Abstract

In this paper, we add to the literature studying the effects of uncertainty. We focus on the effects of economic policy uncertainty across borders. In contrast to the existing literature, we focus on the time-varying correlation structure of economic policy uncertainty across countries and with macroeconomic variables. We employ a multivariate GARCH model to estimate the time-varying conditional covariance matrix. Our results show that they are relevant, vary sizably over time, and that spikes in the time series can be related to policy events. We find relevant spillover effects of policy uncertainty in other countries on the US economy. We find that policy uncertainty and spillover effects are lowest in China, but that during the Global Financial Crisis substantial spillovers existed. Our results have implications for macroeconomic policymaking, financial stability policies, asset allocations, and risk assessment modelling.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Uncertainty is a pervasive factor in decision making by households, firms, and governments. Existing research shows that uncertainty affects consumption and saving behaviour (Caballero 1990), firms’ investment decisions (Bloom 2009; Baker et al. 2016), monetary policymaking (Rudebusch 2001; Orphanides and Williams 2005) and asset pricing (Brogaard and Detzel 2015).

The global structural change termed “Globalization” has resulted in a new global economic system characterized by large flows of goods, capital, and labor across borders and a high degree of economic integration and interconnectedness. In the current global economy, economic policy decisions in one country have spillover effects on other countries (Canova 2005; Auerbach and Gorodnichenko 2013).

In this paper, we focus on the effects of economic policy uncertainty (EPU) across borders. EPU measures uncertainty with respect to monetary, fiscal, and regulatory policy in a country. More precisely, we are interested in the international spillover effects of economic policy uncertainty on the US economy and how economic policy uncertainty is correlated across countries. Extant literature focuses mainly on countries in autonomy; i.e. closed economies (see Bloom 2014 for an overview).

However, a growing body of literature documents the effects of uncertainty shocks across borders, see, for example, Ko and Lee (2015), Kamber et al. (2016), Berger et al. (2017), Caggiano et al. (2018), and Gabauer and Gupta (2018). Most papers mentioned above use some version of a vector auto-regression (VAR) model to estimate the effect of uncertainty shocks. Little is known about the time-varying correlation structure of economic policy uncertainty across countries and with macroeconomic variables. Knowledge about correlations is particularly important for financial markets, as correlations are inputs for hedging strategies, asset allocation and risk assessment models (see Bollerslev et al. 1992 and Engle 2002).

In this paper, we employ a multivariate GARCH model, namely the Dynamic Conditional Correlation (DCC) model developed in Engle and Sheppard (2001) and Engle (2002) to analyse the time-varying correlation between economic policy uncertainty in five countries/regions (United States, China, Canada, the UK, and the EU) and key macroeconomic variables (stock market performance, house prices, inflation, and industrial production) in the United States.

Our paper relates to the literature studying the effect of innovations to uncertainty, especially those papers using DCC models. Jones and Olson (2013) use a DCC-GARCH model to study the relationship between uncertainty innovations and macroeconomic outcomes (inflation and output) for the US. They find that the correlation between uncertainty and output is negative, while it varies between uncertainty and inflation. Yin and Han (2014) use a DCC-GARCH model to study the effect of uncertainty volatility on price and volatility in commodity markets, documenting a positive spillover effect. Li et al. (2015) use an ARMA-ADCC model to study the effect of innovations to policy uncertainty for the US stock market. They find that innovations asymmetrically affect the stock-bond correlation. Li and Peng (2017) show that US policy uncertainty innovations affect the Chinese stock market using a ARMA-DCC model. Fang et al. (2017) investigate the link between economic policy uncertainty and US stock and bond markets showing that there is negative effect on stock-bond correlations. Finally, Xiong et al. (2018) use a DCC-GARCH model to study the effect of policy uncertainty on stock returns in China documenting large fluctuations in the correlation structure over time.

In contrast to the existing studies, we focus on the effects of international uncertainty innovations on other countries uncertainty levels and on US macroeconomic outcomes. We also employ a DCC-VAR model. This model also considers the multivariate relationship when estimating the conditional mean in the first stage which is often ignored when using an ARMA model in the related literature (e.g. Xiong et al. 2018 is an exemption). Our findings show that the conditional variances and all conditional correlations are different from zero, vary sizably over time, and that dynamics can be related to important events. Further, we find that some of the relations between variables are subject to sizable shifts over time. Further, we find relevant spillover effects of policy uncertainty in other countries on the US economy. Our findings have implications for macroeconomic policymaking, financial stability policies, asset allocations, and risk assessment modelling.

