Abstract

A major issue regarding biodiversity offset schemes is uncertainty about conservation and its costs. Although the demand for market expansions for biodiversity banking has increased in the past few decades, they may increase the degree of uncertainty regarding the completion of offsets. Therefore, stipulating the rights and responsibilities of stakeholders about the implementation of offsets is important. However, researchers have overlooked the behavioral aspects of market participants regarding responsibility and uncertainty. This study experimentally investigates the effect of uncertainty and market structure change on credit trading behavior in biodiversity banking. First, we verify that uncertainty regarding additional conservation costs provides significant disincentives for bankers to engage in trading when they are directly responsible for the costs, leading to the over-reduction of transactions. Since developers share the payment for the additional costs through the increase in credit prices, it is important to determine the way of sharing the responsibility for the costs between market participants and the public/society. Second, the provision of insurance to alleviate the uncertainty for bankers may not influence efficiency. Therefore, it may be reasonable for the public sector to incorporate insurance schemes into biodiversity banking programs. Third, increases in the number of bankers and developers improve efficiency, and this lowers the possibility of over-reduction of transactions. Therefore, when market expansions increase degrees of uncertainty, responsibility sharing schemes should be linked and revised according to the expansions.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Development projects usually cause biodiversity losses in the targeted and surrounding areas, and deteriorating ecosystem services cause long-term losses of economic and social benefits. Moreover, as people observe indigenous species suffer from habitat loss, they may experience as sense of disutility. Then, with public awareness of such environmental issues increasing, it has become an important issue for policymakers to consider the conciliation of environmental conservation with the economic benefits of development projects. This leads to the widely accepted notion that development projects should be accompanied by no net loss (NNL) of biodiversity. Upon observing the momentum of environmental conservation issues, numerous countries have been applying the notion of biodiversity offset in their development projects. Although several aspects of biodiversity offset schemes are often criticized, such as imperfection of metrics and ethical issues, the schemes have become popular policy tools and been implemented in several countries.Footnote 1

A major issue of biodiversity offset scheme design is the degree to which market mechanisms are incorporated into these projects. Specifically, while some schemes require developers to carry out offsets that do not incorporate market mechanisms (e.g., creation or restoration of a habitat), other schemes do not necessarily require developers to work on biodiversity creation projects. Instead, the biodiversity creation project can be performed by other economic entities and the developers can obtain credits certified by offset schemes. That is, when it is difficult for developers to create net gains, they buy credits from biodiversity creators. This scheme type is called biodiversity banking, and the creators are called bankers.Footnote 2

1.1 Trends of biodiversity offsets and banking

Various biodiversity banking programs are currently operative worldwide, and the number of biodiversity offset and bank sites has been increasing over the past several decades. For example, the first mitigation banking started in the USA in 1984, and as of January 2023, there are more than 2,400 bank and in-lieu fee sites.Footnote 3 Poudel et al. (2019) surveyed conservation banking in the USA to find 137 conservation banks conserving 153,000 acres of land as of December 2016. Moreover, according to Bull and Strange (2018), 12,983 biodiversity offset projects were completed or in the process of implementation across 37 countries in 2018.

Although the environmental mitigation hierarchy involves the (i) avoidance of negative impacts, (ii) minimization or reduction, and (iii) offset (Bergès et al., 2020), the spread of biodiversity offset programs with banking schemes implies that there is a large demand for biodiversity banking programs by authorities. The advantages of biodiversity banking compared to command-and-control regulations are that the external cost caused by development can be internalized, allowing society to achieve the same environmental goal at a lower cost; this is similar to the function of emission trading programs for CO2 emission reduction. Still, governments and societies often face budget constraints regarding environmental protection, making cost-effectiveness an important topic when designing biodiversity conservation policies.Footnote 4

1.2 Effectiveness and institutional design of biodiversity conservation policies

Upon examining empirical research, it becomes clear that researchers have yet to reach a consensus on the evaluation of the achievement of NNL by biodiversity offsets. For example, zu Ermgassen et al. (2019) reviewed offset policies in Australia, Canada, the UK, and the USA and reported that approximately one-third of them achieved NNL, most of which are wetland mitigation. Theis et al. (2020) conducted a four-grade evaluation (over-compliance = 3; full compliance = 2; partial compliance = 1; no compliance = 0) of the compliance for more than 500 offsetting projects in freshwater ecosystems, classifying more than 50% of projects into over-compliance or full compliance. For example, the mean scores for river, lake, and wetland projects were 1.81, 2.00, and 1.38, respectively.

Although researchers have different opinions on actual compliance ratio levels, many highlight the importance of institutional designs for improving NNL achievement of these offset projects (e.g., Arquitt & Johnstone, 2008; Grimm, 2020; Grimm & Köppel, 2019; Koh et al., 2019; Levrel et al., 2017; Maron et al., 2012; Needham et al., 2019). When designing biodiversity banking programs, several important points should be considered, as follows: what to trade, measures, trading ratios, compensation timing, transparency and monitoring, market scales, and uncertainty. Regarding the first five points, progress in the fields of biology, genetics, ecology, and economics over the past several decades has contributed greatly to the improvement of related institutional designs. For example, Habitat Hectare, developed in Victoria, Australia, is an important synthesized method for measuring the quality and quantity of native vegetation,Footnote 5 and many studies provide lists and comparisons of metrics and valuation methodologies (e.g., Gerber, 2011; Laurila-Plant et al., 2015; Gamarra et al., 2018; Marshall et al., 2020; McVittie and Faccoli, 2020). Moreover, Southwell et al. (2018) examine the optimal timing of offsetting, and Millon et al. (2021) and Oliver et al. (2021) provide up-to-date metrics that incorporate various factors of biodiversity. Thus, advancements in the scientific analysis of biodiversity can contribute to the derivation of desirable trading ratios or time spans.

However, relatively few researchers have focused on the behavioral aspects of biodiversity banking, such as the effect of market structure and uncertainty on transaction behaviors. Nemes et al. (2008) investigated the desirable institutional design for the electronic BushBroker exchange regarding efficiency improvements, conducting simulations to compare the institutional designs while considering the behavior of market participants. These authors listed the following factors as being important in establishing biodiversity offset programs: regulations, definition of property rights, trading rules, contract designs, market mechanisms, and recording systems. Farmers and landholders are often important stakeholders and various studies investigated their incentives to participate in biodiversity offset schemes (Calvet et al., 2019; Cason et al., 2003a; Vaissière et al., 2018). Moreover, Higashida et al., (2012, 2019) examined the effect of inter-regional or -project credit trading on efficiency. Despite the importance and contribution of these studies for the field, more research on the behavior and incentives in biodiversity banking are warranted.

1.3 Focus of this study

This study focuses on three factors regarding the institutional design of biodiversity banking: uncertainty, market structure, and responsibility. The purpose of this research is to clarify the effect of changes in these three factors on transaction behavior and efficiency. Particularly, we elucidate the following issues and the relationships between them.

First, the current status of biodiversity offsets indicates that there are two types of uncertainties. For one, even if the original biodiversity offset project is considered completed, additional negative impacts on biodiversity may arise during offsetting processes.Footnote 6 For example, habitat creation may have a negative impact on non-targeted species in the area surrounding the offset site. For another, as Nemes et al. (2008) and Bull et al. (2013) state, it is uncertain whether biodiversity offset projects can achieve their desired outcomes because they usually require a long period for completion. For example, climate change, technological problems, or both may have negative effects on the smooth creation of biodiversity at an offset site. When these uncertainties are present, authorities should carefully incorporate responsibility schemes for failure or delay in the achievement of NNL into banking programs.Footnote 7 In fact, Damiens et al. (2021) indicated that NNL cannot be achieved unless the long-term impact of development is considered. White et al. (2021) also referred to uncertainty as one of the serious challenges of present and future offset schemes.

Second, unlike CO2 emissions trading, biodiversity is heterogeneous. This is because stakeholders, researchers, and policymakers hold different views and opinions regarding the benefits, costs, and value of biodiversity banking, and these differences have led to controversy regarding the incorporation of market mechanisms into offset programs. Since the target areas of many projects are small, many of these projects have a small number of potential bankers and developers, one-on-one transactions occur often, and even policymakers may mediate these transactions and connect a banker with a developer. For example, Froger et al. (2015) categorized biodiversity banking programs according to the degree of public sector involvement: private, hybrid, and commercial banking programs. Because of these characteristics, Boisvert et al. (2015) and Needham et al. (2019) remark that the market structure (e.g., the area and number of participants) of biodiversity banking should be carefully determined.

