Abstract

The purpose of this paper is to experimentally examine stakeholder punishments in response to poor CSR performance communicated through either internal or external channels. Across two experiments, we find that receiving negative CSR information communicated through internal channels (CSR reports) or external channels (news articles) causes individuals to punish a firm (less investment, lower employment interest, buy less, post negative comments on social media). Furthermore, we find sensitivity to a conflict of information from internal and external channels, which increased Calls to Action on social media. This is a concern for firms because such social media posts can elicit further punishments from stakeholders and inflict reputational costs on the firm. The findings of our studies suggest that firms should accurately report CSR performance, especially if external channels are likely to communicate negative CSR information regarding the firm because such conflicting information can elicit a strong online backlash.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Theory suggests that stakeholders will punish or reward firms based upon corporate social responsibility or irresponsibility (e.g., Barnett 2019; Donaldson and Preston 1995). This logic rests upon the assumption that information regarding misconduct is received, acknowledged, and clearly understood by stakeholders. Yet, as Barnett (2014) notes, misconduct is not always noticed or acted upon by stakeholders. Furthermore, information is not received through only one channel; stakeholders may receive information from firm reporting or advertising (internal channels) or news, activists, and governmental reporting (external channels).

The existence of information from multiple sources raises questions about stakeholder response to various sources of information as well as reactions to conflicting information. CSR information may be provided by the firm itself or by third parties, which raises questions about the effect of the source on stakeholder response to corporate social performance. While firms control the release of information from their own internal channels, they possess little control over information from external channels; therefore, it is important to understand how people respond to CSR reports that conflict with reporting from external channels. Even though research has shown that information from external sources has a strong effect on stakeholder impressions (e.g., Du and Wu 2019), studies comparing internal and external sources do not examine how stakeholders respond when those sources of information conflict. In particular, research suggests that stakeholders may regard firms as hypocritical for mixed messaging which could lead stakeholders to punish the firm through boycotts, divestment or avoiding employment.

One growing area for concern regarding stakeholder responses is on social media, where individuals have the power to reach and mobilize a broad range of stakeholders, thus posing a threat to corporate reputation and inspiring community activism (Earl and Kimport 2011). Research has shown that Calls to Action, a specific form of messaging that asks others to take action against a firm, generate increased responsiveness from other social media users (e.g., Saxton and Waters 2014; Neu et al. 2020). Given that sharing CSR information with stakeholders is meant to enhance a firm’s relationship with stakeholders, any stakeholder backlash, especially Calls to Action against the firm, is important to understand and prevent.

Here, we experimentally examine the responsiveness of stakeholders to both positive and negative CSR information as well as examine the differential effects of internal versus external channels. Using two experiments, we make progress in understanding not only if stakeholders respond, as theory suggests, to negative CSR information, but also whether the source of the information (internal or external channel) and the concurrence of conflicting information affects stakeholder behavior. In the first experiment, we examine stakeholder responsiveness to negative CSR information regarding a fictitious firm received through a firm’s internal channels (a CSR report) and an external channel (news article) and compare the effects to positive CSR information received through internal channels. One benefit of the first experiment is that it allows us to test if stakeholders punish firms for self-disclosure of poor CSR performance by testing reactions against information transmitted through external channels (news source). In the second experiment, we allow the information from those channels to differ, causing a conflict in messaging.

Our studies address several gaps in the literature. First, we examine responsiveness to CSR information across multiple stakeholder groups using experimental methodology which provides causal evidence of informational effects on punishment. Second, we explore the differential effects of internal versus external channels for receiving CSR performance information. Third, by experimentally examining conflicting information from internal and external channels, we examine the reactions of stakeholders and find evidence of a strong reaction through social media. The experimental design of our study allows us to see the causal effects of information on stakeholder intended actions (intentions to buy, invest, seek employment, and post online). These study findings are important for firms that may be inclined to exaggerate CSR performance shared through internal channels because we find that a conflict in information received from internal and external channels causes greater Calls to Action on social media. In the next section, we review the literature on the responsiveness of various stakeholders to CSR information received through internal and external channels.

Literature Review and Hypothesis Development

In this section, we review past research on CSR and stakeholder reactions, consider the information channels by which stakeholders learn of CSR activities, and discuss the ways in which they may punish firms for negative CSR information. More specifically, we consider the reactions of employees, investors, consumers, and social media users.

Stakeholder Reactions

Employment

In previous research, corporate social performance has been related to individual perceptions of firms' attractiveness as employers (Turban and Greening 1997). More specifically, researchers found that job seekers pursue employment with firms that are perceived to have good reputations because reputation signals job attributes such as good opportunities for advancement and high employee morale, and reputation affects organizational pride (Cable and Turban 2003). Some research has suggested that individuals will even accept lower wages to work in firms with positive reputations (Cable and Turban 2003). In a separate study, Glavas and Kelley (2014) show that employee perceptions of CSR are positively related to organizational commitment, work meaningfulness, and job satisfaction. More recent research shows that employees are even more supportive of CSR when the firm practices both internal (aimed at employees themselves) and external social responsibility (Shen and Zhang 2019). Further, employees who participate in firm CSR programs, such as volunteering in the community, are more likely to engage in prosocial behaviors in their personal lives (Lewin et al. 2020).

Beyond positive work outcomes, employees also desire employment with a firm that possesses corporate social performance for identification reasons. Jones et al. (2014) found an organization’s involvement in the community sends signals to job seekers about the organization’s character, values, and prosocial orientation. Through social identification with the organization, these factors affected job seekers’ anticipated pride regarding organizational membership, perceived value fit, and expected treatment by the organization (Jones et al. 2014). In this way, individuals use corporate social responsibility as a set of signals to identify organizations with whom they can feel proud of their association and membership (Ashforth et al. 2013). When job seekers identify with a company that demonstrates responsibility on a given issue, research has shown that regardless of the level of personal interest in that issue, job seekers continued to evaluate a potential employer more highly because of the firm’s social performance in that area (Behrend et al. 2009). For these reasons, we expect the opposite reactions when a firm demonstrates poor CSR performance.

Investment

Similar to the employment studies, researchers have examined investor interest in corporate social performance. Socially responsible investing (SRI) is an investment strategy that considers socially responsible criteria in financial investment decisions (Barnett and Salomon 2006; Berry and Yeung 2013; Glac 2009). In 2020, sustainable investment reached over $15 trillion USD in assets, compared to approximately $3 trillion in 2010 (USSIF Foundation 2020), indicating that more investors are making socially responsible investments, whether their motivations are social, financial, or mixed. In fact, scholars have argued that the growing interest in ethical investing, combined with the ambiguity of many investment options, increased the attention to labeling ethical or socially responsible investments (Nath 2021). However, research has shown that socially responsible investors do not always make investment decisions based primarily on ethical behavior. Berry and Yeung (2013) studied investors who have socially responsible portfolios by presenting several investment scenarios, varying the level of financial gain and firm’s ethical performance. While some investors refused to trade off any decreases in ethical performance for increased financial gain, other investors were willing to sacrifice ethical performance for varying levels of financial gain (Berry and Yeung 2013). Other recent research finds that investors expect a connection between sustainability performance and financial performance, increasingly using sustainability-related information to make investment decisions (Unruh et al. 2016). For younger investors, it may matter even more: Millennial investors are almost twice as likely as other generations to invest in SRI directed at specific social or environmental areas (“Sustainable Investing: The Millennial Investor” 2017).

