Abstract

The last five decades have witnessed dramatic changes in crude oil price dynamics. We identify the influence of extreme oil shocks and changing oil price uncertainty dynamics associated with economic and political events. Neglecting these features of the data can lead to model misspecification that gives rise to: firstly, an explosive volatility process for oil price uncertainty, and secondly, erroneous output growth dynamic responses to oil shocks. Unlike past studies, our results show that the sharp increase in oil price uncertainty after mid-1985 has a pernicious effect on output growth. There is evidence that output growth responds symmetrically (asymmetrically) to positive and negative shocks in the period when oil price uncertainty is lower (higher) and more (less) persistent before (after) mid-1985. These results highlight the importance of accounting for outliers and volatility breaks in oil price and output growth and the need to better understand the response of economic activity to oil shocks in the presence of oil price uncertainty. Our results remain qualitatively unchanged with the use of real oil price.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

There is an established literature that uncertainty about oil prices will tend to reduce current investment (Bernanke 1983; Elder and Serletis 2010) and consumer expenditures (Edelstein and Kilian 2009). The theoretical underpinning for real options in firm-level investment decisions predicts that firms are likely to delay making irreversible decisions in the face of uncertainty about oil prices particularly when the cash flow from investment is contingent on oil prices (Brennan and Schwartz 1985; Majd and Pindyck 1987; Brennan 1990). The decision by firms to postpone investment can in aggregate give rise to cyclical fluctuations in investment (Bernanke 1983; Pindyck 1991). On the other hand, people’s increased precautionary savings in response to greater risks of being made unemployed as the economy slows down in the face of increased oil price uncertainty will result in falling consumer expenditures, particularly consumer durables. Together, these effects will cause aggregate output to further decline.

This paper investigates how oil price uncertainty and oil price shocks affect real economic activity. Our contributions lie in the empirical assessment of how changes in oil price uncertainty dynamics and oil price shocks in the last five decades have impacted on aggregate output in the US economy. Past studies have reported increases in oil price volatility in the mid-1980s. Barsky and Kilian (2004) and Hamilton (1983, 2013) expound on the formation of oil prices prior to the early 1980s. Notably the Texas Railroad Commission was an influential regulator for many years. From the 1930s to the 1960s it largely set world oil prices, but was displaced by OPEC (Organization of Petroleum Exporting Countries) after 1973. There have been interests in extending the sample to earlier years to capture other features notwithstanding clear evidence of structural breaks. In this paper, we show how changes in the underlying dynamic of oil prices can have ramifications for the study of oil price shocks on real economic activities in the presence of oil price uncertainty.

We document the systematic increase in the volatility of crude oil prices since the beginning of 1986 by dating the structural break in oil price return volatility. This break date in oil price volatility process matches with the change in oil price stability when the Saudis abandoned the role of swing producer in late 1985. Furthermore, the Organization of Petroleum Exporting Countries (OPEC) changed from effectively setting the price and letting production fluctuate (during 1974–1985) to setting production quotas and letting the price fluctuate after 1985 (Baffes et al. 2015). A number of other changes enhanced this transformation to a period of more volatile prices, including the growing amount of market-sensitive non-OPEC production. For example, there was a period of rapid growth in the supply of oil from non-OPEC countries (the North Sea and the Gulf of Mexico) when the technology to extract oil from the sea became profitable (Baffes et al. 2015). Baumeister and Peersman (2013) argue that the rise in oil price volatility since 1986 is attributed to decreasing short-run price elasticities of oil supply and oil demand.Footnote 1 The lack of spare oil production capacity and limited investment in oil industry post mid-1980s have given rise to an increase in oil price volatility. At the same time, this increased uncertainty has deepened oil futures markets leading to further reduction in the sensitivity of oil supply and demand to changes in crude oil prices. We also show that there are mean breaks in the data on output growth and oil price changes which need to be accounted when studying the effect of oil price uncertainty on output growth.

The empirical framework follows the approach of Elder and Serletis (2009, 2010, 2011) and Bredin et al. (2011), who measure the impact of oil price uncertainty in a vector autoregressive (VAR) model. Oil price uncertainty is characterised by a generalised autoregressive conditional heteroskedasticity (GARCH) process. Using the GARCH process to model macroeconomic uncertainty has become very popular in the literature on understanding the effect of uncertainty on macroeconomic performance (Chua et al. 2011).Footnote 2 Further, by endogenising the movement of oil prices within the VAR system, the assumption of exogenous oil prices is relaxed. The impact of oil price uncertainty on output is examined through the coefficient associated with the GARCH-in-Mean term in the VAR specification. The effect of oil price shocks on output, conditional on the sign of shock, is analysed through the impulse response function obtained from the VAR GARCH-in-Mean model.

An important, yet often neglected, feature of crude oil price when examining its effect on economic activity is that crude oil price has undergone dramatic changes in its behaviour in the last five decades. Following World War II, oil prices experienced a number of extreme shocks which include the OPEC oil embargo of 1973–1974, the Iranian revolution of 1978–1979, the Iran–Iraq War between 1980–1988, the first Persian Gulf War in 1990–1991, the oil price spike of 2007–2008, and the oil price plunge of 2015. These shocks can cause abrupt shifts not only in the mean of oil prices but also in the unconditional and conditional variances (Charles and Darné 2014). The latter, which is used as a proxy for oil price uncertainty, may also experience breaks in the GARCH process parameters, thereby influencing the degree of persistence in the uncertainty process.

A known fact about oil price return volatility is that it can exhibit long-range dependence or integrated generalised conditional heteroskedasticity (IGARCH) effects. This empirical feature can emanate from non-constant unconditional variances (Diebold 1986; Lamoureux and Lastrapes 1990). More recently, it has been shown both empirically and theoretically that volatility models which accommodate structural changes can also give rise to this IGARCH effect (Mikosch and Starica 2004; Hillebrand 2005; Perron and Qu 2007). These structural changes can arise from outliers in the form of extreme oil shocks and/or variance shifts in oil prices. Identification of variance shifts can be difficult in the presence of outliers. Rodrigues and Rubia (2011) show that outliers like extreme oil shocks can give an impression that there are volatility breaks when in fact there are none. For this reason, we first identify the presence of breaks in mean and adjust the data for these breaks before detecting the presence of variance shifts.

Like oil price uncertainty, the degree of persistence in conditional macroeconomic volatility can be a result of failing to account for breaks in variance caused by extreme shocks (Diebold 1986). Stock and Watson (2012) also point to the observation that macroeconomic shocks were much larger than previously experienced, particularly in the USA, and they were largely attributed to shocks associated with financial disruptions and heightened uncertainty. One example is the effect of the recent global financial crisis when the US economy experienced significant contraction. When assessing the effect of oil price uncertainty on output growth in the presence of these outlier events, it is important to separate the fall in output growth caused by the crisis from oil price uncertainty, so that the output growth retarding effect of oil price uncertainty is not overstated.

We rely on the outlier detection test of Laurent et al. (2016) and the volatility break detection test of Sansó et al. (2004), which is based on the iterative cumulative sum of squares (ICSS) algorithm developed by Inclan and Tiao (1994).Footnote 3 Accounting for outliers in the volatility of crude oil markets is paramount for modelling oil price uncertainty because they can bias: (i) the estimates of the parameters of the equation governing volatility dynamics; (ii) the regularity and non-negativity conditions of GARCH-type models; and (iii) the detection of structural breaks in volatility. Equally, breaks in the volatility of oil prices have repercussions for the choice of model used to characterise oil price uncertainty. More importantly, for the purpose of evaluating the effect of oil price shocks and oil price uncertainty on economic activity, the correct specification of the conditional variance of output and oil price is also important for three reasons. Firstly, hypothesis tests about the mean in a model in which the variance is misspecified can lead to invalid inference. Secondly, inference about the conditional mean can be inappropriately influenced by outliers and high-variance episodes if they are not accounted for (Hamilton 2008). Lastly, impulse responses generated from the misspecified model parameter estimates due to outliers and high-variance episodes may misrepresent the effects of oil shocks on real economic activity.

