Abstract

This study analyzes the effects of a price-cap regulation on market outcomes in Cournot and Stackelberg duopolies. Although two firms are ex-ante identical, there are asymmetric Cournot equilibria as well as the symmetric equilibrium under the price-cap regulation, when the price-cap level is binding. By contrast, the Stackelberg equilibrium is unique and equivalent to the most asymmetric Cournot equilibrium under a binding price-cap level. We present several comparative statics results with respect to the equilibrium outcomes. The main concern of this study is the welfare effect of a change in a price-cap level. We show that when asymmetric Cournot equilibria or the Stackelberg equilibrium are focused on, a reduction in a price-cap level may be socially harmful even if the price-cap level is more than the competitive price.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In several industries such as oil, gas, electricity, railways, hospitals and airlines, firms have been regulated by price caps. In particular, we can observe price-cap regulations in the telecommunications industries of many countries and regions. In most of these industries, it is invalid to assume that the market is approximately perfectly competitive, because the number of firms is not very large. Furthermore, few of the industries are monopolies.Footnote 1 Therefore, we examine an oligopoly model with a price-cap regulation. To be more precise, in our model, firms engage in Cournot or Stackelberg competition and the market price of the good must be less than a certain price-cap level. Our main finding is that tightening the price cap may decrease social welfare even if the price-cap level is higher than the competitive price.

A large number of theoretical works discuss the price-cap regulation in the contexts of monopoly and oligopoly.Footnote 2 Earle et al. (2007) consider Cournot oligopoly models in which demand is deterministic or stochastic and the price-cap level is more than or equal to the competitive price.Footnote 3 They focus only on a symmetric equilibrium and show that social welfare is nonincreasing in the price-cap level as long as the level is more than the competitive price in the deterministic case. However, as shown later in this paper, there are asymmetric Cournot equilibria under a price cap. Furthermore, when we consider asymmetric equilibria, a decrease in the price-cap level may be socially harmful even if the price-cap level is more than the competitive price. When we focus on a Stackelberg game with a price cap, the result of the welfare analysis is clearer.Footnote 4 We show that the Stackelberg equilibrium is unique for any price-cap levels and a decrease in the price-cap level may also be socially harmful.

Earle et al. (2007) show that if demand is uncertain, a reduction of the price-cap level may decrease social welfare. See also Roques and Savva (2009), Grimm and Zöttl (2010) and Corchón and Marcos (2012) for related models and results. Reynolds and Rietzke (2016) discuss an oligopoly model with endogenous entry and show that a decrease of the price-cap level may decrease social welfare. By contrast, we consider a model without any uncertainty and entry.

We discuss simple Cournot and Stackelberg duopoly models with symmetric firms and a strictly convex cost function. First, we characterize the Cournot equilibria with a price cap. If the price-cap level is between the competitive price and the Cournot equilibrium price without any restriction, then the price cap is binding and there is a unique symmetric equilibrium as well as asymmetric equilibria, in which the output of a firm is larger than that of the other firm. We characterize each equilibrium as a convex combination of the symmetric equilibrium and the most asymmetric equilibrium where a coefficient of the convex combination represents the degree of symmetry of the equilibrium. By using the characterization, we provide comparative statics analyses by fixing the degree of symmetry. Unlike the comparative statics results of a monopoly model, we show that tightening a price cap may decrease the equilibrium output of a firm and may increase the profit of a firm.

Second, we show that the Stackelberg equilibrium is always unique. Intriguingly, if the price-cap level is binding, then the unique Stackelberg equilibrium is equivalent to the most asymmetric Cournot equilibrium under the same price-cap level. We give several comparative statics results of the Stackelberg equilibrium. Some are also in sharp contrast to those of a monopoly model.

Third, we consider the welfare effect of the price cap. First, if the price-cap level is binding in Stackelberg competition, then social welfare under Stackelberg competition is less than or equal to that under any Cournot equilibrium. Second, we show that if the price-cap level is equal to the competitive price, then the first best outcome is achieved in both market structures. Third, when we focus on a sufficiently symmetric Cournot equilibrium, social welfare is increased by a decrease in the price-cap level. Fourth, if the price-cap level is sufficiently close to the competitive price, then social welfare is also increased by a decrease in a price-cap level. However, if the price-cap level is sufficiently far from the competitive price, then social welfare may be decreased by a reduction in the price-cap level. This result is satisfied when we focus on the Stackelberg equilibrium or a sufficiently asymmetric Cournot equilibrium.

Finally, we briefly explain why tightening the price-cap regulation may decrease social welfare. In our model, there may be multiple Cournot equilibria but the equilibrium total output does not differ among equilibria for any given price-cap level. We show that if the degree of symmetry is sufficiently small and the price-cap level is sufficiently close to the competitive price, then tightening the price cap increases the difference between the equilibrium outputs of the firms. Since the cost function of each firm is strictly convex, the industry cost is drastically increased by the decrease of the price-cap level. Therefore, a reduction in the price-cap level may decrease Cournot equilibrium social welfare. Since the Stackelberg equilibrium is equal to the most asymmetric Cournot equilibrium when the price cap is binding, tightening the price cap may also decrease Stackelberg equilibrium social welfare. A similar welfare effect is discussed by Matsumura (1998) but he restricts his attention to the effect of privatization policy.

2 Model and competitive equilibrium

We assume that there are exactly two firms 1 and 2 that decide their output denoted by \(x_{i}\) for \(i=1,2\). Let \(X=x_{1}+x_{2}\). The cost functions of the firms are identical and given by \(C(x_{i}),\) which satisfies \(C^{\prime }>0\) and \(C^{\prime \prime }>0\); that is, \(C(x_{i})\) is strictly convex. The inverse demand function of this market is given by P(X) satisfying \(P^{\prime \prime }X+P^{\prime }<0\) for all \(X>0\). The profit of firm \(i=1,2\) is given by \(\pi _{i}=P(X)x_{i}-C(x_{i})\). Note that by the above mentioned assumptions, the profit function of i is strictly concave with \(x_{i}\).Footnote 5

To characterize the Cournot and Stackelberg equilibria, we first derive the competitive equilibrium without any price caps. The supply function of a firm is \(C^{\prime -1}(P)\), because \(P=C^{\prime }(X)\). Let \(\varnothing ^{C}(X)=C^{\prime -1}(P(X))\). Moreover, let \(r^{C}\left( x_{j}\right) \) be the solution of \(x_{i}=\varnothing ^{C}(x_{i}+x_{j})\). The functions \( \varnothing ^{C}(\cdot )\) and \(r^{C}(\cdot )\) are useful to characterize Cournot and Stackelberg equilibria with price caps. The competitive equilibrium output of a firm is \(x^{C}=\varnothing ^{C}(X^{C})\) where \( X^{C}=2\varnothing ^{C}(X^{C})\). Since \(\varnothing ^{C}(X)\) is smooth and \( \varnothing ^{C\prime }\le 0,\) the equilibrium exists uniquely. The price \( P(X^{C})\) is the competitive price, because both demand and supply under \( P(X^{C})\) are equal to \(X^{C}=2\varnothing ^{C}(X^{C})=2C^{\prime -1}(P(X^{C}))\).

3 Cournot equilibria

Without loss of generality, in this section, we assume that \(x_{1}\ge x_{2}\) in any equilibrium.

