Abstract

As one of the strategies local governments adopt in response to fiscal stress, tax competition influences the social optimum level of public goods such as environment. This paper aims to investigate the mechanism of regional tax competitions from the perspective of financial stress. Recently, the effect of tax competition on environmental pollution rises gradually. Existing empirical researches mostly apply a fiscal decentralization-based perspective and ignore the spatial correlation between pollution and tax competition. Under the perspective of financial stress, this paper measures the impact of inter-regional enterprise income tax competition and value-added tax competition on environmental pollution of 30 provinces, using empirical analysis, and then estimates the direct effect, indirect effect and total effect based on it from year 2004–2014. It’s been found that inter-regional tax competition not only brings negative influence to local environment, but also makes the environmental quality become worse in spatial correlation regions. These findings are of enlightening politic revelations to further standardize enterprise tax competition among local governments, and to promote the sustainable development both in economy and environment.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Due to the enterprise income tax revenue sharing reform in 2002, China changed businesses and income tax levying principle of territory and income attribution to the form of revenue sharing between the central and local governments in equal proportions. In 2003, the central authorities adjusted the proportion of corporate income tax between central and local governments into 60–40%. The decreasing ratio directly leads to the decreasing on-budget fiscal revenue of local government. In May 1, 2016, China began to fully implement Camp Changed to Increase which classified business tax to value-added tax, since then business tax withdraw from the stage of Chinese history. The proportion of value-added tax between central and local government is now fifty-fifty instead of 75–25%. As for the local government, although the share of VAT increased, it virtually comes at a price of huge declines in sales tax that had belonged to it. Therefore, the promotion of Camp Changed to Increase actually reduces local tax revenue even more.

Both the enterprise income tax revenue sharing reform and Camp Changed to Increase significantly reduce local governments’ tax revenue, with the steady fiscal expenditure authority however, it makes their financial pressure become increasingly obvious. The mismatch responsibility of fiscal revenue and expenditure induces tax competition among local governments, they intend to enhance regional competitiveness or to fill the fiscal gap by attracting external production factors. However, the supply level of public goods such as environment is considered to deviate from the social optimal because of the non-cooperation among local governments (Cremer et al. 1997). Since it’s unnecessary for them to optimize social public service supply in their jurisdictions in order to achieve the advantages of tax competition and economic interest, on the contrary, they may even deregulate their environmental supervision and governance (Rauscher 2005).

At present, the theoretic researches of tax competition and environmental pollution among overseas and domestic scholars have gradually developed. Oates (1972) previously studies the relationship between regional tax competition and public goods and services. He argues that local governments attract external investment by reducing local taxes, which incurs the decrease of regional fiscal revenue, resulting in the shortage of public services such as environmental governance. Keen and Marchand (1997) believe that for the sake of enhancing tax competitiveness, local governments attend tax competitions in several ways: adjusting tax reduction rate, increasing public investment and infrastructure construction and reducing other types of public goods (such as environmental manegement). Cremer and Gahvari (2004) study the relationship between the tax rate of pollution emission and firm decision behavior under tax competition, they state that firms are tend to choose big pollution technology if the government set the tax rate of emission less than the unlimited Nash equilibrium, which will increase the total pollution emissions and trigger social welfare deterioration. Bierbrauer et al. (2013) study the impact of tax competition on public services supply from the perspective of labor force. They consider in order to avoid the brain drain, the local government will compete viciously by reducing regional tax rate, which dwindle the local government tax revenue and weaken its ability to provide the public goods and services, and further brings the environmental degradation. Above studies involve many aspects, from capital, business decision and labor force, and they provide good inspirations for us to understand the relationship between tax competition and environmental pollution. However these researches mostly study inter-regional tax competition from the point of tax rate, but in fact local governments have no legislative power of taxation. Therefore, it is difficult for the local governments to compete in the way of lowering tax rates.

Since the income tax revenue sharing reform, more and more scholars attend to study competitive behavior of local governments, along with the coming environmental pollution problem at fiscal incentives level. Fredriksson and Millimet (2002) believe if the pollution cost is too high in the decentralization system, local governments will attempt to make environmental standards above social-optimal level and drive polluting enterprises to other place. According to current conditions in China however, a large study show that fiscal incentive is one of chief culprits of high growth in environmental pollution (Zhang and Zou 1998; Weingast 2009; Xu 2011; Liu et al. 2015). Liu et al. (2015) consider fiscal decentralization and local government competition have obvious ‘competition effect’ on environmental pollution, the quality of environment is likely to worsen with the reinforcement of fiscal decentralization. He et al. (2016) bring tax competition, income decentralization and environmental pollution under a system of investigation and discover that tax competition in eastern China helps the environment, competition in the central and western areas however, destroys the environment. Most of these literatures have explored the decision-making behavior of local governments from the perspective of fiscal decentralization. However, the existing fiscal system in China is a system with a high degree of fiscal responsibility and a relatively low proportion of local income, especially the proportion of budgetary revenues (Anselin et al. 1996). Local governments have no or only little formal tax powers. Therefore, it should be more appropriate to explain the problem of tax competition and environmental pollution from the perspective of financial powers concentration, that is, financial pressure.

