Abstract

This paper presents an empirical study of the relationship between residential energy demand and temperature. Unlike previous studies in this field, the data sample has a global coverage and special emphasis is given to the heterogeneous response of different regions and to the contrasting effects on energy demand for cooling and heating purposes. To account for this we distinguish between different regions, seasons, and energy sources. Short- and long-run temperature demand elasticities are estimated. These features make the model results especially valuable in the analysis of climate change impacts as they provide an empirical basis for the study of the impact of climate change on energy demand. To illustrate the potential of the results as a basis for the study of climate change impacts, the estimates are used in a simple exercise that projects changes in energy demand due to temperatures increase in 2085.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The consequences of climate change affect societies and natural ecosystems in different ways. In turn, each of these effects also influence the behavior of those who are affected. This is a form of adaptation to climate change, a change of habits consequent to the effects of climate change. Among the various behavioral changes induced by climate change, the way the increase in average seasonal temperature influences the residential demand for energy is of particular importance (Mansur et al. 2008). On the one hand, energy use decreases with rising temperature because of reduced demand for heating. On the other hand, energy demand can increase to satisfy additional cooling needs. In addition, the temperature elasticity of energy use is likely to vary with climate conditions and income levels. For example, air conditioning is a luxury good for low-income households and therefore their electricity demand might actually be inelastic to temperature changes. Therefore changes in energy demand for heating and cooling purposes are two important effects influencing the final use of energy by households that act in opposite directions.

Residential demand for energy accounts for about a quarter of the overall primary energy used, and it has been increasing since 1990 (IEA 2010). Not only will global warming have consequences on the economy through changes in the demand for energy, but different energy use patterns will have a feedback on climate change. Rising temperature will reduce energy uses because of fewer needs for heating. On the other hand, it will increase the demand for electricity to satisfy additional cooling needs. Should the cooling effect prevail, overall energy demand, and consequently greenhouse gases emissions (GHGs), could eventually increase, with a negative feedback on climate change impacts. Understanding people’s ability to adapt their behavior and habits to global warming is thus relevant. Studying the ability to adapt to climate change may also help to design good policies for mitigation.

The issue of residential energy demand and its relationships with temperature has received a lot of attention in the past. The need to assess the economic consequences of climate change, including those related to energy demand, has spurred a renewed interest. Unfortunately, most of the available estimations can hardly be employed for this purpose, as they do not provide a global coverage (most of them refer to a specific region or country), have a short-run perspective, and refer to variables that are not normally used in climate change models (e.g., cooling/heating degree days).

The existing literature on the impact of weather on energy demand is mostly characterized by fuel- and country-specific studies. Hanley and Peirson (1998) analyzed the effect of temperature on the British residential electricity demand, Vaage (2000) considered different technologies for residential heating in Norway, Asadoorian et al. (2006) addressed the impact of temperature on Chinese provinces, while Mansur et al. (2008) studied the effect on the US electricity market. These are microeconometric studies, estimating, first, the demand for energy-utilizing appliances and, subsequently, the conditional demand for energy. They rely on detailed, disaggregated, data that are not always available for all regions in the world. Other country-specific analysis have been performed with non-parametric estimation techniques, such as Hanley and Peirson (1996, 1997, 1998), who studied the relationship between energy demand for heating purposes and temperature in the UK, and Zarnikau (2003), who analyzed consumption expenditures in the US.

An alternative approach modeled energy demand as a cointegrated process. Cointegration has been used to study the relationship between energy demand and Gross Domestic Product (GDP) growth in works such as Stern (2000), addressing these issues for the US, and Masish and Masish (1996), focusing on South-East Asia. Beenstock et al. (1999) also applied cointegration to study industrial and residential energy demand in Israel, considering cooling and heating degree days, among other variables. More recently, Sadorsky (2009) used an error correction model to estimate short- and long-run effects of CO2 emissions and oil prices on renewable demand.

Another stream of literature modeled energy demand as a dynamic process, depending on a set of covariates and the lagged value of the dependent variable. Pioneered by Balestra and Nerlove (1966), this method is better suited when dealing with many countries and aggregate data. A similar study with an international perspective is Bigano et al. (2006), in which both residential and industrial demand for energy are studied for five types of energy sources (coal, gas, oil, oil products and electricity) by means of a dynamic panel analysis.

