Abstract

We study equilibria in second-price auctions where bidders are independently and privately informed about both their values and participation costs, and where the joint distributions of these values and costs across bidders are not necessarily identical. We show that there always exists an equilibrium in this general setting with two-dimensional types of ex ante heterogeneous bidders. When bidders are ex ante homogeneous, there is a unique symmetric equilibrium, but asymmetric equilibria may also exist. We provide conditions under which the equilibrium is unique (not only among symmetric ones). We find that the marginal density of participation costs and the concentration of values matter for the uniqueness. The presence of private information on participation costs tends to reduce multiplicity of participation equilibria, although multiplicity still persists.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In many auction markets, bidders often incur participation costs. For instance, sellers may charge an entry fee, or require registration or pre-qualification for the auction. It may be costly for bidders to prepare bids, travel to the auction site, or acquire information about the auction rules and the values of the object to be auctioned. In general, bidders also incur opportunity costs for participating in auctions. Moreover, bidders may be privately informed about their participation costs.Footnote 1 In the presence of such participation costs, not all potential bidders would be willing to participate. Therefore, when analyzing bidders’ behavior in auctions, participation decisions, along with bidding strategies should be endogenously determined.

In this paper, we study existence and uniqueness of equilibria in second-price auctions when bidders are independently and privately informed about their participation costs as well as their valuations, and the joint distributions of these values and costs across bidders are not necessarily identical.Footnote 2 In other words, we allow for ex ante heterogeneous bidders with two-dimensional types.

Since, conditional on participating, each bidder cannot do better than bidding his value in a second-price auction, we naturally restrict our attention to (Bayesian–Nash) equilibria in cutoff strategies: a bidder participates in the auction if and only if his cost is below a certain cutoff (as a function of his private value.) To characterize the equilibrium in cutoff strategies, we first convert the equilibrium conditions for a profile of cutoff strategies to a system of integral equations. We then use the Schauder–Tychonoff fixed-point theorem to show that there exists a solution to the system of integral equations. This establishes the existence of equilibrium in a general environment, which includes models in previous studies as special cases. Next, we study the uniqueness issue. When bidders are ex ante symmetric (they have the same joint distribution over two-dimensional types), we show that there is a unique symmetric equilibrium, i.e., each bidder uses the same cutoff strategy. We also show that when there are two heterogeneous bidders, if each bidder’s value and participation cost are independently distributed (not necessarily identical across bidders), the equilibrium is unique under a restriction on the marginal distributions of participation costs. Our results show that when the marginal density of costs is uniformly bounded, relative to the expected valuations, the equilibrium is unique. This happens when the participation costs follow more dispersed distributions and the valuations are concentrated more on low values.

Finally, we identify conditions under which (a specific type of) asymmetric equilibria exist in a symmetric environment. We find that the presence of private information about participation costs tends to reduce the multiplicity of participation equilibria, although the multiplicity still persists.

Green and Laffont (1984) is the first to study equilibrium bidding behavior in a second-price auction where bidders are privately informed of their values and participation costs. Assuming the bidders’ values and participation costs are independently and jointly uniformly distributed, Green and Laffont (1984) show the existence and uniqueness of a symmetric equilibrium in cutoff strategies.

Gal et al. (2007) study second-price procurement auctions with two-dimensional types that are independently and identically distributed with continuously differentiable density. They show the existence and uniqueness of the symmetric equilibrium, and then, restricting attention to the symmetric equilibrium, they prove that the buyer benefits from partially reimbursing the bidders for the costs of preparing their bids. We make several contributions relative to Gal et al. (2007). First, we establish the existence of equilibria for general distributions, not only for the symmetric cases with continuously differentiable density. Second, we identify sufficient conditions for the uniqueness of the equilibrium, not just the uniqueness of the symmetric equilibrium in the symmetric model. Third, we illustrate that the uniqueness is not easily guaranteed, but rather that asymmetric equilibria (and hence multiple equilibria) can easily arise even when bidders are ex ante symmetric. This suggests that one needs to be cautious when making policy recommendations based on the symmetric equilibrium.Footnote 3

When players have multi-dimensional types, the study of equilibrium behavior in auctions is usually challenging, due to the lack of a natural order on types. In the case of multi-dimensional types of bidders, determining the equilibrium cutoff strategies can be complex, even in the case of second-price auctions. The literature on auctions with participation costs has mostly focused on single-dimensional types, where either the valuations or the participation costs are commonly known.Footnote 4 \(^{,}\) Footnote 5 In a related paper to this one, Tan and Yilankaya (2006) characterize the equilibrium structure in second-price auctions when bidders’ values are private information and participation costs are common knowledge and identical across bidders. They find conditions under which the equilibrium is unique and symmetric, as well as conditions under which there exist asymmetric equilibria, despite bidders being ex ante symmetric. The existence and structure of multiple equilibria can have important implications for policy design and empirical studies on auctions.

The remainder of the paper proceeds as follows. We describe our model in Sect. 2 and establish existence in Sect. 3. The uniqueness is addressed in Sect. 4. We discuss multiple equilibria in Sect. 5 and provide some concluding remarks in Sect. 6. All of the proofs are presented in the Appendix.

2 The setup

We consider an independent value environment with one seller and n risk-neutral buyers. Let \(N = \{1, 2, \ldots , n\}\). The seller has an indivisible object which he values at zero. The auction format is the sealed-bid second-price auction (see Vickrey 1961). In order to submit a bid, bidder i must incur a participation cost \(c_i\). Buyer i’s value for the object, \(v_i\), and his participation cost \(c_i\) are independently drawn from the distribution function \(K_i(v_i, c_i)\), with support \([0, 1]\times [0, 1]\).Footnote 6 Let \(k_i(v_i, c_i)\ge 0\) be the corresponding density function.Footnote 7 \(^{,}\) Footnote 8

Bidders know their own values and participation costs when they make their independent participation decisions. If bidder i decides to participate in the auction, he incurs a participation cost \(c_i\) and submits a bid. The bidder with the highest bid wins the object and pays the amount of the second highest bid. If there is only one participant in the auction, he wins the object and pays 0. If there is a tie in the bidding, the allocation is determined by a fair lottery.

