Abstract

This paper develops a model for optimal portfolio allocation for an investor with quantile preferences, i.e., who maximizes the \(\tau \)-quantile of the portfolio return, for \(\tau \in (0,1)\). Quantile preferences allow to study heterogeneity in individuals’ portfolio choice by varying the quantiles, and have a solid axiomatic foundation. Their associated risk attitude is captured entirely by a single dimensional parameter (the quantile \(\tau \)), instead of the utility function. We formally establish the properties of the quantile model. The presence of a risk-free asset in the portfolio produces an all-or-nothing optimal response to the risk-free asset that depends on investors’ quantile preference. In addition, when both assets are risky, we derive conditions under which the optimal portfolio decision has an interior solution that guarantees diversification vis-à-vis fully investing in a single risky asset. We also derive conditions under which the optimal portfolio decision is characterized by two regions: full diversification for quantiles below the median and no diversification for upper quantiles. These results are illustrated in an exhaustive simulation study and an empirical application using a tactical portfolio of stocks, bonds and a risk-free asset. The results show heterogeneity in portfolio diversification across risk attitudes.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Portfolio selection is a fundamental topic in economics and finance and one of the leading applications of decision theory under uncertainty. Modern portfolio theory derives its main results on diversification and risk under the important paradigm of the expected utility (EU) theory; see, for instance, Cochrane (2005) and Campbell (2018). Nevertheless, the EU framework has been subjected to a number of criticisms, mostly arising from experimental evidence.Footnote 1

In this paper we depart from the EU framework and investigate the optimal portfolio allocation of individuals concerned with maximizing a specific quantile of the distribution of portfolio returns. This individual’s behavior is motivated from both practical and theoretical points of view. Regarding the former, quantiles have been used in practical decision making in banking and investment (in the form of Value-at-RiskFootnote 2 and goal-reaching problems) and in mining, oil and gas industries (in the form of “probabilities of exceeding”Footnote 3 a certain level of production). On the latter motivation, there has been increasing theoretical, empirical and experimental interest in decision under uncertainty under quantile preferences (QP). This alternative preference has been characterized in early work by Manski (1988), who studied properties of a quantile model for individual’s behavior. More recently, QP have been formally axiomatized by Chambers (2009), Rostek (2010), and de Castro and Galvao (2021). Mendelson (1987) introduced the concept of quantile-preserving spread, which is a notion of risk aversion for the quantile model that establishes a parallelism with mean-preserving spreads in the standard EU framework. Chambers (2007) considered the problem of aggregating a profile of interpersonally comparable utilities into a social utility and provides a quantile representation of such social aggregation. Bhattacharya (2009) studies the problem of optimally dividing individuals into peer groups to maximize a quantile of social gains from heterogeneous peer effects. Giovannetti (2013) modeled a two-period economy with one risky and one risk-free asset, where the agent has QP instead of the standard EU. de Castro and Galvao (2019) developed a dynamic model of rational behavior under uncertainty, in which the agent maximizes a stream of the future quantile utilities. From an experimental point of view, de Castro et al. (2022) provide evidence that the behavior of between 30 and 50% of the individuals in their experiment can be better described with QP rather than EU.

Overall, QP have several attractive features.Footnote 4 An individual’s decision is independent of the form of her utility function and thus an optimal choice is relatively easy to compute.Footnote 5 The measure of risk aversion is simple, intuitive, and determined by the quantile \(\tau \in (0,1)\). The increasing interest on this recent approach to modeling individuals’ behavior under uncertainty suggests that it is important to understand portfolio choice in this context, and this paper fulfills this gap.

Our study of portfolio choice begins with the observation that the individuals’ risk attitude under QP is captured by a single-dimensional parameter, the quantile \(\tau \in (0,1)\). The lower the \(\tau \), the more averse to risk the \(\tau \)-quantile-maximizer decision maker (\(\tau \)-DM) is. Next we formally establish properties of the quantile model. First, we focus on a simple portfolio given by a risk-free and a risky asset. In contrast to the capital market line characterizing the mutual fund separation theorem in a mean-variance setting (Tobin 1958), the optimal portfolio allocation under QP is to fully invest on the risk-free asset for QP given by \(\tau \) below the magnitude of the risk-free rate, or to fully invest on the risky asset, otherwise. The extension of the portfolio to considering a risk-free asset and two risky assets provides similar insights indicating an optimal binary response with respect to the risk-free asset. However, in this case, we find that diversification between the two risky assets may also be an optimal outcome for middle quantiles even if the allocation to the risk-free asset is null.

The optimal portfolio choice problem is then extended to consider a portfolio of two risky assets. We formally show that a \(\tau \)-DM always diversifies (i.e. invest in both assets) if the distribution functions of the assets in the portfolio have same lower end (i.e. worst-case scenario) and \(\tau \) is sufficiently low. In contrast, if \(\tau \) is sufficiently high, we find that there is no diversification at all: the \(\tau \)-DM only invests on the riskier asset. We illustrate these rich heterogeneous behavior and theoretical insights with examples of two uniform random variables, a case in which we are able to obtain an analytical solution of the portfolio selection problem. We then provide further conditions under which the optimal portfolio decision has an interior solution with diversification vis-à-vis no diversification. The intuition behind the obtained characterization is that, in general, there will be diversification for investors concerned with low quantiles and downside risk. These diversification insights are illustrated in numerical simulation exercises that cover several canonical cases under different scenarios. For the particular case of two independent and identically distributed (iid) random variables, full diversification is optimal for \(\tau \le \tau _0\) but not for values of \(\tau >\tau _0\). The optimal strategy in the upper part of the distribution is investing fully in one risky asset. Therefore, the quantile model is flexible and allows for the possibility of underdiversification in the sense that, in some scenarios, the optimal portfolio choice may be no diversification. This is consistent with evidence of underdiversification compared to standard mean-variance efficient allocations; see Campbell (2006), Mitton and Vorkink (2007) and references therein.

The insights of the QP model for optimal portfolio allocation are applied to an empirical example to illustrate the similarities and differences between the optimal portfolio choices of EU and QP individuals. To do this, we consider a simple portfolio selection of stocks, bonds and cash, and compare the optimal asset allocation of QP individuals with that of EU individuals with mean-variance and power utility functions. We consider monthly data collected from three assets: the risk-free one-month nominal yield on the U.S. Treasury bill rate, the S&P 500 and the G0Q0 Bond Index, for the period January 1980 to December 2016. We compute the optimal portfolio allocation for the full range of \(\tau \in (0,1)\). For low enough quantiles, the optimal strategy is to invest fully in the risk-free asset, and for high enough quantiles, the optimal solution is fully invest in S&P 500 index. There is a rich diversification pattern among the three assets for middle quantile indexes. Overall, the results show portfolio diversification heterogeneity across risk attitudes, with no diversification for very low and large quantiles. These empirical findings contrast with the results obtained from two standard EU cases, the mean-variance and CRRA utility cases that exhibit full diversification under risk aversion.

We remark that the initial reaction to the consideration of QP might be of doubt, since quantile maximization is different from the familiar and well known EU model. Quantile maximization implies, indeed, some choices that might seem unusual at first glance, but can be considered reasonable after we overcome the influence of the EU over our intuition. More than that, there are situations where the maximization of a quantile seems very natural and by varying \(\tau \) they encompass the whole range of risk aversion attitudes encountered in EU. It is not our contention, nevertheless, that quantile maximization is a decision method to be prescribed in all cases and problems, but rather that it is a complement analysis to EU. As such, it is important to document its properties and implications on relevant economic settings, such as the portfolio selection problem that is the focus of this paper. Those properties could then be tested in laboratories or confronted with data.

The remainder of the paper is laid out as follows. Section 1.1 has a brief review of the literature. Section 2 discusses the risk attitudes in QP models. Section 3 contains the main results of the paper. This section derives conditions under which there is full or null diversification in the tails, and conditions that provide focal optimal portfolios for risk averse and risk loving individuals. In addition, this section presents a numerical simulation exercise that illustrates the theoretical insights of the paper. Section 4 presents a simple portfolio allocation exercise among stocks, bonds and a risk-free asset, and Sect. 5 concludes. All mathematical derivations and proofs are collected in Appendix A. Appendix B extends the simulation exercise by considering different distributional assumptions and dependence structures between the assets.

1.1 Literature review

This paper relates to a number of streams of literature in portfolio selection and economic theory. First, the paper relates to the extensive literature on optimal decision theory under uncertainty and portfolio selection. Optimal portfolio decision based on the EU has been the basis of asset pricing equilibrium models such as the Sharpe-Lintner CAPM (Sharpe 1964; Lintner 1965) and more recent alternatives based on factor models. In this context, the investor’s optimal portfolio decision relies heavily on the specification of the utility function for modeling individuals’ preferences. Thus the theoretical optimal portfolio allocation of individuals with constant absolute risk aversion and constant relative risk aversion preferences may be very different although, in practice, it may be difficult to differentiate between both attitudes towards risk from real data. A robust approach within the EU paradigm is stochastic dominance. This theory allows one to rank risky alternatives without relying on specific forms of the individuals’ utility function. Early work by Porter (1974) and Fishburn (1977) characterize the optimal portfolio decisions of EU individuals using stochastic dominance criteria of different orders. However, the equivalence between EU maximization and stochastic dominance is only satisfied, under risk aversion, for well-behaved (increasing and concave) utility functions.