Third, Primmer et al. (2019) mentioned that it is important for offset scheme developers to stipulate the rights and responsibilities of all stakeholder types, as well as that research on desirable institutional designs regarding rights and responsibility is insufficient and incomplete. Moreover, it is possible that the desirable sharing of responsibility for direct conservation and indirect social costs across stakeholders of biodiversity banking projects is related to the projects’ market structure.Footnote 8

Observing these important issues regarding the offset market, we set up the following three research questions: (i) what is the relationship between efficiency and the conservation cost that is uncertain as of credit awarding? (ii) Who should be responsible for the additional conservation cost that is uncertain as of credit awarding, and how is this cost shared across the offset market? (iii) What is the relationship between market expansion and responsibility share in biodiversity banking schemes?

Moreover, this study considers an additional factor: insurance for the risk of additional conservation cost that is generated after credit awarding. This kind of insurance may encourage credit trading because it removes the risk for sellers and buyers responsible for the compensation of additional conservation costs. This means that implementation of insurance schemes after credit awarding may influence the desirable design of the biodiversity banking project, particularly on the aspects of responsibility and market structure.

1.4 Role of laboratory experiment

This study used the laboratory experiment method with a university student sample. Prior laboratory experiments in the economics field have contributed to testing theories and evaluating policies for dealing with environmental and resource issues. In fact, the Intergovernmental Panel on Climate Change refers to laboratory experiment as effective an approach for capturing the key aspects of policy effects, particularly when data for ex-post evaluations are not available (Intergovernmental Panel on Climate Change, 2014, p.1157). Furthermore, Muller and Mestelman (1998) discuss the role of laboratory experiments on emission trading and show that this method can be used to examine the design and efficiency of programs. Friesen and Gangadharan (2013) also provide a survey of experimental studies on environmental markets and clarify their contribution for designing effective environmental programs. These authors particularly emphasized the importance of investigating the behavioral aspects of market participants.

Many experimental studies on emission trading and individual transferrable quotas investigate institutional designs and the behavior of market participants (e.g., Cason, 2003; Cason & Gangadharan, 2006; Cason & Plott, 1996; Cason et al., 2003b; Murphy & Stranlund, 2007; Tanaka et al., 2014). Ben-David et al. (2000) examine the effect of uncertainty on efficiency and demonstrate that uncertainty reduces the function of market mechanisms by impeding investment in efficient emission abatement technologies. Other researchers studied the influence of uncertainty on the effectiveness of public goods provision (Gangadharan & Nemes, 2009) and the enforcement of penalties for violating emission standards (Luengo et al., 2020). A common finding in these studies is that uncertainty reduces the effectiveness of institutions or policies.Footnote 9

Thus, we conducted a laboratory experiment to investigate important aspects of the efficiency and institutional design of biodiversity banking programs. First, we verify whether a similar inefficiency arises across the markets of biodiversity banking programs, which usually have a small number of market participants. Second, we assess whether the effect of uncertainty regarding additional conservation costs on efficiency is influenced by (i) the existence of insurance and/or (ii) additional conservation cost (ACC) type. In doing so, this study complements and extends the results of the study by Nemes et al. (2008) through providing experimental evidence, as we explicitly compare four institution designs from the perspective of uncertainty and responsibility.

Another possible method is a lab-in-the-field experiment, in which subjects are real stakeholders. However, in the real world, the backgrounds and skills of stakeholders vary greatly, which may induce biased results. It is difficult to control these factors in terms of precise comparisons among institutional designs or market structures. Meanwhile, an advantage of laboratory experiments in the context of biodiversity banking is that they can yield data that are comparable to that in the experimental literature in other environmental markets. Thus, we adopt a laboratory experiment to precisely observe the functions of biodiversity banking markets and the behavior of participants.

The remainder of this paper proceeds as follows. Section 2 describes the experimental design. Section 3 examines the results of the experiment, and Sect. 4 discusses the implications for policies and institutional designs. Section 5 concludes the paper.

2 Method

2.1 Experimental design

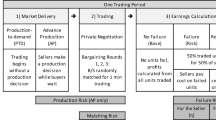

2.1.1 Bilateral transactions under uncertainty

We begin with the sessions of bilateral transactions, each with six, eight, 10, or 12 participants. In the sessions, two participants were randomly paired, and the partners remained the same throughout the session. In each pair, one participant is a seller and the other is a buyer. For example, when 10 participants were in a session, five were sellers and five were buyers (i.e., five pairs).

Each session had 20 rounds. The first half (rounds 1–10) of each session was the same for all sessions. In each round, a seller can make a profit by selling one unit of own product. The production cost is 100 and the profit is the transaction price minus the production cost. Meanwhile, a buyer can make a profit by buying one unit of product from the seller and reselling it. The resale price is 180, and the profit is the resale price minus the transaction price. The production cost and resale price are private information of the seller and buyer, respectively.

In each round, each seller can sell only one unit of the product to the trading partner, and each buyer can buy only one unit of the product from the trading partner. When the buyer and seller make a deal, the product is automatically resold in the market; otherwise, the seller does not need to pay the production cost.

Two points are noteworthy. First, each participant cannot deal with a participant who is a member of another pair. This setting implies that the market for each pair is completely segmented from the other markets in the same session. This allows us to assume extreme heterogeneity between the products in different markets, and reflect the important characteristic of biodiversity, which is far from a homogeneous good.

Second, the profits from development, represented as the resale price in the experiment, are not always greater than the cost of biodiversity creation in the real world. However, no participant would make a deal in such a setting without a subsidy in a laboratory, because either a buyer or a seller would obtain a negative profit. We excluded this situation, in which the resale price is less than the production cost, to focus on the effect of institutional frameworks on transaction behaviors.

At maximum, exchanges opened for 80 s in each round. The basic mechanism is a double auction, that is, both the buyer and seller can make offers. During the transaction period, each seller and buyer can ask and bid for a product any number of times, respectively. Since only one unit can be transacted in each pair’s exchange in each round, the deal is made (i) when the seller accepts the bidding price or (ii) when the buyer accepts the asking price. The exchange is closed when either there is a deal or 80 s elapses without a deal. When all pairs make deals or 80 s elapses, each participant sees the result of her or his own and partner on the screen.

2.1.2 Treatments

We adopted four treatments for the experiment on bilateral transactions. The conditions for the second half (rounds 11–20) of the session differed between treatments. The first treatment is the Banker-Responsibility-No-Insurance (BNI), in which, at the beginning of round 11, an additional instruction is distributed and the following information is mentioned: (1) After the transaction is completed, an ACC may arise because of changes in standards, specifications, or both regarding the productFootnote 10; (2) the probability of the occurrence of ACC is 0.5 and the ACC is 80; (3) whether the ACC arises will be revealed after the exchanges are closed; and (iv) sellers must bear the ACC when it arises.

As described in the Introduction section, this setting is equivalent to risk, rather than ambiguity, because the subjects know the probability of ACC. Using a public goods game, Gangadharan and Nemes (2009) examine both known and unknown probability cases regarding the return from a contribution to private or public goods. The results of this cited study shows that, for both cases, the contribution to private (public) goods is smaller when there is uncertainty about the return from the private (public) goods than when there is no uncertainty. Since our focus is not on the comparison between risk and ambiguity, we simplify the probability structure. In our experiment, the conditions for buyers are the same as those in the first half (i.e., rounds 1–10).

In the BNI treatment, we provide the participants with information about the monetary value of the ACC when it is incurred, 80, and the probability of occurrence, 0.5, but leave the calculation of the expected cost, 40, to each participant. This information ensures that the environmental benefits can be defined in monetary terms. To avoid confusion among participants, we provided clear information on the cost. In real-world situations, various types of biodiversity banking operate, and the possibility of representing the effectiveness of conservation by a single measure depends on the type of banking scheme. For example, it may be easy to measure the outcome when the banking program targets the specific habitat of a single species,Footnote 11 but it may be relatively difficult to use a single measure when the program covers various factors, such as forest conservation. However, some offset schemes incorporate non-monetary conditions, such as ecological performance standards, which means that the credit prices in these schemes may reflect environmental costs and values.Footnote 12

The second treatment is Banker-Responsibility-with-Insurance (BWI). The conditions for the ACC in the BWI are the same as those in the BNI. However, in the BWI treatment, sellers can buy insurance when a deal is made before the information about whether the ACC arises is revealed. If they buy the insurance, they will not need to pay the ACC if it arises. The price of insurance is 40, that is, it is equivalent to the expected ACC. This treatment examines whether regulators can encourage transactions and improve efficiency by introducing insurance systems for bankers that may be hesitant to partake in biodiversity banking because of uncertain cost burdens.

