Abstract

The increasing carbon emissions cause severe environmental issues that threaten the survival of human beings. Such a situation promotes supply chain firms and governments to take various measures to achieve the sustainable goal. This paper investigates the cost-sharing cooperation strategy of emission reductions in a dynamic supply chain consisting of a manufacturer and two distinct retailers with different scales. In the presence of carbon tax and green reputation, we model a Stackelberg differential game to derive and compare the optimal equilibrium decisions and further conduct a numerical study to analyze the chain members’ profits between the cases of no cost sharing and cost sharing. The manufacturer can actualize this sharing, respectively, with either of the competitive retailers. The results show that cost sharing is a better choice for supply chain members than no sharing. In the cost-sharing scenario, the manufacturer and two retailers prefer the case in which the emission reduction cost that a retailer undertakes is relatively high, because the manufacturer can increase emission reduction level to build its green reputation, and thereby the retailers can improve profits. When the proportion of emission reduction cost that a retailer undertakes locates in a certain interval, all the supply chain participants can be better off in the scenario where small-scale retailer shares the emission reduction cost. In addition, the increase in carbon tax improves the flexibility of cost-sharing ratio for the members achieving this consensual scenario on the cost-sharing cooperation.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Nowadays, the rapid economic growth has brought a series of sustainable problems, such as excessive carbon emissions and environmental pollutions. Carbon emissions cause global warming, sea level rising, and soil erosion, thereby threatening the survival of human beings and other species (Cao et al., 2020). For example, the economy of China has dramatically developed after taking the initiation of economic reforms in 1978 and thus, overtook Japan as the world’s second-largest economy according to the reports by the World Bank (Springer et al., 2019). Although China’s GDP per capita is still 25% as that of the USA, China has become the largest energy consumer as early as in 2010 and contributed to 20.3% of the total energy consumption worldwide (Zhang et al., 2017).

A number of countries have begun to take corresponding measures, such as carbon capping, carbon trading, and carbon tax to cure excess emissions (Wang et al., 2018). Among these measures, carbon tax as a worldwide consensus impacts the export and import of goods and improves the competitiveness of countries (Kuo et al., 2016), such as Sweden, Japan, Norway, Netherlands, Denmark, Finland, and Colombia (Baranzini et al., 2000; Zhou et al., 2019). Several important international conferences such as the Paris Agreement and the Kyoto protocol have reached an agreement that encourages firms to reduce carbon emissions (Wang et al., 2018). Meanwhile, the Chinese government has also announced at the Paris Agreement in 2015 that the carbon emissions will reach the peak around 2030 and will take effective measures to lower emissions per unit GDP by 60–65% compared with the level in 2005 (Ding et al., 2019). Moreover, the consumer environmental awareness has played an important role on the sales of products. For example, the Conscious Consumer Report represents that 51% of Americans are willing to pay more for green products and 67% of Americans regard environmental benefit as an important factor before purchasing (Zhang et al., 2015). When buying products, 83% of Europeans pay attention to the environmental effects, especially carbon footprints (Deng & Liu, 2019). Although the price of green product is relatively high, 75% of Europeans decided to purchase them in 2008 compared to 31% in 2005 (Liu et al., 2012). Owing to regulation pressures and consumer environmental awareness, emission reduction activities exhibit an important effect on firms’ decision-makings.

Therefore, firms must invest in emission reduction technologies to manufacture green products. In the perspective of consumers, their environmental awareness enhances the demand of green products. In the perspective of firms themselves, green products involve a higher manufacturing cost but a better green corporate image, green reputation, and ultimately more profits than non-green products (Komarek et al., 2013). Green reputation can be considered as the corporate reputation related to the environmental activities taken by the firms, and it needs time to establish through its green polices (Pritchard & Wilson, 2018; Shin & Ki, 2019). Bazillier et al. (2017) used the data from 551 European firms and found that green activities can improve the firms’ green image/reputation although these firms locate in different countries with weak environmental standards. Meanwhile, Lin et al. (2016) found that the negative activities about the environment taken by the firms can damage their green reputation. Thus, the environmental activities can affect firms’ green image and green reputation. This relationship is further investigated via a game-theory model in our study.

In supply chains, competition and cooperation among firms show an important impact on their decision-makings. The production process involves multiple links and members. For example, Toyota uses its shareholding capital to cooperate with its component supplier Aisin Seiki, and thus, a final product quality depends on the efforts of its own and its partners (Hsieh & Liu, 2010). In addition, cooperation is often used in emission reduction activities. Several important factors can impact the emission reduction level in different cooperation strategies, and the interaction between the supply chain firms also affects the carbon emissions. For example, the suppliers of Walmart can take measures to reduce total packaging volume by 5%, thereby resulting in emission reductions (Gao et al., 2018). The recent studies of supply chain have also presented an interest in multiple manufacturers or retailers. The participation of multiple members in the supply chain cooperation and competition also affects the environmental strategies. Klassen and Vachon (2003) found that the cooperation can significantly improve the form and level of investment in green technologies. What’s more, the cooperation willingness of firms induces the managers of upstream firms increase the investments in pollution prevention. Due to abovementioned considerations, this study examines the case wherein two competitive retailers cooperate with a manufacturer by sharing the emission reduction cost. In the presence of the dynamic green reputation and regulation of carbon tax, this study proposes the following questions:

-

(i)

What are the optimal emission reduction and pricing decision-makings in no-cost-sharing/cost-sharing setting of the supply chain?

-

(ii)

How do the supply chain members choose the strategy between no cost sharing and cost sharing?

-

(iii)

How does key parameters of cost sharing affect the equilibrium decision-makings and profits of the supply chain members?

-

(iv)

How does the manufacturer choose the cooperative partner between the retailers to share the emission reduction cost? Which partner achieves a better performance?

In particular, the manufacturer as a leader that opts for emission reduction level, and two retailers as followers that, respectively, decide their retail prices. We use a differential game to model the problem. The main results are summarized as follows. First, the emission reduction level, green reputation, demands, and retail prices are larger in the cost-sharing strategy than those in the no-cost-sharing strategy. Second, although the retail price is higher, the products show a higher green level and thus, attract more consumers in cost-sharing strategy than in no-cost-sharing one. Therefore, sharing emission reduction cost with the manufacturer is a better choice for the retailers. Third, two thresholds of the cost-sharing ratio can be found in the case wherein the small-scale retailer cooperates with the manufacturer. When the ratio locates between these two thresholds, the profit of each supply chain member can achieve a Pareto improvement.

The remainder of this paper is organized as follows. Section 2 reviews the related literature. In Sect. 3, we formulate a differential game model. Section 4 derives and compares the equilibrium solutions between no-cost-sharing and cost-sharing strategies. We propose a numerical analysis and sensitivity analysis in Sect. 5. Conclusions, limitations, and future research directions are finally summarized in Sect. 6.

2 Literature review

We review the related literature to this study from three streams, that is, low-carbon supply chain management, green reputation, and competition in low-carbon supply chains.

2.1 Low-carbon supply chain management

The environmental issues have impacted the decision-making goals of supply chains, so that the chain firms must take measures to lower carbon emissions to pursue the goal of sustainability. Numerous studies have focused on the low-carbon supply chain management recently. Considering the low-carbon awareness of consumers, Du et al. (2017) examined a supply chain wherein both the manufacturer and the retailer invest in low-carbon efforts. The authors further designed a carbon-related price-discount sharing contract to achieve Pareto improvement for the two members. Given that the government intervention also plays an important role, most studies simultaneously incorporate low-carbon policies, especially the carbon tax policy. For instance, Chen et al. (2020) investigated how to design the optimal carbon tax under different power structure in supply chains and pointed out that this design highly depends on the power structure and emission reduction efficiency. Consequently, the authors claimed that the carbon tax should differ across industry sectors. Besides a carbon cap policy on manufacturers, Wang et al. (2021) examined whether to implement carbon tax policy on consumers in supply chains and found that this implementation may benefit retailers, environment, and overall social welfare. However, this tax is unbeneficial for manufacturers. Given that the cooperation can eliminate the financial pressure and elevate emission reduction levels, many scholars focused on the cooperation in emission reduction activities. One cooperation strategy is sharing the emission reduction costs. For instance, Yuyin and Jinxi (2018) indicated that this cooperation form can improve emission reductions and two chain members’ profit. The authors also found that carbon tax policy is more efficient when the initial amount of emissions is low. Another strategy is sharing the profits from sales of low-carbon products. For instance, Yang and Chen (2018) examined the effect of a retailer offering revenue-sharing and/or cost-sharing schemes on emission reduction efforts of a manufacturer under carbon tax policy and found that the government should set the highest tax level in sole revenue-sharing and both sharing schemes to improve the manufacturer’s effort incentive.

