Abstract

This paper introduces the Rossi and Sekhposyan (Am Econ Rev 105(5): 650–655, 2015) uncertainty index for the Euro Area and its member countries. The index captures how unexpected a forecast error associated with a realization of a macroeconomic variable is relative to the unconditional distribution of forecast errors. Furthermore, it can differentiate between upside and downside uncertainty, which could be relevant for addressing a variety of economic questions. The index is particularly useful since it can be constructed for any country/variable for which point forecasts and realizations are available. We show the usefulness of the index in studying the heterogeneity of uncertainty across Euro Area countries as well as the spillover effects via a network approach.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

This paper introduces macroeconomic uncertainty indices for both the Euro Area (EA) as well as individual EA member countries. The methodology we use to construct the uncertainty index is based on Rossi and Sekhposyan (2015) and relies on the likelihood of the observed forecast error. The index is based on the quantile associated with the actual realized value of the forecast error in the unconditional distribution of observed forecast errors. For example, if according to the distribution of realized forecast errors, the probability of observing a forecast error of \(x\%\) is very unlikely (e.g., a forecast error of \(x\%\) is in the 99th quantile, say, of the historical distribution of forecast errors), and the realized forecast error is indeed \(x\%\), then the index determines that there is substantial uncertainty. The novelty of this paper is the application of the methodology in Rossi and Sekhposyan (2015) to construct uncertainty indices for the EA as well as several of its member economies for which uncertainty indices are not currently available.Footnote 1

The index we propose is appealing since aggregate uncertainty (or uncertainty common to a set of variables, such as policy variables) can be described with probabilistic statements. Further, our measure also has the advantage of providing information on whether the uncertainty is an upside (positive) or a downside (negative) one, while the measures commonly used in the literature, for instance dispersion-based measures, do not have this feature. This is potentially important, since being surprised about positive outcomes may have different macroeconomic effects than being surprised about negative outcomes.Footnote 2 Lastly, our measure of uncertainty is easy to construct and use. It requires no parametric models, which would be hard to implement for a variety of countries for which the data sample is relatively small (such as the EA).

While there are a variety of uncertainty measures available and studied for the US (see Bloom 2014), the available measures of uncertainty for the EA are only a few. The VSTOXX index is a market implied volatility measure for the EA, similar to the VIX/VXO in the USA, which has been used for measuring uncertainty and its macroeconomic impact (see Bloom 2009). Baker et al. (2016) propose a news-based measure, the European economic policy uncertainty (EPU) index by searching for keywords associated with uncertainty across a variety of relevant newspaper articles. Regarding uncertainty indices for individual EA member countries, Baker et al. (2016) build economic policy uncertainty indices for only a few of them (France, Germany, Italy, Spain and the Netherlands), and, in addition, their index is very time-consuming to calculate. On the other hand, our proposed index can be calculated for any country as long as there is a sequence of forecasts and corresponding realizations, and we provide such indices for EA member countries. Our index is also different from theirs since it builds on forecast errors.

There are a few forecast-based uncertainty measures for the Euro Area as well. Both Kenny (2016) and Abel et al. (2016) focus on the Survey of Professional Forecasters conducted by the European Central Bank (which we denote by ECB-SPF). Kenny (2016) uses an uncertainty index based on probability density forecasts. Abel et al. (2016) compare three measures that are typically used as uncertainty proxies: (i) ex-ante measures (i.e., the average dispersion across forecasters’ density forecasts or the median inter-quartile range from individual predictive densities); (ii) disagreement measures (i.e., dispersion in point forecasts or the inter-quartile range of point forecasts across individuals at each point in time); and (iii) ex-post measures of uncertainty captured by forecast error variances. Note that the indices in Kenny (2016) and Abel et al. (2016) are obtained by using the whole cross section of forecasters’ predictions or their predictive densities, and hence can only be constructed for the EA as a whole since no such data are available at the individual country level. Our index, instead, is available for most European countries and several others around the world.

In terms of empirical results, Abel et al. (2016) find that the ex-ante uncertainty measures are counter-cyclical, and that output growth and inflation uncertainty increased since 2007. In addition, they find no meaningful relationship between ex-ante and ex-post uncertainty measures. Furthermore, they conclude that the relationship between disagreement and ex-ante uncertainty is positive, yet mild, with disagreement explaining very little of ex-ante uncertainty fluctuations. The latter finding is consistent with the fact that the empirical evidence on the relationship between disagreement and uncertainty has been mixed in the literature. As discussed in Zarnowitz and Lambros (1987) and Lahiri and Sheng (2010), researchers who use disagreement as a measure of uncertainty implicitly assume that the dispersion among forecasters mimics the dispersion that each forecaster expects across the outcomes. This assumption may not hold, and hence disagreement may not reflect uncertainty. Regardless, Zarnowitz and Lambros (1987) find mild evidence for it in the US data. Lahiri and Sheng (2010), on the other hand, establish conditions under which disagreement and uncertainty are the same. They find that forecast uncertainty is the same as disagreement plus the variance of future aggregate shocks cumulated over the forecast horizon, and hence depends on how the latter varies across time and horizons. Consequently, they find that disagreement is a reliable measure of uncertainty only in stable periods. In a related paper, Rich and Tracy (2010) also find little empirical evidence that disagreement is a useful proxy for uncertainty in the US. Our measure, instead, is not based on disagreement, but on the average of the point forecasts across the cross section of forecasters. See Rossi et al. (2016) for a comprehensive study of the relationship between ex-ante and ex-post uncertainty measures, as well as disagreement over time in the US.