In this second-price auction with participation costs, without loss of generality, the action set for any type of bidder is \(\{No\}\cup [0,1]\), where “No” denotes not participating in the auction. Bidder i incurs the participation cost if and only if his action is different from “No.” Bidders are risk neutral, and they compare their expected payoffs from participating with their participation costs to decide whether or not to participate. If the expected payoff from participating is less than the cost, they will not participate. Otherwise, they will participate and submit bids.

Given the (Bayesian–Nash) equilibrium strategies of all the other bidders, a bidder’s expected payoff from participating in the auction is a non-decreasing function of his valuation. Putting it differently, the maximum one would like to pay to participate in an auction is a non-decreasing function of one’s valuation. Therefore, we focus on Bayesian–Nash equilibria in which each bidder uses a cutoff strategy denoted by \(c^*_i(v_i)\), i.e., one bids his true valuation if his participation cost is less than some cutoff and does not participate otherwise.Footnote 9 Note that if a bidder finds that participating in this second-price auction is optimal, he cannot do better than bidding his true valuation. All of our results on uniqueness or multiplicity on equilibria should be interpreted accordingly.Footnote 10

An equilibrium strategy of each bidder i is then determined by the expected payoff of participating in the auction \(c^*_i(v_i)\) when his value is \(v_i\).Footnote 11 We can interpret \(c_i^{*}(v_i)\) as the maximal amount bidder i would like to pay to participate in the auction when his value is \(v_i\). Let \(b_i(v_i, c_i)\) denote bidder i’s strategy. Then, the bidding function can be characterized by

At equilibrium, bidder i with value \(v_i\) is indifferent between participating and not participating if his cost is \(c^*_i(v_i)\).Footnote 12

3 Existence

Suppose, provisionally, there exists an equilibrium in which each bidder i uses \(c_i^{*}(v_i)\) as his participation strategy. Then, bidder i with value \(v_i=v\) will participate in the auction (and submit v) if and only if \(c_i \le c_i^*(v)\). If we equate not entering with bidding zero, we can then think of the density function of submitting the bid v as

Let \(F_{c_i^{*}(v)}(v)\) be the corresponding cumulative probability function of \(f_{c_i^{*}(v)}(v)\). There is a mass at \(v=0\) for \(F_{c_i^{*}(v)}(v)\), with \(F_{c_i^{*}(v)}(0)\) being the probability that bidder i does not submit a bid. For each bidder i, let the maximal bid of the other bidders be \(m_i\). Since each bidder bids his true valuation, he can win the object whenever \(m_i<v_i\). Note that, if \(m_i>0\), at least one of the other bidders participates in the auction. If \(m_i=0\), no other bidder participates.

The payoff of participating in the auction for bidder i with value \(v_i=v\) is given by

and thus the zero expected net-payoff condition for bidder i to participate in the auction when his valuation is v requires that

Following some algebraic derivations, we have

Lemma 1

For all \(i\in N\),

If \(c_i^{*}(v)\) exists, from (1), it is increasing and therefore continuously differentiable. Taking the derivative of (2) with respect to v, we have

The above equation is a functional differential equation with the initial condition \(c_i^{*}(0)=0\).

To study the existence and uniqueness of the equilibrium, we first characterize some properties of \(c_i^{*}(v)\). These properties are used in the proofs of Theorems 1 and 2. From (1) and (3), we have

Lemma 2

For all \(i\in N\), if it exists, \(c_i^*(v)\) has the following properties:

-

(i)

\(c_i^{*}(0)=0\).

-

(ii)

\(0 \le c_i^{*}(v)\le v\).

-

(iii)

\({c_i^{*}}'(1)=1\).

-

(iv)

\(\frac{{\mathrm{d}}c^*_i(v)}{{\mathrm{d}} v} \ge 0\) and \(\frac{{\mathrm{d}}^2 c^*_i(v)}{{\mathrm{d}} v^2} \ge 0\).

(i) means that when bidder i’s value for the object is 0, then the value of participating in the auction is zero and, thus, the cost cutoff point for the bidder to enter the auction is also zero. Then, as long as the bidder’s participation cost is greater than zero, he will not participate in the auction.

(ii) means that a bidder will not be willing to pay more than his value to participate in the auction.

(iii) means that when a bidder’s value is 1, his marginal willingness to pay to enter the auction is also 1. The intuition is that when his value for the object is 1, he will almost surely win the object, and the marginal willingness to pay is equal to the marginal increase in the valuation.

(iv) states that the expected payoff (from participating) is increasing and convex in valuation.

Definition 1

A cutoff curve equilibrium is an n-dimensional plane comprised of \((c_1^{*}(v),c_2^{*}(v),\ldots ,c_n^{*}(v))\) that is a solution of the following equation system:

The above is an integral equation system. From (3), the derivative of \(c_i^*(v)\) at v depends not only on v itself, but also on \(c_j^*(v)\) with \(j\ne i\), which increases the difficulty of studying the existence of equilibrium.

Note that from Lemma 2, the right-hand side of (P1) defines a mapping of \((c_1^{*}(v),c_2^{*}(v),\ldots ,c_n^{*}(v))\) from a space to itself. In the Appendix, we show that this space is a compact convex non-empty subset of a locally convex topological space and the mapping is continuous. Then, we establish the existence of equilibrium using the Schauder–Tychonoff fixed-point theorem, which states that any continuous mapping from a non-empty compact convex subset of a locally convex topological space to itself has a fixed point. We have the following result on the existence of equilibrium \((c_1^{*}(v),c_2^{*}(v),\ldots ,c_n^{*}(v))\):

Theorem 1

(Existence of Equilibria) The integral equation system (P1) has at least one solution \((c_1^{*}(v),c_2^{*}(v),\ldots ,c_n^{*}(v))\), i.e., there is always an equilibrium in which bidder i uses the cutoff strategy \(c_i^{*}(v)\).