Second, this paper is related to a branch of the literature on models for portfolio selection with alternative preferences to the EU. Many alternative preference measures to the EU have been put forward in the portfolio choice literature. Most of these approaches replace the utility function, which is essentially a distortion in wealth, by a distortion in the probability distribution of wealth. This probability distortion function, as Yaari (1987) shows, represents the risk preference in a different way. Similar approaches involving subjective probability distributions include, most significantly, Kahneman and Tversky (1979)’s prospect theory. Garlappi et al. (2007) develop a model for an investor with multiple priors and aversion to ambiguity. We extend the last two literatures by replacing EU and its variations with QP.

Third, this paper is related to a several works on models using the QP. As mentioned previously, QP were first studied by Manski (1988) and subsequently axiomatized by Chambers (2009), Rostek (2010) and de Castro and Galvao (2021). The risk attitude under QP is based on the concept of quantile-preserving spreads introduced in Mendelson (1987) and reformulated in Manski (1988) in terms of a single-crossing criterion between distribution functions. More recently, QP models have been employed in modeling economic behavior in different frameworks, see e.g., Chambers (2007), Bhattacharya (2009), Giovannetti (2013) and de Castro and Galvao (2019). Also, as mentioned previously, de Castro et al. (2022) show experimental evidence on the use of QP. In the asset pricing literature the use of QP has been hardly explored though.

Fourth, there is a small literature on optimal portfolio allocation using a quantile target variable. Kulldorff (1993) and Föllmer and Leukert (1999) study the goal-reaching problem where the target variable is a specific quantile, and He and Zhou (2011) propose a portfolio choice model in continuous time, where the quantile function of the terminal cash flow is the decision variable. In a similar context, Brown and Sim (2009) provide a framework for measuring the quality of risky positions with respect to their ability to achieve some aspiration level, that can be interpreted with a quantile probability. In the mutual fund industry, quantiles have been used as alternative performance measures, see, for example, Kempf and Ruenzi (2007). We contribute to these two last lines of research by taking the QP together with the quantile maximization to a portfolio selection model and deriving its properties.

We conclude this section by discussing a related literature that shares some of the insights of QP theory but is different in scope. This discussion may serve as further general motivation for use of QP. Quantile measures have been used as risk measures in optimal portfolio allocation. In particular, Value-at-Risk (VaR) and expected shortfall models are closely linked to a low quantile selection, see Duffie and Pan (1997) and Jorion (2007) for a comprehensive review of VaR models. In an optimal asset allocation context, the VaR quantiles act as constraints in the asset allocation optimization exercise rather than as target variables to be optimized. These mean-risk models discussed in Fishburn (1977) can be considered as an extension of standard mean-variance formulations, see Markowitz (1952), rather than as QP models for optimal portfolio allocation. The relevant literature includes Basak and Shapiro (2001), Krokhmal et al. (2001), Campbell et al. (2001), Wu and Xiao (2002), Bassett et al. (2004), Engle and Manganelli (2004) and Ibragimov and Walden (2007), among others, and sheds an interesting light on the properties of VaR-optimal portfolios while acknowledging considerable computational difficulties (Gaivoronski and Pflug 2005; Rachev et al. 2007).

2 Quantile preferences and the risk attitude

This section briefly reviews the definition of risk under quantile preferences (QP). We first introduce the notation and definition of QP. Given any random variable \(X: \Omega \rightarrow {\mathbb {R}}\), we denote by \(F_{X}: {\mathbb {R}}\rightarrow [0,1]\) the cumulative distribution function (CDF) of X. Given \(\tau \in (0,1)\), the \(\tau \)-quantile of X is defined as

A well-known and important property of quantiles, used below, is its invariance with respect to monotonic transformations. More formally, if \(\psi : {\mathbb {R}}\rightarrow {\mathbb {R}}\) is continuous and strictly increasing, then

A preference \(\succeq \) over random variables is a \(\tau \)-quantile preference for some fixed \(\tau \in (0,1)\) if

where \(u(\cdot )\) is the utility function over the possible outcomes of the random variables X and Y. Note that u(X) and u(Y) are also random variables. Manski (1988) was the first to study QP as given in (2). Chambers (2009) shows that these preferences satisfy the properties of monotonicity, ordinal covariance, and continuity. In contrast, Rostek (2010) axiomatized the QP in the context of Savage (1954)’s subjective framework. Recently, de Castro and Galvao (2021) provide an alternative axiomatization for the static case using an uncertainty setting and finite state space.

It is important to notice that the QP defined by (2) are in fact independent of the utility function. Indeed, for any continuous and strictly increasing \(u:{\mathbb {R}}\rightarrow {\mathbb {R}}\), from (1),

This result shows that the utility function plays absolutely no role in defining the preference relation. We can use (1) to make any transformation of u; therefore, we could transform a concave utility function into a convex one without changing the preference. In particular, this implies that the concavity of the utility function has absolutely no implication for the risk attitude (nor any property) of QP.

The risk attitude in QP models is captured by the parameter \(\tau \in (0,1)\). This is discussed in detail by de Castro and Galvao (2019) and de Castro et al. (2022). Here we just summarize the main idea. For comparison of two decision makers, consider the following definition by Ghirardato and Marinacci (2002, Definition 4, p. 263):

Definition 2.1

(Ghirardato-Marinacci) A preference \(\succeq '\) is more uncertainty averse than preference \(\succeq \) if for any \(q \in {\mathbb {R}}\), and random variable X, \(q \succeq X \Rightarrow q \succeq ' X\) and \(q \succ X \Rightarrow q \succ ' X\).

Ghirardato and Marinacci (2002)’s definition is a generalization of the standard notion of risk aversion in the context of risk under expected utility. The idea is that if a DM with preference \(\succeq \) would rather have the certain outcome \(q\in {\mathbb {R}}\) than the risky prospect X, then the more uncertainty averse \(\succeq '\) DM prefers it as well.

The following Proposition 2.2 shows that \(\succeq ^{\tau }\) is more risk averse than \(\succeq ^{\tau '}\) if and only if \(\tau < \tau '\). This property implies that an agent with QP given by \(\tau \) is more risk preferring than another agent with QP given by \(\tau '\) if \(\tau >\tau '\). Thus, a QP decision maker that maximizes a lower quantile is more risk averse than one who maximizes a higher quantile.

Proposition 2.2

Consider quantile maximizing preferences \(\succeq _{\tau }\) and \(\succeq _{\tau '}\). The following statements are equivalent:

-

(1)

\(\tau \geqslant \tau '\);

-

(2)

\(\succeq _{\tau '}\) is more uncertainty averse than \(\succeq _{\tau }\);

Proof

See de Castro et al. (2022). \(\square \)

In fact, de Castro et al. (2022) consider two more equivalent conditions, based on the notion of quantile-preserving spreads introduced by Mendelson (1987), that extend Rothschild and Stiglitz (1970)’s mean-preserving notion. See de Castro and Galvao (2019) for a more detailed discussion.

3 Optimal portfolio choice problem

In this section we first study the case of a portfolio given by a risk-free and a risky asset. This simple portfolio problem serves to establish the intuition about the optimal behavior of individuals with quantile preferences (QP) and motivate the problem of interest, which is the study of the optimal portfolio allocation between two or more risky assets. We focus on the analysis of two risky assets. Prior to this, we set the foundations of the optimal portfolio allocation problem.

3.1 Quantile portfolio selection under quantile preferences

We start by formally describing the portfolio selection problem under QP. The portfolio manager has a budget \(b>0\) to invest in n assets for a given fixed period of time. She will end up devoting \(a_{i} \in [0,b]\) to asset i, satisfying \(\sum _{i=1}^{n}a_{i}=b\). The initial price of asset i is \(p_{i}>0\), so that \(a_{i}=p_{i}q_{i}\), where \(q_{i}\) denotes the number of units of asset i that the portfolio manager buys. After the investment period, asset i’s price will be \({\tilde{p}}_{i} \geqslant 0\), which is random if asset i is not a risk-free asset. Therefore, the net return on asset i after the investment period is \({\tilde{r}}_{i}=\frac{{\tilde{p}}_{i}}{p_{i}} - 1\), which is a random variable. Consider the following portfolio

where \(w\equiv (w_{1},\ldots ,w_{n}) \in [0,1]^n\), with \(\sum _{i=1}^{n}w_{i}=1\). The weights \(w_i=\frac{a_i}{b} \ge 0\) denote the fraction of wealth invested on asset i. Implicitly, we are assuming that the portfolio manager does not short assets.Footnote 6

To be consistent with the literature on optimal portfolio theory under EU preferences, we assume that individuals are endowed with a utility function \(u(S_{w})\), where \(u: {\mathbb {R}}\rightarrow {\mathbb {R}}\), for describing individual’s preferences on wealth. Then, for a given risk attitude \(\tau \in (0,1)\), the portfolio choice problem under QP is

As discussed in Eq. (3) above, the choice of utility function is irrelevant for portfolio selection under QP. Hence the quantile optimization problem (4) using a given utility is equivalent to maximizing the quantile obtained directly from the distribution of the random variable.

