Abstract

The relationship between tax policy and environment is a hot topic of widespread concern. Clarifying the mechanism between them is of great significance to promote the coordinated development of economy and environment. This study constructs a theoretical framework based on the multi-sector model of general equilibrium theory to investigate the effect of tax competition on environmental pollution. It is theoretically supported that such an effect exists and is affected by environmental protection investment (EI), that is, there is a threshold effect derived from EI. The theoretical finding is confirmed by an empirical study employing the spatial panel threshold model and using China’s provincial panel data from 2007 to 2019. The empirical result shows that the threshold effect of EI is significant since that lower tax competition (i.e., higher tax collection and management efficiency) tends to reduce environmental pollution when EI is below the threshold value and vice versa. In addition, we find that the effect of tax competition is regionally heterogeneous. Finally, several policy recommendations are proposed based on the theoretical and empirical results.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction and literature reviews

The history of the development of various countries in the world shows that the industrialization development of a country or region is often accompanied by the unreasonable development and utilization of natural resources and resource consumption which causes relatively serious damage to the ecological environment. The protection of natural resources and environmental pollution have attracted high global attention. As the largest developing country, China has experienced more than 40 years of rapid growth and rapid industrialization. Studies have shown that one of the reasons why China's economic growth for more than 40 years is that the Chinese central government has ranked the local GDP growth rate during the tenure of local government officials and some other relevant economic indicators as important factors in determining the promotion of the official (Chen et al., 2005; Que et al., 2019). However, some scholars also think that the local official excessive pursuit of promotion goals may defy the laws of development and exceed the economic development capacity (Sun et al., 2022). Scholars call the model “Promotion Tournament Model” (Pu & Fu, 2018; Zhou, 2007).

To pursue the rapid growth of the local GDP, the local officials give priority to developing the local economy, so the local governments strive to attract large enterprises (usually industrial enterprises) to the jurisdiction for fierce competition. Tax preferences are an important means of local government competition. Local governments compete for external capital at lower effective tax rates than that of other competitive regions. This process is collectively referred to as tax competition. Tax competition will have an impact on environmental quality in two aspects. On the one hand, it may increase the number of industrial enterprises and decline environmental regulatory standards. It also discharges more pollutants and wastes into natural ecosystems, which is leading to the collapse of the production capacity and self-repair capacity of natural ecosystems. On the other hand, it can increase the environmental protection expenditure in the fiscal expenditure by increasing the local government revenue, thus improving the capacity to govern and improve the environment. At the same time, the introduced enterprises may solve the pollution problem through technological innovation (Hickel & Kallis, 2020), which can realize the industry transformation and upgrading. Not only that, the governments can promote low-carbon structural reform, cultivate endogenous comparative advantages, and then to achieve the transformation from low-end to high-end product processing. (Wang et al., 2022). How does tax competition between local governments in China affect environmental pollution? How much impact does it matter? How to reduce the impact of inter-regional competition on environmental pollution through the design of the tax system? We will answer the above questions based on the study results.

An ecological environment is a public object with an obvious externality. It is difficult to realize the environmental protection only by the market mechanism. The government's fiscal and taxation policies are the important material basis for ensuring the governmental basic environmental services. It determines the effect of environmental protection and improve green fiscal, tax and financial support system to some extent (Ma, 2022; Xu et al., 2020).

Early tax competition theory emphasized that local government competition for capital could lead to tax inefficiency (Zodrow & Mieszkowski, 1986). The supply level of public goods, such as the environment, is considered to deviate from the social optimum in the Nash equilibrium (Bai et al., 2019; Bergstrom et al., 1986; Zhang et al., 2021). Local governments often attract investment through land leasing at a lower price, tax relief, and the refund of tax collection, so that governments compete to improve the economic level (Ding & Lichtenberg, 2011; Huang & Du, 2017; Mao et al., 2022; Wu et al., 2022; Zhang et al., 2021). Their essence is to get more enterprises to their jurisdictions with more attractive tax incentives to increase local GDP. At the same time, many state-owned industrial enterprises rely on highly polluting technologies (Pal & Saha, 2015) and is more vulnerable to the government's green policies (Chai et al., 2022), which has exacerbated the environmental deterioration and is easier to correct. The vicious competition of local governments by lowering local tax rates will reduce the tax revenue, weaken their ability to provide public goods and services, and further degrade the ecological environment (Bierbrauer et al., 2013; Li & Zhao, 2017). Hadjiyiannis et al. (2014) also pointed out that the preferential tax competition in order to attract international capital flows into the country promoted the economic growth of the capital-importing country, and also caused environmental pollution. However, a few scholars believe that tax competition has improved the quality of the local environment (Eichner & Pethig, 2018). As a kind of tax levied to protect and promote the reasonable development of natural resources, and properly adjust the poor resource-level income (Xu, 2011), ad valorem duty of resource tax can correct economic distortions and has a significant positive impact on the economic and environmental performance of China's mining firms (Song et al., 2022; Tang et al., 2017). Relaxing the resource tax collection by local governments is equivalent to relaxing environmental regulation. Pollution haven hypothesis (PHH) believes that pollution enterprises will move to areas with lower environmental supervision to reduce the cost of environmental control after strengthening environmental supervision, which provides a haven for polluting enterprises (Copeland & Taylor, 2004; Solarin et al., 2017; Walter & Ugelow, 1979). Most scholars support the pollution haven hypothesis was founded in China (Cohen et al., 2019; Shen et al., 2017; Sun et al., 2017). Therefore, polluting industries are more likely to gather in areas with low environmental awareness in China. Resource tax has a long history in China, and it is of great significance to analyze the economic and environmental effects of resource tax reform. Extant studies generally believe that the resource tax is related to carbon emissions and the resource tax reform contributes to energy conservation and emission reduction (Berkhout et al., 2004; Doğan et al., 2022; Wissema & Dellink, 2007). However, the results from a regional perspective show that the main role of resource tax is to transfer income from resource enterprises and central governments to local government finance (Zhang et al., 2013).

