Abstract

This research addresses the timely challenge of climate changes by investigating how a carbon emissions taxation scheme can be designed to reduce carbon emissions without hindering long-term economic development. Considering different power structures and green technology investment efficiencies, this research examines the optimal carbon tax design with respect to several key supply chain features. Our findings show that no matter whether customers are sensitive to the carbon emissions or not, the carbon tax should be differentiated across industry sectors, and the supply chain power structure and cost efficiencies in carbon emissions reduction should be taken into account. It is also crucial to have the proper channel leadership to achieve the sustainability objectives.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

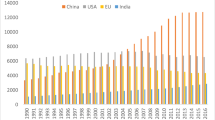

In World Economic Forum 2020,Footnote 1 it is discussed that “carbon emissions from fossil fuels hit a record high in 2019”. Obviously, carbon policies are still in the top agenda in governments and companies all around the world. Although carbon emissions control policies, including mandatory carbon emissions capacities, carbon emissions taxes, cap-and-trade programs, and investment in carbon offsets, have been implemented by many developed and developing countries (Krass et al. 2013; Pezzey and Jotzo 2013), there have been ongoing debates about their fairness, effectiveness, and economic efficiency (Kroes et al. 2012; Cachon 2014; Drake et al. 2015). The Paris agreement also welcomes the intended nationally determined contributions in a manner that facilitates the clarity, transparency and understanding of their contributions (United Nations 2015). It is therefore important for policy makers from all countries to review their existing emissions control polices and revise or develop new polices to achieve their intended national emissions reduction targets.

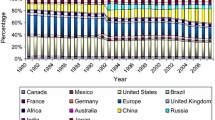

Among the many carbon emissions control policies that support carbon emissions reduction, the carbon emissions tax is one of the popular carbon control policies that can be implemented from the perspective of government policy makers. In Europe, although there is no uniform carbon tax at the European Union level, carbon taxes have been enacted or proposed in a number of countries, such as Finland, Ireland, Sweden, and the UK. The carbon tax in British Columbia, Canada, is regarded by the Carbon Tax Centre as the most significant carbon tax in the Western Hemisphere (Komanoff and Gordon 2015). A carbon tax was imposed at $10 (Canadian) per ton of CO2 initially in 2008 and then incremented by $5/tonne annually until 2012 (Park et al. 2015). Moreover, in addition to variations in the tax level among the existing carbon taxation schemes implemented by many countries, there are also differences in the mechanisms of how a carbon tax is collected (TCT 2016). For instance, a carbon tax may be paid only by the upstream supply chain members at the point where fuels are extracted from the earth, with the cost of the tax then being passed to the downstream of commerce. Alternatively, a carbon tax can be imposed downstream of the supply chains (e.g., on retailers or service providers) when services or products are purchased or to each organisation based on the amount of carbon dioxide it emits.

Despite its wide recognition as a powerful policy mechanism to reduce carbon emissions, carbon taxation schemes also receive a substantial amount of criticisms. For example, carbon tax schemes make the costs associated with controlling carbon emissions overly explicit (Metcalf 2009), which leads to increased operating costs and therefore higher prices for products. Hoel (1996) argues that carbon intensive tradeable sectors should face a lower carbon tax than other sectors of the economy because the tax simply relocates CO2 emissions to countries that have no carbon tax. Therefore, it is important for governments to examine the trade-off between environmental benefits and economic losses when a carbon emissions tax is determined and implemented. In 2014, Australia became the first country to abolish the carbon tax, replacing it with the Emissions Reduction Fund, which is paid by tax payers from consolidated revenue (CTC 2016). There is also ongoing debate in the literature about whether a carbon tax should be differentiated across industry sectors. Different industry sectors may show common or distinctive characteristics. For instance, industrial firms are often operating within supply chains and power relationships within the supply chains may vary between different sectors (Cox 2004; Williams et al. 2011; Touboulic et al. 2014). For example, supermarket chains play a dominant role in the grocery food supply chain in most developed countries. Oil producers and miners are the dominant parties in the energy and mining sector, respectively. Manufacturers have more power in heavy construction and materials. Each sector also exhibits different levels of effectiveness in reducing carbon emissions via green technology investment. For instance, the heavy machinery sector may be more effective in using green technology to achieve emissions reduction than the retail sector. It is essential to explore whether these characteristics should be taken into consideration when developing a new carbon tax.

A thoughtful carbon tax design will address many of these concerns. The main objective of this study is to explore the optimal design of carbon emissions tax that not only meets carbon emissions reduction targets but also achieves the sustainable economic development. The evaluation of optimal carbon tax design also requires the consideration of some key characteristics of different industrial sectors, especially the supply chain power structure and efficiency of green technology investment. To achieve the objective, the following questions are discussed in this paper.

- 1.

How should the carbon emissions tax be designed to optimise the economic and environmental performances of a supply chain? For instance, who should pay for the emissions tax (retailers or manufacturers).

- 2.

To what extent does the supply chain power structure have an impact on the optimal design of the carbon emissions tax and the associated economic and environmental performances?

- 3.

How does the green technology investment efficiency of supply chain members affect the optimal design of the carbon emissions tax and the associated economic and environmental performances?

To answer these questions, we consider a two-echelon supply chain that consists of a manufacturer and a retailer in three different game models: the Manufacturer Stackelberg (MS) model, the Nash model, and the Retailer Stackelberg (RS) model. Three different supply chain power structures are analytically modelled using non-cooperative game theory that focuses on the interaction of supply chain members characterised by the different orders of event sequence. Through a comparison of the optimal decisions on carbon emissions tax design and the associated economic and environmental performances derived in each game model, our research systematically examines the effects of the supply chain power structure on carbon tax decisions and performances. Furthermore, we also analyse the impact of the efficiencies of green technology investment in carbon emissions reduction on the optimal carbon tax design and performances. Moreover, to enhance the adaptability, we also discuss the optimal carbon emissions policy design and supply chain power structure effects under the scenarios with and without carbon emissions sensitive demand.

Our analysis leads to many interesting insights. From the policy maker’s perspective, an optimal design of carbon tax design that delivers the environmental and economic sustainability of the supply chain highly depends on the power structure of the supply chain. More specifically, when the supply chain power structure is asymmetric, collecting more carbon emissions taxes from the follower will induce the entire supply chain to invest more in the green technology and gain more economic benefits. When the supply chain power structure is symmetric, the carbon emissions tax should be allocated to both the manufacturer and the retailer to minimise the unit carbon emissions and to maximise total profit. From the individual firms’ view, the optimal decision for green technology investment depends on the investment cost coefficient of supply chain members. A carbon tax should be differentiated across industry sectors, and the characteristics of the supply chain power structure and cost efficiencies in carbon emissions reduction should be taken into account. It is also crucial to have the right channel leadership to achieve the objectives of sustainability. These findings not only help firms make important operational and technology investment decisions to improve their competitive advantages but also support policy makers in developing effective carbon emissions taxation schemes that support long-term sustainability.

The rest of this paper is organised as follows. Section 2 outlines the theoretical background by reviewing the relevant literature, which is followed by the models and equilibrium analysis in Sect. 3. Section 4 analyses the optimal design of the carbon emissions tax under asymmetric and symmetric supply chain power structures, respectively. Then, the effects of supply chain power structure are discussed in Sect. 5. Section 6 extends the modelling to the demand function that customers are sensitive to carbon emissions and discusses the optimal carbon emissions tax design and the effects of supply chain power structure. Section 7 discusses the main research findings, managerial relevance and insights, and policy implications. Finally, we present our concluding remarks by highlighting research contribution and future research directions in Sect. 8, respectively. All technical proofs are placed in the “Appendix”.

2 Research background and related literature

To outline the research background and highlight our contributions, we reviewed the relevant literature focusing on three key streams: (1) the effect of carbon emissions tax schemes on supply chain decisions (2) green/sustainable supply chain management considering the power structure, and (3) the role of green technology investment in carbon emissions reduction.