First, we derive the Cournot equilibria without any price caps. The first order condition of i is

This condition yields the best reply function of firm i \(r(x_{j})\) for \( i\ne j\). Let \(\varnothing (X)\) be the unique solution of \(x_{i}=r(X-x_{i})\). This function is also used to characterize Cournot equilibria with a price cap.Footnote 6 The Cournot equilibrium output of a firm is \(x^{N}=\varnothing (X^{N})\) where \( X^{N}=2\varnothing (X^{N})\). Since \(\varnothing \) is smooth and \(\varnothing ^{\prime }\le 0,\) the equilibrium uniquely exists. See Vives (2001, Ch.4) for the complete proof of this result. By comparing the competitive case, we obtain \(\varnothing (X)<\varnothing ^{C}(X)\) for all X satisfying \( \varnothing ^{C}(X)>0\). Therefore, we have \(X^{N}<X^{C}\) and \(\varnothing (X)<\varnothing ^{C}(X)\) for all \(X\le X^{C}\).

Next, we derive Cournot equilibria with a price cap. Thus, the profit of the firm is given by

Let \({\bar{X}}\) be such that \(P({\bar{X}})={\bar{P}}\). Throughout this study, we focus on a price-cap level that is more than or equal to the competitive equilibrium price: \({\bar{P}}\ge P(X^{C})\).

We derive the best reply of firm \(i\ne j\) \(r\left( x_{j},{\bar{P}}\right) \) under \({\bar{P}}\). First, if \({\bar{X}}-x_{j}\le r\left( x_{j}\right) \), then \( r\left( x_{j},{\bar{P}}\right) =r\left( x_{j}\right) \) because \({\bar{P}}\) is not binding under \(x_{j}\) and \(x_{i}=r\left( x_{j}\right) \). Second, if \( {\bar{X}}-x_{j}\in \left( r\left( x_{j}\right) ,r^{C}\left( x_{j}\right) \right) \), then the market price under \(x_{j}\) and \(x_{i}=r\left( x_{j}\right) \) is binding, that is; \({\bar{P}}<P(x_{j}+r\left( x_{j}\right) )\). In this case, firm i chooses its output in which the market price \( P\left( x_{i}+x_{j}\right) \) equals \({\bar{P}}\). This is because (i) if i increases its output, then the market price is below the price-cap level, and (ii) if i decreases its output, then the market price is not raised because of the price cap. Hence, \(r\left( x_{j},{\bar{P}}\right) ={\bar{X}} -x_{j} \). Moreover, if \({\bar{X}}-x_{j}\ge r^{C}\left( x_{j}\right) \), \( r\left( x_{j},{\bar{P}}\right) =r^{C}\left( x_{j}\right) \). That is, in this case, firm i acts as a price taker where the market price is equal to \( {\bar{P}}\), because the output of the other firm is very small. In summary, \( r\left( x_{j},{\bar{P}}\right) \) is given by

Now, we derive the Cournot equilibria. First, suppose \({\bar{P}}\ge P(X^{N})\). Then, \(\left( x^{N},x^{N}\right) \) is the unique equilibrium. That is, if the price-cap level is more than or equal to the Cournot equilibrium price without any price cap, then the price-cap level is not binding and thus imposing the price cap does not affect the equilibrium as long as \({\bar{P}} \ge P(X^{N})\).

Second, suppose \({\bar{P}}\in \left[ P(X^{C}),P(X^{N})\right] \). First, consider \(\left( x_{1},x_{2}\right) \) that satisfies \({\bar{P}}>P(x_{1}+x_{2})\). Since \(\left( x^{N},x^{N}\right) \) is the unique Cournot equilibrium without any regulations, either of the firms has the incentive to change its output. Therefore, a pair \(\left( x_{1},x_{2}\right) \) that satisfies \(\bar{P }>P(x_{1}+x_{2})\) is not an equilibrium and thus \({\bar{P}}\) is binding in any equilibrium; that is, \({\bar{P}}=P(x_{1}+x_{2})\) and \(x_{1}+x_{2}={\bar{X}}\).

Now, consider \(\left( x_{1},x_{2}\right) \) that satisfies \(x_{1}+x_{2}={\bar{X}}\). We derive the condition that \(\left( x_{1},x_{2}\right) \) is a pair of equilibrium outputs. First, firm i has no incentive to increase its output if and only if

On the other hand, firm i has no incentive to decrease its output if and only if

This is because, any decrease of firm i’s output never raises the price. Therefore, the equilibrium output of firm i must satisfy \(\varnothing ( {\bar{X}})\le x_{i}\le \varnothing ^{C}({\bar{X}})\).

To characterize the equilibrium completely, consider the symmetric equilibrium \(\left( {\bar{X}}/2,{\bar{X}}/2\right) \) and the most asymmetric equilibrium \(\left( {\overline{x}}\left( {\bar{P}}\right) ,{\underline{x}}\left( {\bar{P}}\right) \right) \) where

Then, as shown later, the equilibrium output is represented by the convex combination of the two equilibria. Thus, let

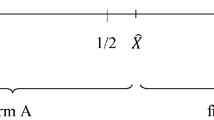

for \({\bar{P}}\in \left[ P(X^{C}),P(X^{N})\right] \) and \(\alpha \in \left[ 0,1 \right] ,\) and \(x_{1}^{N}\left( {\bar{P}},\alpha \right) =x_{2}^{N}\left( {\bar{P}},\alpha \right) =x^{N}\) for \({\bar{P}}>P(X^{N})\) and \(\alpha \in \left[ 0,1 \right] \). Note that \(x_{1}^{N}\left( {\bar{P}},\alpha \right) +x_{2}^{N}\left( {\bar{P}},\alpha \right) ={\bar{X}}\) for any \({\bar{P}}\in \left[ P(X^{C}),P(X^{N})\right] \) and \(\alpha \in \left[ 0,1\right] \). If \(\alpha =1,\) then the equilibrium is symmetric. Moreover, if \(\alpha =0,\) then the equilibrium is the most asymmetric one. Therefore, \(\alpha \) represents the degree of symmetry of the equilibrium. Note that \(\partial x_{1}^{N}\left( {\bar{P}},\alpha \right) /\partial \alpha <0\) and \(\partial x_{2}^{N}\left( {\bar{P}},\alpha \right) /\partial \alpha >0\) for \({\bar{P}}\in \left( P(X^{C}),P(X^{N})\right) \).

In summary, we have the following result.

Theorem 1

Suppose \({\bar{P}}\in \left[ P(X^{C}),P(X^{N})\right] \). A pair of the outputs of the firms is an equilibrium if and only if \(\left( x_{1},x_{2}\right) =\left( x_{1}^{N}\left( {\bar{P}},\alpha \right) ,x_{2}^{N}\left( {\bar{P}}, \alpha \right) \right) \) for \(\alpha \in \left[ 0,1\right] \). In addition, \( {\underline{x}}\left( {\bar{P}}\right) \) is a U-shaped function and \({\overline{x}} \left( {\bar{P}}\right) \) is an inverted U-shaped function of \({\bar{P}}\in \left( P(X^{C}),P(X^{N})\right) \). Moreover, the minimizer of \({\underline{x}} \left( {\bar{P}}\right) ,\) denoted \({\bar{P}}^{*},\) is equivalent to the maximizer of \({\overline{x}}\left( {\bar{P}}\right) \) and \({\bar{P}}^{*}\in \left( P(X^{C}),P(X^{N})\right) \).

The proof of this is provided in the Appendix. In order to provide the intuitions behind Theorem 1, we introduce the following example.

