Abstract

We consider discrete-time portfolio problems of an investor when taking the possibility of market crashes into account. In the case of the logarithmic utility function, we construct the worst-case optimal portfolio strategy by an indifference principle. Then, we extend the setting to general utility functions and derive the worst-case optimal portfolio processes via the characterization by a dynamic programming equation. Furthermore, we numerically examine the convergence behavior of the discrete-time worst-case optimal portfolio processes for the choice of popular utility functions when the time between two possible price changes tends to zero.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

One of the classical problems in financial mathematics is the portfolio optimization problem, that is, the choice of optimal investments for an investor with a given utility function and a fixed initial endowment. Merton (1971) pioneered the modern continuous-time approach to this problem. He applied classical stochastic control methods to the optimal terminal wealth problem in the Black–Scholes market. Since Merton’s pioneering work, complete theories and powerful approaches [see e.g. the monographs by Korn (1997) and Karatzas et al. (1987)] have been developed to solve the portfolio optimization problem in the continuous-time setting. In contrast, discrete-time models have advantages with respect to the computational treatment when there is no analytical solution in continuous time. The discrete-time portfolio optimization problem has also been deeply studied (see e.g. Samuelson 1969; Duffie 1988; Pliska 1997; Bäuerle and Rieder 2011).

One drawback of classical stock price models is that extreme stock price movements cannot be fully explained. However, they are often observed at the markets and can cause large financial losses for investors. To cope with this situation, a worst-case portfolio approach in continuous time that includes crash possibilities has been introduced by Korn and Wilmott (2002). By an indifference argument they showed how to derive the worst-case optimal portfolio processes for logarithmic utility. Korn and Menkens (2005) extended this approach to a more general market setting. Korn and Steffensen (2007) showed that the value function can be found by solving an HJB-system that contains variational inequalities. Further studies on the worst-case portfolio problem in the continuous-time setting are e.g. Korn and Seifried (2009), Menkens (2004), Seifried (2010), Desmettre et al. (2015a, b) and Belak et al. (2015). We particularly want to emphasize that Seifried in Seifried (2010) has been able to solve the continuous-time worst-case problem for the case of general i.i.d. log returns, a framework that goes well beyond the standard geometric Brownian motion setting.

In contrast to continuous-time models of worst-case portfolio optimization problems, relatively little work has been done in the discrete-time setting. Nevertheless, some interesting real-life problems are not tractable in the framework of the continuous-time setting. In practice, trading even on fully electronic systems is only possible at discrete points in time. This motivates us to consider the worst-case portfolio optimization problem in a discrete-time framework. Furthermore, if the parameters in the discrete-time financial markets are chosen appropriately, they can be regarded as an approximation of continuous-time models. This observation serves as another reason for the importance of considering the worst-case portfolio optimization problem in a discrete-time setting.

The paper is organized as follows. We first introduce the basic setting of worst-case portfolio optimization in discrete time in Sect. 2. In Sect. 3, we derive the worst-case optimal portfolio processes for the logarithmic utility function by an indifference argument. Here, we will in particular highlight the usefulness of the discrete-time model via solving a simple portfolio problem with a jump process model for the stock price. It can even be used to derive the ordinary differential equation characterizing the continuous-time worst-case optimal portfolio process. After this, we turn to a more general study of the worst-case portfolio optimization problem in discrete time. Section 4 is devoted to derive a system of dynamic programming equations and to verify the optimal strategies as a system of difference equations. These results will be applied to the power utility, log utility and exponential utility functions. Further, we explicitly show the convergence of the worst-case optimal discrete-time strategy to the continuous-time one in the power utility case.

2 The discrete-time crash model

In this section, we specify the discrete-time worst-case market model and formulate the worst-case optimization problem in discrete time. This model is an extension of the discrete-time market model and allows for a crash in stock prices. As in the worst-case market model in continuous time introduced by Hua and Wilmott (1997) and taken up by Korn and Wilmott (2002), we consider a market consisting of a risk-less bond and one risky security with prices in normal times given by

with constant market coefficient r, and independent and identically distributed random variables \(R_t\). We assume that the mean of the stock return \(E(R_t)\) exceeds the risk-less return factor of \(1+r\), i.e.

Assumption M

Mean stock return exceeds the risk-less return.

At the crash time\(\tau \), the stock price can suddenly fall by a relative amount \(k \in [0, k^*]\), where \(0<k^*<1\) (the biggest possible crash height) is given. Then, in a crash scenario\((\tau , k)\) we have

Moreover we fix the terminal time \(T > 0\). Let further \({\mathcal {F}}_t\), \(t=0, 1, \dots , T\) be the filtration generated by the stock price. We then call a real-valued, \({\mathcal {F}}_t\)-adapted stochastic process a portfolio process. As usual, this process describes the fraction of the investor’s total wealth X(t) that is allocated to the stock at time t. The corresponding position will then be hold until time \(t+1\) where a possible reallocation happens. Obviously, \(1-\pi _t\) equals the fraction of wealth invested in the risk-less asset.

We call a portfolio process \(\pi _t\)self-financing if for a possible crash scenario \((\tau , k)\) with \(t \le \tau \le T\) the dynamics of the wealth process are given by

where \(x > 0\) denotes the initial wealth. We will call a self-financing portfolio process admissible if the corresponding wealth process X(t) stays non-negative. We denote this by \(\pi \in {\mathcal {A}}(x)\).

In the following sections, we first restrict ourselves to the case that at most one crash can occur within the investment period [t, T]. Details how to extend our results to the general case of at most n crashes by an iterative procedure will be given later.

