Abstract

Voluntary, market-based conservation programs are one tool available to land managers and regulators to maintain and enhance environmental resources. One such program type is a habitat exchange, through which a private landowner sells conservation to developers to offset a disturbance on the landscape. Since landowner participation is voluntary, price and contract terms must be sufficiently appealing to induce participation. Moreover, landowners who undertake costly actions to generate sellable credits face risk of failure. In particular, stipulated habitat improvements may fail to be achieved in the future due to events outside the control of landowners, resulting in foregone conservation payments. In the absence of sufficient real-world data for conventional econometric analysis, we implement a laboratory market experiment to assess the impact of market structure, credit failure risk, and a potential reimbursement policy on habitat exchange outcomes (market price, quantity traded, earnings, and efficiency). Findings suggest that failure risk significantly reduces habitat credit production and trade in this market environment, putting the potential success of such emerging markets in question. A private party risk mitigation strategy of buyers reimbursing sellers for production costs on failed units could mitigate these impacts. Specifically, reimbursing sellers for production costs on credits that fail to maintain habitat quality for their contract life can significantly mitigate reductions in conservation production resulting from this risk.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The provision of ecosystem services from agricultural lands often provides many benefits to society, but individual landowners typically are not compensated for providing such goods in their day-to-day operations. Under a payment for ecosystem services (PES) program, landowners receive financial compensation from the government or another entity for generating conservation improvements on their land (Wunder 2005). PES schemes are market-based mechanisms that rely on incentives to induce behavioral change (Jack et al. 2008). They are potentially more efficient than regulatory, command-and-control approaches because they help to focus conservation efforts in areas where the cost of achieving conservation is relatively low. However, since they are voluntary, their success depends on correctly designing the institution and incentives to induce buyer and seller participation.

We focus in this paper on habitat exchanges, a PES mechanism in which buyers and sellers trade quantifiable, third-party verified units of conservation, called credits. Landowners generate credits by implementing practices that produce measurable conservation outcomes to maintain or enhance habitat. Entities that impact the landscape through development can purchase these credits to meet compensatory mitigation requirements placed on them by regulators (Federal Register 2016). Buyers (for example energy companies in need of conservation credits) and sellers (generally private landowners engaged in extensive agricultural activities such as ranching) come to agreement over price and quantity for conservation credits in a two-sided market setting. This is in contrast to a publicly funded conservation program, in which a government agent seeks to maximize the amount of conservation achieved subject to a budget constraint.Footnote 1

Habitat exchanges are similar to transferable pollution rights markets: a regulatory agency requires an energy developer to purchase off-site mitigation credits in exchange for the right to disturb the landscape. The theoretical gains available from implementing a market for tradable discharge permits (conservation credits in our case) over a regulatory, command-and-control approach are well-established (Montgomery 1972; Krupnick et al. 1983; McGartland and Oates 1985). However, market design (delivery mechanisms and contract features) affects the gains realized in practice (Lyon 1982; Hahn 1989). Implementation details must be appropriate to the local context and conducive to landowner participation for habitat exchanges to be successful (Christensen et al. 2011; Hanley et al. 2012; Torres et al. 2013; Hansen et al. 2018). The present study consequently incorporates institutional detail specific to habitat exchanges and the nature of conservation in the western U.S. For example, the trading institution most likely to prevail in habitat exchanges is private negotiation (in which buyer and seller negotiate individually over the price of conservation units) rather than auction, as stakeholders (including landowners) have indicated a preference for private negotiation.Footnote 2 This limits the generalizability of the results, at least on first examination. However, as noted by Cason et al. (2003) in a similar context, the specific details make the results more relevant and useful to the application at hand.

Habitat exchanges are mostly at an early developmental stage. Whether they succeed in producing habitat quality enhancements that improve welfare depends largely on whether the institutional design induces buyer and seller participation. Market participants likely face three important risks that affect habitat exchange outcomes. First is matching risk: the risk of failing to find a willing trading partner in the private negotiation setting. Second is inventory loss risk: the risk to sellers of failing to sell—or being forced to accept discounted prices on—units already produced in an advance production setting. Both have been studied extensively in agricultural markets (Menkhaus et al. 2003a, 2007; Nagler et al. 2015). The second has also been studied in the context of water quality trading (Jones and Vossler 2014). One additional type of risk that exists in habitat exchanges is the post-production risk of credit failure—the risk that conservation credits fail to maintain habitat quality over their contract life due to events outside the control of landowners. If habitat exchanges fail to address these risks, particularly failure risk, they will not attract sufficient buyers and sellers to constitute a viable option for compensatory mitigation, resulting in a failed market.

We implement laboratory market experiments to assess the impact of three features on habitat exchange outcomes: delivery method (which affects the presence of inventory loss risk), failure risk, and potential reimbursement to landowners for failed credits. Transactions are privately negotiated (buyers and sellers negotiate over price in pairs) rather than via auction, reflecting the trading institution likely to prevail in habitat exchanges. The next section presents relevant background on habitat exchange institutions and some theoretical considerations. We follow this with the experimental design and description of the analysis. We then discuss results and conclude with implications for habitat exchange implementation. Our main findings support the necessity of addressing credit failure risk, given the habitat exchange institutions likely to prevail.

2 Policy Background

In 1995, the U.S. Army Corps of Engineers authorized the establishment of wetland mitigation banks, through which developers could offset unavoidable damage to wetlands and other aquatic resources by enhancing and protecting other land in perpetuity (Federal Register 1995). More recently, the U.S. Fish and Wildlife Service (USFWS) authorized conservation banks to offset impacts to species listed as threatened or endangered under the Endangered Species Act (USFWS 2003). In both cases, a developer in need of compensatory mitigation pays a mitigation or conservation bank for credits at a mutually agreed-upon price.

Environmental non-governmental organizations (including Environmental Defense Fund, Environmental Incentives, and Willamette Partnership), landowners, and industry partners developed the habitat exchange concept in response to perceived shortcomings of the mitigation/conservation banking model (EDF 2017). They sought to develop a model of habitat improvement that would increase the scientific rigor associated with quantifying ecological benefit, streamline the regulatory approval process, and facilitate landowner participation in environmental markets both by allowing for term leases rather than just perpetual contracts and by obviating the need for significant upfront capital investment.

The Bureau of Land Management and USFWS have both recognized habitat exchanges as a valid mechanism through which energy companies can meet their compensatory mitigation requirements (BLM 2016; Federal Register 2016). Currently, the western U.S. states of Colorado, Montana, Nevada, and Wyoming are developing habitat exchanges for greater sage-grouse (Centrocercus urophasianus), though few exchanges have executed trades so far.Footnote 3 To date, the major emphasis in habitat exchange development has been specifying the landowner eligibility criteria and ecological quantification metrics needed to assess conservation and designing protocols to ensure conservation credits developed through exchanges meet USFWS requirements on durability, transparency, and accountability (Federal Register 2016; WCE 2017). Developing the market structure through which credit trading will ultimately occur has received less attention. Yet market design is crucial to program success, as the quantity of habitat created and traded depends on interactions between market design and the risks faced by conservation providers in several key ways.

First, habitat exchange transactions are likely to be bilaterally negotiated between interested buyers and sellers (through private negotiation) rather than auction-based (a more commonly modeled conservation market structure), especially if regulatory agencies require that compensatory mitigation be proximate to the disturbance. This market institution creates the potential for a phenomenon termed matching risk. Although matching risk has not been addressed in the literature on conservation program design, it has been studied in the context of conventional agricultural markets. Private negotiation creates the risk that participants cannot find a willing trading partner at the time they desire to trade, since negotiating privately makes it difficult for buyers and sellers to find one another (Menkhaus et al. 2007), especially in geographically constrained or thin markets. In habitat exchanges this risk may limit the quantity of conservation produced and traded.

