Abstract

This paper compares the technical efficiency of small and medium-sized enterprises (SMEs) with that of large firms and studies the factors influencing technical efficiency for Taiwan’s electronics industry. Unlike conventional studies, we use two alternative approaches to control for the influence of size effect. One is the two-stage switching regression to correct for endogenous size effect on technical efficiency and, the other is, a metafrontier production function for firms in different groups. The main results are as follows. First, the average technical efficiency for large firms is higher than that of SMEs, without considering the size effect, and lower when considering the endogenous choice on firm size. This study cannot, therefore, conclude that there is a negative size–technical efficiency relationship. It however, sheds light on the importance of size effect on the size–technical efficiency nexus. Second, the estimates on the determinants of technical efficiency show that being a subcontractor has a statistically significant positive influence on SMEs’ technical efficiency, but the effect decreases with firm size.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The role of small and medium-sized enterprises (SMEs) in economic development and economic growth for both developed and developing countries has been increasingly recognized.Footnote 1 Moreover, the entry of new firms (usually SMEs) is an important influence on the evolution of market structure and market performance, and it could lead to the erosion of high profits among incumbent firms and lower prices for consumers. If the high rate of entry is associated with a high rate of innovation and an increase in efficiency, then the effect of entry should stimulate growth and development of the market (Geroski 1995). However, the available evidence on the size–efficiency relation seems to strongly indicate that there is a positive association between firm size and technical efficiency, and there are also substantial and persistent productivity differences between SMEs and large firms (henceforth referred to as LEs) independent of sector- and country-specific factors (Taymaz 2005). The apparent contradiction between the size–technical efficiency nexus and the emphasis on the role of SMEs dynamism has raised an important and interesting question: are SMEs really less efficient?

Technical efficiency refers to the ability to minimize input use in the production of a given output vector, or the ability to obtain maximum output from a given input vector.Footnote 2 When we compare the technical efficiency across firms, it is assumed that their production technologies are similar. However, as Pack (1982) noted, technology differences may be important in explaining factor choices across firms of differing size. SMEs have come to be identified with more labor-intensive technologies, whereas LEs are more capital intensive, implying that production frontiers perhaps differ across firms of differing firm sizes. Indeed, the argument that SMEs tend to choose a labor-intensive technology, rather than just choose a labor-intensive point of production, had been supported by literature. In Lau and Yotopoulos (1989, p. 242), it was pointed out that when certain distinct objective conditions are imposed on different groups of firms, the firms in different groups would not operate under an identical frontier. Those conditions depend on specific circumstances, such as the ‘basic economic environment’ and ‘structure of relative prices of inputs.’ Cabral and Mata (2003) had claimed that relatively speaking, the ‘basic economic environment’ faced by SMEs is typically more financially constrained, regardless of the mechanism of raising funds is from the capital market (stocks or bonds), the money market (bank) or their own reserves. Hence, the budget (cost line) and production frontier (iso-quant) faced by SMEs would tend to shrink compared to that faced by LEs. Meanwhile, the ‘structure of relative price of inputs’ faced by SMEs would also differ from that faced by LEs. Although the price of labor input (wage rates) might be similar, the price of capital input (rental prices or interest rates) faced by SMEs would be higher than that faced by LEs, reflecting the risk premium (implies that the slope of the cost line of SMEs is flatter than that of LEs). Under the consideration of comparative advantage, a more labor-intensive technology would be rationally chosen by SMEs. Therefore, based on the distinct frontiers faced by these two firms groups, it is more reasonable to believe that SMEs tend to choose a more labor-intensive technology, rather than just choosing a labor-intensive point of production.Footnote 3

The conjecture that SMEs and LEs might operate under different production frontiers was also proposed from the standpoint of econometrics in Garen (1984, p. 1217); in which, it is indicated that as long as the return on productivity to each size choice is affected by a different disturbance, the disturbance in part determines which choice is made. This choice, in turn, influences the disturbances of equations which determine the returns to the choice. However, existing works distinguish SMEs from LEs in such a way by implicitly treating the size distribution as the whole population, albeit the size distribution of SMEs is in effect truncated. Therefore, the suggested results in previous studies, whereby LEs tend to have a higher technical efficiency than SMEs, are suspect due to the econometric problem of endogenous choice on firm size. Moreover, if SMEs and LEs really operate under different production technologies, the technical efficiencies of firms defined by the stochastic frontier production function model are not comparable. Recently, the stochastic metafrontier model developed by Battese and Rao (2002) provides an alternative approach by which comparable technical efficiencies can be estimated.

From a policy perspective, the identification of the size–technical efficiency relation addresses a number of relevant issues. If there exists a positive relationship between them, then is it important from the standpoint of the overall sector performance that firms grow larger? Given the circumstance of high entry flow with SMEs in many countries, whether there is a negative size–technical efficiency relationship, which supports Roberts and Tybout’s (1996) argument that high turnover rates are beneficial for an industry. In this sense, the empirical evidence is very important in identifying those factors that enhance or threaten the technical efficiency of SMEs, generating information for designing support programs for SMEs, and in identifying the determinants of technical efficiency of LEs. Since production technologies are different between SMEs and LEs, the effects of determinants of technical efficiency are likely to be different between them; but there are little existing works which explore this topic separately. What causes the X-inefficiency is also potentially interesting for our understanding about the relationship between firm performance and firm size.Footnote 4

If there are differences on the determinants of technical efficiency between SMEs and LEs, what plays the central role in differentiating technical efficiency? As mentioned above, SMEs usually adopt more labor-intensive technology relative to their larger counterparts that have higher capital–labor ratios.Footnote 5 Under the differences on production technology, “operating as a subcontractor” (hereafter subcontractor) should act as an important method on improving technical efficiency for SMEs under international division of labor. Within the vertical business groups are groups of core-satellites firms. The “core” firm usually exerts control over the management of other firms in the group, enforced by shareholding, financial ties, and long-term contracts. Alternatively, under a formal or informal relationship, subcontractor firms (usually SMEs) can waive the risk of R&D and the competition in consumer markets. Based on the contract theory, the long-term relationship might work to foster efficient risk-sharing arrangements under incomplete information (Taylor and Wiggins 1997), which is particularly important for SMEs that find it uneasy to survive within an industry. Despite the impact of subcontracting on productivity growth and technical efficiency which has already been analyzed in some studies (for an overview see Heshmati 2003), the role of subcontractors on SMEs’ technical efficiency is discussed less frequently.