Let us point out that the optimal portfolio process after the crash has happened coincides with the optimal one in the crash-free setting. Thus, we only have to consider portfolio processes where the final wealth \(X_T\) in the case of a crash of size k at time \(\tau \le T-1\) is given by

with \({\tilde{\pi }}_{t}^*\) being the optimal strategy in the crash-free setting if such a strategy \({\tilde{\pi }}_t\) exists.

To relate the latter one to a corresponding optimization problem in discrete time, let u(.) be a utility function (i.e. a strictly concave and increasing differentiable function) and \({X^\pi _t}\) be the wealth process. Then, the portfolio problem in the crash-free setting is given by its value function

where we simply assume that there is no crash possibility at all. For our considerations in the following, we make the fundamental assumption from now on:

Assumption O

Existence of an optimal admissible portfolio.

We assume that for each pair \((t,x)\in [0,T]\times (0,\infty )\) there exists an optimal admissible deterministic portfolio process \({\tilde{\pi }}^*\) in the sense of

This assumption is in particular satisfied for all the examples considered in this article. Further, it is satisfied if the stock price can attain only a finite number of possible prices. However, this is not the definite collection of all examples where this is the case.

To introduce the worst-case problem in the crash setting, the worst-case bound for the expected utility from using \(\pi \) before the crash is defined as

where we already assume that after the crash an optimal portfolio process in the crash-free setting is followed. The worst-case portfolio problem in discrete time then is to calculate

and to find an admissible strategy \(\pi ^*\) such that \(W(t,x,\pi ^*) = V_1(t,x)\). We denote by \(V_1(t,x)\) the value function of the worst-case portfolio optimization problem.

As motivated by Korn and Wilmott (2002) in continuous time, there are two competing effects, a high crash loss if a high portfolio process is chosen and a bad performance if a low one is preferred. To cope with this, they show how to derive the worst-case optimal portfolio strategy by an indifference argument. In the next section, we look for an optimal portfolio strategy by using a similar indifference principle in the worst-case portfolio problem in discrete time in the case of log utility.

3 Indifference strategies in the logarithmic case

In this section, we consider the special case of the logarithmic utility function

of course, still under Assumptions (M) and (O). In this case, we have the following representation of the value function in the discrete-time crash-free model

with the corresponding optimal portfolio strategy

We make the assumption which is e.g. satisfied in the binomial model setting (see e.g. Kröner 2014):

Assumption L

Constant log-optimal portfolio.

The stock price model in the crash-free setting admits a unique positive optimal constant portfolio process \({\tilde{\pi }}^*\) in Eq. (3.3).

Remark 3.1

As \(\pi _t\) is independent of \(R_t\) and all the \(R_t\) are independent and identically distributed, we can in the following often drop the index t in \(R_t\) when only expectations are considered. Note that due to the independence of \(R_t\) of the past price history, \(R=R_t\) is also independent of every choice of an admissible portfolio process \(\pi _t\). As the expected value in Eq. (3.3) is independent of (t, x), Assumption (L) mainly can be seen as a reformulation of Assumptions (O) and (M).

3.1 Optimality and indifference

We now look for a portfolio strategy that can balance between good performance of the final wealth process when no crash happens and a corresponding loss when a crash happens. Thus, we search for a portfolio strategy which makes the investor indifferent between the two extreme cases:

The crash of maximal size \(k^*\) happens immediately.

No crash happens at all.

This is exactly the indifference principle from Korn and Wilmott (2002).

Remark 3.2

We consider in this section only positive portfolio strategies \(0\le \pi _t \le {\tilde{\pi }}^*\). The reason for this is that under Assumption (M) a strategy which attains negative values would be dominated by its positive part in the worst-case sense. Further, if we take any portfolio process satisfying \(\pi \ge {\tilde{\pi }}^*\) almost surely then the corresponding worst-case bounds satisfy

as the utility function u is strictly increasing. Thus, \({\tilde{\pi }}^*\) dominates any portfolio process \(\pi > {\tilde{\pi }}^*\) in the worst-case sense.

Relations (2.4) and (2.5) directly yield the solution of the single-period case given in Proposition 1:

Proposition 1

The optimal portfolio process \(\pi ^*\) for the single-period worst-case portfolio optimization equals 0. Further, this strategy also satisfies the indifference principle.

We now turn to the multi-period setting:

Proposition 2

Under Assumption (L), there exists a portfolio process \(\pi ^*\) which satisfies the indifference principle if there exists a solution to the equations

with

and \({\tilde{\pi }}^*\) being the optimal portfolio process in the crash-free model in discrete time.

Proof

The expected utility of the portfolio process \(\pi ^*\) corresponding to the case that a crash of maximal size \(k^*\) happens immediately satisfies:

The expected utility for the portfolio process \(\pi ^*\) that corresponds to the scenario that no crash happens at all has the following form:

Having these two equations, we now prove the claims of the proposition via backward induction on the time t. For \(t=T-1\), the form of \(\pi _t^*\) follows from Proposition 1. We thus consider the

Start of the induction with\(t=T-2\):

The equality of the expected utilities of Eqs. (3.6) and (3.7) is equivalent to

Collecting all expectations on the right side of the equation and then applying the exponential function leads to

Dividing both sides of the equation by \(r+k^*\) followed by a division by the exponential function term of the right-hand side and shifting all terms to the right side yields the required form of Eq. (3.4). For this, also note that \(\pi ^*_{T-1}=0\) then appears implicitly on the left side.

