility of the US stock market is significantly affected by the US economic policy uncertainty shocks but not on UK shocks while the UK depends on both.

Recently, Christou et al. (2017) document that the increased policy uncertainty levels have negative impacts on stock market returns of Australia, Canada, China, Japan, Korea, and the US. Moreover, the paper also reports that there are bidirectional spillovers between stock market returns and EPU. The connectedness between EPU and S&P 500 stock market is conducted by Ko and Lee (2015) and Das and Kumar (2018). From the wavelet transform specifications, the authors indicate that the negative relationship between EPU and S&P 500 significantly overlaps when EPU co-moves globally with other countries. Also, the findings suggest that Japan and European countries are more sensitive to US EPU than DEPU. In a same vein, Tiwari et al. (2019) report that the VIX-EPU relationship is time-variant and negative at all the time. Moreover, the interdependence between EPU and VIX is more coherence to the developed than the emerging markets. Li (2017) implements the test on China’ economy policy uncertainty commands a positive equity premium, and provides strong evidence in support of our three hypotheses, even after controlling for macroeconomic and stock market uncertainty factors, conventional risk factors, and firm characteristics, which means that EPU induces leads to real macroeconomic fluctuations in China. In a similar fashion, Yin et al. (2017) test the causality between EPU and exchange rate and indicate that causality is more significant in the tail quantile interval. Luo and Zhang (2020) investigate the influence of EPU on firm-specific crash risk and provide strong evidence that firms are more likely to witness stock price crashes when EPU increases. More importantly, young stocks, small stocks, high volatility stocks are more sensitive to EPU, and EPU has a significantly positive relationship with aggregated stock price crash risk in Chinese listed firms. Similarly, Jin et al. (2019) use data from China to investigate the effect of EPU on stock price crash risk. The results of this paper are similar to the study of Luo and Zhang (2020). More importantly, Syed Abul et al. (2019) explore the effect of EPU shocks on the realized stock volatility of the CARB (Canada, Australia, Russia, and Brazil) countries, and provide that innovation to EPU has a significant positive influence on realized stock market volatility.

At the same time, researchers capture price and volatility spillover between EPU stock markets and using multivariate GARCH-type models to facilitate analysis of multi-dimensional interdependence among the markets (Kido 2016; Chen et al. 2019; Asgharian et al. 2019). An array of research uses various cointegration methods (Arouri et al. 2016; Hung 2020; Kang and Ratti 2013; Reboredo and Uddin 2016; Hung 2019; Li 2017; Yin et al. 2017; Lam and Zhang 2014; Syed Abul et al. 2019) to highlight the level of the interrelationship between stock markets in BRICS countries and EPU. Specifically, Aboura and Chevallier (2014) employ the dynamic equicorrelation (DECO) model to analyze the volatility equicorrelation across markets (equities, bonds, foreign exchange rates and commodities). The authors prove that this model significantly simplifies the estimation process because it reduces to two equicorrelation parameter \(\alpha\) and \(\beta\). Bouri et al. (2020) explore the market integration among 12 leading cryptocurrencies using the DECO model and confirm that the DECO model is able to deal with a huge set of variables compared to the conventional GARCH-type models. Recently, Kang et al. (2019) and Kang and Yoon (2019) use the DECO-GARCH model DECO-GARCH model of Engle and Kelly (2012) alongside with the spillover index of Diebold and Yilmaz (2012) to estimate the dynamic linkages among financial markets. We employ both approaches in this paper.

3 Methodology

We briefly introduce the empirical methods used throughout the paper in this section. It starts with the multivariate GARCH model with the DECO specification to capture equicorrelation between EPU and the BRICS stock markets. Spillover index approach developed by Diebold and Yilmaz (2012) is also employed to identify the dynamic net directional spillover effects across these series.

3.1 The DECO-GARCH Model

Engle and Kelly (2012) develop the dynamic equicorrelation GARCH (DECO-GARCH) model at which the average of the conditional correlation is referred to as equal the average of all pair correlations. Therefore, we can estimate the time-varying linkages across markets over the study period shown. Unlike the standard DCC model proposed by Engle (2002), the DECO framework allows large-scale correlation matrices to be addressed.