Compared with ever researches, the main contribution of this paper lies in: first, we examine local tax competition under the perspective of tax base and illustrate the effects of tax competition on environmental pollution, by analyzing a range of local government’s behaviors in the aim of increasing fiscal revenue, such as broadening the tax base. Secondly, we analyze fiscal expenditure preferences of local governments and tease out how tax competition affects pollution from the view of fiscal pressure. Thirdly, we conduct empirical studies of environmental pollution and tax competition by adopting various spatial model panels, to explore the inherent mechanism and the form of spatial correlation between regional pollution, in the aim of revealing the relationship between tax competition and pollution more scientifically. This paper is organized as followed: the theoretical section analyses the inherent mechanism of the effect from tax competition on pollution in the context of financial pressure; the third section then establishes the spatial econometric model and introduces the relevant variables and data; the fourth section discusses the empirical results, concludes and put forward policy suggestions.

2 Theoretical Framework

The enterprise income tax sharing reform in 2002 reduces the proportion of local government’s revenue and causes tax jurisdiction split from tax usufruct. In May 1, 2016, the promotion of Camp Changed to Increase reduces local government’s revenue further. This decline markedly reduces the local disposable income and keeps pressuring their finances, with the local authority neither changed nor even rigidly increased. Facing the gap between local fiscal revenue and expenditure, tax competition has become an important tool to fill it. The US ACIR and Kenyon (1991) defines the tax competition as a tool for the local governments to win scarce and valuable financial resources or to avoid some particular cost. Local governments can attract the inter-regional flow of production factors by lower tax rate or some other means in tax competition (Brueckner 2003). Since the taxation legislative authority in China is highly integrated, and local governments usually cannot decide the type or rate of tax, tax competition in China presents more on fighting for tax base, namely by promoting local economy to attract the inflow of liquidity of production factors (Oates 1972), and by encouraging the development of high-tax industry to make fiscal revenue grow steadily.

Fiscal pressure of China encourages local governments to actively promote local economic development when they make fiscal expenditure decisions. The development of local economy can bring governments higher tax revenue, which relieves fiscal pressure to some extent. What’s more, local governments’ decision-making behavior is also influenced by the promotion system. For now, the promotion of local officials in China still depends on the higher central government (Cutter and Deshazo 2007; Millimet, 2010), and this makes local government officials who care about their careers have to concern more about economic development in the fiscal expenditure decisions. However, the spending on economics and environmental protection tend to contradict one another with the limited expenditure, therefore it’s hard for local governments to achieve the coordinated development of both economy and environment. Liu and Li (2013) takes tax competition as the reason of pursuing and competing for economic resources among local governments, they would rather sacrifice other non-economic functions for economic growth, first of these functions is environment with obvious externality. Fu (2008) believes that Chinese government’s pursuit for economic growth distorts the structure of their expenditures. In the process of economic development, local governments compete for capital through infrastructure construction and bring insufficient supply of public services such as environment.

Bjorvatn and Schjelderup (2002) argue that when two neighboring areas are competing for tax, one of them will gain a competitive advantage by improving the quality of regional environment and increasing the supply of public goods, so as to stimulate local economic growth. However, the spillover effect of public goods will increase the “free ride” motivation of the other area, which reduces their environmental quality and public service level. Some scholars on the other hand, believe that tax competition and economic development can improve the regional environmental quality. The interlocal tax competition restrains the behavior of local government and dwindles the corporate rent-seeking motives. The local governments are tend to improve the supply of public goods and services in order to stimulate local economic growth (Ihori and Yang 2009), they are also tend to encourage technological innovation by tax policies to enhance the regional competitive force.

In the case of limited resource endowment, attracting the inflow of external capital is also an important tool for the local government to expand tax base and to increase fiscal revenue. But many scholars points out that tax competition in China always results in local resource solidification instead of solving local environmental problems, by reducing environmental standards to contend for mobile production factors (Fredriksson and Millimet 2002; Woods 2006). Therefore, tax competition for mobile production factors accompanied by inefficient and loose environmental standard, which worsens the regional environment (Wilson 1999). According to some researchers, the introduction of foreign capital aggravates the environmental pollution in developing countries. William and Oates (1988) believe that developed countries have higher environmental standard than developing countries. If developing countries produce more pollution intensive products, accelerate development of natural resources and enforce lower environmental standard, just in order to achieve economic growth and more local tax revenue, the high polluting industries will transfer from developed countries then, which exacerbated their pollution problem (Markusen et al. 1995; List and Co 2000).

