Abstract

The paper considers a discrete continuous model where consumers choose quality of the product they buy as well as its usage. The product has two quality dimensions, intrinsic quality and environmental quality, that are in conflict with each other. It analyzes a two-stage game in a vertically differentiated duopoly market, where firms choose intrinsic quality in the first stage, and compete in prices in the second stage. It examines the effects of green network, and environmental regulation in the form of an emission tax on equilibrium qualities, market share, and total emissions. It shows that while both green network effect and environmental regulation, individually, improve the overall environmental quality, the effect is stronger when the tax is imposed in the presence of green network effect. Though an increase in green network effect reduces environmental quality of both firms, the market share of the cleaner firm rises at the expense of the other firm, resulting in an overall improvement of the environment. In the presence of green network effect, an emission tax improves environmental quality of both firms with market shares unaltered, thereby resulting in a reduction in total emissions. The green network effect enhances the effect of an emission tax. We also find that the environmental friendly firm benefits from the green network effect. The optimal tax is increasing in the network effect.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Consumers’ concern for the environment has grown in recent years resulting in a higher willingness to pay for environment-friendly products. A large strand of literature modelling such consumer preferences has analyzed choice of environmental quality in a vertically differentiated product framework, and examined how regulation affects these qualities (Bansal and Gangopadhyay 2003; Amacher et al. 2004; Brecard 2013). Consumers not only choose among the products which vary in quality but also decide on the usage of the product. Moreover, the above literature assumes intrinsic quality to be homogeneous across firms and the product differentiation takes place only in terms of environmental attribute. Often products compete in more than one quality dimension, and the environment-friendly products face competition from the existing standard products. A few papers in the literature have taken cognizance that the intrinsic quality and the environmental quality may be interrelated. While Birg and Voßwinkel (2018) consider these quality dimensions to be substitutes, Mantovani et al. (2016) model them as conflicting.

ln this paper, we incorporate both choice and usage of the product, and assume intrinsic quality to be in conflict with the environmental quality. While purchasing cars consumers not only consider characteristics of the car they are purchasing but also how much fuel they are going to use. They also face trade-offs in terms of different dimensions of quality. For example, electric cars are more environment friendly but may not be as convenient as gasoline cars due to the limited storage capacity of batteries of electric cars. Similarly, luxury cars, SUVs, etc. have high intrinsic quality in terms of size, engine, comfort, safety features, etc., but usage of these cars requires much more fuel as compared to standard small cars. Solar thermal panels are considered environment friendly but may not ensure uninterrupted supply of energy and their installation requires space in the house. Eco-friendly cleaning products are mostly natural in origin and chemical free, therefore, less harmful to the eco-system but their performance may not match that of chemical based cleaning products.

We use a discrete continuous framework similar to Matsukawa (2012) to model choice and usage of the product. The discrete choice faced by the consumers is a decision on the choice of the product, for example, which brand of a car to buy, whether to buy an electric or a gasoline car. The continuous choice faced by the consumers is how much fuel or electricity should be consumed while using the product. The literature on discrete continuous models includes (Burtless and Hausman 1978; Dubin and McFadden 1984; Hanemann 1984; De Jong 1990; Matsukawa 2012) etc. Hanemann (1984) developed econometric model of discrete choice for different brands of a commodity and continuous choice of the quantity of a commodity to be purchased. De Jong (1990) and Matsukawa (2012) analyze vehicle ownership choices based on the hypothesis that a household maximizes utility from discrete choice of vehicle ownership and a continuous choice of vehicle usage. Using data from Netherlands, De Jong (1990) shows that the cost of the car and the fuel price are effective in reducing car ownership levels and also have an effect on car usage. Matsukawa (2012) examine welfare impact of emission taxes and subsidies, and show that as compared to a subsidy, an emission tax results in greater reduction in environmental pollution and higher welfare. Glerum et al. (2014) extends the literature by analyzing dynamic discrete continuous model of car ownership, usage and fuel type. The paper models forward looking behaviour of the households for acquisition of the car.

The literature has also recognized that consumption decisions are made in a social context and consumers are concerned about the choices made by other consumers. Leibenstein (1950) attributes this to a bandwagon or snob effect. Various motivations for these effects include desire to confirm to social norms, status concerns, possible benefits that may accrue as more consumers consume the product (Farrell and Klemperer 2007). Social norms arise from the networks formed by the individuals in a society and may give rise to network effects. The network effects have particularly been analyzed in the context of eco-friendly products -called “green network effect”. Conrad (2006) analyzes network effects that are strengthened by the market share of a firm in a horizontal product differentiation model. The paper shows that the higher the network effect the lower will be equilibrium prices and profits. Griva and Vettas (2011) introduce network effect in a standard Hotelling model and show that high quality firm captures a larger market share when network effects are relatively weak. For stronger network effects, however, either high quality or low quality firm captures the entire market. The network effects may have a dynamic role and continue to exert in future consumption decisions as well. This may warrant a brown good tax to be in excess of Pigovian tax (Greaker and Midttomme 2014). Lambertini and Orsini (2005), Brecard (2013) and Hauck et al. (2014) model green network effect under vertical product differentiation. Lambertini and Orsini (2005) find that when network externalities are large, there is a possibility of Bertrand equilibrium. Brecard (2013) shows that when green network effect is stronger than brown network effect, there is a reduction in environmental quality of both firms and an increase in the market share of the green firm. However, when brown firm network effect is stronger, there is an increase in environmental quality of both firms and an increase in the market share of brown firm. In the former case, a combination of an ad-valorem tax, a pollution tax and a subsidy on green products can achieve optimum. However, in the latter case, the subsidy on green products is replaced with tax on green products. Hauck et al. (2014) has a similar result in terms of the effect of a green network on environmental quality and argues total welfare may decrease with an increase in the network effect. The regulator, thus, would choose a stricter environmental standard. The empirical studies have indicated that network effects increase willingness to pay for environmental friendly products (Rasouli and Timmermans 2016; Grover et al. 2019). Using a discrete choice experiment, Carlsson et al. (2010) find that women’s willingness to pay for ecological friendly coffee is driven by conformity to the social norm and increases when large number of consumers purchase ecological friendly coffee. Network effects have also been found to affect firm behaviour. Bansal et al. (2021) find evidence of peer effects influencing the corporate social responsibility expenditure of firms in India.

Network effects may be modelled in different ways. Often it is modelled as a function of the size of the market (Conrad 2006; Brecard 2013; Hauck et al. 2014). They could influence present consumption decision or also future consumption decisions (Greaker and Midttomme 2014). The network effect could also depend on environmental quality directly, for instance, in Carlsson et al. (2010) average level of environmental quality in the society serves as a social norm. While Lambertini and Orsini (2005) and Brecard (2013) associate network effects with the consumption of both green and brown goods, Hauck et al. (2014) and Falcone (2014) associate network effects with the consumption of green goods.