We can now continue with the

Induction step\(t+1 \mapsto t\):

The equality of the expected utilities of Eqs. (3.6) and (3.7) is equivalent to

By induction we now have

which yields

Collecting the \(\ln \)-terms on one side, the expectation terms on the other side of the equation, applying the exponential function, and then solving for \(\pi ^*_{t+1}\) yields the desired recursive formula

for all \( 0< t < T-1 \). If now there exists a solution \(\pi ^*\) to the recursive equations above, the deterministic strategy \(\pi ^*\) satisfies the indifference principle by construction

\(\square \)

Remark 3.3

(a) Existence of an indifference strategy It remains to prove the existence of a solution to the recursive equations

with

For this, note that for \(\pi _t^* = 0\), the right hand side of Eq. (3.9) has the form

and for \(\pi _t^* = {\tilde{\pi }}^*\), we obtain the right hand side of Eq. (3.9) as

Moreover, the right hand side of Eq. (3.9) is increasing for \(\pi _t^* \in [0, {\tilde{\pi }}^*]\). Therefore, by continuity there exists a solution \(\pi _t^*\) of Eq. (3.9).

Even more, by the above considerations there exists a unique deterministic portfolio process\(\pi _t^*\) solving Eq. (3.9). To see this, note that \(\pi ^*_{T-1}=0\) is obviously deterministic. As then by induction the left-hand side of Eq. (3.9) is always deterministic, we get the existence of a constant (and thus deterministic) value \(\pi _t^*\) solving Eq. (3.9) by using the argument given above to show the existence of a solution as it in particular works for a constant.

(b) For the portfolio strategy \(\pi ^*\) that satisfies the indifference principle, the representation of the worst-case bound if a crash happens at time \(\tau \) immediately with \(t<\tau < T\) is given by:

As the indifference principle is satisfied for all t, we have

Therefore, we have exactly the same expected worst-case bound for all possible times of the crash. By the indifference principle, the exact crash time is no longer important for the investor.

As the next step, we prove that the deterministic strategy \(\pi ^*\) uniquely determined by the Eq. (3.4) indeed solves the worst-case portfolio optimization problem in discrete time (2.10).

Theorem 1

(Worst-case optimal portfolio process for logarithmic utility in discrete time) Under Assumption (L), in the log-utility case, the deterministic portfolio strategy uniquely determined by the Eq. (3.4) is optimal for the worst-case portfolio optimization problem in discrete time 2.10.

Proof

Assume that there exists an admissible portfolio process \(\pi \) with a better worst-case bound than the strategy \(\pi ^*\) which satisfies the recursive equations (3.4).

From the explicit form of \(V_0(t + 1, x(1+r- \pi _t(r+ k^*)))\) it must satisfy that \(\pi _t < \pi _t^*\) almost surely to have a higher worst-case bound if a crash happens immediately.

Furthermore, the expected utility for the portfolio process \(\pi \) corresponding to the scenario if no crash happens at all satisfies:

The inequality is a consequence of the strictly increasing function \(E(\ln (1+r+ \pi (t)(R-1-r)))\). If the portfolio strategy \(\pi \) leads to a higher worst-case bound than \(\pi ^*\) in the no-crash scenario, then there exists a smallest deterministic time \(t_m\) with \(t+1\le t_m \le T-1\) so that

because \(\pi ^*\) has the same worst-case bound in the no-crash scenario according to the indifference property of \(\pi ^*\).

We first want to show that \(E(\ln (1+r+ \pi _s(R-1-r))) \le E(\ln (1+r+ \pi _s^*(R-1-r)))\), when \(E(\pi _s) \le E(\pi _s^*)\) for \(t\le s \le T-1\).

If \(E(\pi _s) \le E(\pi _s^*)\), the concavity of the log utility function implies for any such \(\pi _s\)

Taking the expectation on the both sides, noting that \(\pi _s^*\) is deterministic and that R is independent of both \(\pi _s^*\) and \(\pi _s\), we have

Note that the validity of this relation is implied by the facts that \(\pi ^*\) is a deterministic strategy and that \(\pi ^*_s\) and \(\pi _s\) are both independent of R.

Using the optimality of \({\tilde{\pi }}^*\) in the crash-free setting, \(\pi _s^* \le {\tilde{\pi }}^*\) leads to

Therefore, if \(E(\pi _s) \le E(\pi _s^*)\), we obtain

Hence, the inequality

implies \(E(\pi _{t_m}) > E(\pi ^*_{t_m})\).

The worst-case bound at exactly this time \(t_m\) if a crash happens at \(t_m\) immediately satisfies:

From the explicit form of the wealth process \(X_{t_m}\), we obtain:

By \(E(\ln (1+r+ \pi _s(R-1-r))) \le E(\ln (1+r+ \pi _s^*(R-1-r)))\) for all \(t< s < t_m\), we get

thus,

As we have exactly the same expected worst-case bounds of the optimal strategy \(\pi ^*\) for all possible times of the crash, we get a contradiction to our assumption that the admissible strategy \(\pi \) delivers a higher worst-case bound than \(\pi ^*\). \(\square \)

Remark 3.4

The indifference relation (3.4) is less explicit than the corresponding ordinary differential equation in continuous-time models. Further, it allows for dealing with discrete-time models without having a certain continuous-time limit in view. However, already for the problem in the crash-free setting there do in general not exist explicit formulas for the optimal portfolio process. This of course carries over to the worst-case problem. The reader can convince herself already by dealing with a simple two-period trinomial model. However, the above result is as general as the results on i.i.d. increments of the log returns given by Seifried (2010).

