Abstract

The generally held belief is that government spending on education and research and development is to bring about direct impacts on the advancement and sustainability of an economy. Nonetheless, this evidence is not prevalent within industrialized and third-world economies, particularly among the foremost ten carbon dioxide releasing economies. Therefore, the OLS and the DEA are used to estimate the relationship between government public spending on research and development plus green economic advancement, utilizing data from several countries between 2008 and 2018. The findings reveal a varying green economic expansion indicator, which is a result of inadequate government programs to deliver results. Subsequently, for types of expenditure where formal juxtaposition can be made, such as RE compared with conventional energy, the authors detect that multipliers on green cost are almost twofold their traditional sources. The point approximate of the multipliers is 1.1–1.7 for green energy financing and 0.4 and 0.7 for conventional energy financing, depending on time and modeling. These results passed all the required sensitivity analyses. They provided backing to the bottom-up analysis, which reveals that controlling global warming, including preventing biodiversity extinction, works hand in hand with creating economic development and advancement.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Among the global warming gases, carbon dioxide constitutes around seventy of the cumulative gases and hence is the greenhouse gas causing global socioeconomic concerns (Lin and Xu 2018; Tajudeen et al. 2018). However, the OECD (2013) study has it that the manufacturing value ratio to the generation of significant pollutants is utilized within this study to estimate the level of ecological safeguard (Tajudeen et al. 2018). The International Energy Agency (IEA) (International Energy Agency 2016) documented that EE is required, plus several advanced and emerging countries have placed ambitious goals to cut CO2 pollution and improve power for this. This has to be estimated, and it is necessary to ascertain the significant aspects of EE by undertaking vertical juxtaposition alongside energy use across different sectors and horizontally compare various factors alongside the EC domain as well as horizontally compare different types of energy consumption regarding pollution planning plus EE (Mohsin et al. 2019). EE is now more than ever the number one goal of the manufacturing sector due to bottlenecks within production processes (Kordej-De Villa and Slijepcevic 2019; Khosravi et al. 2019; Ozoike-Dennis et al. 2019; and Hilbers et al. 2019). For climate change triggered by the release of global warming gases, the way energy is being consumed and the accompanying carbon dioxide pollution are a concern to the world. This long-term and multifaceted concern is observed among the leading carbon dioxide polluting economies, comprising industrialized and emerging economies.

Financially, government financing in research and development is a basis not only to expand jobs and fight global warming but also to reduce total energy prices. Energy supply and demand are mainly from traditional sources that increase costs for individuals and society, leading to market distortion that warrants government financing. Thus, this viewpoint arises when specific aspects of public expenditure attain meaningful effects on sustainable economic system activity over others. So, the efficient performance of a country could be expanded by varying the size and structure of cumulative government research and development (Mohsin et al. 2021b, 2018). Emerging economies advocate for the advancement of broader markets via multilateral partnerships across the energy and infrastructure domain (Brahmasrene et al. 2014). The drive for industrial development is growing but is less tilted toward the Agric sector among emerging economies in Asia and Africa; these economies are instead dependent on the manufacturing industry to bring the socioeconomic advancement of their economies meaningfully (Mohsin et al. 2020, 2021a). Developing economies have increased their reliance on energy production to have sound economic growth and inclusive development, since no country can develop without energy. Given this reality, several academics have proposed considering ecological concerns within the leading ten carbon dioxide releasing domains; the analysis is within the developing levels.

Furthermore, due to industrialization and natural resource exploitation, sustainable development concerns have grown over the years. Nevertheless, unbridled ecological destruction brings externalities to these economies (Palm and Backman 2020; Mohsin et al. 2018). Regarding the current study, the leading carbon dioxide releasing economies will increasingly propel economic expansion among the Belt and Road economies. This is a result of the high energy consumption needed by the rising middle class. Factors, such as the reliance on natural resources, insufficient government funding in research and development areas, plus inadequate environmental regulation standards concerning sustainability (Sueyoshi et al. 2017; Aloui et al. 2016), are also significant. This analysis formulates a "sustainable or green economic index" applying the common path distance approach. The index considering the development approach causes variations within an economy's expansion, finance and ecological circumstance (Bhattacharyya 2019). The changes within the index are keenly observed throughout the analysis. The analysis leads to the formulation of the index, which is applied to approximate the impact of education and research and development expenditure on green economic advancement using a double structure known as the ordinary least square procedure. The technological advances and the formulation impact attain a direct statistical result, whereas the formulation impact was seen to obtain a more significant influence over technical implications within the analysis.

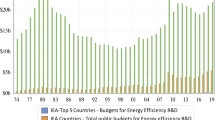

This study considers the impact of the assured probable types of government investment on green economic advancement. Regarding the research results, government spending on education will serve as an impetus for human resource capital development. In this vein, government funding for research and development will turbo-charge technical innovation (Sarangi et al. 2019). The relevance of this study lies within the following parameters: (i) The study assessed and made a comparison of the triple mandate of ten leading carbon dioxide releasing economies with the least square equation that maximizes green economic performance; (ii) the study constructed energy policies onto pollution cuts by estimating energy and ecological efficiency; and (iii) this study utilized the conventional out-oriented data envelope analysis equation to evaluate the CO2, EC and economic-ecological performance of the ten leading industrialized economies between 2008 and 2018. Additionally, the research estimated the manner in which the volume of carbon dioxide plus primary energy utilization could be reduced. This analysis contributes to knowledge by presenting significant granularity to the research area. Therefore, this analysis corroborates the relevance of government spending impacts on green economic advancement. Despite the robustness of the results in this respect, government expenditure attains a direct effect on the costing process. Around 2000, government spending on research and development grew by 20%; it increased in 2008 and was then slowly reduced to two hundred and fifty-three dollars in the USA in 2013.

Section two deliberates on the non-radial distance function approach. Section three discusses the delimitation of the observational results. Section four discusses the mechanism preview and the leading scientific observation. Then, unit five concentrates on the evaluation and policy recommendations.

2 The green economy for minimizing environmental pollution

Scientific evidence has proven that human activity is the primary cause of climate change due to the release of carbon dioxide. This is the critical cause of climate change due to the overconsumption of conventional fuels, cement and land utilization (Lin and Du 2015). Hence, scientists form a view of a low-carbon economy. The critical basis of cost inflexibility is not necessarily confronting; price intransigence may mirror the impact of economic activity within the market. The connection between an energy subsidy, energy taxes and EE depicts the market as oligopolistic, whereas the stage of regulatory performance is within the confines of the monopolistic market structure (Geng et al. 2017). These markets represent the restraints and quick responses concerning energy costs, demand and demand variations, which are supposedly in traditional markets (Yang et al. 2021b; He et al. 2020).

Furthermore, the economic and ecological scenario proposed that there is a need for energy reforms. If the world can save just about 20% from subsidy and reinvest it in EE programs and RE projects, it might assist in cutting about 1% of pollution levels globally. The responsibility of the Conference of Paris is to make sure that preindustrial levels of under 2 degrees Celsius are attained. In recent years, different Chinese cities have witnessed tenacious as well as heavy fog, haze and smog, especially in 2013, due to their EC and pollution emissions.