Some other scholars however, concern the foreign capital inflow not only does not deteriorate environment of the host country, but can improve their local environmental pollution. This is because the developed countries have higher environmental standards and cleaner production technologies, that their investment brings environmentally friendly technique and products to host country, so as to improve local environment quality even with their lower environmental standards (Letchumanan and Kodama 2000; Wang and Jin 2007). Frankel (2003) takes FDI (foreign direct investment) as the new technologies and opportunities to promote green production for developing countries. Dean et al. (2009) takes the settlement of industrial foreign-invested enterprises as the most important reason for environmental pollution in China, although FDI from different sources brings different impacts on China’s pollution.

Furthermore, with the incentive of fiscal pressure, local government is biased to local key tax source enterprises to drive their economic growth, by supporting local high tax industry such as manufacturing industry, housing industry, construction industry and financial industry (Han and Kung 2015), so as to lift its fiscal revenue. Most of the industrial manufacturing industries are not merely product for the local consumers. They are sensitive to production cost and in highly mobile. Therefore, the industrial enterprises always tend to locate in the area with loose environmental regulation in order to reduce production cost. This makes local governments race to lower the threshold of environmental protection, which called ‘Race-to-bottom’, to attract extra-territorial industrial enterprises (Dean et al. 2009). Since the tax sharing reform in China, local governments have provided low-cost land and subsidized infrastructure for manufacturing, they have also established lots of industrial parks and development zones in industrial land at low price or even “zero premium”. The growth model of lowering land prices, loosing labor and environmental regulation to attract investment adversely affect the economic and social sustainable development of China. Some local government officials have strong incentives to intervene the local tax policies under financial pressure, they protect polluting industry which has high output value or pay large amount of tax, by lowering the threshold of environmental protection. Chirinko and Wilson (2011) suggest that local governments adopt ‘seesaw’ strategies for different types of pollution. Cui and Liu (2010) find that provincial governments of China take better governance of industrial solid waste and waste water in tax competition, while they take strategy of deregulation supervision of industrial sulfur dioxide emission. The improvement effect of local environment by enacting environmental standards is very slight, the administrative standard of local tax competition by the central government is more important.

3 Empirical Framework

3.1 Model Estimation

Previous studies usually leave out territorial spatial correlation effect of environmental pollution while examining the impact of tax competition on environmental pollution. Since some pollutants flow between regions such as waste gas and waste water, environmental pollution in an area may also deteriorate the environment in its surroundings. Therefore, ignoring spatial spillover effect of environmental pollution may set the wrong model, as the inter-regional environmental pollution is not completely independent of each other. In this, we establish a spatial econometrics model which takes spatial correlation in environmental pollution in consideration, to investigate the impact of financial pressure on pollution. The common spatial econometrics model includes Spatial Dubin Model (SDM), Spatial Autocorrelation Model (SAC), Spatial Autoregressive Model (SAR) and Spatial Error Model (SEM), according to different impacts of spatial self correlation.

SDM model assumes that spatial correlation effect between dependent and independent variables of spatial correlation area exists. In this model, environmental pollution is not just affected by independent variable of the region, but by independent variable of spatially-related region. We can describe this model with the following expression:

where \( En_{it} \) is pollution level of period t in region i, \( Tax_{it} \) is tax competition in region i, including income tax competition and value-added tax competition. \( Fp_{it} \) represents financial pressure. \( Tax_{it} *Fp_{it} \) is treated as the interaction term with tax competition and financial pressure, to measure the impact of local tax competition on environmental pollution amid financial pressure. If the interaction term is significantly positive, this suggests that tax competition has positive effects on environmental pollution amid financial pressure, otherwise it has negative effects. W is measured as spatial weight matrix. \( \rho WEn_{it} \) denotes the impact of environmental pollution in surrounding areas on local pollution. \( \rho \) is spatial correlation coefficient, indicates the impact of environmental pollution level in spatial correlation area on local pollution. If \( \rho \) is positive, this suggests the positive impact exist, otherwise the negative impact exist. \( x_{ijt} \) is the jth control variable, \( \beta_{j} \) is the coefficient of control variable. \( \theta_{1} WTax_{it} *Fp_{it} \), \( \theta_{2} WTax_{it} \), \( \sum {\theta_{j} W} x_{ijt} \) signify the interaction with tax competition and fiscal pressure in neighboring areas, tax competition, the impact of control variable on local pollution, respectively. \( \theta \) is the corresponding coefficient vector. \( \varepsilon_{it} \) is the random perturbed term that satisfy normal distribution.