Consumption

As with investors and employees, consumers have demonstrated increased demand for CSR (e.g., Brown and Dacin 1997; Caruana and Chatzidakis 2014; Pomering and Dolnicar 2009). In one survey of banking customers in Australia, researchers showed that consumers claimed to want CSR information directly from the firms and that buying intent increased when a firm participated in CSR initiatives (Pomering and Dolnicar 2009). In an experimental study, Sweetin et al. (2013) found that consumers who were presented with socially irresponsible corporate brands were more likely to punish firms than consumers who were presented with socially responsible or environmentally conscious brands.

Consumers appear to evaluate CSR performance in the context of other aspects of firm management (e.g., Brown & Dacin 1997; Yoon et al. 2006). For example, in a survey of consumers recruited while shopping, researchers found that information about both corporate ability (product quality) and CSR both influenced consumer beliefs about and attitudes toward unfamiliar products (Brown and Dacin 1997). Yoon et al. (2006) found that consumers were more likely to positively evaluate the sincerity of a company’s motives when the company spent a substantial amount on CSR initiatives in addition to spending on the advertisement of initiatives. In recent years, research on ethical consumerism also demonstrates the desire of consumers for socially responsible brands (e.g., Kuokkanen and Sun 2020).

Social Media Posts

The rise of social media has stimulated new concerns regarding the voice of stakeholders, who are better able to protest and praise the actions of firms (Briscoe and Gupta 2016; Sobande 2020; Vredenburg et al. 2020; Ward and Ostrom 2006). Recent research has begun to study which factors influence how individuals share information online. For example, Berger and Milkman (2012) show that New York Times articles are more likely to be shared when they arouse strong emotions, such as anger or anxiety. In a 2013 Nielsen survey of participants from 58 countries, sixty-eight percent of survey respondents indicated that they trust consumer opinions posted online, an increase of seven percentage points from the 2007 survey (Nielsen 2015). This suggests that the information and attitudes shared online affect others’ behaviors, raising questions regarding how and why individuals share information regarding corporate responsibility through social media. In one recent study, researchers looked at tweets in response to an Italian oil company’s online CSR campaign. They found that 65% of tweets using the campaign’s hashtag were argumentative, frustrated/insulted, or used sarcasm rather than replying positively (Vollero et al. 2021) We expect that negative information regarding social responsibility will result in negative responses.

Across stakeholder groups, previous evidence suggests that individuals are sensitive to CSR information and are inclined to act in response to negative information. More formally, we hypothesize

H1a

Individuals who receive negative CSR information are less likely to seek employment with that firm than those who receive positive information.

H1b

Individuals who receive negative CSR information are less likely to invest in a firm than those who receive positive information.

H1c

Individuals who receive negative CSR information are less likely to buy products from that firm than those who receive positive information.

H1d

Individuals who receive negative CSR information are more likely to write negative posts on social media than those who receive positive information.

Information Channels

Previous research has demonstrated that CSR reports are of interest to several different stakeholder groups. For example, research has shown that consumers are interested in learning about CSR initiatives and that purchase intent increases when a firm participates in CSR initiatives (Pomering and Dolnicar 2009). However, little research demonstrates how individual stakeholders evaluate this information, or if there is a difference in stakeholder reactions depending on whether CSR information is published internally, by the firm, or externally, by a third party.

As information regarding CSR can be received from either the firm itself or third parties, we consider the effect of the source of the information on stakeholder responsiveness to corporate social performance. More specifically, we consider whether the information is received through external channels (news articles) or internal channels (CSR reports). Because firms have little control over information from external channels, firms need to understand how this information affects stakeholder impressions, which could lead to stakeholder punishments. We also know little about how people respond to CSR reports that conflict with reporting from external channels. While several experiments examine the role of CSR information on stakeholder attitudes (e.g., Berens et al. 2007; Eberle et al. 2013) and perceptions of greenwashing (Nyilasy et al. 2013), most of these experiments do not test the effects of CSR information on stakeholder punishment of firms when the information from internal channels and external channels conflict.

Research on the credibility of internal and external sources has exhibited mixed results. For example, Lee et al. (2017) have shown that consumers perceive advertisements as more credible and trustworthy when they are purportedly created by product users rather than by firms themselves. However, O’Neil and Eisenmann (2017) have shown that while prospective consumers rated consumer product reviews as more trustworthy than firm advertisements, there was no difference in their perception of credibility between the two sources. Further, when presented with negative information, study participants rated the external source (newspaper) as both more trustworthy and more credible than the internal source (firm press release).

Other research has also argued that consumers are responsive to negative information directly from a firm. For example, in studies in which a company self-disclosed the negative side effects of a new drug, participants were more likely to order a free health tool from the company, as well as to rate the firm as more trustworthy, than were those who received the negative information from a third party. However, the effects were moderated by firm reputation such that self-disclosure increased perceptions of trustworthiness for companies with a poor reputation, compared to those firms with a good reputation (Fennis and Stroebe 2014).

Stakeholders sometimes express skepticism in response to CSR information (Bachmann and Ingenhoff 2016; Perego and Kolk 2012), and research shows that verification from external sources can enhance the credibility of CSR reports for firms who have previously engaged in misconduct (Du and Wu 2019). Therefore, we expect stakeholders will respond more strongly to negative corporate social performance information from external sources. When internal and external information aligns, we expect it will be perceived as more credible than information received directly from the firm alone. For example, in a study by Bachmann and Ingenhoff (2016), participants received either one, two, or three pieces of information about CSR issues for a fictitious company. Participants who read information on a greater number of issues were more likely to find the information credible and were less skeptical than participants who read fewer pieces of information. While some stakeholders may not notice, attend to, or assess harm based on limited negative CSR information, information from an additional (external) source would likely strengthen the focus of stakeholder attention on the internal CSR report. Thus, we expect that stakeholders will appreciate honest reporting of information from a firm that self-discloses negative performance. By providing accurate information regarding CSR, firms may signal to stakeholders that they are willing to take responsibility for their behavior. By self-disclosing socially irresponsible behavior, a firm may be able to generate greater trust from stakeholders.

H2a

Individuals who receive negative CSR information from external sources are less likely to seek employment than those who receive negative information from internal sources.

H2b

Individuals who receive negative CSR information from external sources are less likely to invest in a firm than those who receive negative information from internal sources.

H2c

Individuals who receive negative CSR information from external sources are less likely to buy products than those who receive negative information from internal sources.

H2d

Individuals who receive negative CSR information from external sources are more likely to write a negative social media posting than those who receive negative information from internal sources.

Study 1

In this study, we test stakeholder responsiveness to CSR information received through internal and external channels. More specifically, we examine whether stakeholders punish a firm for negative CSR information depending upon the source of the information.

Methods

Research Design and Participants

In this study, 166 participants from an undergraduate business school (50% female; mean age = 22.1 years, 4.48 years of work experience) were randomly assigned to one of three conditions (external-negative information, internal-negative information, and internal-positive information).

For the two internal information conditions, we developed several pages of a CSR report (adapted from Philips, 2013) for Nova Inc, a fictitious company. These materials included a page showing social performance and a page showing environmental performance (see Fig. 1).

In the internal-positive condition, social performance graphs showed positive trends over a five-year period, i.e., carbon footprint and hazardous waste decreased while charitable giving and employee engagement increased.