Compared to other carbon emissions control regulatory policies such as cap-and-trade, there are relatively few studies that investigate operations decisions under carbon emissions taxation schemes. Penkuhn et al. (1997) is one of the early pioneering studies which integrates emissions taxes into a nonlinear programming model for joint production planning problems in the context of process industries. Letmathe and Balakrishnan (2005) develop a linear mixed integer programming model that calculates the optimal production quantities and product mix quantities under different environmental constraints including the emissions tax. Bouchery et al. (2012) incorporate sustainability criteria into the classical economic order quantity model and examine the effectiveness of different regulatory policies to control carbon emissions, including the carbon tax. Choi (2013a) explores the impacts of different carbon emissions tax formats on the supplier selection problem in the context of the fashion apparel supply chain. His investigation on the effects of the carbon footprint taxation scheme on the optimal choice of the sourcing decision also reveals that a properly designed carbon taxation scheme can not only entice the fashion retailer to source from a local manufacturer but also mitigate risk for the fashion retailer (Choi 2013b). More research has been carried out in recent years to examine how carbon emissions tax policies affect different supply chain decisions such as purchasing (Rosic and Jammernegg 2013), pricing and production quantity (Chen and Hao 2015; He et al. 2015), supply chain design and planning (Fahimnia et al. 2015; Jiang and Chen 2016; Turken et al. 2017), transportation sourcing and mode selection (Wang et al. 2015a; Li et al. 2017). However, most of the abovementioned studies consider carbon emissions taxation as a new factor or constraint and concentrate on optimising supply chain decisions (e.g., inventory, pricing, and product mix) with carbon emission tax as an additional consideration. Few researchers have attempted to study carbon emissions tax design through modelling supply chain firms’ behaviours and the resulting economic and environmental performances.

Another relevant stream of literature examines the impact of the supply chain power structure on firms’ operational decisions. The majority of studies on the supply chain power structure focus on vertical competition between manufacturers and their customers or between manufacturers and their suppliers (Xiao et al. 2014; Chen and Wang 2015; Chen et al. 2017). In the context of green or sustainable supply chain management, Touboulic et al. (2014) investigate an imbalanced supply chain relationship for sustainability, and their study illustrates the influences of power on how supply chain members manage their relationships and its effect on organisational responses to sustainability implementation. Wang et al. (2018) present a novel technique to evaluate and assess the network-oriented risks in sustainable product-service systems (SusPSSs) to minimise the material use and emissions. Considering the supply chain power relationship, Chen et al. (2017) design a two-part tariff contract to coordinate the supply chain with a goal of optimising the economic and environmental performance. Although their research consider the carbon emission attribute as a decision variable, they do not incorporate any carbon emission control policies e.g. carbon tax or cap-and-trade. Park et al. (2015) examine the impact of the carbon tax on the equilibrium supply chain structure and social welfare. Their findings show that the carbon cost can significantly influence the supply chain structure when there is intense market competition. Their research also suggests the importance of imposing the optimal carbon tax to curb emissions. Du et al. (2015) investigate the behaviour and decision making of each supply chain member in the cap-and-trade system. Their study develops a game theoretical analytical model, in which supply chain players’ bargaining power is affected by exogenous factors. Considering the carbon emissions tax, Chen and Hao (2015) investigate two competing firms’ optimal pricing and production policies with a balanced power structure. The two abovementioned studies only consider the balanced power structure and obtain a Nash equilibrium. Different industry sectors, such as the energy, steel, fashion, and grocery supermarket sectors, have unique power relationships in their supply chains (Chen and Wang 2015; Chen et al. 2016). Other supply chain power structures, such as the asymmetric power relationship, also influence the efficiency of carbon emission tax for a low carbon supply chain. It will be important to incorporate the power factor into the exploration of optimal carbon tax design from the supply chain perspective. This research aims to address this gap in the literature by systematically examining the effects that the supply chain power structure has on a low-carbon supply chain under carbon emissions taxation schemes.

To reduce carbon emissions, it is essential to encourage organisations to invest in green and cleaner technologies and to adopt green practices in their processes (Wiesenthal et al. 2012; Drake et al. 2015; Chiou et al. 2011; Luo et al. 2016; Xu et al. 2017). Technological investment is considered to be a strategic decision for organisations to control carbon emissions, and many firms regard such investments as possible alternatives for gaining or maintaining competitive advantage (Krass et al. 2013; Wang et al. 2013; Chen and Wang 2016; Govindan et al. 2019). Although investment in greener and cleaner technologies to make these processes energy efficient will reduce the carbon footprint of the supply chain, the cost associated with green technology investment poses major barriers for its wide adoption in industry. Organisations are interested in opportunities in which both economic performance and environmental performance can be improved (Baker and Solak 2014); therefore, a quick return on investment is the key driver for green technology implementation in various supply chain cases. Han et al. (2017) build a mixed-integer linear programming model for a real-world firm to study how to select weight reduction technology and design a supply chain network considering carbon emissions restrictions. Using the Stackelberg game between a regulator and a firm, Krass et al. (2013) examine the role that environmental taxation can play in reducing environmental pollution and inducing the choice of greener technology by a profit-maximising firm. Similarly, Drake et al. (2015) combine the economic and operations approaches and analyse the technology choice under emissions regulations including both tax and cap-and-trade regulatory regimes. Considering a government and two competing firms who sell products and face price and pollution sensitive customers, Bi et al. (2017) examine the government’s subsidy policy as well as the two firms’ selling prices and technology investment. As opposed to the abovementioned studies, which only examine one firm’s or horizontal firms’ technology choice and operations decisions such as price and capacity, our research concentrates on firms’ green technology decisions and operations decisions in the context of a supply chain. Ultimately, achieving the carbon emissions reduction objective requires emissions reduction not only in firms’ own operations but also—and more importantly—in their supply chains.

The main issues and important findings in this field are summarized in Table 1. However, most existing research in the literature mainly examines the carbon emissions tax from an economic perspective (Wissema and Dellink 2007; Mathur and Morris 2014), and little attention has been paid to carbon emissions tax design that considers how firms and supply chains behave under the carbon emissions tax, and how their behaviours affect both economic and environmental performances. In contrast, most of the supply chain management literature on carbon emissions taxation focuses on optimising supply chain decisions under different carbon tax schemes (Choi 2013a, b; Wang et al. 2015a). Most companies will respond to government policies strategically and operationally to maximise their own benefits. Therefore, it is important for policy makers to understand how firms will react to new policies and the consequential economic and environmental performances when they develop new carbon emissions control polices. There are only a few studies (Krass et al. 2013; Drake et al. 2015) that examine the government’s environmental policies (including carbon taxation) from the policymaker perspective by modelling firms’ decisions on pricing and green technology. However, the studies by Krass et al. (2013) and Drake et al. (2015) mainly concentrate on individual firms’ decision behaviours and the corresponding performances without considering the interactions among supply chain partners. To meet the objectives of sustainability, a coordinated effort is required to reduce the carbon emissions of the entire supply chain. To the best of our knowledge, very little research has been undertaken that focuses on the carbon emissions tax design by exploring supply chain features and examining the associated economic and environmental performances. This paper hence contributes to the literature by filling this research gap.

3 The models and equilibrium analysis

3.1 Model formulation and assumption

We consider a two-echelon supply chain that consists of a manufacturer and a retailer. The retailer purchases products from the manufacturer and sells to end customers. Throughout this paper, we use the parameters and variables notated as follows in Table 2.

There are three key assumptions in this paper as stated in the following.

- 1.

The demand faced by the retailer is price-sensitive, that is, \( q = \alpha - \beta p \), where α is the initial market and β means self-price sensitivity (Yalabik and Fairchild 2011). The linear demand function has been used extensively in the literature relating to pricing and supply chain research as an acceptable approximation of demand (Shin and Tunca 2010; Shang et al. 2016). Besides, we use the linear demand function because it is more analytically tractable and helps derive closed-form insights. In Sect. 6, we extend the price-sensitive demand function to the demand function that is both price-sensitive and carbon-emissions-sensitive.

- 2.

Both the manufacturer and the retailer are assumed to actively undertake green technology investment. This assumption is reasonable as carbon emission reduction is not only the responsibility of the dominant party in a supply chain but also other parties within the supply chain. For example, when Sainsbury’s, a leading supermarket chain in the United Kingdom, pledges to halve plastic packaging by 2025, they also call for their suppliers to come forward with new technologies and business models (BBC 2019). According to CDP’s Global Supply Chain Report 2018, Sky, the European entertainment and telecommunications giant, is in partnership with a key supplier, to develop circular economy model for its new set-top box with the aim of creating a closed loop system with zero waste to landfill (CDP 2019).

- 3.

The unit carbon emissions tax τ, is assumed to be an exogenous parameter. The reason is that the unit carbon emissions tax depends on the government’s goal about total carbon emissions reduction. In this paper, we focus on how the carbon emissions tax should be allocated between the manufacturer and the retailer.

Based on the model assumptions, the manufacturer’s profit, denoted by \( \pi_{m} \left( {w,e_{m} } \right) \), is:

The first term is the revenue from product wholesaling. The second term indicates the production costs. The last two terms represent the green technology investments and carbon emissions tax absorbed by the manufacturer, respectively.

Similarly, the retailer’s profit, denoted by \( \pi_{r} \left( {p,e_{r} } \right) \), is:

The first term means the revenue from product retail sales. The second term represents the purchase cost. The last two terms are the green technology investments and carbon emissions tax absorbed by the retailer, respectively.