Our empirical results for crude oil price return volatility demonstrate that it is important to account for both outliers and volatility breaks when characterising oil price uncertainty in the last five decades. Failing to accommodate structural changes in oil price uncertainty can exaggerate the extent of volatility persistence and distort the effects of oil shocks on real economic activity examined through impulse response functions. We show that following proper accounting of breaks in mean and variance by dividing our sample into two subsamples with the break date chosen to coincide with the date when the conditional variance in oil price shifted, the effects of oil price uncertainty on output growth differ starkly across the two samples. There is no evidence to suggest that oil price uncertainty has a pernicious effect on output growth in the period 1973:10–1985:06 when oil price uncertainty was deemed to be lower. However, after mid-1985, the rise in oil price uncertainty tends to cause output growth rate to decline. This is a new finding which was not previously reported in Elder and Serletis (2010).Footnote 4 We perform robustness analysis using real oil price and further show that our results remain qualitatively unchanged even when real oil price is considered.

The remainder of the paper is structured as follows. Section 2 introduces the model VAR GARCH-in-Mean model commonly used to study the response of oil price shock and uncertainty on output growth. The implications of the volatility persistence from the different GARCH specifications on the impulse responses generated by this model are also discussed. Finally, the section ends by discussing the method for identifying possible extreme oil shocks and break in variance, and the treatment of the series when subject to these structural changes. Section 3 describes the US data and the empirical results are presented in Sect. 4. Section 5 concludes.

2 Model and estimation

2.1 A model of oil price uncertainty and output growth

Our empirical model is a structural VAR with multivariate GARCH-in-Mean which is employed by Elder (2003, 2004) and Elder and Serletis (2009, 2010). The VAR model includes only two variables, namely output growth and change in oil prices. The choice of the two variables is consistent with the recommendation of Edelstein and Kilian (2009) who argue that the bivariate VARs in output growth and the change in price of oil are adequate and appropriate for summarising the relevant dynamics. More generally, the model can be written as follows:

and more specifically,

Here, we assume that \(\mathrm{Cov}(e_{\mathrm{IPI},t},e_{\mathrm{Oil},t})=0\). Note also that the specification in Eq. (2) orthogonalises the reduced form errors by allowing \(\Delta \mathrm{Oil}_{t}\) to depend on contemporaneous \(\Delta \mathrm{IPI}_{t}\) through the coefficient \(a_{21}\) while restricting \(\Delta \mathrm{Oil}_{t}\) from influencing \(\Delta \mathrm{IPI}_{t}\) contemporaneously. This restriction implies that \(\Delta \mathrm{Oil}_{t}\) responds quickly to innovations in \(\Delta \mathrm{IPI}_{t},\) while \(\Delta \mathrm{IPI}_{t}\) responds to \(\Delta \mathrm{Oil}_{t}\) innovations with a 1-month lag. This restriction is deemed appropriate given that oil is traded as a commodity and its price adjusts rapidly to new information. By orthogonalising the reduced form errors with this restriction, we are able to identify the structural coefficients.

In Eq. (1) the \(2\times 1\) vector of observable variables, \( y_{t}\) follows a vector autoregressive process whose lag order is determined by the Schwarz criterion (SC), and its dynamic is determined by a multivariate GARCH-in-Mean process, which captures the possible effect of changes in oil price uncertainty on output growth. Given \(\mathcal {F}_{t-1}\) is the information set at time \(t-1,\) \(e_{t}|\mathcal {F}_{t-1}\sim (0,H_{t})\) such that \(H_{t}\) follows a vectorised (VEC) form multivariate GARCH process. The VEC model is a direct generalisation of the univariate GARCH and assumes that \(H_{t}\) is determined by reference to past errors and historical volatility:

Because \(A_{2}\) and \(A_{3}\) assumed a diagonal matrix with zero off-diagonal elements, there are no covariance terms in the conditional variance specification. This assumption can be relaxed.Footnote 5 Nevertheless, for the purpose of comparison with earlier studies by Elder and Serletis (2009, 2010), we have retained this assumption.

Our measure of oil price uncertainty is \(h_{\mathrm{Oil},t},\) the conditional variance of oil which represents the 1-month-ahead forecast for oil price change and the dispersion of the forecast error. The greater is \(h_{\mathrm{Oil},t}\) the more uncertain is the impending realisation of oil prices. The effect of changes in oil price uncertainty on output growth is captured by the parameter \(\lambda \) in Eq. (2). If the real effect of oil price uncertainty tended to retard output growth, then the \(\lambda \) estimate should be negative and significant. It is common in the literature to refer to the dampening effect of oil price uncertainty on output growth arising from both positive and negative oil price shock as an asymmetric response in the VAR model (Brennan and Schwartz 1985; Bernanke 1983). This is usually analysed by examining the response of production to positive and negative oil shocks using impulse response functions. In the event that the response of production to a positive oil shock does not mirror the response to a negative oil shock in terms of having the same magnitude but with opposite sign, then the response of production is asymmetric. The model parameters are obtained using maximum likelihood estimation. Elder (2003) provides the mathematical expression for the associated impulse response function. In addition, for brevity, the additive outlier test of Laurent et al. (2016) and the CUSUM-type test of Sansó et al. (2004) to detect a break in variance are discussed in “Appendix A1 and A2,” respectively.

3 The data and summary statistics

The empirical investigation is based on monthly observations on a domestic index of industrial production (IPI) for the US economy for the period from October 1973 to October 2017. Given that many production decisions have real option components with related labour costs such as hiring, training and firing, as well as short-lived physical capital such as machinery, and other materials which may not be recoverable, the use of IPI is appropriate for the purpose of analysis. In addition, IPI data measure output production in industries that are both energy intensive and extensive with such industries including mining, manufacturing and utilities. Mining industries engage in direct exploration of oil and gas and other energy intensive mining operations. Manufacturing and utilities industries are equally energy intensive. The output data are seasonally adjusted at 2012 constant prices.

Bredin et al. (2011) point out a potential problem with the inclusion of IPI data in 2008 when the global financial crisis had an adverse impact on output growth in the US and Canadian economies, to the extent that measuring the impact of oil price uncertainty on output growth may be biased by the adverse effect of the crisis. This issue, however, does not present a problem to our analysis as the break detection in the mean of output growth identifies the adverse effect of the financial crisis on output growth and the output growth series can be adjusted for this effect.

For oil prices, they are measured in nominal local currency. Like Blanchard and Gali (2010) and Bredin et al. (2011), nominal oil prices are preferred to real oil prices for the reason that the former allows the isolation of uncertainty associated with oil prices from uncertainty associated with the aggregate price level. In addition, we do not use the real price of oil to avoid dividing the nominal oil price by an endogenous variable, the GDP deflator. However, for the purpose of robustness analysis, we repeat the analysis using the real oil price which is the nominal oil price deflated by the GDP deflator (Elder and Serletis 2010) and report the results in Sect. 4.4. The US oil price is the cost of imported crude oil free on board, which is approximately the average of OPEC and non-OPEC free on board crude oil prices since the US imports oil largely from Canada and other OPEC countries. The oil price series is obtained from the US Department of Energy.

