Abstract

In this paper, we analyze how tail risk impacts both asset prices and the optimal asset allocation. For this purpose, we consider an equilibrium model with investors exhibiting an empirically well-justifiable decreasing relative risk aversion (DRRA) and different investment horizons. In contrast to the seminal CAPM, two fund separation does no longer hold, and investors not only regard one risk measure such as the standard deviation but additionally care for the size of tail risk. The shorter the investment period, the more prone they are to negatively skewed returns. In particular, short-term investors not only hold a lower equity ratio than (else equal) long-term investors do, but they also reduce the fraction of assets with negative tail risk. Consistently, the more short-term investors are in a market, the higher the tail risk premium is, i.e., the additional expected return due to skewness beyond a given standard deviation. Consequently, these theoretical findings allow us to draw empirical predictions about (i) the drivers of the skewness premium, (ii) characteristics for markets in which the premium is especially severe, and (iii) the optimal investors’ asset allocation.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

According to the seminal capital asset pricing model (CAPM) by Sharpe (1964), Lintner (1965), and Mossin (1966), optimal investment decisions can be based only on expected returns and standard deviations of the overall portfolio return, but higher moments do not matter at all. To obtain this highly tractable result, the model requires specific assumptions for the return distribution and/or the utility functions of investors. Empirical capital market research [see for example Harvey and Siddique (2000), Ang et al. (2006), Boyer et al. (2010)], however, provides evidence that investors do care about further risk characteristics, which the standard deviation does not fully include. An example of these risk characteristics is tail risk or catastrophe risk. The danger of losing a large part of the portfolio’s wealth with ruinous consequences for the individual with a very small probability is for some investors less attractive than a portfolio with normally distributed returns despite identical means and standard deviations as the other portfolio. Hence, these empirically observed preferences favor an additional risk premium for tail risk or, technically speaking, a skewness premium for (systematic) negatively skewed asset returns.

Since many theoretical applications are based on a CAPM-like notion, skewness premia cannot be analyzed in these approaches as there is no premium for skewness at all due to the consciously imposed set of assumptions. In practice, however, the optimal portfolio choice requires a careful treatment of tail risks and—in case of positive skewness premia—the voluntary selection of skewed returns. Because of a missing established framework for tail risk rather than total market risk, we lack an understanding of the drivers of a potential skewness premium. Moreover, it is doubtful whether each investor should still hold a part of the market portfolio in equilibrium, such as concluded by the CAPM if the extended case that investors not only care for market risk but also tail risk is present.

The aim of this paper is to provide an insightful asset pricing model to explain skewness premia. With the help of this model, we want to deal with the questions: (i) what drives a high skewness premium and (ii) which optimal portfolio should heterogeneous investors choose with regard to tail risk.

Our findings are as follows: first, with decreasing relative risk aversion (DRRA) of investors, we can obtain a positive skewness premium that decreases with the investors’ investment horizon. Second, allowing for heterogeneous investment horizons, our asset pricing model implies a higher equity fraction of long-term investors than short-term investors. Third, contrary to the conclusion of the CAPM, we explain that the composition of the risky portfolio differs among the heterogeneous investors: Long-term investors invest a higher fraction in assets associated with catastrophe risk than short-term investors do. Fourth, we show that the composition of market participants affects the size of the skewness premium: The skewness premium rises with the proportion of short-term investors in the economy.

The paper is related to the rich literature dealing with the implications of skewed returns in financial applications. Based on Arditti (1967) and Scott and Horvath (1980), who provide evidence under general assumptions that investors have a preference for positive skewness, the role of skewness in the context of asset pricing has been studied in numerous papers. For example, Kraus and Litzenberger (1976) extend the CAPM and stress the relevance of systematic skewness in a three-moment CAPM. Mitton and Vorkink (2007) introduce a one-period model with agents having heterogeneous preferences for skewness and conclude that idiosyncratic skewness is priced. Further, the impact of higher moments on the optimal asset allocation decision of investors is highlighted in several studies. These include among others Liu et al. (2003), Wu (2003), Jondeau and Rockinger (2006), and Harvey et al. (2010).

Our paper contributes to this literature by showing how tail risk affects (i) the portfolio decision of investors who differ in terms of their investment horizon and (ii) the equilibrium prices, which lead to skewness premia depending on investors’ investment horizons in a multi-period framework. We deviate from the typical assumption of constant relative risk aversion (CRRA) or a Taylor series expansion to approximate utility functions. Instead, we assume investors with DRRA and thereby capture the often observed behavior of market participants to choose higher equity fractions when their investment periods are longer. In principle, this outcome is in line with the frequently proposed investment rule by practitioners to allocate a percentage of wealth in risky assets equal to 100 minus the investor’s age. While this is arguably a somewhat stylized investment advice, it takes up the idea that younger investors with longer investment periods (should) have higher equity fractions.

The remainder of the paper is organized as follows: Section 2 introduces the asset pricing model and specifies the return generating processes as well as the utility function of investors. The equilibrium characteristics for economies with homogeneous and heterogeneous investment horizons of investors are described in Sect. 3. Section 4 deals with selected parameter modifications as robustness checks. Section 5 concludes.

Model description

Market and time structure

We consider an economy from time \(t_0\) to time T, which consists of a risk-free asset, paying the risk-free rate \(r_f\) per annum (p.a.), and two risky stocks. While both stocks have identical expected returns and standard deviations, the returns of Stock 1 are normally distributed, and the returns of Stock 2 exhibit negative skewness. The left-skewed return distribution implies that the probability of large negative returns exceeds the probability of equally large positive returns. Both stocks pay out their respective fundamental values \({\widetilde{S}}_{1,T}\) and \({\widetilde{S}}_{2,T}\) at time T and nothing at other points in time.

