Abstract

The energy market operates in a highly deregulated and competitive environment, where electricity price plays a crucial role. Forecasting electricity prices presents a significant challenge due to the influence of complex factors such as weather patterns, fuel costs, and the advancement of renewable energy technologies. This study focuses on monthly electricity prices in four neighboring European countries: Bulgaria, Greece, Hungary, and Romania, which share similar weather conditions and economic characteristics. The research investigates the efficacy of four forecasting methods: Grey Verhulst Model (GVM), Nonlinear Regression, Feedforward Neural Network, and Support Vector Regression (SVR). These methods are applied to both short-term (1 month-ahead) and long-term (up to 7 months) electricity price forecasting in the aforementioned countries. The findings reveal that GVM proves suitable for short-term predictions. However, when it comes to long-term forecasting, SVR accurately captures the trends and turning points in electricity prices, albeit with unsatisfactory error rates. To address this issue, a modified version of SVR, referred to as Modified SVR (MSVR), is proposed to mitigate the errors. The results demonstrate that MSVR is an effective approach for long-term electricity price prediction.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

Electricity is the predominant form of energy used worldwide. With the advent of digitalization and the industrial revolution, electricity consumption has experienced a significant increase globally. In recent years, the European Union has witnessed a surge in the use of electric vehicles, further emphasizing the importance of electricity as an energy source. Given the widespread use of electricity and the high demand in Europe, accurately forecasting electricity prices has become a crucial from both economic and social consideration [1]. A comprehensive analysis of electricity prices, coupled with reliable predictions, can assist governments and businesses in formulating optimal policies and maximizing profits. As a result, this subject has garnered considerable attention among researchers. For instance, Klopicic et al. [2] conducted a comprehensive investigation into the evolution of the retail electricity market within the European Union. Their analysis incorporated statistical measures such as the arithmetic mean, standard deviation, and average exchange rates. Nonetheless, these statistical metrics primarily serve as indicators of the dynamics between electricity consumers and suppliers. Notably, the crucial market determinant, electricity price, was not factored into their study. In another study, Vailtali [3] examined electricity transmission dynamics in the southeastern European region. This research emphasized the considerable variation in electricity transmission costs across the states within the region. Such divergence underscores the inherent volatility in electricity prices and the market’s inherent instability. Tschora et al. [4] explored the effectiveness of various forecasting techniques, including random forest (RF), convolutional neural network (CNN), support vector regression (SVR), and deep neural network (DNN), for predicting next-day electricity prices. Their findings indicated that DNN and SVR were suitable methods, whereas RF and CNN exhibited limitations in forecasting day-ahead electricity prices. Chen et al. [5] introduced a hybrid least square-SVM method for forecasting the electricity price on the last day of each month, considering all preceding days of that month as input for their model. Their findings revealed that the electricity price data is affected by noise, and mitigating this noise can lead to enhanced accuracy in prediction outcomes. Ugurlu et al. [6] proposed a three-layer gated recurrent unit for predicting next-day electricity prices, utilizing the electricity prices at each hour of the present day as inputs. They demonstrated that models based on RNNs exhibit greater accuracy in predicting short-term electricity prices due to their ability to retain information from prior data. However, it’s noteworthy that their investigation did not extend to predicting long-term electricity prices. Xie et al. [7] introduced the XGB-SHAP method to forecast electricity prices for the following day. Their study focused on the PJM electricity market within the United States and demonstrated an impressive 94% accuracy rate (MAPE = 6%). Parhizkari et al. [8] compared extreme machine learning (ELM) and multi-layer perceptron (MLP) for mid-term electricity price prediction, revealing that ELM outperformed MLP. Pourhaji et al. [9] investigated long short-term memory (LSTM) with monthly and seasonal clustering to predict short-term electricity prices. Their results indicated that monthly clustering yielded superior performance compared to both seasonal clustering and non-clustering methods. Additionally, Lago et al. [10] conducted a review of existing methods for forecasting day-ahead electricity prices. Their study confirmed that nearly all deep neural network models outperformed the Lasso estimated autoregressive model, although it’s worth noting that the Lasso model exhibited higher computational efficiency.

