Abstract

This paper provides an empirical evidence on the influence of oil price uncertainty on the real economic activity in Jordan and Turkey during the period 1986:01–2014:12. To measure the effect of uncertainty, the paper combines a bivariate structural VAR with a GARCH-in-mean process that allows oil volatility to affect the growth of industrial production. Our results indicate that oil market uncertainty has a negative influence on the industrial output of Jordan and Turkey. For instance, the increase in one standard error of oil price uncertainty is found to be associated with a decline of 0.81 and 1.01% in the industrial production of Jordan and Turkey, respectively. Moreover, consistent with the recent empirical evidence, we find that output growth increases/decreases after a negative/positive oil price shock. These results imply that sound energy policies that mitigate the effect of oil market uncertainty may help in stabilizing output in both countries.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

This paper empirically investigates how shifts in oil price uncertainty influence the growth rate of real output in Jordan and Turkey. Although the influence of oil price shocks on the economies of the Middle East region has been previously discussed, this paper is different as it concentrates on the influence of oil prices uncertainty on real economic activity. The paper implements a state-of-art technique in which uncertainty is simultaneously determined in the model by an integrated GARCH-in-mean process. This model is recently proposed and used by Elder and Serletis (2009, 2010, 2011) for examining the direct responses of output growth in developed countries to an oil price uncertainty shock.

In the literature, many studies concluded that oil price uncertainty causes cyclical fluctuation in real output.Footnote 1 For instance, in the models of Bernanke (1983) and Pindyck (1991), firms postpone irreversible investment decisions and wait for more information as a response to greater oil price uncertainty. This results in cyclical fluctuation in output. Similarly, the models of Kilian and Vigfusson (2011a, b) indicate that the delay in consumption induced by the increase in oil price uncertainty is another reason why output changes. Pointing to the same result, Edelstein and Kilian (2009) show that oil price uncertainty raises ambiguity about jobs and therefore, agents may take precautionary actions such as reducing consumption and/or increasing savings which may lead to output changes. Other studies such as Plante and Traum (2011) find that an increase in oil price volatility leads to higher savings, higher investment, and higher output, but it also leads to temporarily lower durable goods consumption.

Along the same direction, the recent works of Kilian and Vigfusson (2011b), Alquist et al. (2011), and Jo (2014) are located. They show that the role of oil price volatility matters, despite the fact that its effect is limited and cannot explain the vast fluctuations in real output. They also point out that commonly used measures of uncertainty are inadequate and they poorly capture uncertainty in the oil market. Another study that stressed the role of uncertainty is the study of Lee et al. (1995), which emphasizes the importance of oil volatility in predicting economic activity. In addition to the importance of price changes, they find incremental predictive information of oil volatility in forecasting output fluctuation. Ferderer (1997) and Ahmad et al. (2012) establish the empirical link between oil price uncertainty and sectoral reallocation; further they demonstrate how uncertainty influences the industrial production growth in the US economy.

In many of these studies, the analysis of the influence of uncertainty is not unambiguous and it took a certain perspective. For instance, in Lee et al. (1995), Ferderer (1997), and Ahmad et al. (2012) oil prices are exogenously determined to the economy; hence, their results should be viewed carefully.Footnote 2 An alternative approach is to make inference from models that obviously study the role of oil price uncertainty. For instance, in the recent papers of Bredin et al. (2011) and Elder and Serletis (2011) the effect of oil price uncertainty is directly measured in a vector autoregressive model in which uncertainty is assumed to follow a GARCH-in-mean process. The main contribution of this process is that uncertainty is predetermined within the model instead of being exogenously defined (see Kilian and Vega 2011). The VAR GARCH-in-mean model of output growth and oil was implemented on the USA and the G7 countries. The uncertainty effect on growth was significant in the USA and in four of the G7 countries. These studies find that uncertainty during the recent oil price rally between 2003 and 2008 is low and less disruptive to economic activity than previous movements in oil prices.Footnote 3

In our paper, we adopt the GARCH-in-mean methodology that is proposed by Elder and Serletis (2009, 2010, 2011). However, our concentration is shifted to explore the effect of oil market uncertainty in the Jordanian and Turkish manufacturing production. These two countries are net importers of oil, and to the best of our knowledge the analysis of the influence of oil price uncertainty of any country in the MENA region does not exist.Footnote 4

Most studies assume that the relationship between oil shocks and macroeconomic variables is symmetric and that it can be estimated by using linear models (Hamilton 1983; Gisser and Goodwin 1986; Bohi 1991). However, there is some evidence for asymmetric relationship between oil and output (i.e., output responses differently to positive and negative oil price shocks). The paper by Mork (1989) is one of the earliest that provided such evidence, but it is followed by many studies that emphasize the same response of output to positive and negative shocks in oil prices.Footnote 5

The literature has substantial studies which investigate the reasons of asymmetry in output response to oil shocks. For instance, Hamilton (1988) suggests that adjustment costs could lead to an asymmetric response to changing oil prices. Falling oil prices stimulate the economy, but the cost of adjusting to the fall in prices slows down the expected economic expansion. In the same way, it may deepen the expected recession when oil prices rise. Another cause of asymmetry is monetary policy. Bernanke et al. (1997) indicate that the Federal Reserve Bank (Fed) responds more aggressively to rises in crude oil prices than it does to falls. Asymmetry may also stems from precautionary saving (Edelstein and Kilian 2007, 2009) and the irreversibility of the capital–labor ratio and/or investment (Atkeson and Patrick 1999).Footnote 6

A particular channel of the asymmetric effect of oil prices on the macroeconomic variables is uncertainty. If uncertainty is negatively related to output, and then, it is expected to amplify the negative impact of an increase in the price of oil and to dampen the positive influence of a decrease in the price of oil (Ferderer 1997). Hence, uncertainty may cause asymmetry in the response of industrial production to oil price shocks. Therefore, another contribution of our paper is to investigate asymmetry in the response of output to positive and negative oil shocks.