The total supply chain’s profit, denoted by π, is \( \pi = \pi_{m} \left( {w,e_{m} } \right) + \pi_{r} \left( {p,e_{r} } \right) \). That is:

The problem faced by the manufacturer is to decide the unit wholesale price (w) and its unit carbon emissions (em) to maximise its profit. The manufacturer’s decision problem is:

Similarly, the problem faced by the retailer is to decide the optimal unit retail price (p) and its unit carbon emissions (er) to maximise its profit. The retailer’s decision problem is:

The problem faced by the policy maker is to design the ratio of carbon emissions tax absorbed by the manufacturer (θ) to minimise the supply chain’s unit carbon emissions and to maximise the total supply chain’s profit simultaneously so as to achieve a trade-off between economic efficiency and environmental sustainability. That is:

and

where superscript i = m, n, r represents the MS model, the Nash model, and the RS model, respectively. From the environment point of view, the policy marker’s goal is to reduce the total carbon emissions to be consistent with the Paris Climate arrangement. To achieve this environmental goal, they can implement relevant policies (e.g. carbon taxation) to reduce the carbon emission for unit product and/or the total output of product. However, the policy maker also has the responsibility of sustaining economic growth from the economic point of view. Producing fewer products may have negative impact on the financial performance of the supply chain and its members as well as the wide economy. Reducing product unit carbon emissions is a more effective and sustainable approach to achieve the goal of reducing the total carbon emissions.

3.2 The equilibriums

According to the power structure, there are three game models: the MS model, the Nash model, and the RS model. Among the three abovementioned models, the MS model and the RS model are asymmetric, and the Nash model is symmetric. These three power structures are commonly seen in practice (Shi et al. 2013). For instance, in an automobile manufacturing supply chain, the manufacturers usually have more power than the retailers and act as the leader in the supply chain. Some powerful supermarkets, like Wal-Mart, play a dominant role compared with most of their upstream suppliers or manufacturers in the supply chain. There is a more balanced power structure between fashion brands and department stores in the fashion industry such as Zara and its main supplier, AHA (Wilhelm et al. 2016). Empirical evidence from the work of Cotterill and Putsis (2001) also supports that a Nash game can be employed to model the strategic interaction between supply chain parties for a number of product categories.

3.2.1 Asymmetric supply chain power structure models

Asymmetric supply chain power structures (the MS and RS power structures) are characterised by the different sequences in which the wholesale and retail prices and unit carbon emissions are determined by the manufacturer and the retailer, respectively. More detailed interpretations are as follows:

Manufacturer-Stackelberg is widely adopted in the operations and supply chain literature and we follow the standard approach reported in the literature (SeyedEsfahani et al. 2011; Zhang et al. 2012; Shi et al. 2013) to outline the decision sequence in the MS model. With the carbon emissions tax given by the government that includes the unit carbon emissions tax and the ratio to be absorbed, the manufacturer moves first as the Stackelberg leader setting the wholesale price and unit carbon emissions. The retailer is the follower and decides the retail price and unit carbon emissions based on the manufacturer’s wholesale price and unit carbon emissions. The manufacturer takes the retailer’s reaction function into consideration for the respective wholesale price and unit carbon emission decisions. The decision process of the MS model is:

Similarly, we follow the standard Retailer-Stackelberg approach reported in the literature to outline the decision sequence in the RS model (Huang and Li 2001; Shi et al. 2013; Xiao et al. 2014). With the carbon emissions tax given by the government, the retailer moves first as the Stackelberg leader setting the retail price and unit carbon emissions. The manufacturer is the follower and decides the wholesale price and unit carbon emissions based on the retailer’s retail price and unit carbon emissions. The retailer takes the manufacturer’s reaction function into consideration for the respective retail price and unit carbon emission decisions. The decision process of the RS model is:

3.2.2 Symmetric structure model

In the symmetric structure (Nash) model, a Nash equilibrium exists between the two supply chain members. We follow the standard game theoretical approach reported in the literature (Chen et al. 2019; SeyedEsfahani et al. 2011; Chen and Wang 2015) to describe the decision sequence in the Nash model. First, the policy maker gives the ratio of carbon emissions tax at the beginning of the game. Then, the manufacturer sets the wholesale price and the unit carbon emissions and the retailer sets the retail price and the unit carbon emissions simultaneously. Finally, when customer demand is realised, the manufacturer and the retailer gain their revenues. The decision process of the Nash model is:

Table 3 shows the manufacturer’s optimal unit wholesale price (wi) and unit carbon emissions (\( e_{m}^{i} \)), and the retailer’s optimal retail price (pi) and unit carbon emissions (\( e_{r}^{i} \)) in the presence of the carbon emissions tax in the aforementioned power structure models (i = m, r, n). The proofs of these expressions are placed in “Appendix”.

4 Optimal carbon tax

In this section, we discuss how to design the optimal ratio of carbon emissions tax absorbed by the manufacturer in the asymmetric supply chain power structure models (MS and RS models) and the symmetric structure model (Nash model) from the perspective of the supply chain’s environmental performance and supply chain’s profit. Several interesting findings can be obtained.

4.1 Optimal carbon tax in the asymmetric supply chain power structure

As to the optimal ratio of carbon emissions tax absorbed by the manufacturer in the asymmetric supply chain power structure models (MS and RS models), we propose following theorem. The superscripts m and r depict the MS model and the RS model, respectively. Moreover, the superscripts mc and rc indicate the situation to minimise the unit carbon emissions of the supply chain in the MS and RS models, respectively. Besides, the superscripts mp and rp indicate the situation to maximize the profit of the supply chain in the MS and RS models, respectively.

Theorem 1

-

(1)

To minimise the supply chain’s unit carbon emissions with green technology investment,\( \theta^{mc} = 0 \)and\( \theta^{rc} = 1 \).

-

(2)

To gain the maximum profit of the supply chain with green technology investment,\( \theta^{mp} = 0 \)and\( \theta^{rp} = 1 \).

-

(3)

To minimise the supply chain’s unit carbon emissions and maximise the supply chain’s total profit,\( \theta^{m} = 0 \)and\( \theta^{r} = 1 \).

From (1)–(3) in Theorem 1, the optimal solution for the carbon emissions taxation is to tax the follower in the asymmetric supply chain power structures (θi) in order to minimize the unit carbon emissions and maximize the economic benefit for the supply chain. Interestingly, the aforementioned optimal taxation solution is mainly dependent on the power structure but not influenced by the green technology investment cost coefficients (tm or tr). This may be explained by the fact that if the carbon emissions tax is collected only from the leader, the supply chain follower will not take the government’s carbon emissions tax policy into account in the decision making of wholesale/retail prices and green technology investment as they are not taxed on their carbon emissions. In contrast, if the emissions tax is imposed on the follower, they have to consider the taxation policy when making decisions on wholesale/retail prices and green technology investments. Meanwhile, the supply chain leader is able to respond to the follower’s decisions for respective operational decisions. Comparing to a taxation on the supply chain leader that only influences leader’s decision, collecting carbon emissions tax from the follower will have an impact on decision making of both supply chain parties in the asymmetric power structure. Therefore, it is more likely for the policy makers to design an optimal taxation scheme to induce supply chain parties to invest more in green technologies and improve the environmental and economic performance of the supply chain.

For policy makers, collecting more carbon emissions taxes from the follower will induce both the manufacturer and the retailer to invest more in green technology. Meanwhile, the profits of the manufacturer, the retailer and the supply chain are all higher. This increase may be explained by the fact that, on the one hand, the follower will adjust its decisions on pricing and its green technology investment based on the carbon emissions tax imposed on it. On the other hand, the supply chain leader is able to respond to the follower’s decisions to make its decisions on pricing and green technology investments to optimise its performance. By contrast, the optimisation of environmental and economic performances cannot be achieved if the carbon emissions tax is collected only from the leader because the supply chain follower will not be able to optimise its pricing and investment decisions according to the carbon emissions tax.

For the relationships between the manufacturer’s optimal green technology investment (\( T_{m}^{i} \)) and the retailer’s optimal green technology investment (\( T_{r}^{i} \)) in the MS model and in the RS model, respectively, under the scenarios with the optimal ratio of carbon emissions tax absorbed by the manufacturer (θi), where i = m, r, the following lemma can be obtained.

Lemma 1

If tm > tr, then\( T_{m}^{m} < T_{r}^{m} \)and\( T_{m}^{r} < T_{r}^{r} \); if tm = tr, then\( T_{m}^{m} = T_{r}^{m} \)and\( T_{m}^{r} = T_{r}^{r} \); if tm < tr, then\( T_{m}^{m} > T_{r}^{m} \)and\( T_{m}^{r} > T_{r}^{r} \).