From this figure, China is the foremost polluter of CO2 by volume with 27%, next to the USA, India and Russia, contributing to global pollution by 15.2%, 7.3% and 4.6%, respectively (Sun et al. 2019b, 2019c). The least amount of global pollution is emitted in Canada at 1.6%. These nations alone make up 67.7% of cumulative global pollution, which is very problematic for the world (British Petroleum 2019).

Table 1 depicts the data on carbon dioxide post the Kyoto protocol. It portrays the lackadaisical policy responses of these top-emitting economies. The primary aim of the USA and Germany is the quick expansion in RES within their nations, which has cut demand for coal; nonetheless, within the USA, the development of shale gas is a more significant determiner of cutting coal utilization. This brings about a massive supply and cheap distribution of natural gas (Sun et al. 2019c; Tiep et al. 2021). From 2012 to 2013, the major ten polluting economies have increased pollution by 2.2%, whereas the past ten years have been 2.4%. The most significant annual percentage expansion in global warming gas pollution throughout similar years grew by 4.3% and 1%, respectively. Within the past decade, nations comprising Russia and Canada have equally controlled their pollution levels. Current data concentrating on energy-associated CO2 pollution show that at the world level (Baloch et al. 2020), (Sun et al. 2020b) and (Baloch et al. 2020). Methodological research also shows that Jebal et al. (2017) utilized the data envelope analysis approximator to carry out a reduced estimate, whereas Du et al. (2011) utilized the data envelope analysis to evaluate the carbon dioxide pollution efficiency. Wang et al. (2016) suggested the DAE approach to estimate EE, economics and ecology for the industrialized economies (excluding the USA, Japan and Singapore) to obtain the high economic efficiency that has reduced CO2 pollution and gross domestic product to be the principal productivity. Therefore, seven parameters were derived from the provincial level for this analysis.

3 Data and methodology

3.1 DEA approach and green economy as an indicator

Here, the slack-based system data-focused approach is utilized concerning weighting multidimensional metrics equally. For this reason, it is necessary to use a particular kind of productivity characteristic to evaluate efficiency. Mahmoudabadi and Emrouznejad (2019) explained the suitable approach for ascertaining slacks. They established it to be the leading cause of a lack of input utilization. Hence, they considered the case of a manufacturing approach that generates dual wanted and unwanted productivities simultaneously with \(X \in R_{ + }^{N}\), \(Y \in R_{ + }^{M}\) and \(U \in R_{ + }^{J}\) to be a vector of the key-ins, wanted productivity and undesirable productivity. The authors explain the production technology to be the model below:

CO2 grew as a result of advancement in the inefficient DMUs, plus carbon cuts progressed owing to improvements in the not so efficient DMUs (Alemzero et al. 2020a, 2020b; Sun et al. 2020a). Regarding other works, it is costly to cause decreases in unwanted productivity. Nonetheless, it is without cost to trigger an equal reduction in wanted and unwanted productivities if all wanted and unwanted productivity are approximated as disposable. (ii) It is noteworthy that producing unwanted productivity is required to generate unwanted productivity. This approach is equally explained within the productivity pattern.

P(x) denotes the likely productivity with x as the productivity parameter. As x is the primary variable, the transitional dealings z is formulated. The transitional goods formulate the ultimate output vector Y taking into account the necessary vector of the corresponding point. Also, a shortfall within the central trial (Agyekum et al. 2021; Zhang et al. 2021) might impact the general effect. The new data envelope analysis equation analyzes the energy performance of human decision-making units within the objective Eq. (2). Within the circumstance of the non-regular environment stated above, the constraints within equations one and two are almost similar but have nonidentical characteristics. However, P(x) might be an ecological productivity collection. With post-identifying energy conservation to be an often used as well as elaborate process, the slack-based equation is utilized to explain the main events for the decision-making units. Applying the best standards in a slack-based model, a reducing scenario is stated for the core processes. The correlation among Shephard distance function as well as T can be said to be a generalization of the conventional productivity equation—the directional equation.

It has become common to estimate the utilization of the distance equation when parametric circumstances are taken into account along with the following data on the vector of key-ins and wanted productivity: bearing in mind k = 1, 2, …, K decision-making units and DMUk. Here, the vector \(V_{k} = \left( {v_{ki} , \ldots ,v_{ in} } \right)\) is replaced to be the distinguishing factor among the key-ins and productivity where \(X_{k}\) and \(Y_{k}\) depict the key-ins and productivity vectors. \(X_{k} , \ldots ,Y_{k} = X_{k1} , \ldots ,X_{km} , Y_{k1} , \ldots ,Y_{ks}\) (xk1,…,xkm,yk1,…,yks). The inputs vector \(X_{k}\) = \((X_{k1} , \ldots ,X_{km} )\) is used to formulate the productivity vector \(Y_{k}\). = \(\left( {Y_{k1} , \ldots ,Y_{ks} } \right)\). The key-ins X ∈ \(R_{ + }^{p}\) and outputs X ∈ \(R_{ + }\) consequently mean the generation is the group of key-ins and productivity of probable integration.

With Eq. (4), the data envelope analysis range is the modified equation as the restraint can be instituted.

The key aim of the data envelope analysis is to estimate the inefficient consumption of energy via the SMB estimation of each entity. The restraints select the maximum reduction that probably constitutes the most significant expansion and reduction in productivity plus key-ins that can be forecasted. Thus, if one of the decision-making units attains robust inputs and desired outcomes over the other, the energy performance of the dual decision-making units will be similar due to this process. (Li et al. 2021), (Chien et al. 2021) and (Iqbal et al. 2021) formulated a system to solve the shortfall (Velasco-Fernández et al. 2020).

After reviewing many papers, several academics have considered applying the association approach to deliberate the competitive status of the decision-making units. This implies that it is different from the slack-based equation evaluation analysis regarding the capability function of the decision-making units. The poor disposability reference technology T was formulated mainly to obtain the wanted and unwanted findings in reference. The performance equation is stated below:

It is worth stating that, while being the normalized estimator, SBE11 falls within the range (0.1) and has the property "the greater the stronger," implying that it benefits from the forecaster.