Our analysis uncovers several interesting empirical findings. First, uncertainty, as measured by the Rossi and Sekhposyan (2015) index, was uncommonly high in the EA during the financial crisis as well as during the European sovereign debt crisis. Though the crises were accompanied with downside uncertainty, the period after the crises was predominantly characterized as a prolonged period of upside uncertainty (at least in terms of inflation and the unemployment rate). In addition, we find that most European countries share a similar uncertainty cycle, although there is some evidence of divergence and heterogeneity after the last recession, starting in 2013:II. Finally, spillover effects for both output growth- and inflation-based uncertainty are rather large, especially when concentrating on the current composition of the EA. When looking at the original set of EA member economies, the degree of inflation-based uncertainty spillovers decreases somewhat, yet they still show considerable time variation: the spillover effects appear to be counter-cyclical, increasing during the financial and European sovereign debt crises, which also happen to lead/coincide with periods of recessions.

The paper is organized as follows. Section 2 provides an overview of the macroeconomic uncertainty indices we use. Section 3 discusses the proposed uncertainty indices for the EA, while Sect. 4 discusses country-specific uncertainty indices. Section 5 analyzes the dynamics of the uncertainty across the EA and assesses its spillover effects. Section 6 concludes.

2 The uncertainty indices

The uncertainty index we use is proposed in Rossi and Sekhposyan (2015). The index is based on comparing the realized forecast error with the unconditional distribution of forecast errors for that variable. If the realized forecast error is in the tail of the distribution, we conclude that the realization was very difficult to predict, thus the macroeconomic environment is very uncertain.

More specifically, the index is based on the cumulative density of the forecast errors evaluated at the actual realized forecast error. Let the forecast error at time \(t+h\) be denoted by \(e_{t+h}=y_{t+h}-E_{t}(y_{t+h})\), \(t=1,\ldots ,T-h\) (T being the overall sample size), i.e., it is the forecast error associated with the h-step-ahead forecast made using all the available information at time t. Throughout the paper we will refer to time t as a forecast origin date. Let \(f\left( e\right) \) denote the probability distribution function (PDF) of the forecast errors, \(e_{t+h}.\) In our empirical implementation we use the full sample of forecast errors to proxy the unconditional distribution.Footnote 3 Given \(e_{t+h}\) and \(f\left( e\right) \), the Rossi and Sekhposyan (2015) uncertainty index at time \(t+h\) is based on:

Note that, by construction, \(U_{t+h}\) is between zero and one. When \(U_{t+h}\) is close to the extreme values, either one or zero, the realized forecast error is very different from the expected value based on the unconditional distribution, and, hence, we conclude that uncertainty is high. \(U_{t+h}\) in Eq. (1) is the quantile associated with the actual realized value of the forecast error in the unconditional distribution of observed forecast errors.

The measure proposed in Eq. (1) allows us to differentiate between upside (positive) and downside (negative) uncertainty. When \(U_{t+h}\) is close to one, i.e., when the realization is much higher than its expected value relative to the historical average, we label the shock, i.e., the forecast error, as a positive uncertainty “shock.” Conversely, a value of \(U_{t+h}\) close to zero indicates that the realized value is much smaller than the expected value, and we label it a negative unexpected “shock.” To convey information about the asymmetry, Rossi and Sekhposyan (2015) propose two indices:Footnote 4 \(U_{t+h}^{+}=\frac{1}{2}+\max \left\{ U_{t+h}-\frac{1}{2},0\right\} \) and \(U_{t+h}^{-}=\frac{1}{2}+\max \left\{ \frac{1}{2}-U_{t+h},0\right\} .\) Thus, \(U_{t+h}^{+}\) measures upside uncertainty, that is, uncertainty arising from news or outcomes that are unexpectedly positive (e.g., realized output growth turned out to be higher than expected). On the other hand, \(U_{t+h}^{-}\) measures downside uncertainty, that is, uncertainty associated with unexpectedly negative events (e.g., lower output growth than expected).

In order to be able to compare instances of upside and downside uncertainty to each other, we, similarly to Rossi and Sekhposyan (2015), consider the normalized version of \(U_{t+h}\) and define the overall uncertainty index as: \(U_{t+h}^{*}=\frac{1}{2}+\left| U_{t+h}-\frac{1}{2}\right| .\) It should be noted that given the normalization, the uncertainty indices \(U_{t+h}^{*},U_{t+h}^{+}\) and \(U_{t+h}^{-}\) fluctuate between 0.5 and 1. Furthermore, the definitions of upside and downside uncertainty depend on the variable at hand. For example, it is uncontroversial that positive surprises in GDP growth are instances of upside uncertainty, while positive surprises in the unemployment rate proxy for negative uncertainty. The working paper version (Rossi and Sekhposyan 2016) provides illustrative examples on the use of the procedure.

3 The Euro Area uncertainty indices

We construct the overall as well as the upside and downside uncertainty indices for the EA based on the point forecasts from the Survey of Professional Forecasters administered by the European Central Bank. The ECB Survey of Professional Forecasters (ECB-SPF) is a quarterly survey of expectations for several target variables and for a variety of short-, medium- and long-term horizons. It collects professional forecasters’ expectations of inflation (year on year percentage change of the Harmonized Index of Consumer Prices), real GDP growth (year on year percentage change of real GDP) and unemployment rates (defined as the number of unemployed between 15—in some countries 16—and 74 years of age as a percentage of the labor force) in the EA. The ECB-SPF adapts to the changing composition of the EA, i.e., accounting for the new member countries as they join the currency union.