Example 1

Let \(P(X)=1-X/2\) and \(C(x_{i})=x_{i}^{2}/2\). Then, \(X^{N}=4/5\) and \( P(X^{N})=3/5\), and \(X^{C}=1\) and \(P(X^{C})=1/2\), and \({\bar{P}}^{*}=6/11\). In addition,

The best reply function of firm \(i\ne j\) under \({\bar{P}}\) of this example is

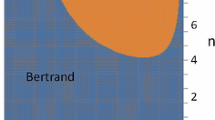

We illustrate the best reply functions of two firms in Figs. 1, 2 and 3. These figures depict the functions in the case where the price-cap level is \( {\bar{P}}_{1}\in \left( 6/11,3/5\right) \), \({\bar{P}}_{2}\in \left( 6/11,{\bar{P}} _{1}\right) \) and \({\bar{P}}_{3}\in \left( 1/2,6/11\right) \), respectively. Each bold line represents the Cournot equilibria and each point represents the most asymmetric Cournot equilibrium.

First, we explain why there are multiple equilibria under \({\bar{P}}\in \left( 1/2,3/5\right) \). If \({\bar{P}}\in \left( 1/2,3/5\right) ,\) then the best reply curves of two firms are overlapped. See the bold lines of Figs. 1, 2 and 3. In this case, \(x_{1}+x_{2}={\bar{X}}\) and \(r(x_{j})\le x_{i}\le r^{C}(x_{j})\) for all \(i=1,2\) are satisfied. Then, first, since \( r(x_{j})\le x_{i}\), i has no incentive to increase its output. Second, since \(x_{i}\le r^{C}(x_{j})\), i has no incentive to decrease its output. This is because in that case, any decrease of output does not increase the price. By the definitions of \(\varnothing ({\bar{X}})\) and \(\varnothing ^{C}( {\bar{X}})\), \(x_{1}+x_{2}={\bar{X}}\) and \(r(x_{j})\le x_{i}\le r^{C}(x_{j})\) are rewritten as \(x_{1}+x_{2}={\bar{X}}\) and \(\varnothing ({\bar{X}})\le x_{i}\le \varnothing ^{C}({\bar{X}})\). Therefore, we have the multiple Cournot equilibria characterized in Theorem 1.

Second, we focus on the most asymmetric equilibrium represented by the point of each figure. The points in Figs. 1 and 2 are the intersections of the lines representing \(x_{1}+x_{2}={\bar{X}}\) and \(r(x_{1})\), respectively. This implies that if \({\bar{P}}\in \left( {\bar{P}}^{*},P(X^{N})\right) \), then the most asymmetric equilibrium is \(({\overline{x}}\left( {\bar{P}}\right) \!, {\underline{x}}\left( {\bar{P}}\right) )=\left( {\bar{X}}-\varnothing \left( {\bar{X}}\right) \!, \varnothing \left( {\bar{X}}\right) \right) \). Comparing the points in Figs. 1 and 2, the output of firm 1 is increased but that of firm 2 is decreased by the reduction in the price-cap level, because \(r(x_{1})\) is a decreasing function. On the other hand, the point in Fig. 3 is the intersection of the lines representing \(x_{1}+x_{2}={\bar{X}}\) and \( r^{C}(x_{2})\). This implies that if \({\bar{P}}_{1}\in \left( {\bar{P}}^{*},P(X^{N})\right) \), then the most asymmetric equilibrium is \(({\overline{x}} \left( {\bar{P}}\right) ,{\underline{x}}\left( {\bar{P}}\right) )=\left( \varnothing ^{C}\left( {\bar{X}}\right) ,{\bar{X}}-\varnothing ^{C}\left( {\bar{X}} \right) \right) \). Comparing the points in Figs. 2 and 3, the output of firm 2 is increased but that of firm 1 is decreased by the reduction in the price-cap level, because \(r^{C}(x_{2})\) is also decreasing. These facts imply that the most asymmetric Cournot equilibrium output of 2 is a U-shaped function and that of 1 is an inverted U-shaped function of \({\bar{P}}\in \left( P(X^{C}),P(X^{N})\right) \) presented in Theorem 1.

Figure 4 depicts the most asymmetric equilibrium \({\overline{x}}\left( {\bar{P}} \right) \) and \({\underline{x}}\left( {\bar{P}}\right) \) of this example. This illustrates the second and third sentences of Theorem 1. Note that the range of the equilibrium outputs; \({\overline{x}}\left( {\bar{P}}\right) -{\underline{x}} \left( {\bar{P}}\right) \), is increasing between \(P(X^{C})\) and \({\bar{P}}^{*}\) and is decreasing between \({\bar{P}}^{*}\) and \(P(X^{N})\). This fact is important for the welfare analysis introduced in Sect. 5 later.

By using the characterization of the Cournot equilibria in Theorem 1, we provide comparative statics results. Since there are multiple equilibria, we fix \(\alpha \) in this analysis. Note that, if we focus on the symmetric equilibrium, \(\alpha \) is fixed at 1. Many previous studies, such as Earle et al. (2007), focus only on the symmetric equilibrium; that is, they assume \(\alpha =1\) in our terminology. Hence, our approach is more general. We mainly analyze comparative statics by fixing \(\alpha \).

In a usual monopoly model, a decrease in a binding price-cap level must increase the output of a monopolist, because the market price is not raised by a reduction of the output. However, in our duopoly model, this result is not satisfied; that is, the output of either firm is decreased by a reduction of the binding price-cap level if the degree of symmetry is sufficiently small.

In order to explain clearly, let \(\alpha =0;\) that is, we focus on the most asymmetric equilibrium. First, if the price-cap level is sufficiently close to the competitive price (i.e., if \({\bar{P}}\in \left( P(X^{C}),{\bar{P}}^{*}\right] )\)), then a reduction in a binding price-cap level must decrease the output of firm 1 \(x_{1}^{N}\left( {\bar{P}},0\right) ={\overline{x}}\left( {\bar{P}}\right) =\varnothing ^{C}({\bar{X}})\). See Fig. 3 for an example of this case. Then, firm 1 acts as a price-taker; that is, 1 decides its output under fixed \({\bar{P}}\). Thus, a reduction of the price-cap level decreases the equilibrium output of firm 1. Second, if the price-cap level is sufficiently close to the Cournot equilibrium price without any regulation; that is, if \({\bar{P}}\in \left( {\bar{P}}^{*},P(X^{N})\right] \), then a reduction in a binding price-cap level must decrease the output of firm 2 \(x_{2}^{N}\left( {\bar{P}},0\right) ={\underline{x}}\left( {\bar{P}} \right) =\varnothing ({\bar{X}})\). See Figs. 1 and 2 for examples of this case. In this case, the equilibrium output of firm 1 is increased by a decrease in \({\bar{P}}\) and firm 2 chooses the best reply to the output of firm 1 without any restriction \(r\left( x_{1}\right) \). These facts indicate that the equilibrium output of firm 2 is decreased by a decrease in \({\bar{P}}\). These comparative statics results sharply contrast to those of a usual monopoly model. Note that the results are the same as those of a usual monopoly model if we focus on a sufficiently symmetric equilibrium; that is, if \(\alpha \) is sufficiently small.

We confirm the comparative statics results by examining Example 1.

First, if \({\bar{P}}\in \left( 1/2,6/11\right] \), then

Thus, in that case, the equilibrium output of 1 is increasing in \({\bar{P}}\) if and only if \(\alpha <1/2\). Second, if \({\bar{P}}\in \left( 6/11,3/5\right] \), then

Hence, in that case, the equilibrium output of 2 is increasing in \({\bar{P}}\) if and only if \(\alpha <2/5\).