Note that the above studies focus only on static decision-makings in a sole period. Due to that the low-carbon activities can vary according to the market environment, a number of scholars concentrate on the dynamic activities. For instance, Dey and Saha (2018) investigated the impact of a retailer’s procurement strategy in a two-period setting and showed that building strategic inventory is beneficial for both economic and environmental performances. In a long-term perspective, Wang et al. (2019) demonstrated that the manufacturer always prefers the farsighted decision-making manner and a high carbon trading price and the myopic manufacturer benefits consumers in a cap-and-trade policy. Under the same policy, Sun et al. (2020) considered a cooperation scheme in which carbon emissions are transferred from the manufacturer to the supplier. The authors established a differential equation to depict the lag time of emission reduction technologies and investigated how this lag time affects the transfer level and supply chain performance. Xia et al. (2020) considered social preferences in a supply chain and investigated a cost-sharing scheme, which can achieve Pareto improvement but not affect the optimal emission reductions. Yu, Wang, et al. (2020) explored the reference emission and cost learning effects between cooperation schemes of cost sharing and revenue sharing. The authors pointed out the advantage of revenue sharing and the significant effect of carbon tax on emission reductions.

Following these studies, we investigate the dynamic decision-makings in a supply chain and further consider the impact of green reputation, which must be considered in a long-term perspective.

2.2 Green reputation

Reputation, which is alternatively named as goodwill in a proportion of studies, is an important factor for firms because a good reputation can improve the competitiveness of firms and attract more customers. In supply chain management, a number of studies have showed that the behaviors taken by the firms present a closed relationship with their own reputation/goodwill. For instance, Zu and Chen (2017), Feng and Liu (2018), and Xiang and Xu (2019), respectively, revealed that cooperative advertisement, online word-of-mouth, and new technology such as “Big Data” can improve the brand reputation and enhance the profit in supply chains.

Thereafter, a growing number of studies have shown concerns about the relationship between the environmental activities and green reputation. Komarek et al. (2013) investigated how the alternative attributes of energy affect the green reputation of a firm through a case study. The results show that the institution’s green reputation can benefit the constituents, and that the choice of the alternative energy can significantly influence its perceived green reputation in the future. Ngai et al. (2018) used the case of three Chinese gas operators to investigate how the corporate social responsibility (CSR) affects the firms’ profit. Three investigated firms practice CSR in several regions, such as employees, consumers, and investors. The results showed that the practice of CSR leads to better quality products and service, loyal consumers, especially positive social image and reputation of the firms. Pineiro-Chousa et al. (2017) formulated a model about the environment management and reputation risk reports to solve the reputation risk problem and provided a hedging instrument for this risk. In the case of voluntary reporting, the environmental firms can reduce the costs and increase the potential profits through reputation. But in the case of mandatory reporting, the assurance firms have a key role in bad reputation. Science and technology related to reputation, such as the blockchain technology and Industry 4.0, are also regarded as key factors studied in the literature. For instance, Khaqqi et al. (2018) formulated a new Emission Trading Scheme (ETS) model based on the industry 4.0 to solve the management and fraud issues through blockchain technology. They examined how a reputation system affects the ETS efficiency and revealed that this ETS model can improve the reputation. Other case studies (Scholtens & Kleinsmann, 2011; Yang et al., 2016) further verify the relationship between the green reputation and environmental activities. However, using a differential game framework to analysis this relationship is still lacking. To our best knowledge, the sole study is conducted by Liang and Futou (2020), who modeled this relationship by assuming that a manufacturer’s emission reduction level and a retailer’s reputation publicity level affect the green reputation. In this study, we further consider this relationship by incorporating competitive retailers in a supply chain.

2.3 Competition in low-carbon supply chains

Due to the complex business environment, competition always arises between similar firms. This research issue in low-carbon supply chains has also attracted a number of scholars. For instance, Yang et al. (2017) considered the emission reduction decisions in two competitive supply chains composed of one manufacturer and one retailer under the cap and trade scheme. The results show that the vertical cooperation improves the emission reduction level and reduces the retail price, but the horizontal cooperation leads to low profits of retailers. Meanwhile, the revenue sharing contract can solve the above problem and thus, lead to a win–win situation for supply chain members, and benefit the environment with a higher emission reduction level. In an identical supply chain structure, Yu, Shang, et al. (2020) further investigated the impact of carbon tax on the two supply chains’ centralized strategy and pointed out that decentralized strategy can simultaneously benefit manufacturers, consumer surplus and social welfare under certain conditions. In the case of competitive retailers in a supply chain, Hosseini-Motlagh et al. (2019) proposed a three-party compensation-based scheme to improve the entire supply chain’s performances regarding profit and environment. Yu and Cao (2020) further considered the competition between incumbent and entrant retailers and examined how the cooperation of information sharing strategy affects the carbon emissions. In a supply chain setting with two competitive manufacturers, Giri et al. (2019) investigated impact of the government’s carbon tax and subsidy on the strategies of competition and cooperation in the supply chain. In the same supply chain structure, Liu et al. (2020) indicated that emission reduction investment of one manufacturer can benefit both itself and the competitor. In a co-opetition supply chain wherein a upstream manufacturer supplies core component to a downstream manufacturer, Zhang et al. (2021) compared the scenarios of none/either/both of manufacturers product a low-carbon product and demonstrated that a high carbon tax rate will induce the manufacturers to adopt the strategy of producing a low-carbon product.

The study of competition in the above literature is of static model adoption. Using a dynamic modeling method to investigate the competition in low-carbon supply chains is lacking. Wherein, Cheng and Ding (2021) considered a competition between two chains and the effect of corporate social responsibility on reputation. In a similar modeling method, our study explores the competition between two retailers in a supply chain by incorporating the impact of emission reduction activity on green reputation.

2.4 Research gap and this paper’s contribution

The above review on literature has demonstrated that few study uses a differential game framework to reveal the effects of green reputation and competition on decision-makings in supply chains. Although Liang and Futou (2020) explored the effect of emission reduction activities on green reputation and used this framework to study the emission reduction activity in a supply chain, they did not consider the pricing decision-making and competition in supply chains. In contrast, our study incorporates pricing and emission reduction decision-makings and investigates the competition between two retailers. Cheng and Ding (2021) used this framework to examine the competition between two supply chains. However, the authors considered the effect of corporate social responsibility but not emission reduction activity on reputation. Another different with Cheng and Ding (2021) is that we consider the competition between two retailers in one supply chain. Moreover, these two studies considered none of low-carbon policies. Whereas, we examined the influence of carbon tax policy.

In summary, the main contributions of this study are fourfold. First, according to the previous empirical studies about the relationship between emission reduction and green reputation, we formulate a differential game model to demonstrate the effect of green reputation on pricing and emission reduction decision-makings, and performance of members in a supply chain. Second, we investigate the emission reduction cost sharing in a dynamic setting of low-carbon supply chain and thus, contribute to the theory of supply chain cooperation. Third, this study simultaneously considers the competition between two retailers with different scales. Both the consideration of competition and cooperation yields certain meaningful insights. Therefore, this study can guide the firms to deal with decision-making problems in such a complex supply chain structure. Fourth, we also examine the influence of carbon tax policy and thus, provide suggestions for the government’s policy-makers.

3 Model formulation

In this section, we consider a two-echelon supply chain system consisting of a manufacturer and two competitive retailers with distinct scales. The manufacturer produces and sells a product to consumers through two retailers. We use the subscripts “\(m\)”, “\({r}_{1}\)” and “\({r}_{2}\)” to denote the manufacturer, large-scale retailer, and small-scale retailer, respectively. The event sequence is described as follows. First, the manufacturer decides an emission reduction level \(\tau \left(t\right)\) in production process. Subsequently, the retailers, respectively, opt for their retail price \({p}_{{r}_{1}}\left(t\right)\) and \({p}_{{r}_{2}}\left(t\right)\) as a reaction. Thus, a Stackelberg differential game occurs between the leading manufacturer and the following retailers. We also consider two strategies in this study. In no-cost-sharing strategy, the manufacturer bears the entire emission reduction cost. In cost-sharing strategy, either of the retailers cooperates with the manufacturer and shares a proportion of the emission reduction cost. We use the superscript “\(N\)” and “\(C\)” signify the no-cost-sharing and cost-sharing strategies.

We define \(G\left(t\right)\) as the green reputation of the manufacturer, which can be affected by the environmental activities. Under the increased environmental pressure, this study considers how the effort in emission reduction to improve the green reputation. Following previous studies (Huang et al., 2018; Nerlove & Arrow, 1962; Zhang et al., 2017), and other similar influence factors, the dynamics of the green reputation can be formulated below:

where \(\theta >0\) represents an effect parameter of the emission reduction level on green reputation, \(\delta >0\) reflects the decay rate of the green reputation stock over time, and \({G}_{0}>0\) denotes the initial stock at time \(t=0\).

