Abstract

We analyze optimal multi-species management in a dynamic bio-economic model taking into account both harvesting profit and biodiversity value. Within an analytical model, we show that extinction is never optimal when a global biodiversity value is taken into account. Moreover, a stronger preference for species diversity leads to a more even distribution of stock sizes in the optimal steady state, and a higher value of biodiversity increases steady state stock sizes for all species when species are ecologically independent or symbiotic. For a predator–prey ecosystem, the effects may be positive or negative depending on relative prices and the strength of species interaction. The analytical results are illustrated and extended using an age-structured three-species predator–prey model for the Baltic cod, sprat, and herring fisheries. In this quantitative application, we find that using stock biomass or stock numbers as abundance indicators in the biodiversity index may lead to opposite results.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Ecosystems, in particular the oceans, provide a wide range of goods and services directly supporting human societies and economies. But in spite of heightened awareness, “the ocean remains chronically undervalued, poorly managed and inadequately governed” (GOC 2014). Similar concerns apply for other types of ecosystems. Conflicting interests between short-term economic uses and conservation continue to cause their over-use and degradation (Kumar 2010; Millennium Ecosystem Assessment 2005; Stavins 2011). In particular, current ocean governance arrangements do not ensure sufficient protection of marine biodiversity, and they do not foster the sustainable use of marine living resources (Visbeck et al. 2014).

Fisheries management has to some extent reacted to these developments by adopting the goal of employing ecosystem-based approaches. This implies that not only economic profits should be maximized but that conservation goals also need to be taken into account (Pikitch et al. 2004). Consequently, bio-economic models, which can be used to derive recommendations for fisheries management, should not only include multiple species but also multiple values. Against this background, we reconsider optimal multi-species management in a bio-economic model taking into account both harvesting profit and biodiversity value. More specifically, we analyze how optimal management decisions change when a biodiversity index is introduced in the objective function of a bio-economic dynamic optimization model to capture the value of biodiversity.

There may be two different reasons for introducing biodiversity into such a model. One is to use a biodiversity value as a place holder for ecosystem services that are not explicitly modeled via ecological interactions in a bio-economic model. The unit value of biodiversity could thus also be interpreted as a proxy for the value of some external effects that are too complex to be integrated explicitly in the model. Such an approach would emphasize the extrinsic value of biodiversity to humans. A second approach is to base the consideration of a biodiversity value on ethical arguments about the intrinsic value of nature, so that biodiversity should be conserved for its own sake (Weitzman 2014), or to attach a value to in-situ stocks of species simply for their existence (Bulte and van Kooten 2000; Eichner and Tschirhart 2007). In this case, the unit value of biodiversity could thus be interpreted as a social willingness-to-pay for species conservation. In our application, this value would not be attributed to a single species but to the entire state of the multi-species ecosystem reflected by a biodiversity index.

In this paper, we explicitly model (provisioning) ecosystem services directly in terms of harvesting benefits. An extrinsic value of biodiversity is thus included by the explicit modeling of species interactions rather than using a biodiversity index as a proxy. In addition, we capture the non-use value of biodiversity. This may be a social benefit due to the compliance with ethical considerations, or a benefit derived from the knowledge that the ecosystem exists in a diverse form, including all species. Therefore, our model includes a biodiversity measure that can be used to track changes in biodiversity over time.

The literature on renewable resources and bio-economic modeling has dealt with the inclusion of existence values before but mostly considers single-species models. For example, Alexander (2000) includes existence values in a one-species model and derives implications for the potential optimality of extinction. More recent papers also include existence values in multi-species models. Kellner et al. (2010) introduce an existence value for each single species in a multi-species predator–prey model but they do not aggregate the values into one index. Voss et al. (2014b) also consider a multi-species predator–prey model, but the existence value they introduce only applies to one stock. With a slightly different focus, Quaas and Requate (2013) include a constant elasticity of substitution (CES) function in a bio-economic model, but preferences for diversity are attached to the consumption of fish, not to the biodiversity of the ecosystem. Finally, Noack et al. (2010) use a biodiversity index similar to the one we are using in this paper, but they do not consider the context of fisheries management and, more importantly, do not investigate the effects of the introduction of this index on the single species stocks captured by the index.

Since multi-species applications are increasingly prominent in bio-economic modeling and biodiversity conservation is high on the international political agenda, it is important to investigate the properties of a bio-economic model when an aggregate biodiversity index based on species abundances is included to capture biodiversity values. Buckland et al. (2005) state axioms which an index based on species abundances should fulfill if it was used for monitoring biodiversity developments over time. These axioms include the requirement that the index value should decrease if overall abundance is decreasing while the number of species as well as species evenness stay constant. Prominent ecological indices such as the Simpson-Index or the Shannon-Index do not fulfill this axiom. Here, we consider the class of CES-functions to aggregate single stocks into one index. CES-functions fulfill the axioms stated in Buckland et al. (2005)Footnote 1 and thus seem well-suited to track biodiversity developments over time. Moreover, the class of CES-functions is a frequently used and well-studied specification to describe production processes or consumer preferences in economics (Arrow et al. 1961; Dixit and Stiglitz 1977).

We explore the effects of introducing such an index in a multi-species model of a harvested ecosystem on the optimal steady state, which has, to our knowledge, not been investigated before. In addition, we exemplify the effects in a more complex age-structured model applied to the example of a predator–prey system of three Baltic Sea fish species (cod, sprat, and herring). The age-structured framework enables us to study the effects of switching from an index calculated using biomasses to an index calculated using the number of individuals. We also illustrate the role of the elasticity of substitution for optimal management. We find that both aspects of the biodiversity index crucially influence optimal management, which has important implications for actual management decisions when biodiversity indices are applied.

The remainder of the paper is structured as follows: Sect. 2 presents a generalized framework for abundance-based biodiversity indices and compares our approach to other approaches that have been used in the ecological and economic literature. Section 3 presents a dynamic biomass model and compares optimal multi-species management without biodiversity value to optimal multi-species management with biodiversity value. We analytically show the effects of changes in the unit value of biodiversity, in market prices, and in the elasticity of substitution between species in the biodiversity index on optimal steady state stocks for different kinds of ecological interactions. Section 4 introduces an age-structured model and simulates the effects of changing the unit value of biodiversity and of changing the elasticity of substitution on steady state stocks, profits, and biodiversity levels for the example of a three-species predator–prey ecosystem in the Baltic Sea. We also compare the effects when switching from a biodiversity index using biomass to an index using the number of individuals. Section 5 discusses the results and concludes.

2 Measuring Biodiversity

One of the most established ways to measure species-level biodiversity is to calculate a diversity index based on individual species abundances.Footnote 2 The elements that influence such a biodiversity index are the number of different species (species richness), and the evenness in the distribution of species abundances. A large number of such indices exist, and they are widely used in ecology to measure species-level biodiversity (Magurran 2004). Buckland et al. (2005) explore the characteristics of such indices when measuring changes in biodiversity over time. They note that species abundance can be measured either in terms of biomass or in terms of the number of individuals to compute these indices. Different weightings for different species are also possible. They also state axioms which a biodiversity index should fulfill if it was used for monitoring biodiversity over time. These axioms are:Footnote 3

1. For a system that has a constant number of species, overall abundance and species evenness, but with varying abundance of individual species, the index should show no trend.

2. If overall abundance is decreasing, but number of species and species evenness are constant, the index should decrease.

3. If species evenness is decreasing, but number of species and overall abundance are constant, the index should decrease.

4. If number of species is decreasing, but overall abundance and species evenness are constant, the index should decrease.

The axioms of Buckland et al. (2005) are thus based on three factors that characterize an ecosystem: i) the number of different species, for which we use the symbol n, ii) overall species abundance, for which we use \(A_t\), and iii) species evenness, for which we use \(E_t\). In the following, we propose a generalized framework to be able to compare the different biodiversity indices used in the ecological and economic literature with each other and with the approach used in this paper. To be more specific about the three factors used by Buckland et al. (2005), we use \(x_{it}\) to denote the absolute abundance of species \(i=1,\ldots ,n\) at time t. Consequently, overall abundance, \(A_t\), at time t is given by:

There are many alternative ways to measure species evenness. Here we use a measure based on the inequality measure by Atkinson (1970, p. 257), which we extend by introducing weighting factors \(w_i\):

The parameter \(\omega \) measures the degree to which individual species can be substitutes for one another. Put differently, \(1/\omega \) is a measure of the degree of inequality aversion between the species (Atkinson 1970, p. 257), or, in more simple terms, \(1/\omega \) measures the preference for species evenness.