3.2 OLS model specification

After utilizing the ordinary least square to the panel models, it is vital to check the equations for any random or default relationship impacts. The figures of the necessary probability derived from the Hausman analysis illustrate the random effect of doing better. As a result of its sameness to different approximation approaches and the likelihood within the preexisting analysis within econometrics, it is appropriate to apply the more appropriate approach to generate the “efficient” approximates. The ordinary least square analysis is one of the current most used different methods in research in econometrics; it is appropriate to apply the lagged endogenous parameter to be the independent parameter in the longitudinal dataset. This draws on (Zhang et al. 2021), (Hsu et al. 2021) and (Ehsanullah et al. 2021) because it gives more consistent and robust results within the presence of equal heteroskedasticity. The method does well for panel data dynamics over the cross-sectional changes plus steady-state approximators. In the words of Woldridge (2018), the ordinary least square is advanced to the channel for interpreting the longitudinal dataset plus the most suitable method for panels that have uncertain pathways. (Taghizadeh-Hesary and Yoshino 2019), (Taghizadeh-Hesary and Yoshino 2020), (Taghizadeh-Hesary and Taghizadeh-Hesary 2020) and (Taghizadeh-Hesary et al. 2021) illustrated how the ordinary least square estimations did well, although the presumptions were not positive. One of the gains is their ability to speculate the many measures where the equations overlooked the external parameters, such as when estimating the relationship between economic advancement and energy parameters. Thus, the ordinary least square equation is stated below:

where Y (i,t) depicts the parameters explained for a nation I at period t and Y (i,t−1) is the past values of i at period t. X (i,t) portrays the category of exploratory parameters, _(i,t) depicts the country-precise results and (i,t) portrays the stochastic name (i,t). The parameter explained within this analysis is (FS), with green finance (GF) and carbon dioxide pollution (CO2), the explained parameter X (i,t) (independent variables) and per head research and advancement (R&DPC) and green economic performance (GEP), Gross domestic product per capita (GDPPC) and foreign direct investment to be controlled. We apply the past values of explained variables to be the estimation instrument of the ordinary least square’s equation. The parameters applied within the analytical study are explained in Table 2.

While the variables are better expanded with the assistance of estimating units, the assessment procedure has a few setbacks, such as removing single findings due to the comparison approach. Second, the instrumental parameter will accentuate the imperfect instrument circumstance where the time variable "T" is a significant issue. The single-step method ordinary least square is said to attain a better interaction alongside the dual system ordinary least square post considering the initial differences. Different approaches are available with the ordinary least square approximator for performance advancement (Hainaut and Cochran 2018).

Thus, the meaningfulness of the deficits of this study is the exclusion of the granularity and its inadequate observation of emerging countries. Subsequently, many nations within the sample are characterized by substantial net energy imports, making up for changing percentages of cumulative energy use. Presuming that the selection of energy security metrics attains reduced impact on a nation’s net energy imports standing. The different means for widening this analysis are to assess the different energy security initiatives regarding a nation’s net energy imports circumstance. Ultimately, because the sample of countries is restrained within local records, energy costs are not accounted for within the analysis. The study comprises a well-researched approach to energy prices' impact on different countries. The focal points of this study are on the energy safeguard metrics instead of energy costs.

3.3 Data sources

The annual data for the leading ten carbon dioxide releasing nations between 2009 and 2018 were added for analysis for this article. Similarly, data concerning labor, money and the gross domestic product were derived from the widowers data on gross energy requirements and carbon dioxide was gathered by applying the IEA dataset. The key-in parameters were labor, money and energy application, gross domestic product is optimum, and carbon dioxide pollution is the undesirable parameter within this setting.

4 Results and discussion

4.1 Green economy performance analysis

R&D obtains the least budgetary allocation from emerging and advanced economies, around 10%. The energy sector is an essential part of the research and development market, especially with solar PV making up 65% of spending at the initial stages. In the past 50 years, the world’s economy has developed so quickly. EC expansion rate figures have changed from 1.40 to 5.30, whereas the carbon dioxide expansion figures have changed from negative 1.05 to 4.98. Using 2008 to 2018, we illustrated how public energy spending and sustainable economic recovery in the top ten highest emitting economies have grown, changed, and adapted thanks to green finance. We were able to do this because we used data from centralized municipalities.

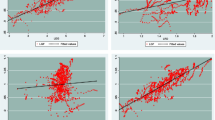

Table 3 depicts the evaluation of economics and EE plus its impacting variables that have been thoroughly analyzed within pre-existing academic works. Nonetheless, there are still aspects to explore further. Nevertheless, concentrating on the effect multiplier might be deceptive, since investments in energy can only be instituted over time and the economy might be reacting slowly. Likewise, the total multiplier for green RE expenditure declined only slightly and rebounded to a five-year figure of 1.21, very close to the initial year impact. This might reflect the reality that RE is developed in sequence and the perseverance of the multiplier and the fact that the composition of their financing vector ordinarily comprises different kinds of projects. Regarding eco-benign energy expenditure, the multiplier was reduced at 5 years to 52%. Put differently, this represents when the extra dollar of government or private money is spent on building more conventional energy infrastructure and power generation plants. This spending strengthens other parts of the gross domestic product—finance, spending or net export—by fifty-one cents within the short run. Moreover, when a similar dollar is invested in solar wind or geothermal energy, twelve cents are instead earned as returns. Additionally, whereas the green multiplier is mathematically meaningful up to four years after the headwinds, the non-eco-friendly multiplier loses its meaningfulness after three years (Fig. 1).

RES financing generates excess jobs at all stages—high-paying and average-paying jobs—across the conventional fuel sector (Abdurehman and Hacilar 2016). Concerning the USA, the analysis reveals that job seekers in RES get an average hourly salary of around 10–20% above the national mean. Their wages are also equal, with job seekers below the other part of the line up to 10 US dollars per hour for other jobs. RES financing also generates more jobs for a given dollar of spending within the same time scale due to greater amounts of entry-level jobs in the conventional energy sector. Consequently, RES means an improved domestic development over traditional energy, which illustrates the crowding out of demand from spending on the latter, as money expended on fossil energy plants or generation leads to spillover effects across the borders. According to Iran, Canada, China, Germany; India; Saudi Arabia; South Korea; United States; Japan; and Russia's five-year energy plan, we found that top high-emitting nations had set an objective of reducing their overall energy concentration (from 18 percent to 5 percent) and substantial contaminants (e.g., carbon dioxide, methane) (from 24 percent to 11 percent). Industrial growth and renewable energy consumption have benefited greatly from this rigorous and crucial energy efficiency and emission reduction recommendations, which may assist ease the energy sector. In other words, green financing has a significant impact on the expansion of business and the maintenance of sector stability. Considering the explicit and implicit expenditure, RES expenditure depends on the economic activities within the domestic economy in the form of retrofitting homes or modernizing the electricity grid system locally rather than expenditure within the traditional energy sector (Dritsakis and Klazoglou 2018). Hence, this analysis confirms the more significant multiplier impact of RES expenditure than that of the non-eco-friendly spending on the whole economy (Table 4).