The objective of our study is to examine the impact of green network effect and government policies such as emission taxes in a discrete-continuous framework where the intrinsic quality and the environmental quality are in conflict. Specifying a fuel demand function we derive a conditional indirect utility function that satisfies all the properties of an indirect utility function. We use this utility function to analyze a two-stage game in a vertically differentiated duopoly framework, where firms choose intrinsic quality in the first stage, and compete in prices in the second stage. Our theoretical model adds value on several counts. Most papers in the previous literature consider one dimension of quality, the environmental quality (Marette et al. 1999; Zago and Pick 2004; Matsukawa 2012). In contrast, we consider products that have two dimensions of quality (intrinsic quality and environmental quality) that are in conflict with each other (Mantovani et al. 2016). Our paper contributes to the theoretical literature analyzing green network effect by introducing green network effect in a discrete-continuous framework, and analyzing environmental regulation in the presence of green network effect in the above framework.

We show that an increase in green network effect reduces environmental quality and increases prices of both firms, decreases the market share and profits of the firm that has high intrinsic quality and low environmental quality, and has an opposite effect on the firm that has low intrinsic quality and high environmental quality. The effects continue to remain the same even when an emission tax is imposed. Our results are different from Lambertini and Orsini (2005) which show that while qualities are independent of the network effect, prices and profits of both firms decreases due to network effect. The results are in line with Brecard (2013) in terms of environmental quality but differ in terms of prices. An emission tax in the absence of network effect leads to an increase in the environmental quality of high intrinsic quality firm and no change in the environmental quality of low intrinsic quality firm. This result is different from Matsukawa (2012), which shows that an increase in emission tax rate in discrete-continuous framework increases environmental quality of both firms. Matsukawa (2012) considers a single quality dimension and does not incorporate green network effects. When we introduce green network effect in our model, the result in terms of increasing environmental quality is similar to Matsukawa (2012). In the presence of green network effect, an emission tax reduces prices of both firms; and does not change market share and profits of both firms. In a standard vertically differentiated product model, Bansal (2008) shows that the effect of an emission tax depends on cost parameter. However, in our study the effect of an emission tax depends on cost as well as usage parameters. We also show that an emission tax reduces total emissions and the reduction in emissions is much higher in the presence of green network effect. For sufficiently small values of the emission tax, welfare is higher under green network with environmental regulation than green network without environmental regulation. The optimal tax rate increases with an increase in green network effect and decreases with the weight assigned to relative environmental quality. Policy implications of our results is that the effect of an emission tax is enhanced if it is complemented by information disclosure or labelling policies for the green network effect to manifest itself.

The rest of the paper is structured as follows. Section 2 develops duopoly model under discrete continuous framework and analyses equilibrium. The section also analyses various possible regulatory scenarios: (i) Benchmark case where green network effect is absent and there is no environmental regulation (ii) Environmental regulation in the absence of green network effect (iii) Green network effect without environmental regulation (iv) Green network effect with environmental regulation. Sections 3 and 4 analyses the impact of green network and policy instrument of emission tax on equilibrium. Section 5 brings together all the scenarios, compares overall environmental quality under different policy instruments, and discuss impact of green network on optimal tax. Finally Sect.n 6 contains the concluding remarks.

2 Model structure

Consider a vertically differentiated product market where two firms produce a quality differentiated product. The product has two quality dimensions - intrinsic quality (pure performance) and environmental quality- that are in conflict with each other. The higher is the intrinsic quality of a product, the lower is the corresponding environmental quality. Let \(s_i\) \(i= H, L\) denote the intrinsic quality of firm i product, where \(s_i \in [{\underline{s}}, \bar{s}]\). We assume firm H has higher intrinsic quality as compared to firm L, i.e., \(s_H > s_L\). Henceforth, we refer to the firm with a higher intrinsic quality as H and the one with a lower intrinsic quality as L.

A1: Let \(C(s_i)\) denote cost function of firm i, given by

where \(b>0\) is marginal cost parameter, \(q\) is quantity produced. Total cost is increasing in the quantity of good produced as well as the intrinsic quality. The cost function is assumed to be increasing and convex in the intrinsic quality. Since in our model, the product with a higher intrinsic quality has a lower environmental quality, this implies that the more environmentally damaging products are also more costly to produce. Various examples of such products include travel by airplanes as compared to trains; luxury cars and SUVs (Sports Utility Vehicles) as compared to standard small cars; paper produced by trees versus recycled paper.

The usage of the product requires fuel or electricity, which generates emissions. Let \(x_i\) denote fuel consumption and \(\rho \) denote emissions per unit of fuel consumption. The emissions generated by usage of firm i product via fuel consumption, \(e_i = \rho x_i\). Further, assume that firm H requires more fuel on usage as compared to firm L, i.e., \(x_H > x_L,\) which implies \(e_H > e_L\). In other words, firm H generates higher emissions per unit of usage and thus has a lower environmental quality (brown good) as compared to firm L (green good) (Mantovani et al. 2016). Due to two dimensions of quality, both firms could have a positive demand even at equal prices, i.e., vertical differentiation ceases to hold under this situation.

There exists a continuum of consumers with each consumer buying one unit of the product. The consumer not only decides from which firm to buy the product but also how much fuel to use. For the latter, she faces a choice between fuel consumption and composite good (\(z_i\)), where \(z_i\) includes all other goods except fuel.

The consumer maximizes her utility subject to a budget constraint

where \(U(x_i, z_i)\) is the utility from usage of the product (which in turn determines fuel consumption, \(x_i\)) and composite good, \(z_i\); \(\theta \) is the marginal willingness to pay for intrinsic quality of the product, which is assumed to be uniformly distributed over [0, 1]; \(e_i\) is the emissions on usage of firm i product with \(i \ne j\); \(q_i\) is the number of consumers buying firm i product; \(\alpha _i\) is the network effect; \(\alpha _H = 0\); \(\alpha _L = \alpha \), \(y\) is the income of the consumer; \(p_i\) is the purchase price of firm i product; \(\omega \) is the price of fuel; \(t_e\) is the emissions tax per unit of emissions (\(t_e \ge 0\)); \(p_z\) is the price of the composite good.

Apart from deriving utility from the intrinsic quality of the product, consumers derive utility from buying from a relatively cleaner firm, which gets reflected in the term \(\gamma (e_j - e_i)\). Parameter \(\gamma \ge 0\) measures the marginal effect of relative emissions on utility. Higher is \(\gamma \), stronger is the weight given to relative environmental quality. When \(\gamma = 0\), we have the standard utility function for intrinsic quality along with green network effect. In our formulation, while consumers are heterogeneous in their preference for intrinsic quality, they all assign equal value to relative emissions. Relative emissions, however, are determined by fuel consumption, which as shown below (Eq. 2) is a function of intrinsic quality.

