Abstract

We argue that the benefits provided by locations inside science and technology parks evolve over time. Firms inside parks can improve performance due to certain advantages related to knowledge spillovers and shared resources that can be particularly useful in earlier stages of the industry life cycle. In these industries, local knowledge sharing is particularly useful because no standards are clearly established, as we have confirmed in a sample of 12,800 firms from the PITEC database, located either on- or off-park. We also find that young firms can benefit more from the park than more established businesses in terms of both business growth and innovative capacity. Although older firms have greater experience and investments that would increase their capacity to absorb external knowledge, their associated rigidities prevent them from incorporating changes into their structures.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

Science and technology parks have been broadly considered as a valuable source of externally available resources and knowledge that help firms to increase their innovative capacity and foster their growth (Ferguson and Olofsson 2004; Löfsten and Lindelöf 2005). In this sense, abundant literature has evaluated park benefits by comparing on-park firms with off-park firms (Westhead 1997; Bakouros et al. 2002; Siegel et al. 2003a; Ferguson and Olofsson 2004; Dettwiler et al. 2006), but the results have not been conclusive. While some studies confirmed the benefits associated to park locations (Colombo and Delmastro 2002; Fukugawa 2006; Vásquez Urriago et al. 2014), some authors observed limited exchange of resources and knowledge among their members (Vedovello 1997; Bakouros et al. 2002), major difficulties in transferring scientific research and personnel from universities to their neighboring firms (Massey et al. 1992), and a low added value of the resources provided locally (Chan and Lau 2005).

These results tend to indicate that there are both contextual and structural factors of the location inside parks that change from a park to another that need to be taken into account. In this research we consider that part of these differences stems from the fact that the benefits associated with in-park locations are not constant over time. We argue that these benefits evolve as external or internal changes happen to the firm, and these changes should be considered in the analysis (Ahuja et al. 2012; Wang et al. 2013; Balland et al. 2013). As a consequence, our research objective is to look further into the benefits of locations inside parks across time, from a dynamic perspective. Rather than considering park benefits as constant and stable, we posit that they depend on two main aspects: the maturity of the industry where the firm competes, and the age of the firm.

Deepening on this research is relevant in order to better understand under which conditions parks can play a better role in promoting local innovation and firms’ growth. As a consequence, both individual firms and government would be able to better establish when it makes sense to invest on park locations. Parks have been expected to play a more significant role for both young firms and emerging markets. Moreover, many parks have exit policies to encourage older firms to leave the park and set up outside and also have incentives to house high technology industries. This is the case of incentives based on subsidies for leasing premises, or mandatory replacement of these firms with others, younger or in emerging industries, whose need is perceived to be greater (Allen and Mccluskey 1990; Clarysse et al. 2005). In this sense, some questions arise that would need further research, such as: Can older firms also benefit from location inside the park, like young ones? Can firms in mature industries improve their performance inside the park? To what extent do the park’s benefits tend to diminish over time?

Our analysis will contribute to the existing literature by incorporating a multi-theoretical approach to explain the benefits associated with science and technology parks. We undertake a dynamic perspective that considers the effect of time in clustered spaces incorporating the contributions of different approaches such as the Resource-Based View (Barney 1991), the knowledge-Based View (Kogut and Zander 1992), alliance network approach (Gulati 1998) and Organizational Learning (Zahra and George 2002). Although there are several papers adopting a temporal perspective, they tend to focus mainly on network-knowledge related aspects, while understanding the benefits of the park requires a theoretical approach comprehensive enough to incorporate the many different effects of the these locations (Mian 1997; McAdam and McAdam 2008; Vásquez Urriago et al. 2014). Moreover, these studies are undertaken in locations, such as industrial districts, where firms tend to share the same industry, markets and in many cases collective norms and values (Wang et al. 2008; McAdam and McAdam 2008; Kukalis 2010). However, analyses in industrial districts cannot be applied entirely to parks precisely because firms inside parks belong to very different industries and they have different experiences and values.

Also, this paper contributes by evaluating business performance in terms of both firm growth (i.e. increase in both sales and employees), and innovation performance (total number of innovations and innovations new to the market in the firm). Belonging to parks may affect various aspects of company performance (Colombo and Delmastro 2002; Löfsten and Lindelöf 2005; Mian 1996; Vásquez Urriago et al. 2014), and there is some debate on the most appropriate method for assessing park effectiveness (Siegel et al. 2003b; Barbero et al. 2012). We consider that part of the lack of consensus in the previous literature might be explained by different consequences of various performance dimensions, as it has been suggested (Ferguson and Olofsson 2004). Company development strategies differ according to their resource restraints and their own objectives (Chandler and Baucus 1996; Delmar et al. 2003), which is why it is recommended to use several performance dimensions.

To test this objective, we have gathered data from 2007 to 2012 for the group of firms that participated in the Spanish Technological Innovation Panel (known by the acronym PITEC in Spanish). This database is particularly relevant to our research since it contains information on approximately 12,800 firms, located either on-or off-park.

This paper is structured into the following sections: the section following this introduction presents the theoretical framework and our proposed hypotheses. The third section deals with the empirical evidence we obtained, explaining the main characteristics of science parks, presents how variables are measured and discusses the main study results. Finally, the fourth section presents our conclusions as a discussion of the results and future research lines.

2 Theoretical framework

2.1 Parks, knowledge and performance

Much of the literature suggests that science and technology parks are important vehicles that can help firms launch new products and increase their growth potential (Ferguson and Olofsson 2004). Along with access to services, physical infrastructures and reputation effects, belonging to the park confers knowledge spillovers to their collocated firms that have been considered as fundamental for business success (Phan et al. 2005; Chan and Lau 2005). From an Intellectual Capital perspective, these benefits can be explained in terms of accumulation of a higher level of intellectual capital (Villasalero 2014). Along with physical resources, such as machinery, procedures or installations (Westhead and Batstone 1998), firms have access to human capital obtained by inter-firm human mobility between firms, hiring personnel from universities, such as researchers or graduate students, and also running training programs for existing staff (Vedovello 1997; Filatotchev et al. 2011). Firms can also improve their technological capital, mainly related to higher R&D capacity or increased patenting behavior (Villasalero 2014). But more importantly, firms can access resources and knowledge from other firms and institutions by establishing relationships with them. This relational capital facilitate firms’ learning by either conducting knowledge through a network of participants or collectively creating new knowledge inside the network (Nahapiet and Ghoshal 1998; Moran 2005). It is the result of interactions, collaborations, trust and other social ties that favour the development of reputation and the exchange of localized knowledge among different firms and organizations, where interactions are non-hierarchical but based on different kind of relationships, such as commercial transactions, trust-based agreements, friendship interactions, formal agreements, etc. (Inkpen and Tsang 2005; Bell and Zaheer 2007).