Our uncertainty index relies on the average point forecasts across the cross section of individual forecasters. In order to construct the unconditional densities of forecast errors, we use forecasts from 1999:I to 2015:II for inflation and unemployment rate and 1999:I–2015:III for output growth. Further, in the benchmark specification, we use the final release of the data as the realization when calculating the forecast errors. However, we also investigate the behavior of our indices when the first release of the data is used instead.

It should be noted that the ECB-SPF dataset provides both fixed and moving horizon forecasts. In other words, each quarter the forecasters are asked to provide forecasts for specific calendar years (moving horizon forecasts) as well as for 1, 2 and 5 year ahead (fixed-horizon forecasts). The difference between the fixed and moving horizon forecasts is as follows.

A moving horizon forecast is a forecast where, in January of 2013 (i.e., the first quarter), the forecasters are asked to provide their expectations for calendar years 2013, 2014 and 2015. Then, they are asked the same information in April of 2013 (i.e., the second quarter). If we were to use the current-year forecasts they provide in the first two quarters of 2013, we would compare forecasts whose horizons are changing: the forecasts made in April would have one quarter of uncertainty that has already been resolved relative to the January forecasts.

A fixed-horizon forecast, instead, is one where, for example, in January 2013 forecasters are requested projections for December 2013 and, subsequently, in April 2013 they are asked their projections for March 2014. We choose to work with the fixed-horizon forecasts since they are not affected by the resolution of uncertainty over time. The available fixed-horizon ECB-SPF forecasts measure expectations for 1-, 2- and 5-years ahead of the period for which the most up-to-date official data releases are available; we focus on forecasts of all the macroeconomic variables at the 1-year-ahead fixed-horizon, since it makes our results more comparable with those in Rossi and Sekhposyan (2015).

There are a few intricacies associated with the ECB-SPF. First, the survey also provides conditional density forecasts where the respondents provide their probabilistic assessments about particular economic outcomes. This could be a natural choice for measuring uncertainty in the EA (as some of the literature discussion in the introduction does).Footnote 5 Instead, we focus on the unconditional densities based on average point forecasts across the forecasters. We made this choice for consistency, as our ultimate goal is to provide country-specific uncertainty indices for a wide set of countries (discussed in Sect. 4): for the majority of the countries we consider, neither densities nor individual forecasts are readily available. Hence, it would be impossible to calculate measures of uncertainty based on predictive densities or other measures of central tendencies extracted from the cross section of forecasts. Our measure of uncertainty based on the point forecast, on the other hand, can be easily obtained. Moreover, Clements (2016) points out that unconditional densities of point forecasts appear to be more informative than conditional predictive densities, at least in the context of the US Survey of Professional Forecasters.

In the ECB-SPF, the forecast horizon also has variable-specific peculiarities. Namely, the 1-year-ahead forecasts refer to a 1-year-ahead time period from the date of the last realization in the information set of both the researchers and the public. As such, though the forecasts of output growth, inflation as well as the unemployment rate are 1-year-ahead forecasts, they pertain to different time periods in the year. As discussed in Genre et al. (2013), the “1-year-ahead forecast is actually around 6–8 months ahead for GDP growth, 11 months ahead for the unemployment rate and 12 months ahead for HICP inflation.” In order to match the forecasts with the realizations accurately, we go through the ECB-SPF’s individual forecast dataset to elicit the specific time period for which the forecasters are asked to provide predictions.

As mentioned earlier, in the benchmark specification the forecasts are evaluated against the final release of the data. This is done in order to be consistent with the country-specific indices, for most of which no real-time data vintages of realizations are available. For the EA, the last vintage of the data that we use to extract the final release values belongs to June 1, 2016. The last observations for output growth, inflation and unemployment rate in the dataset are for 2016Q1, May 2016 and April 2016, respectively. When considering the robustness of the results to using real-time data, we use the first available realization from the real-time database for the EA (as discussed in Giannone et al. 2012).

3.1 Variable-specific uncertainty indices for the Euro Area

Figure 1 plots Rossi and Sekhposyan’s (2015, hereafter labeled RS) overall uncertainty index \(U_{t+h}^{*}\), as well as the downside uncertainty (“Downside UC,” \(U_{t+h}^{-}\)) and upside uncertainty (“Upside UC,” \(U_{t+h}^{+}\)) indices extracted from the distribution of the forecasts errors of inflation, output growth and unemployment rate. The figure also plots the CEPR recession dates, determined by the EA business cycle dating committee (shaded areas). Common wisdom associates the few years after 2007 with high uncertainty, due to the financial crisis in 2007–2009 and the European sovereign debt crisis in 2010–2012. It is reassuring that our uncertainty index captures such episodes (as shown in the left panels in Fig. 1). In fact, the left figures in Panels B and C show that the downside uncertainty in the real side of the economy, namely the uncertainty associated with output growth and unemployment rate, spikes leading to/during recessions; however, there is also an episode of downside uncertainty in the early 2000s. It is worth noting that, after the last recession in the EA, both inflation and unemployment rate have shown considerable upside uncertainty relative to their historical dynamics. On the other hand, the uncertainty associated with output growth has been relatively low.