4 Uniqueness

To investigate the uniqueness of equilibrium, we first consider the case where all bidders are ex ante homogeneous in the sense that they have the same joint distribution function of valuations and participation costs, and we focus on the symmetric equilibrium in which all bidders use the same cutoff curve \(c^{*}(v)\).

(P1) can be rewritten as

and correspondingly we have

We then have the following result.

Theorem 2

(Uniqueness of the Symmetric Equilibrium) Suppose that all bidders have the same distribution function K(v, c). There is a unique symmetric equilibrium where each bidder uses the same cutoff strategy.

Gal et al. (2007) provide a similar result on the uniqueness of the symmetric equilibrium. Our uniqueness result is for general joint distributions while their result is based on the continuously differentiable density. In addition, their proof involves an ordinary differential equation with two mixed boundary conditions, which is a non-trivial mathematical problem and requires a careful treatment. Our proof avoids this difficulty by way of contradiction.Footnote 13

Note that Theorem 2 only shows the uniqueness of the symmetric equilibrium when bidders are ex ante homogeneous. It does not exclude the possible existence of asymmetric equilibria. In the case of unidimensional types, as shown by Stegeman (1996), Campbell (1998), Tan and Yilankaya (2006), and Kaplan and Sela (2006), there may exist asymmetric equilibria where ex ante homogeneous bidders use different cutoff strategies. As such, the uniqueness of the equilibrium cannot generally be guaranteed, which we will address in the next section. However, we show uniqueness in the case where the bidders’ valuations and costs are independently distributed with mild restrictions.

For the rest of the paper, we consider the case where there are two bidders, and costs and valuations are independently distributed. Let \(K_i(v_i,c_i)=F_i(v_i)G_i(c_i)\) and \(k_i(v_i,c_i)=f_i(v_i)g_i(c_i)\), where \(F_i(v_i)\) and \(G_i(c_i)\) are the cumulative distribution functions of bidder i’s valuation and participation cost, and \(f_i(v_i)\) and \(g_i(c_i)\) are the corresponding density functions, \(i=1,2\). In this case, bidder i with value \(v_i=v\) will submit bid v with probability \(G_i(c_i^*(v))\) and stay out with probability \(1-G_i(c_i^*(v))\). Correspondingly, we have

and

for \(i\ne j\).

Thus, when \(v_i\) and \(c_i\) are independent, the equilibrium \((c_1^{*}(v),c_2^{*}(v))\) is a solution of the following integral equation system:

Focusing on the case of two bidders and applying the Contraction Mapping Theorem to (P2), we have the following result on uniqueness.

Proposition 1

(Uniqueness of Equilibrium) If \(n=2\) and if for \(i=1, 2\), (i) \(K_i(v_i,c_i)=F_i(v_i)G_i(c_i)\), (ii) \(G_i(c_i)\) is continuous on [0, 1] and differentiable on (0, 1), and (iii) \(\sup _{[0,1]} g_i(c_i)<\frac{1}{E(v_i)}\), then the equilibrium is unique.

The condition that \(G_i(c_i)\) is continuous on [0, 1] and differentiable on (0, 1) is set for applying the Mean Value Theorem on \(G_i(\cdot )\). The assumption that the marginal density of the participation costs is uniformly bounded by \(\frac{1}{E(v_i)}\), the inverse of the expected value of the valuation, is used to apply the Contraction Mapping Theorem. These conditions can be easily satisfied. For instance, when participation costs are uniformly distributed on [0, 1] for both bidders, the supremum of the density for participation costs is 1, i.e., \(\sup _{[0,1]} g_i(c_i)=1\), and clearly \(E(v_i)<1\) for any \(F_i(\cdot )\) on [0, 1]. Thus, in this case, independent of the distribution of the valuations, the equilibrium is unique. Loosely speaking, \(\sup _{[0,1]} g_i(c_i)<\frac{1}{E(v_i)}\) holds when participation costs are more dispersed and the valuations are more concentrated on the low values.

Remark 1

-

(i)

Proposition 1 also holds when the support of \(c_i\) is a subset of [0, 1] with a slightly modified proof, as we discuss in the Appendix.

-

(ii)

For \(n\ge 3\), there are more product terms inside the first integral on the right-hand side of (P2), which makes the application of the Mean Value Theorem less tractable. The same difficulty applies for the case of correlated distributions.

When bidders are ex ante homogeneous, the unique equilibrium is necessarily symmetric. We now provide the explicit solution of the unique equilibrium when the valuations and participation costs are independently and uniformly distributed on [0, 1], the case studied by Laffont and Green (1984).Footnote 14

Example 1

Suppose \(G_i(c)\) and \(F_i(v)\) are both uniformly distributed on [0, 1]. At equilibrium, we have

Then, \({c_1^*}''(v)=c_2^*(v)\) and \({c_2^*}''(v)=c_1^*(v)\). Thus, we have \({c_1^*}^{(4)}(v)=c_1^*(v)\) and \({c_2^*}^{(4)}(v)=c_2^*(v)\) with \(c_1^*(0)=0\), \({c_1^*}'(1)=1\), \(c_2^*(0)=0\) and \({c_2^*}'(1)=1\). One can check that the only equilibrium is \(c_1^*(v)=c_2^*(v)=ae^v-ae^{-v}\), where \(a=\frac{e}{e^2+1}\).

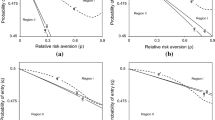

5 Asymmetric equilibria

In this section, we briefly discuss the multiplicity issue in a symmetric environment, again when there are two bidders whose costs and valuations are independently distributed.Footnote 15 We provide conditions for a specific type of asymmetric equilibria: one bidder never participates (independent of his valuation) and the other one participates (and bids his value) if and only if \(v\ge c\).