The redistribution of local government financial expenditure to social and public goods will reduce pollution while increasing total government spending without changing the structure of expenditure does not reduce pollution (López et al., 2011). For different types of pollutants, government expenditures have different effects on environmental pollution (Halkos & Paizanos, 2013; Zhang et al., 2017) and the implementation of the expansionary fiscal policy has alleviated the discharge of pollutants (Galinato & Galinato, 2016; Halkos & Paizanos, 2016). Further, increased public expenditure in the environmental sector, entertainment and cultural industry are crucial for ensuring environmental sustainability and the appropriate allocation of the public expenditure can effectively improve environmental performance (Ercolano & Romano, 2018; Huang, 2018; Shao et al., 2022). However, some local governments cut their environmental spending to answer that increase in neighboring countries (Deng et al., 2012).

Overall, around the relationship between tax competition and environmental pollution, the extant literature mainly focuses on whether tax competition leads to environmental pollution and its transmission mechanism. Some scholars find that tax competition has led to the distortion of the implementation of environmental regulation, which has an significant impact on China's high-quality development (Deng et al., 2022). While the extant literature has not explored the impact of tax competition on environmental pollution with government environmental protection investment as the threshold variable. What’s more, most of the literature on environmental pollution ignores the spatially related relevance of spillover pollutants. As an important tax category to protect natural resources (Cao et al., 2011), the resource tax belongs to the local tax. In addition to the resource tax paid by the offshore oil enterprises belonging to the central government, the taxes paid by the other enterprises all belong to the local governments. Therefore, the local governments have great autonomy in levying the resource tax. But there is rare literature to test the impact of the tax competition of the resource tax on the environment.

Our theoretical model, which aims to clarify the relationship between industry, tax competition, and environmental pollution, is constructed based on the multi-sectoral model of general equilibrium theory and economic growth theory. And we take the Chinese provincial panel data as samples for empirical testing. As a result, this paper can make contributions in the following aspects. First, we explore the internal mechanism and spatial correlation form between regional pollution. We also reveal the relationship between tax competition and environmental pollution more scientifically, which enriches the relevant literature. Second, the first-model extreme distribution is used to represent tax competition, which increases the explanatory ability of the model. Third, we use the maximum likelihood estimate and the Particle Swarm Optimization (PSO) to obtain the estimation coefficient of the space threshold empirical model by the panel data, then the significance of the model statistics can be calculated by Bootstrapping.

The rest of this paper is structured as follows: Sect. 2 investigates the impact of tax competition on sulfur dioxide emissions from the theoretical points of view by constructing an endogenous growth model. Section 3 shows the data and empirical models with fixed effects. Section 4 presents the results with respect to the spatial panel threshold effect model, spatial heterogeneity, endogeneity test, and robustness check. Section 5 concludes the paper and discusses policy implications by presenting the main findings and extensions.

2 Theoretical framework

Studying the interactions between the human economy and ecosystems is essential for the effective use of natural resources and the protection of the environment through the design of policies and management rules. Modelling of coupled ecological and economic systems can be traced back to models dealing with natural resource management. We draw lessons from the practices of Wen and Liu (2019) to allocate financial resources in the clean and pollution sectors based on the multi-sectoral model of general equilibrium theory and economic growth theory. And we detail the relationship between tax competition, environmental input, and environmental pollution in the following models.

We assume that local governments levy taxes on enterprises that use resources and the cost of environmental governance shall only be borne by the government. We also assume that the total capital of potential investment is \(K\), which flows freely between two adjacent competing regions A and B in the perfectly competitive market, and other elements do not flow.

2.1 Government

The government imposes a resource tax on the pollution sector, while the government lowers tax efforts to increase local attractiveness to potential investors. Tax competition \(\pi_{A}\) and \(\pi_{B}\) indicate the level of tax reduction effort in regions A and B, respectively. Given \(\pi_{A}\) and \(\pi_{B}\), \(p\left( {\pi_{A} |\pi_{B} } \right)\) represents the probability of region A successfully attracting capital inflows, which is assumed to increase in \(\pi_{A}\) and decrease in \(\pi_{B}\). According to Basinger and Hallerberg (2004), the stochastic component of region A’s rate of return follows the type I extreme-value distribution (i.e., the log Weibull distribution), which can be specified as:

The government collects product taxes \(\tau\) on all enterprises. And tax revenue will be used for environmental transformation, which is the environmental protection investment \(M_{g}\). \(M_{g}\) is expressed as:

where \(m\) means the proportion of environmental expenditure in fiscal expenditure. And the bigger \(m\) means that the government pays more attention to environmental protection.

2.2 Firm

There are two types of intermediate product sectors in the market, namely the knowledge sector \(z\) that produces new knowledge and the industrial sector \(w\) that produces intermediate output. Potential investment \(K\) can be chosen between the two sectors. And \(K\) is represented as \(K = K_{z} + K_{w}\). The proportion of investment in the pollution sector \(\xi = \frac{{K_{w} }}{K}\). Thus, the expectation of the capital investment in the industrial sector in the A region is represented as:

The knowledge sector is the clean sector, using capital \(K_{z}\) and human capital \(H\) with the speed of technological progress \(\Lambda\). The industrial sector is the pollution sector, using capital \(p\left( {\pi_{A} |\pi_{B} } \right) \cdot K_{w}\) and natural resources \(N\). We assume that the production function of the knowledge sector is \(Y_{z} = \Lambda H^{{z_{1} }} K_{z}^{{z_{2} }}\) (Romer, 1990), and the production function of the industrial sector is \(Y_{w} = N^{{w_{1} }} \left( {\frac{1}{{1 + e^{{\pi_{B} - \pi_{A} }} }}} \right)^{{w_{2} }} K_{w}^{{w_{3} }}\). The final product is produced by the production sector, and the production function is expressed as:

2.3 Social welfare

Suppose that people prefer both consumption and good environments. Referring to the standard fixed elasticity and additivity separable utility function corrected by Huang and Lin (2013), the instantaneous utility of the society is:

where \(\sigma\) indicates the coefficient of relative risk aversion, and \(\omega\) indicates the preference for the environment. Equation (5) reflects different effects of environment and consumption on social welfare, where the marginal utility of consumption is diminishing, and the marginal negative utility of environmental damage is increasing. It is difficult to detect minor damage to the environment. However, when environmental degradation is serious, people pay more and more attention to the environment. Therefore, the larger \(\omega\), the greater the slope of the consumer utility function about the environment, the more sensitive to environmental damage. In other words, the environmental awareness of consumers increases as \(\omega\) increases.

