Abstract

This paper examines the asymmetric effects of changes in oil price and economic policy uncertainty (EPU) on the stock market returns of the G7 countries. It employs quantile regression analysis and allows for asymmetry by differentiating between positive and negative changes in oil price and EPU. Monthly data over the period 1985–2021 are used to conduct the analysis. Overall, we find that changes in oil price and EPU have significant asymmetric effects on the stock returns of the G7 countries and that these asymmetric effects are related to market conditions. An overall negative effect of EPU and a positive effect of oil price are observed on stock returns in all the countries. The results show that while rising EPU lowers stock returns in most countries during bearish and/or normal markets, falling EPU is either insignificant or increases stock returns only when stock markets are bullish. We also find that the impacts of positive changes in EPU are more important and larger than that of the negative changes. In addition, we find that stock returns in most countries are affected by rising and falling oil price when stock markets are bearish and/or bullish.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The stock market has traditionally been viewed as a barometer of economic activity (Fama 1990). It is believed that large increases in stock prices suggest a future expansion of the economy while large decreases suggest future contraction. When stock prices are rising (falling), consumer spending may increase (decrease) due to the stock market wealth effect, which, in turn, increases (decreases) business investment. For example, it is found that for every dollar increase due to stock market wealth, consumer spending rises by 3.2 cents per year (Chodorow-Reich et al. 2019). Thus, changes in stock prices affect consumer spending, which will affect the overall economy.

The literature suggests that stock prices are influenced by changes in different economic and financial variables, including risk factors, business cycles, inflation, interest rates, and gross domestic product (Fama and French 1989). However, recent literature suggests that changes in oil price and EPU are two key factors that affect many economic and financial variables, including stock prices (see, for example, Kang 2022; Ziadat et al. 2022; Kwon 2020; Kang et al. 2017; Kang and Ratti 2013).

Many studies examine the impact of oil price changes on stock prices with some finding a positive effect (Alamgir and Bin Amin 2021; Diaz and Perez de Gracia 2017; Le and Chang 2015; Rafailidis and Katrakilidis 2014; Narayan and Narayan 2010; Bjørnland 2009; Sadorsky 2001), others finding a negative effect (Civcir and Akkoc 2021; Joo and Park 2017; Cunado and Perez de Gracia 2014; Basher et al. 2012; Hamilton 2003), and others finding little or an insignificant effect (Kilian and Park 2009; Henriques and Sadorsky 2008). Moreover, it is also noted that the impact of oil price shocks differs depending on the source of the shock (demand versus supply shock) and whether the country is oil-importing or exporting (Hamilton 2009; Kilian 2009; Kilian and Park 2009; Wang et al. 2013). For instance, Wang et al., (2013) find a positive significant effect of demand shocks in most oil-exporting countries; an insignificant effect of oil supply shocks on the stock markets of oil-exporting countries; and a short-lived positive significant impact in oil-importing countries.

Likewise, many studies examine the effect of EPU on stock prices and find a negative effect of EPU on stock prices (see, for example, Nusair and AL-Khasawneh 2022; Wen et al. 2022; Batabyal and Killins 2021; Chen and Chiang 2020; Chiang 2020; Bahmani-Oskooee and Saha 2019a, b; Peng et al. 2018).

Despite their large number, most of the studies not only do not consider the joint effects of changes in oil price and EPU on stock returns, but also ignore the possibility that these effects can differ across the distribution of returns. Specifically, these studies ignore the possibility that the effects of changes in oil price and EPU may vary with stock market performance (bearish, bullish, or normal market). For example, Sim and Zhou (2015) argue that the response of stock returns to oil price changes may differ depending on whether the stock market is bearish or bullish, and the response to positive and negative oil price shocks may also be asymmetric. Therefore, oil price shocks may have heterogeneous effects on stock returns, with the effect differing with market conditions (Sim and Zhou 2015). For instance, Nusair and Al-Khasawenh (2018) find that oil price shocks have an asymmetric effect on the stock returns of the GCC countries and that the effects are affected by stock market conditions. Likewise, the effect of EPU on stock returns may be different depending on whether the market is bullish, bearish, or normal (Chang et al. 2015).

Against this background, the objective of this paper is to examine the joint impact of changes in oil price and EPU on the stock market returns of the G7 countries (Canada, France, Germany, Italy, Japan, the UK, and the USA). To conduct the analysis, we use monthly data over the period 1985–2021 and utilize asymmetric quantile regression (QR) analysis to examine the asymmetric effects of changes in oil price and EPU on the stock returns of the G7 countries. The choice of the G7 countries is not surprising given that they play a vital role in the global economy as they represent the major industrialized countries in the world. In fact, events occurring in these countries are expected to have significant repercussion effects on the economies of the rest of the world. Therefore, examining the effects of changes in oil price and EPU on the stock returns of the G7 countries can provide important information for policymakers and investors not just in the G7 countries but also in other countries in the rest of the world.

This paper contributes to the extant literature in several ways. First, and to the best of our knowledge, this is the first paper that examines the joint asymmetric impact of changes in oil price and EPU on the stock market returns of the G7 countries accounting for distributional heterogeneity. Second, it addresses the distributional heterogeneity of stock returns by using quantile regression (QR) analysis to examine the effects of changes in oil price and EPU on stock returns throughout the distribution of stock returns. This allows us to ascertain information on how changes in oil price and EPU may affect stock returns in different market conditions (bullish, bearish, or normal market), which can have important implications for investors in terms of risk management and predictability of stock prices. Third, it allows for asymmetries in the effects of changes in oil price and EPU by separating positive and negative changes in oil price and EPU.

Examining the effects of changes in oil price and EPU on stock markets has received a great deal of attention from both investors and policymakers. Theoretically, oil price shocks can have a considerable impact on the aggregate economy as they can cause changes in relative prices, redistribute income, and change inflation expectations and real interest rates. For example, higher oil prices suggest inflationary pressures that is usually addressed by the monetary authority by raising interest rates (You et al. 2017). The higher inflation rates lead to lower real income and consumption, and higher costs of production, which hurts stock prices (Reboredo and Ugolini 2016, Narayan and Narayan 2010). Similarly, uncertainty about the future can have a considerable impact on the economy by affecting business firms and their investment decisions. Specifically, in a highly uncertain environment, business firms reduce their hiring and investment demand and postpone irreversible investments, and consumers also reduce their spending (Bernanke 1983; Bloom 2014). Moreover, uncertainty may increase financing and production costs and may affect inflation, interest rates, and risk premiums, which affects stock prices by affecting expected cash flows and discount rates (Arouri et al. 2016). Accordingly, oil price shocks and high uncertainty can have considerable impacts on the economy by affecting inflation rates, real interest rates, investment, and ultimately stock prices and stock returns. Therefore, examining how changes in oil price and EPU may affect stock returns is important for both investors and policymakers because it can provide important information on when and how to respond to these changes to minimize their negative impacts on the economy.

Overall, the results show that rising and falling oil price and EPU have significant asymmetric effects on the stock returns of all the G7 countries and that these asymmetric effects are related to market conditions (whether the market is bearish, bullish, or normal). An overall negative effect of EPU and a positive effect of oil price are observed on stock returns in all the countries. The results show that while rising EPU lowers stock returns in most countries during bearish and/or normal market, falling EPU is either insignificant or increases stock returns only when stock markets are bullish. Besides, we find that stock returns in most countries are affected by rising and falling oil prices when stock markets are bearish or bullish. Furthermore, the results show that the impacts of positive changes in oil price and EPU are more important and larger than that of the negative changes and that the impacts are mainly during extreme market conditions when markets are bearish and/or bullish.