Lemma 1 indicates that the relationships between the manufacturer’s and the retailer’s optimal green technology investments (\( T_{m}^{m} \) and \( T_{r}^{m} \); \( T_{m}^{r} \) and \( T_{r}^{r} \)) are decided only by the firm’s investment cost coefficients (tm and tr) and not by the supply chain’s power structure under the above optimal carbon emissions tax (θi) design, and the firm with a lower green investment cost coefficient will invest more in green technology. The above results are shown in Fig. 1 to clearly outline the relationships between optimal green technology investment decisions for the manufacturer and retailer in the two models. This phenomenon may be explained by the fact that the firm with a low green technology investment cost coefficient is more efficient in its carbon emissions reduction. Hence, the firm with greater carbon emissions reduction efficiency can invest more in green technology to achieve the optimal economic and environmental performances. Fundamentally, carbon emissions reduction requires green technology investments by all supply chain parties to improve carbon efficiency.

Therefore, to achieve the objective of sustainability, both the power structure and the green technology investment cost coefficients (tm and tr) of supply chain members should be taken into consideration for the development of carbon emissions control policies. Overall, Theorem 1 and Lemma 1 show some interesting results, which are summarised in the following remark.

Remark 1

The optimal carbon tax design is mainly influenced by the supply chain power structure. By contrast, the optimal decision on green technology investment depends on the green technology investment cost coefficients of supply chain members.

This remark means that, in an imbalanced supply chain power structure, the policy maker should consider the power relationship between supply chain members when designing carbon taxation schemes (θi). Meanwhile, firms’ green technology investment (\( T_{m}^{i} \) and \( T_{r}^{i} \)) decisions are mainly affected by their efficiencies (tm and tr) in carbon emissions reduction. Therefore, the policy maker should develop appropriate policies that incentivize those firms with greater carbon emissions reduction efficiency, i.e., the lower green technology investment cost coefficient, to invest more in green technology to achieve sustainable economic and environmental development.

4.2 Optimal carbon tax in the symmetric supply chain power structure

Similarly, to design the optimal ratio of carbon emissions tax absorbed by the manufacturer from the perspective of the supply chain’s unit carbon emissions and profit, the following theorem can be obtained. The superscript n depicts the Nash model. In addition, the superscript nc indicates the situation to minimise the unit carbon emissions of the supply chain in the Nash model. And the superscript np indicates the situation to maximize the profit of the supply chain in the Nash model.

Theorem 2

-

(1)

To gain the supply chain’s minimum unit carbon emissions with green technology investment, if\( t_{m} > t_{r} \), then\( \theta^{nc} = 0 \); if\( t_{m} = t_{r} \), then θnccan be an arbitrary value in the interval [0, 1]; if\( \varvec{t}_{\varvec{m}} < \varvec{t}_{\varvec{r}} \), then θnc = 1.

-

(2)

To gain the supply chain’s maximum profit with green technology investment, if\( t_{m} > \frac{{8t_{r} - \beta \tau^{2} }}{2} \), then\( \theta^{np} = 0 \); if\( \frac{{2t_{r} + \beta \tau^{2} }}{8} < t_{m} < \frac{{8t_{r} - \beta \tau^{2} }}{2} \), then\( \theta^{np} = \frac{1}{2} + \frac{{5\left( {t_{r} - t_{m} } \right)}}{{6\left( {t_{m} + t_{r} } \right) - 2\beta \tau^{2} }} \); if\( t_{m} < \frac{{2t_{r} + \beta \tau^{2} }}{8} \), then\( \theta^{np} = 1 \).

-

(3)

Considering the supply chain’s minimum unit carbon emissions and the supply chain’s maximum profit with green technology investment simultaneously, if\( t_{m} < \frac{{2t_{r} + \beta \tau^{2} }}{8} \), then\( \theta^{n} = 1 \); if\( \frac{{2t_{r} + \beta \tau^{2} }}{8} \le t_{m} \le t_{r} \), then\( \theta^{n} \in \left[ {\frac{1}{2} + \frac{{5\left( {t_{r} - t_{m} } \right)}}{{6\left( {t_{m} + t_{r} } \right) - 2\beta \tau^{2} }},1} \right] \); if\( t_{r} < t_{m} \le \frac{{8t_{r} - \beta \tau^{2} }}{2} \), then\( \theta^{n} \in \left[ {0,\frac{1}{2} + \frac{{5\left( {t_{r} - t_{m} } \right)}}{{6\left( {t_{m} + t_{r} } \right) - 2\beta \tau^{2} }}} \right) \); if\( t_{m} > \frac{{8t_{r} - \beta \tau^{2} }}{2} \), then\( \theta^{n} = 0 \).

Parts (1)–(3) of Theorem 2 mean that, to minimise the supply chain’s unit carbon emissions and maximise the supply chain’s profit, the optimal ratio exists and is affected by the relationship between the manufacturer’s green investment cost coefficient (tm) and the retailer’s green investment cost coefficient (tr). Besides, the optimal design of the carbon emissions tax is determined by two thresholds, the high threshold (\( \frac{{8t_{r} - \beta \tau^{2} }}{2} \)) and the low threshold (\( \frac{{2t_{r} + \beta \tau^{2} }}{8} \)). The two thresholds lead to three decision intervals. As illustrated in Fig. 2, these intervals have important implication for the design of the carbon tax, in this case, the optimal ratio of carbon emissions tax absorbed by the manufacturer (θn). For instance, when the manufacturer’s green investment cost coefficient is higher than the high threshold (\( \frac{{8t_{r} - \beta \tau^{2} }}{2} \)) or lower than the low threshold (\( \frac{{2t_{r} + \beta \tau^{2} }}{8} \)), the policy maker should only collect carbon emissions tax from the firm with greater emissions reduction efficiency. When the manufacturer’s green investment cost coefficient is in the interval between the two thresholds (\( \frac{{2t_{r} + \beta \tau^{2} }}{8} < t_{m} < \frac{{8t_{r} - \beta \tau^{2} }}{2} \)), the carbon emissions tax should be collected from both the manufacturer and the retailer, as shown in the region I in Fig. 2. Additionally, region I(a) depicts that if the manufacturer’s green investment cost coefficient is lower (\( \frac{{2t_{r} + \beta \tau^{2} }}{8} < t_{m} < t_{r} \)), then the optimal ratio is higher (\( \theta^{n} > \frac{1}{2} \)); similarly, region I(b) depicts that if the manufacturer’s green investment cost coefficient is higher (\( t_{r} < t_{m} < \frac{{8t_{r} - \beta \tau^{2} }}{2} \)), then the optimal ratio is lower (\( \theta^{n} < \frac{1}{2} \)). Thus, the firm with greater emissions reduction efficiency, i.e., with a lower green investment cost coefficient, will be subject to a higher carbon emissions tax. The efficiency in carbon emissions reduction through green technology investment varies between different industry sectors as well as companies at different stages of a supply chain, such as manufacturers, logistics providers, and retailers. For instance, green technology investment may have a more significant impact on the transportation and logistics sector than on the retail sector. As noted in the previous literature, the upstream of the supply chain contributes to the majority of the environmental loads on energy consumption (Raz et al. 2013; Wang et al. 2015b). Green technology investment in the upstream of the supply chain is more likely to make a greater contribution to carbon emissions reduction compared to investment in the downstream of the supply chain. Therefore, it is vital for policy makers to not only take this factor into account when designing the carbon emissions tax but also provide more incentives for the upstream supply chain parties to invest in green technologies when using the carbon tax revenue.

Regarding the relationships between the manufacturer’s optimal green technology investments (\( T_{m}^{n} \)) and the retailer’s optimal green technology investments (\( T_{r}^{n} \)) under the scenarios with the optimal ratio of carbon emissions tax absorbed by the manufacturer, the following lemma can be obtained.

Lemma 2

If\( t_{m} > t_{r} ,T_{m}^{n} < T_{r}^{n} \); if\( t_{m} = t_{r} ,T_{m}^{n} = T_{r}^{n} \); if\( t_{m} < t_{r} ,T_{m}^{n} > T_{r}^{n} \).

Lemma 2 indicates that the firm’s optimal green technology investment (\( T_{i}^{n} \)) is decided by the investment cost coefficient (tm and tr), and the firm with a lower green investment cost coefficient will invest more in green technology. A comparison of the investment levels of the same player in both asymmetric and symmetric structure cases, we can conclude that the relationships between the manufacturer’s and retailer’s optimal green technology investments are decided only by the firm’s investment cost coefficients and not by the supply chain’s power structure.