The present work builds on Bigano et al. (2006), but follows Sadorsky (2009) in modeling energy demand as a cointegrated process. The demand for three energy carriers, namely gas, oil products, and electricity is analyzed using a world panel of 31 countries.Footnote 1 Emphasis is given on modeling the possible presence of regional heterogeneity and seasonal differences. Clustering techniques are used to group countries according to their climate characteristics. Countries belonging to the same “temperature cluster” have similar distributions of temperatures, between seasons and across time. Country heterogeneity is addressed not just by using different constant terms in the regression equation, but also by specifying cluster-specific relationships.

The contribution of this paper is twofold. From the methodological point of view, it introduces the use of clustering techniques to account for regional heterogeneities. Because of to this novel approach we are able to identify cooling and heating effects for different country groups. The approach of the analysis, which is based on a dataset with global coverage, allows us to derive results that are applicable in the context of climate impact analysis. The estimated effects of temperature on energy demand can be used in climate-economy models to assess the overall impacts of climate change on energy demand.

The rest of the paper is organized as follows. Section 2 analyses the main factors influencing the relationship between energy demand and temperature and introduces the empirical model. Section 3 presents the dataset and addresses the issue of clustering and partial pooling of the panel. Section 4 illustrates the model, the estimation method, and the results obtained. To illustrate the applicability of the results to climate change impact assessment, Section 5 shows numerical calculations for the impacts of climate change on energy demand in 2085. Finally, Section 6 summarizes our findings and concludes.

2 Overview

The existing literature regarding temperature impacts on energy demand has usually dealt with specific fuels, focusing mostly on residential electricity demand at the local level. While we take a wider approach, considering different types of fuels as well as a range of countries, we share with the existing literature some of the issues related to the model formulation and estimation method.

A first issue is the choice of the indicator to measure climate variability. Average temperature change is only one indicator of changes in climate. Other conditions, such as changes in humidity and precipitations also affect energy demand habits. Following the mainstream literarture, we focus on temperature changes.Footnote 2

A second issue is the choice of the functional form used to best capture the relationship between energy demand, temperature, and other explanatory variables. Energy uses not only decreases with rising temperature because of reduced demand for heating, but it is also expected to increase to satisfy additional cooling needs. In addition, different types of fuels and energy carriers will respond differently to temperature increases. The cooling effect is mostly linked to the use of air conditioning and other household appliances. As these are mostly fueled by electricity, the cooling effect is mostly present for electricity. Gas and oil products instead are mostly used for heating and, therefore, they can be expected to decrease with higher temperatures. Nevertheless, the energy mix of the power sector influences these effects. For instance, in countries where electricity is used for both cooling and heating, there may be a heating effect also for electricity. In order to account for the differences across fuels, we specify different equations for each fuel type.

The relationship between energy demand and temperature depends on the season. The same temperature increase will have different impacts in winter, spring, summer or autumn. An increase in winter temperatures will cause a decrease in energy used for heating purposes, whereas an increase in summer temperatures is likely to cause an increase in energy for cooling. To identify in which seasons there is a cooling or heating effect, as well as their magnitude, we include seasonal temperatures among the explanatory variables.

Geographic variability also influences households’ responses to temperature increases in their use of energy. In warm regions, higher temperatures have a greater impact in the summer, because of the use of more air conditioning. In colder regions, instead, energy demand could be almost unaffected by higher summer temperatures, but will typically be more responsive to winter, fall, or spring temperatures.Footnote 3 We account for geographic variability by controlling for different average temperature-based country groups.

Finally, energy demand is also influenced by income levels, as wealth and income affect the ability to adapt to climate change. For example, richer countries can spend more in cooling devices (which are superior goods). Economic growth and changes in income over time also influence households’ consumption patterns. As illustrated in the OECD Environmental Outlook to 2030 (OECD 2008), energy demand increases as income grows, because of the higher use of household appliances, heating, cooling equipment and other energy-consuming devices.

The demand for fuels is a derived demand for energy services. Household demand for energy is related to the stock of energy-utilizing appliances and equipment in place. Variations in prices, income or temperature, therefore, induce changes in energy demand, which adjust progressively over time because of the physical capital inertia. The literature accounted for the dynamic nature of energy demand using two different approaches. In the first one, energy demand is estimated at a micro level, conditional on the demand for energy-using appliances. This method is very demanding in terms of a data and it has been mostly used in country/sectoral studies. A second approach models energy demand as a dynamic process, depending not only on prices, income, and temperature, but also on the lagged value of energy demand. This method, pioneered by Balestra and Nerlove (1966), is more suitable when dealing with many countries and aggregate data.