The third treatment is Banker-Responsibility-Social-Cost (BSC). In this treatment, the cost is referred to as a social cost, not ACC. We use this term to provide subjects with a clear perception that their transactions may induce social rather than private costs. In the BNI and BWI treatments, sellers are expected to perceive that the ACC is associated with their products; in the BSC, they are expected to perceive that the social cost is not associated with their products. For example, as Primmer et al. (2019) summarized (Table 3, p. 781), biodiversity offset schemes may generate not only direct additional costs related to the offset processes themselves but also indirect negative impacts on the local communities and citizens living in the surrounding area of the offset sites. Despite the identification by stakeholders and researchers of these social costs of offset schemes, no consensus has been reached thus far on who should be responsible for these costs. Thus, we introduce the notion of social cost into BSC. From a pure economic incentive perspective, participants face the same situation as that in BNI, meaning that the difference between the BNI and BSC is simply in the framing of the cost. However, as aforementioned, when considering real-world situations regarding biodiversity banking, these two cost types are clearly different from each other. In the BSC, we do not provide a more detailed explanation on the difference between ACC and social costs to avoid unexpected biases caused by the subjective interpretation of social costs. The conditions for the other aspects of the experiment, including the probability, cost amount, and responsibility for cost, are the same as those in the BNI.

The fourth treatment is Public-Responsibility-Social-Cost (PSC). As in the BSC treatment, social cost arises with a probability of 0.5 in the PSC, but neither the seller nor the buyer must bear the responsibility for the social cost, which implies that the public sector pays the social costs. From a pure economic incentive perspective, transactions are expected to be encouraged in PSC because subjects do not include the social cost in their trading decisions. In the real world, it is possible that the public/local communities, which are neither buyers nor sellers of the credits, share this type of cost. Thus, this treatment examines whether excess transactions, and accordingly, excess development occurs in terms of social surplus when it is not explicitly internalized in the credit market of biodiversity banking.

2.1.3 Additional treatment with multiple sellers and buyers

When regulators consider programs that cover large areas or inter-project trading, multiple bankers and developers participate, and this may induce competition in the credit market. This penetration of market mechanisms into biodiversity banking schemes influences the desirable design of banking programs.Footnote 13 This makes investigations as to the effect of competition among bankers and developers on trading volumes and efficiency an important endeavor. Thus, we conduct an additional treatment, named Multiple-Sellers–Multiple-Buyers (MSMB), with multiple sellers and buyers, and introduce heterogeneity into the production cost for sellers, reflecting differences in the size of the areas that is required to obtain a unit of credit in different conservation banking programs. In this treatment, each seller and buyer can take the same actions through the session as those allowed in the first half of the sessions for bilateral transactions; the difference of the MSMB is that they observe all bids and asks by all sellers and buyers in the same session and can choose any offer to make a deal.

There were four MSMB sessions, among which three sessions had 11 participants (with five buyers and six sellers) and one session had 12 participants (with six buyers and six sellers). In these MSMB sessions, the production cost of three randomly chosen sellers is 100 (i.e., the same as in the bilateral transaction treatments), while that of the other three sellers is 140. Although this treatment does not explicitly include ACC or social costs, sellers whose production cost is 140 are considered to face a certain amount of ACC.

2.1.4 Procedure

We conducted two sessions for each bilateral transaction treatment and four sessions of the MSMB treatment in November and December 2016. The participants in each session were undergraduate students from Kwansei Gakuin University or Musashi University (Table 1).Footnote 14

Each participant participated in only one session. We did not exclude students from any department. Thus, our sample covers students specializing in various fields, including business, economics, law, literature, and social studies. The incentive scheme for the real payment of participants was based only on their profit in the experiment, and the minimum was 2,700 Japanese Yen (JPY). The average was 3,283 JPY.

At the beginning of each session, the subjects had approximately 10 min to read the instructions. Then, to ensure their understanding, the instructor read the instructions aloud. Each session took approximately 90 min.Footnote 15

To describe the experimental design and results of this study, we use technical terms specific to the topics of biodiversity and offsets. In the experiment, however, participants received information with more neutral terminology. For example, we use “preservation” instead of “creation,” “restoration,” or “prevention.”

We conducted the experiment using the University of Zurich’s z-Tree (Fischbacher, 2007), which is one of the major applications for implementing laboratory experiments. After the experiment, the application automatically outputs each participant’s decision making data (transaction data) as the CSV style between sessions.

2.2 Efficiency

The major index for our analyses using experimental data is efficiency, which is also referred to as social surplus. Efficiency is defined in this study as follows,

where RP, PC, and RMC denote the resale price, production cost, and sum of the realized ACC, respectively. It is emphasized that this efficiency includes the ACC, which serves as a form of external cost. When the cost is social (BSC and PSC), RMC is the sum of the realized social costs. Thus, social surplus here represents not pure economic benefits but welfare, including environmental costs/benefits. Based on the ACC of 80 in the experiment, the expected social surplus is larger when a deal is made than when it is not.

2.3 Convergence prices

Moreover, as a robustness check, we examine convergence prices. The analysis and interpretation of experimental market data can be difficult because individual markets often exhibit a convergence process that is not consistent with theoretical predictions. To statistically characterize the processes of price convergence for each treatment, we use the econometric model suggested by Noussair et al. (1995) and Myagkov and Plott (1997), taking the last trading price of each round of the sessions for each treatment as one observationFootnote 16:

where Pkt is the last price of round t in session k; Dm is a dummy variable equal to 1 for m = k, and zero otherwise; βm is a parameter that indicates the convergence price; and ukt is a normally distributed disturbance term with zero mean. Other recent analyses also apply this estimation method (Kotani et al., 2019; Tanaka et al., 2020). In our experiments, transactions occurred only once in each pair in each round in the BNI, BWI, BSC, and PSC treatments. Therefore, we use actual transaction prices as samples for these treatments.

3 Results

Figures 1 and 2 show the average transaction price and volume, respectively, of each treatment. Because the number of participants varies across sessions, we use the ratio of deals made to the number of pairs in each round to capture trading volumes. Figure 3 shows the efficiency of each treatment. First, we verify the differences in transaction prices, volumes, and efficiency in the first half (rounds 1 to 10) between treatments. We adopt the Wilcoxon–Mann–Whitney rank-sum test and Welch’s t-test to compare treatments and rounds.Footnote 17 Tables 2 and 3 summarize the comparisons for the former (z-values) and latter (t-values) tests, respectively.

When a value is significantly positive (negative), the value in the vertically enumerated treatment is greater (smaller) than that in the horizontally enumerated treatment. There were no significant differences in trading volumes and efficiency between the four treatments (BNI, BWI, BSC, and PSC), implying that there are no intrinsic differences in the characteristics of participants between treatments. Although there are significant differences in average trading prices, considering the relatively small sample sizes, it is possible that outliers explain these differences.

We obtain four interesting results. First, Tables 4 and 5 report the results of the two types of tests, comparing the first and second halves of each treatment. A positive value implies that the value in the first half is greater than that in the second half. Introducing uncertainty in the ACC or social cost significantly reduces trading volumes and efficiency in the BNI, BWI, and BSC treatments. However, the difference is relatively unclear in the PSC treatment. Thus, the trading volume of the PSC treatment is significantly larger than that of the other three treatments. The test results for the second half (11 to 20 rounds) of the PSC treatment support this fact (Tables 6 and 7).

Table 8 shows the convergence prices of both halves for each treatment. Tables 9, 10, and 11 show the results of the Wald tests for the first half between the treatments, for the second half, and for the two halvesin each treatment, respectively. The results for convergence prices clearly support the results obtained by Wilcoxon–Mann–Whitney test and Welch’s t-test.Footnote 18 Together, these descriptions lead to the first interesting result:

Result 1. The existence of uncertainty regarding ACCs or social costs hinders the credit transactions if the bankers bear these costs. Insurance does not affect this outcome.