Our formulation also includes a green network effect that is increasing in the market share of the consumers buying the green good. This effect arises due to a social norm created for the consumption of green good, which imparts a social value to its consumption. The larger is the number of such consumers, the stronger is the norm. Such a social norm is more likely to be formed for a good that has social value, viz., green goods. Thus, in our model only green goods have a network effect and there is no network effect associated with the brown good (Hauck et al. 2014; Falcone 2014). Empirical evidence also supports the presence of network effects for green products. Rasouli and Timmermans (2016) showed that consumers’ willingness to pay increases with green network effect. Grover et al. (2019) find that Indian consumers report an increase in willingness to pay of around 300 US Dollars for a fuel efficient car that is driven by 10% of their network. Carlsson et al. (2010) find that women’s willingness to pay for ecological friendly coffee is driven by conformity to the social norm and increases when large number of consumers purchase ecological friendly coffee. Roychowdhury (2019) showed that a one Indian rupee increase in consumption expenditure of a households’ peers leads to an increase of 0.8 Indian rupee in the household’s own expenditure.

The size of the green network is given by the market share of high environmental quality firm (\(q_L\)). Following the literature, (Katz and Shapiro 1985; Conrad 2006), we have assumed a full information model, where consumers have full information about the size of the market, and thus the size of the network.

The budget constraint given by equation (1) states that income (y) net of the purchase price of the product (\(p_i\)) is allocated between fuel consumption, \(x_i,\) and composite good, \(z_i\). In the presence of emission taxes, the amount spent by the consumer on fuel is \((\omega + t_e \rho ) x_i.\) For simplification, we assume \(\rho = 1\) for the rest of the analysis.

2.1 Specification of the utility function

To derive demand functions for the two firms, one can proceed by specifying a functional form for the indirect utility function and then derive demand functions using Roy’s identity. Another possible way is to specify the fuel demand function and use Roy’s identity as a partial differentiation equation (De Jong 1990; Matsukawa 2012). We follow the latter approach, and provide below the derivation of conditional indirect utility function.

Let the fuel demand function conditional on firm i product be given by

where \(\lambda , \beta > 0\) and \(\delta \) are parameters. The demand for fuel for a consumer conditional on the choice of product is assumed to be a sum of three terms. The first term, \(\lambda s_i\), is the product of usage of the product (\(\lambda \)) and the intrinsic quality of the product that the consumer has chosen. The usage parameter is assumed to be independent of the consumer’s choice of the product. Clearly, fuel consumption is higher for firm H as compared to firm L. The second term captures sensitivity of fuel demand to fuel price, \(\omega \), and emission tax \(t_e,\) deflated by the price of the composite good \(p_z.\) Parameter \(\beta \) captures marginal reduction in demand for fuel with a unit rise in either fuel price or emission tax. The third term \(\delta \) captures the effect of socio-economic characteristics such as age, gender, average commuting distance, number of household members, etc., on demand for fuel. The empirical literature reports statistically insignificant coefficients with income variables, with income elasticity ranging from 0.01 to 0.14 (Hensher et al. 1990)Footnote 1. The fuel demand function described in Eq. (2) does not include any income effect.

The conflict in the two dimensions of qualities is evident from the demand function (2) and the utility function (1). Emissions are increasing in fuel consumption (\(x_i\)) which in turn is increasing in intrinsic quality (\(s_i\)). In equation (1) intrinsic quality positively affects utility but emissions negatively affect utility.

The main difference from Matsukawa (2012) is that we have two dimensions of quality as opposed to one dimension of quality in that paper. While in Matsukawa (2012), the fuel demand is inversely related to the (environmental) quality of the product, in our formulation, fuel demand is increasing in the intrinsic quality of the product. But since the two dimensions are in conflict, effectively, fuel demand in our formulation is also decreasing in environmental quality. The difference arises in the utility function because consumers derive positive utility from the intrinsic quality but negative utility from emissions.

From equation (1), each consumer’s conditional indirect utility function (conditional on the consumer’s choice of the firm) is given by

where \(Y_i \equiv y - p_i, \alpha _L=\alpha \), \(\alpha _H=0 \). Applying Roy’s identity to equation (3) and using equation (2), we get the following partial differentiation equation

We next derive a closed form expression for conditional indirect utility function using implicit function theorem in equation (3), keeping utility constant at a certain levelFootnote 2

Using equation (4) and (5), we obtain the following differential equation

Integrating both sides of the above equation and using separability of the differentiation equation, we have

where c is the constant of integration. We choose c as our cardinal measure of utility, i.e., \(c = \psi (\frac{\omega + t_e}{p_z}, \frac{Y_i}{p_z}, s_i) = \frac{Y_i}{p_z} - (\lambda s_i + \delta )\frac{(\omega + t_e)}{p_z} + \frac{\beta }{2} {(\frac{\omega + t_e}{p_z})}^2\). Substituting \(\psi ((\omega + t_e)/p_z, Y_i/p_z, s_i)\) in equation (3) we obtain conditional indirect utility function as

The conditional indirect utility function given in equation (8) satisfies all the properties of an indirect utility function. It is continuous; homogeneous of degree zero in fuel price, emission tax rate, price of the product, price of the composite good and income; non-increasing in price of the fuel (\(\omega \)), price of the composite good (\(p_z\)) and non-decreasing in income (y). The conditional indirect utility function is quasi-convex in prices, i.e., the diagonal elements of Slutsky matrix are non-positive (refer appendix). For simplicity, we assume \(p_z = 1\) for the rest of our analysis.

2.2 Equilibrium analysis

We now consider a two stage game in which firms choose intrinsic quality in the first stage and compete in prices in the second stage. The literature has considered both partially covered market (Amacher et al. 2005; Bansal and Gangopadhyay 2003; Grover and Bansal 2019) and fully covered market (Bansal 2008; Matsukawa 2012; Bottega and Freitas 2013). For simplification, we assume a fully covered market where all consumers buy one unit of the product in equilibrium. This would hold for products such as automobiles, mode of travel, electrical appliances, routine consumer products such as paper, detergents, etc. For the market to be fully covered, the consumer with \(\theta =0\) should also derive a positive net surplus at equilibrium prices and qualities. (Refer to Appendix for conditions under which a fully covered market exists). Using the conditional indirect utility function given by equation (8) and \(e_i = x_i = \lambda s_i - \beta (\omega + t_e) + \delta \) (equation (2)), the consumer who is indifferent between purchasing from firm H and firm L is given by \(\theta _2 = \frac{(p_H - p_L )}{(s_H -s_L)}+ \lambda (2\gamma + \omega + t_e) + \alpha q_L\). The consumers with \(\theta \in [0, \theta _2]\) will buy from firm L and consumers with \(\theta \in [\theta _2, 1 ]\) will buy from firm H. Thus the demand for firm L, \(q_L= \theta _2\) and the demand for firm H, \(q_H = 1-\theta _2\). Substituting the expression for \(q_L = \theta _2\) and simplifying, we get \(\theta _2 = [p_H - p_L + \lambda (2 \gamma + \omega + t_e)(s_H - s_L)]/(s_H - s_L - \alpha )\). The demand for two firms is given by

From (9) we can write conditions under which both firms will have a positive market share. \(q_L\) is positive for \(p_H\ge p_L.\) For \(p_H< p_L,\) \(q_L\) is positive if \(p_L -p_H < \lambda (2\gamma + \omega + t_e)(s_H - s_L)\). Similarly, \(q_H\) is positive under the condition \( (p_H - p_L)< (1 - \lambda (2\gamma + \omega + t_e))(s_H - s_L ) - \alpha \). Both \(q_H\) and \(q_L\) are positive under the condition \(-\lambda (2\gamma + \omega + t_e)(s_H - s_L)< (p_H - p_L)< (1 - \lambda (2\gamma + \omega + t_e))(s_H - s_L ) - \alpha \). We solve the above two stage game by backward induction.