Our findings have important policy implications for both investors and policymakers. The results show that changes in oil price and EPU have significant effects on the stock returns in the G7 countries and that these effects are asymmetric and related to market conditions. Therefore, investors and policymakers should pay close attention to these changes and should know when and how to respond to them. For example, while falling EPU does not affect stock returns in Canada, France, and the USA, rising EPU reduces stock returns in Germany, Italy, Japan, the UK, and the USA only when stock markets are bearish and/or normal. This suggests that while investors and policymakers in Canada, France, and the USA should not respond to falling EPU, they should respond to rising EPU in Germany, Italy, Japan, the UK, and the USA only when stock markets are bearish and/or normal. Moreover, the results show that the impact of positive changes in EPU is more important and larger than that of the negative changes. This suggests that policymakers should devote more attention to rising EPU than falling EPU. We also find that positive oil price changes in most countries are more important than the negative changes and that the impact is positive and mainly during extreme market conditions when stock markets are bearish and bullish. This implies that policymakers should devote more attention to rising than falling oil price and should avoid uncertain information concerning oil price changes that may lead to more volatility in stock markets, notably when markets are bearish or bullish.

The remaining of the papers is structured as follows. The literature review is provided in section two and the theory and methodology in section three. The data and empirical results are discussed in section four, and section five concludes and provides policy recommendations.

2 Literature review

Many studies examine the impact of changes in oil price or EPU on the stock returns of the G7 countries either as a group or for individual countries. For example, Rahman (2022) uses a nonlinear bivariate structural vector autoregressive (SVAR) model and monthly data for the period 1973–2015 and finds that the US stock returns respond asymmetrically to positive and negative oil price shocks and that stock returns increase in response to a negative oil price shock and decrease in response to a positive shock. Using monthly data for the period 1987–2020 and a vector autoregressive (VAR) model, Sardar and Sharma (2022) find a nonlinear relationship between oil price shocks and the US stock returns that is positive when interest rates are close to the zero lower bound and negative when interest rates are higher. Managi et al. (2022) use daily data for the period January 2018–December 2020 and wavelet approach and find that the US stock returns were negatively affected and the level of uncertainty increased because of the lockdown policy due to the outbreak of the COVID-19 pandemic and the resulting oil price shock. Employing quantile and nonlinear autoregressive distributed lag (ARDL) models and daily data for the period 1997–2020 for some oil-exporting and importing countries that included Japan, Hashmi et al. (2021) find no evidence of cointegration using the nonlinear ARDL model in all the countries, whereas using quantile ARDL model they find that stock prices respond asymmetrically to oil price changes in all cases in both the short-run and long-run. Hwang and Kim (2021) use monthly data for the period 1973–2018 and a smooth transition VAR model and find that oil supply shocks have an insignificant effect on the US stock returns, whereas oil demand shocks have an asymmetric significant effect that become stronger during economic recessions. Using monthly data for the period 2002–2015 and panel data approach, Westerlund and Sharma (2019) find that lagged oil price returns have a significant negative effect on current stock returns of the G7 countries. Hatemi-J et al. (2017) use an asymmetric causality test and weekly data for the period 1975–2013 for the G7 countries and find that while rising oil prices increase stock prices in the USA and Japan, falling oil prices reduce stock prices in Germany. Using SVAR model and monthly data for the period 1973–2015, Bastianin et al. (2016) find that while oil supply shocks do not affect the stock market volatility of the G7 countries, oil demand shocks significantly affect volatility. Diaz et al. (2016) find, using monthly data for the period 1970–2014, a negative response of the G7 stock markets to an increase in oil price volatility. In a sample of twelve oil-importing European countries that included France, Germany, Italy, and the UK and using monthly data for the period 1973–2011, Cunado and Perez de Gracia (2014) find a significant negative effect of oil price shocks on stock returns and that oil supply shocks tend to have a larger impact than demand shocks. Using monthly data for the period 1991–2009, Lee et al. (2012) find that the composite stock market index of each of the G7 countries is not affected by oil price shocks.

Similarly, many studies examine the impact of changes in EPU on the stock returns of the G7 countries. For instance, Huang and Liu (2022) use monthly data for the period 1997–2020 and quantile regression analysis for the G7 countries and find that changes in EPU have a negative effect on stock returns and that the effect is asymmetric as the impact of rising EPU is greater than that of falling EPU. Nusair and Al-Khasawneh (2022) use the nonlinear ARDL model and monthly data over the period 1985–2021 for the G7 countries and find evidence of asymmetries in both the short-run and long-run. Using monthly data for the period 2007–2018 and quantile-on-quantile approach, Wen et al. (2022) find that monetary policy uncertainty negatively affects stock returns in the G7 and BRIC countries when the stock market suffers a crash. Using linear and nonlinear ARDL models and monthly data for the period 1985–2015, Batabyal and Killins (2021) find that EPU has negative asymmetric short-run and long-run effects on the Canadian stock returns. Chiang (2020) finds that EPU has a negative effect on the Japanese stock prices over the period 1990–2018. Using monthly data for the period 1997–2019, Smales (2020) finds that financial market uncertainty in the G7 countries increases as EPU increases. Using linear ARDL model and monthly data for the period 1985–2016 for a group of countries that included Canada, Japan, the UK, and the USA, Bahmani-Oskooee and Saha (2019a) find that while EPU has a short-run negative effect on stock prices, it has no long-run effect. In contrast, Bahmani-Oskooee and Saha (2019b) use a nonlinear ARDL model and monthly data for the period 1985–2018 and find that while EPU has an asymmetric short-run effect on the stock prices of Canada, the UK, and the US, but not Japan, they find a significant negative asymmetric long-run effect in all the countries. Chiang (2019) use monthly data for the period 1997–2016 for the G7 countries and find that an increase in EPU leads to a decrease in excess stock returns. Using QR analysis and monthly data for the G7 and BRIC countries, Peng et al. (2018) find that EPU has a negative effect on the bearish market of Germany and Japan; an intermediate dependence in the Canadian market; and no effect on the UK and French markets. In a group of seventeen countries that included Canada, France, Germany, Italy, Japan, and the UK and monthly data over the period 1998–2017, Das and Kumar (2018) find that the combined effect of domestic EPU and US EPU is more significant on stock markets in developed countries, whereas emerging stock markets are more sensitive to domestic EPU. Using monthly data for the period 1985–2016 for sixteen countries that included the G7 countries, Phan et al. (2018) find that while country-specific EPU predicts stock excess returns in all the G7 except in France, global EPU predicts stock excess returns in all the countries except in France, Germany, and the UK. Arouri et al. (2016) find that EPU has a negative effect on the US stock returns over the period 1900–2014.

However, studies that examine the joint effects of changes in oil price and EPU on stock returns are limited. For example, using SVAR model and monthly data for the period 1985–2015, Kang (2022) find that aggregate US earnings contain information about oil price changes and that the effects of oil price shocks are amplified by the endogenous response of EPU. Zhu et al. (2022) use wavelet quantile analysis and monthly data over the period 2005–2020 for a group of markets that included the US S&P500, the UK FTSE 250 and the euro area S&P Euro. Their results show that EPU has a negative effect on stock returns and that oil price has a positive effect on stock returns in the short and long runs and negative in the medium run and that this relationship is more evident when stock markets are bearish and bullish. Using QR analysis and monthly data for the period 2002–2018 for 20 oil-importing and exporting countries that included the G7 countries, Ziadat et al. (2022) find that while stock markets in oil-importing countries are not affected by oil price shocks, they are affected by precautionary demand shocks in oil-exporting countries and that the effect is stronger during bear market conditions. Besides, they find that stock markets in both oil-exporting and importing countries are negatively affected by global EPU and VIX volatility index. Kwon (2020) uses SVAR model and monthly data for the period 1974–2018 and finds that oil-demand shocks and US EPU reduce real stock returns in Canada, France, Germany, Japan, and Norway, and that oil-demand shocks significantly increase US EPU and that the impacts on global stock returns are amplified by the endogenous response of EPU. Using data over the period 1985–2015, Kang et al. (2017) find that oil demand-side shocks have a positive effect on the stock returns of oil and gas companies, whereas EPU shocks have a negative effect. Kang and Ratti (2013) use monthly data for the period 1985–2011 and SVAR model and find that an unanticipated increase in EPU has a significant negative effect on the US real stock returns; that a positive oil-demand shock significantly increases EPU and reduces real stock returns; and that the direct effects of oil shocks on real stock returns are intensified by endogenous EPU responses. Repeating the same exercise for Canada shows that a positive shock to EPU significantly reduces real stock returns, whereas a positive oil-demand shock significantly increases real stock returns.