The analysis of the influence of oil price uncertainty on the real economic activity in two Middle Eastern countries, namely Jordan and Turkey, is very relevant. Unlike most of the MENA countries, Jordan and Turkey are entirely dependent on imported energy to meet their needs. The energy intensity (i.e., the cost of converting energy into GDP) for both countries is the highest in the region, and it is significantly higher than in developed countries such as the USA and Canada. Therefore, finding a negative impact of oil price volatility on the two countries’ manufacturing production could help their governments to inspect an alternative less volatile energy sources such as coal, natural gas, and nuclear power. Furthermore, to the best of the authors’ knowledge, this is the first study that examines the influence of oil price volatility on real economic activity in developing economies utilizing Elder and Serletis (2009, 2010, 2011) framework. Most importantly, unlike most of the existing literature, this paper also looks into asymmetry in the response of output to oil price shocks.

Looking ahead, our results indicate that uncertainty has a negative and significant impact on industrial production of the two countries. The increase in one standard error of oil price uncertainty is found to be associated with substantial declines of 0.81 and 1.01% in the industrial production of Jordan and Turkey, respectively.Footnote 7 This emphasizes the importance of taking into consideration the influence of oil price volatility on projecting economic growth of Jordan and Turkey. The impulse response functions (IRFs hereinafter) of output to oil price shocks show asymmetry in the changes of output of both Jordan and Turkey. This result is consistent with the previous finding that oil price uncertainty is negatively associated with output.Footnote 8

The rest of the paper is organized as follows. Section 2 presents the GARCH-in-mean model. Section 3 describes our data set. Section 4 introduces the estimation results of the model and the empirical analysis. Besides, it provides analysis of asymmetry based on the graphs of IRFs. Section 5 tests for asymmetric relationship between industrial production and oil. Finally, we provide some concluding remarks in Sect. 6.

2 Methodology

To achieve the goals of our paper, we follow Elder and Serletis (2009, 2010, 2011) by employing a bivariate structural VAR with multivariate GARCH-in-mean. This model is a dynamic structural system which consists of a linear function of the relevant vector variables plus a conditional variance of oil that affect the conditional mean. Contrary to the two-step procedures, this methodology estimates all the parameters simultaneously; as a result, it generates internally consistent estimates which avoids the “generated regressor” problem. We can write the VAR for the conditional mean as followsFootnote 9:

where \({y}_{t}\) is a vector of endogenous variables at time t, i.e., real growth rate of industrial production index and the real growth rate of oil price. \(\dim \left( B \right) =\dim \left( {A_i } \right) =\left( {N,N} \right) , \varepsilon _t |\psi _{t-1} \sim iid\,N\left( {0, H_t} \right) \), \(H_t\) is diagonal, \(\varLambda \left( L \right) \) is a matrix polynomial in the lag operator, \(\psi _{t-1} \)denotes the information set at time \(t-1\), which includes variables dated \(t-1\) and earlier, p is the lag length, and T is the sample size.Footnote 10 The term \(\varLambda \left( L \right) H_t^{1/2}\) captures the real effect of oil price uncertainties on industrial production index. The orthogonalized structural innovations \(\left( {F_{t-1} } \right) \) in our model, which are related to the choice of \(N\left( {N-1} \right) /N\) free parameters in the matrix B, are assumed to be independently normally distributed: \(\varepsilon _t |F_{t-1} \sim N\left( {0,H_t } \right) \). Additionally, the structural disturbances, \(\varepsilon _t ,\) are assumed to be conditionally uncorrelated. To ensure the identification of the structural responses, we impose a necessary and sufficient number of identification restrictions on matrix B. The most common way to perform this task is to execute zero restrictions through the Cholesky decomposition, exactly as in a conventional structural VAR model. Following the identification procedure of Elder and Serletis (2010) and Bredin et al. (2011), we restrict the B matrix so that the real industrial production index growth responds instantaneously to innovations in the growth of the real oil price but not the opposite. By following this approach, we succeeded to estimate one free parameter in matrix B for a bivariate VAR.

In the above-mentioned specification, we measure oil prices volatility by the conditional standard deviation of the structural innovations, \(H_t^{1/2}\). As such, \(H_t^{1/2}\) is a measure of the conditional standard deviation of the 1 month ahead of oil prices; as a result, it measures the effect of oil price uncertainty shocks on the conditional mean of \(y_t \). The influence of oil price volatility on the industrial production index can be measured by the coefficient matrix \(\varLambda \left( L \right) \). Specifically, a negative and significant element in \(\varLambda \) means that oil price volatility tends to adversely affect industrial production index. This term also captures any potential asymmetry in the influence on output due to oil price shocks. If \(\varLambda \left( {L} \right) \) is negative, then the positive and negative unanticipated oil price shocks increase uncertainty in the oil market and consequently depress output growth in the short run (Elder and Serletis 2009, 2010).