Traditionally associated with the university and other higher education institutes, these interactions provide knowledge in terms of basic research and support that firms can turn into valuable new products, services or processes (Westhead 1997; Löfsten and Lindelöf 2005). More recently, the relevance has been pointed out of also considering local interactions, either formal or informal, among collocated firms that foster mutual exchange of knowledge such as technology, consultancy, or business skills (Hansson et al. 2005; Filatotchev et al. 2011). The park’s management team can also provide firms with business advice and services related to financial and marketing skills (Mian 1997; Ferguson and Olofsson 2004) functioning as a connecting agent for firms that are collocated with other organizations inside and outside the park (Johannisson 1998; Westhead and Batstone 1998; Chan and Lau 2005).

Nevertheless, empirical evidence has not confirmed this positive influence of location inside a park on a firm’s performance (Westhead 1997; Colombo and Delmastro 2002; Ferguson and Olofsson 2004; Dettwiler et al. 2006), finding that results were not conclusive. Contrary to expected, some studies have found a low level of local interactions among firms in the park, as few firms exchanged knowledge locally, although links that were formed tended to be strong (Bakouros et al. 2002). The role of the university as a provider of local knowledge spillovers has also been questioned, considering that basic academic research is not easily absorbed by local firms and it has a long range perspective that is of little use for the immediate problem-solving activities required by businesses (Quintas et al. 1992; Löfsten and Lindelöf 2005). Finally, park management has not always demonstrated proactive behavior when setting up systems which continually encourage development of local interactions or promote external relationships (Westhead and Storey 1995). Many parks have been found to be primarily a form of prestigious real estate generating few productive synergies (Bakouros et al. 2002).

In this research, we consider this lack of empirical consistency to be based on differences in the moment in time when the research takes place. We consider that the benefits associated with the park change both in terms of the intensity in which they are available and their utility for firms. We particularly consider that the industry life cycle, along with the age of the firm, are determining factors in the evolution of knowledge spillover intensity and utility inside parks.

2.2 The industry life cycle

The industry life cycle framework states that an industry has its own cycle of life evolving from an early formative stage where there is a supply of a new product with relatively primitive design to more mature manufacturing and marketing techniques. Throughout this process, firms within the industry learn about the production process as well as the product, which reduces uncertainty, increases production efficiency, and adapts better to client needs. As the industry evolves, there tend to be fewer innovations, mainly focused on improving product variety and production processes (Audretsch 1998; Wang et al. 2013).

This evolutionary interpretation of the industry over time affects park benefits (McAdam and McAdam 2008; Wang et al. 2013). In the first stages of the life cycle, there is greater heterogeneity among firms and industry standards have yet to be established. As the Resource-Based View (RBV) argues, firms differ in their endowment of valuable internal resources (Barney 1991), these differences peaking in the first stages of the industry life cycle (Karniouchina et al. 2013). The park can provide valuable resources in these first stages, when standards still are not tightly established (Eisingerich et al. 2010). For instance, firms can have improved access to human resources from other companies, by hiring and training a skilled and specialized workforce (McCann and Folta 2008), they can strength their own reputation in the new industry by being located proximate to other highly reputed firms of the park (Kalnins and Chung 2004), and they can also benefit from credit access and financial projects that are supported by local government and park management (Vedovello 1997).

More importantly, most valuable resources are intangible, i.e. based on knowledge, tacit knowledge, and they can be more easily either generated collectively or transferred between organizations inside a park (Podolny and Page 1998). Inside a park firms have access to different firms and organizations, from different industries and backgrounds, which is a great in terms of promoting the generation of wider variety of ideas that are needed for innovations at this stage (Hansson et al. 2005). The organizational learning and knowledge-based literature often focuses on the type of knowledge transferred, dividing knowledge into two types: explicit knowledge that can be codified, and tacit knowledge that is difficult to articulate (Polanyi 1966; Kogut and Zander 1992). Tacit knowledge tends to play a relatively more important role in generating innovation activity and fostering a firm’s development, and it is also most relevant in the first stages of the life cycle (Ter Wal 2014). In these early stages there are no widely accepted standards with respect to product and process specifications, so that knowing “what consumers want and how it can be produced demands proximity to the knowledge sources” (Audretsch and Feldman 1996).

Specifically, scientific knowledge, provided by nearby universities and other higher education institutes, is of great value in these first life cycle stages, when this basic knowledge has yet to be disseminated to the broader community and is not yet available in readily accessible codified form (Zucker et al. 1998). In the same vein, local knowledge networks among similar firms, based on either formal agreements or informal interactions, requires proximity to be transmitted in the early stages, before this knowledge can be codified and patented. Even in firms that have developed research collaboration with other firms, partners find it easier to produce innovative outcomes when they are close by (Audretsch 1998; Gittelman 2007).

While beneficial to an organization, tacit knowledge turns out to be quite difficult to transfer, as the Knowledge-Based View acknowledged (Grant 1996). Tacit knowledge requires of a conduit capable of being transmitted as it is gained through imitation and repetition, not through conscious analysis or explicit instruction (Langlois 1992). “This is because tacit knowledge can only be observed by its application and acquired through practice; its transfer between people is slow, costly and uncertain” (Grant 1996:111). Transmitting this knowledge requires frequently interaction that proximity facilitates, often involve the development of an unique language or code, and may involve learning a set of values (Kogut and Zander 1992). In this sense, belonging to a park tends to reduce the communication and coordination costs associated to the transmission of tacit knowledge (Almeida and Kogut 1999; Levin and Cross 2004). This tacit knowledge tends to be highly contextual and uncertain, so its transmission requires both formal and informal meetings, conferences as well as face-to-face encounters (Bell and Zaheer 2007). Besides, in the event that firms develop shared values and norms, these communication costs will be further reduced. Geographical proximity also fosters developing trust among co-located agents based on similar values and shared backgrounds and routines (Expósito-Langa and Molina-Morales 2010). As a consequence, firms inside parks might increase their mutual trust which, in turn, increases a firm’s willingness to share their knowledge and absorb knowledge from others (Levin and Cross 2004).

As industry evolves to a mature stage, tacit knowledge plays a much less important role and geographical proximity to other sources of knowledge is not so relevant to make it transferable (Audretsch and Feldman 1996; Grant 1996). In the mature stage, most of the product’s technical aspects have become standardized, so it is easier for rivals to come by the knowledge (Teece 1986). As knowledge becomes explicit, it is more applied and specialized, so firms can benefit more from its innovations, but this also implies less ability to control knowledge flows and, hence, a greater risk of unintended knowledge spillovers and imitation by competing firms (Ter Wal 2014). This control problem might exist regardless of a firm’s location, requiring strict property rights (Liebeskind et al. 1996). Nevertheless, this problem could be heightened if firms co-located in the park have developed shared values and norms. If firms have developed similar values and backgrounds while having shared experiences, they would find it easier to understand and incorporate knowledge from other firms within the park, reducing the knowledge appropiability (Baum and Mezias 1992; Shaver and Flyer 2000; Canina et al. 2005).