Euro Area variable-specific uncertainty indices. Note This figure depicts the uncertainty indices obtained from the forecast error distributions implied by the ECB-SPF’s inflation rate (a), output growth (b) and unemployment rate (c) forecasts. The left column in each panel shows the upside \((U_{t+h}^{+})\), downside \((U_{t+h}^{-})\) and overall uncertainty \((U_{t+h}^{*})\) indices, while the right column shows the sensitivity of the overall uncertainty index \((U_{t+h}^{*})\) to using real-time data

The right plots in Fig. 1, Panels A–C, investigate the sensitivity of our uncertainty index to using the final release versus the first release as a realization. The solid line corresponds to the benchmark index calculated based on the final release value as a realization, while the dashed-dotted line calculates the same index using the first release of the data. As can be seen from Panel A, right figure, the inflation-based uncertainty is essentially identical in the second part of the sample regardless of the choice made for the realization, while there are some minor differences in the beginning of the sample. Similarly, as the right figure in Panel B suggests, using the first realization can potentially alter our index, though not considerably. On the other hand, as the right figure in Panel C shows, the choice of the realization is important for the unemployment-based uncertainty index, since uncertainty would be considerably larger in 2005–2007 if calculated based on the first release data.

3.2 A macroeconomic uncertainty index for the Euro Area

The variable-specific uncertainty indices are constructed from forecast errors in specific macroeconomic variables; hence, they provide valuable information about uncertainty measured in terms of these specific variables. However, sometimes, it is useful to have a broader uncertainty index that summarizes the information contained in variable-specific uncertainty indices. This uncertainty index, which we label as the “EA macroeconomic uncertainty index,” is the first principal component extracted from the three variable-specific uncertainty series.

Figure 2 compares our proposed indices with those used in the literature. Panel A juxtaposes the dynamics of our variable-specific uncertainty indices; Panel B, instead, compares our summary macroeconomic uncertainty indices (both the first principal component and the average of the indices in Panel A) with the Baker et al. (2016) EPU index and the implied volatility index for Europe, VSTOXX. Both the EPU and VSTOXX are reported at the quarterly frequency, obtained by averaging (over the quarter) the monthly series in the case of the EPU and the daily series in the case of VSTOXX. All series are standardized, i.e., demeaned and divided by their respective standard deviations, to facilitate comparisons.

As the top plot in Fig. 2 shows, around the time of the financial and sovereign debt crises (between late 2000s and early 2010s) the variable-specific uncertainty indices are highly correlated, while these correlations are lower in the rest of the sample. Moreover, output growth uncertainty diverged from the inflation— and unemployment-based ones toward the end of the sample period; the rest of the time, unemployment and output growth uncertainty move closely together, except during 2005–2007. This is due to the nature of the data: as we have shown earlier (Fig. 1, Panel C), when using real-time data, uncertainty indices based on unemployment rate and output growth move closely together even in the 2005–2007 period.

One way to obtain a measure of macroeconomic uncertainty from variable-specific uncertainty indices is to average them. As an alternative, we use principal component analysis to mitigate the fact that the forecasts of the output growth, inflation and unemployment rate, though all being 1-year-ahead forecasts, potentially refer to different time periods/target dates (as discussed previously). In fact, principal component analysis helps us distinguish between variable-specific uncertainty associated with different forecast horizons, which is captured by the idiosyncratic component, and the common source of uncertainty, which is the one we are interested in estimating. We focus on the first principal component: overall, it explains 48% of the total variation in the observed series. The factor loadings are higher for the output growth and unemployment rate (1.10 and 1.27, respectively) than for inflation (0.41).

The plot at the bottom of Fig. 2 shows that aggregation of the variable-specific uncertainty indices based on principle component analysis (labeled “1st PC” in the figure) results in a very similar series to simple averaging (labeled “Average”). Relative to both the EPU as well as VSTOXX, our macroeconomic index describes the early 2000s as being less uncertain, while the second half of 2000s is associated with a higher degree of uncertainty. At the end of the sample, our aggregate macroeconomic uncertainty measure is in between the EPU and VSTOXX. Our measure, being smoothed, is less volatile than both EPU and VSTOXX.

The working paper (Rossi and Sekhposyan 2016, Table 1) reports correlations between the various variable-specific indices, the macroeconomic uncertainty index, the EPU and VSTOXX and shows that uncertainty indices based on real variables (output growth and employment) are highly correlated with each other as well as with the principal component. The correlation of the real-variable-based uncertainty measures with that of inflation uncertainty is somewhat smaller. Moreover, it appears that our macroeconomic uncertainty index is more correlated with VSTOXX than the EPU, though in absolute value these correlations are small.

4 Individual Euro Area member country-specific uncertainty indices

One of the contributions of this paper is to provide individual Euro Area country-specific uncertainty indices. Baker et al. (2016) build economic policy uncertainty indices for several EA countries, such as Germany, Italy, France, Spain and the Netherlands. However, their index is very time-consuming to calculate, and it is not available for a wide variety of countries. On the other hand, our proposed index can be calculated for any country as long as there is a sequence of forecasts and corresponding realizations. The Euro Area countries for which we have constructed the indices, with the respective periods for which time series of uncertainty indices are available, are reported in the working paper version (Rossi and Sekhposyan 2016, Table 2). The mnemonics are as follows: AUT for Austria, BEL for Belgium, CYP for Cyprus, EST for Estonia, FIN for Finland, FRA for France, DEU for Germany, GRC for Greece, IRL for Ireland, ITA for Italy, LVA for Latvia, LTU for Lithuania, PRT for Portugal, SVK for Slovakia, SVN for Slovenia, ESP for Spain and NLD for the Netherlands. The time series are available on our webpages. We provide the indices for seventeen out of the current nineteen EA member countries. We have no available data for Malta and Luxemburg.