Next, we discuss the equilibrium profits of the firms. Here, we focus on a sufficiently asymmetric equilibrium again. Then, tightening the price cap may increase the equilibrium profit. First, suppose that the price-cap level is sufficiently close to the competitive price; that is, suppose \({\bar{P}}\in \left( P(X^{C}),{\bar{P}}^{*}\right] \). Then, since a decrease in the price-cap level raises the equilibrium output of firm 1 and reduces that of firm 2, it may increase the equilibrium profit of firm 1. Second, suppose that the price-cap level is sufficiently close to the Cournot equilibrium price without any regulation; that is, if \({\bar{P}}\in \left( {\bar{P}}^{*},P(X^{N})\right] \). Then, since a reduction in the price-cap level decreases the equilibrium output of firm 1 and increases that of firm 2, it may increase the equilibrium profit of firm 2.

In fact, we can confirm these results by considering Example 1. Suppose \( \alpha =0\). Then, the profits of firm 1 under \({\bar{P}}=0.88\) and \({\bar{P}} =0.89\) are about 0.297 and 0.289, respectively. Thus, the profit under \( {\bar{P}}=0.88\) is higher. In addition, the profits of firm 2 under \({\bar{P}} =0.64\) and \({\bar{P}}=0.65\) are about 0.134 and 0.131, respectively. Therefore, the profit under \({\bar{P}}=0.64\) is higher.

4 Stackelberg equilibrium

We consider the case in which two firms engage in Stackelberg competition, where one firm is the leader and the other is the follower. Without loss of generality, we assume that firm 1 is the leader and firm 2 is the follower. Note that, in this section, we do not assume \(x_{1}\ge x_{2},\) but it is realized in equilibrium.

First, we derive the Stackelberg equilibrium without any price caps. Firm 1 ’s maximization problem is

Hence, the first-order condition of firm 1 is

Moreover, we assume that the second order condition is satisfied for all \( x_{1}\). Let \(x_{1}^{S}\) and \(x_{2}^{S}\) be the Stackelberg equilibrium outputs of the leader and the follower, respectively, without any price caps. Then, \(\left( x_{1}^{S},x_{2}^{S}\right) \) is unique, and \(x_{1}^{S}\) satisfies (4) and \(x_{2}^{S}=r\left( x_{1}^{S}\right) \). Moreover, let \(X^{S}=x_{1}^{S}+x_{2}^{S}\). We provide two well-known facts on the Stackelberg equilibrium. First, \(x_{1}^{S}>x_{2}^{S}\). Second, \(P\left( X^{N}\right)>P\left( X^{S}\right) >P\left( X^{C}\right) \) or equivalently \( X^{C}>X^{S}>X^{N}\).Footnote 7

Next, we consider the Stackelberg equilibrium with a price cap \({\bar{P}}\). Let \(x_{i}^{S}\left( {\bar{P}}\right) \) be the Stackelberg equilibrium with a price cap \({\bar{P}}\) for \(i=1,2\).

Theorem 2

If \({\bar{P}}>P\left( X^{S}\right) ,\) then \(\left( x_{1}^{S}\left( {\bar{P}} \right) ,x_{2}^{S}\left( {\bar{P}}\right) \right) =\left( x_{1}^{S},x_{2}^{S}\right) \). If \({\bar{P}}\in \left[ P\left( X^{C}\right) ,P\left( X^{S}\right) \right] , \) then \(\left( x_{1}^{S}\left( {\bar{P}}\right) ,x_{2}^{S}\left( {\bar{P}}\right) \right) =\left( x_{1}^{N}\left( {\bar{P}},0\right) ,x_{2}^{N}\left( {\bar{P}},0\right) \right) \). Furthermore, \({\bar{P}} ^{*}<P(X^{S})\).

The proof of this is provided in the Appendix.

Although there may be multiple Cournot equilibria, the Stackelberg equilibrium is always unique. Moreover, if \({\bar{P}}\le P\left( X^{S}\right) (<P\left( X^{N}\right) )\), then the Stackelberg equilibrium is equal to the most asymmetric Cournot equilibrium.

If \(x_{2}={\bar{X}}-x_{1}\) is the best reply of the follower, the leader chooses \(x_{1}=\varnothing ^{C}({\bar{X}})\) because of the price cap. Moreover, if the production of the leader is between \({\bar{X}}-\varnothing ^{C}({\bar{X}})\) and \({\bar{X}}-\varnothing ({\bar{X}})\), then the follower chooses \(x_{2}={\bar{X}}-x_{1}\) and thus the price cap is binding. However, if \(x_{1}>{\bar{X}}-\varnothing ({\bar{X}}),\) then the follower chooses \( \varnothing ({\bar{X}})\) and the market price will be less than \({\bar{P}}\). Since the leader wants to keep the price cap as binding, it chooses \( x_{1}^{S}\left( {\bar{P}}\right) =x_{1}^{N}\left( {\bar{P}},0\right) =\min \{\varnothing ^{C}({\bar{X}}),{\bar{X}}-\varnothing ({\bar{X}})\}\) and thus, the follower chooses \(x_{2}^{S}\left( {\bar{P}}\right) =x_{2}^{N}\left( {\bar{P}},0\right) =\min \{{\bar{X}}-\varnothing ^{C}({\bar{X}}),\varnothing ({\bar{X}})\}\).

Next, we provide comparative statics results on the Stackelberg equilibrium. In the previous section, we provide some counterintuitive results when considering the sufficiently asymmetric Cournot equilibrium. By Theorem 2, we also have similar results as a comparative statics analysis of the unique Stackelberg equilibrium if \({\bar{P}}\in \left[ P\left( X^{C}\right) ,P\left( X^{S}\right) \right] \). First, if \({\bar{P}}\) is binding, then a decrease in \( {\bar{P}}\) increases the output of a firm but decreases that of the other firm. Next, tightening the price cap may increase the equilibrium profit. These results hold because the Stackelberg equilibrium is equal to the most asymmetric Cournot equilibrium.

Figure 5 depicts \(\left( x_{1}^{S}\left( {\bar{P}}\right) , x_{2}^{S}\left( {\bar{P}}\right) \right) \) of Example 1 for \({\bar{P}}\in \left[ 1/2,3/5\right] \). The two bold lines of Figure 5 represent \(x_{1}^{S}\left( {\bar{P}}\right) \) and \(x_{2}^{S}\left( {\bar{P}}\right) \), respectively, and are similar to those of Figure 4, but they are different between \({\bar{P}}\in \left( P(X^{S}),P(X^{N})\right] =\left( 33/56,3/5\right] \) because \({\bar{P}}\in \left( P(X^{S}),P(X^{N})\right] \) is not binding when the firms engage in Stackelberg competition but is binding when they engage in Cournot competition.

5 Welfare effects

We consider the welfare effect of a change in \({\bar{P}}\). Social welfare is defined as the simple sum of consumers’ and producers’ surplus; that is,

Let \(W^{N}({\bar{P}},\alpha )=W\left( x_{1}^{N}\left( {\bar{P}}, \alpha \right) , x_{2}^{N}\left( {\bar{P}},\alpha \right) \right) \) be Cournot equilibrium social welfare and \(W^{S}({\bar{P}})=W\left( x_{1}^{S}\left( {\bar{P}}\right) , x_{2}^{S}\left( {\bar{P}}\right) \right) \) be Stackelberg equilibrium social welfare.Footnote 8

First, we examine the effect of a change in \(\alpha \) on social welfare for given \({\bar{P}}\in \left( P(X^{C}),P(X^{N})\right) \). Then, we obtain the following result.