We have a vector of n return series \(r_{t} = [r_{1,t} , \ldots ,r_{n,t} ]^{\prime}\). The following ARMA(1, 1) process has been estimated:

where \(\mu\) is a constant vector, and \(\varepsilon_{t} = [\varepsilon_{1,t} , \ldots ,\varepsilon_{n,t} ]^{\prime}\) is a vector of residuals.

The dynamic conditional correlation (DCC) is employed. Engle (2002) introduced this estimator to capture the dynamic time-varying behavior of conditional covariance. The conditional covariance matrix \({\rm H}_{t}\) is now defined as,

where \(D_{t} = diag\sqrt {\left\{ {{\rm H}_{t} } \right\}}\) is the diagonal matrix with conditional variances along the diagonal, and \(R_{t}\) is the time-varying correlation matrix.

A GARCH(1, 1) specification of each conditional variance can be written as,

where \(c\) is a \(n \times 1\) vector, \(a_{i}\) and \(b_{i}\) are diagonal \(\left( {n \times n} \right)\) matrices.

Equation (2) can be re-parameterized with standardized returns as follows, \(e_{t} = D_{t}^{^{\prime}} \varepsilon_{t}\)

Engle (2002) suggests the following mean-reverting conditionals with the GARCH(1, 1) specification:

where

And \(\overline{\rho }_{ij}\) is the unconditional correlation between \(e_{i,t}\) and \(e_{j,t}\). Scalar parameters \(\alpha\) and \(\beta\) must satisfy,

\(\alpha \ge 0,\) \(\beta \ge 0,\) and \(\alpha + \beta < 1\).

The value of \((\alpha + \beta )\) close to one reveals high persistence in the conditional variance.

In matrix form,

where \(\overline{Q} = Cov\left[ {e_{t} ,e_{t}^{^{\prime}} } \right] = E\left[ {e_{t} ,e_{t}^{^{\prime}} } \right]\) is unconditional covariance matrix of the standardized errors \(\overline{Q}\) can be estimated as,

\(R_{t}\) is then obtained by

where \(Q_{t}^{*} = diag\left\{ {Q_{t} } \right\}\).

Nevertheless, Aielli (2003) suggests that the estimation of the covariance matrix Qt is inconsistent because \(E[R_{t} ] \ne E[Q_{t} ]\). He illustrates the following consistent model with the correlation-driving process (cDCC):

where \(S^{*}\) is the unconditional covariance matrix of \(Q_{t}^{*1/2} \varepsilon_{t}\).

Engle and Kelly (2012) suggest modelling \(\rho_{t}\) using the cDCC process to gain the conditional correlation matrix Qt and then taking the mean of its off-diagonal elements. DECO specification reduces the estimation time. The scalar equicorrelation can be written as:

where \(q_{ij,t} = \rho_{t}^{DECO} + \alpha_{DECO} \left( {\varepsilon_{i,t - 1} \varepsilon_{j,t - 1} - \rho_{t}^{DECO} } \right) + \beta_{ECO} \left( {q_{ij,t} - \rho_{t}^{DECO} } \right)\), K is a vector of ones and \(q_{i,j,t}\) is the \((i,j)\)th components of the matrix Qt from the DCC model. Then we apply \(\rho_{t}^{DECO}\) to capture the conditional correlation matrix.

where In is the n-dimensional identity matrix.

Hence, the DECO modelling is less burdensome and computationally quicker to estimate. In addition, it reports the relationship of a group with a single dynamic conditional correlation coefficient.

3.2 Spillover Index Approach

Taking into consideration a covariance stationary Vector AutoRegression (VAR) model of order \(p\) and \(N\) variables, \(x_{i} = \sum_{i = 1}^{p} {\phi_{i} x_{t - i} } + \varepsilon_{i}\), where \(\varepsilon \sim \left( {0,\sum } \right)\) is a vector of independent and identically distributed distances. We can turn the VAR into a moving average (MA) representation, that is,\(x_{t} = \sum_{i = 0}^{\infty } {A_{i} \varepsilon_{t - i} }\) where \(N \times N\) coefficient matrix \(A_{i}\) is obtained by the recursive substitution, \(A_{i} = \phi_{1} A_{i - 1} + \phi_{2} A_{i - 2} + \cdots + \phi_{p} A_{i - p}\), with \(A_{0} = I_{n}\), which is an identity matrix of order \(n\), and \(A_{i} = 0\) for \(i < 0\). The MA presentation can be employed to forecast the future with the H-step-ahead.