Based on these considerations, this article aims to provide empirical evidence on the size–technical efficiency relationship in Taiwan’s electronics industry, attempting to contribute in line with the empirical literature by providing the following three distinct types of empirical evidence. First, one of the features differentiating our study from existing works on the size–technical efficiency nexus is correcting the size effect by employing two alternative approaches: one is the two-stage technique of switching regression to deal with the problem of endogenous choice on firm size, and the other is the stochastic metafrontier model by assuming that they have different technologies and potentially face a common technology frontier. Second, we investigate and compare the determinants of technical efficiency for SMEs and LEs separately. Third, the subcontract strategy that is widely adopted among Asian countries is included to explore the role which the ‘subcontractor’ plays on enhancing technical efficiency for SMEs.

In order to implement the aims of this article, we draw on firm-level data of the electronics industry from Taiwan’s 2001 census data and employ both the switching regression of the stochastic frontier model and the stochastic metafrontier model to estimate the technical efficiency score and determinants of inefficiency. The main findings of this analysis are: first, the average technical efficiency for LEs is larger than that of SMEs without correcting the size effect, whereas the SMEs have a higher technical efficiency when controlling for the endogenous choice on firm size or assuming them to have different production technologies. This result sheds light on the issue of size effect for the size–technical efficiency nexus. Second, the separate estimates on the determinants of inefficiency show that there are substantial differences on determinants that influence the firms’ technical efficiency. In particular, the specialized division of being a subcontractor has a significantly positive impact on improving SMEs’ technical efficiency, while the effect is decreasing as the firm size increases.

The rest of this article is organized as follows: Section 2 introduces the concepts of the role played by the size and subcontractor on technical efficiency and reviews the literature on the relationships between firm size, subcontractors, and technical efficiency. The traditional empirical framework of stochastic frontier production function model, data sources, variable definitions, and empirical results are presented in Section 3. In Section 4, we employ both a switching regression and a stochastic metafrontier model to estimate technical efficiencies for SMEs and LEs and then discuss the estimates for technical efficiency with consideration of the size effect and the determinants of technical efficiency for SMEs and LEs. Concluding remarks are offered in the final section.

2 Firm size, subcontractor, and technical efficiency

2.1 Firm size and technical efficiency

In traditional neo-classical economics, there is no reason to expect that firms of different sizes operate at different levels of technical efficiency, while there are various arguments on the impact of firm size on technical efficiency.

Why are LEs more efficient? In a model of firm growth, Jovanovic (1982) assumed that efficiency plays a significant role in the selection process of the industry dynamic, in which efficient firms grow and survive, while inefficient firms stagnate or exit the industry. Therefore, LEs are more efficient than smaller ones. It is also claimed that LEs could be more efficient in production, because they could use more specialized inputs, coordinate their resources better, enjoy the advantage of scale economies, etc. However, LEs usually live in a more monopolistic environment than SMEs, resulting in a lower incentive to improve technical efficiency.

The less efficient SMEs are often attributed to the following causes: such as their inability to take advantage of scale economies, the difficulties they face in getting access to credit for investment, the lack of resources in terms of qualified human capital, and the informality of contracts with clients and suppliers (Alvarez and Crespi 2003). Alternatively, it is emphasized that SMEs could be more efficient, because they have flexible, non-hierarchical structures, and do not suffer from the agency problem. Actually, SMEs are created and die easily. The successful SMEs turn into LEs as with Jovanovic’s (1982) argument. Those who fail are soon replaced by their better peers. Thus, SMEs act as the most competitive players in a Darwinian sense. They are exposed to more competition than larger firms and respond quickly to outside change. Therefore, in the test of a changing environment, perhaps small business prove to be the fittest form of an organization. In this sense, SMEs should have a higher technical efficiency on average.

While much of the analysis of size and technical efficiency has used macro and sector data, over the past two decades a large number of empirical studies using firm-level datasets have arisen. Table 1 presents a list of relevant studies that have been conducted, since the 1990s.Footnote 6 It can be seen clearly that these studies on the relationship between firm size and technical efficiency have not generated unambiguous results, although most of them suggest that LEs tend to be more efficient than SMEs. The two exceptions to this pattern are Biggs et al. (1996) and Hu and Schive (1997).

On the study of African enterprises, Biggs et al. (1996) argued that the size–technical efficiency relationship is positive for SMEs and negative for LEs, implying that there is an inverted U-shaped association between firm size and technical efficiency. This pattern is detected in three of the four sectors (food, wood, textile, and metal sectors), where medium-sized firms (50–199) are the most efficient. Hu and Schive (1997) adopted the transcendental logarithmic production function to estimate the technical efficiency (Farrell index) for Taiwan’s nine manufacturing industries and found that SMEs tend to have a higher level of technical efficiency in four industries. Their findings show the flexibility and better internal performance of SMEs among Taiwan manufacturers.

2.2 Subcontractor and technical efficiency

Efficient firms allocate their resources to activities which enjoy a comparative advantage. Among them, subcontracting has become an increasingly popular alternative for firms worldwide.Footnote 7 Subcontracting is expected to involve production cost savings relative to internal production, because outside suppliers benefit from economies of scale, smoother production schedules, and production specialization (Abraham and Taylor 1996). Is subcontracting value enhancing to the firm engaging in the subcontracting strategy? If firms are profit maximizers and act rationally, then the answer to the question should, of course, be an affirmative. A few studies have found that the impact of subcontracting on the firm’s technical efficiency is significantly positive (see Heshmati 2003 for an overview).

On the other hand, the relative advantages of production for SMEs are more flexibility in production and they usually work as subcontractors for LEs in many Asian countries (Kimura 2002), implying that this strategy should be helpful for SMEs to survive and to improve their technical efficiency. That is, the operation modes of “subcontracting” and “subcontractor” might be a win–win strategy. Why might subcontractors have a higher technical efficiency? The first reason is the factor division. SMEs are usually identified with more labor-intensive technologies and they lack the external financing sources for R&D investment and the purchase of advanced technology. Therefore, SMEs that work as subcontractors can reduce the risk of R&D and specialize on the production side to meet the needs of LEs to subcontract intermediate goods, when parts and components are unskilled and customized. This division on production can improve technical efficiency for SMEs. The second is the reduction of market uncertainty. SMEs find it uneasy to survive within the industrial environment of tough competition. Under the formal or informal relationship of subcontracting systems, they can keep a stable long-term inter-firms relationship with the parent firms. From the point of contract theory, the long-term cooperative relation works to foster efficient risk-sharing arrangements under incomplete information. Subcontractor firms can therefore, waive the uncertainty and competition faced in consumer markets. As it is well known to economists, the source of inefficiency can be largely attributed to the uncontrollable influences of environmental variables. As the uncertainty of consumer markets is lowered, a firm should have a higher technical efficiency.