The market demand of either retailer is simultaneously affected by its own retail price, the competing retailer’s retail price, and the green reputation. The demand functions in our study are similar to the previous related literature (Huang et al., 2018; Wang et al., 2019; Zhang et al., 2018) and expressed as:

where \({\alpha }_{1}>{\alpha }_{2}>0\) represent the effect of green reputation level on current demands of the retailers. Different amount of \({\alpha }_{1}\) and \({\alpha }_{2}\) reflects the scales of the retailers. That is, the green reputation represents a greater impact on the demand of large-scale retailer than that of small-scale retailer. Meanwhile, \(\beta >0\) denotes the effect of retail price on current demand. The coefficient \(\gamma >0\) represents the competitive intensity in terms of the retailers’ retail prices. Equation (2) describes that the demand of retailer \(i\) decreases as its own retail price increases, but increases as its competitor’s retail price increases. Naturally, we set \(\beta \ge \gamma\), and the effect parameter of green reputation level on demand should be high enough to ensure that \({D}_{{r}_{i}}\) is always positive.

Given that the government imposes taxes based on carbon emissions and the manufacturer takes activities to reduce emissions, the total cost includes two parts: one is emission reduction and the other is carbon tax. In accordance with previous literature (Wang et al., 2019; Xu & Wang, 2018; Yuyin & Jinxi, 2018), as shown in Eq. (3), the emission reduction cost is a quadratic function with respect to emission reduction level.

where \(k>0\) is a cost coefficient related to emission reduction level. Equation (3) implies an increasing marginal cost in relation to emission reduction level. The cost of carbon tax is \(s\left(1-\tau \left(t\right)\right){E}_{0}\cdot ({D}_{{r}_{1}}\left(t\right)+{D}_{{r}_{2}}\left(t\right))\), where \(s\) denotes the unit carbon tax set by the government, and \({E}_{0}\) is initial carbon emissions of unit product. Thus, \(\left(1-\tau \left(t\right)\right){E}_{0}\cdot ({D}_{{r}_{1}}\left(t\right)+{D}_{{r}_{2}}\left(t\right))\) represents the actual carbon emissions after taking emission reduction activities.

Price discrimination is widespread in real-life marketing. Pigou and Aslanbeigui (2017) argued that price discrimination is a price difference, which refers to that manufacturer provides goods or services of the same grade and quality to different retailers with different price. The pricing decision in the first-degree price discrimination is based on the retailer’s detailed information, such as scale and sales ability. Based on Price discrimination, some scholars studied the effect of selling a product at different wholesale prices to different retailers on the equilibrium strategies, that is, discriminatory wholesale price strategy (DWPS). De Giovanni (2018) used the case of battery recycling to study DWPS in a supply chain consisting of two competing retailers. Tm and Mahanty (2020) investigated the impact of wholesale price discrimination by a manufacturer based on its offline and online channel preference. Thus, DWPS has been considered in supply chain literature, following which, this study supposes the manufacturer providing a lower wholesale price for large-scale retailer than the small-scale retailer, i.e., \({w}_{{r}_{1}}<{w}_{{r}_{2}}\).

3.1 No-cost-sharing strategy

Assuming an infinite time horizon and a discount rate \(\rho >0\), the objective functional of the manufacturer in no-cost-sharing strategy is expressed as

and the objective functionals of the retailers in this strategy are showed as follows:

By simultaneously considering the dynamic relationships (1), (2), (3), (4), (5), this paper presents the differential game between the supply chain players in no-cost-sharing strategy as follows:

In Eqs. (6a)–(6c), the game among the manufacturer and two retailers involves three control variables, i.e., \({\tau }^{N}(t)\), \({p}_{{r}_{i}}^{N}\left(t\right), i=\mathrm{1,2}\), as well as one state variable, i.e., \({G}^{N}\left(t\right)\).

3.2 Cost-sharing strategy

Cost-sharing strategy considers the situation that either of the retailers bears a part of emission reduction cost. If the retailer \(i\) does, the objective functional of the manufacturer is expressed as

where \(\varphi\) represents the proportion of emission reduction cost that the retailer undertakes. Consequently, the objective functional of the retailer \(i\) is given by

The objective functional of its competitive retailer is expressed as follows:

Thus, the differential game between the supply chain players in cost-sharing strategy is modeled as follows:

In Eqs. (10a)–(10d), the game among the manufacturer and the retailers in cost-sharing strategy is similar to that in no-cost-sharing strategy, thereby involving the same control variables and state variable. To improve readability, the notations used in the model formulation are listed in Table 1.

4 Equilibrium solutions

This section successively derives the equilibrium solutions in the two strategies. We define the variable substitutions \({\Delta }_{1},{\Delta }_{2},{\mathrm{A}}_{1}-{\mathrm{A}}_{7},{X}_{1},{X}_{2},{Y}_{1}\), and \({Z}_{1}\) in "Appendix B" to simplify the expression of the model.

4.1 No-cost-sharing strategy

The optimal control problem of no-cost-sharing strategy is showed in Eqs. (6a)–(6c). In this game, the leading manufacturer initially decides \(\tau \left(t\right)\), and the competitive retailers react to determine their retail prices \({p}_{{r}_{1}}\left(t\right)\) and \({p}_{{r}_{2}}\left(t\right)\). Using backward induction, we initially solve the retailers’ problems to obtain their optimal retail prices. Afterward, the manufacturer’s problem is solved based on the pricing strategy of the retailer. The equilibrium solutions for supply chain players are presented in Proposition 1.

Proposition 1.

In the no-cost-sharing strategy, the optimal retail price of the retailers and emission reduction level of the manufacturer are given by

Proposition 1 indicates that the equilibrium retail prices and emission reduction level are linear and monotonically increasing with respect to the state variable, i.e., the green reputation. When the green reputation increases, the manufacturer and the retailers can increase emission reduction level and retail prices, respectively, to get additional benefits.

Proposition 2.

In the no-cost-sharing strategy, the trajectories of the equilibrium emission reduction level and retail prices are given by

and the trajectories of the green reputation level and the demands are provided by

where \({G}_{\infty }^{N}\), \({\tau }_{\infty }^{N}\),\({p}_{{r}_{i\infty }}^{N},i=\mathrm{1,2}\), and \({D}_{{r}_{i\infty } }^{N}, i=\mathrm{1,2}\), are also shown in "Appendix B" to simplify the expression of the model.

Proposition 2 shows that if \(\frac{{\Delta }_{1}-k(2\beta +\gamma )\rho }{2k(2\beta +\gamma )}>0\), the green reputation \({G}^{N}\left(t\right)\), the retail prices \({p}_{{r}_{1}}^{N}\left(t\right), i=\mathrm{1,2}\), the emission reduction level \({\tau }^{N}\left(t\right)\), and the demands \({D}_{{r}_{1}}^{N}\left(t\right),\mathrm{ i}=\mathrm{1,2}\) can converge to their own steady states \({G}_{\infty }^{N}\), \({p}_{{r}_{i\infty }}^{N},\mathrm{ i}=\mathrm{1,2}\), \({\tau }_{\infty }^{I}\), and \({D}_{{r}_{i\infty }}^{N}, i=\mathrm{1,2}\), when \(t\to \infty\).

Proposition 3.

According to the relationship of the initial green reputation \({G}_{0}\) and the steady-state green reputation \({G}_{\infty }^{N}\) , we provide the pricing and emission reduction strategies in the no-cost-sharing strategy as follows:

-

(1)

If \({G}_{0}>{G}_{\infty }^{N}\) , then the retailers adopt the skimming pricing strategy and the manufacturer employs the penetration emission reduction strategy;

-

(2)

If \({G}_{0}{<G}_{\infty }^{N}\) , then the retailers adopt the penetration pricing strategy and the manufacturer employs the skimming emission reduction strategy.

Proposition 3 demonstrates that if the initial green reputation is higher (lower) than the steady-state green reputation, then the retail price is monotonically decreasing (increasing), thereby indicating the adoption of a skimming (penetration) pricing strategy. For the manufacturer, Eq. (13) shows that the emission reduction level monotonically increases (decreases) over time if the initial green reputation is higher (lower) than the steady-state green reputation, thereby indicating the adoption of a penetration (skimming) emission reduction strategy. Note that the retailers and the manufacturer provide a reverse strategy. If the retailers’ pricing strategy negatively affects the demand, the manufacturer must employ a positive emission reduction activity that can enhance the demand.

In Corollary 4, we compare the two retailers’ steady-state retail prices and demands. The corresponding results show that there exist two thresholds with respect to \(\frac{{w}_{{r}_{i}}-{w}_{{r}_{3-i}}}{{\alpha }_{i}-{\alpha }_{3-i}}\). If this item is above (below) the first threshold, i.e., \(\frac{{G}_{\infty }^{N}}{\beta +\gamma }\), the retailer \(i\)’s steady-state retail price is higher (lower) than its competitor’s steady-state retail price. If this item is above (below) the second threshold, i.e., \(\frac{{G}_{\infty }^{N}}{\beta +2\gamma }\), the retailer \(i\)’s steady-state demand is lower (higher) than its competitor’s steady-state demand. Note that these two thresholds are difference. This is because the demand is also affected by the manufacturer’s emission reduction strategy.

Corollary 4.