We propose to use a power function of the weighted geometric mean of overall abundance, \(A_t\), and species evenness, \(E_t\), to obtain a generalized biodiversity index, \(B_t\):

with weighting parameter \(0\le \alpha <1\) and a real-valued scaling parameter \(\beta \) that is needed to make the various existing biodiversity indices comparable. Several of the most commonly used biodiversity indices can be obtained by specifying values for the parameters \(\alpha \) and \(\beta \) in (3) and for the parameters \(w_i\) and \(\omega \) in the measure for species evenness (2). Table 1 provides an overview of important biodiversity indices used in the ecological and economic literature and how they relate to the generalized form presented in equation (3).

Ecological biodiversity indices such as the Simpson-Index (Simpson 1949) and the Shannon-Index (Shannon 1948a, b) are constructed using information on relative abundances only. In the context of the above generalized index, this implies that the weight they put on absolute species abundances is zero, \(\alpha =0\). In addition, they apply equal weights to the species such that \(w_i = 1\). The Simpson-Index and the Shannon-Index are then obtained by specifying the values for \(\omega \) and \(\beta \) as indicated in Table 1. For our application, it is important to note that these indices, which are based only on relative species abundances, violate Axiom 2 of Buckland et al. (2005)—they remain constant if overall abundance is decreasing while the number of species and species evenness are constant. Thus, they do not allow a consistent comparison of biodiversity levels over time.

In the economic application of Kellner et al. (2010), non-fishing values are modeled such that overall species abundance and species evenness are each weighted equally, \(\alpha =1-\alpha = 1/2\). In addition, the parametric specification of Kellner et al. (2010) implies that the index is a CES-function over the individual species abundances, with the special case that an elasticity of substitution of \(\omega =2\) is considered.

Before we turn to the specification considered in this paper, we shall briefly point out the relationship between (3) and the naturalness-index introduced by Eichner and Tschirhart (2007). The naturalness-index does not intent to measure biodiversity, and thus it follows a slightly different logic than the indices presented above. It is based on divergences from natural population levels rather than on a measure of species evenness. To be able to capture this index by the generalized form given in equation (3), the evenness index \(E_t\) in (3) would have to be replaced by

where \({\hat{x}}_i\) denotes the natural reference population level of species i in absolute terms. Using the index \(E_t^N\) instead of species evenness \(E_t\) in (3) and specifying parameter values \(\alpha = 1/2,\; w_i = {\varphi ^2}/{\hat{x}_{it}^2},\; \omega = -1,\) and \(\beta = 2\), one obtains the naturalness index

proposed by Eichner and Tschirhart (2007).

In this paper, we aim at studying how taking into account a biodiversity value changes optimal management of a multi-species ecosystem. Thus, we use the standard approach and consider species evenness as the goal to be considered in the biodiversity index (3). We follow Kellner et al. (2010) and propose to use equal weights for overall abundance and species evenness, and thus to set \(\alpha =1/2\) as well as \(\beta =2\), such that the biodiversity index becomes the product of \(A_t\) and \(E_t\). Further, we follow the biological literature and assign equal weights to all species, \(w_i=1/n\) for all i. Allowing the preference for species evenness to change, the biodiversity index used in this paper is

The index (4) satisfies the following conditions (using subscripts to denote partial derivatives with respect to the corresponding variables):

The functional form (4) with a constant elasticity of substitution, \(\omega \), does not only fulfill the axiomatic conditions specified in Buckland et al. (2005) for functions that can be used to measure and compare biodiversity levels over time; it is also a common form for production functions (Arrow et al. 1961) or utility functions (Dixit and Stiglitz 1977) in economics and resource economics (Quaas and Requate 2013). In economic terms, the parameter \(\omega > 0\) measures the elasticity of substitution between the stocks of the n species. For \(\omega \rightarrow 0\), the elasticity of substitution would be zero and the stocks would be perfect complements. For \(\omega \rightarrow \infty \), the elasticity of substitution would be infinitely large and the stocks would be perfect substitutes. The index (4) may also be interpreted as a generalized mean of species abundances. For \(\omega \rightarrow \infty \), the index (4) simply gives the arithmetic mean of species. For \(\omega \rightarrow 1\), the index (4) becomes the geometric mean of species abundances.

The axioms stated in Buckland et al. (2005) do not restrict the functional forms of potential biodiversity indices regarding the structure of the exponent outside the parentheses in (4). Any monotone transformation of the CES-function in (4) would fulfill the axioms as well. Here, we assume a structure of the exponent such that the resulting index is linear homogeneous. This is different from the structural form of the exponent used in the ecological indices that are based on relative abundances. Our specification implies that the index value is measured in terms of species abundances, just as the individual stock sizes, \(x_i\), which alleviates the interpretation of the index.

Regarding the role of the elasticity of substitution, \(\omega \), note that the value of the biodiversity index, \(B_t\), ceteris paribus increases as \(\omega \) increases. Only for equal abundances of all stocks, the value of \(B_t\) is not affected by a change in \(\omega \). For the case of complements, \( \omega < 1\), the biodiversity index, \(B_t\), approaches zero if the stock \(x_i\) of any species i, is driven towards zero. The marginal biodiversity values, \(B_{x_j}\), of the other species \(j\ne i\) also go to zero if \(x_i \rightarrow 0\). Substituting a species stock, \(x_i\), by another stock, \(x_j\), thus becomes less acceptable, the smaller the stock of species i already is. For the case \(\omega >1\), substitution between the species is more easily possible, i.e., the biodiversity index would continuously increase with an increasing stock of at least one species even if all other species are driven towards zero or go extinct. More formally, for \(x_i\rightarrow 0\) both \(B_t\) and \(B_{x_j}\), \(j\ne i\) with \(x_j>0\), are finite and stay positive.

Note, however, that for the case \(\omega \le 1\), Axiom 4 cannot be applied because in this case the index is defined only for a constant number of species and not defined if the abundance of any one species becomes zero. Considering the different species as complements, \(\omega \le 1\), is thus only reasonable for issues where species extinction is out of scope, such as the three-species fishery in the Baltic Sea, considered in Sect. 4.3 below. Consequently, for biodiversity considerations where species richness can vary, an index of the form (4) can be applied under the restriction that different species are substitutes, i.e., under the assumption \(\omega >1\). As a varying species diversity is of particular relevance at the global level, we refer to this case as ‘global’ biodiversity value.

Also note that in all cases, the weight of the abundances of the single species in the CES-function (1 / n) needs to be determined once, based on the initial number of species, and may not be changed afterwards, even if the number of species changes, e.g., due to extinction. Changing the weight when measuring biodiversity over time would violate Axiom 4 from Buckland et al. (2005).

3 Dynamic Model of Optimal Multi-species Ecosystem Management

3.1 Model Framework and Optimal Management

In this section, we introduce an analytical biomass model and compare optimal management solutions with biodiversity value to optimal management solutions without biodiversity value. Section 3.2 presents comparative static effects of parameter changes on optimal steady states, differentiating between cases with and without ecological interactions. We use a general set-up with n species and possible ecological interactions. In addition, we use the CES-function (4) aggregating the biomasses of the different species to capture the value of biodiversity in the objective function.

3.1.1 Species Dynamics

There are n species (\(i=1,\ldots ,n\)). The dynamics of each stock \(x_{it}\) are determined by its natural growth, \(G_{it}\), and the biomass harvested, \(h_{it}\), at time t:

We assume perfectly selective harvesting, i.e., harvest of species i does not directly affect the dynamics of any other resource stock \(j\ne i\).Footnote 4 Species may interact ecologically, which is captured by the dependency of species i’s growth function \(G_{it}(\cdot )\) on the other species’ stock sizes \(x_j\). For some parts of the analysis, however, we will reduce the complexity of the model by assuming that species are ecologically independent, i.e., we impose the assumption that all species \(i=1,\ldots ,n\) are ecologically independent:

Time subscripts are dropped for notational clarity from now on unless needed to avoid confusion. Furthermore, we use the vector notation \(\mathbf x \equiv (x_1,\ldots ,x_n)\) and \(\mathbf h \equiv (h_1,\ldots ,h_n)\).

3.1.2 Objective Function

We now consider socially optimal multi-species management. An ecosystem manager simultaneously chooses harvest quantities for all species over time such that the present value of benefits, i.e., the sum of net benefits from harvest plus biodiversity value, is maximized:

subject to the stock growth equations (6) and given the initial stock sizes \(x_{i0}\) for all species i. Here, we use \(\rho \) to denote the social discount rate and \(\Pi (\mathbf h ,\mathbf x )\) to denote the economic net benefit derived from harvesting the multi-species ecosystem at time t. The net benefit per species, \(\Pi _i\), is composed of a fixed price, \(p_i\), multiplied with harvested biomass, \(h_i\), minus possibly stock-dependent harvesting costs, \(C_{i}(x_i,h_i)\) with \(C_{ih_i} >0 \) and \(C_{ix_i}<0\). The parameter v measures the unit value of biodiversity relative to harvest benefits in the objective function.