2 Method

The Dynamic Conditional Correlation (DCC) model was first proposed by Engle and Sheppard (2001) and further explored by Engle (2002). This model allows estimating the variance-covariance matrix of a vector-autoregressive (VAR) process. Intuitively, the model decomposes the variance-covariance matrix of the process into a diagonal matrix of variances and a matrix of correlations, which then enables one to estimate the relevant parameters separately. We estimate a VAR model for the mean and then estimate the DCC model on the standardized residuals from the VAR model to obtain the time-varying conditional variances and correlations.

Technically, a multivariate GARCH model is defined using two equations:

where:

Yt : n x 1 vector of random variables at time t.

at : n x 1 vector of demeaned variables at time t, i.e., E[at] = 0, Cov[at] = Ht.

µt : n x 1 vector of the expected values of Yt.

Ht : n x n positive-definite matrix of conditional variances of at at time t.

zt : n x 1 vector of i.i.d. errors, E[zt] = 0, E[ztzt’] = It, and follows a multivariate normal distribution.

The DCC then models the conditional variances and correlations separately. This approach is especially useful in our context, as we are interested in the time-varying matrix of correlations. First, we decompose the variance-covariance matrix as

where Dt = diag (\(\sqrt{{h}_{1t}}\), …, \(\sqrt{{h}_{nt}}\)) is the diagonal matrix of conditional standard deviations and Rt is the conditional correlation matrix at time t.

Further, the conditional variances, hit, are estimated for each variable using a univariate GARCH model:

In order to estimate the correlation matrix Rt, we begin by normalizing the vector of variables at to obtain a new vector of variables, \({ \in _{\rm{t}}}\), according to:

Because Rt is a positive definite, symmetric matrix where the diagonal elements are one, we further decompose Rt as follows:

where \(\mathop Q\limits^ - = {\rm{E}}[{ \in _t}{ \in '_t}]\) and Qt* = diag (\(\sqrt{{q}_{11, t}}\), …, \(\sqrt{{q}_{nn, t}}\) ) is used to scale the elements of Qt to ensure that they lie between 0 and 1.

This allows estimating the elements of \(\stackrel{-}{Q}\) by using the sample mean:

Thus, the problem of estimating the correlation matrix, Rt, reduces to estimating the parameters \({\alpha }_{m }\) and \({\beta }_{k}\).

The estimation of these parameters is done via maximum likelihood estimation.

Let us denote the set of all parameters involved in the estimation of the conditional variances, hit by \(\phi\) and the set of all parameters {\({\alpha }_{1}\),…, \({\alpha }_{M}\), \({\beta }_{1}\), …, \({\beta }_{K}\)} involved in the estimation of the correlation matrix Rt by \(\psi\).

Then, the likelihood function can be written as

Directly estimating all parameters is computationally expensive as it involves inverting the n x n matrix Ht. The proposed solution involves a simpler two-step estimation procedure.

First, ignore the correlation structure and estimate the parameter set \(\phi\). Put differently, it is assumed that the correlation matrix is the identity matrix in the likelihood function. This assumption allows us to express the likelihood function as a function of only the parameter set \(\phi\). The likelihood function is then given by:

Intuitively, this log-likelihood function is the sum of the log-likelihood estimators for the GARCH models to estimate the conditional variances, hit, and depends only on the parameter set \(\phi\). Maximizing this function gives us estimators \(\hat \phi\) for the parameters \(\phi\).

Second, we substitute these values in the likelihood function, which then only depends on the parameters \(\psi\). Once we plug in the values of \(\hat \phi\) and exclude all constant terms, the function to be maximized is:

This gives us estimators \(\widehat{\psi }\) for the parameters \(\psi\), which can then be used to estimate the correlation matrix Rt. Engle and Sheppard (2001) and Engle (2002) show that this approach gives consistent and asymptotically normal estimators of the correlation matrix. Along this line, Jondeau and Rockinger (2005) shows that the direct maximum likelihood estimation gives very similar results compared to this two-step process.

3 Data and Modelling Choice

We use data for policy uncertainty in six countries: U.S., Canada, UK, EU, and China. We chose these countries (or union of countries) as they are the top export and import countries of goods and financial services in the world and represent around 30% of the world’s population.

We will also investigate the conditional correlation between policy uncertainty and macroeconomic variables in the United States. The macroeconomic variables considered are inflation, house prices, stock prices, and industrial production.