The uncertainty indices for the individual countries are based on Consensus Economics forecast errors. The forecasts generally start in 1990:M1, although for some countries they start later. Moreover, the frequency of the forecasts changes over time. For instance, for Eastern Europe, the survey was conducted every 2 months between May 1998 and April 2007 and monthly thereafter. For the remaining countries, the survey provides monthly point forecasts (which are the average across forecasters). The realizations are from Haver Analytics and correspond to final release values. The data sources we used were chosen to collect the largest possible sample of countries and time periods.

By construction, Consensus Economics forecasts are fixed-event forecasts: data are collected monthly, but forecasts refer to the average rate of growth of GDP and CPI inflation over either the current-year or the next calendar year. Being fixed-event forecasts, their horizon changes over the year (as discussed in Sect. 3). We construct monthly fixed-horizon forecast using the method proposed by Dovern et al. (2012). Dovern et al. (2012) propose taking weighted averages of the current-year and next-year forecasts. For example, in the case of GDP growth, for each month the survey contains a pair of “fixed-event” forecasts for the current-year, which we label \(\widehat{f}_{t+k|t}^{\mathrm{FE}}\), and for the following year, which we label \(\widehat{f}_{t+k+12|t}^{\mathrm{FE}}\). The 12-month-ahead (fixed-horizon) forecast at time t is the average of the two fixed-event forecasts using weights that are proportional to their share of overlap with the forecast horizon. Let k denote the number of months from time t until the end of the year, \(k=1,2,3,4,\ldots ,12;\) then the fixed-horizon forecast is \(\frac{k}{12}\widehat{f}_{t+k|t}^{\mathrm{FE}}+\frac{12-k}{12}\widehat{f}_{t+k+12|t}^{\mathrm{FE}} \).Footnote 6 We use a similar procedure for inflation.Footnote 7

As mentioned, the realizations are the seasonally adjusted inflation and output growth values taken from Haver Analytics. The GDP growth data are available at the quarterly frequency, while inflation is monthly. In order to construct the forecast errors, we first aggregate the fixed-horizon monthly output growth forecasts into quarterly series, and then compare them to the quarterly realization of output growth. For inflation, we construct both monthly and quarterly uncertainty indices. To make the indices comparable to the ECB-SPF EA uncertainty indices, in the paper we only report the quarterly indices; the discussion of the monthly inflation-based indices is relegated to the working paper. We use the quarterly averages of the monthly realizations and the fixed-horizon-forecasts to obtain the quarterly forecast errors.Footnote 8

The timing of the surveys relative to the realizations is worth a separate discussion. When the survey takes place, typically only the past value of the realization is available. Thus, in the first month of the year, when the forecasts are obtained, the realizations for the current-year have not been published yet. Following the procedure that is typically used for the ECB-SPF, which faces a similar problem, we calculate the realizations as 1-year-ahead growth rates from the last data release that was available to the forecasters at the time they made their forecasts. For instance, the realization we associate with the quarterly 1-year-ahead forecast in the first quarter of the year captures GDP growth between the fourth quarter of the current-year relative to the fourth quarter of the previous year.

Figures 3 and 4 depict the upside and downside uncertainty indices for the individual EA countries in our dataset. Figure 3 shows the overall macroeconomic uncertainty index based on GDP growth forecast errors, while Fig. 4 focuses on the inflation-based uncertainty index. The shaded areas highlight EA-wide recessions identified by the CEPR business cycle dating committee, rather than country-specific recession dates which are not available.

Figure 3 shows that most European countries share a similar overall macroeconomic uncertainty cycle, as the downside uncertainty index tracks closely the recession dates. However, the timing and magnitude differ somewhat across countries. Comparing Fig. 3 with Fig. 1, Panel B, the behavior of the individual EA countries is also similar to the behavior of the uncertainty indices in the EA. There is evidence of divergence toward the end of the sample, though, as some countries experienced upside uncertainty (e.g., Ireland, Slovakia, Slovenia, Spain), while others experienced downside uncertainty (Austria, Greece, Latvia, Lithuania, etc.).

Figure 4 shows that inflation uncertainty is more homogeneous across countries relative to output growth uncertainty. There is evidence of upside uncertainty in most countries during the 1990s, which disappears in the 2000s. The latest part of the sample can still be described by upside uncertainty across the board. Considering the overlapping period where the EA (reported in Fig. 2, Panel A) and the individual member country uncertainty indices are both available, their behavior is very similar.

5 Spillover effects of uncertainty in the Euro Area

The previous section described country-specific uncertainty indices based on inflation and output growth forecast errors and analyzed their relationship to the broader EA index by visual inspection. Here we delve in more details. First, we compare the common component of the country-specific indices to the ECB-SPF Euro Area one. Second, we investigate the heterogeneity in uncertainty across EA countries. Third, we formally investigate uncertainty spillovers across countries and over time via network analysis.

5.1 The ECB-SPF Euro Area uncertainty index versus individual countries’ uncertainty index aggregates

In this subsection, we compare the EA uncertainty indices constructed based on the ECB-SPF forecasts to aggregate country-specific indices extracted from the Consensus Economics survey-based country-specific forecasts. The aggregate uncertainty indices constructed from the individual countries’ indices are the principal component and the cross-country average. Note that the latter are based on the current EA composition, while the ECB-SPF EA uncertainty indices are based on the changing composition of the EA instead. We focus our analysis on the sub-sample where all the indices overlap.