Predicting long-term electricity prices is a challenging task due to the complex nature of their behavior [11], which is influenced by factors such as economic growth [12], weather conditions [13], and social events [1]. The electricity market is highly volatile, characterized by sharp price spikes. However, there has been limited research on forecasting monthly electricity prices. Ribeiro et al. [14] introduced an ensemble learning model for predicting industrial and commercial electricity prices in Brazil for the next 3 months. Xie et al. [15] utilized tensor fusion and LSTM to forecast the month-ahead electricity prices for residential, commercial, and industrial sectors. Jahangir et al. [16] proposed a hybrid LSTM model combined with dimension reduction techniques for monthly electricity price prediction. Sultana et al. [17] incorporated the past 5 months’ weather data as input and introduced an enhanced support vector regression method for month-ahead electricity price prediction. Windler et al. [18] employed a deep feed-forward neural network for month-ahead electricity price prediction, focusing on long-term prices.

Given the intricacies of the electricity market influenced by non-storage attributes of electricity, coupled with the impact of various stochastic factors like temperature, renewable energy production variations, and socio-economic influences on electricity consumption [12, 13], analyzing and predicting electricity prices become a challenging task. Researchers have adopted diverse stochastic factors to improve the accuracy of electricity price forecasting. For instance, Wagner et al. used expected photovoltaic and wind energy production as inputs for predicting electricity prices [25]. In a similar vein, Jahangir et al. utilized load demands and different power sources for electricity price forecasting [16]. Ugurlu et al. [6] predicted electricity prices by considering various lagged prices and forecasting demand/supply scenarios. Ribeiro’s approach [14] involved using energy generation, lagged energy prices, and demand to predict electricity prices. Notably, these parameters are mostly stochastic and exhibit high irregularity, resulting in unstable forecasting outcomes. To address this challenge, this paper opts to focus solely on historical monthly electricity prices as a means to overcome the instability associated with the highly irregular and stochastic nature of the considered parameters.

The electricity market is highly competitive, and accurate price forecasting can result in significant cost savings for industries [9]. SVR, feedforward neural network (FNN), nonlinear regression (NLR), and grey models, along with their improved versions, are widely used in the electricity price analysis. SVR, FNN, and NLR methods are suitable for long-term predictions, requiring a sufficient amount of input data. On the other hand, grey models work well with smaller datasets (minimum 4 elements) and are more appropriate for short-term forecasting [19]. To the best of our knowledge, nearly all grey models demonstrate limited ability to predict more than 5 subsequent time series elements with an acceptable error [20, 21]. Notably, grey models have been found to achieve optimal results in predicting the next elements [22, 23]. Therefore, we have defined the prediction of the month-ahead electricity selling price as short-term prediction and the prediction of the 7 upcoming months as long-term prediction. This approach aligns with similar studies, such as Ribeiro et al., who categorized month-ahead electricity price prediction as short-term forecasting [9], and Azad et al., who considered the prediction of wind speed for the next 6 months as long-term forecasting [24]. We focus on monthly electricity prices in Bulgaria, Greece, Hungary, and Romania, aiming to investigate the efficiency of the aforementioned methods in analyzing electricity prices in these regions. The study demonstrated that NLR, FNN, and SVM are not efficient in accurately predicting the electricity selling price for the upcoming months. Therefore, this paper has three main objectives. First, it proposes an improved support vector regression approach to forecast electricity prices for the next 7 months (see Sect. 3). Second, it utilizes SVR to identify trends in monthly electricity prices for the next 7 months, which is particularly important for investment companies. The second objective is deemed more crucial than the first. Third, we explore the effectiveness of the grey Verhulst method for short-term electricity price prediction. The remaining sections of the paper are organized as follows: Sect. 2 discusses the FNN, SVR, and GVM methods. Section 3 presents the numerical results and the improved SVR approach. Finally, Sect. 4 provides a conclusion and suggests future research directions.

2 Materials and methods

2.1 Database

The database obtained from European association for the cooperation of transmission system operators for electricity(ENTSO-e) website [26], specifically focusing on wholesale average monthly electricity prices within the spot market. Notably, any applicable fees, charges, or taxes at the national level have been excluded from this data. During the data preprocessing stage, missing values are estimated by using interpolation methods based on neighboring values. To obtain daily prices, the average of hourly prices within a day is calculated, while the average of daily prices within a month is considered as the monthly price.