2.4 The environment motion equation

The degree of environmental quality optimization is positively related to the investment of government departments in environmental transformation, and negatively related to the environmental resources consumed by production. The equation can be expressed as (Brock & Xepapadeas, 2018; Fullerton & Kim, 2008):

where \(\mu\) represents the speed of environmental optimization, \(\theta\) represents the environmental management efficiency of the environment department, and \(E\) represents the environmental quality.

2.5 The problem of social planner

The goal of social planner is to maximize social welfare, so the social planner problem can be expressed as the following dynamic optimization form (Brock & Xepapadeas, 2018):

The Hamiltonian function for the above dynamical optimization problem is:

Solving this dynamic system, the control variables are \(C\) and \(N\), and the state variables are \(K\) and \(E\). And the first-order conditions for maximizing \(J\) with respect to \(N\) and \(C\) are:

The Euler equation is expressed as:

The growth rate of consumption can be expressed as:

When it is in the stationary state, according to \(\frac{{\dot{C}}}{C} = \frac{{\dot{E}}}{E}\), we can get:

We can get the impact of tax collection and management efficiency on environmental pollution with the partial derivative of \(E\) with respect to the variable \(\pi_{B}\):

where \(\frac{\partial Y}{{\partial \pi_{B} }} = - \left( {1 - \xi } \right)^{{\beta z_{2} }} \xi^{{\alpha w_{2} }} A^{\beta } H^{{\beta z_{1} }} N^{{\alpha w_{1} }} K_{w}^{{\alpha z_{2} + \beta z_{3} }} \alpha w_{2} \left( {\frac{1}{{1 + e^{{\pi_{B} - \pi_{A} }} }}} \right)^{{\alpha w_{2} + 1}} e^{{\pi_{B} - \pi_{A} }} < 0\).

Solving the above equations, we can get the following formulas:

Equation (16) represents that when the government’s environmental protection investment is lower than a certain value, the environment deteriorates with increasing tax competition. Equation (17) reveals when the government’s environmental protection investment is higher than a certain value, tax competition improves environmental quality. The lower environmental expenditure proportion of fiscal expenditure means that area A does not pay attention to environmental improvement. And if competing area B attracts industrial sector investment by reducing tax efficiency, fiscal revenue in region A will be reduced. Therefore, area A will take the same strategy to attract investment. The introduction of a large number of industrial enterprises in area A is prone to environmental deterioration. By contrast, the lower environmental expenditure proportion of fiscal expenditure means that area A does not attach importance to environmental improvement, so area A is not sensitive to the tax competition behavior of area B. If t the tax efficiency is reduced to attract potential investments in region B, the proportion of polluting enterprises in area A will be reduced. At the same time, the fierce tax competition can attract high-quality clean department enterprises into area A. Strong environmental awareness and high investment in environmental governance can further the environment in region A. The analysis above indicates the threshold effect of tax competition on the environment. Therefore, we make the following hypothesis:

Hypothesis

The impact of tax competition on environmental pollution is based on the threshold of government investment in environmental protection:

When government investment in environmental protection is below a certain value, tax competition has a positive impact on environmental pollution.

When the government investment in environmental protection is higher than a certain value, tax competition has a negative impact on environmental pollution.

3 Data and methods

3.1 Data

We use government environmental protection investment as the threshold variable to examine the impact of tax competition on environmental pollution. By the data collection stage, the statistics on environmental protection expenditure of National Bureau of Statistics of China began in 2007, and the statistics on sulfur dioxide emissions ended in 2019. Therefore, a balanced panel dataset of 28 Chinese mainland provinces, autonomous regions, and municipalitiesFootnote 1 over the period 2007–2019 was collected from the China Statistical Yearbook, yielding 364 observations.

3.2 Variables selection and measurement

Our main independent variable is tax collection efficiency (denoted as TF) which is measured by the ratio of the actual tax revenues (denoted as \(T\)) to tax capacities (denoted as \(T^{*}\), Lotz & Morss, 1967; Mkandawire, 2010). Significantly, intense tax competition usually reduces tax collection efficiency. Nevertheless, \(T^{*}\) is unobservable, which can be indirectly measured by the regression model in Eq. (18). In other words, the fitted tax revenues by using \(T\) as the dependent variable and different types of tax bases as the independent variables can appropriately reflect a region’s tax capacities. Under the tax system of China, there are five main indicators of the resource tax bases, including crude oil production (CO), crude salt production (CS), natural gas production (NG), raw ore production (RO) and raw coal (RC). As a result, the regression model can be specified as:

where \(T_{it}^{ * }\) represents province \(i\)’s share of resource tax revenues to GDP in year \(t\). \(\alpha\) is the intercept and \(\mu\) is the error term.

We use per capita sulfur dioxide emissions (PSO2) to indicate the degree of environmental pollution. In order to ensure the dimensional consistency of variables, we standardize it.

In addition, we also identify environmental protection investment (EI) measured by the proportion of local government environmental protection expenditure to local financial expenditure as the threshold variable.

The equation of the environment explained in Eq. (14) reveal that environmental pollution is also affected by citizens' environmental awareness, the scientific and technological innovation ability of regional enterprises, and some other factors. Referring to extant studies, the control variables of the model in this paper include four aspects: environmental characteristics, economy and trade, demographic characteristics, and innovation ability.

We first consider the control variables about environmental characteristics. The environment motion equation expressed in Eq. (6) shows that environmental pollution is affected by citizens' environmental awareness, and the optimization of environmental quality is positively correlated with the investment in environmental transformation and negatively correlated with resource consumption. Therefore, we use the education level of the provincial population to indicate the environmental awareness of the citizens (ENA). The higher the citizens are educated, the stronger the awareness of the environment. According to the method of Leng and Du (2016), the ratio of regional education level to the total regional population is calculated to measure the educational level of the citizens, and the regional level of education is the weight mean of the total length of education. In addition, reference to Yu and Sun's (2017) method, environmental regulation (ENR) is indicated by the ratio of the total investment completed this year to the total regional output value.