Example 1

(The binomial setting) To illustrate the performance of the worst-case optimal strategy compared to the crash-free optimal strategy, we assume that the stock price process follows the binomial model with parameters \(0< d< 1+r < u\) (the up- and down-multipliers of the stock price) and \(0<p<1\) (the probability of a multiplication of the stock price by u at time t). Then, the optimal portfolio \({\tilde{\pi }}^*\) in the discrete-time crash-free model is given by

The indifference equations (3.4) read as

with

Remark 3.3 implies the existence of a unique solution \(\pi _t^*\) of Eq. (3.13) which we compute numerically. Figure 1 shows that \(\pi _t^*\) is decreasing with time for the choices of \(r=0.05\), \(u=1.4918\), \(d=0.67\), \(p=0.5375\), \(k=0.05\) and \(T=10\). Hence, in the multi-period case the investor always has a positive position in the stock, but decreases it to protect against the crash when the time horizon gets close. Only in the last single period, she invests everything in the bond. Further, \(\pi ^*_0\) is always smaller than \({\tilde{\pi }}^*_0\), but the difference is getting smaller as the investment horizon T becomes bigger.

Example 2

(The binomial setting and a continuous-time jump model) To show that our techniques can also help to deal with non-diffusion limits we look at a very simple continuous-time jump model. We assume that the risk-free bond \(B_t\) and risky stock process \(S_t\) have price dynamics modeled as

with \(\eta >0\) and where N(t) is a standard Poisson process with parameter \(\lambda \). Further, we assume

We in particular obtain the explicit form of the stock price as

Hence, the wealth process X(t) for a self-financing portfolio process \(\pi (t)\) satisfies the stochastic differential equation

Let \(T_1, T_2, \dots , T_{N(t)}\) be the successive jump times until time t. The solution to Eq. (3.15) equals

In the log-utility case, we further obtain

where we have used \(E(N(T)) = \lambda T\) and the fact that the jump times are uniformly distributed on [0, T] conditional on N(T). \(\omega \)-wise optimization under the integral yields the optimal portfolio process

for the portfolio problem \(\max \limits _{\pi \in {\mathcal {A}}(x)} E(\ln X^{\pi }(T))\). Note that \(\pi ^*_{pn}(t)\) is positive due to Assumption (3.14).

Having obtained the optimal portfolio in the crash-free setting, we now turn to the discrete-time approximation. For this note that for the special choice of the n-period binomial model given by

with n sufficiently large such that we have \(0<p_n<1\), we obtain the convergence in distribution of the binomial stock prices to the continuous-time jump stock price via the law of small numbers.

As this is a special case of the binomial model of Example 1, one can easily see that the limit of the optimal discrete-time portfolio in the crash-free setting given by Eq. (3.13) (with p replaced by \(p_n\)) yields the appropriate convergence behavior as \(n\rightarrow \infty \):

For our special choice of parameters the indifference relation (3.13) has the form of

Letting now \(\varDelta t \rightarrow 0\) (i.e. \(n\rightarrow \infty \)), we obtain the following limiting ordinary differential equation

One can easily verify that this equation coincides with the differential equation for \(\pi ^*_t\) that is derived from the indifference requirement in the continuous-time jump model.

Remark 3.5

(Infinite horizon: maximizing growth rate) One can also think about a version of the worst-case portfolio approach with an infinite time horizon. However, the classical problem of maximizing the (asymptotic) growth rate (see e.g. the classical reference of Kelly (1956) and the vast amount of literature following it) is not effected by the worst-case approach. The reason for this is that the multiplicative effect of a crash, i.e. the loss of a fraction of wealth at the crash time,

has no effect on the asymptotic growth rate as it is a limiting criterion over all periods defined by

Another infinite horizon problem is the maximization of expected (discounted) utility of consumption. The corresponding worst-case continuous-time problem is already dealt with in Desmettre et al. (2015a). The way this problem is solved there indicates that our above approach has to be significantly enlarged to deal with the consumption problem. This is an aspect of future research.

3.2 Generalizations: an arbitrary number of possible crashes

So far we limited the maximal number of the crashes only to one. We can extend this to an arbitrary upper bound for the number of crashes by a backward induction principle. In such a situation of at most n crashes of size \(k \in [0, k^*]\), we have the following theorem:

Theorem 2

If we allow for at most n crashes of size \(k\in [0, k^*]\) in the discrete-time market model with the logarithmic utility function, then under Assumption (L) the deterministic worst-case optimal portfolio process \(\pi ^*_n(t)\) if still at most n crashes can appear is given by the following system of equations:

with

Here, \(\pi ^*_j(t)\) denotes the worst-case optimal portfolio process if still at most j crashes can occur. Note further that above we used the notation \(\pi ^*_0(t) = {\tilde{\pi }}^*\).

Proof

The proof is done via induction on n, the maximum number of crashes. For \(n=1\), all assertions follow from Proposition 2. Let us therefore assume that the above claims are satisfied for \(n-1\). Then, the expected utility of the portfolio process corresponding to the case that a crash of maximal size \(k^*\) happens immediately satisfies:

Using this, we obtain the form of Eq. (3.16) similar to those in Proposition 2. The reason for the constraints \(0\le \pi ^*_j(t) \le \pi ^*_{j-1}(t)\) follows from our general Assumption (M) and the form of the proof of Theorem 1. The rest of the proofs for existence and optimality is totally similar to the case of \(n=1\). \(\square \)

4 Dynamic programming and general utility functions

In the previous section we showed how to derive the optimal portfolio strategy for the discrete-time worst-case problem by an indifference approach in the case of the logarithmic utility function. For general utility functions u(x), the above methods of proof cannot be imitated directly as they very much benefited from the additive form of both the value function in the crash-free setting and the expected utility of the final wealth under the assumption of no crash. This, however, is only valid for the logarithmic utility function. We thus present a different approach in this section.