Table 1 presents summary statistics of the data. Output and oil prices are also expressed in annualised growth rate, each is denoted by the log first difference of the series multiplied by 1200, so that \(\Delta \mathrm{IPI}_{t}=\) \( 1200\times \ln (IP\dot{I}_{t}/\mathrm{IPI}_{t-1})\) and \(\Delta \mathrm{Oil}_{t}=\) \(1200\times \ln (\mathrm{Oil}_{t}/\mathrm{Oil}_{t-1}),\) respectively. All series, be they in levels or first difference, show deviation of skewness and kurtosis from zero except for the \(\mathrm{IPI}_{t}\) of the USA. The Jarque–Bera test of normality strongly rejects the null of normality for all series. The ARCH test also indicates significant evidence of conditional heteroskedasticity in the data, at least up to lag order 6. The augmented Dickey–Fuller (ADF) test fails to reject the null of a unit root in the series in levels. However, a cursory look at the plots of the series in levels (see Fig. 1, Panel 3) suggests that oil prices may be subject to structural breaks. The data in first difference of the series for IPI and oil prices also exhibit significant shifts in their mean, suggesting that the standard unit root test may not be adequate in identifying the stationarity property of the series. It is evident in Panel 4 that the spikes and plunges in oil price changes reflect the following events: OPEC oil embargo of 1973–1974, the Iranian revolution of 1978–1979, the Iran–Iraq War initiated in 1980, the first Persian Gulf War in 1990–91, the oil price spike of 2007–2008, and the oil price plunge of 2015. It is also evident that the degree of variability in changes in oil prices is much higher post-1985 than at the start of the sample period in the 1970s.

One possibility is to perform the Zivot and Andrews (1992) test (ZA henceforth) and the Perron (1989) test to determine the stationarity property of the data in the presence of a structural break that is determined endogenously. However, the problem with employing such tests is that in the presence of structural break(s) in the unit-root process, the ZA test statistic suffers from size distortion that could lead to a spurious conclusion that a time series is trend stationary when in fact it is nonstationary with breaks (Lee and Strazicich 2001). To remedy the problem, we employ the Carrion-i-Silvestre et al. (2009) tests which allow for multiple structural breaks in the level and/or slope of the trend function under both the null and alternative hypotheses. Because the Carrion-i-Silvestre et al. (2009) tests allow for breaks under both the null of a unit root and the alternative hypothesis of a stationary process, their tests are robust to the presence of breaks under the unit-root null hypothesis. The Carrion-i-Silvestre et al. (2009) test procedure is explained in “Appendix A3”. Results of the Carrion-i-Silvestre et al. (2009) tests are shown in the rows with \(MZ_{\alpha }^{\mathrm{GLS}}\), \(MZ_{t}^{\mathrm{GLS}}\) and \(MZ_{T}^{\mathrm{GLS}}\) in Table 1. The superscript \(\mathrm{GLS}\) indicates that the tests employ the generalised least squares (\(\mathrm{GLS}\)) detrending procedures to estimate the parameters of the model. These test statistics follow the M-class tests in Ng and Perron (2001) but they allow for multiple structural breaks. We perform the test by allowing for a maximum of five breaks, although we only found a single break and therefore only the results for one break are reported. It can be seen that in the case of data series in levels, the test fails to reject the unit-root null hypothesis with one break suggesting that all rates are I(1) process with the structural break reported in the row with the heading “Break date”. With regard to results of the test for \(\Delta \mathrm{IPI}_{t}\) and \(\Delta \mathrm{Oil}_{t}\) the test statistics for the Carrion-i-Silvestre et al. (2009) test, comfortably reject the null hypothesis of I(1) with a break at the 1% significance level, implying that the series are stationary with a break. On the basis of these results, we proceed with modelling \(\Delta \mathrm{IPI}_{t}\) and \(\Delta \mathrm{Oil}_{t}\).

4 Empirical results

4.1 Additive outliers and variance shift

As suggested by Rodrigues and Rubia (2011), the modified iterative cumulative sum of squares (ICSS) algorithm to detect breaks in variance should be applied on the data in differences corrected for the presence of additive outliers. Consequently, we use the outlier detection test of Laurent et al. (LLP) (2016) based on GARCH models on the first differenced data. The results are reported in Table 2. We find one additive outlier for the US \( \bigtriangleup \mathrm{IPI}_{t}\) which occurs in September 2008, and it is associated with the Great Recession and the Global Financial Crisis. For nominal oil prices, we detect several additive outliers where the corresponding dates are associated with various specific economic, political, and financial events: in March 1974 with the end of the OPEC oil embargo, in February 1986 with the Iran–Iraq war, in August 1990 with the invasion of Kuwait by Iraq, in November 2008 with the Global Financial Crisis, and in December 2014 as US production strongly exceeded demand. Figure 2 shows the size of the outliers which are identified by the Laurent et al. (2016) test. In many instances, the size of these outliers is large.

When applying the ICSS algorithm on the outlier-adjusted series, we find one break in variance in June 1985 for the oil prices and none for the IPI. This break date in oil price volatility process matches the change in oil price stability when the Saudis abandoned the role of swing producer in 1985. In addition, the OPEC started setting production quotas and letting the price fluctuate after 1985, a practice which differs from the pre-1985 in which they set the price and let production fluctuate (Baffes et al. 2015). At the same time, a number of other changes enhanced this transformation to a period of more volatile prices, including the growing amount of market-sensitive non-OPEC production. There was a period of rapid growth in the supply of oil from non-OPEC countries (the North Sea and the Gulf of Mexico) when the technology to extract oil from the sea became profitable (Baffes et al. 2015).

4.2 Results for the Whole Sample

Our purpose is to demonstrate that failing to identify breaks in mean and variance, and therefore neglecting to accommodate these features of the data in the empirical modelling can give rise to erroneous inference. To this end, we first estimate a bivariate GARCH-in-Mean VAR with three lags using the entire sample. We also estimate a VAR model with no GARCH-in-Mean for purpose of comparison. The Schwarz criterion (SC) reveals a significant improvement with the inclusion of GARCH-in-Mean specification implying the superior characterisation of the data by the bivariate GARCH-in-Mean VAR model. The SC for VAR(3) model is 9390, while that of the GARCH-in-Mean VAR(3) model is 9025.

The point estimates of the GARCH specification parameters of the bivariate GARCH-in-Mean VAR model using the raw data and the adjusted data are reported in Panel A of Table 3. There is evidence of GARCH in both output growth rate and annualised oil price returns. The volatility process for output growth rate is clearly less persistent than oil price returns. The coefficient of \(h_{\mathrm{IPI},t-1}\) is significantly smaller than that of \( h_{\mathrm{Oil},t-1}\) irrespective of the raw or adjusted data. Moreover, the sum of the coefficients of \(e_{t-1}^{2}\) and \(h_{t-1}\) is smaller for \(\Delta \mathrm{IPI}_{t}\) (0.65) than that of \(\Delta \mathrm{Oil}_{t}\) (1.07). It can also be seen that with the removal of outliers in the data, the sum of the coefficients of \(e_{t-1}^{2}\) and \(h_{t-1}\)for \(\Delta \mathrm{Oil}_{t}\) has fell to 1.03 albeit this is still larger than 1. One concern is that the sum of the parameter estimates of \(e_{\mathrm{Oil},t-1}^{2}\) and \(h_{\mathrm{Oil},t-1}\) which is larger than 1 would imply that shocks to the volatility process will not die out. This also violates the condition of covariance stationarity, which will not result in well- behaved impulse response functions.

The coefficient of interest, which captures the effect of oil price uncertainty on output growth is \(-\,0.021\) and it is statistically significant at conventional levels. The removal of outliers in the data series has little effect on the size of this estimate. The negative coefficient supports the hypothesis that higher oil price uncertainty has a pernicious effect on real economic activity. Our estimate in terms of the magnitude of the effect of oil price uncertainty on output growth is comparable with Elder and Serletis (2010), even though their sample period is shorter than ours covering the period 1975Q2–2008Q1, and they employ real quarterly GDP data and real oil price.

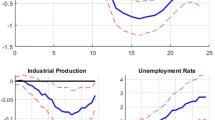

Turning to the effect of incorporating oil price uncertainty on the dynamic response of output growth to an oil price shock, we refer to the plot of the impulse responses in Fig. 3. The impulse responses are based on an oil shock which is the unconditional standard deviation of the annualised change in nominal oil prices. This shock magnitude is chosen to allow comparison with those of standard homoskedastic VAR. The response of output growth to both positive and negative oil price shocks is also plotted to determine whether there is asymmetry in the response to positive and negative shocks.