The H-step-ahead generalized forecast-error variance decomposition can be written as:

where \(\sum\) is the variance matrix of the error vector, \(\sigma_{ii}\) is the standard deviation of the error term for the ith equation, and ei is the selection vector with 1 as the ith elements, and 0 otherwise.

According to the properties of generalized VAR, we have \(\sum_{j = 1}^{N} {\phi_{ij}^{g} (H)} \ne 1\). Each entry of the variance decomposition matrix is normalized by the row sum as

where \(\sum_{j = 1}^{N} {\tilde{\theta }_{ij}^{g} (H)} = 1\) and \(\sum_{i,j = 1}^{N} {\tilde{\theta }_{ij}^{g} (H)} = N\).

Total volatility spillover index proposed by Diebold and Yilmaz (2012) is defined as

We can measure the directional volatility spillovers received by market \(i\) from all other markets \(j\) as:

Similarly, we can calculate the directional spillovers transmitted by market \(i\) to all other markets \(j\) as:

We can also obtain the net volatility spillover for each market by calculating the difference between (5) and (4) as:

4 Data and Descriptive Statistics

The dataset used spans the period from January 1997 to December 2019. We investigate the monthly stock market indices of BRICS countries, China (SSE), India (SENSEX), Brazil (BOVESPA), Russia (RTS), and South Africa (JSE) and the Economic Policy Uncertainty index (EPU). We obtain stock data from the Bloomberg database. For economic certainty policy uncertainty, we use the index developed by Baker et al. (2016), which is a weighted average of three uncertainty elements. The first index element quantifies newspaper coverage of policy-related economic certainty. The second component reflects the number of federal tax code provisions set to expire in future years. The third set of elements measure the disagreement among economic forecasters as a proxy for uncertainty. Empirical papers reveal that EPU has a significant impact on stock performance (Liang et al. 2020). Constricted to the EPU index available on the website https://www.policyuncertainty.com/, and monthly US economic policy uncertainty are selected in this study. All the selected indicators are processed by taking natural logarithms to correct for potential heteroscedasticity and the dimensional difference between series, then we take first-differences of the indicators and multiply by 100 to get month-on-month growth rates of EPU and stock prices in percentages (Arouri et al. 2016; Chen et al. 2019; Li et al. 2020).

Table 1 represents the results of descriptive statistics of BRICS monthly stock market returns and EPU. The findings reveal that the average monthly stock market returns for all the selected variables are positive. The unconditional volatility of each series is measured by the standard deviations. The sample variances range from 6.7% (India) to 40.1% (South Africa). Skewness and kurtosis coefficients suggest that examined series are far from the normal distribution. This situation is formally confirmed by the Jarque–Bera test statistics. The findings of traditional stationarity test for stock and EPU series are stationary at level according to ADF statistics. The Ljung-Box test for serial correlation up to 10 lags, utilized for squared returns, rejects the null hypothesis of autocorrelation. In addition, the ARCH effect demonstrates the existence of heteroskedasticity problems in data. The results of these tests justify the application of the multivariate GARCH types model to measure the return spillover using monthly data series for the selected stock markets and EPU.

Next, we can observe the unconditional correlation between EPU and BRICS stock markets using the correlation matrix. As shown in Fig. 1, the connectedness between EPU and BRICS stock markets is slightly low based on the linearity assumption. Further, the distribution of the examined variables follows the non-normal shape. Figure 2 provides us with further insight into the data contribution and correlation structure of the selected variables.