We then consider the control variables about economy and trade. According to the theoretical analysis, governments attract external capital through tax competition to attract industrial enterprises into the area to both increase local GDP and improve local environment. Firstly, foreign trade may intensify competition in the product market and encourage domestic enterprises to improve operational efficiency by improving energy efficiency or reducing energy consumption, thus reducing environmental pollution (Al-Mulali et al., 2015), while it may increase production and accelerate the consumption of natural resources, leading to increased energy consumption and exacerbating environmental pollution (Li et al., 2019). The total export–import volume (TEIV) is thus selected as the control variable. Secondly, the direct goal of tax competition is to attract foreign investment, foreign direct investment (FDI) which is denoted by the ratio of foreign investment to regional GDP is selected as the control variable. Thirdly, mining industry, manufacturing industry, and other enterprises are currently the biggest impact on the environment. Referring to Li's (2019) approach, we use the proportion of the added value of the secondary industry to regional GDP to show the industrial structure (STR) and use it as a control variable. Fourthly, by the analysis of basic theory such as game theory, financial pressure affects environmental pollution by stimulating local governments. At the same time, the degree of financial pressure also leads local governments to take different economic measures, thus affecting the environment. Therefore, we select financial pressure (FP) as the control variable, measured by the ratio of per capita fiscal income to per capita fiscal expenditure.

In addition, we consider the control variables about demographic characteristics. The distribution of population is more and more concentrated in cities with the acceleration of urbanization, making the domestic sewage increase sharply. China Urban Construction Statistical Yearbook shows that the per capita domestic pollution discharge of the urban population is much higher than that of rural areas. If these pollutants cannot be disposed of properly, environmental pollution will occur. So, we use resident population at the end of the year (YEP) and urban population density (UPD) as the control variables. Besides, population growth can lead to increased demand for resources, and the pressure brought by the rate of population growth on resources is the most basic impact on the environment. Therefore, we use the natural population growth rate (NPGR) as the control variable.

Finally, we consider the control variables about innovation ability. The improvement of technology will reduce the degree of environmental pollution in terms of innovation capacity (Trianni et al., 2013). However, scientific and technological innovation has a ‘compliance cost’ effect, deepening the degree of pollution (Zhang et al., 2019). Therefore, the number of effective invention patents for industrial firms (PIF) above the designated scale is selected to indicate the degree of technological innovation and taken as the control variable.Footnote 2 Industrial firms are the main source of regional environmental pollution. The larger the number of regional industrial enterprises is, the worse the environmental quality will be. Therefore, we choose the number of industrial firms (IND) as the control variable.

It is worth noting that due to the large gap in data dimensions, we standardize data with large values (PSO2s, TEIVs, YEPs, FDIs, UPDs, PIFs, INDs). In addition to the above variables, we further reduce the omitted variable bias by controlling for individual fixed effects. Table 1 presents descriptive statistics of the identified factors.

3.3 Empirical methods

We used panel data models to facilitate the use of more dynamic individual observation information and to alleviate endogenous problems caused by unobservable individual heterogeneity.

First, considering that the emission of sulfur dioxide is a spillover pollutant, the spatial effect is added to test the effect of spatial distance on its effect. A spatial lag model (SLM) was constructed for the following panel data as Eq. (19):

where \(\rho\) is the spatial correlation coefficient, \(y\) indicates the per capita sulfur dioxide emissions (PSO2), \(t\) indicates the time and \(i\) indicates the observed sample. \(TF\) indicates the tax collection efficiency, \(u_{i}\) is the provincial fixed effect, \({\mathbf{control}}\) refer to all control variables explained above, \(\varepsilon_{it}\) is the random disturbance term, and coefficients of the control variables \({{\varvec{\upgamma}}} = \left( {\gamma_{2} ,\gamma_{3} , \ldots ,\gamma_{9} ,\gamma_{10} ,\gamma_{11} } \right)\).

To consider both the spatial of spillover pollutants and the threshold effect of the theoretical analysis, the following threshold model with a spatial effect is constructed.

where \(u_{i}\) indicates the individual fixed effect, \({{\varvec{\upgamma}}}_{1} = \left( {\gamma_{2} ,\gamma_{3} , \ldots ,\gamma_{9} ,\gamma_{10} ,\gamma_{11} } \right)\), \({{\varvec{\upgamma}}}_{2} = \left( {\gamma^{\prime}_{2} ,\gamma^{\prime}_{3} , \ldots ,\gamma^{\prime}_{10} ,\gamma^{\prime}_{11} } \right)\).\({\text{I}}\left( \cdot \right)\) is a characteristic function. \({\text{I}}\left( \cdot \right) = 1\) if the conditions contained in parentheses are met. Otherwise, \({\text{I}}\left( \cdot \right) = 0\).

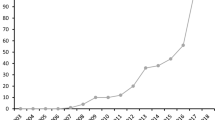

For the model (20), we use both the maximum likelihood estimate (MLE) and the particle swarm optimization (PSO) to obtain the estimation coefficient and finally applies the Bootstrapping to calculate the asymptotic distribution and the significance of the model statistics.

3.4 The setting of the spatial weight matrix

It is important to choose a suitable spatial matrix in our empirical study. Therefore, two commonly used spatial weight matrices, which can be based on boundaries or distances (Kelejian & Robinson, 1995), are used for empirical analysis. The first one is the spatial adjacency weight matrix. It can be defined that the element of the spatial weight matrix \(W_{ij}\) equal to one if two provinces share boundaries and zero otherwise, which is set as follows:

The second matrix is a distance-based spatial weight matrix, and the geometric centers of the provinces are represented by the coordinates of the provincial capitals. The arc distance between the provinces was calculated as \(d_{ij}\), and specify a threshold \(d^{\prime}\) to ensure at least 1 neighbor per province. That is if the arc distance between the provincial capitals is less than \(d^{\prime}\), it indicates that the two provinces are adjacent based on distance. And the specific setting method is represented as follows:

For the distance-based spatial weight matrices, the threshold value was set to 700 and 800 km, respectively. Because Xinjiang province has a vast territory and its geometric center is very apart from other provinces, we ensure that other provinces except Xinjiang have at least one neighbor, and the results do not affect the effectiveness of spatial analysis.

To more clearly characterize the spatial effects and test the robustness of the empirical results, we follow the common methods of empirical studies. We estimated separately using the above three matrices which are spatial adjacency weight matrix, a distance-based spatial weight matrix with thresholds of 700, and 800 km. In practice, \(W_{ij}\) is usually row normalized with the condition of \(\sum\nolimits_{j = 1}^{n} {W_{ij} } = 1,i = 1, \ldots ,n\).