2.2.1 Stage 2 - price competition

The firms simultaneously choose prices to maximize profits. The profit of firm i is given by

Substituting demand functions in the profit functions and maximizing with respect to prices give the following best response functions

From the best responses function it can be seen that prices are strategic complements. Let \(\Delta s \equiv (s_H - s_L)\) denote degree of product differentiation. The equilibrium prices are obtained as

where superscript \(**\) denotes equilibrium value of the variables under green network effect with regulation. The price of high quality firm is rising in the quality gap \(\Delta s\). The price of firm L is rising in higher quality \(s_H\), but the effect of \(s_L\) is ambiguous. For given qualities, an increase in fuel price or emission tax results in a decrease in the price of firm H and an increase in the price firm L.

The equilibrium quantities are

An increase in green network effect impacts demand via a direct effect and an indirect effect through prices. From equation (10) it can be seen that for given qualities, an increase in green network effect results in a decrease in price for both firms, which should cause an increase in demand. It is trivial from equation (11) that an increase in green network effect results in a net decrease in the demand for firm H suggesting that the direct effect dominates the price effect. However, for firm L both effects work in the same direction of increasing quantity demanded.

2.2.2 Stage 1 - intrinsic quality competition

We now turn to stage 1, where firms choose intrinsic qualities. Substituting prices and quantity from equation (10) and (11) into profit equation we have

Maximizing profits with respect to intrinsic quality subject to the constraint \(s_i\ge \underline{s}\) gives the first order condition \(\frac{\partial \pi _i}{\partial s_i} \le {} 0\). If \(\frac{\partial \pi _i}{\partial s_i} = 0, s_i \in [\underline{s}, \overline{s}]\) , and if \(\frac{\partial \pi _i}{\partial s_i} < 0\), then \(s_i = \underline{s}\) \((i = H , L)\). We obtain an interior solution under the former and a corner solution under the latter condition.

The above analyses serves as a general set of equations using which we will now solve for specific cases. We analyze the following four cases (i) Benchmark case, where environmental regulation as well as green network effect are absent (ii) Environmental regulation in the presence of green network effect (iii) Environmental regulation in the absence of green network effect (iv) Green network effect without environmental regulation.

2.3 Benchmark case- absence of regulation and green network effect

Suppose consumers do not take into account green network effect, and the government does not intervene with an emission tax, i.e., \(\alpha = t_e = 0\). The market is fully covered under the condition \(\lambda (2\gamma + \omega ) < 2\) for a sufficiently small \(\delta \) (Refer to Appendix). From now on we assume

A2: \(\lambda (2\gamma + \omega ) < 2\)

Simultaneously solving the two first order conditions given in equation(13) and using \(\alpha = 0\); \(t_e = 0\), we get equilibrium qualities asFootnote 3

Under A2, the intrinsic quality of firm H is positive. The intrinsic quality of firm H is decreasing in the usage parameter (\(\lambda \)), marginal effect of relative emissions (\(\gamma \)), price of fuel (\(\omega \)) and marginal cost parameter b. Firm L chooses the lowest possible quality, i.e., the corner solution.

Substituting the equilibrium level of qualities from equation (14) in equations (10) - (12) and using \(\alpha = t_e = 0\), we get equilibrium prices, quantity and profits of firm H and L as

where superscript \(*\) denotes equilibrium values of the variables in the benchmark case. Both firms enjoy a positive market share under A2, and the market share of low intrinsic quality firm is larger than the high intrinsic quality firm (\(q_L > q_H\)). The second order conditions for profit maximization are satisfied (refer to Appendix). An increase in the fuel price results in a decrease in the intrinsic quality of firm H; no change in the quality of firm L (equation (14)); decreases prices of both firms; decreases market share and profits of firm H; increases market share of firm L; and increases profits of firm L for \(\lambda (2\gamma + \omega ) < 1/2\) and decreases profits of firm L for \(2>\lambda (2\gamma + \omega ) > 1/2\) (equation (15)).

If an environmental regulation in the form of an emission tax, \(t_e,\) is introduced, the only change in the equilibrium outcome described for the benchmark case in equations (14) and (15) is that \(\omega \) is replaced by \((\omega + t_e)\).

2.4 Environmental regulation in the presence of green network effect

Suppose an emission tax is imposed when consumers take into account green network effect. Green network effect manifests in the form of \(\alpha q_L\) term in the utility function. Solving the two first order conditions simultaneously (equation (13)) yields equilibrium qualities as

The second order conditions are satisfied for \(\alpha < (9/16b)\) (refer to Appendix). Under (\(\alpha > 3/8b\)) and \((8b\alpha - 3)/(4(3 - 4b\alpha )) > \lambda (2\gamma + \omega + t_e)\), both qualities are in the interior, i.e., \(s_H^{**}> \underline{s}, s_L^{**} > \underline{s}\). Substituting the value of \(s_H\) and \(s_L\) from (16) in equations (10) - (12), we get equilibrium prices, quantity and profits of firm H and L as

where superscript \(**\) denote equilibrium value to the variables under green network with regulation of emission tax. From equation (17), we get that for \(\alpha <( 9/16b)\) both firms exist in the market. However, for \((9/16b)< \alpha < (9/8b)\), only firm L operates in the market. From equation (16) and (17), an increase in fuel price reduces the intrinsic quality, increases environmental quality; reduces prices and has no impact on market shares and profits of both firms.

Substituting \(t_e = 0\) in equations (16) and (17) provides results for the case of green network effect in the absence of environmental regulation.

3 Impact of green network effect

Consumer preferences for environmental friendly products could be influenced by behavior of other consumers. Social norms arise in a society through networks formed by individuals. These norms guide socially acceptable behavior, and impart a feeling of pride or shame in conforming or violating the norms. In this phenomenon beliefs, ideas and fads arise, whose strength gets affected by the size of the network. Individuals forming a network could be physically connected or have a close market relationship. When a network effect is present the value of the product depends on the number of consumers purchasing that product, i.e., the size of the market. Proposition 1 presents the impact of green network effect on market outcomes.

Proposition 1

Assume interior solution. An increase in the green network effect

-

(i)

increases the intrinsic quality and decreases environmental quality of both firms

-

(ii)

increases the prices of both firms

-

(iii)

reduces the market share of firm H and increases the market share of firm L

-

(iv)

reduces the profits of firm H and increases the profits of firm L

-

(v)

has no impact on the degree of product differentiation

-

(vi)

all the above effects remain the same whether an emission tax is imposed or not.