In addition, local knowledge sources and resources provided inside the park in mature industries become less relevant because firms tend towards homogeneity, suffering a kind of lock-in and ossification (Mcfadyen and Cannella 2004). Managers in the same industry tend to be exposed to similar industry experiences and technical training, so there is a tendency to homogeneity in their mental models and learning paths as industry evolves (Prahalad and Richard 1986). The first stages of the life cycle require of rapid technological development that is promoted by firms’ learning of diverse sources of knowledge (Powell et al. 1996). Following March (1991), the learning process of the firm can be broken down into two main elements: explorative learning and exploitative learning. Explorative learning refers to a firm’s ability to identify, analyse, process, interpret and understand acquired external knowledge. Exploitative learning refers to the application of the acquired knowledge and relates to a firm’s ability to incorporate this into new goods, systems or processes (Zahra and George 2002).

While these two elements are necessary, explorative learning is most important in the first stages of the life cycle, where experimentation, speed and flexibility are critical; and exploitative learning is most useful in mature industries, with a higher orientation to cost, efficiency and incremental innovations (Tushman et al. 1996). Similarly, a firm’s ability to absorb knowledge gained from the park can be mainly related to its skills for exploratory learning (Expósito-Langa et al. 2011). Parks can be instrumental for the exploration of new opportunities and for helping firms to move beyond their traditional views of the market and technological trajectories (Lazaric et al. 2008). On contrary, as the industry matures, norms and organizational routines in the industry are established, making them less aware of new knowledge sources locally provided and more focussed on exploitative learning (Audretsch 1998; Gilsing et al. 2008). Moreover, as the life cycle evolves firms tend to use established procedures, based on previous investments in resources and refuse to see them as reversible commitments (Teece et al. 1997; Ghemawat 2010). While these resources can provide them with a distinctive skill, they also limit the capacity to change their internal resources according to new procedures, ideas or market needs (Kraatz and Zajac 2001).

-

Hypothesis 1. “As industries mature, the positive effects of parks on performance tend to be reduced”.

2.3 The age of the firm

It has been broadly considered among strategy and organization scholars that young firms have higher failure rates than established firms as they are especially vulnerable to obstacles in early development phases. This liability of newness (Stinchcombe 1965) is related to the founders’ lack of knowledge about how to establish effective work roles inside the firm as well as a dearth of trustworthy relationships with other organizations, mainly their providers and clients. Young firms may also lack knowledge about what they can do or they may not be sufficiently endowed with the resources they need (Thornhill and Amit 2003). However, as literature on alliance networks has analyzed (Gulati 1998), young firms can compensate for these liabilities by having access to resources and stable relationships, which can make the difference in their chances of succeeding when launching new products on the market and their development (Baum et al. 2000). Research on networks is interested in understanding how the web of external relationships in which firms are embedded may influence in their behaviour and performance (Yli-Renko et al. 2001; Moran 2005). It builds on the general notion that economic actions are influenced by the social context in which they are embedded and that this context is configured by a myriad of relationships with different agents such as providers, clients, rivals, partners, universities, etc. (Owen-Smith and Powell 2004).

In this sense, science and technology parks have been considered as network of relationships among geographically concentrated firms and institutions that foster the development of young firms (Hansson et al. 2005). It is expected that locations inside this network would significantly reduce the hazards faced by a startup, resulting in differential innovative capacity and growth (Ferguson and Olofsson 2004). New firms lack legitimacy and reliability that are conferred by years of experience and that affect the perceived quality and reliability of their products and services among potential customers, suppliers, employees, collaborators and investors (Baum et al. 2000). Inside parks, firms mitigate this risk of newness by establishing formal or informal relationships with other firms and institutions (e.g. universities and other higher education institutes) with higher legitimacy and prestigious that are also located inside the park (Löfsten and Lindelöf 2005). Thanks to the presence of these institutions, as well as of larger and more experienced firms, parks can create a beneficial image and a higher legitimacy to the younger firms, making it easier the launch of their products (Felsenstein 1994; Ferguson and Olofsson 2004).

In addition, one major problem for young firms is that they need to develop a network of relationships that provide them with the necessary knowledge to promote their business development (Schutjens and Stam 2003). Young firms need technical knowledge, related to new production processes, product development, or more efficient machinery; market knowledge such as client preferences, failures in the product offered or factors that influence sales evolution; and managerial knowledge related to how to run the business or integrate different activities and functions inside the firm (Sammarra and Biggiero 2008). Inside parks, the existence of a network configured by firms in different development stages, and from varied industries, allows them to exchange their respective knowledge in a complementary way (Löwegren 2003). In a similar vein, the existence of an active park management can provide business advice and the experience of other organizations from inside or outside the park, and it can generate collective knowledge and learning among its members (McAdam and McAdam 2008). In general, this proximity to external knowledge sources is expected to improve young companies’ performance allowing them to compensate their lack of internally developed technological capabilities with external sources. They also find it easier to incorporate new ideas and process internally as they have not yet developed strong routines or assets (Gopalakrishnan and Bierly 2006).

Nevertheless, as firms get older the benefits of the park are brought into question. In fact, many parks have developed exit policies that foster firms leaving the park when their incubation time is up – typically after 2 or 3 years. From the network perspective it has been pointed out that older firms would be less interested in developing local networks because they have already acquired their own experience and knowledge from their own products and markets. Instead of investing on local interactions with younger and less experienced firms, old firms can learn about the technological, managerial and competitive environments directly by their own experience. Moreover, they can establish relationships with distant agents that provide a source of knowledge they can use to improve their performance (Belso-Martinez 2006; De Martino et al. 2006; Hendry et al. 2000).

From evolutionary theories (Nelson and Winter 1982) it has been also considered that as firms get older, they suffer a kind of liability of obsolescence, because older firms become inertial, inefficient and unresponsive to changes in their external environment (Henderson 1999). Firms tend to follow path-dependent learning processes, mainly rooted in their existing assets, routines and procedures, making it difficult to develop new processes (Teece et al. 1997). As firms age, they develop organizational principles that reduce their flexibility in terms of incorporating knowledge provided nearby (McCann and Folta 2011). Inside firms, core organizational routines are subject to inertial pressures that reduce firms’ capacity to introduce new practices that are far from their existing routines, languages and practices (Nelson and Winter 1982).