We consider a special case of the general model in Sect. 2, in which the support of (v, c) is \([v_l,v_h]\times [c_l, c_h]\subset [0,1]\times [0,1]\).Footnote 16 There is a unique equilibrium (Proposition 1, see Remark 1 (i)) when \(\sup _{[c_l,c_h]}g(c)<\frac{1}{E(v)}\). Note that \(\int _{c_l}^{c_h}g(c)dc=1\) implies \(\sup _{[c_l,c_h]} g(c)\ge \frac{1}{c_h-c_l}\). Therefore, the sufficient condition for uniqueness is likely to be violated when \(c_h-c_l\) is small or when E(v) is large. In this case, asymmetric equilibria may exist.

The expected payoff of participating in the auction is a non-decreasing function of one’s true value. Thus, a necessary and sufficient condition for a bidder to never participate is that when his value is \(v_h\), participating in the auction still gives him an expected payoff that is less than the minimum participation cost, \(c_l\), given the strategies of the other bidders.

The expected payoff of bidder 2 with \(v_2=v_h\) when he participates in the auction is as follows:

The first term is bidder 2’s expected payoff when bidder 1’s value is less than \(c_l\) (with probability \(F(c_l)\)). In this case, bidder 1 does not participate and bidder 2 will get payoff \(v_h\). The second term is the payoff when bidder 1’s value is between \(c_l\) and \(c_h\). For any \(v_1\in (c_l, c_h)\), bidder 2’s payoff is \(v_h-v_1\) when bidder 1 participates and is \(v_h\) when bidder 1 does not participate, and the probabilities are \(G(v_1)\) and \(1-G(v_1)\), respectively. The third term is the payoff when \(v_1\ge c_h\) and in this case bidder 1 participates for sure. For bidder 2 to never participate, we need \(R<c_l\). Simplifying R, we have the following result.

Proposition 2

Suppose \(n=2\) and \(K(v,c) = F(v)G(c)\) on \([v_l,v_h]\times [c_l, c_h]\) with \(c_h\le v_h\). A necessary and sufficient condition for the existence of an asymmetric equilibrium in which one bidder never participates is

Remark 2

Condition (6) is necessarily inconsistent with \(\sup _{[c_l,c_h]} g(c)E(v)<1\), the condition for uniqueness in Proposition 1. To see this, note that (6) is equivalent to \(\int _{c_l}^{c_h}xG(x)dF(x)+\int _{c_h}^{v_h}xdF(x)>v_h-c_l\), which implies that \(E(v)=\int _0^{c_h}xdF(x)>v_h-c_l\). Thus, \(\sup _{[c_l,c_h]} g(c)E(v)>\sup _{[c_l,c_h]} g(c)(v_h-c_l)\ge 1\) since \(\sup _{[c_l,c_h]} g(c)\ge \frac{1}{c_h-c_l}\) and \(c_h\le v_h\).

Based on (6), we provide simpler sufficient conditions for an asymmetric equilibrium to arise.

Corollary 1

Suppose \(n=2\) and \(K(v,c) = F(v)G(c)\) on \([v_l,v_h]\times [c_l, c_h]\) with \(c_l<c_h<v_l<v_h\). A sufficient condition for the existence of an asymmetric equilibrium in which bidder 1 always participates and bidder 2 never participates is

The economic intuition for Corollary 1 is as follows. If bidder 2 never participates, then bidder 1 will always participate (his lowest possible valuation is greater than the highest possible cost). And if bidder 1 always participates, his expected bid, and hence the expected price faced by bidder 2, is E(v). If \(v_h-E(v)<c_l\), even the highest value–lowest cost type has no incentive to participate, making it obvious that “bidder 1 always enters and bidder 2 never participates” is an equilibrium. One sufficient condition for this to be true is \(v_h-v_l<c_l\) (since \(E(v)\ge v_l\)), which is independent of the distributions of the valuations and participation costs.

There is an important implication for Corollary 1. When participation costs are always less than the value of the object, but the minimum participation cost is more than the range in possible values, there always exists one equilibrium in which one bidder always abstains. That may be an undesirable outcome in terms of revenue and efficiency. This does not happen when participation costs are more dispersed.

The second simple condition for multiplicity involves a strictly convex \(F(\cdot )\) on [0, 1] as follows.

Corollary 2

Suppose \(n=2\), \(K(v,c) = F(v)G(c)\) on \([v_l,v_h]\times [c_l, c_h]\), and \(F(\cdot )\) is strictly convex. There exists a \(\overline{c}\in (0,1)\) such that, when \(c_h>\overline{c}\) and \(c_h-c_l\) is sufficiently small, there exists an asymmetric equilibrium in which one bidder never participates and the other bidder participates whenever \(v\ge c\).

In Corollary 2, the limiting case of \(c_h=c_l=c\) corresponds to the model in Tan and Yilankaya (2006), where participation costs are exogenously fixed. They show that there exists an asymmetric equilibrium when \(F(\cdot )\) is strictly convex. In this case, \(F(c)+\int _{c}^{1}(1-x)dF(x)-c\) represents the payoff of a bidder with value 1 if he participates in the auction while the other participates whenever \(v\ge c\). Combining the above Corollary with the result of Tan and Yilankaya (2006), we see that with the introduction of the private information about the participation cost, or as the support \([c_l,c_h]\) of the participation cost that includes c becomes larger, asymmetric equilibrium still arises, as stated in Corollary 2. However, as \(c_h-c_l\) becomes sufficiently large such that \(E(v)\sup _{[0,1]} g(c)< 1\), Proposition 1 implies that asymmetric equilibria disappear. Therefore, there is a sense in which the presence of private information about participation costs tends to reduce the multiplicity of equilibria in comparison with the case of commonly known participation costs.