Proof: See Appendix

With an increase in the green network effect, the intrinsic quality of the product for both firms goes up, which in turn implies that environmental quality goes down. The gap between two qualities remains the same. However, the market share shifts in favor of the firm with better environmental quality. Thus there are two opposite forces on the overall environmental quality, and the net impact depends on the relative strength of these two effects. The increase in intrinsic quality increases costs, resulting in an increase in prices of both firms. The main economic intuition of our results is the following. The low quality firm will increase its intrinsic quality as consumers are willing to pay more for its product due to a network effect. Since qualities are strategic complements, the high quality firm also increases its intrinsic quality. Our results differ from Lambertini and Orsini (2005) where equilibrium qualities are independent of the network effect as equilibrium prices decrease linearly in the network effect. Our results are in line with Brecard (2013) in terms of environmental quality but differ in terms of prices. Similar to Hauck et al. (2014), there exists a demand effect of green network resulting in an increase in the market share of low quality firm. Due to the green network effect profits of high quality firm reduce and low quality firm increases. In contrast to Lambertini and Orsini (2005), who find that profits of both firms decrease due to network externalities, in our paper, green firm’s profit increases due to network effects. The two main reasons for the difference in the results is that qualities are in conflict in our model and we incorporate network effect only for the green good where as Lambertini and Orsini (2005) have it for both green and brown goods. We also find that the impact of green network on qualities, quantity and profits does not depend on the usage of the product. The effect of an increase in green network effect on intrinsic quality, prices, market share, and profits remain the same whether an emission tax is imposed or not. In the next section, we analyze the impact of an emission tax on market outcomes in the presence and absence of green network effect.

4 Environmental regulation - emission tax

Emission taxes are widely used as a policy instrument to address environmental problems. They have also been used to encourage green products (Lombardini-Riipinen 2005; Bansal 2008). Other possible policy instruments to promote green consumption are minimum quality standards, labeling, ad-valorem taxes/subsidy, emission subsidies, etc. An emission tax is imposed on emissions generated either during the production process or consumption. In our study, emissions are generated during fuel consumption. Propositions 2 and 3 document the impact of an emission tax on market outcomes such as product qualities, prices, market share and profits in the absence and presence of green network effect, respectively.

Proposition 2

In the absence of green network effect, an increase in an emission tax rate

-

(i)

reduces the intrinsic quality and increases environmental quality of firm H and has no effect on the intrinsic quality and the environmental quality of firm L

-

(ii)

reduces prices of both firms

-

(iii)

reduces market share of firm H and increases market share of firm L

-

(iv)

reduces profits of firm H; increases profits of firm L for \(\lambda (2\gamma + \omega + t_e) < 1/2\) and reduces profits of firm L for \(\lambda (2\gamma + \omega + t_e) > 1/2\).

-

(v)

reduces the degree of product differentiation

Proof: See Appendix

Proposition 3

In the presence of green network effect, an increase in an emission tax rate

-

(i)

reduces the intrinsic quality and increases environmental quality of both firms

-

(ii)

reduces the prices of both firms

-

(iii)

has no impact on market shares of both firms

-

(iv)

has no impact on profits of both firms

-

(v)

has no impact on degree of product differentiation

Proof: See Appendix

Our results show that in the absence of green network effect, an emission tax increases environmental quality of high quality firm and does not impact quality choice of low quality firm. This result is different from Matsukawa (2012), which shows that an increase in emission tax rate in discrete-continuous framework increases environmental quality of both firms. However, when we introduce green network effect then the result pertaining to environmental quality corresponds to Matsukawa (2012). As qualities are in conflict, increasing environmental quality implies reduction in intrinsic quality, which reduces fuel consumption. The increase in environmental quality of firms due to an emission tax is larger in the presence of a green network effect as compared to its absence. Further, the effect of an emission tax depends on usage parameter, \(\lambda \), and cost parameter, \(b\). Larger is \(\lambda \) and lower is \(b\), the larger is the effect of an emission tax on the intrinsic quality. The results differ from Bansal (2008), where the effect of an emission tax depends only on the cost parameter, \(b\). In the presence of network effect, an increase in emission tax rate reduces price of both firms, and has no impact on the market share and profits of both firms. Also, when network effect is present, the degree of the product differentiation given by \(\Delta s^{**} = 3/2b\), does not depend on the emission tax.

The next section compares above scenarios in terms of total emissions and welfare.

5 Total emissions and welfare analysis

To assess the impact of green network effect and emission tax on overall environmental quality, we compare total emissions under different scenarios. We also attempt to compare welfare under different scenarios. Due to intractability of expressions, we are only able to compare welfare under green network effect with and without environmental regulation.

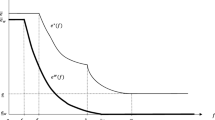

Proposition 4

-

(i)

Total emissions are largest in the benchmark case, where both regulation and green network effect are absent, and are the lowest when both regulation and green network effect are present.

-

(ii)

Total emissions under the other two scenarios, i.e., regulation without green network effect, and the green network effect without regulation lie within these two extremes.

-

(iii)

For a sufficiently small value of \(\beta \), total emissions are lower under green network effect without regulation as compared to the case of regulation in the absence of green network effect.

Proof: See Appendix

In the presence of green network effect, the regulation increases environmental quality of both firms and there is no change in their market shares. Thus total emissions reduce unambiguously.

The green network effect (without regulation) deteriorates environmental quality of both firms, however, the market share of green firm rises at the expense of brown firm. The two effects offset each other in such a manner that there is a reduction in total emissions. The regulation (in the absence of green network effect) increases the environmental quality of firm H , keeping the quality of firm L the same. It also increases the market share of green firm, L, clearly, resulting in a reduction in total emissions. For sufficiently small values of \(\beta \), the impact of green network effect is stronger than that of the regulation. This is because when \(\beta \) is small, the effect of an emission tax on reducing fuel demand and thus emissions is small.

Define welfare as the sum of consumer surplus, profits of both firms, and government budget surplus. We assume perfect competition in the market of fuel and composite good, thus, the profits of the firms supplying fuel and composite goods are zero.

Consumer surplus - It is the net benefit received by the consumers. Using \(y \equiv (\omega + t_e)x_i + p_z z_i + p_i\)Footnote 4, we define consumer surplus (CS) as

Using equation (8), \(p_z = 1\), \(e_i = \rho x_i\), \(\rho = 1\), \(q_L = \theta _2\) and equation (2) we get consumer surplus as

Profits of firm H and L

Government budget surplus - The government budget surplus is positive as it earns revenue from emission tax. As we assume emissions are generated only by the consumption of fuel and not from the production of the products by the firms, the emission tax is being paid by the consumers.