5 The power structure effect

In this section, we discuss the effect of different power structures on the optimal carbon tax design (θi) and the unit carbon emissions. Recall Theorem 1, the optimal carbon ratio absorbed by the manufacturer in the MS model and the RS model is θm = 0 and θr = 0, respectively. Additionally, the optimal carbon ratio in the Nash model is illustrated in Fig. 2. Hence, we can obtain the following corollary:

Corollary 1

\( \theta^{m} \le \theta^{n} \le \theta^{r} \).

This corollary means that, if the manufacturer is the leader, then the optimal ratio of carbon emissions tax absorbed by the manufacturer (θm) is lowest for carbon emissions minimisation and profit maximisation. By contrast, the optimal ratio is highest when it is the follower (θr). This phenomenon demonstrates that the supply chain power structure has a profound effect on the optimal carbon emissions tax design to optimise the environmental and economic performances. Unfortunately, the supply chain power structure has often been ignored by policy makers in the development of carbon tax schemes. In reality, different industry sectors, such as the steel, telecommunication, and grocery store sectors, have unique supply chain power structures. It is important for policy makers to incorporate such difference into the design of the carbon tax.

To explore the effect of the power structures on the optimal ratio of carbon emissions tax from the perspective of minimising the carbon emissions and maximising the profit (θi), we consider a scenario that excludes the effect of the green technology investment cost coefficients, and assume that tm = tr = t. Following theorem can be obtained, where the superscripts mt, rt and nt indicate the situation with the same green technology investment cost coefficients of the manufacturer and the retailer in the MS, RS and Nash models, respectively.

Theorem 3

\( e_{m}^{mt} = e_{m}^{rt} < e_{m}^{nt} ,e_{r}^{mt} = e_{r}^{rt} < e_{r}^{nt} \)and\( e^{mt} = e^{rt} < e^{nt} \), when tm = tr = t.

This theorem means that, in asymmetric supply chain structures, the optimal unit carbon emissions of the manufacturer, the retailer and the supply chain are equal and are all lower than those in the symmetric power structure. This phenomenon can be explained by the fact that a supply chain leader in the symmetric structure is lacking and the implementation of a low-carbon supply chain often requires a leader to impose through strategic and operational decisions. Economically, a balanced power structure is able to achieve equilibrium from the perspective of the entire supply chain, which is often acknowledged in the existing economic and supply chain management literature (Zhang et al. 2012; Chen and Wang 2015). However, to achieve environmental and social sustainability, it is essential to have a channel leadership to drive the sustainability agenda. It is also crucial for governments to develop new policies and incentives to encourage companies to take a leadership role in investing in and implementing new sustainability initiatives.

6 Extended models

In this section, we extend the aforementioned models via considering the demand function that is both price and carbon emissions sensitive, i.e. \( q = \alpha - \beta p - \gamma \left( {e_{m} + e_{r} } \right) \), where γ means carbon emissions sensitivity. Other assumptions in the extended models are the same as those in the basic models, and can be referred to Table 2. Similar to the basic models, first, we also derive the manufacturer’s and retailer’s optimal decisions with the carbon emissions tax under three power structure situations (i = m, r, n). Second, based on these optimal decisions, we conduct a numerical analysis to reveal the optimal carbon tax in each power structure and the effects of power structure on the supply chain’s unit carbon emissions.

6.1 Optimal carbon tax

6.1.1 Optimal carbon tax in the asymmetric supply chain power structure

In this subsection, we discuss the optimal ratio of carbon emissions tax absorbed by the manufacturer in the asymmetric supply chain power structure (MS and RS) models from the perspective of obtaining the supply chain’s unit carbon emissions minimization and profit maximization. We set α = 20, c = 1, β = 1, γ = 1.5, e0 = 4.5, tr = 5 and τ = 0.5. The results are shown as Fig. 3.

Figure 3 shows the same results as those in Theorem 1, that is, to achieve the unit carbon emissions minimization and the economic performance maximization of the supply chain, the optimal carbon emissions taxation is to tax the follower in the asymmetric supply chain power structures (θi). And this optimal tax policy depends on the power structure rather than the green technology investment cost coefficients (tm or tr). Therefore, the policy makers can also design optimal carbon emissions taxation similar to the policy that is referred to Theorem 1.

6.1.2 Optimal carbon tax in the symmetric supply chain power structure

Similarly, we discuss the optimal ratio of carbon emissions tax absorbed by the manufacturer in the extended model in the symmetric supply chain power structure from the perspective of balancing the supply chain’s unit carbon emissions and profit. To this end, we set α = 20, c = 1, β = 1, γ = 1.5, e0 = 4.5, tr = 5 and τ = 0.5. Then, the results are shown in Fig. 4.

Similar to Theorem 2, Fig. 4 means that the optimal ratios (θn) exist and are affected by the relationship between the manufacturer’s green investment cost coefficient (tm) and the retailer’s green investment cost coefficient (tr) to balance the goal of minimizing unit carbon emissions and maximizing profit of the supply chain. Notably, the optimal ratio is also determined by two thresholds, the high threshold (7.875) and the low threshold (3.358) that are relevant to the carbon emissions sensitivity (γ), which are different from the thresholds in the basic models. Similar to the basic models, when the manufacturer’s green investment cost coefficient is higher than the high threshold or lower than the low threshold, only taxing the firm with greater emissions reduction efficiency is optimal. When the manufacturer’s green investment cost coefficient is between the two thresholds, the optimal ratio (θn) is within the regions I(a) and I(b), and the firm with a lower green investment cost coefficient will be collected a higher carbon emissions tax.

6.2 The power structure effect

Figures 3 and 4 show that the optimal carbon ratio absorbed by the manufacturer in three power structure models, respectively. Therefore, we can obtain the following remark:

Remark 2

\( \theta^{m} \le \theta^{n} \le \theta^{r} \).

Remark 2 indicates the same result as Corollary 1 in the basic models, that is, the supply chain power structure can significantly affect the optimal carbon emissions tax design to balance the environmental and economic performances. More amply, under the situation where the manufacturer has the highest (lowest) power, the optimal ratio of carbon emissions tax absorbed by the manufacturer is lowest (highest).

Next, the effects of the power structure on the supply chain’s unit carbon emissions are revealed under the scenario where the optimal ratio of carbon emissions tax from the perspective of minimising the carbon emissions and maximising the profit (θi) is designed. To focus on the power structure effects and exclude the effect of the green technology investment cost coefficients (tm or tr), we let tm = tr = t as the basic models do. Furthermore, we set α = 20, c = 1, β = 1, e0 = 4.5 and τ = 0.5, then the following Fig. 5 can be obtained.

Region I in Fig. 5 illustrates that \( e_{m}^{mt} = e_{m}^{rt} < e_{m}^{nt} ,e_{r}^{mt} = e_{r}^{rt} < e_{r}^{nt} \) and \( e^{mt} = e^{rt} < e^{nt} \); Region II in Fig. 5 illustrates that \( e_{m}^{mt} = e_{m}^{rt} > e_{m}^{nt} ,e_{r}^{mt} = e_{r}^{rt} > e_{r}^{nt} \) and \( e^{mt} = e^{rt} > e^{nt} \). Figure 5 reveals that in the extended models, the power structure effects on the supply chain’s unit carbon emissions are relevant to carbon emissions sensitivity (γ) and the green technology investment cost coefficient (t), which are different to the results in Theorem 3 in the basic models. More specifically, Region I depicts that if carbon emissions sensitivity is low (0 < γ ≤ 0.5), which means customers concern less about carbon emissions than product price, then the manufacturer and retailer may not be willing to reduce carbon emissions. In this case, taxing the follower can push the leader to adjust its carbon emissions reduction decisions according to the follower’s response functions, and that leads the unit carbon emissions in the asymmetric power structure to be lower than that in the symmetric power structure. Besides, Region I also shows that if carbon emissions can affect significantly customers’ demands for product and the manufacturer’s and retailer’s carbon emissions reduction efficiency is high (γ > 0.5 and \( t < \frac{{\left( {1 + 2\gamma } \right)^{2} \left( {1 + 4\gamma } \right)}}{{16\left( {2\gamma - 1} \right)}} \)), then taxing the follower can also gain remarkable effects on carbon emissions reduction in the asymmetric power structure than taxing both the manufacturer and retailer in the symmetric power structure, due to the former policy can stimulate the leader to adjust its decisions about carbon emissions reduction.

In contrast, Region II depicts that if both the carbon emissions sensitivity and the green technology investment cost coefficient are high (γ > 0.5 and \( t > \frac{{\left( {1 + 2\gamma } \right)^{2} \left( {1 + 4\gamma } \right)}}{{16\left( {2\gamma - 1} \right)}} \)), which means customers concern more about carbon emissions yet the manufacturer and retailer have low efficiency on carbon emissions reduction, then in this case, taxing both the manufacturer and retailer in the symmetric power structure is conducive to reduce carbon emissions. When firms have difficulties in reducing carbon emissions, taxing the follower along may ease its effort in carbon emissions reduction to decrease the cost of the green technology investment. However, taxing the manufacturer and retailer can share the cost of carbon emissions tax so as to stimulate the two firms to reduce carbon emissions more.