Remark 3

When \(F(\cdot )\) is concave on [0, 1], there is no equilibrium in which one bidder never participates and the other one participates whenever his value is greater than his participation cost, since \(R=F(c_l)+\int _{c_l}^{c_h}[(1-x)G(x)+v_h(1-G(x))]{\mathrm{d}}F(x) +\int _{c_h}^{1}(1-x){\mathrm{d}}F(x)\ge c_l\).Footnote 17

Before ending this section, we would like to point out that even though our discussion is based on two bidders, we expect that our result can be extended to the case of more than two bidders. Specifically, when \(n>2\), we can find similar conditions such that one bidder participates if and only if \(v\ge c\) while all other \(n-1\) bidders never participate. From the perspective of \(n-1\) bidders who do not participate, only one bidder who participates matters, not the \(n-2\) other bidders who never participate, as if they do not exist, which is the case of \(n=2\). There may be other types of asymmetric equilibria than we consider, which calls for future work.

6 Conclusion

We study the existence and uniqueness of equilibrium in second-price auctions when bidders’ values and participation costs are both private information. We show that under general distribution functions, there always exists an equilibrium in which each bidder uses a cutoff strategy. When bidders are ex ante homogeneous, there is a unique symmetric equilibrium. When there are two heterogeneous bidders, we provide a sufficient condition for the uniqueness of the equilibrium. Future research may be focused on identifying sufficient conditions to guarantee uniqueness of equilibrium in general environments.

We also show that multiple equilibria can easily arise. Specifically, in the symmetric model with two bidders, we identify sufficient conditions under which asymmetric equilibria exist. The multiplicity of equilibria has important consequences for both efficiency and seller’s revenue. For instance, asymmetric equilibria are ex post inefficient: A bidder may obtain the object he bids for even when there is another bidder with a higher valuation and a lower cost, who nevertheless stays out of the auction. Moreover, revenue-maximizing and ex ante efficient auctions may be asymmetric even in a symmetric environment. This is suggested by Celik and Yilankaya (2009), who provide (separate) sufficient conditions for these to happen when the participation cost is commonly known.Footnote 18 It would be interesting to study revenue-maximizing or efficient auctions when both values and participation costs are bidders’ private information.

Notes

Several related terms have been used in the literature, including participation cost, entry fee, entry cost, or opportunity cost. Since we only study equilibrium behavior, we do not need to distinguish between (bidder) participation costs and entry fees (charged by the seller.)

Our analysis in this paper applies to standard English auctions or ascending-price auctions. In this scenario, bidders who participate will stay in the auction until the price reaches their valuations and the participation conditions are identical to those in second-price auctions, which we analyze in this paper.

In another recent paper, Xu et al. (2013) study how resale affects both the entry decision and bidding behavior in a second-price auction model with two-dimensional types of bidders and binomially distributed entry costs, focusing on the symmetric equilibrium.

The support for valuations is set to be [0, 1] by normalization. Bidders with participation costs higher than 1 will not participate in the auction and such a type of bidder is of no practical interest. If the upper bounds of the supports for the participation costs are higher than 1, the above distributions on the participation costs should be interpreted as the truncated distributions of the original distributions on [0, 1]. All the derivations in the paper hold with this interpretation.

When there are atoms in the distribution, \(k_i(v_i,c_i)\) can incorporate Dirac delta functions to handle the infinite density.

Lu and Sun (2007) show that, for any auction mechanism with participation costs, the participating and non-participating types of bidders are divided by a non-decreasing and equicontinuous shutdown curve.

It is well known that there are other (dominated) equilibria of second-price auctions when there is no cost of participation (see Blume and Heidhues (2004) for the characterization of all equilibria). In this paper, we restrict to cutoff equilibria, where all participating bidders bid their valuations.

In equilibrium, \(c_i^*(v_i)\) depends on the distributions of all bidders’ valuations and participation costs.

The description of the equilibria can be slightly different under different informational structures on \(K_i(v_i,c_i)\). For example, when \(v_i\) is private information and \(c_i\) is exogenously fixed for all bidders, \(K_i(v_i, c_i) = F_i(v_i)\) (see Campbell 1998; Stegeman 1996; Tan and Yilankaya 2006; Cao and Tian 2013) and the equilibrium is described by a valuation cutoff \(v_i^*\) for each bidder i such that bidder i submits a bid whenever \(v_i\ge v_i^*\).

Uniqueness of the symmetric equilibrium has been addressed in the literature for the special cases where either costs (see Campbell 1998; Tan and Yilankaya 2006) or valuations (see Kaplan and Sela 2006) are commonly known. Laffont and Green (1984) investigated the existence and uniqueness of the symmetric equilibrium in a symmetric model where valuations and participation costs are uniformly distributed.

Following their proof of Lemma 3, when \(n=2\),

$$\begin{aligned} |F(\lambda ^{t+1}(\theta ))-F(\lambda ^{t}(\theta ))|= & {} |\int _0^{\theta }\int _m^1[\lambda ^{t}(\tau )-\lambda ^{t+1}(\tau )]{\mathrm{d}}\tau {\mathrm{d}}m|\\\le & {} \int _0^{\theta }\int _m^1|\lambda ^{t}(\tau )-\lambda ^{t+1}(\tau )|{\mathrm{d}}\tau {\mathrm{d}}m<\Vert \lambda ^{t}(\cdot )-\lambda ^{t+1}(\cdot )\Vert \int _0^{\theta }{\mathrm{d}}m. \end{aligned}$$Thus,

$$\begin{aligned} \Vert F(\lambda ^{t+1}(\cdot ))-F(\lambda ^t(\cdot ))\Vert <\Vert \lambda ^{t}(\cdot )-\lambda ^{t+1}(\cdot )\Vert . \end{aligned}$$The Contraction Mapping Theorem can be applied to show the uniqueness of the equilibrium without using the claim that Laffont and Green (1984) made at the beginning of their proof. The above statement can be treated as a special case for our proof to Proposition 1.

We can extend the supports of the distributions to be \([0,1]\times [0,1]\) by assigning zero density over the extended areas \([0,1]\times [0,1]\setminus [v_l,v_h]\times [c_l, c_h]\) with \(c_h\le v_h\). Then, by Theorem 1, an equilibrium exists.