Before time T, equilibrium prices of the two stocks are formed under consideration of the known distributions of the two stocks by market participants. At time \(t_0\), the fundamental values \(S_{1,t_0}\) and \(S_{2,t_0}\) of Stock 1 and 2, respectively, are normalized to 1, which might differ from the corresponding (trading) prices \(p_{1,t_0}^{EQ}\) and \(p_{2,t_0}^{EQ}\) in equilibrium. To ensure that the aggregate fundamental value of stocks is equal to 1, the time \(t_0\) supply \({\overline{X}}_k\) of Stock \(k=1,2\) is given by

Investors enter the economy at time \(t_0\), who can either purchase units of the two stocks or invest in the risk-free asset. We assume that the demand for stocks is characterized by perfect competition, which implies that all investors are price takers so that we can use the concept of a representative investor following, e.g., Huang and Litzenberger (1988). This way, we can determine equilibrium prices as if there were only one investor in the economy, endowed with total endowment of (infinitely many) market participants.

To allow for different investment horizons, we consider two types of representative investors: representative long-term Investor L with an investment horizon until time T, and representative short-term Investor S with an investment horizon until time \(T_S\), which is prior to time T. Both investors thereby pursue a buy-and-hold strategy and cannot make any portfolio adjustments throughout their respective investment periods. For tractability, stocks are infinitely divisible and no trading costs exist.

The representative investors at time \(t_0\) are initially endowed with cash, whereby the total monetary endowment \({\overline{X}}_{Cash}\) equals the aggregated fundamental value of all shares outstanding:

Against payment of the equilibrium prices \(p_{1,t_0}^{EQ}\) and \(p_{2,t_0}^{EQ}\), the investors receive units of the stocks at time \(t_0\). While Investor L obtains the fundamental values \({\widetilde{S}}_{1,T}\) and \({\widetilde{S}}_{2,T}\) at time T, Investor S leaves the economy at time \(T_S\), offering the stock holdings \(X_1^S\) in Stock 1 and \(X_2^S\) in Stock 2 without limit.

Analogously to time \(t_0\), stock supply is hence perfectly inelastic, and we consider representative follow-up Investor F to enter the economy at time \(T_S\). This investor, with residual investment horizon \(T-T_S\), is endowed with \({\overline{X}}_{Cash}^F\), which equals the sum of fundamental values of shares outstanding at time \(T_S\):

This treatment assures equal conditions as at time \(t_0\). Investor F purchases the available units of stocks, paying the time \(T_S\) equilibrium prices \(p_{1,T_S}^{EQ}\) and \(p_{2,T_S}^{EQ}\) to Investor S. Figure 1 summarizes the investment horizons of the investors in the economy.

Before turning to the derivation of the equilibrium prices, we set out the statistical stock properties and specify the utility function of investors in the following.

Statistical stock properties

We consider two well-established stochastic processes for Stock 1 and Stock 2: a pure diffusion model (geometric Brownian motion) and a jump diffusion model (compensated geometric Brownian motion with jumps). The considered return generating models enable us to construct return distributions with equal expected return and standard deviation of returns but which differ in terms of their skewness.

For Stock 1, the well-known stochastic differential equation in continuous time of the standard geometric Brownian motion reads

Equation (4) denotes the instantaneous discrete return of Stock 1 over an infinitesimally small time step dt. \(\mu\) and \(\sigma\) denote the expected discrete return and standard deviation (p.a.), respectively, and \(z_t\) a standard Wiener process. The log return representation follows from Ito’s lemma [see, e.g., Hull (2017)] and is given by

where \({\widetilde{z}}_T\) is normally distributed with zero mean and variance T.

Following Merton (1976), we construct the jump diffusion process by adding a Poisson distributed jump component to the stochastic differential equation in Eq. (4). The discrete Poisson probability distribution assigns a probability to the number of events, or jumps, occurring during a fixed period of time and average event rate. For the sake of simplicity, we consider a non-stochastic negative jump of size \(\phi <0\) in the logarithm of the stock price in case a jump occurs, such that the stochastic differential equation of Stock 2, with jump-adjusted drift \(\mu _J\) and volatility \(\sigma _J\) of the diffusion term, reads

The Poisson process is denoted by \(J_t\) and in case a jump occurs, the stock price jumps from \(S_{2,t}\) to the lower value \(e^\phi \cdot S_{2,t}\). The volatility \(\sigma _J\) denotes the standard deviation (p.a.) of returns conditional on no Poisson event to occur. \(dJ_t\) and \(dz_t\) are assumed to be independent. To ensure that the expected discrete return \(\mathbb {E}\left( \frac{dS_{2,t}}{S_{2,t}}\right)\) equals \(\mu \cdot dt\), the jump-adjusted drift \(\mu _J\) in Eq. (6) needs to be set to

where \(\lambda\) denotes the intensity of the Poisson process, i.e., the instantaneous jump probability is \(\lambda \cdot dt\). By subtracting the expected (negative) discrete jump size \(\left( e^\phi -1 \right)\) from \(\mu\), we have \(\mu _J > \mu\) and the expected discrete return of the jump diffusion process coincides with the expected discrete return of the geometric Brownian motion in Eq. (4) and equals \(\mu\).

Similar to Eq. (5), following the Ito formula for jump diffusion processes given by Cont and Tankov (2003), the log return representation of the process considered for the fundamental value \(S_{2,t}\) reads

where \({\widetilde{J}}_T\) follows a Poisson distribution with intensity \(\lambda \cdot T\) and denotes the number of jump occurrences from time \(t_0\) to time T. The variance of the log return from time \(t_0\) to time T is

As we aim to construct two processes with equal standard deviation, we set the volatility \(\sigma _J\) of the diffusion term such that the total standard deviation of the return of Stock 2, i.e., the square root of Eq. (8) per year, is equal to \(\sigma\), the annual standard deviation of Stock 1. Solving for the volatility \(\sigma _J\) of Stock 2 conditional on no Poisson event to occur, we get

For given volatility \(\sigma\), jump intensity \(\lambda\), and jump size \(\phi\), Eq. (9) for \(\sigma _J\) ensures equal standard deviations of returns of both Stock 1 and Stock 2. The skewness of the returns generated by the jump diffusion process is

Contrary to the normally distributed log returns of the pure diffusion process from Eq. (5), the skewness of the jump diffusion process differs from zero. Due to \(\phi < 0\), we always have a negative skewness. Equation (10) shows that the skewness converges to zero with increasing T. Accordingly, the distribution of returns generated by the jump diffusion process converges to the distribution of returns of the pure diffusion process for large T.