As a consequence, firms would become increasingly unable to generate new or important innovations as they age because their structures and routines become institutionalized over time. Moreover, there are political pressures inside firms – i.e. career interests, investment in specific clients, employees’ specialization in certain market niches, etc. – that also restrict the range of organizational actions (Sorensen and Stuart 2000). In this context, age would be negatively related to performance and the benefits of belonging to the park would be negligible. Young firms usually lack of these focused routines, being more flexible in their behavior and more eager to learn from others, and their employees have not invested much in their current organization, so they are not threatened by new external ideas. As firms become more rigid, they will become less sensitive to external knowledge sources that could imply developing new abilities in a certain domain (Gopalakrishnan and Bierly 2006).

Based on that, we can propose that:

-

Hypothesis 2. “As firms age, the positive effects of parks on performance tend to be reduced”.

3 Empirical evidence

3.1 Methodology

The data used in this research is from the Spanish Technological Innovation Panel (henceforth, PITEC),Footnote 1 an annual survey of the innovation activities of Spanish firms set up by the Spanish Statistical Office (INE), the Spanish Foundation for Science and Technology (FECYT), and the Cotec Foundation for Technological Innovation with the objective of providing data from the Community Innovation Survey (CIS). Although Spanish PITEC offers panel data from 2004, our study covers the 2007–2012 period because the science park location information is only available from 2007 onwards.

PITEC is suitable to examine the effect of the economic activity’s maturity and the firm’s age on firm performance when belonging to a science and technological park. First, it comprises a representative sample of the population of Spanish firms in the manufacturing and service sectors. Secondly, the PITEC provides the setup year so we may take into consideration the firm’s age. Finally, this survey can identify whether a firm is located in a science and technology park.

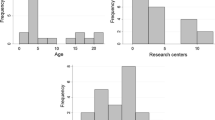

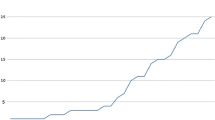

Figure 1 presents the evolution of on- and off-park firms from 2007 to 2012 in PITEC, taking into account not only movements to and from the park, but also firms that just disappear or begin to exist in this period. Nearly seventy per cent of firms that were in science parks in 2007 survived to 2012. Eighteen percent of the 11,156 firms that were off-park had ceased trading by 2012.

3.2 Operationalization of variables

Despite its relevance, research into a firm’s performance suffers from lack of consensus on how to measure this construct (Delmar et al. 2003). We advocate using the same theoretical model on several performance dimensions, firm growth and firm innovation, treating them independently.

To measure firm growth, we calculated the annual average growth of employment and sales for each firm, as already done by prior research in this area (Brixy and Kohaut 1999; Capelleras et al. 2014; Evans 1987):

where log sales t and log employment t are the logarithms of the values for sales and employment at time t and sales t-1 and employment t-1 are the these values at time t-1. Thus, these variables measure a firm’s sales or employment growth rate at time t with respect to time t-1, assuming an exponential growth trend.

We use absolute growth measures rather than relative measures because we try to evaluate annual changes in sales not conditioned by firms’ size (we already control for it). Relative measures tend to ascribe higher growth to smaller firms, getting easily a high relative growth, while large firms would have more difficulties in reaching the same level of growth (Delmar 1997; Gatrell and Reid 2006). In our sample of firms, most of them are small and medium firms, thus, we have chosen an absolute measure. To measure firm innovation performance, we used the percentage of sales from new products, given that it reflects the success of new businesses (Cassiman and Veugelers 2006). In particular, we used the variable radical innovation capacity, which measures the fraction of a firm’s turnover pertaining to products new to the market, and the variable innovation capacity, which represents the fraction of a firm’s turnover pertaining to products new to the firm or new to the market.

To measure the park effect we created a binary variable called belonging to a park that takes a value of 1 if the firm is located on a science and technological park and zero otherwise, following previous literature (Colombo and Delmastro 2002; Siegel et al. 2003b; Ferguson and Olofsson 2004; Yang et al. 2009).

Industry maturity was measured by a continuous variable that takes into account sales evolution over time, mainly according to Bos et al. (2013). Other authors have also used a sales based measurement although in a binary way (Audretsch 1987; Nyström 2005). In particular, we first estimated the following equation for every economic activity j:

where ln(S jt ) is the log of real sales in economic activity j at time t, and t and t 2 is time (1 in 2002) and time squared.

We construct a continuous measure of industry maturity by economic activity by considering the effect of an increase of t on the log of real sales and define economic activity j’s maturity at time t as:

Mjt is decreasing in sales growth as it is derived from the negative sign of the Eq. (2). As a result, the highest values of Mjt represent economic activities with the lowest sales growth.

Table 1 shows the average economic activity-specific maturity estimates as well as the estimated coefficients from Eq. 1.

We define a firm’s age as the number of years elapsed since the year of establishment (Liskey 2008).

We also control factors that are traditionally found to affect a firm’s performance. First, we take into account the firm’s innovation effort intensity. There is a lack of uniformity in how innovation is measured, encompassing a wide variety of methods throughout the literature, such as R&D (O’Regan et al. 2006), R&D intensity (Hitt et al. 1997) and R&D manpower (Sher and Yang 2005). We use an input indicator, the innovation expenditures as a percentage of turnover. This indicator includes not only spending on internal and external R&D, but also non-R&D expenditures such as training, introducing innovation into the market and advertising (Díez-Vial and Fernandez-Olmos 2014).

Firm size also appears as a control variable in many empirical studies on business performance. Since large firms are more likely to exploit economies of scale (Mansfield 1962) and to have broader pools of qualified human resources (Chen and Yang 2009), this variable is expected to have a positive effect on business performance. In line with previous literature, we define firm size as the natural logarithm of the number of employees (Liskey 2008).

3.3 Results

Preliminary analysis was conducted to determine the relationships between each of the explanatory variables used in the regression. Table 2 provides means and standard deviations of the variables as well as Spearman’s correlationsFootnote 2 for each pair. It demonstrates that innovation intensity, firm size, park, maturity and firm age tend to be correlated, but there is no severe multicollinearity.

3.3.1 Firm growth

We conducted several tests to identify the best statistical model for each dependent variable of firm growth, sales growth and employment growth. We obtained similar results for both variables. We performed the Breusch-Pagan LM test and concluded that the panel model data is better than the pooled OLS model. Next we performed the Wooldridge test to choose between a fixed-effects and a random-effects model. The Wooldridge test rejects the fixed-effects model. Likewise, both autocorrelation and heteroskedasticity are detected in panel data analysis. Thus, we implement the panel corrected standard errors because, besides being autocorrelation and heteroskedasticity consistent, they are robust in terms of temporal dependence (see Table 3).

3.3.2 Firm innovation capacity

The standard regression approach is not appropriate when the distribution of the dependent variable exhibits censoring at zero, as happens in innovation capacity and radical innovation capacity. In a dynamic random effect framework, the Tobit model is applied for each one (see Table 4).