Data is taken from the St. Louis FED’s database (FRED). Our data set starts in January 1997 and ends in December 2017 (252 observations). The data is de-trended using the Hodrick-Prescott filter with smoothing parameter λ = 14,400. This ensures stationarity as required by our econometric model.

Our measure of policy uncertainty, for each country, is taken from the database developed and operated by Baker et al. (2016). Baker et al. develop an index for economic policy uncertainty based upon newspaper coverage frequency. This index is designed to cover uncertainty about who makes decisions, what policy actions will be taken and when they are undertaken. In addition, this index covers both, short-term and long-term, policy uncertainty.

We then measure the state of the macro-economy using prices for goods, houses, and all US stocks. Further, we use the industrial production index to analyse the relationship between uncertainty and the real side of the economy. Inflation is measured by the Consumer Price Index for all urban consumers. House prices are measured by the S&P Case-Shiller National Home Price Index. We then use the Wilshire 5000 Total Market Index to measure the performance of all US-stocks.

Table 1 presents the descriptive statistics of our variables. Average uncertainty is highest in the UK and is of similar level in Canada, the EU, and China. The United States have the lowest average uncertainty level. Further, the volatility of uncertainty (measured by the standard deviation) is lowest in the US but highest in the UK and China, with Canada and the EU in between these extremes.

Figure 1 presents the time series of the uncertainty time series by country. Not surprisingly, we find that uncertainty spikes around the Global Financial Crisis (2007–2009), the European debt crisis (2009–2014), and Brexit (2016-present).

Before we present the results from our dynamic conditional correlation model, we argue that a constant conditional correlation model does not fit the data. To do so, we use the test proposed by Engle and Sheppard (2001). The null hypothesis for this test is that if correlations are constant, the residuals of the univariate GARCH processes should be independent and identically distributed (i.i.d.) and the covariance matrix would be the identity. Based on the Engle and Sheppard test, we reject the hypothesis of constant conditional correlation with a p-value of 0.07. Further, if we run a VAR-CC (Constant Correlation) model, we find that the residuals exhibit presence of GARCH terms using a Lagrange multiplier (LM) test.

Finally, our VAR-DCC is specified as follows. For the mean, we find that 2 lags is optimal (AIC criterion). For the DCC model, we find that the following fits the data best: DCC: P = 2, Q = 5, and ARCH P = 5, GARCH Q = 1.

4 Results

4.1 USA and Other Countries

4.1.1 Conditional Variances

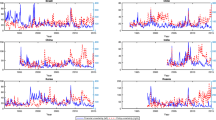

We begin by discussing the conditional variance for each variable obtained by estimating our VAR-DCC model. Figure 2 presents our estimation results.

The conditional variance in policy uncertainty in the United States varies considerably over time. Interestingly, the largest spike in the variance of uncertainty is not observed during the Global Financial Crisis, but around the September 11 attacks in 2001. We observe five other spikes that we can associate with the following events. First, during the Global Financial Crisis (2007–2008), we observe a spike. Then, the debt-ceiling crisis of 2011 and the 2013 Government shutdown (October 1 – October 17) had similarly large effects on the variance of uncertainty. The last two spikes are likely to be related to the Brexit referendum (June 23, 2016) and the 2016 presidential election (November 8, 2016).

The largest spike in the variance of uncertainty in the US (around 9/11) is smaller compared to the increase in the variance of uncertainty in the EU due to the Brexit referendum. This event had, by far, the largest effect of any event in our sample on the variance of uncertainty. Interestingly, while Brexit had the largest effect on the variance of uncertainty in the EU, the spike in policy uncertainty in the UK is rather small. The reason might be that the surprising outcome of the Brexit referendum put stress on the cohesion of the European Union and could have caused other countries to leave the European Union. Therefore, the effect on policy uncertainty was larger for the EU as a whole compared to the UK.

Canada, similar to the UK, shows the lowest levels of variance in policy uncertainty in our sample. Spikes are observed around the US recession in the early 2000’s and 9/11, the Global Financial Crisis, the 2006 and 2015 federal elections, and Brexit.

Turning to the macroeconomic variables in our sample, we find that the largest spikes are observed around the Global Financial Crisis. This holds except for the stock price index, where the largest spike is observed around the U.S. presidential election of 2016.

4.1.2 Conditional Correlations

While the previous discussion offers insights into the dynamics of our variables of interest, we now want to look at the conditional correlation between the variables. Understanding the time-varying correlation structure is important for finance (e.g. risk assessment) and macroeconomists (e.g. policy recommendations might be different in high vs. low uncertainty environments; see Castelnuovo et al. 2016 or Ludvigson et al. 2019).