2.2 Nonlinear regression method

The objective of the nonlinear regression method is to determine the unknown coefficients (c = [c1, c2, c3]) of the predefined function f(x, c) that minimize the difference between the estimated output f(xi) and the actual output yi

where n is the number of input point and εi i = 1,…, n are the error of the regression [27, 28].

In this study, the experimental results show that the function f in the following form is suitable for predicting the future electricity prices. We will use the decomposition method to obtain the values of the unknown coefficients c1, c2 and c3.

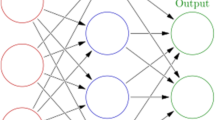

2.3 Feedforward neural network

FNN is a widely employed neural network model for time series forecasting [27]. In this research, a two-layer FNN architecture is considered, with each layer consisting of 20 neurons. The MATLAB software is utilized for the calculations, where its predefined parameters left unchanged. Consequently, the ReLU function is chosen as the activation function, and the limited-memory Broyden-Fletcher-Goldfarb-Shannon quasi-Newton algorithm is employed as the optimization algorithm to determine the unknown weights.

2.4 Grey Verhulst method

Grey system theory refers to a specific category of time series forecasting methods that are suitable for dealing with incomplete or small datasets [21]. The initial step of grey models involves transforming the input time series into another increasing time series known as the augmentation-generated time series [22, 23]. The most commonly used augmented series is the first-order augmented sequence (1-AGO), denoted as X1 = (\({{\varvec{x}}}_{1}^{1},\dots ,{{\varvec{x}}}_{{\varvec{n}}}^{1}\)), which is defined as follows:

where X0 = {\({{\varvec{x}}}_{1}^{0},\dots ,{{\varvec{x}}}_{{\varvec{n}}}^{0}\)} represents the original time series.

In the subsequent step, a differential equation with unknown parameters is employed to capture the dynamics of the augmented time series. The algorithm aims to determine the unknown parameters in a way that minimizes the modeling error. The grey Verhulst model employs the following nonlinear equation to approximate the 1-AGO sequence [20]:

In our study, we utilize the least square method to estimate the unknown coefficients in the grey Verhulst model.

2.5 Support vector regression

SVR is an efficient tool for regressing nonlinear data. SVR considers a subset of input data for determining the unknown coefficients w and b of the function.

where \(\Phi\) is mapping, \(w\in {R}^{n}\) and b are called weighted and intercept coefficients [28]. This paper used the following optimization problem and the sequential minimal optimization method for determining unknown coefficients

where the constant C and ε are related to maximum acceptable error and the variables \({}_{i}\) and \({}_{i}^{*}\) represent the extent of exceeding the acceptable error ε [29, 30].

2.6 Modified support vector regression

MSVR is a variation of SVR specifically designed for long-term prediction. The method consists of two main steps. In the first step, the given time series, which spans the period [0, T], is divided into two distinct subsets: Subset 1 and Subset 2. Subset 1 is defined on the interval [0, T1], while Subset 2 is defined on the interval [T1 + 1, T]. In this step, SVR is applied to Subset 1 to determine the unknown parameters of the model. In the second step, the model obtained from Step 1 is utilized to predict the values of the time series in the interval [T1 + 1, T]. In this step, the error of the model is calculated and utilized to modify the output of the model. Algorithm 1 provides a detailed description of this process.

MSVR, a variant of SVR, is specifically tailored for long-term predictions. The method involves a three-step process:

-

Data segmentation The initial time series, spanning from 0 to T, is segmented into two distinct subsets: Subset 1 and Subset 2. Subset 1 covers the interval [0, T1], while Subset 2 spans [T1 + 1, T]. Subset 1 is utilized to train the SVR model, and Subset 2 is reserved for testing. Adjustment parameters are determined based on the accuracy of the SVR model when tested on Subset 2 (Step 3).

-

SVR model training The regression SVR model is established using Subset 1.

-

Prediction and model refinement Employing the model obtained in Step 2, the values of the time series in the range [T1, T] are predicted. The prediction error is utilized to refine and modify the derived regression model.