Investors

We regard rational investors with decreasing relative risk aversion (DRRA). Contrary to constant relative risk aversion (CRRA), DRRA captures the often observed behavior that investors with a long investment horizon have a higher equity fraction, else equal, than investors with a short horizon. While the availability of closed-form solutions makes CRRA a common choice to model utility in many applications, it can be easily shown that the optimal equity fraction, which results from a static portfolio optimization problem, is independent of the investment horizon of the investor. DRRA utility, however, implies that the wealthier an investor, the less risk averse the investor is, which results in an increasing equity fraction with the investment horizon [see Thorley (1995)].

Following Merton (1971), we assume one functional form of the hyperbolic absolute risk aversion (HARA) family to model utility of investors. Depending on final wealth W at the end of the investment horizon of arbitrary Investor i, the utility function reads

where \(\gamma\) and \(\eta ^i\) specify the risk aversion of Investor i with \(\gamma > 0 \left( \ne 1 \right)\). The relative risk aversion (RRA) coefficient for \(U^i\left( W\right)\) is given by

It follows that \(\eta ^i\) specifies whether Investor i exhibits increasing or decreasing RRA with wealth. While Eq. (11) reduces to CRRA utility for \(\eta ^i=0\), utility is characterized by DRRA for \(\eta ^i > 0\).

Sharpe (2007) refers to \(\eta ^i\) as the minimum required level of wealth, which seizes the fact that the utility function in Eq. (11) is only defined for \(W > \eta ^i\). The condition ensures positive and diminishing marginal utility. He stresses that only values exceeding \(\eta ^i\) “should be considered” (p. 23). In a static portfolio optimization problem, the application of the DRRA utility function hence implies an upper bound of possible equity fractions, which assures that \(W>\eta ^i\). Following Ogaki and Zhang (2001), we refer to \(\eta ^i\) as the investor-specific subsistence level of wealth.

We assume investors to have equal \(\gamma\) and set \(\eta ^i\) as a fraction of monetary endowment of Investor i according to

with \({\overline{X}}_{Cash}^i>0\). Equation (12) assures that investors make identical investment decisions, independent of initial wealth for given subsistence wealth \(\eta\).

With investors’ utility depending on final wealth at time T, intermediate wealth levels prior to time T are not evaluated by the investor: While the investors require a minimum level of wealth at the end of their investment periods, they are willing to endure substantial portfolio losses in the interim. Specifically, we can assume shorter-orientated investors pursuing a buy-and-hold strategy with capital needs in the nearer future at time T for consumption purposes or longer-term investors saving for retirement with a specific (minimum) capital requirement at the beginning of their pension period at time T.Footnote 1

With utility of investors depending on final wealth, we now turn to the specific expressions for final wealth of the investors in the economy.

Long-term Investor L Final wealth of representative Investor L with investment horizon T reads

In this representation, \(X_1^L\) and \(X_2^L\) denote the number of shares of Stock 1 and Stock 2 purchased at time \(t_0\) and \({\widetilde{S}}_{1,T}\) and \({\widetilde{S}}_{2,T}\) the fundamental stock values at time T, respectively, which follow from Eqs. (4) and (7). The investment \(X^L_{Cash}\) at the risk-free rate \(r_f\) can be expressed as the difference of initial monetary endowment \({\overline{X}}^{L}_{Cash}\) and expenditures for the risky assets with trading prices \(p_{1,t_0}\) and \(p_{2,t_0}\). Including this budget constraint, we can write final wealth of Investor L as

Short-term Investor S Similarly to long-term Investor L, we can write final wealth of representative Investor S with investment horizon \(T_S(<T)\) as

While the budget constraint of Investor S reads analogously to the budget constraint of Investor L, Investor S does not receive fundamental values of the stocks at time \(T_S\), but trading prices \({\widetilde{p}}_{1,T_S}\) and \({\widetilde{p}}_{2,T_S}\), which come from trading with Investor F.

Follow-up Investor F With an investment period from time \(T_S\) to time T, representative Investor F receives the fundamental values \({\widetilde{S}}_{1,T}\) and \({\widetilde{S}}_{2,T}\) at time T. The expenditures at time \(T_S\) depend on prices \({\widetilde{p}}_{1,T_S}\) and \({\widetilde{p}}_{2,T_S}\), such that we can write final wealth as

with monetary endowment \({\overline{X}}_{Cash}^F\) of Investor F given in Eq. (3).

Derivation of the equilibrium

The equilibrium is characterized by all representative investors to make expected utility-maximizing investment decisions and by markets at time \(t_0\) and time \(T_S\) for both stocks to clear. Hence, the optimization problem of Investor i at time \(t_0\) for a given price combination \(p_{1}\) and \(p_{2}\) of the two stocks at the trading date reads

With DRRA utility from Eq. (11), a closed-form solution for the optimal number of units of stocks bought does not exist so that we solve Eq. (16) by simulation.Footnote 2 In this way, the demand functions \(\upchi _1^{i}\left( p_{1},p_{2}\right)\) and \(\upchi _2^{i}\left( p_{1},p_{2}\right)\) of Investor i for Stock 1 and Stock 2 are derived. Else equal, demand for a stock is a decreasing function of the respective price of the stock and increasing in the other stock’s price.