In the internal-negative condition, graphs showed an increase in carbon footprint and hazardous waste, and a decrease in employee engagement and charitable giving. See Fig. 1.

For the external condition, we created the first page of an article allegedly published in a national business news magazine (adapted from Figueroa 2012), accusing Nova Inc. of socially irresponsible behavior such as destroying natural habitats, producing high volumes of carbon emissions and failing to provide employees adequate health coverage. The topics of the external condition mirrored the internal-negative condition.

Procedure

Participants entered the behavioral lab and were provided with hard copies of the informational materials regarding the company described above, depending on their assigned condition. They were also directed to a Qualtrics questionnaire on the computer terminal in front of them. Participants read a cover story, “As business students, you have developed strong abilities in assessing corporations. In this study, we will provide you information regarding Nova, a large international healthcare corporation, and then ask you to share your general impressions of the firm.” They were then instructed to read over the materials they had been given and were informed that Nova Inc. is considering opening a facility in the respondents’ geographic location, and they are aware that a hashtag will be used on Twitter. Participants were asked what they would tweet about #NovaInc. Next, participants answered a manipulation check question using a 7-point Likert scale item.

Participants were then provided with the investment, employee, and consumer-dependent variable measures with filler questions in between the main questions. In order to diminish the likelihood that respondents would provide uniform responses across these dependent variables, these stakeholder actions used different response formats. For example, the investor question focused upon choosing a percentage of retirement funds to invest in a company rather than a scale. At the end, participants were asked several demographic items including years of work experience.

Measures

Manipulation Check

A manipulation check was conducted to determine that participants in the three manipulated conditions (internal-positive information, internal-negative information, external-negative information) differed in their assessment of the information received about the target firm. Participants indicated their agreement with the statement, “I received extremely negative information about Nova” using a 7-point Likert scale (1 = Strongly disagree; 7 = Strongly agree).

Employment

Study participants were presented with the following employment stakeholder scenario: “[Your] Business School is currently evaluating some of its corporate partners for student internships. Please rate the following companies according to how interested you are in an internship with this company:” Nova Inc. was listed among a group of six other companies, specifically Johnson & Johnson, Microsoft, Patagonia, IBM, Wal-Mart, and Kraft. Participants expressed their interest in an internship with each firm using a 7-point scale item (1 = Not at all interested to 7 = Very interested). Although participants responded to this prompt for seven firms, interest in Nova served as the primary measure for employee punishment for negative CSR information.

Investment

Study participants were instructed to, “Imagine your new employer offers a retirement savings plan and you are allowed to divide your retirement savings among several company stocks. Please indicate the percentage of your savings that you are willing to invest in each of the following companies. You are allowed to give a specific company 0% but remember, your percentages must add to 100%.” Nova was placed among the same group of six other companies. The percentage awarded to Nova served as the primary measure for investor punishment for negative CSR information.

Consumption

Study participants were presented with the consumer stakeholder scenario in which they were instructed, “Imagine you have the opportunity to purchase or boycott products from the following companies. Please indicate how likely you are to buy or boycott products from these companies.” Nova was listed among the same six companies. Participants expressed their interest in purchasing from the target firm using a 7-point scale item (1 = Boycott to 7 = Buy). Although participants responded to this prompt for seven firms, intentions to boycott products from Nova served as the primary measure for consumer punishment for negative CSR information.

Social Media Posting

Tweets were coded (0 = no; 1 = yes) for negative tone and whether the tweet included a Call to Action by two independent coders who were blind to the purpose of the study. Given past research on community activism (e.g., Besiou et al. 2013; Valenzuela 2013), “Calls to Action” against the firm were an important feature of expressing dissatisfaction online. Coders achieved an agreement level of 92% across dimensions. Any disagreements were resolved through a discussion with both coders and the second author.

Results

Preliminary Analyses and Manipulation Checks

Table 1 provides correlations for the dependent variables. Results from an ANOVA indicate that participants in the negative information conditions differed from the positive information condition in their assessment of information received, F(2, 163) = 23.42, p < 0.001. Participants in the negative CSR report (M = 3.43) and negative news article (M = 4.59) conditions more strongly agreed that they had received extremely negative information about Nova compared to those in the positive CSR report condition (M = 2.16, p < 0.01 for all comparisons using Tukey HSD).

In order to test hypotheses 1a–1d, which predict that stakeholders would be more likely to punish a firm for negative CSR information, we ran a series of ANOVAs with planned contrasts.

For H1a (employment), we ran an ANOVA, F(2, 163) = 6.25, p < 0.01, and found a statistically significant effect of the source of information on employment interest. A planned contrast showed a difference between receiving a negative news article and a positive CSR report (M = 3.56, SD = 1.66), t(163) = 2.19, p = 0.03. The difference in employment interest between receiving a negative internal CSR report and a positive internal CSR report was not statistically significant, t(163) = − 1.76, p = 0.08). See Fig. 2. For H1b (investment), we ran an ANOVA, F(2, 163) = 6.02, p < 0.01, and found a statistically significant effect of the source of information on percent invested. Planned contrasts showed that participants invested less when they received a negative CSR report (M = 5.40, SD = 7.09) than when they received a positive CSR report (M = 8.07, SD = 7.36), t(114.09) = − 2.00, p = 0.05), as well as when they received a negative news article (M = 3.73, SD = 4.41) compared to a positive CSR report, t(93.45) = 3.74, p < 0.001. See Fig. 3. For H1c (consumption), we ran an ANOVA, F(2, 163) = 3.35, p = 0.038, and found a statistically significant effect of the source of information on consumption interest. Participants were more likely to boycott when they received a negative news article (M = 2.76, SD = 1.75) than when they received a positive CSR report (M = 3.47, SD = 1.54), t(163) = 3.54, p < 0.001, and when they received a negative CSR report (M = 2.77, SD = 1.76) compared to a positive CSR report, t(163) = − 2.27, p = 0.02. See Fig 4. For H1d (social media), we used logistic regression and found exposure to different types of CSR information affected decisions to write negative tweets (Χ2 = 29.58, p < 0.000). Participants were 35.46 times more likely to write a negative tweet when they received a negative news article than when they received a positive CSR report (B = 3.57, SE = 1.05, Wald X = 11.54, p = 0.001). However, the results do not provide evidence that participants were more likely to write a negative tweet when they received a negative CSR report compared to a positive CSR report. See Fig. 5. In summary, H1b and H1c are fully supported while H1a and H1d are partially supported. These analyses indicate that individuals are more inclined to punish a firm after receiving negative, rather than positive, CSR information.

In the process of coding the tweets for negative sentiments, we found participants were more likely to write Calls to Action against the firm, depending upon the type and source of information that they received (Χ2 = 9.64, p = 0.008). More specifically, when they received a negative news article, participants were 8.17 times more likely to write a tweet with a Call to Action than when they received a positive CSR report (B = 2.10, SE = 0.80, Wald X = 6.94, p = 0.008). See Fig. 6. For examples of tweets, see Table 2 (Fig. 6).