Figure 3 plots the conditional correlations among the policy uncertainty variables across all countries in the sample. The size of the conditional correlations varies over time. Moreover, the magnitude of these changes is relevant: spikes are often larger than 0.05, which is a sizable change in the correlation. This can have implications for financial strategies and policy making. We find that the conditional correlation of policy uncertainty is positive between all countries – in other words, there are positive spillover effects of policy uncertainty between all countries. Intuitively, high policy uncertainty in one country will go in hand with higher policy uncertainty in another country. The highest correlation (around 0.6) is obtained between the UK and the EU and the US and the EU. This is expected, since strong political and economic ties exist between these countries and regions (e.g. trade flows or NATO membership).

Figure 4 focuses on the link between policy uncertainty in the five countries in our sample and inflation, house prices respectively. The conditional correlation between inflation in the US and the policy uncertainty is positive for the US, UK, EU, and China. It is negative for Canada. Not surprisingly, the strongest correlation (around 0.1) is found between inflation in the US and economic policy uncertainty in the US. Interestingly, there are relevant spillover effects from other countries towards inflation in the US. For example, policy uncertainty in the UK and China has a sizable positive conditional correlation with inflation in the US. Overall, the correlations between policy uncertainty and inflation exhibit sizable time variation. The positive conditional correlation implies that more policy uncertainty will go in hand with higher inflation. This is particularly important information for financial markets as this correlation might affect optimal asset allocations or risk assessments. Further, it has implications for macroeconomic policy making, particularly central banking, as uncertainty can affect policy decisions.

Further, Fig. 4 also plots the conditional correlation between house prices in the US and the economic policy uncertainty in the five countries in our sample. In contrast to our previous result for inflation, we observe a larger volatility in the conditional correlation for house prices and frequent changes between positive and negative correlations. House prices and policy uncertainty in the US are negatively correlated and stable over time. There are only three events at which the conditional correlation becomes positive (around the early 2000 recession, 2005/2006 with midterm elections, Ben Bernanke becoming Chairman of the FED, and the onset of the subprime mortgage crisis and shortly after the GFC). For the other four conditional correlations, we observe fluctuations around zero with spikes in both directions. Most noticeable is the increase in the correlation with policy uncertainty in Canada after the GFC. Further, towards the end of our sample, we observe a stronger, negative conditional correlation with policy uncertainty in the EU, the UK, and China. Overall, lower policy uncertainty will go in hand with higher house prices. Intuitively, lower policy uncertainty should characterize a healthy economy, where (i) higher house prices could signal high demand for houses as people are earning higher wages and (ii) lower uncertainty stimulates investment (cf. Bloom 2009). However, we do observe short periods of positive correlations between house prices and policy uncertainty. These spikes appear to occur usually at the same time the conditional variance spikes. During these events, higher uncertainty goes in hand with higher house prices. Potentially, higher policy uncertainty could create an incentive for people to buy houses as an investment asset as land and property will have a value even in uncertain times. Overall, these findings are relevant for, again, financial markets and policy makers (esp. macroprudential policy) as this could affect the stability of the financial sector, where monitoring is important to detect build-ups of systemic risk factors.

Figure 5 presents the conditional correlation between policy uncertainty in the five countries in our sample and stock market performance, industrial production respectively. Stock market performance is negatively correlated with uncertainty in all countries. Interestingly, the strongest negative correlation (around − 0.2) is not found with the US, but with Canada, the EU, and the UK. Then the US and China come fourth and fifth on the list. The results indicate that higher policy uncertainty will reduce market performance and significant spillover effects exists, i.e. economic policy uncertainty in other countries correlate with macroeconomic variables in the US in a meaningful way. This is mainly interesting for financial analysts, as optimal asset allocation and risk assessment models rely on correlations. Further, our analysis shows a considerable amount of time variation in the conditional correlation. We observe relevant changes in the relationship between stock prices and the policy uncertainty in all countries. This holds especially true for the correlation with policy uncertainty in the EU, where we find swings (around 2011) of about 0.1 in the correlation. This has potentially important implications for financial products in both affected regions.