Table 5 shows the ranking of the top 10 CO2 emitting economies. Low-carbon energy growth coefficients are ignored in all implied estimates. Quantitative methods are thus applied here to find quantitative links across the previous context of environmental degradation. There was no correlation between renewable energy production and air pollution, which is in line with this study's conclusions. The results might have something to do with optimum working simulations and the exclusion of the predictor variables for pollutant emissions. The effect of renewable energy development may be diminished if the air a country breathes is polluted. Position techniques may not reflect growth in the marketplace after the benefits of growth stocks have been acknowledged. When it comes to climate change, South Asian nations gain more renewable energy consumption than other Iran, Canada, China, Germany; India; Saudi Arabia; South Korea; the United States, Japan, and Russia. The first explanation why a plethora of resources impedes the creation of a long-term economic model is that they fight with one another. Most of the countries in our study rely heavily on exporting resources to generate more than half of their GDP.

Table 5 depicts the placing of the leading ten carbon dioxide releasing countries. Likewise, the prediction of the expansion effect of the USA Clean Energy and Security has been undertaken using varied macroeconometric equations that corroborated the findings from differential equations. The transition into a low-carbon future would have no meaningful impact on the US economy's long-term pathway (Lien et al. 2018). These results are still being watched very carefully. All these equations included the direct impacts of more significant jobs, the economic gains of greater levels of domestic development, the potential for significant technological advancements and the financial progress of limiting global warming emissions. Around the world, a study by International Renewable Energy estimates that increasing the amount of RES within the world's energy mix a decade from now may grow the world's gross domestic product by up to 1.1% or nearly 1.3 trillion US dollars relative to BAU scenarios. A lot of these direct effects on the gross domestic product are occasioned by the expanded financing in RES deployment, which has a cascading impact on the entire economy.

Table 6 shows the descriptive statistics of the dataset. To begin with, compared to the number of observations available, the longitudinal estimation equation requires approximating a considerable number of variables; we generated the baseline findings with a similar lag composition of one year. We considered that utilizing an extended lag structure would not be plausible, as there is the likelihood of falling short of the degree of freedom—the study analyzed whether the results are sensitive to the use of a double-year lag structure. Then, to ease the estimation of the baseline multiplier, the study grouped the endogenous parameters by the actual gross domestic product of the corresponding nation. This eschewed the likely inconsistencies that arise from applying the same means of the rates of fiscal parameters to the gross domestic developments within the export conversion of the approximated elasticities to the dollar amount. Within the estimates category, we estimated actual gross domestic product applying the conventional HP filter. Nevertheless, given the uncertainty surrounding the approximates of the latent parameter in the form of the gross domestic product, the survey analyzed whether the findings were robust regarding the application of the filter (Lee 2020). It virtually eliminated the pro-cyclical inconsistencies at the end of sample trend approximates that might increase the application of the HP filter. Similarly, the entire findings were derived from the bassline approximates that withstood the modifications. Whereas green energy financing multipliers are slightly below other modeling, the non-eco benign energy finance multiplier is almost virtual and not affected. Compared to the baseline findings, nuclear energy financing multipliers are, to some extent, more than the lag structure of the dual years and slightly reduced to the different estimates of the possible gross domestic product. Nonetheless, the general dynamic and mathematical meaningfulness are almost the same.

4.2 Environmental efficiency

Globally, it is believed that climate change is primarily caused by human-caused emitting pollution. While climate change can generate adverse outcomes in increasing sea levels, extreme temperatures, ecological disasters and many natural calamities, there is no agreement on a panacea to fight climate change worldwide. Within the Chinese economy, the issue of pollution is assuming severe levels. In 2006, China overtook the USA to lead as the world's most significant global warming gases emitter. However, a study from the State Ecological Protection Administration of China (SEPA) declares that nearly 70% of over three hundred small- and medium-sized cities within China were unable to achieve the air quality standards established by the WHO, as well as seven out of the 10 severely polluted cities within the globe being in China.

While past analysis has proposed policies to ameliorate Chinese ecological deteriorating ecology on consumption, their actual execution might be challenging. Analyses revealed that the mean variations in lifestyles among the inner and periphery of towns in Sydney need varying amounts of natural resources as well as energy application and ecological burdens in the form of air and water pollution. Furthermore, intervention on the demand aspect is necessary and will be efficient in the long run. Green consumption consciousness is inadequate in China plus inhabitants have reduced levels of ecological consciousness relative to developed economies; formulating a means to ease the green consumption lifestyle is cumbersome and might not be efficient in the short term. As a result, even though the study finds that the increasing domestic final requirements are the most substantial contributor to Chinese expansions in materials spending, especially urban expenditure, it is implied that encouraging dematerialization via changing generation and production levels plus production correlated technology are necessary.

Table 7 depicts the efficiency of carbon dioxide for the leading ten emitting economies. Energy demand worldwide was 13,326 million metric tons (MT) in 2011, which increased by 1.82 and surpassed 13,569 million MT in 2011. The fall was very negligible − 0.41% of the energy requirements in the following year, 2013. Nonetheless, post the slight reduction in the dataset, there has been an expansion in energy demand alongside growing trajectories in subsequent years.

The findings explained within the carbon dioxide pollution intensity are between 0.637 and 0.0619. India attains the maximum carbon dioxide intensity score among the ten carbon dioxide emitting economies. Additionally, Saudi Arabia's efficiency score is the highest. Nonetheless, it attains the score of 0.462 in CO2 pollution intensity, placing it fourth.

4.3 Full sample analysis of econometric estimation

The figures estimated utilizing the econometric approximation instruments show that the ordinary least square coefficient for research and development fiscal expenditure is 0.44, meaning a mathematically meaningful and hopeful assessment with meaningfulness of above 5%. The ordinary least square coefficient for fiscal spending for years of schooling is 0.084, alongside a 1% significance level.

Table 8 shows the ordinary least square approximation. Hence, the results of the control variable meet the criteria of this analysis. Ultimately, the baseline modeling does not feature parameters explicitly encapsulating investment circumstances within an economy, which might impact the size of negative emission technologies deployment and a conventional financing multiplier. With this, we considered it fitting to analyze whether the findings are robust for the inclusion of the International Monetary Fund Index in the modeling. Given that the FCL is accessible for a relatively recent sample and a reduced number of economies, the study analyzed this robustness solely on green and conventional energy financing expenditure. These are spending types on the multiplier, of which the authors equally estimate the probability that their variations are more than zero. The findings show that the scale of multipliers is identical to that derived from the baseline modeling. The likelihood of the green energy financing multiplier being more significant than the conventional financing is somehow reduced. In the short, medium, and long term, resolving environmental, public spending, and green finance index is shown to Granger cause energy efficiency index. According to the research, the materials, brick, and incinerator industries all see considerable reductions in pollution as a result of increased energy efficiency. Only in the near term can the pollution reduction index affect the energy efficiency index through transient causation. Also, demonstrate the existence of a positive feedback link between energy efficiency and reduction of environmental. Using energy more effectively leads to decreased energy utilization, replacing fossil fuel sources for renewable ones, and environmental reduction. According to our results, energy efficiency and Greenhouse gases are linked in a long-term causal connection in 30 European nations. The energy efficiency index may forecast the public spending index and green economy in the short, medium, and long term. However, the long-term correlation between Granger's public spending, green finance, and energy efficiency indices suggests a long-term causation link. As a result of public spending and green finance involvement in assigning funds to green finance, the digitization of financial products tends to enhance the use of energy-efficient technology. Nonetheless, it is still high, around 85 and 92%, and leaves the bottom line of the analysis unchanged (Tables 9 and 10).