The limited empirical studies contributing to the relationship between subcontracting and productivity concentrate on the role of subcontracting rather than the subcontractor. Fixler and Siegel (1999) found a positive correlation between productivity and subcontracting. In Glass and Saggi (2001), firms are able to subcontract the basic production of intermediate goods and keep in-house the production of more technologically advanced final goods. This subcontracting leads to reductions in marginal costs, which increase the profits for firms that do subcontract relative to those who do not. Taymaz and Saatci (1997) and Taymaz (2005) investigated the effect of subcontracted output (measured as the proportion of outputs subcontracted by other firms) on Turkish firms’ efficiency and found mixed results across industries.

There are two points worth noting after reviewing the literature. First, we find that theoretical and empirical works on firm size and technical efficiency obtain ambiguous results, suggesting more empirical investigation is needed. More importantly, the mixed conclusion on the efficiency effect of firm size perhaps arises from the endogenous problem of the size choice or they are essential operations under different technologies that were not as well considered in previous studies. Second, although the role of subcontracting on firm performance is increasingly emphasized, the role of the ‘subcontractor’ that is widely adopted by SMEs is never empirically investigated.

3 Technical efficiency analysis without firm size

3.1 Stochastic frontier production model

In order to investigate the relationship between firm size and technical efficiency, a translog specification of a stochastic frontier production function (Aigner et al. 1977) is used extensively in previous studies, because it is a second-order approximation to any arbitrary function. It can be specified as:

where y i is the value-added and is measured as output minus the costs for raw materials and indirect inputs, and x i is a vector of inputs for firm i. The subscripts j and k index inputs (j, k = K, capital; L, labor). These variables are all taken in a natural logarithmic form. The term v i is assumed to be independent and identically distributed as N(0,δ 2 v ). The u-term is assumed to be independent of the v-term, and to be a non-negative random variable accounting for firm-specific technical inefficiency in production. Furthermore, the technical efficiency of a firm is specified as the ratio of its actual output to the potential output. Typically, the technical efficiency of production for the ith firm is defined by:Footnote 8

In addition, the u-term is also assumed to be independently distributed as truncations at zero of the N(m i ,δ 2 u ) distribution; and,

where, the z i is a vector of firm- and industry-specific factors that influence technical efficiency; and the β represents the parameters. Thus, the approach adopted here is the single-stage estimation procedure proposed by Battese and Coelli (1995).Footnote 9

3.2 Data sources and variables

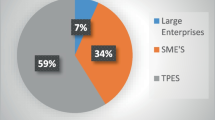

The stochastic production frontiers for all electronics firms in Taiwan are estimated by using cross-sectional data for all firms in the year 2001. The data source is the Industry, Commerce and Service Census (ICS census henceforth) conducted by the Directorate-General of Budget, Accounting and Statistics of Taiwan. The electronics industry that we designate is the two-digit SIC industry (SIC 31), the Electrical Machinery and Electronics Industry. There are 7,590 firms in the database where 7,122 firms are classified into the category of SMEs and the other 468 firms belong to LEs.Footnote 10 This ICS census includes elaborate information on the volume or value of raw data, such as expenditures on raw materials, energy, research and development activities, licenses, sales, and so forth. It thus enables us to utilize the information to calculate and to construct the variables concerning the production function, and the firm- and industry-specific characteristics for the empirical works.

The output variable is the value-added measured as the sum of operating income minus the sum of expenses on raw materials, energy, and electricity. The capital input (k) is measured as the net amount of operating fixed assets. The labor input (l) is measured as the yearly total wage payment. These variables for the production function are all taken in natural logarithmic form.

In order to explore the determinants of technical efficiency, two categories of influences are used in Eq. 3, including firm-specific and industry-specific characteristics. The variables for firm characteristics include:

F-age: Firm age denotes the firm’s operating age which is measured as the sum of the value of 2001 minus the starting year of the firm plus the ratio of 12 minus the starting month to 12. The age–technical efficiency relationship has been estimated to be negative in some studies (Hill and Kalirajan 1993), positive in others (Biggs et al. 1996), or have no effect (Lundvall and Battese 2000). The positive effect is explained as a learning effect, whereas the negative effect is explained in that older firms tend to employ older rather than advanced technologies, which is less productive than younger firms.

F-welfare: This variable represents the welfare expenditure per employee of the firm. It is used as a proxy for the degree of an employee’s loyalty and/or effort. As it is well known, one of the effective treatments for the principle-agent problem is offering a sufficient incentive. If an enterprise offers a large amount of additional welfare for employees, such as bonuses, childcare, leisure subsidies, and so on, then the employees should devote a higher effort on average. Therefore, we expect that welfare is associated with a significant positive impact on technical efficiency.

F-export: This variable shows the export intensity of the firm and is defined as the share of exporting sales to total sales. Exporting can act as a channel for learning and technological advancement for the economic development of small open economies, like Taiwan. Empirical studies find that exporting has a significantly positive impact on productivity for Taiwanese electronics firms (Aw and Huang 1995; Yang 2003), implying that the impact of export on a firm’s technical efficiency should be significantly positive.

F-RD: The term F-RD is a firm’s R&D intensity measured as the ratio of R&D expenditure to sales. This variable is employed to represent a firm’s technological capability, which is widely regarded as one of the major sources on improving technical efficiency. Aw and Batra (1998) estimated the correlation of a firm’s technical efficiency with R&D for Taiwanese manufacturing firms and found that R&D has a positive impact on firms’ technical efficiency. Therefore, we predict that there is a positive association between F-RD variable and efficiency.

F-Suboutput and F-SubD: The F-Suboutput and F-SubD variables are used to capture the effects of being a subcontractor, particularly in the role for SMEs. The F-Suboutput variable is “subcontractor intensity” which measures the proportion of output subcontracted by other firms. The F-SubD variable is a dummy variable, which takes the value of 1 if the firm has output subcontracted by other firms. As mentioned in Sect. 2, how to reduce market uncertainty is important for SMEs to survive. Among them, a close interfirm relation, such as a core-satellite system is an important industrial organization for Asian countries. If networking in the form of being a subcontractor enhances technical efficiency, then the impact of F-Suboutput and F-SubD variables on technical efficiency will be positive. Moreover, we also add the interaction term of subcontractor and size.

As for the industry-specific characteristics, the following six potential influences are included.