Second, federal and state agencies with authority over compensatory mitigation generally require that only verified conservation can be traded through habitat exchanges (BLM 2016; Federal Register 2016; SGI 2017; USFWS 2003). As a consequence, sellers must generate conservation before they have found a buyer or negotiated price. This feature is in contrast to traditional Natural Resources Conservation Service conservation programs through which landowners are paid for practices (for example cheatgrass removal) regardless of whether such practices yield measureable habitat improvements (Hansen et al. 2017). This risk is comparable to the risks agricultural producers face in advance production markets, where sellers incur production costs prior to sale and lose costs on unsold or discounted production. This risk is called inventory loss risk (Menkhaus et al. 2003a).

Inventory loss risk hinders seller bargaining power. Sellers also cut back on production when they risk unsold inventory. The risk of not matching with a willing buyer to trade all units produced (present in the private negotiation trading institution) compounds potential seller losses from unsold inventory. Buyers are consequently able to purchase units for reduced prices (Menkhaus et al. 2003b). As a result, privately negotiated prices and quantity traded under an advance production delivery method are lower than under a production-to-demand delivery method, in which sellers only initiate production after a sales contract is in place (Menkhaus et al. 2003a, b). Jones and Vossler (2014) similarly find that the upfront investment required to produce water quality abatement credits when regulators require sellers to commit to production levels before finding a buyer and negotiating price reduces production.

In traditional agricultural markets, this inventory loss risk stems from the possibility that existing inventory might not be sold. In habitat markets, inventory loss risk is exacerbated by the fact that conservation practices do not always result in verifiable conservation. This is particularly relevant for greater sage-grouse habitat located in semi-arid locations in the western U.S., as new vegetation is typically difficult to establish and grow in this region. Invasive species such as cheatgrass may flourish, reducing establishment and growth of desired forage species. Sellers may also reduce production and trade at reduced prices (to recover at least some production costs) for this reason as well.Footnote 4

Third, federal and state agencies generally require that conservation traded through habitat exchanges be monitored and maintained for the life of the credit (BLM 2016; Federal Register 2016; SGI 2017; USFWS 2003). This durability requirement also places credit failure risk (in addition to matching and inventory loss risks) on sellers. Failure risk is the post-production risk that verified conservation credits fail to maintain habitat quality over their contract life due to events outside the control of landowners. These conservation credits are anticipated to be traded in contracts between 20 and 50 years in length, with periodic monitoring protocols in place to ensure satisfactory maintenance of the credits for the duration of the contract. When credits fail before the end of their contract (perhaps due to climate conditions or wildfire), sellers bear the cost of failed credits. This failure risk is likely to reduce significantly the quantity of conservation credits supplied to the market, and credit price is likely to be higher. A relatively simple risk mitigation strategy—requiring conservation credit buyers (those seeking to offset development impacts) to reimburse sellers the costs they incur to produce failed credits—may mitigate the influence of failure risk, thereby positively affecting market outcomes associated with conservation credits supplied and traded.

Little data exists on market outcomes (quantity traded, price, overall earnings, distribution of earnings between buyers and sellers) for conservation markets. Mitigation and conservation bank pricing information is proprietary. Credit trading through banks also tends to be thin, as regulators often require compensatory mitigation offsets to be located close to the disturbance (Hansen et al. 2017). Once habitat exchanges are operational, they are likely to be just as thin as banks, with similar limitations on access to trading data. This lack of data makes traditional econometric analyses impossible. Thus, to achieve our research objective, we design and conduct laboratory market experiments to test three propositions:

-

\(P_{1}\): Delivery method (whether advance production or production-to-demand in which sellers only initiate production after a sales contract is in place) affects market outcomes.

-

\(P_{2}\): The post-production risk of credit failure affects market outcomes.

-

\(P_{3}\): A private party risk mitigation strategy of seller cost reimbursement by buyers affects market outcomes.

3 Experimental Design and Laboratory Procedures

Trades in the laboratory market were negotiated between buyer–seller pairs submitting bids and offers over a computer network. Each experimental market session consisted of four buyers and four sellers. Buyers and sellers were randomly matched into four buyer–seller pairs to negotiate trades. They traded a generic commodity, or “unit,” in a currency called “tokens,” based on the seller production costs and buyer redemption values for each successive unit provided to them (Table 1). To motivate preference revelation, participant earnings were converted to dollars and paid out in cash at the end of each session (Friedman and Sunder 1994)Footnote 5 at an exchange rate of 100 tokens for $1.00.

Experimental sessions followed a standard procedure. All participants were paid a show-up fee of $15.Footnote 6 Participants were randomly assigned to be either buyers or sellers at the start of each session and retained their roles throughout the session. Participants knew only their own role as a buyer or seller and not the role or identity of other participants. Participants were spaced and positioned at computer stations to ensure that participants’ roles, randomly matched trading partners, and decisions remained confidential.

Instructions (see “Appendix A”) outlining the basic market design, trading mechanics, and how earnings were calculated and paid out were presented to participants. Figure 1 illustrates the timeline of a trading period. Prior to trading, buyers were shown redemption values for the eight units they could purchase and sellers were shown production costs for the eight units they could produce and sell. Participants saw only their own value or cost schedule. In the advance production treatments, sellers made a decision about how many units to produce while buyers waited. In the production-to-demand treatments, the credits produced equaled the credits traded.

One or more practice periods were conducted, depending on participants’ comfort with the computer program and willingness to transition to the actual experiment. The actual experiment began when participants reported being comfortable with the mechanics of trading. The actual experiment used different production cost and redemption value schedules than the practice periods. Each market session continued for a minimum of 20 trading periods with a random stop invoked after period 20.Footnote 7

Each trading period was divided into three 1-min bargaining rounds. Buyers and sellers were randomly matched by the computer program into four trading pairs. Units were traded one at a time, starting with the first units on participants’ redemption value and production cost schedules. Each pair bilaterally bargained over price via the computer. At the end of each 1-min round, the computer re-matched participants into bargaining pairs through stranger matching (Menkhaus et al. 2007) and trading resumed.Footnote 8 A trading screen also showed values and costs for each unit as well as current bids and offers. As trading proceeded, buyers and sellers knew only their own bids or offers and those of their current trading partner. Participants were matched three times to negotiate trades on one set of up to eight units during each trading period. Paired trading over three rounds mimics matching risk in thin or geographically constrained private negotiation markets (Menkhaus et al. 2007). If a participant was matched in a later round with a participant who had already traded their units, they did not have the opportunity to trade units in that round. At the end of each trading period, a re-cap screen privately displayed each participant’s earnings from the current period and cumulative earnings so far for the session. It was at this point that participants learned whether some of the units they had traded in the current period had failed.

We construct six treatments in this experimental market setting to test the stated propositions using a between-subjects design (Charness et al. 2012):

-

1.

Production-to-demand market without failure risk (PTDBase). Only matching risk is present.

-

2.

Advance production market without failure risk (APBase). Adds inventory loss risk to PTDBase.

-

3.

Production-to-demand market with failure risk (PTDRisk). Adds failure risk to PTDBase.

-

4.

Advance production market with failure risk (APRisk). Adds failure risk to APBase.

-

5.

Production-to-demand market with failure risk and seller cost reimbursement (PTDRiskSCReimb). Adds seller cost reimbursement—where buyers reimburse sellers for the costs of producing failed credits—to PTDRisk.

-

6.

Advance production market with failure risk and seller cost reimbursement (APRiskSCReimb). Adds seller cost reimbursement to APRisk

Earnings in PTDBase and APBase are calculated as follows. Profit for the buyers is given by the following:

where R is the value or revenue generated from purchasing units of conservation and qt is units traded. The individual buyer’s demand curve for conservation is MR = R′(qt).

Profit for sellers is given by the following:

where p is the agreed upon transaction price for conservation units, qt is units traded, and C(qp) is total cost of producing qp conservation units. In production-to-demand markets (denoted with superscript pd), q pd t = q pd p and so the supply curve is MCpd = C′(q pd t ).