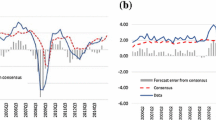

The left panel in Fig. 5 depicts the indices for output growth, and the right panel depicts the indices for inflation. The panels show that the average of country-specific uncertainty indices behaves similarly to the first principal component; thus, it does not matter how we aggregate the individual countries’ uncertainty indices to obtain an aggregate index. However, it matters whether we consider the aggregate index based on individual countries’ indices or the ECB-SPF EA aggregate index, as they turn out to be quite different. In fact, in the case of GDP growth, the ECB-SPF-based measure oscillates roughly around the cross-country average; on the other hand, in the case of inflation, the cross-country average identifies a higher level of uncertainty prior to 2007. It is worth noting that the two measures have diverged in the recent period: the ECB-SPF EA aggregate suggests a lower output growth uncertainty than the cross-country average, while it is the opposite for inflation.Footnote 9 The correlation coefficient between the ECB-SPF EA aggregate and the cross-country averages is 0.62 for output growth and 0.68 for inflation.

ECB-SPF Euro Area vs. the aggregate of country-specific indices. Note The figure compares the cross-country average of the country-specific indices (labeled “Average of Country-Specific”) as well as its first principal component (labeled “1st PC of Country-Specific”) to uncertainty indices obtained from ECB-SPF directly (labeled ECB-SPF Euro Area). The left panel compares uncertainty in output growth, while the right panel compares uncertainty in inflation

5.2 Heterogeneity in Euro Area uncertainty

Figure 6 shows the average uncertainty in the EA and its member economies from 1999:I till 2013:I (Panel A) and 2013:II–2015:II (Panel B). The pictures in Panel A show that the average uncertainty has been more or less homogeneous in the Euro Area up to the end of the last recession. However, as Panel B suggests, after the trough of the last recession the heterogeneity has increased. As shown in the left figure, GDP growth-based uncertainty in Belgium, France, Germany and Slovakia appears to be lower than that based on the ECB-SPF EA, while it is higher in other countries, especially Ireland, Slovenia and Spain. On the other hand, inflation uncertainty in general appears to be higher relative to the GDP-based uncertainty. As discussed previously, the ECB-SPF EA aggregate inflation uncertainty is higher than the cross-sectional average; as evident from Fig. 6, it is also higher than that of any of its members. This emphasizes the divergence between the EA and its members in terms of inflation expectations and outcomes after the crises. This might be indicative of the fact that though the forecasters are more certain about country-specific outcomes, they are more uncertain about the Euro Area wide policy, which is reflected in an increased area wide uncertainty. Moreover, countries with high GDP growth-based uncertainty do not necessarily have high inflation-based uncertainty.

5.3 Uncertainty spillovers in the Euro Area: a network approach

Lastly, we study the spillover of uncertainty in the EA. In order to do so we rely on the methodology proposed by Diebold and Yilmaz (2009) and implement it in the robust framework of Klößner and Wagner (2014). More specifically, we study the spillovers in a vector autoregression (VAR) framework and propose an uncertainty spillover index. The spillover index accounts for the total share of uncertainty shocks of non-domestic origin across all the countries. The analysis is not intended to give a causal interpretation of the spillovers of uncertainty in the EA, but rather provides a measure of pairwise directional and total interconnectedness.

Borrowing some of the notation from Klößner and Wagner (2014), let \(Y_{t}\) be an N-dimensional vector of uncertainty indices for the N countries in the sample and consider the standard VAR\(\left( p\right) \): \(Y_{t}=\Phi _{1}Y_{t-1}+\Phi _{2}Y_{t-2}+\cdots +\Phi _{p}Y_{t-p}+\varepsilon _{t}\), where \(\varepsilon _{t}\) is a white noise with a variance–covariance matrix of \(\Omega _{\varepsilon }\), while \(\left\{ \Phi _{i}\right\} _{i=1}^{p}\) are \(N\times N\) coefficient matrices summarizing the dynamic behavior of the system. Given the maintained assumption of stationarity of the VAR, the MA\(\left( \infty \right) \) representation is: \(Y_{t}=\varepsilon _{t} +A_{1}\varepsilon _{t-2}+A_{2}\varepsilon _{t-2}+\cdots \). The spillover effects are derived from the forecast error decomposition. The h-step-ahead forecast error is \(e_{t+h}=Y_{t+h}-Y_{t+h|t}=\varepsilon _{t+h}+A_{1}\varepsilon _{t+h-1}+A_{2}\varepsilon _{t+h-2}+\cdots A_{h-1}\varepsilon _{t+1}.\) The forecast error covariance matrix, consequently, can be written as \(\Omega _{e,h} =\Sigma _{i=0}^{h-1}A_{i}\Omega _{\varepsilon }A_{i}^{^{\prime }}\), where \(A_{0}\) is the identity matrix. Diebold and Yilmaz (2009) choose to work with the Cholesky factorization of \(\Omega _{\varepsilon }\). If L is the Cholesky factor of \(\Omega _{\varepsilon }\), such that \(LL^{^{\prime }}=\) \(\Omega _{\varepsilon }\), then country k’s contribution to country j’s in terms of forecast error variance can be written as \(\left( \Sigma _{i=0}^{h-1}\left( \Sigma _{k=1}^{N}\left( A_{i}L\right) _{jk}\left( A_{i}L\right) _{jk}^{^{\prime }}\right) \right) ^{-1}\) \(\Sigma _{i=0}^{h-1}\left( A_{i}L\right) _{jk}\left( A_{i}L\right) _{jk}^{^{\prime }}\), and the uncertainty spillover index (USOI) is defined as:

The Cholesky decomposition is not order invariant, and the analysis is not structural, that is, there is no preferred Cholesky rotation over the others based on economic theory; thus, one would have to take into account multiple Cholesky rotations (precisely N!) in a robustness analysis. We implement Klößner and Wagner (2014) algorithm to perform forecast error variance decomposition analysis for all possible Cholesky rotations and report the average over all of them. Diebold and Yilmaz (2009), on the other hand, only verified the robustness of their analysis to a small set of alternative Cholesky rotations.