The spatial cross model (SAC) assumes environmental pollution will affect pollution of other areas through spatial interaction. The expression of this model appears as shown below:

where \( \mu_{it} \) is an error term, λ is the spatial error coefficient that reflects the size of spatial correlation between sample observations in random disturbance, which is the impact of disturbance term based on environmental pollution on local pollution for spatial correlation area. \( W\mu_{it} \) is the spatial correlation coefficient. The definitions of other variables are same as shown above.

Spatial Autoregressive Model (SAR) and Spatial Error Model (SEM) are exceptions of space Dubin (SDM) and space intersection (SAC) model. When spatial interaction in the model is not available that is \( \theta_{i} = 0 \), or when it meets \( \lambda = 0 \) in SAC model, the corresponding model is SAR. SAR model of environmental pollution indicates that pollution in one region affects pollution in other regions by spatial interaction. At this point, an only unidirectional spatial relatedness effect exists between the regions. It can be written as the following expression:

The definitions of variables in formula (3) are same as shown above.

When \( \theta_{i} \), the spatial interaction coefficient in SDM model;\( \delta \), the spatial lagged coefficient of explained variables and \( \beta_{i} \), the regression coefficient satisfy the equation \( \theta_{i} = - \delta \beta_{i} \),or when it meets \( \delta = 0 \) in SAC model, the corresponding model is SEM, or the coefficient of the space lag term in the SAC model is the corresponding SEM model. In this model, spatial spillover effect of environmental pollution is the result of random shocks.

Similarly, the definitions of variables in formula (4) are same as shown above.

3.2 Variable Selection

3.2.1 Environmental Pollution (En)

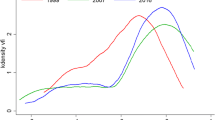

Previous study usually use absolute or relative index of one or more pollutants to represent environmental pollution. We take industrial wastewater emissions, industrial waste gas emissions, industrial so2 emissions and industrial soot emissions as the basic data, use the principal component analysis (PCA) to construct index En, because there is poor conformities in reflecting the overall level of local pollution by single measure, since different pollutants have different qualities. PCA linearly combines multiple original variables to form a new comprehensive variable, and selects the principal component by linear combination of original variables. PCA can effectively avoid evaluating local environmental pollution levels subjectively such as artificial assignment. Before constructing index En, we standardize the data inspect the applicability of PCA.

Before constructing index En, we standardize data and investigate the applicability of principal component analysis by kais-meyer-olkin (KMO) Test and Bartlett Sphere Coefficient Test. Results show that value of KMO Test is 0.672, greater than 0.5, P value of Bartlett Test is 0.000 and is significant at the 1% level. The values of KMO Test and Bartlett Test indicate that principal component analysis is applicable to environmental pollution. The characteristic value of first principal component extracted from it is 2.6923, greater than 1, which means the information obtained by this component should be retained. Meanwhile, cumulative contribution rate of first principal component is 67.31%, which mostly reflects the original variable’s information. Therefore, we adopt first principal component to construct comprehensive index of environmental pollution.

First principal component is composed of industrial wastewater emissions (inwa), industrial waste gas emissions (inga), industrial so2 emissions (inso) and industrial soot emissions (insm), Their coefficients are 0.4161, 0.5237, 0.5536, 0.4962 respectively. We can thereby construct comprehensive index of environmental pollution:

3.2.2 Tax Competition (Tax)

With the fully promotion of corporate income tax sharing reform and the Camp changed to increase, the proportion of local government tax sharing is decreasing with the increasing financial pressure. Where upon the local governments are in tax competition with the goal to expand the tax base, and then alleviate the gap of local financial revenue and expenditure. The tax competition of local government mainly revolves around corporate income tax and value-added tax. On the one hand, the competition among local government is mainly manifested in attracting liquidity production factors such as capital (Wilson 1999), a series of competition behavior belongs to the competition among governments for capital: to increase infrastructure investment, to support the high tax enterprises and ect. Since the capital income tax base is foundational, capital liquidity means the corporate income tax base is also fluid, this is consistent with the theoretical logic of local government horizontally competing for the tax source. Therefore, it would be appropriate of choosing enterprise income tax to characterize tax competition. On the other hand, the role of VAT in tax competition is also important. As the first tax category of China, its levying scope covers many industries and areas. What’s more, it is the main source of tax revenue for all levels of government, thus the tax base fight around value-added tax is a significant part of tax competition. In this, we select enterprise income tax and value-added tax to measure the intensity of regional tax competition, manifested in the ratio between the provinces (autonomous regions and municipalities) and the tax revenue and the regional GDP, the ratio between the provinces (autonomous regions and municipalities) VAT tax revenue and the regional GDP.