The detailed step-by-step process is provided in Algorithm 1. This methodology enables MSVR to iteratively improve predictions by iteratively adjusting based on the test set’s errors, thereby enhancing the accuracy of long-term forecasting.

3 Results

In this section, we assess the effectiveness of the MSVR method and compare it with SVR, NLR, and FNN for electricity price forecasting. Our experimental findings demonstrate that for predicting the electricity price for the next 7 months (F = 7), modifying SVR by considering only 3 elements (k = 3) yields satisfactory results. Additionally, we demonstrate that GVM produces reliable predictions for the electricity price 1 month-ahead, where the reciprocal of the input is taken into account.

To compare the results, we employ the mean average percentage error (MAPE) as our evaluation metric. MAPE is commonly used in practical applications due to its scale independence [22]. The efficiency of a forecasting method is classified into four categories based on the MAPE value, as shown in Table 1.

To facilitate a comprehensive comparison, aside from MAPE, this study also incorporates Mean Absolute Error (MAE)[6] and Root Mean Square Error (RMSE) as evaluation metrics for long-term prediction [31].This section can be divided into subheadings to provide a structured and clear presentation of the experimental results. The subheadings are experimental results, their interpretation, and experimental conclusions.

3.1 Bulgaria

3.1.1 Month-ahead prediction

The monthly electricity prices spanning from July 2021 to October 2021 are taken as the input for GVM to predict the electricity price for November 2021. The obtained results, shown in Table 2 where R-MAPE and F-MAPE are the MAPE of simulated and MAPE of predicted data respectively. The results demonstrate that the GVM method exhibits a high level of accuracy in its predictions.

3.1.2 Long-term prediction

The monthly electricity prices from October 2016 to August 2022 are used as input data for SVR, NLR and FNN to predict the electricity prices from February 2022 to September 2022. The actual and predicted results for the NLR and FNN methods are depicted in Figs. 1 and 2, respectively.

To apply Algorithm 1, the SVR method is first utilized to calculate the monthly electricity prices for the period November 2021 to September 2022. Subsequently, the monthly electricity prices are predicted for the period February 2022 to September 2022 using both SVR and MSVR. The actual and predicted values by SVR and MSVR are plotted in Figs. 3 and 4, respectively.

Figure 3 illustrates that SVR accurately predicts the trends and peaks of the monthly electricity prices in Bulgaria, while Fig. 4 displays the modified values obtained through MSVR. A comparison of the accuracy of long-term prediction methods is presented in Table 3, which indicates that MSVR achieves a high level of accuracy in long-term predictions.

3.2 Greece

3.2.1 Month-ahead prediction

The monthly electricity prices spanning from September 2021 to December 2021 are taken as the input for GVM to predict the electricity price for January 2022. The obtained results, shown in Table 4, demonstrate that the GVM method exhibits a high level of accuracy in its predictions.

3.2.2 Long-term prediction

The monthly electricity prices from October 2016 to March 2022 are used as input data for NLR and FNN to predict the electricity prices from April 2022 to November 2022. The actual and predicted results for the NLR and FNN methods are depicted in Figs. 5 and 6, respectively.

To apply Algorithm 1, the SVR method is first utilized to calculate the monthly electricity prices for the period January 2022 to November 2022. Subsequently, the monthly electricity prices are predicted for the period April 2022 to November 2022 using both SVR and MSVR. The actual and predicted values by SVR and MSVR are plotted in Figs. 7 and 8, respectively.

Figure 7 illustrates that SVR accurately predicts the trends and peaks of the monthly electricity prices in Greece, while Fig. 8 displays the modified values obtained through MSVR. A comparison of the accuracy of long-term prediction methods is presented in Table 5, which indicates that MSVR achieves a high level of accuracy in long-term predictions.

3.3 Hungary

3.3.1 Month-ahead prediction

The monthly electricity prices spanning from March 2021 to June 2021 are taken as the input for GVM to predict the electricity price for July 2021. The obtained results, shown in Table 6, demonstrate that the GVM method exhibits a high level of accuracy in its predictions.