I-MES and I-KL: These two variables are concerned with the degree of barriers to entry. I-MES indicates the minimum efficient scale measured as the ratio of the average size of the largest 50% of firms to the average size of all firms, in terms of employees within the 4-digit industry. I-KL is measured as the ratio of the book value of fixed capital stock to labor within the 4-digit industry. A higher I-MES or I-KL represents that the industrial environment is hard for SMEs to enter and that it might enable incumbents to pay less attention on improving technical efficiency, especially for LEs.

I-RD: This variable shows the RD intensity of the 4-digit industry where a firm is located. Industrial R&D intensity is stressed as one kind of entry barrier in some studies (Bunch and Smiley 1992), but others argue that it represents the extent of innovative opportunity (Marsili 2002). Therefore, the impact of I-RD on technical efficiency is hard to judge a priori.

I-profit: This represents the average profitability of the 4-digit industry that a firm belongs to.

I-scale: This refers to the scale of industry in terms of the overall number of employees in the thousands. A larger scale industry might provide greater market share for incumbents or market room for new ventures. We expect that the industry scale is associated with a positive impact on technical efficiency.

I-Suboptimal: The I-Suboptimal variable is measured as the employment proportion of firms smaller than MES to total industry employment, representing the size advantages of being smaller than the MES. The market structure of Taiwan’s manufacturing sector is dominated by a large share of SMEs. Since a larger I-Suboptimal accommodates more SMEs to survive, we predict that there is a positive impact of the I-Suboptimal variable on technical efficiency, especially for SMEs.

The variable definitions and basic statistics for these variables are summarized in Table 2.

3.3 Estimating results

Without considering the size effect, the estimates of the conventional stochastic frontier model, defined by (1), are obtained for all firms using the FRONTIER 4.1 (Coelli 1996). Table 3 shows the parameter estimates for inputs and determinants. The estimated coefficient on capital is 0.105 and that on labor is 0.738, and both are significant at 1%.Footnote 11

Concerning the determinants of technical efficiency for all electronics firms, all the factors included exhibit significant impacts on the firms’ technical efficiency. According to the specification of the one-step approach, variables with negative coefficients imply that there is a positive impact on technical efficiency, whereas variables with a positive coefficient are negatively associated with technical efficiency.

The estimates for variables of firm characteristics show that a firm with a larger age or welfare expenditure has a higher technical efficiency. It can be attributed to the learning effect and the fact that a higher welfare expenditure per employee can lower the mobility of employees and raise employees’ loyalty and/or effort. Additionally, consistent with the literature studying the relationship between export and productivity in Taiwan (Aw et al. 2001; Yang 2003), our results suggest that a firm with a higher export intensity would exhibit a better performance on technical efficiency. Moreover, this efficiency enhancement effect also applies for R&D efforts in which R&D plays an important role on promoting technical efficiency for Taiwan’s electronics firms.

One interesting and important point worth noting is that the coefficient for subcontractor intensity variable is significantly negative, implying a positive association between subcontractor intensity and technical efficiency for electronics firms. It can be interpreted that a firm can potentially improve its technical efficiency by operating as a subcontractor. We also find a positive coefficient for the interaction term between firm size and the use of subcontractors, showing that the marginal effect of subcontractor intensity on technical efficiency decreases as the firm size increases.

There also exist significant sector effects after controlling for firm characteristics. Overall, an industry with a higher MES and R&D intensity exhibits a negative association with firms’ technical efficiency. A possible explanation is that a more monopolistic environment might encourage firms to live leisurely and pay less attention to increasing technical efficiency. Furthermore, an industry with a higher sub-optimal scale will overall stimulate a firm to increase its technical efficiency. However, firms located in an industry with a larger scale tend to have a lower technical efficiency.

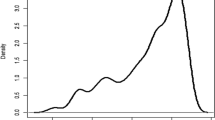

The main issue, which this article is focused on is whether SMEs are really less efficient in terms of technical efficiency than their larger counterparts. In order to obtain a first indication of the size–technical efficiency relationship, we can focus on the calculated average technical efficiencies of LEs and SMEs shown in Table 4. For all samples of the 2-digit electronics industry, the average technical efficiency for LEs is 0.704, which is slightly larger than that of 0.690 for SMEs. However, the difference between them is not statically significant, implying that the mean technical efficiency of LEs and SMEs seems to be indifferent. However, when looking further at the sub-sector of the 3-digit industry, it can be found clearly that there are four industries with a positive difference in favor of LEs, while SMEs seem to perform at a higher technical efficiency within only one industry. The overall analysis reveals that LEs tend to outperform SMEs on technical efficiency as with findings in most studies. The range of the mean technical efficiencies is 0.648–0.770, which indicates a moderate technical efficiency for Taiwan’s electronics industry. This result suggests that a substantial proportion of the total variability is associated with technical inefficiency of production. Thus, identifying the factors influencing technical efficiency is a crucial issue for firms to improve their technical efficiencies.

4 Technical efficiency analysis with the size effect

As mentioned above, however, the size effect of technical efficiency is potentially an endogenous problem in that the choice of optimal factor inputs across firms of differing sizes is based on a firm’s scale and the requirement of production technology. Moreover, firms with different sizes might essentially operate under different production technologies, implying that the technical efficiencies of firms defined by a stochastic frontier production function model are not comparable. If so, are SMEs still less efficient compared with their larger counterparts? In this section, we employ two alternative approaches to compare technical efficiencies between LEs and SMEs by considering this size effect.

4.1 Endogenous size effect: switching regression of the stochastic frontier production model

As discussed in Orea and Kumbhakar (2003), when firms in an industry use different technologies, to estimate an identical frontier function encompassing every firm may not be appropriate. In order to reduce the likelihood of the misspecification, researchers often estimate frontier functions by classifying the firms into certain categories and then separate analyses are carried out for each group. However, it would be problematic as this procedure does not use information contained in one class to estimate the technology of firms that belong to other classes, if these firms are coming from the same industry and share some common features (Orea and Kumbhakar 2003). In order to remedy the problem, we use a two-stage approach combining the switching regression and the stochastic frontier production model in this article.Footnote 12 First, we consider a random sample of N firms in which Mfirms are LEs and the remaining are SMEs and define firm size for firm i to be a dichotomous outcome S i , which is given by:

Here, S i represents the firm size category for firm i that it is divided into two categories, LEs and SMEs. Term H * i denotes the critical size of 200 employees, which is chosen according to the identification of SMEs under the Small and Medium Enterprise Administration, Ministry of Economic Affairs of Taiwan.