Proposition 1

For any given \({\bar{P}}\in \left( P(X^{C}),P(X^{N})\right) ,\) a rise in \( \alpha \) decreases the industry cost and thus increases Cournot equilibrium social welfare. In addition, for any given \({\bar{P}}\in \left( P(X^{C}),P(X^{S})\right) ,\) Stackelberg equilibrium social welfare is lower than the Cournot equilibrium social welfare if \(\alpha \ne 0\) and they are equivalent if \(\alpha =0\).

Since we assume a strictly convex cost function; that is, \(C^{\prime \prime }(\cdot )>0,\) the symmetric equilibrium is the most efficient for any \({\bar{P}}\in \left( P(X^{C}),P(X^{N})\right) \). Moreover, a decrease of the degree of symmetry increases \(x_{1}^{N}\left( {\bar{P}},\alpha \right) -x_{2}^{N}\left( {\bar{P}},\alpha \right) \) and the total cost of this market. Therefore, it reduces social welfare. Furthermore, since the Stackelberg equilibrium is equal to the most asymmetric Cournot equilibrium, social welfare of the Stackelberg equilibrium is less than or equal to that of any Cournot equilibrium as long as \({\bar{P}}\) is binding.

The policy implication of Proposition 1 sharply contrast to that of Daughety (1990), because he shows that the Stackelberg outcome is more socially efficient than the Cournot outcome. This is because he considers a model with a constant marginal cost and the total output of a Stackelberg equilibrium is more than that of a Cournot equilibrium if there is no regulation. Ino and Matsumura (2012) state that under a strictly convex cost, the Stackelberg equilibrium may yield a smaller social surplus than the Cournot equilibrium even if there is no regulation. We have a clearer implication under a binding price cap. That is, the Stackelberg equilibrium always yields a smaller social surplus than the Cournot equilibrium as long as the price-cap regulation is binding; that is, \({\bar{P}}\in \left( P(X^{C}),P(X^{S})\right) \).

Second, we have the following result for the first best outcome.

Proposition 2

If \({\bar{P}}=P(X^{C}),\) then the first best outcome is achieved in both Cournot and Stackelberg equilibria; that is,

for all \(x_{1},x_{2}\) and \(\alpha \in \left[ 0,1\right] \).

Note that the output floor also yields the first-best outcome if the output floor level is equal to \(x^{C}\). See Matsumura and Okumura (2013, 2016) on this issue.

This result implies that the optimal price-cap level should be equal to the competitive price. However, in the real world, it may be difficult to know the exact competitive price. In that case, a policy-maker usually decides the price-cap level by using the average cost of firms as a reference. Obviously, when the cost function is convex, the average cost is more than the marginal cost. Thus, if the price-cap level is equal to the average cost, then the level is more than the competitive level. Hence, we also examine the price-cap level between the competitive price and the Cournot equilibrium price without any price caps.

We consider the Cournot equilibrium social welfare for given \(\alpha \in \left[ 0,1\right] \). Moreover, since any changes in \({\bar{P}}\) do not affect the market outcomes as long as \({\bar{P}}>P(X^{N}),\) we assume \({\bar{P}}\in \left[ P(X^{C}),P(X^{N})\right] \). Note that, this analysis includes the case of Stackelberg competition with a binding \({\bar{P}}\) as a special case.

First, we restrict our attention to the case where the degree of symmetry is sufficiently large.

Proposition 3

Suppose that \(\alpha \) is sufficiently large. If \({\bar{P}}\in \left[ P(X^{C}),P(X^{N})\right) ,\) then tightening the price cap increases Cournot equilibrium social welfare.

Since Cournot equilibrium social welfare is continuous in \(\alpha \), it is sufficient to consider the case in which \(\alpha =1\). We fix \({\bar{P}}\in \left[ P(X^{C}),P(X^{N})\right) \). Then, \(\left( x_{1}^{N}\left( {\bar{P}},1\right) \!,x_{2}^{N}\left( {\bar{P}},1\right) \right) =({\bar{X}}/2,{\bar{X}}/2)\) and social welfare is

Therefore,

as long as \({\bar{X}}<X^{C}\).

Note that Earle et al. (2007) assume that each firm has a constant marginal cost and focus only on the symmetric equilibria. That is, in our terminology, they show \(\partial W^{N}({\bar{P}},\alpha )/\partial {\bar{P}}\le 0\) for all \({\bar{P}}\ge P(X^{C})\). On the other hand, we show that if an equilibrium is sufficiently symmetric, that is, if \(\alpha \) is sufficiently large, then \(\partial W^{N}({\bar{P}},\alpha )/\partial {\bar{P}}\le 0\) for all \({\bar{P}}\ge P(X^{C})\). Therefore, the result of Earle et al. (2007) is robust as long as we focus on a symmetric equilibrium.

This result implies that if the degree of symmetry is sufficiently large, any decrease in \({\bar{P}}\) is socially desirable as long as \({\bar{P}}>P(X^{C})\), because a decrease in \({\bar{P}}\) increases the total production. However, if we focus on asymmetric equilibria, then some decrease in \({\bar{P}}\) may not be socially desirable.

Next, we examine the case in which the degree of symmetry is small. First, we show that a decrease in \({\bar{P}}\) may reduce social welfare only if \({\bar{P}}\in \left[ {\bar{P}}^{*},P(X^{N})\right) \).

Proposition 4

If \({\bar{P}}\in \left( P(X^{C}),{\bar{P}}^{*}\right] ,\) then tightening the price cap increases the Cournot equilibrium social welfare for any \(\alpha \in \left[ 0,1\right] \) and Stackelberg equilibrium social welfare.

Proposition 4 implies that if the price-cap level has already been sufficiently close to the competitive price, then making the price-cap level closer to the competitive level is socially desirable. In this case, a decrease in \({\bar{P}}\) reduces the difference between \(x_{1}^{N}\left( {\bar{P}},\alpha \right) \) and \(x_{2}^{N}\left( {\bar{P}},\alpha \right) \) for all \( \alpha \in \left[ 0,1\right] \). Since we consider a strictly convex cost function, a reduction in the difference decreases the industry cost. Thus, in this case, decreasing the price-cap level is socially desirable.

By Propositions 3 and 4, if \({\bar{P}}\in \left[ P(X^{C}),{\bar{P}}^{*}\right) \) or \(\alpha \) is sufficiently large, then any decrease of \({\bar{P}}\) increases social welfare. However, in the other case, we have the following result.

Proposition 5

If \({\bar{P}}\in \left( {\bar{P}}^{*},P(X^{N})\right] \), then tightening the price cap may decrease Cournot equilibrium social welfare for sufficiently small \(\alpha \) and Stackelberg equilibrium social welfare.

If \({\bar{P}}\in \left( {\bar{P}}^{*},P(X^{N})\right] \) and \(\alpha \) is sufficiently small, then a reduction of \({\bar{P}}\) increases the equilibrium output of a large firm and decreases that of a small firm. That is, in this case, a decrease in \({\bar{P}}\) expands the difference between \( x_{1}^{N}\left( {\bar{P}},\alpha \right) \) and \(x_{2}^{N}\left( {\bar{P}},\alpha \right) \). This implies that although a reduction of \({\bar{P}}\) increases the total output, it drastically increases the industry cost. In other words, the production substitution effect is significant in this case, because of a strictly convex cost function. On the production substitution effect, see, for example, Lahiri and Ono (1988), Dung (1993), Matsumura (1998) and Matsumura and Shimizu (2005).

The production substitution effect of this study is similar to that of Matsumura (1998) who considers the model of mixed duopoly where one firm is a partially privatized firm, the other is a private firm and both firms have a strictly convex cost function. Matsumura (1998) shows that if the degree of privatization decreases, then the total output increases but the output of the private firm decreases and therefore the social welfare may also decrease. In our model, if the degree of asymmetry is sufficiently large, then an increase of the price cap increases the total output but decreases the output of the firm with a smaller output. Hence, in that case, social welfare may be decreased by a reduction in the price-cap level.