Using \(e_i = \rho x_i\), \(\rho = 1\) and equation (2), we get government budget surplus as

Welfare is the sum of equations (18–21). On simplification, we get welfare as

Substituting the equilibrium values of \(s_i\), \(q_i\) and \(\theta _2\) from equations (16), (17) for green network effect with and without regulation, we get the conditions for welfare to be higher under green network effect with environmental regulation than welfare under green network without environmental regulation (Proposition 5).

Proposition 5

For \(t_e \lesseqgtr \frac{\lambda }{b\beta + \lambda ^2} (\frac{15 - 8b\alpha }{2(3 - 4b\alpha )} - b^2 - 4\lambda \gamma )\), we have \(\widetilde{W} \lesseqgtr W^{**}\).

We show that for sufficiently small values of \(t_e\), welfare is higher under green network with environmental regulation than green network without environmental regulation. The environmental regulation in the form of emission tax leads to an increase in environmental quality, reduction in emissions and an increase in budget surplus, thereby increasing welfare.

Optimal tax rate

The optimal emission tax in the presence of green network is derived by maximizing welfare given by equation (22) with respect to emission tax, \(t_e\), given by

We analyze the impact of green network effect \((\alpha \)), and weight given to relative emissions (\(\gamma \)) on optimal tax rate (Proposition 6).

Proposition 6

(i) The optimal tax rate, \(t_e^{**}\) increases with an increase in green network effect (\(\alpha \))

(ii) and decreases in the weight given to relative emissions parameter (\(\gamma \)).

Proof: See Appendix

It can be shown that the optimal emission tax is positive for a sufficiently strong network effect.Footnote 5 An increase in the weight assigned to relative emissions leads to a decrease in optimal tax rate under green network effect. This is because by assigning a greater weight to environmental quality, consumers are internalizing the externality themselves and there is a smaller role for the government intervention. The optimal tax is increasing in the network effect as environmental qualities of both firms deteriorates with an increase in the network effect and thus a higher emission tax is required to compensate for the effect.

We are unable to get closed form expression for an optimal emission tax in the absence of green network effect, however, in Appendix, we show that a small emission tax is welfare improving for a wide range of parameters.

6 Conclusion

The paper analyzes the effects of green network and emission taxes on various market outcomes in a model where products are differentiated along two dimensions of quality, and consumers choose both the quality of the product and the extent of its usage. We find that both green network effect and emission tax improve overall environmental quality by reducing total emissions. The effects are complementary to each other in the sense that the impact of an emission tax is stronger in the presence of the green network effect. We also find that the environmental friendly firm benefits from the green network effect, as its market share and profits increase with the strength of the network effect. Finally, we show that for sufficiently small values of an emission tax rate, welfare is higher under green network with environmental regulation than green network without environmental regulation. The optimal tax is increasing in the network effect.

Since network effects enhance the effect of emission taxes, from a policy perspective, governments may consider interventions that can establish green networks. One possible way is to promote information disclosure policies such as labelling so that consumers are informed of environmental quality of products they are buying, which in turn, would facilitate manifestation of green network effects. The other intervention that can help establish networks is awareness campaigns that may form social norms for consumption of environmentally friendly products. The results are relevant for policy makers aiming to reduce green house gas emissions from the transportation sector.

Notes

Refer to Matsukawa (2012) for further details.

This is the unique solution satisfying the second order conditions.

\(Y_i \equiv y - p_i\) or \(y \equiv Y_i + p_i\) and \(Y_i\) is the amount spent on fuel and composite good which is equal to \((\omega + t_e)x_i + p_z z_i\).

For \(\alpha > 3\gamma \lambda /b(1+4\lambda \gamma )\), the optimal emission tax is positive. This is consistent with the previous assumptions \(\lambda (2\gamma + \omega ) < 2\) and \(\alpha < (9/16b)\).

References

Amacher GS, Koskela E, Ollikainen M (2004) Environmental quality competition and eco-Labeling. J Environm Econom Manag 47:284–306

Amacher GS, Koskela E, Ollikainen M (2005) Quality competition and social welfare in markets with partial coverage: new results. Bull Econom Res 57(4):391–405

Bansal S, Gangopadhyay S (2003) Tax/Subsidy Policies in the Presence of Environmentally Aware Consumers. J Environm Econom Manag 45:333–355

Bansal S (2008) Choice and dsign of regulatory instruments in the presence of green consumers. Resource Energy Econom 30:345–368

Bansal S, Khanna M, Sydlowski J (2021) Incentives for corporate social responsibility in India: Mandate, peer pressure and crowding-out effects. J Environm Econom Manag 105:102382

Birg L, Voßwinkel JS (2018) Minimum quality standards and compulsory labeling when environmental quality is not observable. Resource Energy Econom 53:62–78

Bottega L, Freitas JS (2013) Imperfect eo-labelling signal in a bertrand duopoly. it DEA Working Papers, Department of applied economics, University of Balearic Islands, 1–21

Brecard D (2013) Environmental quality competition and taxation in the presence of green network effect among consumers. Environm Resource Econom 54:1–19

Burtless G, Hausman JA (1978) The efect of taxation on labor supply: evaluating the gary negative income tax experiment. J Polit Econ 86(6):1103–1130

Carlsson F, Garcia JH, Lofgren A (2010) Conformity and the demand for environmental goods. Environm Resource Econom 47:407–421

Conrad K (2006) Price competition and product differentiation when goods have network effects. German Econom Rev 7(3):339–361

De Jong GC (1990) An indirect utility model of car ownership and car use. Eur Econom Rev 34(5):971–985

Dubin JA, McFadden DL (1984) An econometric analysis of residential electric appliance holdings and consumption. Econometrica 52(3):345–362

Farrell J, Klemperer P (2007) Coordination and Lock-in: Com petition with switching costs and network effects. Handbook Indust Organ 3:1967–2072

Falcone PM (2014) Collusion in a Differentiated Market and Environmental Network Externality. Rev Eur Stud 6(3):102–108

Glerum A, Frejinger E, Karlstrom A, Hugosson M.B, Bierlaire M (2014) A dynamic discrete-continuous choice model for car ownership and usage: estimation procedure. Proceedings of the 14th Swiss Transport Research Conference, Switzerland, 1–18

Griva K, Vettas N (2011) Price competition in a differentiated products duopoly under network effects. Inform Econom Policy 23(1):85–97

Greaker M, Midttomme K (2014) Optimal environmental policy with network effects: Will Pigovian taxation lead to excess inertia? CESifo Working Paper No. 4759: 1–38

Grover C, Bansal S (2019) Imperfect certification and eco-labelling of products. Indian Growth Develop Rev 12(3):288–314

Grover C, Bansal S, Martinez Cruz AL (2019) May a regulatory incentive increase WTP for Cars with a fuel efficiency label?. Estimating regulatory costs through a split-sample DCE in New Delhi, India, SSRN Discussion Paper, pp 1–30

Hanemann WM (1984) Discrete/continuous models of consumer demand. Econometrica 52(3):541–562

Hauck D, Ansink E, Bouma J, Soest D.V (2014). Social network effects and green consumerism. Tinbergen Institute Discussion Paper, TI - 150/VIII, 23: 1–27