Lemma 3.1

Let \(u(\cdot )\) be a continuous and increasing utility function defined over the domain of the random variable \(S_{w}\) for \(w \equiv (w_{1},\ldots ,w_{n}) \in [0,1]^{n}\). The maximization argument \(w^*\) solves (4) if and only if it solves the following:

Given the result in Eqs. (4) and (5), for the remaining of the paper, we focus the main analyses on the problem in (5).

It is worth noting that the above portfolio choice problem is different, and more general, than the goal-reaching problem proposed by Kulldorff (1993) in a quantile setting. This author maximizes the cumulative probability of \(\sum _{i=1}^{n} w_{i}{\tilde{r}}_{i}\) subject to achieving some target return \(r_0\). More formally, the objective function is \(\underset{(w_{1},\ldots ,w_{n}) }{\max } \ P \{\sum _{i=1}^{n} w_{i}{\tilde{r}}_{i} \ge r_0 \}\) subject to \(\sum _{i=1}^{n}w_{i}=1\).

The result in Lemma 3.1 is important in the context of portfolio allocation. Theoretically, it implies that the quantile choice rule is able to separate beliefs from tastes. The relevance of this separation criterion was put forward by Ghirardato et al. (2005) in the context of decision theory under uncertainty. These authors offered a result with this separation, but they did not insist on a complete separation of tastes and beliefs, because such a separation would rule out most of the choice rules commonly considered by decision theorists.Footnote 7 In contrast, as shown in Lemma 3.1, the QP deliver a complete separation of tastes and beliefs. Empirically, this separation is very important as well. In particular, it allows portfolio managers to make choices on a particular portfolio without the knowledge of any specified utility function. For instance, a manager only needs to learn about the quantile \(\tau \) of an agent to choose the portfolio weights from a given selection of returns \({\tilde{r}}\).

3.2 Optimal portfolio allocation when there is a risk-free asset

Manski (1988) derives the preferences of a quantile maximizer between two outcomes X and Y when one of the outcome measures is degenerate, and finds a complete separation in preferences between the degenerate and risky outcome. The deterministic choice is the preferred strategy for low quantiles. In contrast, for high quantiles, the risky outcome is the preferred strategy.

In this section, we provide further formality to the example in Manski (1988) and frame it in an optimal asset allocation context. We assume there is a riskless security that pays a rate of return equal to \(R_f={\bar{r}}\), and just one risky security that pays a stochastic rate of return equal to R with distribution function \(F_{R}\). The portfolio return is defined by the convex combination

and the investor’s maximization problem (5) for a specific quantile \(\tau \) is \(\arg \max _{w} \text {Q}_{\tau }[ u({\bar{r}} + (1-w) (R - {\bar{r}}))]\). Using the monotonicity of the quantile process, for a continuous and increasing utility function, the investor’s problem simplifies to

Simple algebra shows that the individual portfolio choice w is then given by the following:

The intuition of this solution is simple. For small values of \(\tau \) the individual’s optimal portfolio choice is \(w^{*} = 1\) and corresponds to full investment on the risk-free asset. This is so because \({\bar{r}}>\text {Q}_{\tau }[R_p]\) for any combination \(R_p\) characterized by \(0< w < 1\). For larger values of \(\tau \), such that \(\text {Q}_{\tau }[R ] > {\bar{r}}\), the optimal portfolio decision reverses and yields \(w^* = 0\). For \(\text {Q}_{\tau }[R] = {\bar{r}}\), the QP maximizer is indifferent between the risk-free and the risky asset for any \(w \in [0,1]\) defining the portfolio return.

In contrast to the capital market line characterizing the mutual fund separation theorem in a mean-variance setting, Tobin (1958), the optimal portfolio allocation under QP specializes in the risk-free asset for individuals with \(\tau \) below the magnitude of the risk-free rate and on the risky asset, otherwise. In Appendix B.4, we extend the analysis of the risk-free asset by adding a second risky asset to the portfolio. We obtain the same findings indicating an optimal binary response to the risk-free asset. We notice that in this case, however, diversification between the two risky assets may be optimal for middle quantiles even if the allocation to the risk-free asset is null.

3.3 The case of two risky assets

This section considers the optimal portfolio allocation problem for an economy with two risky assets and a decision maker endowed with QP.Footnote 8 Consider two risky assets represented, respectively, by the continuous random variables X and Y. Let the portfolio be defined as

with \(0 \le w \le 1\) a scalar portfolio weight. The portfolio selection problem in this context will be:

Define the solution to this problem by \(w^*(\tau ):(0,1)\rightarrow [0,1]\). Whenever there is no confusion we will use simply \(w^*\). We will also assume that X and Y have joint distribution function given by a continuous probability density function (p.d.f.) f defined over intervals \({\mathscr {I}}_{X}\) and \({\mathscr {I}}_{Y}\). More formally:

Assumption 1

X and Y have joint distribution function given by a continuous p.d.f. \(f: {\mathscr {I}}_{X} \times {\mathscr {I}}_{Y}\rightarrow {\mathbb {R}}\), where \({\mathscr {I}}_{X}=[{\underline{x}},{\overline{x}} ]\), \({\mathscr {I}}_{Y} = [{\underline{y}},{\overline{y}} ]\), \(-\infty \leqslant {\underline{x}} < {\overline{x}} \leqslant \infty \), \(-\infty \leqslant {\underline{y}} < {\overline{y}} \leqslant \infty \) and \(0<f(x,y)<\infty \) for all \((x,y) \in {\mathscr {I}}_{X} \times {\mathscr {I}}_{Y}\).

It is important to emphasize that the above assumption does not exclude distributions with support in the whole real line. In particular, X and Y can be normal variables, for instance. In fact, almost all distributions studied in finance satisfy Assumption 1. It shall be understood that if \({\overline{x}}=\infty \) or \({\overline{y}}=\infty \), the intervals are, respectively, \([{\underline{x}}, \infty )\) and \([{\underline{y}}, \infty )\). An analogous observation holds when \({\underline{x}}=-\infty \) or \({\underline{y}}=-\infty \). We will maintain Assumption 1 in all results of this section and will not repeat it.

In the remaining of the section we establish the existence of the optimal portfolio choice under the QP theory as well as derive conditions that determine the existence of diversification.

Lemma 3.2

The optimization problem (7) has at least one solution.

Lemma 3.2 shows that the QP problem has at least one optimal vector, \(w^{*}(\tau )\), that solves the problem for a given quantile \(\tau \). Deriving an explicit expression for \(w^{*}\) is in general a difficult task, but its value can be obtained through numerical calculations.

3.3.1 Diversification for low quantiles

Our first main result is that “in general” for \(\tau \) sufficiently small, diversification is optimal, that is, there exists an interior solution \(w^{*} \in (0,1)\). As we will see in a moment, this requires some assumptions. Perhaps the most important setting is the one described in the following:

Theorem 1

Assume that \({\underline{x}} , {\underline{y}}> - \infty \). If \({\underline{x}} = {\underline{y}} \) and \(\tau \in (0,1)\) is sufficiently small, then any optimal solution must be interior. More formally, there exists \(\tau _0\) such that if \(\tau <\tau _0\) then \(w \in \{ 0,1 \} \) does not solve (7) for that \(\tau \), or yet: if \(w^{*}\) solves (7), \(w^{*} \in (0,1)\).

Intuitively, for a fixed small \(\tau \), the convex combination of the two assets is able to generate a larger quantile. Notice that this result requires no further assumption on the distributions other than the restriction of the same lower bound. Although this condition excludes normal distributions, it includes important distributions, as for example, the lognormal. Nevertheless, Theorem 1 can be extended to symmetric normal distributions, although we omit a formal statement for space considerations.

It is useful to illustrate Theorem 1 for the case of two standard uniform distributions, \(X \sim U(0,1)\) and \(Y\sim U(0,1)\); see Example 3.3. Figure 1 shows the CDFs of the random variable \(S_{w}\) for different w. One can see that for low \(\tau \) (in this case, \(\tau \leqslant 0.5\)), the CDF curve most to the right corresponds to \(w^{*}(\tau )=0.5\). If \(\tau > 0.5 \), the optimal \(w^{*}(\tau )\) is either 0 or 1, that is, there is no diversification (both 0 and 1 are solutions because the two assets are identical in this case).

Example 3.3

Consider \(X\sim U(0,1)\) and \(Y\sim U(0,1)\), independent. With numerical calculations, in this case we have:

Notice that there can be diversification even when one of the distribution functions stochastically dominates the other. See, for instance, Example 3.4 for the case of \(X\sim U(0,2)\) and \(Y\sim U(0,1)\). In this case, even though U(0, 2) stochastically dominates U(0, 1), there is diversification for \(\tau \leqslant 1/4\): the optimal w is interior, \(w^*= 0.5\).

Example 3.4

Consider \(X\sim U(0,2)\) and \(Y\sim U(0,1)\). In this case we have:

This is an interesting result, because despite the fact that X first order stochastically dominates Y, there exists a convex combination \(S_w\) that dominates both random variables X and Y for low quantiles. Notice, however, that this feature is desirable, because the independence of X and Y makes a convex combination of the two less risky than any of them.