We specify a dynamic model of household demand for electricity, gas, and oil products. Energy demand is modeled as an autoregressive process, depending on its own lagged values, as well as a set of independent variables, such as energy prices, temperature, and per capita GDP.

For N number of countries and T years, the model can be specified as follows:

where:

-

y it is the natural logarithm of household demand for respectively electricity, gas, oil products and coal;

-

y it − 1 is the natural logarithm of the lagged dependent variable;

-

x it is the vector of covariates, including natural logarithm of own and alternative energy good prices, average seasonal temperature levels, real per capita GDP;

-

u it is the disturbance term.

3 Data analysis

3.1 Data description

The dataset used in the analysis consists of time series observations, spanning from 1978 to 2000, for 31 OECD and non-OECD countries. As mentioned above, the paper focuses on the residential sector, as industrial demand for energy does not seem to respond significantly to price (Liu 2004) and temperature changes (Bigano et al. 2006; Asadoorian et al. 2006). Table 1 summarizes the sources of data used to construct the dataset.

Data for residential energy demand for different fuel types are obtained from the Energy Balances and Statistics database of the International Energy Agency (IEA). Demanded quantities are expressed in thousand tons of oil equivalent (Ktoe). Figure 1 illustrates the changes in overall energy demand over time for the covered regions. The data show that there has been a slow increase in energy demand with a change in the fuel mix. In particular electricity use has increased while that of coal has decreased. Oil and gas have been rather stable. Household fuel prices, measured in US$/toe, are obtained from the end-user prices indicators of the IEA’s dataset on Energy Prices and Taxes. GDP data are obtained from the Main Economic Indicators dataset of the OECD. GDP is measured in 1995 US$ using Purchasing Power Parity (PPP).

In the choice of the indicator for temperature, two main measures have been considered: average temperatures and heating and cooling degree days.Footnote 4 The use of degree days has become particularly popular in the studies dealing with residential demand for space heating and cooling (Madlener and Alt 1996; Parti and Parti 1980). Degree days are used to segment temperature variations and thus easily capture the increase in electricity demand due to an increase in the cooling days or to a decrease in the heating days. However this measure has some drawbacks. It is threshold-dependent and assumes a sudden switch from heating devices to cooling equipments, while the adjustment to temperature changes is gradual. The approach based on degree days also requires a large amount of information. Heating and cooling degree days are calculated using daily temperature data. The available datasets usually have a regional or national coverage, making it difficult to implement a panel study with global coverage.

Average temperature, which is used in a number of studies (Moral-Carcedo and Vicens-Otero 2005; Mansur et al. 2008; Hanley and Peirson 1998; Asadoorian et al. 2006), allows establishing a direct relationship between temperature and energy demand. Such relationship can be applied more easily to climate-economy models in which the most common indicator used for climate change is a global temperature increase. Further, this approach makes it easier to collect data for different countries and thus to construct a panel. For the purpose of this study, which aims at establishing a relationship between energy demand and climate change to be used in global climate-economy models, the use of average temperatures has been chosen.

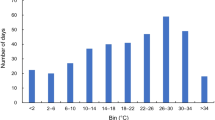

Temperature data have been obtained from the High Resolution Gridded Dataset of the Climate Research Unit University of East Anglia and from the Tyndall Center for Climate Change Research (see Mitchell et al. 2003).Footnote 5 This dataset is unique for geographical coverage, the length of the time series, and monthly details. However, it has limited time coverage as the data are available only until 2000. As illustrated in Fig. 2, there has been a mild increase in annual temperatures but greater changes in seasonal temperatures. In particular, there have been large changes in winter temperatures, including wide fluctuations in the average temperature levels. The difference in changes between seasonal temperatures in the dataset supports the idea that seasonal temperatures should be used instead of the yearly ones.

3.2 Data poolability and clustering

When dealing with country panels, a standard estimator is the fixed effect estimator. This method would estimate a coefficient for temperature common to all countries, with only country specific constant terms. This approach is unsatisfactory here because the effect of temperature is expected to vary between warm and cold countries.