3.2.3 Fiscal Pressure (Fp)

The decrease in tax sharing of corporate income tax and VAT has made the local financial pressure increasingly serious in China. With the enterprise income tax reform and the Camp changed to increase, some revenues of local government are granted to the central government, but the administrative authority of local governments has not changed with it. The mismatch of routine power and financial power causes huge financial pressure of local government. Based on this, we choose the margin between the fiscal expenditure of each province (autonomous region and municipality) and the revenue refer to level government to describe the financial pressure. In this paper we mainly discuss the impact from tax competition on environmental pollution under the background of financial pressure, so we embody financial pressure in the interaction term with tax competition in Sect. 4.

3.2.4 Control Variable

Levels of Economic Development (Eco) Environmental pollution is closely bound up to the level of economic development in the region. Faced with financial pressure, in one way local government may spend more money to boost the economy, while ignoring environmental protection, but in another way, local government may also have more funds to clean up the environment when local economy develops to a certain degree, and then to improve the environmental pollution. We use GDP (billion yuan) of various provinces (autonomous regions and municipalities) to measure each area’s Eco. In order to reduce the impact of heteroscedasticity, we treat GDP as logarithms and eliminate the effect of price index based on year 2000. Industrial Structure (Ind). The differences of inter-regional industrial structure often lead to different levels of local environmental pollution. Compared with the primary and tertiary industry, the secondary industry, especially the industry, is more likely to cause environmental pollutions. Therefore, we select the ratio between value-added of secondary industry of each province (autonomous region and municipality) and gross domestic product (GDP) this year to measure Ind.

Opening Degree (Open) Researchers have two explanations on the impact of opening degree on environmental pollution now: One holds that local governments may reduce the threshold of environmental pollution which is bad for the environment, in order to attract foreign capital and then to expand the tax base. The others hold that, with the improvement of opening to the outside world, foreign enterprises can bring environment-friendly technology and equipment to host countries, so as to improve the regional environmental pollution. We choose the ratio between import and export volume of every province (converting annual exchange rate to RMB) and that year’s GDP to measure Open.

Environmental Regulation (Er) Local governments can take environmental regulation on enterprises by making correspondence policies, and to internalize the external cost of environment. Reasonable environmental regulation helps regulate the production behavior of enterprises, encourage them to develop environmentally friendly production technologies, and then to promote environmental quality. We choose the ratio between the investment for environmental pollution treatment in each area and this year’s GDP to measure Er.

R&D Intensity (Rd) The scale and intensity of R&D activity of an area measure its technological power and R&D degree in a sense. The areas with higher R&D intensity may have more advanced and environmentally friendly production technologies, which mitigates environmental problems caused by enterprises production. We choose the ration between internal R&D spending in every province (autonomous regions and municipalities) and GDP of the year to measure the R&D intensity (Rd).

All the related original data in this article comes from China Statistical Yearbook, China Environment Yearbook, China Statistical Yearbook of Finance and China Statistical Yearbook of Science and Technology, from year 2000 to 2015. All the data with the characteristic of time value are based on year 2000. We choose 30 provincial administrative regions in China to enable this research, Tibet doesn’t be included because the problem of incomplete data.

The descriptive statistics of each variable is shown in Table 1.

4 Empirical Results and Analysis

4.1 Spatial Correlation Analysis

We need to clarify the spatial correlation degree of environmental pollution, before applying spatial econometric model to make empirical research on tax competition and pollution. Moran’s I index method and Geary coefficient method are common ways to identify weather variables have spatial correlation. We use Moran’s I index method to test the spatial correlation of pollution in each area. Moran’s I index can be divided into global and local. Global Moran’s I index measures the overall spatial correlation effect of pollution in each province, the expression is shown as Eq. (5):

where N is the number of provinces, in which N = 30, i and j respectively represent the area i and the area j (1 ≤ i, j ≤ N, i, j are integers). \( G^{2} = \frac{1}{N}\sum\nolimits_{i = 1}^{N} {En_{i} - \overline{En} } \)\( \overline{En} = \frac{1}{N}\sum\nolimits_{i = 1}^{N} {En_{i} } \). Wij is an element in spatial weight matrix, when province i and province j have geographical boundary, Wij equals to 1, means that they have spatial relevance; When no boundary exists or i = j, Wij equals to 0 and they do not have spatial relevance.

The rage of value allowed for Moran’s I index is − 1 to 1, the closer to 1, explaining the stronger positive spatial correlation, on the contrary the closer to − 1, the greater negative spatial correlation. The greater the absolute value of Moran’s I index, the stronger spatial correlation of pollution. We standardize the spatial weight matrix and gain the test results as shown in Table 2.

Index En of each province in China from year 2004–2014 are spatially-related and pass the test at the significance level of 5% as shown in Table 2. Which means the spatial correlation effect of pollution should not be ignored when we examining the impact of tax competition on pollution.