4 Empirical results

4.1 Spatial correlation analysis of interprovincial pollutants in China

Since this paper studies spillover pollutants, we perform spatial correlation tests before performing spatial econometrics model estimates. Spatial correlation tests include the global and local spatial correlation tests, and the spatial econometrics models mostly choose the Moran's I index as the indicator of the correlation test of spatial factors.

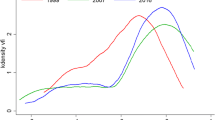

4.1.1 Global spatial correlation analysis

The spatial autocorrelation of spillover pollutants was tested using the Moran's I index, and the results are presented in Table 2. As can be seen from the results, we have 0 < Moran's I < 1 from 2007 to 2019, and most years passed the 1% significance test. Therefore, there are strong spatial positive correlations for the per capita sulfur dioxide emissions in all regions of China, indicating that pollutants have the characteristics of spatial aggregation. That is, areas with high pollution are also mainly distributed around areas with high pollution. Therefore, we estimate the relationship between tax competition and spillover pollutants using a spatial panel model.

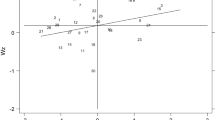

4.1.2 Local spatial correlation analysis

An analysis performed with the local Moran index is needed to further reveal the spatial autocorrelation of spillover pollutants between inter provinces. And the results are obtained by GeoDa software. As can be seen from the analysis of the local moran index, high-polluting cities are more likely to cluster together in northwest China. The reason is that the land in Xinjiang, Gansu, Qinghai, Ningxia, Shaanxi and other provinces is mostly Loess Plateau. The loose soil, arid climate, sediment flooding, mainly grassland and desert, sparse vegetation leads to water and soil loss. The environmental pollution in adjacent areas is easy to spread between the northwest regions, so high-polluting cities gather in these places. Low-polluting cities are more likely to cluster together in the southeast and southwest regions of China. The reason is that these areas have a large vegetation coverage rate and numerous rivers. On the one hand, it is easy to reduce environmental pollution. On the other hand, it can also block the spread of pollution in adjacent areas. Especially, most enterprises in southeast China belong to the knowledge sectors, and the environmental pollution generated is less.

4.2 Analysis of empirical results

4.2.1 Estimated results of the SDM

We perform Spatial Durbin Model (SDM) regression with panel data to investigate the impact of tax efforts on the national average environmental pollution. Table 3 provides the full sample estimation results using Eq. (19). Model 1–3 use the three spatial matrices described in the previous text for SDM regression, and the column Main and column Wx respectively represent the \(\beta_{1}\) and \(\beta_{11}\) of Eq. (19). Table 3 reveals that the tax competition has a significant spatial effect on sulfur dioxide emissions, so we further explore the intrinsic mechanism in the following models.

4.2.2 Estimated results of a threshold model and the SLTM

The theoretical analysis reveals that the government's attention to environmental protection plays a role in the threshold in the impact of tax competition on environmental pollution. In addition, the spatial correlation analysis of interprovincial pollutants analyzed above shows the strong correlation between the spillover pollutants and the geographical location. Therefore, we conduct a panel data spatial lagged threshold model (SLTM) with fixed effects using Eq. (20), whose results are presented in the column (1)–(3) of Table 4, respectively. Among them, TF(0) indicates the coefficient of the impact of tax competition on environmental pollution when the environmental investment is less than the threshold value; TF(1) indicates the coefficient of the impact of tax competition on environmental pollution when the environmental investment is greater than the threshold value. And we find that all the threshold variables pass the 1% significance test. Besides, the impact of tax competition on sulfur dioxide is significant when the environmental investment is greater than or less than the threshold value. One noticeable thing is that the threshold variable is the government's emphasis on the environment. When the local governments pay less attention to the environment, tax competition between regions has become fierce, resulting in more serious pollution or lax pollution treatment enterprises settled in the local area, which leads to increased environmental pollution eventually. On the other hand, when local governments attach more importance to the environment, the fierce tax competition can attract more enterprises in clean departments. For example, it can attract capital from finance, IT, and other departments. Meanwhile, the employees of these departments also have a stronger sense of environmental awareness. The local environment is optimized under the joint action of the government, enterprises, and citizens. This paper finds that industrial emissions of SO2 per capita have a strong spatial aggregation effect, indicating that local SO2 per capita will be influenced by SO2 per capita in neighboring areas and vice versa. Since SO2 and other gases have spillover properties, they will be geographically transferred to neighboring areas with atmospheric flow. More importantly, there is a herding effect of governmental behavior in neighboring areas. The importance of environmental protection by neighboring area governments will influence the level of concern for environmental protection by neighboring area governments. The herding effect among governments further strengthens (or weakens) regional environmental protection investment, so the aggregation effect of SO2 is stronger under the threshold of government environmental protection investment.

The column (1)–(3) of Table 4 present the results of data regression for 28 provinces with three different spatial weight matrices as the robustness test. The results show that both the spatial and threshold effects of tax efforts on per capita sulfur dioxide emissions are significant. More specifically, when the government environmental protection investment is less than 0.0278, a decline in tax competition is associated with 0.1398 increase in per capita sulfur dioxide emissions. However, when the government environmental protection investment is greater than 0.0278, a decline in tax competition is associated with 0.0133 decline in per capita sulfur dioxide emissions. As a result, the results of empirical tests are consistent with the theoretical analysis. The local government tax competition has a significant positive impact on environmental pollution when environmental protection expenditure accounts for a small proportion of fiscal expenditure. If the local government does not have a strong awareness of environmental protection, the self-healing ability of the local environment cannot immediately adapt to the increased pollution caused by the increasing pollution enterprises once the intensity of tax competition changes. And then, the environmental quality drops sharply. The tax competition of local government has a negative impact on environmental pollution when environmental expenditure accounts for a large proportion of fiscal expenditure. The positive impact of the strengthening of environmental regulation brought from tax competition on environmental optimization is greater than the negative impact of tax competition on the environment, so the environmental quality is improved.

4.3 Heterogeneity analysis

To further explore the relationship between tax competition and environmental pollution, we consider regional differences in the province sample and divides 28 provinces into three groups which are eastern, central, and western regions for heterogeneity analysis.Footnote 3 Table 5 reports the heterogeneity effects of tax efforts on sulfur dioxide in the eastern, central and western regions under spatial threshold regression in column (1), (2), (3) using SLTM regression, respectively.