Since the time dimension is sufficiently large, the poolability hypothesis can be tested using a Wald test.Footnote 6 The panel can be considered as N pooled time-series observations of length T, grouped in M pools. For each of these time series, we consider the autoregressive model:

Note that with this formulation the constant term becomes country-specific and the model can be rewritten as a fixed effect model by naming α i = ρ i + c:

This model allows for correlation between the country-specific constant term and the regressors, Cov(α i ,x it ) ≠ 0.

Assuming a homogeneous panel implies that the pool-specific vectors θ j = (β j , γ j ) for j = 1,...,M are the same for all pools. This can be tested with a usual parameter restriction test in which the Null Hypothesis is the homogeneity of the panel:

This test is significantly rejected for all four types of fuel, when each pool contains only one region. The next step involves the identification of characteristics for which countries are similar enough to be grouped into the same pool. In particular, the aim is to diversify the regions according to their temperature characteristics into cold and warm regions.

Clustering algorithms can be used for this purpose. Studies in different fields have used this methodology. For instance, Lehmijoki and Paakkonen (2006) consider demographic pools to study convergence and divergence between the groups. Durlaf and Johnson (1995) consider multiple regimes in which different economies follow different linear models. Vahid (2000) considers clustering of regions to study the gasoline demand functions of OECD countries.

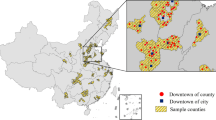

Following Kaufman and Rousseeuw (2005), Hartigan (1975) and Everitt (1974), we use hierarchical cluster analysis to split the sample in terms of average temperature characteristics. This clustering technique splits the sample into partitions in a hierarchical form. Hierarchic cluster analysis is based on the concept of distance. The metric that is used here is the Euclidean distance, though the results are robust to different definitions of distance. The cluster variables, that is, the characteristics used to define a distance between observations, are the annual average, maximum and minimum temperature. The clustering algorithm produces the partition tree (cluster dendrogram) illustrated in Fig. 3.Footnote 7 It is then necessary to decide how many clusters to use (this is usually referred to as “pruning” the dendrogram). Follwing the structure of the dendrogram, we have grouped the countries in three temperature clusters:

-

Group Mild: Austria, Belgium, Denmark, France, Germany, Ireland, Luxembourg, Netherlands, New Zealand, Switzerland, Greece, Hungary, Italy, Japan, South Korea, Portugal, South Africa, Spain, Turkey, United Kingdom, United States.

-

Group Hot: Australia, India, Indonesia, Mexico, Thailand, Venezuela.

-

Group Cold: Canada, Finland, Norway, Sweden.

The high correlation among average, maximum, and minimum temperature (around 0.8) signals the existence of some redundancy, and suggests that it could be sufficient to use one of these three variables to identify the clusters. Indeed, using just one of the three variables leads to the same grouping, except when the maximum temperature was used, in which case two groups were produced. Descriptive statistics of the temperature variables are summarized in the Appendix.

3.3 Data characteristics: time series properties

The panel is characterized by a relatively large time dimension. In this context, the temporal persistence of the series can be an issue and therefore we check their stationarity with unit root tests for panel data. There are a number of tests for panel stationarity, most of which are based on the Null Hypothesis of a unit root. These tests verify whether there is a unit root in the panel, assuming that long- and short-run effects are the same. Examples are the Im–Pesaran–Shin test (Im et al. 2003), the Levin and Lin Chu test (Levin and Lin 1993) and the Fisher test (Maddala and Wu 1999). We also consider the Hadri test (Hadri 2000), which reverses the Null Hypothesis. Table 2 reports panel unit root tests. All tests contain an intercept and a time trend. The first family of tests tends to reject the Null Hypothesis that there is a unit root, with the exceptions of electricity demand and prices, coal and oil prices. For the other variables, not all tests agree in rejecting the Null Hypothesis of a unit root. The results of the Hadri test instead are more homogeneous and they reject the Null Hypothesis of stationarity at 1% significance level.