For more accuracy reflect pollution’s part character in spatial distribution, we use local Moran’s I scatter diagram to analyze further. Moran’s I scatter plot takes (z, Wz)as the coordinate point, it decompose the whole space into four quadrants (\( z_{i} = En_{i} - \overline{En} \) is the spatial lag, Wz is the spatial weighted calculation of space unit measurements).

Each quadrant corresponds to different types of local spatial relationship between provinces. The first and third quadrants are positive spatial correlation, the second and fourth quadrants are negative spatial correlation. The first quadrant represents region units of high observations surrounded by regions of high observations as well (HH); The second quadrant represents regions of low observations surrounded by regions of high observations (LH); The third quadrant represents regions of low observations surrounded by the same kind of regions (LL). The fourth quadrant represents regions of high observations surrounded by regions of low observations (HL). We can determine Chinese provinces (autonomous regions and municipalities) belong to what kind of local spatial agglomeration, according to where the regions are in the quadrants.

Figures 1 and 2 are the Moran’s I scatter plots of Chinese provinces (autonomous regions and municipalities) in year 2004 and 2014 respectively. Number 1–30 in the figures is in turn: Beijing, Tianjin, Hebei, Shanxi, Inner Mongolia, Liaoning, Jilin, Heilongjiang, Shanghai, Jiangsu, Zhejiang, Anhui, Fujian, Jiangxi, Shandong, Henan, Hubei, Hunan, Guangdong, Guangxi, Hainan, Chongqing, Sichuan, Guizhou, Yunnan, Shaanxi, Gansu, Qinghai, Ningxia, Xinjiang.

The two figures above show that the provinces of first quadrant (HH) stay nearly constant, its possibly because the provinces in this quadrant have high levels of environmental pollution, and the pollution of surrounding areas is relatively serious, which make the spatial distribution of pollution in these provinces has no significant changes. Compared with 2004, the numbers of provinces in the second (LH) and fourth quadrant (HL) decrease in 2014, its possibly because provinces with low pollution level has demonstration effect on surrounding provinces with high pollution level, thus the heavily polluted provinces come to appreciate the pollution management in economic development. The numbers of provinces in third quadrant (LL) in 2014 are more than numbers in previous years, including some original provinces from (LH) and (HL), This means China’s environmental quality has improved in the development process.

4.2 Empirical Results and Analysis

We use Spatial Autoregressive Model (SAR), Spatial Error Model (SEM), Spatial Autocorrelation Model (SAC) and Spatial Dubin Model (SDM) to examine the relationship between tax competition and environmental pollution under fiscal pressure. We select fixed effects for space panel metering model after Hausman test. When we use SDM model to estimate two kinds of tax competition, firstly add spatial lagged terms of all the explanatory variables to it, and use cluster-robust standard errors to estimate it. It turns out that only Tax has significant lagged terms in enterprise income tax competition model and value-added tax competition model, so we remove spatial lag item of other variables for further regression.

We estimate spatial econometric model of enterprise income tax and value-added tax by STATA 12.0 software, Respectively obtain calculation results from Spatial Autocorrelation Model, Spatial Error Model, Spatial Intersection Model and Spatial Durbin Model, the results are shown in Table 3.

Model (1) and (2) in Table 3 explore the impact of corporate income tax competition and value-added tax competition on pollution among regions separately, under the perspective of fiscal pressure. The maximum likelihood of Spatial Durbin Model (SDM) in Model (1) and (2) are higher than the others. Furthermore, we test out SDM with Wald test and LR test, in order to better judge its fitting effect. Results show that both the spatial lag and space error term of Wald and LR test pass the test of 1% significance, which means SDM will not degenerate to the SAR and SEM. Based on this, we chooses the spatial SDM to analyze the above two tax competition models. Spatial correlation coefficients ρ in model (1) and (2) are significantly positive, it shows that the spatial spillover effect of environmental pollution is evidently, that is, the increasing level of pollution in one area lead to the worsening environment of space-correlated area. However, when we analyze the impact of tax competition on environmental pollution, SDM cannot directly reflect the relationships between them. Thus we need to take a closer look at the direct effects, indirect effects and total effects of SDM.

As independent variables, the parameters of linear model has direct explanatory for partial derivatives of dependent variables, based on the assumptions of independent samples. While in spatial econometric model that contains spatial lagged terms, the relationship between independent and dependent variables can’t be expressed by simple regression coefficient, as the regression coefficient contains interaction about a large number of spatial correlation samples. The impact of independent variable on dependent variable in spatial econometric model can be divided into direct effect, indirect effect (spatial spillover effect) and total effect (Pace and LeSage 2008). Direct effect measures the average impact of tax competition on local pollution, indirect effect measures the average impact of tax competition on pollution in space-correlation areas, and total effect reflects the overall impact of tax competition on pollution in both local area and surrounding areas. From the view of financial pressure, estimates of direct effect, indirect effect and total effect, based on the impact of regional corporate income tax and value-added tax competitions on pollution are shown in Tables 4 and 5.