The values in the parentheses are the number of transactions (samples).

Second, the result for efficiency is similar to that for trading volumes. The average efficiency in the second half is less than 0.3 in the BNI, BWI, and BSC treatments, and greater than 0.5 in the PSC treatment. Tables 6 and 7 reveal a significant difference in efficiency between the PSC and the other bilateral transaction treatments. In the BNI, BWI, and BSC treatments, bankers bear the responsibility for ACCs or social costs, and this makes their expected profits to be clearly smaller than those of the participants in the PSC treatment. Thus, the responsibility for ACCs or social costs weakens the incentives of market participants to make deals. This leads to the second interesting result:

Result 2. The existence of uncertainty regarding ACCs or social costs reduces social surplus if bankers bear these costs. Insurance does not affect this outcome.

Third, we observe similar trends for the average trading price in the BNI and BWI treatments. Tables 6 and 7 indicate that the average prices in these two treatments are significantly higher than those in the BSC and PSC treatments. This finding that the average trading prices under BNI and BWI are higher than that under PSC is intuitive, and this is because bankers bear the ACC or insurance cost in the former two treatments, but not in the latter. However, because bankers bear the costs (regardless of whether ACC or social cost) in BNI, BWI, and BSC, it is not intuitive that the average prices under BNI and BWI are higher than those under BSC. This provides us with the third interesting result:

Result 3. The average trading prices are higher when there is ACC than when there is social cost.

Fourth, the MSMB treatment provides important findings. Figures 1, 2, and 3, and Tables from 2, 3, 4, 5, 6, 7, 8, 9, 10 and 11 present the general results. In the MSMB treatment, the average price is slightly over 140, which is also the production cost for three of the six sellers; almost all sellers and buyers make deals; and the efficiency is almost 100%. These results imply a simple, yet important, fact: the market is perfectly competitive, even if each seller and buyer can transact only one unit of the product.

Result 4. Efficiency in the MSMB treatment is significantly greater than in any of the four bilateral transaction treatments.

The result for efficiency in our study is comparable to and supports the findings of the study by Nemes et al. (2008). Their simulation shows that the surplus under multilateral transactions can be much greater than the surplus under bilateral transactions. Accordingly, our experimental evidence supports their results.

4 Discussion

In this section, we discuss the relationship between responsibility for ACC and transaction behavior in the context of biodiversity banking and consider its application to institutional designs.

First, the comparison of the results between the first and second halves in the bilateral transaction sessions and the comparison of the results for the second half between the PSC and the other bilateral transaction treatments reveal that transaction volumes are smaller when bankers are responsible for ACC than when they are not. According to the experimental design, social surplus is greater when a deal is made than when no transaction takes place (even when the expected ACC is positive), but efficiency is reduced in the presence of ACC (Result 2). We do not explicitly examine the case in which buyers are responsible for ACC in our experiment because we follow the product liability rule. However, analogously, buyers taking responsibility for ACC may also work to reduce transactions.

The analyses of convergence prices, shown in Tables 8 and 9, also clearly reveal that the trading prices increase when the sellers are responsible for ACC, with the increase in the amount being approximately a half of the ACC. This implies that part of the responsibility for ACC is shared by buyers through changes in credit prices; namely, even when the rule stipulates that buyers take responsibility directly, sellers may share the responsibility through market transactions. Primmer et al., (2019, p. 781) summarized the rights and responsibilities of stakeholders (e.g., offset buyers, sellers, authorities, and citizens). Our results suggest that as far as ACC is concerned, the cost burden is shared between sellers and buyers through credit transactions, and this is regardless of whether the rule formally delegates the responsibility to sellers or buyers. However, as Cole et al. (2022) mentioned, the communities and the citizens in the area targeted by the offset project and those in the surrounding areas are influenced by the offsets, and the market mechanism cannot ensure the share of responsibility between market participants and the public/society, which may be interested local communities. Thus, an important point here is to determine that the way of sharing the responsibility between the market participants and the public/society.

Second, the banker-responsibility scheme may result in an over-reduction of transactions in terms of social surplus. Even in the second half of the experiment of all treatments, there is a chance for both the seller and the buyer to make profits from a transaction. However, in the BNI, BWI, and BSC treatments, the trading volumes suddenly decrease in the 11th round. A possible reason for this is as follows. Each participant can transact only one unit of credit in each session of the experiment. When market participants can sell and buy as many units as they want, they may make decisions based on the expected profits gained from each transaction. However, when market participants can sell or buy only one unit of credit, they may consider avoiding losses even when the worst case occurs. In our experimental sessions of the BNI and BSC treatments, the total cost for sellers when the ACC or social cost arises is 180. Thus, even if the expected total cost is 140, sellers’ offers may be 180 or higher, and this makes it difficult for buyers to accept the offers. In the BWI treatment, the same situation arises when bankers do not buy insurance. Further, even if sellers buy insurance, their offers are 140 or higher. As aforementioned, the possibility of a transaction is lower when sellers may have to bear the ACC or social cost than when this burden does not exist.

Third, Fig. 2 and Result 4 reveal that efficient situations arise in all rounds of the MSMB treatment. Although the production cost of three random sellers is 140, which is significantly higher than that of the other three sellers, this cost heterogeneity does not inhibit efficient market outcomes. Unlike in the case of bilateral transactions, deals in the MSMB treatment are made unless the expected profits are negative. Furthermore, in this treatment, the higher production cost can be considered to be similar to the inclusion of an ACC. This result, particularly based on the comparison between the results of the PSC and MSMB treatments, implies that the greater the number of buyers and sellers in a biodiversity banking program, (i) the weaker the transaction reducing effect, (ii) the less likely it is for over-reduction to arise, and (iii) the greater the efficiency achieved, including the value of biodiversity. Simpson et al. (2021) apply their conceptual model of an offset market to the UK region to examine whether the offset mechanism can achieve NNL. Their results show that (i) developers gains more than bankers and (ii) the larger area the offset market covers, the greater efficiency is achieved because the number of participants become larger. Our experimental results are consistent with their results. In our study, the convergence prices in the first half of the BNI, BWI, BSC, and PSC treatments are lower than 140 (Table 8), and the corresponding prices for the second half are lower than 160, except for the BNI treatment. These prices indicate that buyers generally gain more benefits than sellers do, and our Result 4 reveals that the larger the number of participants, the more efficient the outcome that the credit market achieves; this is because the trading volume of the MSNB treatment is clearly greater than that of the other treatments.

The second and third points discussed here suggest that the relationship between market structure and the responsibility scheme should be considered in biodiversity banking programs. Various researchers have been criticizing market expansion efforts, and many mention that biodiversity banking programs with credit transactions have not been able to achieve NNL, which is the major goal of these programs; Kalliolevo et al. (2022) demonstrated that biodiversity surveys in Finland were not adequate for meeting the requirement of biodiversity offsets. Two other articles describe the necessity of long-term monitoring of offset schemes, something that has not been implemented thus far (Damiens et al., 2021; Josefsson et al., 2021). Drechsler (2022) conducted a simulation based on a generic, agent-based, ecological economic simulation model, with the findings indicating the possibility that NNL is not achieved under award-initiation schemes. Moreover, in the context of Uganda, Kigonya (2022) demonstrated that the practitioners’ perceptions and understanding of offset schemes are different from the original concept and, accordingly, NNL may not be achieved. In such situations, market expansion may aggravate the problem of biodiversity loss (e.g., Zu Ermgassen et al., 2020). The other important criticism among academicians regarding market expansion in the context of biodiversity banking programs is regarding equity. For example, Sponagel et al. (2022) referred to polarization between urban and rural areas using the case study of the Stuttgart Region in Germany. Moreover, Tupala et al. (2022) pointed out the unequal outcome of offset schemes, particularly for local people in the Global South, because they may lose their livelihoods when the offset project is executed in an area far from the place of the development project.

However, the demand for the expansion of biodiversity banking programs to other areas has increased over the past few decades (e.g., Theis & Poesch, 2022). Although the market expansion of biodiversity banking programs may increase the degree of uncertainty regarding offset completion, the economic efficiency under award-initiation schemes is greater than under award-completion schemes when the achievement of NNL is uncertain. This makes market expansion a viable option for environmental authorities. Moreover, researchers have been making steady progress regarding the metrics and evaluation of biodiversity values. We can observe this progress in the literature even when reviewing recent research (Doka et al., 2022; Marshall et al., 2022; Maseyk et al., 2016; Yan et al., 2022).