Let the firm size be determined by a vector of firm- and industry-specific variables (w q ) and specified as below:

Employing the econometric technique of the probit model to estimate Eq. 5 and according to the two-step procedure proposed by Heckman (1979), the selectivity terms (inverse Mill’s ratio) for LEs and SMEs can be calculated by the following Eqs. 6 and 7, respectively:

where Φ is the cumulative function of the standard normal distribution and ϕ is the density function.

In the second stage, we add the selectivity variable λ L i and λ S i as regressors into the original stochastic frontier production function defined as Eq. 1 for both LEs and SMEs, respectively. A point is worth noting here. In view of the operational decisive stages of firms, it should be reasonable to presume that LEs and SMEs face distinct objective economic conditions while first choosing sizes and technologies rationally according to their own comparative advantage respectively. Later, the productive activities would be operated under the determined firm sizes, and the efficiencies (or inefficiencies) are then demonstrated. Consequently, in this article, it is assumed that the choice of firm size is a predetermined variable of technical efficiency performance. The modified stochastic frontier production functions for LEs and SMEs, respectively become:

In order to correct for the endogenous effect of size choice on technical efficiency, the estimation is conducted in two stages. We start by estimating the probit model of size determination in Eq. 5. The fitted values of the probit model are then used to construct the selectivity variable for SMEs and LEs in Eqs. 8 and 9. The results of the two-stage estimation are shown in Table 5.

Panel A of Table 5 presents the maximum likelihood estimates of the size-choice equation. The threshold is 200 employees. An examination of the results reveals that the sign of the estimated coefficient conforms to a priori expectations. A noteworthy result is that the probability of becoming a SME significantly increases with the ratio of the subcontracted output.

Concerning the results shown in panel B, these models reveal that the signs of the parameter estimates for input variables are generally consistent with our expectations. Of interest are the coefficients of the selectivity variables, λ L i and λ S i . The coefficients are significantly negative for the SMEs, but positive in the LEs’ production frontier equation. They imply a positive correlation between value-added production and firm size, lending support to the hypothesis of correcting firm-size effects. It is thus necessary to control for the size effect when studying the size–technical efficiency nexus, which has been neglected in existing work.

Before comparing the mean technical efficiency between LEs and SMEs, we first discuss whether there are differences in determinants of technical efficiency between LEs and SMEs. The results suggest that overall there are substantial differences on the determinants of technical efficiency for the LEs and SMEs. First, the effects of age and welfare expenditure on technical efficiency decrease substantially for LEs, while they both still have a strong positive association with technical efficiency for SMEs. The average age of SMEs is lower than that of their large counterparts, and so the learning effect is more significant for SMEs. On the other hand, the high mobility of employees is a troublesome issue for most Taiwanese electronics firms, because the bonus system plays a major incentive as workers tend to want to be employed in a corporation that can provide a higher stock bonus. This issue is more important for most SMEs which cannot offer stock options as an incentive to hire higher quality employees, because their sizes are too small to issue shares on the stock market. Thus, the effect of welfare expenditure strongly influences employees’ effort among SMEs and subsequently results in higher efficiency.

Second, the coefficients of F-export for all estimates are still negative and statistically significant, while the impact is much stronger for SMEs. The result implies that the international markets-orientated firms would tend to be more efficient than the domestic market-orientated firms, especially for SMEs. The theoretical bases are both the known self-selection and learning-by-exporting hypotheses, but this static analysis cannot answer where this positive effect comes from.

The third and the most interesting point is that the variable of subcontractor intensity is strongly and significantly related to technical efficiency only for SMEs at the 1% statistical level, revealing that a small firm can potentially improve its technical efficiency by operating as a subcontractor. This result is very intuitive economically and is important from the standpoint of SMEs’ policy: Taiwan’s manufacturing sector is predominated by a large share of SMEs that find it easy to enter the market, while it is not easy to survive within an industry. Taiwan’s government has taken several measures to assist in the development of SMEs. Among them, the semi-official program of the core-satellite system is a unique interfirm network of production for East Asian countries. SMEs can decrease their market uncertainty by being a subcontractor and specializing in production according to their comparative advantages on factor use. Thus, the specialized division of production may enhance technical efficiency for SMEs. In order to obtain the robust estimates for the influence as a ‘subcontractor’, we also test an alternative definition of subcontractors by including the dummy variable F-SubD, and the result is the same. We furthermore find a positive and significant coefficient for the interaction term between firm size and a subcontractor, showing that the positive impact of a subcontractor decreases as a firm becomes larger among SMEs. Although ‘subcontractor’ is a practical strategy for SMEs to increase technical efficiency and survive within an industry of tough competition, the major disadvantage of this operation mode is that the satellite firms can only earn a very low profit. Within the highly vertical disintegration of the electronics industry, a large share of the value-added of electronics products is contributed by brand or technological innovation. Hence, as a firm grows larger, how to raise technological capability and establish product brands perhaps become the vital strategies for firms to increase the value-added of production rather than being a subcontractor. Finally, after controlling for firm characteristics, there also exist significant differences in sector effects between LEs and SMEs, mainly the influences of industry R&D intensity and industry scale.

Are small firms really less efficient after controlling for the endogenous size effect? Allowing for multiple production functions to exist, the technical efficiency score cannot be compared directly because firms are using different technologies. In order to make comparisons we employ an adjustment factor used in Aw and Batra (1998) to adjust the calculated technical efficiency for SMEs. The adjustment procedure is below. We assume that the estimated coefficients for Eqs. 8 and 9 representing production technologies for LEs and SMEs, respectively, and then define the ratio of SMEs operating under LEs’ production technology to SMEs operating under SME’s production technology as the adjustment factor; that is:

Let the adjusted technical efficiency for SMEs being:

Then, we can compare the average technical efficiencies between LEs and SMEs.

Table 6 displays these comparisons for two-digit and three-digit industries. One important finding worth emphasizing is that the average technical efficiency of SMEs increases from 0.690 to 0.724 after controlling for the endogenous size effect, whereas the average technical efficiency of LEs decreases slightly from 0.704 to 0.701. More importantly, the difference test shows that the average technical efficiency of SMEs is significantly larger than that of LEs by 0.023 at the 1% statistical level, revealing that SMEs are more efficient on average. This result contradicts the findings in most previous studies, while it is consistent with Hu and Schive’s (1997) study for the Taiwan electronics industry.

It is worth noting that despite the statistical significance, an interesting question arises as to why the average TE scores are so alike. The possible reason is that when the differences of exogenously economic circumstances (such as financial constraints and rental prices of capital input) faced by SMEs and LEs are controlled, the impact of the business environment on the two firms groups would be similar, since that the SMEs and LEs are inherently belong to the same industry and confront an identical industrial structure. Thus, in the S–C–P viewpoint of industrial economics, an identical industrial structure or business environment would result in a similar conduct and performance, herein technical efficiency.