Impulse responses output growth to oil price shock for the whole sample. Note: The blue line is the impulse response of output growth obtained from the standardised homoskedastic VAR model with no GARCH-in-Mean. The black line is the impulse response of output growth obtained from the GARCH-in-Mean VAR. These impulse responses are obtained from estimating the models using the data unadjusted for outliers for the entire sample period 1973:10–2017:10. (Color figure online)

In Fig. 3, we plot the impulse responses based on the standard homoskedastic VAR and the GARCH-in-Mean VAR together to facilitate comparison. These impulse response functions are obtained from estimating the model using the raw data. It seems apparent that the impulse responses of output growth for the standard homosedastic VAR responded differently to positive and negative shocks. There is an increase (decrease) in output growth by about 60 basis points a month after the occurrence of a positive oil shock but this effect dissipates very rapidly so that by the third month the response of output growth to oil shock is nullified. In contrast, when oil price uncertainty is accounted for, the response of output growth to positive oil price shock is noticeably less than that of the standard homoskedastic VAR model in the first 3 months, but the effect of the shock continues to affect output growth negatively as time goes by. In fact, there is no evidence that the effect of oil price shock on output growth will dissipate. The same persistence in response of output growth to a negative oil shock is also observed. The inclusion of oil price uncertainty from the output equation shows an amplified response in output growth to a negative oil price shock. Output growth falls by close to 100 basis points a month after the shock occurred. In our model, the responses to positive and negative shocks are asymmetric.

Recall that the sum of the parameter estimates of \(e_{\mathrm{Oil},t-1}^{2}\) and \( h_{\mathrm{Oil},t-1}\) is greater than unity, and it is precisely due to the violation of the covariance stationarity condition that oil price shock has a persistent effect on the impulse response function of output growth. Figure 4 Panel A shows the impulse responses of output growth to oil shocks with one-standard error bands based on the model estimated using the raw data. It is apparent from this Figure that the oil shock is persistent and continues to retard output growth over time. These results are intuitively unappealing as they imply that aggregate output will contract indefinitely. It becomes apparent from Fig. 4 Panel B that even when outliers are removed from the data series, the impulse responses of output growth to oil shocks continue to suggest that the impact of oil shock on output growh is persistent. While removing the outliers does not lead to a stable GARCH process, the impulse response of output growth for positive oil shock clearly shows a distinctive response for the adjusted data compared to the raw data. Output expansion resulting from positive oil shock is noticeably more significant (i.e. 25 basis points a month after the shock) having adjusted for outliers in the data. We next turn to the results of the subsample analysis.

4.3 Results for Subsamples

We have identified that there are breaks in means in the form of outliers in both output growth and change in oil price, as well as the presence of a variance shift in oil price uncertainty around June 1985. In the subsample analysis, we estimate the model using both the raw data and the adjusted data to show the distinctive effect of the break in variance and outliers on the estimation results.

We remove the influence of outliers and split the total sample into two subsamples, namely the samples prior to and after mid-1985. The model defined by Eqs. (1) to (3) is re-estimated for each subsample and the results are reported in Table 3 under the adjusted data for samples 1 (1973:10–1985:06) and 2 (1985:07–2017:10). Table 3 Panel B shows the results of the subsample analysis for both the raw data and the adjusted series.

Impulse responses output growth to oil price shock for the whole sample. Note: The one-standard error confidence bands are estimated using the Monte Carlo method described in Elder (2004). These impulse responses are obtained from estimating the models using data for the entire sample period 1973:10–2017:10

In the first subsample, the result of outlier adjustment in the data is that the coefficient of \(h_{\mathrm{Oil},t-1}\) increases in size. However, the level of output growth and change in oil price volatility which is given by the coefficient estimate of the constant term of the GARCH process, is found to be lower following the removal of outliers in the data. Moreover, the sum of the parameter estimates of \(e_{\mathrm{Oil},t-1}^{2}\) and \(h_{\mathrm{Oil},t-1}\) is no longer greater than unity; it is 0.972 for the raw data and 0.986 for the adjusted data. The deleterious effect of oil price uncertainty on output growth is found not to be statistically significant at all conventional levels of significance. The sign of the coefficient of \(\sqrt{h_{\mathrm{Oil},t}}\) is positive instead of the predicted negative sign; the estimated coefficient is 0.043 (0.008) for the raw (adjusted) data. Our result corroborates the finding of Elder and Serletis (2010) who show that the coefficient of oil volatility 1986 dummy is not statistically significant at conventional significance levels. The 1986 dummy is to control for an exogenous event, the Tax Reform Act of 1986 (TRA86) which is believed to distort drilling investments and in turn may have a differential impact of oil price uncertainty on output growth.Footnote 6

In the second subsample, the level of volatility of output growth is found to be lower relative to the period prior to mid-1985. In fact, the output growth volatility is better characterised by an ARCH(1) process in the first subsample. Much like the results of the first subsample, outlier adjustment in the data is associated with (1) the coefficient of \( h_{\mathrm{Oil},t-1} \) increases in size, (2) the sum of the parameter estimates of \( e_{\mathrm{Oil},t-1}^{2}\) and \(h_{\mathrm{Oil},t-1}\) increases, and (3) the level of the volatility estimate decreases as depicted by the reduction in the constant coefficient estimated of the GARCH process.

It can be seen from the parameter estimates of the GARCH specification of \( \Delta \mathrm{Oil}_{t}\) that while the unconditional variance prior to 1985:06 is significantly smaller than that of after mid-1985, the degree of persistence measured by the sum of coefficients of \(e_{t-1}^{2}\) and \(h_{t-1}\) is much higher in the former than the latter sample. The degree of persistence in oil price uncertainty reduces to 0.838 (0.862) for the raw (adjusted) data after the variance shift. It can be inferred from these results that there is a structural break in the underlying oil price dynamic both in terms of the level of volatility and the degree of volatility persistence, which could give rise to differences in the output growth effect of oil price uncertainty in the two subsamples. Indeed, the coefficient of oil price uncertainty proxied by \(\sqrt{h_{\mathrm{Oil},t}}\) has a positive sign in subsample 1 albeit the coefficient estimate is not statistically significant at all conventional levels. In contrast, the effect of oil price uncertainty on output growth is negative in subsample 2, a period when oil price uncertainty peaked, and the effect is statistically significant at the 1% level. Comparing the coefficient estimate of \(\sqrt{h_{\mathrm{Oil},t}}\) for the raw and adjusted data (i.e., \(-\,0.048\) vs. \(-\,0.054\)), it is apparent that outliers adjustment helps to capture a larger output growth retarding effect of oil price uncertainty. When comparing the coefficient estimate of \(\sqrt{ h_{\mathrm{Oil},t}}\) for subsample 2 and the whole sample for the adjusted data (i.e. \(-\,0.054\) vs. \(-\,0.02\)), it is clear that failure to account the structural break in oil price dynamic can underestimate the growth retarding effect of oil price uncertainty. Taken together, we can infer that oil price uncertainty did not have a pernicious effect on output growth until after the break in oil price uncertainty in 1985:06 when there was heightened uncertainty about the price of oil. It is important to recognise that the response of real economic activity to this increase in oil price uncertainty has more than doubled when we account for the structural break in the behaviour of oil price volatility and breaks in mean caused by outliers.