7 Managerial relevance and insights

Our results generate some interesting findings. For instance, we show that a properly designed carbon emissions tax can be a regulatory mechanism for carbon emissions reduction while maintaining economic competitiveness for supply chains whether considering customers’ carbon emissions sensitivity or not. We also prove that the optimal carbon tax design is influenced by the supply chain power structure. Therefore, in designing the carbon emissions tax, it is critical to consider the power structure. Specifically, in the symmetric supply chain power structure, the allocation of the carbon emissions tax also depends on the relationship between the manufacturer’s and the retailer’s green technology investment cost coefficients. In addition, the optimal decision on green technology investment is mainly influenced by the carbon emissions reduction efficiency of supply chain members. The optimal carbon emissions tax design will encourage both the manufacturer and the retailer to properly invest in green technologies to reduce carbon emissions under different supply chain power structures. Furthermore, our results also reveal that an optimal carbon tax design yields better environmental performance under an asymmetric power structure than that under a symmetric power structure when not considering customers’ carbon emissions sensitivity. We uncover that an imbalanced supply chain power relationship is more likely to achieve environmental sustainability because an improvement in the supply chain’s sustainability performance often requires a channel leadership to drive the sustainability agenda and take on new initiatives such as green technology investment. Interestingly, when considering customers’ carbon emissions sensitivity, an optimal carbon tax design yields opposite results, namely the environmental performance is better in a symmetric power structure if customers are more sensitive to the carbon emissions yet the firms’ carbon emissions reduction efficiency is low. That because taxing the manufacturer and retailer can share the cost of carbon emissions tax so as to stimulate the two firms to reduce carbon emissions more. Finally, carbon taxation is one policy measure that governments can use for carbon emissions reduction. To achieve the objective of sustainability, fundamentally, we need firms to invest in green technologies to improve their energy efficiency and decrease their unit carbon emissions. Our findings indicate that firms’ optimal decision on green technology investment is mainly influenced by their cost efficiencies in carbon emissions reduction. There are two important thresholds for the green investment cost coefficient, which directly affect the decision on the optimal design of the carbon emissions tax, as illustrated in Fig. 2.

Furthermore, from the perspective of policy makers, our research findings provide interesting insights on how the level of the carbon emissions tax and the method of tax collection affect the economic and environmental performances of the entire supply chain. As opposed to some works in the economic literature that call for a carbon tax that should not be differentiated across sectors in the economy (Hoel 1996), our findings demonstrate it is not ideal to have one single carbon emissions tax for all industry sectors. Unique characteristics of the industry sector (e.g. supply chain power structure) and the economic circumstances of the sector should be considered in the development of carbon emissions taxation scheme. Furthermore, a good use of carbon tax revenue is equally important to drive a low carbon economy. When deciding the use of carbon tax revenue, policy makers should consider the supply chain parties’ technology investment efficiencies and develop incentives for firms to invest in green technologies that can help to further reduce carbon emissions. For instance, various incentives have been given to different industry sectors by countries, e.g., China and the UK to encourage firms to invest on renewable energies and green technologies. This research is not only valuable for countries that plan to introduce the carbon emissions tax but also beneficial for countries that have already implemented carbon taxation to re-examine their current carbon control policies. For instance, our findings suggest a fundamental trade-off between economic efficiency and environmental sustainability. It is crucial for policy makers to balance this and other trade-offs considering their countries’ development stage as well as their immediate and long-term economic and environmental challenges. As one notable example, the UK government has recently reduced the carbon tax level for the steel sector as one of the measures for addressing the crisis faced by the UK steel industry. Our findings will support policy makers in implementing comprehensive carbon emissions reduction policies that support their nations’ long-term sustainability.

8 Conclusion and future research

As a result of the international agreement on climate change signed at the United Nations Paris Climate Change Conference in December 2015, reducing carbon emissions requires urgent actions from both governments and business enterprises all around the world. Undoubtedly, a thoughtfully designed carbon tax will play a significant role in achieving the carbon emissions reduction target. This research responds to the related timely challenges by analytically examining the optimal design of the carbon emissions tax by studying supply chain systems and the resulting economic and environmental performances.

This research makes several important contributions. Theoretically, we complement the existing literature on the carbon emissions tax by analysing the optimal carbon emissions tax design by exploring various critical supply chain features and the associated economic and environmental performances. Different from the examination of the carbon emissions tax from the macroeconomic perspective (Wissema and Dellink 2007; Mathur and Morris 2014) and the optimisation of supply chain decisions under different carbon tax schemes (Choi 2013a, b; Wang et al. 2015a), our approach provides a practical and innovative approach of examining the efficiency of government policies. Furthermore, different industry sectors (e.g., steel, construction, telecommunication, retailing, and many others) have their distinctive supply chain power relationships, investment efficiencies and customers’ carbon emissions sensitivity in carbon emissions reduction. Through considering the effects of supply chain power structures and green technology investment efficiencies on the optimal carbon emissions tax design, we also contribute to the “power (or supply chain leadership)” literature (Touboulic et al. 2014; Du et al. 2015; Chen and Hao 2015; Park et al. 2015; Chen et al. 2017; Wang et al. 2018) and the green technology investment literature (Krass et al. 2013; Drake et al. 2015; Bi et al. 2017; Han et al. 2017; Li et al. 2019) in the context of the sustainable supply chain management. Practically, we have derived the optimal solutions under the carbon emissions tax, helping firms make optimal operational and technology investment decisions to improve their economic and environmental performances.

There are several possible extensions for future investigation. First, our model assumes a supply chain that consists of one manufacturer and one retailer with a deterministic demand. Although this simple configuration enables researchers to effectively model supply chain decisions and draw interesting insights from the analysis, one important extension would be to consider more complex supply chain systems (Choi et al. 2019), such as the ones with multiple manufacturers and retailers. Multi-echelon supply chains with Cournot competitions (Guo et al. 2020) are generally tractable, which enables the robustness of the results to be tested in a more general setting. Such research will certainly generate some interesting findings but will also require a new set of models. Finally, this research can be extended to the design of other carbon emissions control policies such as the emissions cap and cap-and-trade measures, given that achieving the objective of a low-carbon economy requires both regulatory policies and market mechanisms.

Notes

References

Ark, S. J., Cachon, G. P., Lai, G., & Seshadri, S. (2015). Supply chain design and carbon penalty: Monopoly vs. monopolistic competition. Production and Operations Management,24(9), 1494–1508.

Baker, E., & Solak, S. (2014). Management of energy technology for sustainability: How to fund energy technology research and development. Production and Operations Management,23(3), 348–365.

BBC. (2019). Sainsbury’s pledges to halve plastic packaging by 2025, Business News. Retrieved September 14, 2019, from https://www.bbc.co.uk/news/business-49681083.

Bi, G., Jin, M., Ling, L., & Yang, F. (2017). Environmental subsidy and the choice of green technology in the presence of green consumers. Annals of Operations Research,255(1–2), 547–568.

Bouchery, Y., Ghaffari, A., Jemai, Z., & Dallery, Y. (2012). Including sustainability criteria into inventory models. European Journal of Operational Research,222(2), 229–240.

Cachon, G. P. (2014). Retail store density and the cost of greenhouse gas emissions. Management Science,60(8), 1907–1925.

Carbon Tax Centre (CTC). (2016). Where carbon is taxed? Retrieved April 8, 2016, from http://www.carbontax.org/where-carbon-is-taxed/#Australia.

CDP. (2019). Global Supply Chain Report 2018, Disclosure Insight Action. Retrieved September 14, 2019, from https://www.cdp.net/en/research/global-reports/global-supply-chain-report-2018.

Chen, X., & Hao, G. (2015). Sustainable pricing and production policies for two competing firms with carbon emissions tax. International Journal of Production Research,53(21), 6408–6420.

Chen, X., & Wang, X. (2015). Free or bundled: Channel selection decisions under different power structures. Omega,53, 11–20.

Chen, X., & Wang, X. (2016). Effects of carbon emission reduction policies on transportation mode selections with stochastic demand. Transportation Research Part E: Logistics and Transportation Review,90, 196–205.

Chen, X., Wang, X., & Chan, H. K. (2017). Manufacturer and retailer coordination for environmental and economic competitiveness: A power perspective. Transportation Research Part E: Logistics and Transportation Review,97, 268–281.

Chen, X., Wang, X., & Jiang, X. (2016). The impact of power structure on retail service supply chain with an O2O mixed channel. Journal of the Operational Research Society,67(2), 294–301.