As for the comparison of the mean technical efficiency adjusted by size effects for sub-industries, the number of statistics with a significantly negative sign increases from one to three, showing that SMEs tend to have a better performance on technical efficiency for one-third of the industries, compared with that in Table 4. Under the null hypothesis that the average technical efficiency of LEs is larger than that of SMEs, the statistic is larger than the critical value at a conventional statistical level for three industries. On the other hand, the statistics with a positive sign decrease from six to four. Among them, this difference in technical efficiency is statistically significant for three industries.

Drawn from the estimates in Table 6, SMEs seem to have, at least, a moderate technical efficiency compared with their larger counterparts after controlling for the endogenous size choice. Therefore, the traditional estimates for technical efficiency might suffer an estimation bias if the endogenous size effect is not taken into account. This finding sheds light on the importance of the endogenous size effect on examining the relationship between firm size and technical efficiency.

4.2 Different technology: stochastic metafrontier function approach

The specification of switching regression of the stochastic frontier production model assumes that firm size is an endogenous choice of firms operating under different production technology. If we regard the firm size as being an exogenous variable and believe that firms in different groups operate under different technologies the technical efficiencies of these firms should be estimated separately, since the production frontiers faced by these firms are not identical. However, the technical efficiency measures on the basis of different frontiers are incomparable.

On the basis of the fundamental assumption that LEs and SMEs operate under different production technology, the Metafrontier production function model of Battese et al. (2004) originated from Hayami (1969) can be used to bridge over the gaps for the comparison among different frontiers. The metaproduction function is regarded as an envelope curve of the most efficient production points on different frontiers across groups. The idea to estimate the metaproduction function with the concept of the stochastic frontier was introduced by Sharma and Leung (2000), and then refined by Battese and Rao (2002). Till date, a more ideal model is developed by Battese et al. (2004). For the firms in the same industry operating under different technology frontiers, the new approach on estimating the Metafrontier model enables the comparison of technical efficiencies and the concise estimation of ‘technology gaps’ across firms.

We now separate the stochastic frontier production function model shown as Eq. 1 into the following:

where the superscripts L and S are for LEs or SMEs, respectively. Furthermore, the metafrontier production function model can be specified as:

where y * i represents the potential output level on the metafrontier for all the firm i in the industry, and all the α* denote unknown parameters. Thus, the LEs and SMEs’ potential output levels on the metafrontier are \(\ln y_i^{\ast L}\) and \(\ln y_i^{\ast S}, \) respectively. In addition, from the Eqs. 12 and 13, we know that the frontiers of the production functions for the LEs and SMEs can be expressed as:

Since the metafrontier is an envelopment curve for respective frontiers, the following condition must be met.

Thus, Eq. 17 implies that the metafrontier production function is a deterministic parametric function that ensures the potential maximum output level in the metafrontier cannot be lower than that in the respective frontiers. Operationally, according to Battese et al. (2004), the parameters of the metafrontier production function can be obtained by solving the linear programming (LP) problem or quadratic programming (QP) problem.Footnote 13 Accordingly, the technology gap ratios of each firm can be evaluated as:

Finally, on the basis of the metafrontier, the metafrontier technical efficiency can now be calculated by:

Before comparing average technical efficiency between LEs and SMEs, it is important to examine, whether LEs and SMEs share the same technology. If all the firms use the same technology and operate under identical production frontiers, it would not be necessary to estimate the technical levels by using a metafrontier production function. A LR test of the null hypothesis, that the stochastic frontiers are the same for LEs and SMEs, are calculated after estimating the stochastic frontier by pooling the data. The value of the LR statistic is 54, which is significantly higher than the critical value \(\chi_{(0.01, 18)}^{2}=34.81.\) Footnote 14 This result suggests that the stochastic frontiers for LEs and SMEs of electronics firms in Taiwan are not the same, implying that LEs and SMEs operate under different production technology. Therefore, it might induce a bias when comparing technical efficiency between LEs and SMEs without considering for the size effect.

The estimates of the metafrontier obtained by linear and quadratic programming are presented in Appendix 1. There are no significant differences between the LP and QP estimate for the parameters of the metafrontier function. Moreover, values of the TGR, together with the technical efficiencies obtained from the individual stochastic frontier and the metafrontier are computed for all firms in groups of LEs and SMEs. Basic summary statistics for these measures are presented in Table 7.

Using the results of the LP approach for illustration, the mean values of the technology gap ratio are about 0.895 and 0.938 for LEs and SMEs, respectively. These results imply that, for LEs, the electronics firms produce, on average, about 89.5% the potential output given the technology available to them. However, small electronics firms produce, on average, about 93.8% of the potential output. It is interesting to note that, for both LEs and SMEs, the technical efficiencies calculated relative to the metafrontier function are smaller than those calculated from individual frontiers. However, SMEs achieve a higher mean technical efficiency relative to the metafrontier compared with their larger counterparts. This result is consistent with that obtained by the switching regression that SMEs tend to have a higher technical efficiency after controlling for the size effect. These results shed light on the importance of the size effect when the size–technical efficiency nexus is examined.

Turning to the further comparison of technical efficiencies between LEs and SMEs among 3-digit industries, the calculated technical efficiencies relative to the LP and QP metafrontier functions are presented in Table 8.

The table shows overall that the mean technical efficiencies calculated on the basis of LP and QP frontiers for LEs and SMEs are somewhat different in terms of the number of significant test statistics. While it clearly shows that there is a larger share of different test statistics after being negatively significant. This result indicates that SMEs tend to have a higher technical efficiency across 3-digit industries, by assuming that LEs and SMEs operate under different production technology.

In LP estimates, SMEs have a higher mean technical efficiency relative to LEs in the pooling data, while the number of statistics with a significantly negative sign and with a significantly positive sign is the same, two. It implies that, at least, the mean technical efficiency of SMEs is as well as that of LEs, on average. This result is quite similar as that obtained by the switching regression shown in Table 6. In QP estimates, the comparison shows an apparent situation in favor of SMEs. Compared with the results in Table 4, the number of statistics with a significantly negative sign increased from one to five shows that SMEs have a better performance on technical efficiency among more than half of the 3-digit industries. Under the null hypothesis that the average technical efficiency of LEs is larger than that of SMEs, the statistic is larger than the critical value at a conventional statistical level for only one industry.