4.3.1 Green economy performance

Similarly, an expansion in public spending on green findings leads to a 7% expansion within the green economy and an approximately 4% decrease in carbon emissions, presuming that the general public expenditure stays the same. Autoregression values bound to Arellano are between − 6.84 and − 7.8, whereas the autoregression bound to Arrelano ranges from − 0.567 to − 583.

The green economic efficiency indicator is shown in Table 11. Subsequently, for groups of expenditure where a formal comparison can be made, such as the RES against non-RES, the study detected that the multiplier on green spending is about twice as big as its non-green counterparts. Accordingly, the point estimates of the multipliers are 1.2–1.8 for renewable energy financing and 0.4–0.7 for conventional energy financing, based on the time horizon and modeling. The results withstand the many robustness analyses and back the bottom-up analysis, which reveals that stabilizing climate change and controlling biodiversity loss go hand in hand with economic development and inclusiveness.

Concerning the different parameters, in equation one, the initial and second lag periods of Green finance are meaningful and direct at the 10% and 5% levels, respectively. The subsequent lag of EG is adversely associated with the variable explained at a 1% significance level and the absolute value of this coefficient, which is much bigger than that of different parameters in equation one. Reflecting the steep short-run variations in CO2 concentration leads to a meaningful fall in the green finance advancement index. These results are derived from a massive expansion in CO2 engagement. The quick advancement of EI sectors, which are typically asset-intensive, needs more significant amounts of capital financing for rapid deployment. The growth in investment in these sectors will unavoidably cut the acquisition of green projects and result in a fall in the green finance advancement index. Additionally, the first coefficient of GEP is direct and meaningfully associated with foreign direct investment. The coefficient of GB is smaller than that of renewable energy, reflecting that RETs principally cause the modification of short-term green investment.

Within equation two, green finance is negatively meaningfully linked to the second lag of DF at the significance level of 1%. This correlation shows that when the CO2 intensity changes from the long-run steadiness point to the short run, the advancement of green finance can be meaningful and encourages a fall in CI per unit of gross domestic product. This correlation indicates that when the CI changes in front of its long-term steadiness level in the short run, the advancement of green finance can be meaningful and encourages a fall in carbon emission per head of gross domestic product. The coefficient of the second lag year is more significant than the initial lag period, which shows that the prohibiting impact of green finance attains strong inertia. The initial and second variation lag coefficients of foreign direct investment are entirely direct and meaningful at 5%, which shows that RES spending achieves a consistent inertia impact, reflecting that it is better to grow in the short term and complex to modify. Concerning equation three, the first and second lags of green finance are adversely significant at the 1% level, reflecting the advancement of RES’s self-prohibiting impact. Within a comparison of the three equations, the absolute value of the coefficient of each parameter in model two is generally reduced to that of the different equations, indicating that other parameters do not modestly impact CI. Hence, encouraging cuts in CI within a short time is hard work.

4.3.2 Robustness analysis

The sector attains a relatively more significant compositional effect as against the national mean. The research and development financing illustrates a minute advancement within the RETs deployment, which has been further reduced by the present economic system and non-robust ecological legislation. Thus, emerging economies have reduced their capacity to provide further education within this dynamic sector. It is the most suitable area for emerging technologies financing.

The likelihood of understanding the energy mix is plain due to the costly nature of coal use, decreased consumption of RES and findings within lower green financing. Similarly, the likely explanation for CO2 markets is evident because the magnitude of these markets is negligible, plus investment banks relocate from the markets, decreasing green funding. Also, the potential for elucidating the industry structure is plain because the additional service sectors lower the blue sectors and are growing requirements for additional green financing. Further, another plausible understanding of the impact of openness is that its controlling impact is produced via many export manufacturing products that have reduced the technological impact from China. This destabilizes the global trade balance, squeezing green financing in generating benign ecological effects with improved technology. Similarly to openness, the probable reason for foreign direct investment is that its suppressing impact is generated in the heavy industrial sector, which is capital intensive, decreasing financing in green sectors. This conforms with the literature that reveals foreign direct investment directly affects clean energy utilization.

The Granger causality analysis is applied to analyze the Granger causality between the economic parameters, which is the causal correlation according to the '' prediction'' and foreign direct investment was not entirely autocorrelated. Afterward, the initial order difference between the three parameters was meaningfully steady at a 10% significance level. The Granger casualty analysis was performed post the initial difference of each variable, plus the results are shown in Table 12. A dual-direction causality is found among renewable energy and green finance; a similar correlation is found among gross domestic product and foreign direct investment. Even though there is a dual causality between renewable energy and GB at the meaningfulness level of 10%, the p-value of the Granger casualty analysis for the gross domestic product is 0.009. Thus, green finance is said not to play a role in encouraging the advancement of emerging energy sources.

4.4 Discussion

Inferring from the analysis, it is noted that the advancements in technology and human resource development could achieve green economic advancement, maintain progress and simultaneously grow government investment in research and development. However, the impacts of government investment on these twofold aspects are not the same for the study nations. It is evident from the analysis that public expenditure on research and development and education impacts the industrialized economies more significantly than modernizing their industrial setup. Nevertheless, given the phenomenon of technology innovation, such impacts are somewhat reduced. However, regarding harnessing human resources, the effect of spending on education is also backed in the industrialized economies (Muganyi et al. 2021).

Considering the findings in Table 3 for the ecological pollution model, it is clear that the earnings, energy use, natural resource and gross fixed capital formation are active variables to CO2 emissions with expected increasing effects. Hence, the first-order coefficient of earnings is positive and negative, meaning earnings at the initial points meaningfully increase CO2 emissions (Gilchrist et al. 2021), (Zhang et al. 2019). Earnings stop CO2 post achieving an exceptional level of income. This relationship indirectly correlates to an opposite U-shaped of ecological Kuznets curve regarding the BRI economies (Taghizadeh-Hesary and Yoshino 2019). Thus, the connection between energy application and CO2 emissions supports the hypothesis of energy-correlated emission. This happens with the results of Khan et al. (2021) concerning the economies with different incomes, which reveal an expansion in EC makes CO2 emission grow. Consequently, concerning economies that have different incomes, it is found that an expansion in EC increases CO2 emission. Likewise, the relationship between the investment index and CO2 emission is positive, implying that the investment improvement meaningfully affected the quality of the ecology in the selected BRI economies (Wang et al. 2021).