Our comparison of the results for the PSC treatment and other bilateral transaction treatments (BNI, BWI, BSC) reveals that, as the metrics and evaluation techniques of biodiversity offset schemes improve, it may be more reasonable for the public sector to take responsibility for ACC. However, market expansion may increase the seriousness of the biodiversity loss caused by uncertainty. Moreover, as demonstrated by Cole et al. (2022), people consider that a larger compensation site is needed when the offset scheme is executed far away from the actual development project. Accordingly, biodiversity banking should consider not only economic and ecological costs and benefits but also the effects of the transactions on the local society. Thus, when the market of a biodiversity banking program covers a large area, the program should include the rule that either bankers or developers must take direct responsibility for ACC.

Third, our results show that insurance does not influence trading volumes nor reduces efficiency. In the BWI treatment, the maximum possible total trading volume was 120, but the actual volume was 58, among which 39 sellers chose to buy insurance. This implies that insurance contributes to an increase in sellers’ subjective payoffs, as well as that insurance does not significantly influence efficiency in the BWI treatment when compared to that in the BNI and BSC treatments. That is, the share of responsibility through the implementation of insurance schemes can be dissociated from efficiency.

One of the applications of the banker-responsibility scheme is through the design of the trading ratio or multipliers (Moilanen et al., 2009; Curran et al., 2014; Bull et al., 2017; Needham et al., 2019; zu Ermgassen et al., 2019; Bergès et al., 2020). Various offset schemes and banking programs have applied the notion of offset ratios, relative quantity, and quality of the biodiversity compensation and damaged areas. Considering the uncertainty and time lag, multipliers are often greater than one. zu Ermgassen et al. (2019) show evidence that, when multipliers are greater than one, the possibility of NNL achievement is high, and Bull et al. (2017) provide a list of multipliers for various types of offset programs. When offset programs incorporate banking schemes, the multipliers are applied to the trading ratios. In our experiment, the notion of trading ratios greater than one can be applied to the use of insurance. The additional compensation requirement based on a regulated trading ratio is considered as a situation in which sellers must pay ACCs in advance to avoid the risk of additional loss of biodiversity. In the context of biodiversity banking, researchers have discussed multipliers mainly regarding biological uncertainty, externality to surrounding sites, and ethical issues. Our results show that, in addition to these aspects, for stakeholders to obtain the desirable multiplier for each offset program, behavioral aspects related to uncertainty and market structure should also be considered.

Moreover, past scholars have discussed that when a banker fails to complete an offset and, as a consequence, an unexpected biodiversity loss occurs, an adequate compensation should be provided (e.g., Moreno-Mateos et al., 2015). However, when the public shares the responsibility for this unexpected biodiversity loss, the use of a public sector insurance scheme may serve as a reasonable option.

Fourth, we would like to emphasize the topic of ethical cost. Jacob et al. (2017) show in their experimental study that moral costs inhibit rational behavior and reduce efficiency. Although we exclude ethical costs from the experimental design, the PSC treatment may still provide some indications for participants regarding the link between transaction behavior and ethical cost. Our results for the PSC treatment show no significant difference between the two halves, revealing that it is difficult for market participants to consider the social cost during transactions unless they perceive it as their own cost. Still, this study does not delve into the desirable degree of incorporation of ethical costs into biodiversity banking programs; if society reaches a consensus on the desirable degree of incorporation, this would mean that schemes for internalizing ethical costs into the credit market are required. However, even in such a case, because our experimental results show that efficiency can be way lower than 100% when bankers are responsible for the ACC, behavioral aspects of offset schemes and biodiversity banking should be considered when attempting to balance development and conservation.

5 Conclusion and policy recommendations

Focusing on behavioral aspects, this study conducted a laboratory experiment to investigate the effect of uncertainty and market structure changes on credit transactions in biodiversity banking programs. To ensure the desirable institutional design of offset schemes, it is important that we accumulate not only theoretical but also practical knowledge on the behavior of market participants. Our experiment clarifies the incentive effects of ACCs on bankers’ credit trading, showing that uncertainty regarding ACCs significantly reduces transaction volumes. At the same time, if the additional cost is a social cost and is not borne by bankers, the credit market cannot internalize the cost. Moreover, when the biodiversity banking market is competitive, the existence of ACCs and uncertainty do not affect transaction behavior, and the market achieves an efficient situation. It may be tempting to try and evaluate all types of costs using a single measure, such as in monetary terms, but other kinds of costs (e.g., ethical costs) may also exist. Thus, stakeholders should carefully consider the institutional design of the internalization of ACCs.

Our experimental results provide important policy recommendations. It is important for practitioners to stipulate the responsibility for the cost and a method for sharing the costs caused by development projects and their compensation schemes. As explained in detail in Sect. 4, the ACC may be shared between sellers (bankers) and buyers (developers) through credit transactions, and the credit’s price plays a key role in such sharing. However, the market does not have the means to distribute the responsibility between market participants and other stakeholders, such as local communities. Thus, it would be ideal if stakeholders developed policies that ensure the sharing of responsibility for ACCs and social costs of biodiversity banking programs between market participants and the public. In such situation, behavioral aspects of biodiversity banking programs should be carefully considered, and it may be desirable for the public sector to bear the ACC. Moreover, the larger the area of an offset scheme, the greater the number of possible market participants; thus, the responsibility of these market participants (i.e., developers and bankers) should also be greater.

This study has several limitations. First, although the ACC is set at 80 in our experiment, the degree of inefficiency may depend on the size of the ACC, social cost, and insurance cost. The behavior of market participants may also depend on the combination of the degree of uncertainty and market structure. Second, we have not included various stakeholder types into the experiment, and the behaviors of other stakeholders may change according to the changes in institutional designs. This makes future research observing their behaviors in a laboratory experiment.

Third, although we conducted a series of laboratory experiments to observe and evaluate the relationship between credit trading behavior, uncertainty, and market structure, our results could and should be completed by future natural or field experiments. Their data are likely to help us to more accurately identify the factors that inhibit the smooth implementation of new schemes in real biodiversity banking programs. Fourth, it would be interesting to incorporate non-monetary factors, such as ethical benefits and costs, into a laboratory experiment. Experimental methods can be used to measure the intrinsic preferences of subjects, such as altruism and trust. Combining these experiments and information-differentiated treatments, it is possible to uncover behavioral characteristics that are specific to the credit market of biodiversity banking.

Finally, social responsibility related to environmental conservation behavior correlates with the preference for environmental conservation, and high schools and universities in developed countries have introduced educational programs to promote the growth of environmental consciousness. Kurokawa et al. (2023) frevealed that environmental education increases awareness of environmental issues. Meanwhile, our results rely on experimental data collected in 2016, and students’ sensitivity to social costs in current days may differ from that in 2016. Thus, future researchers could examine the role of environmental consciousness on the behavior of market participants in the context of biodiversity banking programs; they could also assess sensitivity to social costs among current-day students.

Data availability

The z-tree programs used in the current study and the data sets analyzed are available from the corresponding author upon reasonable request.

Notes

Several articles refer to the difficulty of incorporating market mechanisms into offset schemes or criticize biodiversity banking on moral and ethical grounds (Ferreira and Ferreira, 2019; Maron et al., 2016; Spash, 2015). These discussions are important when considering the whole picture of biodiversity conservation in society. However, this study focuses on market performance in the presence of uncertainty. Thus, we do not delve into moral and ethical issues. Karlsson and Björnberg (2021) list five points of criticism and provide suggestions for policy makers and practitioners to improve the design and operation of offset schemes.

The actual banking programs have various names, such as mitigation banking and conservation banking. In this study, we use the term “biodiversity banking” to refer to offset programs with market mechanisms, except when we refer to specific programs or literature.

See the site of the Regulatory In-lieu fee and Bank Information Tracking System (RIBITS):

https://ribits.ops.usace.army.mil/ords/f?p=107:2:14343412869856::NO::

The OECD (2001) also refers to these points. See also the page on mitigation banks in the website of the US Environmental Protection Agency: https://www.epa.gov/cwa-404/mitigation-banks-under-cwa-section-404.