4.1 Empirical Results

4.1.1 Results of the DECO Model

We document the time-varying correlations between EPU and BRICS stock markets using the multivariate ARMA-GARCH model with DECO framework in Table 2. The lags selection based on the lowest values of Akaike and Schwarz information criteria was executed to choose an appropriate the ARMA(1, 1)-GARCH(1, 1) for all combination series. In Panel A shows that the parameter of ARCH and GARCH for all the selected variables are statistically significant at 1% level. The sum of (\(\alpha + \beta\)) for all series is close to one and statistically significant, indicating that the conditional volatility is mean-reverting.

Panel B of Table 2 performs the findings of the DECO model. The dynamic equicorrelation coefficient is found to be statistically significant and positive with a value of 0.096318, showing a low degree of integration between EPU and BRICS stock markets. The parameter aDECO is positive and significant, indicating the crucial importance of innovations between EPU and BRICS stock markets. Similarly, the coefficient of bDECO is statistically significant for all cases, showing the high persistence of volatility between EPU and BRICS markets. Put differently, equicorrelations are highly dependent on past correlations. In addition, the sum of aDECO and bDECO estimates is nearly equal to unity, indicating that the volatility equicorrelation is integrated. Furthermore, the significance of the two parameters justifies the appropriateness of the DECO-GARCH model, and we can verify that the DECO parameters lie in the range of standard estimates originating from GARCH(1, 1) models. This implies that the equicorrelations across the concerned variables would be stable. These results are consistent with the studies of (Aboura and Chevallier, 2014; Kang et al. 2019; Kang and Yoon 2019).

Panel C reports the diagnostic tests. The Ljung-Box test statistics for the standardized squared residuals do not reject the null hypothesis of no serial correlation for all cases, which means that the residuals represent no autocorrelation. In addition, we have used the multivariate ARCH-LM test on the residuals of each model to determine whether the ARCH effect still exists in the model. Obviously, there are no problems of ARCH effect for all pairs during the study period.

We are able to draw conclusion that there is no misspecification in our model. Specifically, the Hosking and McLeod and Li test results suggest that the null hypothesis of no serial correlation in the conditional variances estimated by the DECO-GARCH model is accepted, providing that our selected DECO-GARCH model is correctly specified.

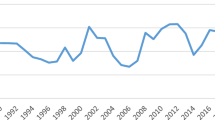

Figure 3 describes the dynamic conditional equicorrelation between EPU and BRICS stock returns, which is obtained from the ARMA-GARCH model with the DECO framework. The DECO dynamics hold itself an interpretative value since the equicorrelation provides an idea of the correlation in the series. The line graph depicts a variation over time with a correlation level varying from a minimum of − 5% to a maximum of 40%. More importantly, we observed a dramatic increase in the equicorrelation levels in the periods 2007–2008 and 2015–2016, corresponding to the dates of the global financial crisis, European debt crisis and Chinese stock market collapse. In general, the dynamic conditional equicorrelation across the variables under examination remarkably fluctuated during the study period. However, the increase was also seen in the period of 2018–2019. These results support the hypothesis of a contagion effect, which is defined as a significant rise in correlation among financial markets in different countries during a crisis period (Hung 2019; Kang et al. 2019a).

To evaluate the robustness of the estimation results, we also estimate the dynamic conditional correlation (DCC) models between the returns of each BRICS market and EPU. It is obvious that the pairwise DCC plots tally with the DECO estimations shown in Fig. 4. Hence, the pairwise DCC results support our findings gained for the selected indicators based on the DECO model.

4.2 Static Spillover Analysis

The return spillovers across the BRICS stock markets and EPU are estimated by using the spillover index method for full sample. The total spillover index matrices of return spillovers contributions to and from among the series under consideration are documented in Table 3. Vector autoregressive model of order 4, and generalized variance decompositions of 10-day-ahead forecast errors were employed to obtain all results. The element of \((i,j)\)th is the contribution to the forecast error variance of variable \(i\) coming from shocks to market \(j\). The off-diagonal components (\(i \ne j\)) in the spillover tables estimate cross-variable transmissions between EPU and BRICS stock markets, while the diagonal components (\(i = j\)) capture own-variable log return transmissions within and between variables.