According to the research of Guild (2020), which stressed the meaningfulness of sustainable fiscal policies, combatting tourism causes CO2 pollution to achieve shared prosperity. Zheng et al. (2021) suggested that they should initially institute ecotourism programs to stop emissions (Yu et al. 2021), underlined by the relevance of tourism standards and sanitation that assist in improving a country's ecological stock, thus combatting tourism-focused emissions. Unfortunately, the coefficient of natural resource within the CO2 emission model is not yet significant for the different generalized method of moments; conversely, it becomes partly backed at 10% in D-SGMM. Generally, these results support the incidence of natural resources caused by the emission hypothesis for BRI economies. Also, the analysis means that an extra burden on natural resources to attain high economic advancement might destroy the performance of the ecology in the long run. The results illustrate that personal investment results in increases in pollution because CF directly relates to CO2 emissions.

Furthermore, RES is stopping CO2 emissions in BRI economies. The results conform to the studies by Hafner et al. (2020) and Zhang and Wang (2021), who obtained the results that renewable energy cuts CO2 emissions. They reemphasized the need for economies to accept the deployment of renewable energy that can reduce emissions plus achieve explicit meaningful benefits on climate change. The findings confirm the exclusion of autocorrelation presumptions. The number of cross sections in the equation is more than the tools, as the analytics results below the bottom of the table explain the instrumental parameters (Yang et al. 2021a, b; Li and Gan 2021; Che et al. 2021).

Srivastava and Kathuria (2020), Pan et al. (2020), and Timilsina and Toman (2018) explained the results are in line with research done by Timilsina and Pargal (2020) and Khalid and Salman (2020), although preexisting research on tax schemes for CO2 emission has significant importance. Fawcett et al. (2019) and Koronen et al. (2020) reveal the strong dependence on economic survival sustain a global antagonism, for example Saudi Arabia's crude oil generation. Jordan, for instance, reforms energy subsidies for liquefied petroleum gas to ensure there is low carbon pollution (Sarrakh et al. 2020; Sun et al. 2019a).

5 Conclusion and policy recommendations

This research utilized data envelope analysis and ordinary least squares to formulate the triplet mandate method between government expenditure, green finance and zero-carbon sources via energy, economic and ecological efficiency by considering the world's leading ten carbon dioxide emitters. The main results show that China, Japan and Saudi Arabia are EE, whereas Russia was revealed as the least efficient of all the top 10 emitting economies between 2008 and 2018. Regarding the EI, Russia demonstrates the top market of 0.409. The findings showed that carbon dioxide pollution intensity is between 0.637 and 0.0619. Also, India attains the maximum carbon dioxide pollution intensity scores, whereas Saudi Arabia has the effects of 0.462 pollution concentration.

Furthermore, the analysis reveals that expenditure on the green economy is both efficient—reaping more gains than the first financing in all instances—and far above the cost of conventional energy projects. Even more, when RE is compared to traditional financing, while the country as well as time samples are the same and, with a formal mathematical contrast, the multiplier on green sustainable funding, at 1.1–1.7, is almost twice as large as conventional sources, at 0 issue to 0.7, based on the calculation timeframe and modeling utilized. These results could be reasoned out by observing that, relative to conventional energy, which is ordinarily mechanized and finance intensive, as well as being finance intensive, the RE industry is more labor driven and investments have more significant benefits to the economy. This characteristic is illustrated within the sector analysis documented within this paper, showing that, on average, more jobs are being created for a unit of electricity produced from RES over conventional energy sources. Similarly, the findings derived for expenditure on nuclear energy, for which the study reveals a bigger multiplier than RE, nonetheless derived a varied dataset, which is not formally comparable.

Firstly, a meaningful long-run symmetry correlation was discovered between CI, green investment and RES. Here, an expansion in the green finance development index and the amount of renewable energy use added to the cut carbon concentration (CI). Secondly, in the short run, the expansion in CI prohibited the advancement of renewable energy and cut green financing, resulting in a fall in the green finance advancement index. Thirdly, RE consumption was principally influenced by green investment plus CI within the short run and long term. Its advancement lacked self-causing capability and mainly depended on policy backing. Fourthly, the Chinese green finance policy robustly influenced carbon reduction; nonetheless, its impacts usually create deficits and do not have consistency. Fifthly, CI changed a little bit over time within China. As a result, cutting CI within a short time is not easy.

Consequently, emerging economies can implement energy-saving business facilities in EE, energy preservation, energy distribution externalization, risk management, energy advancement, power storage and energy conservation projects. Additionally, policy formulators can maximize the capability to react to crude adequacy, ecological circumstances and natural hazards to improve carbon production. Thus, advancing energy equality, stable energy markets, non-energy and distribution of replacement-correlated green energy sources would cut the likelihood of crude imports. The integration of renewable energy sources to improve the impact of RES will create jobs. There is the need to advance the variables allocation capability of farmers and encourage the reforms of conventional agricultural production modes with petrochemical Agric to be the central aspect. Also, developing countries must try to create a way of generating clean energy sources. In addition, they are reducing the extension of conventional energy to make room for energy hostile emission deployment. As a result, the expansion of fossil energy is limited and there will be more latitude for carbon sources deployment. Similarly, at the same time, growing energy generation is the most efficient way to cut the energy supply's ecological footprint.

References

Abdurehman AA, Hacilar S (2016) The relationship between exchange rate and inflation: an empirical study of Turkey. Int J Econ Financ Issues 6:1454–1459

Agyekum EB, Amjad F, Mohsin M, Ansah MNS (2021) A bird’s eye view of Ghana’s renewable energy sector environment: a multi-criteria decision-making approach. Util Policy. https://doi.org/10.1016/j.jup.2021.101219

Alemzero DA, Iqbal N, Iqbal S et al (2020a) Assessing the perceived impact of exploration and production of hydrocarbons on households perspective of environmental regulation in Ghana. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-020-10880-3

Alemzero DA, Sun H, Mohsin M et al (2020b) Assessing energy security in Africa based on multi-dimensional approach of principal composite analysis. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-020-10554-0

Aloui R, Gupta R, Miller SM (2016) Uncertainty and crude oil returns. Energy Econ. https://doi.org/10.1016/j.eneco.2016.01.012

Baloch ZA, Tan Q, Iqbal N et al (2020) Trilemma assessment of energy intensity, efficiency, and environmental index: evidence from BRICS countries. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-020-09578-3

Bhattacharyya SC (2019) Energy data and energy balance. In: Energy economics. pp 7–40

Brahmasrene T, Huang JC, Sissoko Y (2014) Crude oil prices and exchange rates: causality, variance decomposition and impulse response. Energy Econ 44:407–412. https://doi.org/10.1016/j.eneco.2014.05.011

Che C, Chen Y, Zhang X et al (2021) Study on emission reduction strategies of dual-channel supply chain considering green finance. Front Environ Sci. https://doi.org/10.3389/fenvs.2021.687468

Chien F, Pantamee AA, Hussain MS et al (2021) Nexus between financial innovation and bankruptcy: evidence from information, communication and technology (ict) sector. Singapore Econ Rev. https://doi.org/10.1142/S0217590821500181

Dritsakis N, Klazoglou P (2018) Forecasting unemployment rates in USA using Box-jenkins methodology. Int J Econ Financ Issues 8:9–20