We formally consider this fact by reexamining Example 1. In this example, the Stackelberg equilibrium without any price cap is \(\left( x_{1}^{S},x_{2}^{S}\right) =\left( 3/7,11/28\right) \) and \(P\left( X^{S}\right) =33/56\). Next, if \({\bar{P}}\in \left( {\bar{P}}^{*},P(X^{N}) \right] =\left( 6/11,3/5\right] ,\)

If \(\alpha =0\) and \({\bar{P}}\in \left( 6/11,24/43\right) \), then

This result implies that if the firms engage in Stackelberg competition, then a reduction of \({\bar{P}}\) may reduce social welfare. Moreover, if the firms engage in Cournot competition and the degree of symmetry is sufficiently small, then a reduction of \({\bar{P}}\) may also reduce social welfare.Footnote 9

Finally, we provide the policy implications of Propositions 1 to 5. First, by Propositions 2 and 4, if a policy-maker can accurately predict the competitive price, then the price-cap regulation is effective for increasing social welfare. However, as noted above, in the real world, it is sometimes difficult to predict the competitive price. In that case, the difference between the outputs of the firms should be focused on. That is, Proposition 3 implies that if the difference is small, then the price-cap regulation is effective for increasing social welfare. On the other hand, by Proposition 5, if the difference is large, then the price-cap regulation may not be effective. Another implication of Propositions 3 and 5 is that one firm should not have a large share. That is, the combination of tightening a price cap and prohibiting a firm from having a large share must be effective. Furthermore, by Proposition 1, just prohibiting a firm from having a large share also increases welfare.

6 Concluding remarks

This study discusses the effect of a price-cap regulation on market outcomes. First, we consider the Cournot model. If the price-cap level is between the competitive price and the Cournot equilibrium price without any price caps, then there is a unique symmetric equilibrium as well as multiple asymmetric equilibria, and the price cap is binding in any equilibria. Since we assume a convex cost function, the symmetric equilibrium is the most efficient one for any given price-cap levels. Thus, when we examine only the symmetric equilibrium, any decrease of the price-cap level is welfare improving as long as the level is less than the competitive price. However, when we focus on asymmetric equilibria, a decrease of the price-cap level may be socially harmful even if the level is more than the competitive price. Although Earle et al. (2007) also consider a Cournot model, they focus only on the symmetric equilibria and show that social welfare is nonincreasing in the price-cap level in the case where the demand is deterministic. On the other hand, we focus on the asymmetric equilibria and show that if the degree of symmetry is sufficiently low, then an increase in the price-cap level may decrease social welfare.

Moreover, we derive the Stackelberg equilibrium under a price-cap regulation. If the price-cap level is binding, then the Stackelberg equilibrium is equivalent to the most asymmetric Cournot equilibrium. Therefore, social welfare may also be decreased by a reduction of the price-cap level when the firms engage in Stackelberg competition.

Finally, in the previous version of this paper, we examine an endogenous timing duopoly model à la Hamilton and Slutsky (1990) where Cournot competition or Stackelberg competition is achieved depending on the choices of the firms in a preplay stage.Footnote 10 We show that Cournot competition is achieved in the combination of the weakly dominant strategies of the firms in the preplay stage. Amir and Grilo (1999) consider a similar model but without any regulation and show that Cournot competition is realized in the combination of the weakly dominant strategies. Thus, the result shows the robustness of the result of Amir and Grilo (1999).

Notes

There also exist several previous works that consider a Bertrand model with a price cap regulation. See, for example Bhaskar (1997) and Matsumura and Matsushima (2003). Furthermore, there are several works that examine a Cournot model with a quantity cap (quota) regulation. See, for example, Matsumura and Okumura (2014) and Okumura (2015, 2016).

Bergantino et al. (2011) also consider the Stackelberg model with a price cap. They consider a partially regulated duopoly model where a leader is regulated but a follower is not. On the other hand, in our model, both firms are regulated.

The model of Earle et al. (2007) is based on that of Roberts and Sonnenschein (1976); neither requires strict concavity of the profit function of a firm, which is assumed in the Cournot models of most previous works. Instead of relaxing the assumption, they restrict their attention to symmetric equilibria. On the other hand, we assume strict concavity of the profit function of a firm. Note that since Earle et al. (2007) assume a linear cost function, their model is not a generalization of ours.

This function is often called the cumulative best reply function and is useful for discussing Cournot equilibria in general models. See, for example, Vives (2001, Ch. 4) for more on this function.

Note that neither \(W^{N}({\bar{P}},\alpha )\) nor \(W^{S}({\bar{P}})\) is differentiable at \(P^{*}\). However, since they are differentiable at any other point, we use \(\partial W^{N}({\bar{P}},\alpha )/\partial {\bar{P}}\) and \( W^{S\prime }({\bar{P}})\), when we discuss the welfare effect of a small change in \({\bar{P}}\).

In this example, any reduction of \({\bar{P}}\) increases social welfare if \( \alpha \) is not very small; that is, if \(\alpha >1-\sqrt{15}/5\approx 0.225\). In a previous version of this paper, we provide an example such that a reduction of \({\bar{P}}\) may reduce social welfare even if \(\alpha =1/2\). The previous version is available upon request to the author.

The previous version of this paper is available upon request to the author.

References

Amir R, Grilo I (1999) Stackelberg versus Cournot equilibrium. Games Econ Behav 26:1–21

Armstrong M, Sappington D (2007) Recent developments in the theory of regulation. In: Armstrong M, Porter R (eds) Handbook of industrial organization, vol 3. Elsevier, Amsterdam

Bergantino AS, de Villemeur EB, Vinella A (2011) Partial regulation in vertically differentiated industries. J Pub Econ Theory 13(2):255–287

Bhaskar V (1997) The competitive effects of price-floors. J Ind Econ 45:329–340

Corchón LC, Marcos F (2012) Price regulation in oligopolistic markets. International Scholarly Research Network ISRN Economics Article ID 509165

Daughety AF (1990) Beneficial concentration. Am Econ Rev 80:1231–1237

Dung TH (1993) Optimal taxation and heterogeneous oligopoly. Can J Econ 26:933–947

Earle R, Schmedders K, Tatur T (2007) On price caps under uncertainty. Rev Econ Stud 74:93–111

Etro F (2008) Stackelberg competition with endogenous entry. Econ J 118:1670–1697

Grimm V, Zöttl G (2010) Price regulation under demand uncertainty. B.E. J Theor Econ 10(1) (Advances), Article 26

Hamilton J, Slutsky S (1990) Endogenous timing in Duopoly games: Stackelberg or Cournot equilibria. Games Econ Behav 2:29–46

Ino H, Matsumura T (2012) How many firms should be leaders? Beneficial concentration revisited. Int Econ Rev 53:1323–1340

Laffont JJ, Tirole J (1994) A theory of incentives in regulation and procurement. MIT Press, Cambridge

Lahiri S, Ono Y (1988) Helping minor firms reduces welfare. Econ J 98:1199–1202

Matsumura T (1998) Partial privatization in mixed Duopoly. J Pub Econ 70:473–483

Matsumura T, Okumura Y (2013) Privatization neutrality theorem revisited. Econ Lett 118(2):324–326

Matsumura T, Okumura Y (2014) Comparison between specific taxation and volume quotas in a free entry Cournot oligopoly. J Econ 113:125–132