Impulse responses output growth to oil price shock for subsample 1. Note: The blue line is the impulse response of the standardised homoskedastic VAR model with no GARCH-in-Mean. The black line is the impulse response of the GARCH-in-Mean VAR. In panel A, the impulse responses from the two models are indistinguishable as they overlap on each other. In panel B, the impulse responses from the two models do not overlap in subsequent periods. These impulse responses are obtained from estimating the models using data for the subsample period 1973:10–1985:06. (Color figure online)

Impulse responses output growth to oil price shock for subsample 2. Note: The one-standard error confidence bands are estimated using the Monte Carlo method described in Elder (2004). These impulse responses are obtained from estimating the models using data for the subsample period 1985:07–2017:10

The result of removing outliers and accounting for a break in oil price uncertainty is also evident in the impulse responses of output growth to positive and negative oil price shocks in both subsamples. For subsample 1, Fig. 5 shows that output growth decreases with respect to a positive oil price shock, falling by as much as 300 basis points before revising upward to 250 basis points 2 months later for the data adjusted for outliers. The increase in output growth in the second month is less than 100 basis points for the raw data. The effect of the shock dissipates gradually over time. The opposite response is observed for a negative oil price shock, reflecting the mirror image in the response of real economic activity to a positive shock. Given the response of output growth to both positive and negative oil shocks, we can see from the impulse responses that it is symmetric. An interesting observation is made about the impulse responses generated by both the standard homoskedastic VAR model and the GARCH-in-Mean VAR model; the inclusion of GARCH-in-Mean effect in the VAR model does not appear to bring about significant changes to the response of economic activity to oil price shock. This is perhaps not surprising given that \(\hat{\lambda }=0.007\) (0.043) for the adjusted (raw) data is not statistically significant, which suggests that oil price uncertainty has no effect on the response of output growth to oil price shock.

Figure 6 shows impulse responses of output growth to oil price shocks in subsample 2. In response to a positive oil shock, output growth displays an immediate increase by about 25 basis points followed by a downward revision. By the first quarter after impact of oil shock, output growth decreases by about 60 basis points. This is followed by the effect of the shock dissipating over a period longer than a year. For a negative oil price shock, output growth decreases initially by about 25 basis points for both the adjusted and raw data. The downward adjustment in output growth continues a month after the shock occurs by about 100 basis points for both raw and adjusted data. This is followed by an upward revision with the effect of the shock dissipates after one year. The response of output growth to the sign of oil price shock is found to behave asymmetrically. However, this result is at best tentative. The asymmetric response in output growth to the sign of oil price shocks should be tested formally. Kilian and Vigfusson (2011) develop an impulse response-based test to determine the presence of asymmetric response of output growth to positive and negative oil price shocks. This involves computing structural impulse responses conditional on recent history of the data and on the magnitude of the shock following the framework developed by Koop et al. (1996). The implementation of the impulse response-based test needs to factor the nonlinear GARCH-in-Mean VAR model estimated here, which clearly lies outside the scope of this paper. For this reason, we do not undertake a formal test to validate the prima facie evidence of asymmetry found in output growth response to positive and negative oil price shocks.

Impulse responses output growth to oil price shock for subsample 2 with data adjusted for outliers. Note: The blue line is the impulse response of output growth obtained from the standardised homoskedastic VAR model with no GARCH-in-Mean. The black line is the impulse response of output growth obtained from the GARCH-in-Mean VAR. These impulse responses are obtained from estimating the models using data which are adjusted for outliers for the subsample period 1985:07–2017:10. (Color figure online)

Elder and Serletis (2010) find some evidence that controlling for oil price uncertainty tends to exacerbate (dampen) the negative dynamic response of real output to a positive (negative) oil shock. On the contrary, we find that accounting for oil price uncertainty tends to exacerbate the dynamic response of output growth to positive and negative oil price shocks in the period when oil price uncertainty peaked (see Fig. 7). This result is consistently exhibited for both the raw and adjusted data.

It is also interesting to observe the difference in response of output growth to oil price shocks in the two subsamples; a positive (negative) oil price shock before mid-1985 causes a significant contraction (expansion) in US output upon initial impact, but this effect is not observed in the post-1985 sample. These results suggest that the effect of the 1970s oil price shock could have resulted in more acute economic recession than those experienced in the 1990s.

4.4 Robustness Analysis

The results presented thus far are based on nominal oil price. It is common to consider the effect of oil price shock and oil price uncertainty on economic activities using real price of oil (Elder and Serletis 2010; Kilian 2009). Here, we re-estimate our model and perform the analysis using real oil price, which is defined by nominal oil price deflated by GDP deflator (Elder and Serletis 2010). The summary statistics of real oil price and its annualised percentage change are reported in Table 1. The Carrion-i-Silvestre et al. (2009) test statistic for unit root with multiple structural breaks overwhelmingly rejects the null of a unit root for the change in real oil price. The single break date identified by this test is exactly identical to that of the change in nominal oil price. The variance break test and the outlier detection test are applied to the annualised growth rate of the real oil price. The break date of the volatility process of the change in real oil price is exactly identical to that of the change in nominal oil price. Further, the outliers detected for real oil price are found to occur at the same dates as those of nominal oil price (see Table 2). Figure 2 shows the magnitude of the outliers for real oil price change are comparable in size to those of nominal price change.

For brevity, the model estimation results for the whole sample and subsamples are not reported here but are available from the authors upon request. By and large, the results which we have demonstrated for the whole sample using the nominal oil price remain qualitatively unchanged when compared with the results for the real oil price. The explosive GARCH process for the change in real oil price is prevalent in the results for the whole sample. This property of the GARCH process gives rise to an impulse response that shows the effect of oil shock on output growth is persistent. The negative effect of oil price uncertainty on output growth continues to remain statistically significant at the 5% level with a coefficient estimate of \(-\,0.017\) for the real oil price compared to \(-\,0.020\) for the nominal oil price. The impulse responses of output growth to positive and negative real oil price shocks display similar patterns to the ones obtained using nominal oil price shocks. The use of real oil price clearly displays a lower level of volatility relative to that of nominal oil price although this does not bear any effect on the results for the output growth effect of oil price uncertainty and the impulse response. For example, the intercept coefficient estimate of the GARCH specification for the nominal oil price is 65.814 relative to 55.713 for the real oil price.

The subsample analysis also reveals qualitatively similar results. For subsample 1, the effect of oil price uncertainty on output growth is found to be positive (0.033) for the raw data but it is not statistically significant. The coefficient of real oil price uncertainty becomes negative when the data are adjusted for outliers although the size of the estimate is virtually zero (\(-\,0.0005\)) and it is not statistically significant at all conventional levels of significance. On the other hand, for subsample 2, the coefficient estimate of real oil price uncertainty registers a negative sign (\(-\,0.046\)) and only changes marginally (to \(-\,0.043\)) when the data are adjusted for outliers. This coefficient is statistically significant at 1% level and indicates that the deleterious effect of real oil price uncertainty on economic activities is twice as large when compared with the result for the whole sample. Taken together, our results are by and large robust even with the use of real oil price.

For the impulse response analysis, the response of output growth to positive and negative oil price shocks is a mirror image of each other and resembles the ones obtained for nominal oil price in Fig. 5. There is, however, one difference that is for the raw real oil price data, the effect of real oil price shocks on output growth appears to be persistent. This result is driven by the near integrated GARCH process of real oil price both for the raw data (0.987) and the adjusted data (0.989).

Finally, we find largely similar patterns in the impulse responses of output growth to positive and negative oil shocks in subsample 2 for real oil price when compared with nominal oil price (see Fig. 6). For the adjusted real oil price, output growth registers a positive response to positive oil shocks at the time of impact and subsequent 2 months. In contrast, output expands only at the initial impact for positive nominal oil price shock. Further, the largest growth reducing effect of negative real oil price shocks is felt 2 months as opposed to 1 month after the initial impact of negative nominal oil price shock.

5 Conclusion

This paper tests the pernicious effect of oil price uncertainty on US real economic activity in which the effect is to reduce current investment and consumption leading to a contraction in output. Using a long time series data spanning over half a century, we show that there are outliers in both output growth and oil price changes, and the presence of a structural change in oil price uncertainty. Following Elder and Serletis (2010), we estimate a structural vector autoregression model with GARCH-in-Mean specification based on the original data and on the data that are adjusted for these stylised features. The results show that it is important to account for the presence of outliers in both oil prices and output growth, and a variance shift in oil price uncertainty. Failing to do so can lead to erroneous inference and mask the change in the dynamic response of output growth to oil price shock over the period 1973:10–2015:12.