Specifically, since Investor S receives trading prices \({\widetilde{p}}_{1,T_S}\) and \({\widetilde{p}}_{2,T_S}\) at time \(T_S\), which result from trade with follow-up Investor F, a recursive solution of the model is required to determine equilibrium prices \(p_{1,t_0}^{EQ}\) and \(p_{2,t_0}^{EQ}\). In line with the notion of perfect competition, it is thereby assumed that Investor S cannot affect prices at time \(T_S\) by choosing the number of stocks bought at time \(t_0\) strategically.

At time \(T_S\), Investor F maximizes expected utility depending on final wealth from Eq. (15) by choosing optimal stock holdings for prices \(p_{1,T_S}\) and \(p_{2,T_S}\):

Thereby, we derive the corresponding demand functions for Stock 1 and Stock 2, \(\upchi _1^{F}(p_{1,T_S},p_{2,T_S})\) and \(\upchi _2^{F}(p_{1,T_S},p_{2,T_S})\). Equilibrium prices \(p_{1,T_S}^{EQ}\) and \(p_{2,T_S}^{EQ}\) are the price combination such that the demand of Investor F for both stocks at time \(T_S\) equals the respective supply of Investor S. The market clearing conditions at time \(T_S\) read

In this representation, \(\upchi _1^{F}(p_{1,T_S}^{EQ},p_{2,T_S}^{EQ})\) and \(\upchi _2^{F}(p_{1,T_S}^{EQ},p_{2,T_S}^{EQ})\) are the demand functions evaluated at the equilibrium prices at time \(T_S\) and denote the numbers of units of Stock 1 and Stock 2 Investor F purchases in equilibrium. Supply of the two stocks by Investor S in equilibrium is denoted by \(X_1^{S,{EQ}}\) and \(X_2^{S,{EQ}}\) and equal to the priory chosen units of Investor S:

i.e., \(\upchi _1^{S}(p_{1,t_0}^{EQ},p_{2,t_0}^{EQ})\) and \(\upchi _2^{S}(p_{1,t_0}^{EQ},p_{2,t_0}^{EQ})\) are the demand functions of Investor S evaluated at the equilibrium prices at time \(t_0\).

At time \(t_0\), Investor S and Investor L maximize expected utility depending on final wealth given in Eqs. (13) and (14), by choosing the optimal stock holdings for price combinations \(p_{1,t_0}\) and \(p_{2,t_0}\). The optimization problems of Investor L and Investor S read:

From the utility maximization problems follow the demand functions \(\upchi _1^{L}(p_{1,t_0},p_{2,t_0}),\) \(\upchi _2^{L}(p_{1,t_0},p_{2,t_0})\) and \(\upchi _1^{S}(p_{1,t_0},p_{2,t_0}), \ \upchi _2^{S}(p_{1,t_0},p_{2,t_0})\) for Stock 1 and Stock 2, which depend on prices at time \(t_0\). For equilibrium prices \(p_{1,t_0}^{EQ}\) and \(p_{2,t_0}^{EQ}\), aggregate demand of Investor L and Investor S meets the available quantity from Eq. (1) for both Stock 1 and Stock 2, separately. We can write the market clearing conditions at time \(t_0\) as

Model results

The results presented in the following are based on the parameter specifications summarized in Table 1. We employ a generally valid set of parameters for the two stocks with an expected discrete return \(\mu\) of 10% and standard deviation \(\sigma\) of 20%. A jump intensity of \(\lambda =0.1\) implies that, on average, a jump occurs once every ten years with a jump size \(\phi\) of \(-30\)%. It follows from Eq. (9) that the volatility \(\sigma _J\) conditional on no jump to occur is equal to 17.61%. The risk-free rate \(r_f\) is 2% p.a.

Throughout this paper, we assume that the returns of Stock 1 and Stock 2, conditional on no jump to occur, are governed by the same Wiener process \(z_t\). By construction, we thereby mitigate the possibility of diversification and emphasize the impact of the tail risk of Stock 2 on the optimal portfolio decision of investors.

Regarding the specification of the utility function of investors, we assume that the risk aversion parameter \(\gamma\) is equal to 4 and subsistence wealth \(\eta\) equals 0.8, which implies that the investors require at least 80% of their initial endowment at the end of their investment horizons. Hence, the relative risk aversion is always above 4 for all wealth levels. We provide the results of robustness checks for alternative parameter specifications in Sect. 4.

First, we consider an economy with homogeneous investment horizons of investors represented by long-term Investor L. We derive the equilibrium characteristics for investment horizons T of Investor L ranging from 1 year to 30 years for the parameter specifications described. We then turn to an economy with heterogeneous investment horizons of investors.

Economy with homogeneous investment horizons

With long-term investors only in the economy, it follows from Eq. (2) that representative Investor L is endowed with aggregate monetary endowment \({\overline{X}}_{Cash}\) of

The derivation of the equilibrium described in the previous section thereby reduces to the optimization problem of Investor L from Eq. (17) and the market clearing conditions simplify to

For the prices in equilibrium, Investor L purchases all available units of stocks at time \(t_0\) according to her demand function, such that

In equilibrium, the required return of Investor L for Stock \(k = 1,2\) comes from the logarithmic return of the expected fundamental value \(\mathbb {E}_{t_0}\left( {S}_{k,T} \right)\) at time T related to the equilibrium trading price \(p_{k,t_0}^{EQ}\) at time \(t_0\). We define \(y_k^{L,EQ}\) as the required annual return of Investor L and write the required return for Stock k as

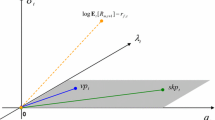

Figure 2a illustrates the required annual returns of Investor L in equilibrium depending on the investment horizon T. \(y_1^{L,EQ}\) and \(y_2^{L,EQ}\) are monotonously decreasing functions of the investment horizon T. While Investor L requires a return of Stock 2 of 94.6% with an investment horizon of one year, the required return reduces to 12.9% (p.a.) for \(T=30\). The result illustrates the effectiveness of time diversification on the investor’s optimal portfolio allocation: With a longer investment horizon of Investor L, else equal, the investor is willing to accept lower returns (p.a.) for both stocks to purchase the outstanding shares.