Du H, Guo J, Mao G et al (2011) CO2 emissions embodied in China-US trade: input-output analysis based on the emergy/dollar ratio. Energy Policy. https://doi.org/10.1016/j.enpol.2011.06.060

Ehsanullah S, Tran QH, Sadiq M et al (2021) How energy insecurity leads to energy poverty? Do environmental consideration and climate change concerns matters. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-021-14415-2

Fawcett T, Rosenow J, Bertoldi P (2019) Energy efficiency obligation schemes: their future in the EU. Energy Effic. https://doi.org/10.1007/s12053-018-9657-1

Geng ZQ, Dong JG, Han YM, Zhu QX (2017) Energy and environment efficiency analysis based on an improved environment DEA cross-model: case study of complex chemical processes. Appl Energy 205:465–476. https://doi.org/10.1016/j.apenergy.2017.07.132

Gilchrist D, Yu J, Zhong R (2021) The limits of green finance: a survey of literature in the context of green bonds and green loans. Sustain 13:1–12. https://doi.org/10.3390/su13020478

Guild J (2020) The political and institutional constraints on green finance in Indonesia. J Sustain Financ Invest. https://doi.org/10.1080/20430795.2019.1706312

Hafner S, Jones A, Anger-Kraavi A, Pohl J (2020) Closing the green finance gap – a systems perspective. Environ Innov Soc Transit. https://doi.org/10.1016/j.eist.2019.11.007

Hainaut H, Cochran I (2018) The landscape of domestic climate investment and finance flows: methodological lessons from five years of application in France. Int Econ 155:69–83

He W, Abbas Q, Alharthi M et al (2020) Integration of renewable hydrogen in light-duty vehicle: nexus between energy security and low carbon emission resources. Int J Hydrogen Energy. https://doi.org/10.1016/j.ijhydene.2020.06.177

Hilbers AM, Sijtsma F, Busscher T, Arts J (2019) Understanding added value in integrated transport planning: exploring the framework of intelligence, design and choice. J Environ Assess Policy Manag. https://doi.org/10.1142/S146433321950011X

Hsu CC, Quang-Thanh N, Chien FS et al (2021) Evaluating green innovation and performance of financial development: mediating concerns of environmental regulation. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-021-14499-w

International Energy Agency (2016) Decoupling of global emissions and economic growth confirmed. IEA Press release

Iqbal W, Tang YM, Chau KY et al (2021) Nexus between air pollution and NCOV-2019 in China: application of negative binomial regression analysis. Process Saf Environ Prot. https://doi.org/10.1016/j.psep.2021.04.039

Jebali E, Essid H, Khraief N (2017) The analysis of energy efficiency of the Mediterranean countries: a two-stage double bootstrap DEA approach. Energy. https://doi.org/10.1016/j.energy.2017.06.063

Khalid SA, Salman V (2020) Welfare impact of electricity subsidy reforms in Pakistan: a micro model study. Energy Policy. https://doi.org/10.1016/j.enpol.2019.111097

Khan MA, Riaz H, Ahmed M, Saeed A (2021) Does green finance really deliver what is expected? An empirical perspective. Borsa Istanbul Rev. https://doi.org/10.1016/j.bir.2021.07.006

Khosravi F, Fischer TB, Jha-Thakur U (2019) Multi-criteria analysis for rapid strategic environmental assessment in tourism planning. J Environ Assess Policy Manag. https://doi.org/10.1142/S1464333219500133

Kordej-De Villa Z, Slijepcevic S (2019) Assessment of local councillors’ attitudes towards energy efficiency projects in Croatia. J Environ Assess Policy Manag. https://doi.org/10.1142/S1464333219500121

Koronen C, Åhman M, Nilsson LJ (2020) Data centres in future European energy systems—energy efficiency, integration and policy. Energy Effic. https://doi.org/10.1007/s12053-019-09833-8

Lee JW (2020) Green finance and sustainable development goals: the case of China. J Asian Financ Econ Bus 7(7):577–586. https://doi.org/10.13106/jafeb.2020.vol7.no7.577

Li C, Gan Y (2021) The spatial spillover effects of green finance on ecological environment—empirical research based on spatial econometric model. Environ Sci Pollut Res 28:5651–5665. https://doi.org/10.1007/s11356-020-10961-3

Li W, Chien F, Hsu CC et al (2021) Nexus between energy poverty and energy efficiency: estimating the long-run dynamics. Resour Policy. https://doi.org/10.1016/j.resourpol.2021.102063

Lien D, Lee HT, Sheu HJ (2018) Hedging systematic risk in the commodity market with a regime-switching multivariate rotated generalized autoregressive conditional heteroskedasticity model. J Futur Mark 38:1514–1532. https://doi.org/10.1002/fut.21959

Lin B, Du K (2015) Energy and CO2 emissions performance in China’s regional economies: Do market-oriented reforms matter? Energy Policy 78:113–124. https://doi.org/10.1016/J.ENPOL.2014.12.025

Lin B, Xu M (2018) Regional differences on CO2 emission efficiency in metallurgical industry of China. Energy Policy. https://doi.org/10.1016/j.enpol.2018.05.050

Mahmoudabadi MZ, Emrouznejad A (2019) Comprehensive performance evaluation of banking branches: a three-stage slacks-based measure (SBM) data envelopment analysis. Int Rev Econ Finance 64:359–376

Mohsin M, Zhou P, Iqbal N, Shah SAA (2018) Assessing oil supply security of South Asia. Energy 155:438–447. https://doi.org/10.1016/j.energy.2018.04.116

Mohsin M, Zhang J, Saidur R et al (2019) Economic assessment and ranking of wind power potential using fuzzy-TOPSIS approach. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-019-05564-6

Mohsin M, Taghizadeh-Hesary F, Panthamit N et al (2020) Developing low carbon finance index: evidence from developed and developing economies. Financ Res Lett. https://doi.org/10.1016/j.frl.2020.101520

Mohsin M, Hanif I, Taghizadeh-Hesary F et al (2021a) Nexus between energy efficiency and electricity reforms: a DEA-based way forward for clean power development. Energy Policy. https://doi.org/10.1016/j.enpol.2020.112052

Mohsin M, Ullah H, Iqbal N et al (2021b) How external debt led to economic growth in South Asia: a policy perspective analysis from quantile regression. Econ Anal Policy 72:423–437. https://doi.org/10.1016/J.EAP.2021.09.012

Muganyi T, Yan L, Sun HP (2021) Green finance, fintech and environmental protection: evidence from China. Environ Sci Ecotechnol. https://doi.org/10.1016/j.ese.2021.100107

OECD (2013) Education at a Glance 2013: OECD Indicators. OECD Publishing. https://doi.org/10.1787/eag-2013-en

Ozoike-Dennis P, Spaling H, Sinclair AJ, Walker HM (2019) SEA, urban plans and solid waste management in Kenya: participation and learning for sustainable cities. J Environ Assess Policy Manag. https://doi.org/10.1142/S1464333219500182