3.3.2 No diversification with different lower ends of the distributions

Given the result in Theorem 1, a natural question is what would happen if the assumption that \({\underline{x}} = {\underline{y}}\) of the theorem does not hold, that is, if \({\underline{x}} \not = {\underline{y}}\). The naïve intuition may be that for low quantiles diversification is always optimal. Theorem 1 shows that this occurs if \(\tau \) is sufficiently small and there is no obvious difference in the lower limits given by \({\underline{x}}\) and \({\underline{y}}\). However, when the tail behavior of the assets in the portfolio is very different, the next result shows that diversification is not optimal for low quantiles. More formally, Theorem 2 shows that for \({\underline{x}}- {\underline{y}} \geqslant \frac{M}{2m}\), with m and M suitable constants, the quantile of X is larger than the quantile of any convex combination of X and Y for low values of \(\tau \). A natural interpretation of this result in a risk management context is to say that the VaR of X is larger than the VaR of any diversified combination of the assets.Footnote 9 The investor allocates all the portfolio weight in the variable that dominates the other in the left tail of the distribution. This is the message of the next result, where we denote X’s \(\tau \)-quantile by \(x_{\tau }\).

Theorem 2

Assume that \({\underline{x}}>{\underline{y}}>-\infty \). Fix \({\overline{\tau }} \in [0,1]\). Let M and m be such that \(m \leqslant f(x,y) \leqslant M\) for all \((x,y)\in [{\underline{x}},x_{{\overline{\tau }}}] \times [{\underline{y}},{\overline{y}}] \cup [{\underline{x}},{\overline{x}}] \times [{\underline{y}}, x_{{\overline{\tau }}}]\).Footnote 10 If \({\underline{x}}- {\underline{y}} \geqslant \frac{M}{2m}\), \(w^{*}=1\) is the unique solution to (7) for all \(\tau \in (0, {\overline{\tau }})\).Footnote 11

Theorem 2 shows that the optimal choice is \(w^{*}=1\) for all \(\tau \) small, provided that the difference between the two distributions at the left end point is sufficiently large. Example 3.5 illustrates this result for the case of \(X\sim U(0.5,1)\) and \(Y\sim U(0,1)\). Since X and Y are uniform and \({\underline{y}}=0\), we can take \(m=M\) and the assumption of Theorem 2 simplifies to \({\underline{x}}\geqslant \frac{1}{2}\), which is precisely the condition satisfied in this example (with \({\underline{x}}=\frac{1}{2}\)).

Example 3.5

Consider \(X\sim U(0.5,1)\) and \(Y\sim U(0,1)\). Then, \(w^*= 1\) for all \(\tau \in (0,1)\).

Notice that in this example, we have the choice \(w^*= 1\) for all \(\tau \in (0,1)\), which is stronger than the result stated in Theorem 2. We can in fact establish this stronger condition if the bounds m and M hold for the entire interval. More precisely, we can fix \({\overline{\tau }}=1\) in Theorem 2 and conclude the following:

Corollary 3.6

Assume that \({\underline{x}}>{\underline{y}}>-\infty \). Let M and m be such that \(m \leqslant f(x,y) \leqslant M\) for all \((x,y)\in [{\underline{x}},{\overline{x}}] \times [{\underline{y}},{\overline{y}}]\). If \({\underline{x}}- {\underline{y}} \geqslant \frac{M}{2m}\), \(w^{*}=1\) is the unique solution to (7) for all \(\tau \in (0, 1)\).

The latter result shows the absence of diversification, across \(\tau \in (0,1)\), for individuals with QP under the conditions of the corollary. This result suggests that in many cases the efforts of portfolio managers may be futile under QP theory. A major implication of Corollary 3.6 is to show that, under QP, if there is no diversification in the lower left tail of the distribution it is very likely that there is no diversification for higher quantiles.

Nevertheless, the behavior with different lower end points can be complex. For instance, it may be the case that the optimal choice is \(w^*\in \{0,1\}\) for small \(\tau \), it becomes interior for intermediate values of \(\tau \) and then becomes \(w^*\in \{0,1\}\) again for large \(\tau \)’s. The following example illustrates a case when the conditions in the corollary are not satisfied. In this case we find the existence of diversification in the middle quantiles of the distribution despite the fact that there is no diversification in the lower left tail.

Example 3.7

Consider (X, Y) a bivariate random vector. Let \(f_X(x)=M\) be the marginal density function of X if \(0<{\underline{x}}\le x \le d\), \(f_X(x)=m\) if \(d< x \le {\overline{x}}<\infty \), and \(f_X(x)=0\) otherwise. The support of X is \([\frac{1}{2},\frac{3}{2}]\), i.e. \({\underline{x}}=\frac{1}{2}\) and \({\overline{x}}=\frac{3}{2}\). Let \(Y \sim U(0,1)\) such that \(f_Y(y)=1\) for \(y\in [{\underline{y}},{\overline{y}}]\), with \({\underline{y}}=0\) and \({\overline{y}}=1\), and \(f_Y(y)=0\), otherwise. Then, the following conditions of Corollary 3.6 are satisfied: (i) \({\underline{x}}>{\underline{y}}>-\infty \), (ii) M and m are such that \(m \leqslant f(x,y) \leqslant M\) for all \((x,y)\in [{\underline{x}},{\overline{x}}] \times [{\underline{y}},{\overline{y}}]\). However, for \(M=4\), \(m=\frac{2}{3}\) and \(d=0.6\), we have \({\underline{x}}-{\underline{y}}=0.5 < 3 = \frac{M}{2m}\), such that the remaining condition of the corollary is not satisfied.

Figure 2 reports the CDFs for different combinations \(S_w\) indexed by \(w \in [0,1]\) for the density functions in Example 3.7. For small and large values of \(\tau \) the optimal allocation is \(w^*=1\), however, there is a middle interval of \(\tau \) for which diversification is optimal. This can be seen by noting that some CDF for \(w\in (0,1)\) crosses from below that of \(w=1\) that corresponds to X.

CDF of \(S_{w}=w X + (1-w) Y\) indexed by \(w \in [0,1]\) when (X, Y) are defined in the Example 3.7

Another interesting case is posed by Theorem 2. One might think that the conclusion of this theorem could hold more generally, whenever \({\underline{x}} > {\underline{y}}\) and \(\tau \) is sufficiently small. This is false, however: the difference between \({\underline{x}}\) and \({\underline{y}}\) must be bounded away from zero to ensure the conclusion. The following examples illustrate this observation.

Example 3.8

Consider \(X\sim U(0.25,0.75)\) and \(Y\sim U(0,1)\). We have \(w^*\in (0,1)\) for \(\tau \in \left( 0,\frac{1}{2} \right) \) and \(w^{*}=0\) for \(\tau \in \left( \frac{1}{2},1 \right) \). See Fig. 3. Its left panel plots the optimal allocation \(w^*(\tau )\), while its right panel plots the \(\tau \)-quantiles of X, Y and the optimal portfolio \(S_{w^{*}(\tau )}\).

Illustration of Example 3.8—Optimal \(w^*\) for \(X \sim U(0.25,0.75)\) and \(Y \sim U(0,1)\)

Example 3.9

Consider \(X\sim U(0.25,1.25)\) and \(Y\sim U(0,1)\). We have \(w^*\in (0,1)\) for \(\tau \in \left( 0 , 0.25 \right) \) and \(w^*=1\) for \(\tau > 0.25\). See Fig. 4. As in the previous case, the left panel plots \(w^*(\tau )\), while its right panel plots the \(\tau \)-quantiles of X, Y and the optimal portfolio \(S_{w^{*}(\tau )}\).

Illustration of Example 3.9—Optimal \(w^*\) for \(X \sim U(0.25,1.25)\) and \(Y \sim U(0,1)\)

3.3.3 No diversification for large quantiles

The examples above suggest that for high \(\tau \), the optimal choice is \(w^*\in \{0,1\}\). This is indeed correct, as the following result establishes. It shows that the optimal portfolio choice for values of \(\tau \) close to 1 is not interior.

Theorem 3

Assume that \({\underline{x}}={\underline{y}}<{\overline{y}} = {\overline{x}} < \infty \). Fix \({\overline{\tau }} \in (0,1)\). Let M and m be such that \(m \leqslant f(x,y) \leqslant M\) for all \((x,y) \in [ x_{{\overline{\tau }}}, {\overline{x}} ] \times [{\underline{y}},{\overline{y}}] \cup [{\underline{x}},{\overline{x}}] \times [x_{{\overline{\tau }}}, {\overline{y}}]\).Footnote 12 If \(x_{{\overline{\tau }}} - {\underline{x}} \geqslant \frac{ M ( {\overline{x}}-{\underline{x}}) }{ 2m}\), then \(w^{*} (\tau ) \in \{0,1\} \) for all \(\tau \in [ {\overline{\tau }},1)\).

Note that in this scenario we may have one or two solutions for \(\tau \) sufficiently close to 1. In other words, there is no portfolio diversification in the upper tail of the distribution. These findings are related to Ibragimov and Walden (2007). These authors find that for truncated versions of heavy-tailed distributions with unbounded support diversification may increase value at risk as long as the random variables are concentrated on a sufficiently large interval. The results in this section generalize Ibragimov and Walden (2007) by considering a wider class of distribution functions characterized by Assumption 1. In particular, we derive the conditions under which diversification in the tails may or may not be an optimal outcome for individuals endowed with QP.