Indeed, we focus on the worst-case portfolio problem in discrete time for general utility functions by applying the dynamic programming approach. The main idea of the dynamic programming approach in portfolio optimization in discrete time is to break a multi-period decision problem up into a sequence of one-period problems. It will help us to reduce the difficulty to verify the optimality.

We only give the basic case when at most one crash can occur within the investment period [t, T]. Extending our results to the general case of at most n crashes by an iterative procedure is notationally cumbersome and will be omitted.

Still, the worst-case portfolio problem in discrete time under the threat of a crash is defined by its value function:

To implement the procedure using the dynamic programming principle in the case of our worst-case portfolio problem, we denote by \(U_t(x)\) the worst-case optimal value function at time t as well as by \({\tilde{U}}_t(x)\) as the crash-free optimal value function at time t. The dynamic programming equation for the discrete-time crash-free model has the form of

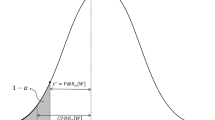

To motivate a dynamic programming equation for the worst-case problem in the crash model, let \(U_t(x)\) denote the value function when still one crash is possible. Noting that the main principle of dynamic programming for the discrete-time optimization problem is that the optimal decision to make now should be consistent with the intention to act optimally in all future periods, we transfer this to the crash setting. If we know the optimal worst-case portfolio process starting at time \(t+1\), then the determination of the optimal worst-case portfolio process starting at time t can be reduced to a one-period problem. In the one-period worst-case portfolio problem at time t there exist only two possible crash scenarios. The first one is that the crash happens immediately at time t. In this case, the value function \(U^1_t(x)\) satisfies the following dynamic programming principle

If no crash occurs in the next period the representation of the value function \(U^2_t(x)\) is given as

By combining these two cases we can heuristically derive the worst-case optimal value function \(U_t(x)\) based on the worst-case optimal value function \(U_{t+1}(x)\):

The value of \(U_t(x)\) at time \(t=T\) satisfies (see also Proposition 3)

Therefore, the dynamic programming equation for the worst-case portfolio optimization problem under the threat of a crash is given as

Of course, by this heuristic derivation, we have not shown any kind of optimality. This has to be proved separately. However, if this is shown then by using this dynamic programming equation (4.8), we can compute the optimal worst-case portfolio strategy and the worst-case optimal value function \(U_t(x)\) in a recursive way.

To prove a suitable verification theorem that justifies our heuristic approach, we first formulate an additional assumption:

Assumption D

Concavity and monotonicity.

Let the value function \(U_t\) be concave, strictly increasing and continuously differentiable in x, and let the function

be strictly increasing on \([0,{\tilde{\pi }}^*_t]\) with the maximum of \(f(\pi )\) attained in \({\tilde{\pi }}^*_t\), the optimal deterministic portfolio process in the crash-free setting.

Theorem 3

(Verification theorem) Let u be a utility function. We further assume that the Assumptions (D), (M), and (O) are satisfied.

Then there exist unique deterministic maximizers \(\pi _t^*\) of the value function which can be computed recursively by the dynamic programming equation

such that the portfolio strategy \(\pi ^* = (\pi _0^*, \dots , \pi _{T-1}^* )\) is optimal for the worst-case portfolio problem.

Remark 4.1

Assumption (D) is a strong requirement, but is satisfied in all examples presented below.

4.1 The characterization and optimality of the indifference strategy

Before we give the proof of the verification theorem, we will show how to construct the candidates for the optimal strategies appearing in the verification theorem. Afterwards, we show that these candidates are indeed the optimal solutions of the worst-case portfolio problem in discrete time .

The optimal strategy \(\pi ^*_{T-1}\) for the single-period worst-case portfolio problem is derived as in the log-utility case.

Proposition 3

The optimal portfolio process \(\pi ^*_{T-1}\) equals 0 for the single-period worst-case portfolio optimization of the terminal time T.

Next we want to show that the candidate for the optimal strategy obtained as a solution to the dynamic programming equation 4.8 exists.

Lemma 1

Under the assumptions of Theorem 3, there exists a portfolio process \(\pi ^*_{t}\) which satisfies

for all \(x>0\) and all \(t\in \{0,1,\dots ,T-1\}\).

Proof

Let us start in defining the functions

As it can easily be shown (by induction using the dynamic programming equation) that \({\tilde{U}}_{t+1}(x)\) is a strictly increasing function, we have that \(g(\pi )\) is a strictly decreasing function.

By Assumption (D), the crash-free optimal portfolio strategy \({\tilde{\pi }}^*_t\) yields the maximum of the function \(f(\pi )\). If now the investor chooses the pure bond strategy \(\pi = 0\), we have

If the optimal strategy \({\tilde{\pi }}^*\) in the crash-free model is not worst-case optimal, the value function under the crash-free model is better than the value function of the crash model, if not, the two value functions are at most equal. Therefore, we get

If the investor chooses the optimal deterministic strategy in the crash-free model \({\tilde{\pi }}_t^*\), we have

The worst-case scenario of this optimal strategy \({\tilde{\pi }}_t^*\) at time \(t+1\) is given by a crash of the maximum size \(k^*\) which leads to the worst-case bound of

Thus, we obtain the following inequality:

Hence, we arrive at

The two Inequalities (4.9) and (4.10) imply the existence of a unique deterministic portfolio process \(\pi ^*_{t} \in [0, {\tilde{\pi }}_t^*]\) for all \(t\in \left\{ 0,1,\dots ,T-2\right\} \) with

which is what we wanted to show. \(\square \)