Table 1 provides a summary of the studies used in the literature review. The table clearly shows that while there are some studies that examine the effect of oil price shocks or the effect of EPU on the stock returns of the G7 countries, there are no studies that examine the joint impact of changes in oil price and EPU on their stock returns. Therefore, this study is an attempt to fill this gap.

3 Theory and methodology

Oil price changes can affect stock prices through several channels (Narayan and Narayan 2010). First, because oil is an important input in the production process, production costs may increase in response to rising oil prices, which may hurt future cash flows and profits of business firms and thus, depress stock prices. Second, since rising oil prices lead to a transfer of income from oil-importing to oil-exporting countries, economic activity may increase in the latter and decrease in the former, which may increase stock prices in oil-exporting countries and decrease it in oil-importing countries (Bjørnland 2009). Third, rising oil prices suggest inflationary pressures, which is usually addressed by raising interest rates (You et al. 2017). Since the value of stocks is determined by the sum of discounted expected future cash flows that is calculated using a discount rate that includes expected inflation and expected real interest rate, rising oil prices are expected to depress stock prices (Narayan and Narayan 2010).

Likewise, the literature explains how uncertainty might affect stock prices. In the investment literature, investors make their investment decisions under uncertainty. Specifically, stock prices are based on expectations about the future, and since these expectations are based on all the currently available information in the market, changes in market participants’ expectations are likely to influence stock prices over time. However, the currently available information in the market is not perfect and can sometimes be difficult to interpret. Therefore, uncertainty about the future remains a key factor affecting investment decisions of market participants. In addition, uncertainty tends to rise during recessions and in response to bad events, such as oil price shocks and wars (Bloom 2014). High uncertainty threatens future earnings of firms and depresses stock prices. In a highly uncertain environment, firms reduce their hiring and investment demand and postpone irreversible investments, and consumers also reduce their spending (Bernanke 1983; Bloom 2014). Furthermore, uncertainty may increase financing and production costs and may affect inflation, interest rates, and risk premiums, which affects stock prices by affecting expected cash flows and discount rates (Arouri et al. 2016).

However, it is argued that oil price shocks and EPU are interrelated and jointly affect real stock returns (Kang and Ratti 2013; You et al. 2017; Das and Kannadhasan 2020). Kang and Ratti (2013) point out that oil price shocks and EPU affect stock prices by affecting expected cash flows and/or discount rates of business firms. Moreover, it is argued that oil price shocks and EPU increase the volatility of stock markets (Pástor and Veronesi 2012; Sadorsky 1999). For example, oil price shocks that change relative prices, inflation expectations, and real interest rates will affect EPU, and changes in EPU may affect systemic risks, which may increase stock market volatility (Kang and Ratti 2013; Yang et al. 2021). Therefore, it is necessary to consider the effect of EPU along with oil price shocks upon stock returns.

This paper uses QR analysis to study the joint impacts of changes in oil price and EPU on the stock market returns of the G7 countries. QR analysis as introduced by Koenker and Bassett (1978), is an extension to the ordinary least squares (OLS) regression analysis. Compared to OLS analysis, which shows only the average relationship between a dependent variable and a set of independent variables based on the conditional mean of the dependent variable, QR analysis shows the relationship at different quantiles of the dependent variable. Thus, while OLS analysis gives an incomplete view of the relationship, QR analysis provides a thorough view of that relationship by describing the entire conditional distribution of the dependent variable. Therefore, QR analysis provides information on the impacts of changes in oil price and EPU on stock returns in different market conditions: during bullish market at upper quantiles, bearish market at lower quantiles, or normal market at intermediate quantiles (Neifer 2015; Mensi et al. 2014). Moreover, QR analysis is more robust to the presence of outliers in the data, non-normal errors, skewness, and heterogeneity in the dependent variable (Zhu et al. 2016).

To conduct the analysis, we follow previous literature (see, for example, Arouri et al. 2016; Das and Kannadhasan 2020; You et al. 2017) and estimate a series of models starting with the following standard OLS modelFootnote 1:

where \({r}_{st}\) is real stock market return calculated as the first difference of the natural logarithm of the real aggregate stock market price index \(({r}_{st}=\mathrm{ln}\left({\mathrm{SP}}_{\mathrm{t}}/{\mathrm{SP}}_{\mathrm{t}-1}\right)*100)\), where \({\mathrm{sp}}_{\mathrm{t}}\) is the aggregate stock price index at time \(t\). \({r}_{st-1}\) is the one-period lagged real stock return. \({r}_{ot}\) is real oil return calculated as the first difference of the natural logarithm of the real West Taxes Intermediate (WTI) crude oil price. \(\mathrm{epu}\) is the first difference of the natural logarithm of the uncertainty policy index. \({r}_{rt}\) is real currency return calculated as the first difference of the natural logarithm of the real effective exchange rate, and \({\varepsilon }_{t}\) is a random error term. The focus of this paper is on \({\alpha }_{2}\) and \({\alpha }_{3}\), which measure the impact of changes in oil price and EPU on stock returns, respectively. The lagged stock return (\({r}_{st-1}\)) is included to see if there is predictability in the stock markets of the G7 countries based on previous return (Arouri et al. 2016). Both \({r}_{rt}\) and \({r}_{st-1}\) serve as control variables.

Equation (1) assumes that changes in oil price and EPU have a linear/symmetric effect on stock returns in that rising and falling oil prices and/or EPU have the same effect on stock returns but in the opposite direction. However, many studies find empirical evidence that oil price changes have an asymmetric effect on many economic and financial variables (Cologni and Manera 2008; Hamilton 1996; Lee et al. 1995; Mork 1989). For example, Mork (1989) finds that US economic activity responds asymmetrically to oil price changes in that the effects of oil price increases were different from those of the decreases. Sadorsky (1999) finds that positive changes in oil price have a larger effect on US stock returns than do negative changes. Likewise, changes in EPU may have an asymmetric effect on stock returns. One explanation for this asymmetry is whether traders perceive changes in EPU as short or long-lived (Bahmani-Oskooee and Saha 2019b). If a decrease in EPU is perceived to be short-lived, traders may relocate only a small portion of their portfolios from stocks to safer assets (or may not relocate at all), but if the decrease is perceived to be long-lived, traders may relocate a large portion of their portfolios into stocks. This behavior results in asymmetries in the effect of EPU on stock returns. Another reason is the way traders may react to good (positive) and bad (negative) news in the market. There is growing evidence suggesting that positive and negative news have asymmetric effects on individuals’ attitudes in that negative news have a much larger impact on individuals’ attitudes than does positive news (Soroka 2006). For example, Zhou (2015) finds that the response of stock prices to bad news is stronger than to good news, and Laakkonen and Lanne (2008) find that bad news increase volatility more than good news.