Given these results, we check for panel cointegration between energy demand, prices and GDP using the Westerlund test for panel data (Westerlund 2007). This test does not pose restrictions on the equality between short- and long-run effects. It is based on the Null Hypothesis of no cointegration, and checks for an Error Correction Model (ECM) specification. Testing whether the Error Correction parameter is zero, allows us to conclude whether the ECM specification is correct and thus whether the panel is cointegrated. The Westerlund test reports four statistics. The Ga and Gt test statistics evaluate the Null Hypothesis of no cointegration for all i against the Alternative of cointegration for at least one i. The Pa and Pt test statistics pool information over all the cross-sectional units to test the Null Hypothesis H 0 of no cointegration for all i versus the Alternative H 1 of cointegration for all i. Using the statistic Ga, we reject the Null Hypothesis of no cointegration for the electricity and oil demand equation, while we cannot reject it for the gas demand equation (results reported in Table 3). The Null Hypothesis H 0 can never be rejected when using the Gt, Pa and Pt statistics.

Although results are mixed, there is some evidence that series are nonstationary and cointegrated. Therefore, we specify an ECM model for the demand of the different energy vectors.

4 Estimation of temperature elasticities

4.1 Model specification

We estimate short- and long-run elasticities using an Error Correction Model (ECM) approach as in Masish and Masish (1996). In this approach changes in the dependent variable, in our case the demand for different energy vectors, is modeled as a function of the level of the disequilibrium in the long-run cointegrating relationship, and changes in the other explanatory variables:

where λ is the error correction towards the long-run relationship. Deviations from the cointegrated relationship are corrected through a series of short-run adjustments.

In order to differentiate the impact of seasonal temperature by temperature cluster, we introduce a dummy for each temperature group. Mild countries are associated with the unit value of d 1; Hot countries are represented by d 2 and finally Cold countries are identified by d 0. This is the reference group and therefore its dummy-related variables are not included in the regressions. Dummies differentiate the effects of temperature increases between groups through a group-specific intercept. To differentiate the effects on the slope, we interact all covariates with the dummies. With these additional variables, the model reads as follows:

where j = 0, 1, 2 and 0 = Cold, 1 = Mild, 2 = Hot.

The effect of each regressor now depends on the value of the dummy which identifies the group considered. This aspect becomes clearer if the model is formalised as follows:

The marginal effect of x on energy demand in the Group of Mild countries, \(\frac{\partial y_{it}}{\partial{x_{it}}}=\beta_{20}+\beta_{21}\), is different from that on countries belonging to either the Group Hot, \(\frac{\partial y_{it}}{\partial{x_{it}}}=\beta_{20}+\beta_{22}\), or the Group Cold, \(\frac{\partial y_{it}}{\partial{x_{it}}}=\beta_{20}\). Moreover, the intercept differs across groups: α i0 + α i1 for Group Mild, α i0 + α i2 for Group Hot and α i0 for Group Cold. We estimate the ECM model using heteroskedasticity robust variance-covariance matrix.

4.2 Results

The results from the ECM estimations are reported in Table 4. The data on coal prices are too few to estimate the model. Thus results are only presented for gas, oil products, and electricity. Group dummies have been included only in the electricity demand regression as there were not sufficient data points to account for cluster heterogeneity in the gas and oil products equations. Very few observations are available for gas price in the cold and hot groups, where there are observations only for one and two countries, respectively. The demand for electricity was initially estimated including all seasonal temperature variables, but in a second stage, the temperature variables that were not significant were dropped. The Appendix reports the regression results when all variables are included.

The estimated coefficient on the error correction term λ is negative and always statistically significant. This demonstrates the importance of the error correction in adjustments to equilibrium, though the small coefficients indicate that when the system is not in equilibrium, there is between 10 and 16% correction towards the long-run equilibrium level in the current period, with the highest adjustment in gas demand. Results reveal the presence of short- and long-run effects of temperature, with an estimated impact that is larger over the long-run. Cooling and heating adjustments are observed both in the short- and long-run. Evidence of the cooling effect are shown by the positive coefficient of either summer or spring temperature, depending on the region considered. The heating effect is captured by the negative elasticity of gas and oil to temperature variables. Summer temperature leads to a higher annual electricity demand to feed a higher usage of air conditioners. The other fuels instead tend to respond negatively to temperature increases, especially when occurring in the fall, spring, or winter.

In the case of electricity demand, different behaviors can be identified for cold, hot, and mild countries. Table 5 reports temperature elasticities for the three countries group and for each type of fuel. Long-run elasticities can be calculated from the results in Table 4 simply by dividing the long-run coefficients by the appropriate adjustment coefficient, λ. While higher summer temperature leads to an increase in electricity demand in mild and hot regions, it has the opposite effect in cold regions. Mild and hot regions are characterized not only by higher average temperature levels, but also by a higher variability in summer temperature, as shown in the Data Statistics in the Appendix. A temperature increase in the spring can also be associated with an increase in electricity demand in regions with extreme weather conditions, namely hot and cold regions. The strong and positive effect of spring temperature compared to summer temperatures can be explained with the fact that the dependent variable is the annual, and not the seasonal, demand for energy. Annual demand is expected to be affected more by the overall length of the hot season than by higher average temperatures in summer.