3.3.2 Long-term prediction

The monthly electricity prices from January 2015 to September 2021 are used as input data for NLR and FNN to predict the electricity prices from October 2021 to May 2022. The actual and predicted results for the NLR and FNN methods are depicted in Figs. 9 and 10, respectively.

To apply Algorithm 1, the SVR method is first utilized to calculate the monthly electricity prices for the period July 2021 to May 2022. Subsequently, the monthly electricity prices are predicted for the period Oct. 2021 to May 2022 using both SVR and MSVR. The actual and predicted values by SVR and MSVR are plotted in Figs. 11 and 12, respectively. Figure 11 illustrates that SVR accurately predicts the trends and peaks of the monthly electricity prices in Hungary, while Fig. 12 displays the modified values obtained through MSVR. A comparison of the accuracy of long-term prediction methods is presented in Table 7, which indicates that MSVR achieves reasonable accuracy in long-term predictions.

3.4 Romania

3.4.1 Month-ahead prediction

The monthly electricity prices spanning from March 2021 to June 2021 are taken as the input for GVM to predict the electricity price for July 2021. The obtained results, shown in Table 8, demonstrate that the GVM method exhibits reasonable accuracy in its predictions.

3.4.2 Long-term prediction

The monthly electricity prices from Jan 2015 to September 2021 are used as input data for NLR and FNN to predict the electricity prices from October 2021 to May 2022. The actual and predicted results for the NLR and FNN methods are depicted in Figs. 13 and 14, respectively.

To apply Algorithm 1, the SVR method is first utilized to calculate the monthly electricity prices for the period July 2021 to May 2022. Subsequently, the monthly electricity prices are predicted for the period October 2021 to May 2022 using both SVR and MSVR. The actual and predicted values by SVR and MSVR are plotted in Figs. 15 and 16, respectively.

Figure 15 illustrates that SVR accurately predicts the trends and peaks of the monthly electricity prices in Romania, while Fig. 16 displays the modified values obtained through MSVR. A comparison of the accuracy of long-term prediction methods is presented in Table 9, which indicates that MSVR achieves a high level of accuracy in long-term predictions.

4 Conclusion

With the rapid development of technology and digitalization, the electricity market has garnered significant attention from economists, governments, and investors. Accurate prediction of electricity prices can potentially save governments millions of dollars. However, achieving precise predictions poses a considerable challenge due to the intricate interplay of factors affecting electricity production and demand. These factors encompass weather patterns, governmental policies, renewable energy technologies, and fuel costs, all of which are inherently uncertain [32]. Notably, probabilistic models [32] considering these uncertainties may lack robustness and can be significantly influenced by volatile inputs. While there have been numerous studies on short-term electricity price prediction, the research on long-term prediction is relatively limited. This paper focuses on GVM for month-ahead selling price prediction and investigates the efficiency of three long-term prediction methods: NLR, FNN, and SVR.

The methods are applied to monthly electricity prices of four European countries—Bulgaria, Greece, Hungary, and Romania—chosen due to their shared borders and similar weather and economic conditions. The results demonstrate that GVM is an efficient tool for month-ahead electricity price prediction. However, NLR and FNN heavily rely on input parameters, making parameter selection a crucial task. In contrast, SVR and GVM exhibit robustness to their input parameters.

While SVR effectively predicts trends and peaks in monthly electricity prices, its accuracy is not satisfactory. To address this limitation, we propose a modification approach where the first three predicted elements from SVR are adjusted. The results indicate that the MSVR method is efficient for long-term monthly electricity price prediction. However, the values of MAPE are bigger than 5% and its improvement should be considered for future works. In addition, considering the factors such as the amount of renewable energy production, delivering cost, weather and environmental conditions and coal, gas and CO2 prices should be considered for improving the accuracy of the considered short-term forecasting grey model. Future research directions include investigating the efficiency of hybrid GVM-SVR models, exploring more complex and multi variable grey models [33, 34] especially for short-term prediction, and comparing them with recent hybrid neural network forecasting methods across different regions.

Data availability

The data used in this study can be shared with the parties, provided that the article is cited.