To allow for asymmetry in the effects of changes in oil price and EPU, we decompose these variables into positive and negative changes: \(r_{ot}^{ + } = \max \left( {r_{ot} ,0} \right)\), \(r_{ot}^{ - } = \min \left( {r_{ot} ,0} \right)\), \(epu_{t}^{ + } = \max \left( {epu_{t} ,0} \right)\), and \({epu}_{t}^{-}=\mathit{min}({epu}_{t},0)\), and include these changes in Eq. (1). This yields the asymmetric OLS model:

where \({\beta }_{2}^{+}\), \({\beta }_{2}^{-}\), \({\beta }_{3}^{+}\), and \({\beta }_{3}^{-}\) measure the effects of positive and negative changes in oil price and EPU on stock returns, respectively.Footnote 2 Whereas the symmetric OLS model in Eq. (1) can provide information on “whether changes in oil price and EPU are important for stock market returns”, it cannot provide information on “whether these changes affect stock returns differently for markets with low returns than for markets with high returns”; that is whether stock market conditions (bearish, bullish, or normal) affect the impact of changes in oil price and EPU on stock returns. The same concern can be raised for the asymmetric OLS model (2); that is, while model (2) can provide information on “whether positive and negative changes in oil price and EPU are important for stock returns”, it cannot provide information on “whether these positive and negative changes in oil price and EPU affect stock market returns differently for markets with low returns than for markets with high returns.” To address these issues, QR analysis is used (Nusair and Al-Khasawenh 2018; Nusair and Olson 2019).

QR analysis is based on modeling the conditional \(\tau {\text{th}}\) quantile of the dependent variable for some value of \(\tau \in (0, 1)\):

where \({Q}_{{r}_{st}}\left(\tau /x\right)\) is the conditional \(\tau {\text{th}}\) quantile of the dependent variable \(({r}_{st})\), \({\alpha }^{\tau }\) is the intercept which depends on \(\tau\), \({\beta }^{\tau }\) is a vector of coefficients associated with \(\tau {\text{th}}\) quantile, and \({x}^{^{\prime}}\) is a vector of explanatory variables (lagged real stock return, oil return, changes in EPU, and currency return). To examine the impacts of changes in oil price and EPU on stock returns using QR analysis, we use the following two QR models:

where (4) and (5) are the symmetric and asymmetric QR models, estimated using nine quantiles (\(\tau =0.10, \dots , 0.90)\). These quantiles are then divided into three regimes: low \((\tau =0.10, 0.20, 0.30)\) corresponding to bearish market, medium \((\tau =0.40, 0.50, 0.60)\) corresponding to normal market, and high \((\tau =0.70, 0.80, 0.90)\) corresponding to bullish market (Nusair and Olson 2019). We focus on \({\alpha }_{2}^{\tau }\) and \({\alpha }_{3}^{\tau }\) in the symmetric QR model (4), which measure the dependence degree of stock returns at the \({\tau }^{th}\) quantile to changes in oil price and EPU in each country. In the asymmetric QR model (5), we focus on \({\beta }_{2}^{\tau +}\), \({\beta }_{2}^{\tau -}\), \({\beta }_{3}^{\tau +}\), and \({\beta }_{3}^{\tau -}\) which measure the dependence degree of stock returns at the \(\tau {\text{th}}\) quantile to positive and negative changes in oil price and EPU, respectively.

4 Data and empirical results

4.1 Data

Monthly data are used to conduct the analysis. Although the sample ends in May 2021 for all the countries, the start date varies by country with the longest sample starting in February 1985 for Canada and the USA and the shortest starting in January 1998 for Italy (Appendix A provides data description). The data contains aggregate stock market price indexes obtained from Yahoo Finance and represent end-of-month closing prices. Uncertainty is measured by the Economic Policy Uncertainty (EPU) index developed by the Policy Uncertainty Group, which is constructed based on the method developed by Baker et al. (2016) and Arbatli et al. (2019).Footnote 3 The index reflects information about news associated with uncertainty and is based on the volume of newspapers’ articles containing words related to “uncertainty”, “economy”, and “policy”. The price of oil is measured by West Texas Intermediate (WTI) obtained from the Federal Reserve Bank of St. Louis,Footnote 4 the consumer price index (CPI) extracted from the IMF’s International Financial Statistics is used to calculate real stock returns. The real effective exchange rate (REER) extracted from the Bank of International Settlements is included as a control variable.Footnote 5

4.2 Preliminary results

Table 2 provides descriptive statistics and a unit root test for the market returns and the changes in EPU. The average monthly real stock return ranges between − 0.111% in Italy to 0.545% in Germany. The highest level of risk is observed in Italy with a standard deviation of 6.424, and the lowest level of risk is in the UK with a standard deviation of 4.078. The average monthly real oil return ranges between − 0.001% in the USA and 0.316% in Italy. The oil market was very volatile and risky relative to the stock market with an average standard deviation of 9.880 across the G7. The average monthly real currency return ranges between − 0.088% in Japan and 0.053% in the UK. The foreign exchange market was the least volatile market as indicated by the standard deviation which ranges between 0.526% in Italy and 2.384% in Japan. Overall, the G7 countries have experienced a great deal of uncertainty over the sample period as indicated by the high standard deviation of EPU that ranges between 18.799% in Japan and 39.442% in Germany. In addition, all the series, except for EPU in Germany and Japan, appear to be non-normal as indicated by the Jarque–Bera normality test, and all the stock and oil return series, the Canadian foreign exchange rate, and EPU indexes of Japan and the UK are skewed to the left. Besides, all the series exhibit a leptokurtic distribution (statistic is above 3), meaning that the series have fatter tails compared with the normal distribution. In this situation, the probability of seeing negatively extreme values is much higher than a normal distribution (Aloui et al. 2012). Given these characteristics of the series, QR analysis provides more efficient estimates for the effects of changes in oil price and EPU on stock returns.

An explanation for our findings that the series are skewed to the left and have a leptokurtic distribution could be the very volatile period for the G7 countries that is covered in this study. Specifically, the period contains Black Monday in 1987; the Iraqi invasion of Kuwait and the First Gulf war in 1990/91; the US recession in 1990; the bursting of the Japanese asset price bubble in 1991; the bursting of the dot.com bubble in 2000; the 9/11 attacks on the USA in 2001; the US financial crisis in 2007; the Chinese stock market crash and the stocks selloff in the USA in 2015/16; the Brexit Referendum in 2016; and the COVID-19 pandemic in 2020.Footnote 6 Lastly, and to avoid spurious results, the Augmented Dickey-Fuller (ADF) unit root test is used to examine the stationarity of the series. The results show that all the series are stationary.

Further analysis using the correlation coefficient showed that the stock returns and changes in EPU are negatively correlated, stock returns and oil returns are positively correlated in all the countries, and that stock returns and currency returns are negatively correlated in all the countries except in Canada.Footnote 7 To gain further insight about the effect of changes in oil price and EPU on the stock returns, the next section provides the results from estimating the symmetric and asymmetric OLS and QR models.

4.3 Symmetric models

This section provides in Table 3 the results from estimating the symmetric OLS and QR models (1) and (4). The OLS results show that while EPU has a significant negative effect on the stock returns in all countries, oil return has a significant positive effect on the stock returns in Canada and Italy and no effect in the other countries. Our finding that EPU has a negative effect on the stock returns is consistent with previous studies, such as Wen et al. (2022) for the G7 and BRIC countries, Chiang (2020) for Japan, Bahmani-Oskooee and Saha (2019a) for Canada, Japan, the UK, and the USA, and Chiang (2019) for the G7 countries. Although our findings that oil price changes have a positive effect on stock returns in Canada and Italy and an insignificant effect in the remaining countries are in line with those of Lee et al. (2012), they contrast with those of Cunado and Perez de Gracia (2014) who find a significant negative effect of oil price shocks on stock returns in a sample of 12 oil-importing European countries that included France, Germany, Italy, and the UK.