Finally, Fig. 4 also shows the conditional correlation between economic policy uncertainty and industrial production. So far, we only considered prices, or the change in prices. We now want to understand the correlation of economic policy uncertainty with real economic activity. We observe a negative conditional correlation for industrial production with all policy uncertainty measures. The strongest correlations are found for US policy uncertainty and EU policy uncertainty. Time variation, again, is large in the obtained correlation series. Especially, around 2005/2006 (US midterm elections, Ben Bernanke became FED Chairman, and subprime mortgage crisis) and the GFC, where we observe a large drop in the correlation, i.e. an even stronger correlation, for some months. As our results for the stock price - policy uncertainty correlations indicate, we find that higher levels of policy uncertainty reduce industrial production. Similarly, all estimated time series for the conditional correlation show a sizable amount of time variability. Production affects uncertainty negatively via effects on households and firms. Households, facing higher levels of uncertainty, can increase precautionary savings (cf. Caballero 1990), which would reduce consumption and, therefore, demand and production. Firms will reduce investment when they face higher uncertainty (cf. Bloom 2009 and Baker et al. 2016).

In conclusion, we find that the conditional variances and all conditional correlations are different from zero, vary sizably over time, and that dynamics can be related to important events. Our results show that some of the relations between variables are subject to shifts over time. Further, we find relevant spillover effects of policy uncertainty in other countries on the US economy.

4.2 China

4.2.1 Conditional Variances

For China, the variance of policy uncertainty shows larger peaks compared to Canada and the UK, but much smaller ones compared to the EU or US (Fig. 2). Three large spikes are observed. The first one around 2000, the second one around the Global Financial Crisis, and the third one around 2013. The first one could be related to the efforts to fight corruption with the execution of a senior official for bribe taking, while the last one is observed around the Bo Xilai scandal (i.e. corruption, abuse of power). This last spike increased uncertainty to levels seen during the 1997 Asian financial crisis, while the other two spikes are almost twice as large.

4.2.2 Conditional Correlations

Interestingly, the conditional correlations between policy uncertainty in China and the other countries in the sample is found to be the smallest being around 0.3 (Fig. 3). We find the largest spikes in the conditional correlation between China and the United States around the 2001 recession. The Global Financial Crisis lead to a large increase in the conditional correlation between the US and China, but much lower changes for the other countries. Generally, level and volatility are lower between China and the other countries compared the correlation between the US and other countries.

Turning to the link between policy uncertainty in China and macroeconomic variables in the US, we find interesting spillover effects. First, the conditional correlation between inflation (Fig. 4) and Chinese policy uncertainty becomes negative for a short while around 1999/2000 (the first political corruption crackdown in China) but is generally positive. Such a positive conditional correlation implies that more policy uncertainty will go in hand with higher inflation. The largest relation was found during the GFC. For house prices (Fig. 4) in the US, we find a much more volatile relationship. While, on average, the relationship is negative, we observe multiple spikes that turn the relationship into a positive correlation. For example, we observe a positive correlation around 2005 and 2011. Industrial production in the US (Fig. 5) and policy uncertainty in China is negatively correlated. While the correlation becomes most negative during the GFC, is has been increasing afterwards. This shows the negative spillover effects of policy uncertainty in China on the real economy of the US. Finally, stock prices in the US (Fig. 5) and Chinese policy uncertainty are also negatively correlated. Again, this shows the negative effects of higher policy uncertainty in China on real activity in the US.

5 Conclusion

Uncertainty is a key driver of economic activity (Bloom 2009; Baker et al. 2016). In this paper, we analyse the effects of economic policy uncertainty within and across countries. In contrast to the existing literature (Kamber et al. 2016 or Caggiano et al. 2018), we focus on studying the dynamic conditional correlations between policy uncertainty across countries and the link to macroeconomic variables. We employ a multivariate GARCH model (Engle and Sheppard 2001; Engle 2002) to analyse the time-varying correlation between economic policy uncertainty in five countries/regions (United States, China, Canada, the UK, and the EU) and key macroeconomic variables (stock market performance, house prices, inflation, and industrial production) in the United States.

Our findings show that the conditional variances and all conditional correlations are relevant, vary over time, and that we can relate real world events to estimated spikes in the time series. Further, we find that some of the relations between variables are subject to sizable shifts over time. We find relevant spillover effects of policy uncertainty in other countries on the US economy. Our findings have implications for macroeconomic policymaking, financial stability policies, asset allocations, and risk assessment modelling.

For China, the variance of policy uncertainty shows larger peaks compared to Canada and the UK, but much smaller ones compared to the EU or US. Similarly, the conditional correlations between policy uncertainty in China and the other countries in the sample is found to be the smallest. However, especially during the Global Financial Crisis, we find substantial spillover effects from China towards the US economy and the US stock market.