For the specification of the conditional covariance in \(H_t \), we use a bivariate version of the GARCH model, introduced by Engle and Kroner (1995), which can be written as:

where  ,

,  , \(F_i \hbox { and }G_j\) are \(N\times N\) with matrices with \(C_{v}\) being an upper triangular to ensure positive definiteness of \(H_{t}\).Footnote 11

, \(F_i \hbox { and }G_j\) are \(N\times N\) with matrices with \(C_{v}\) being an upper triangular to ensure positive definiteness of \(H_{t}\).Footnote 11

Elder (2004) and Elder and Serletis (2010) suggest a modified version of this model to reduce the number of variance function parameters. They adopt a common identifying assumption in the structural VAR, and they also assume a zero contemporaneous correlation of structural disturbance; the covariance matrix, \(H_t \) becomes diagonal and we can write the structural variance function as follows:

The simple specification in Eq. (3) allows the conditional variance to be a function of one lag of its squared errors as well as one lag of its own conditional variances, and thus, parameter matrices \(F_{i}\) and \(G_{i}\) are diagonal as well.

The bivariate GARCH-in-mean VAR model, given by the conditional mean equation in (1) and conditional variance equation in (3), is estimated simultaneously by the full information maximum likelihood (FIML) method as described by Elder (2004). The procedure involves maximizing the following log likelihood function:

where \(L_T\) is the sample likelihood function and \(\theta = (B, C, A_1, A_2, \ldots , A_p, \varLambda , F, \mathrm{and}\, G)\) is a vector of structural parameters,

To yield maximum likelihood estimates, Eq. (4) maximizes numerically with respect to the structural parameters using the Broyden, Fletcher, Goldfarb, and Shanno (BFGS) algorithm method.

With the multivariate GARCH-in-mean VAR, we can also analyze the dynamic effects of a shock to one variable in the system on the conditional forecast of another variable by carrying out the IRFs. Following Elder (2003), the IRF for structural MGARCH-in-mean VAR can be represented asFootnote 12:

where \({l}_0 =\frac{\partial {\varepsilon }_{t} }{\partial {\varepsilon }_{{i,t}} }\) is an \({N}\times 1\) vector with \({\varepsilon }_{{i,t}}\) in the \(i\mathrm{th}\) spot and 0s elsewhere, \({\varTheta }\) is the moving average representation of the VAR process, \(\varPi _0 =B^{-1}\varLambda , F, \hbox { and }G\) are the parameter matrices from the multivariate GARCH. The second term on the RHS of Eq. (6), \(\left( {\varTheta _k B^{-1}} \right) l_0,\) captures the effect of a shock \(\varepsilon _{i,t} \) on the conditional forecast of \(y_{j,t+k}\), and the first term \((\varTheta _\tau \varPi _0 \left( {F+G} \right) ^{k-\tau -1}l_1 )\) captures the effect of conditional volatility on \(y_{j,t+k} \).Footnote 13 Standard error bands for IRFs are then constructed based the Bayesian Monte Carlo simulation technique by utilizing the maximum likelihood estimates of the model’s vector of parameters and its variance–covariance matrix.

3 Data

To investigate the influence of oil price uncertainty on real output growth, we use monthly data on oil price and industrial production indices of Jordan and Turkey.Footnote 14 The sample covers the period that extends from January, 1986, to December, 2014.Footnote 15 The industrial production index is used to proxy real output.Footnote 16 The data of the industrial production is collected from the International Financial Statistics (IFS) that is published by the International Monetary Fund (IMF). The spot price of Brent crude oil is used as a proxy for the world oil price level.Footnote 17 Brent crude oil price is widely being used as the benchmark for oil pricing from regions such as Europe, Africa, and the Middle East. It is useful to mention that it is highly correlated with other alternative measures of crude oil prices, such as the West Texas Intermediate (WTI).Footnote 18 Nominal Brent crude oil price data are collected from the Thomson Reuters Datastream and then divided by the US CPI extracted from IFS to get the inflation-adjusted real prices.Footnote 19 To get stationary time series, we transform each series by taking the logarithmic first differences, so that each variable is expressed in terms of continuously compounded growth rate.

Table 1 reports the summary statistics of growth rates of the two industrial production indices and of the oil price. The two countries have a positive average monthly industrial production over the sample period. Standard deviations are centered on 3% except for the oil price, which stands roughly at a higher level and it is around 4.82 %. All data series display skewness and excess kurtosis; thus, the Jarque–Bera statistics reject the null hypothesis of normality for all variables. Moreover, the LM-ARCH test indicates that ARCH effect is significant for all data series.

We estimate our model by using logarithmic first differences of the real oil price and the industrial production indices. To check for the absence of unit roots in each series, we use a Dickey–Fuller unit root in which the null is a unit root without drift, while the alternative is a stationary autoregressive with no constant and time trend. The optimal lag length is determined by the Schwartz Information Criterion (SIC). All testing results are presented at the bottom of Table 1. In all variables, the null hypothesis of a unit root is rejected at the 1% significance level, and thus, we conclude that oil returns and industrial production growth rates are stationary.

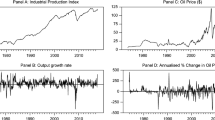

Figure 1 plots the monthly real oil price returns and conditional variance during the sample period.Footnote 20 Besides, it displays big changes in real oil price during certain periods. For example, the collapse of OPEC cooperation in early 1986 led to oil overproduction and significant drops in oil prices. The global recession during this period has also contributed to the low prices of oil. The price of the barrel went to as low as $10 by the mid of 1986. With the decrease in oil prices, uncertainty as measured by the conditional volatility has jumped during this period. Similarly, during the first Gulf War in 1991, oil prices had also seen large swings and the level of uncertainty in the oil market was almost the highest seen during the last three decades. The oil volatility stayed at a relatively low level during the period that extends from 1993 to 1998; then, it peaked in 1998, 1999, and 2000 following the Asian crisis. The oil market volatility also increased substantially in 2002 and 2003 as a result of the strikes that swept Venezuela and the eruption of the second Gulf War in the Middle East. Finally, Fig. 1 shows a pronounced increase in volatility during the recent global financial crisis that started late in 2007 and extended until 2009 and beyond.Footnote 21

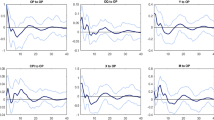

Figure 2 plots the oil price uncertainty in blue and the industrial production of each country in black. It shows that the timing and magnitude of the effect of the oil uncertainty on the industrial production indices are rather similar in the two countries. Further, Fig. 2 reveals that an increase in oil price uncertainty precedes economic downturns as measured by the industrial production index. Additionally, it displays that peaks of uncertainty in oil prices are typically leading to drops in the industrial production index in the two countries.