The one-period lagged stock return has an insignificant effect on the stock returns in all the countries, implying that there no is predictability in the stock markets of the G7 countries based on previous return. Moreover, the results indicate that currency return has a significant positive effect on the stock returns in Canada, a significant negative effect in France, Germany, Japan, the UK, and the USA, and no effect in Italy.

The results from the symmetric QR model show that EPU has a significant negative effect on the stock returns in Canada, France, Italy, and the UK at lower and medium quantiles, suggesting that while falling(rising) EPU leads to higher (lower) stock returns during bearish and normal markets, it has an insignificant effect at higher quantiles when markets are bullish. We also find that EPU has a significant negative effect across the entire quantile distribution of the stock returns in Germany, Japan, and the USA, suggesting co-movement between stock returns and EPU across the entire quantile distribution. This contrasts with Peng et al. (2018) who find that EPU has a negative effect on the bearish market of Germany and Japan; an intermediate dependence in the Canadian market; and no effect on the UK and French markets. As for oil return, the results show that while oil return has a significant positive effect on the stock returns in Canada, Italy, and the UK at lower and medium quantiles, it has a positive significant impact in France and Germany at lower quantiles, and an insignificant effect in Japan and the USA. This suggests that while rising (falling) oil price leads to higher (lower) stock returns in Canada, Italy, and the UK during bearish and normal markets, it leads to higher(lower) stock returns in France and Germany during bearish market. Regarding the effect of the exchange rate, we find that currency return has a positive significant effect on the stock returns in Canada across the entire quantile distribution and that the effect intensifies during extreme market conditions when markets are bearish and bullish, implying that appreciation (depreciation) of the Canadian dollar leads to higher (lower) stock returns. We also find that while currency return has an insignificant effect on the stock returns in Italy, it has a significant negative effect in Germany at lower and higher quantiles during bearish and bullish markets and it has a significant negative effect on the stock returns in France, Japan, the UK, and the USA across the entire quantile distribution, suggesting that currency appreciations (depreciations) lead to lower (higher) stock returns. Lastly, the one-period lagged stock return has a significant effect on stock returns at lower and higher quantiles during bearish and bullish markets in all but Canada, suggesting that there is predictability in the stock markets of the G7 countries based on previous return only during extreme market conditions.

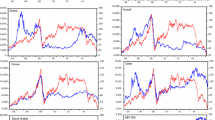

Figure 1 provides summary charts for the QR coefficient estimates with 95% confidence intervals (shaded area) along with the OLS estimates for the impact of changes in EPU and oil price on stock returns. The OLS estimates of the conditional mean effects of changes in both EPU and oil price are given by the red solid line, and these estimates do not change. QR coefficient estimates are given by the solid black curve and these vary across quantiles. As we move up from lower to higher quantiles, the impact of EPU on stock returns increases in all the countries, whereas the impact of oil return decreases in all but Japan which stays stable. Furthermore, we evaluate the null hypothesis that the slopes are equal across different quantiles using an F-test. The results in Table 4 show that this null hypothesis can be rejected at only a few quantiles, suggesting that the estimated coefficients in some cases have not been constant.

4.4 Asymmetric models

This section provide in Table 5 the results from estimating the asymmetric OLS and QR models (2) and (5). The results from the asymmetric OLS model show that while positive changes in EPU have a significant negative effect on the stock returns in Canada, France, Italy, Japan, the UK, and the USA, negative changes are insignificant. This indicates that positive and negative changes in EPU have asymmetric effects on stock returns since rising EPU lowers stock returns but falling EPU has no effect. Both positive and negative changes in EPU have significant negative effects on the stock returns in Germany, suggesting that rising EPU reduces stock returns and falling EPU increases stock returns. Regarding the price of oil, the results show that positive and negative oil price changes have an insignificant effect on the stock returns of all the countries, except for negative changes in France and Italy that have a significant positive effect, implying that falling oil price reduces stock returns in France and Italy. This contrasts with Hatemi-J et al. (2017) who find that rising oil prices increase stock prices in the USA and Japan, whereas falling oil prices reduce stock prices in Germany. Concerning the exchange rate, the results show that currency return has a positive significant effect on the stock returns in Canada, a significant negative effect in France, Germany, Japan, the UK, and the USA, and an insignificant effect in Italy. This implies that while Canadian dollar appreciation leads to higher stock returns, currency appreciations reduce stock returns in France, Germany, Japan, the UK, and the USA. Lastly, the one-period lagged stock return has an insignificant effect on stock returns in all the countries, implying that there no is predictability in the stock markets of the G7 countries based on previous return.

The results from the asymmetric QR model show that while positive changes in EPU have a significant negative effect on the stock returns in Canada, France, and the USA at most of the quantiles, negative changes are insignificant. This implies that changes in EPU have asymmetric effects on the stock returns in these countries since rising EPU reduces stock returns but falling EPU is insignificant. The results for Germany, Italy, Japan, and the UK show that positive changes in EPU have a significant negative effect on stock returns at lower and/or medium quantiles, whereas negative changes have a significant negative effect at medium and/or higher quantiles. This indicates that while rising EPU reduces stock returns during bearish and/or normal markets, falling EPU increases stock returns during normal and/or bullish markets. In addition, the results show that positive changes in EPU in most of the countries have a significant negative effect on the stock returns at most of the quantiles and that the magnitude of the positive changes is larger than that of the negative changes. This suggests that positive and negative changes in EPU have asymmetric effects on stock returns. Our results that EPU changes have negative and asymmetric effects on the stock returns of the G7 countries and that the impact of rising EPU is larger than that of falling EPU are in line with those of Huang and Liu (2022). They are also in line with the results of Nusair and Al-Khasawneh (2022) and Bahmani-Oskooee and Saha (2019b) who find that EPU changes have an asymmetric effect on the stock returns of the G7 countries.

Regarding the price of oil, the results show that while falling oil price has an insignificant effect on the stock returns in Canada and Japan, rising oil price leads to higher stock returns in Canada at medium quantiles when the stock market is normal, and higher stock returns in Japan when the stock market is normal and bullish. Conversely, we find that while rising oil price does not affect stock returns in France, falling oil price reduces stock returns only during extreme market conditions when the stock market is bearish and bullish. In Germany we find that while rising oil price leads to higher stock returns when the market is normal and bullish, falling oil price reduces stock returns when the market is bearish. This implies that positive oil price changes increase stock returns during normal and bullish markets, whereas negative changes reduce stock returns during bearish market. While rising (falling) oil price leads to higher(lower) stock returns in Italy and the UK at lower quantiles during bearish markets, both rising and falling oil price lead to higher stock returns in the USA during normal and bullish markets. Concerning the effect of the exchange rate, the results show that while currency return has a positive significant effect on stock returns in Canada at most of the quantiles, it has a significant negative effect at all quantiles in France, Japan, the UK, and the USA, a significant negative effect in Germany at lower quantiles, and an insignificant effect in Italy. This suggests that while Canadian dollar appreciation increases stock returns at most of the quantiles, currency appreciations reduce stock returns in France, Japan, the UK, and the USA at all quantiles, and lower stock returns in Germany at lower quantiles during bearish market. Lastly, the one-period lagged stock return has an insignificant effect on stock returns in Canada, whereas it has a significant negative effect in France, Japan, the UK, and the USA at all quantiles, it has a significant negative effect in Germany at lower quantiles, and no effect in Italy.