To test hypotheses 2a–2d, which state that stakeholders will react more strongly to negative information from external versus internal sources, we return to the ANOVAs and planned contrasts used to test hypothesis 1. For H1a (employment), there was less interest in an internship with the firm when participants received a negative news article (M = 2.41, SD = 1.46) compared to a negative CSR report (M = 3.02, SD = 1.85), although the test did not reach traditional levels of significance, t(163) = − 1.89, p = 0.06. For H1b (investment), although the percentage of investment was lower when receiving negative information from an external source (M = 3.73, SD = 4.41) compared to an internal source (M = 5.40, SD = 7.09), this difference was not statistically significant. For H1c (consumption), there was no difference between those who received an internal-negative report and an external-negative article. For H1d (social media),we ran a logistic regression and found that participants were 5.6 times more likely to post a negative tweet when they received negative information from an external source compared to negative information from the firm itself, (B = − 1.73, SE = 0.52, Wald X = 11.05, p < 0.001). Thus, we found statistically significant results for H2d and marginally significant results for H2a, which suggest that individuals are more likely to punish a firm in terms of employment choices and social media posts when negative CSR information is received from external, rather than internal, sources.

Discussion

Our study results demonstrate that stakeholders are willing to punish firms for negative CSR information received from both internal and external channels and that depending upon the stakeholder group, negative information from external channels will elicit stronger punishments than information from internal channels. More specifically, we find that individuals are most likely to write negative social media posts and call others to action when they receive negative information from external channels than internal channels. In the next section, we broaden our focus to include conflicting CSR information and we present theory on Calls to Action posted to social media, as they could elicit further punishments from stakeholders.

Study 2

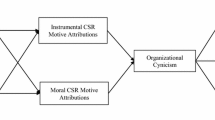

While Study 1 provides a baseline for how stakeholders respond to information received through internal or external channels, the study design did not allow us to identify what happens when the internal and external information occurs simultaneously and the CSR information conflicts, which is more realistic. In research regarding perceptions of hypocrisy, one study presented participants with either consistent or inconsistent information regarding a firm’s internal CSR messaging and behavior reported in a news article (Wagner et al. 2009). Results show that inconsistent messaging increases perceived hypocrisy, and negative beliefs and attitudes toward the firm. As discussed previously, negative perceptions have been shown to drive online behavior (Berger and Milkman 2012).

Calls to Action

Recently researchers have turned to negative social media postings as threats to corporate reputation (Briscoe and Gupta 2016). For example, Ward and Ostrom (2006) examined consumer complaint websites designed to share information about firms’ irresponsible or negative behaviors, and found that one of the primary techniques used by consumer protestors was the attempt to incite communal action. That is, consumer protestors encouraged angry consumers to think of themselves as a group instead of individuals, and to act as a community in punishing the firm. Other research suggests that advances in technological communication have increased activism and communication, by making activism easier (Earl and Kimport 2011). While there is very little research that directly focuses on Calls to Action specifically in response to poor corporate social performance, recent studies have categorized types of social media messages and tallied user responses to them, and Calls to Action do generate a measurable response such as comments and “likes.” (Kwok and Yu 2016; Saxton and Waters 2014). For example, in a study of business-to-consumer Facebook messages, calls for action received a greater number of “likes” than sales tactics such as indirect boasting, CSR related posts, or sales announcements. Calls for action received more direct responses in the form of comments than almost any other category of messages, with the exception of messages directly asking for user feedback (Kwok and Yu 2016). In an unrelated study of Facebook messages posted by the 100 largest non-profit organizations in the U.S., users “liked” Calls to Action over any of the other categories of communications examined such as information (e.g., news stories or organizational rankings), fundraising status, events, and community building. In addition, users were more likely to share Calls to Action than almost any other type of communication, with the exception of informational messages about the organization or its activities. (Saxton and Waters 2014). A more recent micro-linguistic analysis also finds that some Twitter users reacted to the publication of the Panama Papers with Calls for Action directed toward politicians and wealthy individuals. While most tweets did not demand action, those that did were frequently favorited and retweeted (Neu et al. 2020).

Recent research on firm communication and hypocrisy suggests individuals respond harshly to conflicting information, especially when the communications suggests that firms are not what they claim to be (Warren et al. 2020; Wagner et al. 2020). This conflicting information can be perceived as false signaling and elicits a sense of hypocrisy which is tied to several negative outcomes (Jordan et al. 2017). This research aligns with studies on preferences for congruent information. For example, in Smithson's (1999) study, participants were asked to choose which scenario they preferred: receiving information from two equally believable sources that were in agreement but uncertain, or receiving information from two sources that were opposed but certain. Results demonstrate that individuals prefer to receive ambiguous but congruent messages compared to straightforward but conflicting messages. Study participants also perceived the conflicting sources as less credible than the ambiguous sources. (Smithson 1999). Other research found that when participants were presented with coffee packaging that had combinations of internal (company) and external (trusted third party) “eco-labeling”, the external label had the largest effect on brand attitude and purchase intentions, and even on evaluations of the coffee’s aroma (Gosselt et al. 2019). Similarly, Perego and Kolk (2012) argue that third party assurance of firms’ internal CSR reporting improves credibility for stakeholders.

Reflecting upon the theory related to Calls to Action and conflicting information, we argue individuals who receive conflicting information from internal and external sources, will be more likely to call others to take action against the firm as a form of punishment for perceived hypocrisy.

H3

Conflicting information (i.e., positive internal information paired with negative external information) will result in the greatest number of Calls to Action from stakeholders on social media.

Methods

Research Design and Participants

In Study 2, using a 2 × 2 design, we tested internal information provided by the company (positive/negative) and external information (present/not present). 186 undergraduate business students (44% female, 21.2 mean age, 1.4 years of work experience) from a different campus of a U.S. university participated in this study.

The internal and external information materials for Study 2 were the same as in Study 1 (internal CSR report pages and external news article), however, unlike Study 1, there were four different groups, those who received: internal-positive information alone, internal-negative information alone, congruent information (internal negative, external negative), and conflicting information (internal positive, external negative).

Procedure

For Study 2, all materials, including the questionnaire, were presented to participants in hard copy format in an envelope. Participants were asked to evaluate a company based upon information in the envelope, which included either a positive or negative CSR report and, for half of the participants, a negative business article on the company’s CSR. These materials were identical to those used in Study 1. Participants then read the same cover story and were provided with the investment, employee, and consumer-dependent variable measures with filler questions in between the main questions as in Study 1 . All measures were identical to those used in Study 1 but in hardcopy format.

Results

Preliminary Analyses and Manipulation Checks

Table 3 provides correlations for the dependent variables. Results from an ANOVA indicated that participants in the negative information conditions differed from the positive information condition in their assessment of the information received, F(3, 182) = 35.65, p < 0.001. Participants that received the positive CSR report alone expressed the lowest level of agreement with a statement indicating they received negative information (M = 1.98) when compared to those who received the negative CSR report plus negative news article (M = 5.31), negative CSR report alone (M = 3.48), and conflicting information (positive CSR report with negative news article) (M = 4.48), p < 0.001 for all comparisons with positive internal information using Tukey HSD.

Hypotheses 1a through 1d state that stakeholders would be more likely to punish a firm when they received negative information (compared to positive information) about a firm’s social performance. To test this, we ran a series of ANOVAs with planned contrasts.