Our exercise is similar to that in Klößner and Sekkel (2014), although we focus on the EA and use the indices proposed in Rossi and Sekhposyan (2015). Klößner and Sekkel (2014), instead, study spillovers of the Baker et al. (2016) index for countries such as Canada, France, Germany, Italy, USA and the UK. They find that between January 1997 and September 2013 the spillover index among the set of these six developed countries was approximately 27%. Moreover, they find time variation in the spillover effects; the spillovers are counter-cyclical: they were relatively high until 2006, they then decreased and then spiked again around 2008 due to the financial crisis and associated high policy uncertainty. They also find evidence that the spillovers have been declining since then: at the end of their sample, their level was roughly the same as before 2008. Furthermore, they find that some countries (such as the USA, the UK and France) have been net “exporters” of uncertainty, while the rest have on average been net “importers”—although, for some countries, the role has reversed over time.

We perform a similar type of analysis with the objective of understanding the spillover effects in the EA. We report the results for output growth-based uncertainty in Table 1 and those for inflation-based uncertainty in Table 2. Our empirical results are based on estimating VARs with two lags for sixteen EA countries (excluding Cyprus, Luxemburg and Malta from the current list of members) and performing the variance decomposition at the 2-year-ahead forecast horizon (\(h=8\)). We also include the Euro Area aggregate in our analysis in order to capture some of the previously discussed divergence between the EA aggregate and the aggregate measure extracted from country-specific indices.

As Table 1 shows, the spillover effects for output growth-based uncertainty in the EA are high, about 74%. Moreover, some of the countries, namely Austria, Belgium, France, Latvia, Portugal, Slovakia, Slovenia, Spain and the Netherlands have been on average uncertainty “exporters,” as the net contribution (“ To” - “From”) of the uncertainty in these countries is positive (marked in bold in the row labeled “Net”). The three countries with the highest spillover effects are Austria, Belgium and Slovakia: this is certainly surprising given that these countries are relatively small members of the EA. It is interesting to note that the “importers” of uncertainty are Finland and Ireland, while the Euro Area as an aggregate also turns out to be a net importer of uncertainty.

The case of inflation-based uncertainty, shown in Table 2, is somewhat different. In this case, the EA, as well as Austria, Belgium, Estonia, France, Italy, Portugal and Spain, turn out to be uncertainty “exporters.” The overall spillover effects are also fairly high, amounting to about 78%: in particular it is interesting to note that they are much higher (2.5–2.7 times) than those detected by Klößner and Sekkel (2014). According to our spillover index, only about one quarter of the uncertainty in the EA is of idiosyncratic country-specific nature, while the rest derives from the interconnectedness, which transmits the uncertainty. The working paper version (Rossi and Sekhposyan 2016) contains additional robustness analyses: we consider inflation-based uncertainty indices at a monthly frequency, as well as the spillover effects of uncertainty given a variety of network structures and upside and downside uncertainty indices.

6 Conclusions

This paper proposes the Rossi and Sekhposyan (2015) uncertainty index for the EA and its member economies. One of the main advantages of the index is that it is easy to construct and use: the inputs it requires are forecasts and realizations, and hence could be constructed for a large number of countries. We show that our proposed uncertainty index captures perceived episodes of high uncertainty associated with the financial and European sovereign debt crises both at the EA level, as well as at the level of individual countries. The analysis shows similarity in the uncertainty cycles across the EA, with some evidence of divergence after the last recession. Our spillover analysis attributes about three-fourth of the variation in uncertainty to spillover effects from other countries.

Notes

Our measure is easy to construct, and it can be applied to any country for which forecasts and realizations are available. In fact, using GDP growth and CPI inflation forecasts provided by Consensus Economics we can obtain uncertainty indices for most EA individual countries. The time series of the uncertainty indices (in Excel format) are publicly available on our webpages at http://www.tateviksekhposyan.org/ and http://www.barbararossi.eu/.

In fact, as Rossi and Sekhposyan (2015) show, for the USA, upside uncertainty is expansionary, while downside uncertainty is recessionary. Thus, whether uncertainty is an upside or a downside one is relevant for understanding its macroeconomic impact.

In principle, one could rely on the conditional distribution, where the density of forecast errors \(f\left( e\right) \) is constructed based on all the forecast errors realized up to time t. Rossi and Sekhposyan (2015) implement both versions when constructing the uncertainty indices for the US. In the context of the EA (or countries other than the US), using the conditional distribution rather than the unconditional one is more challenging since the overall sample size available for constructing the forecast errors is rather small. Uncertainty indices based on the conditional distribution would result in a very short time series of uncertainty indices, which would not be useful for empirical analysis.

Since \(U_{t+h}\) is a Uniform variable defined over the (0,1) support, the mean value of \(U_{t+h}\) is 1 / 2, and the formulas that follow construct positive and negative uncertainty indices relative to the mean.

For a careful treatment of the ECB-SPF predictive densities in the context of understanding forecasters’ learning mechanisms see Manzan (2016).

E.g.,: in month one, \(k=12\), while in month twelve, \(k=1\). An alternative procedure to construct fixed-horizon forecasts from fixed-event ones is developed by Knueppel and Vladu (2016). Their procedure gives optimal weights that minimize the mean squared forecast error loss function of the fixed-horizon forecast. For the purposes of our index, which is based on the unconditional distribution of the forecast errors, this alternative weighting results in very similar uncertainty indices. However, if one were to construct uncertainty indices based on the conditional distributions, the difference could be non-negligible.