A couple of remarks are in place to discuss the meaning of using the biodiversity index (4) in the objective function (7). Firstly, we interprete the parameter v as the unit value of biodiversity. It converts biodiversity into monetary units. As Eq. (4) is linear homogeneous, biodiversity is measured in units of species abundance. Thus, v is measured in monetary units per species abundance (euros per ton of biomass, for example). As discussed above, however, the value of the biodiversity index (4) changes with \(\omega \). Thus, when a biodiversity index (4) is applied, it has to be kept in mind that v has to be adjusted when using different values of \(\omega \) in the objective function. In other words, the parametrization of \(B(\mathbf x )\) implies that the biodiversity index assumes a certain value, say \(\bar{B}\), for a given value of \(\omega \) and given stock sizes. If stock sizes stay constant but \(\omega \) decreases, for example, the value of the biodiversity index \(B(\mathbf x )\) also decreases. Thus, v has to be adjusted upwards to keep the value of \(vB(\mathbf x )\) constant in the objective function if a different value is assumed for \(\omega \).

Secondly, the assumption of linear homogeneity of the biodiversity index (4) carries economic meaning. Specifically, the particular specification of the exponent outside the parentheses in (4) becomes important because it determines (a) the elasticity of intertemporal substitution between the abundances of species, and (b) the elasticity of substitution between biodiversity and (monetary) income. In both respects, more general specifications of biodiversity are conceivable, but we think that the linear homogeneous index (4) is a simple and appealing specification. Thus we focus on analyzing the implications of using this particular index in the objective function (7).

Thirdly, using a CES-function to aggregate the stocks implies that the marginal biodiversity value of one species depends not only on the own stock but also on the stocks of the other species. This introduces an interdependency between the species on the management side. Hence, species have to be managed jointly even in a case where species are modeled as ecologically independent, i.e., when Assumption A.1 holds. This is in contrast to Kellner et al. (2010), where marginal biodiversity or non-fishing values are non-linear but only depend on the own resource stock. See Sects. 3.1.4 and 3.1.5 for a detailed discussion of the resulting implications.

3.1.3 Necessary First Order Conditions and Optimal Steady State

To derive the conditions for optimal multi-species management, we consider the current-value Hamiltonian

Applying the maximum principle, the necessary conditions for optimal management are

with \(\lambda _i,h_i,x_i\ge 0\), initial stock sizes given, and transversality conditions for all \(i=1,\ldots ,n\). The first condition (9a) states that the marginal net benefit of harvesting species i should equal the marginal opportunity costs of reducing stock i, captured by the shadow price of this stock, \(\lambda _i\). This shadow price is determined by condition (9b). We will have a closer look at the different terms in that condition when discussing the optimal steady state, i.e., the long-run optimal stock sizes and harvest levels for the multi-species ecosystem in Sect. 3.1.4. The steady state conditions are obtained by using (9a) and the conditions \(\dot{x_i}=0\) in (6) and \(\dot{\lambda }_i=0\) in (9b):

both for all \(i=1,\ldots ,n\).

When taking species interactions into account, corner solutions to the dynamic optimization problem (7) may become possible. Here we focus on interior solutions described by the necessary conditions (9). To this end, we assume that species interactions are such that the maximized Hamiltonian is concave in the stock variables, i.e., the sufficiency conditions for the dynamic optimization problem are fulfilled (Arrow and Kurz 1970). We discuss this assumption in “Appendix 1”.

Condition (10b) states that in the optimal steady state the social discount rate, \(\rho \), has to equal the interest rate earned on a marginal increase of each stock \(x_i\). In the general case considered here, this own interest rate is determined by the marginal stock growth of the species itself, the marginal increase of stock growth of all other species \(j\ne i\), the value of the marginal stock effect reducing future harvesting costs, and the marginal contribution to biodiversity value.

3.1.4 Optimal Steady State Solutions for Different Cases of Ecological Interaction and Fishery Structure

To shed some light on the implications of (10b) for optimal steady state solutions, consider the case of ecologically independent species, i.e., impose Assumption A.1. In this case, the second term on the right-hand side (RHS) of (10b) would vanish. Note that even in this case the RHS of Eq. (10b) does not only depend on the stock of species i but also on the stocks of the other species \(j \ne i\) if biodiversity values are considered in addition to harvesting values, i.e., if \(v>0\). Thus, the biodiversity value modeled as a CES-function introduces an interdependency in steady state conditions even if the species are modeled as ecologically independent. It tends to balance steady state stocks and to reduce one-sided stock concentrations.

We argue that this interdependency on the management side is sensible given that so far only the most important, direct interactions between marine species can be explicitly accounted for in bio-economic models such as predator–prey relationships or competition for food, and not all interrelationships are known. This holds particularly for the role of species for ecosystem functioning and regulation (Rockström et al. 2009). It thus seems sensible to consider the whole ecosystem also when determining optimal stock levels for single species.

If, in addition to ecological independence, the economic benefits of harvest were independent of stock size, \(\Pi _{x_i}=0\), and if there was no biodiversity value, \(v=0\), the optimal steady state stock sizes would be below the maximum-sustainable-yield (MSY) stock sizes, \(x_{i,\text {MSY}}\), defined by \(G_{ix_i}(x_{i,\text {MSY}})=0\) for all species i. This is a well-known result of discounting at a positive rate \(\rho >0\). The two effects of stock-dependent harvesting costs, \(\Pi _{x_i}>0\), and of biodiversity value, \(v>0\), both tend to increase optimal steady state stock sizes. If these effects are strong enough, the optimal steady state stock sizes in absence of biological interactions will all be larger than \(x_{i,\text {MSY}}\). Thus, taking into account biodiversity values with a positive weight, \(v >0\), has a similar effect to introducing stock-dependent harvesting costs and implies a positive differential between \(\rho \) and \(G_{i\bar{x}_i}\), i.e., \(\rho > G_{i\bar{x}_i}\) in optimal steady state with \(v>0\).

This result still holds in the case of ecological interactions, i.e., if Assumption A.1 does no longer hold, as long as all other species j depend positively on the stock of species i, i.e., \(G_{j\bar{x}_i}>0\) for all \(j \ne i\). This would imply that there is an additional positive external effect of the stock \(x_i\). Negative ecological interactions, i.e., \(G_{j\bar{x}_i}<0\), can induce a negative differential between \(\rho \) and \(G_{i\bar{x}_i}\), which would imply that steady state stocks of species i are lower. Brown et al. (2005) analyze this effect in a predator–prey model without biodiversity values.

Slightly rearranging (10b), multiplying with \(x_i\) and summing over all species i leads to the following condition:

The RHS of equation (11) is the weighted value of biodiversity in steady state, i.e., the total biodiversity value attached to aggregate steady state stock levels. The LHS of equation (11) represents the opportunity costs connected to introducing biodiversity values and increasing steady state stock levels such that a higher share of fish remains unfished. These opportunity costs are given by the sum of the economic net benefits of each steady state stock multiplied with the differential between the social discount rate and the marginal growth rate, but they are reduced by the positive effect of larger stocks on harvesting costs and further affected by the effect of increased stock sizes of species i on the other species due to ecological interdependencies.

3.1.5 Implications for the Optimality of Extinction

To proceed with the theoretical analysis, we focus on the effect of the biodiversity value and simplify the analysis by neglecting harvesting costs, i.e., we impose the following assumption:

It has been shown in the literature that extinction can be optimal under certain circumstances. More specifically, for the case without biodiversity value, \(v=0\), and in the case of ecologically independent species (Assumption A.1 holds), extinction may be optimal for species with \(G_{ix_i}(0) \le \rho \) (Clark 1973).

Proposition 1

Under Assumptions A.1 and A.2, and if \(1<\omega <\infty \) and \(v>0\) hold, extinction is never optimal, i.e., \(x_i>0\) for all \(i=1,\ldots ,n\).