Note that since \(v_l=0<c_l\), the condition in Corollary 1 is violated. Moreover, there cannot be an equilibrium in which one bidder always participates. If \(F(\cdot )\) is concave on a support with a positive lower bound, this potentially induces convexity on some interval in [0, 1], which may induce asymmetric equilibria. See Tan and Yilankaya (2006) for more on this issue.

Also see Stegeman (1996) for an example of an asymmetric ex ante efficient auction.

References

Blume, A., Heidhues, P.: All equilibria of the vickrey auction. J. Econ. Theory 114, 170–177 (2004)

Burton, T.A.: Stability and Periodic Solutions of Ordinary and Functional Differential Equations. Dover Publications Inc, Mineola, New York (2005)

Campbell, C.M.: Coordination in auctions with entry. J. Econ. Theory 82, 425–450 (1998)

Cao, X., Tian, G.: Equilibria in first price auctions with participation costs. Games Econ. Behav. 69, 258–273 (2010)

Cao, X., Tian, G.: Second price auctions with different participation costs. J. Econ. Manag. Strategy 22(1), 184–205 (2013)

Celik, G., Yilankaya, O.: Optimal auctions with simultaneous and costly participation. BE J. Theor. Econ. 9(1), 1–33 (2009)

Gal, S., Landsberger, M., Nemirovski, A.: Participation in auctions. Games Econ. Behav. 60, 75–103 (2007)

Green, J., Laffont, J.J.: Participation constraints in the vickrey auction. Econ. Lett. 16, 31–36 (1984)

Kaplan, T.R., Sela, A.: Second price auctions with private entry costs. Working paper (2006)

Levin, D., Smith, J.L.: Equilibrium in auctions with entry. Am. Econ. Rev. 84, 585–599 (1994)

Lu, J.: Auction design with opportunity cost. Econ. Theory 38, 73–103 (2009)

Lu, J., Sun, Y.: Efficient auctions with private participation costs. Working Paper (2007)

McAfee, R.P., McMillan, J.: Auctions with entry. Econ. Lett. 23, 343–347 (1987)

Samuelson, W.F.: Competitive bidding with entry costs. Econ. Lett. 17, 53–57 (1985)

Stegeman, M.: Participation costs and efficient auctions. J. Econ. Theory 71, 228–259 (1996)

Tan, G.: Entry and R&D costs in procurement contracting. J. Econ. Theory 58, 41–60 (1992)

Tan, G., Yilankaya, O.: Equilibria in second price auction with participation costs. J. Econ. Theory 130, 205–219 (2006)

Vickrey, W.: Counterspeculation, auctions, and competitive sealed tenders. J. Finance 16, 8–37 (1961)

Xu, X., Levin, D., Ye, L.: Auctions with entry and resale. Games Econ. Behav. 79, 92–105 (2013)

Author information

Authors and Affiliations

Corresponding author

Additional information

We thank three anonymous referees and a co-editor for helpful comments and suggestions that substantially improved the paper. Xiaoyong Cao thanks the financial supports from the National Natural Science Foundation of China (NSFC-71201030) and “the Fundamental Research Funds for the Central Universities” in UIBE (14YQ02). Guoqiang Tian thanks the financial support from the National Natural Science Foundation of China (NSFC-71371117). Okan Yilankaya thanks the Social Sciences and Humanities Research Council of Canada and a Marie Curie International Reintegration Grant for financial support.

Appendix

Appendix

Proof of Lemma 1

If \(m_i=0\), none of the other bidders will participate, the probability of which is

Otherwise, at least one other bidder submits a bid. Then,

Thus, the cutoff for individual i, \(i\in {1,2,\ldots n}\), which is \(c_i^{*}(v)=\int _{0}^{v}(v_i-m_i){\mathrm{d}}\prod _{j\ne i} F_{c_j^{*}}(m_i)\), can be expressed as

Integrating by parts, we have

Since

thus we have

\(\square \)

Proof of Lemma 2

-

(i)

Let \(v=0\) in the expression of \(c_i^{*}(v)\), we have the result.

-

(ii)

Since

$$\begin{aligned} c_i^{*}(v)=\int _{0}^{v}\prod _{j\ne i}\left[ 1-\int _{m_i}^1\int _0^{c_j^*(\tau )}k_j(\tau , c_j){\mathrm{d}}c_j {\mathrm{d}}\tau \right] {\mathrm{d}}m_i \leqslant \int _0^{v}{\mathrm{d}}m_i=v \end{aligned}$$by \(0\le \int _{m_i}^1\int _0^{c_j^*(\tau )}k_j(\tau , c_j){\mathrm{d}}c_j{\mathrm{d}}\tau \le \int _{0}^{1}\int _{0}^{1}k_j(\tau , c_j) {\mathrm{d}}c_j {\mathrm{d}}\tau = 1\), thus \(0\le c_i^{*}(v)\le v\).

-

(iii)

Letting \(v=1\) in (3), we have the result.

-

(iv)

$$\begin{aligned} \frac{{\mathrm{d}}c^*_i(v)}{{\mathrm{d}} v}=\prod _{j\ne i}\left[ 1-\int _{v}^1\int _0^{c_j^*(\tau )}k_j(\tau , c_j){\mathrm{d}}c_j {\mathrm{d}}\tau \right] \ge 0 \end{aligned}$$

by noting that \(\int _{v}^1\int _0^{c_j^*(\tau )}k_j(\tau , c_j){\mathrm{d}}c_j {\mathrm{d}}\tau \le 1\). Then,

$$\begin{aligned} \frac{{\mathrm{d}}^2 c^*_i(v)}{{\mathrm{d}} v^2}{=}\sum _{k\ne i}\prod _{j\ne i, j\ne k}\left[ 1{-}\int _{v}^1\int _0^{c_j^*(\tau )}k_j(\tau , c_j){\mathrm{d}}c_j {\mathrm{d}}\tau \right] \int _0^{c_k^*(v)}k_j(\tau , c_j){\mathrm{d}}c_j {\mathrm{d}}\tau {\ge } 0. \end{aligned}$$

\(\square \)

Proof of Theorem 1

In the following, we apply the Schauder–Tychonoff fixed-point theorem (see Burton 2005, p. 185) ), which states that any continuous mapping from a compact convex non-empty subset of a locally convex topological space to itself has a fixed point, to show the existence of the equilibria.