In the sample periods where forecasts are available only every 2 months, the current-year and next-year forecasts are weighted based on the adjusted formula: \(\frac{k}{6}\widehat{f}_{t+k|t}^{\mathrm{FE}}+\frac{6-k}{6}\widehat{f}_{t+k+6|t}^{\mathrm{FE}}\), where \(k=1,2,\ldots ,6.\)

The survey forecasts as well as the realizations for the countries start at different points in time. If we miss some observations for the 3 months of the quarter for either the forecasts or the realizations, we construct the quarterly average based on the available observations. This situation occurs only in the case of forecasts for the Eastern European economies in the beginning of the sample period when the forecasts are available for every other month rather than being monthly.

Besides the imposed fixed country-composition in the construction of the aggregate index relative to the changing composition embedded in the ECB-SPF, other potential reasons for the divergence between the two measures could be the fact that they come from different surveys, with potentially different participants. Moreover, it is possible that the ECB-SPF participants weigh the country-specific data differently than our averaging or principal component extraction imply. In addition, though the two sets of forecasts are compared to each other as of the forecast origin dates, their target dates vary. As discussed earlier, the target date for the weighted Consensus forecasts in the first quarter would be the year-over-year growth from the fourth quarter of the last year to the fourth quarter of the current year. On the other hand, that of GDP growth-based uncertainty from the ECB-SPF is based on the growth from quarter 3 of the previous year to quarter 3 of the current-year. For inflation, the target periods are the same, so the differential in the target dates should be irrelevant.

References

Abel J, Rich R, Song J, Tracy J (2016) The measurement and behavior of uncertainty: evidence from the ECB Survey of Professional Forecasters. J Appl Econ 31(3):533–550

Baker SR, Bloom N, Davis SJ (2016) Measuring economic policy uncertainty. Q J Econ 131(4):1593–1636

Bloom N (2009) The impact of uncertainty shocks. Econometrica 77(3):623–685

Bloom N (2014) Fluctuations in uncertainty. J Econ Perspect 28(2):153–175

Clements M (2016) Are macroeconomic density forecasts informative?. ICMA Center, Discussion Paper No. ICM-2016-02, University of Reading (U.K.)

Diebold FX, Yilmaz K (2009) Measuring financial asset return and volatility spillovers, with application to global equity markets. Econ J 119(534):158–171

Dovern J, Fritsche U, Slacalek J (2012) Disagreement among forecasters in G7 countries. Rev Econ Stat 94(4):1081–1096

Genre V, Kenny G, Meyler A, Timmermann A (2013) Combining expert forecasts: can anything beat the simple average? Int J Forecast 29(1):108–121

Giannone D, Henry J, Lalik M, Modugno M (2012) An area-wide real-time database for the euro area. Rev Econ Stat 94(4):1000–1013

Kenny G (2016) Macroeconomic uncertainty and policy. Mimeo, European Central Bank, Frankfurt, (Germany)

Klößner S, Sekkel R (2014) International spillovers of policy uncertainty. Econ Lett 124(3):508–512

Klößner S, Wagner S (2014) Exploring all VAR orderings for calculating spillovers? Yes, we can!—a note on Diebold and Yilmaz (2009). J Appl Econ 29(1):172–179

Knueppel M, Vladu AL (2016) Approximating fixed-horizon forecasts using fixed-event forecasts. Deutsche Bundesbank Discussion Paper No. 28/2016, Frankfurt (Germany)

Lahiri K, Sheng X (2010) Measuring forecast uncertainty by disagreement: the missing link. J Appl Econ 25(4):514–538

Manzan S (2016) Are professional forecasters bayesian? Mimeo, New York

Rich R, Tracy J (2010) The relationship among expected inflation, disagreement and uncertainty: evidence from matched point and density forecasts. Rev Econ Stat 92(1):200–207

Rossi B, Sekhposyan T (2015) Macroeconomic uncertainty indices based on nowcast and forecast error distributions. Am Econ Rev 105(5):650–655

Rossi B, Sekhposyan T (2016) Macroeconomic uncertainty indices for the euro area and its individual member countries. Barcelona GSE Working Paper No. 820, Barcelona (Spain)

Rossi B, Sekhposyan T, Soupre M (2016) Understanding the sources of macroeconomic uncertainty. CEPR Discussion Paper No. 11415, London (U.K.)

Zarnowitz V, Lambros LA (1987) Consensus and uncertainty in economic prediction. J Polit Econ 95:591–621

Author information

Authors and Affiliations

Corresponding author

Additional information

Supported by the Spanish Ministry of Economy and Competitiveness Grant ECO2015-68136-P and FEDER, UE. This research was carried out while Barbara Rossi visited the European Central Bank. We thank Badi Baltagi, two anonymous referees and Gergely Ganics for comments, the European Central Bank, and in particular Alistair Dieppe, Grintzalis Ioannis, Bernd Schnatz and Aidan Meyer, as well as Sebastiano Manzan for their help with the data and Malte Knueppel for providing the code for the optimal weighting of the fixed-event forecasts.

Rights and permissions

About this article

Cite this article

Rossi, B., Sekhposyan, T. Macroeconomic uncertainty indices for the Euro Area and its individual member countries. Empir Econ 53, 41–62 (2017). https://doi.org/10.1007/s00181-017-1248-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-017-1248-z