References

Dindar B, Gül Ö (2023) Supply continuity in Turkish electricity distribution grid: electricity interruption cost forecasting with time series analysis and machine learning. Electr Eng 105:43–59. https://doi.org/10.1007/s00202-022-01639-9

Klopčič AL, Hojnik J, Bojnec Š (2022) What is the state of development of retail electricity markets in the EU? Electr J 35:107092. https://doi.org/10.1016/j.tej.2022.107092

Vailati R (2009) Electricity transmission in the energy community of south East Europe. Util Policy 17:34–42. https://doi.org/10.1016/j.jup.2008.03.005

Tschora L, Pierre E, Plantevit M, Robardet C (2022) Electricity price forecasting on the day-ahead market using machine learning. Appl Energy 313:118752. https://doi.org/10.1016/j.apenergy.2022.118752

Chen Y, Li M, Yang Y, Li C, Li Y, Li L (2018) A hybrid model for electricity price forecasting based on least square support vector machines with combined kernel. J Renew Sustain Energy 10:055502. https://doi.org/10.1063/1.5045172

Ugurlu U, Oksuz I, Tas O (2018) Electricity price forecasting using recurrent neural networks. Energies 11:1255. https://doi.org/10.3390/en11051255

Xie H, Chen S, Lai C, Ma G, Huang W (2022) Forecasting the clearing price in the day-ahead spot market using extreme gradient boosting. Electr Eng 104:1607–1621. https://doi.org/10.1007/s00202-021-01410-6

Parhizkari L, Najafi A, Golshan M (2020) Medium term electricity price forecasting using extreme learning machine. J Energy Manag Technol 4:20–27

Pourhaji N, Asadpour M, Ahmadian A, Elkamel A (2022) The investigation of monthly/seasonal data clustering impact on short-term electricity price forecasting accuracy: Ontario province case study. Sustainability 14:3063. https://doi.org/10.3390/su14053063

Lago J, Marcjasz G, De Schutter B, Weron R (2021) Forecasting day-ahead electricity prices: a review of state-of-the-art algorithms, best practices and an open-access benchmark. Appl Energy 293:116983. https://doi.org/10.1016/j.apenergy.2021.116983

Salkuti SR (2018) Short-term electrical load forecasting using radial basis function neural networks considering weather factors. Electr Eng 100:1985–1995. https://doi.org/10.1007/s00202-018-0678-8

Bakeer A, Elmorshedy MF, Salama HS, Elkadeem MR, Almakhles DJ, Kotb KM (2023) Optimal design and performance analysis of coastal microgrid using different optimization algorithms. Electr Eng. https://doi.org/10.1007/s00202-023-01954-9

Yildiriz G, Öztürk A (2022) Electrical energy consumption forecasting using regression method considering temperature effect for distribution network. Electr Eng 104:3465–3476. https://doi.org/10.1007/s00202-022-01559-8

Ribeiro M, Stefenon S, De Lima J, Nied A, Mariani V, Coelho L (2020) Electricity price forecasting based on self-adaptive decomposition and heterogeneous ensemble learning. Energies 13:5190. https://doi.org/10.3390/en13195190

Xie X, Li M, Zhang D (2021) A multiscale electricity price forecasting model based on tensor fusion and deep learning. Energies 14:7333. https://doi.org/10.3390/en14217333

Jahangir H, Tayarani H, Baghali S, Ahmadian A, Elkamel A, Golkar MA, Castilla M (2020) A novel electricity price forecasting approach based on dimension reduction strategy and rough artificial neural networks. IEEE Trans Ind Inf 16:2369–2381. https://doi.org/10.1109/TII.2019.2933009

Sultana, T.; Khan, Z.A.; Javaid, N.; Aimal, S.; Fatima, A.; Shabbir, S. (2019) Data analytics for load and price forecasting via enhanced support vector regression. In advances in internet, data and web technologies; Barolli, L., Xhafa, F., Khan, Z.A., Odhabi, H., Eds.; Lecture notes on data engineering and communications technologies; Springer international publishing: Cham. Vol. 29, pp. 259–270 ISBN 978–3–030–12838–8.