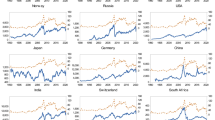

Figure 2 plots QR coefficient estimates along with OLS estimates and 95 percent confidence intervals. The figure shows that QR coefficient estimates vary across quantiles. This suggests that the sensitivity of the stock returns to changes in oil price and EPU varies across the different states of the market. Furthermore, as we move up from lower to higher quantiles, the impact of EPU on stock returns increases and the impact of oil return decreases in most countries. Lastly, we provide in Table 6 an F-test for equality of quantile slopes, and the results show that this hypothesis can be rejected at only a few quantiles, suggesting that the estimated coefficients in some cases have not been constant.

Overall, our results show that the oil price has a positive effect and EPU has a negative effect on the stock returns of the G7 countries. The positive effect of the price of oil implies that rising oil price leads to higher stock returns. Theoretically, the positive effect of the price of oil on the stock returns could be due to the state of an expanding economy. Specifically, when the economy is expanding, production increases and the demand for oil rises, which leads to higher oil price. However, the increase in production is expected to have a positive effect on business firms’ cash flows, which will, in turn, lead to higher stock prices (Das and Kannadhasan 2020). Likewise, our finding that EPU has a negative effect on stock returns concurs with theoretical connotations. As mentioned earlier that in a highly uncertain environment, firms reduce their hiring and investment demand and postpone irreversible investments, and consumers reduce their spending (Bernanke 1983; Bloom 2014). Moreover, high uncertainty may increase financing and production costs and may affect inflation, interest rates, and risk premiums, which will have a negative effect on expected cash flows of business firms and thus, depress stock prices (Arouri et al. 2016).

The results from asymmetric QR model clearly show that the positive and negative changes in oil price and EPU have asymmetric effects on the stock returns of the G7 countries and that the stock returns are more vulnerable to changes in oil price and EPU mainly during extreme market conditions of bearish and bullish markets. This suggests that not only do positive and negative changes in oil price and EPU have asymmetric effects on the stock returns of the G7 countries but are also affected by market conditions. For example, while positive and negative oil price changes affect stock returns in Italy and the USA when stock markets are bullish, they affect the UK stock returns when the stock market is bearish. In France, negative oil price changes affect stock returns when the stock market is bearish and bullish. This suggests that positive and negative oil price changes may be related to investors’ sentiments. For instance, when stock markets are bullish, investors may interpret rising oil prices as good news, which may encourage investors to become more optimistic about the economy and therefore, buy more stocks. Conversely, when the stock market is bearish, investors may interpret falling oil prices as bad news due to their expectation of falling economic activity, in which case they may feel pessimistic about the economy and hence, sell stocks. Likewise, positive and negative changes in EPU are, in some cases, related to market conditions. For instance, in Germany, while positive changes in EPU affect stock returns when the stock market is bearish, negative changes affect stock returns during normal and bullish markets. In the UK, positive changes in EPU affect stock returns during bearish and normal markets, whereas negative changes in EPU affect stock returns only the stock market is normal. Additionally, we find that the impact of the positive changes in EPU is larger than that of the negative changes.

We can compare our results with the results from previous studies that considered the joint impact of changes in oil price and EPU on the stock returns and used the same methodology (asymmetric QR analysis). Only one study by Ziadat et al. (2022) that used symmetric QR analysis and considered the joint impact of changes in oil price and EPU on the markets of 20 oil-importing and exporting countries that included France, Germany, Italy, Japan, and the UK from the oil-importing countries, and Canada and the USA from the oil-exporting countries. While their finding that stock markets are not affected by oil price shocks in oil-importing countries is not in line with our findings, their results that global EPU has a negative effect on the stock markets in both oil-exporting and importing countries is in line with our findings that EPU has a negative effect on the stock returns of the G7 countries, albeit our results show evidence of asymmetries in the effects of changes of both oil price and EPU. This is also in line with Zhu et al. (2022) who find that EPU has a negative effect on stock returns of six countries that included the USA, the UK, and the Euro Area. They also find that oil price has a positive effect on stock returns in the short-run and long-run and a negative effect in the medium run, especially when stock markets are bearish and bullish. This also seems to be in line with our findings for the UK and the USA that oil price changes affect stock returns during bearish and /or bullish markets. Similar findings are documented by Kang and Ratti (2013) who find a negative effect of EPU and a positive effect of oil price on the stock returns in Canada and the USA.

4.5 Robustness check

In the previous analysis, we examined the impact of changes in oil price and EPU on stock returns in the G7 countries by estimating models (1), (2), (4), and (5). The real effective exchange rate in addition to the lagged first-differenced real stock return were included in the models as control variables. To check the robustness of our results, we re-estimate the asymmetric OLS and QR models (4) and (5) without including the control variables and see if the results for positive and negative changes in oil price and EPU still hold. The results, reported in Table 7, show that the effects of positive and negative changes in oil price and EPU on stock returns are similar to those obtained from models that included the control variables reported in Table 5. The estimated coefficients still carry the same signs and significance, indicating that including control variables does not change the main conclusion of the paper about the impact of changes in oil price and EPU on stock returns. Therefore, we can conclude that our results are robust because we still obtain similar results whether control variables are included.

5 Conclusion and policy implications

We employ quantile regression (QR) analysis to study the asymmetric effects of changes in oil price and EPU on the stock market returns of the G7 countries. QR analysis provides information on the co-movement between stock returns and changes in oil price and EPU in specific market conditions. We allow for asymmetries by differentiating between positive and negative changes in oil price and EPU.

We use monthly data from February 1985 to May 2021 and estimate four models for each country: symmetric and asymmetric OLS and QR models. The symmetric OLS model shows that while changes in EPU have a negative effect on the stock returns in all countries, oil price changes have a positive effect on the stock returns in Canada and Italy and an insignificant effect in the other countries. In contrast, the asymmetric OLS model shows that while positive changes in EPU have a negative effect on the stock returns in all the countries, negative changes are insignificant in all the countries except in Germany where they have a negative effect. This indicates that positive and negative changes in EPU have asymmetric effects on stock returns since rising EPU lowers stock returns, whereas falling EPU is insignificant. We find that positive and negative oil price changes have an insignificant effect on the stock returns in all the countries, except for negative changes in France and Italy that have a positive effect, implying that falling oil price reduces stock returns in France and Italy.

The symmetric QR model shows that while EPU has a negative effect on the stock returns of Canada, France, Italy, and the UK during bearish and normal markets, it has a negative effect across the entire quantile distribution on the stock returns of Germany, Japan, and the USA. We also find that while oil price changes have a positive effect on the stock returns in Canada, Italy, and the UK during bearish and normal markets, they have a positive effect in France and Germany during bearish market, and no effect in Japan and the USA. On the other hand, the asymmetric QR models show that while positive changes in EPU have a negative effect on stock returns in Canada, France, and the USA across most of the quantiles, negative changes are insignificant. This suggests that changes in EPU have an asymmetric effect on the stock returns since rising EPU reduces stock returns whereas falling EPU is insignificant. We also find that while rising EPU lowers stock returns in Germany, Italy, Japan, and the UK when stock markets are bearish and/or normal, falling EPU increases stock returns in Germany, Japan, and the UK when stock markets are normal and/or bullish but reduces stock returns in Italy when the stock market is bullish. Besides, the results show that while rising oil price increases stock returns in Canada, Germany, and Japan when stock markets are normal and/or bullish, falling oil price has no effect in Canada and Japan but it reduces stock returns in Germany when the stock market is bearish. We also find that while falling oil price reduces the stock returns in France during bearish and bullish markets, rising oil price is insignificant. Moreover, while positive and negative oil price changes have a positive effect on the stock returns in Italy and the UK at lower quantiles, positive changes have a positive effect and negative changes have a negative effect in the USA at medium and higher quantiles. This implies that while rising oil price increases stock returns and falling oil price reduces stock returns in Italy and the UK during bearish markets, both positive and negative changes increase stock returns in the USA during normal and bullish markets.