The total and net return spillover index between EPU and BRICS stock markets are reported in Table 3. The lower right corner indicates that the total spillover reaches 29.2%, which means a high level of return spillover between concerned variables. More precisely, the total return spillover index reveals an average of 29.2% for return forecast error variance and suggests that there exist the bidirectional return transmissions between EPU and BRICS stock markets. Looking at the directional spillover transmitted “to”, the Brazil is the highest contributor to other markets, contributing 55.5%, followed by Russia (41.4%) and India (25.2%), South Africa (24.6%), China (19%) and EPU (9.5%), respectively. South Africa transmits, on average, 24.6% to other markets, whilst it receives 19.2% from the other markets.

Similarly, Brazil transmits to other markets 55.5% and receives 44.3% from the other markets.

By contrast, the rest of the BRICS markets and EPU are net recipients because their contributions to all the other markets are less than what they receive from the other markets. India is the highest recipients of return spillovers with a net value of − 4.2%, followed by China with a net value of − 4.2%. This result suggests the favorable opportunities that investors could not gain by investing in these countries after an increase in policy uncertainty levels in the US economy.

Figure 5 plots time-varying total return spillover index calculated based on the spillover index specification. Total spillovers are somewhat high over the research period shown, suggesting a high degree of relationship between EPU and BRICS stock markets over the full sample. The graph shows that total spillovers vary over time and respond to economic events. More precisely, the return spillovers reached a peak of nearly 32% in the periods 2007–2008 and 2017–2018, which corresponded to the slowdown in global economic activity. The average spillovers for the return of the BRICS markets and EPU significantly decreased during 2014–2015, which can be interpreted as a sign of global economic recovery. The spillover index related to the return of these series rose slightly from 29 to 32 percent till 2019. These findings are consistent with the hypothesis of market contagion in the literature that the periods of financial distress trigger large return spillover in BRICS stock markets and EPU.

4.3 Net Directional Spillovers

The next vital objective of the paper is to compute the net directional spillovers that correspond to the difference of the contribution from others and contribute to others. Put another way, to identify which markets are net transmitters and net recipients of spillovers, we estimate the time-varying net return spillovers based on 200-day rolling windows. Positive (negative) values show a transmitter (recipient) to (from) other markets. Figure 6 presents the rolling sample net-directional spillover for return.

Figures 6 represents the sign of the time evolution of the net return spillovers between BRICS markets and EPU over time. Throughout the visual inspection of these figures, the EPU, China, and India are net receivers of risks, whereas South Africa and Brazil are a net transmitter of shocks in the sample period. It is in line with the results for the whole sample indicated in Table 3. This outcome supports the findings of Arouri et al. (2016) and Demirer et al. (2016).

Figure 7 plots the net-pairwise directional connectedness between EPU and BRICS stock markets during the sample period. The graphical evidence is in line with the findings of Table 3. Nevertheless, it is worth noting that EPU is strong recipients of shocks from BRICS stock markets.

4.4 Robustness Check

In this section, we evaluate the robustness of our spillover results after the detailed analysis of the return spillovers by tackling the issues of the sensitivity to forecasting period and the selection of the return estimations (Diebold and Yilmaz 2012).

To test for robustness, we apply slightly modify our baseline model to assess the sensitivity of our time-varying return spillover results. In the first step, we compute the dynamic indices for orders 2 through 6 of VAR, we plot the minimum, maximum, and median values of the related estimations, which are obtained in Fig. 8, and we do not detect a significant distinction among these time-varying estimation results. Then, we investigate the findings for forecast horizons varying from five to ten days rolling window VAR analysis. As we can see in Fig. 8, the dynamic total return plots are not sensitive to the choice of the order, and the forecast horizon of the VAR model. Therefore, we can conclude that our findings for directional return spillovers are robust to the selection of various return measures.

Taking into account the empirical literature that sheds light on the dynamic between EPU and stock markets, our results are in line with Demirer et al. (2019), who reveals that extreme outcomes in the stock markets can occur during low EPU states. Asgharian et al. (2016) and Brogaard and Detzel (2015) confirm that there is a long-term positive correlation between EPU and the stock market in the US. Liu and Zhang (2015) unveil that the effects of the past EPU on the current stock markets are remarkably positive, which means an increase in EPU rises stock market return uncertainty. However, Christou et al. (2017) indicate that EPU has a significant negative influence on stock returns for all the six Pacific-Rim countries. Specifically, this price spillover effect result is different from the empirical evidence documented by Mensi et al. (2014) that the BRICS stock markets experience dependence with EPU, possibly because of the data and methods used.