We have run four separate regressions for each dependent variable (sales growth, employment growth, radical innovation and innovation), to test the stability of the results. The first regression is the baseline model that only includes the control variables (Models I, V, IX and XIII). The second regression displays the independent variables without interaction variables (Models II, VI, X and XIV). The third regression is estimated with all the variables (Models III, VII, XI and XV) and finally the four regression is estimated with all the variables (Models IV, VIII, XII and XVI) but without quadratic effects for the variables age and maturity. We obtain stable results through each dependent variable.

For each firm performance measurement, there is a negative relationship between greater combined maturity and park location with greater firm performance, which supports Hypothesis 1. Likewise, the parameter estimate for the interaction belonging to a park*firm age was negative and significant,Footnote 3 following the logic of hypothesis 2.

The substantive results of the independent variables were identical to the different firm performance measurements, with the exception of industry maturity. A positive relationship between being located in a park and firm performance has been widely supported. We also found that maturity has a non-linear effect for firm growth, suggesting that less mature and more mature industries outperform in sales and employees those middle-mature industries. However, a greater level of maturity for the firm’s economic activity resulted in worse firm innovation performance, and this negative effect is exponential. Finally, there is a quadratic relationship between firm age and firm performance, that is, younger and older firms outperform in firm performance (growth and innovation) those middle-aged firms (Almus and Nerlinger 1999).

With respect to the control variables, the variable innovation intensity, innovation expenditures, presents a different effect depending on the dependent variable: negative and significant with sales growth, positive and significant with employment growth, and not significant with both measures of innovation performance. Finally, greater firm size resulted in better firm performance on all measurements.

3.4 Discussion

Considering that the main objective of this paper is to evaluate the benefits of the park according to changes in the industry and the firm, we have evaluated them in terms of consequences to both firm growth and innovative capacity. In this sense, we firstly observed that belonging to a park has a positive effect on a firm’s growth and innovation capacity, so these locations confer some advantage related to shared equipment, services, human resources, higher reputation and knowledge spillovers. Firms located inside a park can enjoy of human and technological capital, as well as relational capital created by local interactions with other firms and institutions. These results are coherent with previous studies (Lindelöf and Löfsten 2003; Dettwiler et al. 2006) although there is a lack of consensus about the effect of the park on a firm’s profitability. The fact that we observe the same positive effect for variables related to growth and innovation is interesting as previous studies have pointed out that part of the lack of consensus is related to measurement differences (Siegel et al. 2003a; Barbero et al. 2012).

Maturity has a negative effect on firm growth and innovation because as the industry matures, the opportunities to increase sales and innovate tend to fall. Competitive intensity tends to increase and firms find it more difficult to introduce new products or processes that help them stand out against their rivals (Audretsch and Feldman 1996). Moreover, we observe that firms in the middle stages of maturity are the less likely to growth. Maturity has also significant quadratic relationships with innovation, being both coefficients of maturity and its square negatives. This finding suggests that, while firms’ innovation capacity decreases with maturity, it does so at a faster rate during the later maturity years.

Belonging to the park does not attenuate this problem; on the contrary, it accentuates it. Proximity to other firms that might be direct rivals makes it easier for ideas and experience to be transmitted from one firm to other, putting the firm at risk of losing its advantage. The opposite happens when the industry is growing as firms can obtain resources from the park and also benefit from the access to tacit knowledge exchange, so important in the first stages of the life cycle.

In their study on Ontario’s winery industry, (Wang et al. 2013) found that concentrated spaces are more attractive to new investments in the growth stage of the industry. On the contrary, locations in concentrated spaces only prevent mature industry firms from disappearing. In his study on the semiconductor and pharmaceutical industries (Kukalis 2010) also confirmed that isolated firms outperformed clustered firms in the late stages of the industry life cycle.

The interaction term between age and park also has a negative effect on performance. Young firms, as expected, benefit most from local spillovers provided by the park, improving their capacity to grow and innovate. Abundant research has tested the park’s benefit for young firms, particularly new technology based firms (Colombo and Delmastro 2002; Ferguson and Olofsson 2004; Dettwiler et al. 2006). Compared to mature firms, young firms have both more interest in learning from co-located firms and more flexibility to incorporate changes and new ideas into their existing assets and routines. Likewise some authors have pointed out that age of the firm may have a positive effect on innovation because older firms have accumulated experience and developed internal routines and procedures that make them more efficient and more able to include new versions of products or services (Sorensen and Stuart 2000). Nevertheless, empirical evidence tends to indicate that older firms may not benefit from the park that much, mainly due to rigidities and past investments. In order words, within a certain time inside the park, the benefits of this location become negligible. Previous empirical evidence on the relationship between age and innovation was not clearly stated and, in a certain way, this debate can be extended to the benefits of new knowledge on older firms (Sorensen and Stuart 2000).

4 Conclusions and future research lines

The results of this research demonstrate that the temporal dynamics underlying science and technology parks contribute to a better understanding of their benefits over time. These results can help managers decide whether to locate inside or outside the park. Although the park might be considered a source of valuable resources and knowledge for firms, the opportunities to incorporate them into existing activities depend on the novelty of new knowledge in the industry. As the industry matures, the knowledge becomes highly codified and standardized and proximity to new sources of ideas becomes less relevant. In a similar vein, older firms find it difficult to incorporate new knowledge into their existing routines and procedures. As a consequence, firms in mature industries or old ones should carefully consider the benefits that these locations can imply.

These results also have interesting policy implications, related to existing policies established in many parks. Some parks do not set a limit to how long a firm stays in the park, so they can stay as long as they consider useful. The logic of these policies lies in the idea that firms need support to overcome their initial liabilities, but once they are established they should be able to develop independently. In this research, we find similar conclusions although from another point of view: there are few benefits to be gleaned after a certain period. As firms spend more time in the park, the industry evolves and the firms age, so staying too long in the park does not seem to help too much in terms of increasing a firm’s growth and local innovation.

Research results and its own limitations can also be considered as opportunities for new research. First, in this study we have assumed that firms inside the park might benefit from the same knowledge spillovers, but this is not necessarily the case. Each firm establishes a different network of relationships providing a specific knowledge combination that can affect their capacity to grow or innovate. In this research, we did not collect these detailed data, but following Social Network Analysis (Ter Wal and Boschma 2009), an interesting research line could be developed based on measuring these knowledge flows inside the park.

In a similar vein, it would be interesting to evaluate the kind of relationships that firms develop locally and if there is any change over time. Some studies point out that firms tend to change relationships from informal to more formal but there are no conclusive results (Audretsch 1998; Eisingerich et al. 2010). Moreover, it could be stated that the kind of relationships that firms develop affect the extent to which they can exploit local externalities.

We have undertaken the study comparing on-park and off-park firms across time, but it would be interesting to evaluate other agglomerated spaces, such as industrial districts, that share some of the benefits already identified in parks. Firms inside industrial districts tend to share values, norms and experiences, making the sharing of tacit knowledge even easier, but also increasing the risk of leaking codified knowledge in mature stages of the industry. Future research could evaluate how this fact affects the relationships between life cycle and location benefits.