Now let us get back to consider the right side of the value function

Lemma 1 above yields that the supremum in (4.11) is attained for the smallest \(\pi _t\) which satisfies

or the portfolio strategy \(\pi _t\) with the biggest \(\pi _t\) with

The value functions \(E(U_{t+1}(x(1+r+\pi _t(R-1-r)))\mid {\mathcal {F}}_t)\) and \(E({\tilde{U}}_{t+1}(x(1+r- \pi _t(r+k^*)))\mid {\mathcal {F}}_t)\) are both continuous, therefore we obtain the supremum when we have the equality

In Lemma 1, we already showed the existence of those portfolio strategies along the dynamic programming equations and derived how to construct the candidates of the optimal portfolio strategies. In the following we show that the derived candidates are indeed the optimal solutions of the worst-case portfolio problem in discrete time.

Proof

(Theorem 3) Assume that there exists an admissible portfolio process \(\pi = (\pi _t, \dots , \pi _{T-1})\) with a better worst-case bound than the portfolio process \(\pi ^* = (\pi _t^*, \dots , \pi _{T-1}^*)\) obtained by the dynamic programming equation 4.8 as proved by Lemma 1. We show the non-existence of such a portfolio process \(\pi \) via backward induction in time.

\({t=T-1:}\)

Here, we must have \(\pi _{T-1}=0=\pi ^*_{T-1}\) due to Proposition 3.

\({t=j\in \left\{ 0,1,\dots ,T-2\right\} :}\)

Now we assume that the portfolio process \((\pi _j, \dots , \pi _{T-1})\) leads to a better worst-case bound than \((\pi _j^*, \dots , \pi _{T-1}^*)\), and \((\pi _{j+1}, \dots , \pi _{T-1})\) has the same worst-case bound as \((\pi _{j+1}^*, \dots , \pi _{T-1}^*)\). Then, as we have

we must have both strict inequalities

Due to the fact, that both \(\pi _j\) and \(\pi ^*_j\) are \({\mathcal {F}}\)-measurable, the first inequality leads to

and thus to

almost surely (see also the argument for \({\tilde{U}}_t(x)\) being increasing in x at the beginning of the proof of Lemma 1). As the function \(f(\pi _t)\) as defined in Lemma 1 is increasing, we obtain

which is in contradiction to the strict inequality (4.13). Thus, the assumption of the existence of an admissible portfolio strategy \(\pi \) yielding a bigger worst-case bound than \(\pi ^*\) is proved to be wrong. \(\square \)

4.2 Numerical examples

We present some examples of the solution of the worst-case portfolio problem via the dynamic programming equation to illustrate our theory with the most popular utility functions.

4.2.1 Power utility

Let us start to consider the case of power utility

To apply our just obtained results, we have to check if indeed all assumptions of Theorem 3 are satisfied. For this, we first look at the crash-free setting. By using the corresponding dynamic programming equations, one can directly show that we have

with

where the constant portfolio process \({\tilde{\pi }}^*\) is determined as the solution of the maximization problem

By the general Assumption (O) on the market model, the supremum is indeed attained. Due to the multiplicative form of the wealth process and the independence of the returns \(R_t\) from the past price evolutions combined with the identical distributions of \(R_t \sim R\), the optimal portfolio process has to be a constant one. Further, by Assumption (M), we have

We next consider the form of the value function of the worst-case problem and claim that we have

for a suitable positive, deterministic and decreasing function H(t) with \(H(t)\le h(t)\). Starting from \(U_T(x)=x^\gamma /\gamma \) and using \(\pi ^*_{T-1}=0\), we have

which constitutes the start of the induction on \(T-t\) with \(t=1\). Let us assume that we have proved the representation (4.17) for \(t-1\). We will now prove it for t. We then have

Note that the supremum in the equation above is independent of x and is given by a deterministic function of time as – again – the randomness in the optimization problem is only given by R which is independent of \({\mathcal {F}}_{T-t}\). Note that the maximum of \(E\left( (1+r+\pi _{T-t}(R-1-r))^\gamma \mid {\mathcal {F}}_{T-t}\right) \) is attained for the crash-free optimal portfolio process \({\tilde{\pi }}^*\) and the function increases in \(\pi \) on \([0,{\tilde{\pi }}^*]\). For the second term \(h(T-t+1) (1+r-\pi _{T-t}(r+k^*))^\gamma \) the optimal portfolio value would be zero and decreases in \(\pi \). As, however, \(h(T-t+1)\ge H(T-t+1)\), the optimal value \(\pi ^*_{T-t}\) has to be in \([0,{\tilde{\pi }}^*]\). As the two functions containing \(\pi _{T-t}\) are identical for all times \(t<T-1\), but their multipliers \(H(T-t+1)\), \(h(T-t+1)\) are larger than their counterparts at the next time step, we have also proved that the value of the supremum is bigger at time \(T-t\) than at time \(T-t+1\). Thus, we have

where the positivity is implied by the positivity of all ingredients of the optimization problem and the fact that it has a positive lower bound which is attained for choosing \(\pi (T-t) = 0\).

Thus, Assumption (D) is satisfied. We can thus make full use of the claims of Theorem 3.

Due to Theorem 3, we have

for the optimal portfolio process in the crash setting. Using the form of the value function in the crash-free setting, we obtain

Applying the dynamic programming equation in \(E(U_{t+1}(x(1+r+\pi _t(R-1-r))))\) we get

By comparing Eqs. 4.19 and 4.20, the optimal strategy \(\pi _t^*\) has to satisfy

which directly leads to

As we have that \(E(1+r+\pi _t(R-1-r))^{\gamma }> 0\) in the interval \([0, {\tilde{\pi }}^*]\), we can transform this into the following recursive relation for the optimal strategy

with

where the latter equation follows from Proposition 3.