Hensher DA, Milthorpe FW, Smith NC (1990) The demand for vehicle use in the Urban household sector. J Transport Econom Policy 24(2):119–137

Katz ML, Shapiro C (1985) Network externalities, competition, and compatibility. Am Econom Rev 73(3):424–440

Lambertini L, Orsini R (2005) The eexistence of equilibrium in a differentiated duopoly with network externalities. Japanese Econom Rev 56(1):55–56

Leibenstein H (1950) Bandwagon, snob and veblen effects in the theory of consumers’ demand. Quart J Econom 64(2):183–207

Lombardini-Riipinen C (2005) Optimal tax policy under environmental quality competition. Environm Resource Econom 32:317–336

Mantovani A, Tarola O, Vergari C (2016) Hedonic and environmental quality: a hybrid model of product differentiation. Resource Energy Econom 45:99–123

Marette S, Crespi JM, Schiavina A (1999) The role of common labelling in a context of asymmetric information. Eur Rev Agricul Econom 26(2):167–178

Matsukawa I (2012) The welfare effects of environmental taxation on a green market where consumers emit a pollutant. Environm Resource Econom 52:87–107

Rasouli S, Timmermans H (2016) Influence of social networks on latent choice of electric cars: a mixed logit specification using experimental design data. Netw Spat Econ 16:99–130

Roychowdhury (2019) Peer effects in consumption in Inda: An instrumental variables approach using negative idiosyncratic shocks. World Develop 114:122–137

Zago AM, Pick D (2004) Labeling policies in food markets: private incentives, public intervention, and welfare effects. J Agricul Resource Econom 29(1):150–165

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix

Properties of indirect utility function

The conditional indirect utility function is non-increasing in price of the fuel (\(\omega \)), price of the composite good (\(p_z\)) and non-decreasing in income (y) -

The conditional indirect utility function is quasi-convex in prices. We use expenditure function to calculate diagonal elements of Slutsky matrix. Rearranging terms in equation (8) and using \(Y_i \equiv y - p_i\), we get expenditure function as

The diagonal elements of Slutsky equation, \(s_{11}\) and \(s_{22}\) are given by

Thus all the properties of an indirect utility function are satisfied.

Conditions for fully covered market

For the market to be fully covered, all consumers including the consumer with the lowest preference parameter \(\theta = 0\) should derive a positive utility from buying a unit of the product in equilibrium. Plugging \(\theta = 0\) in equation (8), the utility is

Substituting the equilibrium values from equation (14),(15) in equation (24), we get the utility which consumer with \(\theta =0\) obtains from buying from firm L under the benchmark case (in the absence of regulation and green network effect) -

Assuming \(\delta \) is sufficiently small, the condition \(\lambda (2\gamma + \omega ) < 2\) ensures that market is fully covered.

Similarly, we can derive a condition for the market to be fully covered under environmental regulation in the presence of green network effect. Substituting the equilibrium values from equation (16), (17) in equation (24), we get utility function as

The equation (25) ensures that market is fully covered, i.e., for sufficiently small values of \(\delta \) and \(\lambda (\omega + t_e)\).

Second order conditions for profit maximization

Absence of green network effect and no regulation

The second order conditions at the market equilibrium are given by (using equation (13), (14) and \(\alpha = t_e = 0\))

The second order conditions holds under A2.

Green network effect with environmental regulation

Using equation (13), (16) we get second order conditions at the market equilibrium as

The above condition for high quality firm holds for \(\alpha < 9/16b\). The second order conditions is same for green network with no regulation.

Proof of proposition 1

Impact of green network effect with emission tax

-

(i)

From equation (16), we have \(\frac{ds_i^{**}}{d\alpha } = \frac{3}{(3 - 4 b \alpha )^2} > 0\)

-

(ii)

From equation (17),we have

$$\begin{aligned} \frac{dp_H^{**}}{d\alpha }= & {} -\frac{2}{3} + \frac{3(9 - 8b\alpha )}{4(3 - 4b\alpha )^3} - \frac{3\lambda (2\gamma + \omega + t_e)}{(3 - 4b\alpha )^2}> 0 \\ \frac{dp_L^{**}}{d\alpha }= & {} -\frac{1}{3} + \frac{9}{4(3 - 4b\alpha )^3} - \frac{3\lambda (2\gamma + \omega + t_e)}{(3 - 4b\alpha )^2}> 0 \end{aligned}$$ -

(iii)

From equation (17),we have

$$\begin{aligned} \frac{dq_H^{**}}{d\alpha }= & {} -\frac{2b}{(3 - 4b\alpha )^2} < 0 \\ \frac{dq_L^{**}}{d\alpha }= & {} \frac{2b}{(3 - 4b\alpha )^2} > 0 \end{aligned}$$ -

(iv)

From equation (17),we have

$$\begin{aligned} \frac{d\pi _H^{**}}{d\alpha }= & {} -\frac{(9 - 16b\alpha ) (63 - 108b\alpha + 64 (b\alpha )^2)}{36(3 - 4b\alpha )^3} < 0 \\ \frac{d\pi _L^{**}}{d\alpha }= & {} \frac{(9 -8b\alpha )( 9 + 36b\alpha - 32(b\alpha )^2)}{36(3 - 4b\alpha )^3} > 0 \end{aligned}$$ -

(v)

From equation (16), we have \(\Delta s^{**} = s_H^{**} - s_L^{**} = 3/2b\)

-

(vi)

By substituting \(t_e = 0\) in equation (16) and (17), it can be seen that above results hold for green network effect without environmental regulation.

Proof of proposition 2

Impact of emission tax in the absence of green network effect

The values \(\hat{s_i}\), \(\hat{p_i}\), \(\hat{q_i}\) and \(\hat{\pi _i}\) denote qualities, prices, quantity and profits under absence of green network without environmental regulation. It is calculated by replacing \(\omega \) with \((\omega + t_e)\) in equations (14) and (15).

-

(i)

From equation (14), we have \(\frac{d\hat{s_H}}{dt_e} = -\frac{2\lambda }{3b} < 0\) and \(\frac{d\hat{s_L}}{dt_e} = 0.\)

-

(ii)

From equation (15), we have \(\frac{d\hat{p_H}}{dt_e} = -\frac{20\lambda (2 - \lambda (2\gamma + \omega + t_e))}{27b} < 0\) and \(\frac{d\hat{p_L}}{dt_e} = -\frac{2\lambda (1 + 4\lambda (2\gamma + \omega + t_e))}{27b} < 0\).

-

(iii)

From equation (15), we have \(\frac{d\hat{q_H}}{dt_e} = -\frac{2\lambda }{9} < 0\) and \(\frac{d\hat{q_L}}{dt_e} = \frac{2\lambda }{9} > 0\).