Finally, as a future research line we propose studying the age of the firm in a nonlinear way, as we have already assumed in this study. Firms can grow very differently and age does not imply the same evolution. Previous studies have analyzed this evolution inside parks (McAdam and McAdam 2008) pointing out how, depending on the stage, firms need different kinds of resources to grow.

Notes

An open database available online http://icono.fecyt.es/PITEC/Paginas/descarga_bbdd.aspx

The Kolmogorov-Smirnov test determined that the variables were not normally distributed, so we could not use Pearson’s correlations.

Model XV was nearly significant

References

Ahuja G, Soda G, Zaheer A (2012) The genesis and dynamics of organizational networks. Organ Sci 23:434–448

Allen DN, Mccluskey R (1990) Structure, policy, services, and performance in the business incubator industry. Entrep Theory Pract Vol: 15, No: 2: 61–77

Almeida P, Kogut B (1999) Localization of knowledge and the mobility of engineers in regional networks. Manag Sci 45:905–917. doi:10.1287/mnsc.45.7.905

Almus M, Nerlinger EA (1999) Growth of new technology-based firms: which factors matter? Small Bus Econ 13:141–154

Audretsch D (1987) An empirical test of the industry life cycle. Weltwirtschaftliches Archiv 123(2):297–308

Audretsch DB (1998) Agglomeration and the location of innovative activity. Oxford Rev Econ Poli 14:18–29

Audretsch DB, Feldman MP (1996) Innovative clusters and the industry life cycle. Rev Ind Organ 11:253–273

Bakouros YL, Mardas DC, Varsakelis NC (2002) Science park, a high tech fantasy?: an analysis of the science parks of Greece. Technovation 22:123–128. doi:10.1016/S0166-4972(00)00087-0

Balland PA, De Vaan M, Boschma RA (2013) The dynamics of interfirm networks along the industry life cycle: the case of the global video game industry, 1987–2007. J Econ Geogr 13:741–765. doi:10.1093/jeg/lbs023

Barbero JL, Casillas JC, Ramos A, Guitar S (2012) Revisiting incubation performance. Technol Forecast Soc Chang 79:888–902. doi:10.1016/j.techfore.2011.12.003

Barney J (1991) Firm resources and sustained competitive advantage. J Manag 17:99–120. doi:10.1177/014920639101700108

Baum JAC, Mezias S (1992) Localized competition and organizational failure in the Manhattan Hotel Industry, 1898–1990. Adm Sci Q 37:580–604

Baum JAC, Calabrese T, Silverman BS (2000) Don’t go it alone: alliance network composition and startups’ performance in Canadian biotechnology. Strat Manag J 21:267–294. doi:10.1002/(SICI)1097-0266(200003)21:3<267::AID-SMJ89>3.0.CO;2-8

Bell GG, Zaheer A (2007) Geography, networks, and knowledge flow. Organ Sci 18:955–972. doi:10.1287/orsc.1070.0308

Belso-Martinez JA (2006) Do industrial districts influence export performance and export intensity? Evidence for Spanish SMEs’ internationalization process. Eur Plan Stud 14:791–810

Bos JWB, Economidou C, Sanders MWJL (2013) Innovation over the industry life-cycle: evidence from EU manufacturing. J Econ Behav Organ 86:78–91. doi:10.1016/j.jebo.2012.12.025

Brixy U, Kohaut S (1999) Employment growth determinants in new firms in Eastern Germany. Small Bus Econ 13:155–170

Canina L, Enz CA, Harrison JS (2005) Agglomeration effects and strategic orientations: evidence from the U.S. lodging industry. Acad Manag J 48:565–581

Capelleras JL, Rialp A, Rialp J (2014) Individual and joint effects of export and technological collaboration on SME growth. The 10th Iberian International Business Conference, Zaragoza, Spain, 256th and 27th September 2014.

Cassiman B, Veugelers R (2006) In search of complementarity in innovation strategy: internal R&D and external knowledge acquisition. Manag Sci 52:68–82

Chan KF, Lau T (2005) Assessing technology incubator programs in the science park: the good, the bad and the ugly. Technovation 25:1215–1228. doi:10.1016/j.technovation.2004.03.010

Chandler G, Baucus D (1996) Gauging performance in emerging businesses: longitudinal evidence and growth pattern analysis. In: Reynolds P, Birley S, Butler J et al (eds) Frontiers of Entrepreneurship Research, Babson Par 491–504

Chen KH, Yang CH (2009) Are small firms less efficient? Small Bus Econ 32(4):375–395

Clarysse B, Wright M, Lockett A et al (2005) Spinning out new ventures: a typology of incubation strategies from European research institutions. J Bus Ventur 20:183–216. doi:10.1016/j.jbusvent.2003.12.004

Colombo MG, Delmastro M (2002) How effective are technology incubators? Evidence from Italy. Res Poli 31:1103–1122

De Martino R, Mc Hardy Reid D, Zygliodopoulos SC (2006) Balancing localization and globalization:exploring the impact of firm internationalization on a regional cluster. Entrep Reg Dev 18:1–24. doi:10.1080/08985620500397648

Delmar F (1997) Measuring growth: methodological considerations and empirical results. In: Donckels R, Miettinen A (eds) Entrepreneurship and SME research: on its way to the next millennium. Ashgate, Aldershot, pp 199–216

Delmar F, Davidsson P, Gartner WB (2003) Arriving at the high-growth firm. J Bus Ventur 18:189–216. doi:10.1016/S0883-9026(02)00080-0

Dettwiler P, Lindelöf P, Löfsten H (2006) Utility of location: a comparative survey between small new technology-based firms located on and off science parks—Implications for facilities management. Technovation 26:506–517. doi:10.1016/j.technovation.2005.05.008

Díez-Vial I, Fernandez-Olmos M (2014) Knowledge spillovers in science and tecnology parks: how can firms benefit most? The Journal of Technology Transfer, 40(1) 70–84

Eisingerich AB, Bell SJ, Tracey P (2010) How can clusters sustain performance? The role of network strength, network openness, and environmental uncertainty. Res Poli 39:239–253. doi:10.1016/j.respol.2009.12.007

Evans DS (1987) Tests of alternative theories of firm growth. J Polit Econ 95:657–674

Expósito-Langa M, Molina-Morales FX (2010) How relational dimensions affect knowledge redundancy in industrial clusters. Eur Plan Stud 18:1975–1992. doi:10.1080/09654313.2010.515817

Expósito-Langa M, Molina-morales FX, Capó-Vicedo J (2011) New product development and absorptive capacity in industrial districts: a multidimensional approach. Reg Stud 45:319–331. doi:10.1080/00343400903241535