Chen, X., Wang, X., & Xia, Y. (2019). Production coopetition strategies for competing manufacturers that produce partially substitutable products. Production and Operations Management,28(6), 1446–1464.

Chiou, T. Y., Chan, H. K., Lettice, F., & Chung, S. H. (2011). The influence of greening the suppliers and green innovation on environmental performance and competitive advantage in Taiwan. Transportation Research Part E: Logistics and Transportation Review,47(6), 822–836.

Choi, T. M. (2013a). Optimal apparel supplier selection with forecast updates under carbon emission taxation scheme. Computers & Operations Research,40(11), 2646–2655.

Choi, T. M. (2013b). Local sourcing and fashion quick response system: The impacts of carbon footprint tax. Transportation Research Part E: Logistics and Transportation Review,55, 43–54.

Choi, T. M., Cai, Y., & Shen, B. (2019). Sustainable fashion supply chain management: A system of systems analysis. IEEE Transactions on Engineering Management,66(4), 730–745.

Cotterill, R. W., & Putsis, W. P. (2001). Do models of vertical strategic interaction for national and store brands meet the market test? Journal of Retailing,77(1), 83–109.

Cox, A. (2004). The art of the possible: Relationship management in power regimes and supply chains. Supply Chain Management: An International Journal,9(5), 346–356.

Drake, D. F., Kleindorfer, P. R., & Van Wassenhove, L. N. (2015). Technology choice and capacity portfolios under emissions regulation. Production and Operations Management,25(6), 1006–1025.

Du, S., Ma, F., Fu, Z., Zhu, L., & Zhang, J. (2015). Game–theoretic analysis for an emission-dependent supply chain in a ‘cap-and-trade’ system. Annals of Operations Research,228(1), 135–149.

Fahimnia, B., Sarkis, J., Choudhary, A., & Eshragh, A. (2015). Tactical supply chain planning under a carbon tax policy scheme: A case study. International Journal of Production Economics,164, 206–215.

Govindan, K., Agarwal, V., Darbari, J. D., & Jha, P. C. (2019). An integrated decision making model for the selection of sustainable forward and reverse logistic providers. Annals of Operations Research,273(1–2), 607–650.

Govindan, K., & Sivakumar, R. (2016). Green supplier selection and order allocation in a low-carbon paper industry: Integrated multi-criteria heterogeneous decision-making and multi-objective linear programming approaches. Annals of Operations Research,238(1–2), 243–276.

Guo, S., Choi, T. M., & Shen, B. (2020). Green product development under competition: A study of the fashion apparel industry. European Journal of Operational Research,280(2), 523–538.

Han, S., Jiang, Y., Zhao, L., Leung, S. C., & Luo, Z. (2017). Weight reduction technology and supply chain network design under carbon emission restriction. Annals of Operations Research. https://doi.org/10.1007/s10479-017-2696-8.

He, P., Zhang, W., Xu, X., & Bian, Y. (2015). Production lot-sizing and carbon emissions under cap-and-trade and carbon tax regulations. Journal of Cleaner Production,103, 241–248.

Hoel, M. (1996). Should a carbon tax be differentiated across sectors? Journal of Public Economics,59(1), 17–32.

Huang, Z., & Li, S. X. (2001). Co-op advertising models in manufacturer–retailer supply chains: A game theory approach. European Journal of Operational Research,135(3), 527–544.

Jiang, W., & Chen, X. (2016). Optimal strategies for manufacturer with strategic customer behaviour under carbon emissions-sensitive random demand. Industrial Management & Data Systems,116(4), 759–776.

Komanoff, C., & Gordon, M. (2015). British Columbia carbon tax: By the numbers. A carbon tax centre report. Retrieved April 8, 2016, from http://www.carbontax.org/wp-content/uploads/CTC_British_Columbia’s_Carbon_Tax_By_The_Numbers.pdf.

Krass, D., Nedorezov, T., & Ovchinnikov, A. (2013). Environmental taxes and the choice of green technology. Production and Operations Management,22(5), 1035–1055.

Kroes, J., Subramanian, R., & Subramanyam, R. (2012). Operational compliance levers, environmental performance, and firm performance under cap and trade regulation. Manufacturing & Service Operations Management,14(2), 186–201.

Letmathe, P., & Balakrishnan, N. (2005). Environmental considerations on the optimal product mix. European Journal of Operational Research,167(2), 398–412.

Li, G., Li, L., Choi, T. M., & Sethi, S. P. (2019). Green supply chain management in Chinese firms: Innovative measures and the moderating role of quick response technology. Journal of Operations Management(published online).

Li, J., Su, Q., & Ma, L. (2017). Production and transportation outsourcing decisions in the supply chain under single and multiple carbon policies. Journal of Cleaner Production,141, 1109–1122.

Luo, Z., Chen, X., & Wang, X. (2016). The role of co-opetition in low carbon manufacturing. European Journal of Operational Research,253(2), 392–403.

Mathur, A., & Morris, A. C. (2014). Distributional effects of a carbon tax in broader US fiscal reform. Energy Policy,66, 326–334.

Metcalf, G. E. (2009). Designing a carbon tax to reduce US greenhouse gas emissions. Review of Environmental Economics and Policy,3(1), 63–83.

Penkuhn, T., Spengler, T., Püchert, H., & Rentz, O. (1997). Environmental integrated production planning for ammonia synthesis. European Journal of Operational Research,97(2), 327–336.

Pezzey, J. C., & Jotzo, F. (2013). Carbon tax needs thresholds to reach its full potential. Nature Climate Change,3(12), 1008–1011.

Raz, G., Druehl, C. T., & Blass, V. (2013). Design for the environment: Life-cycle approach using a newsvendor model. Production and Operations Management,22(4), 940–957.

Rosic, H., & Jammernegg, W. (2013). The economic and environmental performance of dual sourcing: A newsvendor approach. International Journal of Production Economics,143(1), 109–119.

SeyedEsfahani, M. M., Biazaran, M., & Gharakhani, M. (2011). A game theoretic approach to coordinate pricing and vertical co-op advertising in manufacturer–retailer supply chains. European Journal of Operational Research,211(2), 263–273.

Shang, W., Ha, A., & Tang, S. (2016). Information sharing in a supply chain with a common retailer. Management Science,62(1), 245–263.

Shi, R., Zhang, J., & Ru, J. (2013). Impacts of power structure on supply chains with uncertain demand. Production and Operations Management,22(5), 1232–1249.

Shin, H., & Tunca, T. (2010). Do firms invest in forecasting efficiently? The effect of competition on demand forecast investments and supply chain coordination. Operations Research,58(6), 1592–1610.

Touboulic, A., Chicksand, D., & Walker, H. (2014). Managing imbalanced supply chain relationships for sustainability: A power perspective. Decision Sciences,45(4), 577–619.

Turken, N., Carrillo, J., & Verter, V. (2017). Facility location and capacity acquisition under carbon tax and emissions limits: To centralize or to decentralize? International Journal of Production Economics,187, 126–141.

United Nations. (2015). Framework convention on climate change, Paris climate change conference—November 2015, COP 2. Available online from UNFCCC. Conference of the Parties (COP). Retrieved December 24, 2015.

Wang, X., Chan, H. K., & Li, D. (2015a). A case study of an integrated fuzzy methodology for green product development. European Journal of Operational Research,241(1), 212–223.

Wang, X., Chen, X., Durugbo, C., & Cai, Z. (2018). Manage risk of sustainable product–service systems: A case-based operations research approach. Annals of Operations Research. https://doi.org/10.1007/s10479-018-3051-4.

Wang, W., Ferguson, M. E., Hu, S., & Souza, G. C. (2013). Dynamic capacity investment with two competing technologies. Manufacturing & Service Operations Management,15(4), 616–629.

Wang, M., Liu, K., Choi, T. M., & Yue, X. (2015b). Effects of carbon emission taxes on transportation mode selections and social welfare. IEEE Transactions on Systems, Man and Cybernetics: Systems,45(11), 1413–1423.

Wiesenthal, T., Leduc, G., Haegeman, K., & Schwarz, H. G. (2012). Bottom-up estimation of industrial and public R&D investment by technology in support of policy-making: The case of selected low-carbon energy technologies. Research Policy,41(1), 116–131.

Wilhelm, M. M., Blome, C., Bhakoo, V., & Paulraj, A. (2016). Sustainability in multi-tier supply chains: Understanding the double agency role of the first-tier supplier. Journal of Operations Management,41, 42–60.

Williams, N., Kannan, P. K., & Azarm, S. (2011). Retail channel structure impact on strategic engineering product design. Management Science,57(5), 897–914.