Further, the required returns in Fig. 2a indicate that Investor L requires a higher annual compensation for the negatively skewed Stock 2 than for Stock 1, as it holds for all T that

The additional annual compensation required for Stock 2 relative to Stock 1, \(y_2^{L,EQ} - y_1^{L,EQ}\), thereby decreases with T. Since both stocks have identical means and variances at time T, but Stock 2 suffers from a lower market price in equilibrium due to tail risk, there must be a positive premium for (negative) skewness. We define the skewness premium as the logarithmic price difference between Stocks 1 and 2 in equilibrium:

Figure 2b indicates that the skewness premium is positive for all T. The skewness premium measures the additional logarithmic return of Stock 2 relative to Stock 1 until time T as compensation for a disliked negative jump risk. Thereby, the skewness premium is a decreasing function of T, which declines from 35.6% for \(T=1\) to 0.6% for \(T=30\), and approaches zero for longer investment horizons.

Fig. 2a shows the required return (p.a.), \(y_1^{L,EQ}\) and \(y_2^{L,EQ}\), of Investor L for Stock 1 and Stock 2, defined as the annualized logarithmic expected return for each stock in equilibrium according to Eq. (21). The skewness premium \(sk^{prem}\) in Fig. 2b is the logarithmic price difference between Stock 1 and Stock 2 in equilibrium as defined in Eq. (22)

For short investment horizons, Investor L hence requires a relatively high additional compensation for being exposed to the negative jump risk in prices of Stock 2. Even though the probability of one or more jumps to occur is relatively small, already the size \(\phi = -30\)% of a jump leads to substantial losses in wealth from which final wealth hardly recovers over short investment horizons. For longer investment horizons, however, the impact of negative jumps on final wealth diminishes because the return distribution of Stock 2 converges to the return distribution of Stock 1 for long T indicated by the limit of the skewness of Eq. (10). Intuitively speaking, over a shorter investment period, the portfolio return of an investor is hence more strongly affected if a surprising jump in fact occurs.

Accordingly, the impact of catastrophe risk on investors with DRRA utility is less pronounced at longer investment horizons, so that the prices \(p_{1,t_0}^{EQ}\) and \(p_{2,t_0}^{EQ}\) converge to each other for long T despite the negative jump risk in Stock 2 prices. We summarize the first implication of our model in:

Stylized fact 1

(Skewness premium) The skewness premium is positive and decreases with the investment horizon T of the investors.

Economy with heterogeneous investment horizons

We now consider an economy with long-term investors, who have an investment horizon of 10 years, and short-term investors, who leave the economy after five years. Hence, the investment horizon \(T-T_S\) of the follow-up investors also equals five years. With short-term investors being identically endowed as long-term investors, representative Investor L and Investor S hold half of the aggregate monetary endowment \({\overline{X}}_{Cash}\) each, such that

In equilibrium, the required return of Investor S for Stock \(k = 1,2\) is the logarithmic return between the expected equilibrium trading price \(\mathbb {E}_{t_0}\left( {p}_{k,T_S}^{EQ} \right)\) at time \(T_S\) and the equilibrium trading price \(p_{k,t_0}^{EQ}\) at time \(t_0\). With \(y_{k}^{S,EQ}\) defined as the annual return required of Investor S, we can write

Similarly, the required return of Investor F, conditional on time \(t_0\) expectations, is the logarithmic return of the expected fundamental value \(\mathbb {E}_{t_0}\left( {S}_{k,T} \right)\) at time T and the expected equilibrium trading price \(\mathbb {E}_{t_0}\left( {p}_{k,T_S}^{EQ} \right)\) at time \(T_S\):

where \(y_k^{F,EQ}\) is the required annual return of Investor F from the perspective of time \(t_0\).

Since Investor S and Investor F split the investment period of Investor L and trade Stock 1 and Stock 2 at time \(T_S\), we can express the required return of Investor L from Eq. (21) as the sum of the required logarithmic returns of Investor S and Investor F from Eq. (23) and (24):

This is a result of well-known logarithm computation rules. Substituting the expressions of the required returns in Eq. (25) and dividing by T, we obtain

The relation states that the required return (p.a.) of Investor L for Stock \(k=1,2\) is equal to the average of the respective required returns of Investor S and Investor F, weighted by the investor’s investment horizon.

In principle, the return required by an investor is affected by two sources: (i) the investment horizon of the investor and (ii) the number of stocks the investor holds in total.

First, from the results of the previous section with homogeneous investment horizons, we know that the required returns (p.a.) for both stocks are decreasing functions of the investor’s investment horizon. For Investor L and Investor S to purchase equally many units of both stocks at time \(t_0\), the returns Investor S requires exceed the required returns of Investor L. The same is true for Investor F, i.e., she requires higher returns than Investor L for identical holdings due to a shorter investment period. Hence, for identical holdings \(X^{S}_{k}=X^{L}_{k}= 0.25\), the right-hand side of Eq. (26) would exceed the left-hand side and is therefore no equilibrium. As a result, Investor L and Investor S must not buy equally many units of stocks in equilibrium.

Second, a reduction (increase) of the units of a stock bought, else equal, reduces (increases) the required return for the stock. Table 2 presents the quantity of stocks Investor S and Investor L purchase in equilibrium, and Table 3 provides the respective annual returns required. In the considered example, Investor S reduces the numbers of stocks purchased to 0.21 units of Stock 1 and 0.17 units of Stock 2, which lowers the required returns on the right-hand side of Eq. (26).