5.1 Policy implications

Our findings have some important policy implications. First, because the impacts of changes in oil price and EPU are not constant throughout the distribution of the stock returns, policy recommendations drawn based on results from standard OLS can be misleading. Second, our results show that changes in oil price and EPU have significant effects on the stock returns in the G7 countries and that the effects are asymmetric and related to market conditions. Accordingly, policymakers should pay close attention to changes in the oil price and EPU and should know when and how to respond to these changes. For example, falling EPU does not affect the stock returns in Canada, France, and the USA, which suggests that investors and policymakers in these countries should not respond to falling EPU. On the other hand, rising EPU in Germany, Italy, Japan, the UK, and the USA reduces stock returns only when stock markets are bearish and/or normal. This implies that while investors and policymakers in these countries should not respond to rising EPU when stock markets are bullish, they should respond to rising EPU only when stock markets are bearish and/or normal. Third, the results show that the impact of positive changes in EPU is more important and larger than that of the negative changes. This suggests that policymakers should devote more attention to rising EPU than falling EPU. Fourth, positive oil price changes in most countries seem to be more important than negative changes, and the impact is positive and mainly during extreme market conditions during bearish and bullish markets. This suggests that policymakers should devote more attention to rising than falling oil price and should avoid uncertain information concerning oil price changes that may lead to more volatility in stock markets, notably when markets are bearish or bullish.

Notes

This literature used these models or some other variants.

A positive change in a variable indicates that the variable is increasing, whereas a negative change indicates that the variable is falling.

More information on the index can be found at https://www.policyuncertainty.com/index.html.

Federal Reserve Bank of St. Louis, https://fred.stlouisfed.org/series/WTISPLC.

Bank of International Settlements, https://www.bis.org/statistics/eer.htm.

We applied Bai-Perron multiple breakpoint test to the relationship between the variables and the test showed no significant breaks for Canada and Italy, whereas it suggested one and two breaks in the other countries (around the 2007/08 US financial crisis). However, including these breaks in the different models did not produce significant differences. Therefore, the models are estimated without including these breaks. All unreported results are available upon request from the authors.

Results are not reported but available upon request from the authors.

References

Alamgir F, Bin Amin S (2021) The nexus between oil price and stock market: evidence from South Asia. Energy Rep 7:693–703

Aloui C, Nguyen D, Njeh N (2012) Assessing the impacts of oil price fluctuations on stock returns in emerging markets. Econ Model 29:2686–2695

Arbatli E, Davus S, Ito A, Miake N, Saito I (2019) Policy uncertainty in Japan (August 5, 2019). Becker Friedman Institute for Research in Economics Working Paper No. 2017-09. Available at SSRN: https://ssrn.com/abstract=2972891 or https://doi.org/10.2139/ssrn.2972891

Arouri M, Estay C, Rault C, Raubaud D (2016) Economic policy uncertainty and stock markets: long-run evidence from the US. Financ Res Lett 18:136–141

Bahmani-Oskooee M, Saha S (2019a) On the effects of policy uncertainty on stock prices. J Econ Financ 43:764–778

Bahmani-Oskooee M, Saha S (2019b) On the effect of policy uncertainty on stock prices: an asymmetric analysis. Quant Financ Econ 3(2):412–424

Baker S, Bloom N, Davis S (2016) Measuring economic policy uncertainty. QJ Econ 131(4):1593–1636

Basher S, Haug A, Sadorsky P (2012) Oil prices, exchange rates and emerging stock markets. Energy Econ 34(1):227–240

Bastianin A, Conti F, Manera M (2016) The impacts of oil price shocks on stock market volatility: evidence from the G7 countries. Energy Policy 98:160–169

Batabyal S, Killins R (2021) Economic policy uncertainty and stock market returns: evidence from Canada. J Econ Asymmetries 24:1–14

Bernanke B (1983) Irreversibility, uncertainty, and cyclical investment. Q J Econ 98(1):85–106

Bjørnland H (2009) Oil price shocks and stock market booms in an oil exporting country. Scott J Polit Econ 56(2):232–254

Bloom N (2014) Fluctuations in uncertainty. J Econ Perspect 28(2):153–176

Chang T, Chen W-Y, Gupta R, Nguyen D (2015) Are stock prices related to the political uncertainty index in OECD countries? evidence from the bootstrap panel causality test. Econ Syst 39:288–300

Chodorow-Reich G, Nenov P, Simsek A (2019) Stock market wealth and the real economy: a local labor market approach. NBER Working Paper 25959. http://www.nber.org/papers/w25959

Chen X, Chiang T (2020) Empirical investigation of changes in policy uncertainty on stock returns—evidence from China’s market. Res Int Bus Financ 53:1–19

Chiang T (2020) Economic policy uncertainty and stock returns—evidence from the Japanese market. Quant Financ Econ 4(3):430–458

Chiang T (2019) Economic policy uncertainty, risk and stock returns: evidence from G7 stock markets. Financ Res Lett 29:41–49

Civcir I, Akkoc U (2021) Non-linear ARDL approach to the oil-stock nexus: detailed sectoral analysis of the Turkish stock market. Resour Policy 74:102424

Cologni A, Manera M (2008) Oil price, inflation and interest rates in a structural cointegrated VAR model for the G-7 countries. Energy Econ 30:856–888

Cunado J, Perez de Gracia F (2014) Oil price shocks and stock market returns: evidence for some European countries. Energy Econ 42:365–377

Das D, Kannadhasan M (2020) The asymmetric oil price and policy uncertainty shock exposure of emerging market sectoral equity returns: a quantile regression approach. Int Rev Econ Financ 69:563–581

Das D, Kumar S (2018) International economic policy uncertainty and stock prices revisited: multiple and Partial wavelet approach. Econ Lett 164:100–108

Diaz E, Molero J, Perez de Gracia F (2016) Oil price volatility and stock returns in the G7 economies. Energy Econ 54:417–430

Diaz E, Perez de Gracia F (2017) Oil price shocks and stock returns of oil and gas corporations. Financ Res Lett 20:75–80

Fama E (1990) Stock returns, expected returns, and real activity. J Financ 45:1089–1108

Fama E, French K (1989) Business conditions and expected returns on stocks and bonds. J Financ Econ 25(1):23–49

Hamilton J (2009) Causes and consequences of the oil shock of 2007–08. Brookings Papers on Economic Activity, Spring, 215–261

Hamilton J (2003) What is an oil shock? J Econom 113(2):363–398

Hamilton J (1996) This is what happened to the oil price-macroeconomy relationship. J Monet Econ 38(2):215–220

Hashmi S, Chang B, Bhutto N (2021) Asymmetric effect of oil prices on stock market prices: new evidence from oil-exporting and oil-importing countries. Resour Policy 70:101946. https://doi.org/10.1016/j.resourpol.2020.101946

Hatemi-J A, Al Shayeb A, Roca E (2017) The effect of oil prices on stock prices: fresh evidence from asymmetric causality tests. Appl Econ 49(16):1584–1592

Huang W-Q, Liu P (2022) Asymmetric effects of economic policy uncertainty on stock returns under different market conditions: evidence from G7 stock markets. Appl Econ Lett 29(9):780–784

Hwang I, Kim J (2021) Oil price shocks and the US stock market: a nonlinear approach. J Empir Financ 64:23–36

Henriques I, Sadorsky P (2008) Oil prices and the stock prices of alternative energy companies. Energy Econ 30:998–1010

Joo Y, Park S (2017) Oil prices and stock markets: does the effect of uncertainty change over time? Energy Econ 61:42–51