Drawn from the estimates in Table 8, when we consider the size effect on production technology and treat LEs and SMEs operating under different technology frontiers, the metafrontier model enables the calculation of comparable technical efficiencies for firms operating under different technologies. More importantly, the results tend to lend supportive views that SMEs have a better performance on technical efficiency compared with their larger counterparts.

In summary, the traditional estimates for size–technical efficiency nexus may suffer an estimation bias without dealing with the size effect. The size effect may be treated as an endogeneity problem or it implies that firms with different sizes operate under different production technology. This finding sheds light on the importance of the size effect on examining the relationship between firm size and technical efficiency.

5 Concluding remarks

The size–technical efficiency relationship has been widely discussed in the past two decades, while the potential influence of the size effect is not covered as extensively in previous studies. This article aims to compare the technical efficiency of SMEs and LEs and studies the factors influencing their technical efficiency for Taiwan’s electronics industry. We employ two alternative approaches to deal with the size effect in this study. One is adopting the two-stage switching regressions to correct for the endogenous firm-size effect on technical efficiency and the other is assuming that LEs and SMEs operate under different production technology and then adopt the stochastic metafrontier model to calculate comparable technical efficiencies for firms operating under different technologies. The main findings of this study are as below. First, the average technical efficiency for LEs is larger than that of SMEs without correcting the size effect, whereas the SMEs have a higher technical efficiency when we consider the potential influence of size effect. The results obtained in this article show that the average technical efficiency of SMEs in Taiwan’s electronics industry ranges from 67.9% to 75.2% under different estimates, implying a production level substantially smaller than they could have achieved. This result may be attributed to the fact that the distribution of the technical efficiencies of SMEs is negatively skewed in that some SMEs are operating at a very low level of technical efficiency.

Comparing the average technical efficiency levels between SMEs and LEs by productive subsectors, we find that SMEs tend to have a better performance on technical efficiency after controlling for the potential influences of the size effect. This reveals that there are also important industrial factors rather than size related to technical efficiency. This study cannot conclude that there is a negative relationship between size and technical efficiency and cannot judge whether a switching regression approach or a stochastic metafrontier model is more appropriate in dealing with the size effect. However, this study does shed light on the importance of the size effect on the empirical investigation of the size–technical efficiency nexus.

Regression analysis allows for the identification of some firm- and industry- characteristics determinants of technical efficiency. Our results show that there are substantial differences on the determinants that influence technical efficiency between SMEs and LEs. One point worth noting is the role played by being a subcontractor on improving SMEs’ technical efficiency. The specialized division of being a subcontractor has a significant impact on improving SMEs’ technical efficiency, while the effect is decreased when the firm size increases.

Notes

For a study on the role of SMEs in economic development and growth, please refer to Acs (1992). On the basis of both economics and welfare, You (1995) argued that an expansion of the small-firm segment leads to more efficient resource allocation, less unequal income distribution, and less underemployment, because small firms tend to use more labor-intensive technologies.

The concepts of efficiency, allocative efficiency, and technical efficiency, please refer to Kumbhakar and Lovell (2000).

X-efficiency is the effectiveness with which a given set of inputs are used to produce outputs. If a firm is producing the maximum output it can, given the resources it employs and the best technology available, it is said to be x-efficient. Therefore, X-inefficiency occurs when X-efficiency is not achieved. The concept of X-efficiency was introduced by Leibenstein (1966).

For the linkage between factor demand and a firm’s technology and factor price, see Little et al. (1987) for an extensive discussion.

As for the pre-1990 studies, please refer to Lundvall and Battese (2000) for a comprehensive review.

A large body of related literature defines this behavior as “outsourcing.” We prefer to adopt the term “subcontracting” in this article, because the term is traditionally used in many of the Asian countries.

For the calculation of technical efficiency in the stochastic frontier production function, please refer to Jondrow et al. (1982).

There is also a two-stage approach using the technique of the Tobit model as the second-step to investigate the determinants of technical efficiency. However, recent research has shown how inappropriate the two-step framework is and suggests that the single-stage estimation procedure is more appropriate (Wang and Schmidt 2002; Greene 2005; Simar and Wilson 2007).

Due to the null values of inputs or output, 246 observations are dropped from our empirical work.

The value of the generalized likelihood-ratio (LR) statistic not displayed in this article shows that the Cobb–Douglas technology is rejected, meaning that input and substitution elasticities are not constant among firms.

Refer to Battese et al. (2004) for more details.

The LR statistic is defined by \(\lambda=-2\ \{\ln[\hbox{H}_{0}/\hbox{H}_{1}]\}= -2\ \{\ln[(\hbox{H}_{0})]-\ln[(\hbox{H}_{1})]\},\) where \(\ln[(\hbox{H}_{0})]\) is the value of the log likelihood function for the stochastic frontier estimated by pooling the data for LEs and SMEs and \(\ln[(\hbox{H}_{1})]\) is the sum of the values of the likelihood functions for production frontiers of LEs and SMEs.

References

Abraham, K. G., & Taylor, S. K. (1996). Firms’ use of outside contractors: Theory and evidence. Journal of Labor Economics, 14, 394–424.

Acs, Z. J. (1992). Small business economics: A global perspective. Challenge, 35(6), 38–44.

Aigner, D. J., Lovell, C. A. K., & Schmidt, P. (1977). Formulation and estimation of stochastic frontier function models. Journal of Econometrics, 6, 21–37.

Alvarez, R., & Crespi, G. (2003). Determinants of technical efficiency in small firms. Small Business Economics, 20, 233–244.

Aw, B. Y., & Batra, G. (1998). Technological capability and firm efficiency in Taiwan. World Bank Economic Review, 12(1), 59–79.

Aw, B. Y., & Huang, A. R. (1995). Productivity and the export market: A firm-level analysis. Journal of Development Economics, 47(2), 313–332.

Aw, B. Y., Chen, X., & Roberts, M. J. (2001). Firm-level evidence on productivity differentials and turnover in Taiwanese manufacturing. Journal of Development Economics, 66, 51–86.

Battese, G. E., & Coelli, T. J. (1995). A model for technical inefficiency effects in a stochastic frontier production function for panel data. Empirical Economics, 20, 325–332.

Battese, G. E., & Rao, D. S. P. (2002). Technology gap, efficiency and a stochastic metafrontier function. International Journal of Business and Economics, 1(2), 1–7.

Battese, G. E., Rao, D. S. P., & O’Donnell, C. J. (2004). A metafrontier production function for estimation of technical efficiencies and technology gaps for firms operation under different technologies. Journal of Productivity Analysis, 21, 91–103.