Felsenstein D (1994) University-related science parks - ‘seedbeds’ or “enclaves” of innovation? Technovation 14:93–110

Ferguson R, Olofsson C (2004) Science parks and the development of NTBFs— Location, survival and growth. J Technol Trans 29:5–17. doi:10.1023/B:JOTT.0000011178.44095.cd

Filatotchev I, Liu X, Lu J, Wright M (2011) Knowledge spillovers through human mobility across national borders: evidence from Zhongguancun Science Park in China. Res Poli 40:453–462. doi:10.1016/j.respol.2011.01.003

Fukugawa N (2006) Science parks in Japan and their value-added contributions to new technology-based firms. Int J Ind Organ 24:381–400. doi:10.1016/j.ijindorg.2005.07.005

Gatrell J, Reid N (2006) A geographic perspective on economics, environments and ethics. Springer, The Netherlands

Ghemawat P (2010) Finding your strategy in the new landscape. Harv Bus Rev 88:54–60

Gilsing V, Nooteboom B, Vanhaverbeke W et al (2008) Network embeddedness and the exploration of novel technologies: technological distance, betweenness centrality and density. Res Poli 37:1717–1731. doi:10.1016/j.respol.2008.08.010

Gittelman M (2007) Does geography matter for science-based firms? Epistemic communities research and patenting in biotechnology. Organ Sci 18:724–741

Gopalakrishnan S, Bierly PE (2006) The impact of firm size and age on knowledge strategies during product development: a study of the drug delivery industry. IEEE Trans Eng Manag 53:3–16

Grant RM (1996) Toward a knowledge-based theory of the firm. Strat Manag J 17:109–122. doi:10.2307/2486994

Gulati R (1998) Alliances and networks. Strat Manag J 19:293–317. doi:10.2307/3094067

Hansson F, Husted K, Vestergaard J (2005) Second generation science parks: from structural holes jockeys to social capital catalysts of the Knowledge society. Technovation 25:1039–1049

Henderson AD (1999) Firm strategy and age dependence: a contingent view of the liabilities of newness, adolescence, and obsolescence. Adm Sci Q 44:281–314

Hendry C, Brown J, Defillippi R (2000) Regional clustering of high technology-based firms: opto-electronics in three countries. Reg Stud 34:129–144

Hitt M, Hoskisson RE, Kim H (1997) International diversification: effects on innovation and firm performance in product‐diversified firms. Acad Manag J 40(4):767–798

Inkpen AC, Tsang EWK (2005) Social capital, networks, and knowledge transfer. Acad Manag Rev 30:146–165. doi:10.5465/AMR.2005.15281445

Johannisson B (1998) Personal networks in emerging knowledge-based firms: spatial and functional patterns. Entrep Reg Dev 10:297–312

Kalnins A, Chung W (2004) Resource-seeking agglomeration: a study of market entry in the lodging industry. Strat Manag J 25:689–699. doi:10.1002/smj.403

Karniouchina EV, Carson SJ, Short JC, Jr DJK (2013) Research notes and commentaries extending the firm vs. Industry debate: does industry life cycle stage matter? Strat Manag J 34:1010–1018. doi:10.1002/smj

Kogut B, Zander U (1992) Knowledge of the firm, combinative capabilities, and the replication of technology. Organ Sci 3:383–397

Kraatz MS, Zajac EJ (2001) How organizational resources affect strategic change and performance in turbulent environments. Organ Sci 12:632–657. doi:10.1287/orsc.12.5.632.10088

Kukalis S (2010) Agglomeration economies and firm performance: the case of industry clusters. J Manag 36:453–481. doi:10.1177/0149206308329964

Langlois RN (1992) Transaction-cost economics in real time. Ind Corp Chang 1:99–127

Lazaric N, Longhi C, Thomas C (2008) Gatekeepers of knowledge versus platforms of knowledge: from potential to realized absorptive capacity. Reg Stud 42:837–852. doi:10.1080/00343400701827386

Levin DZ, Cross R (2004) The strength of weak ties you can trust: the mediating role of trust in effective knowledge transfer. Manag Sci 50:1477–1490. doi:10.1287/mnsc.1030.0

Liebeskind JP, Oliver AL, Zucker L, Brewer M (1996) Social networks, sourcing in new learning, scientific and flexibility: knowledge biotechnology firms. Organ Sci 7:428–443

Lindelöf P, Löfsten H (2003) Science Park location and new technology-based firms in Sweden – Implications for strategy and performance. Small Bus Econ 20:245–258

Liskey M (2008) Knowledge spillovers from public research institutions: evidence from Japanese high-technology start-up firms, chapter 9. In: A Groen, P Van Der Sijde, R Oakey, G Cook (eds) New technology-based firms in the new millennium (New Technology-Based Firms in the New Millennium, Emerald Group Publishing Limited: 117–145

Löfsten H, Lindelöf P (2005) R&D networks and product innovation patterns—academic and non-academic new technology-based firms on science parks. Technovation 25:1025–1037. doi:10.1016/j.technovation.2004.02.007

Löwegren M (2003) New technology-based firms in science parks: a study of resources and absorptive capacity. Lund University Press, Sweden

Mansfield E (1962) Entry, Gibrat’s Law, Innovation, and the growth of firms. Am Econ Rev 52(5):1023–1051

March JG (1991) Exploration and exploitation in organizational learning. Organ Sci 2:101–123

Massey D, Quintas P, Wield D (1992) High-tech fantasies: science parks in society, science and space. Routledge, London

McAdam M, McAdam R (2008) High tech start-ups in University Science Park incubators: the relationship between the start-up’s lifecycle progression and use of the incubator’s resources. Technovation 28:277–290. doi:10.1016/j.technovation.2007.07.012

McCann BT, Folta TB (2008) Location matters: where we have been and where we might go in agglomeration research. J Manag 34:532–565. doi:10.1177/0149206308316057

McCann BT, Folta TB (2011) Performance differentials within geographic clusters. J Bus Ventur 26:104–123. doi:10.1016/j.jbusvent.2009.04.004

Mcfadyen MA, Cannella AA (2004) Social capital and knowledge creation: diminishing returns of the number and strength of exchange. Acad Manag J 47:735–746

Mian SA (1996) Assessing value-added contributions of university technology business incubators to tenant firms. Res Poli 25:325–335

Mian SA (1997) Assessing and managing the university technology business incubator: an integrative framework. J Bus Ventur 12:251–285

Moran P (2005) Structural vs. relational embeddedness: social capital and managerial performance. Strat Manag J 26:1129–1151. doi:10.1002/smj.486

Nahapiet J, Ghoshal S (1998) Social capital, intellectual capital, and the organizational advantage. Acad Manag Rev 23:242–266

Nelson RR, Winter SG (1982) An evolutionary theory of economic change. Harvard University Press, Harvard.