In advance production markets (denoted with superscript ap), q ap t ≤ q ap p , since the quantity of conservation produced is decided prior to trading and sellers may not sell all units they produce. The individual seller’s supply curve for conservation in advance production markets is thus MCap = C′(q ap p ). This inventory loss risk has been found to significantly decrease the quantity that sellers are willing to supply (Menkhaus et al. 2003a, b).

The first order market-clearing conditions require the following:

Given that q ap t ≤ q ap p , C′(q ap t ) ≤ C′(q ap p ), resulting in agents behaving as if MCpd ≤ MCap. Thus we expect that q ap t ≤ q pd t at equilibrium.

In the absence of market risks, the buyer and seller schedules result in a competitive market equilibrium price of 80 tokens and an equilibrium quantity of 20 units (five trades per buyer/seller). This suggests buyer and seller earnings at equilibrium of 150 tokens and total earnings (sum of buyer and seller earnings) of 1200 tokens per trading period (Table 2). Buyer redemption values, seller production costs, and the resulting equilibrium values were selected to be consistent with past market experiment research rather than to replicate realistic values for habitat exchanges, which are generally not publicly available. Results reported below thus indicate generalized market outcomes rather than outcomes with values specific to habitat exchanges.

In the failure risk treatments PTDRisk and APRisk, the seller incurs the cost to produce a unit (before negotiating price in the advance production market or after negotiating the price in the production-to-demand market), but faces the risk that the unit will not maintain habitat quality for its contract life. We represent this risk as ηt. A seller’s expected value of their supply schedule is now:

When a unit fails, the seller cannot sell the unit and receives no revenue yet still incurs its production cost. We employ an average 25% unit failure rate (FR); 50% of sellers in every period lose 50% of credits produced. Davies et al. (2011) conclude that restoration efforts in sagebrush communities with severe (rather than moderate) disturbances are more likely to fail. Thus, we model those units requiring more effort (and so higher production costs) as more likely to fail. In recognition of the fact that more aggressive, higher-cost habitat restoration activities are more likely to fail than less expensive habitat restoration activities (that is, land is already closer to meeting standards before restoration investment), the highest-cost units produced are deemed to be the failed units. The number of units that fail is rounded up. (A seller who trades three units and is randomly selected for half of those units to fail loses two units.)

Failure risk shifts the expected value of supply schedule inward. (The demand schedule remains unchanged.) The decrease in supply is not a linear transformation of the original supply. The premium required to induce supply in the presence of failure risk is equal to ηt, which is decreasing in the number of units traded. For example, if a seller trades only one unit without failure risk, MC1 = 30. With failure risk, the seller must invest more than MC1 into production of the first unit to be assured of producing a non-failing unit:

If MC1 is 30 and the failure rate is 50% (which it is for the first unit because of the rounding up condition), the effective marginal cost of producing a non-failing unit is 30/(1–0.50) = 60. Thus \({\text{MC}}^{\prime }_{1}\) = 60, and η1 = 30. On the other hand, if a seller trades three units, each of the last two units has a 50% chance of failing but the first unit will not fail in any event. In this situation, the total cost of producing three working units is 30 + (1/1 − 0.5)*(40 + 50), for a total cost of 210 tokens.Footnote 9 The same logic yields a total cost of 290 for a seller who trades four units, so the effective marginal cost for producing four working units is 290 − 210 = 80. Thus η4 = \({\text{MC}}^{\prime }_{4} - {\text{MC}}_{4}\) = 20. Incorporating ηt into the augmented expected value of the supply schedule results in a predicted equilibrium quantity traded of 16 and predicted competitive equilibrium price of 100, generating a total surplus of 700 tokens (55 for each buyer and 120 for each seller) (Table 2).

In the reimbursement treatments PTDRiskSCReimb and APRiskSCReimb, the buyer receives no value from a unit that fails to maintain habitat quality for its contract life and also reimburses the seller for the costs incurred to produce the unit. Because a buyer may have purchased the failed unit anywhere in their demand schedule, the risk to the buyer, γt, is not equal to ηt. A buyer’s expected value of the demand schedule is now:

Although the seller’s highest cost units (those associated with the lowest profits) are the ones at risk to fail, buyers are at risk of having to reimburse sellers for the cost of a unit (and losing the revenue generated by that lost unit) anywhere on the buyer’s redemption schedule. Since the risk of failure emanates from the supply side, any unit that a buyer receives from a seller has a failure risk. For example, assume that a buyer trades only one unit. Without failure risk, a buyer’s value for the first unit purchased is 130: MR1 = 130. There is a 25% chance this first unit will fail with failure risk, leaving the buyer with no revenue from the unit’s sale and with the obligation to reimburse the seller for the cost of production: \({\text{MR}}_{1}^{\prime }\) = 130 − 0.25(130 + 30) = 90. Thus γ1 = 40. Yet when a seller trades four units, γt increases. Here the buyer faces the risk that any of the four units sold by the seller will fail: thus the \({\text{MR}}_{4}^{\prime }\) = 100 − 0.25 * (100 + 45) = 63.75, where 45 is the average production cost of the seller’s first four units. Thus γ4 = 36.25. Regardless of how many units are traded, ηt is lower than γt. The market equilibrium price with seller cost reimbursement is 70 tokens and the equilibrium quantity traded is 16 units. Given the differences in these risks, seller cost reimbursement treatments generate a surplus of 660 tokens (80 for each buyer and 85 for each seller), which is less than the surplus of 700 from the failure risk treatments (Table 2).

4 Data Analysis

We compare treatments graphically and empirically using the asymptotic convergence model first employed in economics experiments by Noussair et al. (1995). Convergence analysis weights later periods more heavily than earlier periods to account for participant learning. Within the convergence specification,

\(Z_{it}\) is the dependent variable of interest (quantity of conservation credits or units traded, units produced, average price, total earnings, buyer earnings, or seller earnings) for treatment cross-section i and trading period t. \(B_{0}\) is the asymptotic convergence value of the dependent variable for the baseline treatment, production-to-demand with no failure risk (PTDBase). \(B_{0}\) is weighted more heavily in later periods. \(B_{1}\) is the starting value of the dependent variable for the baseline treatment. The coefficients \(\alpha_{j}\) and \(\varGamma_{j}\) are, respectively, adjustments to the asymptote and starting level for each treatment’s relation to the baseline treatment. In the analysis these coefficients indicate mean difference for the parameter of interest in the baseline treatment. The dummy variable \(D_{j}\) captures potential differences across treatments (equal to zero for the baseline treatment and one for the jth compared treatment), and \(u_{it}\) is an error term.

Panel datasets collected over multiple trading periods may be serially correlated and heteroskedastic. Data may also be contemporaneously correlated between treatment cross sections because the same unit values or costs are used across subjects. Panel-corrected standard error estimates and the Prais-Winston transformation (assuming a common AR(1) coefficient across groups) were used to adjust for these statistical issues (STATA n.d.).

Adjusted treatment coefficients for market outcomes estimated in the convergence model are tested for statistical differences between treatments using a t test. Formal hypothesis testing on convergence analysis parameters is only valid if the residuals for each variable of interest are normally distributed. Using a Shapiro–Wilk test at a 95% confidence level, we fail to reject the null hypothesis that residuals are normally distributed for each variable of interest.

5 Results

A total of 248 subjects recruited at the University of Wyoming participated in 31 market sessions (Table 3).Footnote 10 Each market session generated 20 periods of data, for a total of 620 trading period averages across all market outcomes.Footnote 11 Participants earned an average of $40.54 for a 2-h time commitment.

To describe converged market outcomes over time, estimated converged asymptotes (\(B_{0}\)) are reported for the baseline treatment with additional adjustment coefficients (\(\alpha_{j}\)) for each test treatment (j) in Table 4.Footnote 12 (Treatment averages and their standard deviations are reported in “Appendix B”).