We can interpret \(y^{F,EQ}_k\) as the conditional on time \(t_0\) expected discount rate Investor S applies to discount the expected fundamental value \(\mathbb {E}_{t_0}\left( S_{k,T}\right)\). Investor S anticipates the annually required returns of Investor F, which equal 25.4% for Stock 1 and 27.2% for Stock 2. For the reduced holdings in equilibrium, Investor S only requires 15.7% and 15.4%, respectively.

Analogously, Investor L increases stock holdings and buys 0.29 units of Stock 1 and 0.33 units of Stock 2 with jump risk in equilibrium, which in turn increases the required returns (p.a.) on the left-hand side of Eq. (26) to 20.6 and 21.3%, respectively. The quantities purchased by Investor S and Investor L in equilibrium ensure that the relation between the required returns in Eq. (26) holds. Table 2 shows that Investor L has 41.8% of wealth invested in the two stocks, while Investor S has an equity fraction of only 25.3%. We summarize the implication in:

Stylized fact 2

(Equity fraction) For investors who differ only in terms of their investment horizon, long-term investors have a higher equity fraction than short-term investors.

Further, we can conclude that the composition of the investors’ portfolios in equilibrium differs: Particularly, Investor L (Investor S) acquires 0.04 units more (less) of Stock 2 with tail risk than of Stock 1 in equilibrium. Accordingly, besides the higher equity fraction of Investor L, the portfolio of Investor L is characterized by a higher fraction invested in Stock 2 of 51.4% compared to 43.0% of Investor S. As a result of the previous section with homogeneous investment horizons, we know that the additional annual compensation required for Stock 2 relative to Stock 1 is a decreasing function of the investor’s investment horizon. Hence, for the skewness premium of 7.2% in equilibrium, Investor L is willing to bear—in relative and absolute terms—more tail risk than Investor S. This is a major difference to the conclusion of the CAPM that all market participants invest a fraction of their wealth in an identical portfolio of risky assets, i.e., the market portfolio (two fund separation theorem). We summarize the implication in:

Stylized fact 3

(Portfolio composition) For investors who differ only in terms of their investment horizon, long-term investors hold a higher portfolio weight in assets with tail risks than short-term investors.

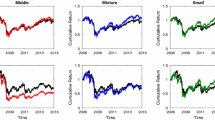

Varying proportions of investors in the economy

For the previous analysis with heterogeneous investment horizons, we assumed an economy with equal proportion of short-term investors and long-term investors, which can be interpreted as Investor L and Investor S with equal monetary endowment. By varying initial monetary endowment \({\overline{X}}_{Cash}^L\) and \({\overline{X}}_{Cash}^S\) for given aggregate monetary endowment \({\overline{X}}_{Cash}\) from Eq. (2), we can modify the composition of investors in the economy. The higher \({\overline{X}}_{Cash}^S\) at the cost of \({\overline{X}}_{Cash}^L\), the higher the proportion of short-term investors relative to long-term ones. Table 4 presents the outcomes of the economies for different proportions of short-term investors.

In the absence of short-term investors, Investor L purchases the outstanding 0.5 units of each stock in equilibrium with an equity fraction of 39.2% and a fraction invested in Stock 2 of 49.2%. The skewness premium equals 3.2%.

With 25% of all investors being short-term investors, Investor L is endowed with three times as much cash as Investor S. For equivalent behavior of both investors, Investor S should hold 0.125 units and Investor L 0.375 units of each stock. Investor S and Investor F, however, require higher annual returns for both stocks on average and a higher additional compensation for Stock 2 relative to Stock 1 than Investor L to purchase respective units of each stock. Therefore, the right-hand side of the relation in Eq. (26) would exceed the left-hand side for each stock and respective holdings cannot represent equilibrium.

In equilibrium, to satisfy Eq. (26) for both stocks, Investor S reduces the stock holdings to a volume equal to 0.09 units of Stock 1 and 0.07 units of Stock 2. Correspondingly, Investor L increases the stocks purchased to 0.41 units of Stock 1 and 0.43 units of Stock 2. The equity fraction of Investor L increases from 39.2% with long-term investors only to 40.6% in the considered example. Similarly, the fraction invested in Stock 2 of Investor L rises from 49.2 to 50.2%, and the skewness premium from 3.2 to 4.9%.

With 75% short-term investors, the equity fraction of Investor L increases to 44.9% and the fraction invested in Stock 2 to 52.4%. The skewness premium rises to 10.5%. With short-term investors only, Investor S purchases all outstanding units of stocks in equilibrium and the skewness premium equals 12.6%, which is four times as high as with long-term investors only. We summarize the implication of our model in:

Stylized fact 4

(Market participants) The skewness premium increases with the proportion of short-term investors in the economy. Moreover, long-term investors increase both their equity fraction and their portfolio weight in the asset with tail risk with the proportion of short-term investors in the economy.

Robustness checks

The aim of this section is to analyze the impact of parameter modifications on the key characteristics of the economy with heterogeneous investment horizons. For this purpose, we change one parameter from the previously utilized set of parameters given in Table 1 at a time. The results are presented in Table 5, whereby the first row recapitulates the results from Table 2, which we refer to as the benchmark.

The first three analyses deal with parameter alternations of the stock properties. First, we consider a more negative jump size \(\phi\) of \(-40\)%, while keeping the standard deviation of returns \(\sigma\) constant at 20%. From Eq. (10) follows that the resulting skewness of the returns of Stock 2 is more negative than in the benchmark analysis. With identical equilibrium stock holdings as in the benchmark, both Investor L and Investor S bear greater tail risk so that investors require higher compensation. Accordingly, the skewness premium almost doubles to 13.6%.