In the following section we proceed to characterize the existence of interior solutions to the QP optimal portfolio choice problem.

3.3.4 Characterization of the interior solution in QP optimal portfolio choice

The preceding section has presented conditions on the support of the random variables X and Y that lead to either full diversification or null diversification. We have also extended the results to the tails of the distributions by showing that for lower bound supports far apart diversification is not an optimal outcome. In this section, we build upon these results and provide a characterization of the interior solutions to the optimal portfolio choice problem under QP theory. The section also establishes properties of the portfolio selection problem in a QP framework.

The proof of the results below will depend on some new definitions. First, let us denote \(\Pr \left( S_w \leqslant q \right) \) by h(w, q), that is,

if \(w \in (0,1)\), \(h(0,q) \equiv F_{Y}(q)\) and \(h(1,q) \equiv F_{X}(q)\). Let us focus on the case \(w \in (0,1)\). From Assumption 1, we know that as long as \(\left\{ \left( x, \frac{q-wx}{1-w} \right) : x \in {\mathbb {R}}\right\} \cap {\mathscr {I}}_{X} \times {\mathscr {I}}_{Y} \) contains more than one point, the equation \(h(w,q) = \tau \in (0,1)\) implicitly defines the quantile \(q=q_{w,\tau }\) of \(S_{w}\) as a function of \(w \in (0,1)\) and \(\tau \in (0,1)\), that is,

In what follows, we will omit \(\tau \) from \(q(w,\tau )\) such that \(q(w,\tau ) \equiv q(w)\).

Let us define \({\mathscr {I}}_{Z}={\mathscr {I}}_{Z}^{w,q}= \{x \in {\mathbb {R}}: \left( x, \frac{q-wx}{1-w} \right) \in {\mathscr {I}}_{X} \times {\mathscr {I}}_{Y} \}\) and assume that w and q are such that \({\mathscr {I}}_{Z}={\mathscr {I}}_{Z}^{w,q}\) is a proper interval. Now, let us define a random variable \(Z=Z_{w,q}\) that is characterized by the following density function:

for \(x \in {\mathscr {I}}_{Z}\). This density function is strictly positive on \({\mathscr {I}}_{Z}\) and zero otherwise. In order to understand what Z corresponds to, consider Fig. 5. This figure plots the region \(\left\{ \left( x, \frac{q-wx}{1-w} \right) : x \in {\mathbb {R}}\right\} \cap [0,1] \times [0,1]\) in a XY plane for the case of two standard uniform distributions. The left plot in Fig. 5 describes the problem for small quantiles (\(\tau \le \frac{1}{2}\)) and \(w=\frac{1}{2}\), and the right plot for large quantiles (\(\tau > \frac{1}{2}\)) and \(w=\frac{1}{2}\). More generally, the random variable Z can be interpreted as the projection of \(Y=\frac{q - wX}{1-w}\) onto X, and has support drawn in red and density given by the values in the probability distribution function along the blue line.Footnote 13

The definition of the random variable Z through the characterization of its density function (9), allow us to state our first result in this section.

Proposition 3.10

Let X and Y be random variables satisfying assumption 1, and let \(Z =Z_{w,q}\) be a random variable characterized by the density function (9). Then, the function q(w) is differentiable at \(w \in (0,1)\) and

provided that one of the following cases hold: (1) \({\mathscr {I}}_{X}={\mathscr {I}}_{Y}={\mathbb {R}}\); (2) \({\mathscr {I}}_{X}={\mathscr {I}}_{Y}={\mathbb {R}}_{+}\); (3) \({\mathscr {I}}_{X}={\mathscr {I}}_{Y}=[0,c]\), with \(c>0\) a constant defining a compact support.

This result allows one to derive the optimality condition characterizing the optimal portfolio choice.

Corollary 3.11

Let \(w^* \in (0,1)\) be an interior solution to the maximization problem (7) for a given \(\tau \in (0,1)\). Under the conditions of Proposition 3.10, the optimal \(w^{*}\) satisfies the condition  , with \(\frac{\partial }{\partial w} E[Z_{w^*,q}] <0\).

, with \(\frac{\partial }{\partial w} E[Z_{w^*,q}] <0\).

To understand the optimality condition in Corollary 3.11, we revisit Example 3.3 by considering again the particular case of two standard uniform random variables, \(X,Y \sim U(0,1)\).

Example 3.12

Let X and Y be iid U(0, 1) random variables. In this case, if \(\tau \le \frac{1}{2}\), we have \(\text {E}[Z] = \frac{q}{2w}\). Then, q(w) is increasing if

The maximum is achieved at \(w^*=\frac{1}{2}\) given that \(E[Z] = q \iff \frac{q}{2w^*} = q \iff w^*= \frac{1}{2}\). To show that \(w^*\) is a maximum we also note that the function q(w) is strictly decreasing for \(w>\frac{1}{2}\) and \(\tau \le \frac{1}{2}\). This case is illustrated in Fig. 5a. On the other hand, if \(\tau > \frac{1}{2}\), Fig. 5b depicts Z. In this case, we can see that

which implies that the function q(w) is increasing for \(w > \frac{1}{2}\) and achieves the maximum at \(w^*=1\), for all \(\tau >\frac{1}{2}\).

In this example there is a separation in the optimal portfolio allocation between risk-averse individuals and risk lovers. The optimal portfolio allocation of risk-averse individuals, characterized by \(\tau \in (0, \frac{1}{2}]\), is full diversification given by \(w^*=\frac{1}{2}\). Risk lovers, characterized by \(\tau \in (\frac{1}{2},1)\), maximize the objective function (7) at \(w^*=1\). This important result that separates the optimal portfolio allocation into two regions broadly representing the risk preferences of risk-averse and risk-loving individuals can be generalized to other density functions under the following assumptions.

Assumption 2

The joint density function f(x, y) of the bivariate random variable (X, Y) is \(C^1\) and satisfies that, for all fixed \(\mu \in {\mathbb {R}}\), \(f(\mu +\varepsilon ,\mu -\frac{w}{1-w}\varepsilon )\) is unimodal on \(\varepsilon \in {\mathbb {R}}\), with mode at \(\varepsilon =0\).

Assumption 3

The joint density function f(x, y) of the bivariate random variable (X, Y) is such that there exists some \(w^* \in (0,1)\) satisfying the condition

for all \(\mu \in {\mathbb {R}}\) and \(\varepsilon >0\).

Assumption 2 evaluated at the optimal \(w^*\) guarantees the unimodality of the density function \(f_{Z}\) defined in (9). Similarly, Assumption 3 guarantees its symmetry. Note that condition (11) does not necessarily imply the symmetry of f(x, y) in the sense \(f(x,y)=f(y,x)\) unless \(w^*=\frac{1}{2}\).

The following result constitutes one of the main results of this study, namely, we show the existence of two regimes in the optimal portfolio allocation for individuals characterized by QP and maximizing the objective function (7).

Proposition 3.13

Let f(x, y) be the joint density function of the pair (X, Y). Under assumptions 1 to 3, the solution to the maximization problem (7), for all \(\tau \in (0,\tau _0]\), is \(w^* \in (0,1)\) that satisfies expression (11). For \(\tau >\tau _0\), the solution is \(w^* \in \{0,1\}\). More specifically, \(w^*=0\) for \(\tau >\tau _0\) if \(w^*\ge \frac{1}{2}\) in the interval \((0,\tau _0]\), and \(w^*=1\) for \(\tau >\tau _0\) if \(w^* \le \frac{1}{2}\) in the interval \(\tau \in (0,\tau _0]\). The threshold \(\tau _0\) is defined by the condition \(\tau \le P(Z \le q)\) for \(\tau \in (0,\tau _0]\), and \(P(Z \le q) < \tau \) for \(\tau \in (\tau _0,1)\).

This result accommodates the iid case as a particular example.

Corollary 3.14

Let X and Y be two iid random variables with unimodal density function \(f_X(\cdot )\) that satisfies assumption 1. The solution to the maximization problem (7) is \(w^*=\frac{1}{2}\) for \(\tau \in (0,\tau _0]\), and \(w^* \in \{0,1\}\), indistinctively, for \(\tau >\tau _0\).

Proposition 3.13 and Corollary 3.14 offer very interesting insights about portfolio allocation and the importance of diversification. Under some general assumptions that accommodate, among other examples, very popular families of density functions such as the Normal distribution and the Student-t distribution, diversification is optimal for individuals with preferences characterized by risk aversion (low \(\tau \)-quantiles). Individuals characterized by these preferences choose the same portfolio, regardless their specific \(\tau \), that is given by an interior solution. For iid random variables or for symmetric bivariate random variables the optimal allocation is full diversification, interpreted as an equal contribution of each asset to the portfolio. In contrast, individuals with preferences characterized by high values of \(\tau \), do not diversify at all. The optimal investment strategy of these agents is full investment in the asset with more upside potential, that in these cases corresponds to the asset with higher downside risk too. In this case the specific value of \(\tau \) characterizing the individual’s quantile preference is not relevant for determining the optimal portfolio allocation as long as this value is greater than the cut-off point \(\tau _0\). For symmetric distributions, \(\tau _0=0.5\).