Proof

Under the given assumptions, the condition for the optimal steady state simplifies to

for all \(i=1,\ldots ,n\). Here,

For \(x_i \rightarrow 0\) and \(1<\omega <\infty \), \(B_{x_i}\) diverges to infinity. Thus, the RHS of Eq. (12) diverges to infinity while the LHS of Eq. (12) is positive but finite. Equation (12) will thus never be balanced for \(x_i\rightarrow 0\). \(\square \)

Thus, extinction is never optimal when a biodiversity value specified as above is part of the objective function, and for \(1<\omega <\infty \), i.e., the specification of the biodiversity index that is applicable with a changing number of species. The reason for this result is that the marginal biodiversity value, \(B_{x_i}\), diverges to infinity in this case if the stock \(x_i\) approaches zero. For the case \(\omega <1\), Proposition 1 makes no statement. The reason is that for this case, the marginal biodiversity value, \(B_{x_i}\), is bounded from above if the stock \(x_i\) approaches zero since the CES-function (4) does not fulfill the corresponding Inada condition.

Extinction can, however, be optimal if the elasticity of substitution is infinitely large, i.e., in the case of perfect substitutes, \(\omega =\infty \), but only for a species with \(G_{ix_i}(0)<\rho -\frac{v\,n}{p_i}\). This implies that extinction can only be optimal in the case of perfect substitutes when the intrinsic growth rate is sufficiently small. Note that given that v, n, and \(p_i\) are all positive, extinction in the case with biodiversity value is ceteris paribus optimal at lower levels of intrinsic growth rates than in the case without biodiversity value.

3.2 Effects of Parameter Changes on Optimal Management

In this section, we analyze how changes in the unit value of biodiversity, v, the market prices of the different species, \(p_i\), and the elasticity of substitution, \(\omega \), influence optimal steady state solutions. We discuss the results for different cases of ecological interactions, i.e., case i) for ecologically independent species (Assumption A.1 holds), case ii) for a symbiotic system, \(G_{ix_j}>0\) for \(i\ne j\), case iii) for a competitive system, \(G_{ix_j}<0\) for \(i\ne j\), and case iv) for a predator–prey system, \(G_{1x_2}>0\) and \(G_{2x_1}<0\) or the other way around. In all cases, we assume that there are no harvesting costs, i.e., Assumption A.2 holds, and we reduce complexity by considering a two-species ecosystem.

3.2.1 Comparative Statics with Respect to the Unit Value of Biodiversity

We now analyze how changes in the unit value of biodiversity, v, influence optimal steady state stocks in a two-species ecosystem. Under Assumption A.2, but with ecological interactions, we derive the following conditions:

The derivation and the definition of \(\Delta \) is contained in “Appendix 2”. As, by assumption, the sufficient conditions for optimality are met, it follows that \(\Delta >0\). The signs of the comparative static effects of a change in the unit value of biodiversity, v, on the optimal steady state stock sizes depend on the types of ecological interactions (cases i-iv) and, in case iii) of competition, or case iv) of a predator–prey relationship, also on output prices and the marginal value of biodiversity. Only for case i) of ecologically independent species or case ii) of a symbiotic relationship, the sign is unambiguous, as stated in the following proposition.

Proposition 2

The optimal steady state stocks \(\bar{x}_i\) of species \(i=1,2\), increase with v,

if i) species j and i are ecologically independent, i.e., if \(G_{i\bar{x}_i\bar{x}_j}=0\), or if ii.) species i and j have a symbiotic relationship, i.e., if \(G_{i\bar{x}_j \bar{x}_i}>0 \;\; \forall \;\; i,j \;\; \text {with} \;\; i\ne \, j\).

Proof

See “Appendix 3”. \(\square \)

We shall briefly discuss all possible cases of ecological relationships between the two species.

Case i) In the case of ecologically independent species, the term \(p_1\,G_{1\bar{x}_1\bar{x}_2}+p_2\,G_{2\bar{x}_1\bar{x}_2}\) vanishes such that the effect of v on steady state stocks can be directly and unambiguously determined.

Case ii) In the case of symbiosis, the term \(p_1\,G_{1\bar{x}_1\bar{x}_2}+p_2\,G_{2\bar{x}_1\bar{x}_2}\) is unambiguously positive such that the RHS of (13) and (14) are positive, and the effect of v on steady state stocks can be unambiguously determined.

Case iii) In a competitive ecosystem, the effect of v on both steady state stocks is ambiguous as \(p_1\,G_{1\bar{x}_1\bar{x}_2}+p_2\,G_{2\bar{x}_1\bar{x}_2}<0\).

Case iv) In a predator–prey system, the sign of \(p_1\,G_{1\bar{x}_1\bar{x}_2}+p_2\,G_{2\bar{x}_1\bar{x}_2}\) is ambiguous and depends on the relative prices and the predation relationship between the species.

Consider the example of a Lotka-Volterra predator–prey relationship such that the term modifies to \(p_1\,d_1+p_2\,d_2\), with constants \(d_1\) and \(d_2\). Assume without loss of generality that species 1 is the prey (\(d_1<0\)) and species 2 is the predator (\(d_2>0\)). Now, the term \(p_1\,d_1+p_2\,d_2\) would only be positive if the predator is an “efficient converter of biomass in terms of value” (Hannesson 1983, p. 341). This is the case if the predator is sufficiently more valuable than the prey, \(p_2>(-d_1/d_2)\,p_1\), or if the predation coefficient \(d_2\) is sufficiently larger than \(d_1\) in absolute terms, \(d_2>(-p_1/p_2)\,d_1\), In this case, again, the effect of v on both predator and prey stocks would be positive in steady state.

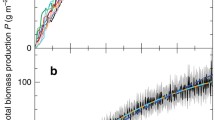

The effect of biodiversity considerations in a predator–prey model for an “efficient predator”. Solid red curves show condition (10b) for the prey (\(i=1\)), dotted blue curves for the predator (\(i=2\)). Biological parameter values are taken from Hannesson (1983): \(r_1=0\); \(r_2=0\); \(d_1=-0.05\); \(d_2=0.01\). Furthermore, \(p=10\); \(\rho =0.25\); \(\omega =2\). The unit value of biodiversity is \(v=0\) in the top left graph; \(v=0.1\) in the top right graph; \(v=1.0\) in the bottom left graph and \(v=2.5\) in the bottom right graph

In order to illustrate the effect of the biodiversity index on the optimal steady state for the case of predator–prey interactions, consider the phase diagrams in Fig. 1. These diagrams show the state space of the two-species predator–prey system, with the stock of the prey on the horizontal and the stock of the predator on the vertical axis. The solid (red) curve shows the nullcline for the dynamics of the prey stock under optimal management, as characterized by conditions (9) and the stock dynamics (6). If the prey stock, given a particular stock of the predator, is larger (smaller) than the size indicated by that line, it is optimal to change harvest such that the stock is reduced (increased), as indicated by the arrows. In a similar fashion, the dotted (blue) curve shows the nullcline for the dynamics of the predator stock under optimal dynamics, with optimal dynamics indicated by the arrows.

We are considering a case where, without taking a biodiversity value into account, it would be optimal to eliminate the predator because of the large discount rate (graph on the top left in Fig. 1; Hannesson 1983, p. 341). Even with a tiny unit value of biodiversity, \(v=0.1\), the optimal steady state is at a small but strictly positive stock size for the predator (graph on the top right). This shows that the result from Proposition 1 holds true also in this example with predator–prey species interaction. With a higher unit value of biodiversity (graph on the bottom left), the optimal steady state stock sizes of both species increase compared to the case with a smaller v.

If the unit value of biodiversity becomes very large, the optimal steady state is at the “border” of the phase diagram, which is determined by the condition that the harvest of the prey may not become negative. The corresponding limit to the steady state stock sizes of the prey species is depicted as the dotted straight line \(h_1=0\) in the bottom right graph of Fig. 1. If the unit value of biodiversity, v, would be further increased, the optimal steady state predator stock would further increase, but the optimal steady state stock of the—relatively abundant–prey species would decrease. As the arrows indicate, the optimal steady state is unique and globally stable in all cases considered.

3.2.2 Comparative Statics with Respect to Output Prices

We now analyze how changes in the market prices of the two species, \(p_i\), influence optimal steady state stocks in a two-species ecosystem. Under Assumption A.2, but with ecological interactions, we derive the following conditions (cf. “Appendix 4”):

with \(\Delta >0\) as above. From these conditions, we derive the following result.

Proposition 3

The optimal steady state stocks \(\bar{x}_j\) of species \(j=1,2\) decrease with \(p_i\),

if i) species j and i are ecologically independent, i.e., if \(G_{i \bar{x}_j}=0\) and \(G_{i\bar{x}_i\bar{x}_j}=0\), or if ii) species j and i have a symbiotic relationship, i.e., if \(G_{i \bar{x}_j}>0\) and \(G_{i\bar{x}_j \bar{x}_i}>0 \;\; \forall \;\; i,j \;\; \text {with} \;\; i\ne \, j\).