In the next two analyses, we consider both higher and lower standard deviation \(\sigma\) in the stocks’ returns. For fixed jump size \(\phi =-30\)%, the standard deviation \(\sigma _J\) conditional on no jump to occur is adjusted according to Eq. (9) for Stock 2. From Eq. (10) follows that a higher (lower) standard deviation \(\sigma\) reduces (increases) the negative skewness of the returns of Stock 2. Hence, a higher standard deviation of 24% decreases the skewness premium to 2.3%. On the contrary, a lower standard deviation of 16% results in a skewness premium of 24.2%, which is more than three times as high as in the benchmark. Therefore, the level of tail risk compared to total risk matters. In case that tail risk relative to total risk is high, the skewness premium rises.

The following two robustness checks deal with the specifications of the utility function of the investors. Specifically, we assume investors who exhibit a higher RRA, either by increasing the risk aversion parameter \(\gamma\) or the subsistence level of wealth \(\eta\). First, by increasing \(\gamma\) from 4 to 6, Investor L (Investor S) buys more (less) units of Stock 1, while the holdings in Stock 2 remain unchanged compared to the benchmark. The skewness premium increases by 60 basis points to 7.8%. Accordingly, a higher risk aversion parameter \(\gamma\) results in a greater skewness premium.

Second, with a subsistence level of wealth of \(\eta =0.9\), we find that investors are particularly more averse against skewness risk and require higher additional compensations for Stock 2 relative to Stock 1. Thereby, the effect is more pronounced for short-term investors: For the skewness premium of 16% in equilibrium, Investor L (Investor S) increases (decreases) the number of units bought of Stock 2, while the holdings in Stock 1 remain unchanged compared to the benchmark.

This section illustrates that the derived stylized facts from Sect. 3 do not follow from a specific parameter choice of the DRRA utility function or of the stock properties but hold for a wide range of parameter constellations. We particularly find that:

Robustness check (Skewness premium) The skewness premium increases with the negative skewness in the returns of assets and with the relative risk aversion of the investors specified by \(\gamma\) and \(\eta\).

Conclusion

In this paper, we introduce a theoretical framework to analyze how tail risk affects both asset prices and the optimal asset allocation of investors. Particularly, we contribute to the understanding of skewness premia with an insightful multi-period equilibrium model that accounts for heterogeneous investment horizons and investors with DRRA, capturing the empirically observed behavior of investors to allocate more wealth to equities when their investment horizons are longer. The investors’ portfolio compositions and endogenous market prices enable a rigorous analysis of investors’ tail risk preferences depending on their respective investment horizons.

While only expected returns and standard deviations of the overall portfolio return are relevant for the optimal portfolio allocation according to the CAPM, our empirically justified model explains that investors incorporate assets’ distributional properties of returns higher than the second (centralized) moment in their portfolio allocation decision. Notably, since investors require higher compensation to hold the stock with tail risk, there is a positive skewness premium. As a main result, this skewness premium decreases with the length of the investment period of investors as a surprising jump in the stock price more strongly affects final wealth of investors with a shorter investment period. With heterogeneous investment horizons, long-term investors hold both a higher equity fraction and portfolio weight in the asset with negative skewness in equilibrium than short-term investors so that as a major distinction from the seminal CAPM, two fund separation no longer holds.

Our results provide a fruitful foundation by means of testable implications for an empirical analysis of the impact of heterogeneous investment horizons on skewness premia for future research: First, the model’s implication that additional premia for assets with tail risk, else equal, exist is not limited to equities but holds for other asset classes with an even stronger negative skewness such as high-yield bonds. Likewise, assets exhibiting positive skewness—such as growth stocks or lottery-like venture capital investments—are supposed to yield lower expected returns, else equal, due to a preference for positively skewed returns. Second, from an investor’s perspective, it may be optimal for longer-orientated investors, who pursue a buy-and-hold strategy, to deliberately select investments with tail risk to benefit from tail risk premia. Third, these tail risk premia are the higher, (i) the more negative the returns’ skewness, (ii) the higher the relative risk aversion of market participants, (iii) the more dominated respective markets are by short-term oriented investors, and (iv) the shorter these investment horizons. Consequently, we can expect high premia in stock markets and private equity investments due to a relatively short investment period and/or significant tail risks: The average holding period of US stocks traded at the NYSE has been less than 12 months from 2010 to 2020 [see Chatterjee and Adinarayan (2020)], which indicates that shorter-orientated investors represent a substantial proportion of investors in stock markets. An example for a longer investment horizon is private equity investments with an average holding period of the investments of approximately four years [see, e.g., Jenkinson and Sousa (2015)].

Further, we expect high transaction costs and/or low liquidity of assets to induce investors to hold respective assets for longer periods. With longer-orientated investors selecting higher proportions of those investments, we can conclude from our theoretical model that the ownership structure lowers respective skewness premia. For example, higher entry and exit costs typically characterize mutual funds and real estate investments (or funds). Real estate investments and covered bonds are further examples of (more) illiquid assets, which are hence less attractive to short-term investors.

The stylized facts derived in this paper are intended to raise awareness of the existence of tail risk premia, provide an intuitive understanding of the drivers of these premia, and emphasize the practical relevance for investors to carefully consider tail risks in their investment decisions. Holding the same portfolio of risky assets might not be equally optimal for investors, as being exposed to tail risk can be less or more attractive for investors depending on respective investment horizons.

Notes

Whether the investor’s utility depends only on wealth at time T or interim shortfalls impact the investor’s utility and/or the investor is not willing to endure substantial losses during the investment period is subject to controversial discussions [see, e.g., Bodie (2015)]. Following the discretionary wealth hypothesis by Wilcox (2003), for example, which builds on the investment criteria by Kelly (1956) and Markowitz (1952), risk aversion of investors is determined by the necessity to avoid “shortfalls, not only at some far-off ending period, but all along the way” (p. 62). Maximizing the expected periodic log return of discretionary wealth, investors do not tolerate a periodic (e.g., monthly or annual) percentage loss exceeding a pre-specified value such that the optimal equity fraction is independent of investors’ investment horizons in a static portfolio optimization problem with repeating periods (Wilcox 2020). For a one-periodic investment horizon, the investment policy by Wilcox is equivalent to the DRRA utility function for the special case of \(\gamma = 1\) and \(\eta =W_0 \cdot \left( 1-\frac{1}{L}\right)\) in terms of identical asset allocation implications.