Berry, A., & Mazumdar, D. (1991). Small-scale industry in the Asian-Pacific region. Asian-Pacific Economic Literature, 5, 35–67.

Biggs, T., Shah, M., & Srivastava, P. (1996). Technological capabilities and learning in African enterprises. Case studies series. Washington: Regional Program of Enterprise Development (RPEP), World Bank.

Brada J. C., King, A. E., & Ma, C. Y. (1997). Industrial economics of transition: Determinants of enterprise efficiency in Czechoslovakia and Hungary. Oxford Economic Paper, 49, 104–127.

Bunch, D., & Smiley, R. (1992). Who deters entry? Evidence on the use of strategic entry deterrents. Review of Economics and Statistics, 79, 509–521.

Cabral, L. M. B., & Mata, J. (2003). On the evolution of the firm size distribution: Facts and theory. American Economic Review, 93, 1075–1090.

Coelli, T. J. (1996). A Guide to FRONTIER Version 4.1: A computer program for frontier production function estimation. CEPA Working Paper 97/07, Department of Econometrics, University of New England, Australia.

Fixler, D., & Siegel, D. (1999). Outsourcing and productivity growth in services. Structural Change and Economic Dynamic, 10, 177–194.

Garen, J. E. (1984). The returns to schooling: A selectivity bias approach with a continuous choice variable. Econometrica, 25, 1199–1218.

Geroski, P. A. (1995). What do we know about entry? International Journal of Industrial Organization, 13, 421–440.

Glass, A. J., & Saggi, K. (2001). Innovation and wage effects of international outsourcing. European Economic Review, 45(1), 67–86.

Greene, W. (2002). Alternative panel data estimators for stochastic frontier models. Working Paper, Department of Economics, Stern School of Business, NYU.

Greene, W. (2005). Reconsidering heterogeneity in panel data estimators of the stochastic frontier model. Journal of Econometrics, 126(2), 269–303.

Haddad, M., & Harrison, A. (1993). Are there positive spillovers from foreign direct investment? Evidence from panel data for Morocco. Journal of Development Economics, 42, 51–74.

Hayami, Y. (1969). Sources of agricultural productivity gap among selected countries. American Journal of Agricultural Economics, 51, 564–575.

Heckman, J. J. (1979). Sample selection bias as a specification error. Econometrica, 47, 153–161.

Heshmati, A. (2003). Productivity growth, efficiency and outsourcing in manufacturing and service industries. Journal of Economic Surveys, 17, 79–112.

Hill, H., & Kalirajan, K. P. (1993). Small enterprise and firm-level technical efficiency in the Indonesian garment industry. Applied Economics, 25(9), 1137–1144.

Hu, M. W., & Schive, C. (1997). A study on the productivity and efficiency of SMEs in Taiwan manufacturers. Taiwan Economic Review, 25(1), 1–26.

Jondrow, J., Lovell, C. A. K., Materov, I. S., & Schmidt, P. (1982). On the estimation of technical inefficiency in the stochastic frontier production function model. Journal of Econometrics, 19, 233–238.

Jovanovic, B. (1982). Selection and the evolution of industries. Econometrica, 50(3), 649–670.

Kimura, F. (2002). Subcontracting and the performance of small and medium firms in Japan. Small Business Economics, 18, 163–175.

Kitching, G. (1982). Development and underdevelopment in historical perspective. London: Metheun.

Kumbhakar, S. C., & Lovell, C. A. K. (2000). Stochastic frontier analysis. Cambridge: Cambridge University Press.

Kumbhakar, S. C., & Tsionas, E. G. (2006). Does deregulation change economic behavior of firms? A latent class approach. Working Paper, Department of Economics, University of Crete.

Lau, L. J., & Yotopoulos, P. A. (1989). The meta-production function approach to technological change in world agriculture. Journal of Development Economics, 31, 241–269.

Leibenstein, H. (1966). Allocative efficiency versus X-efficiency. American Economic Review, 56(3), 392–415.

Little, I. M. D., Mazumdar, D., & Page, J. M. Jr. (1987). Small manufacturing enterprises: A comparative analysis of Indian and other economies. Washington: Oxford University Press.

Lundvall, K., & Battese, G. E. (2000). Firm size, age and efficiency: Evidence from kenyan manufacturing firms. Journal of Development Studies, 36, 146–163.

Marsili, O. (2002). Technological regimes and source of entrepreneurship. Small Business Economics, 19, 217–231.

Orea, L., & Kumbhakar, S. C. (2003). Efficiency measurement using a stochastic frontier latent class model. State University of New York at Binghamton, mimeo.

Pack, H. (1982). Aggregate implications of factor substitution in industrial processes. Journal of Development Economics, 11, 1–38.

Roberts, M. J., & Tybout, J. R. (1996). Industrial evolution in developing countries: Micro patterns of turnover, productivity and market structure. Oxford: Oxford University Press

Sharma, K. R., & Leung, P. S. (2000). Technical efficiency of carp production in India: A stochastic frontier production function analysis. Aquaculture Research, 31, 937–947.

Simar, L., & Wilson, P. W. (2007). Estimation and inference in two-stage, semi-parametric models of production processes. Journal of Econometrics, 136(1), 31–64.

Soderbom, M., & Teal, F. (2004). Size and efficiency in African manufacturing firms: Evidence from firm-level panel data. Journal of Development Economics, 73, 369–394.

Taylor, C. R., & Wiggins, S. N. (1997). Competition or compensation: Supplier incentives under the American and Japanese subcontracting systems. American Economic Review, 87(4), 598–618.

Taymaz, E. (2005). Are small firms really less productive? Small Business Economics, 25, 429–445.

Taymaz, E., & Saatci, G. (1997). Technical change and efficiency in Turkish manufacturing industries. Journal of Productivity Analysis, 8, 461–475.

Wang, H. J., & Schmidt, P. (2002). One-step and two-step estimation of the effects of exogenous variables on technical efficient levels. Journal of Productivity Analysis, 18, 129–144.

Yang, C. H. (2003). Exporting and productivity—a firm-level analysis of the Taiwan electronics industry. Developing Economies, 41(3), 340–361.

You, J. I. (1995). Small firms in economic theory. Cambridge Journal of Economics, 19(3), 441–462.

Acknowledgments

We thank anonymous referees and the Editor for their helpful suggestions and Chia-Hui Huang for excellent research assistant.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Yang, CH., Chen, KH. Are small firms less efficient?. Small Bus Econ 32, 375–395 (2009). https://doi.org/10.1007/s11187-007-9082-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-007-9082-x