Proof

See “Appendix 5”. \(\square \)

The sign of the comparative-static effect of output prices on optimal steady state stock sizes is unambiguous only for case i) of ecologically independent species or case ii) of a symbiotic relationship. In the other cases, the sign also depends on output prices and the marginal value of biodiversity. Again, we shall briefly discuss all possible cases of ecological relationships between the two species.

Case i) In the case of ecologically independent species, equations (16) and (17) simplify such that the RHS of both are unambiguously negative. The negative effect of an increase in the price of species i on the steady state stock of species j is in contrast to a model of independent species without biodiversity value. For the case \(v=0\), a change in the price of either species would not affect the optimal steady state stock sizes, as then \(\rho =G_{i\bar{x}_i}\) for \(i=1,2\). The negative cross price effect follows from the consideration of the biodiversity value which tends to balance steady state stock sizes among species. More specifically, increasing the price of species i leads to larger harvesting of this species and thus lower stock sizes in steady state. This in turn implies that the marginal value of conserving species j also decreases such that the steady state stocks of both species decrease.

Case ii) In the case of symbiosis, the term \(p_1 \,G_{1\bar{x}_1 \bar{x}_2} + p_2 \, G_{2\bar{x}_1 \bar{x}_2}\) is unambiguously positive such that the effect of \(p_i\) on steady state stocks can be unambiguously determined as for case i).

Case iii) In a competitive system, the effect of p on both steady state stocks is ambiguous as \(p_1 \,G_{1\bar{x}_1 \bar{x}_2} + p_2 \, G_{2\bar{x}_1 \bar{x}_2}<0\).

Case iv) For a predator–prey system, the effect depends on the relative prices and the predation relationship between the two species.

Consider, again, the example of a Lotka-Volterra model with species 1 being the predator and species 2 being the prey, such that \(p_1\,d_1+p_2\,d_2\) is the decisive term. If the predator is sufficiently more valuable than the prey or if the predation coefficient \(d_1\) is sufficiently larger than \(d_2\) in absolute terms, the effect of changes in the price of the predator species is negative on both predator and prey. The effect of changes in the price of the prey species is still ambiguous in this case.

3.2.3 Comparative Statics with Respect to the Elasticity of Substitution \(\omega \) Between Species in the Biodiversity Index

We now analyze how changes in the elasticity of substitution between the two species, \(\omega \), influence optimal steady state stock sizes. We focus on a two-species ecosystem \(n=2\). Unambiguous conclusions for the effect of \(\omega \) on steady state stocks are, however, only possible for ecologically independent species, i.e., for case i). Under Assumptions A.1 and A.2, we derive the following conditions:

We have (using the notation \({\hat{x}}=x_1/x_2\)):

It turns out that the comparative static effect of a change in the elasticity of substitution, \(\omega \), on the optimal steady state stock sizes, is rather complicated. The reason is that a change in \(\omega \) has two effects on the biodiversity index. One effect is that with a higher value of \(\omega \) the decision maker cares somewhat less for the evenness in species abundances. In addition, for a given unit value of biodiversity, v, the biodiversity value decreases with \(\omega \), as pointed out in Sect. 2. The following proposition states conditions under which the former effect dominates over the latter. We use \(\hat{\omega }\) to denote the solution of \(\hat{\omega }+\ln (\hat{\omega }-1)=0\), which is \(\hat{\omega }\approx 1.28\).

Proposition 4

(a) If \(\omega \ge \hat{\omega }\), the smaller steady state stock decreases with \(\omega \); the effect on the larger stock is ambiguous. (b) If \(\omega <\hat{\omega }\), there exists a \(0 \le \underline{{\hat{x}}} < 1\) such that the smaller steady state stock decreases with \(\omega \) for all \({\hat{x}}\in (\underline{{\hat{x}}},1)\); the effect on the larger stock is ambiguous.

Proof

See “Appendix 6”. \(\square \)

The sign of the comparative static effect of a change in the elasticity of substitution, \(\omega \), on the optimal steady state stock sizes is ambiguous for the larger steady state stock and negative for the smaller one if \(\omega \) is large enough. The intuition behind this result is that a larger elasticity of substitution allows a larger divergence between optimal stock sizes in steady state. Consequently, the smaller stock decreases with \(\omega \) in steady state. Again, this result only holds for case i) and cannot be unambiguously derived for the other three cases of possible ecological interactions.

4 Application to Baltic Sea Fisheries

4.1 Baltic Sea Fisheries

The marine ecosystem in the central Baltic Sea is dominated by three fish species: cod, sprat, and herring. These species also form the basis of the economically most important fisheries in the Baltic Sea. In addition, their stocks are closely connected by strong ecological inter-connections among species (Köster and Möllmann 2000), as cod preys on both sprat and herring. In economic terms, the cod fishery used to be the most important of the three. Overfishing, however, caused a decline in the cod stock during the last decades, and only recently the introduction of a long-term management plan has led to some signs of stock recovery again.

The upper panel in Fig. 2 shows the development of the stock sizes of cod, sprat, and herring from 1974 to 2012 measured in units of spawning stock biomass, i.e., the biomass of all fish in spawning age. The lower panel shows the corresponding levels of the biodiversity index (4) using spawning stock biomasses as abundance indicators for a relatively large elasticity of substitution (\(\omega =2\)) and for a relatively small elasticity of substitution (\(\omega =0.5\)). It becomes obvious that the biodiversity indices for both elasticities of substitution follow the same trend in general. Biodiversity measured using the smaller elasticity of substitution, however, always is below biodiversity levels measured using a larger elasticity of substitution. This reflects the influence of \(\omega \) discussed in Sect. 2. The effect of \(\omega \), however, is lower when species are more evenly distributed. In addition, when the elasticity of substitution between the species is low, i.e., \(\omega \) is low, the relative importance of the species with the smallest stock increases.

4.2 Description of the Age-Structured Model

For the application to the Baltic sea fisheries, we replace the biomass model of resource dynamics (equation 6) by a state-of-the-art age-structured population model. Considering the more complex age-structured model allows us to compare the effects of using biodiversity indices calculated in terms of biomasses and in terms of the number of individuals as measures of species abundance. The model we employ here builds on Voss et al. (2014a, b), who provide a bio-economic fishery model for the Baltic cod, sprat, and herring fisheries, taking the predator–prey relationship between cod and the two other species into account. This model is an extension of a single-species age-structured fishery model (Tahvonen 2009; Tahvonen et al. 2013). A second deviation from the continuous-time model used in Sect. 3 is that we consider a discrete-time, discrete age-structured setting for the quantitative application.

In the following, we use \(x_{ist}\) to denote the number of fish of species \(i\in \{C,S,H\}\), where C stands for cod, S for sprat, and H for herring, in age group \(s=1,\ldots ,S\) and at the beginning of period \(t=0,1,\ldots \). Using the indices \(i\in \{C,S,H\}\) for the species, and \(s=1,\ldots ,S\) for the age group, where \(S>1\) is the oldest age group considered in the model, we use \(\alpha _{is}>0\) to denote age-specific survival rates, \(\gamma _{is}>0\) to denote age-specific proportions of mature individuals, and \(w_{is}\) to denote the mean weights (in kilograms). For cod, all of these parameters are assumed to be constant (Tahvonen 2009) as in the standard biological stock assessments for the Eastern Baltic cod (ICES 2012). For sprat and herring, we assume that proportions of mature individuals and weights are constant, but the survival rates of both depend on cod spawning stock biomass. For the age-specific survival rates, we use the specification

where \(M_{2is}\) is instantaneous natural mortality of sprat (\(i=S\)) and herring (\(i=H\)) cohort s in the absence of cod, and \(\delta _{is}>0\) is a parameter that measures the dependency of instantaneous natural mortality of sprat (\(i=S\)) and herring (\(i=H\)) cohort s on cod spawning stock biomass, \(x_{C0t}\). Denoting the recruitment function for species i by \(\varphi _i(\cdot )\) and the spawning biomass by \(x_{i0t}\), the age-structured population model with harvesting activity can be summarized as

Here, we use \(h_{ist}\) to denote the number of fish harvested from cohort s of species i in period t. We maintain the assumption of perfect selectivity of harvest with respect to the species, which is a reasonable assumption for the Baltic, as different species are caught by different fleets. Aggregate instantaneous fishing mortality \(F_{it}\) for species i in year t translates into age-specific fishing mortalities, captured by the constant, age-specific catchability coefficients \(q_{is}\ge 0\), such that

For cod and herring, we assume stock-recruitment functions of the Ricker (1954) type (Voss et al. 2014b), i.e., we assume

with \(\phi _{i1},\phi _{i2}>0\). For sprat, we assume a Beverton-Holt type (Tahvonen et al. 2013), i.e., we assume

with \(\phi _{S1},\phi _{S2}>0\). For modeling the profits of the cod fishery, we use the specification from Quaas et al. (2012) with age-specific prices and a cost function of the Spence type (Spence 1974). Thus, profits of the cod fishery in year t are

where \(p_{Cs}\) are prices for cod in age group s, instantaneous fishing mortality \(F_{Ct}\) equals instantaneous effort, and \(c_C\) is the unit effort cost for the cod fishery. Sprat and herring are modeled as schooling fisheries (Tahvonen et al. 2013), where the market price \(p_i\) is assumed to be independent of age. The profits in the sprat and herring fisheries thus are

with analogous interpretations for the symbols as for the cod fishery. The values for the parameters of the population model and for prices and harvesting costs are taken from Voss et al. (2014a) and can be found in “Appendix 7”. Prices are assumed to be constant for all species. Thus, the model treats species as independent on the market.