3.4 Numerical results

In this section we study optimal asset allocation under QP for portfolios given by the mixture of two continuous random variables X and Y with payoff realizations defined as \(S_{w}=w X+(1-w)Y\). We also compare the results with the optimal asset allocation obtained under EU. Here, for simplicity and brevity, we concentrate on the simple case of two Gaussian independent and identically distributed random variables. Nevertheless, “Appendix B” presents a more comprehensive examination across different scenarios of the problem allowing for dependence and different configurations of the Gaussian and Chi-squared distributions.

In order to compute the optimal portfolio \(w^*(\tau ):(0,1)\rightarrow [0,1]\) we are required to compute the cumulative distribution function \(F_{S_w}\) and quantile function \(Q_\tau [S_w]\), for which in many cases we do not have an analytical expression to work with. We approximate the optimal portfolio allocation \(w^*\) and quantile function through simulation. The following example aims to illustrate the practical selection and diversification of portfolios, as well as the theoretical findings of the previous sections.

3.4.1 Design

In this numerical study we seek to compute the optimal portfolio weights \(w^*(\tau )\) for the QP model in Eq. (5) for \(\tau \in (0,1)\). To simulate a portfolio, we draw \(n=10,000\) realizations of the random variables (X, Y), which are chosen from different distributions, say Gaussian and Chi-squared. We investigate several alternative scenarios using independence and dependence of the variables X and Y. In addition, we vary the mean and variance of the distribution functions.

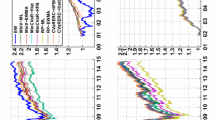

For each case below, we report two figures. The figures on the left panel plot the cumulative distribution functions generated by the portfolio value \(S_{w}\), that is, we plot \(F_{S_{w}}\) for \(w\in \{0.1,\ldots ,0.9\}\). These figures intuitively characterize the solutions because for any \(\tau \) we can draw a horizontal line and find the optimal QP solution by searching for the largest CDF. Second, figures on the right panel plot the graph of the portfolio selection \(\{w^*(\tau ),\tau \}\) for different values of \(\tau \).

3.4.2 Computation of portfolio

To implement the optimization, we use a simple grid search. Let \(T_j=\{0<\tau _1<\cdots<\tau _j<1\}\) be a grid of values for the quantile index \(\tau \) with j values, and let \(\Lambda _l=\{0 \le w_1<\cdots <w_l \le 1\}\) be a grid of values for w with l values. For each fixed \(\tau \in T_j\) we solve the following portfolio problem numerically

where \(\widehat{\text {Q}}_{\tau }\) is the sample counterpart of the quantile function \(Q_{\tau }\).

We consider \(T_j\) with grid spacing of 0.01 (\(\#T_j=99\), with \(\tau _1=0.01\) and \(\tau _{99}=0.99\)) and \(\Lambda _l\) with grid spacing of 0.01 (\(\#\Lambda _j=101\), with \(w_1=0\) and \(\tau _{101}=1\)).

Consider a simulation exercise given by a very simple case where we consider a weighted combination of two independent standard Gaussian random variables, \(X, Y \sim iid \ N(0,1)\). It is well known that \(S_{w}= w X + (1-w)Y\) also follows a Gaussian distribution with \(S_{w} \sim N(0,w^2+(1-w)^2)\). In this scenario, under risk aversion and for very general forms of the utility function, e.g. mean-variance, CRRA and CARA utility functions embedded in the optimal portfolio decision, risk-averse EU individuals choose the investment portfolio that minimizes the variance of the random variable \(S_{w}\). In this setting this is given by \(w^*=0.5\).

The results for the QP model presented on the right panel of Fig. 6 confirm these findings for low quantiles of the distribution but show more heterogeneity in the optimal portfolio decision for the upper quantiles. The findings of this simulation exercise provide empirical evidence showing that the optimal QP choice depends on the quantile \(\tau \in (0,1)\). In particular, for this specification of the random variables X and Y the optimal weight \(w^*\) is a function of \(\tau \) such that \({\widehat{w}}_n^{*}(\tau )=0.5\) for \(\tau \le 0.5\), and either \({\widehat{w}}_n^*(\tau )=0\) or \({\widehat{w}}_n^*(\tau )=1\) for \(\tau > 0.5\). This result is a consequence of the fact that the distributions of X and Y are identical and confirm the predictions in Corollary 3.14 about a lack of diversification in the upper tail of the distribution of portfolio returns. The left panel of the figure plots all combinations of distributions \({\widehat{F}}_{S_{w}}\) as a function of \(w \in [0,1]\). These distributions reveal a unique single-crossing point at \(\tau _0=0.5\) for all w.

This simple exercise sheds light on portfolio selection under QP. As mentioned above, the QP do not rely on any functional form of the utility function. In addition, QP models have the advantage of allowing for heterogeneity through the quantiles because it offers a family of preferences indexed by \(\tau \), with the risk attitude under the QP being captured by the quantile. The results in Fig. 6 show that individuals with QP encompass both risk-averse and risk-loving behavior. Those economic agents concerned with downside risk (low quantiles) diversify by investing equally in each asset, whereas individuals with preferences driven by the upper quantiles of the distribution of portfolio returns do not diversify at all. The critical point that determines whether an individual diversifies or not is \(\tau _0=0.5\).Footnote 14

This neat separation between risk-aversion and risk-loving behaviors characterized by the quantile \(\tau _0\) is also observed, more generally, for distribution functions satisfying the conditions of Proposition 3.13. The result in the proposition accommodates departures from the iid case, otherwise, if the conditions of the proposition are not satisfied then the optimal asset allocation under QP is \(\tau -\)dependent and shifts smoothly from a risk-averse optimal allocation to a risk-loving optimal allocation. “Appendix B” illustrates this case and collects several additional results across different scenarios, including the analysis of portfolios with a risk-free asset. The results provide strong support to the theoretical findings in this paper.

4 Empirical application to a portfolio of stocks, bonds and cash

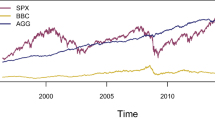

This section provides an empirical application illustrating the methods developed in the paper. We investigate the optimal portfolio choice of an investor with quantile preferences (QP) that can allocate wealth among three assets: a risk-free asset (one-month Treasury bill rate), a bond index (G0Q0 Bond Index), and a stock index (S&P 500). We consider monthly data collected from Bloomberg on the S&P 500 and G0Q0 Bond Index for the period January 1980 to December 2016. The G0Q0 Bond Index is a Bank of America and Merrill Lynch U.S. Treasury Index that tracks the performance of U.S. dollar denominated sovereign debt publicly issued by the U.S. government in its domestic market. The nominal yield on the U.S. one-month risk-free rate is obtained from Kenneth French website.

Nonparametric kernel estimates of the unconditional densities of monthly log-returns on the U.S. one-month Treasury bill, the G0Q0 bond index and the S&P 500 index. Monthly data are collected from Bloomberg on the S&P 500 and G0Q0 Bond Index for the period January 1980 to December 2016. The risk-free rate is obtained from Kenneth French website

Prior to computing the portfolio weights, we report nonparametric kernel estimates of the unconditional density functions of the returns on the three assets. The results are given in Fig. 7. Visual inspection of the densities shows that the three density functions are unimodal and exhibit similar mean returns but very different standard deviations. A formal statistical analysis rejects, however, the null hypothesis of equality of means for all pairwise combinations of the U.S. Treasury bill, the G0Q0 index and the S&P 500 index, and the null hypothesis of symmetry of the three density functions. More specifically, the mean return and standard deviation for the U.S. one-month Treasury bill are 0.363 and 0.296, respectively; the mean return and standard deviation for the G0Q0 bond index are 0.608 and 1.584, respectively, and 0.680 and 3.635 for the S&P 500 index. These summary statistics suggest that the equity index has the highest expected return and variance, and is followed by the bond index with regards to expected return and risk. In contrast, the U.S. Treasury bill has the lowest mean and variance.

We compute the QP portfolio optimal weights by solving the maximization problem (5) numerically, as in Eq. (12). We divide the analysis in two. First, we study the optimal portfolio allocation between the U.S. one-month Treasury bill and the G0Q0 index, and between the U.S. one-month Treasury bill and the S&P 500 index. Figure 8 clearly confirms the predictions of previous sections. The optimal portfolio allocation of a QP investor can be divided into two regions indexed by \(\tau \in (0,1)\). For low values of \(\tau \), individuals are risk averse and choose to minimize risk by allocating all the wealth on the risk-free asset. However, for high values of \(\tau \), individuals become risk lovers and choose the riskiest strategy that brings the highest upside potential. Interestingly, the results in Fig. 8 highlight the role of the U.S. one-month Treasury bill as a risk-free investment and are consistent with the insights discussed in Sect. 3.2 on the mutual fund separation theorem for the QP case. For low quantiles, the optimal choice is to fully invest on the risk-free asset, whereas for high quantiles, the optimal choice is to invest fully on the risky alternative.