The heating effect is stronger for oil than gas. Only a temperature increase in winter would reduce the demand for all three energy carriers considered here. The demand for gas and oil products, mostly used for heating, is particularly sensitive to changes in winter, spring, and fall temperatures. An increase in temperature in these seasons reduces the demand for these types of energy vectors, but only in mild-climate regions. Only in the summer cold countries seem to use less electricity. Instead cold regions would increase electricity use in spring.

Regarding the other covariates, GDP per capita and fuel prices are significant only in the long-run. Table 6 reports the own price and income long-run elasticities. Table 7 reports the results of the exiting literature. Our price and income elasticities are within the ranges estimated in other studies. When significant, income elasticity is always less than one and positive, signaling the tendency for richer people to increase energy consumption. Significant price elasticities are always negative, pointing at the substitution possibilities among fuels.

The Appendix reports additional regression results obtained considering a shorter time period. A number of countries are characterized by a significant reduction in oil demand immediately after the oil shock, between 1978 and 1983. The three demand equations were thus estimated for the sub-period 1984–2000. Coefficient estimates are in line with the estimates obtained using the full sample, although shortening the sample tends to weaken energy temperature elasticity, especially in the short-run.

5 Assessing climate change impacts on energy demand: an illustrative application

A novel aspect of the estimation exercise described in this paper is its global coverage and the selection of explanatory variables, which makes it possible to apply the results to study the economic impacts of climate change on energy demand. To exemplify the point, this section presents a simple application merely intended at illustrating the procedure and the type of output that can be obtained.

Energy consumption levels for a selected group of countries have been projected to 2085, distinguishing the three categories of electric energy, gas and oil products,Footnote 8 neglecting changes in temperatures. In a second step, we considered the seasonal temperature scenarios for the century available through High Resolution Gridded Dataset of the Climate Research Unit University of East Anglia and from the Tyndall Center for Climate Change Research (Mitchell et al. 2003). Using temperature elasticities described in the previous section, we constructed the variations in energy demand induced by temperature changes. These variations, expressed in thousands tons oil equivalent (Ktoe), are displayed in Table 8.

The results show that there is a clear heating effect for cold countries and a cooling and heating effect in hot countries. Results are mixed for mild countries. This application shows that it is possible to calculate the overall effect of temperature rise on energy demand. This will be positive or negative according to whether the heating or cooling effect prevails. In most countries, the heating effect prevails leading to an overall decrease in energy demand. The exceptions for this are New Zealand, South Africa and Australia. The heating effect also prevails at the global level, as temperature causes an overall decrease in energy demand.

The country-specific results can also be related to the fuel mix in the various regions. Cold regions have declining levels of fossil fuel energy as well as electricity. This is not only due to the prevailing heating effect, but also to the fact that in these regions electricity occupies a large share of the energy mix (ranging from almost 30% in Canada to around 80% in Norway). This is true also for other countries, such as France, where the share of electricity is high due to the widespread use of nuclear energy. An opposite example, is that of Germany, where the share of electricity is lower and its consumption increases due to a cooling effect.

It is important to keep in mind that this exercise is merely illustrative, as it does not consider any general equilibrium effect or over-time adjustments. A reliable conclusion on the overall change in energy demand can only be obtained applying the empirical results in a climate-economy model that considers economy-wide effects.

6 Conclusions and extensions

Climate change causes variations in seasonal temperatures, which affect patterns of residential energy demand for heating and cooling. This paper has attempted to identify and quantify these effects through an empirical analysis of energy demand responses to temperature variations. The analysis is based on a panel of OECD and non-OECD countries for different types of fuels. The empirical model is based on an Error Correction formulation, which reflects the statistical characteristics of the data.