4 Results and discussion

We estimate the bivariate GARCH-in-mean VAR Eqs. (1) and (3) simultaneously using the full information maximum likelihood (FIML) method. The purpose is to assess whether oil price volatility affects real output growth. We follow the argument of Hamilton and Herrera (2004), Edelstein and Kilian (2007), Elder and Serletis (2010), and Kilian and Vigfusson (2011a, b) and estimate our model with 12 lags using monthly data.Footnote 22 The above-mentioned authors suggest that oil price shocks influence real output within one-year lag length. Hence, they recommended taking at least one-year lag in the VAR model.

To ensure that our model captures the important features of the data, we calculate the Schwarz information criterion (SIC) of our bivariate GARCH-in-mean VAR and then we compare it to a homoscedastic VAR. We report the comparison results in Table 2. They show that the bivariate GARCH-in-mean VAR model better fits the sample than its conventional homoscedastic counterpart.

Table 3 reports the estimated coefficients of the conditional variance equations for each of the two variables in the two countries. The estimates clearly show that ARCH and GARCH coefficients are statistically significant in the industrial production index equation for both countries. The ARCH coefficients are also significant in the oil equation. These results provide further support to the validity of the GARCH-in-mean VAR framework. It is also important to note that the ARCH term is the only significant coefficient in the oil volatility equation across the two regressions. This suggests weak time-persistence behavior in the conditional volatility process of oil prices.Footnote 23

To measure the effect of uncertainty on real output growth, we report the point estimates of the coefficient of \(H_{11}(t)^{1/2}\) with asymptotic t-statistics in parentheses in Table 4. This parameter represents the coefficient of the conditional volatility of real oil price changes in the real output growth mean equation. We find a negative and statistically significant coefficient of \(H_{11}(t)^{1/2}\) across the two countries. The values of the coefficients for Jordan and Turkey are \(-\) 0.03 and \(-\) 0.04, respectively.Footnote 24 These calculations indicate that unanticipated oil price shocks whether positive or negative will tend to increase the conditional standard deviation of oil. This increase will ultimately depress output growth in the short run. This finding conforms very well with the results of Elder and Serletis (2010, 2011), Rahman and Serletis (2012), Bredin et al. (2011), and Aye et al. (2014) who find that the oil price volatility negatively influence the aggregate economic activity of Canada, USA, G-7 countries, and South Africa. This is also in accord with the findings of Ferderer (1997) who finds that it is oil price volatility rather than oil prices that causes much damage to economic activity. One conventional explanation of these results is that increased oil price volatility may delay investment by raising uncertainty (Bernanke 1983; Dixit and Pindyck 1994) or it induces costly sectoral reallocation of resources (Kilian and Vigfusson 2011a, b) that depress economic activity.

We estimate how oil price volatility influence output changes by assuming shocks to the conditional standard deviation of oil returns. We seek from this estimation to get more economic interpretation of our results. As a result, we follow Elder (2004), and we take the sample standard deviation of oil price conditional volatility, which is 26.88 in our case, as the average shock magnitude. Then, we estimate the effect on real output growth by multiplying it with the estimated coefficient \(H_{11}(t)^{1/2}\). One-unconditional-standard-deviation shock to oil price uncertainty reduces the growth rate of output within 1 month by approximately 0.81 and 1.01% in Jordan and Turkey, respectively. These calculations show that oil price uncertainty has quite large effect on the real economic activity of oil importer countries in the Middle East.

We clearly observe that the negative effect of oil price uncertainty on the industrial production index growth rate in Turkey is stronger and more persistent than in Jordan. This result may be partially explained by the higher energy intensity and the lower diversification of energy sources of Turkey.Footnote 25 According to the data published by the World Bank in 2013, Jordan’s oil intensity at constant purchasing power parities is 9.9% compared with 11.6% for Turkey. This means that Turkey is less energy-efficient; therefore, its industrial production is more sensitive to oil price uncertainty than the industrial production of Jordan.

Hence, we conclude that Turkey’s output is more affected by oil price shocks. Another explanation for Turkey’s more sensitivity to the uncertainty in the oil market can be attributed to its undiversified energy sources compared to Jordan. The Herfindahl–Hirschman (HH) index which measures the extent of diversification is found to be around 71.1 and 82.0% for Jordan and Turkey, respectively. This suggests that Jordan uses more energy alternatives than Turkey, which justifies why its industrial production is less affected.Footnote 26

The difference in energy price policies between Jordan and Turkey may also provide additional explanation of these results. For instance, Jordan has traditionally pursued a stabilization price policy through subsidizing petroleum products. This policy action has kept domestic fuel prices around a constant level. The policy has also smoothed variation in the prices of domestic petroleum products.Footnote 27 This energy policy has reduced domestic oil uncertainty and its influence on macroeconomic growth. However, in the recent years in which the government budget faces serious fiscal deficits, Jordan has removed all fuel subsidies. Instead, the government has adopted in 2012 a monthly price adjustment mechanism whereby international oil prices are reviewed monthly. The new domestic prices are then regularly determined according to an explicit formula.