Left panel reports the optimal portfolio allocation between the U.S. risk-free asset and G0Q0 bond index. Right panel reports the optimal portfolio allocation between the U.S. risk-free asset and the S&P 500 index. Monthly data are collected from Bloomberg on the S&P 500 and G0Q0 Bond Index for the period January 1980 to December 2016. The risk-free rate is obtained from Kenneth French website

Second, we study the allocation problem where the investment universe comprises the three assets. In this case we report the weights of all the three assets. The results are given in Fig. 9 and provide similar insights about the optimal portfolio allocation exercise. We observe a separation between the risk-free and riskiest asset for low and high quantiles. In particular, for very low quantiles the optimal portfolio allocation is given by only investing in the risk-free asset. In contrast, for values of \(\tau \) beyond the mode, the optimal asset allocation is given by fully investing on the S&P 500 index. As \(\tau \) increases, we find that the optimal portfolio allocation is given by a combination of the three assets, with a large share of investment on the risk-free asset and a small share of investment distributed equally between the G0Q0 bond index and the equity index. The allocation to the S&P 500 index with respect to the other two assets increases as the tolerance of the individual towards risk grows.

We conclude the section by comparing these results with the optimal portfolio allocation of a EU investor with preferences characterized by two different types of utility function: mean-variance and power utility functions. The mean-variance utility function is defined as

with \(\mu \) the vector of mean returns and C the covariance matrix of returns; the vector w denotes the optimal portfolio weights. This is performed for different degrees of risk aversion \(\alpha \). The left panel of Fig. 10 presents the optimal portfolio allocations for values of \(\alpha \) between 0 and 0.5. In this range, the optimal portfolio allocation leads to a diversified portfolio that contains non-zero combinations of the three assets. For values of \(\alpha \) close to zero, corresponding to risk neutrality, the optimal portfolio allocation is mainly driven by investment in the S&P 500 index. However, as the tolerance to risk decreases, investment in the bond index and the US Treasury bill gains importance. Investment in the risk-free asset is monotonically increasing on \(\alpha \) and dominates the portfolio for values greater than 0.3. Comparison of both sets of results suggests interesting similarities and differences across types of individuals. Thus, there is a mapping between the optimal portfolio choice of the QP investor with risk preferences characterized by \(\tau \) in the interval (0.40, 0.60) and the optimal portfolio choice of the mean-variance investor with values of \(\alpha \) in the range 0.05 to 0.45. The QP optimal allocation for values of \(\tau \) close to zero is also similar to the mean-variance allocation for values of \(\alpha \) greater than 0.5, signaling risk aversion. The main differences are, however, for behaviors related to risk-loving attitudes. Thus, for values of \(\tau \) greater than 0.5 we find that the allocation of the QP individual is concentrated on the equity index. This result is only found for mean-variance investors for values of \(\alpha \) very close to zero that reflect no risk penalty in the utility function (13).

For completeness, the right panel of Fig. 10 reports the optimal asset allocation problem for a EU individual with a power utility function characterized by different degrees of relative risk aversion. Interestingly, the results are very similar to those obtained for the mean-variance case. In this example, risk-loving attitudes for EU individuals take place for values of \(\gamma \) that converge to zero.

Left panel reports the optimal portfolio allocation for a mean-variance investor with risk preferences modeled by \(\alpha \in [0,0.5]\). Right panel reports the optimal portfolio allocation for an investor with a CRRA utility function with risk aversion coefficient given by \(\gamma \in [10,100]\). Monthly data are collected from Bloomberg on the S&P 500 and G0Q0 Bond Index for the period January 1980 to December 2016. The risk-free rate is obtained from Kenneth French website

5 Conclusion

This paper studies the optimal asset allocation problem for individuals with quantile preferences (QP). The proposed QP model has several attractive features: (i) the portfolio choice is independent of the utility function and related to the risk attitude \(\tau \); (ii) the ability to capture heterogeneity by varying the quantiles; (iii) robustness; and (iv) it has a solid axiomatic foundation.

We divide the portfolio allocation problem in two scenarios: with and without a risk-free asset. In the former case, we find that an investor with quantiles preferences with risk aversion characterized by a small \(\tau \) reacts to the presence of a risk-free asset by fully investing on it. Otherwise, for higher values of \(\tau \) the optimal strategy is to fully invest on the risky portfolio. This result is in stark contrast with the standard mutual fund separation theorem that shows that the optimal combination between the risk-free asset and a risky portfolio is convex and determined by the investor’s risk aversion profile. Under QP, we observe an all-or-nothing behavior, instead. For the case of two risky assets, we derive theoretically conditions on the support of the random variables under which the optimal portfolio decision has an interior solution. This result provides the setup under which diversification strategies are optimal for investors endowed with quantile preferences. These insights are in clear contrast to the EU paradigm that claims that diversification is always an optimal strategy under very general forms of risk aversion.

The paper has also explored the optimality of diversification strategies in the tails of the distribution of portfolio returns. In particular, we have derived conditions under which diversification in the tails is outperformed by fully investing in one risky asset. This result is of interest for the characterization of underdiversification strategies in finance.

Additionally, we have characterized the optimal portfolio allocation under QP when an interior solution exists. Under unimodality and a symmetry condition on the bivariate distribution of the random lotteries, the individual’s optimal portfolio decision under QP is characterized by two regions: for quantiles below the median full diversification is optimal, for quantiles above the median diversification is dominated by fully investing on the asset with highest upside potential. This strategy characterizes the optimal portfolio decision of risk-loving individuals.

Notes

Some studies suggesting that individuals did not always employ objective probabilities resulted in, among others, Prospect Theory (Kahneman and Tversky 1979), Rank-Dependent Expected Utility Theory (Quiggin 1982), Cumulative Prospect Theory (Tversky and Kahneman 1992), Regret (Bell 1982), and Ambiguity Aversion (Gilboa and Schmeidler 1989). Rabin (2000) criticized EU theory arguing that EU would require unreasonably large levels of risk aversion to explain the data from some small-stakes laboratory experiments. See also Simon (1979), Tversky and Kahneman (1981), Payne et al. (1992) and Baltussen and Post (2011) as examples providing experimental evidence on the failure of the EU paradigm.

Rostek (2010) discusses other advantages of the QP, such as robustness, ability to deal with categorical (instead of continuous) variables, and the flexibility of offering a family of preferences indexed by quantiles.

Intuitively, the monotonicity of quantiles allows one to avoid modeling individuals’ utility function. This is because the maximization problem is invariant to monotonic transformations of the distribution of portfolio returns.

Our model can deal with short sale, but we leave this to future work.

For instance, if the preference is given by EU, the belief is captured by the probability while the tastes by the utility function over outcomes or consequences (such as monetary payoffs). Beliefs and tastes are not completely separated, however, because if we take a monotonic transformation of the utility function, which maintains the same tastes over consequences, we may end up with a different preference. That is, the pair beliefs and tastes come together and are stable only under affine transformations of the utility function. In other words, the EU preferences, as many other preferences, do not allow a separation of tastes and beliefs.

See, e.g., Damodaran (2010) for an argument that every asset carries some risk.

The inferior limit m may be taken over a limited region, not over the whole support. That is, we can accommodate cases in which the support is infinite so that \(f(x,y) \rightarrow 0\) when \(y \rightarrow \infty \).

Of course, \(w^{*}=0\), when \({\underline{y}}>{\underline{x}}>-\infty \) and \({\underline{y}}- {\underline{x}} \geqslant \frac{M}{2m}\).

The inferior limit m may be taken over a limited region, not over the whole support. That is, we can accommodate cases in which the support is infinite so that \(f(x,y) \rightarrow 0\) when \(y \rightarrow \infty \).

The two illustrations (a) and (b) correspond, respectively, to \(\tau \leqslant \Pr \left( \left[ \frac{X+Y}{2} \leqslant q \right] \right) \) and \(\tau > \Pr \left( \left[ \frac{X+Y}{2} \leqslant q \right] \right) \). In the first case (a), the line \(wX+(1-w)Y=q\) is below the dashed blue line joining (1, 0) to (0, 1). In case (b) \(\tau >\Pr \left( \left[ \frac{X+Y}{2} \leqslant q \right] \right) \), the line \(wX+(1-w)Y=q\) is above the dashed blue line.

The simulation algorithm reflects this issue by selecting either \(w=0\) or \(w=1\) for \(\tau _0=0.5\).

When \({\mathscr {I}}_{X}\) or \({\mathscr {I}}_{Y}\) are not \({\mathbb {R}}\), then we have to consider limits that make the derivatives more complex.

The case of two risky assets with different means is available from the authors upon request.