5 Conclusion

In this paper, we uncover the evolution of the return spillover effects between EPU and BRICS stock markets by employing both the multivariate DECO-GARCH model proposed by Engle and Kelly (2012) and the spillover index of Diebold and Yilmaz (2012). DECO refers to as a novel covariance matrix estimator, which relies on the assumption that any pair of series are equicorrelated at every period, but this correlation varies over time.

We summarize the empirical results as follows. First, the results indicate that the average return equicorrelation across the BRICS stock indices and EPU are positive, even though it is found to be very time-varying with pronounced regime shifts after the global financial crisis 2007–2008, 2011–2012 and 2015–2016 European debt crises when the market witnessed significant uncertainty regarding the viability of the Eurozone and its impact on global fundamentals. Second, we estimate the total mean spillover index between BRICS stock markets and EPU. We find that the directional spillovers from EPU to BRICS countries is somewhat lower than that in the opposite direction. Put another way, there is a bidirectional return between EPU and BRICS stock returns in the aftermath of the recent European debt crises and the global financial crisis. Third, the net volatility spillover bursts in either a negative or positive direction and its sign remains unchanged over the research period shown.

Overall, our results reveal the existence of the short term, the pass-through impact of EPU via stock price fluctuation in BRICS countries, spilling over to stock markets, providing support for the portfolio and wealth channel that facilitates risk transmissions. In addition, the outcomes raise a fundamental question about the role of EPU as a driver of risk transmission across stock markets and represent a robust opportunity for policymakers to boost strategies to manage stock market risk exposures based on the signals from the divergent elements of policy uncertainty level. Furthermore, the findings of this article shed light on the crucial importance for authorities in BRICS countries to maintain transparency and stability in the execution of economic policies to prevent their influences on stock markets and assist in generating a more favorable investment environment.

Data availability

Please contact author for data and program codes requests. Data is obtained from Bloomberg and R and Rats are used to organize data.

References

Aielli, G. P. (2013). Dynamic conditional correlation: On properties and estimation. Journal of Business & Economic Statistics, 31(3), 282–299.

Al-Yahyaee, K. H., Shahzad, S. J. H., & Mensi, W. (2020). Tail dependence structures between economic policy uncertainty and foreign exchange markets: Nonparametric quantiles methods. International Economics, 161, 66–82.

Antonakakis, N., Chatziantoniou, I., & Filis, G. (2014). Dynamic spillovers of oil price shocks and economic policy uncertainty. Energy Economics, 44, 433–447.

Arouri, M., Estay, C., Rault, C., & Roubaud, D. (2016). Economic policy uncertainty and stock markets: Long-run evidence from the US. Finance Research Letters, 18, 136–141.

Aboura, S., & Chevallier, J. (2014). Volatility equicorrelation: A cross-market perspective. Economics Letters, 122(2), 289–295.

Asgharian, H., Christiansen, C., Gupta, R., & Hou, A. J. (2016). Effects of Economic Policy Uncertainty Shocks on the Long-Run US-UK Stock Market Correlation. Available at SSRN 2846925.

Asgharian, H., Christiansen, C., & Hou, A. J. (2019). Economic policy uncertainty and long-run stock market volatility and correlation. Available at SSRN 3146924.

Bouri, E., Vo, X. V., & Saeed, T. (2020). Return equicorrelation in the cryptocurrency market: Analysis and determinants. Finance Research Letters. https://doi.org/10.1016/j.frl.2020.101497.

Bartsch, Z. (2019). Economic policy uncertainty and dollar-pound exchange rate return volatility. Journal of International Money and Finance, 98, 102067.

Baker, S. R., Bloom, N., & Davis, S. J. (2016). Measuring economic policy uncertainty. The Quarterly Journal of Economics, 131(4), 1593–1636.