The estimate result of the central and west region showed in Column (2) and (3) of Table 5 are in line with theoretical expectations. To be more specific, the spatial effect and threshold variables are both significant. Column (1) of Table 5 shows that local tax competition in the eastern region has a significant negative impact on environmental pollution. The environment is greatly affected by total import and export, urban population density, environmental regulation, industrial structure. What’s more, the eastern region has better environmental self-healing ability and a large number of firms belonging to technical cleaning departments. Due to the innovation of science and technology, the eastern coastal areas are being transferred to the non-material productive departments such as finance, catering, communication, education and public services. And the preferential tax benefits of local governments are also being transferred to the non-industrial production sector.

4.4 Robustness test

We adopt three ways to conduct the robustness tests. (1) The kind spatial weight matrixes may affect the estimation results, so we apply three spatial weight matrixes to the SLTM, and the results are shown in column (2)–(4) of Table 4. (2) We replace the explanatory variable with carbon emission intensity, which is showed in column (1) of Table 6 and find that the result is still robust. (3) The endogenous problem is discussed by introducing instrumental variables into the regression model, using the two-period variable of tax competition lag (lag2_TF) as the instrumental variable, and the two-stage least squares model estimation (2SLS/IV estimation), which can better solve the endogenous problem. Specifically, for lag2_TF, the endogenous variable—the current tax competition (TF) is related to it, but the variable that lags for two periods has occurred and does not directly affect the current enterprise value. Columns (2) and (3) of Table 6 show the results of Stage I and Stage II, respectively. The results of the first stage show that there is a significant positive correlation between the tax competition in the two lagging periods and the tax competition in the current period, and the F statistics in the first stage reject the weak instrumental variable hypothesis. Therefore, lag2_TF is a valid tool variable. The results of the second stage show that the threshold effect of tax competition on sulfur dioxide emissions does exist, and the conclusion is robust.

5 Conclusions and policy implications

We take the general equilibrium theory and economic growth theory as the main framework and construct an economic model considering the industry, tax competition, and environmental pollution. We know that the impact of tax competition on the environment has threshold characteristics based on government investment in environmental protection by solving the model. When the government invests in environmental protection is small, tax competition has a positive impact on environmental pollution; when the government invests a lot in environmental protection, tax competition has a negative impact on environmental pollution. The efficiency of tax collection is taken as the agent index of tax competition, and the proportion of environmental protection expenditure to government fiscal expenditure is taken as the agent index of government environmental protection investment on this basis. The threshold model with spatial effect is tested using 13 years of provincial government level data in 28 provinces in China. Our main empirical results suggest that environmental pollution is serious with the increase of tax competition when environmental protection expenditure is below the threshold; environmental pollution decreases and the environment is optimized with the fierce of tax competition when environmental protection expenditure is above the threshold. In addition, we find that spillover pollutants have an aggregation effect in spatial distribution. The environment around heavily polluted areas is also heavily polluted. Besides, China's local governments tend to choose lower environmental investment in fiscal spending. This phenomenon is even more pronounced in central and western China. The official promotion system, called the “promotion tournament model”, cannot maximize the social welfare that prefers consumption and a good environment. What’s more, the heterogeneity analysis based on the division of China shows that the impact of tax competition on environmental pollution varies from different regions. The effect of tax competition in the central region has a significant threshold effect with the opposite direction below and above the threshold. Tax competition in the eastern region has a significantly negative impact on environmental pollution. The effect of tax competition in the western region has a significant threshold effect with the same direction below and above the threshold.

Based on the findings of the previous theoretical and empirical studies, we make the following policy recommendations. Firstly, the results of the empirical study found that pollutants have significant spatial spillover effects, indicating that local governments should pay attention to the spatial correlation of ecological environment between regions, environmental governance should adhere to systemic thinking, and different regions should cooperate to formulate more scientific and reasonable tax policies to optimize environmental quality on the whole. Secondly, the evidence shows that when the proportion of environmental protection spending is high, tax competition is conducive to improving the regional environmental management capacity and citizens' awareness of environmental protection, thus improving environmental quality, and from the experience of developed countries, environmental protection investment can curb the trend of environmental pollution when the proportion of national income is between 1 and 1.5%, and it is possible to optimize the environment only when the proportion reaches 2–3%.Footnote 4 The local government should increase its environmental protection expenditure. Thirdly, from the perspective of the factors influencing regional environmental pollution, to improve the overall level of China's ecological environment, local governments should accelerate industrial transformation and upgrading, to continuously optimize the industrial structure, the introduction of advanced energy-saving technologies, improve the efficiency of energy use, increase investment in environmental management, industrial transformation and upgrading needs as a guide to further accelerate the development of productive services, thus forming a tax competition to promote environmental improvement. Fourthly, the central government should develop a reasonable and balanced fiscal transfer policy to ensure that regions have sufficient investment in environmental protection. The central government should do a good job of allocating tax sources to ensure that the economic development of the central and western regions does not lag too far behind that of the eastern regions and to avoid an extremely unbalanced economic geography nationwide. At the same time, it should make balanced transfer payments to ensure that the central and western regions are able to invest in ecological, environmental and social aspects, so as to stop the old way of “polluting first and treating later”. Fifthly, the central government should continue to implement the environmental performance assessment system and strengthen environmental regulation, improve the incentive and constraint mechanisms for local governments’ environmental governance, urge the implementation of local governments’ main responsibilities in environmental protection, and avoid local governments’ inaction and disorderly actions in treating environmental protection. At the same time, local governments should raise the environmental protection access threshold for heavy polluters in the process of attracting liquid capital, eliminate the possibility of introducing backward production capacity through tax competition, and maximize social welfare.

The limitation of this article is that the use of provincial data leads to a large amount of information being absorbed. In fact, there are many cities, counties, towns, and villages under each province, and the level of economic development, population size, and other factors vary greatly between different cities (counties, towns, and villages). Therefore, economic and geographical data of cities (counties, towns, and villages) can be used to conduct research in future studies, which may lead to more interesting conclusions.

Notes

Due to data availability, Hong Kong, Macau, Taiwan, and Tibet are not included in this paper. Also, Beijing and Shanghai are not included in this paper because of their special political and economic status, respectively.