5.1 Impacts of Failure Risk and Seller Cost Reimbursement on Quantity of Conservation Traded

The risk of matching buyers and sellers at different points in trading schedules has been found to reduce quantity traded in privately negotiated markets relative to the predicted competitive equilibrium (Menkhaus et al. 2003a). Our results are consistent with this finding; the converged value for quantity traded in PTDBase, the treatment without inventory loss risk or failure risk, is at 17.14 units (Table 4, column 1), below the competitive equilibrium of 20. Quantity traded in PTDBase is, however, significantly higher than in any other treatment. With the addition of inventory loss risk, quantity traded converges to a significantly lower number of units traded in APBase (13.96 units) than it does in PTDBase. This result of fewer units traded in advance production markets is also consistent with previous research (Menkhaus et al. 2003a).

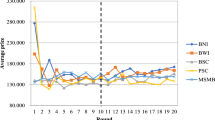

The four failure risk treatments are most relevant to habitat exchange market design. Fewer units are traded relative to PTDBase and APBase when sellers bear the risk of unit failure (APRisk converges at 13.33 units and PTDRisk converges at 11.17). However, when the risk of unit failure is transferred to the buyers, quantity traded increases substantially (APRiskSCReimb converges at 16.20 units and PTDRiskSCReimb converges at 15.28 units), even to the point of surpassing quantity traded in APBase (13.96). This is remarkable, as the predicted equilibrium quantity is the same (16) for both the failure and seller cost reimbursement treatments. The seller cost reimbursement mechanism is designed to protect sellers from credit failure risk, but it also acts to reduce sellers’ perceived risk of inventory loss, encouraging them to increase quantity. By reducing the risk borne by sellers, the seller cost reimbursement treatments encourage more conservation trades overall.

Delivery method creates some interesting differences between treatments in quantity traded. Failure risk reduces quantity traded substantially in the production-to-demand treatments (Fig. 2, left side); in the absence of inventory loss risk, failure risk is significant. (Quantity traded in PTDRisk is about six units below PTDBase; PTDRiskSCReimb increases quantity traded to about two units below PTDBase.) The addition of failure risk has a less dramatic effect on quantity traded in the advance production treatments, however (Fig. 2, right side). (Quantity traded in APRisk is less than one unit below APBase; quantity traded in APRiskSCReimb is higher than in APBase, by about two units.) Sellers in APBase already face inventory loss risk; the impact of adding the additional failure risk in APRisk is thus lessened. The most likely reason for this modest decrease is that the risk associated with inventory loss is a sufficiently strong motivator for sellers to decrease quantity that the addition of failure risk has a relatively small effect. Sellers who bear inventory loss risk under advance production may choose to sell units at a loss rather than not sell the units. Reimbursement thus helps mitigate inventory loss risk as well as failure risk.

Statistical tests show significant differences between all treatments for quantities traded. These results suggest delivery method, failure risk, and seller cost reimbursement significantly affect quantities traded and provide support for our propositions.

5.2 Impacts on Conservation Credit Prices

Prices are generally higher for the failure risk treatments relative to the comparable base treatments. This change is due to the constrained supply of conservation credits available in the market (as predicted) and reflects the need for sellers to receive higher prices to cover the risks they bear. Prices are lower than the predicted price of 100 in the failure treatments (Fig. 3). Price is highest in PTDRisk (92.67) and much lower in APRisk (81.22), reflecting the reduced bargaining power that sellers have when they bear both inventory loss risk and failure risk (Table 4, column 2).Footnote 13 Inventory loss risk associated with advance production allows buyers to exert downward pressure on prices, which are lower in APBase (74.80) than in PTDBase (80.94) and lower in APRisk than in PTDRisk (as noted above).

Prices in the seller cost reimbursement treatments generally come very close to the predicted equilibrium of 70 tokens (Fig. 3); converged prices are 68.13 for PTDRiskSCReimb and 69.31 for APRiskSCReimb. As expected, when buyers reimburse sellers for failed units, demand shifts downward relative to the comparable base treatments. But sellers also produce and trade more units. The net effect is lower prices in the presence of seller cost reimbursement relative to the failure risk treatments. These results support our proposition; delivery method and failure risk do affect exchange outcomes.

5.3 Earnings and Efficiency Changes from Failure Risk and Risk-Sharing

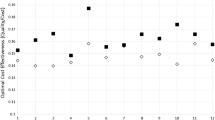

Total earnings, or total surplus, are a measure of market efficiency. Total earnings (sum of all buyer and seller earnings within a market session) are noticeably lower in the four treatments with failure risk than they are in PTDBase (1074.06 tokens) and APBase (1001.20 tokens) (Table 4, column 3). The difference is due to the loss in production costs (borne by sellers in the failure treatments and by buyers in the reimbursement treatments) on failed units. Total earnings for the risk treatments PTDRiskSCReimb (545.76 tokens), PTDRisk (510.16 tokens) and APRisk (488.06 tokens) are not statistically significantly different from one another. APRiskSCReimb (647.60 tokens) does however result in higher total earnings than the other three treatments with failure risk. We return to this result below.

Total earnings in PTDBase and APBase are 90% and 83% of the 1200-token surplus predicted for the comparable base treatments. In PTDBase, the lower total earnings is due to matching risk. In APBase, lower earnings is due to matching risk and inventory loss risk (Menkhaus et al. 2003a).

Failure risk reduces predicted quantity traded well below the equilibrium predicted for the comparable base treatments, from 20 to 16 units; as such the predicted total surplus is greatly reduced, from 1200 to 700 tokens. It is appropriate to compare experimental results for the failure risk treatments to the lower prediction, as this represents the maximum surplus available given the risky environment. Total earnings in PTDRisk and APRisk are only 73% and 70% of the maximum surplus available in the failure risk treatments (Fig. 4). These efficiency percentages are lower than those for the comparable base treatments; buyers and sellers have more difficulty realizing surplus in the presence of failure risk, even controlling for the lower maximum surplus available. Overall market efficiency is greatly reduced in the presence of failure risk.

Seller cost reimbursement was predicted to decrease total earnings relative to the treatments in which sellers bore the risk of credit failure. However, our experimental results do not support these theoretical predictions. Introducing seller cost reimbursement increases quantity traded, expands total earnings, and improves market efficiency overall compared to the presence of credit failure risk alone. The increases are significant: total earnings rise to 545.76, reaching 83% of the predicted equilibrium of 660 tokens in PTDRiskSCReimb and 647.60 (or 98%) in APRiskSCReimb (Fig. 4). In short, seller cost reimbursement improves efficiency by 10–28% points relative to PTDRisk and APRisk, treatments. Seller cost reimbursement appears to mitigate both inventory loss and failure risk effects in APRiskSCReimb significantly, as total earnings are 15% points closer to the predicted equilibrium than they are in PTDRiskSCReimb. This result is surprising, given that PTDRiskSCReimb appears at first blush to possess less risk overall compared to APRiskSCReimb.

To explain APRiskSCReimb results, we turn to our experimental design—recall credits lost to failure risk are those with the highest production costs. A seller in APRiskSCReimb is cognizant of being reimbursed for highest production costs incurred from failure risk, while simultaneously maximizing sold credit profit to make up for any inventory loss risk. Thus, the participant achieves earnings equal to or, as in our results, higher than, PTDRiskSCReimb by trading with buyers at volumes and prices slightly higher than in PTDRiskSCReimb. These results point to the overall benefits of seller cost reimbursement and support our final proposition.