For the harvesting benefits \(\Pi (\mathbf h ,\mathbf x )\), we assume that the fishery manager has some aversion against income inequality across fisheries. This captures the empirical observation that policy makers tend to preserve fishing opportunities for the different fleet segments (Voss et al. 2014b). We thus specify

In our simulations, we use \(\eta =0.25\).

We assume that the aim is to maximize (7) with harvesting benefits (29) and taking a biodiversity value (4) into account. Here, we use two versions of the biodiversity index: In one version, we use the spawning stock numbers, \(\sum _{s=1}^S \gamma _{is}\,x_{ist}\), as abundance indicators for species i, in the other one, we use the spawning stock biomasses, \(x_{i0t}\), as abundance indicators. We vary the unit value of biodiversity, v, and use a discount rate of zero, \(\rho =0\), in the numerical optimization.

The numerical optimization is performed using Knitro (version 8.1) with AMPL. Programming codes are available as online appendix.

4.3 Numerical Optimization Results

The results of our numerical optimization show the effects of changes in the unit value of biodiversity, v, on the optimal steady state stocks of cod, sprat, and herring as well as on the optimal profits of the three fisheries and on optimal biodiversity levels. We show the sensitivity of the results to the unit value of biodiversity, v, for a relatively large elasticity of substitution (\(\omega =2\)) and for a relatively small elasticity of substitution (\(\omega =0.5\)), and we do so for formulating the biodiversity index in the objective function in terms of biomass and in terms of number of individuals.

4.3.1 Main Effects of Stock Changes on Biodiversity

Before interpreting the simulation results in more detail, we would like to point out that a change in the steady state stock of one species has two main effects on biodiversity that drive the results to be presented. Firstly, there is the stock or abundance effect: Increasing overall abundance, in terms of biomass or numbers, ceteris paribus increases biodiversity. Secondly, there is the diversity or scarcity effect: If the stock of a scarce species increases, this increases the evenness of stock sizes in the ecosystem, which ceteris paribus increases biodiversity. If the stock of a relatively abundant species increases, however, the evenness of the stock sizes in the ecosystem is reduced, which ceteris paribus decreases biodiversity.

In our application, the relatively scarce predator species cod crucially influences the biodiversity of the ecosystem. Firstly, there is a positive scarcity or diversity effect: Cod is a relatively scarce species; in terms of number of individuals, it even is the scarcest species among the three species in the Baltic ecosystem considered here. Thus, increasing cod stocks is positive for biodiversity as it increases the evenness of the species distribution. Secondly, however, there is a negative effect on the stocks of the prey species: An increase in the cod stock leads to decreasing stocks of sprat and herring. If this leads to a reduction of total stock biomass or number of individuals, this tends to reduce the biodiversity index.

Effects of varying the unit value of biodiversity v for a biodiversity objective with relatively large elasticity of substitution, \(\omega =2\). Panels on the left-hand side show results when the biodiversity objective is formulated with spawning stock biomasses, SSB, as abundance measures, panels on the right-hand side show results for biodiversity objective with spawning stock numbers, SSN, as abundance measures. The panels in the rows show, from top to bottom, optimal steady state stock sizes in terms of SSB and SSN, profit and biodiversity indices with abundance measures SSB and SSN

Effects of varying the unit value of biodiversity v for a biodiversity objective with relatively small elasticity of substitution, \(\omega =0.5\). Panels are as in Fig. 3

4.3.2 Effects on Optimal Steady State Stocks

Figure 3 shows the results of a change in the unit value of biodiversity, v, for a relatively large elasticity of substitution, \(\omega = 2\). The optimal stocks of the prey species sprat and herring increase with v while the optimal stock of the predator species cod decreases with v. This holds for optimal stocks measured in biomass (first row) and for optimal stocks measured in numbers (second row). This shows that the species interaction makes a qualitative difference compared to an ecosystem with ecologically independent species. As our theoretical results derived in Sect. 3.2.1 have shown, the effect of v on optimal steady state stocks would be unambiguously positive if there was no ecological interactions between the species.

The results for \(\omega =2\) are quite similar when comparing whether the objective is to maximize biodiversity in terms of biomass (left panel in Fig. 3) or in terms of numbers (right panel in Fig. 3), although the evenness of species is very different when abundances are measured in terms of biomasses or in terms of numbers. With abundances measured in terms of numbers, the stock size of cod is about two orders of magnitude smaller than the stock sizes of sprat and herring, while with biomasses as abundance measures the difference is much smaller. The relatively large elasticity of substitution, however, implies that an even distribution of species abundances is relatively less important than the absolute aggregate biomass or number of individuals such that the main aim is to increase overall abundances.

Figure 4 shows the results for a relatively low elasticity of substitution, \(\omega = 0.5\). In this case, the evenness of species abundances plays a relatively large role. The figure shows that this leads to interesting differences in the effect of a change in v on optimal stocks between the objective to maximize biodiversity in terms of biomass and in terms of numbers. For the biodiversity objective measured in terms of numbers, the optimal stock of cod now increases while the optimal stock of sprat first increases and then decreases with v. The reason is that cod is particularly scarce when abundance is measured in numbers of individuals. This scarcity effect dominates the overall abundance effect such that the cod stock increases with v, although this causes increased predation on the more numerous sprat and herring stocks.

4.3.3 Effects on Optimal Levels of Biodiversity

For \(\omega =2\), we observe the expected effect that biodiversity levels both measured in terms of biomass and number of individuals increase with v. For \(\omega =0.5\), in contrast, we find a trade-off between the two types of biodiversity measures for large values of the unit value of biodiversity. The left panel of Fig. 4, where the biodiversity objective is formulated in biomass, shows that the biodiversity index in terms of biomass unambiguously increases with v, as expected. If we measure the biodiversity outcome in terms of numbers of individuals, however, we observe a decline in biodiversity when the unit value of biodiversity increases beyond a level of about 20 euros per ton of spawning stock biomass. Looking at the right-hand panel of Fig. 4, we find the reverse pattern for unit values of biodiversity beyond about 100 euros per million fish: While the biodiversity index in terms of numbers (the one included in the objective function in this case) continues to slightly increase with v, biodiversity measured in terms of biomass decreases with the unit value of (number) biodiversity.

The reason for this trade-off is that in terms of biomass the unevenness between the three stock sizes is by far not as pronounced as in terms of numbers of individual fish. Thus, when caring for biodiversity in terms of biomass, the desire for an overall larger abundance of fish dominates the desire for evenness, and one tends to slightly decrease the cod stock in order to build up the other two stocks. Measuring biodiversity in terms of numbers, however, implies that the unevenness increases so strongly that the biodiversity index decreases despite an overall increasing abundance of fish. This effect is reversed if the fishery manager cares for biodiversity measured in terms of numbers of individual fish (right-hand panel of Fig. 4), which in this case leads to a decrease in the biomass-biodiversity index when the unit value of biodiversity in numbers increases beyond a certain value.

As discussed in Sect. 3.1, the unit value of biodiversity, v, is not independent of the elasticity of substitution, \(\omega \), and the index value, B, which is also reflected in the numerical optimization results. Comparing Figs. 3 and 4, it becomes obvious that for the same objective and the same stock sizes, the value of B is lower for \(\omega =0.5\) than for \(\omega =2.0\). This is particularly pronounced for biodiversity in terms of numbers for the case \(\omega =0.5\), for which the unevenness is highest and (number) biodiversity is two orders of magnitudes smaller than for \(\omega =2\).