Future research could use these obtained dynamic correlations as inputs into models of risk assessment. This would offer valuable insights to financial analysts and policy makers.

Data Availability

Data is available from the authors by request.

References

Auerbach A, Gorodnichenko Y (2013) Output Spillovers from Fiscal Policy. The American Economic Review, Papers and Proceedings, 103(3): 141–146

Baker SR, Bloom N, Davis SJ (2016) Measuring Economic Policy Uncertainty. Q J Econ 131(4):1593–1636

Berger T, Grabert S, Kempa B (2017) Global Macroeconomic Uncertainty. J Macroecon 53:42–56

Bloom N (2009) The Impact of Uncertainty Shocks. Econometrica 77(3):623–685

Bloom N (2014) Fluctuations in Uncertainty. J Economic Perspect 28(2):153–176

Bollerslev T, Chao RY, Kroner KF (1992) ARCH Modeling in Finance: A Review of the Theory and Empirical Evidence. J Econ 52(1–2):5–59

Brogaard J, Detzel AL (2015) The Asset Pricing Implications of Government Economic Policy Uncertainty. Manage Sci 61(1):3–18

Caballero R (1990) Consumption Puzzles and Precautionary Savings. J Monet Econ 25:113–136

Caggiano G, Castelnuovo E, Figueres JM (2018) Economic Policy Uncertainty Spillovers in Booms and Busts. CAMA Working Paper, No. 27/2018

Canova F (2005) The Transmission of Us Shocks to Latin America. J Appl Econom 20(2):229–251

Castelnuovo E, Lim G, Robinson T, T (2016) Introduction to the Policy Forum: Macroeconomic Consequences of Macroprudential Policies. Aust Econ Rev 49(1):77–82

Engle R, Sheppard K (2001) Theoretical and Empirical Properties of Dynamic Conditional Correlation Models. NBER Working Papers, No. 8554

Engle R (2002) Dynamic Conditional Correlation. A Simple Class of Multivariate Generalized Autoregressive Conditional Heteroskedasticity Models. J Bus Economic Stat 20(3):339–350

Fang L, Yu H, Li L (2017) The effect of economic policy uncertainty on the long-term correlation between U.S. stock and bond markets. Econ Model 66:139–145

Gabauer D, Gupta R (2018) On the Transmission Mechanism of Country-Specific and International Economic Uncertainty Spillovers: Evidence from a TVP-VAR Connectedness Decomposition Approach. Econ Lett 171:63–71

Jondeau E, Rockinger M (2005) Conditional Asset Allocation under Non-Normality: How Costly is the Mean-Variance Criterion. EFA 2005 Moscow Meetings Paper, SSRN No. 674424.

Jones PM, Olson E (2013) The time-varying correlation between uncertainty, output, and inflation: Evidence from a DCC-GARCH model. Econ Lett 118:33–37

Kamber G, Karagedikli O, Ryan M, Vehbi T (2016) International Spill-Overs of Uncertainty Shocks: Evidence from a FAVAR. CAMA Working Papers, No. 61/2016

Ko J-H, Lee C-M (2015) International Economic Policy Uncertainty and Stock Prices: Wavelet Approach. Econ Lett 134:118–122

Li X-M, Zhang B, Gao R (2015) Economic policy uncertainty shocks and stock-bond correlations: Evidence from the US market. Econ Lett 132:91–96

Li X-M, Peng L (2017) US economic policy uncertainty and co-movements between Chinese and US stock markets. Econ Model 61:27–39

Ludvigson SC, Ma S, Ng S (2019) Uncertainty and Business Cycles: Exogenous Impulse or Endogenous Response? NBER Working Papers, No. 21803

Orphanides A, Williams J (2005) Inflation Scares and Forecast-Based Monetary Policy. Rev Econ Dyn 8(2):498–527

Rudebusch G (2001) Is the Fed Too Timid? Monetary Policy in an Uncertain World. Rev Econ Stat 83(2):203–217

Xiong X, Bian Y, Shen D (2018) The Time-Varying Correlation between Policy Uncertainty and Stock Returns: Evidence from China. Phys A 499:413–419

Yin L, Han L (2014) Macroeconomic uncertainty: does it matter for commodity prices? Appl Econ Lett 21(10):711–716

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Electronic Supplementary Material

Below is the link to the electronic supplementary material.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Sen, A., Wesselbaum, D. On the International Spillover Effects of Uncertainty. Open Econ Rev 34, 541–554 (2023). https://doi.org/10.1007/s11079-022-09694-2

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11079-022-09694-2