Since we mainly inspect the impact of tax competition on environment pollution from the view of fiscal pressure, we list out direct effect, indirect effect and total effect of only interactions in Tables 4 and 5. Viewed in Table 4, the direct effect of interactions with corporate income tax competition and fiscal pressure is significant positive. This might in part reflect the income tax competitions among local governments improve local environmental pollution, it might be because, the tax sharing decline makes local government had to face the dilemma of responsibilities to fiscal revenue and expenditure are imbalanced, and the pressure of budget deficit distorts local government’s expense preference behavior. In tax competition, local governments do not necessarily aim at the optimization of public services such as local environment. In the case of limited fiscal expenditure, local governments prefer devoting resources to economic fields like infrastructure construction, in order to relax financial pressure and gain more economic benefits. Consequently, the investment to public services (such as environment) may be lowered to some extent and result in environmental deterioration.

Table 4 also shows that indirect effect and total effect of interaction with tax competition and fiscal pressure are positive. The result in a certain extent illustrates, responding to financial pressure, the enterprise income tax competition affects environment pollution through direct impact in local area, it also affects expenditure behavior of local government in other areas, and then disadvantages environment in spatial correlated areas through indirect effect. In tax competition among local governments, the positive externalities of pollution management makes local governments in spatially-related areas adopt the approach of ”free-riding” as their fiscal policy. Not only so, in order to expand tax base and make up the gap between fiscal revenue and expenditure, local government may compete to reduce the standard of environmental quality and relax environmental controls, so as to reduce enterprises’ production cost and attract liquid factors of production inflow. In addition, local governments may even take the cost of sacrificing environmental quality during the course of economic development, for the sake of some high taxes, big polluting enterprises to consolidate local tax fund. A series of above-mentioned tax competition behavior bring adverse effects on the environment.

Interactions with value-added tax competition and financial pressure both have positive correlation with environmental pollution, in the estimation of direct effect, indirect effect and total effect, and at least pass the test at the significance level of 10% as shown in Table 5. Similar to the enterprise income tax competition, regional value-added tax competition under financial pressure is not only detrimental to the improvement of local environment, but also repress the improvement of environmental quality in surrounding areas. Greater the fiscal pressure, stronger the incentive of local governments to contend for regional tax base by value-added tax competition. Meanwhile, since it’s difficult for local governments to invest in environmental protection, which makes their fiscal expenditure on environmental protection non optimal and ultimately lead to the deterioration of environment.

5 Conclusions

With the income tax sharing reform and the camp changed to increase proceeding, tax sharing ratio of China’s local governments is decreasing, which makes the financial pressure faced by them constantly increasing. First, this article attempts to examine the impact of local government’s tax competitions on environmental pollution under the increasing financial pressure. Second, this article is fitted to panel data of 30 provinces from Chinese mainland from year 2004–2014. Third, this article makes an empirical analysis for tax competition impacting on environmental pollution, by building the comprehensive index of pollution and establishing spatial econometric model. The main findings of this article are as follows.

The environmental pollution has significant spatial correlation effect among provinces in China. Worsening trend of pollution in one area raises the level of pollution in spatial-related areas, in turn, an increase in environmental quality in the spatial-related areas also improve environment in this area. Therefore, from the policy level, local governments should strengthen regional communication and cooperation in the process of environmental management, so as to gain the better effects of pollution cleanup, since the spillover effect of environmental pollution is evidently.

In direct effect, indirect effect and total effect, the interactions remain significantly positive with fiscal pressure and both regional corporate income tax or value-added tax competition. This means the local government’s tax competition is unfavorable to the development of environment both in the region and the surrounding areas, because the impact of financial pressure. Financial pressure distorts the fiscal preferences of local governments, makes them race to lower the threshold of environmental protection so as to attract investment and expand tax base. Besides, local governments also support some high tax big polluting enterprises, in order to stabilize the tax revenue source and increase revenues.

Therefore, in order to avoid malign tax competition, the central government should take effective measures to supervise and guide the local governments, especially to prevent them racing to lower the environmental protection threshold. Of course, central government should also reduce tax, increase transfer payments as well as financial subsidies to ease fiscal burden of local governments, so as to improve their ability of environmental management, which is doubtlessly in favor of the coordinated development of regional economy and environment.