According to the regulations of the National Bureau of Statistics, since 2007, the statistical scope of the industrial enterprises above designated scale is the industrial legal person enterprises with an annual main business income of 5 million yuan or above. In 2011, when approved by the State Council, the starting point standard was raised from 5 million yuan in the annual main business income to 20 million yuan.

9 eastern provinces: Tianjin, Hebei, Liaoning, Jiangsu, Zhejiang, Fujian, Shandong, Guangdong, and Hainan; 8 central provinces: Shanxi, Jilin, Heilongjiang, Anhui, Jiangxi, Henan, Hubei, Hunan; 11 western provinces: Inner Mongolia, Guangxi, Chongqing, Sichuan, Guizhou, Yunnan, Shaanxi, Gansu, Qinghai, Ningxia, Xinjiang.

January 23, 2019, China Environment News, Edition 03: Views.

References

Al-Mulali, U., Ozturk, I., & Lean, H. H. (2015). The influence of economic growth, urbanization, trade openness, financial development, and renewable energy on pollution in Europe. Natural Hazards, 79(1), 621–644.

Bai, J., Lu, J., & Li, S. (2019). Fiscal pressure, tax competition and environmental pollution. Environmental and Resource Economics, 73(2), 431–447.

Basinger, S. J., & Hallerberg, M. (2004). Remodeling the competition for capital: How domestic politics erases the race to the bottom. American Political Science Review, 98(2), 261–276.

Bergstrom, T., Blume, L., & Varian, H. (1986). On the private provision of public goods. Journal of Public Economics, 29(1), 25–49.

Berkhout, P. H., Ferrer-i-Carbonell, A., & Muskens, J. C. (2004). The ex post impact of an energy tax on household energy demand. Energy Economics, 26(3), 297–317.

Bierbrauer, F., Brett, C., & Weymark, J. A. (2013). Strategic nonlinear income tax competition with perfect labor mobility. Games and Economic Behavior, 82, 292–311.

Brock, W. A., & Xepapadeas, A. (2018). Modeling coupled climate, ecosystems, and economic systems. In Handbook of environmental economics (Vol. 4, pp. 1–60). Elsevier.

Cao, A., Han, B., & Qi, A. (2011). The policy research on the resource tax reform in China. China Population Resources and Environment, 21, 158–163. (In Chinese).

Chai, S., Zhang, K., Wei, W., Ma, W., & Abedin, M. Z. (2022). The impact of green credit policy on enterprises’ financing behavior: Evidence from Chinese heavily-polluting listed companies. Journal of Cleaner Production, 363, 132458.

Chen, Y., Li, H., & Zhou, L. A. (2005). Relative performance evaluation and the turnover of provincial leaders in China. Economics Letters, 88(3), 421–425.

Cohen, G., Jalles, J. T., Loungani, P., Marto, R., & Wang, G. (2019). Decoupling of emissions and GDP: Evidence from aggregate and provincial Chinese data. Energy Economics, 77, 105–118.

Copeland, B. R., & Taylor, M. S. (2004). Trade, growth, and the environment. Journal of Economic Literature, 42(1), 7–71.

Deng, H., Zheng, X., Huang, N., & Li, F. (2012). Strategic interaction in spending on environmental protection: Spatial evidence from Chinese cities. China & World Economy, 20(5), 103–120.

Deng, Y., You, D., & Wang, J. (2022). Research on the nonlinear mechanism underlying the effect of tax competition on green technology innovation—an analysis based on the dynamic spatial Durbin model and the threshold panel model. Resources Policy, 76, 102545.

Ding, C., & Lichtenberg, E. (2011). Land and urban economic growth in China. Journal of Regional Science, 51(2), 299–317.

Doğan, B., Chu, L. K., Ghosh, S., Truong, H. H. D., & Balsalobre-Lorente, D. (2022). How environmental taxes and carbon emissions are related in the G7 economies? Renewable Energy, 187, 645–656.

Eichner, T., & Pethig, R. (2018). Competition in emissions standards and capital taxes with local pollution. Regional Science and Urban Economics, 68, 191–203.

Ercolano, S., & Romano, O. (2018). Spending for the environment: General government expenditure trends in Europe. Social Indicators Research, 138(3), 1145–1169.

Fullerton, D., & Kim, S. R. (2008). Environmental investment and policy with distortionary taxes, and endogenous growth. Journal of Environmental Economics and Management, 56(2), 141–154.

Galinato, G. I., & Galinato, S. P. (2016). The effects of government spending on deforestation due to agricultural land expansion and CO2 related emissions. Ecological Economics, 122, 43–53.

Hadjiyiannis, C., Hatzipanayotou, P., & Michael, M. S. (2014). Cross-border pollution, public pollution abatement and capital tax competition. The Journal of International Trade & Economic Development, 23(2), 155–178.

Halkos, G. E., & Paizanos, E. Α. (2013). The effect of government expenditure on the environment: An empirical investigation. Ecological Economics, 91, 48–56.

Halkos, G. E., & Paizanos, E. Α. (2016). The effects of fiscal policy on CO2 emissions: Evidence from the USA. Energy Policy, 88, 317–328.

Hickel, J., & Kallis, G. (2020). Is green growth possible? New Political Economy, 25(4), 469–486.

Huang, J. T. (2018). Sulfur dioxide (SO2) emissions and government spending on environmental protection in China—evidence from spatial econometric analysis. Journal of Cleaner Production, 175, 431–441.

Huang, M. X., & Lin, S. F. (2013). Pollution damage, environmental management and sustainable economic growth——based on the analysis of five-department endogenous growth model. Economic Research Journal, 12, 30–41.

Huang, Z., & Du, X. (2017). Government intervention and land misallocation: Evidence from China. Cities, 60, 323–332.

Kelejian, H. H., & Robinson, D. P. (1995). Spatial correlation: a suggested alternative to the autoregressive model. New Directions in Spatial Econometrics, 75–95.

Li, K., Fang, L., & He, L. (2019). How population and energy price affect China’s environmental pollution? Energy Policy, 129, 386–396.

Li, X. J., & Zhao, N. (2017). How tax competition influences environmental pollution—an analysis from the pollutant properties of spillover. Financ. Trade Econ, 11, 131–146.

López, R., Galinato, G. I., & Islam, A. (2011). Fiscal spending and the environment: Theory and empirics. Journal of Environmental Economics and Management, 62(2), 180–198.