Wissema, W., & Dellink, R. (2007). AGE analysis of the impact of a carbon energy tax on the Irish economy. Ecological Economics,61(4), 671–683.

Xiao, T., Choi, T. M., & Cheng, T. C. E. (2014). Product variety and channel structure strategy for a retailer-Stackelberg supply chain. European Journal of Operational Research,233(1), 114–124.

Xu, L., Wang, C., & Li, H. (2017). Decision and coordination of low-carbon supply chain considering technological spillover and environmental awareness. Scientific Reports,7(1), 3107.

Yalabik, B., & Fairchild, R. J. (2011). Customer, regulatory, and competitive pressure as drivers of environmental innovation. International Journal of Production Economics,131(2), 519–527.

Zhang, R., Liu, B., & Wang, W. (2012). Pricing decisions in a dual channels system with different power structures. Economic Modelling,29(2), 523–533.

Acknowledgements

The first author is partially supported by National Natural Science Foundation of China (Nos. 71432003, 91646109), and Youth Team Program for Technology Innovation of Sichuan Province (No. 2016TD0013).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Proof of Table 3

Case 1: Manufacturer Stackelberg (MS) model

We assume that \( t_{m} > \frac{{\beta \tau^{2} t_{r} }}{{2\left( {4t_{r} - \beta \tau^{2} } \right)}} \) and \( t_{r} > \frac{{\beta \tau^{2} }}{4} \). These assumptions are mathematical conditions for making the Hessian Matrix be negatively definite so that closed-form analysis is feasible.

From (2), we obtain \( \pi_{r} \left( {p,e_{r} } \right) = \left[ {p - w - \left( {1 - \theta } \right)\tau \left( {e_{m} + e_{r} } \right)} \right]\left( {\alpha - \beta p} \right) - t_{r} \left( {e_{0} - e_{r} } \right)^{2} \), then \( \frac{{\partial^{2} \pi_{r} \left( {p,e_{r} } \right)}}{{\partial p^{2} }} = - 2\beta < 0,\frac{{\partial^{2} \pi_{r} \left( {p,e_{r} } \right)}}{{\partial e_{r}^{2} }} = - 2t_{r} \) and \( \frac{{\partial^{2} \pi_{r} \left( {p,e_{r} } \right)}}{{\partial p\partial {e}_{r} }} = \frac{{\partial^{2} \pi_{r} \left( {p,e_{r} } \right)}}{{\partial {e}_{r} \partial p}} = \beta \left( {1 - \theta } \right)\tau \). Then, the Hessian Matrix

That is, \( \pi_{r} \left( {p,e_{r} } \right) \) is jointly concave in p and er. Let \( \frac{{\partial \pi_{r} \left( {p,e_{r} } \right)}}{\partial p} = \frac{{\partial \pi_{r} \left( {p,e_{r} } \right)}}{{\partial e_{r} }} = 0 \); we obtain

and

From (1), we obtain \( \pi_{m} \left( {w,e_{m} } \right) = \left[ {w - c - \theta \tau \left( {e_{m} + e_{r} } \right)} \right]\left( {\alpha - \beta p} \right) - t_{m} \left( {e_{0} - e_{m} } \right)^{2} \). Replace pm and \( e_{r}^{m} \) into \( \pi_{m} \left( {w,e_{m} } \right) \), then

and

Thus, the Hessian Matrix is

That is, \( \pi_{m} \left( {w,e_{m} } \right) \) is jointly concave in w and em. From \( \frac{{\partial \pi_{m} \left( {w,e_{m} } \right)}}{\partial w} = \frac{{\partial \pi_{m} \left( {w,e_{m} } \right)}}{{\partial e_{m} }} = 0 \), we obtain \( w^{m} = \frac{\alpha }{\beta } - 2\left( {1 - \theta } \right)\tau e_{0} - \frac{{\left( {\alpha - c\beta - 2\beta \tau e_{0} } \right)\left[ {4t_{m} t_{r} - \beta \left( {1 - \theta } \right)\tau^{2} t_{r} - t_{m} \beta \left( {1 - \theta } \right)^{2} \tau^{2} } \right]}}{{\beta \left[ {8t_{m} t_{r} - \beta \tau^{2} t_{r} - 2\beta \left( {1 - \theta } \right)\tau^{2} t_{m} } \right]}} \), \( e_{m}^{m} = e_{0} - \frac{{\tau t_{r} \left( {\alpha - c\beta - 2\beta \tau e_{0} } \right)}}{{8t_{m} t_{r} - \beta \tau^{2} t_{r} - 2\beta \left( {1 - \theta } \right)\tau^{2} t_{m} }},p^{m} = \frac{\alpha }{\beta } - \frac{{2t_{m} t_{r} \left( {\alpha - c\beta - 2\beta \tau e_{0} } \right)}}{{\beta \left[ {8t_{m} t_{r} - \beta \tau^{2} t_{r} - 2\beta \left( {1 - \theta } \right)\tau^{2} t_{m} } \right]}} \) and \( e_{r}^{m} = e_{0} - \frac{{\left( {1 - \theta } \right)\tau t_{m} \left( {\alpha - c\beta - 2\beta \tau e_{0} } \right)}}{{8t_{m} t_{r} - \beta \tau^{2} t_{r} - 2\beta \left( {1 - \theta } \right)\tau^{2} t_{m} }} \).

Case 2: Retailer Stackelberg (RS) model

We assume that \( t_{m} > \frac{{2\beta \tau^{2} t_{r} }}{{8t_{r} - \beta \tau^{2} }} \) and \( t_{r} > \frac{{\beta \tau^{2} }}{4} \). These assumptions are mathematical conditions for making the Hessian Matrix be negatively definite to derive closed-form insights.

From (1), we obtain \( \pi_{m} \left( {w,e_{m} } \right) = \left[ {w - c - \theta \tau \left( {e_{m} + e_{r} } \right)} \right]\left[ {\alpha - \beta \left( {w + m} \right)} \right] - t_{m} \left( {e_{0} - e_{m} } \right)^{2} \), then \( \frac{{\partial^{2} \pi_{m} \left( {w,e_{m} } \right)}}{{\partial w^{2} }} = - 2\beta < 0,\frac{{\partial^{2} \pi_{m} \left( {w,e_{m} } \right)}}{{\partial e_{m}^{2} }} = - 2t_{m} \) and \( \frac{{\partial^{2} \pi_{m} \left( {w,e_{m} } \right)}}{{\partial w\partial e_{m} }} = \frac{{\partial^{2} \pi_{m} \left( {w,e_{m} } \right)}}{{\partial e_{m} \partial w}} = \beta \theta \tau \). So, we obtain

That is, \( \pi_{m} \left( {w,e_{m} } \right) \) is jointly concave in w and em. From \( \frac{{\partial \pi_{m} \left( {w,e_{m} } \right)}}{\partial w} = \frac{{\partial \pi_{m} \left( {w,e_{m} } \right)}}{{\partial e_{m} }} = 0 \), we get \( w^{r} = \frac{{\alpha + c\beta - \beta p + \beta \theta \tau \left( {e_{0} + e_{r} } \right)}}{\beta } - \frac{{\left( {\alpha - \beta p} \right)\theta^{2} \tau^{2} }}{{2t_{m} }} \) and \( e_{m}^{r} = e_{0} - \frac{{\left( {\alpha - \beta p} \right)\theta \tau }}{{2t_{m} }} \).

From (2), we get \( \pi_{r} \left( {p,e_{r} } \right) = \left[ {p - w - \left( {1 - \theta } \right)\tau \left( {e_{m} + e_{r} } \right)} \right]\left( {\alpha - \beta p} \right) - t_{r} \left( {e_{0} - e_{r} } \right)^{2} \). Replace wr and \( e_{m}^{r} \) into \( \pi_{r} \left( {p,e_{r} } \right) \), then \( \frac{{\partial^{2} \pi_{r} \left( {p,e_{r} } \right)}}{{\partial p^{2} }} = - 2\beta \left[ {1 - \frac{{\partial w_{m}^{r} }}{\partial p} - \left( {1 - \theta } \right)\tau \frac{{de_{m}^{r} }}{dp}} \right] = - \frac{{\beta \left( {4t_{m} - \beta \theta \tau^{2} } \right)}}{{t_{m} }} < 0,\frac{{\partial^{2} \pi_{r} \left( {p,e_{r} } \right)}}{{\partial e_{r}^{2} }} = - 2t_{r} \) and \( \frac{{\partial^{2} \pi_{r} \left( {p,e_{r} } \right)}}{{\partial p\partial e_{r} }} = \frac{{\partial^{2} \pi_{r} \left( {p,e_{r} } \right)}}{{\partial e_{r} \partial p}} = \beta \tau \). Thus, we obtain