Let \(h_i(m_i, \mathbf c ^*)=\prod _{j\ne i}[1-\int _{m_i}^1\int _0^{c_j^*(\tau )}k_j(\tau , c){\mathrm{d}}c{\mathrm{d}}\tau ]\) with \(\mathbf c ^*=(c_1^*,\ldots ,c_n^*)\). Since \(k_j(\tau , c)\) is integrable over c as it is a density function, there exists a continuous function \(\gamma _j(\tau , c)\) with \(\frac{\partial \gamma _j(\tau , c)}{\partial c}=k_j(\tau , c)\) such that \(\int _0^{c_j^*(\tau )}k_j(\tau , c){\mathrm{d}}c=\gamma _j(\tau , c_j^*(\tau ))-\gamma _j(\tau ,0)\). Thus, \(h_i(m_i, \mathbf c ^*)=\prod _{j\ne i}[1-\int _{m_i}^1[\gamma _j(\tau , c_j^*(\tau ))-\gamma _j(\tau ,0)]{\mathrm{d}}\tau ]\), which is a continuous mapping from \([0, 1]\times [0,1]^n\rightarrow [0,1]\).

Let \(H(m, \mathbf c ^*))=(h_1(m_1, \mathbf c ^*)), h_2(m_2, \mathbf c ^*)),\ldots , h_n(m_n, \mathbf c ^*)))'\), which is a continuous mapping from \([0,1]^n\times [0,1]^n\rightarrow [0,1]^n\). By Lemma 2, H is bounded above by one. Define

where \(\varphi \) is the space of continuous functions \(\phi \) defined on \([0,1]^n\rightarrow [0,1]^n\) with \(\Vert c\Vert =\sup _{0\le v\le 1}c(v)\). Then, by Ascoli Theorem, M is compact. M is clearly convex.

Define an operator \(P: M\rightarrow M\) by

To see that P is continuous, let \(\phi \in M\) and let \(\epsilon >0\) be given. We show that there exists an \(\eta >0\) such that \(\varphi \in M\) and \(\Vert \phi -\varphi \Vert <\eta \) implies \(\Vert (P\phi )(v)-(P\varphi )(v)\Vert \le \epsilon \). Now

and \(h_i\) is continuous, so for \(\epsilon >0\), there is an \(\eta \) such that \(\big | \phi (\tau )-\varphi (\tau )\big |<\eta \) implies \(\big |h_i(m_i, \phi (\tau ))-h_i(m_i, \varphi (\tau ))\big |<\epsilon \). Thus, for \(\Vert \phi -\varphi \Vert <\eta \), we have

Then, by Lemma 2, P is a continuous function from M to itself. Thus, by Schauder–Tychonoff fixed-point theorem, there exists a fixed point, i.e., a solution for the functional differential equation system exists. \(\square \)

Proof of Theorem 2

The existence of the symmetric equilibrium can be established by the Schauder–Tychonoff fixed-point theorem. Here, we only need to prove the uniqueness of the symmetric equilibrium. Suppose, by way of contradiction, that we have two different symmetric equilibria x(v) and y(v). Then, we have

Suppose \(x(1)>y(1)\), then by the continuity of x(v) and y(v), we can find a \(v^*\) such that \(x(v^*)=y(v^*)=c(v^*)\) and \(x(v)>y(v)\) for all \(v\in (v^*, 1]\) by noting that \(x(0)=y(0)\).

Case 1: If \(k(v,c)>0\) with positive probability measure on \((v^*,1)\times (c(v^*),1)\), then \(x(\tau )>y(\tau )\) for all \(\tau \in (v^*, 1]\) implies that

for \(\tau \in (v^*,1)\). Then, we have \(x'(v^*)<y'(v^*)\) which is a contradiction to \(x(v)>y(v)\) for \(v>v^*\). So we have \(x(1)=y(1)\).

Now suppose there exists an interval \([\alpha ,\beta ]\subset [0,1]\) such that \(x(\alpha )=y(\alpha )\) and \(x(\beta )=y(\beta )\) while for all \(v\in (\alpha ,\beta )\), \(x(v)>y(v)\) and for all \(v\in [\beta ,1]\), \(x(v)=y(v)\), by the same logic above, we have \(x(\beta )=y(\beta )\) and \(x'(v)<y'(v)\) for \(v\in (\alpha ,\beta )\), which is inconsistent with \(x(v)>y(v)\) for all \(v\in (\alpha ,\beta )\). Thus, we can prove that \(x(v)=y(v)\) for all \(v\in [0,1]\) and so the symmetric equilibrium is unique.

Case 2: If \(k(v,c)>0\) with zero probability measure on \((v^*,1)\times (c(v^*),1)\), then we have \(x'(v)=y'(v)\) for all \(v\in (v^*,1]\). By \(x(v^*)=y(v^*)\), we have \(x(v)=y(v)\) for all \(v>v^*\), which is a contradiction to \(x(v)>y(v)\). Thus, there is a unique symmetric equilibrium.

Then, in both cases, we prove that there is a unique symmetric equilibrium. \(\square \)

Proof of Proposition 1

Based on (P2), define a mapping

where \(c=(c_1, c_2)'\).