5.4 Impacts of Failure Risk and Risk-Sharing on Agent Incentives to Participate

As expected, seller earnings are highest in PTDBase (138.96 tokens) and APBase (107.26 tokens) (Fig. 5; Table 4, column 4). Once failure risk is introduced, sellers supply far fewer units to the market. In PTDRisk, absent inventory loss risk, sellers are able to receive significantly higher prices than in APRisk, mitigating some of the loss in earnings associated with fewer trades. Sellers on average receive 69.52 tokens in PTDRisk, about half of what they receive in PTDBase. Seller earnings are reduced even more dramatically in APRisk, where they receive approximately only one-third of their earnings in APBase (37.65 tokens). This dramatic reduction is brought on again by a reduction in supply, but is further compounded by lower prices due to reduced bargaining power of sellers in the advance production market. These dramatic changes in earnings for sellers point to the potential impact failure risk may have on the incentive for landowners to participate in these types of markets. Seller cost reimbursement, however, greatly improves seller outcomes in the advance production market when failure risk is present—earnings improve from 37.65 tokens in APRisk to 84.16 tokens in APRiskSCReimb.

Buyer earnings are highest in APBase and only somewhat lower in PTDBase (converging at 143.40 and 129.24 tokens, respectively) (Fig. 5; Table 4, column 5). This mirrors earlier findings that advance production (relative to production-to-demand) improves buyer earnings (Menkhaus et al. 2003a). Our result that buyer earnings are higher in APRisk than in PTDRisk (84.31 and 57.45, respectively) is also consistent with these earlier findings. But with the addition of seller cost reimbursement, advance production no longer significantly improves buyer earnings over the comparable production-to-demand treatment, PTDRiskSCReimb. Further, buyer earnings are actually not harmed when buyers reimburse sellers for failed units. (Buyer earnings are not significantly different in APRiskSCReimb and APRisk, and not significantly different in PTDRiskSCReimb and PTDRisk.) Generally the act of mitigating failure risk for sellers through seller cost reimbursement helps sellers yet does not hurt buyers. Seller cost reimbursement has the added benefit—valued by regulators—of increasing the quantity of conservation provided and traded.

6 Conclusion

Seller earnings must be sufficiently high to attract landowner participation if habitat exchanges are to be successful. The expected value of conservation credits must exceed habitat restoration costs and the opportunity cost of putting the associated land to agricultural purpose. However, generating, verifying, and maintaining high-quality habitat can be a risky proposition—and therefore expensive—in the semi-arid conditions that persist in much of the western U.S. Finding ways to reduce seller exposure to some of these risks could help increase conservation credit transactions in habitat exchanges. This study uses laboratory experiments to examine three principal risks present in habitat exchanges: (1) matching risk inherent in the private negotiation trading institution likely to prevail in habitat exchanges; (2) inventory loss risk stemming from the requirement that sellers produce and verify credits before finding a buyer and negotiating price; and (3) the post-production risk that credits fail to maintain habitat quality during their contract life. We find several key results relevant to the establishment of successful habitat exchanges.

First, requiring buyers to reimburse sellers for credits that fail post-production improves market outcomes, even for buyers, because sellers produce and trade more units when this post-production risk is mitigated. Seller cost reimbursement has some potential to improve welfare and overall market efficiency, which in turn increases buyer earnings through the higher quantities traded. This is particularly true if landowners also face the inventory loss risk associated with advance production, though the same result holds even if the inventory loss risk associated with advance production is absent.

Second, experiment outcomes in the advance production treatment with seller cost reimbursement were closer to predicted outcomes than were the other risk treatments. Seller cost reimbursement seems to mitigate some inventory loss risk associated with advance production in addition to the post-production failure risk for which it was designed. The seller cost reimbursement mechanism is designed to protect sellers from failure risk, but it also acts to reduce sellers’ perceived risk of inventory loss, encouraging them to increase quantity. This result is unexpected but points to the necessity of performing such experiments rather than relying solely on theoretical calculations to inform market design. It is also an important finding, because regulators prefer that conservation credits traded through habitat exchanges be verified, making inventory loss risk an unavoidable feature of habitat exchanges. This finding should also be of interest to regulators and environmental NGOs interested in increasing habitat. Inventory loss creates a cost to sellers, but unsold conservation credits still have ecological value on the landscape.

Although the results clearly indicate the benefits of having buyers reimburse sellers for failure risk, none of the habitat exchanges currently in development contemplate seller cost reimbursement. Broadly speaking, energy companies prefer to fulfill their compensatory mitigation requirements upfront rather than having a long-term relationship with a conservation credit seller (Hansen et al. 2015). Thus, it is unlikely companies would reimburse landowners without regulatory incentive to do so. Yet our results suggest in certain instances buyers could be better off if they are required to reimburse landowners for failed credits.

It is also interesting to note that most western U.S. states developing sage-grouse habitat exchanges have established seed funds that will be used to reimburse sellers when management practices undertaken do not result in habitat improvements. This study demonstrates that expanded use of these seed funds to address post-production credit failure risk in addition to credit production risk could be beneficial for increasing market volume and establishing a successful institution. If states or federal entities are unable to sustain some type of fund for reimbursing landowners (sellers), our results suggest an alternate strategy that might have merit would be to require energy companies (buyers) to reimburse landowners. This type of risk sharing is not uncommon in other arrangements familiar to landowners. For example, agricultural land lease arrangements often allow for both landlords and tenants to share in risks (Bastian and Olson 1991).

Even without seller cost reimbursement or some other mechanism in place to assist sellers with failure risk, results show the significant impact that failure risk can have on these markets. Our failure rate was chosen to elicit a response rather than to replicate current habitat restoration rates. Future treatments could explore the extent to which different failure rates affect the market linearly, consistent with risk-neutral agents under expected utility theory, versus risk-averse agents under expected utility or prospect theory.

Although Nagler et al. (2013) found no treatment effect differences between sessions conducted with students and those conducted with agricultural professionals, their study did not consider failure risk. Future treatments could include agricultural producers and other business people as participants, to identify whether the anomalies identified in this study also occur with agricultural professionals.

Demand for compensatory mitigation is driven by regulatory requirements and may consequently be relatively inelastic. Regulators, however, generally allow developers to choose from among several mitigation programs, including conservation banks, in-lieu fee programs, and proponent-funded reclamation. The availability of close substitutes for compensatory mitigation programs (or where alternatives do not currently exist, the threat of close substitutes) serves to keep habitat exchange demand more elastic than it would otherwise be. These conditions suggest the potential for different supply and demand conditions than exist in our laboratory setting. Future research could alter the schedules used here to test the impact of differing supply and demand conditions on market outcomes given failure risk. While the magnitudes of outcomes might be altered compared to our results, we expect our findings regarding the importance of potential reimbursement for landowners would be relatively robust across a potential range of supply and demand conditions. Overall, we believe that without some mechanism to mitigate failure risk, habitat exchanges, at the very least, could result in much less conservation than hoped for, and, in the extreme, habitat exchanges could fail to attract sufficient landowners to supply credits, ultimately dooming them to fail.

Notes

One such well-known PES program is the Conservation Reserve Program (CRP) in the United States, which over the past decade has made payments of more than $1.6 billion annually to agricultural producers who adopted conservation-minded management practices on around 25 million acres (USDA FSA 2017). Past research has focused on increasing cost-effectiveness of such government programs through, for example, science-based spatial targeting of enrolled lands (Claassen et al. 2001; Parkhurst et al. 2002; Banerjee et al. 2015), the effect of information on auction efficiency (Cason et al. 2003; Cason and Gangadharan 2004; Messer et al. 2017; Conte and Griffin 2017), reducing complexity for potential participants (McCann and Claassen 2016; Palm-Forster et al. 2016), and exploring non-price methods for increasing conservation quality and compliance (Banerjee 2017; Wallander et al. 2017).

Landowners have expressed a preference for private negotiation rather than auction within the habitat exchange structure, perhaps because they believe their negotiating power to be stronger under private negotiation in the thin and geographically constrained markets likely to prevail (at least initially). Habitat exchanges should reduce transaction costs and uncertainty for sellers (thereby inducing greater participation) by establishing set protocols and ecological valuation standards. Centering compensatory mitigation activity within a habitat exchange where protocols and standards have been established should reduce search costs for buyers and sellers, even without benefit of an auction institution. There is no guidance regarding price in the habitat exchanges currently being developed in the western United States though all market participants have a very good idea of the range of prices likely to prevail. (The floor on these estimates is the opportunity cost to the seller of foregoing alternative land uses.)