For H1a (employment), we ran an ANOVA, F(3, 182) = 6.18, p = 0.001) and found that CSR information affected the level of employment interest of participants. Participants who received a negative CSR report (M = 3.13, SD = 1.76) were less interested in employment than participants who received a positive CSR report (M = 4.25, SD = 1.60), t(182) = 3.31, p = 0.001. Receiving negative congruent information from both sources (CSR report plus news article) (M = 2.79, SD = 2.21) caused less employment interest than a positive CSR report, t(182) = 3.95, p < 0.001. See Fig. 7. For H1b (investment), results from an ANOVA demonstrated that type of information and communication channel predicted interest in investing in the firm, F(3, 182) = 6.94, p < 0.001. As expected, participants who received a negative CSR report (M = 6.07, SD = 6.23) invested less in the firm than those who received a positive CSR report (M = 9.41, SD = 7.55), t(108.7) = 2.61, p = 0.01. Those who received the negative information from both a CSR report and a news article (M = 3.24, SD = 4.43) invested less than those who received positive information (M = 9.41, SD = 7.55), t(92.90) = 5.09, p < 0.001. See Fig. 8. For H1c (consumption), results from an ANOVA demonstrated that type of information and communication predicted interest in consuming firm products, F(3, 182) = 9.39, p < 0.001. As expected, participants who received a negative CSR report (M = 3.37, SD = 1.60) were more likely to boycott firm products than those who received a positive CSR report (M = 4.44, SD = 1.46), t(182) = 3.64, p < 0.001. Those who received congruent information (a negative CSR report with a negative news article) (M = 2.81, SD = 1.74) were more likely to boycott than those who only received a positive CSR report, t(182) = 5.04, p < 0.001. See Fig. 9. For H1d (social media), participants were 8.24 times more likely to write a negative tweet when they received a negative CSR report than when they received a positive CSR report (B = 2.11, SE = 0.58, Wald X = 13.10, p < 0.001). See Fig. 10. Thus, we found support for H1a, H1b, H1c and H1d indicating that individuals are less interested in employment, invested less, less likely to buy, and more likely to post negative messages to social media after receiving negative CSR information from external rather than internal sources. Although not hypothesized, we also found exposure to different types of CSR information affected decisions to write tweets that include a Call to Action (Χ2 = 16.20, p = 0.001). Participants were 8.62 times more likely to write a tweet with a Call to Action when they received a negative CSR report than when they received a positive CSR report (B = 2.15, SE = 1.08, Wald X = 3.99, p = 0.046). See Fig. 11.

To test hypotheses 2a–2d, that stakeholders will respond more strongly to negative information from external rather than internal sources, we ran several ANOVAs with planned contrasts on employment, investment, and consumption interest. We found that for H2a (employment), there is no statistically significant difference between receiving both internal and external-negative information and negative internal information alone, although the mean employment interest trends as expected. See Fig. 7. For H2b (investment), planned contrasts show that as expected, participants who received both the negative internal information and the negative external information invested less (M = 3.24, SD = 4.43) than those who received the negative internal information alone (M = 6.07, SD = 6.23, t(99.96) = − 2.68, p = 0.01). See Fig. 8. Similarly, for H2c (consumption), participants who received both the negative internal information and the negative external information showed less consumption interest (M = 2.81, SD = 1.74) than those who received the negative internal information alone (M = 3.37, SD = 1.60), although this finding did not achieve traditional levels of statistical significance, t(182) = − 1.74, p = 0.08. See Fig. 9. For H2d (social media), a binary logistic regression suggests, but does not meet traditional levels of statistical significance for, an effect of combined internal and external-negative information on social media posts compared to internal-negative information alone, (B = 0.72, SE = 0.41, Wald X = 3.06, p = 0.08). In sum, we found support for H2b indicating that individuals respond more negatively to negative information from external rather than internal sources when considering investment. We did not find statistically significant support at the 95% confidence level for H2c and H2d, but the data suggests that external-negative information may have a stronger effect on purchasing and social media posting, relative to negative CSR information shared through internal channels.

Hypothesis 3 predicted that conflicting information would cause the strongest punishments from stakeholders. When participants received conflicting information (a positive CSR report with a negative news article), they were over 14 times more likely to write a Call to Action than when they received congruent information (negative CSR report and negative news article) (B = 2.66, SE = 1.10, Wald X = 5.83, p = 0.02).

Discussion

Study 2 results suggest negative CSR information results in less interest in employment, investment, and consumption, and a greater number of negative tweets and Calls to Action. Additionally, we find information from external sources is more powerful than from internal sources in influencing investment behavior. Furthermore, we find a willingness to punish the firm regardless of whether the information was internally reported by the firm alone or confirmed by an external source.

While individuals are more likely to write negative messages and Calls to Action on social media when they receive negative CSR information from external channels, they exhibit the strongest online reaction after receiving conflicting information from external and internal channels. When individuals receive conflicting CSR information (positive CSR report combined with negative news article), they are most likely to post Calls to Action on social media, which could ultimately encourage others to act against the firm. Interestingly, this suggests that social media users are more responsive to a conflict between information from internal and external channels than purely negative CSR information. It also suggests that if a firm has negative aspects to their CSR performance, it is better to report honestly than overstate performance. This aligns with research that indicates that individuals prefer honesty and consistency (e.g., Nyilasy et al. 2013).

General Discussion

Using two experiments, we find stakeholders punish a firm for negative CSR information from both internal and external channels. Further, we analyzed the social media reactions to CSR information and found that Calls to Action against the firm on social media occurred most frequently when the study participants received conflicting information. Calls to Action posts pose a unique risk to the firm, compared to other types of stakeholder punishments, because they could motivate further punishments from other stakeholder groups. In this section, we discuss how our findings lay the foundation for future work.

Punishment for Poor CSR

Previous researchers assert that stakeholders do not always punish a firm for poor CSR performance (e.g., Barnett 2014; Carrigan and Attalla 2001), but our study findings suggest that individuals are less interested in engaging with a firm as a customer, employee and investor after receiving negative, versus positive, CSR information. Because our studies took several approaches to capturing stakeholder reactions to the information, we find evidence to confirm the desire to punish from a variety of stakeholder vantage points expressed through specific choices as well as written responses.

In both studies, study participants not only punished the firm by reducing their engagement with the firm as a customer, employee, and investor, but they also chose to write explicitly negative statements in the form of tweets. Most notably for firms, negative CSR information also predicts Calls to Action on social media. These calls could have downstream consequences, such that even more stakeholders are inspired to punish the firm by reading the calls of trusted social network members. In both studies, participants posted messages asking other social media users to stop supporting Nova Inc. and suggesting punishments such as boycotts and petitions. In Study 2, conflicting information increased the number of Calls to Action, such as “NovaInc is harming our environment! Speak up and petition against NovaInc” and “Strongly disagree with NovaInc which destroys our habitats. Stay away from it.” Previous research has argued that corporate social initiatives, compared to other corporate initiatives, can evoke perceptions of hypocrisy because social responsibility is perceived as a moral signal (Warren et al. 2020; Warren 2022). Thus, conflicting negative external and positive internal CSR information may cause perceptions of hypocrisy and increase Calls to Action, which can have the additional effect of increasing punishments through social networks.

In social activism, mobilization refers to activists bringing in new participants and motivating and empowering current activists to take action (Briscoe et al. 2015). Research shows that activists can have strong influence on one another’s behavior (Strang and Soule 1998). The goal (or result) of activism is often to disrupt a firm’s reputation and/or resources. For example, boycotts aim to both diminish profit and to increase negative publicity, which can force companies to respond, even if there is minimal economic impact. When media coverage is extensive, firms’ responses are more likely (McDonnell and King 2013). Research suggests that this is due to perceived reputational threat by organizational decision makers, or actual reputational decline after significant media attention (Briscoe et al. 2015).