Our empirical result shows that oil price uncertainty experienced a break in June of 1985. The evidence of a shift in oil price uncertainty during 1985 is well supported by historical events when the Saudis abandoned its role as the swing producer coupled with OPEC setting production quotas and letting the price fluctuate in 1985. At the same time, a number of other changes enhanced this transformation to a period of more volatile prices, including the growing amount of market-sensitive non-OPEC production. The shift in the variance of oil prices implies that oil price uncertainty has a pernicious effect on US output growth after mid-1985. This effect was absent in the data prior to the increase in oil price uncertainty in mid-1985. The growth retarding effect of oil price uncertainty was found to be double the effect which is estimated from a model that does not take into consideration these outliers and variance shift. Moreover, the results indicate that failure to account for the shift in the variance of oil prices can give rise to a GARCH process that appears explosive, and the associated impulse responses are untenable to interpretation. Nevertheless, a number of methods may accommodate the longer memory present in oil price uncertainty; the inclusion of more GARCH terms may accommodate the longer memory and retain the stationary property, the use of fractionally integrated GARCH or stochastic volatility is also appropriate, or the use of a barrier function to enforce stationarity may be congenial without adding complexity to an already nonlinear and relatively complicated model. Accounting for oil price uncertainty tends to exacerbate the response of output growth to positive and negative oil price shocks in the period following mid-1985. On the other hand, we fail to find any difference in the response of output growth to oil price shocks prior to mid-1985 even when we accommodate the effect of oil price uncertainty. Our results remain qualitatively unchanged when we use real oil price in place of nominal oil price.

Notes

Baumeister and Peersman (2013) use a time-varying-parameter VAR model to demonstrate that changes in the crude oil market have been gradual. While their model specification permit inference on the gradual dynamic of change in the price elasticity of oil supply and demand, we do not impose this structure to our model given that our basis of comparison is the model of Elder and Serletis (2009, 2010, 2011). Be that as it may, the application of the variance break test is able to detect whether there has been a change in the volatility process of oil price change partly explained by this gradual change in the price elasticity of oil supply and demand.

The proxy for uncertainty which is measured by the conditional variance of oil prices is subject to certain caveats. This proxy measures the dispersion in the forecast error produced by the econometric model estimated using historical data, and it therefore may not capture other forward-looking components of uncertainty other than the one parameterised in the model. Nevertheless, the use of autoregressive conditional heteroskedasticity-based measures of uncertainty is widespread in the empirical literature for modelling output growth uncertainty (Grier et al. 2004; Chua et al. 2011), inflation uncertainty (Engle 1982; Elder 2004), and oil price uncertainty (Elder and Serletis 2009, 2010).

Recently, Rodrigues and Rubia (2011) have studied the size properties of Sansó et al.’s (2004) ICSS algorithm for detecting structural breaks in variance under the hypothesis of additive outliers. Their results indicate that neglected outliers tend to bias the ICSS test. They advise applying the modified ICSS algorithm on outlier-adjusted return series to identify sudden shifts in volatility.

Elder and Serletis (2010) undertook a robustness analysis post-1986, but this was for the purpose of addressing the effect of the 1986 Tax Reform Act on investment. Specifically, following the sharp drop in oil prices in 1986 the decline in real GDP growth rate was primarily due to declines in private nonresidential investment expenditures. The fall in private nonresidential investment expenditures can be attributed to provisions in TRA86 such as the repeal of the investment tax credit and the elimination of some real estate tax shelters.

Rahman and Serletis (2012) study the effects of oil price uncertainty on the Canadian economy using a multivariate conditional variance specification that does not impose this assumption.

One damaging aspect of the tax reform is its application of the alternative minimum tax (AMT) to the main tax mechanisms for drilling cost and capital recovery, which comprise current year expensing of intangible drilling costs and the remnants of percentage depletion. In theory, producers can recover AMT tax payments through credits when and if they become so profitable that their regular income tax exceeds AMT tax. However, most producers are not that profitable. To the extent they cannot recover AMT payments, and lost opportunity costs associated with them, producers pay taxes on drilling capital.

The critical values are defined by \(g_{T,\lambda }=-\log \left( -\log (1-\lambda )\right) b_{T}+c_{T}\), with \(b_{T}=1/\sqrt{2\log T}\), and \( c_{T}=(2\log T)^{1/2}-[\log \pi +\log (\log T)]/[2(2\log T)^{1/2}]\). Laurent et al. (2016) suggest setting \(\lambda =0.5\)

References

Andersen TG, Bollerslev T, Dobrev D (2007) No arbitrage semi-martingale restrictions for continous-time volatility models subject to leverage effects, jumps and i.i.d. noise: theory and testable distributional implications. J Econ 138:125–180

Baffes J, Kose M, Ohnsorge F, Stocker M (2015) The great plunge in oil prices: causes, consequences, and policy responses. Policy Research Note No 15/01, World Bank Group

Barsky RB, Kilian L (2004) Oil and the macroeconomy since the 1970s. J Econ Perspect 18:115–134

Baumeister C, Peersman G (2013) The role of time-varying price elasticities in accounting for volatility changes in the crude oil market. J Appl Econ 28:1087–1109

Bernanke B (1983) Irreversibility, uncertainty and cyclical investment. Quart J Econ 98:85–106

Blanchard O, Gali J (2010) The macroeconomic effects of oil price shocks: why are the 2000s so different from the 1970s? In: Gal J, Gertler M (eds) International dimensions of monetary policy. University of Chicago Press, Chicago, pp 373–421

Boudt K, Danielsson J, Laurent S (2013) Robust forecasting of dynamic conditional correlation GARCH Models. Int J Forecast 29:244–257

Box G, Tiao G (1975) Intervention analysis with applications to economic and environmental problems. J Am Stat Assoc 70:70–79

Bredin D, Elder J, Fountas S (2011) Oil volatility and the option value of waiting: An analysis of the G-7. J Futures Mark 31:679–702

Brennan M, Schwartz E (1985) Evaluating natural resource investment. J Bus 58:1135–1157

Brennan M (1990) Latent assets. J Finance 45:709–730

Carrion-i-Silvestre JL, Kim D, Perron P (2009) GLS-based unit root tests with multiple structural breaks both under the null and the alternative hypotheses. Econ Theory 25:1754–1792

Charles A, Darné O (2014) Volatility persistence in crude oil markets. Energy Policy 65:729–742

Chua C, Kim D, Suardi S (2011) Are empirical measures of macroeconomic uncertainty alike? J Econ Surv 25:801–827

Diebold F (1986) Modeling the persistence of conditional variances: a comment. Econ Rev 5:51–56

Edelstein P, Kilian P (2009) How sensitive are consumer expenditures to retail energy prices? J Monet Econ 56:766–779

Elder J (2003) An impulse-response function for a vector autoregression with multivariate GARCH-in-mean. Econ Lett 79:21–26

Elder J (2004) Another perspective on the effects of inflation volatility. J Money Credit Bank 36:911–928

Elder J, Serletis A (2009) Oil price uncertainty in Canada. Energy Econ 31:852–856

Elder J, Serletis A (2010) Oil price uncertainty. J Money Credit Bank 42:1137–1159

Elder J, Serletis A (2011) Volatility in oil prices and manufacturing activity: an investigation on real options. Macroecon Dyn 15:379–395

Elliott G, Rothenberg TJ, Stock JH (1996) Efficient tests for an autoregressive unit root. Econometrica 64:813–836

Engle RF (1982) Autoregressive conditional heteroscedasticity with estimates of the variance of United Kingdom inflation. Econom 50:987–1007

Grier K, Henry O, Olekalns N, Shield K (2004) The asymmetric effects of uncertainty on inflation and output growth. J Appl Econ 19:551–565

Hamilton JD (1983) Oil and the macroeconomy since World-War-II. J Polit Econ 91:228–248