4.3.4 Comparison Between Optimal and Historic Stocks and Biodiversity Levels

Comparing optimal biodiversity levels and stock sizes to historic ones (Fig. 2), we observe that current biodiversity levels measured in biomass are below the optimal levels, even if one considers \(v=0\). The same applies to current stocks of herring and cod, which are also below optimal levels. Both results hold for \(\omega = 0.5\) and for \(\omega = 2.0\). Current stocks of sprat, in contrast, are above optimal levels for low values of v. In the case of \(\omega = 0.5\) and when biodiversity in terms of numbers is the objective, current sprat stocks are higher than optimal levels even for a larger range of values for v. Comparing optimal biodiversity levels to historically high levels that prevailed for example during the 1980s, we observe that these historically high levels are in the range of optimal levels for all cases except the one in which \(\omega =0.5\) and the objective is to maximize biodiversity in terms of numbers.

4.3.5 Effects on Optimal Profits

The effects of v on fishing profit are mostly negative, and aggregate profits always fall with the introduction of biodiversity values. Increasing the unit value of biodiversity, v, has this negative effect on profits because harvested amounts of fish go down in order to increase the standing stocks. For \(\omega =2\), a positive effect of v on profits only occurs for the herring fishery when the objective is to maximize biodiversity in numbers. The reason is that the concern for biodiversity leads to a decreasing cod stock, thus alleviating predation pressure on herring. The resulting larger steady state stock size of herring enables a more profitable fishery.

For \(\omega =0.5\), and small values of the unit value of biodiversity, we also see an increase in cod profits with v. The reason is that without biodiversity value, it is optimal to reduce the cod stock below the single-species optimal steady state stock size (i.e., the steady state stock size that would result when neglecting the predation effect on the two other species), in order to reduce fishing pressure on the two prey species. As cod is the scarcest species among the three in terms of stock numbers, increasing the biodiversity value leads to an increased cod stock size in steady state. Thus, the cod stock approaches its single-species optimal stock size and profit increases. For still higher unit values of biodiversity, also the cod stock is built up beyond the single-species profit-maximizing stock level and profits decrease again.

5 Discussion and Conclusions

In this paper, we have studied how the consideration of a biodiversity value in the objective function of a dynamic bio-economic model affects the optimal management of a multi-species ecosystem with and without ecological interactions. The biodiversity index used in this paper is a constant-elasticity-of-substitution (CES) function of in-situ species abundances. This index fulfills all axioms of Buckland et al. (2005) if the species are assumed to be (imperfect) substitutes, \(\omega > 1\). Such an index thus seems well-suited to monitor developments of biodiversity over time, in particular if the number of species might change over time as it is the case for global biodiversity. Specifying the substitution elasticity to a value below or equal to one, \(\omega \le 1\), however, is sensible only for situations where extinction is out of scope because the biodiversity index would be undefined in that case.

We have shown analytically that species extinction is never optimal when biodiversity, measured as a CES-function with \(1<\omega <\infty \), plays a role in the objective function. This is in contrast to prior findings such as by Alexander (2000), where existence values made extinction less likely but not impossible in optimal steady states. The reason for our result is that for the case of imperfect substitutes, the marginal contribution of a species to the biodiversity index goes to infinity if its stock size approaches zero.

Our analysis has also revealed the implications of varying the unit value of biodiversity, v, in the objective function. This unit value controls how strongly conservation goals are weighted in the objective function. Without ecological interactions, increasing v unequivocally increases the steady state stock sizes of all species in the system. With predator–prey interactions, optimal steady state stock sizes may increase or decrease with v, depending on the strength of species interaction and the relative market price of predator and prey species. A quantitative application to the three-species fishery in the Baltic Sea has shown that the steady state stock of a relatively scarce predator species may decrease with the unit value of biodiversity. This is the case if substitutability between the species is relatively high such that the objective of increasing overall abundance dominates the objective of increasing species evenness.

In our simulations, we have studied how optimal multi-species management depends on v, without fixing v to a particular value. Indeed, obtaining a reliable value for v for some particular ecosystem may impose some challenges. One approach could be to elicit individual willingness-to-pay for existence values of biodiversity by means of a contingent valuation approach. Our analysis has shown, however, that for such an approach there needs to be agreement on the appropriate biodiversity indicator first. In our framework, this means that an agreement has to be obtained with respect to the questions how to measure species abundance (for example, in terms of biomass or in terms of numbers of individuals), and on the elasticity of substitution, \(\omega \), between the different species.

We have further shown how the specification of the substitution elasticity, \(\omega \), between species, and the choice of abundance indicators in the biodiversity index influence optimal management solutions. The larger the elasticity of substitution, \(\omega \), between the species, the more valuable it is to increase aggregate abundance compared to ensuring an even distribution of species abundances. In the case of the Baltic fisheries, cod is significantly less abundant than sprat and herring. This relative scarcity of cod is particularly pronounced when species abundance is measured in terms of numbers, as individual cod are much larger than individual sprat or herring. Consequently, optimal cod stocks increase with the unit value of biodiversity, v, when the objective is to maximize biodiversity in numbers and \(\omega \) is relatively small. In all other cases, the optimal cod stocks decrease with v, in order to reduce cod predation on herring and sprat stocks and thus increase the overall abundance of fish in the ecosystem.

These results show that the exact specification of the biodiversity index has important implications for optimal management. Results can change qualitatively when the indicator of species abundance or the value for the elasticity of substitution is changed. One conclusion, however, seems to be robust: as long as species diversity (as measured by a CES-function) plays a role in the objective function, and species are imperfect substitutes, species extinction is never optimal.

Notes

More specifically, a CES-function fulfills the first four axioms mentioned in Buckland et al. (2005). Axiom 5 and 6 refer to characteristics of the biodiversity measures related to their empirical estimation, which is not relevant in the theoretical context of this paper.

Species-level biodiversity can also be measured by phenotypic variation. Higher diversity scores would then be assigned to collections of species that are evolutionarily more divergent (Armsworth et al. 2004). Applications in the economic context using phenotypic variation as a measure for biodiversity include Weitzman (1992) and Nehring and Puppe (2004).

These are the first four out of six axioms in Buckland et al. (2005); Buckland et al.’s last two axioms refer to the sampling and empirical estimation of the indices and are thus not relevant in the theoretical context of this paper.

This is a reasonable assumption for the Baltic Sea as different species are caught by different fleets (Voss et al. 2014a). We thus use this assumption in the analytical part of this paper as well as in the application to Baltic Sea fisheries.

References

Alexander R (2000) Modelling species extinction: the case for non-consumptive values. Ecol Econ 35:259–269

Armsworth PR, Kendall BE, Davis FW (2004) An introduction to biodiversity concepts for environmental economists. Resour Energy Econ 26:115–136

Arrow KJ, Chenery H, Minhas BS, Solow RM (1961) Capital-labor substitution and economic efficiency. Rev Econ Stat 43(3):225–250

Arrow KJ, Kurz M (1970) Public investment, the rate of return, and optimal fiscal policy. Johns Hopkins University Press, Baltimore

Atkinson AB (1970) On the measurement of inequality. J Econ Theory 2(3):244–263

Brown G, Berger B, Ikiara M (2005) A predator–prey model with an application to lake victoria fisheries. Mar Resour Econ 20(3):221–248

Buckland S, Magurran A, Green R, Fewster R (2005) Monitoring change in biodiversity through composite indices. Philos Trans R Soc B 360:243–254

Bulte E, van Kooten G (2000) The economics of nature: managing biological assets. Blackwell, Massachusetts

Clark C (1973) Profit maximization and the extinction of animal species. J Polit Econ 81(4):950–961

Dixit AK, Stiglitz JE (1977) Monopolistic competition and optimum product diversity. Am Econ Rev 67(3):297–308

Eichner T, Tschirhart J (2007) Efficient ecosystem services and naturalness in an ecological/economic model. Environ Resour Econ 37:733–755

Flaaten O (1991) Bioeconomics of sustainable harvest of competing species. J Environ Econ Manag 20(2):163–180

GOC (2014) From decline to recovery: a rescue package for the global ocean. Report Summary, Global Ocean Commission, Oxford, UK

Hannesson R (1983) Optimal harvesting of ecologically interdependent fish species. J Environ Econ Manag 10(4):329–345

ICES (2012) Report of the Baltic fisheries assessment working group (WGBFAS). ICES, Copenhagen

Kellner J, Sanchirico J, Hastings A, Mumby P (2010) Optimizing for multiple species and multiple values: tradeoffs inherent in ecosystem-based fisheries management. Conserv Lett 00:1–10