In the presence of significant production risk, the commodity traded under a production-to-demand contract (conservation practices) is markedly different than the commodity traded under an advance production contract (conservation outcomes). Advance production may be more likely to develop organically in situations where production risk is significant, as buyers would be less likely to accept a production-to-demand contract when production risk is significant. However, this risk is separate from the inventory loss risk identified and studied by Menkhaus et al. (2003a) and others.

Seller participants saw this $15 as an initial endowment at the start of the experiment, from which they could produce units and cover potential losses. If any participant had cumulative losses beyond this initial endowment during the 20-period session, trading would cease. This procedure is consistent with Friedman and Sunder’s (1994) recommendation to avoid bankruptcy in induced value experiments to limit the experimenter’s loss of control over subject preferences and behavior. One participant in one experimental session had cumulative losses beyond the initial endowment and so trading for all participants in that session ceased before period 20. The data from that session was consequently not included in the experimental analysis.

We did not use perfect stranger matching; subjects are randomly paired with the same trading partner more than once because of the small number of subjects per market and the large number of random pairings per session. However, the pairings are anonymous, and the participants are not provided with any identifying information about their trading partners.

Equation (5) calculates the marginal cost to the seller of producing the first non-failing unit. The formula changes for subsequent units due to the rounding up condition and the fact that the most costly units to produce are the ones at risk of failure. The general formula for the marginal cost to produce one non-failing unit is thus \({\text{MC}}^{\prime }_{\text{t}} = {\text{TC}}^{\prime }_{\text{t}} - {\text{TC}}^{\prime }_{{{\text{t}} - 1}}\), where \({\text{TC}}^{\prime }_{\text{t}}\) is the sum of the marginal costs of producing the units not at risk of failure, plus the sum of the units subject to failure multiplied by the failure rate, when producing a total of t units.

Alm et al. (2015), among others, object to the use of undergraduate students in experiments. Such criticism has largely been of value elicitation experiments. In induced value laboratory market experiments with a private negotiation trading institution similar to this one, Nagler et al. (2013) find the same treatment effects with student participants as with agricultural professionals.

Market sessions for treatments 1 and 2 (PTDBase, APBase) were conducted in 1999 and 2010, and initially reported in Phillips and Menkhaus (2010). Experimental procedures for treatments 1 and 2 were comparable to experimental procedures for the subsequent treatments. Parameter values for treatments 3 through 6 were chosen to be consistent with treatments 1 and 2. Show-up fees were $7.00 and participants earned an average of $21 in these sessions.

The combination of participant learning and heterogeneity in participant strategies led to particularly high within-treatment variability during the first five periods. We consequently drop the first five periods of each market session in the convergence analysis. Additionally, data collected after trading period 20 owing to the random stop were dropped to maintain consistent time series datasets.

Of the 1469 units traded during the five failure risk sessions, 43 units (2.9%) were traded below the seller’s production cost. At least one of these below-cost sales occurred in each advance production session.

References

Alm J, Bloomquist KM, McKee M (2015) On the external validity of laboratory tax compliance experiments. Econ Inq 53(2):1170–1186

Banerjee S (2017) Improving spatial coordination rates under the agglomeration bonus scheme: a laboratory experiment with a pecuniary and a non-pecuniary mechanism (nudge). Am J Agric Econ 100(1):172–197

Banerjee S, Kwasnica AM, Shortle JS (2015) Information and auction performance: a laboratory study of conservation auctions for spatially contiguous land management. Environ Resour Econ 61(3):409–431

Bastian CT, Olson CE (1991) An evaluation of three methods of leasing cropland: crop share, fixed cash and variable cash. J Am Soc Farm Manag Rural Apprais 54:35–42

Bureau of Land Management (BLM) (2016) MS-1794 Mitigation manual (final). https://www.blm.gov/media/blm-policy/manuals (General Management Manuals, 1000 Series-MS-1794, Mitigation). Cited 14 Sept 2017

Cason TN, Gangadharan L (2004) Auction design for voluntary conservation programs. Am J Agric Econ 86(5):1211–1217

Cason TN, Gangadharan L, Duke C (2003) A laboratory study of auctions for reducing non-point source pollution. J Environ Econ Manag 46:446–471

Charness G, Gneezy U, Kuhn MA (2012) Experimental methods: between-subject and within-subject design. J Econ Behav Organ 81:1–8

Christensen T, Pedersen AB, Nielsen HO, Mørkbak MR, Hasler B, Denver S (2011) Determinants of farmers’ willingness to participate in subsidy schemes for pesticide-free buffer zones—a choice experiment study. Ecol Econ 70(8):1558–1564

Claassen R et al (2001) Agri-environmental policy at the crossroads: guideposts on a changing landscape. Economic Research Service, USDA, Agricultural Economic Report Number 794, Washington, DC

Colorado Habitat Exchange (CHE) (2017) About the Colorado habitat exchange—home. https://www.thepwc.org/habitat-exchange/. Cited 14 Sept 2017

Conte MN, Griffin R (2017) Quality information and procurement auction outcomes: evidence from a payment for ecosystem services laboratory experiment. Am J Agric Econ 99(3):571–591

Davies K, Boyd CS, Beck JL, Bates JD, Svejcar TJ, Gregg MA (2011) Saving the sagebrush sea: an ecosystem conservation plan for big sagebrush plant communities. Biol Conserv 144(2):2573–2584

Environmental Defense Fund (EDF) (2017) Habitat exchanges: creating conservation incentives that work for people, wildlife and the economy. http://www.habitatexchanges.org/. Cited 14 Sept 2017

Federal Register (1995) Federal guidance for the establishment, use and operation of mitigation banks. 60(228):58605–58614. November 28, 1995. https://www.epa.gov/cwa-404/federal-guidance-establishment-use-and-operation-mitigation-banks. Cited 29 Jan 2018

Federal Register (2016) Endangered and threatened wildlife and plants; Endangered Species Act compensatory mitigation policy. 81(248), December 27, 2016. https://www.gpo.gov/fdsys/pkg/FR-2016-12-27/pdf/2016-30929.pdf. Cited 14 Sept 2017

Friedman D, Sunder S (1994) Experimental methods: a primer for economists. Cambridge University Press, Cambridge

Hahn RW (1989) Economic prescriptions for environmental problems: how the patient followed the doctor’s orders. J Econ Perspect 3(2):95–114

Hanley N, Banerjee S, Lennox GD, Armsworth PR (2012) How should we incentivize private landowners to “produce” more biodiversity? Oxford Rev Econ Policy 28(1):93–113

Hansen K, Purcell M, Paige G, MacKinnon A, Lamb J, Coupal R (2015) Development of a market-based conservation program in the Upper Green River Basin of Wyoming: Feasibility study. Bulletin B-1267. University of Wyoming Extension, Laramie. http://www.wyoextension.org/publications/Search_Details.php?pubid=1876. Cited 14 Sept 2017

Hansen K, Bastian C, Jones-Ritten C, Nagler A (2017) Designing markets for habitat conservation: lessons learned from agricultural markets research. Bulletin B 1297. University of Wyoming Extension, Laramie

Hansen K, Duke E, Bond C, Purcell M, Paige G (2018) Landowner preferences for a payment-for-ecosystem services program in Southwestern Wyoming. Ecol Econ 146:240–249

Jack BK, Kousky C, Sims KRE (2008) Designing payments for ecosystem services: lessons from previous experience with incentive-based mechanisms. Proc Natl Acad Sci 105(28):9465–9470