To generate distributions of final wealth, we simulate 50,000 values for the diffusion term \({\widetilde{z}}_T\) for the two stocks. For numerical stability, we explicitly take into account the number of jumps from zero to \({\overline{J}}_T\) of Stock 2, rather than simulating the Poisson-distributed number of jumps \({\widetilde{J}}_T\) for each realization of \({\widetilde{z}}_T\). The maximum number of jumps considered with respect to time T, \({\overline{J}}_T\), satisfies that the cumulative probability \(\sum _{\xi =0}^{{\overline{J}}_T} p{(\xi ;\lambda \cdot T)}\) of all jumps included just exceeds 99.9999%, whereby \(p{(\xi ; \lambda \cdot T)}\) denotes the probability function of the Poisson distribution with number of jumps \(\xi\) and intensity \(\lambda \cdot T\):

$$\begin{aligned} p{(\xi ;\lambda \cdot T)} = \frac{(\lambda \cdot T)^\xi }{\xi !} \cdot e^{-\lambda \cdot T}. \end{aligned}$$We add the residual probability \(1-\sum _{\xi =0}^{{\overline{J}}_T} p{(\xi ; \lambda \cdot T)}\) to the respective probability of \({\overline{J}}_T\). The expected utility is then derived as the average of the utilities weighted by the occurrence probability \(p{(\xi ; \lambda \cdot T)}\) of the respective jumps \(\xi\).

References

Ang, A., J. Chen, and Y. Xing. 2006. Downside risk. The Review of Financial Studies 19 (4): 1191–1239.

Arditti, F.D. 1967. Risk and the required return on equity. The Journal of Finance 22 (1): 19–36.

Bodie, Z. 2015. Thoughts on the future: life-cycle investing in theory and practice. Financial Analysts Journal 71 (1): 43–48.

Boyer, B., T. Mitton, and K. Vorkink. 2010. Expected idiosyncratic skewness. The Review of Financial Studies 23 (1): 169–202.

Cont, R., and P. Tankov. 2003. Financial modelling with jump processes, Chapman and Hall/CRC Financial Mathematics Series.

Chatterjee S., T. Adinarayan. 2020. Buy, sell, repeat! no room for ‘hold’ in whipsawing markets. Reuters. Accessed 01 March 2022.

Harvey, C.R., J.C. Liechty, M.W. Liechty, and P. Müller. 2010. Portfolio selection with higher moments. Quantitative Finance 10 (5): 469–485.

Harvey, C.R., and A. Siddique. 2000. Conditional skewness in asset pricing tests. The Journal of Finance 55 (3): 1263–1295.

Huang, C.-F., and R.H. Litzenberger. 1988. Foundations for financial economics. North-Holland.

Hull, J.C. 2017. Options, futures, and other derivatives, 9th edn. Pearson.

Jenkinson, T., and M. Sousa. 2015. What determines the exit decision for leveraged buyouts? Journal of Banking & Finance 59: 399–408.

Jondeau, E., and M. Rockinger. 2006. Optimal portfolio allocation under higher moments. European Financial Management 12 (1): 29–55.

Kelly, J.J. 1956. A new interpretation of information rate. The Bell System Technical Journal 35: 917–926.

Kraus, A., and R.H. Litzenberger. 1976. Skewness preference and the valuation of risk assets. The Journal of Finance 31 (4): 1085–1100.

Lintner, J. 1965. Security prices, risk, and maximal gains from diversification. The Journal of Finance 20 (4): 587–615.

Liu, J., F.A. Longstaff, and J. Pan. 2003. Dynamic asset allocation with event risk. The Journal of Finance 58 (1): 231–259.

Markowitz, H. 1952. Portfolio selection. The Journal of Finance 7 (1): 77–91

Merton, R.C. 1971. Optimum consumption and portfolio rules in a continuous-time model. Journal of Economic Theory 3 (4): 373–413.

Merton, R.C. 1976. Option pricing when underlying stock returns are discontinuous. Journal of Financial Economics 3 (1–2): 125–144.

Mitton, T., and K. Vorkink. 2007. Equilibrium underdiversification and the preference for skewness. The Review of Financial Studies 20 (4): 1255–1288.

Mossin, J. 1966. Equilibrium in a capital asset market. Econometrica: Journal of the Econometric Society 34 (4): 768–783.

Ogaki, M., and Q. Zhang. 2001. Decreasing relative risk aversion and tests of risk sharing. Econometrica 69 (2): 515–526.

Scott, R.C., and P.A. Horvath. 1980. On the direction of preference for moments of higher order than the variance. The Journal of Finance 35 (4): 915–919.

Sharpe, W.F. 1964. Capital asset prices: A theory of market equilibrium under conditions of risk. The Journal of Finance 19 (3): 425–442.

Sharpe, W.F. 2007. Expected utility asset allocation. Financial Analysts Journal 63 (5): 18–30.

Thorley, S.R. 1995. The time-diversification controversy. Financial Analysts Journal 51 (3): 68–76.

Wilcox, J. 2003. Harry Markowitz and the discretionary wealth hypothesis. The Journal of Portfolio Management 29 (3): 58–65.

Wilcox, J. 2020. Better portfolios with higher moments. Journal of Asset Management 21 (7): 569–580.

Wu, L. 2003. Jumps and dynamic asset allocation. Review of Quantitative Finance and Accounting 20 (3): 207–243.

Funding

Open Access funding enabled and organized by Projekt DEAL.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Kipp, M., Koziol, C. Tail risk management and the skewness premium. J Asset Manag 23, 534–546 (2022). https://doi.org/10.1057/s41260-022-00281-1

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41260-022-00281-1