Brogaard, J., & Detzel, A. (2015). The asset-pricing implications of government economic policy uncertainty. Management Science, 61(1), 3–18.

Chen, X., Sun, X., & Wang, J. (2019). Dynamic spillover effect between oil prices and economic policy uncertainty in BRIC countries: A wavelet-based approach. Emerging Markets Finance and Trade, 55(12), 2703–2717.

Chen, L., Du, Z., & Hu, Z. (2020a). Impact of economic policy uncertainty on exchange rate volatility of China. Finance Research Letters, 32, 101266.

Chen, X., Sun, X., & Li, J. (2020b). How does economic policy uncertainty react to oil price shocks? A multi-scale perspective. Applied Economics Letters, 27(3), 188–193.

Christou, C., Cunado, J., Gupta, R., & Hassapis, C. (2017). Economic policy uncertainty and stock market returns in PacificRim countries: Evidence based on a Bayesian panel VAR model. Journal of Multinational Financial Management, 40, 92–102.

Das, D., & Kumar, S. B. (2018). International economic policy uncertainty and stock prices revisited: Multiple and Partial wavelet approach. Economics Letters, 164, 100–108.

Demir, E., Gozgor, G., Lau, C. K. M., & Vigne, S. A. (2018). Does economic policy uncertainty predict the Bitcoin returns? An empirical investigation. Finance Research Letters, 26, 145–149.

Demirer, R., Gkillas, K., Suleman, T. (2019) Economic policy uncertainty and extreme events in the US stock market Working paper. https://scholar.google.com/scholar_lookup?title=Economic%20policy%20uncertainty%20and%20extreme%20events%20in%20the%20US%20stock%20market&publication_year=2019&author=R.%20Demirer&author=K.%20Gkillas&author=T.%20Suleman

Diebold, F. X., & Yilmaz, K. (2012). Better to give than to receive: Predictive directional measurement of volatility spillovers. International Journal of Forecasting, 28(1), 57–66.

Engle, R., & Kelly, B. (2012). Dynamic equicorrelation. Journal of Business & Economic Statistics, 30(2), 212–228.

Engle, R. (2002). Dynamic conditional correlation: A simple class of multivariate generalized autoregressive conditional heteroskedasticity models. Journal of Business & Economic Statistics, 20(3), 339–350.

Fang, L., Bouri, E., Gupta, R., & Roubaud, D. (2019). Does global economic uncertainty matter for the volatility and hedging effectiveness of Bitcoin? International Review of Financial Analysis, 61, 29–36.

Jin, X., Chen, Z., & Yang, X. (2019). Economic policy uncertainty and stock price crash risk. Accounting & Finance, 58(5), 1291–1318.

Hung, N. T. (2020). Market integration among foreign exchange rate movements in central and eastern European countries. Society and Economy, 42(1), 1–20.

Hung, N. T. (2019). An analysis of CEE equity market integration and their volatility spillover effects. European Journal of Management and Business Economics, 29(1), 23–40.

Ko, J. H., & Lee, C. M. (2015). International economic policy uncertainty and stock prices: Wavelet approach. Economics Letters, 134, 118–122.

Kido, Y. (2016). On the link between the US economic policy uncertainty and exchange rates. Economics Letters, 144, 49–52.

Kang, W., & Ratti, R. A. (2013). Oil shocks, policy uncertainty and stock market return. Journal of International Financial Markets, Institutions and Money, 26, 305–318.

Kang, S. H., Uddin, G. S., Troster, V., & Yoon, S. M. (2019). Directional spillover effects between ASEAN and world stock markets. Journal of Multinational Financial Management, 52, 100592.

Kang, S. H., & Yoon, S. M. (2019). Financial crises and dynamic spillovers among Chinese stock and commodity futures markets. Physica A: Statistical Mechanics and its Applications, 531, 121776.

Li, X. L., Balcilar, M., Gupta, R., & Chang, T. (2016). The causal relationship between economic policy uncertainty and stock returns in China and India: evidence from a bootstrap rolling window approach. Emerging Markets Finance and Trade, 52(3), 674–689.