Take any \(x(v)=(x_1(v), x_2(v))'\) and \(y(v)=(y_1(v), y_2(v))'\) with x(v), \(y(v)\in \varphi \) where \(\varphi \) is the space of monotonic increasing continuous functions defined on \([0,1]\rightarrow [0,1]\). First note that by mean value theorem, \(\forall i=1, 2\),

where \(\widehat{x}_i(\tau )\) is some number between \(x_i(\tau )\) and \(y_i(\tau )\). In the following, for presentation convenience, denote

Then, we have

Thus, when \(\sup _{[0,1]} g_i(c)\int _0^1(1-F_i(s)){\mathrm{d}}s=\sup _{[0,1]} g_i(c)E(v_i)<1\), or \(\sup _{[0,1]} g_i(c)<\frac{1}{E(v_i)}\) by noting that \(E(v_i)=\int _0^1sf_i(s){\mathrm{d}}s=\int _0^1(1-F_i(s)){\mathrm{d}}s\), the above mapping is a contraction, so there exists a unique equilibrium.

We further show Proposition 1 also holds when the support of \(c_i\) is a subset of [0, 1] and the proof is slightly modified. Suppose that the support of \(G_i(c_i)\) is \([c_l,c_h]\subset [0,1]\) and \(G_i(c_i)\) is differentiable on \((c_l,c_h)\). Then, for any \(c_1(\tau )\) and \(c_2(\tau )\), if \(c_l\le c_i(\tau )\le c_h\) for \(i=1,2\), we can follow the proof above to apply the Mean Value Theorem. Otherwise, if one of them is not in \([c_l,c_h]\), an extra treatment is needed. For instance, if \(c_l\le c_1(\tau )\le c_h\) and \(c_2(\tau )<c_l\), then \(|G_i(c_1(\tau ))-G_i(c_2(\tau ))|=|G_i(c_1(\tau ))-G_i(c_l)|\le \sup _{[c_l,c_h]}g_i(c_i)|(c_1(\tau )-c_l)|<\sup _{[c_l,c_h]}g_i(c_i)|(c_1(\tau )-c_2(\tau ))|\). Similar inequalities hold for other possible cases. Thus, if \(\sup _{[c_l,c_h]} g_i(c_i)<\frac{1}{E(v_i)}\) for \(i=1, 2\), the equilibrium is unique. \(\square \)

Proof of Proposition 2

We first prove necessity. Suppose, in an asymmetric equilibrium, bidder 2 never participates, then bidder 1 participates if and only if \(v_1\ge c_1\) and thus we have \(c_1^*(v_1)=v_1\). Simplifying R, the expected revenue of bidder 2 with \(v_2=v_h\) when he participates in the auction while bidder 1 participates whenever \(v_1\ge c_1\), we get (6) and thus necessity holds.

Next we prove sufficiency. Suppose (6) holds. Consider the strategies that bidder 2 never participates and bidder 1 participates whenever \(v_1\ge c_1\). Given the strategy of bidder 2, bidder 1’s best response is to participate whenever \(v_1\ge c_1\). Given the strategy of bidder 1, since (6) holds, the expected revenue of bidder 2 with \(v_2=v_h\) is less than \(c_l\); thus, the best response for bidder 2 is never participating for any type. Thus, there exists an asymmetric equilibrium in which one bidder never participates and sufficiency satisfies. \(\square \)

Proof of Corollary 1

Suppose we have an equilibrium in which bidder 1 always participates and bidder 2 never participates. Then, bidder 1 always participates is a best response to bidder 2’s strategy since \(v_l>c_h\). For bidder 2’s strategy to be a best response, we just check that (6) holds with \(c_l<c_h<v_l<v_h\). To see this, note that \(F(c_h)=0\), \(\int _{c_h}^{v_h}(v_h-x)dF(x)=\int _{v_l}^{v_h}(v_h-x){\mathrm{d}}F(x)=v_h-E(v)\) and \(\int _{c_l}^{c_h}xG(x){\mathrm{d}}F(x)=0\), thus

by noting that \(v_h-E(v)<c_l\). \(\square \)

Proof of Corollary 2

Let \(\lambda (c)=v_hF(c)+\int _{c}^{v_h}(v_h-x){\mathrm{d}}F(x)-c\) with \(c\in [0,v_h]\) and notice that (6) can be written as \(\lambda (c_h)-\int _{c_l}^{c_h}xG(x){\mathrm{d}}F(x)+c_h-c_l<0\). Note that when v is distributed on [0, 1], \(v_h=1\), and we have \(\lambda (c)=F(c)+\int _c^1(1-x){\mathrm{d}}F(x)-c\). First we prove for any strictly convex \(F(\cdot )\) with support [0, 1], there exists a unique \(\overline{c}\in (0,1)\) such that \(\lambda (c)<0\) if and only if \(c\in (\overline{c},1)\). To see this, note that from \(\lambda (c)\), we have \(\lambda (0)=\int _0^1(1-x){\mathrm{d}}F(x)>0\), \(\lambda (1)=0\) and \(\lambda '(c)=-1+cf(c)\). When \(F(\cdot )\) is strictly convex on [0, 1], \(\lambda (c)\) is a strictly convex function of c with \(\lambda (1)=0\) since \(\lambda ''(c)=f(c)+cf'(c)>0\). Also note that \(\lambda '(1)=f(1)-1>0\), by the strict convexity of \(\lambda (c)\) with \(\lambda (1)=0\), there exists a unique \(\overline{c}\) such that \(\lambda (c)<0\) if and only if \(c\in (\overline{c},1)\). Thus, we have \(\lambda (c_h)>0\) for \(c_h\in (\overline{c},1)\). Note that \(c_h-c_l-\int _{c_l}^{c_h}xG(x){\mathrm{d}}F(x)=0\) when \(c_h=c_l\). By continuity, when \(c_h-c_l\) is sufficiently small,

for all \(c_h\in (\overline{c},1)\). Thus, (6) holds with \(v_h=1\) and an asymmetric equilibrium in which one bidder never participates exists. The other bidder participates whenever \(v\ge c\). \(\square \)

Rights and permissions

About this article

Cite this article

Cao, X., Tan, G., Tian, G. et al. Equilibria in second-price auctions with private participation costs. Econ Theory 65, 231–249 (2018). https://doi.org/10.1007/s00199-016-1028-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00199-016-1028-6

Keywords

- Two-dimensional types

- Private participation costs

- Second-price auctions

- Existence and uniqueness of equilibrium