Matsumura T, Okumura Y (2016) Privatization neutrality theorem in free entry markets. Mimeo

Matsumura T, Shimizu D (2005) Spatial Cournot competition and economic welfare: a note. Reg Sci Urban Econ 35:658–670

Matsumura T, Matsushima N (2003) Mixed duopoly with product differentiation: sequential choice of location. Aust Econ Pap 42(1):18–34

Okumura Y (2015) Volume and share quotas in cournot competition. Econ Model 47:137–144

Okumura Y (2016) Individual transferable quotas in Cournot competition. Econ Model 55:315–321

Organization for Economic Cooperation and Development (2013) OECD communications outlook 2013, OECD Publishing

Reynolds SS, Rietzke D (2016) Price caps, oligopoly, and entry. Econ Theor. doi:10.1007/s00199-016-0963-6

Roberts J, Sonnenschein H (1976) On the existence of Cournot equilibrium without concave profit functions. J Econ Theory 13(1):112–117

Roques F, Savva N (2009) Investment under uncertainty with price ceilings in oligopolies. J Econ Dyn Control 33(2):507–524

Sappington DEM (2002) Price regulation and incentives. In: Cave M, Majumdar S, Vogelsang I (eds) Handbook of telecommunications economics. Elsevier, Amsterdam

Vives X (2001) Oligopoly pricing. MIT Press, Cambridge

Acknowledgements

An earlier version of this paper is presented at the ISS Industrial Organization Workshop at the University of Tokyo. The author is grateful to the participants of the workshop, especially Toshihiro Matsumura, Dan Sasaki and Taiju Kitano for their comments and suggestions. This work was supported by JSPS KAKENHI Grant Number JP16K03612.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Proof of Theorem 1

We show the first sentence. First, suppose \( {\bar{P}}\ge P(X^{N})\). If \({\bar{P}}\) is not binding, then any pairs of outputs are not equilibrium unless \(x_{i}=x^{N}\) for \(i=1,2\). This is because \(\left( x^{N},x^{N}\right) \) is the pair of the unique Cournot equilibrium output without any regulation. Suppose that \(\left( x_{1},x_{2}\right) \ne \left( x^{N},x^{N}\right) \) and \({\bar{P}}\) is binding; that is, \(\left( x_{1},x_{2}\right) \) satisfies \({\bar{P}}\le P(x_{1}+x_{2})\). Then, \(x_{1}+x_{2}\le {\bar{X}}\) and \(x_{2}\le {\bar{X}} /2<x^{N}\). However, since \(\varnothing (x_{1}+x_{2})\ge \varnothing ({\bar{X}})\ge x^{N}\), firm 2 has the incentive to increase its output. Therefore, if \({\bar{P}}\le P(X^{N})\), then \(\left( x^{N},x^{N}\right) \) is the unique equilibrium.

Second, suppose \({\bar{P}}\in \left[ P(X^{C}),P(X^{N})\right] \). We have \( \varnothing ({\bar{X}})\le {\bar{X}}/2\le \varnothing ^{C}({\bar{X}})\), because \( X^{C}\) \(=2\varnothing ^{C}(X^{C})\), \(X^{N}=2\varnothing (X^{N})\), \( \varnothing ^{C\prime }\le 0\) and \(\varnothing ^{\prime }\le 0\). As is explained before, for given \({\bar{P}}\in \left( P(X^{C}),P(X^{N})\right] ,\) \( \left( x_{1},x_{2}\right) \) is an equilibrium if and only if \(x_{1}+x_{2}= {\bar{X}}\) and \(\varnothing ({\bar{X}})\le x_{i}\le \varnothing ^{C}({\bar{X}})\) for all \(i=1,2\). First, suppose \({\bar{X}}-\varnothing ({\bar{X}})<\varnothing ^{C}({\bar{X}})\). Then, \({\bar{X}}-\varnothing ^{C}({\bar{X}})<\varnothing ({\bar{X}} )\). If \(x_{1}>{\bar{X}}-\varnothing ({\bar{X}}),\) then \({\bar{X}} -x_{1}<\varnothing ({\bar{X}})\). Therefore, if \(x_{1}>{\bar{X}}-\varnothing ( {\bar{X}}),\) then \(\left( x_{1},x_{2}\right) \) satisfying \(x_{1}+x_{2}={\bar{X}}\) is not equilibrium, because firm 2 has an incentive to increase its output. On the other hand, if \(x_{1}\le {\bar{X}}-\varnothing ({\bar{X}}),\) then \({\bar{X}}-x_{1}\ge \varnothing ({\bar{X}})\). Thus, \(\left( x_{1},x_{2}\right) \) satisfying \(x_{1}+x_{2}={\bar{X}}\) is an equilibrium if and only if \({\bar{X}} /2\le x_{1}\le {\bar{X}}-\varnothing ({\bar{X}})\) or equivalently \(\varnothing ({\bar{X}})\le x_{2}\le {\bar{X}}/2\). Second, suppose \({\bar{X}}-\varnothing ( {\bar{X}})>\varnothing ^{C}({\bar{X}})\). Then, \({\bar{X}}-\varnothing ^{C}({\bar{X}} )>\varnothing ({\bar{X}})\). If \(x_{1}>\varnothing ^{C}({\bar{X}}),\) then \(\left( x_{1},x_{2}\right) \) is not equilibrium. On the other hand, if \(x_{1}\le \varnothing ^{C}({\bar{X}}),\) then \({\bar{X}}-x_{1}\ge {\bar{X}}-\varnothing ^{C}( {\bar{X}})>\varnothing ({\bar{X}})\). Thus, \(\left( x_{1},x_{2}\right) \) satisfying \(x_{1}+x_{2}={\bar{X}}\) is an equilibrium if and only if \({\bar{X}} /2\le x_{1}\le \varnothing ^{C}({\bar{X}})\) or equivalently \({\bar{X}} -\varnothing ^{C}({\bar{X}})\le x_{2}\le {\bar{X}}/2\). These fact imply that \( \left( x_{1},x_{2}\right) \) is an equilibrium if and only if \( x_{1}=x_{1}^{N}\left( {\bar{P}},\alpha \right) =\alpha {\bar{X}}/2+\left( 1-\alpha \right) {\overline{x}}\left( {\bar{P}}\right) \) and \( x_{2}=x_{2}^{N}\left( {\bar{P}},\alpha \right) =\alpha {\bar{X}}/2+\left( 1-\alpha \right) {\underline{x}}\left( {\bar{P}}\right) \) for all \(\alpha \in \left[ 0,1\right] \).