Lotz, J. R., & Morss, E. R. (1967). Measuring “tax effort” in developing countries. Staff Papers, 14(3), 478–499.

Ma, H. (2022). Chinese-style modernization and high-quality development of finance and taxation undertakings. Sub National Fiscal Research, 11, 4–9. (In Chinese).

Mao, J., Guo, Y., Cao, J., & Xu, J. (2022). Local government financing vehicle debt and environmental pollution control. Journal of Management World, (10), 96–118. https://doi.org/10.19744/j.cnki.11-1235/f.2022.0147. (In Chinese)

Mkandawire, T. (2010). On tax efforts and colonial heritage in Africa. The Journal of Development Studies, 46(10), 1647–1669.

Pal, R., & Saha, B. (2015). Pollution tax, partial privatization and environment. Resource and Energy Economics, 40, 19–35.

Pu, Z., & Fu, J. (2018). Economic growth, environmental sustainability and China mayors’ promotion. Journal of Cleaner Production, 172, 454–465.

Que, W., Zhang, Y., & Schulze, G. (2019). Is public spending behavior important for Chinese official promotion? Evidence from city-level. China Economic Review, 54, 403–417.

Romer, P. M. (1990). Endogenous technological change. Journal of political Economy, 98(5, Part 2), S71–S102.

Shao, L., Zhang, H., & Irfan, M. (2022). How public expenditure in recreational and cultural industry and socioeconomic status caused environmental sustainability in OECD countries? Economic Research-Ekonomska Istraživanja, 35(1), 4625–4642.

Shen, J., Wei, Y. D., & Yang, Z. (2017). The impact of environmental regulations on the location of pollution-intensive industries in China. Journal of Cleaner Production, 148, 785–794.

Solarin, S. A., Al-Mulali, U., Musah, I., & Ozturk, I. (2017). Investigating the pollution haven hypothesis in Ghana: An empirical investigation. Energy, 124, 706–719.

Song, Y., Zhang, Y., & Zhang, Y. (2022). Economic and environmental influences of resource tax: Firm-level evidence from China. Resources Policy, 77, 102751.

Sun, C., Zhang, F., & Xu, M. (2017). Investigation of pollution haven hypothesis for China: An ARDL approach with breakpoint unit root tests. Journal of Cleaner Production, 161, 153–164.

Sun, Y., Tang, Y., & Li, G. (2022). Economic growth targets and green total factor productivity: evidence from China. Journal of Environmental Planning and Management, 1–17.

Tang, L., Shi, J., Yu, L., & Bao, Q. (2017). Economic and environmental influences of coal resource tax in China: A dynamic computable general equilibrium approach. Resources, Conservation and Recycling, 117, 34–44.

Trianni, A., Cagno, E., & Worrell, E. (2013). Innovation and adoption of energy efficient technologies: An exploratory analysis of Italian primary metal manufacturing SMEs. Energy Policy, 61, 430–440.

Walter, I., & Ugelow, J. L. (1979). Environmental policies in developing countries. Ambio, 102–109.

Wang, S., Wang, X., & Chen, S. (2022). Global value chains and carbon emission reduction in developing countries: Does industrial upgrading matter? Environmental Impact Assessment Review, 97, 106895.

Wen, S., & Liu, X. (2019). Financial misallocation, pollution and sustainable growth. Research on Economics and Management, 40(03), 3–20.

Wissema, W., & Dellink, R. (2007). AGE analysis of the impact of a carbon energy tax on the Irish economy. Ecological Economics, 61(4), 671–683.

Wu, M., Cao, J., & Mao, J. (2022). Local public debt and enterprise total factor productivity: effect and mechanism. Economic Research Journal, (01), 107–121. (In Chinese)

Xu, X. (2011). Government’s decision and economic behaviors in resource tax reform. China Population, Resources and Environment, 21(05), 10–15.

Xu, S., Cheng, L., Chen, P., Liu, S., & Gao, J. (2020). Changes and optimization suggestions on the fiscal and tax policies of ecological environment in the 70 years. Chinese Journal of Environmental Management, 12(3), 32–39. (In Chinese).

Yu, D. H., & Sun, T. (2017). Environmental regulation, skill premium and international competitiveness of manufacturing industry. China Industrial Economics, 5, 35–53. (In Chinese).

Zhang, K., Xu, D., Li, S., Wu, T., & Cheng, J. (2021). Strategic interactions in environmental regSulation enforcement: Evidence from Chinese cities. Environmental Science and Pollution Research, 28(2), 1992–2006.

Zhang, M., Liu, X., Ding, Y., & Wang, W. (2019). How does environmental regulation affect haze pollution governance?—An empirical test based on Chinese provincial panel data. Science of the Total Environment, 695, 133905.

Zhang, Q., Zhang, S., Ding, Z., & Hao, Y. (2017). Does government expenditure affect environmental quality? Empirical evidence using Chinese city-level data. Journal of Cleaner Production, 161, 143–152.

Zhang, Z., Qian, D., Xue, Y., & Cai, L. (2013). Effects and mechanism of influence of China’s resource tax reform: A regional perspective. Energy Economics, 36, 676–685.

Zhou, L. (2007). Governing China’s local officials: An analysis of promotion tournament model. Economic Research Journal, 7, 36–50. (In Chinese).

Zodrow, G. R., & Mieszkowski, P. (1986). Pigou, Tiebout, property taxation, and the underprovision of local public goods. Journal of Urban Economics, 19(3), 356–370.

Acknowledgements

The work is supported by grants from the National Social Science Fund of China (Grant No. 22BTJ026), MOE (Ministry of Education in China) Project of Humanities and Social Sciences (Grant No.19YJC910002), Natural Science Foundation of Fujian Province in China (Grant No. 2020J01458, 2021J01113), Science and Technology Innovation Special Fund Project (Social Sciences) of Fujian Agricultural and Forestry University (CXZX2022026), Science and Technology Innovation Special Fund Project of Fujian Agricultural and Forestry University (KFb22106XA).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Li, K., Wen, J., Jiang, T. et al. How tax competition affects China’s environmental pollution?: A spatial econometric analysis. Environ Dev Sustain 26, 18535–18557 (2024). https://doi.org/10.1007/s10668-023-03402-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10668-023-03402-x