References

Anselin L, Florax R, Bera AK et al (1996) Simple diagnostic tests for spatial dependence. Reg Sci Urban Econ 26(1):77–104

Bierbrauer F, Brett C et al (2013) Strategic nonlinear income tax competition with perfect labor mobility. Games Econ Behav 82(1):292–311

Bjorvatn K, Schjelderup G (2002) Tax competition and international public goods. Int Tax Public Finance 9(2):111–120

Brueckner JK (2003) Strategic interaction among governments: an overview of empirical studies. Int Reg Sci Rev 26(2):175–188

Chirinko R, Wilson DJ (2011) Tax competition among US states: racing to the bottom or riding on a seesaw?. Federal Reserve Bank, San Francisco

Cremer H, Gahvari F (2004) Environmental taxation, tax competition, and harmonization. J Urban Econ 55(1):21-45

Cremer H, Marchand M, Pestieau P (1997) Investment in local public services: nash equilibrium and social optimum. J Public Econ 65(1):23–35

Cui YF, Liu XC (2010) Provincial tax competition and environmental pollution: based on panel data from 1998 to 2006 in China. J Finance Econ 36(4):46–55

Cutter WB, Deshazo JR (2007) The environmental consequences of decentralizing the decision to decentralize. J Environ Econ Manag 53(1):32–53

Dean JM, Lovely ME et al (2009) Are foreign investors attracted to weak environmental regulations? Evaluating the evidence from China. J Dev Econ 90(1):1–13

Frankel JA (2003) The environment and globalization. Nber Working Papers 55(2):161–210

Fredriksson PG, Millimet DL (2002) Strategic interaction and the determination of environmental policy across U.S. States. J Urban Econ 51(1):101–122

Fu Y (2008) Why China’s decentralization is different: an analytical framework considering political incentives and fiscal incentives. J World Econ 11:16–25

Han L, Kung KS (2015) Fiscal incentives and policy choices of local governments: evidence from China. J Dev Econ 116:89–104

He J, Liu LL, Zhang YJ (2016) Tax competition, revenue decentralization and China’s environmental pollution. China Popul Resour Environ 26(4):1–7

Ihori T, Yang CC (2009) Interregional tax competition and intraregional political competition: the optimal provision of public goods under representative democracy. J Urban Econ 66(3):210–217

Keen M, Marchand M (1997) Fiscal competition and the pattern of public spending. Core Discussion Papers RP 66(1):33–53

Letchumanan R, Kodama F (2000) Reconciling the conflict between the ‘pollution-haven’ hypothesis and an emerging trajectory of international technology transfer. Res Policy 29(1):59–79

List JA, Co CY (2000) The effects of environmental regulations on foreign direct investment. J Environ Econ Manag 40(1):1–20

Liu J, Li W (2013) Environmental pollution and intergovernmental tax competition in China: based on spatial panel data model. China Popul Resour Environ 23(04):81–88

Liu JM, Wang B, Chen X (2015) A study on the nonlinear effect of political decentralization on environmental pollution—based on the PSTR model analysis of the panel data in 272 cities, China. Econ Perspect 03:82–89

Markusen JR, Morey ER, Olewiler N (1995) Competition in regional environmental policies when plant locations are endogenous. J Public Econ 56(1):55–77

Millimet DL (2010) Assessing the empirical impact of environmental federalism. J Reg Sci 43(4):711–733

Oates WE (1972) Fiscal federalism. Harcourt Brace Jovanovich, San Diego

Pace RK, Lesage JP (2008) Biases of ols and spatial lag models in the presence of an omitted variable and spatially dependent variables. Social Science Electronic Publishing

Rauscher M (2005) Economic growth and tax-competing leviathans. Int Tax Public Finance 12(4):457–474

United States. Advisory Commission on Intergovernmental Relations, Kenyon DA (1991) Interjurisdictional tax and policy competition: good or bad for the federal system? Advisory Commission on Intergovernmental Relations, United States

Wang H, Jin Y (2007) Industrial ownership and environmental performance: evidence from china. Environ Resour Econ 36(3):255–273

Weingast BR (2009) Second generation fiscal federalism: the implications of fiscal incentives. J Urban Econ 65(3):279–293

William JB, Oates WE (1988) The theory of environmental policy: efficiency without optimality: the charges and standards approach. Cambridge University Press, Cambridge

Wilson JD (1999) Theories of tax competition. Natl Tax J 52(2):269–304

Woods ND (2006) Interstate competition and environmental regulation: a test of the race-to-the-bottom thesis. Soc Sci Q 87(1):174–189

Xu C (2011) The fundamental institutions of China’s reforms and development. J Econ Lit 49(4):1076–1151

Zhang T, Zou HF (1998) Fiscal decentralization, public spending, and economic growth in China. J Public Econ 67(2):221–240

Author information

Authors and Affiliations

Corresponding author

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Bai, J., Lu, J. & Li, S. Fiscal Pressure, Tax Competition and Environmental Pollution. Environ Resource Econ 73, 431–447 (2019). https://doi.org/10.1007/s10640-018-0269-1

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10640-018-0269-1