Jones LR, Vossler CA (2014) Experimental tests for water quality trading markets. J Environ Econ Manag 68(3):449–462

Kagel JH, Roth A (1995) Introduction to experimental economics. In: Kagel JH, Roth AE (eds) The handbook of experimental economics, Chapt 1. Princeton University Press, Princeton, New Jersey

Krupnick A, Oates W, Van De Verg E (1983) On marketable air pollution permits: the case for a system of pollution offsets. J Environ Econ Manag 10:233–247

Lyon RM (1982) Auctions and alternative procedures for allocating pollution rights. Land Econ 58(1):16–32

McCann L, Claassen R (2016) Farmer transaction costs of participating in federal conservation programs: magnitudes and determinants. Land Econ 92(2):256–272

McGartland AM, Oates WE (1985) Marketable permits for the prevention of environmental deterioration. J Environ Econ Manag 12:207–228

Menkhaus DJ, Phillips OR, Bastian CT (2003a) Impacts of alternative trading institutions and methods of delivery on laboratory market outcomes. Am J Agric Econ 85(5):1323–1329

Menkhaus DJ, Phillips OR, Johnston AFM, Yakunina AV (2003b) Price discovery in private negotiation trading with forward and spot deliveries. Appl Econ Perspect Policy 25(1):89–107

Menkhaus DJ, Phillips OR, Bastian CT, Gittings LB (2007) The matching problem (and inventories) in private negotiation. Am J Agric Econ 89(4):1073–1084

Messer KD, Duke JM, Lynch L, Li T (2017) When does public information undermine the efficiency of reverse auctions for the purchase of ecosystem services? Ecol Econ 134:212–226

Montana Sage Grouse Habitat Conservation Program (MSGHCP) (2017) Montana Sage Grouse Habitat Conservation Program—Montana.gov official state website https://sagegrouse.mt.gov/. Cited 14 Sept 2017

Montgomery WD (1972) Markets in licenses and efficient pollution control programs. J Econ Theory 5:395–418

Nagler AM, Menkhaus DJ, Bastian CT, Ehmke M, Coatney KT (2013) Subsidy incidence in factor markets: an experimental approach. J Agric Appl Econ 45(1):17–33

Nagler AM, Bastian CT, Menkhaus DJ, Feuz B (2015) Managing marketing and pricing risks in evolving agricultural markets. Choices 30(1):1–6

Natural Resources Conservation Service (NRCS) (2017) More than 80 years helping people help the land: a brief history of NRCS. USDA NRCS. https://www.nrcs.usda.gov/wps/portal/nrcs/detail/national/about/history/?cid=nrcs143_021392. Cited 14 Sept 2017

Nevada Conservation Credit System (NCCC) (2017) State of Nevada conservation credit system—home. Environ Incent. https://www.enviroaccounting.com/NVCreditSystem/Program/Home. Cited 14 Sept 2017

Noussair CN, Plott CR, Riezman RO (1995) An experimental investigation of the patterns of international trade. Am Econ Rev 85:462–491

Palm-Forster LH, Swinton SM, Redder TM, DePinto JV, Boles CMW (2016) Using conservation auctions informed by environmental performance models to reduce agricultural nutrient flows into Lake Erie. J Great Lakes Res 42:1357–1371

Parkhurst GM, Shogren JF, Bastian C, Kivi P, Donner J, Smith RBW (2002) Agglomeration bonus: an incentive mechanism to reunite fragmented habitat for biodiversity conservation. Ecol Econ 41:305–328

Phillips OR, Menkhaus DJ (2010) The culture of private negotiation: endogenous price anchors in simple bilateral bargaining experiments. J Econ Behav Organ 76:705–715

Roth A (2015) Experiments in market design. In: Kagel JH, Roth AE (eds) The handbook of experimental economics, Chapt 5, vol 2. Princeton University Press, Princeton, New Jersey

Sabasi DM, Bastian CT, Menkhaus DJ, Phillips OR (2013) Committed procurement in privately negotiated markets: evidence from laboratory markets. Am J Agric Econ 95(5):1122–1135

Sage Grouse Initiative (SGI) (2017) Sage grouse initiative: wildlife conservation through sustainable ranching. Sage Grouse Initiative. http://www.sagegrouseinitiative.com/. Cited 14 Sept 2017

STATA (n.d.) Xtpcse—linear regression with panel-corrected standard errors. https://www.stata.com/manuals13/xtxtpcse.pdf

Torres AB, MacMillan DC, Skutsh M, Lovett JC (2013) Payments for ecosystem services and rural development: landowners’ preferences and potential participation in Western Mexico. Ecosyst Serv 6:72–81

US Department of Agriculture Farm Service Agency. (USDA FSA) (2017) Conservation reserve program statistics. CRP enrollment and rental payments by state, 1986–2016. https://www.fsa.usda.gov/programs-and-services/conservation-programs/reports-and-statistics/conservation-reserve-program-statistics/index. Cited 29 Jan 2018

US Department of the Interior (US DOI) (2015) Historic conservation campaign protects greater sage-grouse. https://www.doi.gov/pressreleases/historic-conservation-campaign-protects-greater-sage-grouse. Cited 14 Sept 2017

US Fish and Wildlife Service (USFWS) (2003) Guidance for the reestablishment, use, and operation of conservation banks. https://www.fws.gov/endangered/esa-library/pdf/Conservation_Banking_Guidance.pdf. Cited 14 Sept 2017

Wallander S, Ferraro P, Higgins N (2017) Addressing participant inattention in federal programs: a field experiment with the conservation reserve program. Am J Agric Econ 99(4):914–931

Wunder S (2005) Payments for environmental services: Some nuts and bolts. Center for International Forestry Research. CIFOR occasional paper no. 42. https://www.cifor.org/publications/pdf_files/OccPapers/OP-42.pdf. Cited 26 Jan 2018

Wyoming Conservation Exchange (WCE) (2017) Wyoming conservation exchange manual v 2.0. WCE. http://www.wyomingconservationexchange.org/about/documents/. Cited 14 Sept 2017

Acknowledgements

The authors would like to thank Rick Matza for technical assistance, and participants at the 2017 Conference on Behavior & Experimental Agri-Environmental Research, the editors, and two reviewers, for invaluable comments on the paper. Any remaining errors are those of the authors. Funding is from the Center for Behavioral and Experimental Agri-Environmental Research (CBEAR).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A: Experiment Instructions

1.1 SpotRisk Treatment, Updated February 2017

1.1.1 Introduction

This is an experiment in the economics of market decision making. In this experiment, we will set up a market in which some of you will be BUYERS and some of you will be SELLERS.

The commodity you are trading is referred to as a “unit”. Sellers make earnings by producing units at a cost and selling these units to buyers. Buyers make earnings by purchasing units from sellers and then redeeming (or reselling) these units to the experimenter. Earnings are recorded in a fictitious currency called tokens. Tokens are exchanged for cash at the rate of 100 tokens = $1.00. Your earnings will be paid to you in CASH at the end of the experiment. To begin, every seller and buyer will be given an initial balance of 1500 tokens ($15.00). You may keep this money PLUS any you earn.

Buyers and sellers will be randomly paired and will exchange units for tokens in computerized markets over a sequence of trading periods. Each trading period consists of three trading rounds or rounds during which pairs of buyers and sellers negotiate trading prices. Each trading period consists of what is commonly referred to as a spot market. The spot market occurs after sellers have produced units. A trade in the spot market is a momentary decision between buyer and seller. In other words, the seller produces an amount of units that the buyer can buy all, some, or none of.

All trading is conducted over the computer network. Each trading period will consist of a production period followed by random pairings of buyers and sellers and negotiations for trade prices. During the production period, the sellers determine the number of units to produce and the buyers wait. After the sellers have produced the units, buyers and sellers are randomly paired in each of the 31-min bargaining rounds during which each buyer and seller pair negotiate for trade prices.