We argue that social media can have the same amplification effects as traditional media, in part, by gaining the attention of traditional media. In one study, the release of a documentary increased online participation in a campaign against fracking as well as media attention. These were shown to affect the enactments of related state laws (Vasi et al. 2015). While the participants in our study may not have the power or intention to become activists that attack a firm’s reputation, social media, like traditional media, can play a role in broadening the scope of who receives information about a firm’s social irresponsibility. Thus, the ability for individual members of a community to post negatively on social media, or call for action, has the potential to reach larger groups of people who may act more aggressively to target a firm’s reputation.

Past research has documented how corporate reputation affects various stakeholder actions (e.g., Walsh et al. 2009; Wang 2013; E. Yoon et al. 1993). For example, several studies have found that positive corporate reputations can increase customer loyalty (e.g., Cretu and Brodie 2007; Walsh et al. 2009), and word of mouth (Walsh et al. 2009) in addition to customers' purchase intention (e.g., Yoon et al. 1993). Employment research has demonstrated a relationship between corporate reputation and job pursuit intention (Wang 2013). Furthermore, investment research has found that corporate reputation increases investor affective loyalty and investor satisfaction (Helm 2007). Here, we extend this research on corporate reputation by experimentally examining how stakeholder reactions are tied to specific pieces of CSR information received through internal and external channels.

Importance of Information Source

In the U.S., firms voluntarily issue CSR reports, and the content is not regulated. Additionally, research has found that investors are more likely to believe that CSR information is externally assured, and more credible, when it is incorporated into financial reports than when separately reported (Haji et al. 2021). Importantly, a firm could simply choose not to report negative information. One reason for not voluntarily disclosing negative information is to avoid needlessly exposing the firm to stakeholder punishments. Here we test not only stakeholder desire to punish firms for negative CSR information but the importance of the channel (internal or external) to the punishment. We find both sources of negative CSR information (CSR report and news article) can affect stakeholder choices. We also find that stakeholders who received positive internal information and negative external information increased punishments on social media by calling others to action compared to those who received only negative information.

These findings are in line with previous research, which found that study participants had more negative beliefs and attitudes toward a firm after reading positive internal CSR statements combined with negative CSR information from an external source (Wagner et al. 2009). The present studies add to this research by demonstrating that specific actions of stakeholders related to employment, investment, boycotting, and public, online messaging related to the firm, are also affected more strongly by external information. Additionally, due to the type of data we collected, we were able to analyze qualitative behavioral data in the form of tweets, which demonstrated the Calls for Action.

In order to better understand the negative effects of a CSR report, we should focus on the ways in which individuals process information from these sources to better grasp why and when news articles are more influential than CSR reporting as well as tolerance or thresholds for negative CSR reporting. More specifically, how much negative CSR reporting will a stakeholder accept before punishing the firm for poor CSR performance.

Limitations

Although the experimental design used in these studies allows us to clearly examine the differences in responses among stakeholders who receive information from internal and external channels, the natural drawback to the experimental design is that it does not always reflect the noise that stakeholders experience in their actual information environment, such as a constant barrage of additional communication from multiple sources on various topics that occurs simultaneously. Another concern in experimental manipulations is the possibility of demand artifacts, in which study participants are biased by their subconscious desire to help the researchers confirm their hypotheses. While always a possibility, we believe we have minimized the risk by using a between subjects design in which participants are not aware of the other manipulations and by using a cover story to disguise the purpose of the studies. Additionally, recent research shows no difference between participant response when they are aware or unaware of the researchers’ hypotheses (Mummolo and Peterson 2019). We also understand that hypothetical scenarios are not the same as actual experiences. However, hypothetical scenarios are considered more effective when they entail realistic stimuli with pictures (CSR report pages, news articles) and involve open-ended response questions (e.g., Aguinis and Bradley 2014). To mitigate some of the shortcomings of hypothetical situations, we adapted materials from real news articles and CSR reports, and we asked study participants to write social media posts. Hypothetical scenarios also offer the ability to test ethical decision making across many contexts and eliminate any bias based on previous awareness of the target firm.

A second limitation is the use of undergraduates as study participants, although this student population had experience with all of the stakeholder roles embedded in this study. Our study participants possessed work experience, studied investment, and were consumers.

Another limitation is that we addressed each stakeholder group by referencing specific stakeholder behaviors. While we acknowledge this limitation, we also note that individuals are often members of multiple stakeholder groups. For example, an employee may consume a product made by the employer, and employees often own the employer’s stock. As a first step in understanding differences in the punishments across stakeholder groups, we separate these behaviors, but future research should examine them in combination as well as separately. In other words, by studying them together, we allowed for a consistency in responses that may not occur if they were asked separately. We strove to prevent this consistency by asking the stakeholder behavioral questions in different formats (e.g., percentage invested, likelihood to boycott, interest in employment), but future research should examine these stakeholder behaviors in ways that better differentiate reactions across stakeholder groups.

Conclusion

In this paper, we establish that individuals serving in several stakeholder roles (employer, investor, consumer, community member) are inclined to punish firms after receiving negative CSR information shared through internal channels (a CSR report) as well as external channels (a news article). Individuals react even more strongly on social media through negative messaging and Calls to Action when the negative CSR information is received from a news article than from a CSR report. Findings from our second experiment reveal Calls to Action on social media occurred more frequently when a negative news article was received with a positive CSR report. Conflicting information from internal and external channels elicited even more Calls to Action than when individuals received entirely negative CSR information. This finding is especially important because Calls to Action on social media serve as a way for individuals to incite other stakeholders to join them in punishing the firm and are opportunities for one stakeholder to amplify their influence over a firm. The findings from our studies suggest that firms should be wary of exaggerating the reporting of their CSR performance, especially if conflicting information could be reported through external sources, such as news stories.

References

Aguinis, Herman, and Kyle J. Bradley. 2014. Best Practice Recommendations for Designing and Implementing Experimental Vignette Methodology Studies. Organizational Research Methods 17 (4): 351–371. https://doi.org/10.1177/1094428114547952.

Ashforth, Blake E., Mahendra Joshi, Vikas Anand, and Anne M. O’Leary-Kelly. 2013. Extending the Expanded Model of Organizational Identification to Occupations. Journal of Applied Social Psychology 43 (12): 2426–2448.

Bachmann, Philipp, and Diana Ingenhoff. 2016. Legitimacy Through CSR Disclosures? The Advantage Outweighs the Disadvantages. Public Relations Review 42 (3): 386–394. https://doi.org/10.1016/j.pubrev.2016.02.008.

Barnett, Michael L. 2014. Why Stakeholders Ignore Firm Misconduct: A Cognitive View. Journal of Management 40 (3): 676–702.

Barnett, Michael L. 2019. The Business Case for Corporate Social Responsibility: A Critique and an Indirect Path Forward. Business and Society 58 (1): 167–190. https://doi.org/10.1177/0007650316660044.

Barnett, Michael L., and Robert M. Salomon. 2006. Beyond Dichotomy: The Curvilinear Relationship Between Social Responsibility and Financial Performance. Strategic Management Journal 27 (11): 1101–1122.

Behrend, Tara S., Becca A. Baker, and Lori Foster Thompson. 2009. Effects of Pro-Environmental Recruiting Messages: The Role of Organizational Reputation. Journal of Business and Psychology 24 (3): 341–350.