The analysis shows that the cooling effect can be seen through the increase in electricity demand caused by rising summer and spring temperatures. Such an effect is present in mild and warm regions. The heating effect can be seen through a demand reduction for those fuels that are typically used for heating purposes, gas, and oil products. The overall effect of higher temperatures on annual energy demand depends on the region. Cold countries, such as Canada and Norway, experience reductions in all components of energy demand. In mild countries, like Italy, the higher demand for electricity during the summer is compensated by a lower demand for gas and oil products in winter and spring. In warm countries, such as Mexico, the cooling effect leads to increases in energy demand not only in the summer, but also in the spring.

The contribution of this paper is twofold. First, the differentiation between different temperature clusters employed in the paper facilitates the identification of the cooling and heating effects. Second, this paper takes a more global approach using a broader dataset than earlier studies, in terms of regional disaggregation and fuel types. Because of their global coverage, the results from the analysis can be applied to climate-economy models and used for the climate change impacts assessments.

To illustrate the potential of the results in supporting climate impact assessment, we used the estimates to gauge the economic impacts of climate change on energy demand in the year 2085. We found that the total effect, for the group of countries we considered, is a significant reduction in energy consumption, amounting to more than 1.8 bn Ktoe. Most of this reduction is due to a drop in demand for oil products, used for heating purposes.

Notes

We exclude the analysis of coal because of data limitations regarding coal prices.

The choice of the indicator used for temperature change is discussed in the following section.

Note that the distinction between colder and warmer climates can only partially account for the geographic variability between and within regions. In fact, variables other than average temperatures may be relevant, such as the presence of mountains, coastal areas, lakes, precipitations or monsoons.

Degree days are defined in relation to the difference between the observed temperature and a threshold value, which can vary across regions. When the average daily temperature is above a certain threshold, the day is classified as a cooling degree day. It is a heating degree day when the average daily temperature is below the threshold and therefore, when it is cold. The threshold is calculated based on the heating and cooling needs.

The present work deals with a panel of countries that belong to different hemispheres. In this context simply using seasonal averages for all countries would have created a bias in the different behavior between northern- and southern-hemisphere countries. Consequently, seasonal temperatures were calculated as the average temperature in the months related to a certain season. For example, winter temperature in France is the average between the temperatures of December, January and February, whereas in Australia it is the average between the temperatures of June, July, and August.

Recent econometric literature on panel data have compared the validity of homogeneous versus heterogeneous estimators, to obtain energy demand elasticities with respect to price and income. Whereas some authors favor the pool estimator despite the rejection of the poolability assumption (Baltagi and Griffin 1997), Pesaran and Smith (1995) favor an estimator based on the individual time series.

Not all countries are included as the tree only displays countries with a certain degree of difference in annual temperatures. Nevertheless, the cluster analysis is applied to all countries in the sample used for the estimation and they are all assigned to a certain group.

To this end, we considered baseline consumption levels at 2000. Increases in energy consumption have been obtained on the basis of available population (source:GGI Scenario Database, http://www.iiasa.ac.at/Research/Models/index.html, referring to IPCC SRES scenario B2) and income per capita growth scenarios (source: own elaboration from World Bank data). Changes in energy demand due to higher income levels were obtained using income demand elasticities estimated in this study.

References

Asadoorian OM, Eckaus R, Schlosser CA (2006) Modeling climate feedbacks to energy demand: the case of China, MIT joint program on the science and policy of global change. Report no. 135

Balestra P, Nerlove M (1966) Pooling cross-section and time-series data in the estimation of a dynamic model: the demand for natural gas. Econometrica 31:585–612

Baltagi BH, Griffin JM (1997) Pooled estimators versus their heterogeneous counterparts in the context of dynamic demand for gasoline. J Econom 77:300–327

Beenstock M, Goldin E, Nabot D (1999) The demand for electricity in Israel. Energy Econ 21:168–183

Bigano A, Bosello F, Marano G (2006) Energy demand and temperature: a dynamic panel analysis. Fondazione ENI Enrico Mattei working paper no. 112.06

Durlaf SN, Johnson PA (1995) Multiple regimes and cross-country growth behavior. J Appl Econ 10(4):365–384

Engested T, Bentzen J (1993) Short- and long-run elasticities for energy demand a co-integration approach. Energy Econ 15(1):9–16

Everitt B (1974) Cluster analysis. Heinemann Educ. Books, London

Hartigan JA (1975) Clustering algorithms. Wiley, New York

Hadri K (2000) Testing for stationarity in heterogeneous panel data. Econom J 3:148–161