At the end of each trading period, any unit sold is automatically produced, and the cost of production is deducted from the seller’s token balance. In addition, the computer will automatically account for sales or purchases that you have made and adjust your token balance accordingly. A listing of sales or purchases you have made and your adjusted token balance will be displayed on the computer screen at the end of every trading period. After you have viewed this information and clicked on OK, a new trading period with three trading rounds will begin. This experiment will consist of several trading periods. We will conduct a practice trading period to familiarize you with the mechanics of the computerized market before the actual experiment begins. During the practice trading period the information you see will be different than that in the actual experiment.

1.2 Specific Instructions to Buyers

During each trading period you are free to purchase up to 8 units. There is a 25% chance that, even after you successfully negotiate a trade price on a specific unit, the trade will not be completed. If a trade is not completed, you do not incur any costs but you do not receive the unit. For the first unit that you buy during a trading period, you will receive the amount listed under UNIT VALUE for Unit 1. In this example, this amount is 55 tokens. Unit 1’s redemption value is 55 tokens. For the second unit that you buy you will receive the amount listed under UNIT VALUE for Unit 2, which is 50 tokens. The redemption values for these and subsequent units will be displayed on your computer screen.

The earnings from each unit that you purchase (which are yours to keep) are computed by taking the difference between the redemption value and purchase price of the unit bought. That is,

Suppose, for example, that you buy 2 units in a trading period. If you pay 35 tokens for the first unit and 30 tokens for the second unit your earnings are:

Recall that there is a 25% chance that each unit fails. If no units fail, your total earnings are:

If one unit fails, your total earnings will be only the 20 tokens that you receive from the first trade:

During the experiment this trading information will be summarized on the computer screen at the end of each trading period. If a trade has failed, it will be listed on the buyer’s screen as “FAILED” when the trading period has ended. Buyers also should be aware that they will not be allowed to spend more tokens buying units than what they have in their beginning balance in any one period.

1.3 Specific Instructions to Sellers

During each trading period you are free to sell up to 8 units. Remember, you must decide on the number of units you wish to produce and then sell in the production period. There is a 25% chance that, even after you successfully negotiate a trade price on a specific unit, the trade will not be completed. If you are a seller, you could see more than one of your units fail in some periods and no unit failures in other periods. However, know that overall, the chance that a unit fails is approximately 25%. If a trade is not completed, you incur production costs but do not sell the unit or receive the sale price. Because you must decide on the number of units to produce before you sell them in the production period, you will also incur production costs for all units you produce, even the ones you do not sell in the trading period. The first unit that you sell during a trading period will cost you the amount listed under UNIT COST for Unit 1. In this example, this cost is 15 tokens. Unit 1’s unit cost is 15 tokens. The second unit that you sell will cost you the amount listed under UNIT COST for Unit 2, which is 20 tokens and Unit 3 is 25 tokens. The unit costs for these and subsequent units will be displayed on your computer screens.

The earnings from each unit that you sell (which are yours to keep) are computed by taking the difference between the sale price and unit cost of the unit sold. That is,

Let’s suppose that in the spot market you sell Unit 1 for 45 tokens, Unit 2 for 40 tokens and Unit 3 for 35 tokens. Your earnings would then be:

Recall that there is a 25% chance that each unit fails. If no units fail, your total earnings are:

If one unit fails, your total earnings will be the 50 tokens that you receive from the first and second trades minus the 25 tokens you lose in production costs of Unit 3:

During the experiment this trading information will be summarized on the computer screen at the end of each trading period. If a trade has failed, it will be listed on the seller’s screens as “FAILED” when the trading period has ended. Sellers also should be aware that they will not be allowed to incur a production cost greater than the amount in their beginning token balance in any one period.

1.4 Trading Rules for the Market

Only one unit may be bought and sold at a time. A buyer makes bids to the seller to purchase a unit. A “bid” is a proposed price at which a buyer is willing to purchase a unit. Bids must become progressively higher. In other words, if the first bid for a unit is 50 tokens, then the second bid must be higher than 50. Suppose the second bid is 55 tokens, then the third bid must be higher than 55, and so on.

A seller makes offers to the buyer to sell a unit. An “offer” is a proposed price at which a seller is willing to sell a unit. Offers must become progressively lower. In other words, if the first offer to sell a unit is for 60 tokens, then the second offer must be lower than 60. Suppose the second offer is 55 tokens, then the third offer must be less than 55, and so on.

There is one further set of restrictions on bids and offers. The reason for these restrictions is just common sense. A buyer’s bid cannot be higher than what is labeled on the computer screen as the BEST OFFER. In other words, a buyer cannot attempt to pay a price that is higher than that for which the seller is willing to sell. Similarly, a seller’s offer cannot be lower than what is labeled as the BEST BID. In other words, a seller cannot attempt to sell at a price below that which the buyer is willing to pay. In fact, the computer will not allow such bids and offers.

After a seller and buyer have made a trade, the trading price will be listed on both the buyer’s and seller’s screens. If a trade has failed, it will be listed on both the buyer’s and seller’s screens as “FAILED” when the trading period has ended. After a trade has been made, bid and offer values are cleared from the screen. A buyer and seller pair may then resume entering bids and offers for additional units. Trades are made between buyer and seller pairs for 1 min. After a minute has elapsed, buyers and sellers are again randomly paired and the next trading round begins.

Each spot market or trading period has a maximum time limit of 3 min or 31-min trading rounds. A market will be terminated automatically if profitable trades cannot be made by the randomly matched buyer and seller. Because buyers incur a purchase price for units and sellers incur costs to produce units for sale, it is possible to reach a token balance of 0. If a player reaches a 0 token balance, they cannot continue to buy or produce units in the market and the experimental session will end. There will be at least 20 periods in the experiment. There is a 1 in 5 chance that period 20 will be the last period. For every period after 20, the probability of a random stop is 1 in 5.

1.5 Your Name and Student ID Number

Before the practice trading period, the computer will ask for your name and student ID number. This information is kept confidential, but it is important to the funding agency as proof of your participation. The bids and earnings of people in the experiment are confidential. Please do not look at someone else’s screen and do not speak to another participant once the experiment begins. You may ask the experimenter questions at any time during the experiment. Are there any questions before we conduct the practice trading period?

1.6 Screenshots Shown to Experimental Participants (as a PowerPoint Projection) During the Instructions

Appendix B: Descriptive Statistics

Period average (standard deviation) across treatments for market outcomes

Treatment | Quantity traded | Price | Total earnings | Seller earnings | Buyer earnings |

|---|---|---|---|---|---|

PTDBase | 16.61 | 79.36 | 132.81 | 130.53 | 135.14 |

(0.79) | (1.26) | (3.99) | (8.22) | (4.75) | |

APBase | 14.56 | 74.16 | 118.39 | 92.73 | 147.21 |

(0.46) | (1.42) | (6.60) | (10.10) | (6.25) | |

PTDRisk | 13.19 | 84.84 | 68.27 | 52.39 | 84.56 |

(1.29) | (3.84) | (7.13) | (11.70) | (15.83) | |

APRisk | 14.78 | 76.81 | 65.00 | 26.43 | 104.19 |

(1.07) | (3.93) | (6.01) | (15.22) | (15.75) | |

PTDRiskSCReimb | 15.68 | 68.10 | 71.61 | 71.62 | 72.17 |

(0.91) | (0.75) | (5.28) | (3.72) | (10.46) | |

APRiskSCReimb | 17.07 | 70.39 | 72.91 | 75.97 | 70.43 |

(0.67) | (1.22) | (5.19) | (6.09) | (8.49) |

Rights and permissions

About this article

Cite this article

Lamb, K., Hansen, K., Bastian, C. et al. Investigating Potential Impacts of Credit Failure Risk Mitigation on Habitat Exchange Outcomes. Environ Resource Econ 73, 815–842 (2019). https://doi.org/10.1007/s10640-019-00332-z

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-019-00332-z