Berens, Guido, Cees B.M.. Van Riel, and Johan Van Rekom. 2007. The CSR-Quality Trade-off: When Can Corporate Social Responsibility and Corporate Ability Compensate Each Other? Journal of Business Ethics 74 (3): 233–252.

Berger, Jonah, and Katherine L. Milkman. 2012. What Makes Online Content Viral? Journal of Marketing Research 49 (2): 192–205.

Berry, R.H., and F. Yeung. 2013. Are Investors Willing to Sacrifice Cash for Morality? Journal of Business Ethics 117 (3): 477–492.

Besiou, Maria, Mark Lee Hunter, and Luk N. van Wassenhove. 2013. A Web of Watchdogs: Stakeholder Media Networks and Agenda-Setting in Response to Corporate Initiatives. Journal of Business Ethics 118 (4): 709–729.

Briscoe, Forrest, and Abhinav Gupta. 2016. Social Activism in and Around Organizations. Academy of Management Annals 10 (1): 671–727. https://doi.org/10.1080/19416520.2016.1153261.

Briscoe, Forrest, Abhinav Gupta, and Mark S. Anner. 2015. Social Activism and Practice Diffusion. Administrative Science Quarterly 60 (2): 300–332.

Brown, Tom J., and Peter A. Dacin. 1997. The Company and the Product: Corporate Associations and Consumer Product Responses. Journal of Marketing 61 (1): 68–84.

Cable, Daniel M., and Daniel B. Turban. 2003. The Value of Organizational Reputation in the Recruitment Context: A Brand-Equity Perspective. Journal of Applied Social Psychology 33 (11): 2244–2266.

Carrigan, Marylyn, and Ahmad Attalla. 2001. The Myth of the Ethical Consumer—Do Ethics Matter in Purchase Behaviour? Journal of Consumer Marketing 18 (7): 560–578.

Caruana, Robert, and Andreas Chatzidakis. 2014. Consumer Social Responsibility (CnSR): Toward a Multi-Level, Multi-Agent Conceptualization of the ‘Other CSR.’ Journal of Business Ethics 121 (4): 577–592.

Cretu, Anca E., and Roderick J. Brodie. 2007. The Influence of Brand Image and Company Reputation Where Manufacturers Market to Small Firms: A Customer Value Perspective. Industrial Marketing Management 36 (2): 230–240. https://doi.org/10.1016/j.indmarman.2005.08.013.

Donaldson, Thomas, and Lee E. Preston. 1995. The Stakeholder Theory of the Corporation: Concepts, Evidence, and Implications. Academy of Management Review 20 (1): 65–91. https://doi.org/10.5465/amr.1995.9503271992.

Du, Kai, and Wu. Shing Jen. 2019. Does External Assurance Enhance the Credibility of CSR Reports? Evidence from CSR-Related Misconduct Events in Taiwan. Auditing 38 (4): 101–130. https://doi.org/10.2308/AJPT-52418.

Earl, Jenifer, and Katrina Kimport. 2011. Digitally Enabled Social Change: Activism in the Internet Age. Cambridge: New Media & Society, MIT Press.

Eberle, David, Guido Berens, and Ting Li. 2013. The Impact of Interactive Corporate Social Responsibility Communication on Corporate Reputation. Journal of Business Ethics 118 (4): 731–746. https://doi.org/10.1007/s10551-013-1957-y.

Fennis, Bob M., and Wolfgang Stroebe. 2014. Softening the Blow: Company Self-Disclosure of Negative Information Lessens Damaging Effects on Consumer Judgment and Decision Making. Journal of Business Ethics 120 (1): 109–120.

Figueroa, Alyssa. 2012. The Top Five Most Hypocritical Corporate Sponsors. Truthout. 2012. http://www.truth-out.org/news/item/10702-the-top-five-most-hypocritical-corporate-sponsors.

Glac, Katherina. 2009. Understanding Socially Responsible Investing: The Effect of Decision Frames and Trade-off Options. Journal of Business Ethics 87 (SUPPL. 1): 41–55.

Glavas, Ante, and Ken Kelley. 2014. The Effects of Perceived Corporate Social Responsibility on Employee Attitudes. Business Ethics Quarterly 24 (02): 165–202.

Gosselt, Jordy F., Thomas van Rompay, and Laura Haske. 2019. Won’t Get Fooled Again: The Effects of Internal and External CSR ECO-Labeling. Journal of Business Ethics 155 (2): 413–424. https://doi.org/10.1007/s10551-017-3512-8.

Haji, Abdifatah Ahmed, Paul Coram, and Indrit Troshani. 2021. Effects of Integrating CSR Information in Financial Reports on Investors’ Firm Value Estimates. Accounting and Finance 61 (2): 3605–3647. https://doi.org/10.1111/ACFI.12713.

Helm, Sabrina. 2007. The Role of Corporate Reputation in Determining Investor Satisfaction and Loyalty. Corporate Reputation Review 10 (1): 22–37. https://doi.org/10.1057/palgrave.crr.1550036.

Jones, David A., Chelsea R. Willness, and Sarah Madey. 2014. Why Are Job Seekers Attracted by Corporate Social Performance? Experimental and Field Tests of Three Signal-Based Mechanisms. Academy of Management Journal 57 (2): 383–404.

Jordan, Jillian J., Roseanna Sommers, Paul Bloom, and David G. Rand. 2017. Why Do We Hate Hypocrites? Evidence for a Theory of False Signaling. Psychological Science 28 (3): 356–368.

Kuokkanen, Henri, and William Sun. 2020. Companies, Meet Ethical Consumers: Strategic CSR Management to Impact Consumer Choice. Journal of Business Ethics 166 (2): 403–423. https://doi.org/10.1007/S10551-019-04145-4.

Kwok, Linchi, and Yu. Bei. 2016. Taxonomy of Facebook Messages in Business-to-Consumer Communications: What Really Works? Tourism and Hospitality Research 16 (4): 311–328.

Lee, Jin Kyun, Shu-Yueh. Lee, and Sara Steffes Hansen. 2017. Source Credibility in Consumer-Generated Advertising in Youtube: The Moderating Role of Personality. Current Psychology 36 (4): 849–860. https://doi.org/10.1007/s12144-016-9474-7.

Lewin, Lisa D., Danielle E. Warren, and Mohammed AlSuwaidi. 2020. Does CSR Make Better Citizens? The Influence of Employee CSR Programs on Employee Societal Citizenship Behavior Outside of Work. Business and Society Review 125 (3): 271–288. https://doi.org/10.1111/basr.12212.

McDonnell, Mary Hunter, and Brayden King. 2013. Keeping up Appearances: Reputational Threat and Impression Management after Social Movement Boycotts. Administrative Science Quarterly. https://doi.org/10.1177/0001839213500032.

Mummolo, Jonathan, and Erik Peterson. 2019. Demand Effects in Survey Experiments: An Empirical Assessment. American Political Science Review 113 (2): 517–529. https://doi.org/10.1017/S0003055418000837.

Nath, Saheli. 2021. The Business of Virtue: Evidence from Socially Responsible Investing in Financial Markets. Journal of Business Ethics 169 (1): 181–199. https://doi.org/10.1007/S10551-019-04291-9.

Neu, Dean, Gregory Saxton, Jeffery Everett, and Abu Rahaman Shiraz. 2020. Speaking Truth to Power: Twitter Reactions to the Panama Papers. Journal of Business Ethics 162 (2): 473–485. https://doi.org/10.1007/S10551-018-3997-9.