-

(iv)

From equation (15), we have \(\frac{d\hat{\pi _H}}{dt_e} = -\frac{6\lambda (2 - \lambda (2\gamma + \omega + t_e))^2}{2187b} < 0\) and \(\frac{d\hat{\pi _L}}{dt_e} = \frac{\lambda (1 - 2\lambda (2\gamma + \omega + t_e))(5 + 2\lambda (2\gamma + \omega + t_e))}{1458b} \gtrless 0\) for \(\lambda (2\gamma + \omega + t_e) \lessgtr 1/2\)

-

(v)

From equation (14), \(\Delta {\hat{s}} \equiv (\hat{s_H} - \hat{s_L}) = \frac{4 - 2\lambda (2\gamma + \omega + t_e)}{3b}\) and \(\frac{\Delta {\hat{s}}}{dt_e} = -\frac{2\lambda }{3b} < 0\)

Proof of proposition 3

Impact of emission tax under green network

-

(i)

From equation (16),we have \(\frac{ds_H^{**}}{dt_e} = \frac{ds_L^{**}}{dt_e} = -\frac{\lambda }{b} < 0\).

-

(ii)

Change in the prices can be written as

$$\begin{aligned} \frac{dp_i^{**}}{dt_e}= & {} \frac{\partial p_i^{**}}{\partial s_H^{**}} \frac{ds_H^{**}}{dt_e} + \frac{\partial p_i^{**}}{\partial s_L^{**}} \frac{ds_L^{**}}{dt_e} + \frac{\partial p_i^{**}}{\partial t_e}, i = H,L \end{aligned}$$Using equation (10) and \(\frac{ds_H^{**}}{dt_e} = \frac{ds_L^{**}}{dt_e} = -\frac{\lambda }{b}\), we have

$$\begin{aligned} \frac{dp_H^{**}}{dt_e}= & {} \frac{b(2s_H^{**} + s_L^{**})\frac{ds_H^{**}}{dt_e}}{3} - \frac{\lambda \Delta s^{**}}{3} = -\lambda s_H^{**}< 0 \\ \frac{dp_L^{**}}{dt_e}= & {} \frac{b(s_H^{**} + 2s_L^{**})\frac{ds_H^{**}}{dt_e}}{3} + \frac{\lambda \Delta s^{**}}{3} = -\lambda s_L^{**} < 0 \end{aligned}$$ -

(iii)

Change in the quantity can be written as

$$\begin{aligned} \frac{dq_i^{**}}{dt_e}= & {} \frac{\partial q_i^{**}}{\partial s_H^{**}} \frac{ds_H^{**}}{dt_e} + \frac{\partial q_i^{**}}{\partial s_L^{**}} \frac{ds_L^{**}}{dt_e} + \frac{\partial q_i^{**}}{\partial t_e}, i = H,L \end{aligned}$$Using equation (11) and \(\frac{ds_H^{**}}{dt_e} = \frac{ds_L^{**}}{dt_e} = -\frac{\lambda }{b}\), we have

$$\begin{aligned} \frac{dq_H^{**}}{dt_e}= & {} -\frac{b\Delta s^{**}\frac{ds_H^{**}}{dt_e}}{3(\Delta s^{**} - \alpha )} - \frac{\lambda \Delta s^{**}}{3(\Delta s^{**} - \alpha )} = 0 \\ \frac{dq_L^{**}}{dt_e}= & {} \frac{b\Delta s^{**}\frac{ds_H^{**}}{dt_e}}{3(\Delta s^{**} - \alpha )} + \frac{\lambda \Delta s^{**}}{3(\Delta s^{**} - \alpha )} = 0 \end{aligned}$$ -

(iv)

Change in the profits can be written as

$$\begin{aligned} \frac{d\pi _i^{**}}{dt_e}= & {} \frac{\partial \pi _i^{**}}{\partial s_H^{**}} \frac{ds_H^{**}}{dt_e} + \frac{\partial \pi _i^{**}}{\partial s_L^{**}} \frac{ds_L^{**}}{dt_e} + \frac{\partial \pi _i^{**}}{\partial t_e}, i = H,L \end{aligned}$$Using equation (12) and \(\frac{ds_H^{**}}{dt_e} = \frac{ds_L^{**}}{dt_e} = -\frac{\lambda }{b}\), we have

$$\begin{aligned} \frac{d\pi _H^{**}}{dt_e}= & {} \frac{d\pi _L^{**}}{dt_e} = 0 \end{aligned}$$ -

(v)

Using equation (16), \(\Delta {s}^{**} \equiv ({s_H}^{**} - {s_L}^{**}) = \frac{3}{2b}\)

Proof of proposition 4

The total emissions are given by \(E = e_Hq_H + e_Lq_L\). Using \(p_z = 1\) and \(e_i = x_i = \lambda s_i - \beta (\omega + t_e) + \delta \), we get \(E = \lambda (s_H q_H + s_L q_L) - \beta (\omega + t_e) + \delta \). We calculate total emissions by substituting the values of \(s_H\), \(s_L\), \(q_H\) and \(q_L\) for each case discussed below.

Benchmark case- absence of green network effect and no regulation

Using equation (14) and (15) we get total emissions as

Environmental regulation in absence of green network effect

Replacing \(\omega \) with (\(\omega + t_e)\) in benchmark case, we get total emissions as

Green network effect without environmental regulation

Using equations (16), (17) and \(t_e = 0\) we get total emissions as

Green network effect with environmental regulation

Using equations (16) and (17) we get total emissions as

It can be clearly seen that \(E^{*} > \hat{E}\) and \(\widetilde{E} > E^{**}\). For sufficiently small values of \(\beta \) and \(3/8b< \alpha < 9/16b\) we observe that \(\hat{E} > \widetilde{E}\). Thus, \(E^{*}> \hat{E}> \widetilde{E} > E^{**}.\)

Proof of proposition 6

Optimal tax rate under green network effect with environmental regulation

Using equation (22) and substituting the equilibrium values of \(s_H\), \(s_L\) and \(\theta _2 = q_L\) from equation (16, 17) we get -

The optimal tax rate is obtained by setting \(\frac{dW}{dt_e} = 0\), is given by

For \(\alpha > \frac{3\lambda \gamma }{b(1 + 4\lambda \gamma )}\), optimal tax rate is positive, \(t_e^{**} > 0\).

The effect \(\alpha \) and \(\gamma \) on opitmal tax rate is given by

Optimal tax rate under absence of green network effect with environmental Regulation

Using equation (22) and substituting the equilibrium values of \(s_H\), \(s_L\) and \(\theta _2 = q_L\) from equation (14, 15) we get -

The optimum is achieved with a small positive emission tax - \(t_e > 0\) if \(328\lambda ^2(2\gamma + \omega )^2 + 524\lambda (2\gamma + \omega ) > 162\lambda \gamma + 209\) which holds for \(\lambda (2\gamma +\omega )>0.33\).

About this article

Cite this article

Grover, C., Bansal, S. Effect of green network and emission tax on consumer choice under discrete continuous framework. Environ Econ Policy Stud 23, 641–666 (2021). https://doi.org/10.1007/s10018-021-00312-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10018-021-00312-y