The comparative steady-state retail prices and demands in no-cost-sharing strategy are satisfied with the following conditions:

-

(1)

If \(\frac{{w}_{{r}_{i}}-{w}_{{r}_{3-i}}}{{\alpha }_{i}-{\alpha }_{3-i}}>\frac{{G}_{\infty }^{N}}{\beta +\gamma }\) , then the retailer \(i\) ’s steady-state retail price is higher than its competitor’s steady-state retail price, i.e., \({p}_{{r}_{i\infty }}^{N}>{p}_{{r}_{3-i\infty }}^{N}\) ; if \(\frac{{w}_{{r}_{i}}-{w}_{{r}_{3-i}}}{{\alpha }_{i}-{\alpha }_{3-i}}<\frac{{G}_{\infty }^{N}}{\beta +\gamma }\) , then the retailer \(i\) ’s steady-state retail price is lower than its competitor’s steady-state retail price, i.e., \({p}_{{r}_{i\infty }}^{N}<{p}_{{r}_{3-i\infty }}^{N}\) ;

-

(2)

If \(\frac{{w}_{{r}_{i}}-{w}_{{r}_{3-i}}}{{\alpha }_{i}-{\alpha }_{3-i}}<\frac{{G}_{\infty }^{N}}{\beta +2\gamma }\) , then the retailer \(i\) ’s steady-state demand is higher than its competitor’s steady-state demand, i.e., \({D}_{{r}_{i\infty }}^{N}>{D}_{{r}_{3-i\infty }}^{N}\) ; if \(\frac{{w}_{{r}_{i}}-{w}_{{r}_{3-i}}}{{\alpha }_{i}-{\alpha }_{3-i}}>\frac{{G}_{\infty }^{N}}{\beta +2\gamma }\) , then the retailer \(i\) ’s steady-state demand is lower than its competitor’s steady-state demand, i.e., \({D}_{{r}_{i\infty }}^{N}<{D}_{{r}_{3-i\infty }}^{N}\) .

4.2 Cost-sharing strategy

The optimal control problem of cost-sharing strategy is showed in Eqs. (10a)–(10d). The event sequence in this strategy is similar with that in no-cost-sharing strategy. The different is that the retailer \(i\) cooperates with the manufacturer by undertaking a proportion of the emission reduction cost in cost-sharing strategy. The equilibrium solutions for supply chain members are presented in Proposition 5.

Proposition 5.

In the cost-sharing strategy, the optimal retail prices of the retailers and emission reduction level of the manufacturer are given by

Proposition 5 is similar with the results as shown in the no-cost-sharing strategy. The equilibrium retail prices and emission reduction level increase as the green reputation level increases. Thus, the retailers have a certain incentive to increase retail prices to earn extra profit. The manufacturer may intend to increase emission reduction level to enhance demand due to the consumers’ preference for green products.

Corollary 6.

Given that \({\alpha }_{1}>{\alpha }_{2}\) , we can obtain \({\left({p}_{{r}_{1}}^{N}\left(G\right)\right)}^{^{\prime}}>{\left({p}_{{r}_{2}}^{N}\left(G\right)\right)}^{^{\prime}}\) and \({\left({p}_{{r}_{1}}^{C}\left(G\right)\right)}^{^{\prime}}>{\left({p}_{{r}_{2}}^{C}\left(G\right)\right)}^{^{\prime}}\) , which imply that the green reputation level exhibits a greater effect on the large-scale retailer’s retail price than the small-scale retailer’s retail price in the both Strategies.

Corollary 6 reveals that the impact of green reputation level on the retail price depends on the parameter \({\alpha }_{i}\). This parameter reflects the scale of two retailers. The large-scale retailer can earn a larger profit by increasing the green reputation than the small-scale retailer due to the impact of \({\alpha }_{i}\).

Proposition 7.

In the cost-sharing strategy, the trajectories of the equilibrium emission reduction level and retail prices are provided by

and the trajectories of the green reputation and the demands of the retailers are given by

where \({G}_{\infty }^{C}\), \({\tau }_{\infty }^{C}\),\({p}_{{r}_{i\infty }}^{C},i=\mathrm{1,2}\), and \({D}_{{r}_{i\infty } }^{C}, i=\mathrm{1,2}\), are also shown in "Appendix B".

Similar to Proposition 2, in the cost-sharing strategy, the green reputation level, the retail prices, the emission reduction level, and the demands can converge to their steady states when \(t\to \infty\). Meanwhile, two retailers can choose a skimming or penetration pricing strategy, and the manufacturer can adopt either a skimming or a penetration emission reduction strategy. The corresponding results are shown in Proposition 8.

Proposition 8.

According to the relationship between the initial green reputation level \({G}_{0}\) and the steady-state green reputation level \({G}_{\infty }^{C}\) , we provide the pricing and emission reduction strategies in the cost-sharing strategy as follows:

-

(1)

If \({G}_{0}>{G}_{\infty }^{C}\) , then the retailers adopt the skimming pricing strategy and the manufacturer employs the penetration emission reduction strategy;

-

(2)

If \({G}_{0}{<G}_{\infty }^{C}\) , then the two retailers select the penetration pricing strategy and the manufacturer employs the skimming emission reduction strategy.

Proposition 8 demonstrates that the adoption of a skimming or penetration pricing strategy by the retailers depends on the relationship between the initial green reputation level and the steady-state one. The manufacturer’s decision on skimming or penetration emission reduction strategy also depends on this relationship.

Corollary 9 compares the retailers’ steady-state retail prices and demands in the cost-sharing strategy. The corresponding results are similar to Corollary 4. Two thresholds can also be found and equal the steady-state prices and demands, respectively.

Corollary 9.

In the cost-sharing strategy, the comparative steady-state retail prices and demands are satisfied with the following conditions:

-

(1)

If \(\frac{{w}_{{r}_{1}}-{w}_{{r}_{2}}}{{\alpha }_{1}-{\alpha }_{2}}>\frac{{G}_{\infty }^{C}}{\beta +\gamma }\) , then the large-scale retailer’s steady-state retail price is higher than the small-scale retailer’s steady-state retail price, i.e., \({p}_{{r}_{1\infty }}^{C}>{p}_{{r}_{2\infty }}^{C}\) , if \(\frac{{w}_{{r}_{1}}-{w}_{{r}_{2}}}{{\alpha }_{1}-{\alpha }_{2}}<\frac{{G}_{\infty }^{C}}{\beta +\gamma }\) , then the large-scale retailer’s steady-state retail price is lower than the small-scale retailer’s steady-state retail price, i.e., \({{p}_{{r}_{1\infty }}^{C}<p}_{{r}_{2\infty }}^{C}\) ;

-

(2)

If \(\frac{{w}_{{r}_{1}}-{w}_{{r}_{2}}}{{\alpha }_{1}-{\alpha }_{2}}<\frac{{G}_{\infty }^{C}}{\beta +2\gamma }\) , then the large-scale retailer’s steady-state demand is higher than the small-scale retailer’s steady-state demand, i.e., \({D}_{{r}_{1\infty }}^{C}>{D}_{{r}_{2\infty }}^{C}\) ; if \(\frac{{w}_{{r}_{1}}-{w}_{{r}_{2}}}{{\alpha }_{1}-{\alpha }_{2}}>\frac{{G}_{\infty }^{C}}{\beta +2\gamma }\) , then the large-scale retailer’s steady-state demand is lower than the small-scale retailer’s steady-state demand, i.e., \({D}_{{r}_{1\infty }}^{C}<{D}_{{r}_{2\infty }}^{C}\) .

Corollary 10 compares the steady-state strategies between no-cost-sharing and cost-sharing strategies. These results illustrate that the steady-state green reputation, emission reduction level, retail prices and demands in the cost-sharing strategy are higher than those in the no-cost-sharing strategy. This finding reveals that when a retailer cooperates with the manufacturer on emission reduction cost sharing, although the retail price is relatively high and which is undesirable for consumers, other solutions are all improved. Thus, cost-sharing cooperation in the supply chain is a good choice for chain members in some extent. In the following section, we will further study the impact of this cooperation via a numerical example.

Corollary 10.

The comparisons of steady-state green reputations, emission reduction levels, retail prices and demands between no-cost-sharing and cost-sharing strategies are \({G}_{\infty }^{N}<{G}_{\infty }^{C}\) , \({\tau }_{\infty }^{N}<{\tau }_{\infty }^{C}\) , \({p}_{{r}_{i\infty }}^{N}<{p}_{{r}_{i\infty }}^{C}, i=\mathrm{1,2}\) , and \({D}_{{r}_{i\infty }}^{N}< {D}_{{r}_{i\infty }}^{C}, i=\mathrm{1,2}\)

5 Numerical analysis

This section provides a numerical analysis, which mainly concentrates on the comparison between the cases wherein two competitive retailers, respectively, cooperate with the manufacturer on cost sharing. It can provide suggestions for supply chain members on how to cooperate and demonstrate what these cases differ.

As we mentioned in the model formulation, the large-scale retailer involves a lower wholesale price than the small-scale one. In addition to the inherent difference of wholesale price, we also suppose that the cost-sharing retailer can obtain an additional procurement discount \({w}_{0}\) as a reward. The value of \({w}_{0}\) is proportionally related to cost-sharing ratio, i.e., \({w}_{0}={w}_{{r}_{i}}*\varphi\).