Hamilton JD (2008) Macroeconomics and ARCH. Working Paper No. 14151. NBER

Hamilton JD (2013) Historical oil shocks. In: Parker RE, Whaples R (eds) Handbook of major events in economic history. Taylor and Francis Group, Routledge, pp 239–265

Hillebrand E (2005) Neglecting parameter changes in GARCH models. J Econom 129:121–138

Inclan C, Tiao GC (1994) Use of cumulative sums of squares for retrospective detection of changes of variance. J Am Stat Assoc 89:913–923

Kilian L (2009) Not all oil price shocks are alike: disentangling demand and supply shocks in the cude oil market. Am Econ Rev 99:1053–69

Kilian L, Vigfusson RJ (2011) Are the responses of the US economy asymmetric in energy price increases and decreases? Quant Econ 2:419–453

Koop G, Pesaran MH, Potter SM (1996) Impulse response analysis in nonlinear multivariate models. J Econ 74:119–147

Lamoureux C, Lastrapes W (1990) Persistence in variance, structural change and the GARCH model. J Bus Econ Stat 8:225–234

Laurent S, Lecourt C, Palm FC (2016) Testing for jumps in GARCH models, a robust approach. Comput Stat Data Anal 100:383–400

Lee J, Strazicich MC (2001) Break point estimation and spurious rejections with endogenous unit root tests. Oxford Bull Econ Stat 63:535–558

Lee SS, Mykland PA (2008) Jumps in financial markets: a new nonparametric test and jump dynamics. Rev Financ Stud 21:2535–2563

Majd S, Pindyck R (1987) Time to build, option value and investment decisions. J Financ Econ 18:7–27

Mikosch T, Starica C (2004) Nonstationarities in financial time series, the long-range dependence, and the IGARCH effect. Rev Econ Stat 86:378–390

Muler N, Peña D, Yohai V (2009) Robust estimation for ARMA models. Ann Stat 37:816–840

Muler N, Yohai V (2008) Robust estimates for GARCH models. J Stat Plan Inference 138:2918–2940

Newey W, West K (1994) Automatic lag selection in covariance matrix estimation. Rev Econ Stud 61:631–653

Ng S, Perron P (2001) Lag length selection and the construction of unit root tests with good size and power. Econometrica 69:1519–1554

Perron P (1989) The great crash, the oil price shock and the unit root hypothesis. Econometrica 57:1361–1401

Perron P, Qu Z (2007) A simple modification to improve the finite sample properties of Ng and Perron’s unit root tests. Econ Lett 94:12–19

Pindyck R (1991) Irreversibility, uncertainty and investment. J Econ Lit 29:110–148

Rahman S, Serletis A (2012) Oil price uncertainty and the Canadian economy: evidence from a VARMA, GARCH-in-Mean, asymmetric BEKK model. Energy Econ 34:603–610

Rodrigues P, Rubia A (2011) The effects of additive outliers and measurement errors when testing for structural breaks in variance. Oxford Bull Econ Stat 73:449–468

Sansó A, Aragó V, Carrion-i-Silvestre J (2004) Testing for changes in the unconditional variance of financial time series. Revista de Economía Financiera 4:32–53

Stock J, Watson M (2012) Disentagling the channels of the 2007–2009 Recession. Working Paper No. 18094, NBER

Zivot E, Andrews DWK (1992) Further evidence on the great crash, the oil price shock and the unit root hypothesis. J Bus Econ Stat 10:251–270

Acknowledgements

The authors gratefully acknowledge the two referees, Associate Editor and the Editor for their constructive comments, which have improved the quality of the paper. Any remaining errors are our own. Amélie Charles and Olivier Darné gratefully acknowledge financial support from the Région des Pays de la Loire (France) through the Grant PANORisk.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A: Impulse response function

To study the response of endogenous variables to the impact of a unit or standard deviation shock in the VAR system we use the impulse response function. Elder (2003) provides an analytical representation of the impulse responses in a VAR model with GARCH-in-Mean. The impulse response function captures the time profile of the effect of a shock on the \(m-\)th variable, \( m\in \{1,2\},\) at time t, being \(e_{mt}\), on the expected value of \( y_{v,t+n}\) where \(n\ge 0\). Note that in the case of our model, \(m=1\) denotes \(\mathrm{IPI}\) while \(m=2\) denotes \(\mathrm{Oil}\). Mathematically, we write the impulse response function of \(y_{v,t+n}\) at horizon n given information up to \(\mathcal {F}_{t-1}\) as:

The impulse response for \(y_{v,t+n}\) stemming from a shock \(e_{m,t}\) takes the following analytical expression

where \(\Upsilon _{1}\) is an \(4\times 1\) vector such that its \(\left( 2(m-1)+m\right) \)th row contains \(2e_{mt}\) and zeros elsewhere, and \( \Upsilon _{0}\) is an \(4\times 1\) vector such that its \(\left( \left( j-1\right) 2+i\right) \)th row and its \(\left( 2\left( i-1\right) +1+(j-1\right) \)th row contain \(e_{jt}\) for \(i,j=1,2\) and \(i\ne j\). The subscripts \(\{v,m\}\) indicate elements in the vth row and mth column of a matrix and \(\{v,:\}\) indicates the vth row vector. Here, \(\Xi _{i}\) and \(\Theta _{i}\) are sub-matrices of \(\Omega _{i}^{*}\) where \(\Omega _{i}^{*}=\) \(\left[ \begin{array}{cc} \widetilde{\Xi }_{i} &{} \widetilde{\Theta }_{i} \\ \Xi _{i} &{} \Theta _{i} \end{array} \right] \) and is a product of \(\Omega _{1}\) and \(\Omega _{i-1}^{*}\) with \( \Omega _{0}^{*}=I_{3}\) and \(\Omega _{s}^{*}=0\) for \(s<0\). Note also that \(\Omega (L)=I-\left[ \begin{array}{cc} \Phi (L) &{} \Psi ^{*}(L) \\ 0 &{} A^{-1}\Gamma (L) \end{array} \right] \) where \(\Psi ^{*}\) is an null matrix. It is important to highlight that the coefficient estimates of the GARCH process \(h_{\mathrm{Oil},t}\) given by \(\hat{a}_{22}^{2}+\hat{a}_{22}^{3}\) need to be strictly less than unity to ensure that the effect of oil shock on output growth will dissipate over time. In this regard, it is important that any outliers and regime changes in the underlying oil price volatility are identified and accounted for appropriately to ensure that the GARCH parameter estimates are not biased towards an integrated or even an explosive GARCH process. An evaluation of the response of output growth to oil price shocks critically relies on unbiased parameter estimates of the model.

Appendix B: Detecting additive outliers

There are methods for detecting outliers in GARCH-type models based on interventional analysis approach which was first put forward by Box and Tiao (1975). We apply the semi-parametric procedure to detect additive outliers proposed by Laurent et al. (LLP) (2016).Footnote 7 They assume that the returns \(r_{t}\) are described by the ARMA(p,q)-GARCH(1,1) model, which is defined in Eqs. (7)–(9).

Consider the return series with an independent outlier component \(a_{t}I_{t}\) , defined as

where \(r_{t}^{*}\) denotes observed returns, \(I_{t}\) is a dummy variable taking the value 1 in the case of an additive outlier on day t and 0 otherwise while \(a_{t}\) is the outlier size. The model for \( r_{t}^{*}\) has the properties that an additive outlier \(a_{t}I_{t}\) will not affect \(\sigma _{t+1}^{2}\) (the conditional variance of \(r_{t+1}\)), and it allows for non-Gaussian fat-tailed conditional distributions of \( r_{t}^{*}\). LLP then use the bounded innovation propagation (BIP)-ARMA model proposed by Muler et al. (2009) and the BIP-GARCH(1,1) model proposed by Muler and Yohai (2008) to obtain robust estimations of \(\mu _{t}\) and \(\sigma _{t}^{2}\), respectively. These are shown in Eqs. (7)–(9) as \(\widetilde{\mu }_{t}\) and \( \widetilde{\sigma }_{t}\), respectively and that they are robust to potential presence of additive outliers \(a_{t}I_{t}\). In other words, the model is estimated based on \(r_{t}^{*}\) and not on \(r_{t}\). The BIP-ARMA and BIP-GARCH(1,1) are defined as

respectively where \(\xi _{i}\) are the coefficients of the AR(p ) and MA(q) polynomials defined in Eq. (8), \(\omega _{k_{\Delta }}^{MPY}(.)\) is the weight function, and \(c_{\Delta }\) a factor which ensures that the conditional expectation of the weighted squared unexpected shocks is the conditional variance of \(r_{t}\) in the absence of outliers (Boudt et al. 2013).