Palm J, Backman F (2020) Energy efficiency in SMEs: overcoming the communication barrier. Energy Effic. https://doi.org/10.1007/s12053-020-09839-7

Pan X, Guo S, Han C et al (2020) Influence of FDI quality on energy efficiency in China based on seemingly unrelated regression method. Energy. https://doi.org/10.1016/j.energy.2019.116463

Petroleum B (2019) BP statistical review of world energy 2019|68th edition. BP World Energy 4:64. https://doi.org/10.2307/3324639

Sarangi GK, Mishra A, Chang Y, Taghizadeh-Hesary F (2019) Indian electricity sector, energy security and sustainability: an empirical assessment. Energy Policy 135:110964. https://doi.org/10.1016/j.enpol.2019.110964

Sarrakh R, Renukappa S, Suresh S, Mushatat S (2020) Impact of subsidy reform on the kingdom of Saudi Arabia’s economy and carbon emissions. Energy Strateg Rev. https://doi.org/10.1016/j.esr.2020.100465

Srivastava G, Kathuria V (2020) Impact of corporate governance norms on the performance of Indian utilities. Energy Policy. https://doi.org/10.1016/j.enpol.2020.111414

Sueyoshi T, Yuan Y, Goto M (2017) A literature study for DEA applied to energy and environment. Energy Econ 62:104–124. https://doi.org/10.1016/j.eneco.2016.11.006

Sun HP, Tariq G, Haris M, Mohsin M (2019) Evaluating the environmental effects of economic openness: evidence from SAARC countries. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-019-05750-6

Sun H, Edziah BK, Sun C, Kporsu AK (2019a) Institutional quality, green innovation and energy efficiency. Energy Policy. https://doi.org/10.1016/j.enpol.2019.111002

Sun H, Ikram M, Mohsin M, Abbas Q (2019b) Energy security and environmental efficiency: evidence from OECD countries. Singap Econ Rev. https://doi.org/10.1142/S0217590819430033

Sun H, Pofoura AK, Adjei Mensah I et al (2020a) The role of environmental entrepreneurship for sustainable development: evidence from 35 countries in Sub-Saharan Africa. Sci Total Environ. https://doi.org/10.1016/j.scitotenv.2020.140132

Sun L, Cao X, Alharthi M et al (2020b) Carbon emission transfer strategies in supply chain with lag time of emission reduction technologies and low-carbon preference of consumers. J Clean Prod. https://doi.org/10.1016/j.jclepro.2020.121664

Taghizadeh-Hesary F, Taghizadeh-Hesary F (2020) The impacts of air pollution on health and economy in Southeast Asia. Energies. https://doi.org/10.3390/en13071812

Taghizadeh-Hesary F, Yoshino N (2019) The way to induce private participation in green finance and investment. Financ Res Lett. https://doi.org/10.1016/j.frl.2019.04.016

Taghizadeh-Hesary F, Yoshino N (2020) Sustainable solutions for green financing and investment in renewable energy projects. Energies. https://doi.org/10.3390/en13040788

Taghizadeh-Hesary F, Rasoulinezhad E, Yoshino N et al (2021) The energy-pollution-health nexus: a panel data analysis of low-and middle-income asian countries. Singap Econ Rev. https://doi.org/10.1142/S0217590820430043

Tajudeen IA, Wossink A, Banerjee P (2018) How significant is energy efficiency to mitigate CO2 emissions? Evidence from OECD countries. Energy Econ. https://doi.org/10.1016/j.eneco.2018.04.010

Tiep NC, Wang M, Mohsin M et al (2021) An assessment of power sector reforms and utility performance to strengthen consumer self-confidence towards private investment. Econ Anal Policy. https://doi.org/10.1016/j.eap.2021.01.005

Timilsina GR, Pargal S (2020) Economics of energy subsidy reforms in Bangladesh. Energy Policy. https://doi.org/10.1016/j.enpol.2020.111539

Timilsina GR, Toman MA (2018) Carbon pricing and cross-border electricity trading for climate change mitigation in South Asia. Econ Energy Environ Policy 7:111–124. https://doi.org/10.5547/2160-5890.7.2.gtim

Velasco-Fernández R, Dunlop T, Giampietro M (2020) Fallacies of energy efficiency indicators: recognizing the complexity of the metabolic pattern of the economy. Energy Policy. https://doi.org/10.1016/j.enpol.2019.111089

Wang Z, He W, Chen K (2016) The integrated efficiency of economic development and CO2 emissions among Asia Pacific economic cooperation members. J Clean Prod. https://doi.org/10.1016/j.jclepro.2016.04.097

Wang X, Zhao H, Bi K (2021) The measurement of green finance index and the development forecast of green finance in China. Environ Ecol Stat 28:263–285. https://doi.org/10.1007/s10651-021-00483-7

Woldridge E (2018) Promoting probabilistic programming system (PPS) development in probabilistic programming for advancing machine learning (PPAML). Galois, Inc.

Yang Y, Su X, Yao S (2021a) Nexus between green finance, fintech, and high-quality economic development: empirical evidence from China. Resour Policy. https://doi.org/10.1016/j.resourpol.2021.102445

Yang Z, Abbas Q, Hanif I et al (2021b) Short- and long-run influence of energy utilization and economic growth on carbon discharge in emerging SREB economies. Renew Energy. https://doi.org/10.1016/j.renene.2020.10.141

Yu CH, Wu X, Zhang D et al (2021) Demand for green finance: resolving financing constraints on green innovation in China. Energy Policy. https://doi.org/10.1016/j.enpol.2021.112255

Zhang B, Wang Y (2021) The effect of green finance on energy sustainable development: a case study in China. Emerg Mark Financ Trade 57:3435–3454. https://doi.org/10.1080/1540496X.2019.1695595

Zhang D, Zhang Z, Managi S (2019) A bibliometric analysis on green finance: current status, development, and future directions. Financ Res Lett. https://doi.org/10.1016/j.frl.2019.02.003

Zhang D, Mohsin M, Rasheed AK et al (2021) Public spending and green economic growth in BRI region: mediating role of green finance. Energy Policy. https://doi.org/10.1016/j.enpol.2021.112256

Zheng GW, Siddik AB, Masukujjaman M, Fatema N (2021) Factors affecting the sustainability performance of financial institutions in Bangladesh: the role of green finance. Sustain. https://doi.org/10.3390/su131810165

Funding

Funding was provided by National Natural Science Foundation of China, 719115130164, Zhen Liu, the Swedish Foundation for International Cooperation in Research and Higher Education (STINT), CH2018-7762, Assem ABU HATAB.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Liu, Z., Abu Hatab, A. Assessing stakeholder engagement in public spending, green finance and sustainable economic recovery in the highest emitting economies. Econ Change Restruct 56, 3015–3040 (2023). https://doi.org/10.1007/s10644-022-09414-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10644-022-09414-3