To begin with, the benchmark values of parameters in the model are provided below:

Demand parameters: \({\alpha }_{1}=1.1\), \({\alpha }_{2}=1\), \(\beta =0.7\), \(\gamma =0.3\);

Proportion of emission reduction cost that retailer undertakes:\(\varphi =0\).3;

Manufacturer’s marginal revenues:\({w}_{{r}_{1}}=0.45\), \({w}_{{r}_{2}}=0.5\);

Cost coefficient of emission reductions: \(k=4\);

Green reputation parameters: \(\theta =1\), \(\delta =0.4\), \({G}_{0}=5\);

Emission parameters: \({E}_{0}=0.2\), \(s=0.5\);

Discount rate: \(\rho =0.1\).

The above values are referred from previous studies about low-carbon supply chains (Huang et al., 2018; Wang et al., 2019).

We first investigate the effect of \(\varphi\) on steady-state solutions and profits. Then, we provide sensitivity analysis of the other two key parameters, i.e., \(\gamma\) and \(s\).

5.1 Effect of \(\varphi\) on steady-state solutions

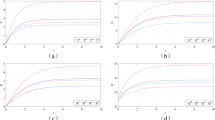

The sharing ratio of emission reduction cost, i.e., \(\varphi\), plays an important role on decision-makings and state variable in the supply chain, as depicted in Figs. 1a–d.

As shown in Fig. 1a, with the increase of \(\varphi\), regardless of cooperative partner, the manufacturer will increase emission reduction level. When the emission reduction cost is shared by a retailer, the manufacturer can exert additional effort on emission reduction without the increase in effort cost. Consequently, a higher \(\varphi\) leads to greener products, attracts more consumers and thus, achieves a higher profit. Meanwhile, this figure also shows that the emission reduction level is higher when emission reduction cost is shared by the small-scale retailer than the case when the cost is shared by the large-scale retailer. The reason is that the manufacturer provides a lower procurement discount to the cooperative small-scale retailer and hence obtains a fund to exert more effort on emission reductions than that to the large-scale retailer. The trend of green reputation affected by \(\varphi\) in Fig. 1b is similar to that in Fig. 1a. This implies that the green reputation closely related with the environmental activities taken by the supply chain.

As shown in Fig. 1c, with the increase of \(\varphi\), regardless of cooperative partner, the demands of two retailers will increase. This is because if the retailer shares the emission reduction cost, the manufacturer will produce lower-carbon products to attract more consumers, thereby leading to the demand of retailer who shares the emission reduction cost with the manufacturer increasing. Meanwhile, the demand of no-cost-sharing retailer also increases because of the free-riding phenomenon. This figure also demonstrates that the demand of the cost-sharing retailer is always higher than the demand of its competitor. The reason is that the cost-sharing retailer can obtain a larger procurement discount and set a lower retail price than its competitor does.

Figure 1d shows that the retail price of the cost-sharing retailer first decreases and then increases with \(\varphi\). The reason is that if the retailer undertakes little fraction of emission reduction cost, the resulting increase in green reputation cannot boost an enough demand. Thus, the cost-sharing retailer must further set a low retail price in some extent to attract more consumers for profit-seeking. However, if \(\varphi\) is high enough, the effect of resulting green reputation is sufficient for profit-seeking and hence, the cost-sharing retailer can raise the price as \(\varphi\) increases. Meanwhile, the retail price of no-cost-sharing retailer always increases with \(\varphi\). This trend results from the free-ride phenomenon. What is more, if the retailer cooperates with the manufacturer on cost sharing, the retail price of itself is higher (lower) than the retail price of its competitor when \(\varphi\) is relatively low (high). The reason is also of the double-edge sword of cooperation. A low \(\varphi\) leads to the cost factor dominating the demand-boosting factor, and hence, the cost-sharing retailer will adopt a relatively-high price strategy to offset the cost and neglect its competitor; a high \(\varphi\) leads to the demand-boosting factor being of dominant and hence, the cost-sharing retailer can set a relative-low price regarding the price competition. This trend also provides useful conclusions for consumers. When \(\varphi\) is relatively low (high), consumers prefer to buy products from the no-cost-sharing retailer (cost-sharing retailer). Finally, we can find that when \(0.13<\varphi <0.15\), consumers always benefit from buying products from a large-scale retailer regardless of which retailer cooperates with the manufacturer on cost sharing.

5.2 Effect of \(\varphi\) on profits

This subsection investigates how \(\varphi\) affects the profits. First, we analyze the effect on manufacturer’s profit, as shown in Fig. 2a. Regardless of which retailer cooperates with the manufacturer on cost sharing, the manufacturer’s profit always increases with \(\varphi\). If retailer undertakes part of the emission reduction cost, the manufacturer can produce greener products, thereby resulting in the increase in demand. Thus, a relatively high cost-sharing ratio benefits the manufacturer. Moreover, Fig. 2a demonstrates that the manufacturer’s profit is higher when cooperating with the small-scale retailer than with the large-scale retailer. This phenomenon is caused by two reasons. First, the manufacturer provides a relatively low procurement price to the large-scale retailer, and it further provides an additional discount in cost-sharing strategy. When cooperating with the small-scale retailer, the overall procurement price is higher than that if cooperating with the large-scale retailer. Second, the total demand is higher in the case of cooperating with the small-scale retailer than the case of cooperating with the large-scale retailer.

As shown in Fig. 2b, two \(\varphi\) thresholds can be found. First, if \(\varphi <0.17\), the profits of retailers when they choose to cooperate with the manufacturer on cost sharing are higher than the counterparts in the case of their competitors sharing the emission reduction costs. The reason is that when \(\varphi <0.17\), the increase in retailer’s cost is relatively low in the case of itself cooperating with the manufacturer, and this cost increase can be offset by the relatively high demand and retail price, as shown in Figs. 1c and d. Second, if \(\varphi >0.25\), the profits of retailers when their competitors choose to share the cost with the manufacturer are higher than the counterparts when they share the cost with the manufacturer. The reason is that when the emission reduction cost that shared by the retailers is relatively high, the increased costs lead to the decrease in profits. While the no-cost-sharing retailer obtains a free-riding to make its own profit increase. Moreover, if \(0.17<\varphi <0.25\), we can find that the profits of two retailers are higher in the case of the small-scale retailer sharing the cost with the manufacturer than the case of the large-scale retailer sharing with the manufacturer.

In addition, we can get several useful conclusions according to the effect of \(\varphi\) on the profits of supply chain firms from Fig. 2. First, regardless of cooperative partner, the manufacturer prefers to sharing the emission reduction cost with small-scale retailer. Second, when \(\varphi\) is relatively low, the cost-sharing cooperation between itself and the manufacturer is a good choice for the retailer. Third, when \(\varphi\) is relatively high, the cooperation between its competitor and the manufacturer is a good choice for the retailer. Finally, when \(\varphi\) locates between these two thresholds, all supply chain members prefer the small-scale retailer to share the cost with the manufacturer.

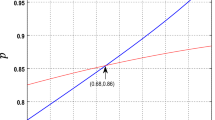

5.3 Effect of \(s\) on cost-sharing cooperation

As we mentioned in Fig. 2b, when \(\varphi\) locates in the interval between 0.17 and 0.25, all the supply chain members can reach a consensus, i.e., the small-scale retailer sharing the emission reduction cost. This subsection investigates how \(s\) affects this cooperation.

Figure 3 shows that the \(s-\varphi\) space can be divided into three parts by the curves of \({\varphi }_{1}\) and \({\varphi }_{2}\). The region above \({\varphi }_{2}\) (depicted as CR-CM) indicates that for the retailers, each is more inclined to its competitor to share the cost with the manufacturer. The part below \({\varphi }_{1}\) (depicted as RT-CM) means that either of the retailer prefers itself to share the emission reduction cost. The part between \({\varphi }_{1}\) and \({\varphi }_{2}\) (depicted as LR-CM) reveals that a consensus can be achieved among the supply chain members, i.e., they all prefer that the small-scale retailer to share the cost with the manufacturer, given that this consensus makes them better off. In addition, as \(s\) increases, the LR-CM and RT-CM areas enlarge, whereas the CR-CM area shrinks. Thus, a high setting of \(s\) value leads to a large space for the cost-sharing cooperation in the supply chain, thereby easily achieving the consensus.

5.4 Sensitivity analysis of \(\gamma\) and \(s\)

\(\gamma\) is the parameter that represents the competing intensity of the two retailers’ retail prices. \(s\) implies the government’s policy for emission reduction, and \(k\) reflects the cost related to emission reduction. These parameters jointly affect the equilibrium solutions and profits of the supply chain players. Tables 2 and 3 list the sensitivity of \(\gamma\) and \(s\) in the settings of \(k=4\) and \(k=2\), respectively.