Consider the standardised return on day t, which is given by

To detect the presence of additive outliers they test the null hypothesis \(H_{0}:a_{t}I_{t}=0\) against the alternative \(\hbox {H} _{1}:a_{t}I_{t}\ne 0\). The null is rejected if

where \(g_{T,\lambda }\) is the suitable critical value.Footnote 8 If \(H_{0}\) is rejected, a dummy variable is defined as follows

where I(.) is the indicator function, with \(\widetilde{I}_{t}=1\) when an additive outlier is detected at time t and 0 otherwise. LLP show that their test does not suffer from size distortions irrespective of the parameter values of the GARCH model from Monte Carlo simulations. The filtered returns or adjusted data are obtained as follows:

Appendix C: Detecting variance changes

Having identified and adjusted the data for possible additive outliers, we apply the CUSUM-type test of Sansó et al. (2004) to the series \(\Delta \mathrm{IPI}_{t}\) and \(\Delta \mathrm{Oil}_{t}\). The test is based on the iterative cumulative sum of squares (ICSS) algorithm developed by Inclan and Tiao (1994). This algorithm makes it possible to detect multiple breakpoints in variance.

Define \(\tilde{y}_{t}\) as the mean-adjusted series for \(y_{t}\) so that it has a mean of zero for \(y_{t}=\{\Delta \mathrm{IPI}_{t},\Delta \mathrm{Oil}_{t}\}\). Further assume that \(\{\tilde{y}_{t}\}\) is a series of independent observations from a normal distribution with zero mean and unconditional variance \(\sigma _{t}^{2}\) for \(t=1,\ldots ,T\). We know from the data summary statistics that both \(\Delta \mathrm{IPI}_{t}\) and \(\Delta \mathrm{Oil}_{t}\) display serial dependence/correlation (see Sect. 3) and that the violation of the independence property of the series will cause serious size distortions to the ICSS test statistic (Sansó et al. 2004). Sansó et al. (2004), therefore, propose a test that explicitly takes into consideration the fourth moment properties of \(\tilde{y }_{t}\) and the conditional heteroskedasticity. The non-parametric adjustment to the test statistic allows for \(\tilde{y}_{t}\) to obey a wide class of dependent processes under the null hypothesis. This is discussed below.

Assume that the variance within each interval is denoted by \(\sigma _{j}^{2}\) for \(j=0,1,\ldots ,N_{T}\) where \(N_{T}\) is the total number of variance changes with \(1<\kappa _{1}<\kappa _{2}<\cdots<\kappa _{N_{T}}<T\) being the set of breakpoints. Accordingly, the variances over the \(N_{T}\) intervals are defined as:

The cumulative sum of the squared observations, \(C_{k},\) is used to estimate the number of variance changes and to identify the point in time when the variance shifts such that \(C_{k}=\sum _{t=1}^{k}\) \(\tilde{y}_{t}^{2}\) for \(k=1,\ldots ,T\). Sansó et al. (2004) propose the adjusted test statistic – non-parametric adjustment based on the Bartlett kernel—given by:

where \(G_{k}=\hat{\lambda }^{-0.5}\left[ C_{k}-\left( \frac{k}{T}\right) C_{T} \right] \) and \(\hat{\lambda }=\hat{\gamma }_{0}+2\sum _{l=1}^{m}\left[ 1-l(m+1)^{-1}\right] \hat{\gamma }_{l}\).

Here, \(\hat{\gamma }_{l}=T^{-1}\sum _{t=l+1}^{T}\left( \tilde{y}_{t}^{2}-\hat{\sigma }^{2}\right) \left( \tilde{y}_{t-l}^{2}-\hat{\sigma }^{2}\right) \) and \(\hat{\sigma }^{2}=T^{-1}C_{T}\), with \(C_{T}=\) \( \sum _{t=1}^{T}\) \(\tilde{y}_{t}^{2}\). The lag truncation parameter m is selected using the Newey and West (1994) procedure. Under general conditions, the asymptotic distribution of AIT is also given by \( \sup _{r}\left| W^{*}(r)\right| \) and the finite sample critical values are obtained from simulation.

Appendix D: The Carrion-Kim-Perron (CKP) test

Carrion-i-Silvestre et al. (2009) propose a testing procedure which allows for multiple structural breaks in the level and/or slope of the trend function under both the null and alternative hypotheses. The model is given by

with \(d_t\) denotes the deterministic component given by

where \(z_t(T_0^{0})=(1,t)^{\prime }\), \(\psi _0=(\mu _0,\beta _0)^{ \prime })\), and \(z_t(T_j^{0})=\left( DU_t(T_j^{0}),DT_t(T_j^{0})\right) ^{\prime }\) for \(1\le j \le m\), with m is the number of breaks. \(DU_{t}(T_j^{0})=1\) and \(DT_t(T_j^{0})=(t-T_j^{0})\) for \(t>T_j^{0}\) and 0 elsewhere, with \(T_j^{0}=[T\lambda _j^0]\) is the jthe break date, with [.] the integer part and \(\lambda _j^0\equiv T_j^{0}/T \in (0,1)\) the break fraction parameter.

Carrion-i-Silvestre et al. (2009) consider extensions of the M class of unit root tests analysed in Ng and Perron (2001) and the feasible point optimal statistic of Elliott et al. (1996). The GLS-detrended unit root test statistics are based on using the quasi-differenced variable \(y_{t}{\bar{ \alpha }}=(1-\bar{\alpha }L)y_{t}\) and \(z_{t}{\bar{\alpha }}(\lambda ^{0})=(1- \bar{\alpha }L)z_{t}(\lambda ^{0})\) for \(t=2,\ldots ,T\), with \(\bar{\alpha }=1+ \bar{c}/T\) and \(\bar{c}=-13.2\) when \(z_{t}(T_{0}^{0})=(1,t)^{\prime }\). The feasible point optimal statistic is given by

where \(S \left( \bar{\alpha },\lambda ^0\right) \) is the minimum of the following sum of squared residuals from the quasi-differenced regression \(S \left( \psi ,\bar{\alpha },\lambda ^0\right) =\sum _{t=1}^T \left( y_t{\bar{ \alpha }} - \psi ^{\prime }y_t{\bar{z}}(\lambda ^0) \right) ^2\), and \( s^2(\lambda ^0)\) is an estimate of the spectral density at frequency zero of \( v_t\) defined by

where \(s^2_{ek}=(T-k)^{-1}\sum _{t=k+1}^{T}\hat{e}_{t,k}^2\) and \(\{ \hat{b}_j,\hat{e}_{t,k}\}\) are obtained from the following OLS regression

with \(\tilde{y}_t=y_t \hat{\psi }'z_t(\lambda ^0)\), where \( \hat{\psi }\) minimises \(S \left( \psi ,\bar{\alpha },\lambda ^0\right) \). The lag order k is selected using the modified information criteria suggested by Ng and Perron (2001) with the modification proposed by Perron and Qu (2007).

The M-class of tests are defined by

Rights and permissions

About this article

Cite this article

Charles, A., Chua, C.L., Darné, O. et al. On the pernicious effects of oil price uncertainty on US real economic activities. Empir Econ 59, 2689–2715 (2020). https://doi.org/10.1007/s00181-019-01801-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-019-01801-6