References

Apiwatcharoenkul, W., Lake, L., Jensen, J.: Uncertainty in proved reserves estimates by decline curve analysis. In: SPE/IAEE Hydrocarbon Economics and Evaluation Symposium, Society of Petroleum Engineers (2016)

Artzner, P., Delbaen, F., Eber, J., Heath, D.: Coherent measures of risk. Math Finance 9, 203–228 (1999)

Baltussen, G., Post, G.T.: Irrational diversification: an examination of individual portfolio choice. J Financ Quant Anal 46, 1463–1491 (2011)

Basak, S., Shapiro, A.: Value-at-risk based risk management: optimal policies and asset prices. Rev Financ Stud 14, 371–405 (2001)

Bassett, G.W., Koenker, R., Kordas, G.: Pessimistic portfolio allocation and choquet expected utility. J Financ Econom 2, 477–492 (2004)

Bell, D.E.: Regret in decision making under uncertainty. Oper Res 30, 961–981 (1982)

Bhattacharya, D.: Inferring optimal peer assignment from experimental data. J Am Stat Assoc 104, 486–500 (2009)

Brown, D.B., Sim, M.: Satisficing measures for analysis of risky positions. Manag Sci 55, 71–84 (2009)

Campbell, J.: Household finance. J Financ Econ 61, 1553–1604 (2006)

Campbell, J.Y.: Financial Decisions and Markets: A Course in Asset Pricing. Princeton: Princeton University Press (2018)

Campbell, R., Huisman, R., Koedijk, K.: Optimal portfolio selection in a value-at-risk framework. J Bank Finance 25, 1789–1804 (2001)

Chambers, C.P.: Ordinal aggregation and quantiles. J Econ Theory 137, 416–431 (2007)

Chambers, C.P.: An axiomatization of quantiles on the domain of distribution functions. Math Finance 19, 335–342 (2009)

Cochrane, J.H.: Asset Pricing, Revised. Princeton: Princeton University Press (2005)

Damodaran, A.: Into the abyss: what if nothing is risk free? Available at SSRN: https://ssrn.com/abstract=1648164. https://doi.org/10.2139/ssrn.1648164 (2010)

de Castro, L., Galvao, A.F.: Dynamic quantile models of rational behavior. Econometrica 87, 1893–1939 (2019)

de Castro, L., Galvao, A.F.: Static and dynamic quantile preferences. Econ Theory (2021) (Forthcoming)

de Castro, L., Galvao, A.F., Noussair, C.N., Qiao, L.: Do people maximize quantiles? Games Econ Behav 132, 22–40 (2022)

Duffie, D., Pan, J.: An overview of value at risk. J Deriv 4, 7–49 (1997)

Engle, R.F., Manganelli, S.: CAViaR: conditional autoregressive value at risk by regression quantiles. J Bus Econ Stat 22, 367–381 (2004)

Fanchi, J.R., Christiansen, R.L.: Introduction to Petroleum Engineering. New York: Wiley (2017)

Fishburn, P.C.: Mean-risk analysis with risk associated with below-target returns. Am Econ Rev 67, 116–126 (1977)

Föllmer, H., Leukert, P.: Quantile hedging. Finance Stoch 3, 251–273 (1999)

Gaivoronski, A., Pflug, G.: Value-at-risk in portfolio optimization: properties and computational approach. J Risk 7(2), 1–31 (2005)

Garlappi, L., Uppal, R., Wang, T.: Portfolio selection with parameter and model uncertainty: a multi-prior approach. Rev Financ Stud 20, 41–81 (2007)

Ghirardato, P., Marinacci, M.: Ambiguity made precise: a comparative foundation. J Econ Theory 102, 251–289 (2002)

Ghirardato, P., Maccheroni, F., Marinacci, M.: Certainty independence and the separation of utility and beliefs. J Econ Theory 120, 129–136 (2005)

Gilboa, I., Schmeidler, D.: Maxmin expected utility with a non-unique prior. J Math Econ 18, 141–153 (1989)

Giovannetti, B.C.: Asset pricing under quantile utility maximization. Rev Financ Econ 22, 169–179 (2013)

He, X.D., Zhou, X.Y.: Portfolio choice via quantiles. Math Finance Int J Math Stat Financ Econ 21, 203–231 (2011)

Ibragimov, R., Walden, D.: The limits of diversification when losses may be large. J Bank Finance 31, 2551–2569 (2007)

Jorion, P.: Value at Risk. The New Benchmark for Managing Financial Risk, vol. 81, 3rd edn. New York: McGraw-Hill (2007)

Kahneman, D., Tversky, A.: Prospect theory: an analysis of decision under risk. Econometrica 47, 263–292 (1979)

Kempf, A., Ruenzi, S.: Tournaments in mutual-fund families. Rev Financ Stud 21, 1013–1036 (2007)

Krokhmal, P., Uryasev, S., Palmquist, J.: Portfolio optimization with conditional value-at-risk objective and constraints. J Risk 4(2), 43–68 (2001)

Kulldorff, M.: Optimal control of favorable games with a time limit. SIAM J Control Optim 31, 52–69 (1993)

Lintner, J.: The valuation of risky assets and the selection of risky investments in the portfolios and capital budgets. Rev Econ Stat 47, 13–37 (1965)

Manski, C.: Ordinal utility models of decision making under uncertainty. Theor Decis 25, 79–104 (1988)

Markowitz, H.: Portfolio selection. J Finance 7, 77–91 (1952)

Mendelson, H.: Quantile-preserving spread. J Econ Theory 42, 334–351 (1987)

Mitton, T., Vorkink, K.: Equilibrium underdiversification and the preference for skewness. Rev Financ Stud 20, 1255–1288 (2007)

Payne, J.W., Bettman, J.R., Johnson, E.J.: Behavioral decision research: a constructive processing perspective. Annu Rev Psychol 43, 87–131 (1992)

Porter, R.B.: Semivariance and stochastic dominance: a comparison. Am Econ Rev 64, 200–204 (1974)

Quiggin, J.: A theory of anticipated utility. J Econ Behav Organ 3, 323–343 (1982)

Rabin, M.: Risk aversion and expected-utility theory: a calibration theorem. Econometrica 68, 1281–1292 (2000)

Rachev, S.T., Stoyanov, S., Fabozzi, F.J.: Advanced Stochastic Models, Risk Assessment, and Portfolio Optimization: The Ideal Risk, Uncertainty, and Performance Measures. New York: Wiley (2007)

Rostek, M.: Quantile maximization in decision theory. Rev Econ Stud 77, 339–371 (2010)

Rothschild, M., Stiglitz, J.E.: Increasing risk: I. A definition. J Econ Theory 2, 225–243 (1970)

Savage, L.: The Foundations of Statistics. New York: Wiley (1954)

Sharpe, W.F.: Capital asset prices: a theory of market equilibrium under conditions of risk. J Finance 19, 425–462 (1964)

Simon, H.A.: Rational decision making in business organizations. Am Econ Rev 69, 493–513 (1979)

Tobin, J.: Liquidity preference as behavior towards risk. Rev Econ Stud 67, 65–86 (1958)

Tversky, A., Kahneman, D.: The framing of decisions and the psychology of choice. Science 211, 453–458 (1981)

Tversky, A., Kahneman, D.: Advances in prospect theory: cumulative representation of uncertainty. J Risk Uncertain 5, 297–323 (1992)

Wu, G., Xiao, Z.: An analysis of risk measures. J Risk 4(4), 53–75 (2002)

Yaari, M.E.: The dual theory of choice under risk. Econometrica 55, 95–115 (1987)

Author information

Authors and Affiliations

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

The authors would like to express their appreciation to the Editor-in-Chief Anne Villamil, an anonymous reviewer, Nabil Al-Najjar, Hide Ichimura, Derek Lemoine, Richard Peter, Tiemen Woutersen, María Florencia Gabrielli and seminar participants at the University of Iowa, INSPER, JOLATE Bahía Blanca, RedNIE, Southampton Econometrics Conference, and Universidad de Buenos Aires for helpful comments and discussions. Luciano de Castro acknowledges the support of the National Council for Scientific and Technological Development – CNPq. Computer programs to replicate the numerical analyses are available from the authors.

Appendices

Appendix

A Proofs

This Appendix collects the proofs for the results in the main text.

1.1 Proof of Lemma 3.1

Proof

The objective function of the primal problem in (4) is

Noticing that \(u(\cdot )\) is continuous and increasing, and that the quantile is invariant with respect to monotone transformations, then the above maximization argument is given by

\(\square \)

1.2 Proof of Lemma 3.2

Proof

It is sufficient to show that \( w \mapsto \text {Q}_{\tau }\left[ w X + (1-w) Y \right] =\text {Q}_{\tau }[S_{w}] \) is continuous. But this follows from Assumption 1, which implies that the CDF of \(S_{w}=w X + (1-w) Y \) is strictly increasing, thus making its quantile continuous. \(\square \)

1.3 Proof of Theorem 1

Proof

(1) By appealing to translations if necessary, we may assume without loss of generality that \({\underline{x}}={\underline{y}}=0\), that is, if this is not the case, we may consider the random variables \(X' = X - {\underline{x}}\) and \(Y'= Y - {\underline{y}}\). We may also assume without loss of generality that \({\overline{x}}, {\overline{y}}< \infty \), for if \({\overline{x}}=\infty \) or \({\overline{y}}=\infty \), we may truncate the distribution at large \({\hat{x}}, {\hat{y}}\) so that \(\Pr ( \{ (x,y): x> {\hat{x}} \text { or } y> {\hat{y}} \} ) < \epsilon \) for some small \(\epsilon >0\). Thus, without loss of generality, we may assume that there exists \(m,M \in {\mathbb {R}}_{+}\) such that \(0< m< f(x,y)< M < \infty \) for all \((x,y) \in [0,{\overline{x}} ] \times [0,{\overline{y}} ]\).