Nielsen. 2015. Word-of-Mouth Recommendations Remain the Most Credible. Nielsen. 2015. http://www.nielsen.com/id/en/press-room/2015/WORD-OF-MOUTH-RECOMMENDATIONS-REMAIN-THE-MOST-CREDIBLE.html.

Nyilasy, Gergely, Harsha Gangadharbatla, and Angela Paladino. 2013. Perceived Greenwashing: The Interactive Effects of Green Advertising and Corporate Environmental Performance on Consumer Reactions. Journal of Business Ethics 125 (4): 693–707. https://doi.org/10.1007/s10551-013-1944-3.

O’Neil, Julie, and Marianne Eisenmann. 2017. An Examination of How Source Classification Impacts Credibility and Consumer Behavior. Public Relations Review 43 (2): 278–292. https://doi.org/10.1016/j.pubrev.2017.02.011.

Perego, Paolo, and Ans Kolk. 2012. Multinationals’ Accountability on Sustainability: The Evolution of Third-Party Assurance of Sustainability Reports. Journal of Business Ethics 110 (2): 173–190.

Pomering, Alan, and Sara Dolnicar. 2009. Assessing the Prerequisite of Successful CSR Implementation: Are Consumers Aware of CSR Initiatives? Journal of Business Ethics 85 (S2): 285–301.

Saxton, Gregory D., and Richard D. Waters. 2014. What Do Stakeholders Like on Facebook? Examining Public Reactions to Nonprofit Organizations’ Informational, Promotional, and Community-Building Messages. Journal of Public Relations Research 26 (3): 280–299.

Shen, Jie, and Hongru Zhang. 2019. Socially Responsible Human Resource Management and Employee Support for External CSR: Roles of Organizational CSR Climate and Perceived CSR Directed Toward Employees. Journal of Business Ethics 156 (3): 875–888. https://doi.org/10.1007/S10551-017-3544-0.

Smithson, Michael. 1999. Conflict Aversion: Preference for Ambiguity vs Conflict in Sources and Evidence. Organizational Behavior and Human Decision Processes 79 (3): 179–198. https://doi.org/10.1006/obhd.1999.2844.

Sobande, Francesca. 2020. Woke-Washing: ‘Intersectional’ Femvertising and Branding ‘Woke’ Bravery. European Journal of Marketing 54 (11): 2723–2745. https://doi.org/10.1108/EJM-02-2019-0134.

Strang, David, and Sarah A. Soule. 1998. Diffusion in Organizations and Social Movements: From Hybrid Corn to Poison Pills. Annual Review of Sociology 24: 265–290. https://doi.org/10.1146/annurev.soc.24.1.265.

Sustainable Investing: The Millennial Investor. 2017.

Sweetin, Vernon H., Lynette L. Knowles, John H. Summey, and Kand S. McQueen. 2013. Willingness-to-Punish the Corporate Brand for Corporate Social Irresponsibility. Journal of Business Research 66 (10): 1822–1830.

Turban, D.B., and D.W. Greening. 1997. Corporate Social Performance and Organizational Attractiveness to Prospective Employees. Academy of Management Journal 40 (3): 658–672.

Unruh, Gregory, David Kiron, Nina Kruschwitz, Martin Reeves, Holger Rubel, and Alexander Meyer zum Felde. 2016. Investing for a Sustainable Future. MIT Sloan Management Review.

USSIF Foundation. 2020. Sustainable and Impact Investing—Overview.

Valenzuela, Sebastián. 2013. Unpacking the Use of Social Media for Protest Behavior. American Behavioral Scientist 57 (7): 920–942.

Vasi, Ion Bogdan, Edward T. Walker, John S. Johnson, and Hui Fen Tan. 2015. ‘No Fracking Way!’ Documentary Film, Discursive Opportunity, and Local Opposition against Hydraulic Fracturing in the United States, 2010 to 2013. American Sociological Review 80 (5): 934–959. https://doi.org/10.1177/0003122415598534.

Vollero, Agostino, Maria Palazzo, Alfonso Siano, and Pantea Foroudi. 2021. From CSR to CSI: Analysing Consumers’ Hostile Responses to Branding Initiatives in Social Media-Scape. Qualitative Market Research 24 (2): 143–160. https://doi.org/10.1108/QMR-12-2017-0184.

Vredenburg, Jessica, Sommer Kapitan, Amanda Spry, and Joya A. Kemper. 2020. Brands Taking a Stand: Authentic Brand Activism or Woke Washing? Journal of Public Policy and Marketing 39 (4): 444–460. https://doi.org/10.1177/0743915620947359.

Wagner, Tillmann, Daniel Korschun, and Cord Christian Troebs. 2020. Deconstructing Corporate Hypocrisy: A Delineation of Its Behavioral, Moral, and Attributional Facets. Journal of Business Research 114: 385–394. https://doi.org/10.1016/j.jbusres.2019.07.041.

Wagner, Tillmann, Richard J. Lutz, and Barton A. Weitz. 2009. Corporate Hypocrisy: Overcoming the Threat of Inconsistent Corporate Social Responsibility Perceptions. Journal of Marketing 73 (6): 77–91. https://doi.org/10.1509/jmkg.73.6.77.

Walsh, Gianfranco, Vincent Wayne Mitchell, Paul R. Jackson, and Sharon E. Beatty. 2009. Examining the Antecedents and Consequences of Corporate Reputation: A Customer Perspective. British Journal of Management 20 (2): 187–203. https://doi.org/10.1111/j.1467-8551.2007.00557.x.

Wang, Rong Tsu. 2013. Modeling Corporate Social Performance and Job Pursuit Intention: Mediating Mechanisms of Corporate Reputation and Job Advancement Prospects. Journal of Business Ethics 117 (3): 569–582. https://doi.org/10.1007/s10551-012-1538-5.

Ward, James C., and Amy L. Ostrom. 2006. Complaining to the Masses: The Role of Protest Framing in Customer-Created Complaint Websites. Journal of Consumer Research 33 (2): 220–230.

Warren, Danielle E. 2022. ‘Woke’ Corporations and the Stigmatization of Corporate Social Initiatives. Business Ethics - Concepts and Cases 32 (1): 169–198. https://doi.org/10.1017/beq.2021.48.

Warren, Danielle E., Tobey K. Scharding, Lisa D. Lewin, and Ushma Pandya. 2020. Making Sure Corporate Social Innovations Do Social Good. Rutgers Business Review 5 (2): 166–184.

Yoon, Eunsang, Hugh J. Guffey, and Valerie Kijewski. 1993. The Effects of Information and Company Reputation on Intentions to Buy a Business Service. Journal of Business Research 27 (3): 215–228. https://doi.org/10.1016/0148-2963(93)90027-M.

Yoon, Yeosun, Zeynep Gurhan-Canli, and Norbert Schwarz. 2006. The Effect of Corporate Social Responsibility (CSR) Activities on Companies with Bad Reputations. Journal of Consumer Psychology 16 (4): 377–390.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

On behalf of all authors, the corresponding author states that there is no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Lewin, L.D., Warren, D.E. Calls to Action: The Dangers of Negative CSR Information and Stakeholder Punishments. Corp Reputation Rev 27, 1–17 (2024). https://doi.org/10.1057/s41299-023-00158-y

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41299-023-00158-y