To show the existence of a solution \(\pi _t^*\in [0, {\tilde{\pi }}^*]\) of Eq. 4.21, note first that right hand side of Eq. 4.21 is increasing for \(\pi _{t}^* \in [0, {\tilde{\pi }}^*]\). However, if we choose \(\pi _t^* = 0\) on the right hand side, we obtain (by backward induction starting at time \(t=T-2\))

For the choice of \(\pi _t^* ={\tilde{\pi }}^*\) on the right hand side of Eq. 4.21, we obtain

Therefore, there indeed exists a unique solution \(\pi _{t}^*\) of Eq. 4.21.

To continue our example, we now have to choose a stock price model so that we can explicitly check the remaining assumptions of Theorem 3. If we assume that the price process of the stock follows the binomial model (as in the case of our log-utility example), then the remaining assumptions of Theorem 3 follow immediately. Further, by calculating the relevant expectation in Eq. 4.16, the crash-free optimal portfolio strategy \({\tilde{\pi }}^*\) is of the form

Thus, we obtain the recursive formula for the worst-case optimal strategy as follows

which again has to be solved numerically.

Figure 2 compares the optimal trading strategies \(\pi _t^*\) with and without crash possibility for power utility for the choices of \(r=0.05\), \(\gamma =0.5\), \(u=1.4918\), \(d=0.67\), \(p=0.5375\), \(k=0.05\) and \(T=10\). The worst-case optimal trading strategies \(\pi _t^*\) is decreasing with time when we approach the time horizon. Only in the last single period starting in \(T-1\), the fraction of risky investments is reduced to zero.

Approximation of the Black–Scholes–Merton model Using the above results in the binomial setting, we now introduce a general time step \(\varDelta t\) with the intention to let it tend to zero to approximate the geometric Brownian motion model of the stock price in the Black–Scholes–Merton setting via a sequence of binomial models. For this, we define the parameters of the binomial model by

For notational simplicity, we will in the following use the abbreviation r for the interest rate again. With the above choice, it is well-known that this sequence of binomial models converges weakly to the geometric Brownian motion with parameters \(\mu \) and \(\sigma ^2\).

The recursive formula for the worst-case optimal portfolio process \(\pi _{t+\varDelta t}^*\) now has the form of

with

We expect the worst-case optimal discrete-time strategy computed by the dynamic programming equations to be close to the expression in the continuous-time model, at least for small values of \(\varDelta t\). To check this, we compute

To examine, the above limit, let \(A = (A_1 + A_2)^{\frac{1}{\gamma }}\) with

Using the Taylor expansion of first order for the exponential function and then binomial series expansion, we have

and

Using the binomial series expansion again, we obtain

Therefore, taking the limit of \(\varDelta t \rightarrow 0\) leads to

and

This then leads to

In particular, the limit on the left hand side of this equation exists and equals \(d\pi ^*_t\). Thus, the optimal portfolio strategy computed by the dynamic programming equations 4.8 converges to the optimal control of the worst-case portfolio problem in continuous time. Figure 3 illustrates this convergence of the worst-case optimal portfolio process in discrete time to the worst-case optimal portfolio process in continuous time for decreasing values of \(\varDelta t\).

4.2.2 Log utility

In the log utility case,

it can directly be verified that all assumptions of Theorem 3 are satisfied that do not depend on the particular choice of the stock price model. The optimal strategy \(\pi _t^*\) can then be obtained from the dynamic programming equations 4.8 by solving the indifference requirement

Due to \(\ln (x)\) being concave and increasing, Assumption (M) yields

in the interval \([0, {\tilde{\pi }}^*]\). Then, the recursive formula for the optimal strategy is given by

which is consistent with the result obtained by the indifference approach of the previous section.

4.2.3 Exponential utility

The exponential utility function is given by

for some \(\theta > 0\).

Compared to the examples of log utility and power utility, the situation for the exponential utility is totally different. First of all, the separation of the wealth x and the portfolio \(\pi \) in the value function is not possible already in the crash-free setting. Therefore, we no longer consider the portfolio process \(\pi _t\) to describe the investor’s strategy. Instead it will turn out that the amount of money invested in the risky stock at time t given by \(\pi _t X_t\) is the appropriate term. Further, the exponential utility has a finite slope in \(x=0\). As a consequence, the optimal strategy does no longer automatically ensure the positivity of the corresponding optimal final wealth. On the other hand, this does not cause theoretical problems as the maximization problem of the expected terminal wealth is also well-defined in that case, which is not allowed in the previous cases of log utility and power utility.

So let us in the following slightly misuse the notation of \(\pi _t\) (and the corresponding optimal values \(\pi _t^{*}\), \({\tilde{\pi }}_t^{*}\)) to now denote the amount of money invested in the risky asset. Then, in the crash-free setting, it can be shown (via induction) that using the corresponding dynamic programming equation, we obtain the value function as

Here, the values \({\tilde{\pi }}_s^*\) are determined as the solutions of

Note that due to the independence of \(R_t\) of \({\mathcal {F}}_t\) and the fact that there is no requirement on the wealth process \(X_t\) in the exponential utility case, it is enough to consider the optimization problem for constant values \(\pi \). Further, due to Assumption (M), the optimal amount of money invested in the stock will be positive at each time s. Even more, in the case of \(r=0\), it is optimal for the crash-free setting to keep the amount of money invested in the risky asset fixed. Gains and losses of stock investment will then always be allocated to the position of the riskless investment.