In contrast, the domestic petroleum products prices in Turkey are determined in the free market, which is closely linked to international crude oil prices and without any government interventions. The domestic petroleum products’ prices are subject to high variation that corresponds to world oil price volatility. Moreover, other than changes in world oil prices, the Turkish Lira fluctuations against the US dollar, in which the world crude oil price is denominated, play a role in determining the domestic petroleum products’ prices. This generates another explanation of why the relationship between world oil volatility and real output in Turkey is stronger and more persistent compared to Jordan.Footnote 28

The above-mentioned results provide evidence that oil price uncertainty has significant effects on real economic activity for oil importer countries in the Middle East region. The volatility in the oil market increases uncertainty and discourages investment in the oil sector.

IRF to one-standard-deviation positive and negative shocks to the real oil price changes. A note: The graphs display IRFs of the industrial production index growth (GIP) to one-standard-deviation shocks in oil price changes (solid line) from bivariate MGARCH-in-mean VAR. One-standard-error bands (dashed lines) are generated by Monte Carlo simulation technique based on 1000 repetitions

To better understand the dynamic impact of oil price shocks on real economic activity with the presence of uncertainty, we calculate the IRFs by simulating the maximum likelihood estimates of the model’s parameters as indicated in Sect. 2. Figure 3 reports the 12 month ahead IRFs of the industrial production growth to positive and negative oil price shocks (the soiled line).Footnote 29 In the VAR model, we choose a 12-month lag length for three reasons. First, Hamilton and Herrera (2004) show that short lag length might conceal the response of economic activity to oil shock as the influence may show up with a lag. Second, to improve the robustness of the results of the nonlinear VAR models, it is necessary to include sufficiently long lags. Finally, we choose a lag order of 12 months in order to be able to compare to the literature as most studies have used 12 lags (Elder and Serletis 2009, 2010, 2011; Rahman and Serletis 2012; Aye et al. 2014).Footnote 30

As mentioned previously, we choose the size of the shock to equal to the annualized unconditional standard deviation of the change in the price of oil. The one-standard-error bands are the dashed lines in Fig. 3, and they are constructed from 1000 replications as is common in the literature. In the figure, the X-axis represents the forecast horizon and the Y-axis represents the responses of industrial production growth to oil price shocks.

The first column of Fig. 3 reports the response of industrial production to a positive oil price shock for each of the two countries. The IRFs display that an unexpected upward shock in oil prices would result in an instantaneous drop in the growth rate of the industrial production. The shock induces a slower growth rate by about 30–40 basis points following 1 month in both Jordan and Turkey. The effect is statistically significant at all horizons. Again, the relatively higher efficiency use of oil and the higher diversification of energy sources in Jordan may explain why Turkey’s industrial production index is more responsive to unexpected shocks.

It is also observed that the response of real output to a positive oil price shocks reaches its peak after 1 month; then, it is followed by substantial reversals that wipe partially those increases within 2 months and finally output becomes stable after the lapse of 4 months. This response function holds true for both Jordan and Turkey.

These results are in line with the previous findings of Elder and Serletis (2009, 2010, 2011), Rahman and Serletis (2012), Bredin et al. (2011), and Aye et al. (2014), who account for the influence of uncertainty. They find that oil shocks tend to immediately reduce GDP growth in Canada, USA, G-7 countries, and South Africa.

Figure 3 also reports the IRFs of the industrial production growth to a dynamic negative oil price shock. It is obvious that a negative oil price shock tends to have a statistically significant effect on the industrial production. Besides, it increases growth by about 40 and 30 basis points after 1 month in both countries. Again, the response reaches its peak after about 1 month, then it is followed by a substantial decrease, after that the industrial production grow for about 2 months. Finally, it becomes stable after the lapse of 4 months.

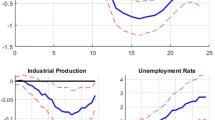

Finally, we compare the response of the industrial production to positive and negative oil price shocks without multivariate GARCH-in mean effects.Footnote 31 Figure 4 plots the impulse response functions for both the homoscedastic VAR and the multivariate GARCH-in-mean VAR of each country. The solid line represents impulse responses from the multivariate GARCH-in-mean VAR, whereas the dashed line represents the impulse responses of a conventional homoscedastic VAR. The figure shows that the dynamic pattern associated with the multivariate GARCH-in-mean VAR is very similar to those of the homoscedastic VAR. This suggests that the multivariate GARCH-in-mean VAR is an appropriate speciation model for capturing the influence of oil price uncertainty on the real economic activity of the two Middle Eastern countries.

IRF with and without multivariate GARCH-in-mean. A note: The graphs display IRFs of Homoscedastic and multivariate GARCH-M VARs. The solid line represents impulse responses from the multivariate GARCH-in-mean VAR, whereas the dashed line represents impulse responses from the conventional homoscedastic VAR. The graphs are generated by Monte Carlo simulation technique based on 1000 repetitions

5 Robustness

To investigate the robustness of our results, we regress industrial production on lagged industrial production, lagged oil and oil volatility as follows:

where \(\hat{H}_\mathrm{oil} \left( t \right) \) is the measure of oil price uncertainty that is extracted from a univariate GARCH (1, 1) model. The estimated parameters of the two equations are included in Table 5. The parameter estimates in the table that corresponds to oil volatility are negative and significant in both countries. The table also shows that Turkey’s industrial production is more responsive to oil volatility compared to Jordan.Footnote 32 The parameter estimates are also close particularly for Jordan. These results coincide with our previous findings.