See Parkes et al. (2003) for the details of this method. See also the Biodiversity Information Explanatory Document published by the Department of Environment, Land, Water and Planning of the Victoria State Government, available from the department website at.

Considering the existence of over-compliance in Theis et al. (2020), the additional impact on biodiversity may be positive. Because our focus is on the risk of failure of NNL, we concentrate on the negative additional impact caused by economic development.

Martin (2021) further classify the second uncertainty into two types: uncertainty about the length for offset completion and on the possibility of failure. Then, he compares two credit-awarding schemes, one at the initiation and the other at the completion of the restoration, in terms of cost-effectiveness. Drechsler (2022) also conducted a simulation based on a generic, agent-based, ecological economic model and compare two types of credit awarding; this author demonstrated that the award-initiation scheme may fail to achieve NNL.

Bidaud et al. (2018) focused on the case of the biodiversity offset program of the Ambatovy nickel mine in eastern Madagascar and referred to the responsibilities for social and environmental impacts, and the importance of considering the costs for local people whose daily lives are dependent on biodiversity resources. Vatn (2018) discussed the introduction of market mechanism for dealing with environmental and resource problems and the roles of public and private actors.

The term uncertainty has been used to represent risk, ambiguity, or both. As we explain later, our experimental setting regarding uncertainty is equivalent to the topic of risk. However, considering the reality of biodiversity offset schemes, there may be uncertainty related to non-monetary costs (See Sect. 4). Thus, we use the term uncertainty throughout the paper.

As we explain in Subsection 2.4, we used “preservation cost” instead of “additional conservation cost” in the experimental sessions because the term “preservation” has a more neutral connotation than the term “conservation” in the Japanese language. Moreover, we adopt the term “changes in standards or specifications” instead of “additional negative impact on biodiversity” to make the experiment as neutral as possible.

The Bobolink project is one such conservation program. For more on the project, refer to the study by Swallow (2018).

Bankers may not be able to completely account for these non-monetary costs and values. Thus, it would make for an interesting extension to give participants relatively vague information on environmental costs or benefits in non-monetary terms.

Biodiversity banking institutions that cover various offset sites may be necessary to ensure the connectivity of different sites and achieve NNL effectively; this is because territorial management of offset projects makes it possible for the authority to create green corridors and rich ecosystems. See, for example, Tarabon et al. (2021).

All the data we use in the current study were obtained through the series of laboratory experiments we conducted. Because of research ethics issues, we do not include in this report any type of raw data. Still, the z-tree programs and data sets that were used are available from the corresponding author upon reasonable request.

All procedures were performed in compliance with the guidelines of Kwansei Gakuin University Regulations for Behavioral Research with Human Participants, and this study was approved by Kwansei Gakuin University Institutional Review Board for Behavioral Research with Human Participants (2021–84). All participants that partook in each session provided informed consent.

Noussair et al. (1995) discussed how to capture the laboratory market convergence index using a regression model. They mention that the convergence process could not be perfectly understood from a theoretical perspective. Further, many empirical studies suffer from some critical problems regarding their statistical procedures, such as serial correlation and heteroscedasticity issues, when attempting to reveal the convergence process of each market outcome using market data. Based on these theoretical and empirical problems, Noussair et al. (1995) propose the regression model procedures based on the study of Ashenfelter et al. (1992).

We implement Welch’s t-test to consider the unequal variance between the treatments.

The correlation between \({D}_{m}\left(\frac{1}{t}\right)\) and \(t\left(\frac{1}{t}\right)\) relies on sample size (the number of participants and sessions) in each treatment. The lowest coefficient correlation between the variables is -0.623 in the PSC treatment, and the highest coefficient correlation is -0.430 in the BNI treatment.

References

Arquitt, S., & Johnstone, R. (2008). Use of system dynamics modelling in design of an environmental restoration banking institution. Ecological Economics, 65(1), 63–75. https://doi.org/10.1016/j.ecolecon.2007.05.013

Ashenfelter, O. C., Currie, J., Farber, H. S., & Spiegel, M. (1992). An experimental comparison of dispute rates in alternative arbitration systems. Econometrica, 60(6), 1407–1433. https://doi.org/10.2307/2951527

Ben-David, S., Brookshire, D., Burness, S., McKee, M., & Schmidt, C. (2000). Attitudes toward risk and compliance in emission permit markets. Land Economics, 76(4), 590–600. https://doi.org/10.2307/3146954

Bergès, L., Avon, C., Bezombes, L., Clauzel, C., Duflot, R., Foltête, J. C., Gaucherand, S., Girardet, X., & Spiegelberger, T. (2020). Environmental mitigation hierarchy and biodiversity offsets revisited through habitat connectivity modelling. Journal for Nature Conservation, 256, 109950. https://doi.org/10.1016/j.jenvman.2019.109950

Bidaud, C., Schreckenberg, K., & Jones, J. P. (2018). The local costs of biodiversity offsets: Comparing standards, policy and practice. Land Use Policy, 77, 43–50. https://doi.org/10.1016/j.landusepol.2018.05.003

Boisvert, V. (2015). Conservation banking mechanisms and the economization of nature: An institutional analysis. Ecosystem Services, 15, 134–142. https://doi.org/10.1016/j.ecoser.2015.02.004

Bull, J. W., Lloyd, S. P., & Strange, N. (2017). Implementation gap between the theory and practice of biodiversity offset multipliers. Conservation Letters, 10(6), 656–669. https://doi.org/10.1111/conl.12335

Bull, J. W., & Strange, N. (2018). The global extent of biodiversity offset implementation under no net loss policies. Nat. Sustain., 1, 790–798. https://doi.org/10.1038/s41893-018-0176-z

Bull, J. W., Suttle, K. B., Gordon, A., Singh, N. J., & Milner-Gulland, J. (2013). Biodivesity offsets in theory and practice. Oryx, 47(3), 369–380. https://doi.org/10.1017/S003060531200172X

Calvet, C., Le Coent, P., Napoleone, C., & Quétier, F. (2019). Challenges of achieving biodiversity offset outcomes through agri-environmental schemes: Evidence from an empirical study in Southern France. Ecological Economics, 163, 113–125. https://doi.org/10.1016/j.ecolecon.2019.03.026

Cason, T. N. (2003). Buyer liability and voluntary inspections in international greenhouse gas emissions trading: A laboratory study. Environ. Res. Econ., 25, 101–127. https://doi.org/10.1023/A:1023665517698

Cason, T. N., & Gangadharan, L. (2006). Emissions variability in tradable permit markets with imperfect enforcement and banking. Journal of Economic Behavior & Organization, 61(2), 199–216. https://doi.org/10.1016/j.jebo.2005.02.007

Cason, T. N., Gangadharan, L., & Duke, C. (2003a). A laboratory study of auctions for reducing non-point source pollution. Journal of Environmental Economics and Management, 46(3), 446–471. https://doi.org/10.1016/S0095-0696(03)00026-3

Cason, T. N., Gangadharan, L., & Duke, C. (2003b). Market power in tradable emission markets: A laboratory testbed for emission trading in Port Phillip Bay. Victoria. Ecol. Econ., 46(3), 469–491. https://doi.org/10.1016/S0921-8009(03)00187-3

Cason, T. N., & Plott, C. R. (1996). EPA’s new emission trading mechanism: A laboratory evaluation. Journal of Environmental Economics and Management, 30(2), 133–160. https://doi.org/10.1006/jeem.1996.0010

Cole, S., Hasselström, L., Jönsson, K. I., Lindblom, E., & Söderqvist, T. (2022). Expert guidance for environmental compensation is consistent with public preferences–Evidence from a choice experiment in Sweden. Land Use Policy, 118, 106127. https://doi.org/10.1016/j.landusepol.2022.106127

Curran, M., Hellweg, S., & Beck, J. (2014). Is there any empirical support for biodiversity offset policy? Ecological Applications, 24(4), 617–632. https://doi.org/10.1890/13-0243.1

Damiens, F. L. P., Backstrom, A., & Gordon, A. (2021). Governing for “no net loss” of biodiversity over the long term: Challenges and pathways forward. One Earth, 4(1), 60–74. https://doi.org/10.1016/j.oneear.2020.12.012