In principle, the shift from the portfolio process to the process of money invested in the risky asset does not allow a direct application of Theorem 3. However, it can be shown that by dropping the requirement of a non-negative wealth process, one can imitate all the steps leading to Theorem 3 [compare Korn (2005) for the continuous-time case]. Thus, the corresponding dynamic programming equations yields the following relation for the optimal amount of money invested in the stock:

with

and

Therefore, we have

which can be reordered as

This results in a recursive formula for the optimal amount of the money \(\pi ^*_t\):

with

If we assume that the price process of the stock follows the binomial model, we obtain the crash-free optimal trading strategy (the amount of money invested in the stock) as follows

Thus, the recursive equation for the optimal worst-case strategy is given by

The form of the optimal trading strategies are illustrated in Fig. 4 for the choices of \(\theta = 0.01\), \(u=1.4918\), \(d=0.67\), \(p=0.5375\), \(k=0.05\), \(T=10\), \(r=0\) and \(r=0.05\). The curves for \(r=0\) look very similar to the optimal portfolio processes in Fig. 2. However, note that, we plot here the amount of money invested in the stock. If we plot the optimal portfolio processes, the curve will be irregular and inversely proportional to the actual wealth processes. The curves for \(r=0.05\) look totally different. The optimal trading strategy \(\pi ^*_t\) in the crash setting is initially increasing with time as the optimal trading strategy \({\tilde{\pi }}_t^* \) in the crash-free setting is increasing with time, too. It then decreases until maturity to \(\pi ^*_T=0\).

5 Conclusion

In this paper, we have formulated a discrete-time counterpart to the continuous-time worst-case portfolio problem introduced by Korn (1997) for dealing with the threat of a crash. As our setting is very general, we have to restrict it by making suitable assumptions on the model parameters and on the form of the optimal portfolio processes in the crash-free setting.

This, however, helps us to

introduce the indifference concept between the worst-crash happening now or no crash happening at all and derive the worst-case optimal portfolio process from it in the case of the logarithmic utility function,

come up with a variant of a discrete-time dynamic programming equation for the worst-case crash setting in the general case,

show existence and uniqueness of the worst-case optimal portfolio process in the general market setting,

apply our results explicitly in the case of log utility, power utility and exponential utility,

illustrate the behavior of the worst-case optimal portfolio processes in the binomial model for log utility and power utility,

demonstrate the convergence of the worst-case optimal portfolio processes in a series of binomial models towards the worst-case optimal portfolio process in the continuous-time Black–Scholes–Merton setting in the power utility case.

There are many possible extensions and generalizations such as the consideration of frictions like transaction costs or the relaxations of Assumptions (M), (O), or (D). A further possible challenge is the extension to a multi-asset setting.

References

Bäuerle N, Rieder U (2011) Markov decision processes with applications to finance. Springer, Berlin

Belak C, Menkens M, Sass J (2015) Worst-case portfolio optimization with proportional transaction costs. Stoch Process Appl 87(4):623–663

Desmettre S, Korn R, Ruckdeschel P, Seifried FT (2015a) Robust worst case optimal investment. OR Spectr 37(3):677–701

Desmettre S, Korn R, Seifried FT (2015b) Worst case consumption-portfolio optimization. Int J Theor Appl Finance 18(1):1550004

Duffie D (1988) Security markets: stochastic models. Academic Press, New York

Hua P, Wilmott P (1997) Crash course. Risk Mag 10(6):64–67

Karatzas I, Lehoczky J, Sehti S, Shreve S (1987) Optimal portfolio and consumption decisions for a small investor on a finite horizon. SIAM J Control Optim 27:1157–1186

Kelly JC (1956) A new interpretation of information rate. Bell Syst Tech J 35:917–926

Korn R (1997) Optimal portfolios: stochastic models for optimal investment and risk management in continuous time. World Scientific, Singapore

Korn R (2005) Worst-case scenario investment for insurers. Insur Math Econ 36:1–11

Korn R, Menkens O (2005) Worst-case scenario portfolio optimization: a new stochastic control approach. Math Methods Oper Res 62(1):123–140

Korn R, Seifried FT (2009) A worst-case approach to continuous-time portfolio optimization. Radon Ser Comput Appl Math 8:327–345

Korn R, Steffensen M (2007) On worst-case portfolio optimization. SIAM J Control Optim 46(6):2013–2030

Korn R, Wilmott P (2002) Optimal portfolios under the threat of a crash. Int J Theor Appl Finance 5(2):171–187

Kröner H (2014) Portfoliooptimierung im Binomialmodell. PhD thesis, University of Kaiserslautern

Menkens O (2004) Crash hedging strategies and optimal portfolios. PhD thesis, University of Kaiserslautern

Merton RC (1971) Optimum consumption and portfolio rules in a continuous time. J Econ Theory 3(4):373–413

Pliska SR (1997) Introduction to mathematical finance, discrete time models. Blackwell Publishers Inc, Oxford

Samuelson P (1969) Lifetime portfolio selection by dynamic stochastic programming. Rev Econ Stat 51(3):239–246

Seifried FT (2010) Optimal investment for worst-case crash scenarios: a Martingale approach. Math Oper Res 35(3):559–579

Acknowledgements

Suggestions and constructive comments from the associate editor and an anonymous referee are gratefully acknowlegded.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Chen, L., Korn, R. Worst-case portfolio optimization in discrete time. Math Meth Oper Res 90, 197–227 (2019). https://doi.org/10.1007/s00186-019-00668-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00186-019-00668-8