The sample estimates of the structural errors in the previous two equations are used to test for any potential interdependence. Table 5 shows that the correlation between the estimated errors is negligible and therefore we may conclude that the underlying assumptions of the multivariate GARCH-in-mean model of Elders and Serletis are not unreasonable.

An extension that allows greater interaction in the volatility model is the bivariate GARCH-in-mean VAR with a BEKK (1, 1, 1) variance specification of Engle and Kroner (1995) and Kroner and Ng (1998). This model can be used as an alternative approach to study the influence of oil price uncertainty on real output growth.Footnote 33 In this model, the conditional mean equation of the industrial production index growth rates and the real price of oil can be written as:

where \(\varOmega _{t-1}\) is the information set available at time \(t-1\), and

The conditional variance matrix is specified as:

where C, B, and A are \(2\times 2\) parameters matrices. The C matrix is lower triangular and it ensures the positive definiteness of \(H_{t-1}\).Footnote 34 In the above model, the primary parameter of interest is \(\phi _{21}^{(i)}\) in the conditional mean equation, which measures the effect of oil price uncertainty on the growth rate of the industrial production index. The estimated values of this coefficient are \(-\) 0.36 (with a p value of 0.00) and \(-\) 0.69 (with a p value of 0.00) for Jordan and Turkey, respectively. These results reconfirm the previous findings in Tables 4 and 5 of our paper. Thus, we conclude that our findings are robust to the alternative approaches.

6 Conclusion and policy implications

In this paper, we explore the impact of oil price uncertainty on real output levels in the Jordanian and Turkish economies during the period 1986:01–2014:12. The two countries are working hard to improve the performance and standards of living for their own people. However, the increase in oil prices is an obvious obstacle to their development process. The value of oil imports in both countries has grown exponentially since 2000, and the oil bill consumes much of their governments’ budget. Therefore, the response of output to changes in oil volatility is expected to be negative and significant.

Our paper is a first attempt to measure the influence of oil price uncertainty on the industrial production of Jordan and Turkey. We have also looked into the difference of the responses of industrial output to positive and negative oil shocks.

We used a bivariate structural VAR in which uncertainty is endogenous and predetermined within the model. Our results indicate that oil price shocks have a negative and significant effect on aggregate real economic activity in Jordan and Turkey. The estimation of the model’s parameters shows that one-unconditional-standard-deviation shock to oil price uncertainty reduces the growth rate of real output within 1 month by 0.81 and 1.01% in Jordan and Turkey, respectively. The IRFs show that negative/positive oil shocks lead to drop/increase in the industrial production of both countries. In line with the recent evidence from developed countries, we find similar magnitude of influence of negative and positive oil price shocks and in both countries. These results are important for simulating output growth in Jordan and Turkey conditional on various scenarios of volatility in the oil market. They are also helpful in forecasting the influence of oil shocks on the industrial production in both countries.

Over all, we suggest energy policies that contribute to the economic stability and reduce the adverse effect of oil volatility on economic growth. These policies may include incentives for vehicles to economize on fuel consumption and for factories to improve the efficiency of their power plants that are fired by diesel or fueled oil. These incentives can be in the form of tax savings for lower energy consumption. Diversifying energy sources by using alternatives such as renewable energy is also helpful in reducing the influence of oil market uncertainty.

It may also help to increase the countries’ strategic oil reserves. This can be done, for instance, by issuing new mandates that require the private sector to hold additional energy reserves. Hedging energy exposure in sensitive industries by using derivatives also increases the flexibility of the economy to oil price shocks. Finally, oil price stabilization policies such as providing subsidies and/or tax reductions are costly, but it is helpful in stabilizing the economy and insulating it against oil shocks.

Notes

The theoretical foundations of the theories of investment under uncertainty and real options at the firm level are developed by Henry (1974), Bernanke (1983), Brennan and Schwartz (1985), Majd and Pindyck (1987), Brennan (1990), Gibson and Schwartz (1990), Triantis and Hodder (1990), and Aguerrevere (2009).

It is expected for economic activity in large countries to influence the oil market. Therefore, oil is endogenous and this should be reflected by the model that studies output–oil relationship.

Our analysis is restricted only to these two countries because sufficient data on industrial production index are unavailable for most of MENA countries.

Turkey is more sensitive to oil price uncertainty shocks compared to Jordan because of its higher oil intensity in terms of the amount of oil consumption needed to produce a unit of its GDP.

If oil volatility has a negative effect, then the impulse response of output is asymmetric. This point has been raised to us thankfully by one of the referees.

The theoretical literature, however, does not provide any definitive guideline for choosing appropriate level of lag length in a VAR model. However, Hamilton and Herrera (1983, 1996, 2004), Hooker (1996), and Jiménez-Rodríguez and Sánchez (2005) argue that a lag length of 4 quarter (12 months) is sufficient to capture the dynamic impacts of oil price shocks on real activity. Consequently, we use the long lag of 12 as is common with prior empirical literature (i.e., Herrera et al. 2011, 2015; Kilian and Vigfusson 2011a, b), although our results are robust to alternatives lag length.

Based on the Schwartz Information Criterion, we choose a lag length of \(q=r=1\) in Eq. (2).

The sample is selected on the basis of the availability of data of the industrial production index.

In some previous literature, the scale of economic output is measured by real gross domestic production (GDP) on quarterly basis (see, i.e., Rahman and Serletis 2012; Kilian and Vigfusson 2014). However, time series for quarterly GDP data is only available from 1999 and 2003 for Jordan and Turkey, respectively. Therefore, in this paper we use the industrial production index to proxy real GDP.