Doka, S. E., Minns, C. K., Valere, B. G., Cooke, S. J., Portiss, R. J., Sciscione, T. F., & Rose, A. (2022). An ecological accounting system for integrated aquatic planning and habitat banking with case study on the Toronto Waterfront, Ontario. Canada. Environ. Manag., 69(5), 952–971. https://doi.org/10.1007/s00267-021-01531-5

Drechsler, M. (2022). On the cost-effective temporal allocation of credits in conservation offsets when habitat restoration takes time and is uncertain. Environ. Res. Econ., 82(2), 437–459. https://doi.org/10.1007/s10640-022-00685-y

Ferreira, C., & Ferreira, J. (2019). Failure to expand? Socio-technical practices and moral judgement in markets for biodiversity offsets. New Polit. Econ., 24, 716–733. https://doi.org/10.1080/13563467.2018.1501357

Fischbacher, U. (2007). z-Tree: Zurich toolbox for ready-made economic experiments. Experimental Economics, 10, 171–178. https://doi.org/10.1007/s10683-006-9159-4

Friesen, L., & Gangadharan, L. (2013). Environmental markets: What do we learn from the lab? J. Econ. Surv., 27(3), 515–535. https://doi.org/10.1111/joes.12021

Froger, G., Ménard, S., & Méral, P. (2015). Towards a comparative and critical analysis of biodiversity banks. Ecosystem Services, 15, 152–161. https://doi.org/10.1016/j.ecoser.2014.11.018

Gamarra, M. J. C., Lassoie, J. P., & Milder, J. (2018). Accounting for no net loss: A critical assessment of biodiversity offsetting metrics and methods. Journal of Environmental Management, 220, 36–43. https://doi.org/10.1016/j.jenvman.2018.05.008

Gangadharan, L., & Nemes, V. (2009). Experimental analysis of risk and uncertainty in provisioning private and public goods. Economic Inquiry, 47(1), 146–164. https://doi.org/10.1111/j.1465-7295.2007.00118.x

Gerber, N. (2011). Biodiversity measures based on species-level dissimilarities: A methodology for assessment. Ecological Economics, 70(12), 2275–2281. https://doi.org/10.1016/j.ecolecon.2011.08.013

Grimm, M. (2020). Conserving biodiversity through offsets? Findings from an empirical study on conservation banking. Journal for Nature Conservation., 57, 125871. https://doi.org/10.1016/j.jnc.2020.125871

Grimm, M., & Köppel, J. (2019). Biodiversity offset program design and implementation. Sustainability, 11(24), 6903. https://doi.org/10.3390/su11246903

Higashida, K., Tanaka, K., Managi, S. (2012). Evaluation of offset schemes with a laboratory experiment. In: S. Managi (Ed) The Economics of Biodiversity and Ecosystem Services. Routledge: New York, USA, pp 164–181.

Higashida, K., Tanaka, K., & Managi, S. (2019). The efficiency of conservation banking schemes with inter-regionally tradable credits and the role of mediators. Econ. Analysis Policy, 62, 175–186. https://doi.org/10.1016/j.eap.2019.02.002

Intergovernmental Panel on Climate Change. (2014). AR5 Climate Change 2014: Mitigation of Climate Change. https://www.ipcc.ch/report/ar5/wg3/

Jacob, M., Kübler, D., Steckel, J. C., & van Veldhuizen, R. (2017). Clean up your own mess: An experimental study of moral responsibility and efficiency. J. Pub. Econ., 155, 138–146. https://doi.org/10.1016/j.jpubeco.2017.09.010

Josefsson, J., Widenfalk, L. A., Blicharska, M., Hedblom, M., Pärt, T., Ranius, T., & Öckinger, E. (2021). Compensating for lost nature values through biodiversity offsetting–Where is the evidence? Biological Conservation, 257, 109117. https://doi.org/10.1016/j.biocon.2021.109117

Kalliolevo, H., Salo, M., Hiedanpää, J., Jounela, P., Saario, T., & Vuorisalo, T. (2022). Considerable qualitative variability in local-level biodiversity surveys in Finland: A challenge for biodiversity offsetting. Journal for Nature Conservation., 68, 126194. https://doi.org/10.1016/j.jnc.2022.126194

Karlsson, M., & Björnberg, K. E. (2021). Ethics and biodiversity offsetting. Conservation Biology, 35(2), 578–586. https://doi.org/10.1111/cobi.13373

Kigonya, R. (2022). ‘Old wine in a new bottle’: Conceptualization of biodiversity offsets among environmental practitioners in Uganda. Environmental Management, 69(6), 1202–1216. https://doi.org/10.1007/s00267-022-01639-2

Koh, N. S., Hahn, T., & Boonstra, W. J. (2019). How much of a market is involved in a biodiversity offset? A typology of biodiversity offset policies. J. Environ. Manag., 232, 679–691. https://doi.org/10.1016/j.jenvman.2018.11.080

Kotani, K., Tanaka, K., & Managi, S. (2019). Which performs better under trader settings, double auction or uniform price auction? Experimental Economics, 22(1), 247–267. https://doi.org/10.1007/s10683-018-9585-0

Kurokawa, H., Igei, K., Kitsuki, A., Kurita, K., Managi, S., Nakamuro, M., & Sakano, A. (2023). Improvement impact of nudges incorporated in environmental education on students’ environmental knowledge, attitudes, and behaviors. Journal Environmental Management, 325(1), 116612. https://doi.org/10.1016/j.jenvman.2022.116612

Laurila-Pant, M., Lehikonien, A., Uusitalo, L., & Venesjärvi, R. (2015). How to value biodiversity in environmental management? Ecol. Indicators, 55, 1–11. https://doi.org/10.1016/j.ecolind.2015.02.034

Levrel, H., Scemama, P., & Vaissière, A. C. (2017). Should we be wary of mitigation banking? Evidence regarding the risks associated with this wetland offset arrangement in Florida. Ecological Economics, 135, 136–149. https://doi.org/10.1016/j.ecolecon.2016.12.025

Luengo, C., Caffera, M., & Chávez, C. (2020). Uncertain penalties and compliance: Experimental evidence. Environmental Economics and Policy Studies, 22, 197–216. https://doi.org/10.1007/s10018-019-00255-5

Maron, M., Hobbs, R. J., Moilanen, A., Matthews, J. W., Christie, K., Gardner, T. A., Keith, D. A., Lindemayer, D. B., & McAlpine, C. A. (2012). Faustian bargains? Restoration realities in the context of biodiversity offset policies. Biological Conservation, 155, 141–148. https://doi.org/10.1016/j.biocon.2012.06.003

Maron, M., Ives, C. D., Kujala, H., Bull, J. W., Maseyk, F. J. F., Bekessy, S., Gordon, A., Watson, J. E. M., Lentini, P. E., Gibbons, P., Possingham, H. P., Hobbs, R. J., Keith, D. A., Wintle, B. A., & Evans, M. C. (2016). Taming a wicked problem: Resolving controversies in biodiversity offsetting. BioScience, 66(6), 489–498. https://doi.org/10.1093/biosci/biw038

Marshall, E., Visintin, C., Valavi, R., Wilkinson, D. P., Southwell, D., Wintle, B. A., & Kujala, H. (2022). Integrating species metrics into biodiversity offsetting calculations to improve long-term persistence. Journal of Applied Ecology, 59(4), 1060–1071. https://doi.org/10.1111/1365-2664.14117

Marshall, E., Wintle, B. A., Southwell, D., & Kujala, H. (2020). What are we measuring? A review of metrics used to describe biodiversity in offsets exchanges. Biology Conservation., 241, 108250. https://doi.org/10.1016/j.biocon.2019.108250

Martin, D. (2021). On the cost-effective temporal allocation of credits in conservation offsets when habitat restoration takes time and is uncertain. MARA Paper No.108029. https://mpra.ub.uni-muenchen.de/108209/

Maseyk, F. J. F., Barea, L. P., Stephens, R. T. T., Possingham, H. P., Dutson, G., & Maron, M. (2016). A disaggregated biodiversity offset accounting model to improve estimation of ecological equivalency and no net loss. Biolog. Conserv., 204(Part B), 322–332. https://doi.org/10.1016/j.biocon.2016.10.016

McVittie, A., & Faccioli, M. (2020). Biodiversity and ecosystem services net gain assessment: A comparison of metrics. Ecosyst. Serv., 44, 101145. https://doi.org/10.1016/j.ecoser.2020.101145