Liang, C. C., Troy, C., & Rouyer, E. (2020). US uncertainty and Asian stock prices: Evidence from the asymmetric NARDL model. The North American Journal of Economics and Finance, 51, 101046.

Luo, Y., & Zhang, C. (2020). Economic policy uncertainty and stock price crash risk. Research in International Business and Finance, 51, 101112.

Lam, S. S., & Zhang, W. (2014). Does policy uncertainty matter for international equity markets. Manuscript, Department of Finance, National University of Singapore. http://papers.ssrn.com/sol3/papers. cfm.

Li, X. M. (2017). New evidence on economic policy uncertainty and equity premium. Pacific-Basin Finance Journal, 46, 41–56.

Li, R., Li, S., Yuan, D., & Yu, K. (2020). Does economic policy uncertainty in the US influence stock markets in China and India? Time-frequency evidence. Applied Economics, 52(2), 1–17.

Liu, L., & Zhang, T. (2015). Economic policy uncertainty and stock market volatility. Finance Research Letters, 15, 99–105.

Mensi, W., Hammoudeh, S., Reboredo, S. H., & Nguyen, D. K. (2014). Do global factors impact BRICS stock markets? A quantile regression approach. Emerging Markets Review, 19, 1–17.

Mei, D., Zeng, Q., Cao, X., & Diao, X. (2019). Uncertainty and oil volatility: New evidence. Physica A: Statistical Mechanics and its Applications, 525, 155–163.

Paule-Vianez, J., Prado-Román, C., & Gómez-Martínez, R. (2020). Economic policy uncertainty and Bitcoin. Is Bitcoin a safe-haven asset? European Journal of Management and Business Economics. https://doi.org/10.1108/ejmbe-07-2019-0116.

Reboredo, J. C., & Uddin, G. S. (2016). Do financial stress and policy uncertainty have an impact on the energy and metals markets? A quantile regression approach. International Review of Economics & Finance, 43, 284–298.

Syed Abul, B., Alfred A, H., & Perry, S. (2019). The impact of economic policy uncertainty and commodity prices on CARB country stock market volatility (No. 96577). University Library of Munich, Germany.

Tiwari, A. K., Jana, R. K., & Roubaud, D. (2019). The policy uncertainty and market volatility puzzle: Evidence from wavelet analysis. Finance Research Letters. https://doi.org/10.1016/j.frl.2018.11.016.

Tsung-Pao, Wu., Liu, S.-B., & Hsueh, S.-J. (2016). The causal relationship between economic policy uncertainty and stock market: A panel data analysis. International Economic Journal, 30(1), 109–122. https://doi.org/10.1080/10168737.2015.1136668.

Vo, X. V., & Ellis, C. (2018). International financial integration: Stock return linkages and volatility transmission between Vietnam and advanced countries. Emerging Markets Review, 36, 19–27.

Wang, G. J., Xie, C., Wen, D., & Zhao, L. (2019). When Bitcoin meets economic policy uncertainty (EPU): Measuring risk spillover effect from EPU to Bitcoin. Finance Research Letters. https://doi.org/10.1016/j.frl.2018.12.028.

Yin, D. A. I., Zhang, J. W., Yu, X. Z., & Xin, L. I. (2017). Causality between economic policy uncertainty and exchange rate in China with considering quantile differences. Theoretical & Applied Economics, 24(3), 29–38.

Zhang, D., Lei, L., Ji, Q., & Kutan, A. M. (2019). Economic policy uncertainty in the US and China and their impact on the global markets. Economic Modelling, 79, 47–56.

Acknowledgements

The authors are grateful to the anonymous referees of the journal for their extremely useful suggestions to improve the quality of the article. Usual disclaimers apply.

Funding

The author received no financial support for the research, authorship and/or publication of this article.

Author information

Authors and Affiliations

Contributions

NTH conceived of the study, carried out drafting the manuscript.

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Hung, N.T. Directional Spillover Effects Between BRICS Stock Markets and Economic Policy Uncertainty. Asia-Pac Financ Markets 28, 429–448 (2021). https://doi.org/10.1007/s10690-020-09328-y

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10690-020-09328-y