Very similar results were obtained when using Texas Intermediate crude oil as a benchmark for oil prices.

Over our sample period, we find that the correlation coefficient between WTI and Brent oil prices is 0.9864.

Very similar results were obtained when denominating the oil price in the country-specific consumer price index, which was obtained from the IFS. We also got similar results when the nominal price of oil was used.

We estimated conditional volatility of real oil price using AR(1)–GARCH(1,1) model.

We also test the lag length using the AIC, FPE, and HQC information criteria. All suggest that 12 lags are sufficient to summarize the dynamics of the system.

For a robustness check, we re-estimated the model for a sample that excludes the recent global financial crises. Results have not changed. Still the influence of uncertainty is negative and highly significant. The coefficients with the t-statistics were \(-\) 0.03 (\(-\) 3.44) and \(-\) 0.03 (\(-\) 3.69) for Jordan and Turkey, respectively.

Oil intensity is measured as the oil consumption needed to produce one unit of GDP. Energy diversification is defined as diversification of energy sources. Following the empirical literature (e.g., Löschel et al. 2010), we use the Herfindahl–Hirschman (HH) index to measure diversification energy sources. This index is equal to the sum of the squares of the fractional share of each source (standardized in energy units). The more energy diversification of energy sources, the lower is the value of the index. We use six energy sources in calculating the HH index: crude oil, natural gas, coal, hydropower, nuclear power, and other forms of renewable energy (geothermal, solar, wind, wood, and waste electricity generation). The data on share in total energy consumption of each energy source were retrieved from the US Energy Information Administration (http://www.eia.gov/opendata/).

Note that energy diversification is more helpful in mitigating the negative influence on output when prices and price volatilities of different energy sources are weakly correlated.

The budget deficit due to the oil subsidy scheme has been always covered by foreign aid from Saudi Arabia and other oil-rich Arab countries.

Currently, Jordan is adopting the pegged exchange rate regime. The Jordanian Dinar is pegged to the US dollar. Turkey is adopting a floating exchange rate regime.

Note that similar results are obtained when we use 6- and 24-month forecast horizon. These results are only available from the authors upon request.

Herrera et al. (2015) also argue that the standard lag selection criteria such as the Bayesian Information Criterion (BIC) do not work well for nonlinear models and may yield misleading results in small samples.

That is, we restrict the coefficient on oil price uncertainty to zero, which effectively eliminates the multivariate GARCH-in-mean term from Eq. (6).

Note that getting the fitted volatilities from the structural VAR with multivariate GARCH also produce similar results.

Note that given the weak dependence of structural breaks, we expect tiny values in the off-diagonal locations of the volatility matrices of the BEKK and hence similar results. A drawback of this model is that it complicates the interpretation of the structural shocks. This point has been raised to us thankfully by one of the referees.

References

Aguerrevere FL (2009) Real options, product market competition, and asset returns. J Finance 64:957–983

Ahmad H, Bashar O, Wadud I (2012) The transitory and permanent volatility of oil prices: what implications are there for the US industrial production? Appl Energy 92:447–455

Alquist R, Kilian L, Vigfusson R (2011) Forecasting the price of oil. Available at SSRN: http://ssrn.com/abstract=1911194 or http://dx.doi.org/10.2139/ssrn.1911194

Atkeson A, Patrick JK (1999) Models of energy use: putty-putty versus putty-clay. Am Econ Rev 89:1028–1043

Aye G, Dadam V, Gupta R, Mamba B (2014) Oil price uncertainty and manufacturing production. Energy Econ 43:41–47

Baumeister C, Peersman G (2013) Time-varying effects of oil supply shocks on the US economy. Am Econ J Macroecon 5:1–28

Bernanke B (1983) Irreversibility, uncertainty, and cyclical investment. Q J Econ 98:85–106

Bernanke BS, Gertler M, Watson M (1997) Systematic monetary policy and the effects of oil price shocks. Brookings Papers Econ Act 1:91–157

Bohi DR (1991) On the macroeconomic effects of energy price shocks. Resour Energy 13:145–162

Bredin D, Elder J, Fountas S (2011) Oil volatility and the option value of waiting: an analysis of the G-7. J Futures Mark 31:679–702

Brennan MJ (1990) Latent assets. J Finance 45:709–730

Brennan MJ, Schwartz ES (1985) Evaluating natural resource investments. J Bus 58:135–157

Brown SP, Yücel MK (2002) Energy prices and aggregate economic activity: an interpretative survey. Q Rev Econ Finance 42:193–208

Dixit AK, Pindyck RS (1994) Investment under uncertainty. Princeton University Press, Princeton

Donayre L, Wilmot NA (2015) The asymmetric effects of oil price shocks on the Canadian economy. Available at SSRN: http://ssrn.com/abstract=2567576 or https://doi.org/10.2139/ssrn.2567576

Edelstein P, Kilian L (2007) The response of business fixed investment to changes in energy prices: a test of some hypotheses about the transmission of energy price shocks. BE J Macroecon 7:35

Edelstein P, Kilian L (2009) How sensitive are consumer expenditures to retail energy prices? J Monet Econ 56:766–779

Elder J (2003) An impulse-response function for a vector autoregression with multivariate GARCH-in-mean. Econ Lett 79:21–26

Elder J (2004) Another perspective on the effects of inflation uncertainty. J Money Credit Bank 36:911–28

Elder J, Serletis A (2009) Oil price uncertainty in Canada. Energy Econ 31:852–856

Elder J, Serletis A (2010) Oil price uncertainty. J Money Credit Bank 42:1137–1159