Millon, L., Barré, K., Julliard, R., Compère, P., & Kerbiriou, C. (2021). Calculation of biodiversity level between different land-uses to improve conservation outcomes of biodiversity offsetting. Land Use Policy, 101, 105161. https://doi.org/10.1016/j.landusepol.2020.105161

Moilanen, A., van Teeffelen, A. J. A., Ben-Haim, Y., & Ferrier, S. (2009). How much compensation is enough? A framework for incorporating uncertainty and time discounting when calculating offset ratios for impacted habitat. Restoration Ecology, 17(4), 470–478. https://doi.org/10.1111/j.1526-100X.2008.00382.x

Moreno-Mateos, D., Maris, V., Béchet, A., & Curran, M. (2015). The true loss caused by biodiversity offsets. Biology Conservation, 192, 552–559. https://doi.org/10.1016/j.biocon.2015.08.016

Muller, R. A., & Mestelman, S. (1998). What have we learned from emissions trading experiments? Managerial and Decision Economics, 19(4–5), 225–238. https://doi.org/10.1002/(SICI)1099-1468(199806/08)19:4/5%3c225::AID-MDE888%3e3.0.CO;2-V

Murphy, J. J., & Stranlund, J. K. (2007). A laboratory investigation of compliance behavior under tradable emissions rights: Implications for targeted enforcement. Journal of Environmental Economics and Management, 53(2), 196–212. https://doi.org/10.1016/j.jeem.2006.08.003

Myagkov, M., & Plott, C. R. (1997). Exchange economics and loss exposure: Experiments exploring prospect theory and competitive equilibria in market environments. The American Economic Review, 87(5), 801–828.

Needham, K., de Vries, F. P., Armsworth, P. R., & Hanley, N. (2019). Designing markets for biodiversity offsets: Lessons from tradable pollution permits. Journal of Applied Ecology, 56(6), 1429–1435. https://doi.org/10.1111/1365-2664.13372

Nemes, V., Plott, C. R., & Stoneham, G. (2008). Electronic BushBroker exchange: Designing a combinatorial double auction for native vegetation offsets. Available at SSRN. https://doi.org/10.2139/ssrn.1212202

Noussair, C. N., Plott, C. R., & Riezman, R. G. (1995). An experimental investigation of the patterns of international trade. The American Economic Review, 85(3), 462–491.

OECD. (2001). Valuation of biodiversity benefits: selected studies. OECD. https://doi.org/10.1787/9789264195844-en

Oliver, I., Dorrough, J., & Saidel, J. (2021). A new Vegetation Integrity metric for trading losses and gains in terrestrial biodiversity value. Ecol. Indicators, 124, 107341. https://doi.org/10.1016/j.ecolind.2021.107341

Parkes, D., Newell, G., & Cheal, D. (2003). Assessing the quality of native vegetation: The ‘habitat hectares’ approach. Ecological Management and Restoration, 4(s1), S29–S38. https://doi.org/10.1046/j.1442-8903.4.s.4.x

Poudel, J., Zhang, D., & Simon, B. (2019). Habitat conservation banking trends in the United States. Biodiversity and Conservation, 28, 1629–1646. https://doi.org/10.1007/s10531-019-01747-2

Primmer, P., Varumo, L., Kotilainen, J. M., Raitanen, E., Kattainen, M., Pekkonen, M., Kuusela, S., Kullberg, P., Kangas, J. A. M., & Ollikainen, M. (2019). Institutions for governing biodiversity offsetting: An analysis of rights and responsibilities. Land Use Policy, 81, 776–784. https://doi.org/10.1016/j.landusepol.2018.11.040

Simpson, K. H., de Vries, F., Dallimer, M., Armsworth, P. R., & Hanley, N. (2021). Understanding the performance of biodiversity offset markets: Evidence from an integrated ecological-economic model. Land Economics, 97(4), 836–857. https://doi.org/10.3368/le.97.4.030420-0032R

Southwell, D. M., Heard, G. W., & McCarthy, M. A. (2018). Optimal timing of biodiversity offsetting for metapopulations. Ecological Applications, 28(2), 508–521. https://doi.org/10.1002/eap.1666

Spash, C. L. (2015). Bulldozing biodiversity: The economics of offsets and trading-in nature. Biological Conservation, 192, 541–551. https://doi.org/10.1016/j.biocon.2015.07.037

Sponagel, C., Bendel, D., Angenendt, E., Weber, T. K. D., Gayler, S., Streck, T., & Bahrs, E. (2022). Integrated assessment of regional approaches for biodiversity offsetting in urban-rural areas–A future based case study from Germany using arable land as an example. Land Use Policy, 117, 106085. https://doi.org/10.1016/j.landusepol.2022.106085

Swallow, S. K., Anderson, C. M., & Uchida, E. (2018). The Bobolink project: Selling public goods from ecosystem services using provision point mechanisms. Ecological Economics, 143, 236–252. https://doi.org/10.1016/j.ecolecon.2017.06.040

Tanaka, K., Higashida, K., & Managi, S. (2014). A laboratory assessment of the choice of vessel size under individual transferable quota regimes. Aust. J. Agr. Res. Econom., 58(3), 353–373. https://doi.org/10.1111/1467-8489.12064

Tanaka, K., Matsukawa, I., & Managi, S. (2020). An experimental investigation of bilateral oligopoly in emissions trading markets. China Econ. Rev., 59, 101349. https://doi.org/10.1016/j.chieco.2019.101349

Tarabon, S., Dutoit, T., & Isselin-Nondedeu, F. (2021). Pooling biodiversity offsets to improve habitat connectivity and species conservation. J. Environ. Manag., 277, 111425. https://doi.org/10.1016/j.jenvman.2020.111425

Theis, S., & Poesch, M. (2022). Current capacity, bottlenecks, and future projections for offsetting habitat loss using Mitigation and Conservation banking in the United States. J. Nature Conserv., 67, 126159. https://doi.org/10.1016/j.jnc.2022.126159

Theis, S., Ruppert, J. L. W., Roberts, K. N., Minns, C. K., Koops, M., & Poesch, M. S. (2020). Compliance with and ecosystem function of biodiversity offsets in North American and European freshwaters. Conservation Biology, 34(1), 41–53. https://doi.org/10.1111/cobi.13343

Tupala, A. K., Huttunen, S., & Halme, P. (2022). Social impacts of biodiversity offsetting: A review. Biological Conservation, 267, 109431. https://doi.org/10.1016/j.biocon.2021.109431

Vaissière, A., Tardieu, L., Quétier, F., & Roussel, S. (2018). Preferences for biodiversity offset contracts on arable land: A choice experiment study with farmers. European Review of Agricultural Economics, 45(4), 553–582. https://doi.org/10.1093/erae/jby006

Vatn, A. (2018). Environmental governance–from public to private? Ecological Economics, 148, 170–177. https://doi.org/10.1016/j.ecolecon.2018.01.010

White, T. B., Bull, J. W., Toombs, T. P., & Knight, A. T. (2021). Uncovering opportunities for effective species conservation banking requires navigating technical and practical complexities. Conserv. Sci. Pract., 3(7), e431. https://doi.org/10.1111/csp2.431

Yan, N., Liu, G., Xu, L., Deng, X., & Casazza, M. (2022). Emergy-based eco-credit accounting method for wetland mitigation banking. Water Res., 210, 118028. https://doi.org/10.1016/j.watres.2021.118028

ZuErmgassen, S. O. S. E., Baker, J., Griffiths, R. A., Strange, N., Struebig, M. J., & Bull, J. W. (2019). The ecological outcomes of biodiversity offsets under “no net loss” policies: A global review. Conserv. Lett., 12(6), e12664. https://doi.org/10.1111/conl.12664

ZuErmgassen, S. O., Maron, M., Walker, C. M. C., Gordon, A., Simmonds, J. S., Strange, N., Robertson, M., & Bull, J. W. (2020). The hidden biodiversity risks of increasing flexibility in biodiversity offset trades. Biolog. Conserv., 252, 108861. https://doi.org/10.1016/j.biocon.2020.108861

Acknowledgement

The authors thank Jun Goto, Takeshi Ogawa, Kanae Tokunata, and Fukuji Yamada for helpful comments. We acknowledge financial support from Japan Society for the Promotion of Science under Grant-in-Aid for Challenging Exploratory Research (16K13366) and Scientific Research (B, 16H03012).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.