Kang W (2022) The asymmetric responses of aggregate earnings and stock returns to oil shocks and policy uncertainty. Asia-Pac J Acc Econ 29(1):97–109

Kang W, Perez de Gracia F, Ratti R (2017) Oil price shocks, policy uncertainty, and stock returns of oil and gas corporations. J Int Money Financ 70:344–359

Kang W, Ratti R (2013) Oil shocks, policy uncertainty and stock market returns. J Int Financ Mark Inst Money 26:305–318

Kilian L (2009) Not all oil price shocks are alike: disentangling demand and supply shocks in the crude oil market. Am Econ Rev 99:1053–1069

Kilian L, Park C (2009) The impact of oil price shocks on the us stock market. Int Econ Rev 50(4):1267–1287

Koenker R, Bassett G (1978) Regression quantiles. Econometrica 46(1):33–50

Kwon D (2020) The impacts of oil price shocks and United States economic uncertainty on global stock markets. Int J Financ Econ. https://doi.org/10.1002/ijfe.2232

Laakkonen H, Lanne M (2008) Asymmetric news effects on volatility: good vs. bad news in good vs. bad times. Discussion Paper No. 207, Helsinki Center of Economic Research. ISSN 1795-0562

Lee B-J, Yang C, Huang B-N (2012) Oil price movements and stock markets revisited: a case of sector stock price indexes in the G-7 countries. Energy Econ 34:1284–1300

Lee K, Ni S, Ratti R (1995) Oil shocks and the macroeconomy: the role of price variability. Energy J 16(4):39–56

Le T-H, Chang Y (2015) Effects of oil price shocks on the stock market performance: do nature of shocks and economies matter? Energy Econ 51:261–274

Managi S, Yousfi M, Ben Zaied Y, Ben Mabrouk N, Ben Lahouel B (2022) Oil price, US stock market and the US business conditions in the era of COVID-19 pandemic outbreak. Econ Policy Anal 73:129–139

Mensi W, Hammoudeh S, Reboredo J, Nguyen D (2014) Do global factors impact BRICS stock markets? a quantile regression approach. Emerg Mark Rev 19:1–17

Mork K (1989) Oil and the macroeconomy when prices go up and down: an extension of Hamilton’s results. J Polit Econ 97(3):740–744

Neifer N (2015) Do global risk factors and macroeconomic conditions affect global Islamic index dynamics? a quantile regression approach. Q Rev Econ Financ. https://doi.org/10.1016/j.qref.2015.10.004

Narayan P, Narayan S (2010) Modelling the impact of oil prices on Vietnam’s stock prices. Appl Energy 97:356–361

Nusair S, Al-Khasawneh J (2022) Impact of economic policy uncertainty on the stock markets of the G7 Countries: a nonlinear ARDL approach. J Econ Asymmetries 26:e00251. https://doi.org/10.1016/j.jeca.2022.e00251

Nusair S, Al-Khasawneh J (2018) Oil price shocks and stock market returns of the GCC countries: empirical evidence from quantile regression analysis. Econ Chang Restruct 51(4):339–372

Nusair S, Olson D (2019) The effects of oil price shocks on Asian exchange rates: evidence from quantile regression analysis. Energy Econ 78:44–63

Pástor L, Veronesi P (2012) Uncertainty about government policy and stock prices. J Financ 67(4):1219–1264

Peng G, Huiming Z, Wanhai Y (2018) Asymmetric dependence between economic policy uncertainty and stock market returns in G7 and BRIC: a quantile regression approach. Financ Res Lett 25:251–258

Phan D, Sharma S, Tran V (2018) Can economic policy uncertainty predict stock returns? global evidence. J Int Financ Mark Inst Money 55:134–150

Rafailidis P, Katrakilidis C (2014) The relationship between oil prices and stock prices: a nonlinear asymmetric cointegration approach. Appl Financ Econ 24(12):793–800

Rahman S (2022) The asymmetric effects of oil price shocks on the U.S. stock market. Energy Econ 105:105694. https://doi.org/10.1016/j.eneco.2021.105694

Reboredo J, Ugolini A (2016) Quantile dependence of oil price movements and stock returns. Energy Econ 54:33–49

Sadorsky P (2001) Risk factors in stock returns of Canadian oil and gas companies. Energy Econ 23(1):17–28

Sadorsky P (1999) Oil price shocks and stock market activity. Energy Econ 21(5):449–469

Sardar N, Sharma S (2022) Oil prices & stock returns: modeling the asymmetric effects around the zero lower bound. Energy Econ 107:105814. https://doi.org/10.1016/j.eneco.2022.105814

Smales L (2020) Examining the relationship between policy uncertainty and market uncertainty across the G7. Int Rev Financ Anal 71:1–17

Sim N, Zhou H (2015) Oil prices, US stock returns, and the dependence between their quantiles. J Bank Financ 55:1–8

Soroka S (2006) Good news and bad news: asymmetric responses to economic information. J Polit 68(2):372–385

Wang Y, Wu C, Yang L (2013) Oil price shocks and stock market activities: evidence from oil-importing and oil-exporting countries. J Comp Econ 41:1220–1239

Wen F, Shui A, Cheng Y, Gong X (2022) Monetary policy uncertainty and stock returns in G7 and BRICS countries: a quantile-on-quantile approach. Int Rev Econ Financ 78:475–482

Westerlund J, Sharma S (2019) Panel evidence on the ability of oil returns to predict stock returns in the G7 area. Energy Econ 77:3–12

Yang T, Zhou F, Du M, Du Q, Zhou S (2021) Fluctuation in the global oil market, stock market volatility, and economic policy uncertainty: a study of the US and China. Q Rev Econ Financ. https://doi.org/10.1016/j.qref.2021.08.006

You W, Guo Y, Zhu H, Tang Y (2017) Oil price shocks, economic policy uncertainty and industry stock returns in China: asymmetric effects with quantile regression. Energy Econ 68:1–18

Zhou J (2015) The good, the bad, and the ambiguous: the aggregate stock market dynamics around macroeconomic news (24 Jan 2015). Available at SSRN: https://ssrn.com/abstract=2555050 or https://doi.org/10.2139/ssrn.2555050

Zhu H, Wu H, Ren Y, Yu D (2022) Time-frequency effect of investor sentiment, economic policy uncertainty, and crude oil on international stock markets: evidence from wavelet quantile analysis. Appl Econ. https://doi.org/10.1080/00036846.2022.2057912

Zhu H, Guo Y, You W, Xu Y (2016) The heterogeneity dependence between crude oil price changes and industry stock market returns in China: evidence from quantile regression approach. Energy Econ 55:30–41

Ziadat S, McMillan D, Herbst P (2022) Oil shocks and equity returns during bull and bear markets: the case of oil importing and exporting nations. Resour Policy 75:102461. https://doi.org/10.1016/j.resourpol.2021.102461

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A

Data range

The table below gives the sample range for each country and the name of the stock market price index:

Country | Sample | Stock market index name |

|---|---|---|

Canada | February 1985–May 2021 | S&P/TSX Composite |

France | April 1990–May 2021 | France CAC 40 |

Germany | February 1993–May 2021 | Frankfurt DAX |

Italy | January 1998–May 2021 | FTSE MIB |

Japan | February 1987–May 2021 | NIKKEI 225 |

UK | February 1997–May 2021 | FTSE 100 |

USA | February 1985–May 2021 | S&P 500 |

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Nusair, S.A., Al-Khasawneh, J.A. Changes in oil price and economic policy uncertainty and the G7 stock returns: evidence from asymmetric quantile regression analysis. Econ Change Restruct 56, 1849–1893 (2023). https://doi.org/10.1007/s10644-023-09494-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10644-023-09494-9