We show the second sentence. First, we show that \({\underline{x}}\left( {\bar{P}} \right) \) is a U-shaped function between \(P(X^{C})\) and \(P(X^{N})\). If \({\bar{P}}=P(X^{C})+\varepsilon \) where \(\varepsilon \) is a sufficiently small positive integer, then \(\varnothing ({\bar{X}})<{\bar{X}}-\varnothing ^{C}({\bar{X}})\) and thus \({\underline{x}}\left( {\bar{P}}\right) =\varnothing ({\bar{X}})\). This is because, if \({\bar{P}}=P(X^{C})\), then \(2\varnothing ^{C}({\bar{X}})= {\bar{X}}\) and \(\varnothing ({\bar{X}})<\varnothing ^{C}({\bar{X}})\). Next, if \( {\bar{P}}=P(X^{N})-\varepsilon \), then \({\bar{X}}-\varnothing ^{C}({\bar{X}} )<\varnothing ({\bar{X}})\) and thus \({\underline{x}}\left( {\bar{P}}\right) ={\bar{X}}-\varnothing ^{C}({\bar{X}})\). This is because, if \({\bar{P}}=P(X^{N})\), then \( 2\varnothing ({\bar{X}})={\bar{X}}\) and \(\varnothing ({\bar{X}})<\varnothing ^{C}( {\bar{X}})\). Moreover, \(\varnothing ({\bar{X}})\) is increasing and \({\bar{X}} -\varnothing ^{C}({\bar{X}})\) is decreasing in \({\bar{X}}\). Therefore, \( {\underline{x}}\left( {\bar{P}}\right) \) is a U-shaped function between \( P(X^{C}) \) and \(P(X^{N})\). Finally, we show \({\underline{x}}\left( {\bar{P}} \right) >0\). To show \(\varnothing ({\bar{X}})>0\) for all \({\bar{X}}\in \left[ X^{N},X^{C}\right] \) is sufficient for the proof. If \(\varnothing ({\bar{X}} )=0,\) then \(P({\bar{X}})-C^{\prime }(0)\le 0\). This contradicts \( P(X^{C})-C^{\prime }(x^{C})=0\) and \(x^{C}>0\).

We show the third sentence. The minimizer of \({\underline{x}}\left( {\bar{P}} \right) \) between \(P(X^{C})\) and \(P(X^{N})\) is \({\bar{P}}\) that satisfies

We similarly show that \({\underline{x}}\left( {\bar{P}}\right) \) is an inverted U-shaped function between \(P(X^{C})\) and \(P(X^{N})\). The maximizer of \( {\overline{x}}\left( {\bar{P}}\right) \) between \(P(X^{C})\) and \(P(X^{N})\) is \( {\bar{P}}\) satisfying (5). Therefore, \({\bar{P}}^{*}\) is also the maximizer of \({\underline{x}}\left( {\bar{P}}\right) \). \(\square \)

Proof of Theorem 2

The first sentence is obvious. We show the second sentence. Suppose \({\bar{P}}\in \left[ P\left( X^{C}\right) ,P\left( X^{S}\right) \right] \Leftrightarrow {\bar{X}}\in \left[ X^{S},X^{C}\right] \). Since \({\bar{X}}\ge X^{S},\) \({\bar{X}}\ge x_{1}^{S}+r\left( x_{1}^{S}\right) \). Moreover, \(r^{C}\left( x_{1}^{S}\right) >r\left( x_{1}^{S}\right) .\) Therefore, if \(x_{1}=x_{1}^{S},\) then \(x_{1}^{S}+r_{2}\left( x_{1}^{S},{\bar{P}}\right) \le {\bar{X}}\) and thus the price cap is binding.

First, we focus on \(x_{1}\) satisfying

Then, for any \(x_{1}\) that satisfies (6), \(r\left( x_{1},{\bar{P}} \right) =r\left( x_{1}\right) \). Since \(r^{\prime }\in \left( -1,0\right] ,\) \(x_{1}+r\left( x_{1}\right) \) is increasing in \(x_{1}\). Since \( x_{1}^{S}+r\left( x_{1}^{S}\right) \le {\bar{X}},\) \(x_{1}\ge x_{1}^{S}\) for all \(x_{1}\) that satisfies (6). By the second order condition of 1, the profit of 1 at \(\hat{x}_{1}\) satisfying \({\hat{x}}_{1}+r\left( {\hat{x}} _{1}\right) ={\bar{X}}\) is higher than that at any \(x_{1}\) satisfying (6).

Second, we focus on \(x_{1}\) that satisfies

Then, for any \(x_{1}\) that satisfies (7), \(r\left( x_{1},{\bar{P}} \right) =r^{C}\left( x_{1}\right) \). In this case, the price cap must be binding. If \({\bar{X}}-x_{1}=r^{C}\left( x_{1}\right) ,\) then \(x_{1}={\bar{X}} -\varnothing ^{C}({\bar{X}})\). Since \(r^{C\prime }\in \left( -1,0\right] ,\) \( x_{1}+r^{C}\left( x_{1}\right) \) is increasing in \(x_{1}.\) Thus, (7) implies \(x_{1}\ge {\bar{X}}-\varnothing ^{C}({\bar{X}})\). Since \(\varnothing ^{C}({\bar{X}})\ge {\bar{X}}-\varnothing ^{C}({\bar{X}})\) and the second order condition is satisfied, the profit of 1 at \(x_{1}={\bar{X}}-\varnothing ^{C}( {\bar{X}})\) is higher than that at any \(x_{1}>{\bar{X}}-\varnothing ^{C}({\bar{X}} ) \).

Third, we focus on \(x_{1}\) that satisfies

Then, for any \(x_{1}\) that satisfies (8), \(r\left( x_{1},{\bar{P}} \right) ={\bar{X}}-x_{1}\). Since (8) includes the case where \({\bar{X}} -x_{1}=r\left( x_{1}\right) \) and \({\bar{X}}-x_{1}=r^{C}\left( x_{1}\right) ,\) the profit maximizer of the leader satisfies (8). Since \( x_{1}+r^{C}\left( x_{1}\right) \) is increasing in \(x_{1}\), (8) is equivalent to \(x_{1}\in \left[ {\bar{X}}-\varnothing ^{C}({\bar{X}}),{\bar{X}} -\varnothing ({\bar{X}})\right] \) and the price cap must be binding. Therefore, the profit of firm 1 is maximized at \(\min \left\{ {\bar{X}} -\varnothing ({\bar{X}}),\varnothing ^{C}({\bar{X}})\right\} =x_{1}^{N}\left( {\bar{P}},0\right) \) because \(\varnothing ^{C}({\bar{X}})>{\bar{X}}-\varnothing ^{C}({\bar{X}})\). Moreover,

In sum, if \({\bar{P}}\in \left[ P\left( X^{C}\right) ,P\left( X^{S}\right) \right] \), then \(\left( x_{1}^{S}\left( {\bar{P}}\right) ,x_{2}^{S}\left( {\bar{P}}\right) \right) =\left( x_{1}^{N}\left( {\bar{P}},0\right) ,x_{2}^{N}\left( {\bar{P}},0\right) \right) \).

Finally, we show \({\bar{P}}^{*}<P(X^{S})\). Since \(x_{2}^{S}=\) \(r\left( x_{1}^{S}\right) ,\) \(x_{2}^{S}=\varnothing (X^{S})\) and \(x_{1}^{S}=X^{S}- \varnothing (X^{S})\). Therefore, \({\bar{P}}^{*}<P(X^{S})\). \(\square \)

Proof of Proposition 4

Fix \(\alpha \in \left[ 0,1\right] \) and \( {\bar{P}}\in \left[ P(X^{C}),{\bar{P}}^{*}\right) \). Then,

and social welfare is

Since

we will show that \(dW^{N}({\bar{P}},\alpha )/d{\bar{X}}>0\) for all \(\alpha \in \left[ 0,1\right] \). Moreover,

We have

Moreover, since \(\varnothing ^{C\prime }({\bar{X}})<0\), \(\alpha /2+\left( 1-\alpha \right) \varnothing ^{C\prime }({\bar{X}})<1-\alpha /2-\left( 1-\alpha \right) \varnothing ^{C\prime }({\bar{X}}),\) \(dW^{N}({\bar{P}},\alpha )/d{\bar{X}}>0\) for all \(\alpha \in \left[ 0,1\right] \). \(\square \)

Rights and permissions

About this article

Cite this article

Okumura, Y. Asymmetric equilibria under price cap regulation. J Econ 121, 133–151 (2017). https://doi.org/10.1007/s00712-017-0521-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00712-017-0521-0