Nyström K (2005) Firm maturity and product and process R & D in Swedish Manufacturing Firms. Tech. Rep. 39. Centre of Excellence for Science and Innovation Studies, Royal Institute of Technology (39):1–29

O’Regan N, Ghobadian A, Gallear D (2006) In search of the drivers of high growth in manufacturing SMEs. Technovation 26(1):30–41

Owen-Smith J, Powell WW (2004) Knowledge networks as channels and conduits: the effects of spillovers in the Boston Biotechnology community. Organ Sci 15:5–21

Phan PH, Siegel DS, Wright M (2005) Science parks and incubators: observations, synthesis and future research. J Bus Ventur 20:165–182. doi:10.1016/j.jbusvent.2003.12.001

Podolny JM, Page KL (1998) Networks forms of organization. Annu Rev Soc 24:57–76

Polanyi M (1966) The tacit dimension. Anchor Day Books, New York

Powell WW, Koput KW, Smith-Doerr L (1996) Interorganizational and the collaboration locus of innovation: networks of learning in biotechnology. Adm Sci Q 41:116–145

Prahalad CK, Richard AB (1986) The dominant logic: a new linkage between diversity and performance. Strat Manag J 7:485–501. doi:10.2307/2486135

Quintas P, Wield D, Massey D (1992) Academic-industry links and innovation: questioning the science park model. Technovation 12:161–175. doi:10.1016/0166-4972(92)90033-E

Sammarra A, Biggiero L (2008) Heterogeneity and specificity of inter-firm knowledge flows in innovation networks. J Manag Stud 45:800–829

Schutjens V, Stam E (2003) The evolution and nature of young firm networks: a longitudinal perspective. Small Bus Econ 21:115–134

Shaver JM, Flyer F (2000) Agglomeration economies, firm heterogeneity, and foreign direct investment in the United States. Strat Manag J 21:1175–1193

Sher PJ, Yang PY (2005) The effects of innovative capabilities and R&D clustering on firm performance: the evidence of Taiwan’s semiconductor industry. Technovation 25(1):33–43

Siegel DS, Westhead P, Wright M (2003a) Science Parks and the performance of new technology-based firms: a review of recent U. K. Evidence and an agenda for future research. Small Bus Econ 20:177–184

Siegel DS, Westhead P, Wright M (2003b) Assessing the impact of university science parks on research productivity: exploratory firm-level evidence from the United Kingdom. International journal of industrial organization 21:1357–1369

Sorensen JB, Stuart TE (2000) Aging, obsolescence, and organizational innovation. Adm Sci Q 45:81–112

Stinchcombe (1965) Stinchcombe, A. L., & March, J. G. (1965). Social structure and organizations. Advances in strategic management, 17, 229-259.

Teece DJ (1986) Profiting from technological innovation: implications for integration, collaboration, licensing and public policy. Res Poli 15:285–305

Teece DJ, Pisano G, Shuen A (1997) Dynamic capabilities and strategic management. Strat Manag J 18:509–533. doi:10.1002/(SICI)1097-0266(199708)18:7<509::AID-SMJ882>3.0.CO;2-Z

Ter Wal ALJ (2014) The dynamics of the inventor network in German biotechnology: geographic proximity versus triadic closure. J Econ Geogr 14:589–620. doi:10.1093/jeg/lbs063

Ter Wal ALJ, Boschma RA (2009) Applying social network analysis in economic geography: framing some key analytic issues. Ann Reg Sci 43:739–756. doi:10.1007/s00168-008-0258-3

Thornhill S, Amit R (2003) Learning about failure: bankruptcy, firm age, and the resource-based view. Organ Sci 14:497–509

Tushman ML, Tushman ML, O’Reilly CA, O’Reilly CA (1996) Ambidextrous organizations: managing evolutionary and revolutionary change. Calif Manage Rev 38:8–30. doi:10.1080/09652540903536982

Vásquez-Urriago, Á. R., Barge-Gil, A., Rico, A. M., & Paraskevopoulou, E. (2014). The impact of science and technology parks on firms’ product innovation: empirical evidence from Spain. Journal of Evolutionary Economics, 24(4), 835–873

Vedovello C (1997) Science parks and university-industry interaction: geographical proximity between the agents as a driving force. Technovation 17:491–531. doi:10.1016/S0166-4972(97)00027-8

Villasalero M (2014) University knowledge, open innovation and technological capital in Spanish science parks: research revealing or technology selling? J Intellect Cap 15:1469–1930

Wang C, Hsu L, Fang S (2008) The determinants of internationalization: evidence from the Taiwan high technology industry. Technol Forecast Soc Chang 75:1388–1395

Wang L, Madhok A, Li SX (2013) Agglomeration and clustering over the industry life cycle: toward a dynamic model of geographic concentration. Strat Manag J 35:995–1012. doi:10.1002/smj

Westhead P (1997) R&D “inputs” and “outputs” of technology-based firms located on and off science parks. R&D Manag 27:45–62. doi:10.1111/1467-9310.00041

Westhead P, Batstone S (1998) Independent technology-based firms: the perceived benefits of a Science Park location. Urban Stud 35:2197–2219. doi:10.1080/0042098983845

Westhead P, Storey D (1995) Links between higher education institutions and high-technology firms. J Manag Sci 23:345–360

Yang C-H, Motohashi K, Chen J-R (2009) Are new tecnology-based firms located on science parks really more innovative? Res Poli 38:77–85. doi:10.1016/j.respol.2008.09.001

Yli-Renko H, Autio E, Sapienza HJ (2001) Social capital, knowledge acquisition, and knowledge exploitation in young technology-based firms. Strat Manag J 22:587–613. doi:10.1002/smj.183

Zahara AA, George G (2002) Absorptive capacity: a review, reconceptualization, and extension. Acad Manag Rev 27:185–203

Zucker LG, Darby MR, Armstrong J (1998) Geographically localized knowledge: spillovers or markets? Econ Inq 36:65–86

Acknowledgments

Funding for this research was provided by the Spanish Ministry of Science and Innovation (ECO2015-67122-R, ECO2014-57131-R, ECO2011-29445), the Government of Aragón (Spain) and the European Social Fund through the COMPETE research group (S125). The authors are also grateful for the financial assistance obtained through Project ref UZ2016-SOC-01 and project 27242 from the Cátedra de Empresa Familiar (University of Zaragoza) and Grupo de Investigación Consolidado Estrategias de Crecimiento Empresarial (940376) – Universidad Complutense de Madrid.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Diez-Vial, I., Fernández-Olmos, M. The effect of science and technology parks on a firm’s performance: a dynamic approach over time. J Evol Econ 27, 413–434 (2017). https://doi.org/10.1007/s00191-016-0481-5

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00191-016-0481-5