Windler T, Busse J, Rieck J (2019) One month-ahead electricity price forecasting in the context of production planning. J Clean Prod 238:117910. https://doi.org/10.1016/j.jclepro.2019.117910

Bilgil H (2021) New grey forecasting model with its application and computer code. AIMS Math 6:1497–1514. https://doi.org/10.3934/math.2021091

Heidari H, Zeng B (2023) An optimized grey transition verhulst method. Eng Appl Artif Intell 120:105870. https://doi.org/10.1016/j.engappai.2023.105870

Yang S, Li S, Zeng B, Liu S, Heidari H (2022) Commonality refinement and code reuse of grey prediction model based on MATLAB. J Grey Syst 34(139):153

Jalali FM, Heidari H (2020) Predicting changes in bitcoin price using grey system theory. Financ Innov 6:13. https://doi.org/10.1186/s40854-020-0174-9

Afandizadeh Zargari S, Amoei Khorshidi N, Mirzahossein H, Heidari H (2022) Analyzing the effects of congestion on planning time index-grey models vs. random forest regression. Int J Transp Sci Technol. https://doi.org/10.1016/j.ijtst.2022.05.008

Azad HB, Mekhilef S, Ganapathy VG (2014) Long-term wind speed forecasting and general pattern recognition using neural networks. IEEE Trans Sustain Energy 5:546–553. https://doi.org/10.1109/TSTE.2014.2300150

Wagner A, Ramentol E, Schirra F, Michaeli H (2022) Short- and long-term forecasting of electricity prices using embedding of calendar information in neural networks. J Commod Mark 28:100246. https://doi.org/10.1016/j.jcomm.2022.100246

ENTSO-E Is the european association for the cooperation of transmission system operators (TSOs) for Electricity. Learn about ENTSO-E Available online: https://www.entsoe.eu/, https://ember-climate.org/data-catalogue/european-wholesale-electricity-price-data/.

Ozanich E, Gerstoft P, Niu H (2020) A feedforward neural network for direction-of-arrival estimation. J Acoust Soc Am 147:2035–2048. https://doi.org/10.1121/10.0000944

Hong W-C (2011) Electric load forecasting by seasonal recurrent SVR (support vector regression) with chaotic artificial bee colony algorithm. Energy 36:5568–5578. https://doi.org/10.1016/j.energy.2011.07.015

Zhong H, Wang J, Jia H, Mu Y, Lv S (2019) Vector field-based support vector regression for building energy consumption prediction. Appl Energy 242:403–414. https://doi.org/10.1016/j.apenergy.2019.03.078

Smola AJ, Schölkopf B (2004) A tutorial on support vector regression. Stat Comput 14:199–222. https://doi.org/10.1023/B:STCO.0000035301.49549.88

Yuan J, Farnham C, Azuma C, Emura K (2018) Predictive artificial neural network models to forecast the seasonal hourly electricity consumption for a university campus. Sustain Cities Soc 42:82–92. https://doi.org/10.1016/j.scs.2018.06.019

Ziel F, Steinert R (2018) Probabilistic mid- and long-term electricity price forecasting. Renew Sustain Energy Rev 94:251–266. https://doi.org/10.1016/j.rser.2018.05.038

Jalali MFM, Heidari H, Boriskov P (2023) Forecasting CO2 emissions using grey system theory. AIP Conf Proc 2812:020037. https://doi.org/10.1063/5.0161272

Han X, Chang J (2021) A hybrid prediction model based on improved multivariable grey model for long-term electricity consumption. Electr Eng 103:1031–1043. https://doi.org/10.1007/s00202-020-01124-1

Funding

This research received no external funding.

Author information

Authors and Affiliations

Contributions

Conceptualization, MA, AJ, AG and HH; methodology, HH; software, MA and HH; validation, MA, AJ and AG; formal analysis, H.H.; data curation, H.H.; writing—original draft preparation, M.A.; writing—review and editing, MA, AJ, AG and HH; visualization, HH; supervision, AJ and AG; project administration, AJ; funding acquisition, MA All authors have read and agreed to the published version of the manuscript.

Corresponding authors

Ethics declarations

Conflict of interest

The authors declare no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Abroun, M., Jahangiri, A., Shamim, A.G. et al. Predicting long-term electricity prices using modified support vector regression method. Electr Eng 106, 4103–4114 (2024). https://doi.org/10.1007/s00202-023-02174-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00202-023-02174-x