Initially, we concentrate on the case of \(k=4\). First, we can find that when \(\gamma\) is unchanged, the steady-state solutions and profits in the both cost-sharing strategies decrease as \(s\) increases. This is because the increase in \(s\) causes the tax cost increases and thus, finally leads to the decrease in each member’s profit. Meanwhile, although the emission reduction level declines, the total carbon emissions decrease due to the demand abatement, thereby achieving the government’s goal of emission reduction. Moreover, the decrease in emission reduction level leads to a lower green reputation.

Second, Table 2 also indicates that if \(s\) is constant, as \(\gamma\) increases, the steady-state values and profits increase regardless of the cost-sharing partners. The reason is that when \(\gamma\) increases, the competition between the retailers intensifies. Either of the retailers who decides to sharing the emission reduction cost with the manufacturer, to seek a profit, will increase its retail price, and its competitor can also increase the price and earn additional profit by free-riding. Meanwhile, the manufacturer will exert an increasing effort on emission reduction and thus provide greener products, which benefit green consumers. In addition, the relatively high competitive intensity leads to a high green reputation and, together with the effects of prices and resulting demands, achieves a non-intuitive finding that it yields a high profit of the cost-bearing retailer.

By contrast, the effects of \(\gamma\) and \(s\) on the equilibrium solutions and profits when \(k\) is small (\(k=2\)) are different from the case of a large \(k\) (\(k=4\)). First, Table 3 shows that when \(\gamma\) is unchanged, the steady-state retail price, demand, green reputation level, and emission reduction level in the both cost-sharing strategies increase as \(s\) increases. Because the total carbon tax increases with \(s\), the manufacturer must increase emission reduction level to ensure its own profit. The increased emission reduction cost makes the cooperative retailer and its competitor increase retail prices by cost pressure and free-riding, respectively. Meanwhile, demands and green reputation also increase. Interestingly, we can also find that as \(s\) increases, the retailers’ profits raise. This is because the increased prices and demands can make up for the sharing cost for the cooperative retailer. Moreover, Table 3 also shows that if \(s\) is constant, as \(\gamma\) increases, the trend of steady-state solutions and profits is similar to that in the case of a large \(k\).

6 Conclusion

Consumers’ environmental awareness and government’s carbon tax induce/force firms to take emission reduction activities and provide green products. In this background, this study investigates a dynamic supply chain consisting of a manufacturer and two competitive retailers. The leading manufacturer decides the emission reduction level and the following retailers determine the retail prices as a reaction. We consider two strategies in this study. In no-cost-sharing strategy, neither of the retailers cooperates with the manufacturer on emission reduction; in cost-sharing strategy, either of the retailers cooperates with the manufacturer by sharing the emission reduction cost. Consequently, the equilibrium solutions in these strategies can be obtained via the optimal control theory. Several managerial insights can be obtained as follows.

First, the manufacturer should seek a cost-sharing cooperation with the small-scale retailer on emission reduction given that this choice is the best in terms of profit and green reputation when compared with the choices of no cost sharing and sharing with the large-scale retailer. Moreover, the manufacturer can benefit from a higher cost-sharing ratio, which leads to higher reputation, demand, and ultimate profit. However, the manufacturer must set an appropriate ratio to achieve this cooperation choice due to that the free-riding phenomenon of cost-sharing cooperation exists between the retailers. The ratio setting should consider the retailers’ tradeoff between the free-riding benefit and the purchase cost saving of cooperation. Only when the purchase saving is dominant for the small-scale retailer and the free-riding is dominant for the large-scale retailer will this choice be preferred by the two retailers.

Second, consumers can obtain a greener product from the cost-sharing cooperation in the supply chain. As the cost-sharing ratio increases, both the green level of the product and the retail price of the free-riding retailer will increase. However, the price of the cooperative retailer will first decrease and then increase. This finding indicates that consumers of the cooperative retailer can obtain a both green and cheap product under certain conditions. In addition, the cost-sharing ratio can influence the buying decision of consumers if they present no preference between the retailers. When this ratio is relatively low (high), consumers should buy the product from the no-cost-sharing retailer (cost-sharing retailer) to pursue a low price. However, when this ratio is medium, consumers should always buy the product from the large-scale retailer, regardless of which retailer being the cooperative partner.

Third, the carbon tax has an important effect on cost-sharing cooperation consensus in supply chains. A high tax increases the flexibility of cost-sharing ratio for this consensus. The increase in carbon taxes encourages supply chain members to achieve this cooperation. This finding guides government to formulate the carbon tax policy. If the government merely encourages firms to reduce carbon emissions, it should set a relatively high tax. If the government also considers the profits of supply chain members, it should set an appropriate tax rate to make supply chain members reach an agreement about cooperation.

Although our study obtains certain useful managerial insights, several limitations may motivate future studies. First, we study a supply chain consisting of one manufacturer and two different scales of competitive retailers. Our model could be extended to a supply chain with multiple manufacturers and multiple retailers. Second, this study does not consider the decision-making of governments or regulators. Therefore, this issue can be solved in the future. Third, we investigate the cooperation on cost-sharing of emission reduction. Future studies could investigate other forms of cooperation in low-carbon supply chains.

References

Baranzini, A., Goldemberg, J., & Speck, S. (2000). A future for carbon taxes. Ecological Economics, 32, 395–412. https://doi.org/10.1016/S0921-8009(99)00122-6

Bazillier, R., Hatte, S., & Vauday, J. (2017). Are environmentally responsible firms less vulnerable when investing abroad? The role of reputation. Journal of Comparative Economics, 45, 520–543. https://doi.org/10.1016/j.jce.2016.12.005

Cao, K., Xu, B., He, Y., & Xu, Q. (2020). Optimal carbon reduction level and ordering quantity under financial constraints. International Transactions in Operational Research, 27, 2270–2293. https://doi.org/10.1111/itor.12606

Chen, X., Yang, H., Wang, X., & Choi, T.-M. (2020). Optimal carbon tax design for achieving low carbon supply chains. Annals of Operations Research. https://doi.org/10.1007/s10479-020-03621-9

Cheng, H., & Ding, H. (2021). Dynamic game of corporate social responsibility in a supply chain with competition. Journal of Cleaner Production, 317, 128398. https://doi.org/10.1016/j.jclepro.2021.128398

De Giovanni, P. (2018). A joint maximization incentive in closed-loop supply chains with competing retailers: The case of spent-battery recycling. European Journal of Operational Research, 268, 128–147. https://doi.org/10.1016/j.ejor.2018.01.003

Deng, W. S., & Liu, L. (2019). Comparison of carbon emission reduction modes: Impacts of capital constraint and risk aversion. Sustainability-Basel, 11, 30. https://doi.org/10.3390/su11061661

Dey, K., & Saha, S. (2018). Influence of procurement decisions in two-period green supply chain. Journal of Cleaner Production, 190, 388–402. https://doi.org/10.1016/j.jclepro.2018.04.114

Ding, S., Zhang, M., & Song, Y. (2019). Exploring China’s carbon emissions peak for different carbon tax scenarios. Energy Policy, 129, 1245–1252. https://doi.org/10.1016/j.enpol.2019.03.037

Du, S., Hu, L., & Wang, L. (2017). Low-carbon supply policies and supply chain performance with carbon concerned demand. Annals of Operations Research, 255, 569–590. https://doi.org/10.1007/s10479-015-1988-0

Feng, J., & Liu, B. (2018). Dynamic impact of online word-of-mouth and advertising on supply chain performance. International Journal of Environmental Research and Public Health, 15, 69. https://doi.org/10.3390/ijerph15010069

Gao, H., Liu, S., Xing, D., & Cao, G. (2018). Optimization strategy of cooperation and emission reduction in supply chain under carbon tax policy. Journal of Discrete Mathematical Sciences and Cryptography, 21, 825–835. https://doi.org/10.1080/09720529.2018.1479165

Giri, R. N., Mondal, S. K., & Maiti, M. (2019). Government intervention on a competing supply chain with two green manufacturers and a retailer. Computers and Industrial Engineering, 128, 104–121. https://doi.org/10.1016/j.cie.2018.12.030

Hosseini-Motlagh, S.-M., Ebrahimi, S., & Jokar, A. (2019). Sustainable supply chain coordination under competition and green effort scheme. Journal of the Operational Research Society. https://doi.org/10.1080/01605682.2019.1671152

Hsieh, C.-C., & Liu, Y.-T. (2010). Quality investment and inspection policy in a supplier–manufacturer supply chain. European Journal of Operational Research, 202, 717–729. https://doi.org/10.1016/j.ejor.2009.06.013

Huang, Z. S., Nie, J. J., & Zhang, J. X. (2018). Dynamic cooperative promotion models with competing retailers and negative promotional effects on brand image. Computers and Industrial Engineering, 118, 291–308. https://doi.org/10.1016/j.cie.2018.02.034

Khaqqi, K. N., Sikorski, J. J., Hadinoto, K., & Kraft, M. (2018). Incorporating seller/buyer reputation-based system in blockchain-enabled emission trading application. Applied Energy, 209, 8–19. https://doi.org/10.1016/j.apenergy.2017.10.070

Klassen, R. D., & Vachon, S. (2003). Collaboration and evaluation in the supply chain: The impact on plant-level environmental investment. Production and Operations Management, 12, 336–352. https://doi.org/10.1111/j.1937-5956.2003.tb00207.x