Köster FW, Möllmann C (2000) Trophodynamic control by clupeid predators on recruitment success in baltic cod? ICES J Mar Sci 57:310–323

Kumar P (ed) (2010) The economics of ecosystems and biodiversity (TEEB) ecological and economic foundations. Routledge, New York

Magurran A (2004) Measuring biological diversity. Blackwell Publishing, Malden

Millennium Ecosystem Assessment (2005) Ecosystems and human well-being: synthesis report. Island Press, Washington, DC

Nehring K, Puppe C (2004) Modelling phylogenetic diversity. Resour Energy Econ 26(2):205–235

Noack F, Manthey M, Ruitenbeek J, Mohadjer M (2010) Separate or mixed production of timber, livestock and biodiversity in the caspian forest. Ecol Econ 70:67–76

Pikitch E, Santora C, Babcock E, Bakun A, Bonfil R, Conover D, Dayton P, Doukakis P, Fluharty D, Heneman B, Houde E, Link J, Livingston P, Mangel M, McAllister M, Pope J, Sainsbury K (2004) Ecosystem-based fishery management. Science 305(5682):346–347

Quaas M, Requate T (2013) Sushi or fish fingers—seafood diversity, collapsing fish stocks, and multispecies fishery management. Scand J Econ 155(2):381–422

Quaas MF, Froese R, Herwartz H, Requate T, Schmidt JO, Voss R (2012) Fishing industry borrows from natural capital at high shadow interest rates. Ecol Econ 82:45–52

Ricker WE (1954) Stock and recruitment. J Fish Res Board Can 11:559–623

Rockström J, Steffen W, Noone K, Persson A, Chapin F, Lambin E, Lenton T, Scheffer M, Folke C, Schellnhuber H, Nykvist B, Wit CD, Hughes T, van der Leeuw S, Rodhe H, Sörlin S, Snyder P, Costanza R, Svedin U, Falkenmark M, Karlberg L, Corell R, Fabry V, Hansen J, Walker B, Liverman D, Richardson K, Crutzen P, Foley J (2009) Planetary boundaries: exploring the safe operating space for humanity. Ecol Soc 14(2):32

Shannon C (1948a) A mathematical theory of communication. Bell Syst Tech J 27:379–423

Shannon C (1948b) A mathematical theory of communication. Bell Syst Tech J 28:623–656

Simpson E (1949) Measurement of diversity. Nature 163:688

Spence AM (1974) Blue whales and applied control theory. In: Gottinger HW (ed) System approaches and environmental problems. Vandenhoeck and Ruprecht, Göttingen, pp 97–124

Stavins R (2011) The problem of the commons: still unsettled after 100 years. Am Econ Rev 101(1):81–108

Tahvonen O (2009) Economics of harvesting age-structured fish populations. J Environ Econ Manag 58(3):281–299

Tahvonen O, Quaas M, Schmidt J, Voss R (2013) Optimal harvesting of an age-structured schooling fishery. Environ Resour Econ 54(1):21–39

Visbeck M, Kronfeld-Goharani U, Neumann B, Rickels W, Schmidt J, van Doorn E, Matz-Lück N, Proelss A (2014) A sustainable development goal for the ocean and coasts: global ocean challenges benefit from regional initiatives supporting globally coordinated solutions. Mar Policy 49:87–89

Voss R, Quaas M, Schmidt J, Hoffmann J (2014a) Regional trade-offs from multi-species maximum sustainable yield (MMSY) management options. Mar Ecol Prog Ser 498:1–12

Voss R, Quaas M, Schmidt J, Tahvonen O, Lindegren M, Möllmann C (2014b) Assessing social-ecological trade-offs to advance ecosystem-based fisheries management. PLoS ONE 9(9):e107811. doi:10.1371/journal.pone.0107811

Weitzman ML (1992) On diversity. Q J Econ 107(2):363–405

Weitzman ML (2014) Book review on ’nature in the balance: the economics of biodiversity’. J Econ Lit 52(4):1193–1194

Acknowledgments

We thank Lena Bednarz, Wilfried Rickels, and three anonymous reviewers for valuable comments on earlier versions of the paper.

Author information

Authors and Affiliations

Corresponding author

Electronic supplementary material

Below is the link to the electronic supplementary material.

Appendices

Appendix 1: Sufficiency Conditions

It is straightforward to verify that the sufficiency conditions are always fulfilled in the absence of species interactions, i.e., if Assumption A.1 holds, and if the biomass growth functions are concave.

For problems of optimal harvesting in multi-species systems however, non-concavities can easily arise, thus potentially violating the Arrow/Kurz (1970) sufficiency condition. Since the biodiversity index we are considering here is a concave function of stock sizes, the only way how including a biodiversity index may affect the sufficiency conditions is that the maximized Hamiltonian tends to become “more” concave. We formally illustrate this in the following by considering optimal harvesting of an ecosystem with competing species, based on Flaaten (1991). Consider the optimal harvesting of two competing species, where biomass dynamics are described by

with no harvesting costs and prices \(p_1\) and \(p_2\) for the harvest of the two species. To keep the analysis simple, we assume symmetric competition coefficients, \(\gamma \). From the first-order conditions (9) for this case, we obtain that the maximized Hamiltonian is given by

For \(v=0\), the leading principal minors of the Hessian matrix for \(H^{\max }\) are

The Hessian of the maximized Hamiltonian is negative definite if the leading principal minors have alternating signs. \(M_1\) is always negative. \(M_2\) is positive if

i.e., if the competition coefficient \(\gamma \) is smaller than the ratio of the geometric to the arithmetic mean of \(p_1\,r_1\) and \(p_2\,r_2\).

For \(v>0\), the leading principal minors of the Hessian matrix for \(H^{\max }\) are

Consequently, a value \(v>0\) increases the range of values for \(\gamma \) for which the second principal minor of the Hessian is positive.

Appendix 2: Comparative Statics w.r.t. v

Under Assumption A.2, but with ecological interactions, condition (10b) simplifies to

Differentiating (38) with respect to v, we obtain

Solving yields

with

Appendix 3. Proof of Proposition 2

For \(G_{i\bar{x}_i\bar{x}_j}=0\), the expressions (13) and (14) simplify to

with

This concludes the proof of part (i) of the proposition.

For \(G_{i\bar{x}_i\bar{x}_j}>0\), \(p_1\,G_{1\bar{x}_1\bar{x}_2}+p_2\,G_{2\bar{x}_1\bar{x}_2}>0\) such that the RHS of (13) and (14) are positive. This concludes the proof of part (ii) of the proposition.

Appendix 4: Comparative Statics w.r.t. p

Differentiating (38) with respect to \(p_1\) for \(i=1,2\) we obtain

Solving yields

with \(\Delta \) as above.

Appendix 5: Proof of Proposition 3

For \(G_{i \bar{x}_j}=0\) and \(G_{i\bar{x}_i\bar{x}_j}=0\), the expressions (16) and (17) simplify to

with

This concludes the proof of part (i) of the proposition.

For \(G_{i \bar{x}_j}>0\) and \(G_{i\bar{x}_j\bar{x}_i}>0\), \(p_1\,G_{1\bar{x}_1\bar{x}_2}+p_2\,G_{2\bar{x}_1\bar{x}_2}>0\) and \((\rho -G_{1 \bar{x}_1})>0\) such that the RHS of (16) and (17) are negative. This concludes the proof of part (ii) of the proposition.

Appendix 6: Proof of Proposition 4

We first determine the sign of the following term in (19):

Lemma 1

\(\Omega \ge 0\) with \(\Omega =0\) only for \({\hat{x}}=1\).

Proof

\(\Omega \) has a global minimum \(\Omega =0\) at \({\hat{x}}=1\), as

is zero if and only if \({\hat{x}}=1\), negative for all \({\hat{x}}<1\), and positive for all \({\hat{x}}>1\). \(\square \)

Lemma 1 implies that \(d\bar{x}_1/d\omega <0\) if \(\frac{\partial B_{x_1}}{\partial \omega }<0\). To determine the sign of this last expression, we define

Note that \(\frac{\partial B_{x_1}}{\partial \omega }\lesseqqgtr 0\) if and only if \(\Gamma \lesseqqgtr 0\).

We have \(\Gamma =0\) for \({\hat{x}}=1\), and furthermore

Thus, for \({\hat{x}}\ge 1\), \(d\Gamma /d{\hat{x}}>0\). Thus, \(\Gamma >0\) for all \({\hat{x}}>1\). This shows that for the larger stock, the effect of \(\omega \) on \(\bar{x}\) is ambiguous.