Elder J, Serletis A (2011) Volatility in oil prices and manufacturing activity: an investigation of real options. Macroecon Dyn 15:379–395

Engle RF, Kroner KF (1995) Multivariate simultaneous generalized ARCH. J Econ Theory 11:122–150

Ferderer JP (1997) Oil price volatility and the macroeconomy. J Macroecon 18:1–26

Gibson R, Schwartz ES (1990) Stochastic convenience yield and the pricing of oil contingent claims. J Finance 45:959–976

Gisser M, Goodwin TH (1986) Crude oil and the macroeconomy: tests of some popular notions: Note. J Money Credit Bank 18:95–103

Hamilton JD (1983) Oil and the macroeconomy since World War II. J Polit Econ 91:228–48

Hamilton JD (1988) A neoclassical model of unemployment and the business cycle. J Polit Econ 96:593–617

Hamilton JD (1996) This is what happened to the oil price-macroeconomy relationship. J Monet Econ 38:215–220

Hamilton JD (2003) What is an oil shock? J Econom 113:363–98

Hamilton JD (2013) Historical oil shocks. In: Parker RE, Whaples R (eds) Routledge Handbook of major events in economic history. Routledge Taylor and Francis Group, New York, pp 239–265

Hamilton JD, Herrera AM (2004) Oil shocks and aggregate macroeconomic behavior: The role of monetary policy: comment. J Money Credit Bank 36:265–86

Henry C (1974) Investment decisions under uncertainty: the irreversibility effect. Am Econ Rev 64:1006–1012

Herrera AM, Lagalo LG, Wada T (2011) Oil price shocks and industrial production: is the relationship linear? Macroecon Dyn 15:472–497

Herrera AM, Lagalo LG, Wada T (2015) Asymmetries in the response of economic activity to oil price increases and decreases? J Int Money Finance 50:108–133

Hooker MA (1996) What happened to the oil price-macroeconomy relationship? J Monet Econ 38:195–213

Jiménez-Rodríguez R, Sánchez M (2005) Oil price shocks and real GDP growth: empirical evidence for some OECD countries. Appl Econ 37:201–228

Jo S (2014) The effects of oil price uncertainty on global real economic activity. J Money Credit Bank 46:1113–1135

Kilian L (2009) Not all oil price shocks are alike: disentangling demand and supply shocks in the crude oil market. Am Econ Rev 99:1053–1069

Kilian L (2014) Oil price shocks: causes and consequences. Annu Rev Resour Econ 6:133–154

Kilian L, Vega C (2011) Do energy prices respond to US macroeconomic news? A test of the hypothesis of predetermined energy prices. Rev Econ Stat 93:660–671

Kilian L, Vigfusson RJ (2011a) Nonlinearities in the oil price-output relationship. Macroecon Dyn 15:337–363

Kilian L, Vigfusson RJ (2011b) Are the responses of the US economy asymmetric in energy price increases and decreases? Quant Econ 2:419–453

Kilian L, Vigfusson RJ (2014) The role of oil price shocks in causing U.S. recessions. International Finance Discussion Papers No. 1114, Board of Governors of the Federal Reserve System. http://www.federalreserve.gov/pubs/ifdp/2014/1114/ifdp1114.pdf

Kroner FK, Ng VK (1998) Modelling asymmetric comovements of asset returns. Rev Financ Stud 11:817–844

Lee K, Ni S (2002) On the dynamic effects of oil price shocks: a study using industry level data. J Monet Econ 49:823–852

Lee K, Ni S, Ratti RA (1995) Oil shocks and the macroeconomy: the role of price variability. Energy J 16:39–56

Löschel A, Moslener U, Rübbelke DTG (2010) Indicators of energy security in industrialised countries. Energy Policy 38:1665–1671

Majd S, Pindyck RS (1987) Time to build, option value, and investment decisions. J Financ Econ 18:7–27

Mehrara M (2008) The asymmetric relationship between oil revenues and economic activities: the case of oil-exporting countries. Energy Policy 36:1164–1168

Mork KA (1989) Oil and the macroeconomy when prices go up and down: an extension of Hamilton’s results. J Political Econ 97:740–4

Mork KA (1994) Business cycles and the oil market. Energy J 15:15–38

Mory JF (1993) Oil prices and economic activity: is the relationship symmetric? Energy J 14:151–161

Pindyck RS (1991) Irreversibility, uncertainty, and investment. J Econ Lit 29:1110–48

Plante M, Traum N (2011) Time-varying oil price volatility and macroeconomic aggregates: what does theory say? In: Midwest Economics Association Conference. http://www.elsevier.com/__data/assets/pdf_file/0004/114889/N_Traum.pdf

Rahman S, Serletis A (2011) The asymmetric effects of oil price shocks. Macroecon Dyn 15:437–471

Rahman S, Serletis A (2012) Oil price uncertainty and the Canadian economy: evidence from a VARMA, GARCH-in-mean, asymmetric BEKK mode. Energy Econ 34:603–610

Serletis A, Istiak K (2013) Is the oil price-output relation asymmetric? J Econ Asymmetries 10:10–20

Triantis AJ, Hodder JE (1990) Valuing flexibility as a complex option. J Finance 45:549–565

Acknowledgements

The authors would like to thank the editor and two anonymous referees of Empirical Economics for their valuable and helpful comments. The authors are responsible for any remaining errors.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Maghyereh, A.I., Awartani, B. & Sweidan, O.D. Oil price uncertainty and real output growth: new evidence from selected oil-importing countries in the Middle East. Empir Econ 56, 1601–1621 (2019). https://doi.org/10.1007/s00181-017-1402-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-017-1402-7