Komarek, T. M., Lupi, F., Kaplowitz, M. D., & Thorp, L. (2013). Influence of energy alternatives and carbon emissions on an institution’s green reputation. Journal of Environmental Management, 128, 335–344. https://doi.org/10.1016/j.jenvman.2013.05.002

Kuo, T. C., Hong, I. H., & Lin, S. C. (2016). Do carbon taxes work? Analysis of government policies and enterprise strategies in equilibrium. Journal of Cleaner Production, 139, 337–346. https://doi.org/10.1016/j.jclepro.2016.07.164

Liang, L., & Futou, L. (2020). Differential game modelling of joint carbon reduction strategy and contract coordination based on low-carbon reference of consumers. Journal of Cleaner Production, 277, 123798. https://doi.org/10.1016/j.jclepro.2020.123798

Lin, H., Zeng, S., Wang, L., Zou, H., & Ma, H. (2016). How does environmental irresponsibility impair corporate reputation? A multi-method investigation. Corporate Social Responsibility and Environmental Management, 23, 413–423. https://doi.org/10.1002/csr.1387

Liu, J., Ke, H., & Tian, G. (2020). Impact of emission reduction investments on decisions and profits in a supply chain with two competitive manufacturers. Computers and Industrial Engineering, 149, 106784. https://doi.org/10.1016/j.cie.2020.106784

Liu, Z., Anderson, T. D., & Cruz, J. M. (2012). Consumer environmental awareness and competition in two-stage supply chains. European Journal of Operational Research, 218, 602–613. https://doi.org/10.1016/j.ejor.2011.11.027

Nerlove, M., & Arrow, K. J. (1962). Optimal advertising policy under dynamic conditions. Economica, 29, 129–142. https://doi.org/10.2307/2551549

Ngai, E. W. T., Law, C. C. H., Lo, C. W. H., Poon, J. K. L., & Peng, S. S. (2018). Business sustainability and corporate social responsibility: Case studies of three gas operators in China. International Journal of Production Research, 56, 660–676. https://doi.org/10.1080/00207543.2017.1387303

Pigou, A. C., & Aslanbeigui, N. (2017). The economics of welfare. Routledge. https://doi.org/10.4324/9781351304368

Pineiro-Chousa, J., Vizcaino-Gonzalez, M., Lopez-Cabarcos, M. A., & Romero-Castro, N. (2017). Managing reputational risk through environmental management and reporting: An options theory approach. Sustainability-Basel, 9, 15. https://doi.org/10.3390/su9030376

Pritchard, M., & Wilson, T. (2018). Building corporate reputation through consumer responses to green new products. Journal of Brand Management, 25, 38–52. https://doi.org/10.1057/s41262-017-0071-3

Scholtens, B., & Kleinsmann, R. (2011). Incentives for subcontractors to adopt CO2 emission reporting and reduction techniques. Energy Policy, 39, 1877–1883. https://doi.org/10.1016/j.enpol.2011.01.032

Shin, S., & Ki, E.-J. (2019). The effects of congruency of environmental issue and product category and green reputation on consumer responses toward green advertising. Management Decision, 57, 606–620. https://doi.org/10.1108/MD-01-2017-0043

Springer, C., Evans, S., Lin, J., & Roland-Holst, D. (2019). Low carbon growth in China: The role of emissions trading in a transitioning economy. Applied Energy, 235, 1118–1125. https://doi.org/10.1016/j.apenergy.2018.11.046

Sun, L., Cao, X., Alharthi, M., Zhang, J., Taghizadeh-Hesary, F., & Mohsin, M. (2020). Carbon emission transfer strategies in supply chain with lag time of emission reduction technologies and low-carbon preference of consumers. Journal of Cleaner Production, 264, 121664. https://doi.org/10.1016/j.jclepro.2020.121664

Tm, R., & Mahanty, B. (2020). Impact of wholesale price discrimination by the manufacturer on the profit of supply chain members. Management Decision Ahead-of-Print. https://doi.org/10.1108/MD-11-2019-1644

Wang, C., Peng, Q., & Xu, L. (2021). Decision and coordination of a low-carbon supply chain considering environmental tax policy on consumers. Kybernetes, 50, 2318–2346. https://doi.org/10.1108/K-05-2020-0318

Wang, J., Cheng, X. X., Wang, X. Y., Yang, H. T., & Zhang, S. H. (2019). Myopic versus farsighted behaviors in a low-carbon supply chain with reference emission effects. Complexity, 2019, 3123572. https://doi.org/10.1155/2019/3123572

Wang, X. F., Zhu, Y. T., Sun, H., & Jia, F. (2018). Production decisions of new and remanufactured products: Implications for low carbon emission economy. Journal of Cleaner Production, 171, 1225–1243. https://doi.org/10.1016/j.jclepro.2017.10.053

Xia, L., Bai, Y., Ghose, S., & Qin, J. (2020). Differential game analysis of carbon emissions reduction and promotion in a sustainable supply chain considering social preferences. Annals of Operations Research. https://doi.org/10.1007/s10479-020-03838-8

Xiang, Z. H., & Xu, M. L. (2019). Dynamic cooperation strategies of the closed-loop supply chain involving the internet service platform. Journal of Cleaner Production, 220, 1180–1193. https://doi.org/10.1016/j.jclepro.2019.01.310

Xu, L., & Wang, C. X. (2018). Sustainable manufacturing in a closed-loop supply chain considering emission reduction and remanufacturing. Resources, Conservation and Recycling, 131, 297–304. https://doi.org/10.1016/j.resconrec.2017.10.012

Yang, H., & Chen, W. (2018). Retailer-driven carbon emission abatement with consumer environmental awareness and carbon tax: Revenue-sharing versus cost-sharing. Omega-International Journal of Management Science, 78, 179–191. https://doi.org/10.1016/j.omega.2017.06.012

Yang, L., Li, F. Y., & Zhang, X. (2016). Chinese companies’ awareness and perceptions of the Emissions Trading Scheme (ETS): Evidence from a national survey in China. Energy Policy, 98, 254–265. https://doi.org/10.1016/j.enpol.2016.08.039

Yang, L., Zhang, Q., & Ji, J. (2017). Pricing and carbon emission reduction decisions in supply chains with vertical and horizontal cooperation. International Journal of Production Economics, 191, 286–297. https://doi.org/10.1016/j.ijpe.2017.06.021

Yu, B., Wang, J., Lu, X., & Yang, H. (2020). Collaboration in a low-carbon supply chain with reference emission and cost learning effects: Cost sharing versus revenue sharing strategies. Journal of Cleaner Production, 250, 119460. https://doi.org/10.1016/j.jclepro.2019.119460

Yu, M., & Cao, E. (2020). Information sharing format and carbon emission abatement in a supply chain with competition. International Journal of Production Research, 58, 6775–6790. https://doi.org/10.1080/00207543.2019.1685704

Yu, W., Shang, H., & Han, R. (2020). The impact of carbon emissions tax on vertical centralized supply chain channel structure. Computers and Industrial Engineering, 141, 106303. https://doi.org/10.1016/j.cie.2020.106303

Yuyin, Y., & Jinxi, L. (2018). The effect of governmental policies of carbon taxes and energy-saving subsidies on enterprise decisions in a two-echelon supply chain. Journal of Cleaner Production, 181, 675–691. https://doi.org/10.1016/j.jclepro.2018.01.188

Zhang, H., Li, P., Zheng, H., & Zhang, Y. (2021). Impact of carbon tax on enterprise operation and production strategy for low-carbon products in a co-opetition supply chain. Journal of Cleaner Production, 287, 125058. https://doi.org/10.1016/j.jclepro.2020.125058

Zhang, L., Wang, J., & You, J. (2015). Consumer environmental awareness and channel coordination with two substitutable products. European Journal of Operational Research, 241, 63–73. https://doi.org/10.1016/j.ejor.2014.07.043

Zhang, Q., Tang, W., & Zhang, J. (2018). Who should determine energy efficiency level in a green cost-sharing supply chain with learning effect? Computers and Industrial Engineering, 115, 226–239. https://doi.org/10.1016/j.cie.2017.11.014

Zhang, Q., Zhang, J., & Tang, W. (2017). Coordinating a supply chain with green innovation in a dynamic setting. 4OR, 15, 133–162. https://doi.org/10.1007/s10288-016-0327-x

Zhou, D., An, Y., Zha, D., Wu, F., & Wang, Q. (2019). Would an increasing block carbon tax be better? A comparative study within the Stackelberg Game framework. Journal of Environmental Management, 235, 328–341. https://doi.org/10.1016/j.jenvman.2019.01.082

Zu, Y., & Chen, L. (2017). Myopic versus far-sighted behaviors in dynamic supply chain coordination through advertising with reference price effect. Discrete Dynamics in Nature and Society, 2017, 9759561. https://doi.org/10.1155/2017/9759561

Funding

None.