Hanley A, Peirson J (1996) Energy pricing and temperature interaction: British experimental evidence. Aberystwyth Economic Research Paper, no. 96-16, University of Wales Aberystwyth

Hanley A, Peirson J (1997) Non-linearities in electricity demand and temperature: parametric vs. non-parametric methods. Oxf Bull Econ Stat 59:149–162

Hanley A, Peirson J (1998) Residential energy demand and the interaction of price temperature: British experimental evidence. Energy Econ 20:157–171

IEA (2010) International energy balances 2010. IEA, Paris

Im KS, Pesaran MH, Shin Y (2003) Testing for unit roots in heterogeneous panels. J Econom 115:53–74

Kaufman L, Rousseeuw PJ (2005) Finding group in data: an intro to cluster analysis. In: Wiley series in probability and statistics

Kouris G (1983) Energy consumption and economic activity in industrialised economies: a note. Energy Econ 5(3):207–212

Lehmijoki U, Paakkonen J (2006) Demographic clubs; convergence within, divergence between. Discussion paper no. 136, Helsinki Center of Economic Research

Levin A, Lin C-F (1993) Unit root tests in panel data: new results. Discussion paper 93-56, University of California, San Diego

Liu G (2004) Estimating energy demand elasticities for OECD countries—a dynamic panel data approach. Discussion papers no. 373, Statistics Norway, Research Department

Maddala GS, Wu S (1999) A comparative study of unit root tests and a new simple test. Oxf Bull Econ Stat 61:631–652

Madlener R, Alt R (1996) Residential energy demand analysis: an empirical application of the closure test principle. Empir Econ 21:203–220

Mansur ET, Mendelsohn R, Morrison W (2008) A climate change adaptation: a study of fuel choice and consumption in the US energy sector. J Environ Econ Manage 55:175–193

Masish AMM, Masish R (1996) Energy consumption, real income and temporal causality: results from a multy-country study based on cointegration and error-correction modeling techniques. Energy Econ 18:165–183

Mitchell T, Hulme M, New M (2003) A comprehensive set of climate scenarios for Europe and the globe. Tyndall Centre working paper 55

Moral-Carcedo J, Vicens-Otero J (2005) Modeling the non-linear response of Spanish electricity demand to temperature variations. Energy Econ 27:477–494

Nordhaus WD (1977) The demand for energy: an international perspective. In: Nordhaus WD (ed) International studies of the demand for energy. North Holland, Amsterdam

OECD (Organisation for Economic Co-operation and Development) (2008) OECD environmental outlook to 2030. OECD, Paris

Parti P, Parti C (1980) The total and appliance-specific conditional demand for electricity in the household sector. Bell J Econ 11:309–321

Pesaran MH, Smith R (1995) Estimating long-run relationships from dynamic heterogenous panels. J Econom 68:79–113

Pindyck RS (2006) Uncertainty in environmental economics. NBER working paper 12752

Prosser RD (1985) Demand elasticities in OECD: dynamical aspects. Energy Econ 7:9–12

Sadorsky P (2009) Renewable energy consumption, CO2 emissions and oil prices in the G7 countries. Energy Econ 31:456–462

Stern DI (2000) A multivariate cointegration analysis of the role of energy in the US macroeconomy. Energy Econ 22:267–289

Vaage K (2000) Heating technology and energy use: a discrete/continuous choice approach to Norwegian household energy demand. Energy Econ 22:649–666

Vahid F (2000) Clustering regression functions in a panel. Econometric Society world congress 2000 contributed papers 0251

Westerlund J (2007) Testing for error correction in panel data. Oxford Bull Econ Stat 69(6):1468–0084

Zarnikau J (2003) Functional forms in energy demand modeling. Energy Econ 26(6):603–613

Acknowledgements

The authors would like to thank Francesco Bosello, Claudio Agostinelli and Andrea Bigano for their guidance, and Carlo Carraro and Ian Sue Wing for useful comments. Andrea Bigano, Francesco Bosello and Giuseppe Marano are also gratefully acknowledged for providing the initial dataset used for the analysis.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix A: Data statistics summary

Appendix B: Additional regressions

Rights and permissions

About this article

Cite this article

De Cian, E., Lanzi, E. & Roson, R. Seasonal temperature variations and energy demand. Climatic Change 116, 805–825 (2013). https://doi.org/10.1007/s10584-012-0514-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10584-012-0514-5