Author information

Authors and Affiliations

Contributions

JW conceptualized the study and edited the manuscript. RM wrote the original draft and was a major contributor in formal analysis. XL contributed the methodology. BY supervised this study.

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A

1.1 Proof of Proposition 1

Letting \({V}_{{r}_{1}}^{N}\), \({V}_{{r}_{2}}^{N}\), and \({V}_{m}^{N}\) represent the value functions of the large-scale retailer, the small-scale retailer, and the manufacturer in no-cost-sharing strategy, the HJB equations are given by

Using the first-order condition to maximize the right-hand side of Eq. (23), we can obtain

Simultaneous Eqs. (25) yield Eq. (11).

Substituting Eq. (11) into the right-hand side of Eq. (24) yields

Using the first-order condition to solve the right-hand side of Equation (26) with respect to \(\tau\), we can obtain Eq. (12).

Conjecture the manufacturer’s value function as a quadratic form, which is expressed as follows:

where \({I}_{1}\), \({I}_{2}\), and \({I}_{3}\) are the coefficients to be determined. From Equation (27), we have

By Substituting Eqs. (27) and (28) into (26), and letting the corresponding coefficients of \({G}^{2}\) on both sides of equation be equal, we can obtain

Solving Eq. (29) yields

where \({\Delta }_{1}\ge 0\) is required to guarantee the existence of the solution. Note that when \({I}_{1}\) takes a smaller root, the green reputation level will not converge to a steady-state value. Thus, the smaller root is abandoned.

Similarly, \({I}_{2}\) and \({I}_{3}\) are obtained as the following:

Substituting Eqs. (11), and (12) into the right-hand side of Eq. (23) yields

Conjecture the large-scale retailer’s value function as a quadratic form, which is expressed as follows:

where \({J}_{1}\), \({J}_{2}\), and \({J}_{3}\) are the coefficients to be determined. From Equation (34), we have

By Substituting Equations (28), (34), and (35) into (33), and letting the corresponding coefficients of \({G}^{2}\) on both sides of equation be equal, we can obtain

Substituting Equation (30) into Equation (36) yields

Similarly, \({J}_{2}\) and \({J}_{3}\) are obtained as the following:

Substituting Eqs. (11), and (12) into the right-hand side of Eq. (23) yields

Conjecture the small-scale retailer’s value function as a quadratic form, which is expressed as follows:

where \({K}_{1}\), \({K}_{2}\), and \({K}_{3}\) are the coefficients to be determined. From Eq. (41), we have

By Substituting Equations (28), (41), and (42) into (40), and letting the corresponding coefficients of \({G}^{2}\) on both sides of equation be equal, we can obtain

Substituting Equation (30) into Equation (43) yields

Similarly, \(K_{2}\) and \(K_{3}\) are obtained as the following:

1.2 Proof of Proposition 2

By substituting Eq. (12) into (1), we obtain the following differential equation:

Given that \(G\left(0\right)={G}_{0}\), solving Equation (47) yields Eq. (15), where \({G}_{\infty }^{N}\) can also be showed in Eq. (93).

By substituting Eqs. (15) and (93) into (12), we can obtain Eqs. (13) and (94).

By substituting Eqs. (15) and (93) into (11), we can obtain Eqs. (14) and (95).

By substituting Eqs. (15) and (93) into (2), we can obtain Eqs. (16) and (96).

1.3 Proof of Proposition 3

Proposition 3 shows that the monotonicity of retail price relates to \({G}_{0}\) and \({G}_{\infty }^{N}\) for two retailers. When \({G}_{0}>{G}_{\infty }^{N}\), the retail price decreases with time. Therefore, the skimming pricing strategy should be adopted. When \({G}_{0}<{G}_{\infty }^{N}\), the retail price increases with time, thereby requiring the adoption of the penetration pricing strategy.

Proposition 3 also shows that the monotonicity of emission reduction level relates to \({G}_{0}\), \({G}_{\infty }^{N}\), and \(\frac{k\left(2\beta +\gamma \right)\left(\rho +2\delta \right)-{\Delta }_{1}}{2k\theta \left(2\beta +\gamma \right)}\) for the manufacturer. When \(\frac{k\left(2\beta +\gamma \right)\left(\rho +2\delta \right)-{\Delta }_{1}}{2k\theta \left(2\beta +\gamma \right)}\left({G}_{0}-{G}_{\infty }^{N}\right)>0\), the emission reduction level decreases with time. Therefore, the skimming emission reduction strategy should be adopted. When \(\frac{k\left(2\beta +\gamma \right)\left(\rho +2\delta \right)-{\Delta }_{1}}{2k\theta \left(2\beta +\gamma \right)}\left({G}_{0}-{G}_{\infty }^{N}\right)<0\), the emission reduction level increases with time, thereby meaning the adoption of the penetration emission reduction strategy.

1.4 Proof of Corollary 4

According to Eq. (95), we can get

Thus, we can get the relationship between \({p}_{{r}_{1\infty }}^{N}\) and \({p}_{{r}_{2\infty }}^{N}\), as shown in Corollary 4.

According to Equation (96), we can get

Thus, we can get the relationship between \({D}_{{r}_{1\infty }}^{N}\) and \({D}_{{r}_{2\infty }}^{N}\), as shown in Corollary 4.

1.5 Proof of Proposition 5

Letting \({V}_{m}^{C}\), \({V}_{{r}_{1}}^{C},\) and \({V}_{{r}_{2}}^{C}\) represent the value functions of the manufacturer, the large-scale retailer, and the small-scale retailer in cost-sharing strategy, the HJB equations are given by

Using the first-order condition to maximize the right-hand side of Eqs. (51) and (52), we can obtain

Simultaneous Eq. (53) yield Eq. (17).

Substituting Eqs. (17) into the right-hand side of Equation (50), and using the first-order condition to solve the right-hand side with respect to \(\tau\), we can obtain Eq. (18).

Substituting Eqs. (17), and (18) into the right-hand side of Eq. (50) yields

Conjecture the manufacturer’s value function as a quadratic form, which is expressed as follows:

where \({X}_{1}\), \({X}_{2}\), and \({X}_{3}\) are the coefficients to be determined. From Eq. (55), we have

By Substituting Eqs. (55) and (56) into (54), and letting the corresponding coefficients of \({G}^{2}\) on both sides of equation be equal, we can obtain

Solving Eq. (57) yields

where \({\Delta }_{2}\ge 0\) is required to guarantee the existence of the solution. Note that when \({X}_{1}\) takes a smaller root, the green reputation level will not converge to a steady-state value. Thus, the smaller root is abandoned.

Similarly, \({X}_{2}\) and \({X}_{3}\) are obtained as the following:

Substituting Eqs. (17), and (18) into the right-hand side of Equation (51) yields

Conjecture the large-scale retailer’s value function as a quadratic form, which is expressed as follows:

where \({Y}_{1}\), \({Y}_{2}\), and \({Y}_{3}\) are the coefficients to be determined. From Eq. (62), we have

By Substituting Eqs. (56), (62), and (63) into (61), and letting the corresponding coefficients of \({G}^{2}\) on both sides of equation be equal, we can obtain

Solving Eq. (64) yields

Substituting Eq. (58) into Eq. (65) yields

Similarly, \({Y}_{2}\) and \({Y}_{3}\) are obtained as the following:

Substituting Eqs. (17), and (18) into the right-hand side of Eq. (52) yields

Conjecture the small-scale retailer’s value function as a quadratic form, which is expressed as follows:

where \({Z}_{1}\), \({Z}_{2}\), and \({Z}_{3}\) are the coefficients to be determined. From Eq. (70), we have

By Substituting Eqs. (56), (70), and (71) into (69), and letting the corresponding coefficients of \({G}^{2}\) on both sides of equation be equal, we can obtain

Solving Eq. (72) yields

Substituting Eq. (58) into Eq.(73) yields

Similarly, \({Z}_{2}\) and \({Z}_{3}\) are obtained as the following:

1.6 Proof of Corollary 6

Based on Eq. (11) in Proposition 1, and Eq. (17) in Proposition 5, Corollary 6 can easily be obtained.

1.7 Proof of Proposition 7

By substituting Eq. (18) into (1), we obtain the following differential equation:

Given that \(G\left(0\right)={G}_{0}\), solving Eq. (77) yields Eq. (21), where \({G}_{\infty }^{C}\) can also be showed in Eq. (97).

By substituting Eqs. (21) and (97) into (18), we can obtain Eqs. (19) and (98).

By substituting Eqs. (21) and (97) into (17), we can obtain Eqs. (20) and (99).

By substituting Eqs. (21) and (97) into (2), we can obtain Eqs. (22) and (100).

1.8 Proof of Proposition 8

Proposition 8 shows that the monotonicity of retail price relates to \({G}_{0}\) and \({G}_{\infty }^{C}\) for the two retailers. When \({G}_{0}>{G}_{\infty }^{C}\), the retail price decreases with time. Therefore, the skimming pricing strategy should be adopted. When \({G}_{0}<{G}_{\infty }^{C}\), the retail price increases with time, thereby requiring the adoption of the penetration pricing strategy.